194dc8e268a47995f34d33cb3b83c05c.ppt

- Количество слайдов: 24

Accelerating Growth Recipes, Ingredients and the Global Context Michael Spence The Israel 2021 Conference January 12 -13, 2011

Re’ut Institute and the Marker • Have initiated an import discussion of longer term economic and social goals • and of policies that may help achieve them • Learning from the experience of other countries, advanced and developing, is useful – But all edible recipes are country, context and time specific – And they cannot be created independent of the evolving external global environment • The evolving global economy presents opportunities and challenges • In my view, it is crucial to take these structural shifts into account in formulating strategies for inclusive growth and employment generation

Planning and Time Horizons • • There are 13 high growth developing countries (7%+ for 25+ years) Soon to be 15 (India and Vietnam) Despite differences in form of governance Shared certain characteristics (ingredients) – Long time horizons – Low revealed social discount rates – they invest at high rates – Agreement on objectives and focus in inclusive growth – Ongoing debate about strategy and policy with inputs from all sectors of society – That means a process that leads to a shared sense of direction – The effect is coherence of policy on “a long voyage with imperfect charts” – Engagement by government in the longer term agenda • What are the five year plans in India and China? – Pragmatic, problem solving orientation and relatively little ideology

Israeli Economy Advanced (economically, technologically, human capital) Impressive development given resources required for security Per capita income around $30, 000 Rank 25 -30 (less with PPP adjustment) Advanced human capital and technology Small (7. 3 M people) – economically specialized – $200 B economy Open (exposed globally with benefits and risk) – X+I about 80% of GDP • Growth substantial – but so is populations growth • Slow growth in advanced countries will help raise rank • •

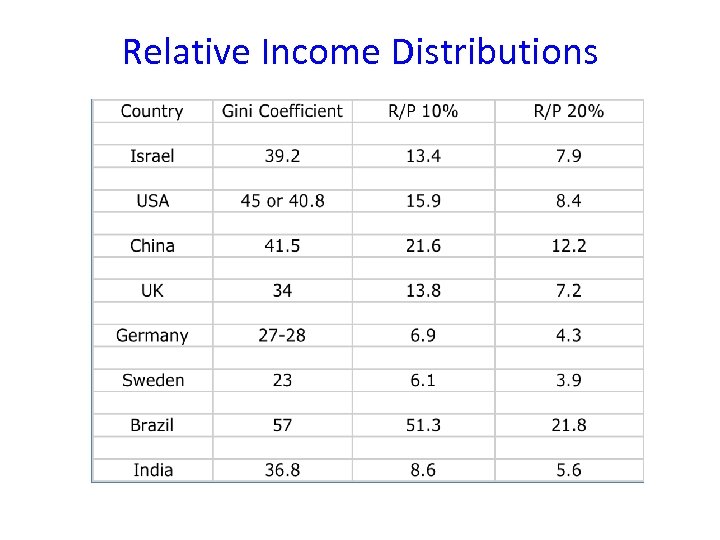

Relative Income Distributions

Accelerated Growth • Impressive crisis response and recovery • Reasonable chance to accelerate and leapfrog • Focus should be on human capital and employment opportunities in the middle income group • This will require elevating public investment • Also requires expanding institutional and technological base for diversification of the economy and the export sector – Reverse net exports of human capital • Above average or trend growth requires structural change in the economy – This is clearly visible in the microeconomic dynamics of the high growth developing countries

Economic Diversification and Structural Change • Porter, The Competitive Advantage of Nations (30 years ago) – Industries are not scattered randomly around the world – Economies diversify on different paths – Industries in the global competitive sector are concentrated geographically, though the supply chains are dispersing globally now • Ricardo Hausman’s work on export diversification patterns. – There are richer and less rich clusters – Defined by overlaps in the value added chains

Lessons from Emerging Economies – Recipes are not ingredients or lists of todos – More like strategies – There are common ingredients • Openness and leveraging global economy markets and technology • Hence the term catch-up growth • High levels of investment on public and private sector sides • Inclusiveness and management of the degree of inequality • Competent macro management and macro stability – Otherwise investment subject to too much risk and is dampened

Growth Strategies and Supporting Policies • Differ across countries and across time within countries • Responsive to initial conditions • Sequencing and political feasibility matter and depend on the political system and the composition of interest groups • Willingness to trade off present consumption for future opportunity varies (for high growth it has to be tipped toward the future) – That is harder but not impossible in democratic systems • Accept market incentives, decentralization, price signals and capitalist dynamics driven by private sector investment • Government has several key roles – As investor (human capital and infrastructure) to increase the returns to private sector investment – Maintain stability and predictability

Leadership However hard to define, is crucial Consensus building among stakeholders around a vision and strategy Credible commitment to inclusiveness Adopting a workable model (there are lots of alternatives that do not work) • Acting as a counterweight to the normal short term incentives inherent in democratic structures • •

• Intent matters – the goal has to be making future generations better off in a reasonably equitable way • Hence the term (from India) inclusive growth • Persistence, pragmatism and a problem solving orientation • You don’t know the answers in advance – ideologues do but they are usually wrong • Willingness to experiment, change course • Use economic analysis and experience of other cases, as guides, but not doctrine or othodoxy

Evolving Structure of Global Economy • Emerging economies are increasingly large and systemically important • Also higher income and on supply side moving rapidly up the value chain, • Increasing impact on the structure of the tradable sector in the advanced economies. • Creates challenges for employment, growth and income distribution in the advanced economies • Risk is the advanced economies get crowded into the a declining set of high value added components of global supply chains.

The Century of Convergence • • In 1750, 10% of the measured income inequality was due to inter country differences By 1950, the figure was 60% Post 1950, the pattern shifted – Hard to see at first Mid-point of a century at the end of which the vast majority (70% or more) will live in advanced economies • The Next Convergence • High speed growth in developing world, and the growing impact on the global economy In my view, in most advanced countries, way too little attention is paid to these trends and the underlying driving forces The result is domestically and supply side focused – half the picture if you like • •

Efficiency and Distribution • • • Global economy has powerful market forces It is highly efficient – Multinational companies go where the market and supply chain opportunities exist – it is a highly competitive, constantly shifting landscape – Global supply chains are decomposable and moveable Efficiency does not guarantee that outcomes in terms of distribution will be acceptable • The ongoing challenge is to shift the market outcomes enough to achieve distributional objectives while keeping benefits of openness • It is a challenge at the national level (in most countries) and internationally in the G 20, to adapt the rules of engagement so that the distributional objectives can be met.

Structural Evolution • Tradable and non tradable sectors • Shifting boundary • Components of the value added chain • Project to collect similar data for G 20 plus or a wide range of countries with MGI

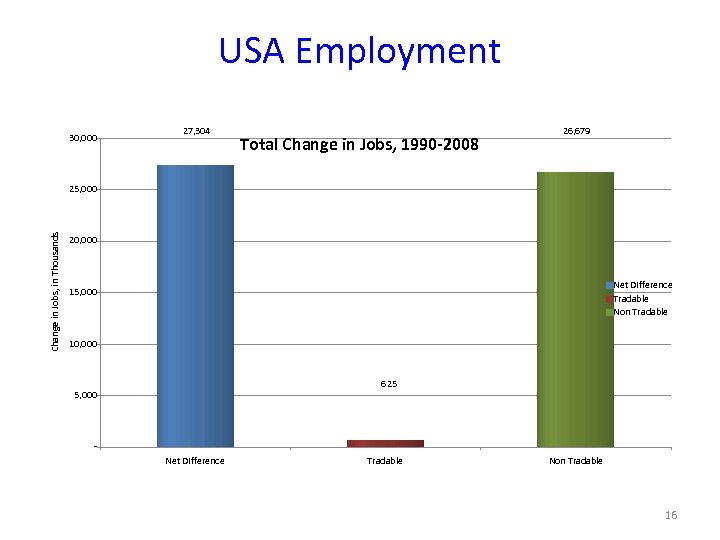

USA Employment 30, 000 27, 304 Total Change in Jobs, 1990 -2008 26, 679 Change in Jobs, in Thousands 25, 000 20, 000 Net Difference Tradable Non Tradable 15, 000 10, 000 625 5, 000 Net Difference Tradable Non Tradable 16

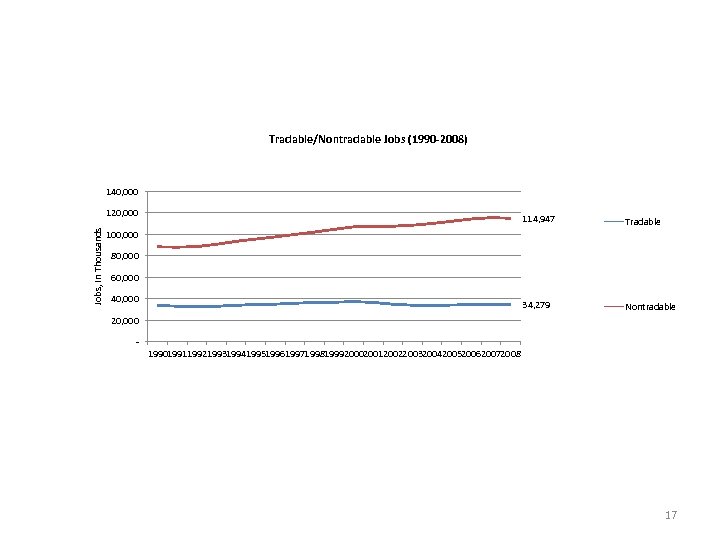

Tradable/Nontradable Jobs (1990 -2008) 140, 000 Jobs, In Thousands 120, 000 114, 947 Tradable 34, 279 Nontradable 100, 000 80, 000 60, 000 40, 000 20, 000 1990199119921993199419951996199719981999200020012002200320042005200620072008 17

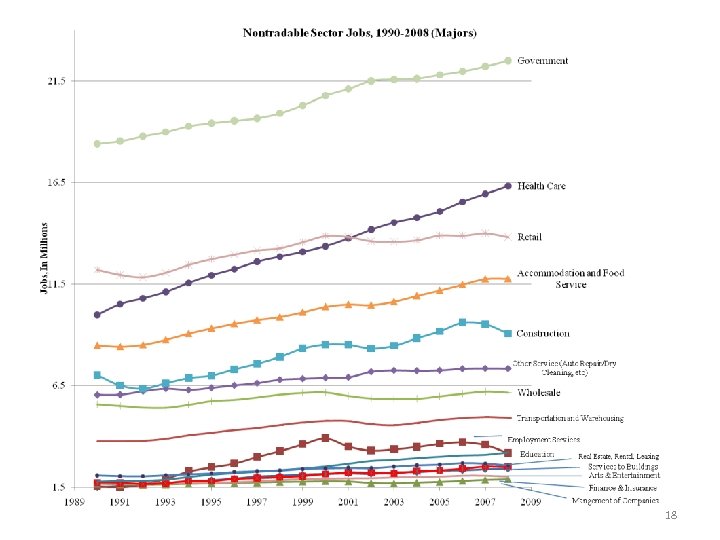

18

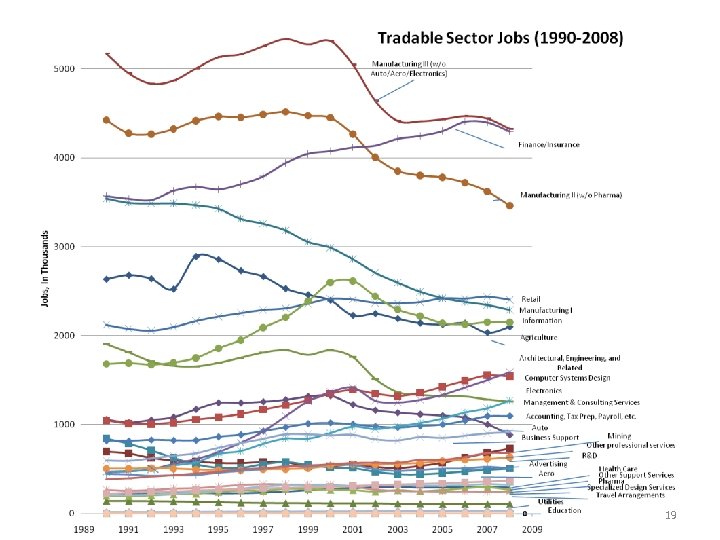

19

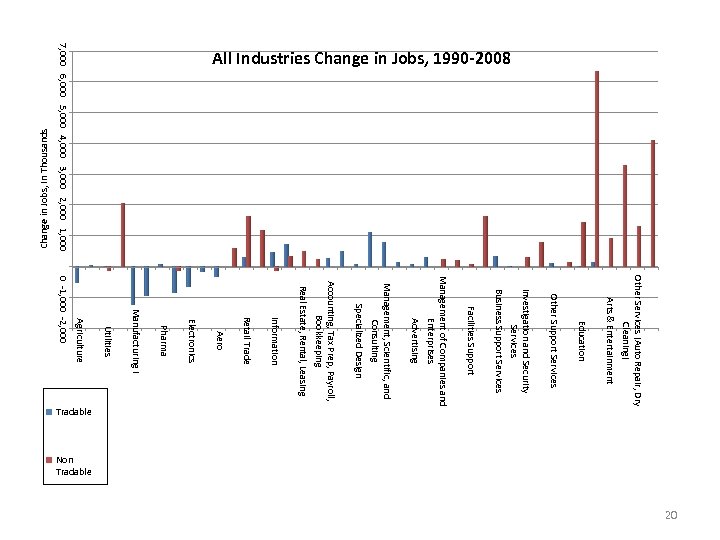

Change in Jobs, In Thousands 7, 000 6, 000 5, 000 4, 000 3, 000 2, 000 1, 000 All Industries Change in Jobs, 1990 -2008 Other Services (Auto Repair, Dry Cleaning) Arts & Entertainment Education Other Support Services Investigation and Security Services Business Support Services Facilities Support Management of Companies and Enterprises Advertising Management, Scientific, and Consulting Specialized Design Accounting, Tax Prep, Payroll, Bookkeeping Real Estate, Rental, Leasing Information Retail Trade Aero Electronics Pharma Manufacturing I Utilities Agriculture 0 -1, 000 -2, 000 Tradable Non Tradable 20

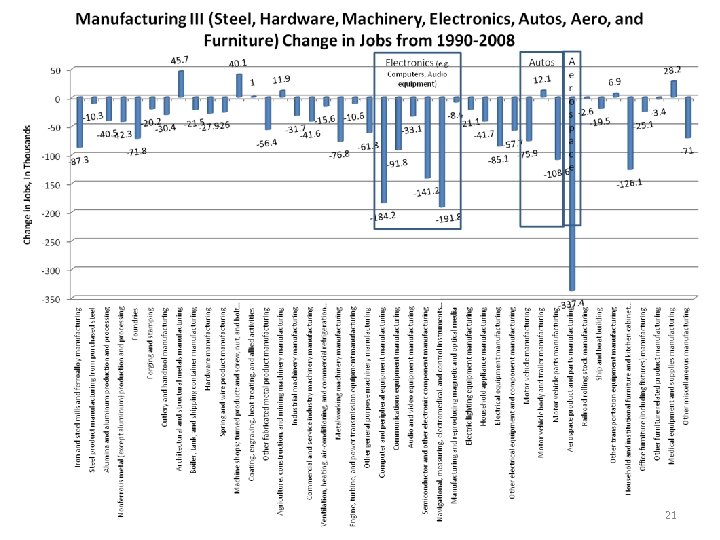

21

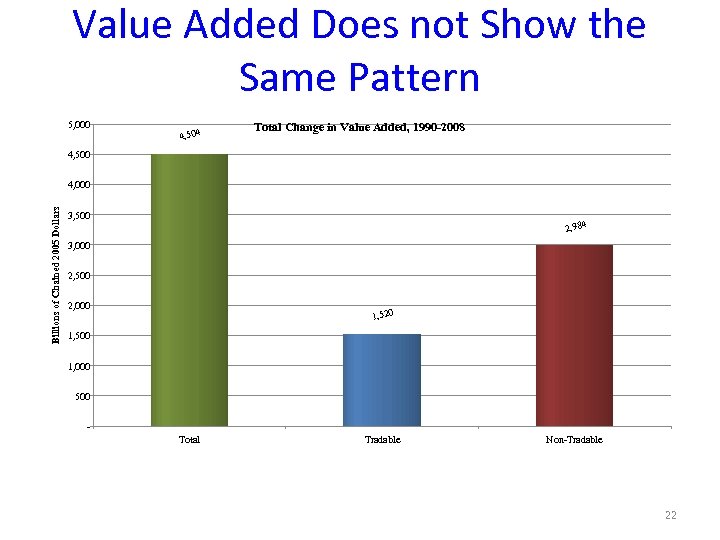

Value Added Does not Show the Same Pattern 5, 000 4, 504 Total Change in Value Added, 1990 -2008 4, 500 Billions of Chained 2005 Dollars 4, 000 3, 500 2, 984 3, 000 2, 500 2, 000 1, 520 1, 500 1, 000 500 Total Tradable Non-Tradable 22

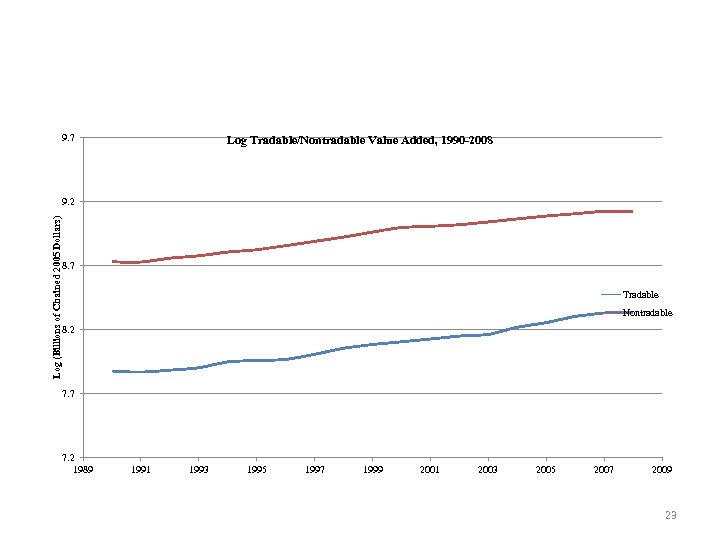

9. 7 Log Tradable/Nontradable Value Added, 1990 -2008 Log (Billions of Chained 2005 Dollars) 9. 2 8. 7 Tradable Nontradable 8. 2 7. 7 7. 2 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 23

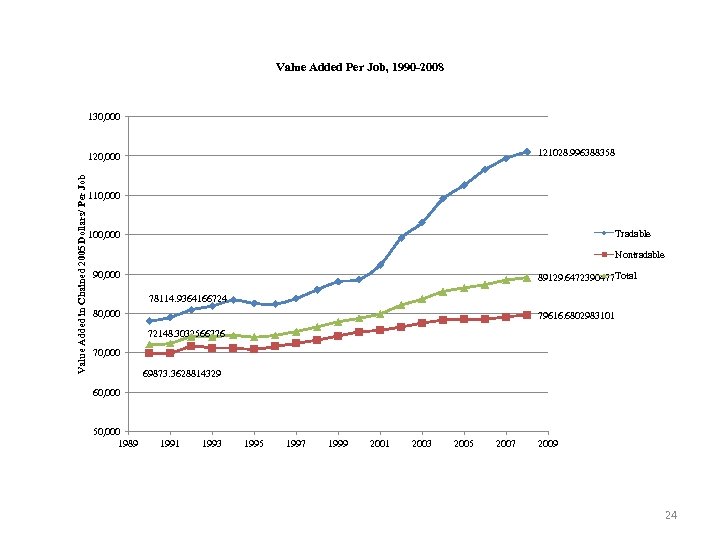

Value Added Per Job, 1990 -2008 130, 000 121028. 996388358 Value Added in Chained 2005 Dollars/ Per Job 120, 000 110, 000 Tradable 100, 000 Nontradable 90, 000 89129. 6472390477 Total 78114. 9364166724 80, 000 79616. 6802983101 72148. 3032566776 70, 000 69873. 3628814329 60, 000 50, 000 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 24

194dc8e268a47995f34d33cb3b83c05c.ppt