11823cf610d1375fb4d3f752f0bf4e24.ppt

- Количество слайдов: 8

Accelerate the value creation process and help the company to develop and grow 14 May 2012

Accelerate the value creation process and help the company to develop and grow 14 May 2012

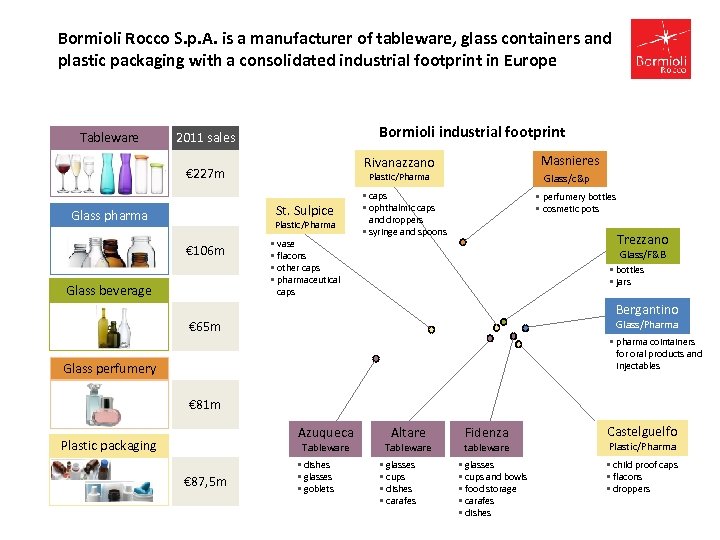

Bormioli Rocco S. p. A. is a manufacturer of tableware, glass containers and plastic packaging with a consolidated industrial footprint in Europe Tableware Bormioli industrial footprint 2011 sales Plastic/Pharma St. Sulpice Glass pharma Plastic/Pharma € 106 m Glass beverage Masnieres Rivanazzano € 227 m • vase • flacons • other caps • pharmaceutical caps Glass/c&p • caps • ophthalmic caps and droppers • syringe and spoons • perfumery bottles • cosmetic pots Trezzano Glass/F&B • bottles • jars Bergantino Glass/Pharma € 65 m • pharma cointainers for oral products and injectables Glass perfumery € 81 m Azuqueca Plastic packaging Tableware € 87, 5 m • dishes • glasses • goblets Altare Tableware • glasses • cups • dishes • carafes Fidenza tableware • glasses • cups and bowls • food storage • carafes • dishes Castelguelfo Plastic/Pharma • child proof caps • flacons • droppers

Bormioli Rocco S. p. A. is a manufacturer of tableware, glass containers and plastic packaging with a consolidated industrial footprint in Europe Tableware Bormioli industrial footprint 2011 sales Plastic/Pharma St. Sulpice Glass pharma Plastic/Pharma € 106 m Glass beverage Masnieres Rivanazzano € 227 m • vase • flacons • other caps • pharmaceutical caps Glass/c&p • caps • ophthalmic caps and droppers • syringe and spoons • perfumery bottles • cosmetic pots Trezzano Glass/F&B • bottles • jars Bergantino Glass/Pharma € 65 m • pharma cointainers for oral products and injectables Glass perfumery € 81 m Azuqueca Plastic packaging Tableware € 87, 5 m • dishes • glasses • goblets Altare Tableware • glasses • cups • dishes • carafes Fidenza tableware • glasses • cups and bowls • food storage • carafes • dishes Castelguelfo Plastic/Pharma • child proof caps • flacons • droppers

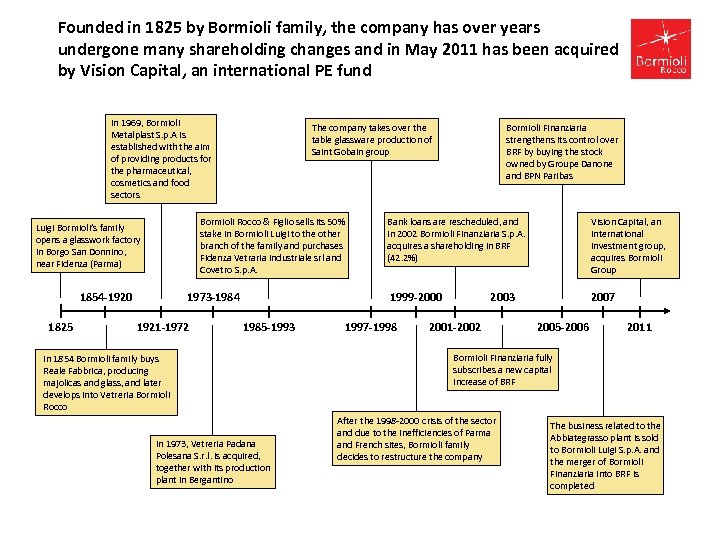

Founded in 1825 by Bormioli family, the company has over years undergone many shareholding changes and in May 2011 has been acquired by Vision Capital, an international PE fund In 1969, Bormioli Metalplast S. p. A is established with the aim of providing products for the pharmaceutical, cosmetics and food sectors 1854 -1920 1825 1973 -1984 1921 -1972 1985 -1993 In 1854 Bormioli family buys Reale Fabbrica, producing majolicas and glass, and later develops into Vetreria Bormioli Rocco In 1973, Vetreria Padana Polesana S. r. l. is acquired, together with its production plant in Bergantino Bank loans are rescheduled, and in 2002 Bormioli Finanziaria S. p. A. acquires a shareholding in BRF (42. 2%) Vision Capital, an international investment group, acquires Bormioli Group 1999 -2000 Bormioli Rocco & Figlio sells its 50% stake in Bormioli Luigi to the other branch of the family and purchases Fidenza Vetraria Industriale srl and Covetro S. p. A. Luigi Bormioli’s family opens a glasswork factory in Borgo San Donnino, near Fidenza (Parma) Bormioli Finanziaria strengthens its control over BRF by buying the stock owned by Groupe Danone and BPN Paribas The company takes over the table glassware production of Saint Gobain group 2007 1997 -1998 2003 2001 -2002 2005 -2006 2011 Bormioli Finanziaria fully subscribes a new capital increase of BRF After the 1998 -2000 crisis of the sector and due to the inefficiencies of Parma and French sites, Bormioli family decides to restructure the company The business related to the Abbiategrasso plant is sold to Bormioli Luigi S. p. A. and the merger of Bormioli Finanziaria into BRF is completed

Founded in 1825 by Bormioli family, the company has over years undergone many shareholding changes and in May 2011 has been acquired by Vision Capital, an international PE fund In 1969, Bormioli Metalplast S. p. A is established with the aim of providing products for the pharmaceutical, cosmetics and food sectors 1854 -1920 1825 1973 -1984 1921 -1972 1985 -1993 In 1854 Bormioli family buys Reale Fabbrica, producing majolicas and glass, and later develops into Vetreria Bormioli Rocco In 1973, Vetreria Padana Polesana S. r. l. is acquired, together with its production plant in Bergantino Bank loans are rescheduled, and in 2002 Bormioli Finanziaria S. p. A. acquires a shareholding in BRF (42. 2%) Vision Capital, an international investment group, acquires Bormioli Group 1999 -2000 Bormioli Rocco & Figlio sells its 50% stake in Bormioli Luigi to the other branch of the family and purchases Fidenza Vetraria Industriale srl and Covetro S. p. A. Luigi Bormioli’s family opens a glasswork factory in Borgo San Donnino, near Fidenza (Parma) Bormioli Finanziaria strengthens its control over BRF by buying the stock owned by Groupe Danone and BPN Paribas The company takes over the table glassware production of Saint Gobain group 2007 1997 -1998 2003 2001 -2002 2005 -2006 2011 Bormioli Finanziaria fully subscribes a new capital increase of BRF After the 1998 -2000 crisis of the sector and due to the inefficiencies of Parma and French sites, Bormioli family decides to restructure the company The business related to the Abbiategrasso plant is sold to Bormioli Luigi S. p. A. and the merger of Bormioli Finanziaria into BRF is completed

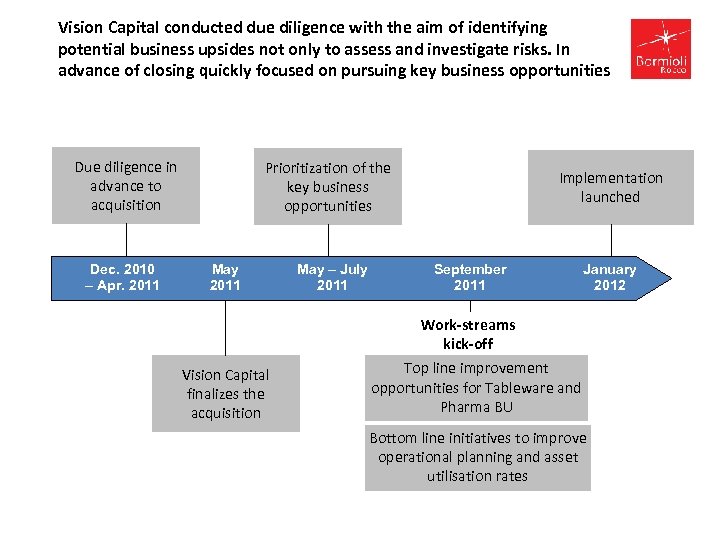

Vision Capital conducted due diligence with the aim of identifying potential business upsides not only to assess and investigate risks. In advance of closing quickly focused on pursuing key business opportunities Due diligence in advance to acquisition Dec. 2010 – Apr. 2011 Prioritization of the key business opportunities May 2011 May – July 2011 Implementation launched September 2011 January 2012 Work-streams kick-off Vision Capital finalizes the acquisition Top line improvement opportunities for Tableware and Pharma BU Bottom line initiatives to improve operational planning and asset utilisation rates

Vision Capital conducted due diligence with the aim of identifying potential business upsides not only to assess and investigate risks. In advance of closing quickly focused on pursuing key business opportunities Due diligence in advance to acquisition Dec. 2010 – Apr. 2011 Prioritization of the key business opportunities May 2011 May – July 2011 Implementation launched September 2011 January 2012 Work-streams kick-off Vision Capital finalizes the acquisition Top line improvement opportunities for Tableware and Pharma BU Bottom line initiatives to improve operational planning and asset utilisation rates

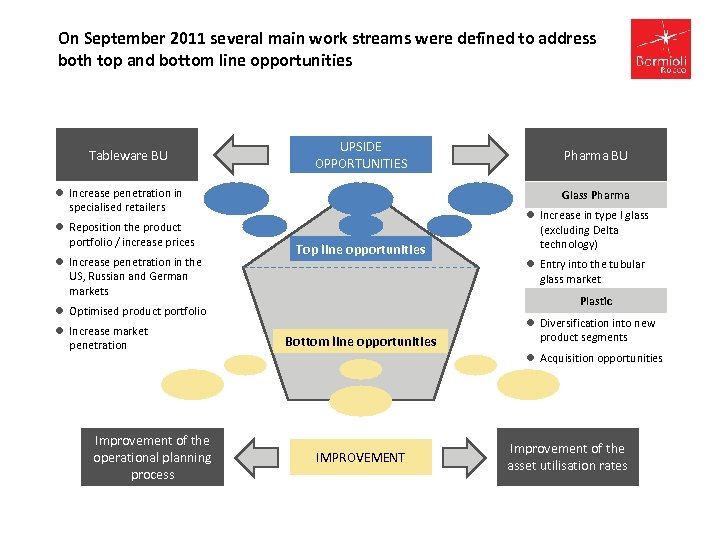

On September 2011 several main work streams were defined to address both top and bottom line opportunities Tableware BU UPSIDE OPPORTUNITIES l Increase penetration in specialised retailers l Reposition the product portfolio / increase prices l Increase penetration in the US, Russian and German markets Glass Pharma Top line opportunities Improvement of the operational planning process l Increase in type I glass (excluding Delta technology) l Entry into the tubular glass market Plastic l Optimised product portfolio l Increase market penetration Pharma BU Bottom line opportunities l Diversification into new product segments l Acquisition opportunities IMPROVEMENT Improvement of the asset utilisation rates

On September 2011 several main work streams were defined to address both top and bottom line opportunities Tableware BU UPSIDE OPPORTUNITIES l Increase penetration in specialised retailers l Reposition the product portfolio / increase prices l Increase penetration in the US, Russian and German markets Glass Pharma Top line opportunities Improvement of the operational planning process l Increase in type I glass (excluding Delta technology) l Entry into the tubular glass market Plastic l Optimised product portfolio l Increase market penetration Pharma BU Bottom line opportunities l Diversification into new product segments l Acquisition opportunities IMPROVEMENT Improvement of the asset utilisation rates

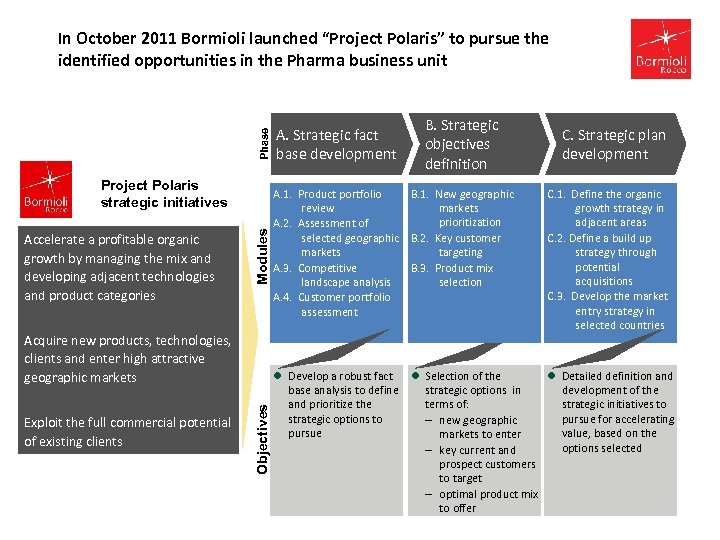

Phase In October 2011 Bormioli launched “Project Polaris” to pursue the identified opportunities in the Pharma business unit A. 1. Product portfolio B. 1. New geographic review markets prioritization A. 2. Assessment of selected geographic B. 2. Key customer markets targeting A. 3. Competitive B. 3. Product mix landscape analysis selection A. 4. Customer portfolio assessment l Develop a robust fact l Selection of the l Detailed definition and base analysis to define strategic options in development of the and prioritize the terms of: strategic initiatives to strategic options to pursue for accelerating new geographic pursue value, based on the markets to enter options selected key current and prospect customers to target optimal product mix to offer Acquire new products, technologies, clients and enter high attractive geographic markets Exploit the full commercial potential of existing clients C. Strategic plan development Modules Accelerate a profitable organic growth by managing the mix and developing adjacent technologies and product categories B. Strategic objectives definition Objectives Project Polaris strategic initiatives A. Strategic fact base development C. 1. Define the organic growth strategy in adjacent areas C. 2. Define a build up strategy through potential acquisitions C. 3. Develop the market entry strategy in selected countries

Phase In October 2011 Bormioli launched “Project Polaris” to pursue the identified opportunities in the Pharma business unit A. 1. Product portfolio B. 1. New geographic review markets prioritization A. 2. Assessment of selected geographic B. 2. Key customer markets targeting A. 3. Competitive B. 3. Product mix landscape analysis selection A. 4. Customer portfolio assessment l Develop a robust fact l Selection of the l Detailed definition and base analysis to define strategic options in development of the and prioritize the terms of: strategic initiatives to strategic options to pursue for accelerating new geographic pursue value, based on the markets to enter options selected key current and prospect customers to target optimal product mix to offer Acquire new products, technologies, clients and enter high attractive geographic markets Exploit the full commercial potential of existing clients C. Strategic plan development Modules Accelerate a profitable organic growth by managing the mix and developing adjacent technologies and product categories B. Strategic objectives definition Objectives Project Polaris strategic initiatives A. Strategic fact base development C. 1. Define the organic growth strategy in adjacent areas C. 2. Define a build up strategy through potential acquisitions C. 3. Develop the market entry strategy in selected countries

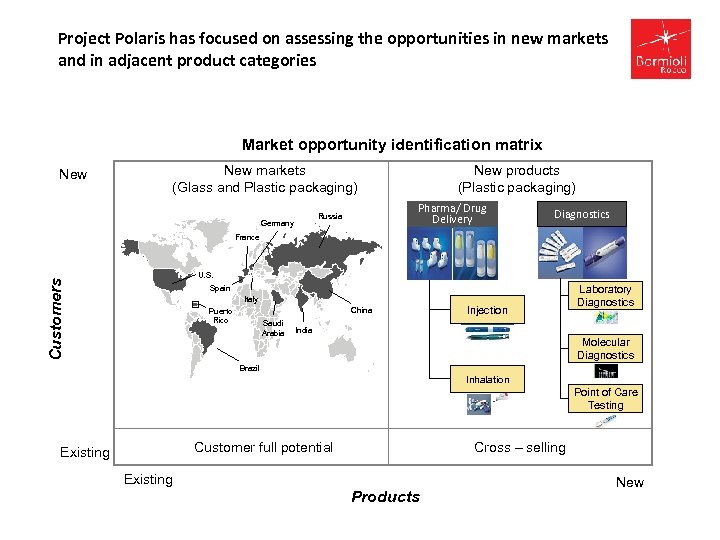

Project Polaris has focused on assessing the opportunities in new markets and in adjacent product categories Market opportunity identification matrix New markets (Glass and Plastic packaging) Pharma/ Drug Delivery Russia Germany New products (Plastic packaging) Diagnostics France Customers U. S. Spain Italy China Puerto Rico Saudi Arabia Injection Laboratory Diagnostics India Molecular Diagnostics Brazil Inhalation Point of Care Testing Customer full potential Existing Cross – selling Existing Products New

Project Polaris has focused on assessing the opportunities in new markets and in adjacent product categories Market opportunity identification matrix New markets (Glass and Plastic packaging) Pharma/ Drug Delivery Russia Germany New products (Plastic packaging) Diagnostics France Customers U. S. Spain Italy China Puerto Rico Saudi Arabia Injection Laboratory Diagnostics India Molecular Diagnostics Brazil Inhalation Point of Care Testing Customer full potential Existing Cross – selling Existing Products New

Key take-ways in order to help businesses develop and grow l Provide in-depth managerial expertise to bring extensive experience on a specific sector and to help the business excel l When necessary, conduct strategic repositioning of businesses to unlock value l Support management in developing a 100 -day plan to rapidly pursue identified opportunities and: ‒ foster strategic geographical expansion in promising countries ‒ innovate product range and diversify for cross-selling and up-selling ‒ pursue build-up acquisitions to widen the companies’ dimension and leverage on operational synergies

Key take-ways in order to help businesses develop and grow l Provide in-depth managerial expertise to bring extensive experience on a specific sector and to help the business excel l When necessary, conduct strategic repositioning of businesses to unlock value l Support management in developing a 100 -day plan to rapidly pursue identified opportunities and: ‒ foster strategic geographical expansion in promising countries ‒ innovate product range and diversify for cross-selling and up-selling ‒ pursue build-up acquisitions to widen the companies’ dimension and leverage on operational synergies