b91ef72f8c343ee3ec199e50a5e3ddba.ppt

- Количество слайдов: 86

ACCA Paper F 6 Taxation 万 莹 E-mail: jxcjdx_wy@163. com

n Related taxes Income tax -unincorporated business and individuals Corporation tax -corporate business Capital gains tax -unincorporated business and individuals Value added tax -corporate and unincorporated business National insurance -employers, employees and the self-employed Inheritance tax – the dead n Teaching objectives — Compute tax liabilities — Explain the basis of their calculations — Apply tax planning techniques for individuals and companies

n To study efficiently and effectively — Positive attitude — Exam focus — Timetable your study — Preview — Review, review — Do exercises, the more the better

n Format of the examination Five compulsory questions by a 3 -hour paper: ● ● ● Question 1 will focus on income tax and question 2 on corporation tax. Total will be for 55 marks, with one for 30 marks and the other being 25 marks. Question 3 will focus on chargeable gains (either personal or corporate) and will be for 15 marks. Questions 4 and 5 will be on any area of the syllabus and will r be for 15 marks each.

Chapter 1 Introduction to the UK tax system n The function and purpose of taxation — Economic factors — Social factors — Environmental factors Administrative cost vs. Compliance cost n Different types of taxes Finance acts — The documents that make changes which apply mainly to the tax year ahead. (FA 2010) Direct taxes vs. Indirect taxes Revenue tax vs. Capital tax

n Administration HM Revenue and Customs (HMRC) n Tax avoidance and tax evasion Tax evasion — Not paying taxes legally due. Tax avoidance — Altering behavior in such a way as to reduce your legal tax liability.

Part A Taxation of individuals Chapter 2 Outline of Income Tax n The scope of income tax Resident jurisdiction—infinite liability—worldwide income Source jurisdiction — definite liability—UK income An individual is resident in the UK if : — He is present in the UK for 183 days or more — He makes visits to the UK averaging 91 days or more a year for each of four consecutive years — His residence in the UK is of a habitual nature

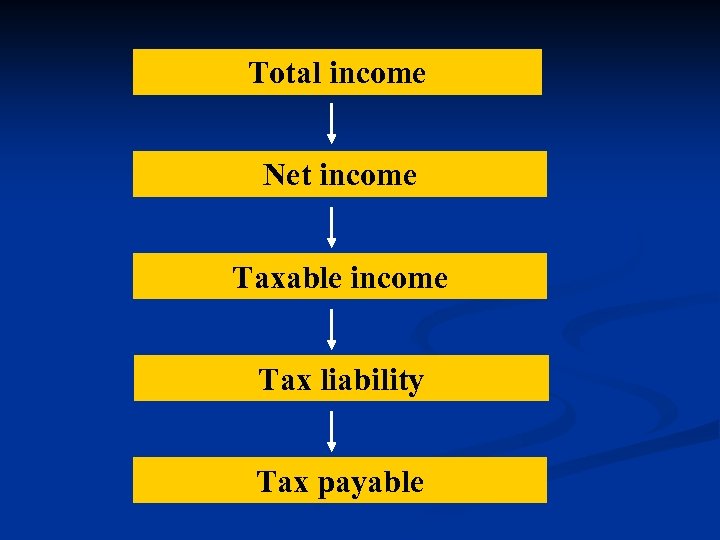

Total income Net income Taxable income Tax liability Tax payable

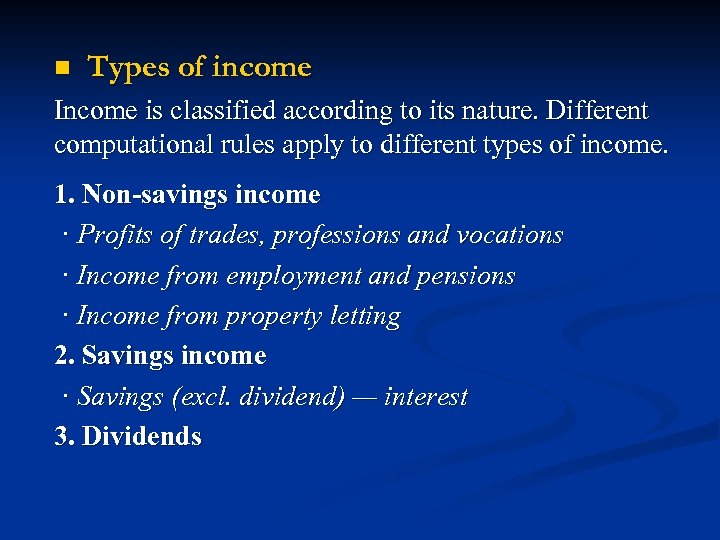

n Types of income Income is classified according to its nature. Different computational rules apply to different types of income. 1. Non-savings income · Profits of trades, professions and vocations · Income from employment and pensions · Income from property letting 2. Savings income · Savings (excl. dividend) — interest 3. Dividends

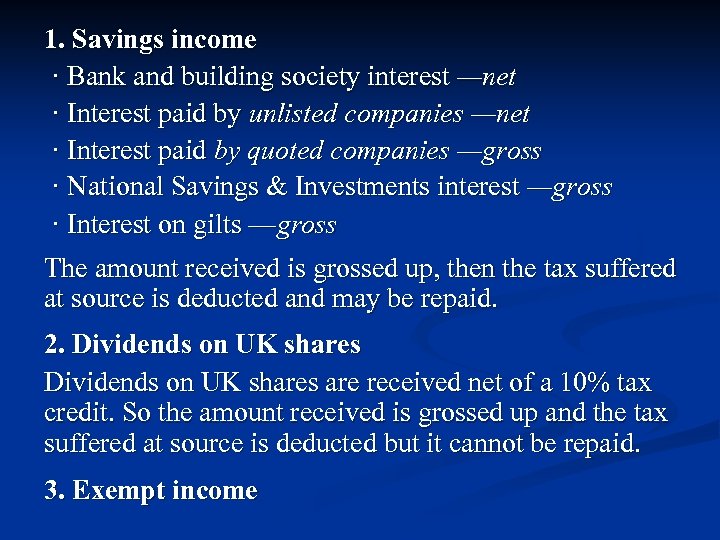

1. Savings income · Bank and building society interest —net · Interest paid by unlisted companies —net · Interest paid by quoted companies —gross · National Savings & Investments interest —gross · Interest on gilts —gross The amount received is grossed up, then the tax suffered at source is deducted and may be repaid. 2. Dividends on UK shares are received net of a 10% tax credit. So the amount received is grossed up and the tax suffered at source is deducted but it cannot be repaid. 3. Exempt income

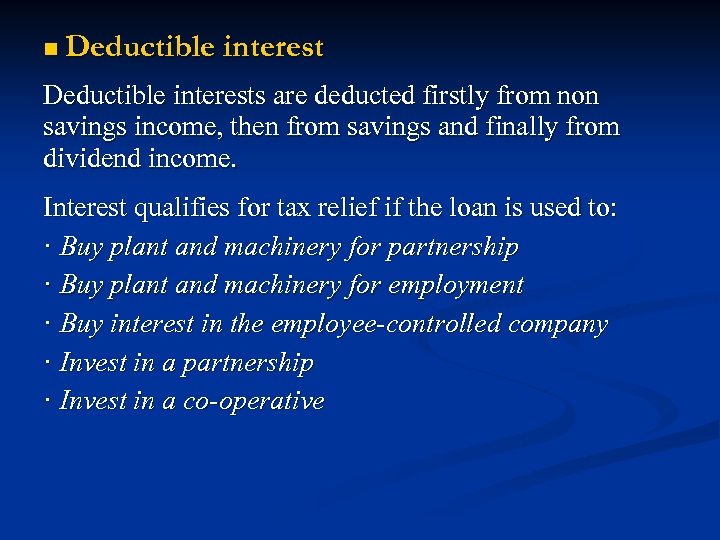

n Deductible interests are deducted firstly from non savings income, then from savings and finally from dividend income. Interest qualifies for tax relief if the loan is used to: · Buy plant and machinery for partnership · Buy plant and machinery for employment · Buy interest in the employee-controlled company · Invest in a partnership · Invest in a co-operative

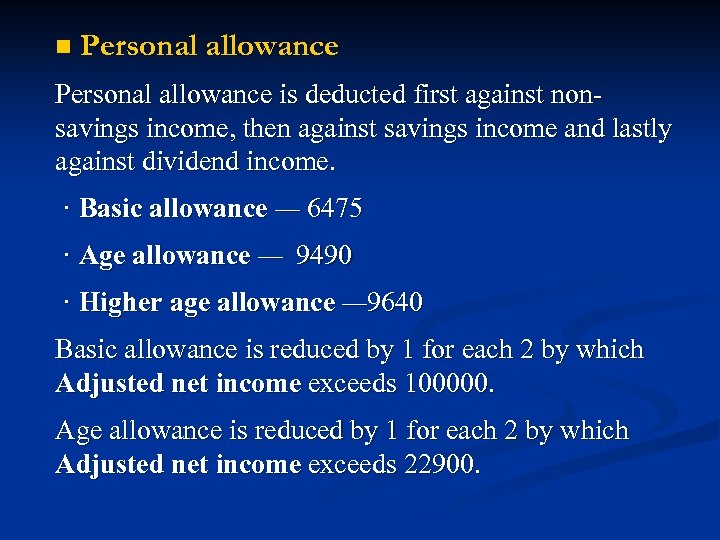

n Personal allowance is deducted first against nonsavings income, then against savings income and lastly against dividend income. · Basic allowance — 6475 · Age allowance — 9490 · Higher age allowance — 9640 Basic allowance is reduced by 1 for each 2 by which Adjusted net income exceeds 100000. Age allowance is reduced by 1 for each 2 by which Adjusted net income exceeds 22900.

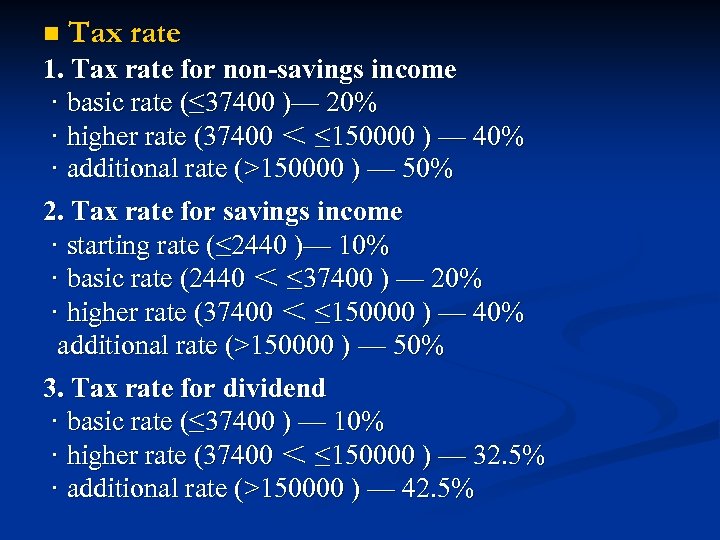

n Tax rate 1. Tax rate for non-savings income · basic rate (≤ 37400 )— 20% · higher rate (37400 < ≤ 150000 ) — 40% · additional rate (>150000 ) — 50% 2. Tax rate for savings income · starting rate (≤ 2440 )— 10% · basic rate (2440 < ≤ 37400 ) — 20% · higher rate (37400 < ≤ 150000 ) — 40% additional rate (>150000 ) — 50% 3. Tax rate for dividend · basic rate (≤ 37400 ) — 10% · higher rate (37400 < ≤ 150000 ) — 32. 5% · additional rate (>150000 ) — 42. 5%

Notes: There is only one set of rate bands to cover all types of income. Savings income is taxed as the top part of a tax payer’s income. Dividend income is taxed as the top-most slice of taxable income.

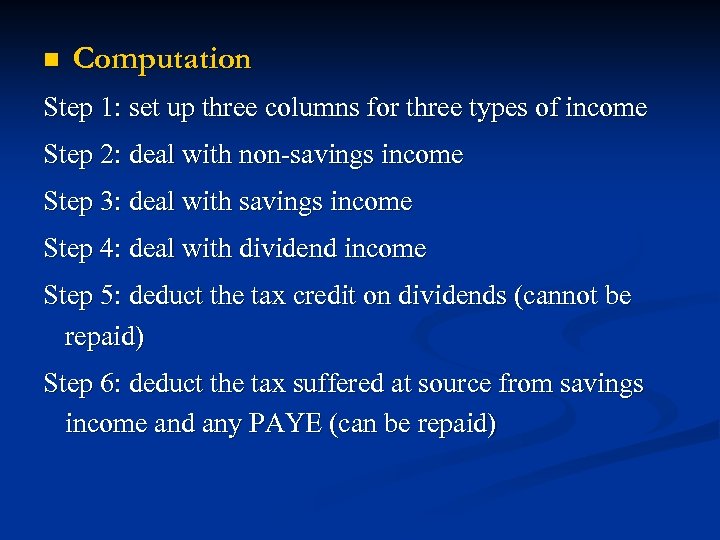

n Computation Step 1: set up three columns for three types of income Step 2: deal with non-savings income Step 3: deal with savings income Step 4: deal with dividend income Step 5: deduct the tax credit on dividends (cannot be repaid) Step 6: deduct the tax suffered at source from savings income and any PAYE (can be repaid)

n Gift Aid A gift aid donation is treated as though it is paid net of basic rate tax. Additional tax relief for higher rate taxpayers is given by increasing the donor’s basic rate band by the gross amount of the gift. n Joint held property Income on property held jointly by married couples and members of civil partnership is treated as if it were shared equally unless the couple makes a joint declaration of the actual shares of ownership.

n Adjusted net income Adjusted income is net income less the gross amounts of: · personal pension contributions · gift aid donations The restrictions on the personal allowance and age allowance are calculated in relation to adjusted net income.

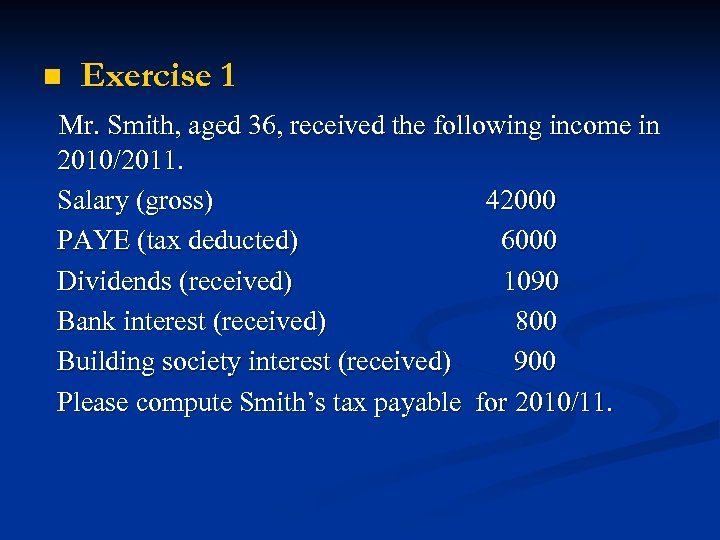

n Exercise 1 Mr. Smith, aged 36, received the following income in 2010/2011. Salary (gross) 42000 PAYE (tax deducted) 6000 Dividends (received) 1090 Bank interest (received) 800 Building society interest (received) 900 Please compute Smith’s tax payable for 2010/11.

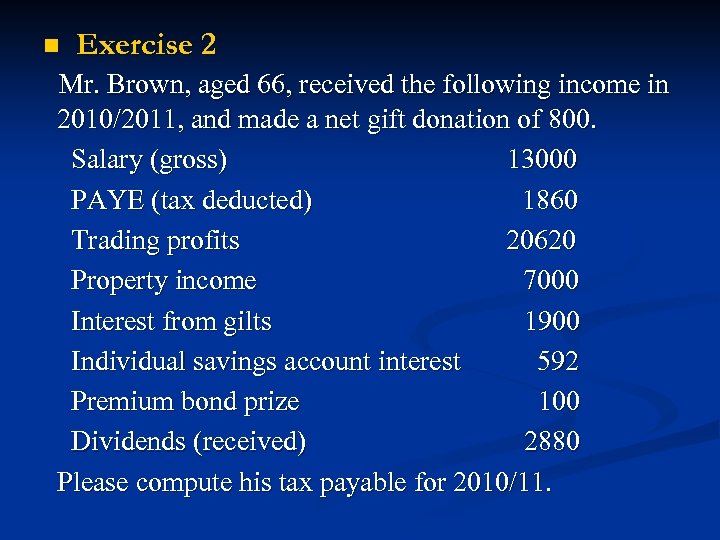

n Exercise 2 Mr. Brown, aged 66, received the following income in 2010/2011, and made a net gift donation of 800. Salary (gross) 13000 PAYE (tax deducted) 1860 Trading profits 20620 Property income 7000 Interest from gilts 1900 Individual savings account interest 592 Premium bond prize 100 Dividends (received) 2880 Please compute his tax payable for 2010/11.

Chapter 3 Employment Income Distinction between employment and selfemployment n Employment involves a contract of service, whereas self employment involves a contract for services. Taxpayers tend to prefer self employment because: — the rules on deductions are more generous — self employment generally pay less NICs

Employment income includes income of employees and directors. ★ Earnings — on receipts basis · the time when payment is made · the time when entitlement to payment arises ★ Taxable benefits — on receipts basis ★ Pensions — on accruals basis n n Allowable deductions 1. General rule Expenses can be deducted only if they are incurred wholly, exclusively and necessarily in performing the duties.

2. Travel expenses Qualifying travel expenses — obliged to incur in traveling in the performance of duties Normal commuting cost is not deductible. ★Exceptions · Site based employee — relief for the costs of all journeys made from home to wherever they are working · Temporary workplace — relief for all related travel, accommodation and subsistence expenses

3. Other expenses ·contributions to occupational pension schemes ·subscriptions to professional bodies ·insurance premiums to cover employment-related liabilities and payments ·capital allowances on plant and machinery ·mileage allowance relief ·charitable donations under the payroll deduction scheme

Chapter 4 Taxable Benefits and PAYE System n Types of employees Excluded employees are only taxable on certain benefits. · lower paid employee · full time director or director in non-profitable Co. P 11 D employees are taxable on all benefits. n Benefits taxable on all employees 1. Vouchers are taxable on all employees at the cost of providing the benefits.

2. Accommodation · The rent actually paid · Annual value · Additional amount: (cost-75000)× 5% There is no taxable benefit for job related accommodation. n Benefits taxable on P 11 D employees 1. Expenses ★ General business expenses ★ Private incidental expenses ★ Expenses related to living accommodation

2. Cars ★ Car benefit (list price-capital contributions)×% · The % depends on the CO 2 emissions of the car. · Car emitting 121 -130 g/km have % of 15%, the % increases by 1% for each 5 g/km up to a maximum of 35%, The % is increased by 3% for diesel cars. · Car emitting 76-120 g/km have % of 10% · Car emitting ≤ 75 g/km have % of 5% The benefits are scaled down on a time basis. The benefit is then reduced by any contribution by the employee for private use.

★ Fuel for cars Fuel for private use is charged at the same % of car benefit of base figure (18000 for 2010/11). No deduction for partial reimbursement by employee. ★ Vans and heavier commercial vehicles The benefit of private use of van is an annual scale charge of 3000 or 500. There is no taxable benefit where an employee takes a van home. There is no taxable benefit of partial private use of heavier commercial vehicles.

3. Beneficial loans Loans of over 5000 give rise to taxable benefits equal to the difference between the actual interest and interest at the official rate. · Average method · Strict method A written-off of a loan gives rise to a taxable benefit equal to the amount written off. ★ Qualifying loans

4. Private use of other asset 1. Use benefit If assets are made available for private use, the taxable benefit is the higher of 20% of the market value when first provided as a benefit to any employees and the rent paid by the employer. The charge is time-apportioned and reduced by any contribution made by the employee. 2. Transfer benefit If the asset is subsequently given to the employee, the taxable benefit is the higher of: · Original cost less amounts already taxed · Market value at date of gift less any contribution

5. Scholarships The employee is taxable on the cost of scholarships unless the payments are not more than 25% of its total amount. 6. Residual charge A residual charge is made on the taxable value of other benefits at the cost of the benefit less any contribution made by the employees. Excluded employees are only taxed on the second hand value of any benefit that could be converted into money. n Exempt benefits

n The PAYE system The objective of PAYE system is to deduct the correct amount of tax over the tax year. It is the employer’s duty to deduct income tax from the pay of his employees. Failing to do this he may be subject to penalties. 1. Scope of PAYE system most cash payments and certain non-cash payments 2. Operation of PAYE system Tax is normally worked out on a cumulative basis.

3. PAYE code The PAYE code number reflects the allowances which can be set against the employee’s total income. An employee’s PAYE code is designed to ensure that allowances are given evenly over the year. The code number is determined by deleting the last digit in the sum representing the employee’s tax free allowances. 4. Payment under PAYE system The employer must pay over the tax monthly, 14 days after the end of each tax month — 19 th of each month.

Chapter 5 Pensions n Pension arrangements 1. Occupational pension scheme · Defined benefits arrangements · Defined contribution arrangements 2. Personal pensions Any individual (whether employed or not) may join a personal pension scheme. An individual may make a number of different pension arrangements.

n Methods of giving tax relief 1. Contributions to personal pensions · paid net of basic rate tax · extending the basic rate band by the gross amount 2. Contributions to occupational pensions deducted from earnings before operating PAYE n Limits of pension scheme 1. Limits of personal pensions The maximum amount of contributions is the higher of: · relevant UK earnings · the basic amount(3600 for 2010/11)

2. Annual allowance The limit applies to all the pensions one makes, not each of them. There is a charge to income tax on the excess. 3. Lifetime allowance If the pension fund exceeds the lifetime allowance this will give rise to an income tax charge on the excess value of the fund. n Benefits An individual can take one quarter of his pension fund as a tax free lump sum, and the balance as a pension.

Chapter 6 Property Income n Property business income 1. Income taxable · rents under any lease or tenancy agreement · premium received on the grant of a short lease All the rents and expenses for all properties are pooled to give a single profit or loss. Property income is computed for tax year on accruals basis.

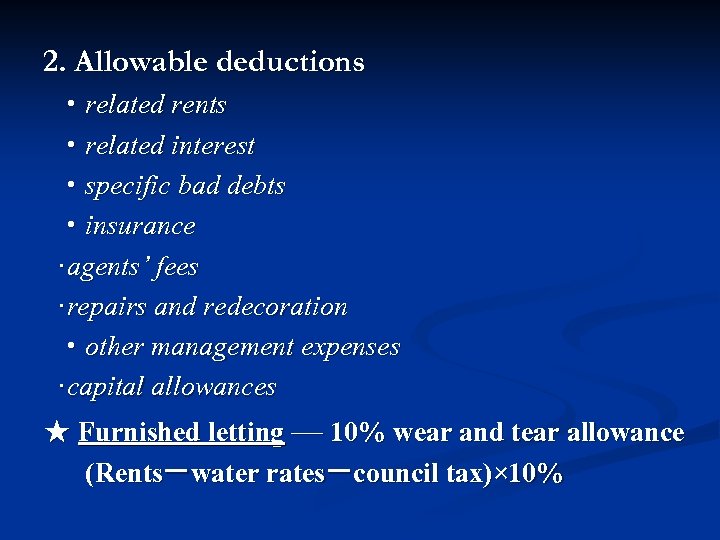

2. Allowable deductions ·related rents ·related interest ·specific bad debts ·insurance ·agents’ fees ·repairs and redecoration ·other management expenses ·capital allowances ★ Furnished letting — 10% wear and tear allowance (Rents-water rates-council tax)× 10%

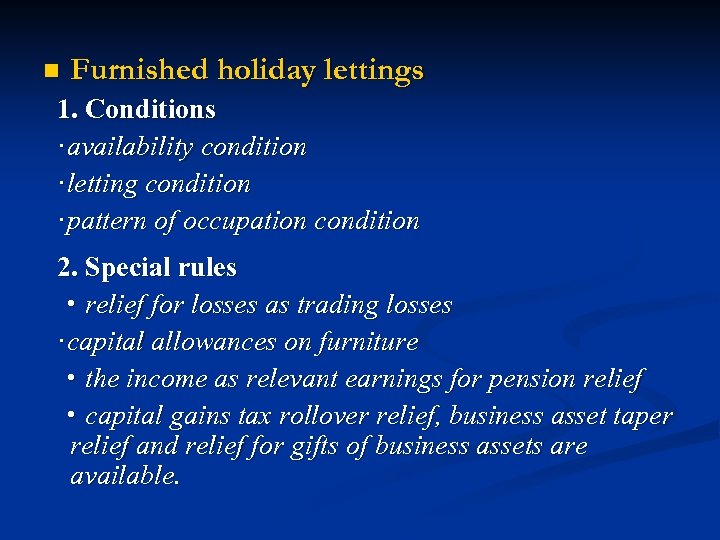

n Furnished holiday lettings 1. Conditions ·availability condition ·letting condition ·pattern of occupation condition 2. Special rules ·relief for losses as trading losses ·capital allowances on furniture ·the income as relevant earnings for pension relief ·capital gains tax rollover relief, business asset taper relief and relief for gifts of business assets are available.

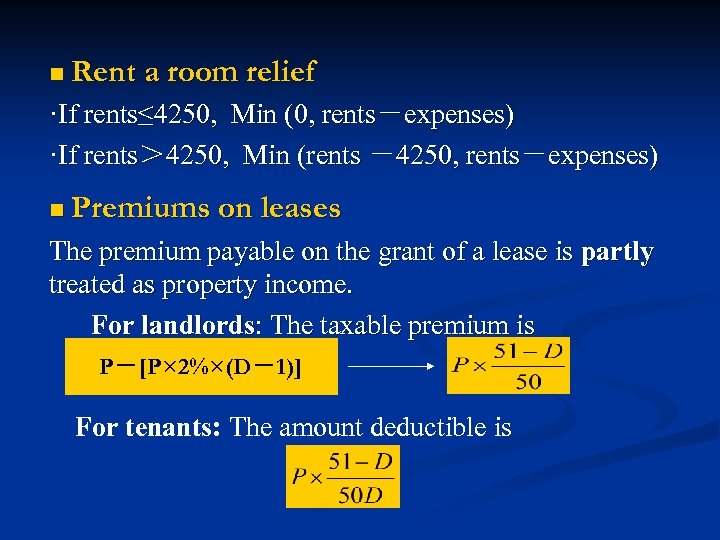

n Rent a room relief ·If rents≤ 4250, Min (0, rents-expenses) ·If rents> 4250, Min (rents -4250, rents-expenses) n Premiums on leases The premium payable on the grant of a lease is partly treated as property income. For landlords: The taxable premium is P-[P× 2%×(D-1)] For tenants: The amount deductible is

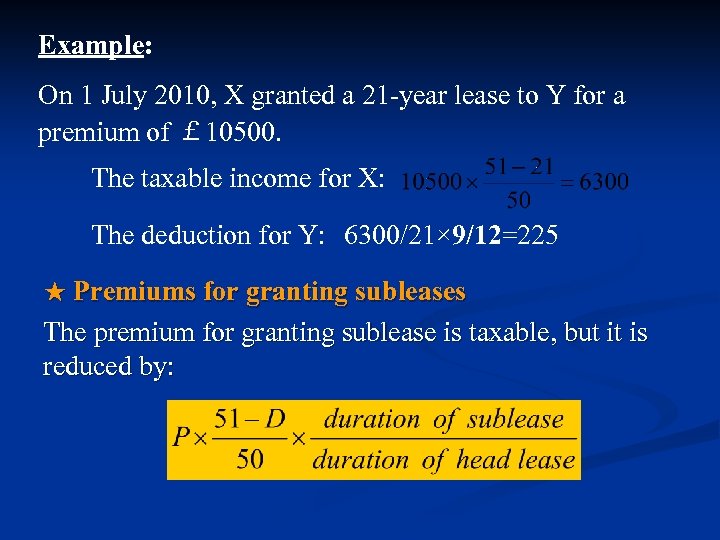

Example: On 1 July 2010, X granted a 21 -year lease to Y for a premium of £ 10500. The taxable income for X: The deduction for Y: 6300/21× 9/12=225 ★ Premiums for granting subleases The premium for granting sublease is taxable, but it is reduced by:

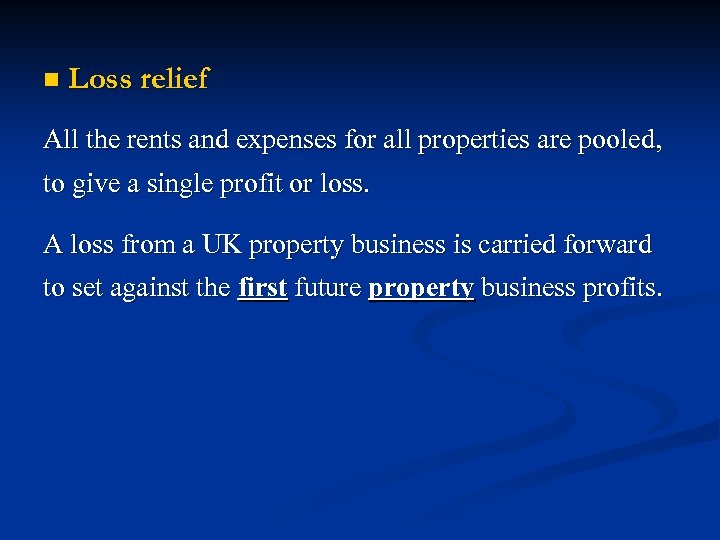

n Loss relief All the rents and expenses for all properties are pooled, to give a single profit or loss. A loss from a UK property business is carried forward to set against the first future property business profits.

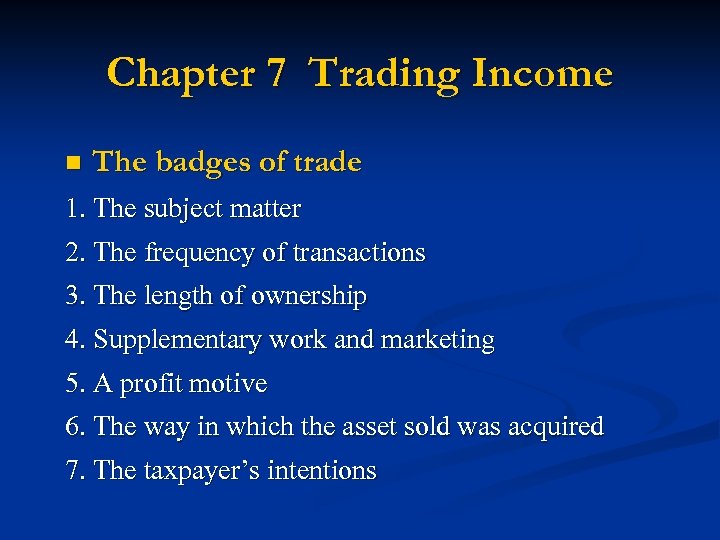

Chapter 7 Trading Income n The badges of trade 1. The subject matter 2. The frequency of transactions 3. The length of ownership 4. Supplementary work and marketing 5. A profit motive 6. The way in which the asset sold was acquired 7. The taxpayer’s intentions

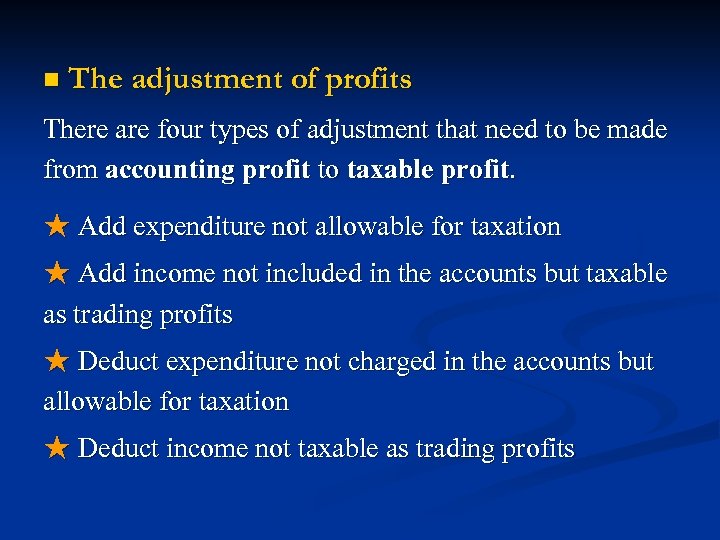

n The adjustment of profits There are four types of adjustment that need to be made from accounting profit to taxable profit. ★ Add expenditure not allowable for taxation ★ Add income not included in the accounts but taxable as trading profits ★ Deduct expenditure not charged in the accounts but allowable for taxation ★ Deduct income not taxable as trading profits

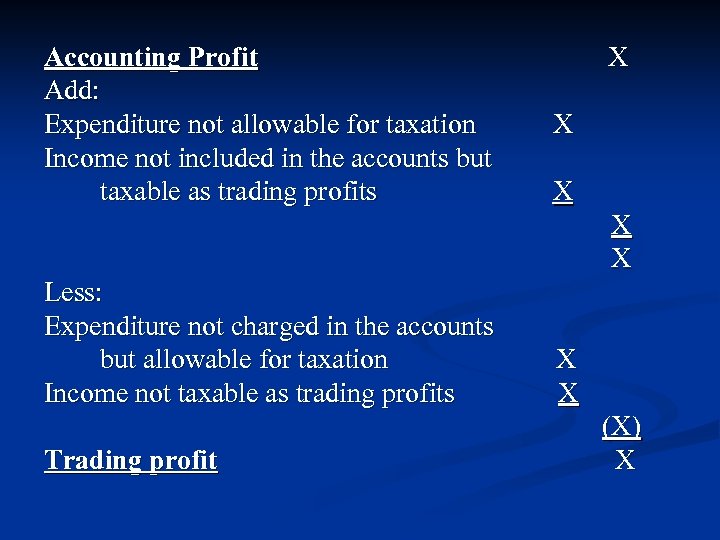

Accounting Profit Add: Expenditure not allowable for taxation Income not included in the accounts but taxable as trading profits X X X Less: Expenditure not charged in the accounts but allowable for taxation Income not taxable as trading profits Trading profit X X (X) X

n Non-deductible expenditure 1. Expenditure not incurred wholly and exclusively for trading purposes (W&E test) · remoteness test · duality test 2. Payments contrary to public policy and illegal payments Fines, interest on tax paid late, penalties, payments constituting a criminal offence, defalcation are not deductible. But parking fines and petty theft by non-senior employees which is not covered by insurance are generally allowed.

3. Capital expenditure vs. revenue expenditure · Treatment of restoration costs · Repair vs. improvement costs ★ Patents and trade marks 4. Bad debts Impairment debts incurred in the course of a business are deductible. The recovery of deducted bad debts already written off is taxable. 5. Unpaid remuneration and employee benefit contributions

6. Entertaining and gifts Entertaining expenditure and gifts are disallowed except for employees. ★ Gifts to customers are allowed if: · Cost less than £ 50 per recipient per year · Not food, drink, tobacco or vouchers · Carry a conspicuous advertisement for the company 7. Lease charges for expensive cars ★ Exception: low emission cars

8. Patent royalties and copyright royalties Patent and copyright royalties paid in connection with an individual’s trade are deductible as trade expenses. 9. National insurance contributions No deduction is allowed for any NICs except for employer’s contribution. 10. Penalties and interest on tax Penalties and interest on late paid tax are not deductible. 11. Appropriations Salary or interests on capital paid to a proprietor are not deductible.

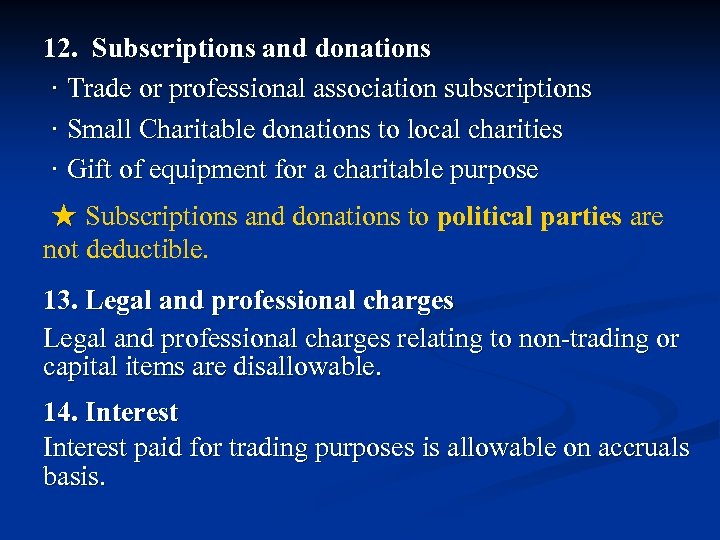

12. Subscriptions and donations · Trade or professional association subscriptions · Small Charitable donations to local charities · Gift of equipment for a charitable purpose ★ Subscriptions and donations to political parties are not deductible. 13. Legal and professional charges relating to non-trading or capital items are disallowable. 14. Interest paid for trading purposes is allowable on accruals basis.

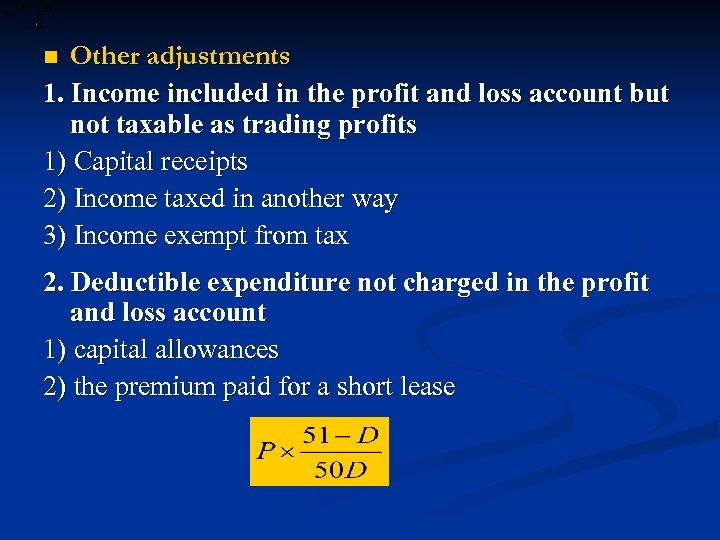

Other adjustments 1. Income included in the profit and loss account but not taxable as trading profits 1) Capital receipts 2) Income taxed in another way 3) Income exempt from tax n 2. Deductible expenditure not charged in the profit and loss account 1) capital allowances 2) the premium paid for a short lease

n Relief for pre-trading expenditure Any allowable revenue expenditure incurred in the seven years before a company commences to trade is treated as an expense incurred on the first day of trading.

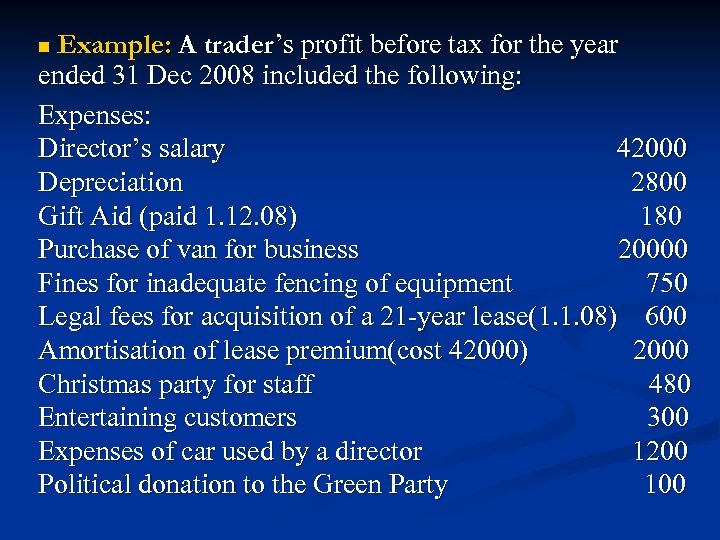

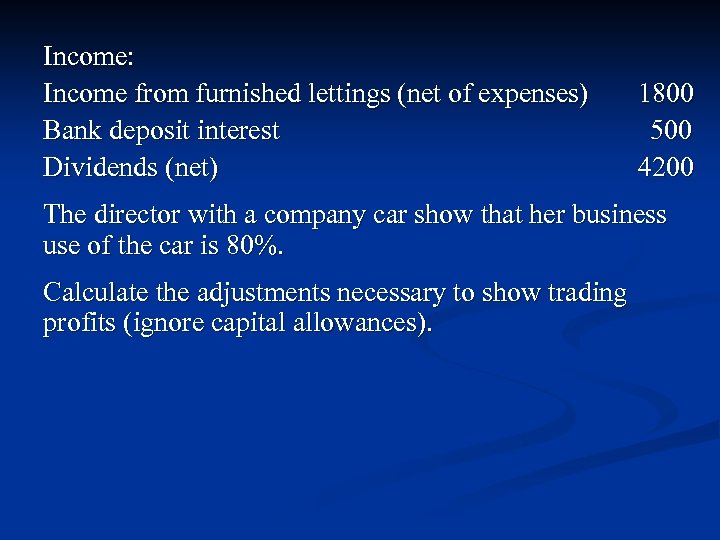

Example: A trader’s profit before tax for the year ended 31 Dec 2008 included the following: Expenses: Director’s salary 42000 Depreciation 2800 Gift Aid (paid 1. 12. 08) 180 Purchase of van for business 20000 Fines for inadequate fencing of equipment 750 Legal fees for acquisition of a 21 -year lease(1. 1. 08) 600 Amortisation of lease premium(cost 42000) 2000 Christmas party for staff 480 Entertaining customers 300 Expenses of car used by a director 1200 Political donation to the Green Party 100 n

Income: Income from furnished lettings (net of expenses) Bank deposit interest Dividends (net) 1800 500 4200 The director with a company car show that her business use of the car is 80%. Calculate the adjustments necessary to show trading profits (ignore capital allowances).

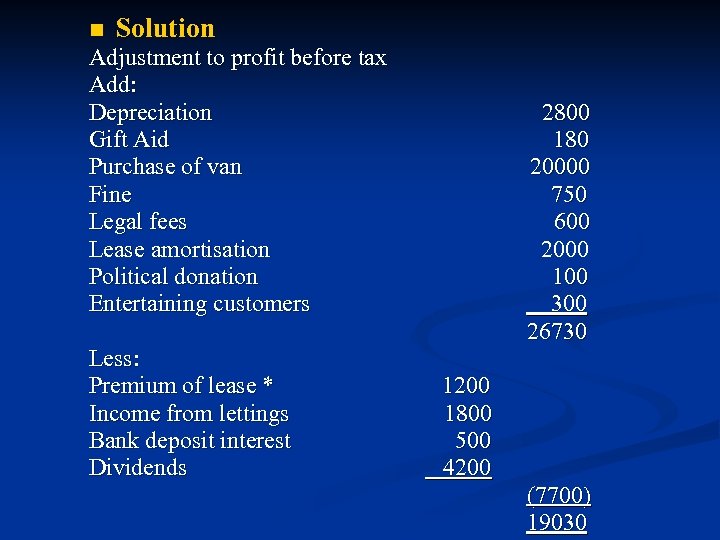

n Solution Adjustment to profit before tax Add: Depreciation Gift Aid Purchase of van Fine Legal fees Lease amortisation Political donation Entertaining customers Less: Premium of lease * Income from lettings Bank deposit interest Dividends 2800 180 20000 750 600 2000 100 300 26730 1200 1800 500 4200 (7700) 19030

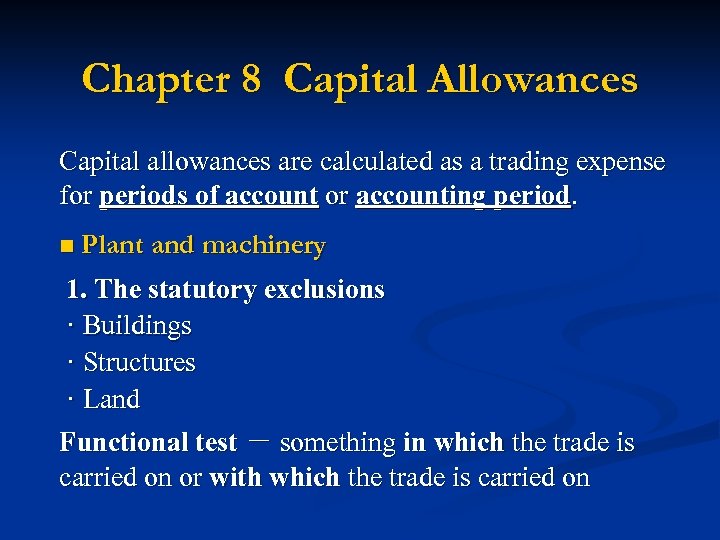

Chapter 8 Capital Allowances Capital allowances are calculated as a trading expense for periods of account or accounting period. n Plant and machinery 1. The statutory exclusions · Buildings · Structures · Land Functional test - something in which the trade is carried on or with which the trade is carried on

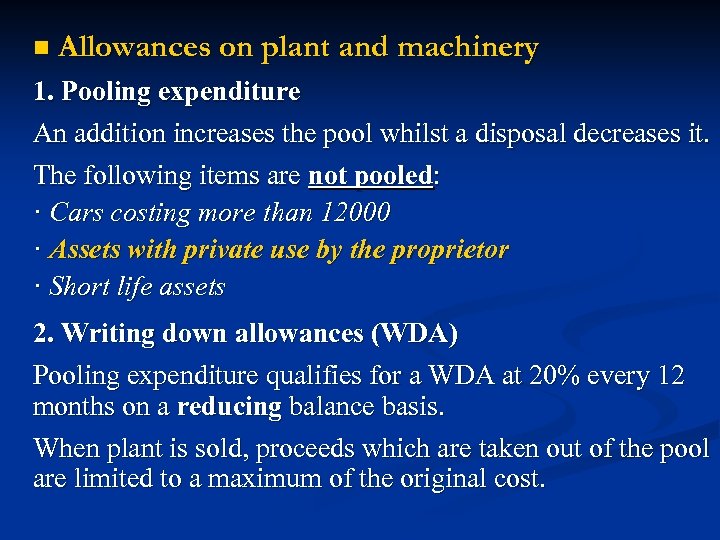

n Allowances on plant and machinery 1. Pooling expenditure An addition increases the pool whilst a disposal decreases it. The following items are not pooled: · Cars costing more than 12000 · Assets with private use by the proprietor · Short life assets 2. Writing down allowances (WDA) Pooling expenditure qualifies for a WDA at 20% every 12 months on a reducing balance basis. When plant is sold, proceeds which are taken out of the pool are limited to a maximum of the original cost.

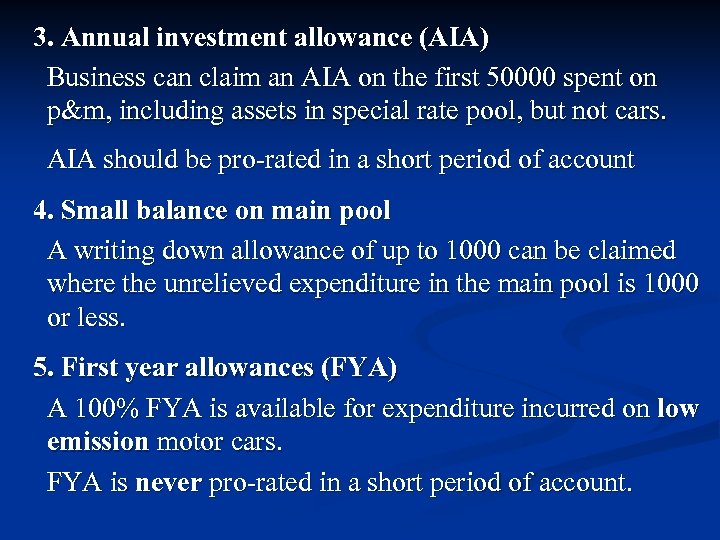

3. Annual investment allowance (AIA) Business can claim an AIA on the first 50000 spent on p&m, including assets in special rate pool, but not cars. AIA should be pro-rated in a short period of account 4. Small balance on main pool A writing down allowance of up to 1000 can be claimed where the unrelieved expenditure in the main pool is 1000 or less. 5. First year allowances (FYA) A 100% FYA is available for expenditure incurred on low emission motor cars. FYA is never pro-rated in a short period of account.

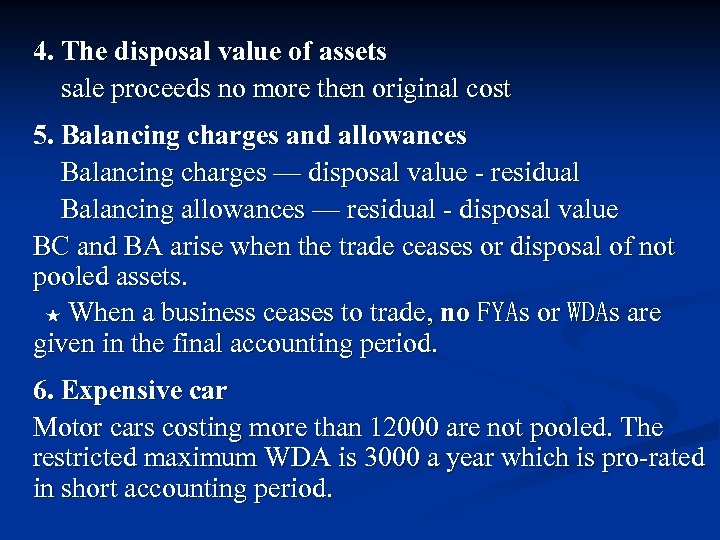

4. The disposal value of assets sale proceeds no more then original cost 5. Balancing charges and allowances Balancing charges — disposal value - residual Balancing allowances — residual - disposal value BC and BA arise when the trade ceases or disposal of not pooled assets. ★ When a business ceases to trade, no FYAs or WDAs are given in the final accounting period. 6. Expensive car Motor cars costing more than 12000 are not pooled. The restricted maximum WDA is 3000 a year which is pro-rated in short accounting period.

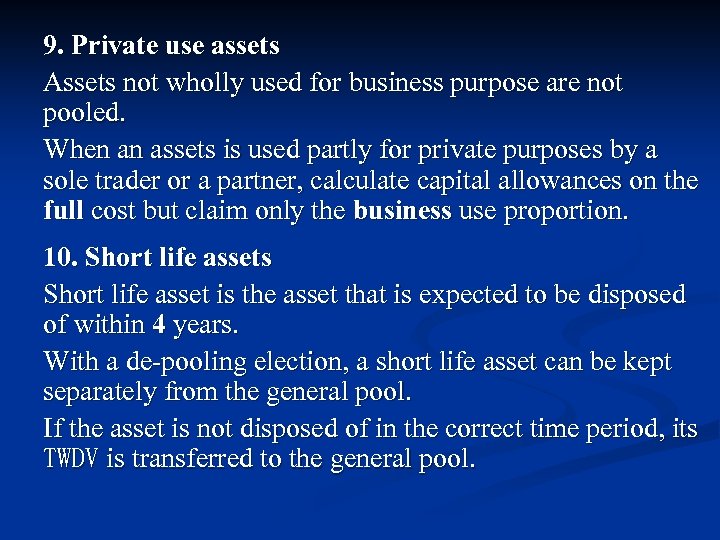

9. Private use assets Assets not wholly used for business purpose are not pooled. When an assets is used partly for private purposes by a sole trader or a partner, calculate capital allowances on the full cost but claim only the business use proportion. 10. Short life assets Short life asset is the asset that is expected to be disposed of within 4 years. With a de-pooling election, a short life asset can be kept separately from the general pool. If the asset is not disposed of in the correct time period, its TWDV is transferred to the general pool.

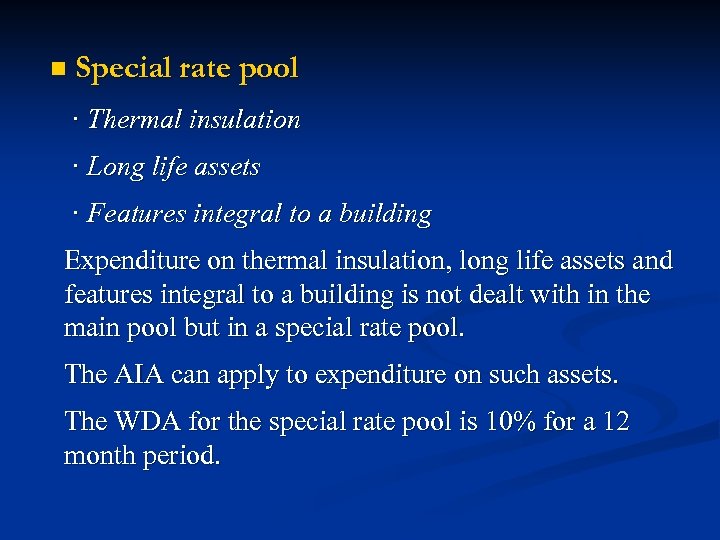

n Special rate pool · Thermal insulation · Long life assets · Features integral to a building Expenditure on thermal insulation, long life assets and features integral to a building is not dealt with in the main pool but in a special rate pool. The AIA can apply to expenditure on such assets. The WDA for the special rate pool is 10% for a 12 month period.

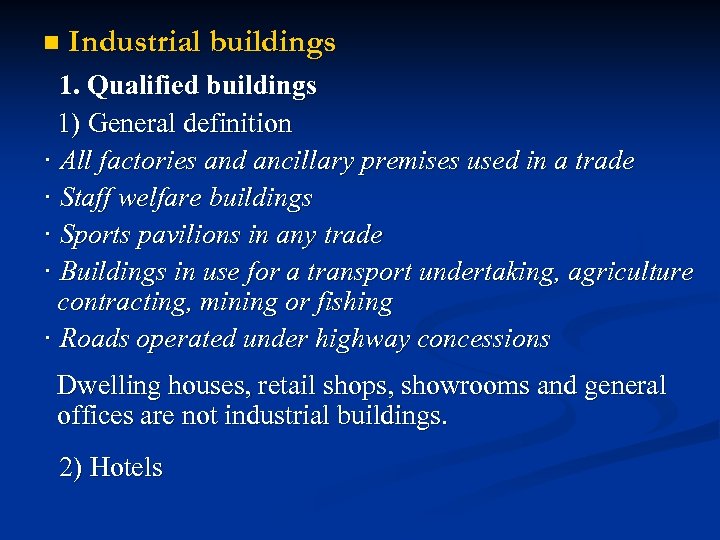

n Industrial buildings 1. Qualified buildings 1) General definition · All factories and ancillary premises used in a trade · Staff welfare buildings · Sports pavilions in any trade · Buildings in use for a transport undertaking, agriculture contracting, mining or fishing · Roads operated under highway concessions Dwelling houses, retail shops, showrooms and general offices are not industrial buildings. 2) Hotels

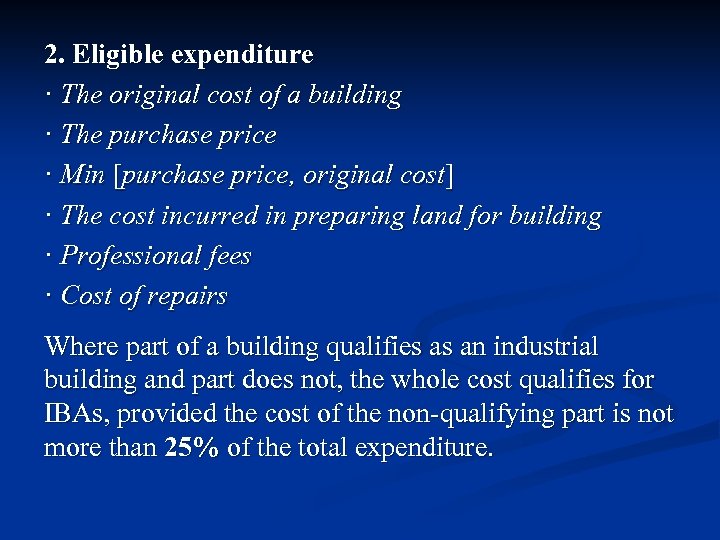

2. Eligible expenditure · The original cost of a building · The purchase price · Min [purchase price, original cost] · The cost incurred in preparing land for building · Professional fees · Cost of repairs Where part of a building qualifies as an industrial building and part does not, the whole cost qualifies for IBAs, provided the cost of the non-qualifying part is not more than 25% of the total expenditure.

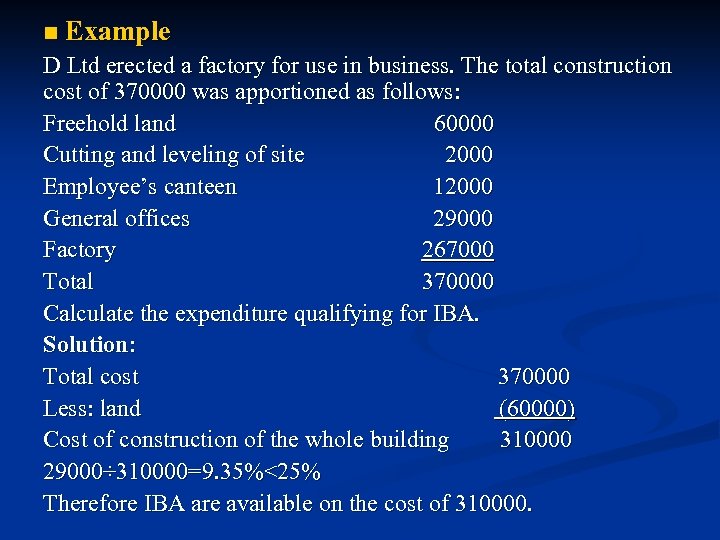

n Example D Ltd erected a factory for use in business. The total construction cost of 370000 was apportioned as follows: Freehold land 60000 Cutting and leveling of site 2000 Employee’s canteen 12000 General offices 29000 Factory 267000 Total 370000 Calculate the expenditure qualifying for IBA. Solution: Total cost 370000 Less: land (60000) Cost of construction of the whole building 310000 29000÷ 310000=9. 35%<25% Therefore IBA are available on the cost of 310000.

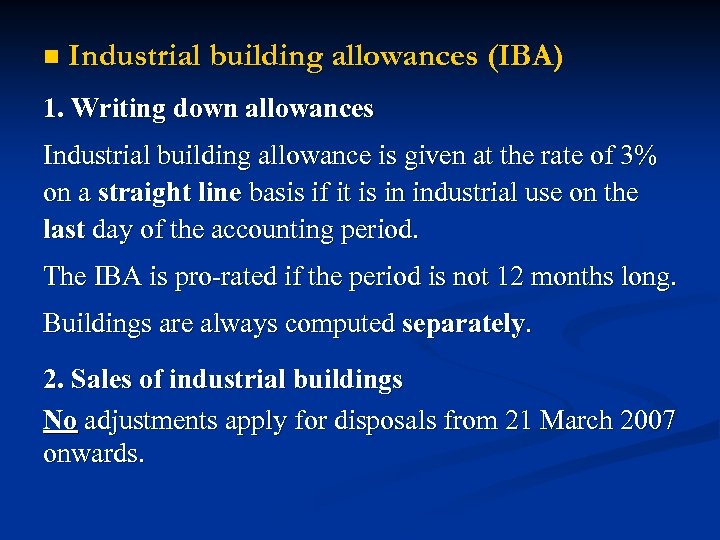

n Industrial building allowances (IBA) 1. Writing down allowances Industrial building allowance is given at the rate of 3% on a straight line basis if it is in industrial use on the last day of the accounting period. The IBA is pro-rated if the period is not 12 months long. Buildings are always computed separately. 2. Sales of industrial buildings No adjustments apply for disposals from 21 March 2007 onwards.

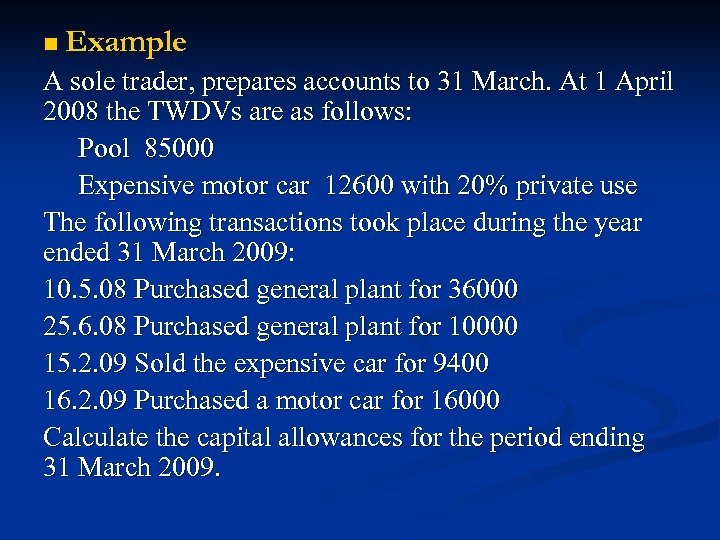

n Example A sole trader, prepares accounts to 31 March. At 1 April 2008 the TWDVs are as follows: Pool 85000 Expensive motor car 12600 with 20% private use The following transactions took place during the year ended 31 March 2009: 10. 5. 08 Purchased general plant for 36000 25. 6. 08 Purchased general plant for 10000 15. 2. 09 Sold the expensive car for 9400 16. 2. 09 Purchased a motor car for 16000 Calculate the capital allowances for the period ending 31 March 2009.

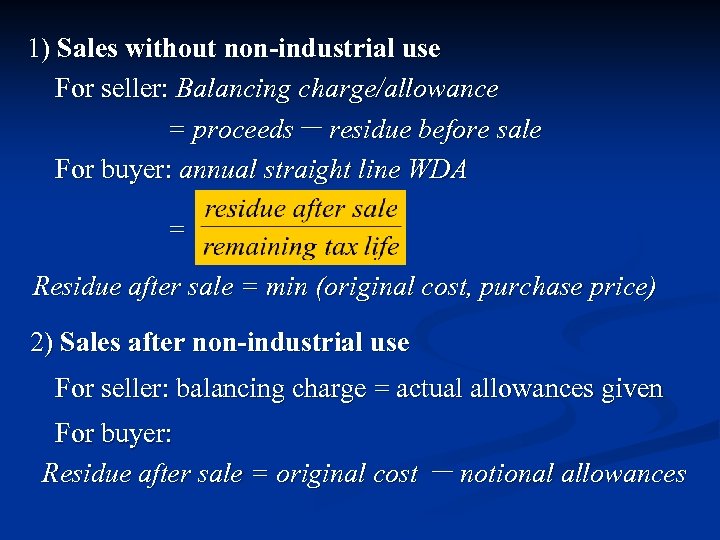

1) Sales without non-industrial use For seller: Balancing charge/allowance = proceeds- residue before sale For buyer: annual straight line WDA = Residue after sale = min (original cost, purchase price) 2) Sales after non-industrial use For seller: balancing charge = actual allowances given For buyer: Residue after sale = original cost - notional allowances

Chapter 9 Assessable Trading Income n Basis periods are used to link periods of accounts to tax years. If the basis period is not identical to a period of account, the profits of periods of account are timeapportioned to the nearest month. - General rule - Special rules

n Commencement and Cessation 1. The first tax year The basis period for the first tax year runs from the date starts to the next 5 April. 2. The second tax year · If period of account is less than 12 months — first 12 months · If period of account is 12 months or more — 12 months to accounting date ending in year 2 · If there is no accounting date — 6 April to 5 April 3. The third tax year The basis period for the third tax year is 12 months down to the accounting date ending in the year.

4. Later tax year For later tax years, the basis period is the period of account ending in the tax year (CYB). 5. The final tax year The basis period runs from the end of the basis period for the previous year to the date of cessation. 6. The overlap profits Profits which have been taxed more than once are called overlap profits. Overlap profits may be deducted /relieved on a change of accounting date or deducted from the final year’s taxable profits on cessation. 7. The choice of an accounting date Overlap profits ; tax deference

n Change of accounting date 1. One short period of account The basis period is 12 months to the new accounting date. It will create overlap profits. 2. One long period of account The basis period ends on the new accounting date. Relief is available for brought forward overlap profits. The overlap relief cannot reduce the number of months worth of profits taxed in the year to below 12.

Chapter 10 Trading Losses n Carry forward trade loss relief A trade loss not relieved in any other way may be carried forward to set against the first available trade profits of the same trade. n Relief when incorporation When a business is incorporated, pre-incorporation loses can be carried forward by the trader against first available income he receives from the company. Order of relief: salary → interest and dividends Condition: 80% or more of the consideration consists of shares.

n Relief against general income 1. Relief against total income Relief is against the income of the tax year of the loss and/or the preceding tax year. Order of loss relief non-savings income → savings → dividend 2. Relief against capital gains Once an s 380 claim has been made in any year, the remaining loss can be set against net chargeable gains. 3. Choice between loss reliefs Tax rate; timing; waste of personal allowance

n Losses in early years of a trade Losses arising in the first four tax years of a trade may be set against general income in the three years preceding the loss making year, taking the earliest year first. Condition: on a commercial basis n Terminal loss relief Terminal loss arising in the last 12 months of trading may be set against trade profits of the tax year of cessation and the previous 3 years, taking the last year first.

Chapter 11 Partnerships n Basis of assessment A partnership is treated like a sole trader. !Partners’ salaries and interest on capital are not deductible expenses and must be added back in computing profits. ·First, compute trading profits as a whole ·Second, divide profits between partners ·Third, work out the basis periods and the taxable trade profits for each partner

n The tax positions of individual partners Each partner is taxed like a sole trader who runs a business which: · starts when he joins the partnership · finishes when he leaves the partnership · has the same periods of account as the partnership n Loss reliefs Partners are entitled to the same loss reliefs as sole traders. Different partners may claim loss reliefs in different ways.

Chapter 12 National Insurance Contributions n Scope of NICs There are four classes of NICs: · Class 1: primary—paid by employees Secondary Class 1 A and 1 B —paid by employers · Class 2: paid by the self-employed · Class 3: Voluntary contributions · Class 4: paid by the self-employed

n NICs for employed persons 1. Class 1 NICs Employees pay primary contribution of 11% of earnings between 5225 and 34840, pay 1% on earnings above the upper limit. Employers pay secondary contributions of 12. 8% on earnings above 5225. 2. Class 1 A NICs Employers must pay Class 1 A NIC at 12. 8% in respect of most taxable benefits. 3. Payment of Class 1 NICs Class 1 contributions are collected under the PAYE system.

n NICs for the self-employed Class 2 contributions are payable at a flat rate, which is 2. 2 a week for 2007/08. Class 4 contributions are calculated by applying a fixed percentage to the individual’s profits, which is 8% for profits falling between the lower limit (5225) and the upper limit (34840), and 1% for profits beyond that limit.

Chapter 13 Capital Gains Tax n Basis of assessment Individuals are charged to CGT on their gains arising from investments and from assets used in an unincorporated business. Taxable gains are the net chargeable gains (gains minus losses of current year) of the year reduced by: ·Unrelieved losses brought forward from previous year ·Taper relief ·Annual exemption (8500 for 2005/06)

Taxable gains are taxed at the same rate as savings income, i. e. 10%, 20%, 40%, as if the gains were an extra slice of savings income. n Allowable losses Allowable capital losses are first set off against chargeable gains in the same tax year. Any excess can be carried forward and set off against first available future chargeable gains. Note:Allowable losses brought forward are only set off to reduce current chargeable gains less current losses to the annual exempt amount.

n Taper relief Individuals are not entitled to indexation allowances after 6. 4. 98. It is replaced by taper relief. The amount of taper relief depends on the number of complete years for which an asset has been held since acquisition or 6 April 1998 and whether the asset is a business or non-business asset. Non-business assets acquired before 17 March 1998 qualify for an addition of 1 year. If an asset qualifies as a business asset for part of the time of ownership, the business part and non-business part are treated as separate assets calculated by time apportionment.

For taper relief purposes business assets are: · Assets used in trade of any individual, partnership or qualifying company; · Assets held for use in office or employment · Shares in: — An unlisted trading company; — Trading company of which individual is employee or officer; — Trading company in which shareholder holds at least 5% of voting rights; — A non-trading company of which the individual is an officer or employee and in which he does not have more than a 10% interest.

n Shares and securities are not pooled for individuals since 5 April 1998. Each acquisition is treated separately. Matching order: · Same day acquisition; · Acquisitions within the following 30 days; · Previous acquisitions after 5 April 1998 on a LIFO basis; · FA 1985 pool (runs from 6. 4. 82 to 5. 4. 98)

Deferral relief 1. Gift relief n The transferor and transferee must make a jointly election for the relief. The transferor’s gain will be reduced to nil, and the transferee is deemed to acquire the asset for market value at the date of transfer less the transferor’s deferred gain before taper relief. If a disposal involves actual consideration rather than being a pure gift but is still not a bargain made at arm’s length, then any excess of actual consideration over allowable costs (excluding indexation allowance) is chargeable immediately.

2. Incorporation relief The gain (before taper relief) arising on incorporation can be deferred into the base cost of the shares acquired. Incorporation relief is automatic. Conditions: · The business is transferred as a going concern · All assets are transferred · The consideration is wholly or partly in shares If only a proportion of the consideration is in the form of shares, only that proportion of the gain can be relieved.

3. Rollover reliefs are available to unincorporated businesses which reinvest in qualifying assets in the period commencing one year before and ending 36 months after the disposal. If the replacement asset is a depreciating asset, the gain is frozen until it crystallized on the earliest of: · The disposal of the replacement asset · Ten years after the acquisition · The date the replacement asset ceases to be used in the trade In this case, taper relief is applied to the original gain before it is deferred.

b91ef72f8c343ee3ec199e50a5e3ddba.ppt