41a88327c1237702a6505bd15051bcca.ppt

- Количество слайдов: 49

ACADEMIA DE STUDII ECONOMICE BUCUREŞTI FACULTATEA DE RELAŢII ECONOMICE INTERNAŢIONALE “Finanţare internaţională” CURSUL II: “Pieţe, instituţii şi instrumente folosite pe pieţele financiare internaţionale” Conf. dr Cristian PĂUN

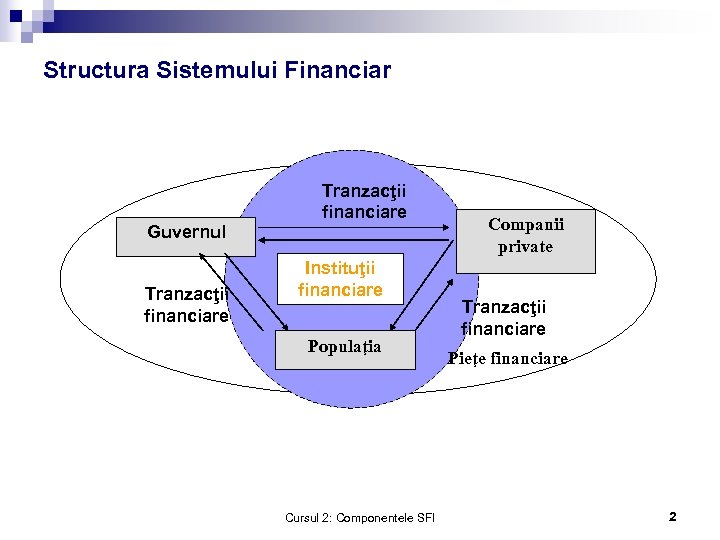

Structura Sistemului Financiar Guvernul Tranzacţii financiare Instituţii financiare Populaţia Cursul 2: Componentele SFI Companii private Tranzacţii financiare Pieţe financiare 2

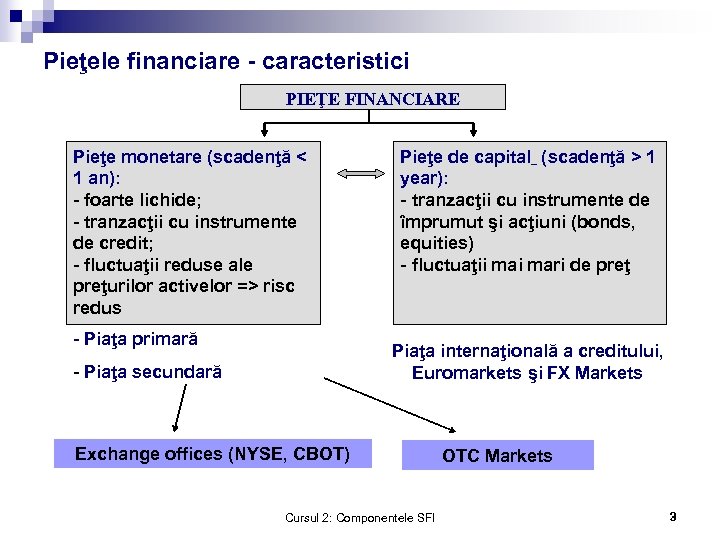

Pieţele financiare - caracteristici PIEŢE FINANCIARE Pieţe monetare (scadenţă < 1 an): - foarte lichide; - tranzacţii cu instrumente de credit; - fluctuaţii reduse ale preţurilor activelor => risc redus - Piaţa primară Pieţe de capital (scadenţă > 1 year): - tranzacţii cu instrumente de împrumut şi acţiuni (bonds, equities) - fluctuaţii mari de preţ Piaţa internaţională a creditului, Euromarkets şi FX Markets - Piaţa secundară Exchange offices (NYSE, CBOT) Cursul 2: Componentele SFI OTC Markets 3

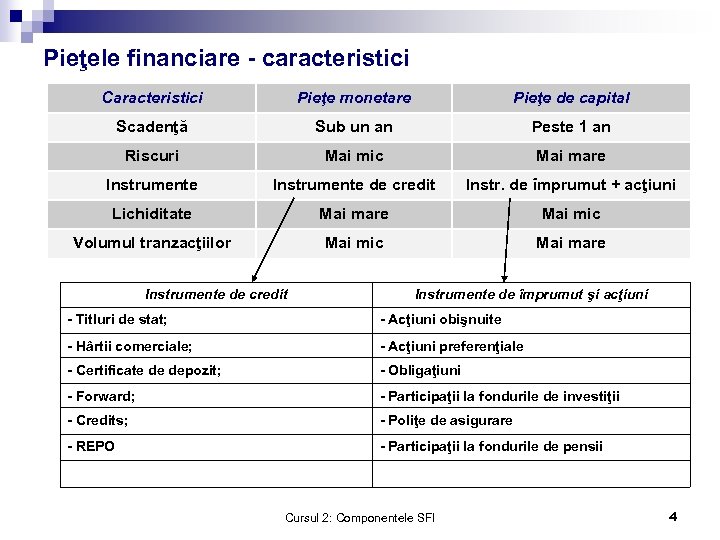

Pieţele financiare - caracteristici Caracteristici Pieţe monetare Pieţe de capital Scadenţă Sub un an Peste 1 an Riscuri Mai mic Mai mare Instrumente de credit Instr. de împrumut + acţiuni Lichiditate Mai mare Mai mic Volumul tranzacţiilor Mai mic Mai mare Instrumente de credit Instrumente de împrumut şi acţiuni - Titluri de stat; - Acţiuni obişnuite - Hârtii comerciale; - Acţiuni preferenţiale - Certificate de depozit; - Obligaţiuni - Forward; - Participaţii la fondurile de investiţii - Credits; - Poliţe de asigurare - REPO - Participaţii la fondurile de pensii Cursul 2: Componentele SFI 4

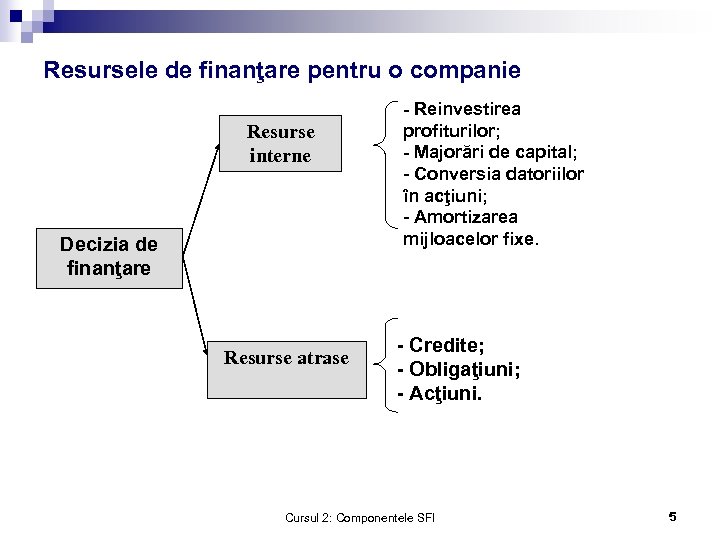

Resursele de finanţare pentru o companie Resurse interne Decizia de finanţare Resurse atrase - Reinvestirea profiturilor; - Majorări de capital; - Conversia datoriilor în acţiuni; - Amortizarea mijloacelor fixe. - Credite; - Obligaţiuni; - Acţiuni. Cursul 2: Componentele SFI 5

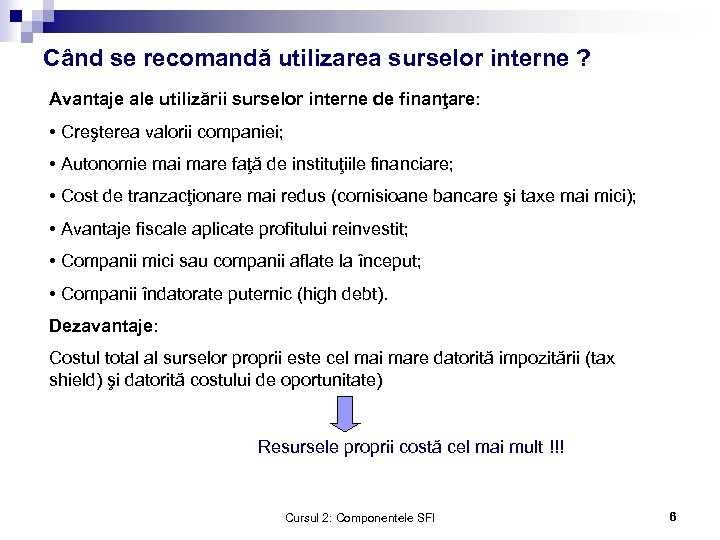

Când se recomandă utilizarea surselor interne ? Avantaje ale utilizării surselor interne de finanţare: • Creşterea valorii companiei; • Autonomie mai mare faţă de instituţiile financiare; • Cost de tranzacţionare mai redus (comisioane bancare şi taxe mai mici); • Avantaje fiscale aplicate profitului reinvestit; • Companii mici sau companii aflate la început; • Companii îndatorate puternic (high debt). Dezavantaje: Costul total al surselor proprii este cel mai mare datorită impozitării (tax shield) şi datorită costului de oportunitate) Resursele proprii costă cel mai mult !!! Cursul 2: Componentele SFI 6

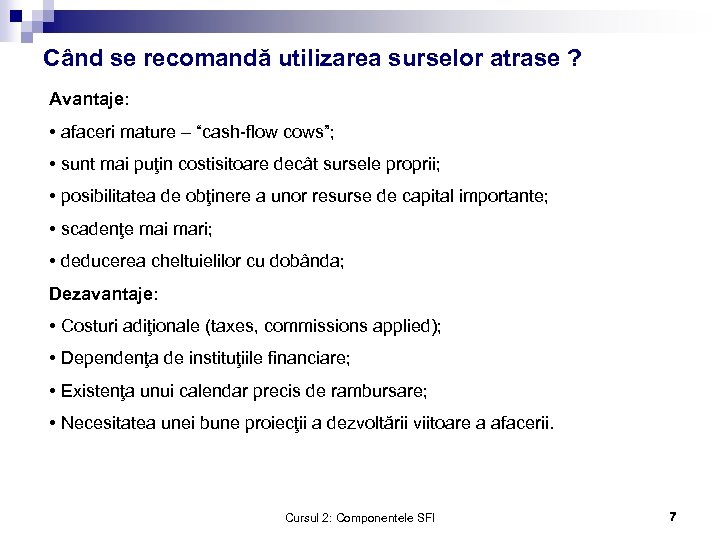

Când se recomandă utilizarea surselor atrase ? Avantaje: • afaceri mature – “cash-flow cows”; • sunt mai puţin costisitoare decât sursele proprii; • posibilitatea de obţinere a unor resurse de capital importante; • scadenţe mai mari; • deducerea cheltuielilor cu dobânda; Dezavantaje: • Costuri adiţionale (taxes, commissions applied); • Dependenţa de instituţiile financiare; • Existenţa unui calendar precis de rambursare; • Necesitatea unei bune proiecţii a dezvoltării viitoare a afacerii. Cursul 2: Componentele SFI 7

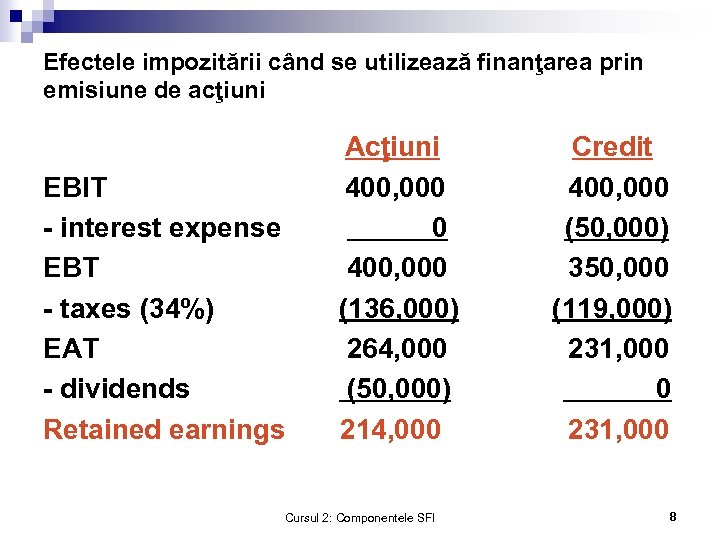

Efectele impozitării când se utilizează finanţarea prin emisiune de acţiuni EBIT - interest expense EBT - taxes (34%) EAT - dividends Retained earnings Acţiuni 400, 000 0 400, 000 (136, 000) 264, 000 (50, 000) 214, 000 Cursul 2: Componentele SFI Credit 400, 000 (50, 000) 350, 000 (119, 000) 231, 000 0 231, 000 8

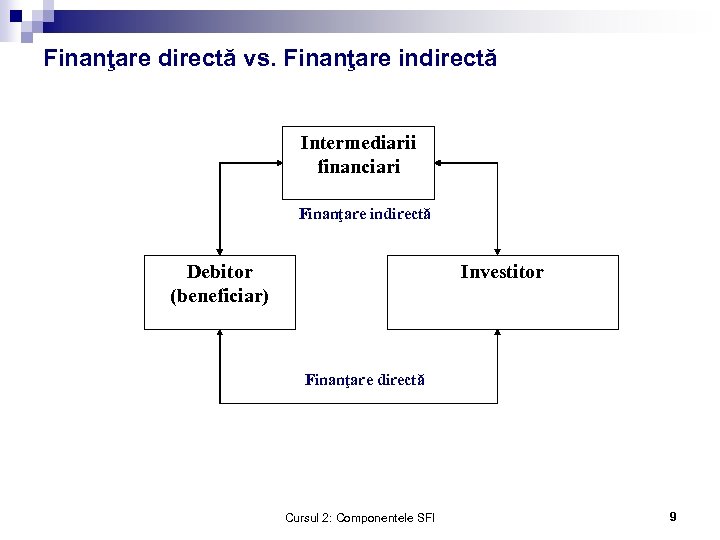

Finanţare directă vs. Finanţare indirectă Intermediarii financiari Finanţare indirectă Debitor (beneficiar) Investitor Finanţare directă Cursul 2: Componentele SFI 9

Finanţare directă vs. Finanţare indirectă Avantajele intermedierii financiare: • o mai bună informare cu privire la excedentul de resurse financiare; • risc mai redus (unele instituţii financiare pot prelua din riscuri); • consultanţa financiară; • facilităţile de finanţare; • o multitudine de tehnici de financiare; • condiţiile impuse de intermediarii financiari; • cost de tranzacţionare mai scăzut. Dezavantajele intermedierii financiare: • costuri operaţionale mai mari; • inexistenţa unui contact direct cu piaţa; • impunerea unui istoric al relaţiilor cu piaţa. Cursul 2: Componentele SFI 10

Serviciile furnizate de intermediarii financiari • Vânzarea şi cumpărarea de active financiare; • Derularea fluxurilor de încasări şi plăţi; • Finanţarea afacerilor (incl. export financing); • Consultanţa financiară; • Monitorizarea pieţelor financiare internaţionale (rating agencies); • Asigurarea împotriva riscurilor financiare; • Garantarea riscurilor financiare; • Expertiza managerială; • Monitorizarea companiilor (competitors, clients); • Management de portofoliu; • Administrarea fondurilor de investiţii. Cursul 2: Componentele SFI 11

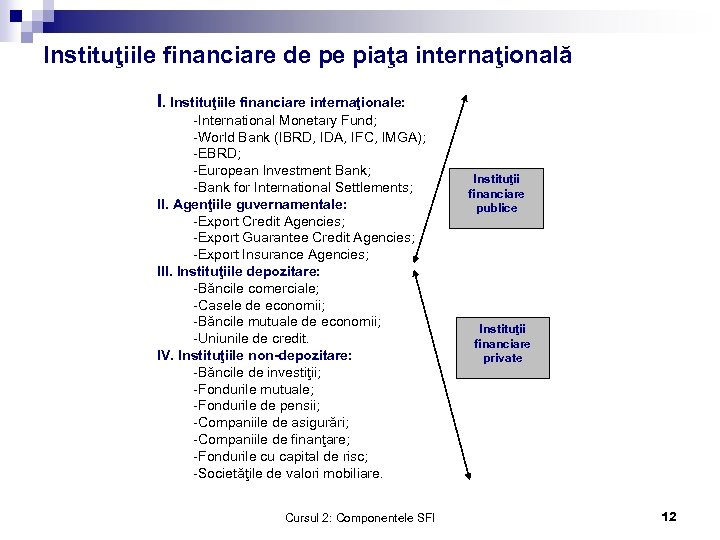

Instituţiile financiare de pe piaţa internaţională I. Instituţiile financiare internaţionale: -International Monetary Fund; -World Bank (IBRD, IDA, IFC, IMGA); -EBRD; -European Investment Bank; -Bank for International Settlements; II. Agenţiile guvernamentale: -Export Credit Agencies; -Export Guarantee Credit Agencies; -Export Insurance Agencies; III. Instituţiile depozitare: -Băncile comerciale; -Casele de economii; -Băncile mutuale de economii; -Uniunile de credit. IV. Instituţiile non-depozitare: -Băncile de investiţii; -Fondurile mutuale; -Fondurile de pensii; -Companiile de asigurări; -Companiile de finanţare; -Fondurile cu capital de risc; -Societăţile de valori mobiliare. Cursul 2: Componentele SFI Instituţii financiare publice Instituţii financiare private 12

Banca Europeană pentru Reconstrucţie şi Dezvoltare Cursul 2: Componentele SFI 13

Banca Europeană pentru Reconstrucţie şi Dezvoltare • BERD a fost creată în 1991; • Obiectivul iniţial: să furnizeze suport pentru crearea şi dezvoltarea sectorului privat în ţările foste comuniste; • În prezent BERD furnizează asistenţă pentru dezvoltarea economiei de piaţă în 27 de ţări din Europa Centrală şi de Est şi din Asia. • BERD este cel mai important investitor în regiune şi mobilizează importante investiţii străine directe în plus de propriile finanţări acordate. • BERD interacţionează şi cu instituţiile publice, oferindu-şi sprijinul în procesul de privatizare, restructurare a companiilor de stat şi îmbunătăţire a serviciilor publice / municipale. • BERD are 60 ţări membre şi două instituţii interguvernamentale (UE şi Banca Europeană de Investiţii). Cursul 2: Componentele SFI 14

Banca Europeană pentru Reconstrucţie şi Dezvoltare Obiectivele BERD: • Să ajute ţările foste comuniste să se îndrepte cât mai rapid către o economie de piaţă funcţională • Să îşi asume o parte din riscurile investiţionale • Să promoveze principii bancare sănătoase BERD promovează: • Reformele structurale şi sectoriale • Competiţia, privatizarea and spiritul antreprenorial • Instituţii financiare puternice şi sistemul legal - instituţional • Dezvoltarea infrastructurii necesare sectorului privat • O guvernare sănătoasă • Cofinanţarea şi ISD • Mobilizarea resurselor locale de capital • Furnizarea de asistenţă tehnică Cursul 2: Componentele SFI 15

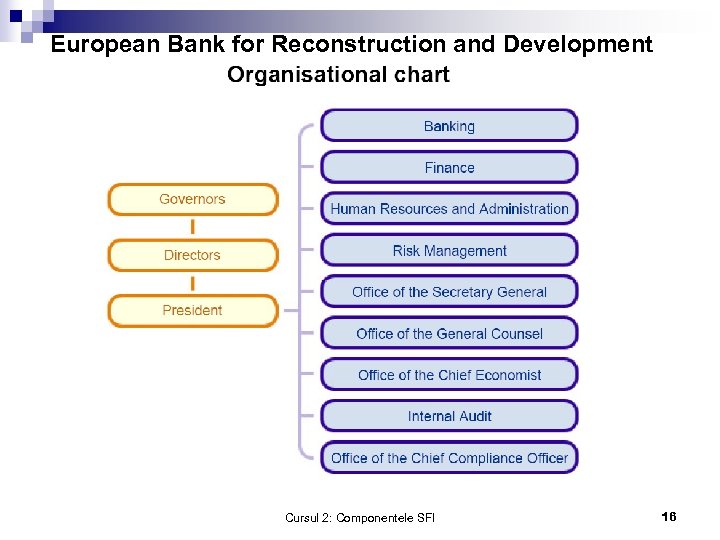

European Bank for Reconstruction and Development Cursul 2: Componentele SFI 16

BERD în România • BERD este cel mai mare investitor din România cu o sumă ce depăşeşte 2. 5 miliarde de euro. • România se află pe locul al III-lea ca beneficiar al resurselor BERD. • Portofoliul BERD în ţara noastră este foarte diversificat şi include investiţii în sectorul privat, dezvoltarea sectorului financiar, infrastructura de bază (electricitate, transport, infrastructura municipală) şi privatizarea cu investitori strategici. • EBRD încurajează finanţarea privată a infrastructurii prin promovarea unor finanţări de tip “project finance” • BERD susţine dezvoltarea sistemului financiar nebancar, prin promovarea investiţiilor în sectorul leasing şi a companiilor de asigurare, fondurilor de pensii şi fondurilor private de investiţii. Cursul 2: Componentele SFI 17

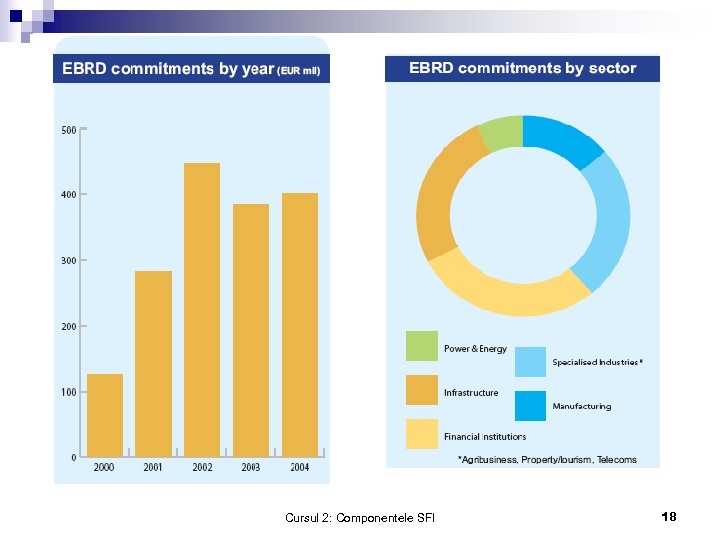

Cursul 2: Componentele SFI 18

Proiecte BERD de succes în România • Susţinerea privatizării cu succes a celei mari bănci din România– Romanian Commercial Bank (In 2003 the EBRD agreed to buy a 25 per cent stake in BCR together with the IFC for a combined investment of € 176 million); • Privatizarea cu succes a PETROM: - in 2002, EBRD arranged a syndicated US$ 150 million pre-privatisation corporate loan to SNP Petrom, the Bank’s largest non-sovereign long-term syndicated loan to a state-owned company in Romania at the time. • Furnizarea de fonduri pentru terminalul din Constanţa: - In September 2004, the Bank granted a € 16 million non sovereign loan to the Administration of Constanta Port to finance a new barge terminal in what has been the first non sovereign guaranteed loan by the Bank for a state owned company in the Romanian Transport sector. • Transelectrica - Regional Transmission Line Project: - in December 2004 the Bank signed a € 23. 2 million loan with Transelectrica in order to finance: (i) the Romanian part of a 110 km transmission line between Oradea (Romania) and Bekescsaba (Hungary), and (ii) the construction of a 400 k. V substation at Nadab along the route of the line. • Banca Transilvania: - BT managed to implement the Mortgage Loan of € 10 million in a short period of time, reaching around 830 clients with a large geographic spread covering 32 main counties through a network of 130 branches and agencies as of end. March 2005. Cursul 2: Componentele SFI 19

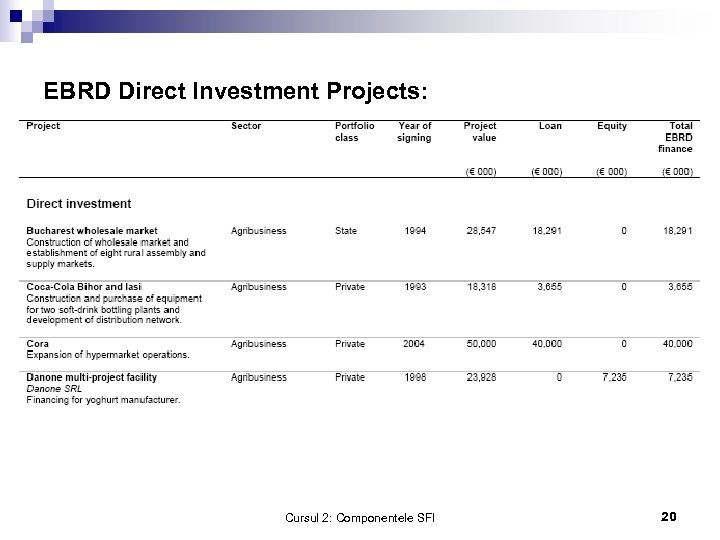

EBRD Direct Investment Projects: Cursul 2: Componentele SFI 20

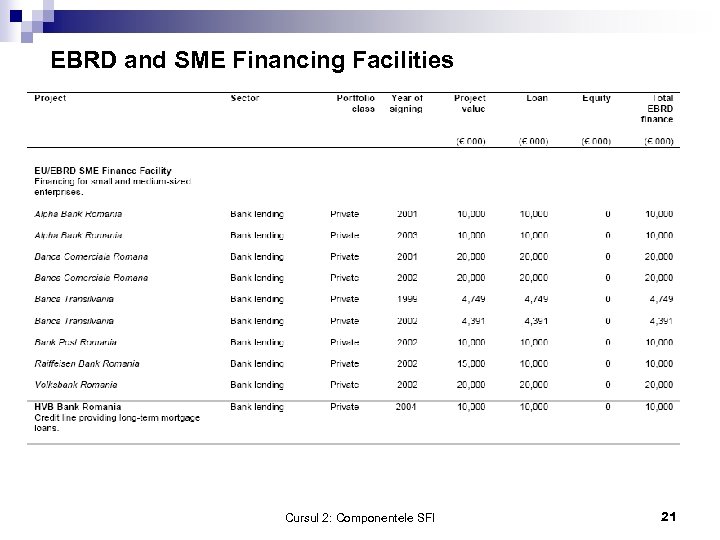

EBRD and SME Financing Facilities Cursul 2: Componentele SFI 21

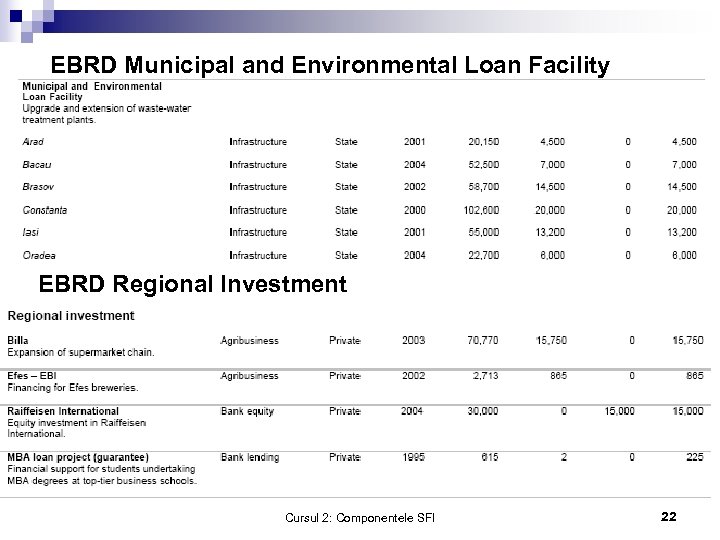

EBRD Municipal and Environmental Loan Facility EBRD Regional Investment Cursul 2: Componentele SFI 22

Banca Europeană de Investiţii Cursul 2: Componentele SFI 23

Banca Europeană de Investiţii • The task of the European Investment Bank, the European Union's financing institution, is to contribute towards the integration, balanced development and economic and social cohesion of the Member Countries. • The European Investment Bank (EIB), the financing institution of the European Union, was created by the Treaty of Rome. • The members of the EIB are the Member States of the European Union, who have all subscribed to the Bank's capital. • The EIB grants loans mainly from the proceeds of its borrowings, which, together with "own funds" (paid-in capital and reserves), constitute its "own resources". • Outside the European Union, EIB financing operations are conducted principally from the Bank's own resources but also, under mandate, from Union or Member States' budgetary resources. Cursul 2: Componentele SFI 24

Banca Europeană de Investiţii Obiective şi priorităţi de finanţare pentru BEI: • Economic and social cohesion in the enlarged EU • Implementation of the Innovation 2010 Initiative • Development of Trans-European and Access Networks • Support of EU development and cooperation policies in partner countries • Environmental protection and improvement, including climate change and renewable energy. • Support for small and medium-sized enterprises as well as mid-cap companies of intermediate size • Support for human capital, notably health. Cursul 2: Componentele SFI 25

European Investment Bank Shareholders • The shareholders of the European Investment Bank are the 25 Member States of the European Union. • Each Member State’s share in the Bank’s capital is calculated in accordance with its economic weight within the European Union (expressed in GDP) at the time of its accession. • In total, the Bank’s subscribed capital amounts to more than 163. 6 billion. • The EU Member States are fully eligible for Bank financing operations, without any geographical or sectorial quotas being applied. • Under its Statute, the Bank may have maximum loans outstanding equivalent to two and half times its capital. Cursul 2: Componentele SFI 26

European Investment Bank - Structure 1. Board of Governors: consists of Ministers designated by each of the 25 Member States, usually Finance Ministers. 2. Board of Directors: has the power to take decisions in respect of loans, guarantees and borrowings. The Board of Directors consists of 26 Directors, with one Director nominated by each Member State and one by the European Commission. 3. The Management Committee: is the Bank’s permanent collegiate executive body. It has nine members. Under the authority of the President and the supervision of the Board of Directors, it oversees day-to-day running of the EIB, prepares decisions for Directors and ensures that these are implemented. 4. The Audit Committee: is an independent body answerable directly to the Board of Governors and responsible for verifying that the operations of the Bank have been conducted and its books kept in a proper manner. Cursul 2: Componentele SFI 27

European Investment Fund • Following the conclusions of the Lisbon European Council in March 2000, which called for increased support for operations to assist SME’s, the Board of Governors decided to set up the "EIB Group", consisting of the European Investment Bank and the European Investment Fund. • The EIB became the majority shareholder in the European Investment Fund, which nevertheless retains a tripartite share-ownership structure consisting of the EIB (59. 15%), the European Commission (30%) and European banks and financial institutions (10. 85%). • EIB Group is thus able to play a predominant role in boosting the competitiveness of European industry through the diversified support it provides for the activities of SMEs (medium and long-term loans, venture capital and guarantees). • The EIB continues to promote smaller businesses through its medium and long-term global loan financing, arranged in collaboration with the banking sector. • The relationship between the EIB and the EIF encourages a productive sharing of expertise between the Bank and the Fund in support of finance for SMEs; Cursul 2: Componentele SFI 28

Financing Facilities offered by EIB The EIB offers various financial services to support projects, depending on eligibility and project category. • Loans for SMEs through an intermediary (credit lines made available to banks, leasing companies or financial institutions, which on lend the proceeds for small or medium-scale investment projects meeting the Bank's criteria) • Venture capital • Direct loans (also known as Individual loans) (Promoters in both the public and private sectors, including banks); • Structured Finance Facility (SFF) (senior loans and guarantees incorporating pre-completion and early operational risk; subordinated loans and guarantees ranking ahead of shareholder subordinated debt; mezzanine finance, including high-yield debt for industrial companies in transition from SME scale or in the course of restructuring; projectrelated derivatives. ) Cursul 2: Componentele SFI 29

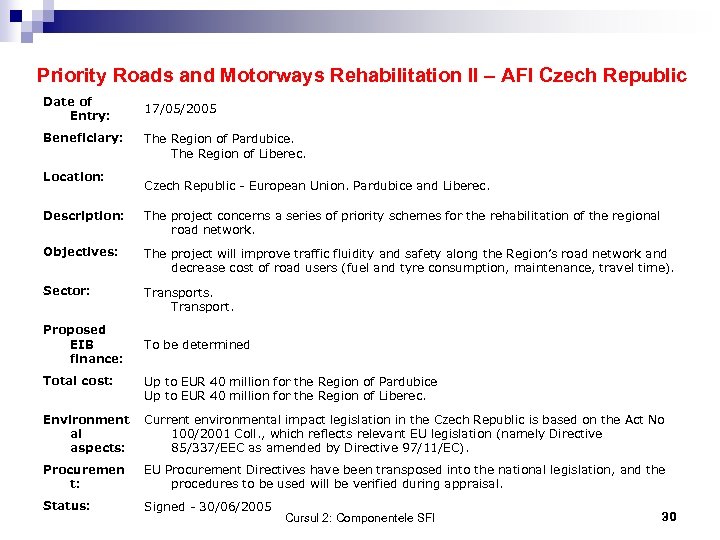

Priority Roads and Motorways Rehabilitation II – AFI Czech Republic Date of Entry: Beneficiary: Location: 17/05/2005 The Region of Pardubice. The Region of Liberec. Czech Republic - European Union. Pardubice and Liberec. Description: The project concerns a series of priority schemes for the rehabilitation of the regional road network. Objectives: The project will improve traffic fluidity and safety along the Region’s road network and decrease cost of road users (fuel and tyre consumption, maintenance, travel time). Sector: Transports. Transport. Proposed EIB finance: To be determined Total cost: Up to EUR 40 million for the Region of Pardubice Up to EUR 40 million for the Region of Liberec. Environment al aspects: Current environmental impact legislation in the Czech Republic is based on the Act No 100/2001 Coll. , which reflects relevant EU legislation (namely Directive 85/337/EEC as amended by Directive 97/11/EC). Procuremen t: EU Procurement Directives have been transposed into the national legislation, and the procedures to be used will be verified during appraisal. Status: Signed - 30/06/2005 Cursul 2: Componentele SFI 30

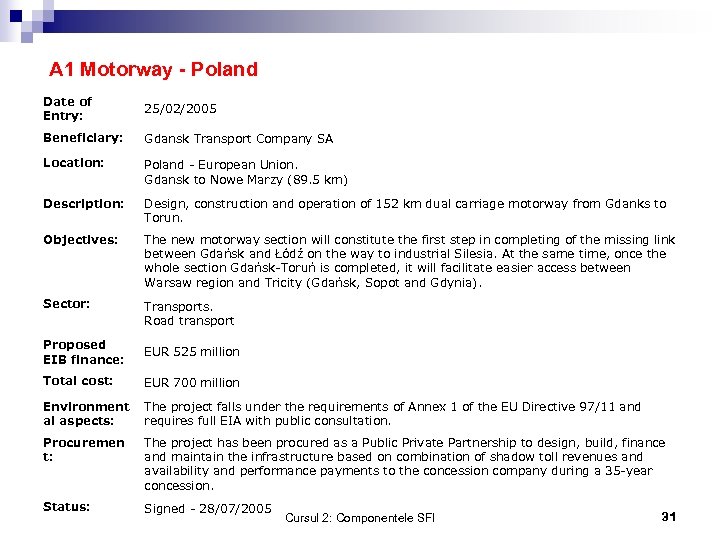

A 1 Motorway - Poland Date of Entry: 25/02/2005 Beneficiary: Gdansk Transport Company SA Location: Poland - European Union. Gdansk to Nowe Marzy (89. 5 km) Description: Design, construction and operation of 152 km dual carriage motorway from Gdanks to Torun. Objectives: The new motorway section will constitute the first step in completing of the missing link between Gdańsk and Łódź on the way to industrial Silesia. At the same time, once the whole section Gdańsk-Toruń is completed, it will facilitate easier access between Warsaw region and Tricity (Gdańsk, Sopot and Gdynia). Sector: Transports. Road transport Proposed EIB finance: EUR 525 million Total cost: EUR 700 million Environment al aspects: The project falls under the requirements of Annex 1 of the EU Directive 97/11 and requires full EIA with public consultation. Procuremen t: The project has been procured as a Public Private Partnership to design, build, finance and maintain the infrastructure based on combination of shadow toll revenues and availability and performance payments to the concession company during a 35 -year concession. Status: Signed - 28/07/2005 Cursul 2: Componentele SFI 31

Budapest Central Waste Water Treatment Plant Project Date of Entry: 16/09/2004 Beneficiary: Municipality of Budapest Location: Hungary - European Union. Budapest. Description: The project concerns the design, construction, operation and maintenance of the BCWWTP and ancillary investments. It includes the following main investments: Objectives: The project represents a cost-effective solution to wastewater collection, treatment and sludge disposal in central Budapest to meet EU and Hungarian environmental standards. It is expected that there will be indirect benefits to the city through reduced pollution of the Danube and greater tourism potential of the riverfront. Sector: Water, sewerage. Environment sector. Proposed EIB finance: Up to EUR 147 million. Total cost: Approximately EUR 529 million. Environment al aspects: The project has been designed in full compliance with national and relevant EU environmental directives. Upon completion and successful start of operation wastewater generated by more than 90% of Budapest population (for the time being some 1. 8 million) will be treated biologically. 32 Cursul 2: Componentele SFI

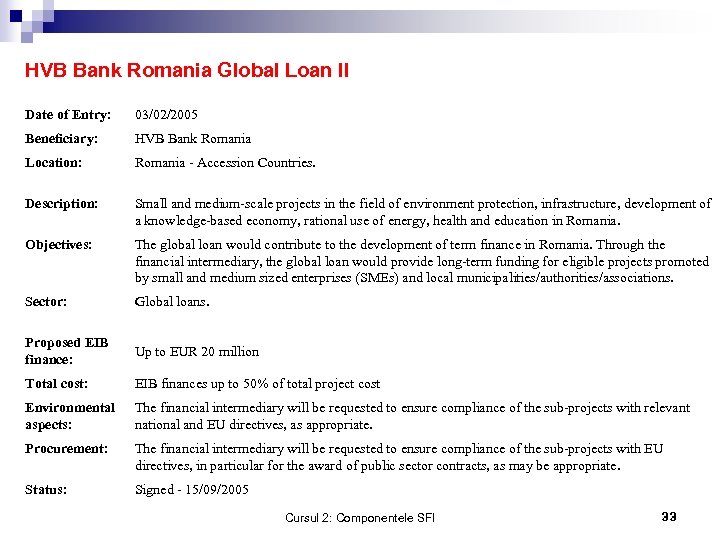

HVB Bank Romania Global Loan II Date of Entry: 03/02/2005 Beneficiary: HVB Bank Romania Location: Romania - Accession Countries. Description: Small and medium-scale projects in the field of environment protection, infrastructure, development of a knowledge-based economy, rational use of energy, health and education in Romania. Objectives: The global loan would contribute to the development of term finance in Romania. Through the financial intermediary, the global loan would provide long-term funding for eligible projects promoted by small and medium sized enterprises (SMEs) and local municipalities/authorities/associations. Sector: Global loans. Proposed EIB finance: Up to EUR 20 million Total cost: EIB finances up to 50% of total project cost Environmental aspects: The financial intermediary will be requested to ensure compliance of the sub-projects with relevant national and EU directives, as appropriate. Procurement: The financial intermediary will be requested to ensure compliance of the sub-projects with EU directives, in particular for the award of public sector contracts, as may be appropriate. Status: Signed - 15/09/2005 Cursul 2: Componentele SFI 33

Grupul Băncii Mondiale Cursul 2: Componentele SFI 34

World Bank Group • The World Bank is a vital source of financial and technical assistance to developing countries around the world. • WBG includes two international financial institutions owned by 184 member countries—the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA). • The IBRD focuses on middle income and creditworthy poor countries; • IDA focuses on the poorest countries in the world. • Together we provide low-interest loans, interest-free credit and grants to developing countries for education, health, infrastructure, communications and many other purposes. Cursul 2: Componentele SFI 35

World Bank Group Organization • The World Bank is like a cooperative, where its 184 member countries are shareholders. • The shareholders are represented by a Board of Governors, who are the ultimate policy makers at the World Bank. Generally, the governors are member countries' ministers of finance or ministers of development. They meet once a year at the Annual Meetings of the Boards of Governors of the World Bank Group and the International Monetary Fund. • Because the governors only meet annually, they delegate specific duties to 24 Executive Directors, who work on-site at the bank. The five largest shareholders, France, Germany, Japan, the United Kingdom and the United States appoint an executive director, while other member countries are represented by 19 executive directors. • The World Bank operates day-to-day under the leadership and direction of the president, management and senior staff, and the vice presidents in charge of regions, sectors, networks and functions. Vice Presidents are the principal managers at the World Bank. Cursul 2: Componentele SFI 36

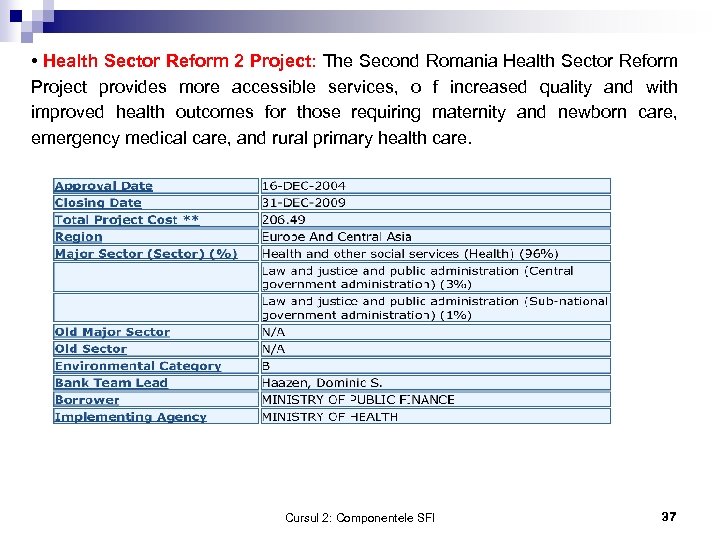

• Health Sector Reform 2 Project: The Second Romania Health Sector Reform Project provides more accessible services, o f increased quality and with improved health outcomes for those requiring maternity and newborn care, emergency medical care, and rural primary health care. Cursul 2: Componentele SFI 37

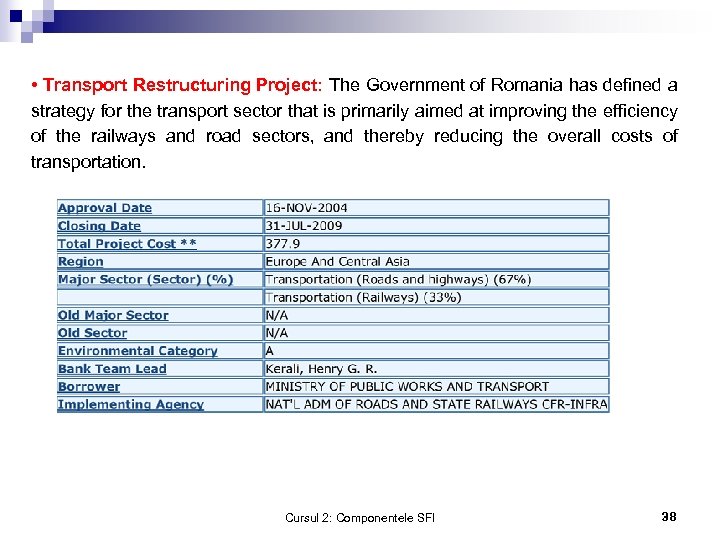

• Transport Restructuring Project: The Government of Romania has defined a strategy for the transport sector that is primarily aimed at improving the efficiency of the railways and road sectors, and thereby reducing the overall costs of transportation. Cursul 2: Componentele SFI 38

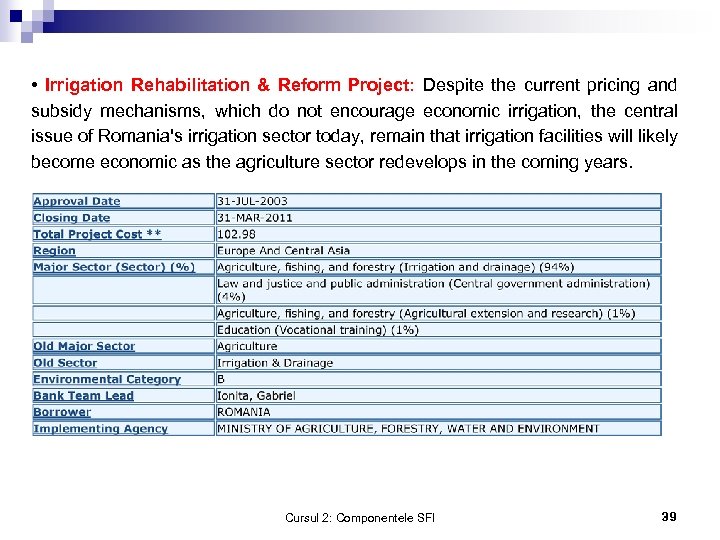

• Irrigation Rehabilitation & Reform Project: Despite the current pricing and subsidy mechanisms, which do not encourage economic irrigation, the central issue of Romania's irrigation sector today, remain that irrigation facilities will likely become economic as the agriculture sector redevelops in the coming years. Cursul 2: Componentele SFI 39

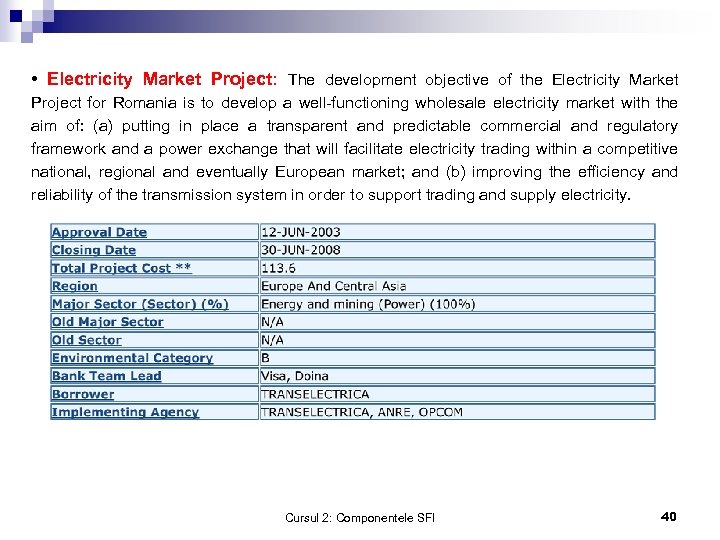

• Electricity Market Project: The development objective of the Electricity Market Project for Romania is to develop a well-functioning wholesale electricity market with the aim of: (a) putting in place a transparent and predictable commercial and regulatory framework and a power exchange that will facilitate electricity trading within a competitive national, regional and eventually European market; and (b) improving the efficiency and reliability of the transmission system in order to support trading and supply electricity. Cursul 2: Componentele SFI 40

• Energy Community of South East Europe Project: A strategy paper for energy trade in South East Europe outlines the Bank's vision for regional energy market development, and defines its role in supporting the evolution of regional energy trade. The framework elaborates the Bank's role in supporting policy reform, institutional development, and lending for power generation, transmission, distribution. Cursul 2: Componentele SFI 41

Instituţii financiare private Cursul 2: Componentele SFI 42

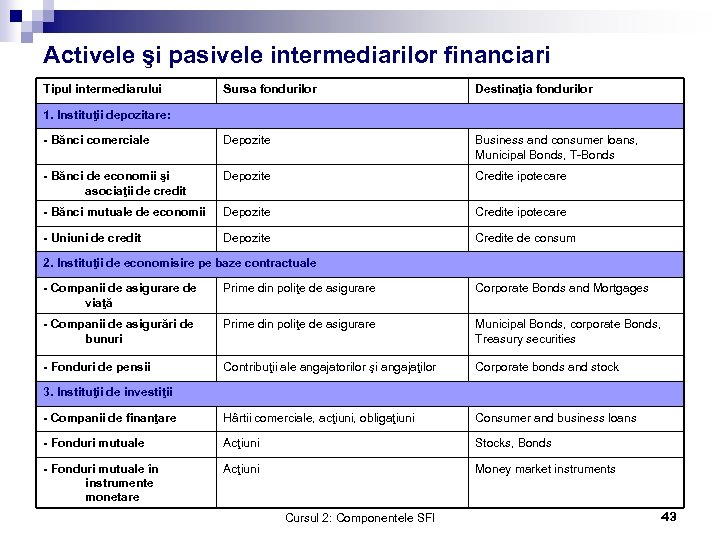

Activele şi pasivele intermediarilor financiari Tipul intermediarului Sursa fondurilor Destinaţia fondurilor - Bănci comerciale Depozite Business and consumer loans, Municipal Bonds, T-Bonds - Bănci de economii şi asociaţii de credit Depozite Credite ipotecare - Bănci mutuale de economii Depozite Credite ipotecare - Uniuni de credit Depozite Credite de consum 1. Instituţii depozitare: 2. Instituţii de economisire pe baze contractuale - Companii de asigurare de viaţă Prime din poliţe de asigurare Corporate Bonds and Mortgages - Companii de asigurări de bunuri Prime din poliţe de asigurare Municipal Bonds, corporate Bonds, Treasury securities - Fonduri de pensii Contribuţii ale angajatorilor şi angajaţilor Corporate bonds and stock - Companii de finanţare Hârtii comerciale, acţiuni, obligaţiuni Consumer and business loans - Fonduri mutuale Acţiuni Stocks, Bonds - Fonduri mutuale în instrumente monetare Acţiuni Money market instruments 3. Instituţii de investiţii Cursul 2: Componentele SFI 43

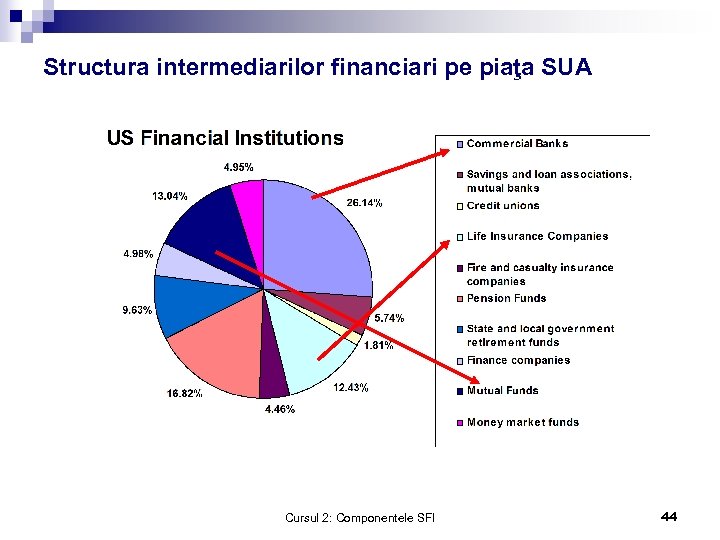

Structura intermediarilor financiari pe piaţa SUA Cursul 2: Componentele SFI 44

Instrumentele financiare • Un instrument financiar este un contract între investitor şi debitor; • Acest contract stabileşte: • mecanismul finanţării; • rolul fiecărei instituţii implicate în mecanism; • suma împrumutată; • scadenţa; • moneda în care se face împrumutul; • costul finanţării (rata de dobândă) şi modalitatea de plată a ei; • alocarea riscului între părţile implicate; • condiţiile de rambursare a împrumutului; • Alte aspecte (clauzele speciale din contractul de finanţare). Cursul 2: Componentele SFI 45

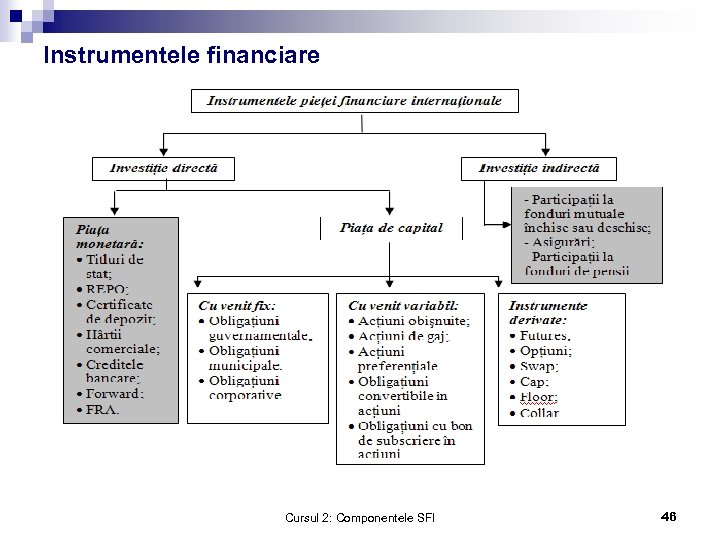

Instrumentele financiare Cursul 2: Componentele SFI 46

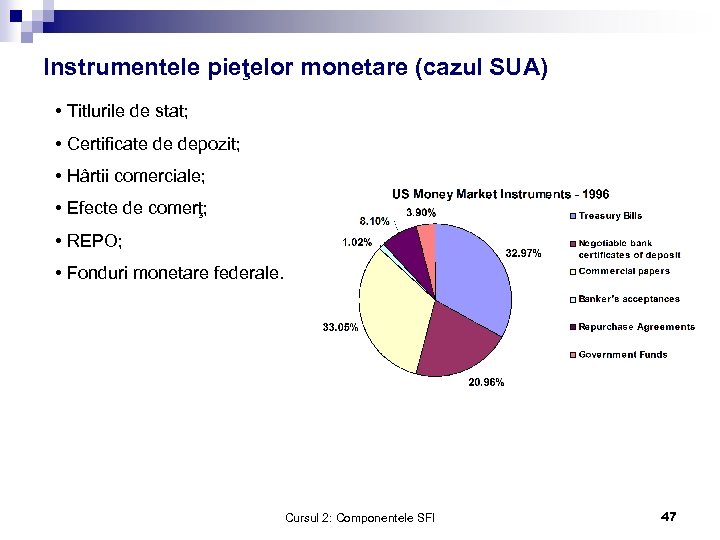

Instrumentele pieţelor monetare (cazul SUA) • Titlurile de stat; • Certificate de depozit; • Hârtii comerciale; • Efecte de comerţ; • REPO; • Fonduri monetare federale. Cursul 2: Componentele SFI 47

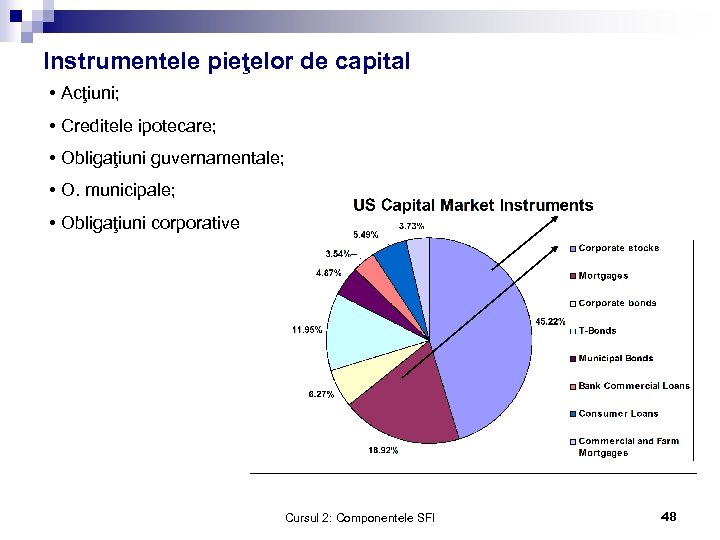

Instrumentele pieţelor de capital • Acţiuni; • Creditele ipotecare; • Obligaţiuni guvernamentale; • O. municipale; • Obligaţiuni corporative Cursul 2: Componentele SFI 48

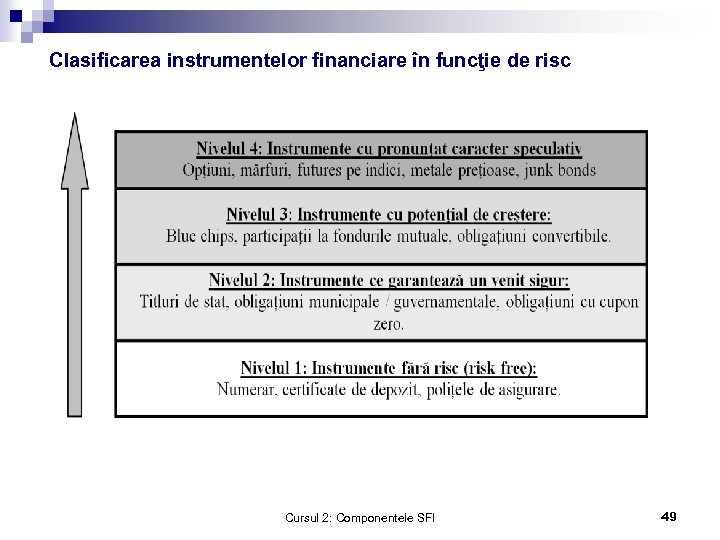

Clasificarea instrumentelor financiare în funcţie de risc Cursul 2: Componentele SFI 49

41a88327c1237702a6505bd15051bcca.ppt