c25435d02c598c5b931c8cde72c0440c.ppt

- Количество слайдов: 69

ACA and the New Individual Segment: Profiling the Uninsured and Non-Group Insured Populations with MEPS 2010 and SAS Survey Procedures Jessica Hampton September 2013

ACA and the New Individual Segment: Profiling the Uninsured and Non-Group Insured Populations with MEPS 2010 and SAS Survey Procedures Jessica Hampton September 2013

Presentation Outline • • • Introduction • Statement of Purpose • PPACA • MEPS 2010 • Survey Design • Literature Review • Intro to SAS Survey Procedures Data Preparation • Selected Variables • Derived Variables Statistical Analysis • PROC SURVEYMEANS • PROC SURVEYFREQ • Profiles (with PROC CORR, PROC SURVEYREG) • CART Models (SPSS) • PROC SURVEYLOGISTIC Models Conclusions/Recommendations References 2

Presentation Outline • • • Introduction • Statement of Purpose • PPACA • MEPS 2010 • Survey Design • Literature Review • Intro to SAS Survey Procedures Data Preparation • Selected Variables • Derived Variables Statistical Analysis • PROC SURVEYMEANS • PROC SURVEYFREQ • Profiles (with PROC CORR, PROC SURVEYREG) • CART Models (SPSS) • PROC SURVEYLOGISTIC Models Conclusions/Recommendations References 2

Introduction

Introduction

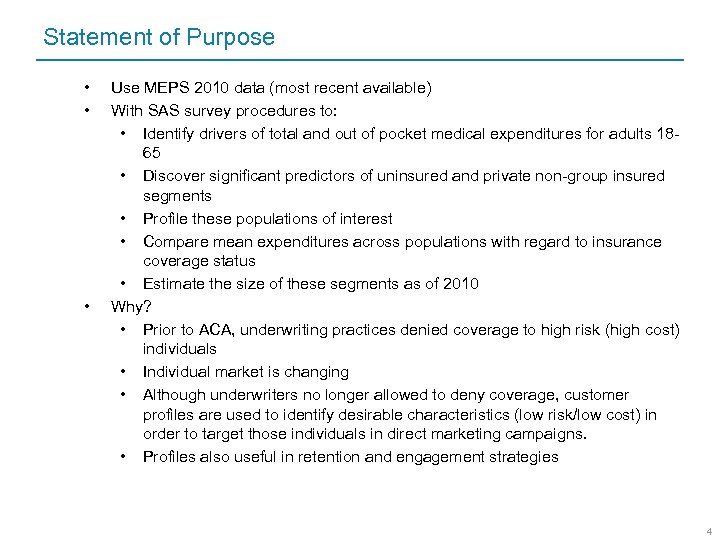

Statement of Purpose • • • Use MEPS 2010 data (most recent available) With SAS survey procedures to: • Identify drivers of total and out of pocket medical expenditures for adults 1865 • Discover significant predictors of uninsured and private non-group insured segments • Profile these populations of interest • Compare mean expenditures across populations with regard to insurance coverage status • Estimate the size of these segments as of 2010 Why? • Prior to ACA, underwriting practices denied coverage to high risk (high cost) individuals • Individual market is changing • Although underwriters no longer allowed to deny coverage, customer profiles are used to identify desirable characteristics (low risk/low cost) in order to target those individuals in direct marketing campaigns. • Profiles also useful in retention and engagement strategies 4

Statement of Purpose • • • Use MEPS 2010 data (most recent available) With SAS survey procedures to: • Identify drivers of total and out of pocket medical expenditures for adults 1865 • Discover significant predictors of uninsured and private non-group insured segments • Profile these populations of interest • Compare mean expenditures across populations with regard to insurance coverage status • Estimate the size of these segments as of 2010 Why? • Prior to ACA, underwriting practices denied coverage to high risk (high cost) individuals • Individual market is changing • Although underwriters no longer allowed to deny coverage, customer profiles are used to identify desirable characteristics (low risk/low cost) in order to target those individuals in direct marketing campaigns. • Profiles also useful in retention and engagement strategies 4

PPACA/ACA • • • • Patient Protection and Affordable Care Act (March 2010) Full implementation January 1, 2014 Guaranteed coverage for people with pre-existing conditions Minimum standards for coverage Phases out annual and lifetime maximums Standardized premiums with regard to gender and prior medical diagnoses Pricing based on age and smoking status Smoothes age-based premium differences (younger people will pay more than they used to) Income-based subsidies (up to 400% poverty level) Health insurance exchanges for each state to facilitate purchase Penalizes those who elect not to purchase health insurance Health insurance sales tax Dramatically expands the individual segment Previously uninsured purchase insurance through the exchanges Others lose their private employer group coverage 5

PPACA/ACA • • • • Patient Protection and Affordable Care Act (March 2010) Full implementation January 1, 2014 Guaranteed coverage for people with pre-existing conditions Minimum standards for coverage Phases out annual and lifetime maximums Standardized premiums with regard to gender and prior medical diagnoses Pricing based on age and smoking status Smoothes age-based premium differences (younger people will pay more than they used to) Income-based subsidies (up to 400% poverty level) Health insurance exchanges for each state to facilitate purchase Penalizes those who elect not to purchase health insurance Health insurance sales tax Dramatically expands the individual segment Previously uninsured purchase insurance through the exchanges Others lose their private employer group coverage 5

Medical Expenditures Panel Survey (MEPS) • • • Administered annually by the U. S. Department of Health and Human Services since 1996 Agency for Healthcare Research and Quality (AHRQ) Anonymity protected by removing individual identifiers from the public data files MEPS 2010 consolidated data file released September 2012 Multiple components (household, insurance/employer, and medical provider). Household component (1, 911 variables) covers the following topics: • Demographics • Household income • Employment • Diagnosed health conditions • Additional health status issues • Medical expenditures and utilization • Satisfaction with and access to care • Insurance coverage 18, 692 after excluding out of scope, negative person weights, under 18 and 65+ U. S. civilian, noninstitutionalized population ~3% out of scope (birth/adoption, death, incarceration, living abroad) 6

Medical Expenditures Panel Survey (MEPS) • • • Administered annually by the U. S. Department of Health and Human Services since 1996 Agency for Healthcare Research and Quality (AHRQ) Anonymity protected by removing individual identifiers from the public data files MEPS 2010 consolidated data file released September 2012 Multiple components (household, insurance/employer, and medical provider). Household component (1, 911 variables) covers the following topics: • Demographics • Household income • Employment • Diagnosed health conditions • Additional health status issues • Medical expenditures and utilization • Satisfaction with and access to care • Insurance coverage 18, 692 after excluding out of scope, negative person weights, under 18 and 65+ U. S. civilian, noninstitutionalized population ~3% out of scope (birth/adoption, death, incarceration, living abroad) 6

MEPS Survey Design Methods • • MEPS is a representative but NOT a random sample of the population Person weights must be used to produce reliable population estimates Stratification: • By demographic variables such as age, race, sex, income, etc. • Goal is to maximize homogeneity within and heterogeneity between strata • Sometimes used to oversample certain groups under-represented in the general population or with interesting characteristics relevant to study • For example: blacks, Hispanics, and low-income households Clustering: • By geography in order to reduce survey costs -- not feasible or costeffective to do a random sample of the entire population of the U. S. • Within-cluster correlation underestimates variance/error -- two families in the same neighborhood are more likely to be similar demographically (for example, similar income) • Desire clusters spatially close for cost effectiveness but as heterogeneous within as possible for reasonable variance. • Multi-stage clustering used in MEPS: • sample of counties >> sample of blocks >> individuals/households surveyed from block sample 7

MEPS Survey Design Methods • • MEPS is a representative but NOT a random sample of the population Person weights must be used to produce reliable population estimates Stratification: • By demographic variables such as age, race, sex, income, etc. • Goal is to maximize homogeneity within and heterogeneity between strata • Sometimes used to oversample certain groups under-represented in the general population or with interesting characteristics relevant to study • For example: blacks, Hispanics, and low-income households Clustering: • By geography in order to reduce survey costs -- not feasible or costeffective to do a random sample of the entire population of the U. S. • Within-cluster correlation underestimates variance/error -- two families in the same neighborhood are more likely to be similar demographically (for example, similar income) • Desire clusters spatially close for cost effectiveness but as heterogeneous within as possible for reasonable variance. • Multi-stage clustering used in MEPS: • sample of counties >> sample of blocks >> individuals/households surveyed from block sample 7

Survey Design Considerations • • • If person weights are ignored and one tries to generalize sample findings to the entire population, total numbers, percentages, or means are inflated for the groups that are oversampled and underestimated for others In regression analysis, ignoring person weights leads to biased coefficient estimates If sampling strata and cluster variables are ignored, means and coefficient estimates are unaffected, but standard error (or population variance) may be underestimated; that is, the reliability of an estimate may be overestimated Or when comparing one estimated population mean to another, the difference may appear to be statistically significant when it is not (Machlin, S. , Yu, W. , & Zodet, M. , 2005) 8

Survey Design Considerations • • • If person weights are ignored and one tries to generalize sample findings to the entire population, total numbers, percentages, or means are inflated for the groups that are oversampled and underestimated for others In regression analysis, ignoring person weights leads to biased coefficient estimates If sampling strata and cluster variables are ignored, means and coefficient estimates are unaffected, but standard error (or population variance) may be underestimated; that is, the reliability of an estimate may be overestimated Or when comparing one estimated population mean to another, the difference may appear to be statistically significant when it is not (Machlin, S. , Yu, W. , & Zodet, M. , 2005) 8

Literature Review

Literature Review

Literature Review – KFF 2011 • • • Most literature focuses on data available prior to 2012 which describes these segments (uninsured/non-group) through 2008 Kaiser Family Foundation (KFF) 2011 study, “A Profile of Health Insurance Exchange Enrollees, ” based on MEPS 2007 Model simulation of demographic, health, and medical utilization profiles of the people expected to enroll in exchanges by 2019 Compares exchange population profile to privately insured and uninsured Estimates the exchange population in 2019 to include: • 16 million formerly uninsured individuals • 5 million formerly employer group insured • 1 million formerly private non-group insured Exchange population older, with lower education and income levels, more racially diverse than current privately insured population Expect self-reported worse health but fewer pre-existing medical diagnoses, possibly due to lack of access to care Expect utilization and expenditures to increase for the previously uninsured once they gain access to care – similar to those of non-group insured Some higher income will continue purchasing non-group insurance outside of the exchanges – those with lower income will favor exchanges 10

Literature Review – KFF 2011 • • • Most literature focuses on data available prior to 2012 which describes these segments (uninsured/non-group) through 2008 Kaiser Family Foundation (KFF) 2011 study, “A Profile of Health Insurance Exchange Enrollees, ” based on MEPS 2007 Model simulation of demographic, health, and medical utilization profiles of the people expected to enroll in exchanges by 2019 Compares exchange population profile to privately insured and uninsured Estimates the exchange population in 2019 to include: • 16 million formerly uninsured individuals • 5 million formerly employer group insured • 1 million formerly private non-group insured Exchange population older, with lower education and income levels, more racially diverse than current privately insured population Expect self-reported worse health but fewer pre-existing medical diagnoses, possibly due to lack of access to care Expect utilization and expenditures to increase for the previously uninsured once they gain access to care – similar to those of non-group insured Some higher income will continue purchasing non-group insurance outside of the exchanges – those with lower income will favor exchanges 10

Literature Review – KFF 2010 • • 2010 study by KFF: “Comparison of Expenditures in Nongroup and Employer Sponsored Insurance: 2004 -2007 Recent focus on the non-group market prompted by healthcare reform, which would expand the non-group market Di. Julio and Claxton, study authors, use combined data from MEPS 2004 -2007 for the nonelderly adult population Non-group insured have lower premiums, higher out-of-pocket expenses and better (self-reported) health than the private employer group segment Implies some combination of more cost-sharing, higher deductible levels, and/or less coverage for non-group If lower income people are entering the group market, they may not be able to afford the high out-of-pocket costs Plans may need higher premiums if the uninsured population is not as healthy as the non-group segment (Di. Julio, B. & Claxton, G. , 2010) 11

Literature Review – KFF 2010 • • 2010 study by KFF: “Comparison of Expenditures in Nongroup and Employer Sponsored Insurance: 2004 -2007 Recent focus on the non-group market prompted by healthcare reform, which would expand the non-group market Di. Julio and Claxton, study authors, use combined data from MEPS 2004 -2007 for the nonelderly adult population Non-group insured have lower premiums, higher out-of-pocket expenses and better (self-reported) health than the private employer group segment Implies some combination of more cost-sharing, higher deductible levels, and/or less coverage for non-group If lower income people are entering the group market, they may not be able to afford the high out-of-pocket costs Plans may need higher premiums if the uninsured population is not as healthy as the non-group segment (Di. Julio, B. & Claxton, G. , 2010) 11

Literature Review – KFF 2008 • • 2008 Kaiser study, prior to ACA being signed into law: “How Non-Group Health Coverage Varies with Income” Based on combined data from MEPS 2000 -2003 for nonelderly adults Finds that even higher income people may prefer to remain uninsured than to buy in the non-group market if they have no coverage offered through an employer At 4 x the poverty level, 25% purchase non-group At 10 x the poverty level, only 50% purchase non-group coverage Although people are more likely to purchase non-group plans at higher income levels, study concludes that the non-group insurance market is unattractive to consumers Insurers either need to improve their product or the government needs to subsidize such plans even for higher incomes in order to encourage participation 12

Literature Review – KFF 2008 • • 2008 Kaiser study, prior to ACA being signed into law: “How Non-Group Health Coverage Varies with Income” Based on combined data from MEPS 2000 -2003 for nonelderly adults Finds that even higher income people may prefer to remain uninsured than to buy in the non-group market if they have no coverage offered through an employer At 4 x the poverty level, 25% purchase non-group At 10 x the poverty level, only 50% purchase non-group coverage Although people are more likely to purchase non-group plans at higher income levels, study concludes that the non-group insurance market is unattractive to consumers Insurers either need to improve their product or the government needs to subsidize such plans even for higher incomes in order to encourage participation 12

Literature Review – MEPS Statistical Brief 2009 • • • A MEPS statistical brief from 2009 examines trends in group and non-group private coverage 1996 -2007, nonelderly adult population 65% had private group coverage at some time in 2007 Percentage private group has remained similar since 1996, with increasing overall numbers corresponding to population increase Non-group coverage has declined in the same time period, falling from 6% to 4% (Cohen, J. W. & Rhoades, J. A. , 2009). 13

Literature Review – MEPS Statistical Brief 2009 • • • A MEPS statistical brief from 2009 examines trends in group and non-group private coverage 1996 -2007, nonelderly adult population 65% had private group coverage at some time in 2007 Percentage private group has remained similar since 1996, with increasing overall numbers corresponding to population increase Non-group coverage has declined in the same time period, falling from 6% to 4% (Cohen, J. W. & Rhoades, J. A. , 2009). 13

Literature Review – O’Neill & O’Neill 2009 • • • O’Neill and O’Neill (2009) conducted an analysis of the characteristics of the uninsured population Employment Policies Institute study finds that a large portion of the uninsured are “voluntarily uninsured” • Percentage varies by state from as low as 27% to as high as 55% • Defined as nonelderly adults at or exceeding 2. 5 times the poverty level The media tends to portray the uninsured population as being in very poor health and without options, but the authors say this portrayal is exaggerated and does not present a full picture Uninsured population has very different demographic characteristics from the privately insured: • young • low education levels • immigrants • lower medical utilization/expenditure levels Higher mortality rates (about 3% higher than those of the privately insured segment after controlling for other risk factors such as smoking) among uninsured Lack of health insurance coverage not the major contributing factor – other disadvantages associated with poor health, such as lack of education (O’Neill & O’Neill, 2009) 14

Literature Review – O’Neill & O’Neill 2009 • • • O’Neill and O’Neill (2009) conducted an analysis of the characteristics of the uninsured population Employment Policies Institute study finds that a large portion of the uninsured are “voluntarily uninsured” • Percentage varies by state from as low as 27% to as high as 55% • Defined as nonelderly adults at or exceeding 2. 5 times the poverty level The media tends to portray the uninsured population as being in very poor health and without options, but the authors say this portrayal is exaggerated and does not present a full picture Uninsured population has very different demographic characteristics from the privately insured: • young • low education levels • immigrants • lower medical utilization/expenditure levels Higher mortality rates (about 3% higher than those of the privately insured segment after controlling for other risk factors such as smoking) among uninsured Lack of health insurance coverage not the major contributing factor – other disadvantages associated with poor health, such as lack of education (O’Neill & O’Neill, 2009) 14

Literature Review – Summary • • • Private non-group coverage declining over time Non-group market unpopular and overpriced Non-group insured have lower premiums, higher out-of-pocket expenses and better (self-reported) health than the private employer group segment Large portion of the uninsured are “voluntarily uninsured” Uninsured population has very different demographic characteristics from the privately insured Exchange population characteristics will be driven by large influx of formerly uninsured Lower education and income levels, more racial diversity than current privately insured population Fewer pre-existing medical diagnoses Conflicting information on whether uninsured population is actually healthier or not 15

Literature Review – Summary • • • Private non-group coverage declining over time Non-group market unpopular and overpriced Non-group insured have lower premiums, higher out-of-pocket expenses and better (self-reported) health than the private employer group segment Large portion of the uninsured are “voluntarily uninsured” Uninsured population has very different demographic characteristics from the privately insured Exchange population characteristics will be driven by large influx of formerly uninsured Lower education and income levels, more racial diversity than current privately insured population Fewer pre-existing medical diagnoses Conflicting information on whether uninsured population is actually healthier or not 15

SAS Survey Procedures

SAS Survey Procedures

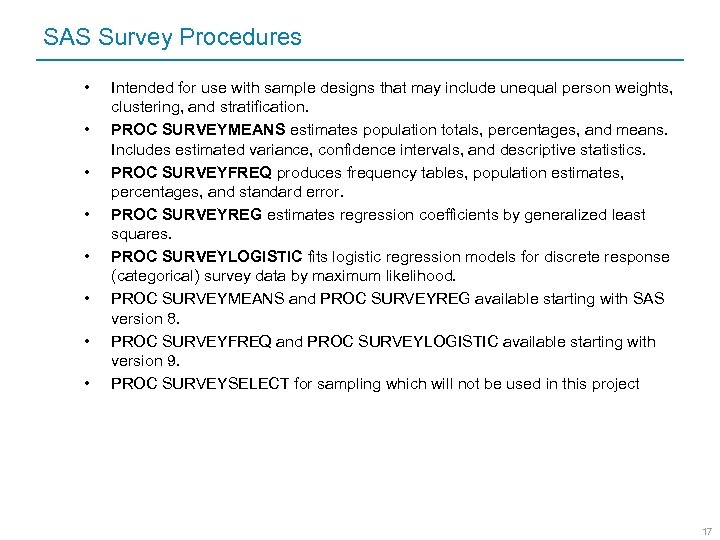

SAS Survey Procedures • • Intended for use with sample designs that may include unequal person weights, clustering, and stratification. PROC SURVEYMEANS estimates population totals, percentages, and means. Includes estimated variance, confidence intervals, and descriptive statistics. PROC SURVEYFREQ produces frequency tables, population estimates, percentages, and standard error. PROC SURVEYREG estimates regression coefficients by generalized least squares. PROC SURVEYLOGISTIC fits logistic regression models for discrete response (categorical) survey data by maximum likelihood. PROC SURVEYMEANS and PROC SURVEYREG available starting with SAS version 8. PROC SURVEYFREQ and PROC SURVEYLOGISTIC available starting with version 9. PROC SURVEYSELECT for sampling which will not be used in this project 17

SAS Survey Procedures • • Intended for use with sample designs that may include unequal person weights, clustering, and stratification. PROC SURVEYMEANS estimates population totals, percentages, and means. Includes estimated variance, confidence intervals, and descriptive statistics. PROC SURVEYFREQ produces frequency tables, population estimates, percentages, and standard error. PROC SURVEYREG estimates regression coefficients by generalized least squares. PROC SURVEYLOGISTIC fits logistic regression models for discrete response (categorical) survey data by maximum likelihood. PROC SURVEYMEANS and PROC SURVEYREG available starting with SAS version 8. PROC SURVEYFREQ and PROC SURVEYLOGISTIC available starting with version 9. PROC SURVEYSELECT for sampling which will not be used in this project 17

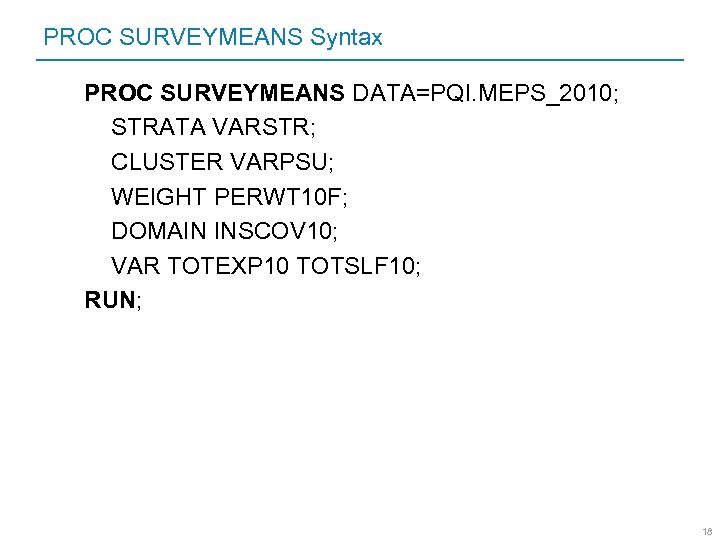

PROC SURVEYMEANS Syntax PROC SURVEYMEANS DATA=PQI. MEPS_2010; STRATA VARSTR; CLUSTER VARPSU; WEIGHT PERWT 10 F; DOMAIN INSCOV 10; VAR TOTEXP 10 TOTSLF 10; RUN; 18

PROC SURVEYMEANS Syntax PROC SURVEYMEANS DATA=PQI. MEPS_2010; STRATA VARSTR; CLUSTER VARPSU; WEIGHT PERWT 10 F; DOMAIN INSCOV 10; VAR TOTEXP 10 TOTSLF 10; RUN; 18

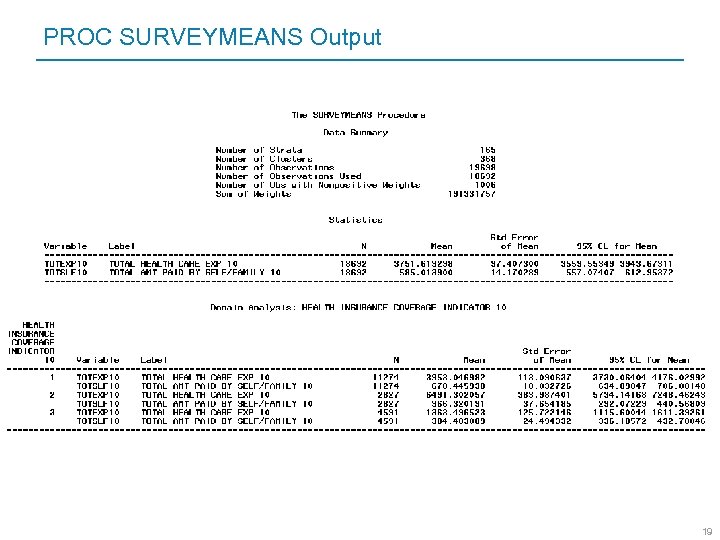

PROC SURVEYMEANS Output 19

PROC SURVEYMEANS Output 19

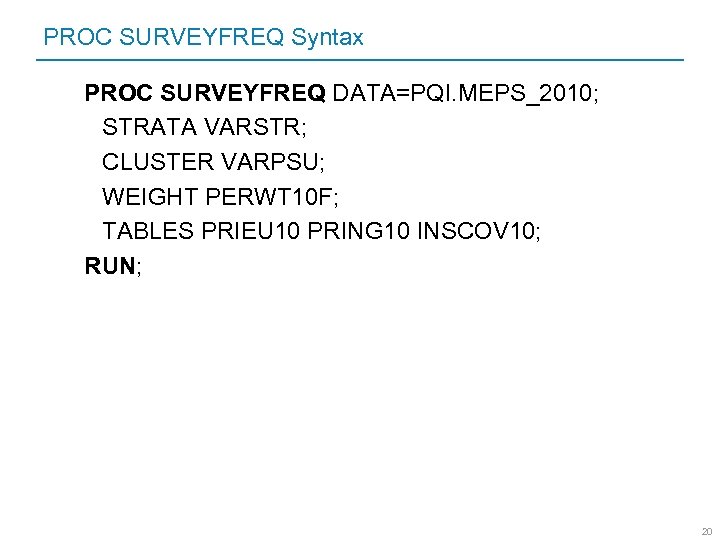

PROC SURVEYFREQ Syntax PROC SURVEYFREQ DATA=PQI. MEPS_2010; STRATA VARSTR; CLUSTER VARPSU; WEIGHT PERWT 10 F; TABLES PRIEU 10 PRING 10 INSCOV 10; RUN; 20

PROC SURVEYFREQ Syntax PROC SURVEYFREQ DATA=PQI. MEPS_2010; STRATA VARSTR; CLUSTER VARPSU; WEIGHT PERWT 10 F; TABLES PRIEU 10 PRING 10 INSCOV 10; RUN; 20

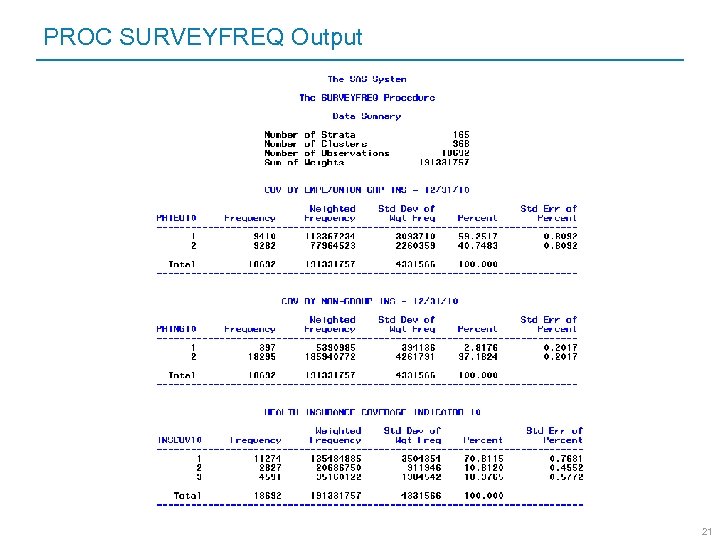

PROC SURVEYFREQ Output 21

PROC SURVEYFREQ Output 21

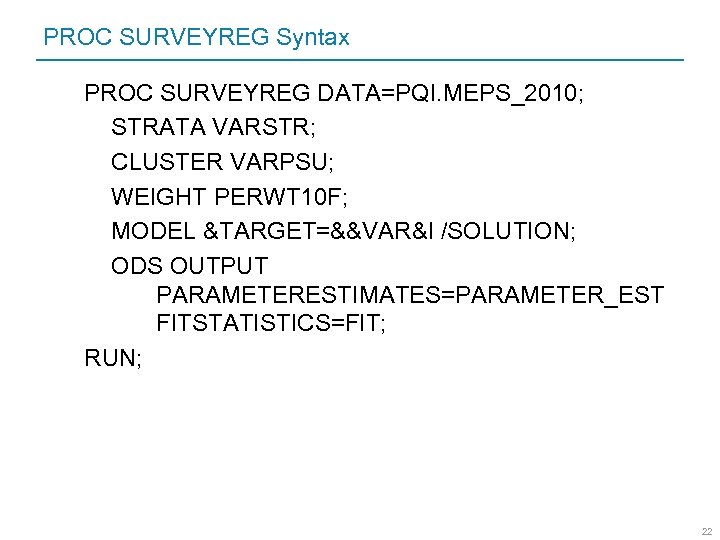

PROC SURVEYREG Syntax PROC SURVEYREG DATA=PQI. MEPS_2010; STRATA VARSTR; CLUSTER VARPSU; WEIGHT PERWT 10 F; MODEL &TARGET=&&VAR&I /SOLUTION; ODS OUTPUT PARAMETERESTIMATES=PARAMETER_EST FITSTATISTICS=FIT; RUN; 22

PROC SURVEYREG Syntax PROC SURVEYREG DATA=PQI. MEPS_2010; STRATA VARSTR; CLUSTER VARPSU; WEIGHT PERWT 10 F; MODEL &TARGET=&&VAR&I /SOLUTION; ODS OUTPUT PARAMETERESTIMATES=PARAMETER_EST FITSTATISTICS=FIT; RUN; 22

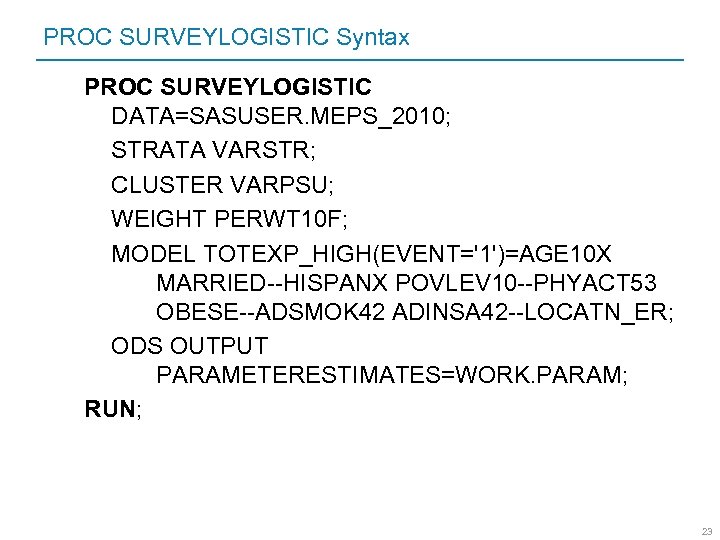

PROC SURVEYLOGISTIC Syntax PROC SURVEYLOGISTIC DATA=SASUSER. MEPS_2010; STRATA VARSTR; CLUSTER VARPSU; WEIGHT PERWT 10 F; MODEL TOTEXP_HIGH(EVENT='1')=AGE 10 X MARRIED--HISPANX POVLEV 10 --PHYACT 53 OBESE--ADSMOK 42 ADINSA 42 --LOCATN_ER; ODS OUTPUT PARAMETERESTIMATES=WORK. PARAM; RUN; 23

PROC SURVEYLOGISTIC Syntax PROC SURVEYLOGISTIC DATA=SASUSER. MEPS_2010; STRATA VARSTR; CLUSTER VARPSU; WEIGHT PERWT 10 F; MODEL TOTEXP_HIGH(EVENT='1')=AGE 10 X MARRIED--HISPANX POVLEV 10 --PHYACT 53 OBESE--ADSMOK 42 ADINSA 42 --LOCATN_ER; ODS OUTPUT PARAMETERESTIMATES=WORK. PARAM; RUN; 23

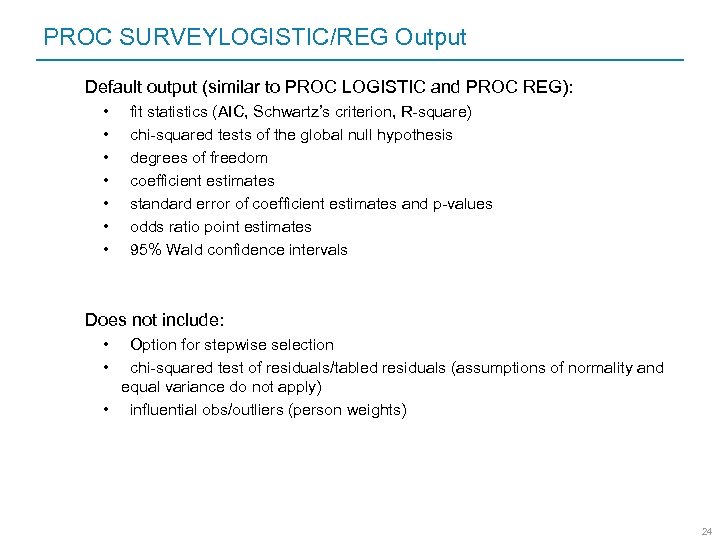

PROC SURVEYLOGISTIC/REG Output Default output (similar to PROC LOGISTIC and PROC REG): • • fit statistics (AIC, Schwartz’s criterion, R-square) chi-squared tests of the global null hypothesis degrees of freedom coefficient estimates standard error of coefficient estimates and p-values odds ratio point estimates 95% Wald confidence intervals Does not include: • Option for stepwise selection • chi-squared test of residuals/tabled residuals (assumptions of normality and equal variance do not apply) • influential obs/outliers (person weights) 24

PROC SURVEYLOGISTIC/REG Output Default output (similar to PROC LOGISTIC and PROC REG): • • fit statistics (AIC, Schwartz’s criterion, R-square) chi-squared tests of the global null hypothesis degrees of freedom coefficient estimates standard error of coefficient estimates and p-values odds ratio point estimates 95% Wald confidence intervals Does not include: • Option for stepwise selection • chi-squared test of residuals/tabled residuals (assumptions of normality and equal variance do not apply) • influential obs/outliers (person weights) 24

Data Preparation

Data Preparation

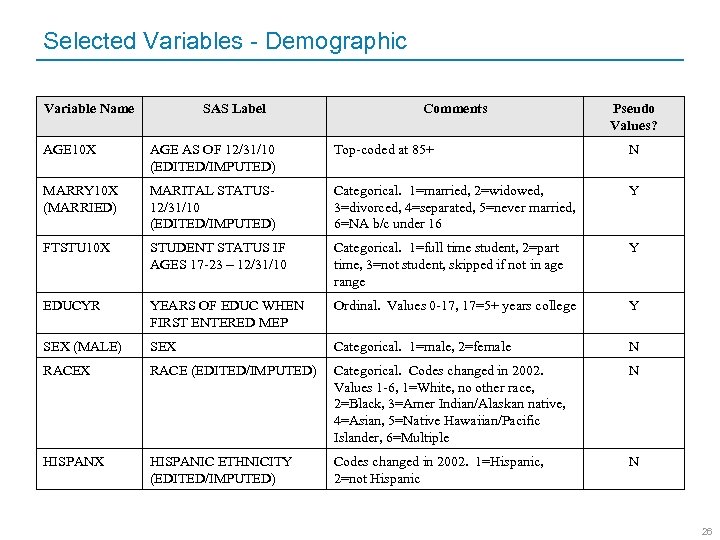

Selected Variables - Demographic Variable Name SAS Label Comments Pseudo Values? AGE 10 X AGE AS OF 12/31/10 (EDITED/IMPUTED) Top-coded at 85+ N MARRY 10 X (MARRIED) MARITAL STATUS 12/31/10 (EDITED/IMPUTED) Categorical. 1=married, 2=widowed, 3=divorced, 4=separated, 5=never married, 6=NA b/c under 16 Y FTSTU 10 X STUDENT STATUS IF AGES 17 -23 – 12/31/10 Categorical. 1=full time student, 2=part time, 3=not student, skipped if not in age range Y EDUCYR YEARS OF EDUC WHEN FIRST ENTERED MEP Ordinal. Values 0 -17, 17=5+ years college Y SEX (MALE) SEX Categorical. 1=male, 2=female N RACEX RACE (EDITED/IMPUTED) Categorical. Codes changed in 2002. Values 1 -6, 1=White, no other race, 2=Black, 3=Amer Indian/Alaskan native, 4=Asian, 5=Native Hawaiian/Pacific Islander, 6=Multiple N HISPANX HISPANIC ETHNICITY (EDITED/IMPUTED) Codes changed in 2002. 1=Hispanic, 2=not Hispanic N 26

Selected Variables - Demographic Variable Name SAS Label Comments Pseudo Values? AGE 10 X AGE AS OF 12/31/10 (EDITED/IMPUTED) Top-coded at 85+ N MARRY 10 X (MARRIED) MARITAL STATUS 12/31/10 (EDITED/IMPUTED) Categorical. 1=married, 2=widowed, 3=divorced, 4=separated, 5=never married, 6=NA b/c under 16 Y FTSTU 10 X STUDENT STATUS IF AGES 17 -23 – 12/31/10 Categorical. 1=full time student, 2=part time, 3=not student, skipped if not in age range Y EDUCYR YEARS OF EDUC WHEN FIRST ENTERED MEP Ordinal. Values 0 -17, 17=5+ years college Y SEX (MALE) SEX Categorical. 1=male, 2=female N RACEX RACE (EDITED/IMPUTED) Categorical. Codes changed in 2002. Values 1 -6, 1=White, no other race, 2=Black, 3=Amer Indian/Alaskan native, 4=Asian, 5=Native Hawaiian/Pacific Islander, 6=Multiple N HISPANX HISPANIC ETHNICITY (EDITED/IMPUTED) Codes changed in 2002. 1=Hispanic, 2=not Hispanic N 26

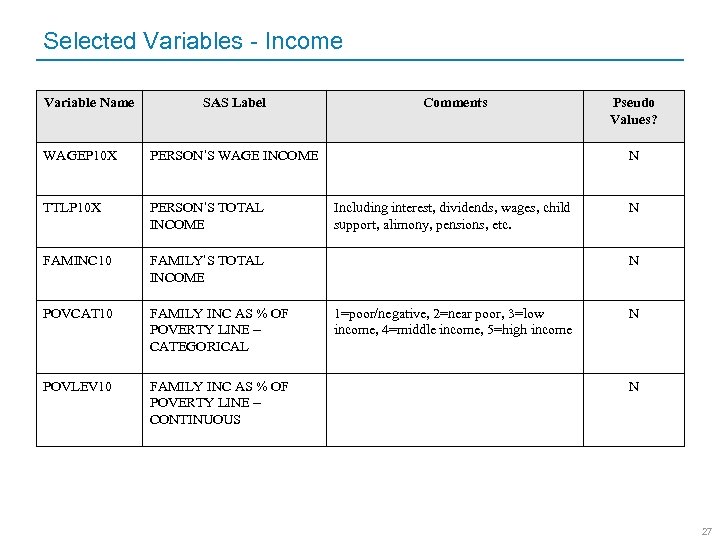

Selected Variables - Income Variable Name SAS Label WAGEP 10 X PERSON’S WAGE INCOME TTLP 10 X PERSON’S TOTAL INCOME FAMINC 10 FAMILY’S TOTAL INCOME POVCAT 10 FAMILY INC AS % OF POVERTY LINE – CATEGORICAL POVLEV 10 FAMILY INC AS % OF POVERTY LINE – CONTINUOUS Comments Pseudo Values? N Including interest, dividends, wages, child support, alimony, pensions, etc. N N 1=poor/negative, 2=near poor, 3=low income, 4=middle income, 5=high income N N 27

Selected Variables - Income Variable Name SAS Label WAGEP 10 X PERSON’S WAGE INCOME TTLP 10 X PERSON’S TOTAL INCOME FAMINC 10 FAMILY’S TOTAL INCOME POVCAT 10 FAMILY INC AS % OF POVERTY LINE – CATEGORICAL POVLEV 10 FAMILY INC AS % OF POVERTY LINE – CONTINUOUS Comments Pseudo Values? N Including interest, dividends, wages, child support, alimony, pensions, etc. N N 1=poor/negative, 2=near poor, 3=low income, 4=middle income, 5=high income N N 27

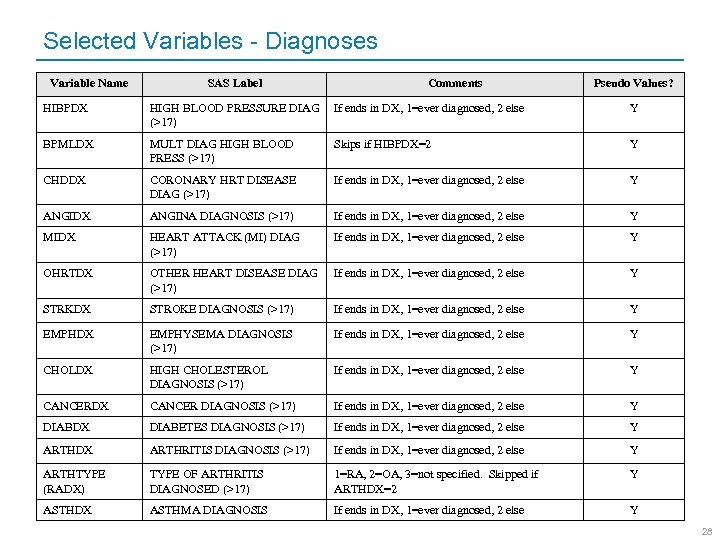

Selected Variables - Diagnoses Variable Name SAS Label Comments Pseudo Values? HIBPDX HIGH BLOOD PRESSURE DIAG (>17) If ends in DX, 1=ever diagnosed, 2 else Y BPMLDX MULT DIAG HIGH BLOOD PRESS (>17) Skips if HIBPDX=2 Y CHDDX CORONARY HRT DISEASE DIAG (>17) If ends in DX, 1=ever diagnosed, 2 else Y ANGIDX ANGINA DIAGNOSIS (>17) If ends in DX, 1=ever diagnosed, 2 else Y MIDX HEART ATTACK (MI) DIAG (>17) If ends in DX, 1=ever diagnosed, 2 else Y OHRTDX OTHER HEART DISEASE DIAG (>17) If ends in DX, 1=ever diagnosed, 2 else Y STRKDX STROKE DIAGNOSIS (>17) If ends in DX, 1=ever diagnosed, 2 else Y EMPHDX EMPHYSEMA DIAGNOSIS (>17) If ends in DX, 1=ever diagnosed, 2 else Y CHOLDX HIGH CHOLESTEROL DIAGNOSIS (>17) If ends in DX, 1=ever diagnosed, 2 else Y CANCERDX CANCER DIAGNOSIS (>17) If ends in DX, 1=ever diagnosed, 2 else Y DIABDX DIABETES DIAGNOSIS (>17) If ends in DX, 1=ever diagnosed, 2 else Y ARTHDX ARTHRITIS DIAGNOSIS (>17) If ends in DX, 1=ever diagnosed, 2 else Y ARTHTYPE (RADX) TYPE OF ARTHRITIS DIAGNOSED (>17) 1=RA, 2=OA, 3=not specified. Skipped if ARTHDX=2 Y ASTHDX ASTHMA DIAGNOSIS If ends in DX, 1=ever diagnosed, 2 else Y 28

Selected Variables - Diagnoses Variable Name SAS Label Comments Pseudo Values? HIBPDX HIGH BLOOD PRESSURE DIAG (>17) If ends in DX, 1=ever diagnosed, 2 else Y BPMLDX MULT DIAG HIGH BLOOD PRESS (>17) Skips if HIBPDX=2 Y CHDDX CORONARY HRT DISEASE DIAG (>17) If ends in DX, 1=ever diagnosed, 2 else Y ANGIDX ANGINA DIAGNOSIS (>17) If ends in DX, 1=ever diagnosed, 2 else Y MIDX HEART ATTACK (MI) DIAG (>17) If ends in DX, 1=ever diagnosed, 2 else Y OHRTDX OTHER HEART DISEASE DIAG (>17) If ends in DX, 1=ever diagnosed, 2 else Y STRKDX STROKE DIAGNOSIS (>17) If ends in DX, 1=ever diagnosed, 2 else Y EMPHDX EMPHYSEMA DIAGNOSIS (>17) If ends in DX, 1=ever diagnosed, 2 else Y CHOLDX HIGH CHOLESTEROL DIAGNOSIS (>17) If ends in DX, 1=ever diagnosed, 2 else Y CANCERDX CANCER DIAGNOSIS (>17) If ends in DX, 1=ever diagnosed, 2 else Y DIABDX DIABETES DIAGNOSIS (>17) If ends in DX, 1=ever diagnosed, 2 else Y ARTHDX ARTHRITIS DIAGNOSIS (>17) If ends in DX, 1=ever diagnosed, 2 else Y ARTHTYPE (RADX) TYPE OF ARTHRITIS DIAGNOSED (>17) 1=RA, 2=OA, 3=not specified. Skipped if ARTHDX=2 Y ASTHDX ASTHMA DIAGNOSIS If ends in DX, 1=ever diagnosed, 2 else Y 28

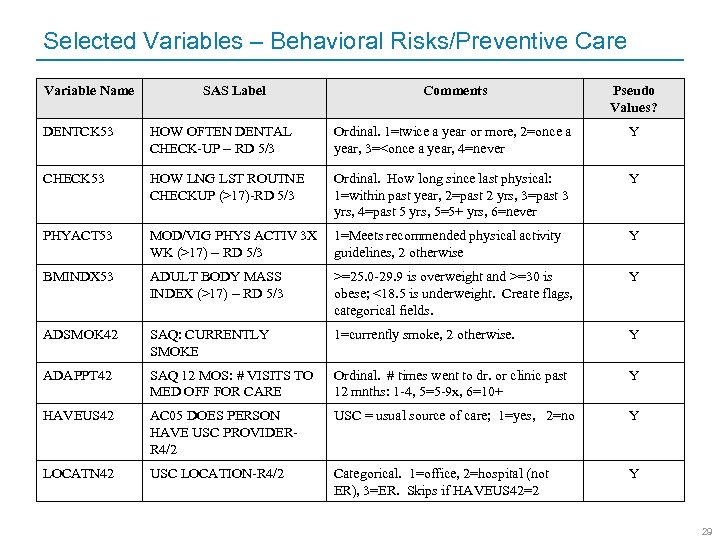

Selected Variables – Behavioral Risks/Preventive Care Variable Name SAS Label Comments Pseudo Values? DENTCK 53 HOW OFTEN DENTAL CHECK-UP – RD 5/3 Ordinal. 1=twice a year or more, 2=once a year, 3=

Selected Variables – Behavioral Risks/Preventive Care Variable Name SAS Label Comments Pseudo Values? DENTCK 53 HOW OFTEN DENTAL CHECK-UP – RD 5/3 Ordinal. 1=twice a year or more, 2=once a year, 3=

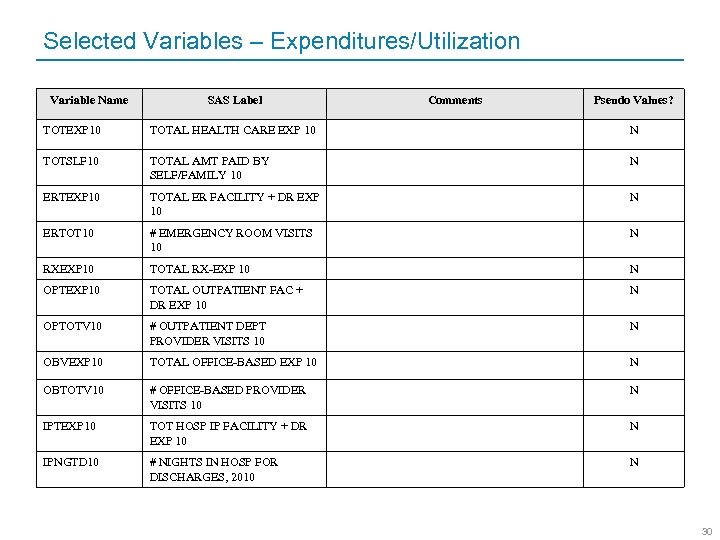

Selected Variables – Expenditures/Utilization Variable Name SAS Label Comments Pseudo Values? TOTEXP 10 TOTAL HEALTH CARE EXP 10 N TOTSLF 10 TOTAL AMT PAID BY SELF/FAMILY 10 N ERTEXP 10 TOTAL ER FACILITY + DR EXP 10 N ERTOT 10 # EMERGENCY ROOM VISITS 10 N RXEXP 10 TOTAL RX-EXP 10 N OPTEXP 10 TOTAL OUTPATIENT FAC + DR EXP 10 N OPTOTV 10 # OUTPATIENT DEPT PROVIDER VISITS 10 N OBVEXP 10 TOTAL OFFICE-BASED EXP 10 N OBTOTV 10 # OFFICE-BASED PROVIDER VISITS 10 N IPTEXP 10 TOT HOSP IP FACILITY + DR EXP 10 N IPNGTD 10 # NIGHTS IN HOSP FOR DISCHARGES, 2010 N 30

Selected Variables – Expenditures/Utilization Variable Name SAS Label Comments Pseudo Values? TOTEXP 10 TOTAL HEALTH CARE EXP 10 N TOTSLF 10 TOTAL AMT PAID BY SELF/FAMILY 10 N ERTEXP 10 TOTAL ER FACILITY + DR EXP 10 N ERTOT 10 # EMERGENCY ROOM VISITS 10 N RXEXP 10 TOTAL RX-EXP 10 N OPTEXP 10 TOTAL OUTPATIENT FAC + DR EXP 10 N OPTOTV 10 # OUTPATIENT DEPT PROVIDER VISITS 10 N OBVEXP 10 TOTAL OFFICE-BASED EXP 10 N OBTOTV 10 # OFFICE-BASED PROVIDER VISITS 10 N IPTEXP 10 TOT HOSP IP FACILITY + DR EXP 10 N IPNGTD 10 # NIGHTS IN HOSP FOR DISCHARGES, 2010 N 30

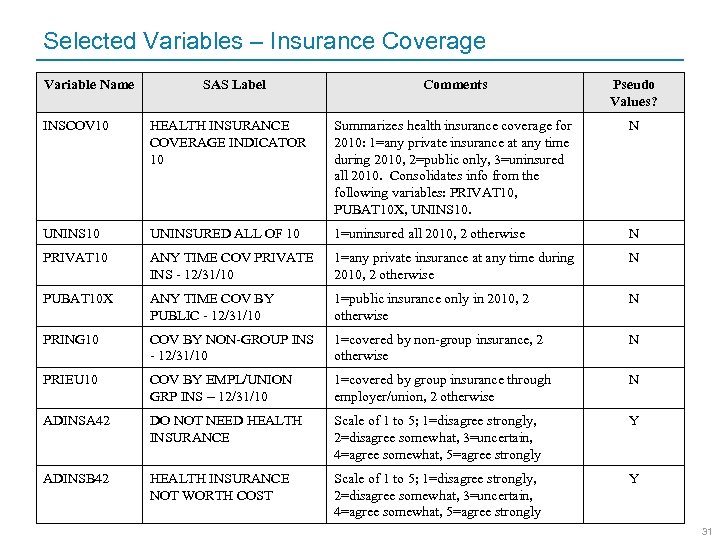

Selected Variables – Insurance Coverage Variable Name SAS Label Comments Pseudo Values? INSCOV 10 HEALTH INSURANCE COVERAGE INDICATOR 10 Summarizes health insurance coverage for 2010: 1=any private insurance at any time during 2010, 2=public only, 3=uninsured all 2010. Consolidates info from the following variables: PRIVAT 10, PUBAT 10 X, UNINS 10. N UNINS 10 UNINSURED ALL OF 10 1=uninsured all 2010, 2 otherwise N PRIVAT 10 ANY TIME COV PRIVATE INS - 12/31/10 1=any private insurance at any time during 2010, 2 otherwise N PUBAT 10 X ANY TIME COV BY PUBLIC - 12/31/10 1=public insurance only in 2010, 2 otherwise N PRING 10 COV BY NON-GROUP INS - 12/31/10 1=covered by non-group insurance, 2 otherwise N PRIEU 10 COV BY EMPL/UNION GRP INS – 12/31/10 1=covered by group insurance through employer/union, 2 otherwise N ADINSA 42 DO NOT NEED HEALTH INSURANCE Scale of 1 to 5; 1=disagree strongly, 2=disagree somewhat, 3=uncertain, 4=agree somewhat, 5=agree strongly Y ADINSB 42 HEALTH INSURANCE NOT WORTH COST Scale of 1 to 5; 1=disagree strongly, 2=disagree somewhat, 3=uncertain, 4=agree somewhat, 5=agree strongly Y 31

Selected Variables – Insurance Coverage Variable Name SAS Label Comments Pseudo Values? INSCOV 10 HEALTH INSURANCE COVERAGE INDICATOR 10 Summarizes health insurance coverage for 2010: 1=any private insurance at any time during 2010, 2=public only, 3=uninsured all 2010. Consolidates info from the following variables: PRIVAT 10, PUBAT 10 X, UNINS 10. N UNINS 10 UNINSURED ALL OF 10 1=uninsured all 2010, 2 otherwise N PRIVAT 10 ANY TIME COV PRIVATE INS - 12/31/10 1=any private insurance at any time during 2010, 2 otherwise N PUBAT 10 X ANY TIME COV BY PUBLIC - 12/31/10 1=public insurance only in 2010, 2 otherwise N PRING 10 COV BY NON-GROUP INS - 12/31/10 1=covered by non-group insurance, 2 otherwise N PRIEU 10 COV BY EMPL/UNION GRP INS – 12/31/10 1=covered by group insurance through employer/union, 2 otherwise N ADINSA 42 DO NOT NEED HEALTH INSURANCE Scale of 1 to 5; 1=disagree strongly, 2=disagree somewhat, 3=uncertain, 4=agree somewhat, 5=agree strongly Y ADINSB 42 HEALTH INSURANCE NOT WORTH COST Scale of 1 to 5; 1=disagree strongly, 2=disagree somewhat, 3=uncertain, 4=agree somewhat, 5=agree strongly Y 31

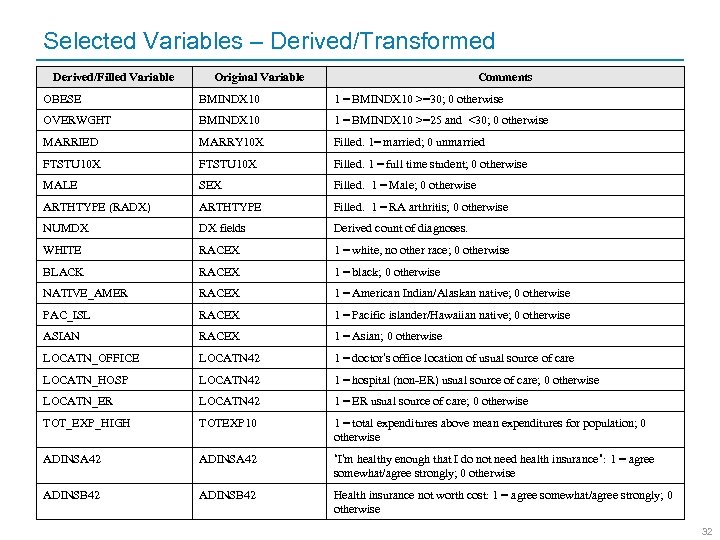

Selected Variables – Derived/Transformed Derived/Filled Variable Original Variable Comments OBESE BMINDX 10 1 = BMINDX 10 >=30; 0 otherwise OVERWGHT BMINDX 10 1 = BMINDX 10 >=25 and <30; 0 otherwise MARRIED MARRY 10 X Filled. 1= married; 0 unmarried FTSTU 10 X Filled. 1 = full time student; 0 otherwise MALE SEX Filled. 1 = Male; 0 otherwise ARTHTYPE (RADX) ARTHTYPE Filled. 1 = RA arthritis; 0 otherwise NUMDX DX fields Derived count of diagnoses. WHITE RACEX 1 = white, no other race; 0 otherwise BLACK RACEX 1 = black; 0 otherwise NATIVE_AMER RACEX 1 = American Indian/Alaskan native; 0 otherwise PAC_ISL RACEX 1 = Pacific islander/Hawaiian native; 0 otherwise ASIAN RACEX 1 = Asian; 0 otherwise LOCATN_OFFICE LOCATN 42 1 = doctor’s office location of usual source of care LOCATN_HOSP LOCATN 42 1 = hospital (non-ER) usual source of care; 0 otherwise LOCATN_ER LOCATN 42 1 = ER usual source of care; 0 otherwise TOT_EXP_HIGH TOTEXP 10 1 = total expenditures above mean expenditures for population; 0 otherwise ADINSA 42 “I’m healthy enough that I do not need health insurance”: 1 = agree somewhat/agree strongly; 0 otherwise ADINSB 42 Health insurance not worth cost: 1 = agree somewhat/agree strongly; 0 otherwise 32

Selected Variables – Derived/Transformed Derived/Filled Variable Original Variable Comments OBESE BMINDX 10 1 = BMINDX 10 >=30; 0 otherwise OVERWGHT BMINDX 10 1 = BMINDX 10 >=25 and <30; 0 otherwise MARRIED MARRY 10 X Filled. 1= married; 0 unmarried FTSTU 10 X Filled. 1 = full time student; 0 otherwise MALE SEX Filled. 1 = Male; 0 otherwise ARTHTYPE (RADX) ARTHTYPE Filled. 1 = RA arthritis; 0 otherwise NUMDX DX fields Derived count of diagnoses. WHITE RACEX 1 = white, no other race; 0 otherwise BLACK RACEX 1 = black; 0 otherwise NATIVE_AMER RACEX 1 = American Indian/Alaskan native; 0 otherwise PAC_ISL RACEX 1 = Pacific islander/Hawaiian native; 0 otherwise ASIAN RACEX 1 = Asian; 0 otherwise LOCATN_OFFICE LOCATN 42 1 = doctor’s office location of usual source of care LOCATN_HOSP LOCATN 42 1 = hospital (non-ER) usual source of care; 0 otherwise LOCATN_ER LOCATN 42 1 = ER usual source of care; 0 otherwise TOT_EXP_HIGH TOTEXP 10 1 = total expenditures above mean expenditures for population; 0 otherwise ADINSA 42 “I’m healthy enough that I do not need health insurance”: 1 = agree somewhat/agree strongly; 0 otherwise ADINSB 42 Health insurance not worth cost: 1 = agree somewhat/agree strongly; 0 otherwise 32

Data Overview

Data Overview

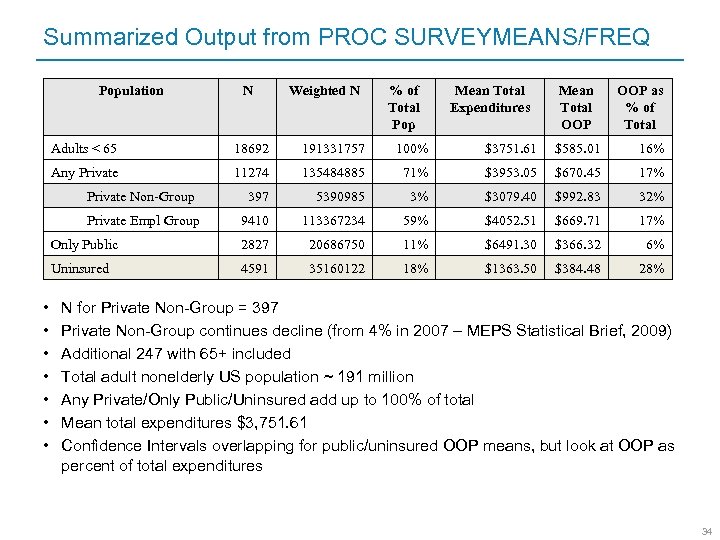

Summarized Output from PROC SURVEYMEANS/FREQ Population N Weighted N % of Total Pop Mean Total Expenditures Mean Total OOP as % of Total Adults < 65 191331757 100% $3751. 61 $585. 01 16% Any Private 11274 135484885 71% $3953. 05 $670. 45 17% Private Non-Group 397 5390985 3% $3079. 40 $992. 83 32% Private Empl Group 9410 113367234 59% $4052. 51 $669. 71 17% Only Public 2827 20686750 11% $6491. 30 $366. 32 6% Uninsured • • 18692 4591 35160122 18% $1363. 50 $384. 48 28% N for Private Non-Group = 397 Private Non-Group continues decline (from 4% in 2007 – MEPS Statistical Brief, 2009) Additional 247 with 65+ included Total adult nonelderly US population ~ 191 million Any Private/Only Public/Uninsured add up to 100% of total Mean total expenditures $3, 751. 61 Confidence Intervals overlapping for public/uninsured OOP means, but look at OOP as percent of total expenditures 34

Summarized Output from PROC SURVEYMEANS/FREQ Population N Weighted N % of Total Pop Mean Total Expenditures Mean Total OOP as % of Total Adults < 65 191331757 100% $3751. 61 $585. 01 16% Any Private 11274 135484885 71% $3953. 05 $670. 45 17% Private Non-Group 397 5390985 3% $3079. 40 $992. 83 32% Private Empl Group 9410 113367234 59% $4052. 51 $669. 71 17% Only Public 2827 20686750 11% $6491. 30 $366. 32 6% Uninsured • • 18692 4591 35160122 18% $1363. 50 $384. 48 28% N for Private Non-Group = 397 Private Non-Group continues decline (from 4% in 2007 – MEPS Statistical Brief, 2009) Additional 247 with 65+ included Total adult nonelderly US population ~ 191 million Any Private/Only Public/Uninsured add up to 100% of total Mean total expenditures $3, 751. 61 Confidence Intervals overlapping for public/uninsured OOP means, but look at OOP as percent of total expenditures 34

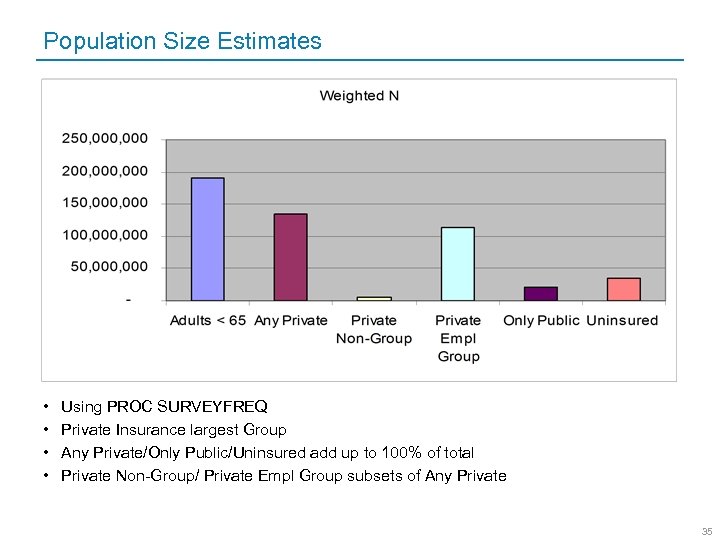

Population Size Estimates • • Using PROC SURVEYFREQ Private Insurance largest Group Any Private/Only Public/Uninsured add up to 100% of total Private Non-Group/ Private Empl Group subsets of Any Private 35

Population Size Estimates • • Using PROC SURVEYFREQ Private Insurance largest Group Any Private/Only Public/Uninsured add up to 100% of total Private Non-Group/ Private Empl Group subsets of Any Private 35

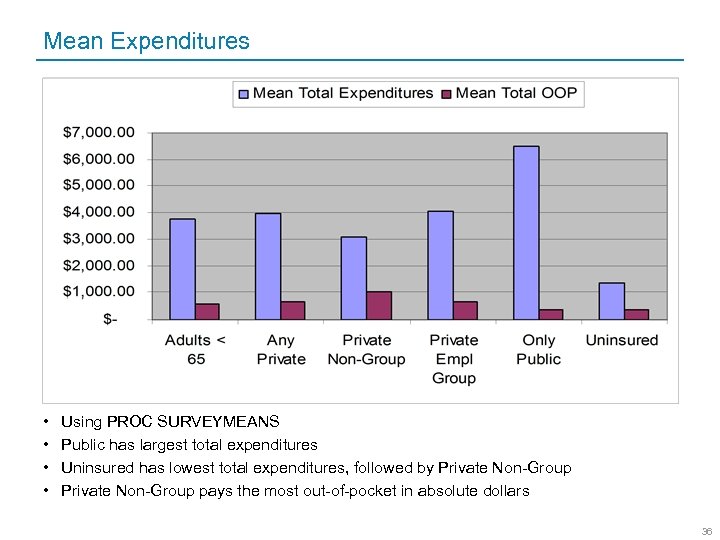

Mean Expenditures • • Using PROC SURVEYMEANS Public has largest total expenditures Uninsured has lowest total expenditures, followed by Private Non-Group pays the most out-of-pocket in absolute dollars 36

Mean Expenditures • • Using PROC SURVEYMEANS Public has largest total expenditures Uninsured has lowest total expenditures, followed by Private Non-Group pays the most out-of-pocket in absolute dollars 36

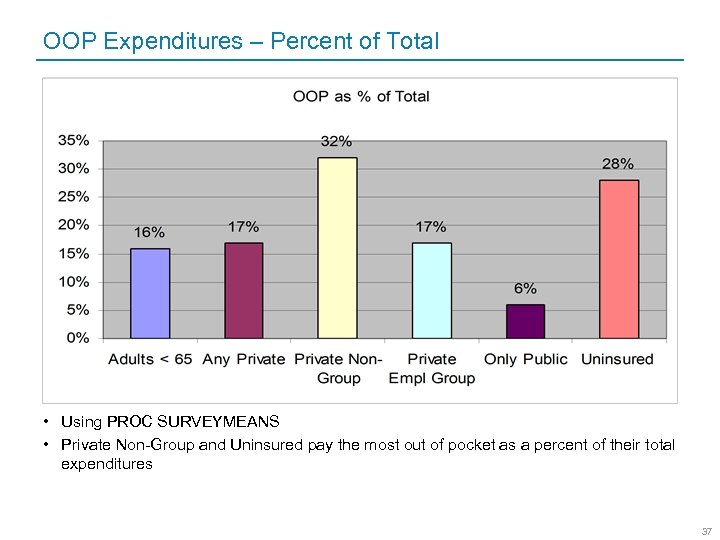

OOP Expenditures – Percent of Total • Using PROC SURVEYMEANS • Private Non-Group and Uninsured pay the most out of pocket as a percent of their total expenditures 37

OOP Expenditures – Percent of Total • Using PROC SURVEYMEANS • Private Non-Group and Uninsured pay the most out of pocket as a percent of their total expenditures 37

Profiles

Profiles

Building Profiles • • • Three approaches Unweighted PROC CORR with person weights “PROC SURVEYCORR” macro with PROC SURVEYREG: • Uses all survey design variables (strata/cluster/weight) • Iteratively runs simple regression models for each predictor variable • Builds table with r-squared, r, and p-values • Sorted by r • See NESUG paper/presentation for more about this approach Similar results for all three approaches 39

Building Profiles • • • Three approaches Unweighted PROC CORR with person weights “PROC SURVEYCORR” macro with PROC SURVEYREG: • Uses all survey design variables (strata/cluster/weight) • Iteratively runs simple regression models for each predictor variable • Builds table with r-squared, r, and p-values • Sorted by r • See NESUG paper/presentation for more about this approach Similar results for all three approaches 39

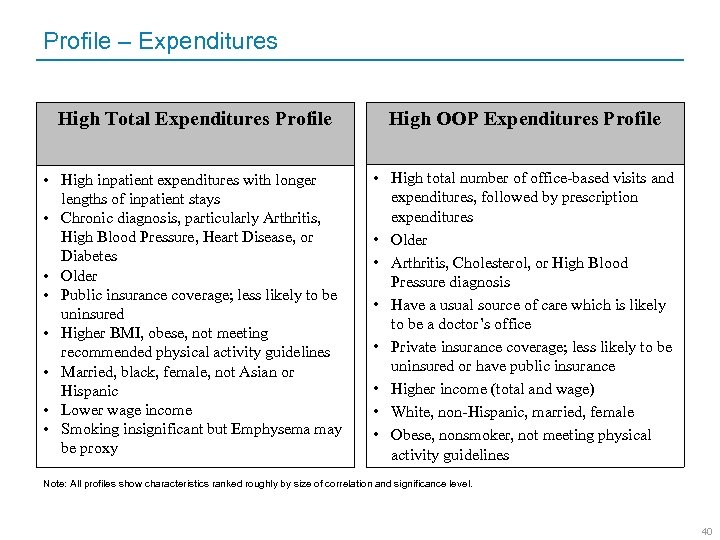

Profile – Expenditures High Total Expenditures Profile High OOP Expenditures Profile • High inpatient expenditures with longer lengths of inpatient stays • Chronic diagnosis, particularly Arthritis, High Blood Pressure, Heart Disease, or Diabetes • Older • Public insurance coverage; less likely to be uninsured • Higher BMI, obese, not meeting recommended physical activity guidelines • Married, black, female, not Asian or Hispanic • Lower wage income • Smoking insignificant but Emphysema may be proxy • High total number of office-based visits and expenditures, followed by prescription expenditures • Older • Arthritis, Cholesterol, or High Blood Pressure diagnosis • Have a usual source of care which is likely to be a doctor’s office • Private insurance coverage; less likely to be uninsured or have public insurance • Higher income (total and wage) • White, non-Hispanic, married, female • Obese, nonsmoker, not meeting physical activity guidelines Note: All profiles show characteristics ranked roughly by size of correlation and significance level. 40

Profile – Expenditures High Total Expenditures Profile High OOP Expenditures Profile • High inpatient expenditures with longer lengths of inpatient stays • Chronic diagnosis, particularly Arthritis, High Blood Pressure, Heart Disease, or Diabetes • Older • Public insurance coverage; less likely to be uninsured • Higher BMI, obese, not meeting recommended physical activity guidelines • Married, black, female, not Asian or Hispanic • Lower wage income • Smoking insignificant but Emphysema may be proxy • High total number of office-based visits and expenditures, followed by prescription expenditures • Older • Arthritis, Cholesterol, or High Blood Pressure diagnosis • Have a usual source of care which is likely to be a doctor’s office • Private insurance coverage; less likely to be uninsured or have public insurance • Higher income (total and wage) • White, non-Hispanic, married, female • Obese, nonsmoker, not meeting physical activity guidelines Note: All profiles show characteristics ranked roughly by size of correlation and significance level. 40

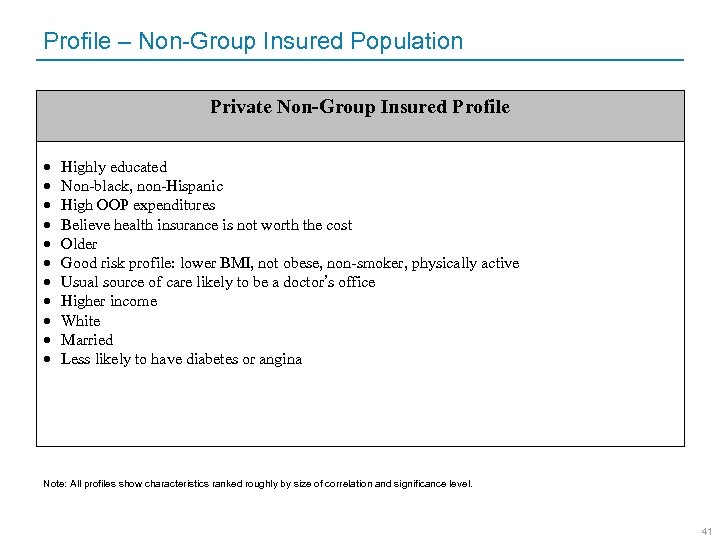

Profile – Non-Group Insured Population Private Non-Group Insured Profile Highly educated Non-black, non-Hispanic High OOP expenditures Believe health insurance is not worth the cost Older Good risk profile: lower BMI, not obese, non-smoker, physically active Usual source of care likely to be a doctor’s office Higher income White Married Less likely to have diabetes or angina Note: All profiles show characteristics ranked roughly by size of correlation and significance level. 41

Profile – Non-Group Insured Population Private Non-Group Insured Profile Highly educated Non-black, non-Hispanic High OOP expenditures Believe health insurance is not worth the cost Older Good risk profile: lower BMI, not obese, non-smoker, physically active Usual source of care likely to be a doctor’s office Higher income White Married Less likely to have diabetes or angina Note: All profiles show characteristics ranked roughly by size of correlation and significance level. 41

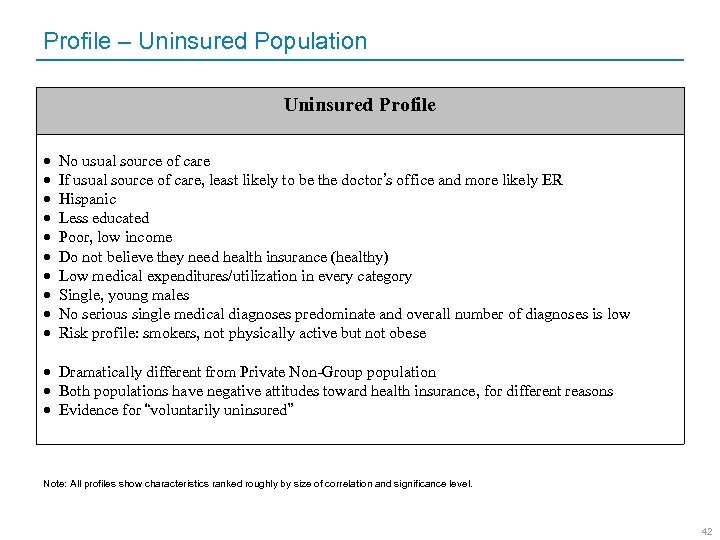

Profile – Uninsured Population Uninsured Profile No usual source of care If usual source of care, least likely to be the doctor’s office and more likely ER Hispanic Less educated Poor, low income Do not believe they need health insurance (healthy) Low medical expenditures/utilization in every category Single, young males No serious single medical diagnoses predominate and overall number of diagnoses is low Risk profile: smokers, not physically active but not obese Dramatically different from Private Non-Group population Both populations have negative attitudes toward health insurance, for different reasons Evidence for “voluntarily uninsured” Note: All profiles show characteristics ranked roughly by size of correlation and significance level. 42

Profile – Uninsured Population Uninsured Profile No usual source of care If usual source of care, least likely to be the doctor’s office and more likely ER Hispanic Less educated Poor, low income Do not believe they need health insurance (healthy) Low medical expenditures/utilization in every category Single, young males No serious single medical diagnoses predominate and overall number of diagnoses is low Risk profile: smokers, not physically active but not obese Dramatically different from Private Non-Group population Both populations have negative attitudes toward health insurance, for different reasons Evidence for “voluntarily uninsured” Note: All profiles show characteristics ranked roughly by size of correlation and significance level. 42

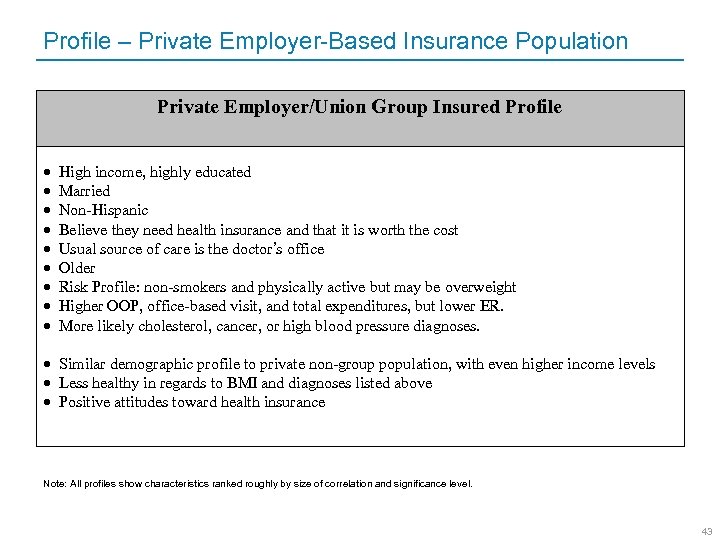

Profile – Private Employer-Based Insurance Population Private Employer/Union Group Insured Profile High income, highly educated Married Non-Hispanic Believe they need health insurance and that it is worth the cost Usual source of care is the doctor’s office Older Risk Profile: non-smokers and physically active but may be overweight Higher OOP, office-based visit, and total expenditures, but lower ER. More likely cholesterol, cancer, or high blood pressure diagnoses. Similar demographic profile to private non-group population, with even higher income levels Less healthy in regards to BMI and diagnoses listed above Positive attitudes toward health insurance Note: All profiles show characteristics ranked roughly by size of correlation and significance level. 43

Profile – Private Employer-Based Insurance Population Private Employer/Union Group Insured Profile High income, highly educated Married Non-Hispanic Believe they need health insurance and that it is worth the cost Usual source of care is the doctor’s office Older Risk Profile: non-smokers and physically active but may be overweight Higher OOP, office-based visit, and total expenditures, but lower ER. More likely cholesterol, cancer, or high blood pressure diagnoses. Similar demographic profile to private non-group population, with even higher income levels Less healthy in regards to BMI and diagnoses listed above Positive attitudes toward health insurance Note: All profiles show characteristics ranked roughly by size of correlation and significance level. 43

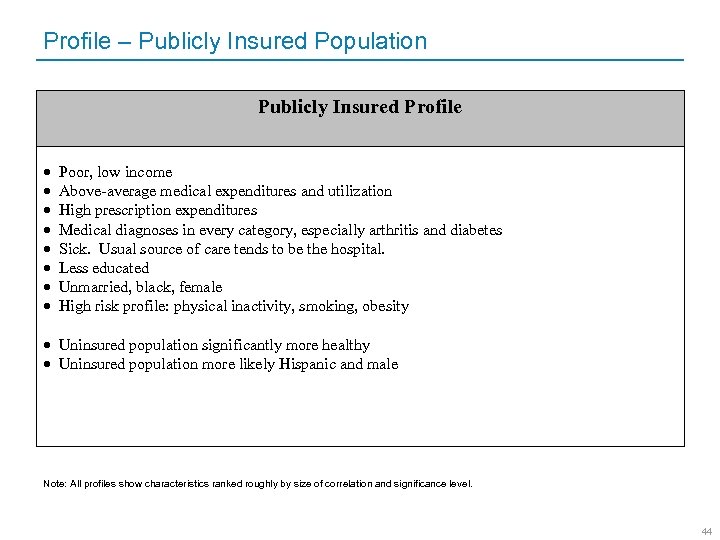

Profile – Publicly Insured Population Publicly Insured Profile Poor, low income Above-average medical expenditures and utilization High prescription expenditures Medical diagnoses in every category, especially arthritis and diabetes Sick. Usual source of care tends to be the hospital. Less educated Unmarried, black, female High risk profile: physical inactivity, smoking, obesity Uninsured population significantly more healthy Uninsured population more likely Hispanic and male Note: All profiles show characteristics ranked roughly by size of correlation and significance level. 44

Profile – Publicly Insured Population Publicly Insured Profile Poor, low income Above-average medical expenditures and utilization High prescription expenditures Medical diagnoses in every category, especially arthritis and diabetes Sick. Usual source of care tends to be the hospital. Less educated Unmarried, black, female High risk profile: physical inactivity, smoking, obesity Uninsured population significantly more healthy Uninsured population more likely Hispanic and male Note: All profiles show characteristics ranked roughly by size of correlation and significance level. 44

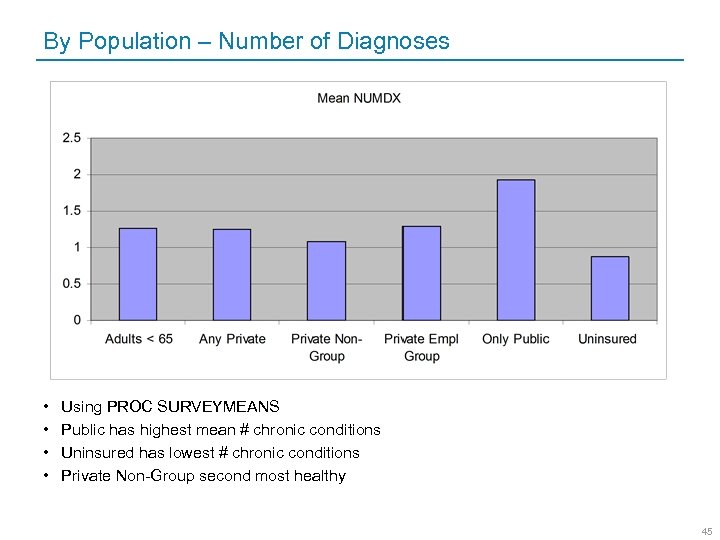

By Population – Number of Diagnoses • • Using PROC SURVEYMEANS Public has highest mean # chronic conditions Uninsured has lowest # chronic conditions Private Non-Group second most healthy 45

By Population – Number of Diagnoses • • Using PROC SURVEYMEANS Public has highest mean # chronic conditions Uninsured has lowest # chronic conditions Private Non-Group second most healthy 45

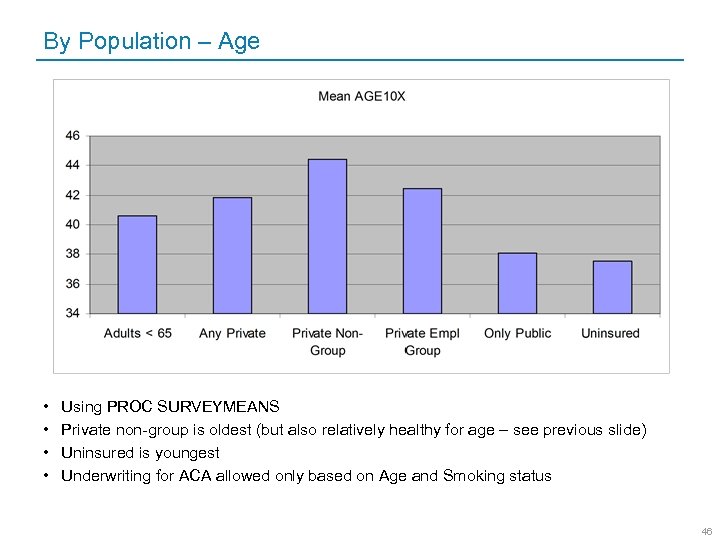

By Population – Age • • Using PROC SURVEYMEANS Private non-group is oldest (but also relatively healthy for age – see previous slide) Uninsured is youngest Underwriting for ACA allowed only based on Age and Smoking status 46

By Population – Age • • Using PROC SURVEYMEANS Private non-group is oldest (but also relatively healthy for age – see previous slide) Uninsured is youngest Underwriting for ACA allowed only based on Age and Smoking status 46

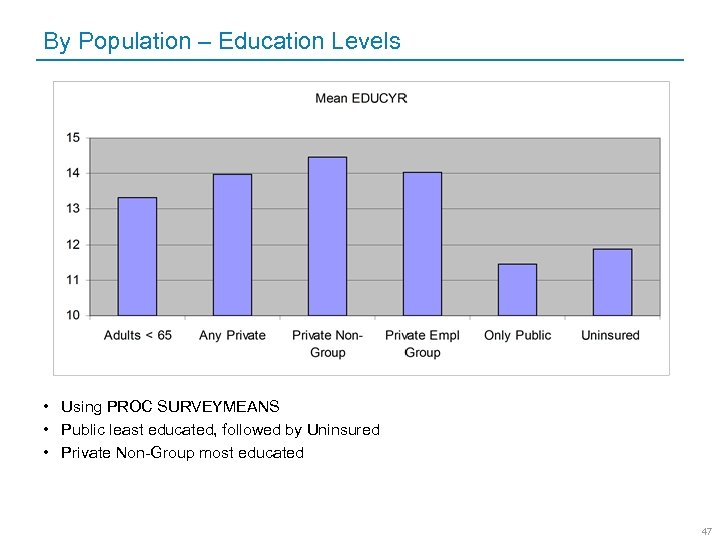

By Population – Education Levels • Using PROC SURVEYMEANS • Public least educated, followed by Uninsured • Private Non-Group most educated 47

By Population – Education Levels • Using PROC SURVEYMEANS • Public least educated, followed by Uninsured • Private Non-Group most educated 47

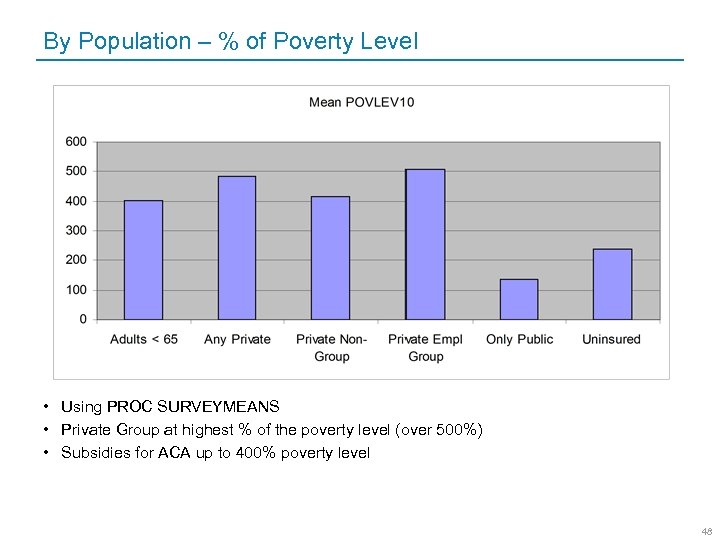

By Population – % of Poverty Level • Using PROC SURVEYMEANS • Private Group at highest % of the poverty level (over 500%) • Subsidies for ACA up to 400% poverty level 48

By Population – % of Poverty Level • Using PROC SURVEYMEANS • Private Group at highest % of the poverty level (over 500%) • Subsidies for ACA up to 400% poverty level 48

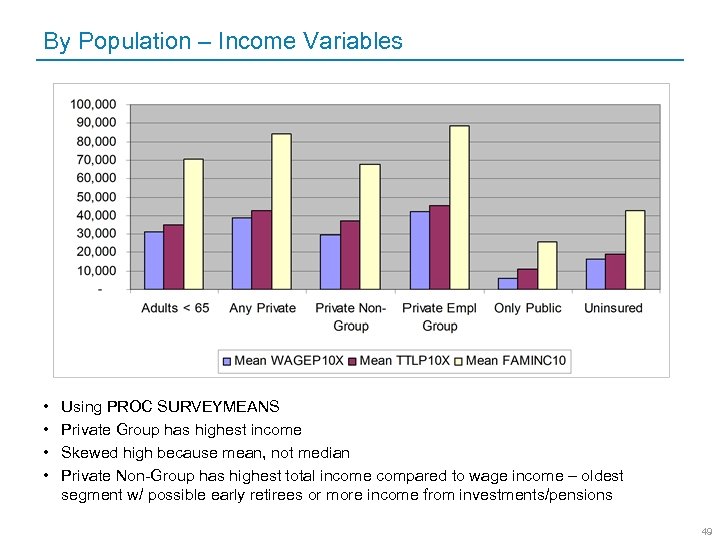

By Population – Income Variables • • Using PROC SURVEYMEANS Private Group has highest income Skewed high because mean, not median Private Non-Group has highest total income compared to wage income – oldest segment w/ possible early retirees or more income from investments/pensions 49

By Population – Income Variables • • Using PROC SURVEYMEANS Private Group has highest income Skewed high because mean, not median Private Non-Group has highest total income compared to wage income – oldest segment w/ possible early retirees or more income from investments/pensions 49

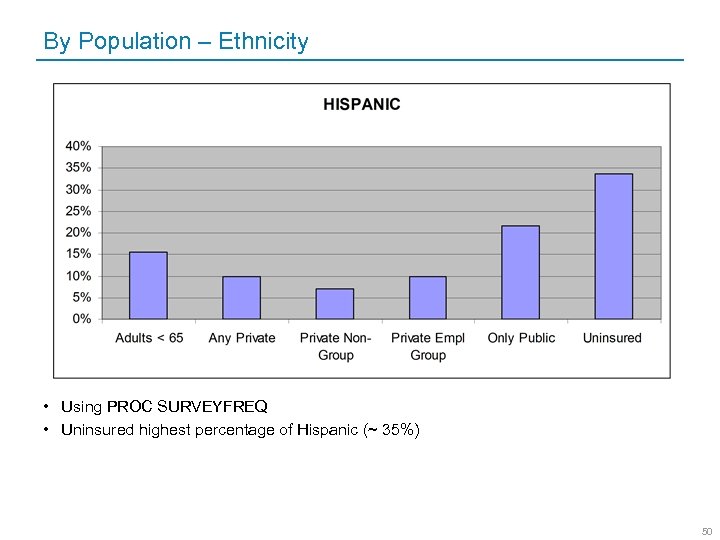

By Population – Ethnicity • Using PROC SURVEYFREQ • Uninsured highest percentage of Hispanic (~ 35%) 50

By Population – Ethnicity • Using PROC SURVEYFREQ • Uninsured highest percentage of Hispanic (~ 35%) 50

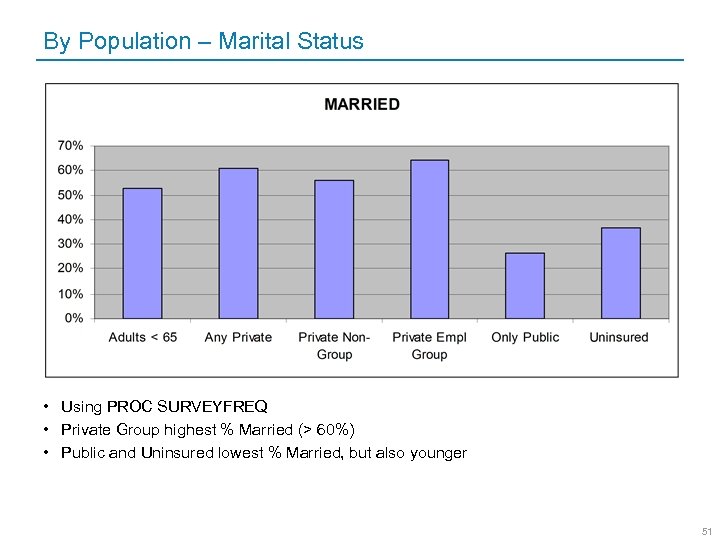

By Population – Marital Status • Using PROC SURVEYFREQ • Private Group highest % Married (> 60%) • Public and Uninsured lowest % Married, but also younger 51

By Population – Marital Status • Using PROC SURVEYFREQ • Private Group highest % Married (> 60%) • Public and Uninsured lowest % Married, but also younger 51

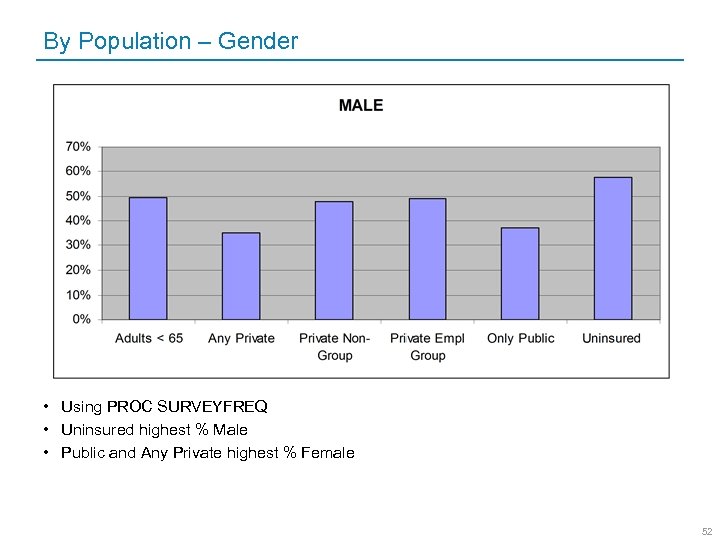

By Population – Gender • Using PROC SURVEYFREQ • Uninsured highest % Male • Public and Any Private highest % Female 52

By Population – Gender • Using PROC SURVEYFREQ • Uninsured highest % Male • Public and Any Private highest % Female 52

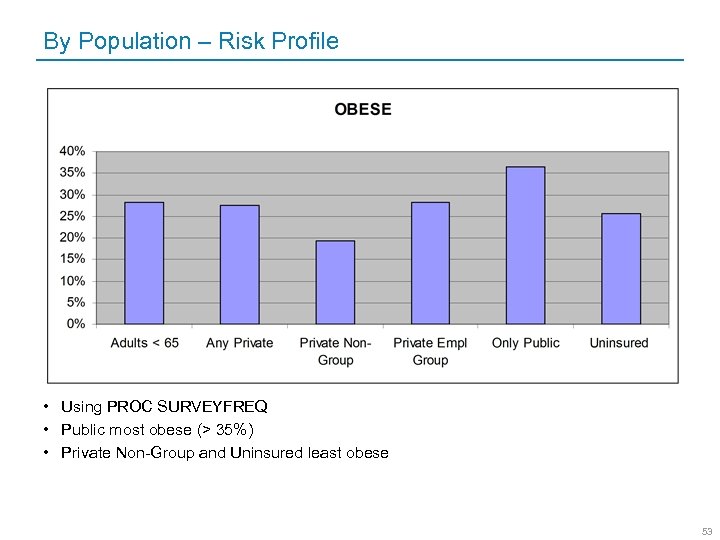

By Population – Risk Profile • Using PROC SURVEYFREQ • Public most obese (> 35%) • Private Non-Group and Uninsured least obese 53

By Population – Risk Profile • Using PROC SURVEYFREQ • Public most obese (> 35%) • Private Non-Group and Uninsured least obese 53

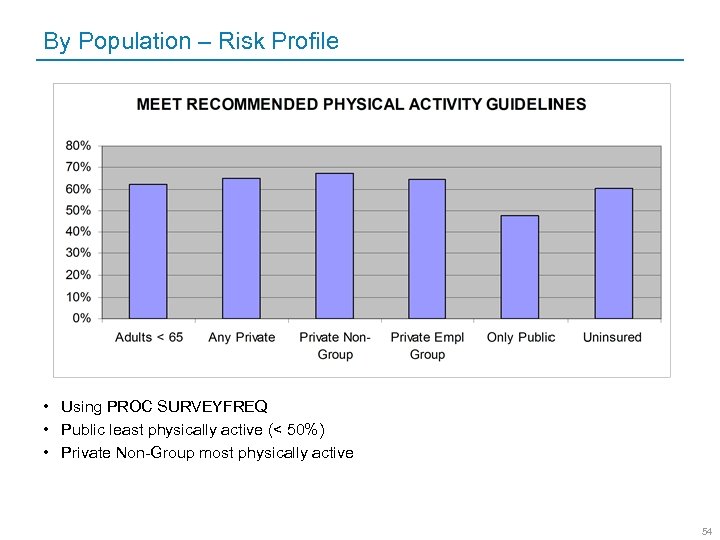

By Population – Risk Profile • Using PROC SURVEYFREQ • Public least physically active (< 50%) • Private Non-Group most physically active 54

By Population – Risk Profile • Using PROC SURVEYFREQ • Public least physically active (< 50%) • Private Non-Group most physically active 54

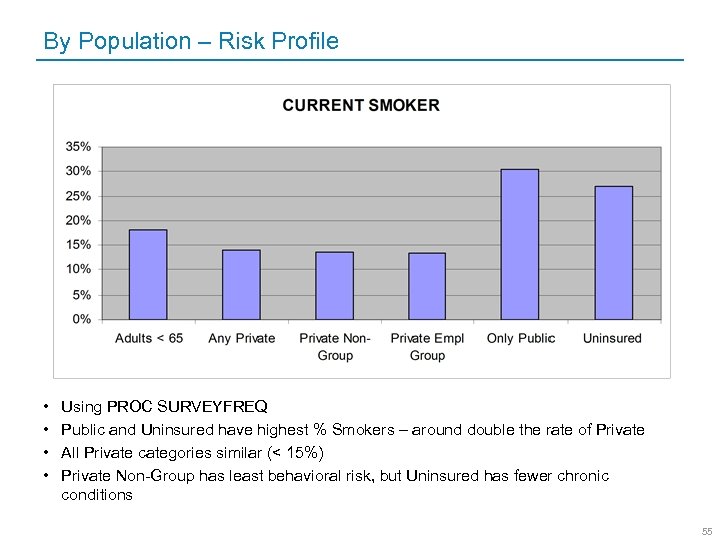

By Population – Risk Profile • • Using PROC SURVEYFREQ Public and Uninsured have highest % Smokers – around double the rate of Private All Private categories similar (< 15%) Private Non-Group has least behavioral risk, but Uninsured has fewer chronic conditions 55

By Population – Risk Profile • • Using PROC SURVEYFREQ Public and Uninsured have highest % Smokers – around double the rate of Private All Private categories similar (< 15%) Private Non-Group has least behavioral risk, but Uninsured has fewer chronic conditions 55

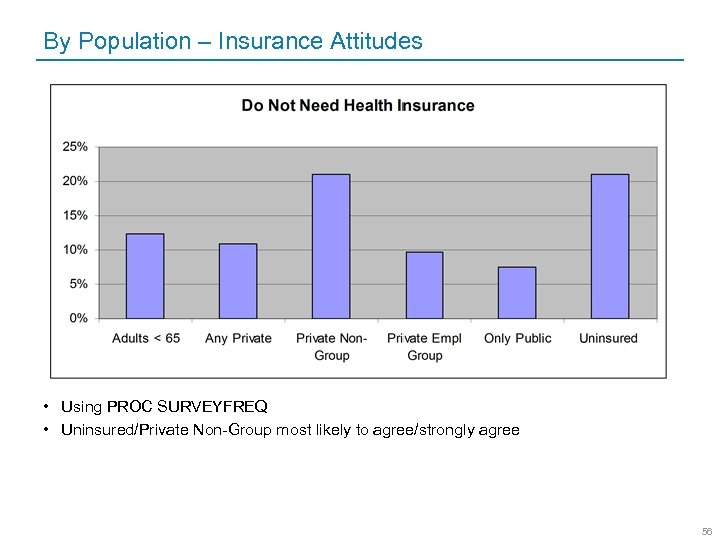

By Population – Insurance Attitudes • Using PROC SURVEYFREQ • Uninsured/Private Non-Group most likely to agree/strongly agree 56

By Population – Insurance Attitudes • Using PROC SURVEYFREQ • Uninsured/Private Non-Group most likely to agree/strongly agree 56

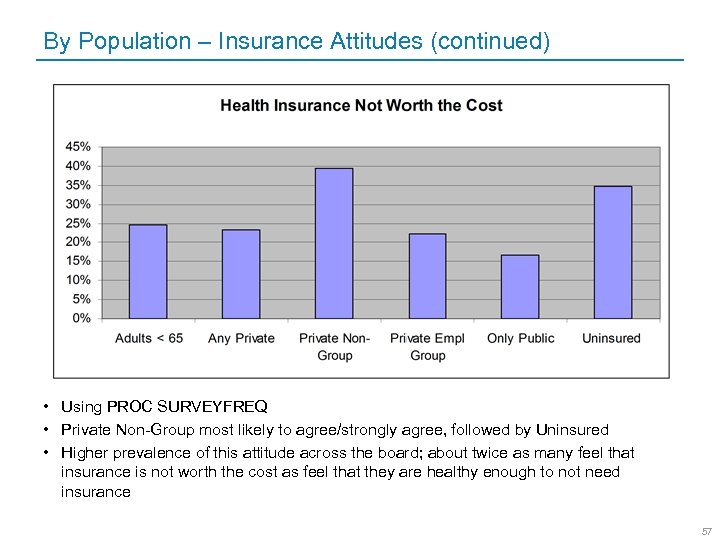

By Population – Insurance Attitudes (continued) • Using PROC SURVEYFREQ • Private Non-Group most likely to agree/strongly agree, followed by Uninsured • Higher prevalence of this attitude across the board; about twice as many feel that insurance is not worth the cost as feel that they are healthy enough to not need insurance 57

By Population – Insurance Attitudes (continued) • Using PROC SURVEYFREQ • Private Non-Group most likely to agree/strongly agree, followed by Uninsured • Higher prevalence of this attitude across the board; about twice as many feel that insurance is not worth the cost as feel that they are healthy enough to not need insurance 57

Models

Models

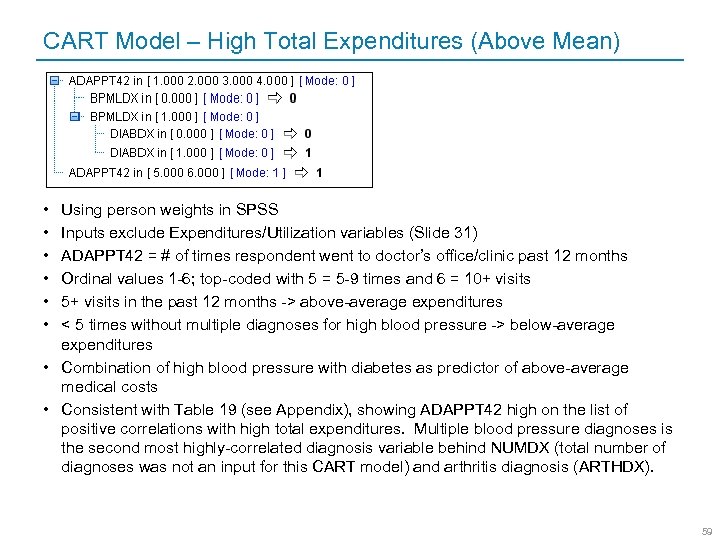

CART Model – High Total Expenditures (Above Mean) • • • Using person weights in SPSS Inputs exclude Expenditures/Utilization variables (Slide 31) ADAPPT 42 = # of times respondent went to doctor’s office/clinic past 12 months Ordinal values 1 -6; top-coded with 5 = 5 -9 times and 6 = 10+ visits 5+ visits in the past 12 months -> above-average expenditures < 5 times without multiple diagnoses for high blood pressure -> below-average expenditures • Combination of high blood pressure with diabetes as predictor of above-average medical costs • Consistent with Table 19 (see Appendix), showing ADAPPT 42 high on the list of positive correlations with high total expenditures. Multiple blood pressure diagnoses is the second most highly-correlated diagnosis variable behind NUMDX (total number of diagnoses was not an input for this CART model) and arthritis diagnosis (ARTHDX). 59

CART Model – High Total Expenditures (Above Mean) • • • Using person weights in SPSS Inputs exclude Expenditures/Utilization variables (Slide 31) ADAPPT 42 = # of times respondent went to doctor’s office/clinic past 12 months Ordinal values 1 -6; top-coded with 5 = 5 -9 times and 6 = 10+ visits 5+ visits in the past 12 months -> above-average expenditures < 5 times without multiple diagnoses for high blood pressure -> below-average expenditures • Combination of high blood pressure with diabetes as predictor of above-average medical costs • Consistent with Table 19 (see Appendix), showing ADAPPT 42 high on the list of positive correlations with high total expenditures. Multiple blood pressure diagnoses is the second most highly-correlated diagnosis variable behind NUMDX (total number of diagnoses was not an input for this CART model) and arthritis diagnosis (ARTHDX). 59

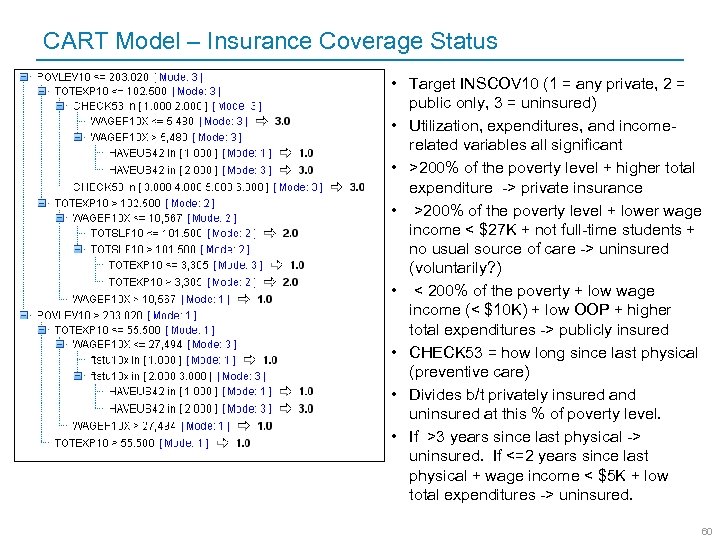

CART Model – Insurance Coverage Status • Target INSCOV 10 (1 = any private, 2 = public only, 3 = uninsured) • Utilization, expenditures, and incomerelated variables all significant • >200% of the poverty level + higher total expenditure -> private insurance • >200% of the poverty level + lower wage income < $27 K + not full-time students + no usual source of care -> uninsured (voluntarily? ) • < 200% of the poverty + low wage income (< $10 K) + low OOP + higher total expenditures -> publicly insured • CHECK 53 = how long since last physical (preventive care) • Divides b/t privately insured and uninsured at this % of poverty level. • If >3 years since last physical -> uninsured. If <=2 years since last physical + wage income < $5 K + low total expenditures -> uninsured. 60

CART Model – Insurance Coverage Status • Target INSCOV 10 (1 = any private, 2 = public only, 3 = uninsured) • Utilization, expenditures, and incomerelated variables all significant • >200% of the poverty level + higher total expenditure -> private insurance • >200% of the poverty level + lower wage income < $27 K + not full-time students + no usual source of care -> uninsured (voluntarily? ) • < 200% of the poverty + low wage income (< $10 K) + low OOP + higher total expenditures -> publicly insured • CHECK 53 = how long since last physical (preventive care) • Divides b/t privately insured and uninsured at this % of poverty level. • If >3 years since last physical -> uninsured. If <=2 years since last physical + wage income < $5 K + low total expenditures -> uninsured. 60

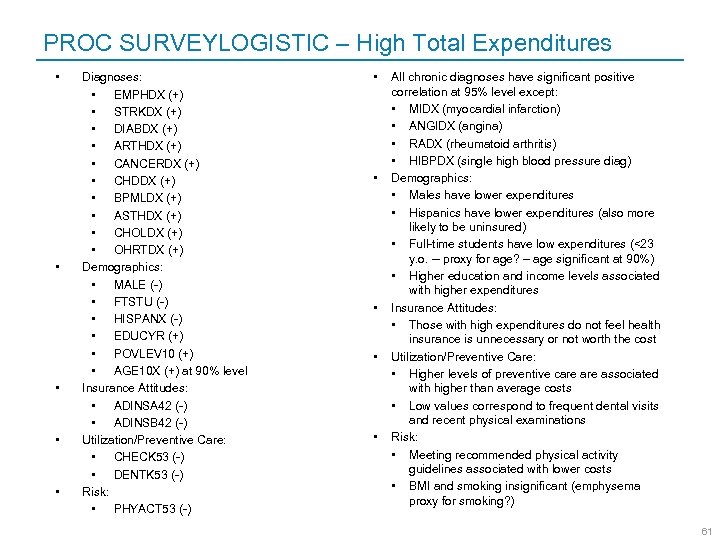

PROC SURVEYLOGISTIC – High Total Expenditures • • • Diagnoses: • EMPHDX (+) • STRKDX (+) • DIABDX (+) • ARTHDX (+) • CANCERDX (+) • CHDDX (+) • BPMLDX (+) • ASTHDX (+) • CHOLDX (+) • OHRTDX (+) Demographics: • MALE (-) • FTSTU (-) • HISPANX (-) • EDUCYR (+) • POVLEV 10 (+) • AGE 10 X (+) at 90% level Insurance Attitudes: • ADINSA 42 (-) • ADINSB 42 (-) Utilization/Preventive Care: • CHECK 53 (-) • DENTK 53 (-) Risk: • PHYACT 53 (-) • • • All chronic diagnoses have significant positive correlation at 95% level except: • MIDX (myocardial infarction) • ANGIDX (angina) • RADX (rheumatoid arthritis) • HIBPDX (single high blood pressure diag) Demographics: • Males have lower expenditures • Hispanics have lower expenditures (also more likely to be uninsured) • Full-time students have low expenditures (<23 y. o. -- proxy for age? – age significant at 90%) • Higher education and income levels associated with higher expenditures Insurance Attitudes: • Those with high expenditures do not feel health insurance is unnecessary or not worth the cost Utilization/Preventive Care: • Higher levels of preventive care associated with higher than average costs • Low values correspond to frequent dental visits and recent physical examinations Risk: • Meeting recommended physical activity guidelines associated with lower costs • BMI and smoking insignificant (emphysema proxy for smoking? ) 61

PROC SURVEYLOGISTIC – High Total Expenditures • • • Diagnoses: • EMPHDX (+) • STRKDX (+) • DIABDX (+) • ARTHDX (+) • CANCERDX (+) • CHDDX (+) • BPMLDX (+) • ASTHDX (+) • CHOLDX (+) • OHRTDX (+) Demographics: • MALE (-) • FTSTU (-) • HISPANX (-) • EDUCYR (+) • POVLEV 10 (+) • AGE 10 X (+) at 90% level Insurance Attitudes: • ADINSA 42 (-) • ADINSB 42 (-) Utilization/Preventive Care: • CHECK 53 (-) • DENTK 53 (-) Risk: • PHYACT 53 (-) • • • All chronic diagnoses have significant positive correlation at 95% level except: • MIDX (myocardial infarction) • ANGIDX (angina) • RADX (rheumatoid arthritis) • HIBPDX (single high blood pressure diag) Demographics: • Males have lower expenditures • Hispanics have lower expenditures (also more likely to be uninsured) • Full-time students have low expenditures (<23 y. o. -- proxy for age? – age significant at 90%) • Higher education and income levels associated with higher expenditures Insurance Attitudes: • Those with high expenditures do not feel health insurance is unnecessary or not worth the cost Utilization/Preventive Care: • Higher levels of preventive care associated with higher than average costs • Low values correspond to frequent dental visits and recent physical examinations Risk: • Meeting recommended physical activity guidelines associated with lower costs • BMI and smoking insignificant (emphysema proxy for smoking? ) 61

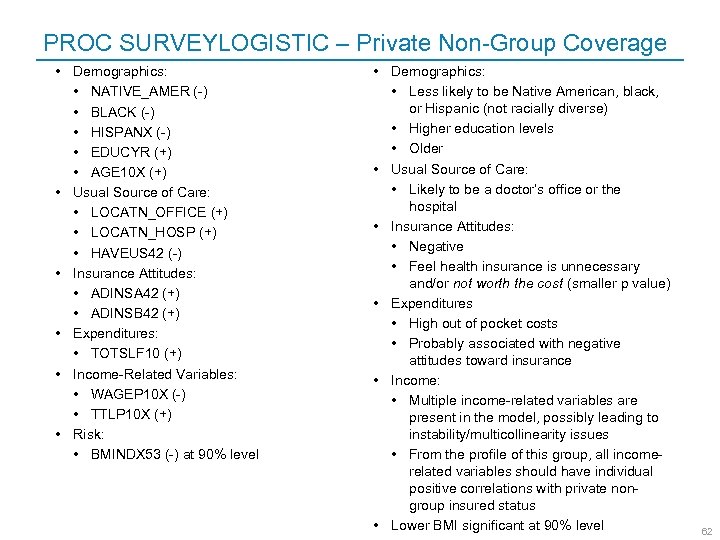

PROC SURVEYLOGISTIC – Private Non-Group Coverage • Demographics: • NATIVE_AMER (-) • BLACK (-) • HISPANX (-) • EDUCYR (+) • AGE 10 X (+) • Usual Source of Care: • LOCATN_OFFICE (+) • LOCATN_HOSP (+) • HAVEUS 42 (-) • Insurance Attitudes: • ADINSA 42 (+) • ADINSB 42 (+) • Expenditures: • TOTSLF 10 (+) • Income-Related Variables: • WAGEP 10 X (-) • TTLP 10 X (+) • Risk: • BMINDX 53 (-) at 90% level • Demographics: • Less likely to be Native American, black, or Hispanic (not racially diverse) • Higher education levels • Older • Usual Source of Care: • Likely to be a doctor’s office or the hospital • Insurance Attitudes: • Negative • Feel health insurance is unnecessary and/or not worth the cost (smaller p value) • Expenditures • High out of pocket costs • Probably associated with negative attitudes toward insurance • Income: • Multiple income-related variables are present in the model, possibly leading to instability/multicollinearity issues • From the profile of this group, all incomerelated variables should have individual positive correlations with private nongroup insured status • Lower BMI significant at 90% level 62

PROC SURVEYLOGISTIC – Private Non-Group Coverage • Demographics: • NATIVE_AMER (-) • BLACK (-) • HISPANX (-) • EDUCYR (+) • AGE 10 X (+) • Usual Source of Care: • LOCATN_OFFICE (+) • LOCATN_HOSP (+) • HAVEUS 42 (-) • Insurance Attitudes: • ADINSA 42 (+) • ADINSB 42 (+) • Expenditures: • TOTSLF 10 (+) • Income-Related Variables: • WAGEP 10 X (-) • TTLP 10 X (+) • Risk: • BMINDX 53 (-) at 90% level • Demographics: • Less likely to be Native American, black, or Hispanic (not racially diverse) • Higher education levels • Older • Usual Source of Care: • Likely to be a doctor’s office or the hospital • Insurance Attitudes: • Negative • Feel health insurance is unnecessary and/or not worth the cost (smaller p value) • Expenditures • High out of pocket costs • Probably associated with negative attitudes toward insurance • Income: • Multiple income-related variables are present in the model, possibly leading to instability/multicollinearity issues • From the profile of this group, all incomerelated variables should have individual positive correlations with private nongroup insured status • Lower BMI significant at 90% level 62

Conclusions

Conclusions

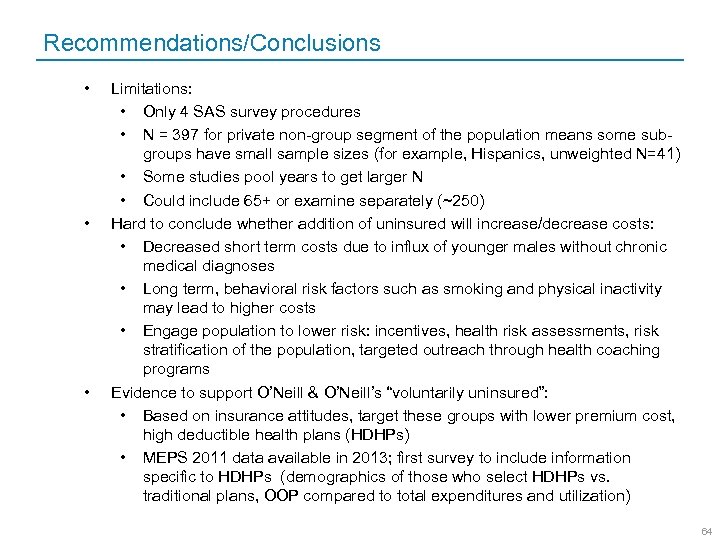

Recommendations/Conclusions • • • Limitations: • Only 4 SAS survey procedures • N = 397 for private non-group segment of the population means some subgroups have small sample sizes (for example, Hispanics, unweighted N=41) • Some studies pool years to get larger N • Could include 65+ or examine separately (~250) Hard to conclude whether addition of uninsured will increase/decrease costs: • Decreased short term costs due to influx of younger males without chronic medical diagnoses • Long term, behavioral risk factors such as smoking and physical inactivity may lead to higher costs • Engage population to lower risk: incentives, health risk assessments, risk stratification of the population, targeted outreach through health coaching programs Evidence to support O’Neill & O’Neill’s “voluntarily uninsured”: • Based on insurance attitudes, target these groups with lower premium cost, high deductible health plans (HDHPs) • MEPS 2011 data available in 2013; first survey to include information specific to HDHPs (demographics of those who select HDHPs vs. traditional plans, OOP compared to total expenditures and utilization) 64

Recommendations/Conclusions • • • Limitations: • Only 4 SAS survey procedures • N = 397 for private non-group segment of the population means some subgroups have small sample sizes (for example, Hispanics, unweighted N=41) • Some studies pool years to get larger N • Could include 65+ or examine separately (~250) Hard to conclude whether addition of uninsured will increase/decrease costs: • Decreased short term costs due to influx of younger males without chronic medical diagnoses • Long term, behavioral risk factors such as smoking and physical inactivity may lead to higher costs • Engage population to lower risk: incentives, health risk assessments, risk stratification of the population, targeted outreach through health coaching programs Evidence to support O’Neill & O’Neill’s “voluntarily uninsured”: • Based on insurance attitudes, target these groups with lower premium cost, high deductible health plans (HDHPs) • MEPS 2011 data available in 2013; first survey to include information specific to HDHPs (demographics of those who select HDHPs vs. traditional plans, OOP compared to total expenditures and utilization) 64

Recommendations/Conclusions • • • Trend in domestic private individual/non-group coverage has been steadily decreasing market share • International non-group markets augment declining U. S. sales • Increased customer segmentation efforts as part of strategies to identify, understand, and target desirable (low-risk) clusters for IFP marketing Underwriting practices are curtailed under ACA, but selective direct marketing to desirable segments will develop and increase in importance. Insurance companies are interested in purchasing behavior, socio-economic indicators, and demographics of potential customers, and should note the distinguishing characteristics (young, single, male, Hispanic, etc. ) of the uninsured population in marketing, retention, and engagement strategies. Individual segment is unpopular with customers: • Insurance companies need to demonstrate that they are adding value to consumers and differentiate themselves from competitors. • Example: Cigna’s “GO YOU” branding and advertising campaign (October 2011) • Dramatic switch to individual-focused, “customer-centric” business model touted as offering highly-personalized service to customers • Part of a strategy developed in anticipation of healthcare reform to increase competitiveness in the changing marketplace with its expanded individual segment 65

Recommendations/Conclusions • • • Trend in domestic private individual/non-group coverage has been steadily decreasing market share • International non-group markets augment declining U. S. sales • Increased customer segmentation efforts as part of strategies to identify, understand, and target desirable (low-risk) clusters for IFP marketing Underwriting practices are curtailed under ACA, but selective direct marketing to desirable segments will develop and increase in importance. Insurance companies are interested in purchasing behavior, socio-economic indicators, and demographics of potential customers, and should note the distinguishing characteristics (young, single, male, Hispanic, etc. ) of the uninsured population in marketing, retention, and engagement strategies. Individual segment is unpopular with customers: • Insurance companies need to demonstrate that they are adding value to consumers and differentiate themselves from competitors. • Example: Cigna’s “GO YOU” branding and advertising campaign (October 2011) • Dramatic switch to individual-focused, “customer-centric” business model touted as offering highly-personalized service to customers • Part of a strategy developed in anticipation of healthcare reform to increase competitiveness in the changing marketplace with its expanded individual segment 65

References

References

References • • • Carrington, W. J. , Eltinge, J. L. , & Mc. Cue, K. (2000). An Economist’s Primer on Survey Samples. Working Paper no. 00 -15. Suitland, MD: Center for Economic Studies, U. S. Bureau of the Census, October 2000. Retrieved from ftp: //tigerline. census. gov/ces/wp/2000/CES-WP-00 -15. pdf January 15, 2013. Cohen, J. W. , & Rhoades, J. A. (2009). Group and Non-Group Private Health Insurance Coverage, 1996 to 2007: Estimates for the U. S. Civilian Noninstitutionalized Population under Age 65. Medical Expenditure Panel Survey (MEPS) Statistical Brief #267. Agency for Healthcare Research and Quality, Rockville, MD. Retrieved from http: //meps. ahrq. gov/data_files/publications/st 267/stat 267. pdf Di. Julio, B. , & Claxton, G. (2010). Comparison of Expenditures in Nongroup and Employer. Sponsored Insurance: 2004 -2007. Kaiser Family Foundation, Menlo Park, CA. Retrieved from http: //www. kff. org/insurance/snapshot/chcm 111006 oth. cfm Kaiser Family Foundation (2008). How Non-Group Health Coverage Varies with Income. Menlo Park, CA. Retrieved from http: //www. kff. org/insurance/upload/7737. pdf Machlin, S. , & Yu, W. (2005). MEPS Sample Persons In-Scope for Part of the Year: Identification and Analytic Considerations. April 2005. Agency for Healthcare Research and Quality, Rockville, MD. Retrieved from http: //www. meps. ahrq. gov /survey_comp/hc_survey/hc_sample. shtml 67

References • • • Carrington, W. J. , Eltinge, J. L. , & Mc. Cue, K. (2000). An Economist’s Primer on Survey Samples. Working Paper no. 00 -15. Suitland, MD: Center for Economic Studies, U. S. Bureau of the Census, October 2000. Retrieved from ftp: //tigerline. census. gov/ces/wp/2000/CES-WP-00 -15. pdf January 15, 2013. Cohen, J. W. , & Rhoades, J. A. (2009). Group and Non-Group Private Health Insurance Coverage, 1996 to 2007: Estimates for the U. S. Civilian Noninstitutionalized Population under Age 65. Medical Expenditure Panel Survey (MEPS) Statistical Brief #267. Agency for Healthcare Research and Quality, Rockville, MD. Retrieved from http: //meps. ahrq. gov/data_files/publications/st 267/stat 267. pdf Di. Julio, B. , & Claxton, G. (2010). Comparison of Expenditures in Nongroup and Employer. Sponsored Insurance: 2004 -2007. Kaiser Family Foundation, Menlo Park, CA. Retrieved from http: //www. kff. org/insurance/snapshot/chcm 111006 oth. cfm Kaiser Family Foundation (2008). How Non-Group Health Coverage Varies with Income. Menlo Park, CA. Retrieved from http: //www. kff. org/insurance/upload/7737. pdf Machlin, S. , & Yu, W. (2005). MEPS Sample Persons In-Scope for Part of the Year: Identification and Analytic Considerations. April 2005. Agency for Healthcare Research and Quality, Rockville, MD. Retrieved from http: //www. meps. ahrq. gov /survey_comp/hc_survey/hc_sample. shtml 67

References (continued) • • • Machlin, S. , Yu, W. , & Zodet, M. (2005). Computing Standard Errors for MEPS Estimates. January 2005. Agency for Healthcare Research and Quality, Rockville, Md. Retrieved from http: //www. meps. ahrq. gov/survey_comp/standard_errors. jsp Medical Expenditure Panel Survey (MEPS). (2012). MEPS HC-138: 2010 Full Year Consolidated Data File. Rockville, MD: Agency for Healthcare Research and Quality (AHRQ), September 2012. Retrieved from http: //meps. ahrq. gov/data_stats/download_data/pufs/h 138 doc. pdf September 27, 2012. Medical Expenditure Panel Survey (MEPS). (2012). MEPS HC-138: 2010 Full Year Consolidated Data Codebook. Rockville, MD: Agency for Healthcare Research and Quality (AHRQ), August 30, 2012. Retrieved from http: //meps. ahrq. gov/mepsweb/data_stats/download_data_files_codebook. jsp? PUFId=H 13 8 September 27, 2012. Medical Expenditure Panel Survey (MEPS). MEPS-HC Panel Design and Collection Process. Agency for Healthcare Research and Quality, Rockville, Md. Retrieved from http: //www. meps. ahrq. gov/survey_comp/hc_data_collection. jsp Medical Expenditure Panel Survey (MEPS). Data Use Agreement. Agency for Healthcare Research and Quality, Rockville, Md. Retrieved from http: //meps. ahrq. gov/mepsweb/data_stats/data_use. jsp 68

References (continued) • • • Machlin, S. , Yu, W. , & Zodet, M. (2005). Computing Standard Errors for MEPS Estimates. January 2005. Agency for Healthcare Research and Quality, Rockville, Md. Retrieved from http: //www. meps. ahrq. gov/survey_comp/standard_errors. jsp Medical Expenditure Panel Survey (MEPS). (2012). MEPS HC-138: 2010 Full Year Consolidated Data File. Rockville, MD: Agency for Healthcare Research and Quality (AHRQ), September 2012. Retrieved from http: //meps. ahrq. gov/data_stats/download_data/pufs/h 138 doc. pdf September 27, 2012. Medical Expenditure Panel Survey (MEPS). (2012). MEPS HC-138: 2010 Full Year Consolidated Data Codebook. Rockville, MD: Agency for Healthcare Research and Quality (AHRQ), August 30, 2012. Retrieved from http: //meps. ahrq. gov/mepsweb/data_stats/download_data_files_codebook. jsp? PUFId=H 13 8 September 27, 2012. Medical Expenditure Panel Survey (MEPS). MEPS-HC Panel Design and Collection Process. Agency for Healthcare Research and Quality, Rockville, Md. Retrieved from http: //www. meps. ahrq. gov/survey_comp/hc_data_collection. jsp Medical Expenditure Panel Survey (MEPS). Data Use Agreement. Agency for Healthcare Research and Quality, Rockville, Md. Retrieved from http: //meps. ahrq. gov/mepsweb/data_stats/data_use. jsp 68

References (continued) • • • O’Neill, J. , & O’Neill, D. (2009). Who are the uninsured? An Analysis of America’s Uninsured Population, Their Characteristics, and Their Health. Employment Policies Institute, Washington, D. C. SAS Institute Inc. (2008). SAS/STAT 9. 2 User’s Guide. Chapter 14: Introduction to Survey Sampling and Analysis Procedures. Pp. 259 -270. Cary, NC: SAS Institute Inc. Retrieved from http: //support. sas. com/documentation/cdl/en/statugsurveysamp/61762/PDF/default/statugs urveysamp. pdf on January 15, 2013. Trish, E. , Damico, A. , Claxton, G. , Levitt, L. , & Garfield, R. (2011). A Profile of Health Insurance Exchange Enrollees. Kaiser Family Foundation, Menlo Park, CA. Retrieved from http: //www. kff. org/healthreform/upload/8147. pdf 69

References (continued) • • • O’Neill, J. , & O’Neill, D. (2009). Who are the uninsured? An Analysis of America’s Uninsured Population, Their Characteristics, and Their Health. Employment Policies Institute, Washington, D. C. SAS Institute Inc. (2008). SAS/STAT 9. 2 User’s Guide. Chapter 14: Introduction to Survey Sampling and Analysis Procedures. Pp. 259 -270. Cary, NC: SAS Institute Inc. Retrieved from http: //support. sas. com/documentation/cdl/en/statugsurveysamp/61762/PDF/default/statugs urveysamp. pdf on January 15, 2013. Trish, E. , Damico, A. , Claxton, G. , Levitt, L. , & Garfield, R. (2011). A Profile of Health Insurance Exchange Enrollees. Kaiser Family Foundation, Menlo Park, CA. Retrieved from http: //www. kff. org/healthreform/upload/8147. pdf 69