ae03df091ba41329fe2ba5c3fe3fb836.ppt

- Количество слайдов: 40

ABE EBA STEP 2 A Pan-European ACH for the Single Euro Payments Area Oct. . 2003 Payment Systems Conference, Budapest, 9 th October 2003 1

ABE EBA Overview • EBA history and background • High-level overview of EURO 1 and STEP 1 • STEP 2 objectives, benefits and participation • STEP 2 and SEPA Oct. . 2003 2

Introduction ABE EBA was founded in 1985 • by 18 commercial banks and the European Investment Bank • today : more than 190 members from all EU countries and the US, Switzerland, Norway, Australia, Japan, China 18 years of experience in • operating a cross-border payment system with the BIS as Settlement Agent (till end-1998) and the ECB (since 1999) • consensus building and decision making within a pan-European, industry owned organisation Oct. . 2003 3

Introduction ABE EBA Successful migration to the euro • development of the EURO 1 and STEP 1 system • creation of EBA Clearing Company as operator of the system, 74 EURO 1 banks are shareholders • Association pursues its mission with further initiatives Oct. . 2003 4

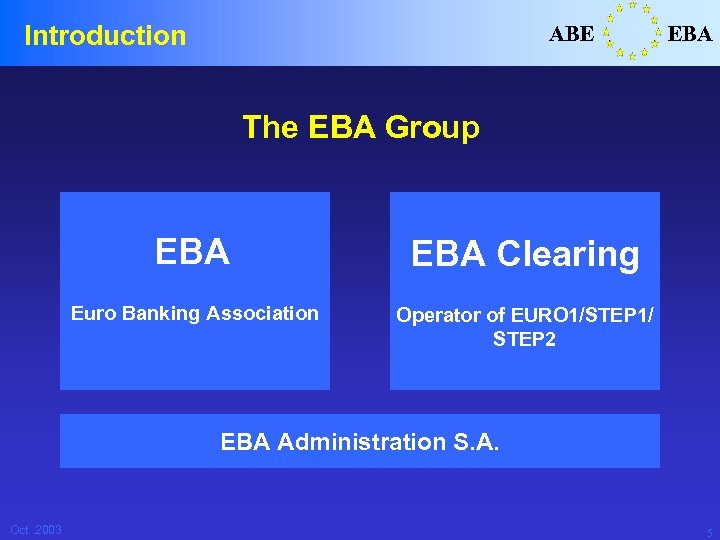

Introduction ABE EBA The EBA Group EBA Euro Banking Association EBA Clearing Operator of EURO 1/STEP 1/ STEP 2 EBA Administration S. A. Oct. . 2003 5

Introducing EBA ABE EBA The Euro Banking Association’s mission • to initiate further interbank cooperation arrangements in relation to payments infrastructure needs • to serve as a forum for the practitioners in the euro payments industry • to carry out studies and research to increase the general knowledge and awareness of the euro payments industry Oct. . 2003 6

Introducing EBA Clearing ABE EBA The mission of EBA Clearing • to develop and implement processing arrangements for new pan-European payment schemes • to ensure that services delivery conforms to the highest levels of cost-effectiveness, robustness and resiliency • to facilitate the migration of the banks’ payment traffic from domestic to pan-European platforms Oct. . 2003 7

The EBA ABE EBA … a source of private sector initiatives for pan-European payment infrastructures • a meeting place of practitioners • capable of building consensus • creating commitment • delivering solutions Oct. . 2003 8

ABE EBA Overview • EBA history and background • High-level overview of EURO 1 and STEP 1 • STEP 2 features, benefits and participation • STEP 2 and SEPA Oct. . 2003 9

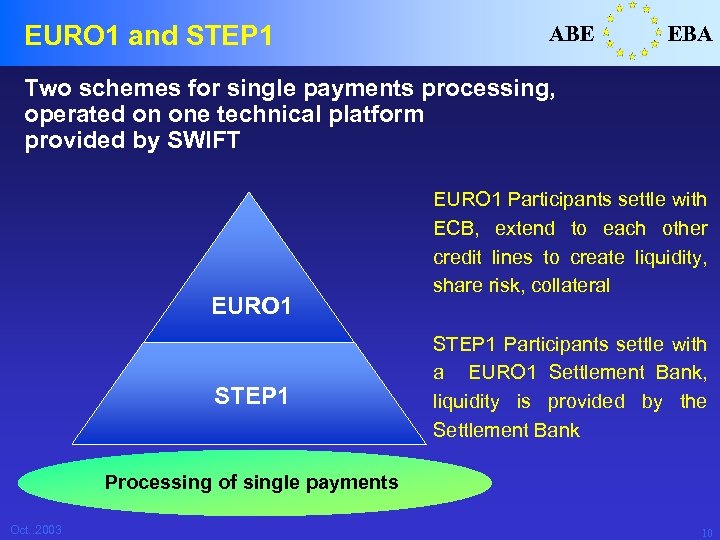

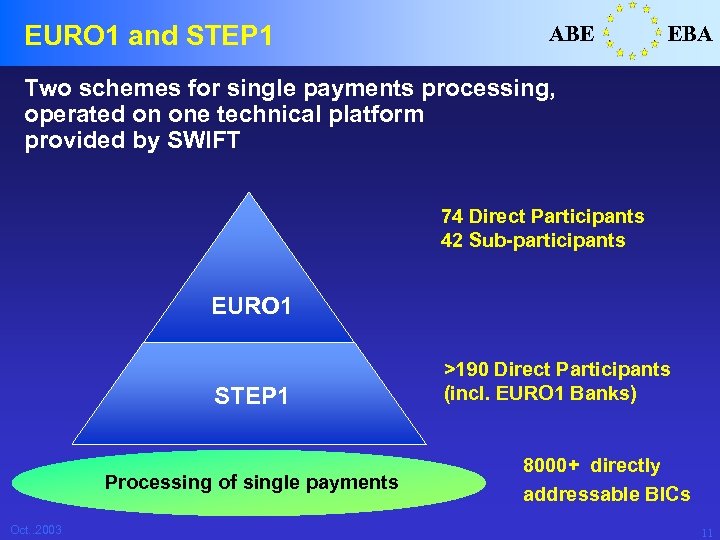

EURO 1 and STEP 1 ABE EBA Two schemes for single payments processing, operated on one technical platform provided by SWIFT EURO 1 STEP 1 EURO 1 Participants settle with ECB, extend to each other credit lines to create liquidity, share risk, collateral STEP 1 Participants settle with a EURO 1 Settlement Bank, liquidity is provided by the Settlement Bank Processing of single payments Oct. . 2003 10

EURO 1 and STEP 1 ABE EBA Two schemes for single payments processing, operated on one technical platform provided by SWIFT 74 Direct Participants 42 Sub-participants EURO 1 STEP 1 Processing of single payments Oct. . 2003 >190 Direct Participants (incl. EURO 1 Banks) 8000+ directly addressable BICs 11

EURO 1/STEP 1 Traffic ABE Daily average volume (000) Daily average value (EUR bn) EBA - 200 - 180 160 140 120 100 80 60 40 0 x 1000 Oct. . 2003 Q 1 Q 2 Q 3 Q 4 2000 Q 1 Q 2 Q 3 Q 4 Q 1 2001 Q 2 Q 3 Q 4 2002 Q 1 Q 2 2003 12

EURO 1/STEP 1 platform ABE EBA Key facts Second-largest high-value system in the world in terms of volume Settlement at the European Central Bank Includes all major players of the European payments industry Evolution towards Flexible Settlement Capability Oct. . 2003 13

ABE EBA Overview • EBA history and background • High-level overview of EURO 1 and STEP 1 • STEP 2 features, benefits and participation • STEP 2 and SEPA Oct. . 2003 14

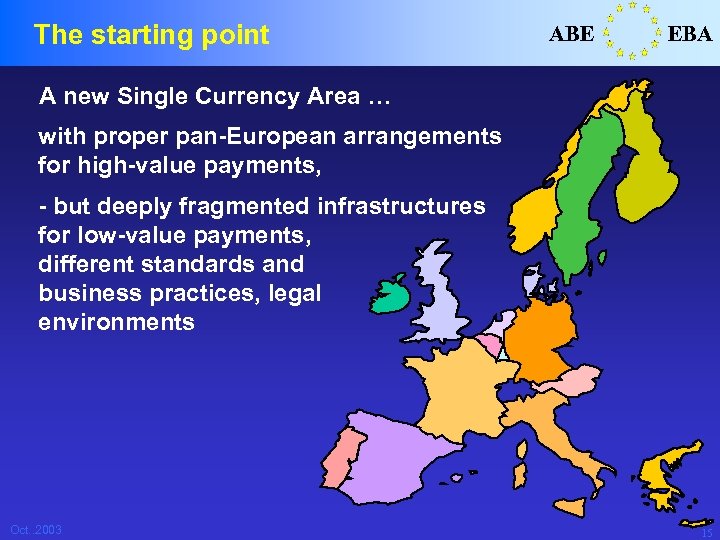

The starting point ABE EBA A new Single Currency Area … with proper pan-European arrangements for high-value payments, - but deeply fragmented infrastructures for low-value payments, different standards and business practices, legal environments Oct. . 2003 15

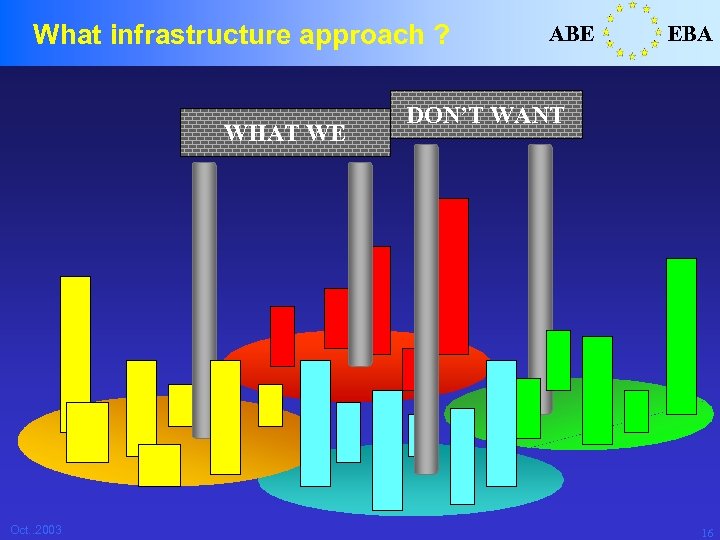

What infrastructure approach ? WHAT WE Oct. . 2003 ABE EBA DON’T WANT 16

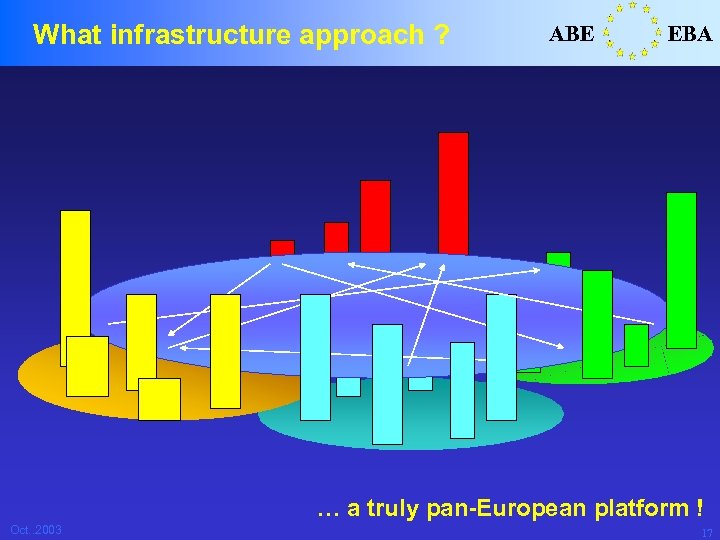

What infrastructure approach ? ABE EBA … a truly pan-European platform ! Oct. . 2003 17

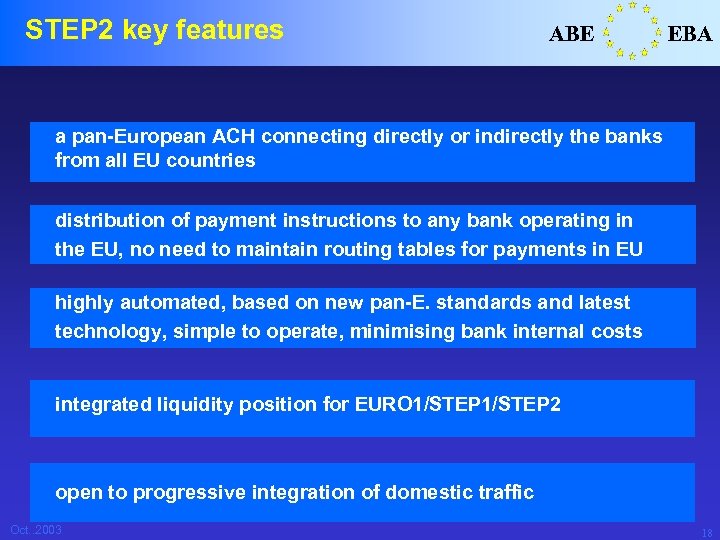

STEP 2 key features ABE EBA a pan-European ACH connecting directly or indirectly the banks from all EU countries distribution of payment instructions to any bank operating in the EU, no need to maintain routing tables for payments in EU highly automated, based on new pan-E. standards and latest technology, simple to operate, minimising bank internal costs integrated liquidity position for EURO 1/STEP 2 open to progressive integration of domestic traffic Oct. . 2003 18

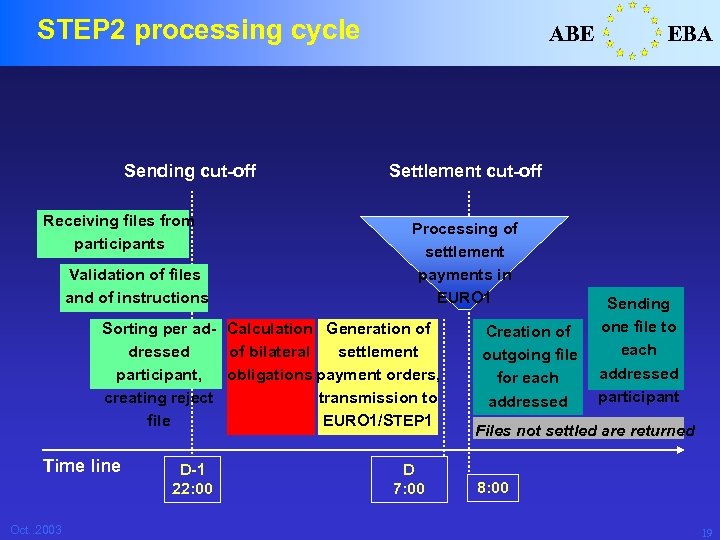

STEP 2 processing cycle Sending cut-off Receiving files from participants Validation of files and of instructions ABE Settlement cut-off Processing of settlement payments in EURO 1 Sorting per ad- Calculation Generation of dressed of bilateral settlement participant, obligations payment orders, creating reject transmission to file EURO 1/STEP 1 Time line Oct. . 2003 D-1 22: 00 EBA D 7: 00 Sending one file to Creation of each outgoing file addressed for each participant addressed participant Files not settled are returned 8: 00 19

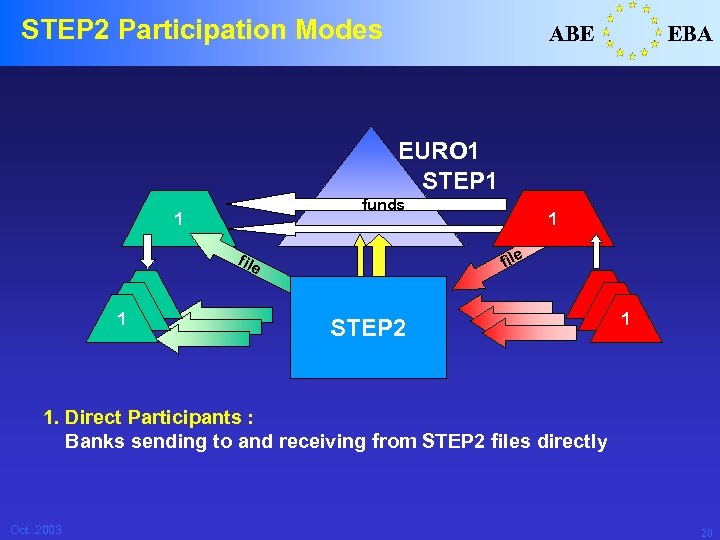

STEP 2 Participation Modes ABE EBA EURO 1 STEP 1 funds 1 file 1 1 STEP 2 1 1. Direct Participants : Banks sending to and receiving from STEP 2 files directly Oct. . 2003 20

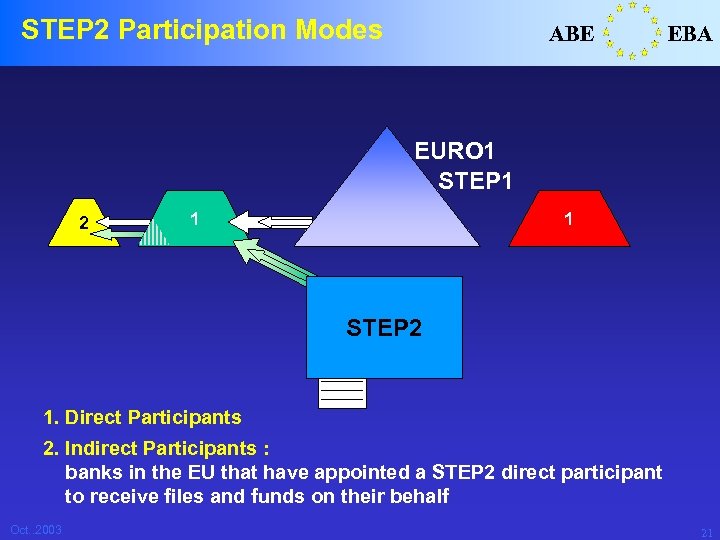

STEP 2 Participation Modes ABE EBA EURO 1 STEP 1 2 1 1 STEP 2 1. Direct Participants 2. Indirect Participants : banks in the EU that have appointed a STEP 2 direct participant to receive files and funds on their behalf Oct. . 2003 21

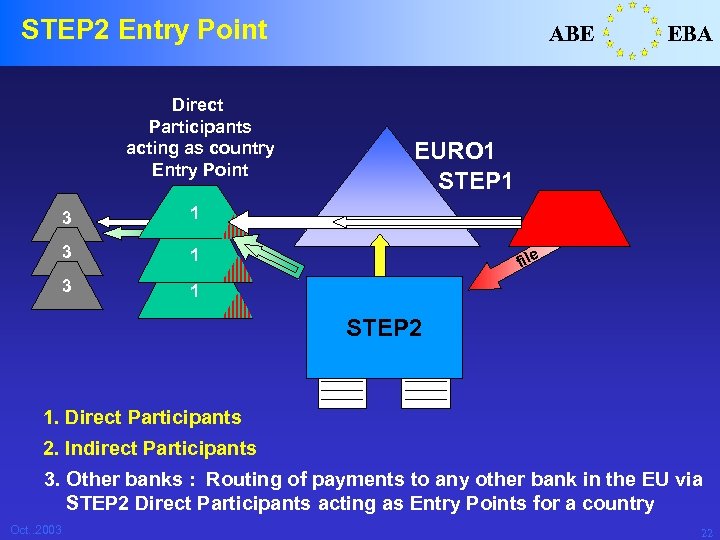

STEP 2 Entry Point Direct Participants acting as country Entry Point 3 EURO 1 STEP 1 1 3 EBA 1 3 ABE 1 file STEP 2 1. Direct Participants 2. Indirect Participants 3. Other banks : Routing of payments to any other bank in the EU via STEP 2 Direct Participants acting as Entry Points for a country Oct. . 2003 22

STEP 2 ramp-up ABE EBA Direct Participants in STEP 2, since live date in April 2003 Banca Intesa Banco Bilbao Vizcaya Argentaria Banco Commercial Portugues Banco Espirito Santo Banco Popular Español Banco Santander Central Hispano Bank Austria Creditanstalt Banque Fed. du Credit Mutuel Barclays Bank BCEE CECA Commerzbank Credit Commercial de France Deutsche Bank Dresdner Bank EFG Eurobank Oct. . 2003 HSBC Hypovereinsbank ING Belgium JP Morgan Chase Bank La Caixa National Bank of Greece Nordea Bank Danmark Nordea Bank Finland Rabobank Nederland San. Paolo IMI Société Générale Sydbank Unicredito Italiano West. LB 23

STEP 2 ramp-up ABE EBA Banks joining in October 2003 as Direct Participants Banca Pop. Verona e Novara Banca Popolare di Milano BNP Paribas Caixa Geral de Depositos Capitalia Caja Madrid Credit Agricole Credit Lyonnais Credito Bergamasco Danske Bank Den norske Bank Deutsche Bundesbank Oct. . 2003 Dexia – BIL Fortis Bank KBC Bank Natexis Banques Populaires Österreichische Nationalbank SEB Swedbank 760+ Indirect Participants by the end of 2003 24

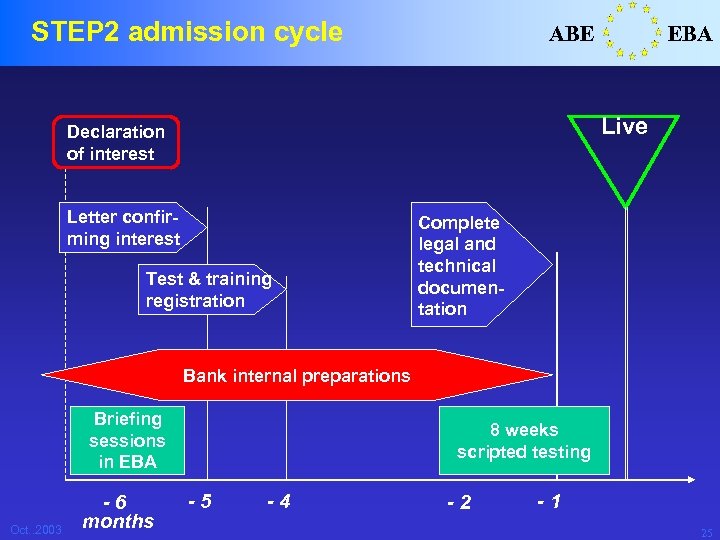

STEP 2 admission cycle ABE EBA Live Declaration of interest Letter confirming interest Test & training registration Complete legal and technical documentation Bank internal preparations Briefing sessions in EBA Oct. . 2003 - 6 months 8 weeks scripted testing - 5 - 4 - 2 - 1 25

STEP 2 admission cycle ABE EBA Joining windows in 2004 8 March 5 July 8 November Indirect Participants join on a monthly basis Oct. . 2003 26

STEP 2 ramp-up ABE EBA Receiver Capability as of 31/12/03 STEP 2 Direct Participants in 14 EU countries act as Entry Points to ensure country wide distribution of payments coming from STEP 2 Oct. . 2003 27

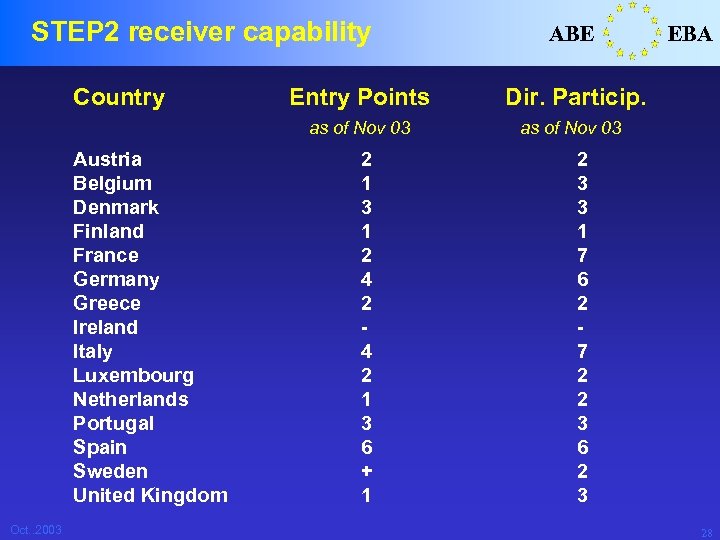

STEP 2 receiver capability Country Austria Belgium Denmark Finland France Germany Greece Ireland Italy Luxembourg Netherlands Portugal Spain Sweden United Kingdom Oct. . 2003 Entry Points as of Nov 03 2 1 3 1 2 4 2 1 3 6 + 1 ABE EBA Dir. Particip. as of Nov 03 2 3 3 1 7 6 2 7 2 2 3 6 2 3 28

EU 25 ABE EBA Receiver Capability as of 31/12/04 STEP 2 Direct Participants in 14 EU countries act as Entry Points to ensure country wide distribution of payments coming from STEP 2 Oct. . 2003 29

ABE EBA Overview • EBA history and background • High-level overview of EURO 1 and STEP 1 • STEP 2 features, benefits and participation • STEP 2 and SEPA Oct. . 2003 30

Where do we have to go ? ABE EBA The Single Euro Payments Area ! Oct. . 2003 31

Challenges and opportunities ABE EBA • SEPA : a change of scale or changes of horizons ? • How equal are banks vis-à-vis - scale driven cost saving potentials ? - opportunities emerging from de-fragmentation and broadening business horizons ? • En route to SEPA : which sort of business cases for abandoning domestic standards/infrastructures and creating new ones ? • New infrastructures : the difficult balance between the need for consensus, the need for leadership and market driven consolidation. Oct. . 2003 32

STEP 2 : a migration project ABE EBA Step 2 not only provides a solution for the future pan-European mass payments processing … … Step 2 also offers a variety of paths to individual banks and bank communities for migrating their traffic to PEACH ! Oct. . 2003 33

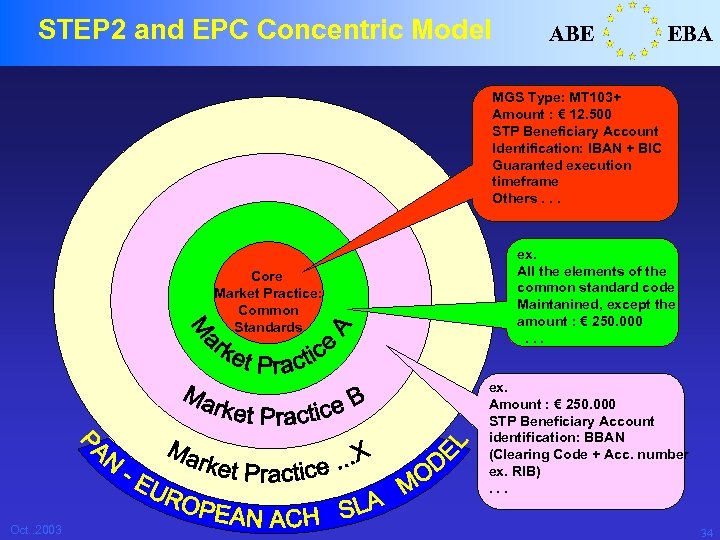

STEP 2 and EPC Concentric Model ABE EBA MGS Type: MT 103+ Amount : € 12. 500 STP Beneficiary Account Identification: IBAN + BIC Guaranted execution timeframe Others. . . Core Market Practice: Common Standards ex. All the elements of the common standard code Maintanined, except the amount : € 250. 000 . . . ex. Amount : € 250. 000 STP Beneficiary Account identification: BBAN (Clearing Code + Acc. number ex. RIB). . . Oct. . 2003 34

STEP 2 key features ABE EBA Innovation and value for SEPA A new technology : Inter. Act and File. Act, SWIFT XML Standards for Bulk Payments A new business platform : a pan-European ACH supporting the new pan-European payment instruments A new customer proposition : low cost, secure and rapid payment services across Europe for retail customers Oct. . 2003 35

STEP 2 and SEPA ABE EBA The next steps … «. . . the Pan-European Infrastructure WG should ensure that the following milestones are respected : . . . • By mid-2003, the pan-European infrastructure should be operational for cross-border STP compliant credit transfers. • By mid 2004, 50% of current cross-border credit transfers volumes should be processed on the pan-European infrastructure as well as, potentially, domestic payments from countries with no ACH infrastructure. • By mid-2005, the pan-European infrastructure should accommodate new Euro direct debit schemes. • By 2007, the agreed target service levels as defined should be met (e. g. same day settlement). » Oct. . 2003 (Excerpts of S. E. P. A. Workshop report, March 2002) 36

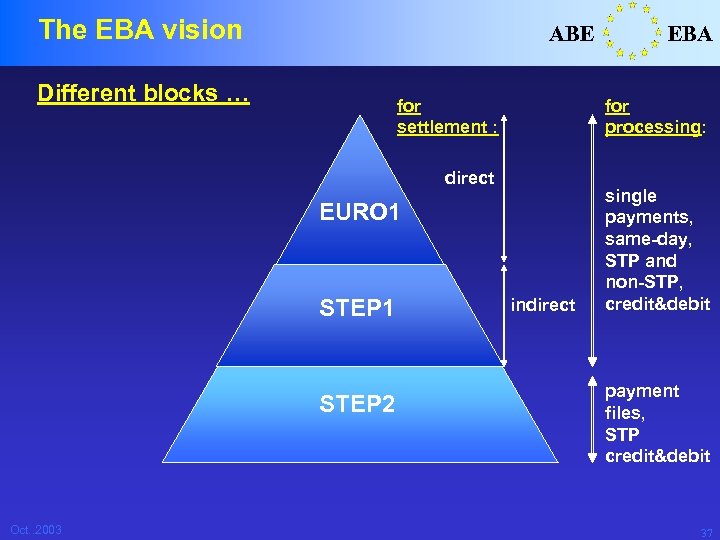

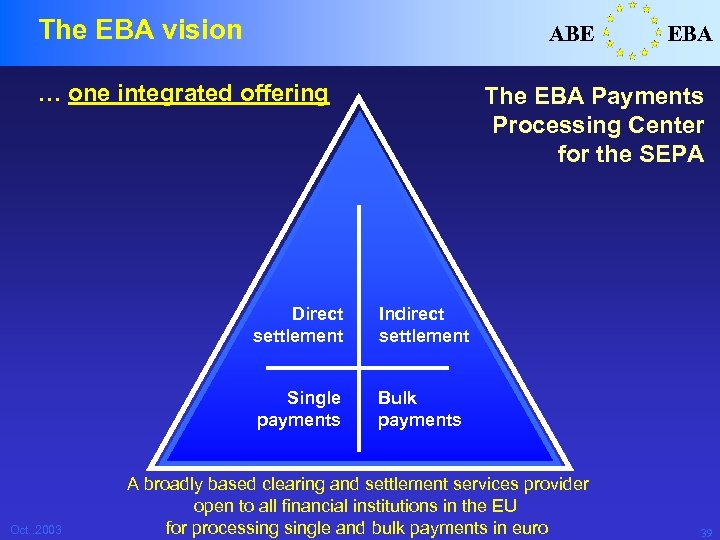

The EBA vision ABE Different blocks … for settlement : for processing: direct EURO 1 STEP 2 Oct. . 2003 EBA indirect single payments, same-day, STP and non-STP, credit&debit payment files, STP credit&debit 37

The EBA vision ABE EBA … one integrated offering EURO 1 STEP 2 Oct. . 2003 38

The EBA vision ABE … one integrated offering The EBA Payments Processing Center for the SEPA Direct settlement Indirect settlement Single payments Oct. . 2003 EBA Bulk payments A broadly based clearing and settlement services provider open to all financial institutions in the EU for processingle and bulk payments in euro 39

ABE EBA The EBA Payments Processing Center Oct. . 2003 www. abe. org 40

ae03df091ba41329fe2ba5c3fe3fb836.ppt