0b64c01c020204b9f65cad67481e9904.ppt

- Количество слайдов: 34

abcd Critical Illness – A Turbulent Year Ross Ainslie Tuesday 2 nd December 2003

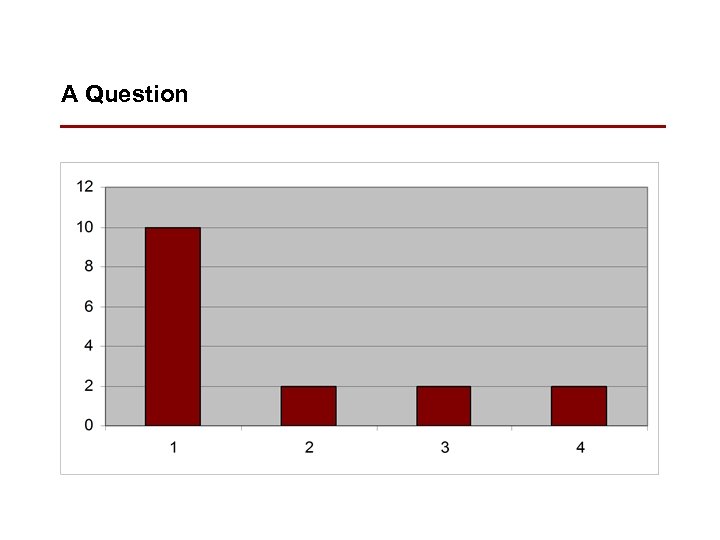

A Question

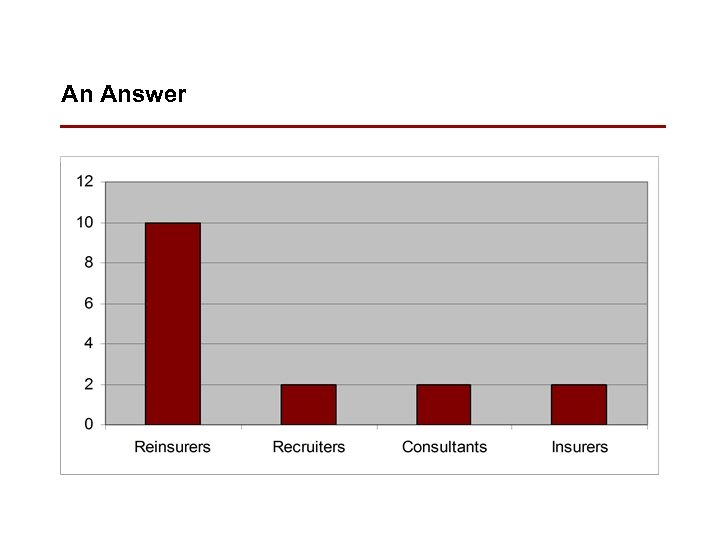

An Answer

Contents n n A short market history Reinsurance changes Insurers strategies The future

Contents n n A short market history Reinsurance changes Insurers strategies The future

Market history Single Cover Products Price

Market history Single Cover Products Single Cover & Menu Products Features Price

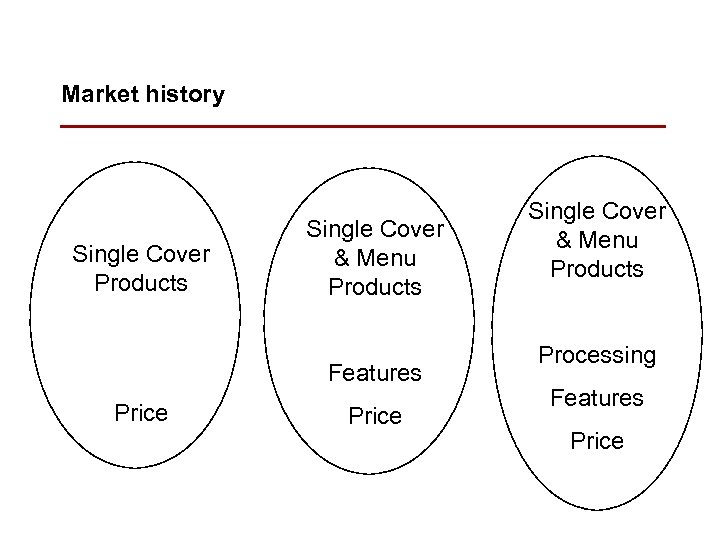

Market history Single Cover Products Single Cover & Menu Products Features Price Single Cover & Menu Products Processing Features Price

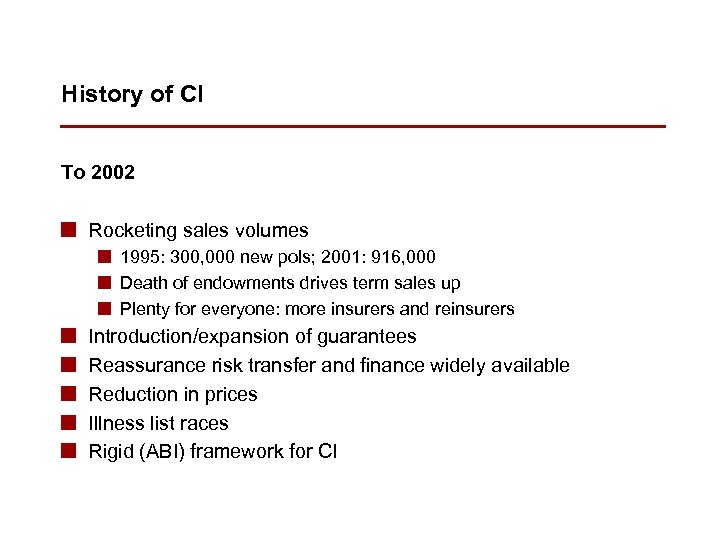

History of CI To 2002 n Rocketing sales volumes n 1995: 300, 000 new pols; 2001: 916, 000 n Death of endowments drives term sales up n Plenty for everyone: more insurers and reinsurers n n n Introduction/expansion of guarantees Reassurance risk transfer and finance widely available Reduction in prices Illness list races Rigid (ABI) framework for CI

In the last 24 months of CI 2002 n Swiss Re announce withdrawal from guaranteed CI n Unable to reconcile experience with client business models n Trend risk n Other reassurers respond n Some leave, some enter n Guaranteed CI expected to disappear

Contents n n A short market history Reinsurance changes Insurers strategies The future With thanks to Steve Payne.

Reassurance Drivers n n n Availability of reassurance Capital scarcity Influence of the Rating Agencies Risk management Parental constraints

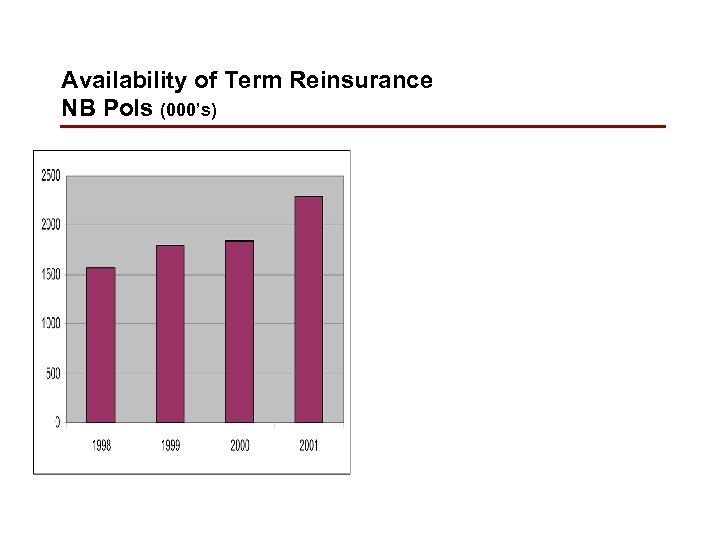

Availability of Term Reinsurance NB Pols (000’s)

Availability of Term Reinsurance NB Pols (000’s) NB Sums Reinsured (bns)

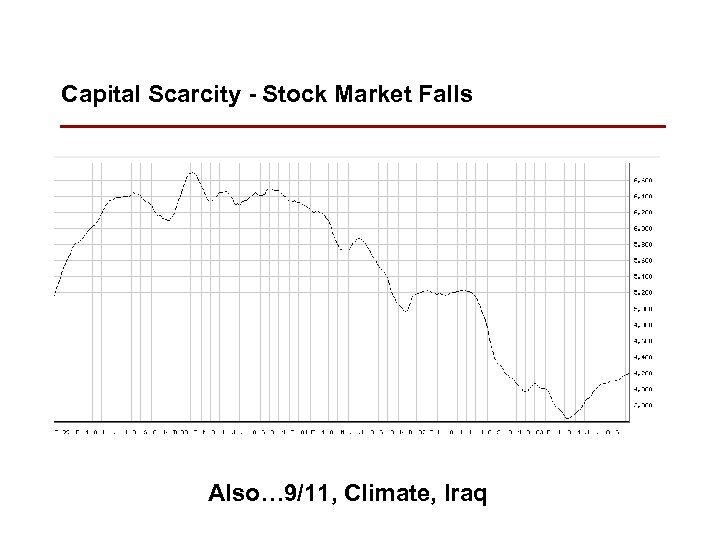

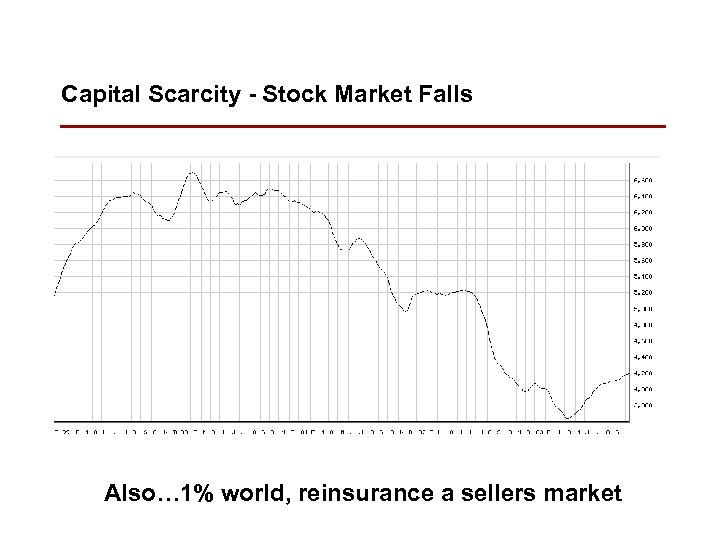

Capital Scarcity - Stock Market Falls Also… 9/11, Climate, Iraq

Capital Scarcity - Life or General r

Reinsurer Drivers: Influence of the Rating Agencies AAA AA+ AA AAA+ A ABBB BB+ BB BBB+ B B- UNRATED

Reinsurer Drivers: Risk management n Systemic risk of CI n Reassurance risks

Reinsurer Drivers: Parental constraints n n n Capital Liquidity Rating objectives Product Peer pressure n …The Americans…

Reinsurer strategies n Deal based n Focus on today’s deal n Business preferences n Limit front-end risks n Risky products dropped n Less innovation n Reduced services n Relationship based n Focus on clients n Partnerships can work n Services included

What does the CI market look like now n n n n Reduced CI capacity Reviewable CI availability Price increases Product withdrawals Greater reassurer influence over CI Reduced capital availability Active business management

Contents n n A short market history Reinsurance changes Insurers strategies The future

Capital Scarcity - Stock Market Falls Also… 1% world, reinsurance a sellers market

Insurer strategies n Bluster, but acceptance, of reinsurer-driven changes n Prices up, capacity down n Reinsurance gaps met with own capacity…for now n But have insurers adjusted to the new commercial reality?

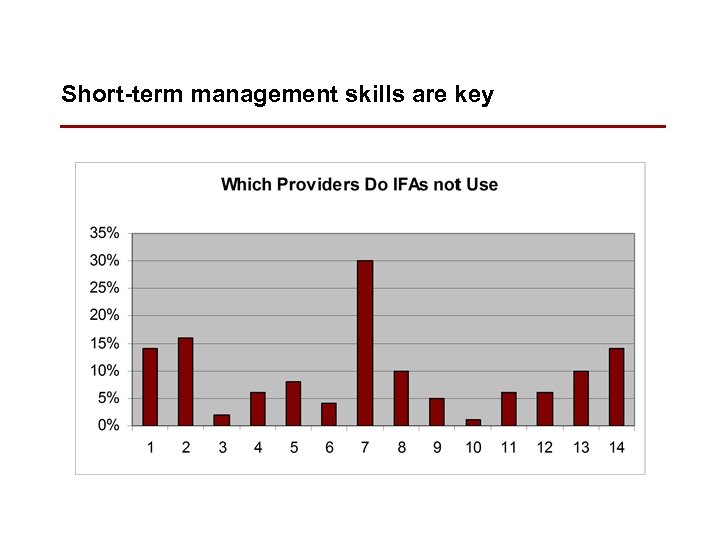

Short-term management skills are key

Contents n n A short market history Reinsurance changes Insurers strategies The future

Market history Single Cover Products Single Cover & Menu Products Features Price Single Cover & Menu Products Processing Features Price

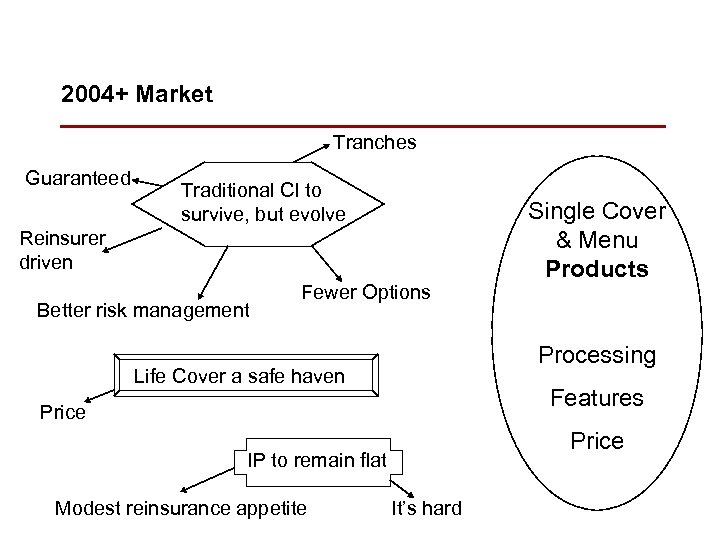

2004+ Market Tranches Guaranteed Traditional CI to survive, but evolve Reinsurer driven Better risk management Fewer Options Processing Life Cover a safe haven Features Price IP to remain flat Modest reinsurance appetite Single Cover & Menu Products It’s hard

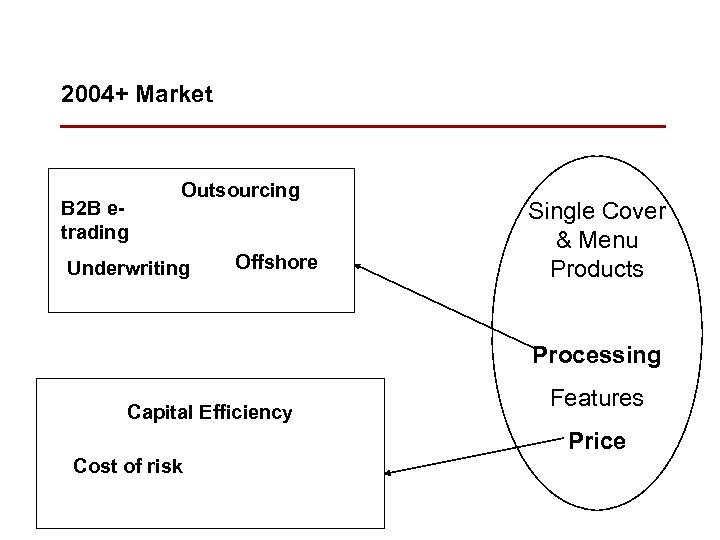

2004+ Market B 2 B etrading Outsourcing Underwriting Offshore Single Cover & Menu Products Processing Capital Efficiency Features Price Cost of risk

2004+ Market Product complexity prevents economy of scale Product complexity drives process complexity Single Cover & Menu Products Single Cover Products Processing Process complexity means inflexibility and cost Features Price Bells and whistles add more cost than value

Alternative views about CI are available n Windfall benefits? n “Do not matter as long as you price for them” n “Any product with a windfall is fundamentally flawed as this does not meet a need” n Guarantees? n “Genetics, new detection techniques, diagnostic developments etc. mean that it is impossible to guarantee CI with current definitions” n “Current high rates enable some guarantees to be offered” n Reviewability? n “Too complex, can never work. 3 player games always have a victim. It is not being done properly” n “This is the best we can do to give a ‘fair’ deal at a ‘fair’ price” n The Benefits n “Tiered benefits fit to need - we should be selling IP style products” n “Lump sums sell - it is what the market wants”

Will guaranteed CI survive: Proportion of market players offering product

Acknowledgements n Steve Payne – for use of many of his slides from Healthcare Convention 2003 n GE Frankona

abcd Critical Illness – A Turbulent Year Ross Ainslie Tuesday 2 nd December 2003

0b64c01c020204b9f65cad67481e9904.ppt