dde4afc3490a38169a2e8a954c8bd7fc.ppt

- Количество слайдов: 75

abcd ART Phillip Petterson Gillian James General Insurance Spring Seminar 19 -20 May 2003 Scarman House

ART § This presentation aims to give an overview of ART, however it does not cover all products that might be considered to fall under the ART heading § The opinions presented are those of the authors, and do not necessarily reflect the views of the Benfield Group

ART § No simple definitions of alternative risk transfer (ART) § Originally methods by which companies financed part of their “insurance” risks § Hard market in the mid 1980’s brought serious shortages in cover & problems with affordability § Consequently financial reinsurance & capital market products developed

ART § The Art landscape can be divided into the following silos: § Alternative Carriers & § Alternative products such as: § Alternative Risk Transfer Products (Cat Bonds) § Risk Financing Products (Finite structures) § Hybrid Structures (could be a combination of Capital market and traditional reinsurance such as a cat option)

ART (Motivators) 1 § Regulatory or Accounting drivers § § Solvency margin Stabilisation of results Regulatory arbitrage Discounting of reserves § Taxation § Transfer of taxable profits / losses to a more favoured environment / company § Use of tax favoured status § More effective provision of cover § New sources of capacity and diversification

ART (Motivators) 2 § Greater customer focus /alignment § May include risks otherwise “uninsurable” § Highly customised to client’s specific needs – no standard solutions § Integrated risk management § Better alignment of risk transfer to customers financial needs § Funding rather than transferring § Locking in terms for more than 12 months § Greater security of payment § Credit enhancing by utilising reinsurers balance sheet § Credit enhancing by substituting reinsurer balance sheet for cash e. g. Cat Bond

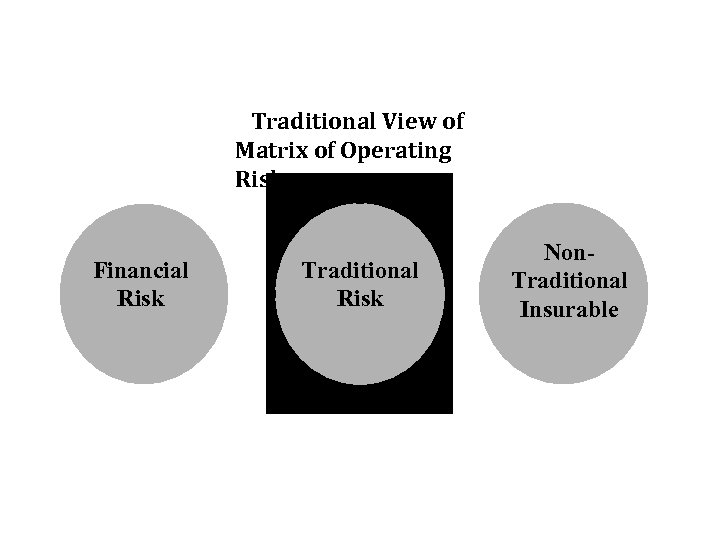

Traditional View of Matrix of Operating Risks Financial Risk Traditional Risk Non. Traditional Insurable

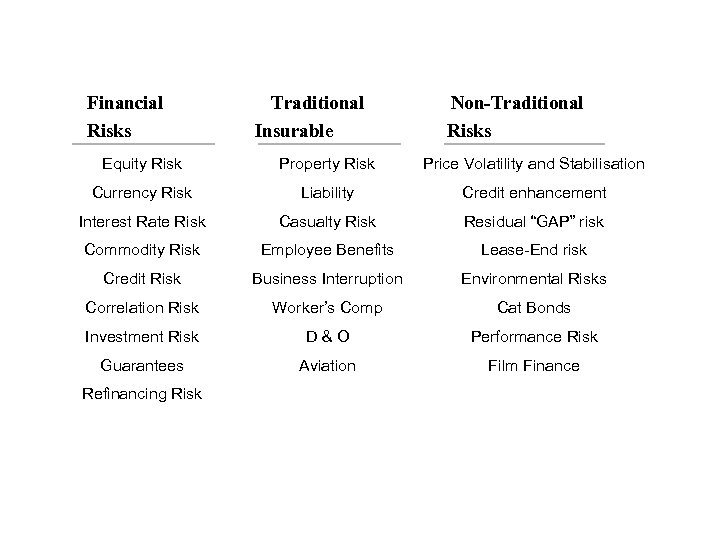

Financial Risks Traditional Insurable Non-Traditional Risks Equity Risk Property Risk Price Volatility and Stabilisation Currency Risk Liability Credit enhancement Interest Rate Risk Casualty Risk Residual “GAP” risk Commodity Risk Employee Benefits Lease-End risk Credit Risk Business Interruption Environmental Risks Correlation Risk Worker’s Comp Cat Bonds Investment Risk D&O Performance Risk Guarantees Aviation Film Finance Refinancing Risk

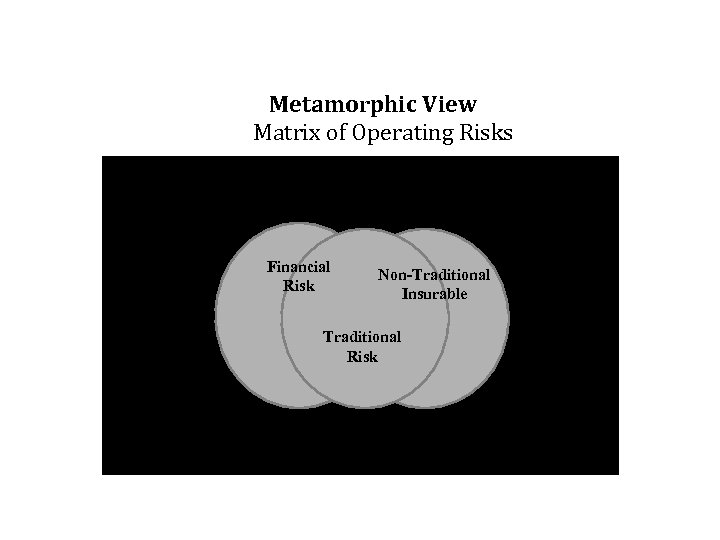

Metamorphic View Matrix of Operating Risks Financial Risk Non-Traditional Insurable Traditional Risk

Alternative carriers § § § Self insurance (US) Captives Risk retention groups Pools Contingent capital

Self Insurance § By definition, does not provide risk transfer § Commonly used in the US for § § § Workers compensation General liability Products liability Auto liability Property § US workers compensation and auto liability only self insured as regulated programs

What Is a Captive? § “Insurance” or “Reinsurance” company § Generally owned through a common interest – which may or may not primarily be engaged in the business of insurance or reinsurance § All or a significant portion of risks written in the “captive” Related to the shareholders § Third party risks which shareholders may control §

Definition of industry segments that form captives § Most early captives formed by industrial or manufacturing companies i. e. not insurance or reinsurance companies § Other types of captives were industry groups or associations, rent-a -captives etc § Their bespoke needs are different to the formation of insurance /reinsurance captives by players within the insurance and reinsurance arena!

The common captive drivers and reasons when captives make sense

The principle motivators § The assumption of uninsurable or hard to place risks § Additional retentions in a hard market environment § The creation of a Special Purpose Reinsurer (SPR) as a vehicle for capital market proposals such as Cat Bonds, Swaps, Options etc (note Tokio Millennium Re and MS Frontier Re) § The assumption of the so called “Enterprise Risks” § Cash flow reasons (usually related to long tail claims) § To enhance underwriting capacity or to assist growth strategy

The principle motivators § Other benefits: § Regulatory arbitrage – the captive is usually able to take advantage of a more flexible regulatory environment than that of the home domicile, which leads to financial benefits for example the creation of equalisation reserves § Taxation - the captive is able to take advantage of a more generous tax environment which can bring benefits when accumulating reserves for example

Captives - Tax § Until 1970, use of captives was very taxefficient § Since then, tax benefits reduced § In US premiums to captives with substantial third party business are tax deductible § In most European countries, company must demonstrate substantial risk transfer § Premiums must reflect underwriting risk § But still a number of tax advantages

The business the captive may write § Catastrophe business – as long as it does not increase the overall correlation § Non-cat risks currently reinsured externally: focus on high reinsurer margins and building balanced retained risk profile § Internal LPTs (loss portfolio transfers) which move past activities to a more beneficial regulatory / tax environment. § Specific gaps in historic risk protection e. g. EMF, RSI, toxic mould, passive smoking

The business the captive may write § Any mismatches between original coverage and reinsurance where captive might offer DIC (e. g. terrorism? ) § PML error and/or reinstatement exhaustion cover § Write finite prospective risks or retrospective risks for example; pharmaceutical liability business § Deterioration in guaranteed annuity provisions § Own insurances (at least current retentions)

A summary of “when does a Captive make Sense? ” Sense § § § Special risk needs Cost control center Tax efficiency desires Regulatory arbitrage Increase efficiency by retaining highfrequency risks § Low-risk companies can benefit from their superior risk profile

Interesting Captive Facts! § Average premium for direct captives US$223 m although the range was from US$1 m to US$1. 98 bn § The median premium income US$316. 5 m § Reinsurance captives average is up from US$107 m to US$ 131 m and the range is estimated to be between US$5 m to US$550 m § The median is US$15. 5 m § It is expected that the direct and reinsurance premium volumes will increase by 24%

Risk retention groups § Introduced in the US in 1986 § Specialised liability insurance companies § Allow US companies to access liability insurance § Mainly professional services and healthcare (PI, med mal) § Premium close to USD 1 bn

Pools § Arrangements between companies to protect against very large risks § Typically organised on a national basis § Cover a specific risk class § § US workers compensation pools Spanish natural catastrophe pool Nuclear risk pool in Germany UK terrorism pool

Contingent capital § § Used since 1995 Deals worth USD 6 bn written to date Provide capital after specific event Purchaser has right to sell its securities § At pre-set price, for fixed period after specified event § Provides capital when it is most needed § Pre-set price is better than post-event market § Has been regarded as uncorrelated with other investments. . . .

Alternative products § § § § Loss Portfolio Transfers (LPTs) Adverse Development Covers (ADCs) Finite quota share Multi-trigger protections Multi-year spread loss Whole account stop Loss Credit securitisation Insurance securitisation

Alternative products § Multi year and/or multi class § Complement existing (re)insurance to improve efficiency of risk transfer § Expand range of insurable risks § New risk classes § Classes with insufficient market data § Classes close to business risks and so with potential moral hazard risks

Loss Portfolio Transfers (LPTs) § Transfer reserves for specific blocks of business § But this is reinsurance, not novation § Cedant still ultimately responsible for claim payments § So some credit risk remains § Policies usually have limit on maximum recoveries § Policies sometimes have additional features: § § sub-limits for specific classes, claims etc additional premiums profit share co-insurance

LPTs § “Net of inuring” - inuring reinsurance deemed fully recoverable § “Gross with benefit of inuring” – protects against any irrecoverable inuring reinsurance § Claims handling may be taken on by reinsurer § Or claims handling agreements determine how cedant will manage claims § Potential moral hazard if cedant has ongoing relationships

LPTs § Cedant § Crystallises future investment income on reserves § Removes impact or reserve deterioration § Improves stability in earnings § Protects solvency § Retains / enhances credit rating § May enable M&A activity § Reinsurer § Receives large premium at outset § May regard this as inexpensive capital source § Assumes risk of reserve deterioration up to policy limit § Has benefit of reserve improvements

Adverse Development Covers (ADCs) § Protect against reserve deterioration for specific blocks of business § Policies always have limit on maximum recoveries § Policies may have additional features § § Sub-limits Additional premiums Profit share Co-insurance

ADCs § Cedant retains claims handling § Although reinsurer will impose reporting requirements § Reinsurer may want features to encourage good behaviour once attachment point is breached § Common to see some co-reinsurance or profit share

ADCs § Cedant § Crystallises future investment income on reserves § Retains benefit of reserve improvements, but transfers deteriorations § Improves stability in earnings § Protects solvency § Retains / enhances credit rating § May enable M&A activity § Reinsurer § Assumes risk of reserve deterioration up to policy limit § But has no direct benefit from reserve improvements § Rarely assumes credit risk on inuring reinsurance § May appear expensive compared to LPTs

ADC example § Booked reserves £ 200 m § Company wants to protect against reserve deterioration to £ 300 m § ADC options § £ 150 m xs £ 150 m § £ 100 m xs £ 200 m § £ 75 m xs £ 225 m § Cedant pays claims to excess, then reinsurer pays up to limit

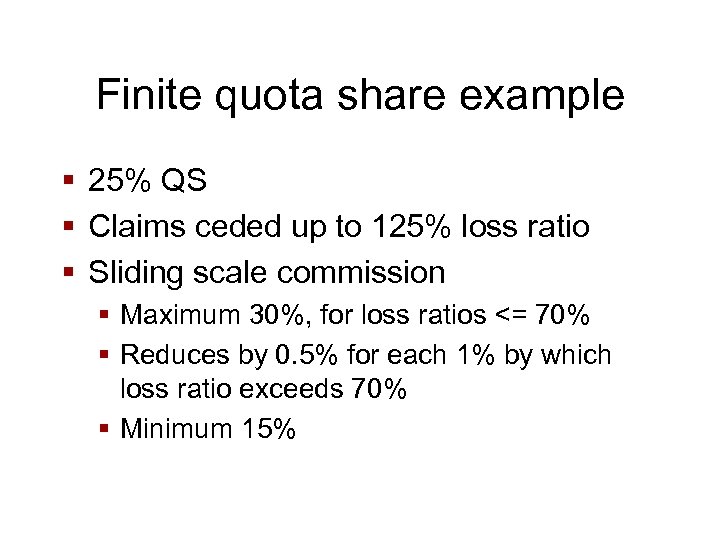

Finite quota share § Quota share with finite ceded loss ratio § May also have loss corridor, in which cedant funds claims § Usually has sliding scale ceding commission § May be a financing contract § Commonly used is the US § Purchased to improve solvency position, or financing benefits § Under increased scrutiny to ensure appropriate risk transfer

Finite quota share example § 25% QS § Claims ceded up to 125% loss ratio § Sliding scale commission § Maximum 30%, for loss ratios <= 70% § Reduces by 0. 5% for each 1% by which loss ratio exceeds 70% § Minimum 15%

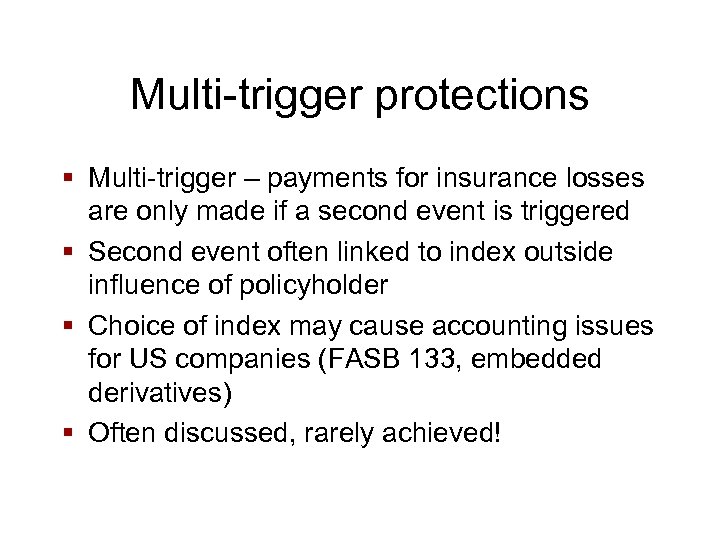

Multi-trigger protections § Multi-trigger – payments for insurance losses are only made if a second event is triggered § Second event often linked to index outside influence of policyholder § Choice of index may cause accounting issues for US companies (FASB 133, embedded derivatives) § Often discussed, rarely achieved!

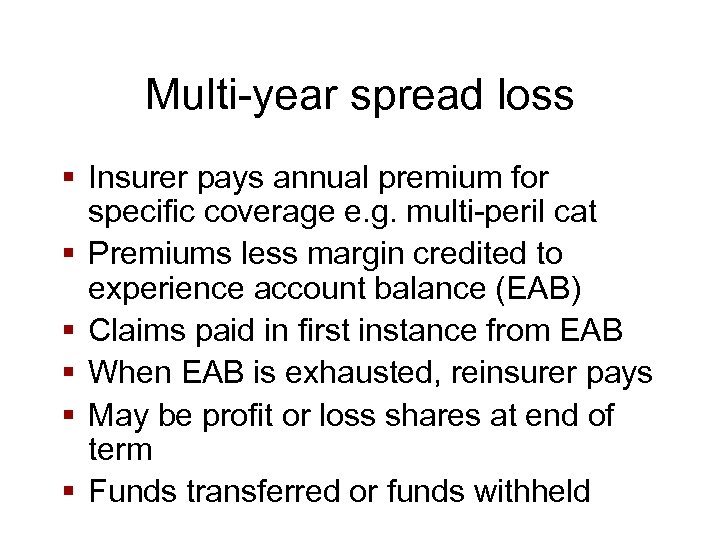

Multi-year spread loss § Insurer pays annual premium for specific coverage e. g. multi-peril cat § Premiums less margin credited to experience account balance (EAB) § Claims paid in first instance from EAB § When EAB is exhausted, reinsurer pays § May be profit or loss shares at end of term § Funds transferred or funds withheld

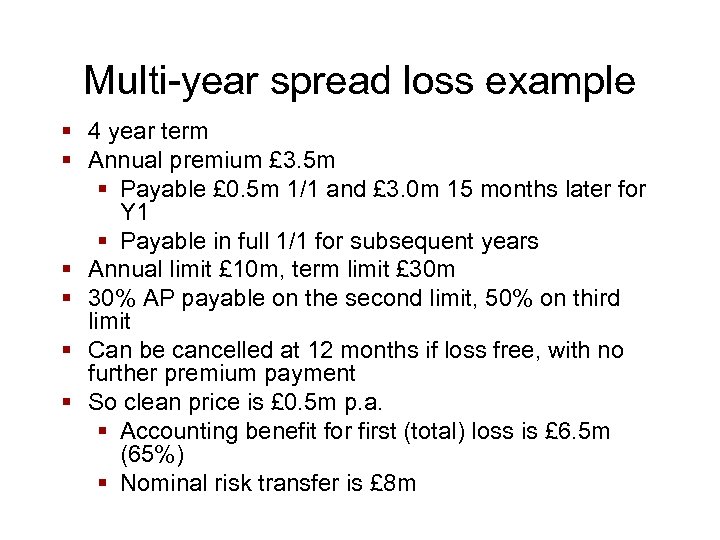

Multi-year spread loss example § 4 year term § Annual premium £ 3. 5 m § Payable £ 0. 5 m 1/1 and £ 3. 0 m 15 months later for Y 1 § Payable in full 1/1 for subsequent years § Annual limit £ 10 m, term limit £ 30 m § 30% AP payable on the second limit, 50% on third limit § Can be cancelled at 12 months if loss free, with no further premium payment § So clean price is £ 0. 5 m p. a. § Accounting benefit for first (total) loss is £ 6. 5 m (65%) § Nominal risk transfer is £ 8 m

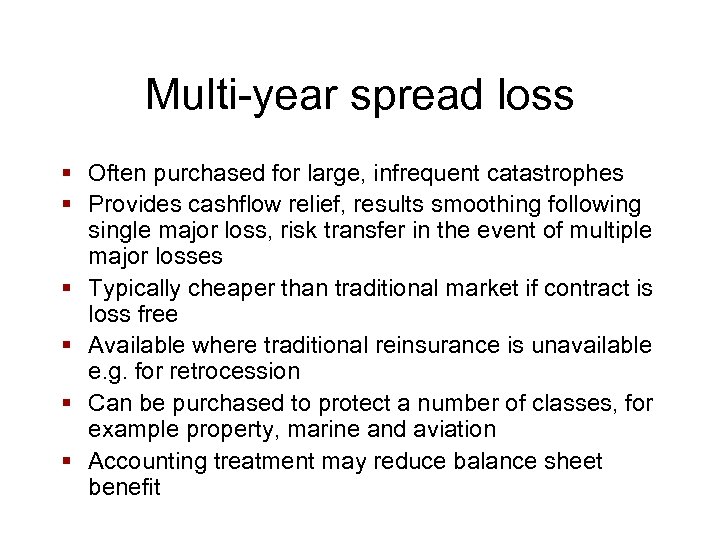

Multi-year spread loss § Often purchased for large, infrequent catastrophes § Provides cashflow relief, results smoothing following single major loss, risk transfer in the event of multiple major losses § Typically cheaper than traditional market if contract is loss free § Available where traditional reinsurance is unavailable e. g. for retrocession § Can be purchased to protect a number of classes, for example property, marine and aviation § Accounting treatment may reduce balance sheet benefit

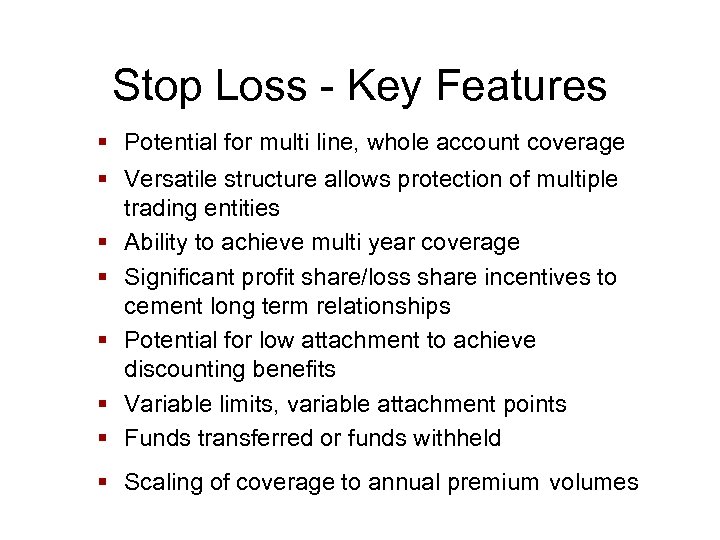

Stop Loss - Key Features § Potential for multi line, whole account coverage § Versatile structure allows protection of multiple trading entities § Ability to achieve multi year coverage § Significant profit share/loss share incentives to cement long term relationships § Potential for low attachment to achieve discounting benefits § Variable limits, variable attachment points § Funds transferred or funds withheld § Scaling of coverage to annual premium volumes

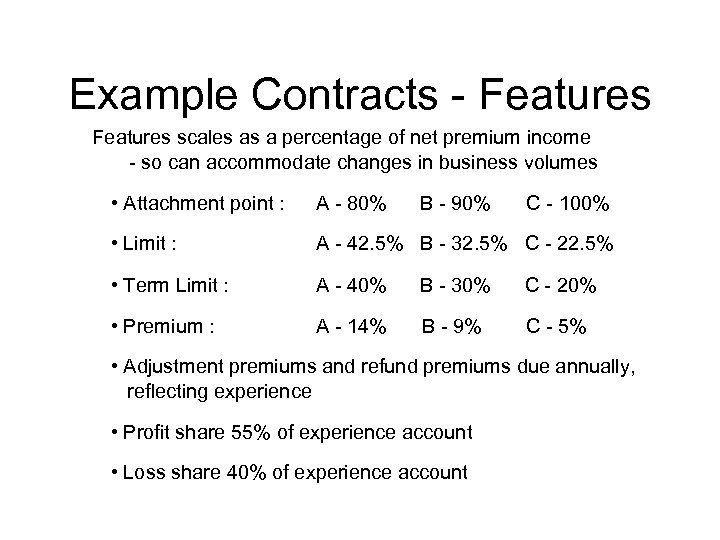

Example Contracts - Features scales as a percentage of net premium income - so can accommodate changes in business volumes • Attachment point : A - 80% • Limit : A - 42. 5% B - 32. 5% C - 22. 5% • Term Limit : A - 40% B - 30% C - 20% • Premium : A - 14% B - 9% C - 5% B - 90% C - 100% • Adjustment premiums and refund premiums due annually, reflecting experience • Profit share 55% of experience account • Loss share 40% of experience account

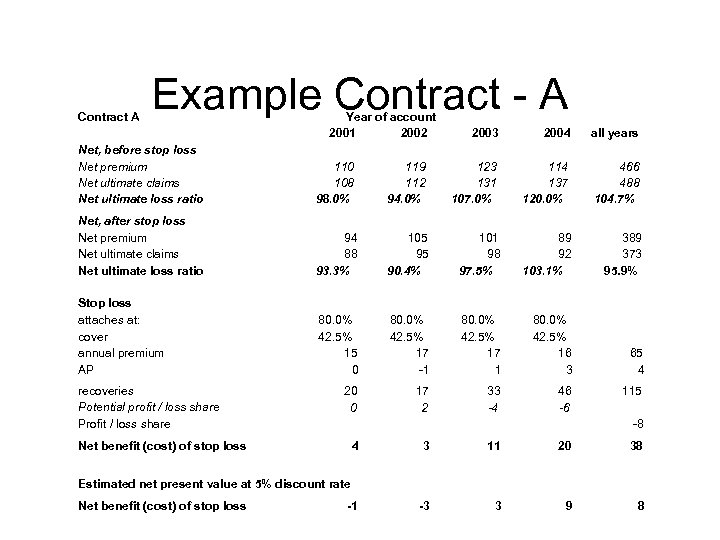

Contract A Example Contract - A Year of account 2001 2002 2003 2004 all years 123 131 107. 0% 114 137 120. 0% 466 488 104. 7% Net, before stop loss Net premium Net ultimate claims Net ultimate loss ratio 110 108 98. 0% 119 112 94. 0% Net, after stop loss Net premium Net ultimate claims Net ultimate loss ratio 94 88 93. 3% 105 95 90. 4% 101 98 97. 5% 89 92 103. 1% 389 373 95. 9% Stop loss attaches at: cover annual premium AP 80. 0% 42. 5% 15 0 80. 0% 42. 5% 17 -1 80. 0% 42. 5% 17 1 80. 0% 42. 5% 16 3 65 4 20 0 17 2 33 -4 46 -6 recoveries Potential profit / loss share Profit / loss share 115 -8 Net benefit (cost) of stop loss 4 3 11 20 38 -1 -3 3 9 8 Estimated net present value at 5% discount rate Net benefit (cost) of stop loss

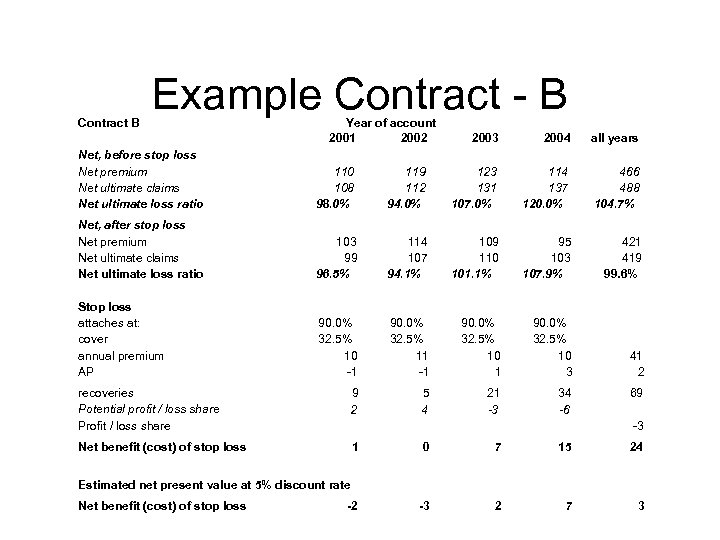

Contract B Example Contract - B Year of account 2001 2002 2003 2004 all years 466 488 104. 7% Net, before stop loss Net premium Net ultimate claims Net ultimate loss ratio 110 108 98. 0% 119 112 94. 0% 123 131 107. 0% 114 137 120. 0% Net, after stop loss Net premium Net ultimate claims Net ultimate loss ratio 103 99 96. 5% 114 107 94. 1% 109 110 101. 1% 95 103 107. 9% 421 419 99. 6% Stop loss attaches at: cover annual premium AP 90. 0% 32. 5% 10 -1 90. 0% 32. 5% 11 -1 90. 0% 32. 5% 10 3 41 2 recoveries Potential profit / loss share Profit / loss share 9 2 5 4 21 -3 34 -6 Net benefit (cost) of stop loss 1 0 7 15 24 -2 -3 2 7 3 69 -3 Estimated net present value at 5% discount rate Net benefit (cost) of stop loss

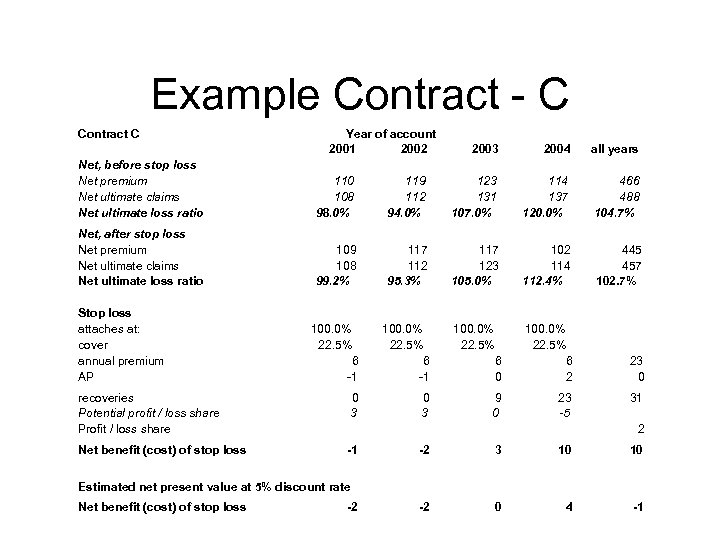

Example Contract - C Contract C Year of account 2001 2002 2003 2004 all years Net, before stop loss Net premium Net ultimate claims Net ultimate loss ratio 110 108 98. 0% 119 112 94. 0% 123 131 107. 0% 114 137 120. 0% 466 488 104. 7% Net, after stop loss Net premium Net ultimate claims Net ultimate loss ratio 109 108 99. 2% 117 112 95. 3% 117 123 105. 0% 102 114 112. 4% 445 457 102. 7% 100. 0% 22. 5% 6 -1 100. 0% 22. 5% 6 0 100. 0% 22. 5% 6 2 23 0 recoveries Potential profit / loss share Profit / loss share 0 3 9 0 23 -5 Net benefit (cost) of stop loss -1 Stop loss attaches at: cover annual premium AP 31 2 -2 3 10 10 -2 0 4 -1 Estimated net present value at 5% discount rate Net benefit (cost) of stop loss -2

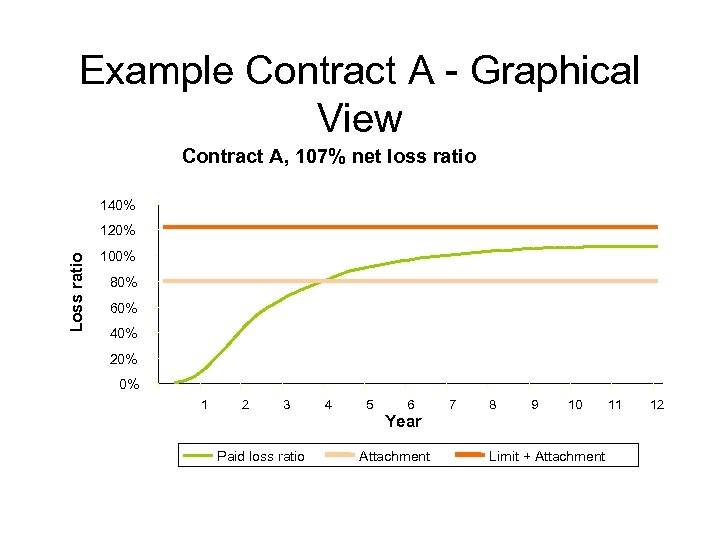

Example Contract A - Graphical View Contract A, 107% net loss ratio 140% Loss ratio 120% 100% 80% 60% 40% 20% 0% 1 2 3 Paid loss ratio 4 5 6 Year Attachment 7 8 9 10 Limit + Attachment 11 12

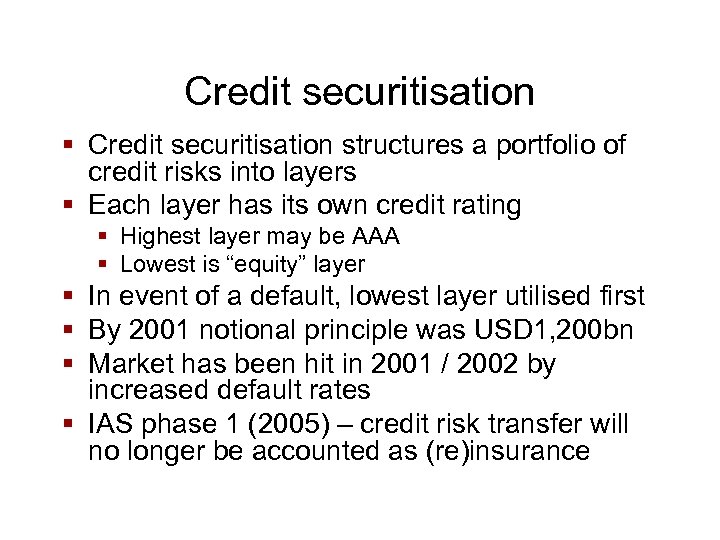

Credit securitisation § Credit securitisation structures a portfolio of credit risks into layers § Each layer has its own credit rating § Highest layer may be AAA § Lowest is “equity” layer § In event of a default, lowest layer utilised first § By 2001 notional principle was USD 1, 200 bn § Market has been hit in 2001 / 2002 by increased default rates § IAS phase 1 (2005) – credit risk transfer will no longer be accounted as (re)insurance

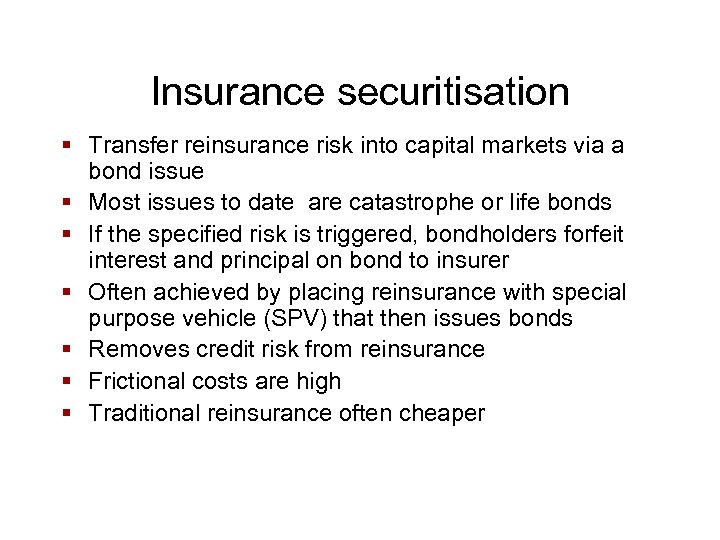

Insurance securitisation § Transfer reinsurance risk into capital markets via a bond issue § Most issues to date are catastrophe or life bonds § If the specified risk is triggered, bondholders forfeit interest and principal on bond to insurer § Often achieved by placing reinsurance with special purpose vehicle (SPV) that then issues bonds § Removes credit risk from reinsurance § Frictional costs are high § Traditional reinsurance often cheaper

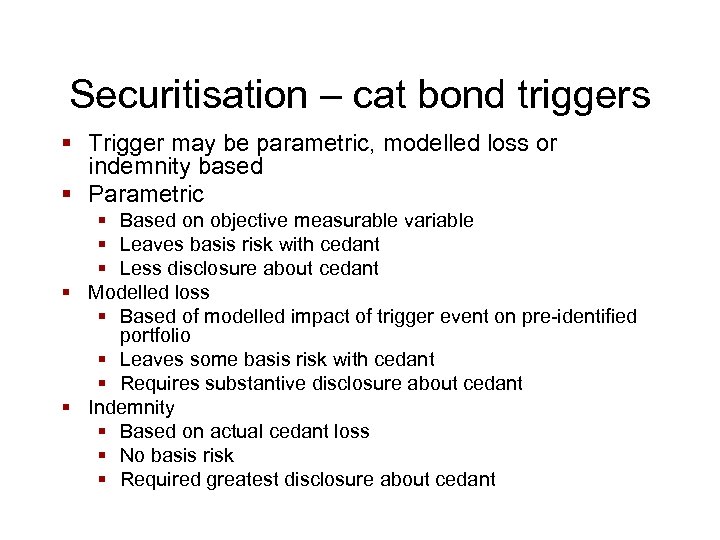

Securitisation – cat bond triggers § Trigger may be parametric, modelled loss or indemnity based § Parametric § Based on objective measurable variable § Leaves basis risk with cedant § Less disclosure about cedant § Modelled loss § Based of modelled impact of trigger event on pre-identified portfolio § Leaves some basis risk with cedant § Requires substantive disclosure about cedant § Indemnity § Based on actual cedant loss § No basis risk § Required greatest disclosure about cedant

Accounting complications

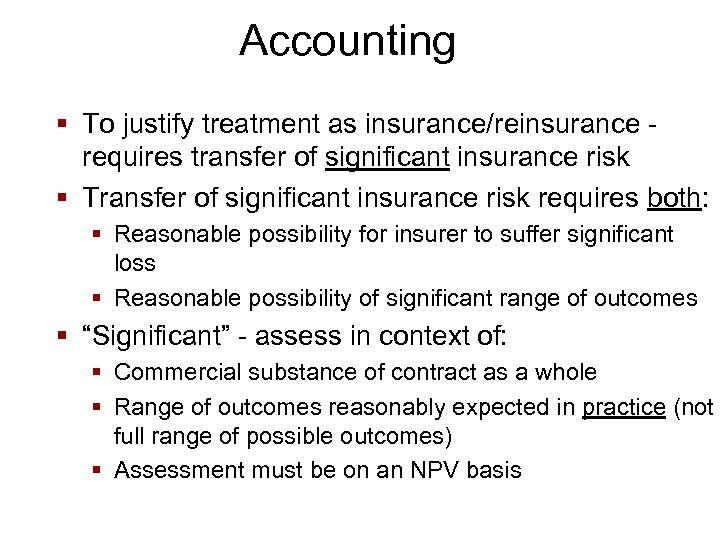

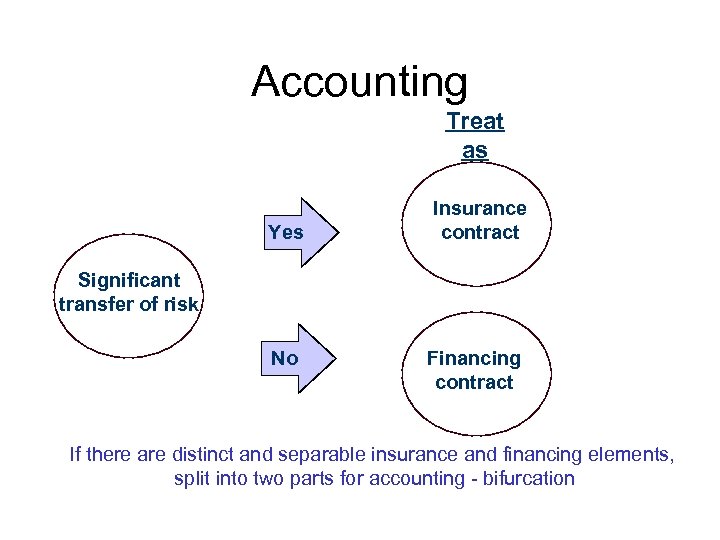

Accounting § To justify treatment as insurance/reinsurance requires transfer of significant insurance risk § Transfer of significant insurance risk requires both: § Reasonable possibility for insurer to suffer significant loss § Reasonable possibility of significant range of outcomes § “Significant” - assess in context of: § Commercial substance of contract as a whole § Range of outcomes reasonably expected in practice (not full range of possible outcomes) § Assessment must be on an NPV basis

Accounting § Insurance risk - comprises either or both § U/w risk - uncertainty of occurrence/amount of loss § Timing risk - uncertainty re timing of claim payments § Not sufficient if insurer only receives a lender’s rate of return under all reasonably possible scenarios § Assessment of contract performed prospectively

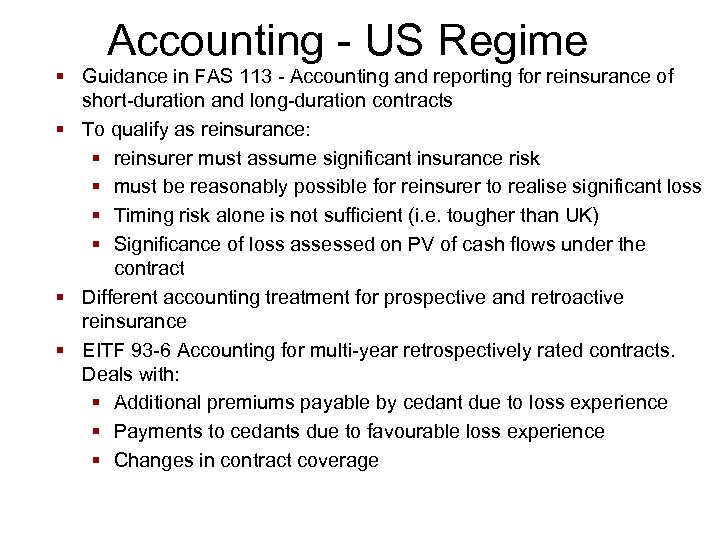

Accounting - US Regime § Guidance in FAS 113 - Accounting and reporting for reinsurance of short-duration and long-duration contracts § To qualify as reinsurance: § reinsurer must assume significant insurance risk § must be reasonably possible for reinsurer to realise significant loss § Timing risk alone is not sufficient (i. e. tougher than UK) § Significance of loss assessed on PV of cash flows under the contract § Different accounting treatment for prospective and retroactive reinsurance § EITF 93 -6 Accounting for multi-year retrospectively rated contracts. Deals with: § Additional premiums payable by cedant due to loss experience § Payments to cedants due to favourable loss experience § Changes in contract coverage

Accounting Treat as Yes Insurance contract Significant transfer of risk No Financing contract If there are distinct and separable insurance and financing elements, split into two parts for accounting - bifurcation

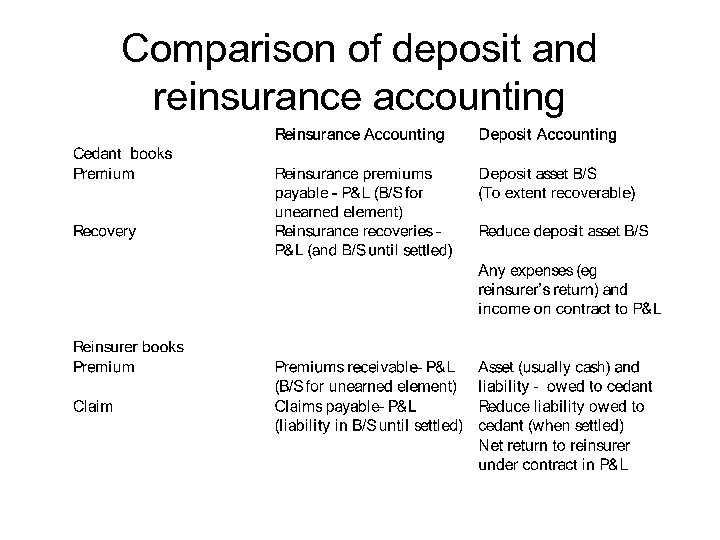

Comparison of deposit and reinsurance accounting

International Accounting Standards (IAS) § IAS to be used by all European listed companies by 2005 § Currently no reporting standard for insurance and insurance contracts are exempt from existing standards § Latest guidance is the Draft Statement of Principals (DSOP)

IAS – why does it matter to ART? § ART is often about arbitrage between accounting/regulatory/economic effect § IAS will introduce a new accounting basis for valuing insurance assets and liabilities § Existing International standards, say on consolidation, already have an impact (SPV’s) § Treatment of credit protection

Securitisation A brief overview

The Emergence of Insurance Securitisation has highlighted the following concerns! § Will Capital Market products be in the long run, superior to conventional reinsurance? And § Could it replace traditional reinsurance? § In BG view it is not an issue of either or, but the concept must be seen as a tool of the risk financing spectrum and therefore it’s use will be determined by client needs.

Convergence of Insurance and Capital Markets § Many of today’s products are hybrids combining insurance risk with capital markets techniques § A modern Broker must not only provide know how over the different traditional insurance lines but also offer capital markets expertise

Convergence of Insurance and Capital Markets available products: § § § § Traditional reinsurance Finite Reinsurance Double Trigger Covers ILW’S OTC Cat Swaps Securitisation Exchange traded Cat Options Contingent Capital arrangements

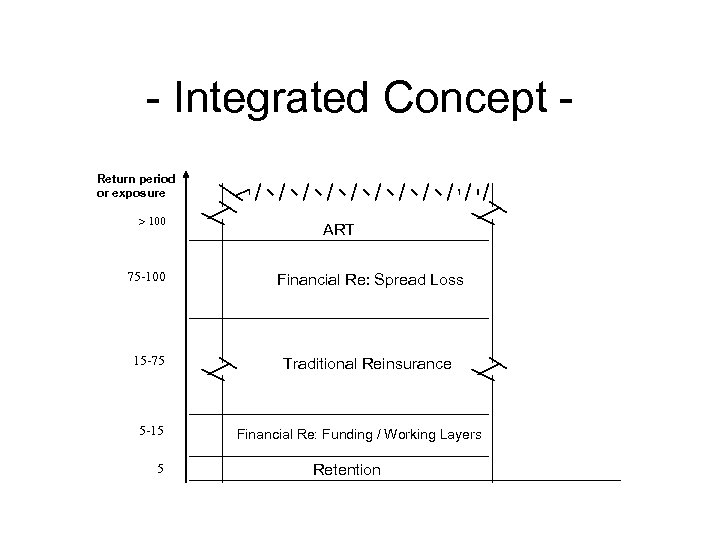

- Integrated Concept Return period or exposure 100 ART 75 -100 Financial Re: Spread Loss 15 -75 Traditional Reinsurance 5 -15 5 Financial Re: Funding / Working Layers Retention

Identify and understand the underlying objectives driving a need for Securitisation. § § § § § Capacity creation and or enhancement Arbitraging capacity and or price inefficiencies Profit smoothing by locking in price & capacity Eliminate Counterparty risk Alternative to traditional capacity A non indemnity structure facilitates cash flow Maximisation of shareholder wealth Balance sheet constraints or enhancement Market maker / leader

Establish any underlying issues with regard to: § § § § § The public disclosure of information Volume of underwriting information required Accounting, Tax & Regulatory issues. Legal implications (prospectus) Level of risk transfer required Trigger structure and Basis risk Rating Agency considerations Cost considerations Model creation and validation.

Evaluation of competing products: Traditional Reinsurance (Price , capacity, period) Finite structured alternatives Catastrophe options Other contingent capital products. Blended solutions of traditional/options etc.

A Typical function a broker may perform: § Analysing the risk iro § § § Determining probability of loss for single event risk Determining probability of multiple losses Stress test assumptions Compare estimated loss with credit default models estimate return required for investors (premium).

Excedance Probability Curve Annual Probability of Excedence Probability of Attachment Expected Loss to XOL Layer Probability of Exhaustion Portfolio Loss

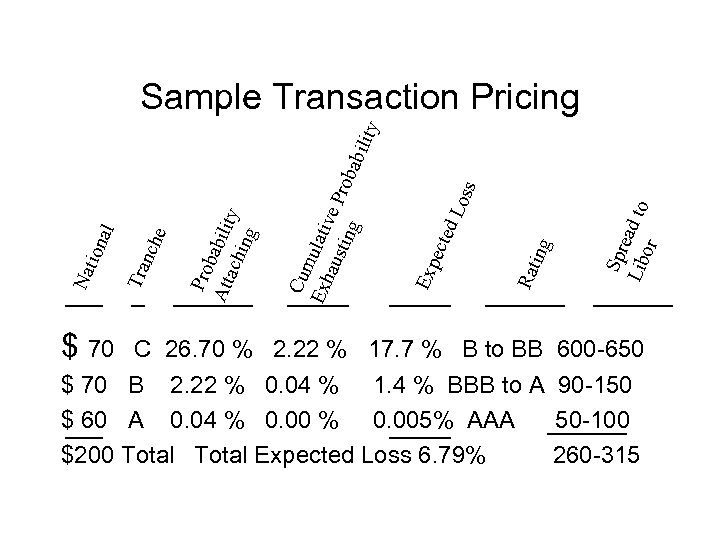

$ 70 ing Rat Spr e Lib ad to or s Los ecte d Exp Cum Exh ulativ aus e ting Prob abi lity Pro b Att abilit ach y ing e nch Tra Nat ion al Sample Transaction Pricing C 26. 70 % 2. 22 % 17. 7 % B to BB 600 -650 $ 70 B 2. 22 % 0. 04 % 1. 4 % BBB to A 90 -150 $ 60 A 0. 04 % 0. 005% AAA 50 -100 $200 Total Expected Loss 6. 79% 260 -315

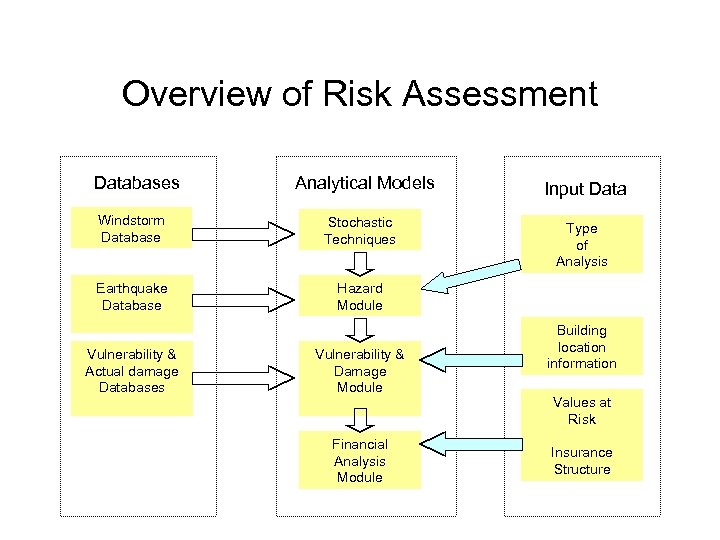

Overview of Risk Assessment Databases Analytical Models Windstorm Database Stochastic Techniques Earthquake Database Input Data Hazard Module Vulnerability & Actual damage Databases Vulnerability & Damage Module Financial Analysis Module Type of Analysis Building location information Values at Risk Insurance Structure

Modeling Considerations Examples: § Peril(s) Covered 2003 Hurricane / Windstorm § Geographic Region(s) Covered Florida / Germany § Total Coverage/Limit $54 M (90% of $60 M) § Type of Trigger Indemnity Losses / Parametric § Underlying Portfolio US Hurricane/Country Portfolio § Trigger Attachment Point $70 M § Duration 1 year or multiple years § Reset Mechanism Post-event Reset of Terms § Rated/Non-rated Rated (Moody’s, Fitch) § Instrument Bond / Option

Modeling Challenges § § § § Feasibility analysis Definition of underlying exposure data Limiting exclusions Catastrophic loss vs background loss Secondary uncertainty and demand surge Timing Reset and drop downs

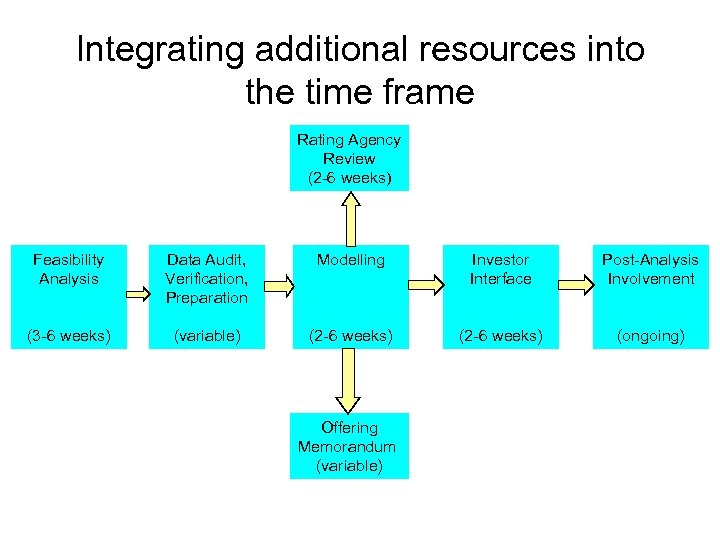

Integrating additional resources into the time frame Rating Agency Review (2 -6 weeks) Feasibility Analysis Data Audit, Verification, Preparation Modelling Investor Interface Post-Analysis Involvement (3 -6 weeks) (variable) (2 -6 weeks) (ongoing) Offering Memorandum (variable)

Designing a Suitable Structure § A Reinsurance contract with a Special Purpose Reinsurer (SPR) would be placed § The SPR would hedge itself in the Capital Markets § Evaluate if the risk could be placed with different investors E. g. : - First loss could be placed privately - Second & third losses as part of a rated program

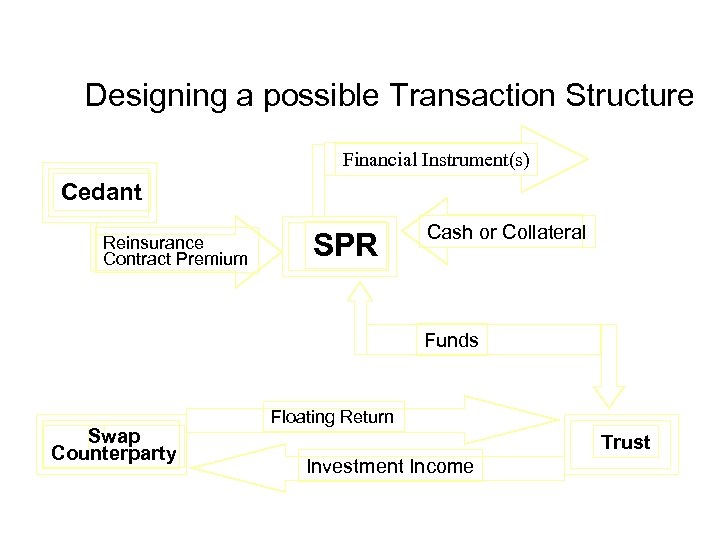

Designing a possible Transaction Structure Financial Instrument(s) Cedant Reinsurance Contract Premium SPR Cash or Collateral Funds Swap Counterparty Floating Return Trust Investment Income

Placement Options Available § Private Placement § Market read to verify pricing § Determine whether funds required: § Unfunded: - Swap Option Collateralised by letter of credit § Funded: Insurance Linked Securities Route - Identify potential investors and merchant Banking Partner

dde4afc3490a38169a2e8a954c8bd7fc.ppt