71a771415d81f21cabeef57ce5d04476.ppt

- Количество слайдов: 34

AAMP Training Materials Module 2. 1: Factors Affecting Smallholder Commercialization T. S. Jayne & William Burke, (MSU) jayne@msu. edu, burkewi 2@msu. edu

AAMP Training Materials Module 2. 1: Factors Affecting Smallholder Commercialization T. S. Jayne & William Burke, (MSU) jayne@msu. edu, burkewi 2@msu. edu

Contents • Agricultural commercialization • Definition • Indicators – Labor productivity • Pros and cons • Agricultural commercialization and the Structural Transformation framework • Constraints and challenges facing the promotion of agricultural commercialization • Market participation modeling: strengths, weaknesses, and an example of an applied model

Contents • Agricultural commercialization • Definition • Indicators – Labor productivity • Pros and cons • Agricultural commercialization and the Structural Transformation framework • Constraints and challenges facing the promotion of agricultural commercialization • Market participation modeling: strengths, weaknesses, and an example of an applied model

Agricultural Commercialization (Definition) • The degree to which agricultural production and marketing is based on market exchange and specialization vs. internalized within the household

Agricultural Commercialization (Definition) • The degree to which agricultural production and marketing is based on market exchange and specialization vs. internalized within the household

Agricultural Commercialization (Indicators) • Household Commercialization Index (HCI) – HCI = value of farm sales / value of farm production – Ranges from 0 – 1. 0 – The higher the number, the more commercialized the household • Existence of / degree of reliance on: – Factor markets (fertilizer, labor, etc) – Financial markets (loans) – Output markets (crop sales) • Rising labor productivity in agriculture…

Agricultural Commercialization (Indicators) • Household Commercialization Index (HCI) – HCI = value of farm sales / value of farm production – Ranges from 0 – 1. 0 – The higher the number, the more commercialized the household • Existence of / degree of reliance on: – Factor markets (fertilizer, labor, etc) – Financial markets (loans) – Output markets (crop sales) • Rising labor productivity in agriculture…

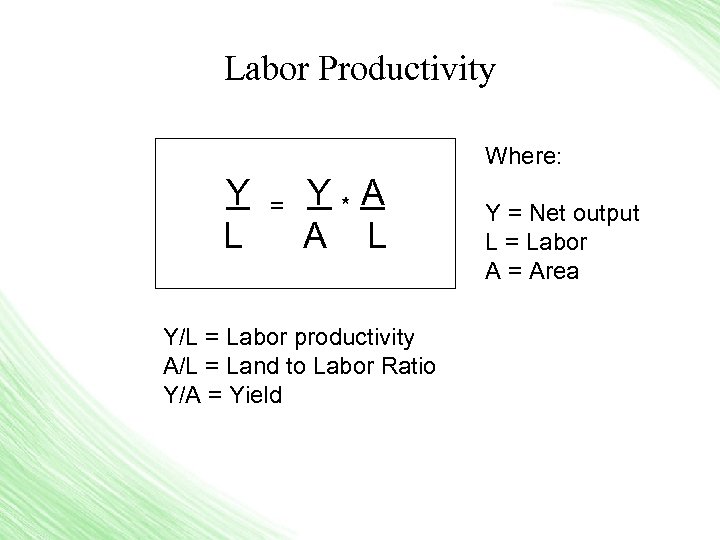

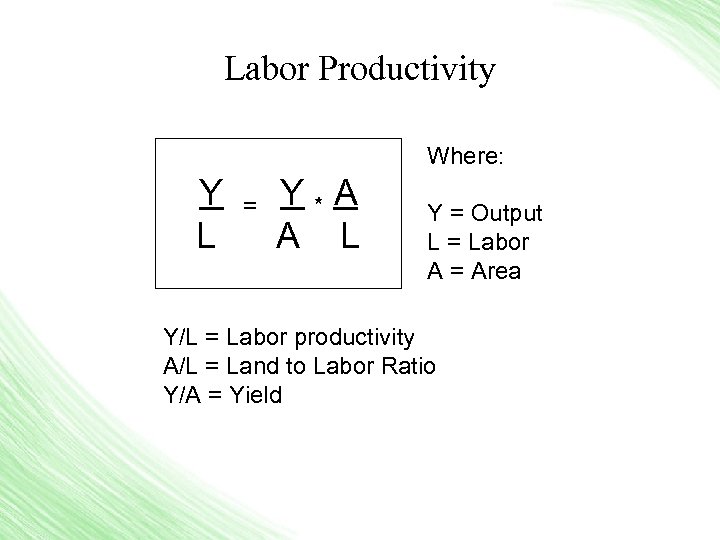

Labor Productivity Where: Y = Y * A L A L Y/L = Labor productivity A/L = Land to Labor Ratio Y/A = Yield Y = Net output L = Labor A = Area

Labor Productivity Where: Y = Y * A L A L Y/L = Labor productivity A/L = Land to Labor Ratio Y/A = Yield Y = Net output L = Labor A = Area

Commercialization: Some Pros and Cons • Pros: ‒ Can achieve growth in net output per unit area (Y/A) with shifts in cropping patterns toward higher value crops ‒ Can be the result of input intensification, as long as the value of output exceeds the costs of the additional inputs. • Cons: ‒ Dependence on markets, both for the commercialized crops as well as the food market. ‒ Competition from large-scale farming • Important: Commercialization only works if the food market is functioning well!

Commercialization: Some Pros and Cons • Pros: ‒ Can achieve growth in net output per unit area (Y/A) with shifts in cropping patterns toward higher value crops ‒ Can be the result of input intensification, as long as the value of output exceeds the costs of the additional inputs. • Cons: ‒ Dependence on markets, both for the commercialized crops as well as the food market. ‒ Competition from large-scale farming • Important: Commercialization only works if the food market is functioning well!

Agricultural commercialization and the Structural Transformation framework • Structural transformation / Demographic Transition – Based on economic history of Asia and Europe (B. Johnston, J. Mellor, Binswanger, Lipton) – In early stages of development, 80% of population is primarily engaged in staple food production – Broad-based rural productivity growth triggers demographic transition

Agricultural commercialization and the Structural Transformation framework • Structural transformation / Demographic Transition – Based on economic history of Asia and Europe (B. Johnston, J. Mellor, Binswanger, Lipton) – In early stages of development, 80% of population is primarily engaged in staple food production – Broad-based rural productivity growth triggers demographic transition

Ag Commercialization & Structural Transformation • There is a symbiotic relationship between rural farms and towns – Urban areas provide a market for surplus farm output – Farmers with cash generate demand for urban employment – As demand for off-farm jobs rises people migrate to towns – Increased urbanization “pulls” rural labor to urban areas – birth rates decline and levels of education rise FUNDAMENTALLY A SMALLHOLDER-LED MODEL!

Ag Commercialization & Structural Transformation • There is a symbiotic relationship between rural farms and towns – Urban areas provide a market for surplus farm output – Farmers with cash generate demand for urban employment – As demand for off-farm jobs rises people migrate to towns – Increased urbanization “pulls” rural labor to urban areas – birth rates decline and levels of education rise FUNDAMENTALLY A SMALLHOLDER-LED MODEL!

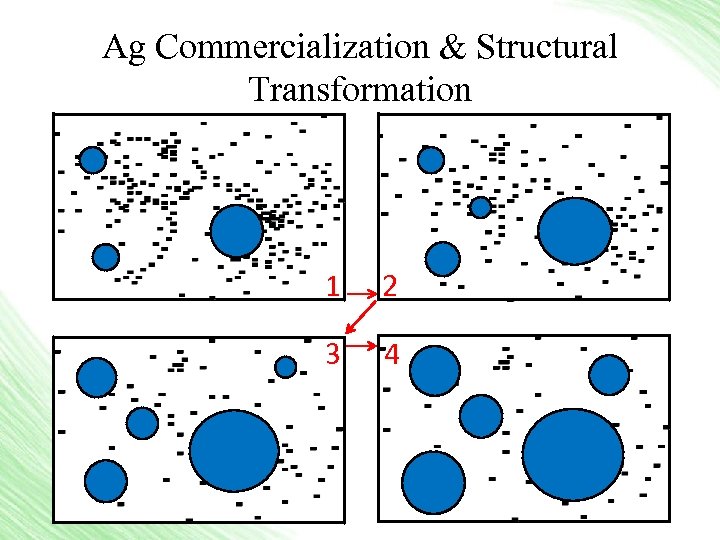

Ag Commercialization & Structural Transformation 1 2 3 4

Ag Commercialization & Structural Transformation 1 2 3 4

Key elements of structural transformation • Growth processes that effectively reach a large proportion of the population • Especially the poor – equitable growth • That being said, broad based equitable growth is difficult to achieve.

Key elements of structural transformation • Growth processes that effectively reach a large proportion of the population • Especially the poor – equitable growth • That being said, broad based equitable growth is difficult to achieve.

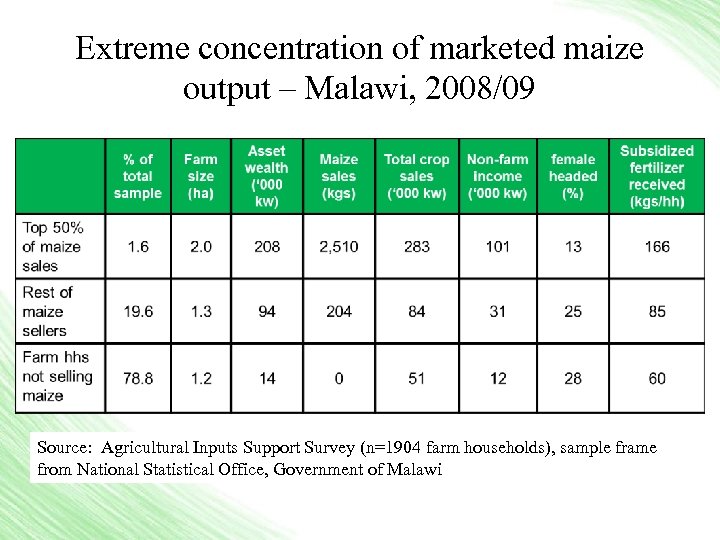

Extreme concentration of marketed maize output – Malawi, 2008/09 Source: Agricultural Inputs Support Survey (n=1904 farm households), sample frame from National Statistical Office, Government of Malawi

Extreme concentration of marketed maize output – Malawi, 2008/09 Source: Agricultural Inputs Support Survey (n=1904 farm households), sample frame from National Statistical Office, Government of Malawi

Challenges to commercialization • The major challenge to the success of smallholder-led commercialization strategies is to address the asset constraints that prevent such a large % of the rural population from being able to respond to growth opportunities and incentives.

Challenges to commercialization • The major challenge to the success of smallholder-led commercialization strategies is to address the asset constraints that prevent such a large % of the rural population from being able to respond to growth opportunities and incentives.

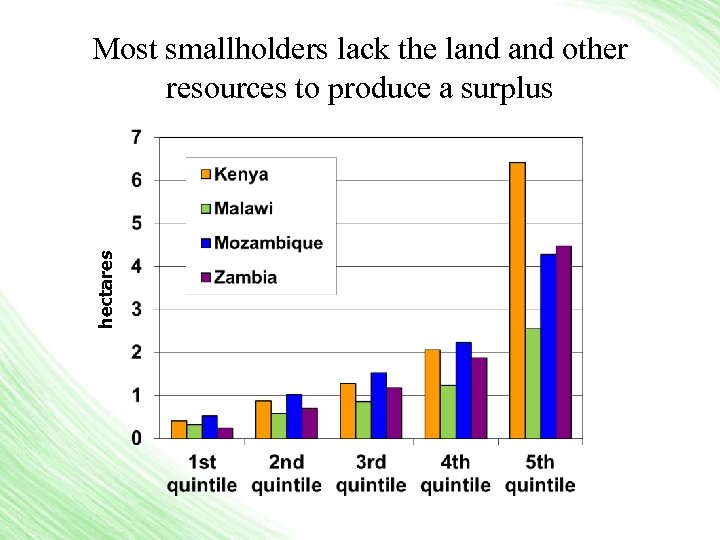

hectares Most smallholders lack the land other resources to produce a surplus

hectares Most smallholders lack the land other resources to produce a surplus

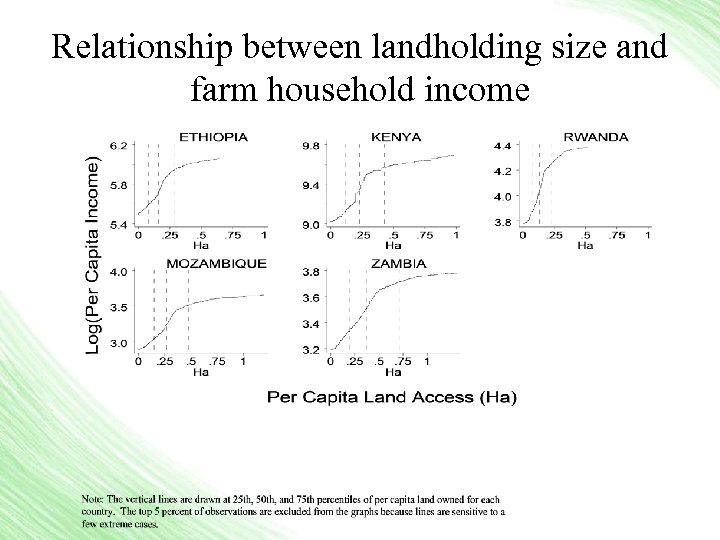

Relationship between landholding size and farm household income

Relationship between landholding size and farm household income

Labor Productivity Where: Y = Y * A L A L Y = Output L = Labor A = Area Y/L = Labor productivity A/L = Land to Labor Ratio Y/A = Yield

Labor Productivity Where: Y = Y * A L A L Y = Output L = Labor A = Area Y/L = Labor productivity A/L = Land to Labor Ratio Y/A = Yield

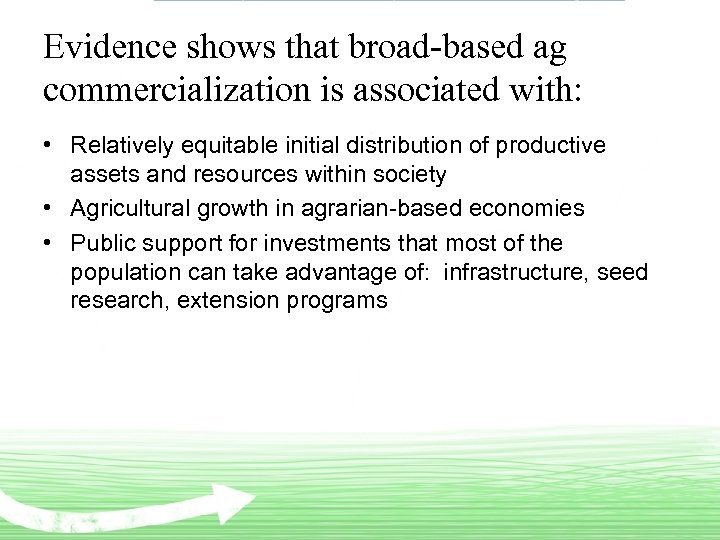

Evidence shows that broad-based ag commercialization is associated with: • Relatively equitable initial distribution of productive assets and resources within society • Agricultural growth in agrarian-based economies • Public support for investments that most of the population can take advantage of: infrastructure, seed research, extension programs

Evidence shows that broad-based ag commercialization is associated with: • Relatively equitable initial distribution of productive assets and resources within society • Agricultural growth in agrarian-based economies • Public support for investments that most of the population can take advantage of: infrastructure, seed research, extension programs

Evidence shows that inequitable commercialization is associates with: • Highly concentrated initial distribution of productive assets and resources within society – e. g. , latifundia-type landholding systems • Elite capture of political process • Use of public funds to invest in ways that are primarily appropriated by elites – Marketing board operations that raise prices with regressive income distributional effects – Input subsidy programs that are disproportionately targeted to better-off farmers (not in all cases though)

Evidence shows that inequitable commercialization is associates with: • Highly concentrated initial distribution of productive assets and resources within society – e. g. , latifundia-type landholding systems • Elite capture of political process • Use of public funds to invest in ways that are primarily appropriated by elites – Marketing board operations that raise prices with regressive income distributional effects – Input subsidy programs that are disproportionately targeted to better-off farmers (not in all cases though)

Now let’s move to methods for assessing the factors associated with smallholders’ ability to participate in markets (commercialization)

Now let’s move to methods for assessing the factors associated with smallholders’ ability to participate in markets (commercialization)

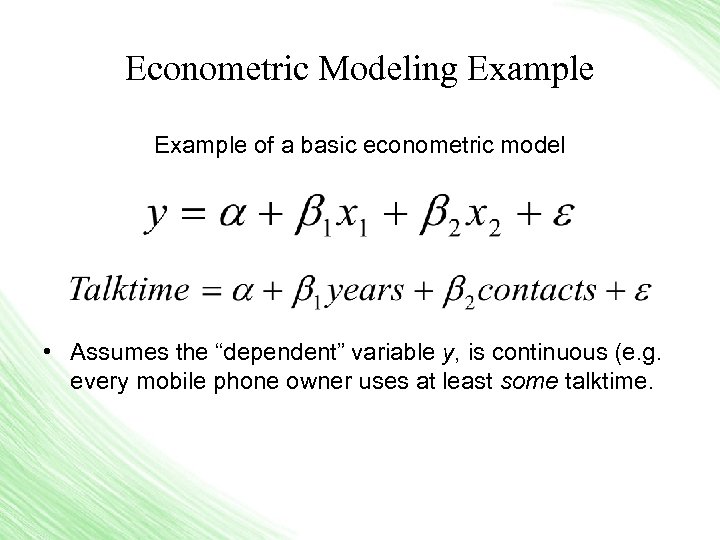

Econometric Modeling Example of a basic econometric model • Assumes the “dependent” variable y, is continuous (e. g. every mobile phone owner uses at least some talktime.

Econometric Modeling Example of a basic econometric model • Assumes the “dependent” variable y, is continuous (e. g. every mobile phone owner uses at least some talktime.

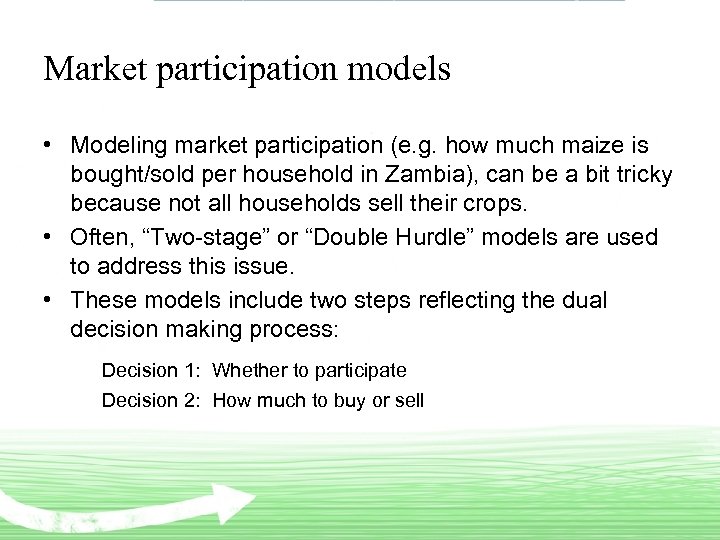

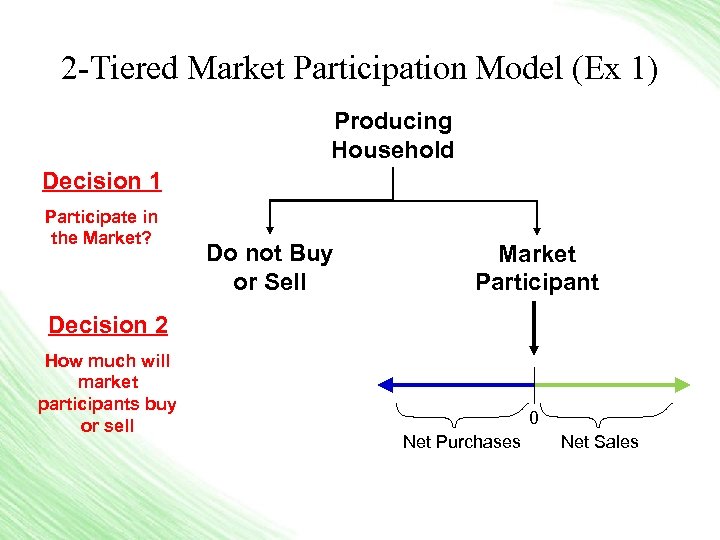

Market participation models • Modeling market participation (e. g. how much maize is bought/sold per household in Zambia), can be a bit tricky because not all households sell their crops. • Often, “Two-stage” or “Double Hurdle” models are used to address this issue. • These models include two steps reflecting the dual decision making process: Decision 1: Whether to participate Decision 2: How much to buy or sell

Market participation models • Modeling market participation (e. g. how much maize is bought/sold per household in Zambia), can be a bit tricky because not all households sell their crops. • Often, “Two-stage” or “Double Hurdle” models are used to address this issue. • These models include two steps reflecting the dual decision making process: Decision 1: Whether to participate Decision 2: How much to buy or sell

2 -Tiered Market Participation Model (Ex 1) Producing Household Decision 1 Participate in the Market? Do not Buy or Sell Market Participant Decision 2 How much will market participants buy or sell 0 Net Purchases Net Sales

2 -Tiered Market Participation Model (Ex 1) Producing Household Decision 1 Participate in the Market? Do not Buy or Sell Market Participant Decision 2 How much will market participants buy or sell 0 Net Purchases Net Sales

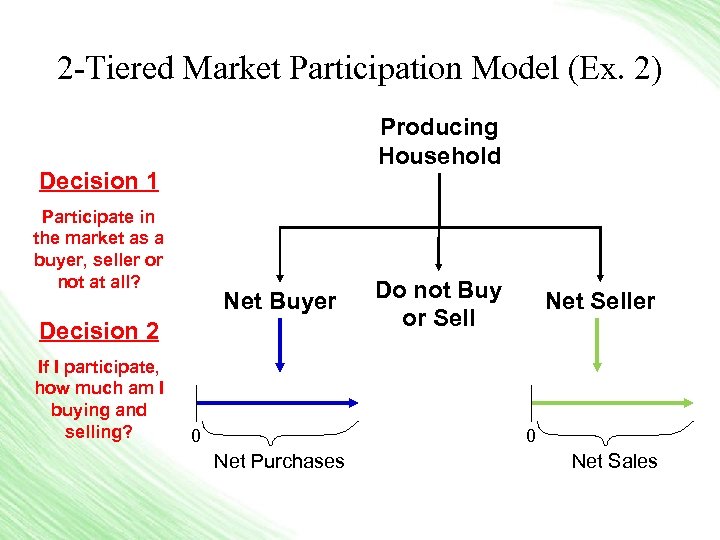

2 -Tiered Market Participation Model (Ex. 2) Producing Household Decision 1 Participate in the market as a buyer, seller or not at all? Net Buyer Decision 2 If I participate, how much am I buying and selling? 0 Do not Buy or Sell Net Seller 0 Net Purchases Net Sales

2 -Tiered Market Participation Model (Ex. 2) Producing Household Decision 1 Participate in the market as a buyer, seller or not at all? Net Buyer Decision 2 If I participate, how much am I buying and selling? 0 Do not Buy or Sell Net Seller 0 Net Purchases Net Sales

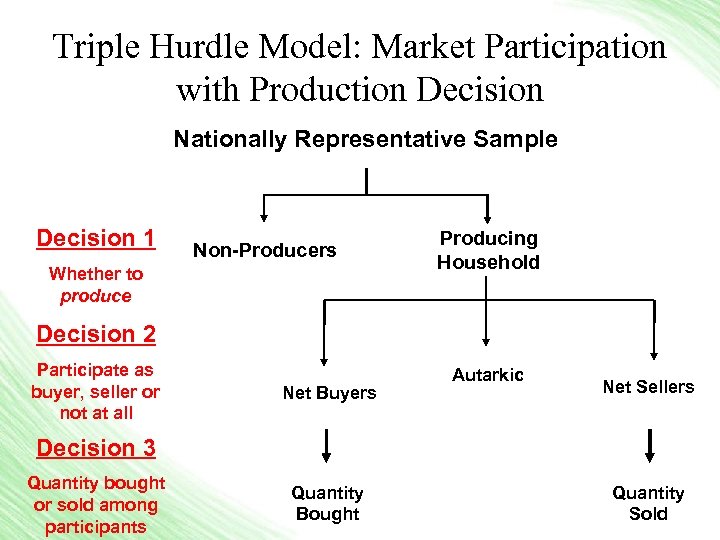

Market participation models • The previous models include two steps reflecting the dual decision making process: Decision 1: Whether to participate Decision 2: How much to buy or sell • The weakness of the two-tiered models discussed so far is that it requires all observations to be producers – Can’t extrapolate to entire country – May under-estimate the effects of a given policy on marketing behaviour (i. e. if policy affects the decision to produce) • The Triple Hurdle Model (Burke, 2009) can give a more comprehensive perspective

Market participation models • The previous models include two steps reflecting the dual decision making process: Decision 1: Whether to participate Decision 2: How much to buy or sell • The weakness of the two-tiered models discussed so far is that it requires all observations to be producers – Can’t extrapolate to entire country – May under-estimate the effects of a given policy on marketing behaviour (i. e. if policy affects the decision to produce) • The Triple Hurdle Model (Burke, 2009) can give a more comprehensive perspective

Triple Hurdle Model: Market Participation with Production Decision Nationally Representative Sample Decision 1 Non-Producers Whether to produce Producing Household Decision 2 Participate as buyer, seller or not at all Net Buyers Autarkic Net Sellers Decision 3 Quantity bought or sold among participants Quantity Bought Quantity Sold

Triple Hurdle Model: Market Participation with Production Decision Nationally Representative Sample Decision 1 Non-Producers Whether to produce Producing Household Decision 2 Participate as buyer, seller or not at all Net Buyers Autarkic Net Sellers Decision 3 Quantity bought or sold among participants Quantity Bought Quantity Sold

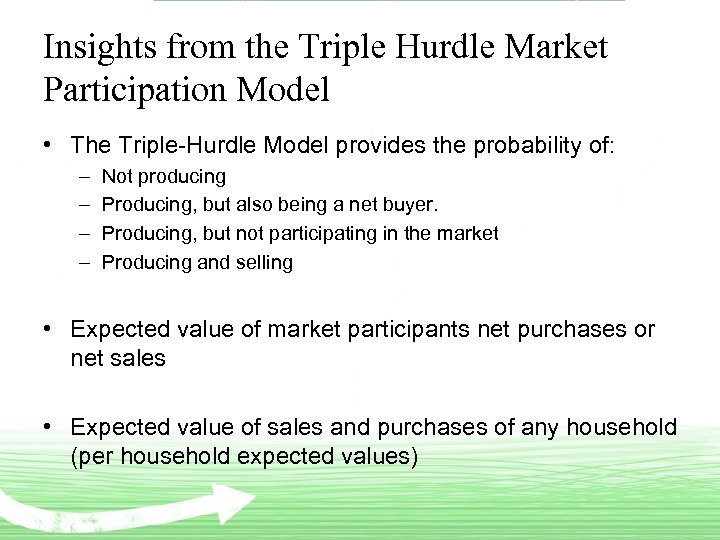

Insights from the Triple Hurdle Market Participation Model • The Triple-Hurdle Model provides the probability of: – – Not producing Producing, but also being a net buyer. Producing, but not participating in the market Producing and selling • Expected value of market participants net purchases or net sales • Expected value of sales and purchases of any household (per household expected values)

Insights from the Triple Hurdle Market Participation Model • The Triple-Hurdle Model provides the probability of: – – Not producing Producing, but also being a net buyer. Producing, but not participating in the market Producing and selling • Expected value of market participants net purchases or net sales • Expected value of sales and purchases of any household (per household expected values)

Kenyan dairy example • About 85% of East Africa’s 3. 5 million dairy cattle in are raised in Kenya • Compared to Maize – – Although nearly all households produce maize, Less than ½ of maize producers sell to generate cash On the contrary, about 70% of dairy producers are net sellers Top 10% of households generate ~ 80% of maize revenue, versus ~ 55% of dairy revenue

Kenyan dairy example • About 85% of East Africa’s 3. 5 million dairy cattle in are raised in Kenya • Compared to Maize – – Although nearly all households produce maize, Less than ½ of maize producers sell to generate cash On the contrary, about 70% of dairy producers are net sellers Top 10% of households generate ~ 80% of maize revenue, versus ~ 55% of dairy revenue

Kenyan dairy example (2) • Since private dairy purchasing enterprises became legal, there are four principle buyers of dairy: – – Kenya Creamery Company Other co-ops Private processors Informal dairy “hawkers” tolerated, not legal • Despite growth, domestic supply is outpaced by domestic demand export. • Why?

Kenyan dairy example (2) • Since private dairy purchasing enterprises became legal, there are four principle buyers of dairy: – – Kenya Creamery Company Other co-ops Private processors Informal dairy “hawkers” tolerated, not legal • Despite growth, domestic supply is outpaced by domestic demand export. • Why?

What explains market participation? • • • Transfer cost determinants Endowments Access to production inputs Market Prices Production shocks

What explains market participation? • • • Transfer cost determinants Endowments Access to production inputs Market Prices Production shocks

Triple Hurdle Model Simulation (Exercises) • Open the Excel workbook corresponding to this presentation • Read the information in the [NOTES] sheet carefully • You will use the output from a triple-hurdle model of market participation in the Kenyan Dairy sector to evaluate the impacts of various shocks on dairy market participation • Changes to yellow-highlighted values in [Simulation values] sheet create changes in the probabilities listed in row 3 of the [Simulation results] sheet

Triple Hurdle Model Simulation (Exercises) • Open the Excel workbook corresponding to this presentation • Read the information in the [NOTES] sheet carefully • You will use the output from a triple-hurdle model of market participation in the Kenyan Dairy sector to evaluate the impacts of various shocks on dairy market participation • Changes to yellow-highlighted values in [Simulation values] sheet create changes in the probabilities listed in row 3 of the [Simulation results] sheet

Triple Hurdle Model Simulation (Exercise 1: Baseline) a) At the mean data values provided, what is the probability that the average household does not produce dairy? b) What is the probability that they are a producer, but net buyer of dairy? c) What is the probability that they produce, but neither buy nor sell dairy? d) What is the probability that they are a producer and net seller of dairy? e) Finally, what is the unconditional expected value of net sales at the data means?

Triple Hurdle Model Simulation (Exercise 1: Baseline) a) At the mean data values provided, what is the probability that the average household does not produce dairy? b) What is the probability that they are a producer, but net buyer of dairy? c) What is the probability that they produce, but neither buy nor sell dairy? d) What is the probability that they are a producer and net seller of dairy? e) Finally, what is the unconditional expected value of net sales at the data means?

Triple Hurdle Model Simulation Exercise 2: Distance to Electricity a) Holding all other factors at their data means, what is the expected value of net sales for a given household that is 10 kilometers from the nearest source of electricity? (Change cell 22 E to 10 in [Simulation values] sheet) b) What is the expected value of net sales for a given household that has electricity nearby? (Change cell 22 E to 0) c) Why would a dairy farmer closer to electricity be expected to sell more dairy?

Triple Hurdle Model Simulation Exercise 2: Distance to Electricity a) Holding all other factors at their data means, what is the expected value of net sales for a given household that is 10 kilometers from the nearest source of electricity? (Change cell 22 E to 10 in [Simulation values] sheet) b) What is the expected value of net sales for a given household that has electricity nearby? (Change cell 22 E to 0) c) Why would a dairy farmer closer to electricity be expected to sell more dairy?

Triple Hurdle Model Simulation Exercise 3: Land Holdings Return cell E 22 to it’s data mean value (4. 17). a) What is the likelihood of being a producer when lagged acres owned is 15? (Cell E 30 = 15) b) What is the likelihood of being a producer when lagged acres owned is 0. 5? (Cell E 30 = 0. 5) c) What does this tell us about dairy farming in Kenya, and what are the policy implications of this result?

Triple Hurdle Model Simulation Exercise 3: Land Holdings Return cell E 22 to it’s data mean value (4. 17). a) What is the likelihood of being a producer when lagged acres owned is 15? (Cell E 30 = 15) b) What is the likelihood of being a producer when lagged acres owned is 0. 5? (Cell E 30 = 0. 5) c) What does this tell us about dairy farming in Kenya, and what are the policy implications of this result?

Triple Hurdle Model Simulation Exercise 3: Land Holdings Reset lagged acres owned to the mean (Cell E 30 = 3. 5). a) Simulate an observation in which no organized purchasers are present. (Change E 25: E 28 = 0) What are the unconditional expected net sales? b) Is it feasible that this household could be a net seller? How? c) The presence of which buying agent is correlated with the highest unconditional expected net sales, and how many litres of milk per year are sold by the average household? d) What are the policy implications of this finding?

Triple Hurdle Model Simulation Exercise 3: Land Holdings Reset lagged acres owned to the mean (Cell E 30 = 3. 5). a) Simulate an observation in which no organized purchasers are present. (Change E 25: E 28 = 0) What are the unconditional expected net sales? b) Is it feasible that this household could be a net seller? How? c) The presence of which buying agent is correlated with the highest unconditional expected net sales, and how many litres of milk per year are sold by the average household? d) What are the policy implications of this finding?

Resources • Bellemare, M. F. , and C. B. Barrett. 2006. “An Ordered Tobit Model of Market Participation: Evidence from Kenya and Ethiopia. ” American Journal of Agricultural Economics 88: 324 -337 • Burke, W. J. 2009. "Triple Hurdle Model of Smallholder Production and Particiaption in Kenya's Dairy Sector. " MS Thesis. Department of Agriculture Food and Resource Economics. Michigan State University. • Goetz, S. J. 1992. “A Selectivity Model of Household Food Marketing Behavior in Sub-Saharan Africa. ” American Journal of Agricultural Economics 74: 444 -452. • Key, N. , E. Sadoulet, and A. De. Janvry. 2000. “Transactions Costs and Agricultural Household Supply Response. ” American Journal of Agricultural Economics 82: 245 -259.

Resources • Bellemare, M. F. , and C. B. Barrett. 2006. “An Ordered Tobit Model of Market Participation: Evidence from Kenya and Ethiopia. ” American Journal of Agricultural Economics 88: 324 -337 • Burke, W. J. 2009. "Triple Hurdle Model of Smallholder Production and Particiaption in Kenya's Dairy Sector. " MS Thesis. Department of Agriculture Food and Resource Economics. Michigan State University. • Goetz, S. J. 1992. “A Selectivity Model of Household Food Marketing Behavior in Sub-Saharan Africa. ” American Journal of Agricultural Economics 74: 444 -452. • Key, N. , E. Sadoulet, and A. De. Janvry. 2000. “Transactions Costs and Agricultural Household Supply Response. ” American Journal of Agricultural Economics 82: 245 -259.