adc3bd8f38c88c239d27f3fcee867676.ppt

- Количество слайдов: 30

AAG/WR 100 Day Post-Merger Integration Plan Prepared by: 11/10/01 True Blue Consulting Natasa Azman Werner Arnaud Despierre Judson Duncan Graham Goodrich Daryl Leach -1 - WR Due Diligence Summary Confidential Source: True Blue Consulting

Agenda The purpose of today’s meeting is to secure GAI’s commitment to the proposed AAG/WR integration initiative. 8 Where Are We Today? 8 Where Do We Want To Go? 8 How & When Will We Get There? -2 - WR Due Diligence Summary Source: True Blue Consulting

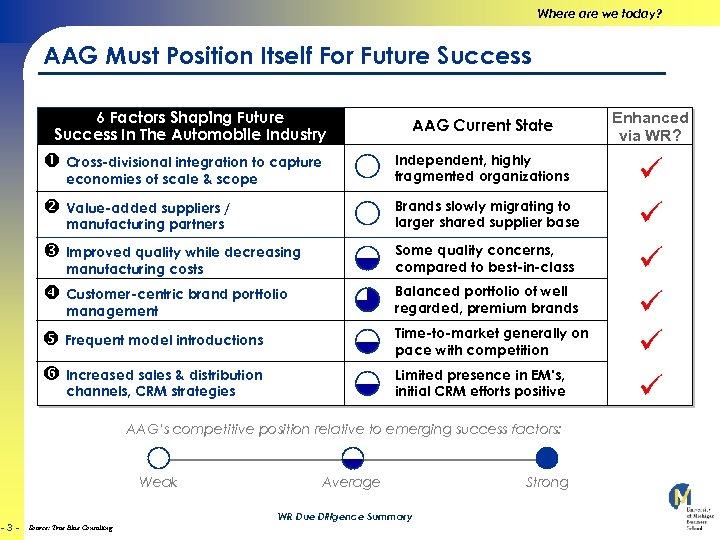

Where are we today? AAG Must Position Itself For Future Success 6 Factors Shaping Future Success In The Automobile Industry AAG Current State Enhanced via WR? Cross-divisional integration to capture Independent, highly fragmented organizations Value-added suppliers / Brands slowly migrating to larger shared supplier base Improved quality while decreasing Some quality concerns, compared to best-in-class Customer-centric brand portfolio Balanced portfolio of well regarded, premium brands Frequent model introductions Time-to-market generally on pace with competition Increased sales & distribution Limited presence in EM’s, initial CRM efforts positive ü ü ü economies of scale & scope manufacturing partners manufacturing costs management channels, CRM strategies AAG’s competitive position relative to emerging success factors: Weak -3 - Average WR Due Diligence Summary Source: True Blue Consulting Strong

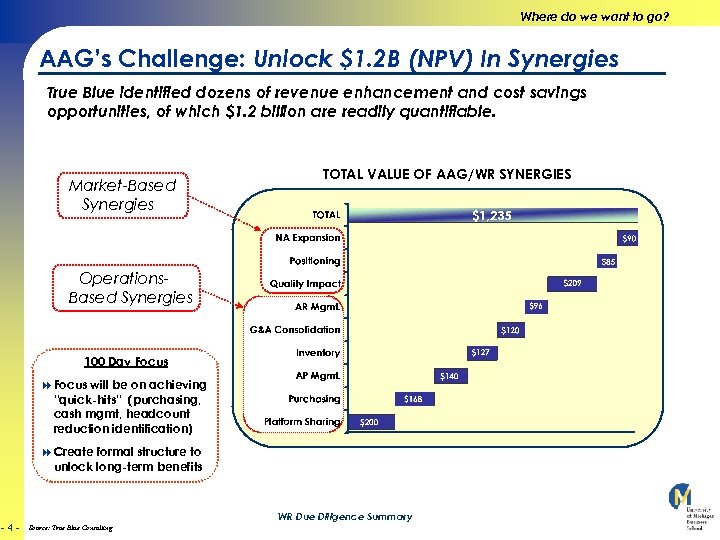

Where do we want to go? AAG’s Challenge: Unlock $1. 2 B (NPV) In Synergies True Blue identified dozens of revenue enhancement and cost savings opportunities, of which $1. 2 billion are readily quantifiable. Market-Based Synergies TOTAL VALUE OF AAG/WR SYNERGIES Operations. Based Synergies 100 Day Focus 8 Focus will be on achieving “quick-hits” (purchasing, cash mgmt, headcount reduction identification) 8 Create formal structure to unlock long-term benefits -4 - WR Due Diligence Summary Source: True Blue Consulting

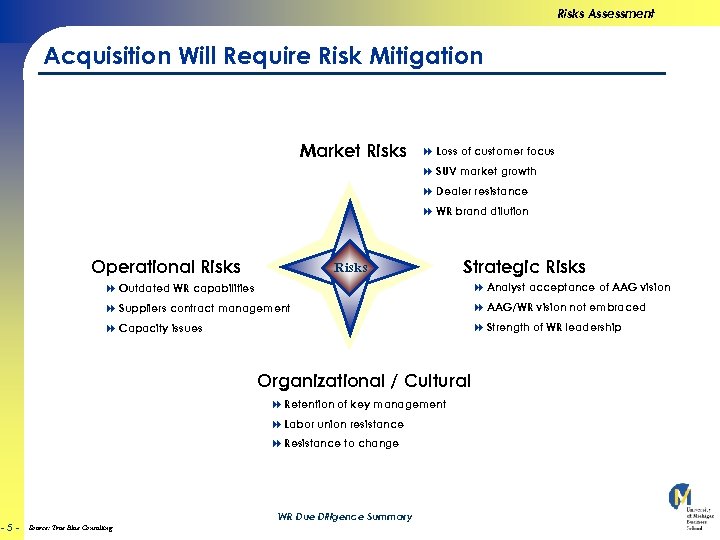

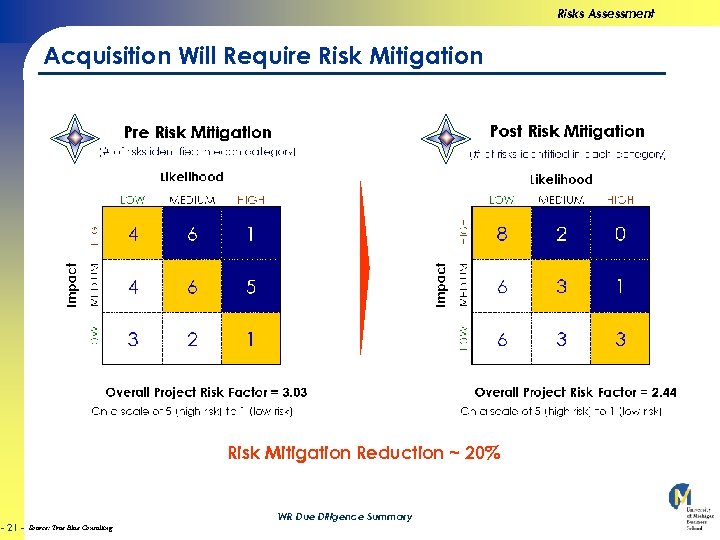

Risks Assessment Acquisition Will Require Risk Mitigation Market Risks 8 Loss of customer focus 8 SUV market growth 8 Dealer resistance 8 WR brand dilution Operational Risks Strategic Risks 8 Outdated WR capabilities 8 Analyst acceptance of AAG vision 8 Suppliers contract management 8 AAG/WR vision not embraced 8 Capacity issues 8 Strength of WR leadership Organizational / Cultural 8 Retention of key management 8 Labor union resistance 8 Resistance to change -5 - WR Due Diligence Summary Source: True Blue Consulting

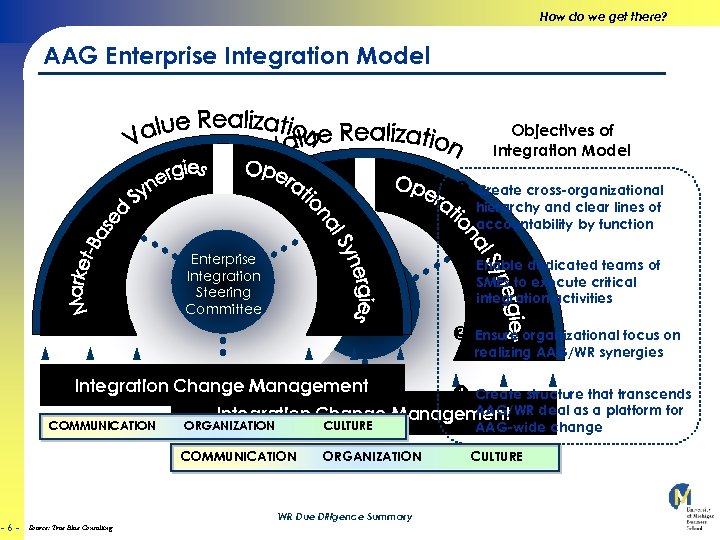

How do we get there? AAG Enterprise Integration Model Objectives of Integration Model Create cross-organizational hierarchy and clear lines of accountability by function Enterprise Integration Steering Committee Enable dedicated teams of SMEs to execute critical integration activities Ensure organizational focus on realizing AAG/WR synergies Integration Change Management COMMUNICATION AAG/WR deal as a platform for Integration Change Management ORGANIZATION CULTURE COMMUNICATION -6 - ORGANIZATION WR Due Diligence Summary Source: True Blue Consulting Create structure that transcends AAG-wide change CULTURE

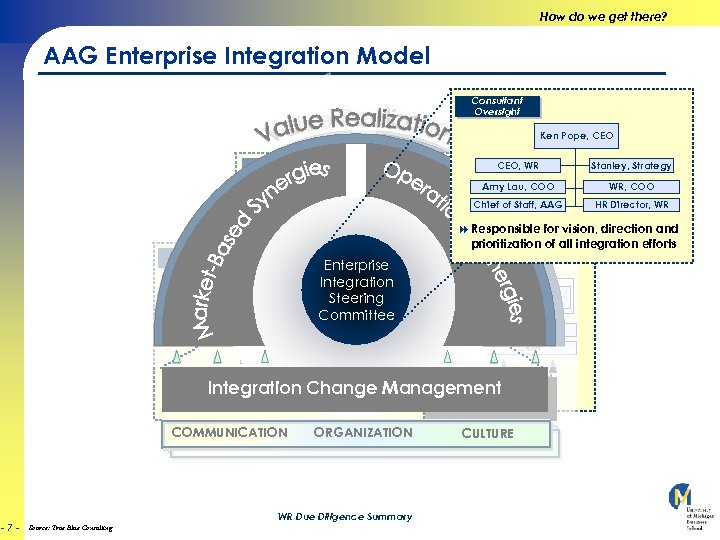

How do we get there? AAG Enterprise Integration Model Consultant Oversight Ken Pope, CEO Consultant Oversight CEO, WR Amy Lau, COO CEO, WR Consultant Oversight Stanley, Strategy Cultural Integration HR Consultant Communication Legal/Environ. Oversight Enterprise Stanley, Strategy WR, COO Chief of Staff, AAG HR Director, WR 8 Responsible for vision, direction and prioritization of all integration efforts Enterprise Integration 8 Accountable for integration Amy Lau, COO Scott Bowman, Dir. Steering &Marketing Sales facilitation & risk mitigation Committee Purchasing Manufacturing Technology (R&D) Finance Enterprise Information Tech. VP Sales & Marketing, WR Brand Distribution Research Enterprise CRM Integration 8 Responsible. Steering for realizing Steering identified 8 Responsible Steering identified. Management for realizing Integration Change Management market-based synergies Integration Change Committee operational synergies Change Management Integration Committee COMMUNICATION -7 - ORGANIZATION WR Due Diligence Summary Source: True Blue Consulting CULTURE

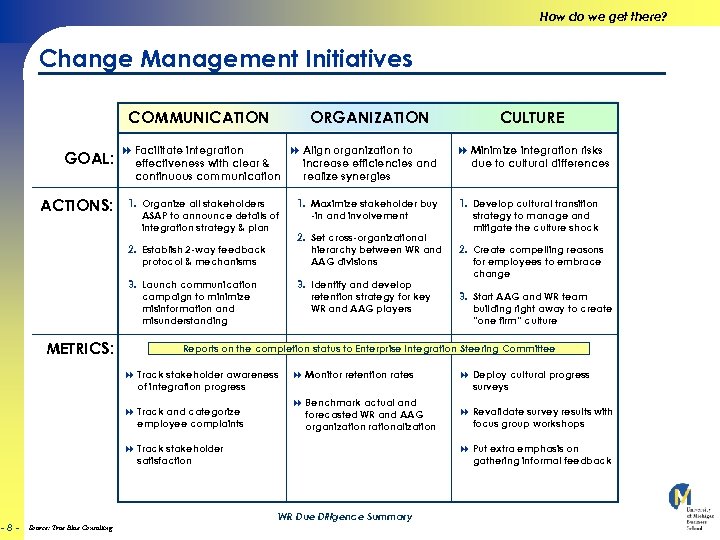

How do we get there? Change Management Initiatives COMMUNICATION GOAL: ACTIONS: 8 Facilitate integration 8 Align organization to effectiveness with clear & increase efficiencies and continuous communication realize synergies 1. Organize all stakeholders ASAP to announce details of integration strategy & plan 2. Establish 2 -way feedback protocol & mechanisms 3. Launch communication campaign to minimize misinformation and misunderstanding METRICS: ORGANIZATION 1. Maximize stakeholder buy -in and involvement 2. Set cross-organizational hierarchy between WR and AAG divisions 3. Identify and develop retention strategy for key WR and AAG players 8 Track and categorize employee complaints 8 Monitor retention rates 8 Benchmark actual and forecasted WR and AAG organization rationalization 8 Track stakeholder satisfaction 1. Develop cultural transition strategy to manage and mitigate the culture shock 2. Create compelling reasons for employees to embrace change 3. Start AAG and WR team building right away to create “one firm” culture 8 Deploy cultural progress surveys 8 Revalidate survey results with focus group workshops 8 Put extra emphasis on gathering informal feedback WR Due Diligence Summary Source: True Blue Consulting 8 Minimize integration risks due to cultural differences Reports on the completion status to Enterprise Integration Steering Committee 8 Track stakeholder awareness of integration progress -8 - CULTURE

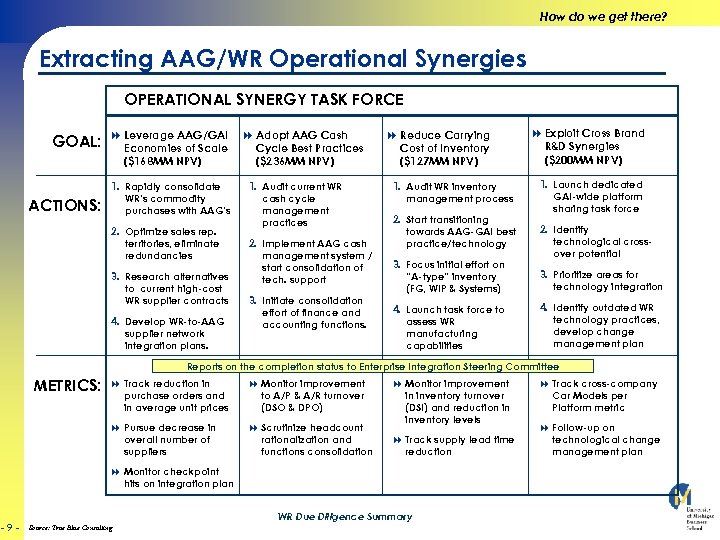

How do we get there? Extracting AAG/WR Operational Synergies OPERATIONAL SYNERGY TASK FORCE GOAL: ACTIONS: 8 Leverage AAG/GAI Economies of Scale ($168 MM NPV) 1. Rapidly consolidate WR’s commodity purchases with AAG’s 2. Optimize sales rep. territories, eliminate redundancies 3. Research alternatives to current high-cost WR supplier contracts 4. Develop WR-to-AAG supplier network integration plans. 8 Adopt AAG Cash Cycle Best Practices ($236 MM NPV) 1. Audit current WR cash cycle management practices 2. Implement AAG cash management system / start consolidation of tech. support 3. Initiate consolidation effort of finance and accounting functions. 8 Reduce Carrying Cost of Inventory ($127 MM NPV) 1. Audit WR inventory management process 2. Start transitioning towards AAG-GAI best practice/technology 3. Focus initial effort on “A-type” inventory (FG, WIP & Systems) 4. Launch task force to assess WR manufacturing capabilities 8 Exploit Cross Brand R&D Synergies ($200 MM NPV) 1. Launch dedicated GAI-wide platform sharing task force 2. Identify technological crossover potential 3. Prioritize areas for technology integration 4. Identify outdated WR technology practices, develop change management plan Reports on the completion status to Enterprise Integration Steering Committee METRICS: 8 Track reduction in purchase orders and in average unit prices 8 Monitor improvement to A/P & A/R turnover (DSO & DPO) 8 Pursue decrease in overall number of suppliers 8 Scrutinize headcount rationalization and functions consolidation 8 Monitor improvement in inventory turnover (DSI) and reduction in inventory levels 8 Track supply lead time reduction 8 Monitor checkpoint hits on integration plan -9 - WR Due Diligence Summary Source: True Blue Consulting 8 Track cross-company Car Models per Platform metric 8 Follow-up on technological change management plan

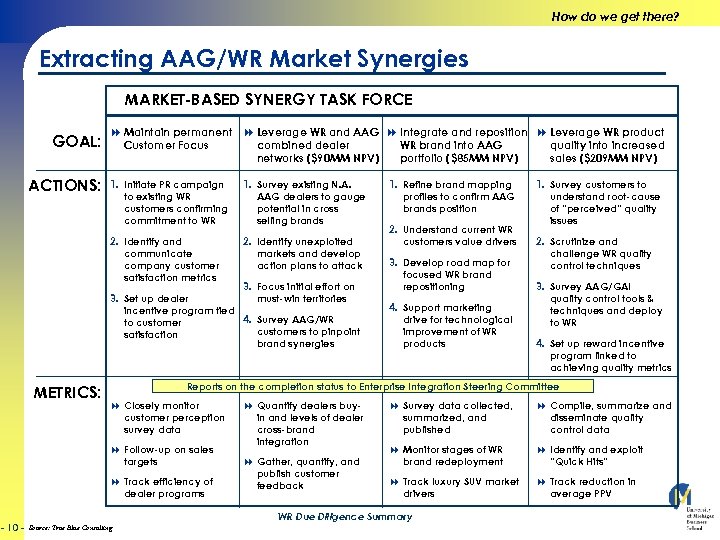

How do we get there? Extracting AAG/WR Market Synergies MARKET-BASED SYNERGY TASK FORCE GOAL: ACTIONS: 8 Maintain permanent 8 Leverage WR and AAG 8 Integrate and reposition 8 Leverage WR product Customer Focus combined dealer quality into increased WR brand into AAG networks ($90 MM NPV) sales ($209 MM NPV) portfolio ($85 MM NPV) 1. Initiate PR campaign to existing WR customers confirming commitment to WR 1. Survey existing N. A. AAG dealers to gauge potential in cross selling brands 2. Identify and communicate company customer satisfaction metrics 2. Identify unexploited markets and develop action plans to attack 3. Focus initial effort on must-win territories 3. Set up dealer incentive program tied 4. Survey AAG/WR to customers to pinpoint satisfaction brand synergies METRICS: 2. Understand current WR customers value drivers 3. Develop road map for focused WR brand repositioning 4. Support marketing drive for technological improvement of WR products 1. Survey customers to understand root-cause of “perceived” quality issues 2. Scrutinize and challenge WR quality control techniques 3. Survey AAG/GAI quality control tools & techniques and deploy to WR 4. Set up reward incentive program linked to achieving quality metrics Reports on the completion status to Enterprise Integration Steering Committee 8 Closely monitor customer perception survey data 8 Follow-up on sales targets 8 Track efficiency of dealer programs - 10 - 1. Refine brand mapping profiles to confirm AAG brands position 8 Quantify dealers buyin and levels of dealer cross-brand integration 8 Gather, quantify, and publish customer feedback 8 Survey data collected, summarized, and published 8 Compile, summarize and disseminate quality control data 8 Monitor stages of WR brand redeployment 8 Identify and exploit “Quick Hits” 8 Track luxury SUV market drivers 8 Track reduction in average PPV WR Due Diligence Summary Source: True Blue Consulting

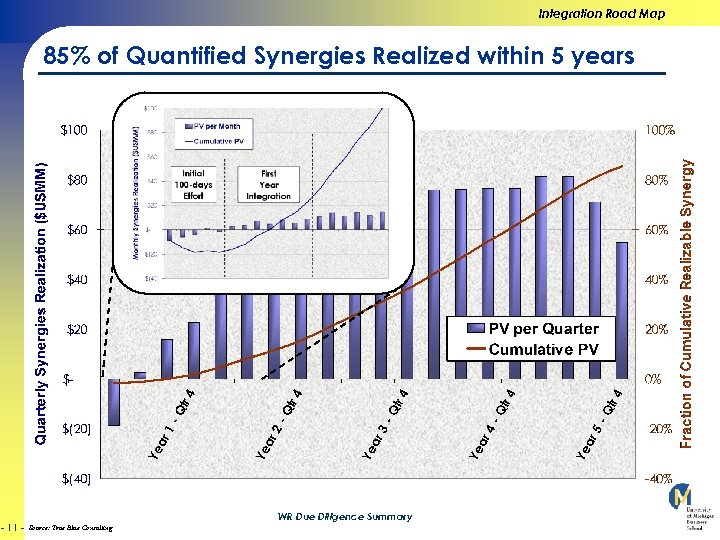

Integration Road Map 85% of Quantified Synergies Realized within 5 years - 11 - WR Due Diligence Summary Source: True Blue Consulting

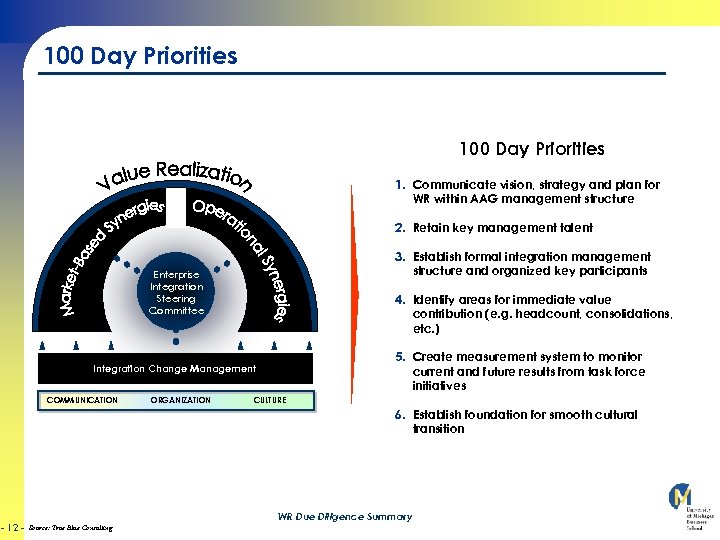

100 Day Priorities 1. Communicate vision, strategy and plan for WR within AAG management structure 2. Retain key management talent 3. Establish formal integration management structure and organized key participants Enterprise Integration Steering Committee 4. Identify areas for immediate value contribution (e. g. headcount, consolidations, etc. ) 5. Create measurement system to monitor current and future results from task force initiatives Integration Change Management COMMUNICATION ORGANIZATION CULTURE 6. Establish foundation for smooth cultural transition - 12 - WR Due Diligence Summary Source: True Blue Consulting

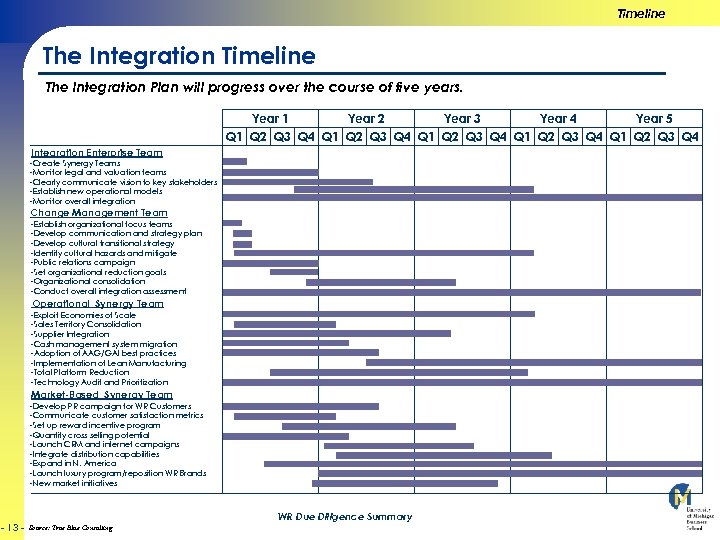

Timeline The Integration Plan will progress over the course of five years. Year 1 Year 2 Year 3 Year 4 Year 5 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Integration Enterprise Team -Create Synergy Teams -Monitor legal and valuation teams -Clearly communicate vision to key stakeholders -Establish new operational models -Monitor overall integration Change Management Team -Establish organizational focus teams -Develop communication and strategy plan -Develop cultural transitional strategy -Identify cultural hazards and mitigate -Public relations campaign -Set organizational reduction goals -Organizational consolidation -Conduct overall integration assessment Operational Synergy Team -Exploit Economies of Scale -Sales Territory Consolidation -Supplier Integration -Cash management system migration -Adoption of AAG/GAI best practices -Implementation of Lean Manufacturing -Total Platform Reduction -Technology Audit and Prioritization Market-Based Synergy Team -Develop PR campaign for WR Customers -Communicate customer satisfaction metrics -Set up reward incentive program -Quantify cross selling potential -Launch CRM and internet campaigns -Integrate distribution capabilities -Expand in N. America -Launch luxury program/reposition WR Brands -New market initiatives - 13 - WR Due Diligence Summary Source: True Blue Consulting

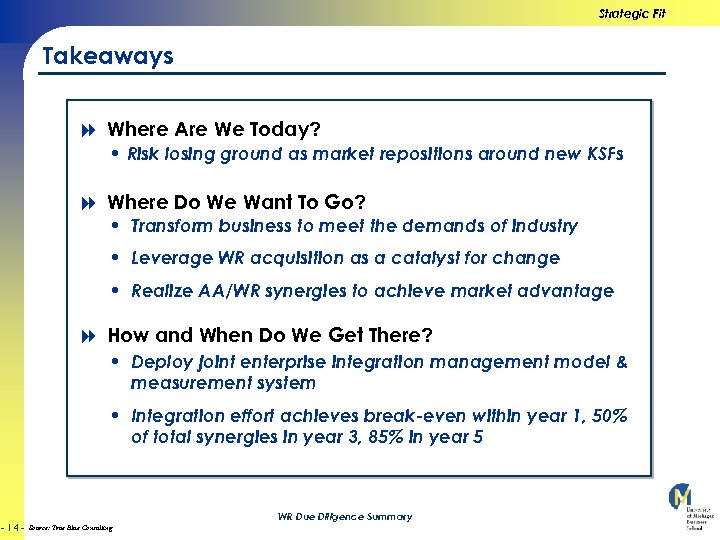

Strategic Fit Takeaways 8 Where Are We Today? • Risk losing ground as market repositions around new KSFs 8 Where Do We Want To Go? • Transform business to meet the demands of industry • Leverage WR acquisition as a catalyst for change • Realize AA/WR synergies to achieve market advantage 8 How and When Do We Get There? • Deploy joint enterprise integration management model & measurement system • Integration effort achieves break-even within year 1, 50% of total synergies in year 3, 85% in year 5 - 14 - WR Due Diligence Summary Source: True Blue Consulting

QUESTIONS? - 15 - WR Due Diligence Summary Source: True Blue Consulting

Back-up Charts - 16 - WR Due Diligence Summary Source: True Blue Consulting

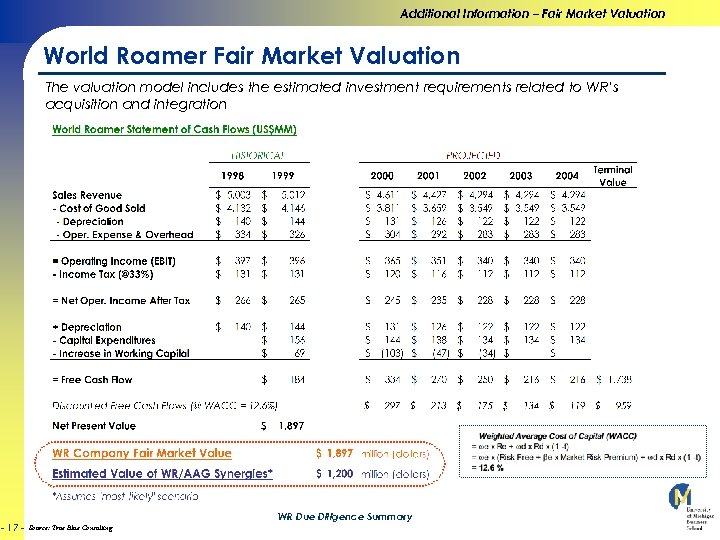

Additional Information – Fair Market Valuation World Roamer Fair Market Valuation The valuation model includes the estimated investment requirements related to WR’s acquisition and integration - 17 - WR Due Diligence Summary Source: True Blue Consulting

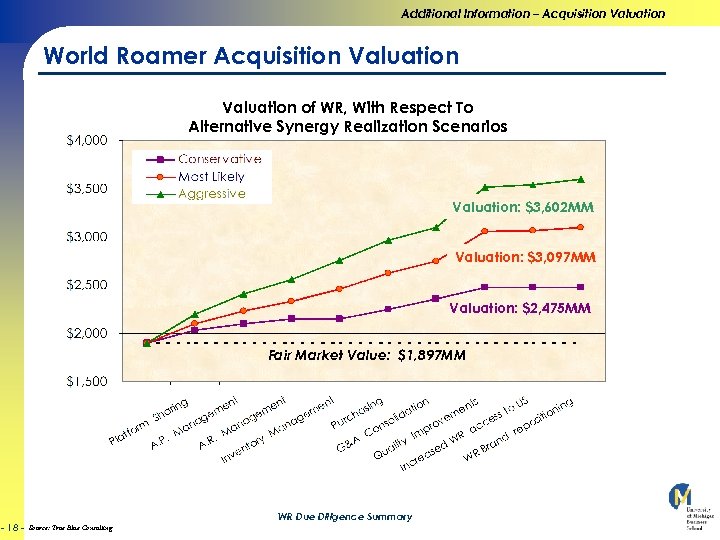

Additional Information – Acquisition Valuation World Roamer Acquisition Valuation of WR, With Respect To Alternative Synergy Realization Scenarios Valuation: $3, 602 MM Valuation: $3, 097 MM Valuation: $2, 475 MM Fair Market Value: $1, 897 MM - 18 - WR Due Diligence Summary Source: True Blue Consulting

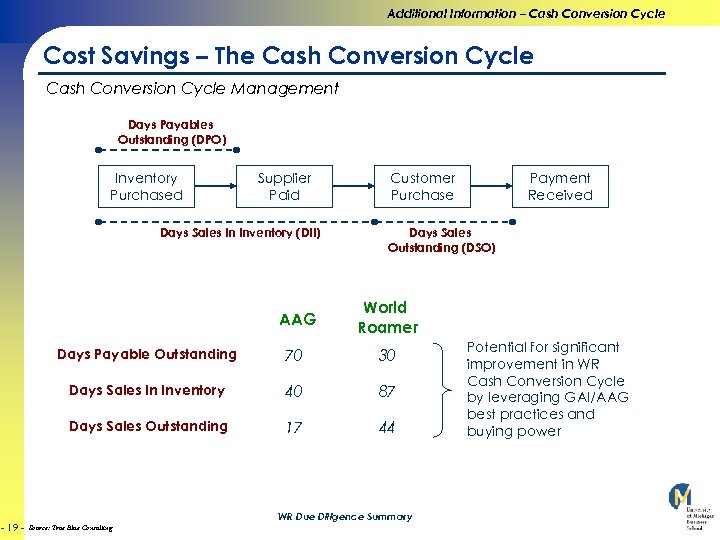

Additional Information – Cash Conversion Cycle Cost Savings – The Cash Conversion Cycle Management Days Payables Outstanding (DPO) Inventory Purchased Supplier Paid Days Sales In Inventory (DII) Customer Purchase Days Sales Outstanding (DSO) AAG World Roamer Days Payable Outstanding 70 30 Days Sales In Inventory 40 87 Days Sales Outstanding - 19 - Payment Received 17 44 WR Due Diligence Summary Source: True Blue Consulting Potential for significant improvement in WR Cash Conversion Cycle by leveraging GAI/AAG best practices and buying power

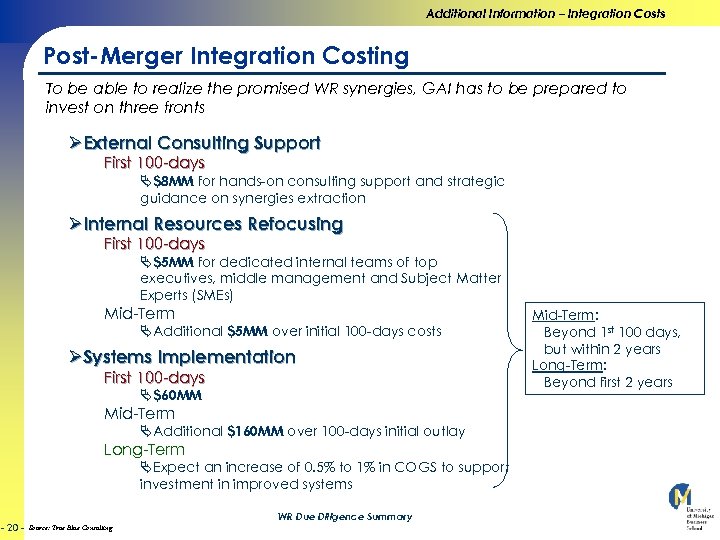

Additional Information – Integration Costs Post-Merger Integration Costing To be able to realize the promised WR synergies, GAI has to be prepared to invest on three fronts ØExternal Consulting Support First 100 -days Ä$8 MM for hands-on consulting support and strategic guidance on synergies extraction ØInternal Resources Refocusing First 100 -days Ä$5 MM for dedicated internal teams of top executives, middle management and Subject Matter Experts (SMEs) Mid-Term ÄAdditional $5 MM over initial 100 -days costs ØSystems Implementation First 100 -days Ä$60 MM Mid-Term ÄAdditional $160 MM over 100 -days initial outlay Long-Term ÄExpect an increase of 0. 5% to 1% in COGS to support investment in improved systems - 20 - WR Due Diligence Summary Source: True Blue Consulting Mid-Term: Beyond 1 st 100 days, but within 2 years Long-Term: Beyond first 2 years

Risks Assessment Acquisition Will Require Risk Mitigation Reduction ~ 20% - 21 - WR Due Diligence Summary Source: True Blue Consulting

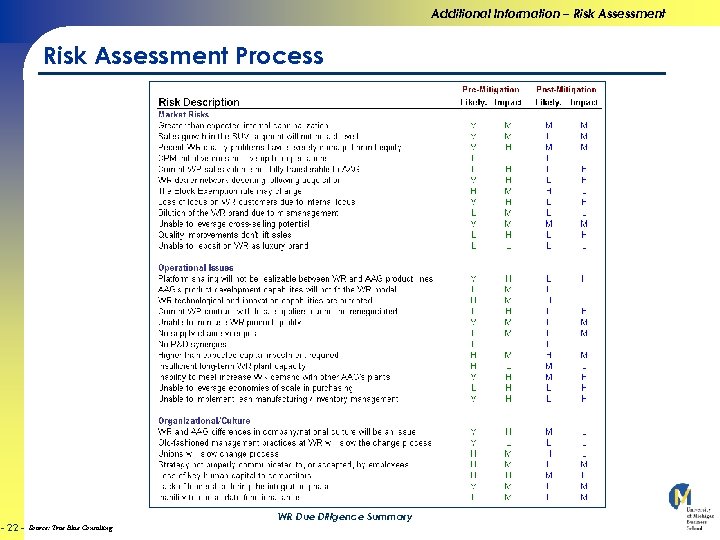

Additional Information – Risk Assessment Process - 22 - WR Due Diligence Summary Source: True Blue Consulting

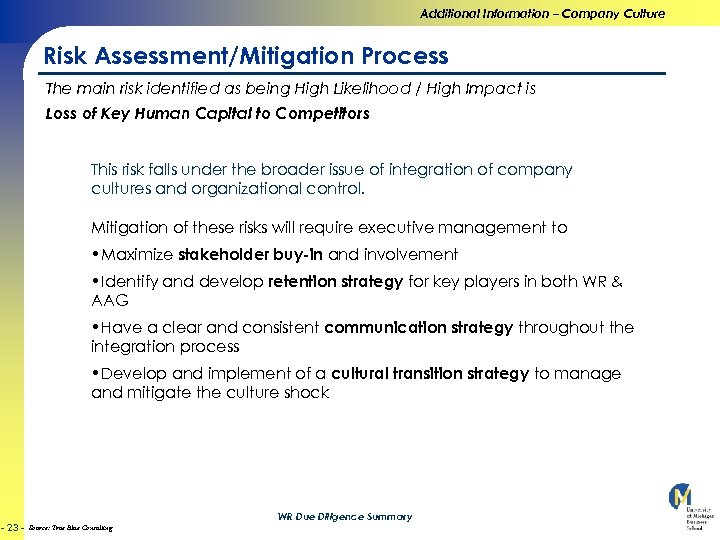

Additional Information – Company Culture Risk Assessment/Mitigation Process The main risk identified as being High Likelihood / High Impact is Loss of Key Human Capital to Competitors This risk falls under the broader issue of integration of company cultures and organizational control. Mitigation of these risks will require executive management to • Maximize stakeholder buy-in and involvement • Identify and develop retention strategy for key players in both WR & AAG • Have a clear and consistent communication strategy throughout the integration process • Develop and implement of a cultural transition strategy to manage and mitigate the culture shock - 23 - WR Due Diligence Summary Source: True Blue Consulting

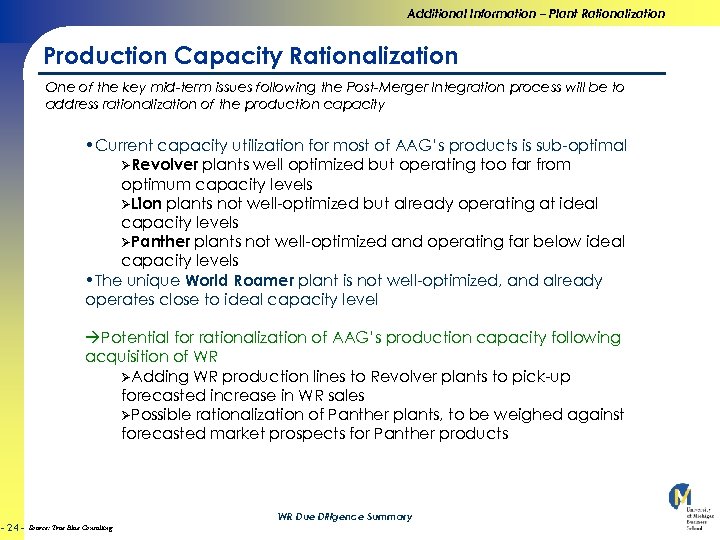

Additional Information – Plant Rationalization Production Capacity Rationalization One of the key mid-term issues following the Post-Merger Integration process will be to address rationalization of the production capacity • Current capacity utilization for most of AAG’s products is sub-optimal ØRevolver plants well optimized but operating too far from optimum capacity levels ØLion plants not well-optimized but already operating at ideal capacity levels ØPanther plants not well-optimized and operating far below ideal capacity levels • The unique World Roamer plant is not well-optimized, and already operates close to ideal capacity level Potential for rationalization of AAG’s production capacity following acquisition of WR ØAdding WR production lines to Revolver plants to pick-up forecasted increase in WR sales ØPossible rationalization of Panther plants, to be weighed against forecasted market prospects for Panther products - 24 - WR Due Diligence Summary Source: True Blue Consulting

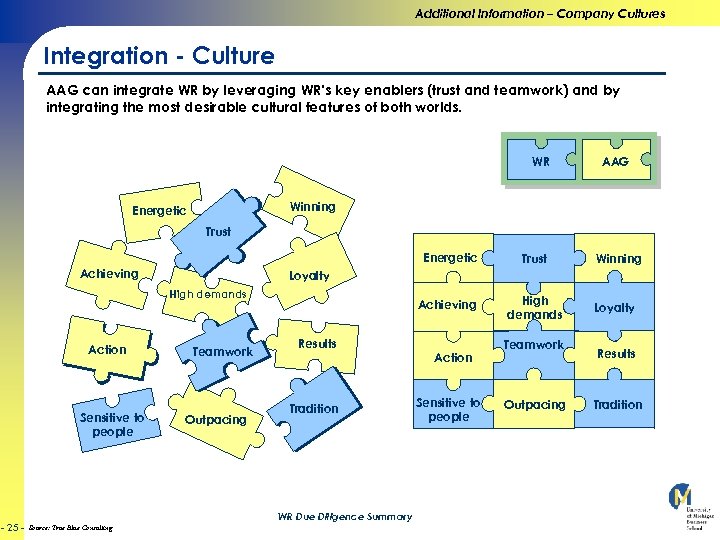

Additional Information – Company Cultures Integration - Culture AAG can integrate WR by leveraging WR’s key enablers (trust and teamwork) and by integrating the most desirable cultural features of both worlds. WR AAG Winning Energetic Trust Energetic Achieving Sensitive to people - 25 - Teamwork Outpacing Achieving Results Tradition WR Due Diligence Summary Source: True Blue Consulting Winning Loyalty High demands Action Trust Action Sensitive to people High demands Teamwork Outpacing Loyalty Results Tradition

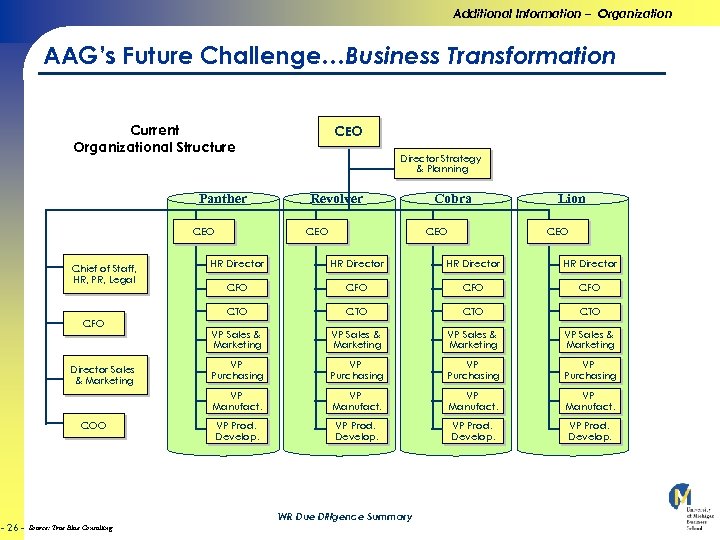

Additional Information – Organization AAG’s Future Challenge…Business Transformation Current Organizational Structure Panther CEO Director Strategy & Planning Revolver CEO Cobra CEO Lion CEO CFO Director Sales & Marketing COO - 26 - HR Director CFO CFO CTO CTO VP Sales & Marketing VP Purchasing VP Manufact. Chief of Staff, HR, PR, Legal VP Manufact. VP Prod. Develop. WR Due Diligence Summary Source: True Blue Consulting

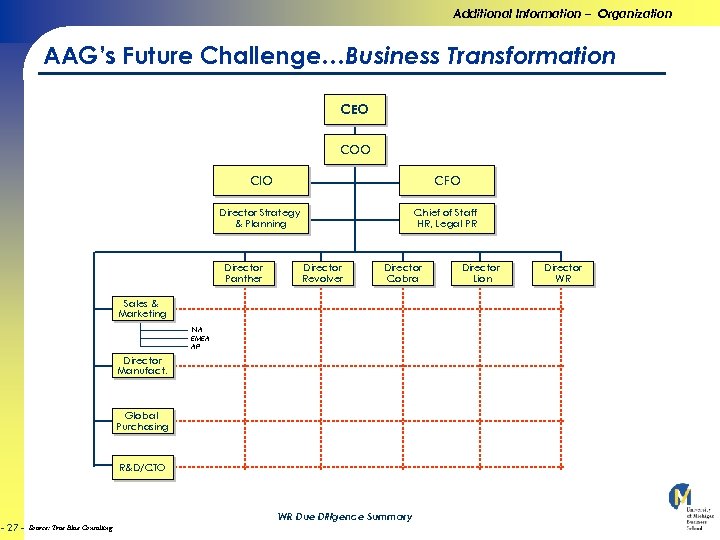

Additional Information – Organization AAG’s Future Challenge…Business Transformation CEO COO CIO CFO Director Strategy & Planning Chief of Staff HR, Legal PR Director Panther Director Revolver Director Cobra Sales & Marketing NA EMEA AP Director Manufact. Global Purchasing R&D/CTO - 27 - WR Due Diligence Summary Source: True Blue Consulting Director Lion Director WR

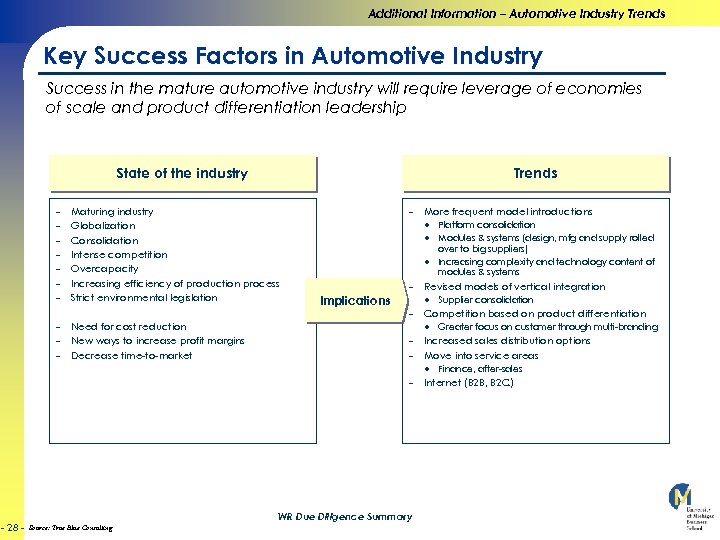

Additional Information – Automotive Industry Trends Key Success Factors in Automotive Industry Success in the mature automotive industry will require leverage of economies of scale and product differentiation leadership State of the industry – – – – Trends Maturing industry Globalization Consolidation Intense competition Overcapacity Increasing efficiency of production process Strict environmental legislation – Platform consolidation l Modules & systems (design, mfg and supply rolled over to big suppliers) l Increasing complexity and technology content of modules & systems l – Implications – – Need for cost reduction New ways to increase profit margins Decrease time-to-market Revised models of vertical integration l – – More frequent model introductions Competition based on product differentiation l – – - 28 - WR Due Diligence Summary Source: True Blue Consulting Greater focus on customer through multi-branding Increased sales distribution options Move into service areas l – Supplier consolidation Finance, after-sales Internet (B 2 B, B 2 C)

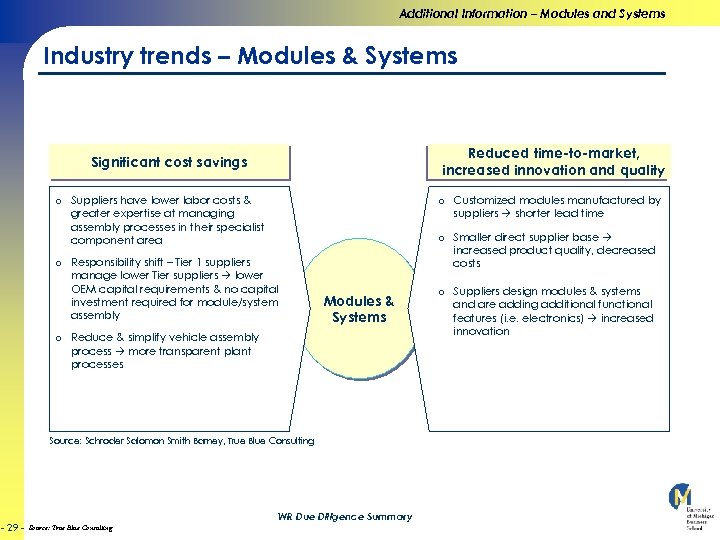

Additional Information – Modules and Systems Industry trends – Modules & Systems Reduced time-to-market, increased innovation and quality Significant cost savings o o o Suppliers have lower labor costs & greater expertise at managing assembly processes in their specialist component area o o Responsibility shift – Tier 1 suppliers manage lower Tier suppliers lower OEM capital requirements & no capital investment required for module/system assembly Modules & Systems Reduce & simplify vehicle assembly process more transparent plant processes Source: Schroder Salomon Smith Barney, True Blue Consulting - 29 - WR Due Diligence Summary Source: True Blue Consulting Customized modules manufactured by suppliers shorter lead time Smaller direct supplier base increased product quality, decreased costs o Suppliers design modules & systems and are adding additional functional features (i. e. electronics) increased innovation

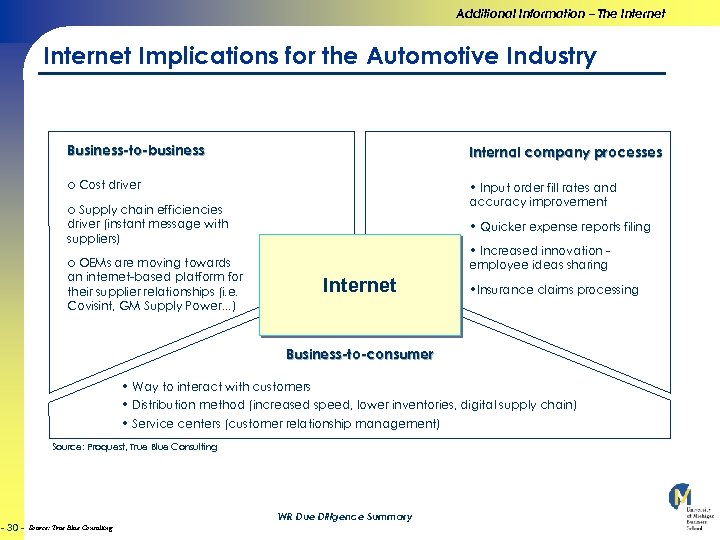

Additional Information – The Internet Implications for the Automotive Industry Business-to-business Internal company processes o Cost driver • Input order fill rates and accuracy improvement o Supply chain efficiencies driver (instant message with suppliers) o OEMs are moving towards an internet-based platform for their supplier relationships (i. e. Covisint, GM Supply Power. . . ) • Quicker expense reports filing • Increased innovation employee ideas sharing Internet • Insurance claims processing Business-to-consumer • Way to interact with customers • Distribution method (increased speed, lower inventories, digital supply chain) • Service centers (customer relationship management) Source: Proquest, True Blue Consulting - 30 - WR Due Diligence Summary Source: True Blue Consulting

adc3bd8f38c88c239d27f3fcee867676.ppt