adbd8800e5c0cf72bea094c7e164aa40.ppt

- Количество слайдов: 28

A. THE FLEET MARKET: CHALLENGES AND STRATEGY TABLE OF CONTEN T A. 1. Europe: Challenges and Strategy A. 2. Challenges and Strategy for the network 1

A. 1. EUROPE: CHALLENGES AND STRATEGY TABLE OF CONTENT A. 1, A. 1. 1. The global context > > > Introduction The stakes for Hyundai Motor Europe The stakes for Hyundai's network “The fleets”: what are they? The fleet market ▶ ▶ ▶ > PROFITABILITY MARKET SHARE MATURITY The European market: the players in the fleet market A. 1. 2. Hyundai’s approach > > The means implemented by Hyundai Motor Europe The necessary evolutions of the network Fleet Business Centre Manual Fleet Academy 2

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context Introduction In the Mature European Market, vehicle sales to private customers has stagnated in the last few years. At the same time sales to business customers continues to strengthen in most countries. After a massive drop in 2009, due to the Financial crisis, the Fleet Market is recovering. The Fleet Business accounts for 52% of the EU car market. In the countries which recently entered the European Union, the purchasing power remains weak and the convergence of the prices due to this return is not favorable for the sales of new cars to private customers. In these countries the purchase of new vehicles are increasingly carried out by the fleets having the financial means allowing them to acquire these vehicles. To play a significant role in the European Market, it is necessary for Hyundai Motor Europe to increase its positioning. To achieve this goal it is absolutely necessary to be one of the brands that are considered by this segment of customers. In this context, all car manufacturers and contract hire leasing companies are focusing on the fleet and business market. 3

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context The strategic stakes for Hyundai Motor Europe (1/2) > Volume ▶ ▶ > The current Hyundai market share on True Fleet is at 2, 4% Hyundai True Fleet market share targets 2015 -2020: 2, 5% to 5% Distribution and -as a consequence- the stability of the distribution network ▶ Maintaining the current Fleet Business Centres coverage across Europe • 425 FBCs ▶ Upgrade high quality service for fleet customers ▶ Monitoring the FBC‘s performance in both, quantity and quality 4

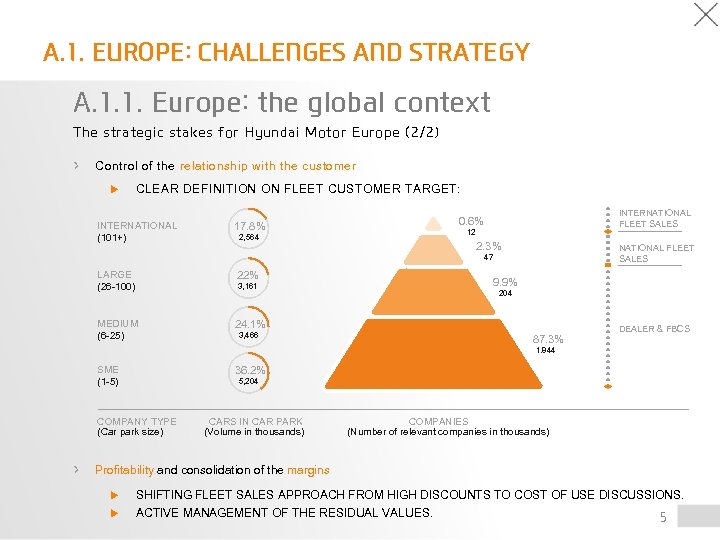

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context The strategic stakes for Hyundai Motor Europe (2/2) > Control of the relationship with the customer ▶ CLEAR DEFINITION ON FLEET CUSTOMER TARGET: INTERNATIONAL (101+) INTERNATIONAL FLEET SALES 0. 6% 17. 8% 12 2, 564 2. 3% NATIONAL FLEET SALES 47 LARGE (26 -100) 22% MEDIUM (6 -25) 24. 1% 9. 9% 3, 161 204 3, 466 87. 3% DEALER & FBCS 1. 844 SME (1 -5) 36. 2% 5, 204 COMPANY TYPE (Car park size) > CARS IN CAR PARK (Volume in thousands) COMPANIES (Number of relevant companies in thousands) Profitability and consolidation of the margins ▶ ▶ SHIFTING FLEET SALES APPROACH FROM HIGH DISCOUNTS TO COST OF USE DISCUSSIONS. ACTIVE MANAGEMENT OF THE RESIDUAL VALUES. 5

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context The stakes for Hyundai Europe and its networks. This means that HME and its network should work closely together. > HME to offer: ▶ A product line adapted to the needs of the customers; ▶ An offer of financing products answering to the specific needs of the fleet buyer; ▶ A service package allowing a complete offering. > Hyundai FBC network to offer: ▶ a service quality corresponding to the expectations of a fleet customer; ▶ professional fleet sales and after sales people positioning themselves as advisors and partners of these fleet customers; ▶ adapted services (e. g. opening schedules, replacement vehicles, quick service, …). 6

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context The “fleets”, what are they? The word “fleet” is often used to indicate the large accounts and the leasing companies. In this sense it is misleading, since these large customers on average only represent 25% of the total fleet market. The other 75% of the market are realised through the market of the “business” customer starting from the smallest level of the individual customer using his vehicle to do his job (e. g. : independent professions, small shopkeepers, craftsmen) and ending at the highest level by fleets of 50+ vehicles. The “True Fleet” is usually defined as the non-private sales excluding demo cars and short term rental. In other words: “True fleet” includes corporate clients, SME and leasing companies. Depending of the country, it could also include the liberal professions. 7

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context Profitability of the fleet and business market Why is it interesting to work with a fleet customer ? > From one to many cars to sell to one decision maker. > Vehicles with more frequent use and therefore a more rapid renewal. > A more rational customer, open for a TCO discussion and contracts including services. > The fleet client is more loyal, especially when he is familiar with the full service approach. > Increasing market share of the fleet customers (illustrated on next screen) 8

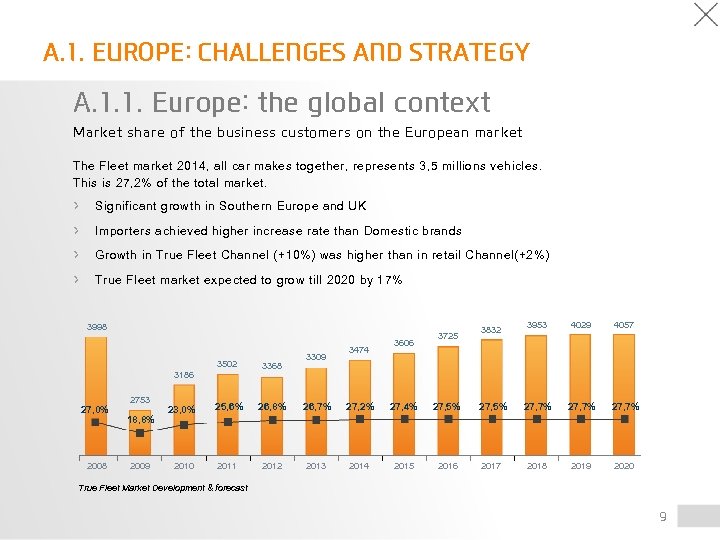

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context Market share of the business customers on the European market The Fleet market 2014, all car makes together, represents 3, 5 millions vehicles. This is 27, 2% of the total market. > Significant growth in Southern Europe and UK > Importers achieved higher increase rate than Domestic brands > Growth in True Fleet Channel (+10%) was higher than in retail Channel(+2%) > True Fleet market expected to grow till 2020 by 17% 3998 3309 3474 3606 3725 3832 3953 4029 4057 3502 3368 23, 0% 25, 6% 26, 8% 26, 7% 27, 2% 27, 4% 27, 5% 27, 7% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 3186 27, 0% 2008 2753 18, 8% 2009 True Fleet Market Development & forecast 9

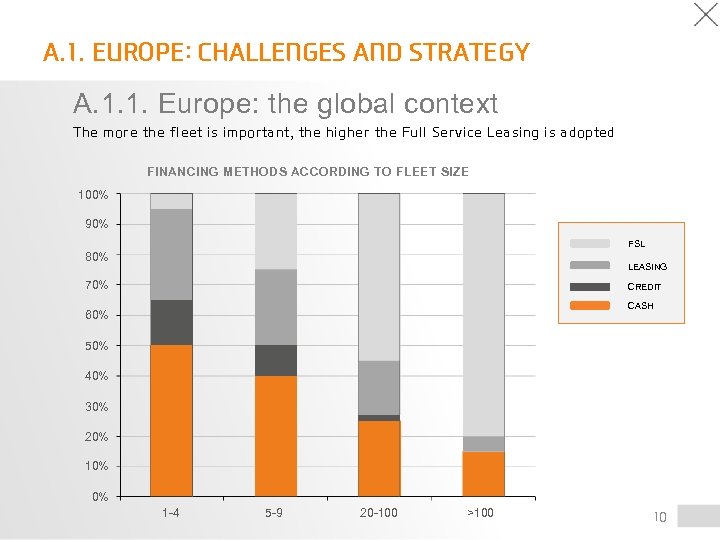

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context The more the fleet is important, the higher the Full Service Leasing is adopted FINANCING METHODS ACCORDING TO FLEET SIZE 100% 90% FSL 80% LEASING 70% CREDIT CASH 60% 50% 40% 30% 20% 10% 0% 1 -4 5 -9 20 -100 >100 10

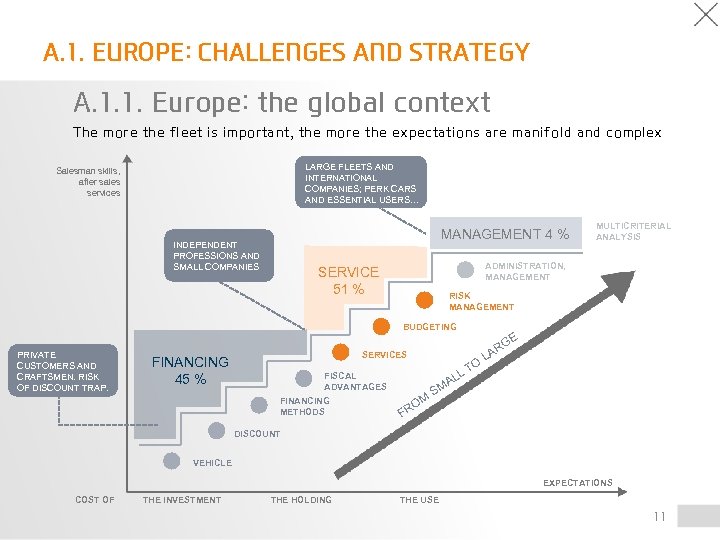

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context The more the fleet is important, the more the expectations are manifold and complex LARGE FLEETS AND INTERNATIONAL COMPANIES; PERK CARS AND ESSENTIAL USERS… Salesman skills, after sales services MANAGEMENT 4 % INDEPENDENT PROFESSIONS AND SMALL COMPANIES MULTICRITERIAL ANALYSIS ADMINISTRATION, MANAGEMENT SERVICE 51 % RISK MANAGEMENT BUDGETING PRIVATE CUSTOMERS AND CRAFTSMEN. RISK OF DISCOUNT TRAP. SERVICES FINANCING 45 % O LT FISCAL ADVANTAGES FINANCING METHODS M O FR E RG A L L MA S DISCOUNT VEHICLE EXPECTATIONS COST OF THE INVESTMENT THE HOLDING THE USE 11

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context The European market: the players in the fleet market > Click on the visuals to see what the different players are interested in: VEHICLE FINANCING SERVICE 12

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context The European market: the players in the fleet market > Click on the visuals to see what the different players are interested in: VEHICLE 13

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context The European market: the players in the fleet market > Click on the visuals to see what the different players are interested in: FINANCING LEASING 14

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context The European market: the players in the fleet market > Click on the visuals to see what the different players are interested in: SERVICE LEASING INSURANCE TIRE COMPANY 15

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context The European market: the players in the fleet market > Click on the visuals to see what the different players are interested in: VEHICLE FINANCING SERVICE LEASING INSURANCE TIRE COMPANY 16

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 1. Europe: the global context The European market: the players in the fleet market > Click on the visuals to see what the different players are interested in: VEHICLE Conclusion: only the car manufacturer proposes the full mobility solution to its customers FINANCING SERVICE LEASING INSURANCE TIRE COMPANY 17

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 2. Hyundai’s approach The means implemented by Hyundai in Europe > A - Human Resources. ▶ A centrally adapted commercial organization in each country. > B - The products: ▶ ▶ ▶ > A variety of models targeted to appeal the business market All new Light Commercial vehicle A plan of new models within 1 year which will allow HME to become a serious competitor in the business market C - A package of financing and service offerings adapted to the needs of the fleet and business customers. > D - Commercial methods and network standards adapted to the fleet market. > E - Marketing and communication tools specifically for the fleet market. > F - A Fleet Academy training programme. > G - A Remarketing Programme (illustrated on next screen). 18

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 2. Hyundai’s approach Remarketing Programme > Purpose: ▶ Develop global naming for Certified Pre Owned program vitalization and better customer communication > Naming : ▶ Emphasizing Credibility: “H” means Hyundai heritage with high quality and “Promise” means Hyundai’s credible promises to customers > Expectations: ▶ Quantitative Growth: Sales focussed CPO business ▶ Brand Management: Use global CPO naming for brand leadership and modern premium ▶ Market: Efficient management through UC awareness and Synergy effect with Hyundai brand ▶ Dealer: Increase dealer profit through UC awareness and Support NC sales through increasing RV’s ▶ CS: Increase customer credibility for Hyundai UC and Increase customer expectation for service / warranty > Benefits: ▶ Increased trust in Hyundai used cars ▶ Grow profitability of used car business ▶ Improve brand image & gain new customers ▶ Increase residual values of used cars ▶ Optimize used car management of the dealer network ▶ Support new car sales ▶ Constant delivery of Hyundai’s confidence on approved vehicles to customers ▶ Increase of level of customer satisfaction by providing confidence in high quality and improving the ▶ overall residual value’s Modern design to attract new and young customers 19

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 2. Hyundai’s approach The necessary evolutions of the network > The implementation and the strict application of the 2 -Tier standards. > Creating a consistent standard within the Hyundai Fleet Business Centres. > Providing an evaluation of salesmen capable of dealing with fleet customers, for Fleet Business Centres. > Selected fleet salesmen have to follow an adapted training programme with further assessments. > Implementation of Fleet specific services. 20

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 2. Hyundai’s approach Fleet Business Centre Manual > An interactive application > Rolled-out in European countries together with the local organisations > To help the 425 FBCs to raise their expertise and better serve the fleet customer THE FLEET MARKET THE FLEET BUSINESS CENTRE MY ACTION PLAN COACHING 21

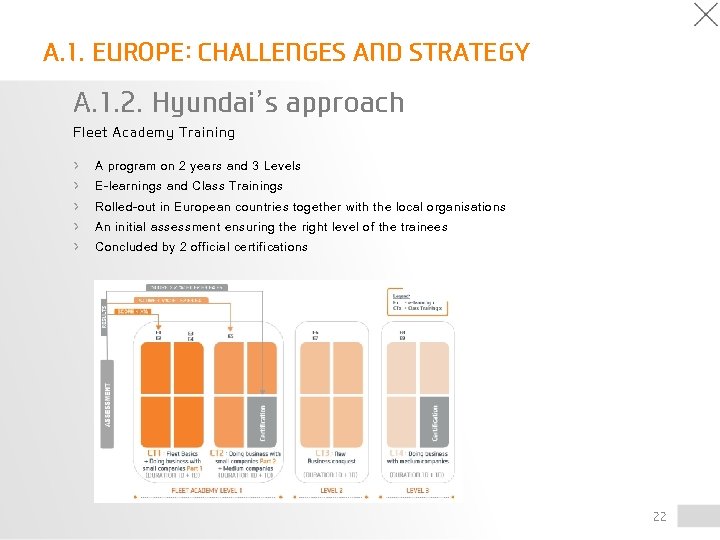

A. 1. EUROPE: CHALLENGES AND STRATEGY A. 1. 2. Hyundai’s approach Fleet Academy Training > A program on 2 years and 3 Levels > E-learnings and Class Trainings > Rolled-out in European countries together with the local organisations > An initial assessment ensuring the right level of the trainees > Concluded by 2 official certifications 22

FLEET ACADEMY TRAINING There are in total 4 class trainings, each of 2 days … day 1 day 2 a. m. p. m. 23

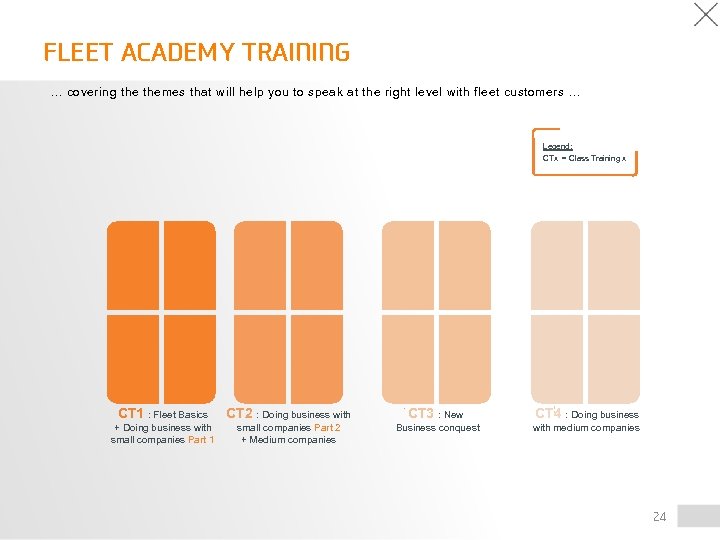

FLEET ACADEMY TRAINING … covering themes that will help you to speak at the right level with fleet customers … Legend: CTx = Class Training x CT 1 : Fleet Basics + Doing business with small companies Part 1 CT 2 : Doing business with small companies Part 2 + Medium companies CT 3 : New Business conquest CT 4 : Doing business with medium companies 24

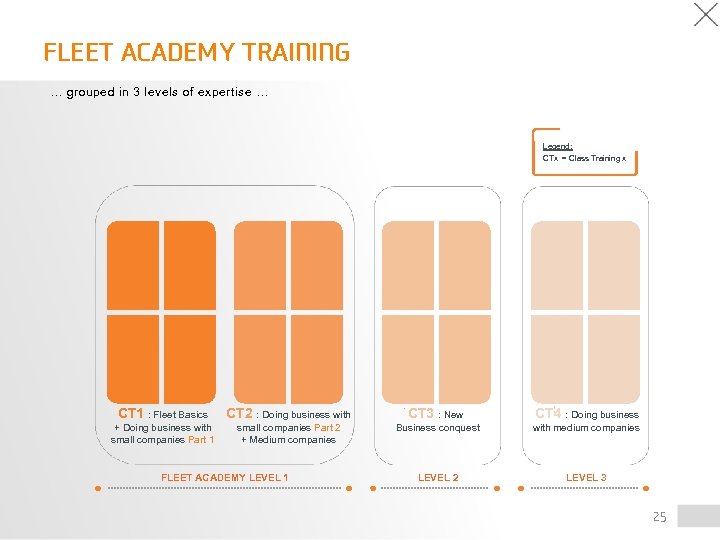

FLEET ACADEMY TRAINING … grouped in 3 levels of expertise … Legend: CTx = Class Training x CT 1 : Fleet Basics + Doing business with small companies Part 1 CT 2 : Doing business with small companies Part 2 + Medium companies FLEET ACADEMY LEVEL 1 CT 3 : New Business conquest CT 4 : Doing business with medium companies LEVEL 2 LEVEL 3 25

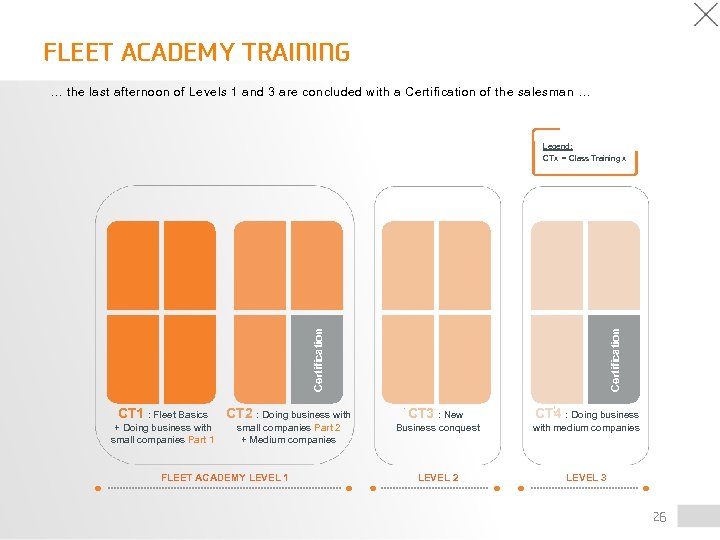

FLEET ACADEMY TRAINING … the last afternoon of Levels 1 and 3 are concluded with a Certification of the salesman … CT 1 : Fleet Basics + Doing business with small companies Part 1 CT 2 : Doing business with small companies Part 2 + Medium companies FLEET ACADEMY LEVEL 1 Certification Legend: CTx = Class Training x CT 3 : New Business conquest CT 4 : Doing business with medium companies LEVEL 2 LEVEL 3 26

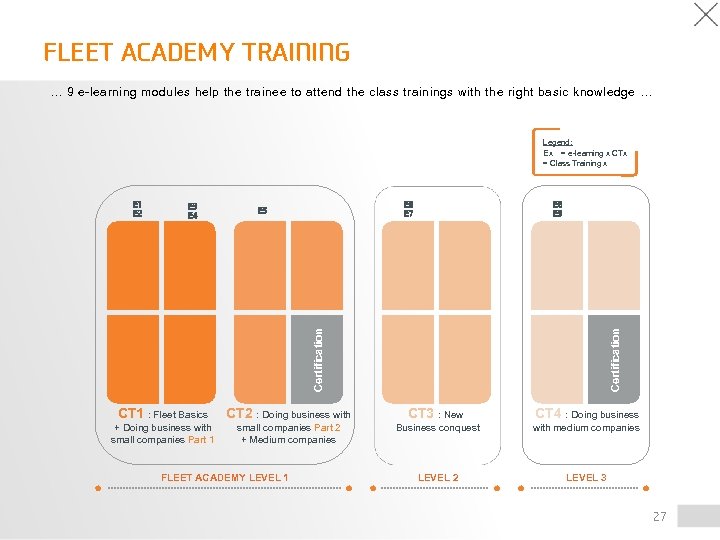

FLEET ACADEMY TRAINING … 9 e-learning modules help the trainee to attend the class trainings with the right basic knowledge … Legend: Ex = e-learning x CTx = Class Training x E 6 E 7 E 5 E 8 E 9 Certification E 3 E 4 Certification E 1 E 2 CT 1 : Fleet Basics + Doing business with small companies Part 1 CT 2 : Doing business with small companies Part 2 + Medium companies FLEET ACADEMY LEVEL 1 CT 3 : New Business conquest CT 4 : Doing business with medium companies LEVEL 2 LEVEL 3 27

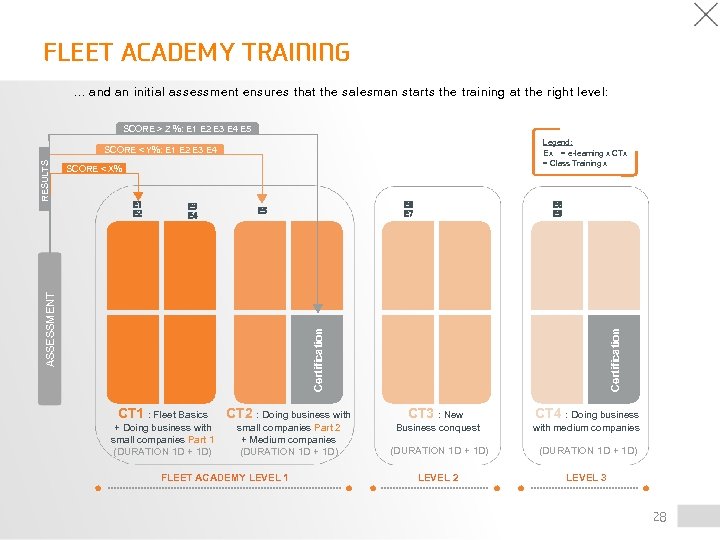

FLEET ACADEMY TRAINING … and an initial assessment ensures that the salesman starts the training at the right level: SCORE > Z %: E 1 E 2 E 3 E 4 E 5 Legend: Ex = e-learning x CTx = Class Training x SCORE < X% E 1 E 2 E 3 E 4 E 6 E 7 E 5 E 8 E 9 CT 1 : Fleet Basics + Doing business with small companies Part 1 (DURATION 1 D + 1 D) CT 2 : Doing business with small companies Part 2 + Medium companies (DURATION 1 D + 1 D) FLEET ACADEMY LEVEL 1 Certification ASSESSMENT RESULTS SCORE < Y%: E 1 E 2 E 3 E 4 CT 3 : New Business conquest CT 4 : Doing business with medium companies (DURATION 1 D + 1 D) LEVEL 2 LEVEL 3 28

adbd8800e5c0cf72bea094c7e164aa40.ppt