7101494798b9ea8a8490df9bfff22aea.ppt

- Количество слайдов: 121

a subsidiary of Providing Energy Choices 1

Providing Energy Choices Agenda: § § § § Welcome & Introduction Rates and Energy Markets 2011 Conservation & Load Management Programs Financing Programs at CDA Overview of Southern Conn Gas Company Renewable Energy Efficiency Programs The Future of Energy: Building a Smart System Q&A / Adjourn

Welcome Mr. Anthony J. Vallillo Executive Vice President and Chief Operating Officer, UIL President, UI

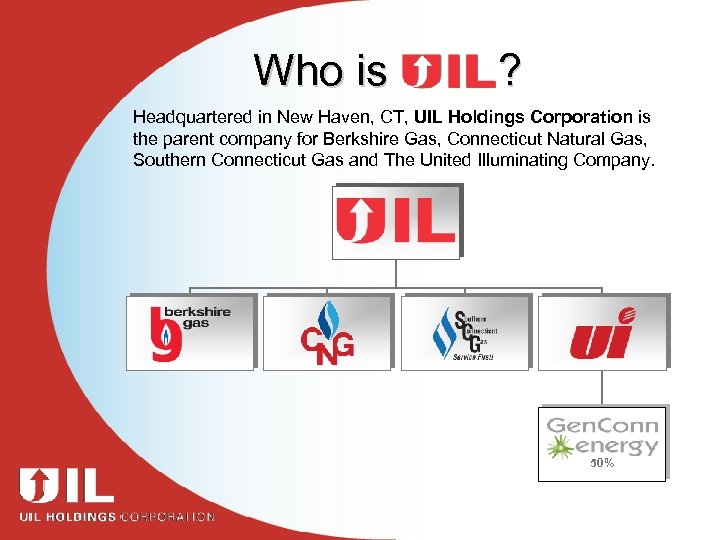

Who is ? Headquartered in New Haven, CT, UIL Holdings Corporation is the parent company for Berkshire Gas, Connecticut Natural Gas, Southern Connecticut Gas and The United Illuminating Company. 50%

Who is ? 66 Towns in CT & MA -- 694, 000 Customers -- 1, 858 Employees Southwest & Coast Line of CT No. Central & Southwest Corner of CT Southwest & Central Coast Line of CT Western Mass. ~324, 000 Customers ~158, 000 Customers ~173, 000 Customers ~35, 000 Customers 1, 066 Employees 341 Employees 324 Employees 127 Employees 333 Sq. Miles 716 Sq. Miles 512 Sq. Miles 738 Sq. Miles

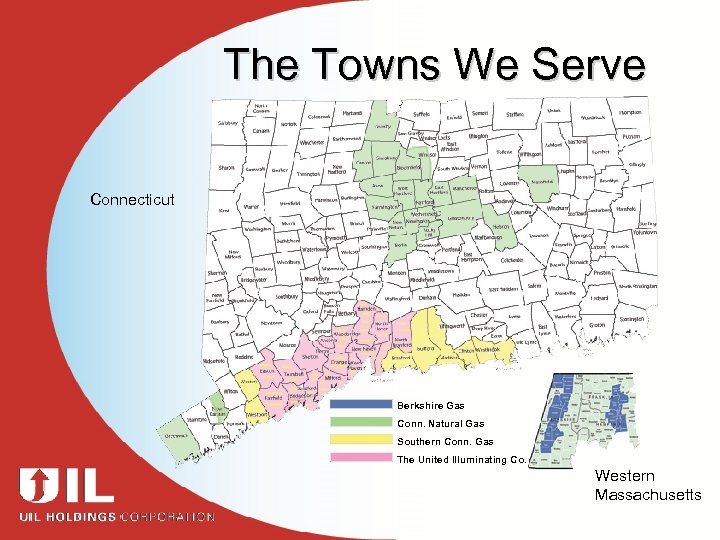

The Towns We Serve Connecticut Berkshire Gas Conn. Natural Gas Southern Conn. Gas The United Illuminating Co. Western Massachusetts

Why Natural Gas? • Consistent with core business – regulated energy delivery • Creates a larger, diversified energy delivery company • Integrates resources, efficiencies and best practices to benefit all customers

For More Information Please Visit Our Web Sites… Ø www. . com Ø www. berkshiregas. com Ø www. cngcorp. com Ø www. soconngas. com Ø www. uinet. com

Local Companies Working For You Questions?

Rates and Energy Markets Mr. Michael Coretto Associate Vice President Regulatory Affairs, UIL

Topics for Today § January 2011 Rate Changes & Impacts § Update on UI Power Procurement § Looking Ahead § Questions

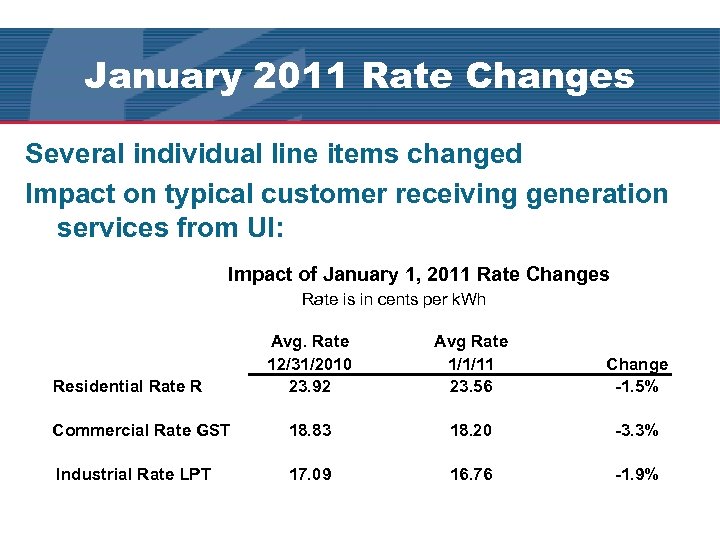

January 2011 Rate Changes Several individual line items changed Impact on typical customer receiving generation services from UI: Impact of January 1, 2011 Rate Changes Rate is in cents per k. Wh Avg. Rate 12/31/2010 23. 92 Avg Rate 1/1/11 23. 56 Change -1. 5% Commercial Rate GST 18. 83 18. 20 -3. 3% Industrial Rate LPT 17. 09 16. 76 -1. 9% Residential Rate R

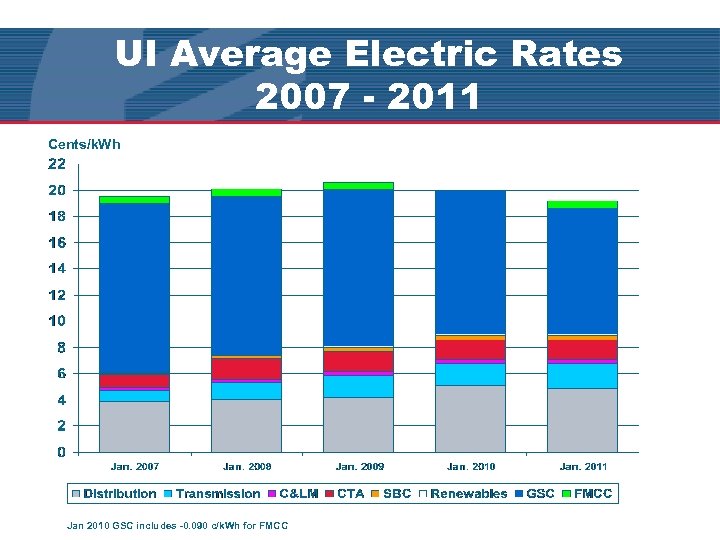

UI Average Electric Rates 2007 - 2011 Cents/k. Wh Jan 2010 GSC includes -0. 090 c/k. Wh for FMCC

How UI Procures Power Full Requirements Service § § § Required by statute and regulation Bundled - all products needed to serve load Supplier takes share of UI load serving obligation Supplier takes all volume/migration risk “Laddered” procurements over time Quarterly RFPs § Oversight by consultants to DPUC and OCC § Joint Recommendation to DPUC

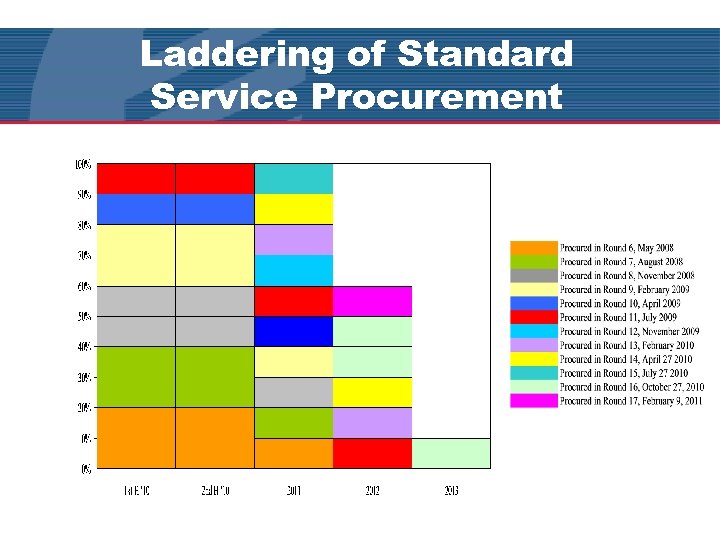

Laddering of Standard Service Procurement

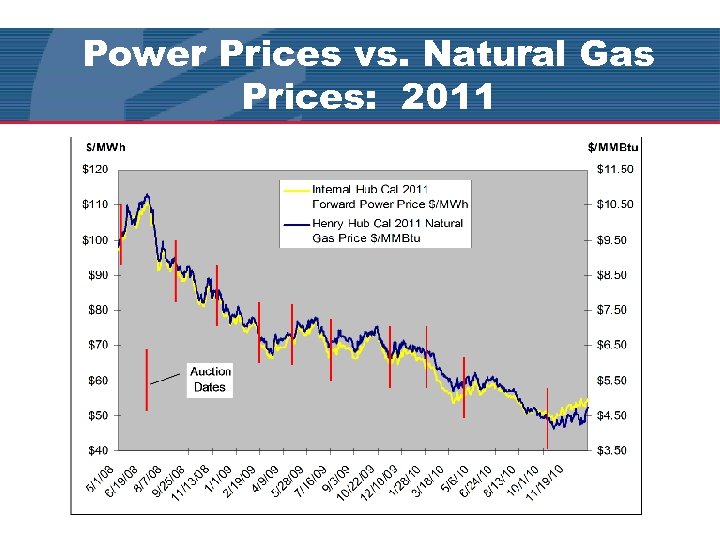

Power Prices vs. Natural Gas Prices: 2011

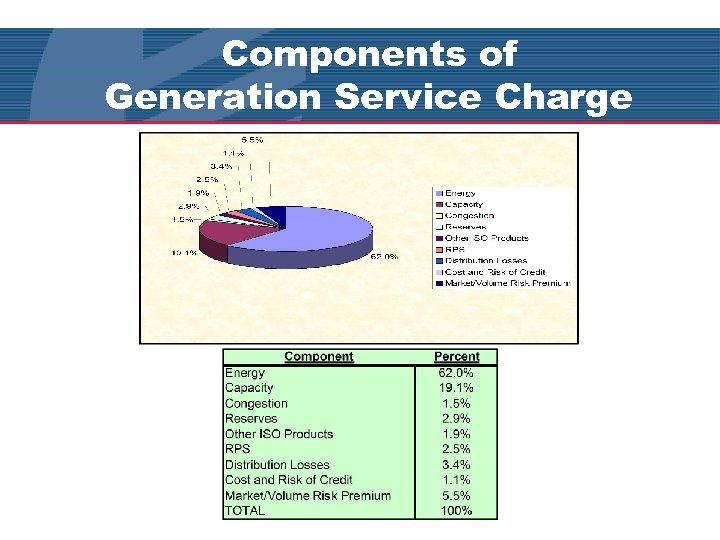

Components of Generation Service Charge

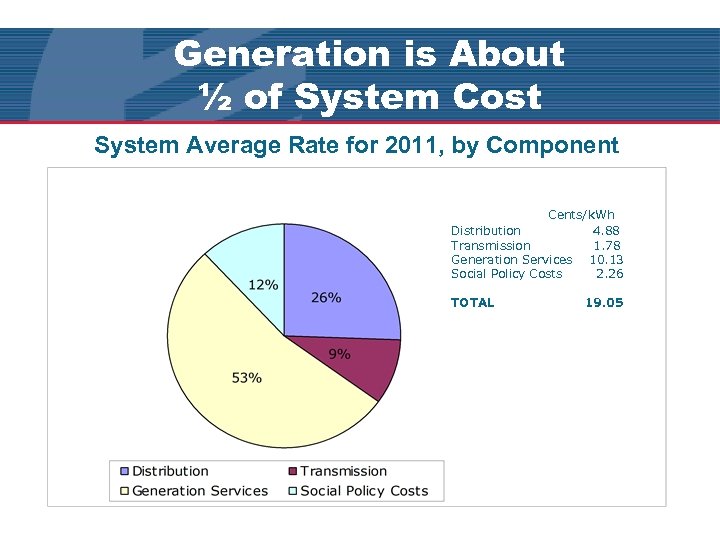

Generation is About ½ of System Cost System Average Rate for 2011, by Component Cents/k. Wh Distribution 4. 88 Transmission 1. 78 Generation Services 10. 13 Social Policy Costs 2. 26 TOTAL 19. 05

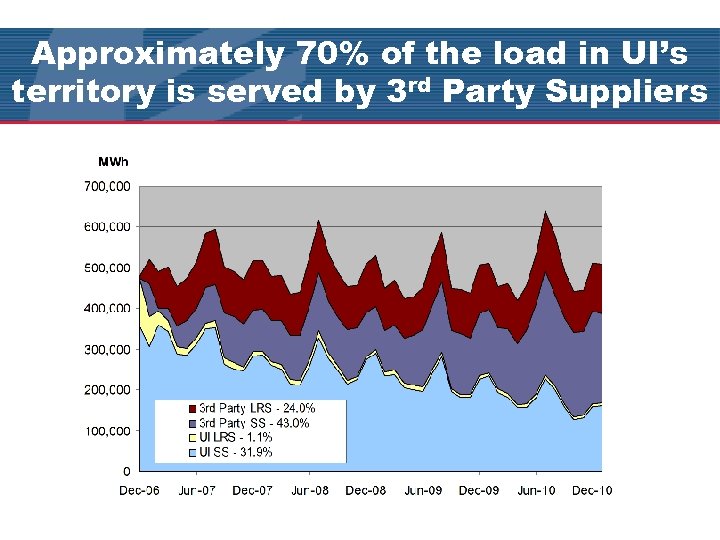

Approximately 70% of the load in UI’s territory is served by 3 rd Party Suppliers

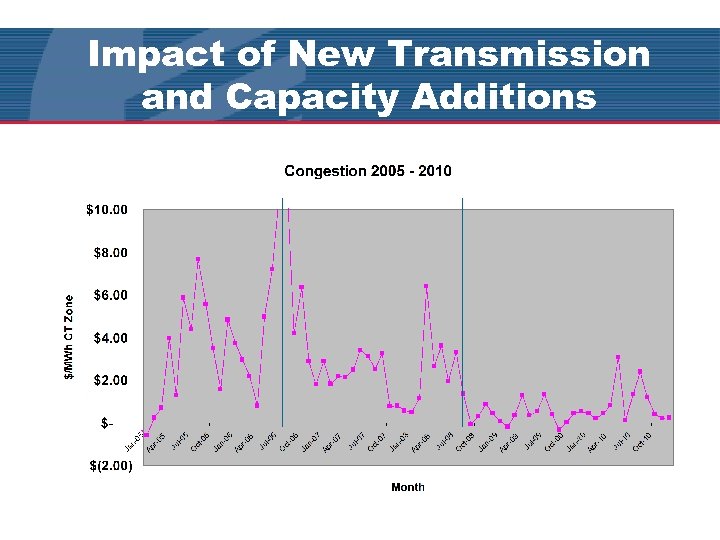

Looking Ahead Under Current Market Conditions, UI’s Generation Services Charge for Standard Service is projected to decline in 2012 vs. 2011 Congestion Costs in CT continue to be a non-issue, due to transmission additions, new generating capacity, and customer DG installations Issue of Renewable Portfolio Standards and how best to meet them

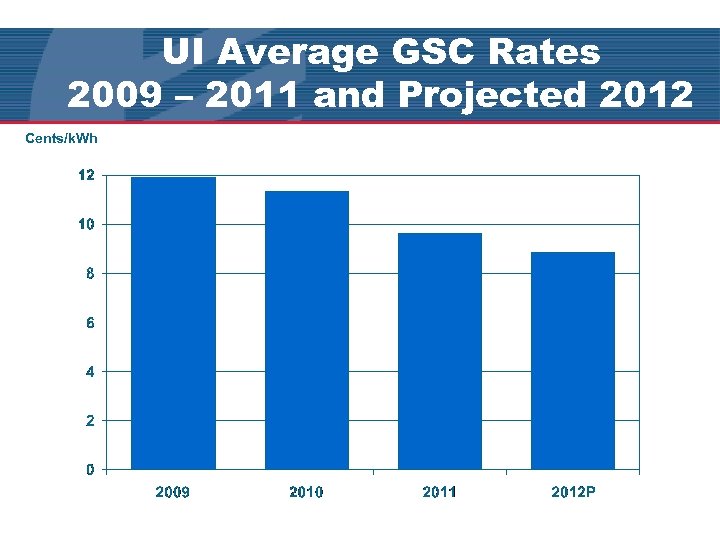

UI Average GSC Rates 2009 – 2011 and Projected 2012 Cents/k. Wh

Impact of New Transmission and Capacity Additions

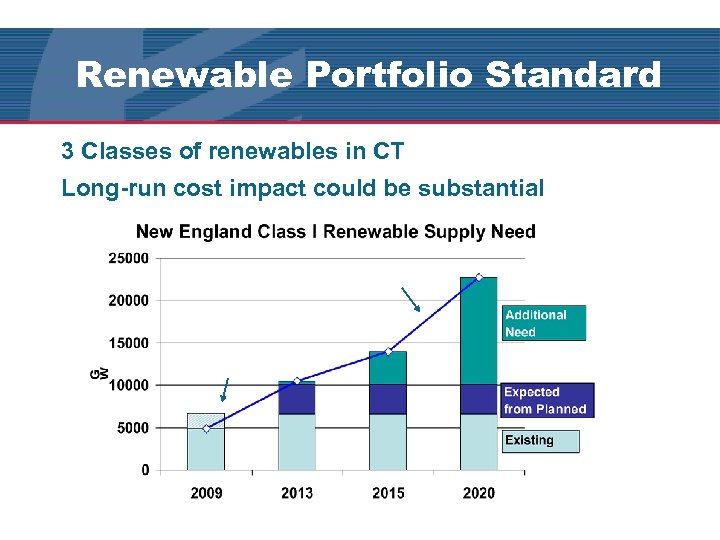

Renewable Portfolio Standard 3 Classes of renewables in CT Long-run cost impact could be substantial Demand for Class I Renewables Surplus

CT Renewable Portfolio Standards Q & A Data from DPUC presentation , 12/ 2010

Costs of Renewable Technology Estimated Levelized Costs Cents/k. Wh Landfill Gas 5. 6 Biomass 11. 0 Hydro 11. 0 Wind 11. 2 Fuel Cells 17. 4 Offshore Wind 19. 9 Solar PV 52. 0 Source: IRP, Table 10, P. 62; Brattle Report, Section 10 D (RPS Section) Today’s power supply costs are in the range of 7 -8 cents/k. Wh.

Questions?

2011 Conservation and Load Management Programs Mr. Richard Steeves Energy Efficiency Board Chairperson Mr. Patrick Mc. Donnell Senior Director, UI

Energy Efficiency & Background The overall vision for the future evolution of the Energy Efficiency Fund C&I programs is to cost-effectively support a sustainable and competitive business climate for Connecticut’s businesses and industries based on bottom-line solutions for economic competitiveness, environmental stewardship, and social responsibility. Connecticut Energy Efficiency Fund was created in 1998 by CT State Legislature Energy efficiency is a valuable resource § Reduces air pollutants and greenhouse gases § Creates monetary savings for customers § Reduces need for more energy generation § Creates jobs

Energy Efficiency Programs § Offer technical assistance to commercial & industrial customers who want to improve energy efficiency § Offer financial incentives to help implement energy-efficient measures § No. 8 ranking in ACEEE’s 2010 State Scorecard § Support economic growth in Connecticut* – Creates more than 2, 675 direct jobs – Acts as an economic development engine creating businesses to deliver energy efficiency services *CT Renewable Energy / Energy Efficiency Economy Baseline Study - March 27, 2009

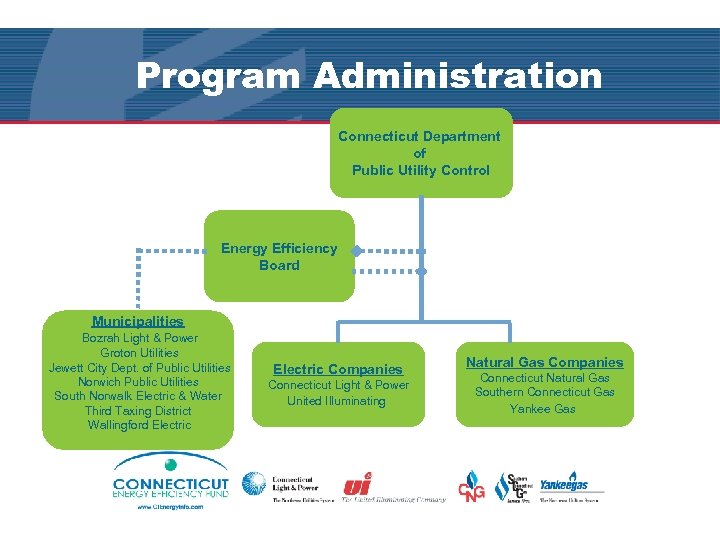

Program Administration Connecticut Department of Public Utility Control Energy Efficiency Board Municipalities Bozrah Light & Power Groton Utilities Jewett City Dept. of Public Utilities Norwich Public Utilities South Norwalk Electric & Water Third Taxing District Wallingford Electric Companies Connecticut Light & Power United Illuminating Natural Gas Companies Connecticut Natural Gas Southern Connecticut Gas Yankee Gas

2010 Energy Efficiency Fund Program Results for UI § 2010 lifetime energy savings – 793. 7 Million k. Wh § 2010 summer peak demand savings – 10. 7 MW § $152. 8 M saved in electric energy costs (Lifetime from 2010 investments) • ~$18. 4 M saved annually Every dollar spent in 2010 on efficiency programs will generate more than $3 in future lifetime electric system benefits

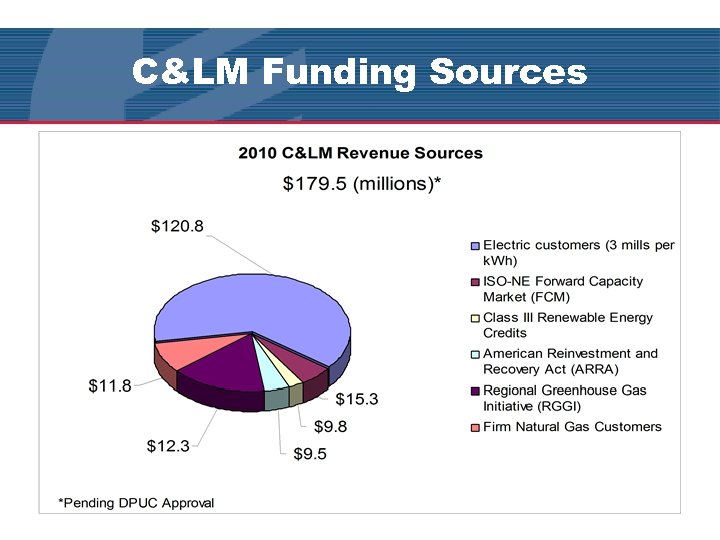

C&LM Funding Sources

Energy Efficiency Fund Sources § Funding is generated from electric and natural gas utility customers – Electric customers pay 3 mils per kilowatt-hour § Funding is generated from natural gas utility customers – Natural gas programs are funded through gas utility bills and approved by the Department of Public Utility Control – Programs are for firm gas customers only

2011 Conservation & Load Management Programs Maximizing CT’s Energy Efficiency Funds Pat Mc. Donnell Sr. Director, Conservation & Load Management

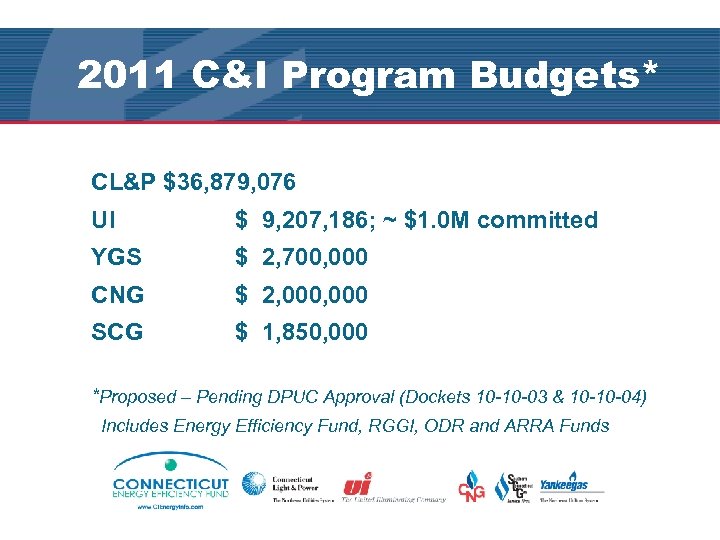

2011 C&I Program Budgets* CL&P $36, 879, 076 UI $ 9, 207, 186; ~ $1. 0 M committed YGS $ 2, 700, 000 CNG $ 2, 000 SCG $ 1, 850, 000 *Proposed – Pending DPUC Approval (Dockets 10 -10 -03 & 10 -10 -04) Includes Energy Efficiency Fund, RGGI, ODR and ARRA Funds

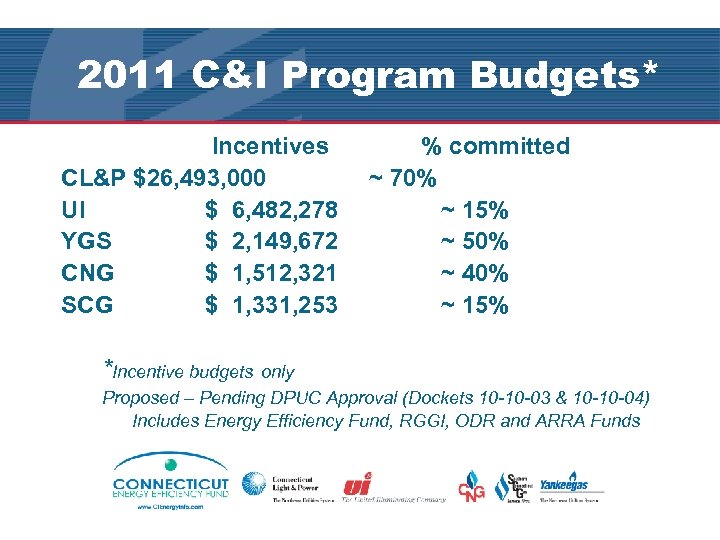

2011 C&I Program Budgets* Incentives % committed CL&P $26, 493, 000 ~ 70% UI $ 6, 482, 278 ~ 15% YGS $ 2, 149, 672 ~ 50% CNG $ 1, 512, 321 ~ 40% SCG $ 1, 331, 253 ~ 15% *Incentive budgets only Proposed – Pending DPUC Approval (Dockets 10 -10 -03 & 10 -10 -04) Includes Energy Efficiency Fund, RGGI, ODR and ARRA Funds

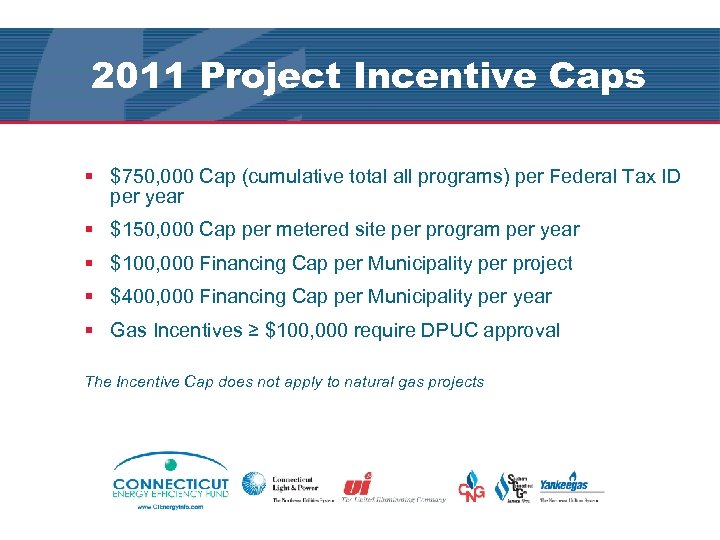

2011 Project Incentive Caps § $750, 000 Cap (cumulative total all programs) per Federal Tax ID per year § $150, 000 Cap per metered site per program per year § $100, 000 Financing Cap per Municipality per project § $400, 000 Financing Cap per Municipality per year § Gas Incentives ≥ $100, 000 require DPUC approval The Incentive Cap does not apply to natural gas projects

Commercial & Industrial Programs New Construction, Major Renovation & Equipment Replacement PRIME Retrofit Projects & Small Business Operations & Maintenance Projects Loans & Financing Retro Commissioning Load Management

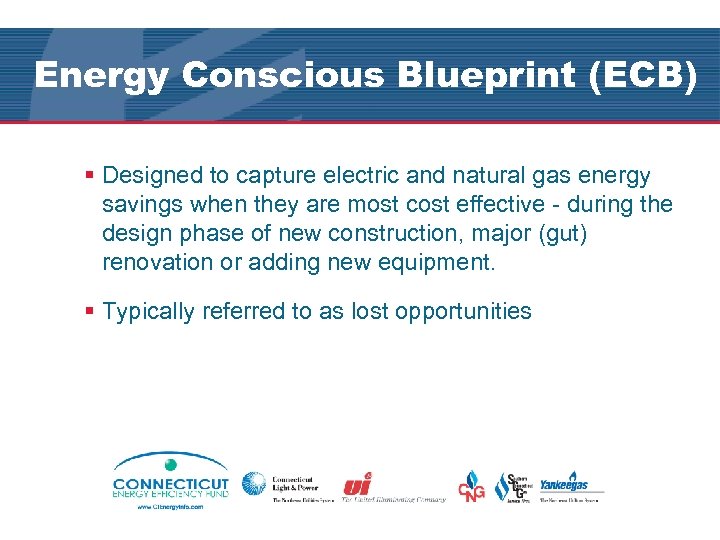

Energy Conscious Blueprint (ECB) § Designed to capture electric and natural gas energy savings when they are most cost effective - during the design phase of new construction, major (gut) renovation or adding new equipment. § Typically referred to as lost opportunities

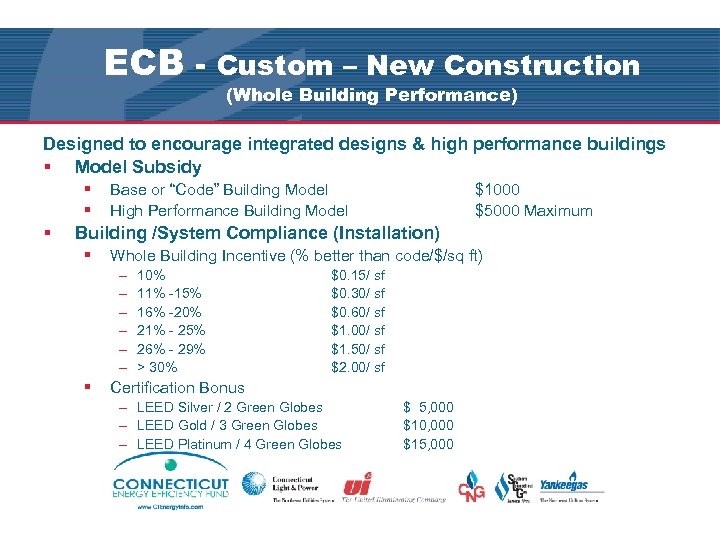

ECB - Custom – New Construction (Whole Building Performance) Designed to encourage integrated designs & high performance buildings § Model Subsidy § § § Base or “Code” Building Model High Performance Building Model $1000 $5000 Maximum Building /System Compliance (Installation) § Whole Building Incentive (% better than code/$/sq ft) – – – § 10% 11% -15% 16% -20% 21% - 25% 26% - 29% > 30% $0. 15/ sf $0. 30/ sf $0. 60/ sf $1. 00/ sf $1. 50/ sf $2. 00/ sf Certification Bonus – LEED Silver / 2 Green Globes – LEED Gold / 3 Green Globes – LEED Platinum / 4 Green Globes $ 5, 000 $10, 000 $15, 000

ECB - Prescriptive Lighting System Related Projects § Lighting designs/installations ≥ 10% less than code – Incentives = lesser of $0. 15/sq ft or $50/fixture § Lighting designs/installations ≥ 30% less than code – Incentives = lesser of $0. 50/sq feet or $50/fixture § Occupancy Sensors $20/fixture controlled – Buildings over 5, 000 sq. ft. must have lighting control strategy (as required by code) § Subject To Utility Caps * Code = ASHRAE 90. 1 -2004 (all addenda)

ECB - Prescriptive (continued) For non-lighting system related projects: § We pay up to 95% of the incremental cost for new construction and up to 75% for equipment replacement § We measure the incremental cost and the energy savings relative to Building Code* or reasonable & customary design practices § Agreement is prepared and signed prior to ordering equipment & materials, or construction § Subject to Utility Caps *Code = ASHRAE 90. 1 -2004 (all addenda)

Specific Examples § New construction § High reflectivity roofing § HE lighting, including w/occupancy sensors § HE brine chillers § HE heat pump loop system § HE rooftop HVAC units § Water-to-air heat wheels § Variable frequency drives w/ HE motors on fans, pumps & kitchen hoods § Oversized cooling towers § CO 2 control for air handling units

Energy Opportunities (EO) § Designed to improve the energy efficiency of customers’ existing facilities via retrofit opportunities. § Retrofit: to voluntarily exchange or modify inefficient, functioning equipment with high-efficiency alternatives (for the sole purpose of saving $)

Energy Opportunities (EO) § Replace inefficient building systems § Lighting system replacements & controls § Heating & cooling system upgrades § Process system upgrades § Building control systems & repair § Incentives designed to pay up to 50% of the retrofit cost for qualified projects

Energy Opportunities (EO) For Lighting & non lighting system projects § We can pay up to 40% of the installed cost of the energyefficient system change. – Up to 40% for qualified LED / Induction lighting technologies – Interior or exterior applications § Lighting design must exceed Code by at least 15%. If not, use Express Lighting Rebate Application § We measure the installed cost and the energy savings relative to what currently exists § Agreement is prepared and signed prior to ordering equipment & materials

Comprehensive Initiative A Comprehensive project is defined by the following criteria: § Must have energy savings from at least two electric end uses and at least two measures – Gas measures within the project are not considered by the criteria § One end use must equal 85 percent or less of the project’s energy savings or peak summer demand reduction value (based on $0. 35 per annual k. Wh or $1000 per k. W). § The remaining end use(s) must equal 15 percent or more of the project’s energy savings or peak summer demand reduction value (based on $0. 35 per annual k. Wh or $1000 per k. W). * For more information, contact your UI Representative.

Comprehensive Incentives • Lesser of: – 50% installed cost (electric portion only) – Buy-down of project to 2–year payback based on customer electric metered savings – Energy savings caps based on the greater of $0. 35 /annual k. Wh or $1000/summer peak k. W combined § Additional comprehensive incentives for firm gas projects: – 10% added to all qualifying gas measures

Operations & Maintenance § Improve electrical & gas efficiency of equipment through changes/repairs § Not intended for normal preventive maintenance, repetitive procedures for a customer on a regular basis, or to subsidize major equipment purchases Typical Measures - EMS maintenance, i. e. , replacement of defective sensors, relays and actuators, reprogramming - Compressed air system improvements (repair of leaks) Incentives - Up to 40% of installed costs

Retro-Commissioning (RCx) § Provides technical, engineering & implementation support to optimize the operation of your facility with out installing capital equipment § Improve electrical and/or gas efficiency through changes or repairs Reset chiller discharge temperature § Reset pump and fan speeds; Demand ventilation Optimization of AHU supply fan static pressure Broaden humidity set points in data centers Boiler optimization Confirm sequence of operations for EMS equipment Facilities must be ≥ 100, 000 sq. ft. with Direct Digital Control system that can conduct trending & reporting - Incentives up to 100% for investigation fees (implementation required) - Incentives up to 40% for the implementation costs

PRIME (Process Reengineering for Increased Manufacturing Efficiency) § Increase productivity and reduces per-unit energy usage through Lean Manufacturing Techniques and the Kaizen process § Focuses on industrial manufacturing processes § Typical benefits – Reduces waste of material, time and transportation – Reduces inventory requirements § Using utility approved contractors, the first two events are provided at no cost to the customer. The customer shares 50% of the cost for up to two subsequent events

Business Sustainability Challenge § Utilizes a holistic approach to educating customers on the value of managing energy as a resource § Makes energy and carbon management an integral and sustainable part of your business § Provides businesses an opportunity to achieve long-term sustainability through: − energy management practices and investments − defined environmental/sustainable objectives − continuous improvement objectives

Small Business Energy Advantage (SBEA) § Retrofit program for C&I customers with ≤ 200 k. W average billing demand § Audits and installation provided by approved contractors § 0% financing for qualifying customers § Maximum loan amount - $100, 000 § On the Bill repayment available § Maximum Loan Term – UI - 48 months – CL&P - 36 months

SBEA § Typical measures include: – – – – Energy-efficient lighting, Lighting controls, Refrigeration equipment and controls, Compressed air systems, Variable speed drives, Energy management systems Programmable T-stats, etc. § Incentives up to 40% of installed costs for eligible measures § Eligible comprehensive projects can earn incentives up to 50% of the installed costs § Subject to utility caps

Loans & Financing § 2011 SBEA & Municipal Financing – 0% Interest free loan with On Bill Repayment – $100, 000 Maximum Loan (per qualified project) – Maximum Loan Terms • UI - 48 months; CL&P - 36 months – Customer size • up to 200 k. W – Requires good bill payment history with utility – Utilities provide the funding source

Loans & Financing § 2011 Small C&I Energy Efficiency Loan – – Third-party lender and loan approval Subsidized low interest loan - ~7% Maximum Term = 5 yrs Loans between $2, 000 and $250, 000 with interest subsidies on the first $100, 000 – Customer eligibility • in business for at least 3 years • average 12 month demand greater than 10 k. W up to 350 k. W – Projects not eligible • Projects utilizing SBEA or Municipal Financing • Any new construction/major renovation projects

Other Financing Opportunities Connecticut Hospital Association (CHA) § Helps Connecticut hospitals finance major energy-efficiency projects. – Contact - Bob Sandler – (203) 294 -7312 Department of Public Utility Control (DPUC) - offers loans to C&I customers for installing distributed generation equipment & energy efficiency projects that reduce system demand. § 3 rd Party - Bank of America § One percent below Customer’s applicable rate or no more than the prime rate § Minimum Loan Amount $1, 000 – Contact - Courtney Guzman (Bank of America) • (617) 434 -2888 • courtney. guzman@bankofamerica. com – Contact - Maureen Hoffman (DPUC) • (860) 827 -2811 • maureen. hoffman@po. state. ct. us • DPUC Web Information: http: //www. ct. gov/dpuc

Tax Incentives § Energy-efficient Commercial Buildings Tax Deduction (projects completed before Jan. 1, 2014) § Renewable-energy Tax Credits And Grants § Qualifying Advanced Energy Project Investment Tax Credit – More Info: • • • www. efficientbuildings. org www. energytaxincentives. org/business www. dsireusa. org www. irs. gov/irb/2006 -26_IRB/ar 11. html www. treas. gov/recovery

Tax Incentives Tax Deduction vs. Tax Credit § A deduction is a cost subtracted from the adjusted gross income when calculating the taxable income; tax liability is not reduced dollar for dollar like a tax credit, but in proportion to the tax payer’s tax bracket § Commercial Buildings Tax Deduction (all systems) capped at $1. 80 per sq ft § Commercial Buildings Tax Deduction (partial systems) capped at $. 60 per sq ft § Consult EPAct 2005 and IRS Notice 2006 -52 for qualifications Courtesy of www. efficientbuildings. org and www. lightingtaxdeduction. org/tax_deduction. html

Upcoming Training Events § § § March – Energy Basics April – LEED, An Overview May – Building Performance Modeling: Equest (Interactive) May – O&M Best Practices June – Commissioning June – Retro. Commissioning Check CL&P/UI Web Site Events Calendars For Updates/Registration

Summary § Energy Efficiency Fund offers significant monetary assistance for energy efficiency – UI offers funding, financing and technical assistance § CT is a national leader when it comes to implementing the Energy Efficiency programs § Maximize the “Double Dip” − CEEF $$$; Federal Tax $$$

How Do You Get Involved? § Pre-design / Design Phase § Become aware of utility incentive programs § Engage a utility representative throughout project § Sign a Standard Agreement prior to proceeding with the project

UI Contacts • UI Account Managers – Nick Cerjanec, Larry Mai, Tom Marella, Roger Parisi, John Albini, Barbara Pellicano, Gary Pattavina, Rick Valine, Chuck Winchell • Energy Engineers – Ken Bouchard, Mike Doucette, Mike Guarino, Dick Lombardo, Pat Reavy, John Sigona, Mike Stein • C&I Programs Roy W. Haller (203) 499 -2025 • Residential Programs Chris Ehlert (203) 499 -2965 • Natural Gas Programs Roy W. Haller (203) 499 -2025

Web Information CEEF/DPUC www. CTEnergy. Info. com CL&P www. cl-p. com UI www. uinet. com Yankee Gas www. yankeegas. com CNG www. cngcorp. com SCG www. soconngas. com CCEF www. ctcleanenergy. com

Questions? Pat Mc. Donnell Senior Director, Conservation & Load Management The United Illuminating Co. Office 203 -499 -2923 Pat. Mcdonnell@uinet. com

Financing Programs - CDA Ms. Cynthia Petruzzello Vice President Connecticut Development Authority

About CDA • CDA is a quasi-public authority that provides credit enhancements that enable and encourage companies across Connecticut to expand succeed and, in the process, drives economic growth • CDA’s mission is to provide debt financing and to help businesses grow in Connecticut • Self-sustaining – not part of the state’s budget • Through its network of partnerships with banks and other private-sector entities, CDA offers a wide variety of financial assistance programs www. ctcda. com

What We Do • Stimulate business investment and create jobs by providing financing that: – Creates economically vibrant urban communities – Enhances the state’s industrial and economic base – Redevelops environmentally contaminated properties – Encourages the expansion of cutting-edge industries – Increases employment – Increases the state and local tax revenues www. ctcda. com

How We Do It • Provide loans for all general business purposes • Comprehensive financing for companies undertaking major expansion in Connecticut • Incentives for municipalities and developers for remediation and redevelopment of Brownfields and for information technology projects www. ctcda. com

How We Do It • CDA is authorized to issue individual loans up to $10 million, with favorable interest rates and terms up to 20 years • The Small Business Loan Guarantee Program (URBANK) provides portfolio insurance to participating banks to assist them in making loans that are somewhat riskier than conventional loans • Tax Increment Financing (TIF) creates funding for projects that may otherwise be unaffordable to municipalities such as Brownfield and IT investments www. ctcda. com

Energy Initiatives • In partnership with the Connecticut Clean Energy Fund (CCEF), CDA has been qualified to participate as a risk sharing partner in the Department of Energy’s (DOE) Loan Guarantee Program • CDA provides loans or loan guarantees for energy efficiency projects • CDA finances clean energy projects and can bridge State and Federal grants • CDA administers the Qualified Energy Conservation Bond (QECB) ARRA program www. ctcda. com

DOE – Loan Guarantee Program • ARRA 2009 - Title XVII of Energy Policy Act provides broad authority for DOE to guarantee loans for energy projects • As Connecticut’s loan-guarantee issuing authority, CDA has been actively involved in the development of the public-private partnership model www. ctcda. com

Eligible Project Categories • Alternative Fuel Vehicles • Biomass • Efficient Electricity Transmission, Distribution and Storage • Energy Efficient Building Technologies and Applications • Geothermal • Hydrogen and Fuel Cell Technologies • Energy Efficiency Projects • Solar • Wind and Hydropower www. ctcda. com

Qualified Energy Conservation Bonds • Over $36 million in bonding allocation to Connecticut via ARRA to help lower the financing costs of green energy projects • QECBs are tax credit bonds designed to benefit private and public entities by providing a 70% interest subsidy • CDA administers the program and acts as conduit issuer of the allocations for private activity projects for applications www. ctcda. com

CDA Solutions that Deliver Value • CDA offers a think tank of financial solutions that can be customized to address specific customer borrowing needs • CDA provides timely implementation of financial analysis and loan approval • CDA resources and experience allow quick responses to changing economic conditions www. ctcda. com

In Closing • CDA is a stable, strong member of the state’s economic development team • CDA’s strength is as a committed lender and in providing simple, flexible and efficient financing programs • CDA’s resources and experience allow quick responses to changing economic conditions • CDA’s goal is to ensure that business growth, job creation and exports are not hindered by lack of financing www. ctcda. com

• 999 West Street • Rocky Hill, CT 06067 • Cynthia Petruzzello - (860) 258 -7833 • www. ctcda. com

Overview of Southern Conn. Gas Company Mr. William Reis Vice President Administrative Services, UIL Mr. Gregg Therrien Director, Regulatory and Pricing SCG/CNG

Southern Connecticut Gas New Haven Gas Light – 1847 Bridgeport Gas - 1849 Serve 177, 000 customers in 23 towns 2, 300 miles of main 315 employees Acquired by UIL Holdings in November 2010 Wholly owned Subsidiary

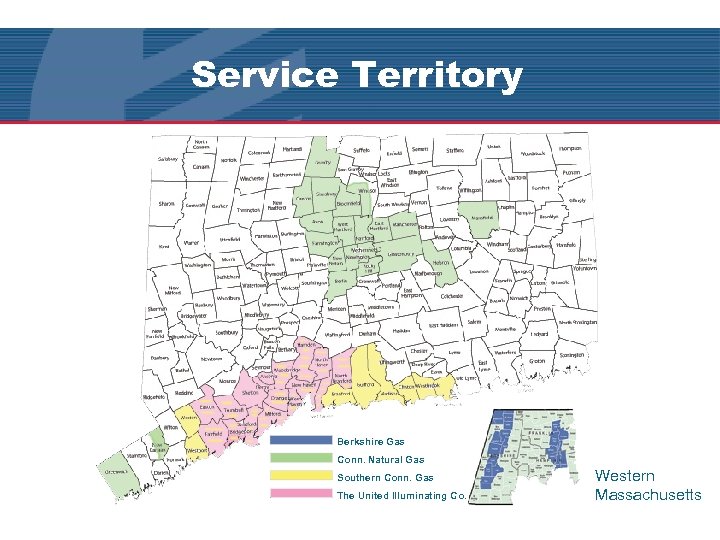

Service Territory Berkshire Gas Conn. Natural Gas Southern Conn. Gas The United Illuminating Co. Western Massachusetts

Orange Operations Center

Customer Relations Center. Bridgeport

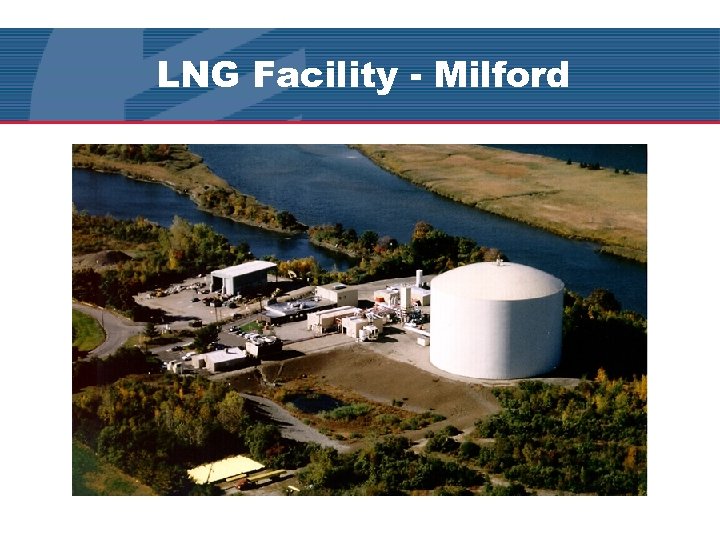

LNG Facility - Milford

Key Account Representatives Your primary contact at SCG Help find solutions to your most complex energy projects or assist with day to day activities They are well versed in the technologies for natural gas, such as distributed generation (DG), desiccant dehumidification, micro turbines, fuel cells, and natural gas vehicles Help you determine best rate or help get a supplier Assist customers with Natural Gas Conservation Programs

Key Account Representatives

SCG Rates Structure Gas Rates comprised of two major categories: • Delivery Rates • • Customer charge Daily demand Meter charge Demand charge Delivery per CCF charge • Supply Rates • PGA • Sales Services Charge (“SSC”) - OR - • 3 rd Party transportation charge (Gas Marketer) • Transportation Services Charge (“TSC”)

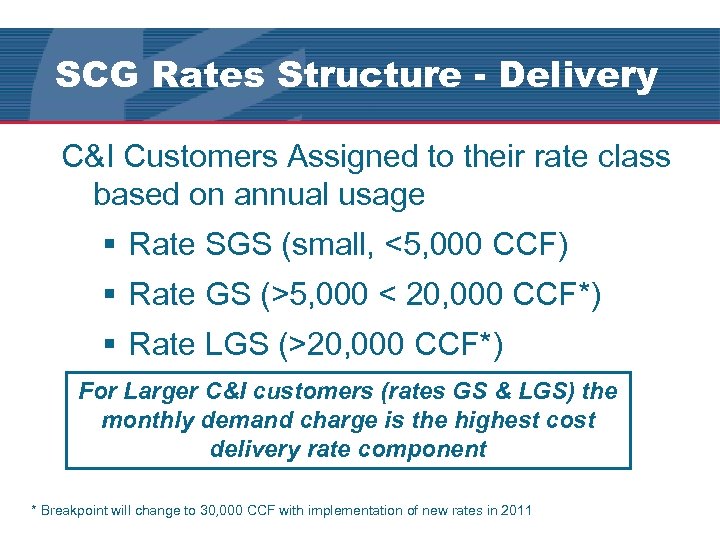

SCG Rates Structure - Delivery C&I Customers Assigned to their rate class based on annual usage § Rate SGS (small, <5, 000 CCF) § Rate GS (>5, 000 < 20, 000 CCF*) § Rate LGS (>20, 000 CCF*) For Larger C&I customers (rates GS & LGS) the monthly demand charge is the highest cost delivery rate component * Breakpoint will change to 30, 000 CCF with implementation of new rates in 2011

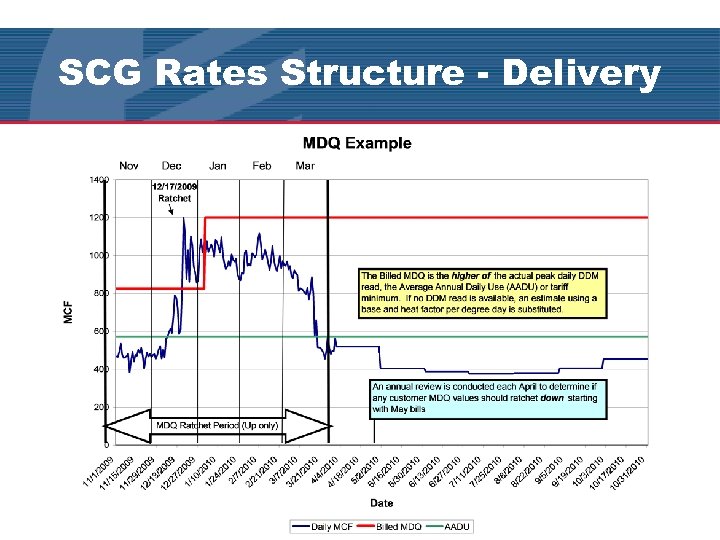

SCG Rates Structure - Delivery

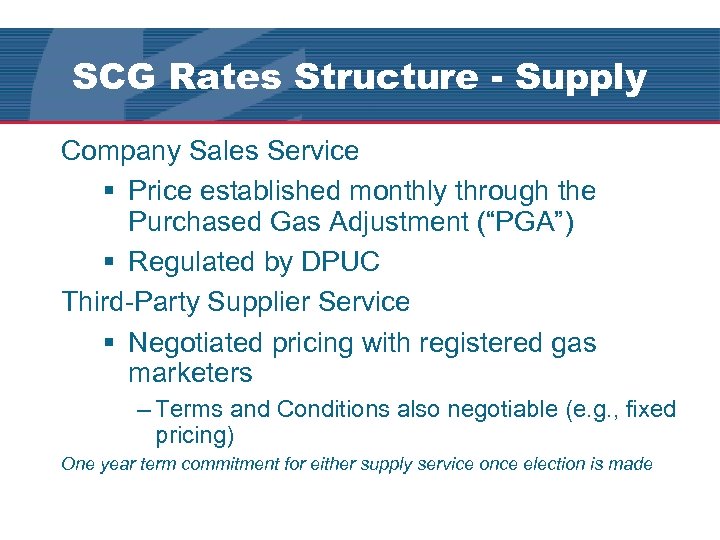

SCG Rates Structure - Supply Company Sales Service § Price established monthly through the Purchased Gas Adjustment (“PGA”) § Regulated by DPUC Third-Party Supplier Service § Negotiated pricing with registered gas marketers – Terms and Conditions also negotiable (e. g. , fixed pricing) One year term commitment for either supply service once election is made

Questions? John Dobos (203) 795 -7830 Mike Smalec (203) 795 -7748 Gregg Therrien (860) 727 -3184

Renewable Energy Efficiency Programs Mr. David Ljungquist Associate Director – Project Development Connecticut Clean Energy Fund

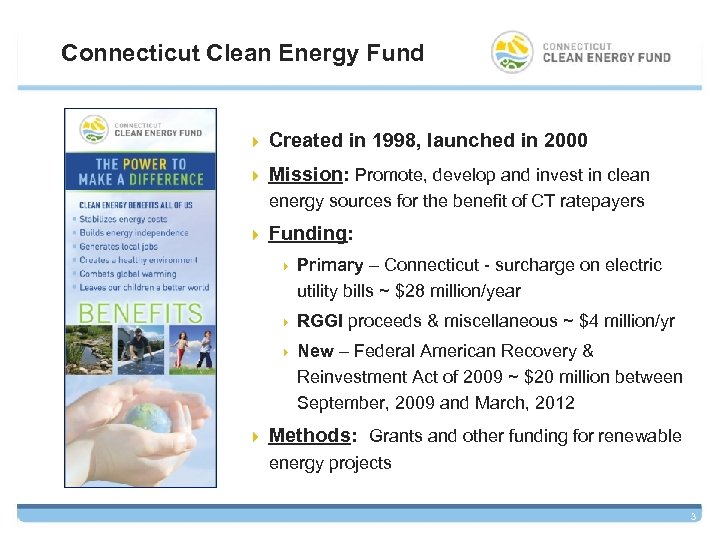

Connecticut Clean Energy Fund 4 Created in 1998, launched in 2000 4 Mission: Promote, develop and invest in clean energy sources for the benefit of CT ratepayers 4 Funding: 4 Primary – Connecticut - surcharge on electric utility bills ~ $28 million/year 4 RGGI proceeds & miscellaneous ~ $4 million/yr 4 New – Federal American Recovery & Reinvestment Act of 2009 ~ $20 million between September, 2009 and March, 2012 4 Methods: Grants and other funding for renewable energy projects 3

CCEF Goals 1. Create a supply of clean energy (installed capacity) 2. Foster the growth, development and commercialization of clean energy technologies Stimulate use of clean energy by increasing public awareness 3.

Clean Energy Technologies – On-site Solar PV and Solar Thermal Wind Geothermal Fuel Cells Click here for more information.

Clean Energy Technologies – Grid-Feed Biomass Wave/Tidal Landfill Gas Hydro

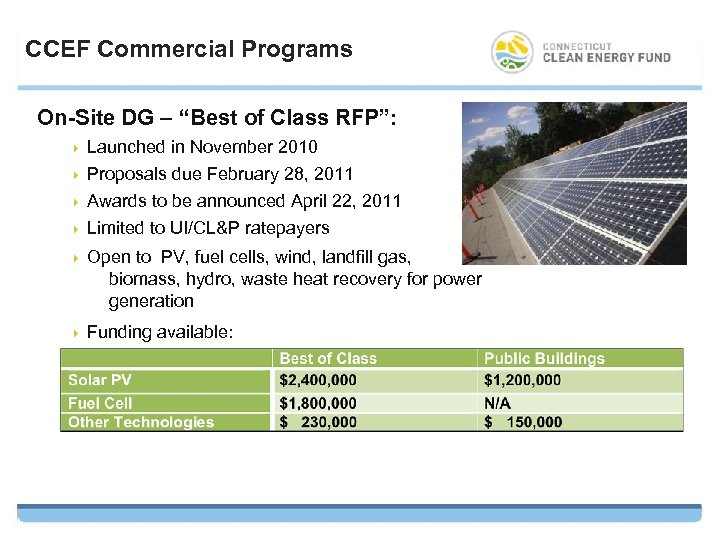

CCEF Commercial Programs On-Site DG – “Best of Class RFP”: 4 Launched in November 2010 Proposals due February 28, 2011 4 Awards to be announced April 22, 2011 4 Limited to UI/CL&P ratepayers 4 4 Open to PV, fuel cells, wind, landfill gas, biomass, hydro, waste heat recovery for power generation 4 Funding available:

CCEF Commercial Programs – Cont’d On-Site DG – “Best of Class RFP” (continued): 4 Competitive process, no guarantee of any grant 4 Maximum total incentive to any one owner is $4 million during any two-year period. 4 Building must meet current energy codes or energy audit recommended measures 4 Incentive paid as grant, in 3 stages:

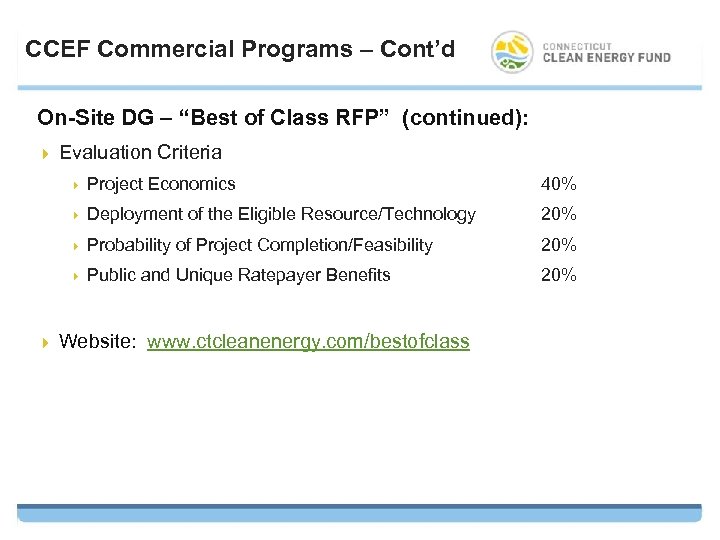

CCEF Commercial Programs – Cont’d On-Site DG – “Best of Class RFP” (continued): 4 Evaluation Criteria 4 Project Economics 40% 4 Deployment of the Eligible Resource/Technology 20% 4 Probability of Project Completion/Feasibility 20% 4 Public and Unique Ratepayer Benefits 20% 4 Website: www. ctcleanenergy. com/bestofclass

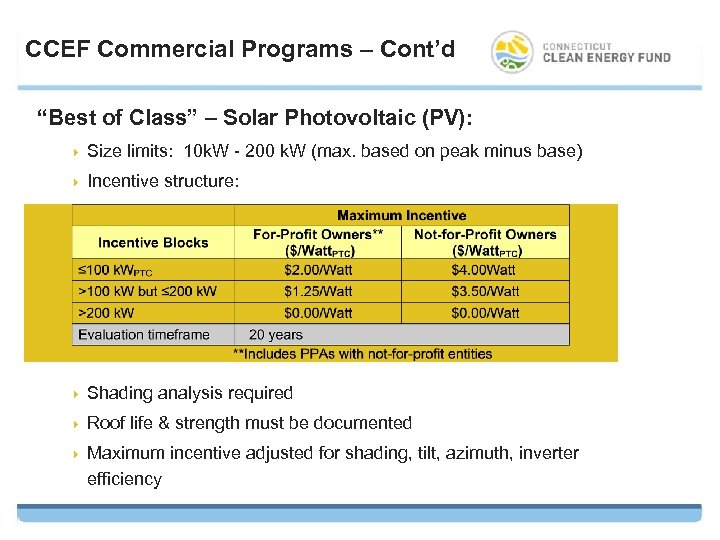

CCEF Commercial Programs – Cont’d “Best of Class” – Solar Photovoltaic (PV): 4 Size limits: 10 k. W - 200 k. W (max. based on peak minus base) 4 Incentive structure: 4 Shading analysis required 4 Roof life & strength must be documented 4 Maximum incentive adjusted for shading, tilt, azimuth, inverter efficiency

CCEF Commercial Programs – Cont’d “Best of Class” – Other Technologies: 4 Incented size limits (all other): None - must be appropriate to on-site load 4 Incentive limits: 4 Fuel cell projects need documentation of electric and thermal loads 4 Wind projects <100 k. W need computer wind analysis report, wind map of area. Projects >100 k. W need six months of on-site wind data 4 Hydro projects need water resource documentation, ability to meet LIHI certification standards

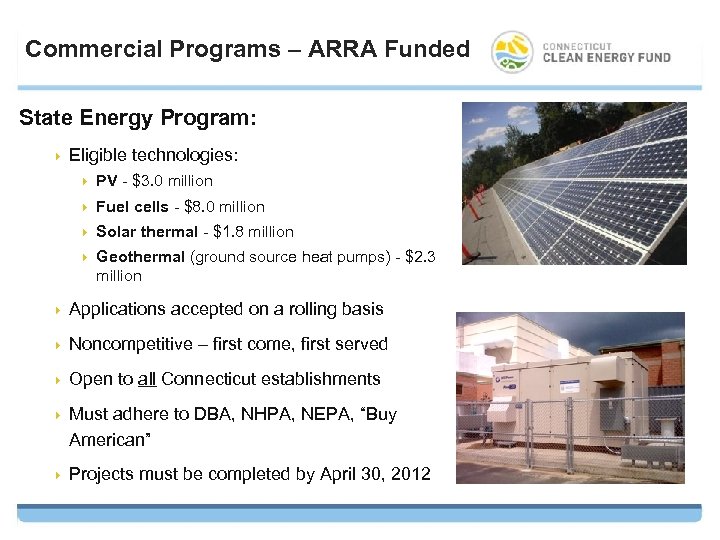

Commercial Programs – ARRA Funded State Energy Program: 4 Eligible technologies: 4 PV - $3. 0 million 4 Fuel cells - $8. 0 million 4 Solar thermal - $1. 8 million 4 Geothermal (ground source heat pumps) - $2. 3 million 4 Applications accepted on a rolling basis 4 Noncompetitive – first come, first served 4 Open to all Connecticut establishments 4 Must adhere to DBA, NHPA, NEPA, “Buy American” 4 Projects must be completed by April 30, 2012

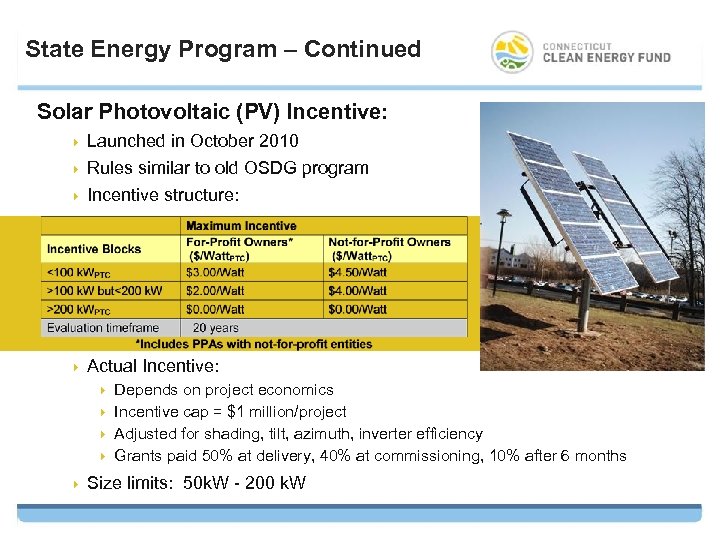

State Energy Program – Continued Solar Photovoltaic (PV) Incentive: 4 Launched in October 2010 Rules similar to old OSDG program 4 Incentive structure: 4 4 Actual Incentive: Depends on project economics 4 Incentive cap = $1 million/project 4 Adjusted for shading, tilt, azimuth, inverter efficiency 4 Grants paid 50% at delivery, 40% at commissioning, 10% after 6 months 4 4 Size limits: 50 k. W - 200 k. W

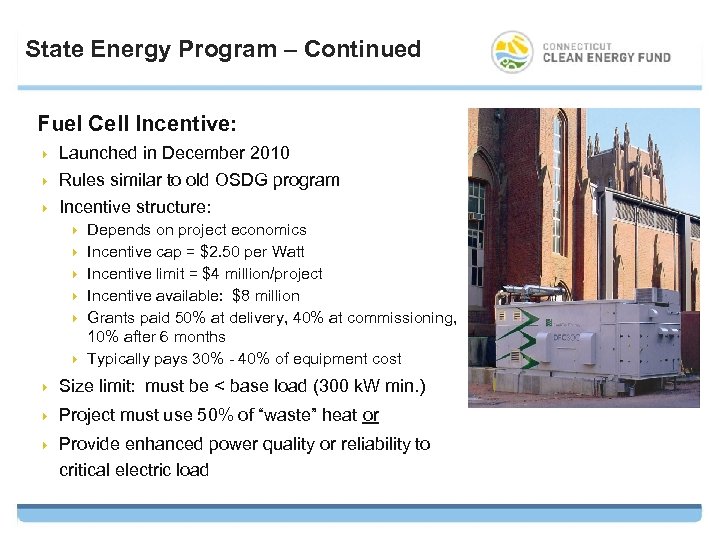

State Energy Program – Continued Fuel Cell Incentive: 4 Launched in December 2010 Rules similar to old OSDG program 4 Incentive structure: 4 4 4 4 Depends on project economics Incentive cap = $2. 50 per Watt Incentive limit = $4 million/project Incentive available: $8 million Grants paid 50% at delivery, 40% at commissioning, 10% after 6 months Typically pays 30% - 40% of equipment cost 4 Size limit: must be < base load (300 k. W min. ) 4 Project must use 50% of “waste” heat or 4 Provide enhanced power quality or reliability to critical electric load

State Energy Program – Continued Solar Thermal Rebate Program: 4 Launched October, 2009 4 Incentive structure: For-profit CI&I -- $450 per MMBtu of predicted annual output 4 Not-for-profit -- $550 per MMBtu of predicted annual output 4 Incentive available – $1. 8 M for C I & I projects ($1. 2 M left) 4 Typically covers 35 – 50% of cost for standard flat plate or evacuated tube systems 4 Incentive limits – $300, 000 or 75% of cost 4 Grant paid in full at project completion 4 4 Size based on DHW, process water needs 4 Space heating systems don’t qualify 104

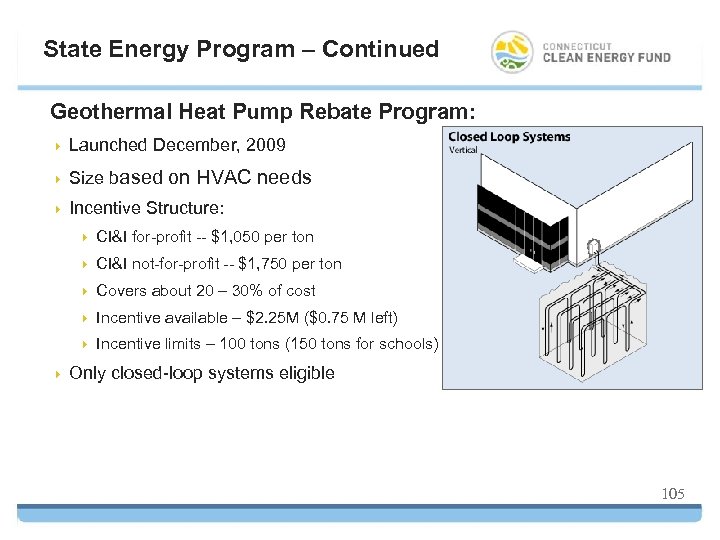

State Energy Program – Continued Geothermal Heat Pump Rebate Program: 4 Launched December, 2009 4 Size based on HVAC needs 4 Incentive Structure: 4 4 CI&I not-for-profit -- $1, 750 per ton 4 Covers about 20 – 30% of cost 4 Incentive available – $2. 25 M ($0. 75 M left) 4 4 CI&I for-profit -- $1, 050 per ton Incentive limits – 100 tons (150 tons for schools) Only closed-loop systems eligible 105

Federal Incentives For Energy Efficiency: 4 Energy-Efficient Commercial Buildings Tax Deduction 4 Residential Energy Efficiency Tax Credit For Renewable Energy Generation: 4 Business Energy Investment Tax Credit or Grant (30%) 4 30% for solar, fuel cells and small wind 4 10% for geothermal, microturbines and CHP 4 Renewable Electricity Production Tax Credit (PTC) 4 Residential Renewable Energy Tax Credit (30%) 4 MACRS + Bonus Depreciation (2008 -2012) 4 USDA - Rural Energy for America Program (REAP) Grants (25%) and Loans (<50%)

Where Do I Start? Best source for information about all renewable energy and energy efficiency incentives: http: //www. dsireusa. org/

Program Contacts Dave Ljungquist: 860 -257 -2352 Rick Ross: 860 -257 -2887 (fuel cells) Christin Cifaldi: 860 -257 -2891 (solar photovoltaic) Bill Colonis: 860 -257 -2888 (solar thermal, geothermal) Connecticut Clean Energy Fund 200 Corporate Place, 3 rd Floor Rocky Hill, CT 06067 http: //www. ctcleanenergy. com

Visit us online at ctcleanenergy. com

The Future of Energy: Building a Smart System Mr. Roddy Diotalevi Senior Director, UI

What is the Smart Grid? EPRI’s definition to NIST: § The term ‘Smart Grid’ refers to a modernization of the electricity delivery system so it monitors, protects, and automatically optimizes the operation of its interconnected elements – from the central and distributed generator through the high voltage network and distribution system, to industrial users and building automation systems, to energy storage installations and to end-use consumers and their thermostats, electric vehicles, appliances, and other household devices.

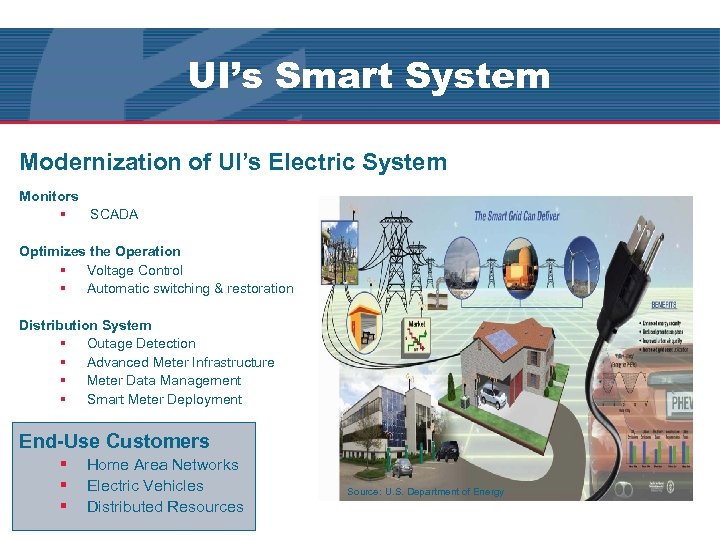

UI’s Smart System Modernization of UI’s Electric System Monitors § SCADA Optimizes the Operation § Voltage Control § Automatic switching & restoration Distribution System § Outage Detection § Advanced Meter Infrastructure § Meter Data Management § Smart Meter Deployment End-Use Customers § § § Home Area Networks Electric Vehicles Distributed Resources Source: U. S. Department of Energy

Smart System Value Centered around the Customer § Increase system reliability § Improve operational efficiency § Improve asset utilization § Integration of Distributed Resources and energy storage § Educate customers on energy consumption to help them better manage their usage 113

Network Meter Deployment SMART Meters § Deployment of 80, 000 meters began 2010 - 45, 000 installed to date § Two way communications to customer premise § Remote Meter Controls § Ability to leverage technical capabilities of AMI – System related • Voltage control and outage detection – Customer related • Zig. Bee enabled Home Area Network (HAN) 114

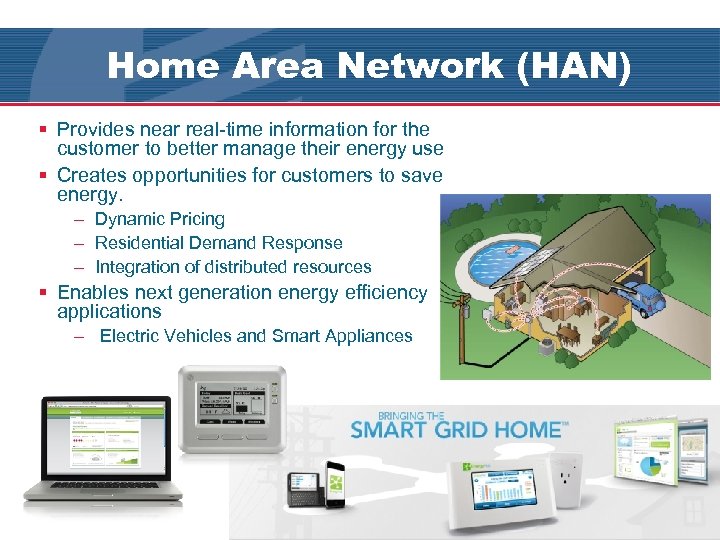

Home Area Network (HAN) § Provides near real-time information for the customer to better manage their energy use § Creates opportunities for customers to save energy. – Dynamic Pricing – Residential Demand Response – Integration of distributed resources § Enables next generation energy efficiency applications – Electric Vehicles and Smart Appliances

UI’s HAN Pilot Objective – Evaluate HAN system solutions including devices, software, and implementation process in order to determine costs, benefits, and potential program offerings to the customer § Initial pilot to include approximately 925 households § HAN devices - Tendril & Energy Hub – In-home display, programmable t-stats, controllable plugs, EVSEs § Research study with UC Davis – Assess customer engagement & savings § Explore potential programs during pilot – Demand Response – Dynamic Pricing – Integration of Behavioral component § Assess applicability to other customer segments – Business customers are often more sensitive to price – Open to innovative product and service offerings that boost profitability.

HAN Challenges § Customer engagement and education § Benefit / Cost of investment § Rapid evolution of technology § National standards for data privacy, cybersecurity and interoperability § Bandwidth availability of AMI § Hype vs. reality around smart grid programs

Electric Vehicles UI’s EV Goals EVs are coming to CT § Goal of 25, 000 electric cars statewide by 2020 § Electric Vehicle Infrastructure Council – Strategize on preparing CT for rapid & seamless integration of EVs into the market – (http: //www. ct. gov/ecd/lib/ecd/ev_final_recommendation_9. 1. 10. pdf) § Key Recommendations – Gain early access to EVs – Enact Legislation to incent EV adoption – Support build-out of EV charging infrastructure – Develop policies for rates, pricing, and charging options – Collaborate to develop regional corridor for public charging

Preparing for EV Arrival UI’s EV Pilot UI Activities § Provide leadership and educate customers on EV technology § Stay engaged with stakeholders – EVIC, REVI, EDTA, EPRI, EEI, etc. § Build-out of EV charging infrastructure – EVSE pilot for 10 - 12 charging stations underway § Explore residential charging options – First Volt has arrived – 95% of EV charging will occur at home § Assess impact to distribution system – Impacts are most severe on transformers and low voltage wires § Assess future opportunities, such as “Smart Charging” and “Vehicle-2 -Grid”

Questions

Thank you! Please complete the survey Have a great day and drive safely

7101494798b9ea8a8490df9bfff22aea.ppt