45ebab01fe1bda00067b6bec217af90c.ppt

- Количество слайдов: 19

A study into the benefits which storage facilities may provide to the UK gas transmission system Nick Wye Presentation to NTS Charging Methodology Forum 19 May 2014

Background • In November 2013 ACER published the Framework Guidelines on rules regarding harmonised EU transmission tariff structures for gas. • In December 2013 ENTSOG commenced work on drafting a corresponding Network Code. This will conclude end December 2014. • With regards to storage, ACER deliberately kept the Framework Guideline text ‘open’ to allow flexibility within Member States: “The Network Code on Tariffs shall specify that, in setting or approving tariffs for entry and exit points from and to gas storage facilities, NRAs shall consider the following aspects: – The benefits which storage facilities may provide to the transmission system – The need to promote efficient investments in networks NRAs shall also minimize any adverse effect on cross border flows. ” • ENTSOG preference is that decisions on tariffs for entry and exit points, from and to gas storage, should be made on the national level and thus the Code should avoid prescriptive detail. – Current ENTSOG thinking is to keep Code text close to that in ACER’s Framework Guidelines

The benefits which storage facilities may provide to the transmission system: the 2007 WWA analysis • In response to these developments, the Gas Storage Operators’ Group (GSOG) asked WWA to update its 2007 analysis which assessed the UK Gas Transmission System Benefits from Gas Storage. • Recap on the 2007 analysis: – tested the hypothesis that gas storage sites provide a benefit to the transmission system because on peak days they deliver to the system close to consumer demand, thereby reducing the need for pipe and compression capacity between alternative sources of gas and the demand offtakes. • The 2007 analysis performed consisted of following steps: – Evaluate the role which gas storage facilities play in GB gas supplies on a peak winter day for which the gas transmission system is designed – Identify the transmission investments which would be required to manage peak gas demands and flows if those storage facilities did not exist – Convert those investments into a transmission benefit of gas storage, which can be expressed as an annual cost saving and/or an NPV No attempt was made to assess any OPEX benefits, as the information required to carry out the analysis is only available to National Grid • The 2007 results concluded that gas storage facilities provided substantial benefits (in terms of the avoided transportation infrastructure) to GB and quantified that those benefits could be in the range of £ 24 m to over £ 200 m per annum with most concentration around £ 30 m to £ 40 m range.

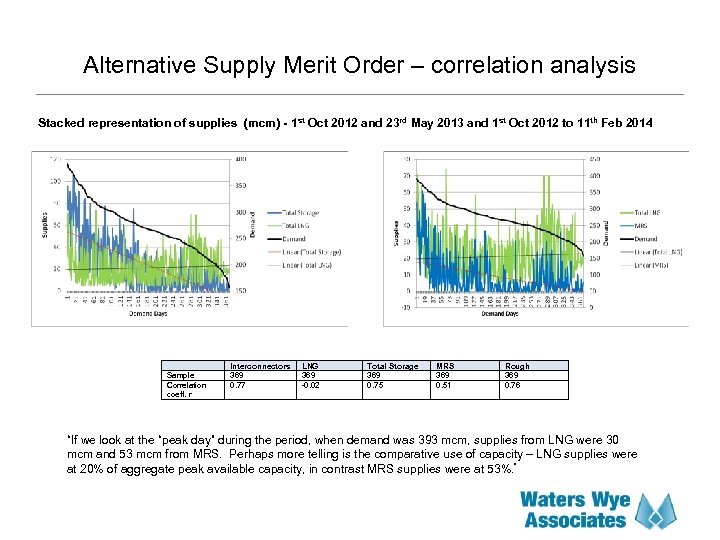

The benefits which storage facilities may provide to the transmission system: updated analysis • In order to re-evaluate the findings from the WWA 2007 storage benefits report, it was necessary to redefine the supply merit order employed by National Grid to underpin its Transportation Model (TM). – The current supply merit order has been changed since 2007. It assumes that no MRS supplies are required to meet 1 in 20 peak day gas demand which, in turn, forms the basis for the determination of the LRMCs used by National Grid to derive NTS TO related capacity charges. – WWA has carried out supply/demand correlation analysis based on historical flow patterns over the two most recent winter periods – The analysis shows • • • a positive correlation between MRS supplies and demand a negative correlation between LNG supplies and demand on the peak demand day MRS flows equated to 53% of available withdrawal capacity compared to a LNG equivalent measure of 20%. • WWA analysis coupled with the Winter Outlook “cold day” forecasts suggests that 50 mcm/d is a more realistic assumption for LNG supplies on a peak day, than the current 121 mcm/d which is allowed for in the supply stack. • This provides a robust justification for a re-examination of the supply merit order currently employed within the TM

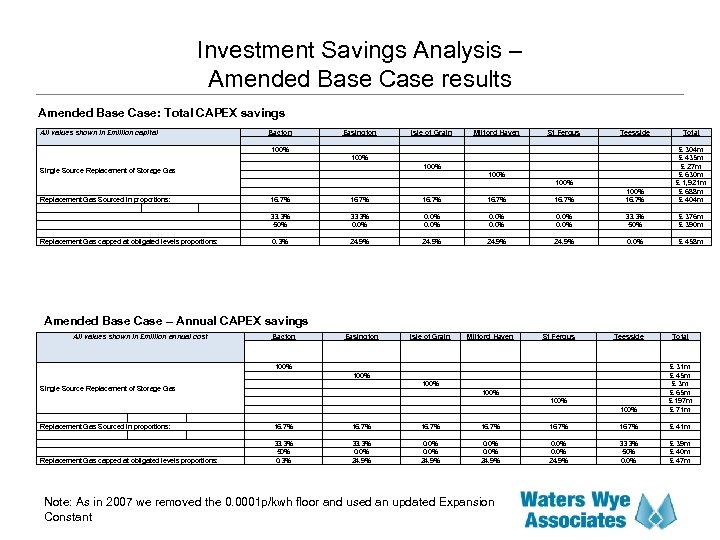

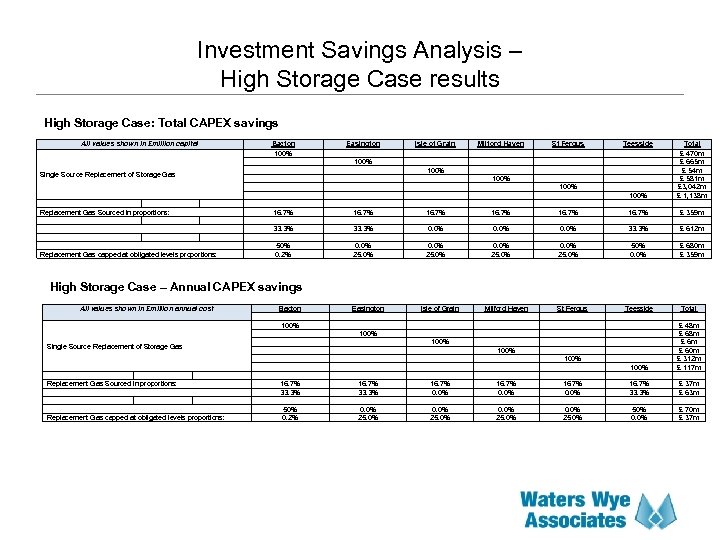

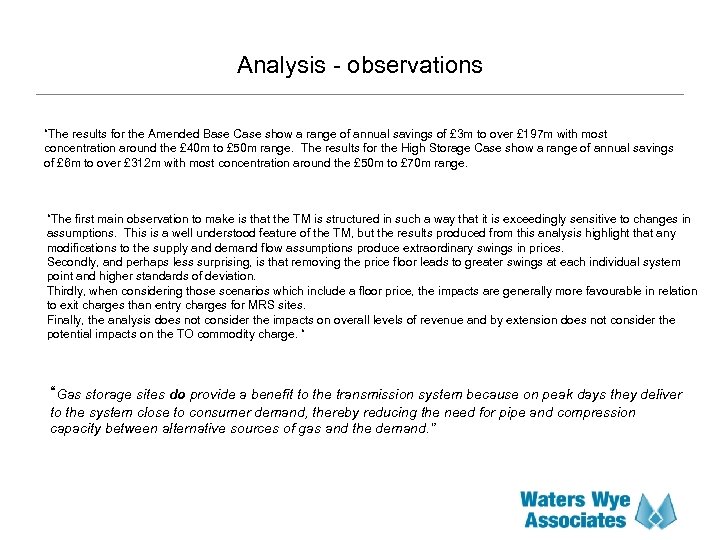

The benefits which storage facilities may provide to the transmission system: updated analysis • Two scenarios were used to test the NTS CAPEX benefits which could be ascribed to storage. – The first scenario, termed the Amended Base Case, translates the findings in the correlation analysis into relative peak day demand supply contributions, with LNG supplying 551. 5 GWh and MRS supplying 783. 2 GWh. – The second scenario termed the High Storage Case provides a more extreme scenario, with peak day LNG supplies set to zero (placed below MRS in the merit order) and MRS supplies at 1334. 7 GWh • Ten different alternate supply scenarios were used to evaluate the impact of ‘no storage’ and thus identify CAPEX benefits for each of the Cases. – The results for the Amended Base Case show a range of annual savings of £ 3 m to over £ 197 m with most concentration around the £ 40 m to £ 65 m range. – The results for the High Storage Case show a range of annual savings of £ 6 m to over £ 312 m with most concentration around the £ 50 m to £ 70 m range.

The benefits which storage facilities may provide to the transmission system: conclusions and recommendations • EU Tariffs Framework Guideline makes special provision for the treatment for storage • Gas storage sites do provide a benefit to the GB transmission system because on peak days they deliver to the system close to consumer demand, thereby reducing the need for pipe and compression capacity between alternative sources of gas and the demand” • In summary, WWA’s recommendations are as follows: – i) Consider proposing changes to the Transportation Model supply merit order; – ii) Consider introducing “bespoke” charging arrangements for storage related transmission charges. Options include: • • • potential for negative capacity charges (as in electricity transmission) or simply removing all transmission charges currently applied at storage; application of ex-ante credits for storage flows akin to those applied at DN entry points; potential for the application of a “corrective” ex post credit to storage users delivering gas on peak days (e. g. using a mechanism akin to electricity transmission ‘triad’).

The benefits which storage facilities may provide to the transmission system: Back-up slides

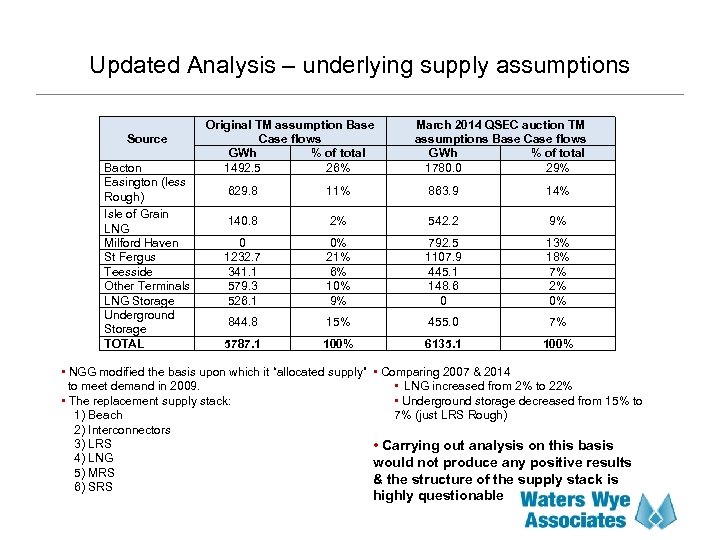

Updated Analysis – underlying supply assumptions Source Bacton Easington (less Rough) Isle of Grain LNG Milford Haven St Fergus Teesside Other Terminals LNG Storage Underground Storage TOTAL Original TM assumption Base Case flows GWh % of total 1492. 5 26% March 2014 QSEC auction TM assumptions Base Case flows GWh % of total 1780. 0 29% 629. 8 11% 863. 9 14% 140. 8 2% 542. 2 9% 0 1232. 7 341. 1 579. 3 526. 1 0% 21% 6% 10% 9% 792. 5 1107. 9 445. 1 148. 6 0 13% 18% 7% 2% 0% 844. 8 15% 455. 0 7% 5787. 1 100% 6135. 1 100% • NGG modified the basis upon which it “allocated supply” to meet demand in 2009. • The replacement supply stack: 1) Beach 2) Interconnectors 3) LRS 4) LNG 5) MRS 6) SRS • Comparing 2007 & 2014 • LNG increased from 2% to 22% • Underground storage decreased from 15% to 7% (just LRS Rough) • Carrying out analysis on this basis would not produce any positive results & the structure of the supply stack is highly questionable

Alternative Supply Merit Order – correlation analysis Stacked representation of supplies (mcm) - 1 st Oct 2012 and 23 rd May 2013 and 1 st Oct 2012 to 11 th Feb 2014 Sample Correlation coeff. r Interconnectors 369 0. 77 LNG 369 -0. 02 Total Storage 369 0. 75 MRS 369 0. 51 Rough 369 0. 76 “If we look at the “peak day” during the period, when demand was 393 mcm, supplies from LNG were 30 mcm and 53 mcm from MRS. Perhaps more telling is the comparative use of capacity – LNG supplies were at 20% of aggregate peak available capacity, in contrast MRS supplies were at 53%. ”

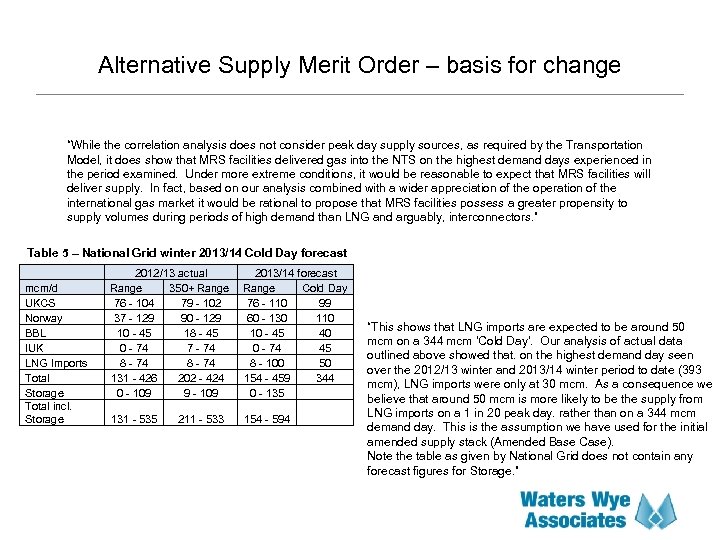

Alternative Supply Merit Order – basis for change “While the correlation analysis does not consider peak day supply sources, as required by the Transportation Model, it does show that MRS facilities delivered gas into the NTS on the highest demand days experienced in the period examined. Under more extreme conditions, it would be reasonable to expect that MRS facilities will deliver supply. In fact, based on our analysis combined with a wider appreciation of the operation of the international gas market it would be rational to propose that MRS facilities possess a greater propensity to supply volumes during periods of high demand than LNG and arguably, interconnectors. ” Table 5 – National Grid winter 2013/14 Cold Day forecast mcm/d UKCS Norway BBL IUK LNG Imports Total Storage Total incl. Storage 2012/13 actual Range 350+ Range 76 - 104 79 - 102 37 - 129 90 - 129 10 - 45 18 - 45 0 - 74 7 - 74 8 - 74 131 - 426 202 - 424 0 - 109 9 - 109 2013/14 forecast Range Cold Day 76 - 110 99 60 - 130 110 10 - 45 40 0 - 74 45 8 - 100 50 154 - 459 344 0 - 135 131 - 535 154 - 594 211 - 533 “This shows that LNG imports are expected to be around 50 mcm on a 344 mcm ‘Cold Day’. Our analysis of actual data outlined above showed that. on the highest demand day seen over the 2012/13 winter and 2013/14 winter period to date (393 mcm), LNG imports were only at 30 mcm. As a consequence we believe that around 50 mcm is more likely to be the supply from LNG imports on a 1 in 20 peak day. rather than on a 344 mcm demand day. This is the assumption we have used for the initial amended supply stack (Amended Base Case). Note the table as given by National Grid does not contain any forecast figures for Storage. ”

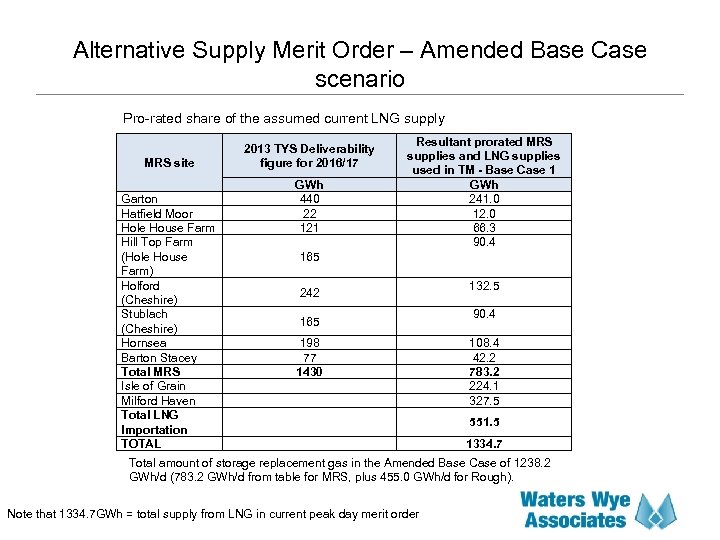

Alternative Supply Merit Order – Amended Base Case scenario Pro-rated share of the assumed current LNG supply MRS site Garton Hatfield Moor Hole House Farm Hill Top Farm (Hole House Farm) Holford (Cheshire) Stublach (Cheshire) Hornsea Barton Stacey Total MRS Isle of Grain Milford Haven Total LNG Importation TOTAL 2013 TYS Deliverability figure for 2016/17 GWh 440 22 121 Resultant prorated MRS supplies and LNG supplies used in TM - Base Case 1 GWh 241. 0 12. 0 66. 3 90. 4 165 242 165 198 77 1430 132. 5 90. 4 108. 4 42. 2 783. 2 224. 1 327. 5 551. 5 1334. 7 Total amount of storage replacement gas in the Amended Base Case of 1238. 2 GWh/d (783. 2 GWh/d from table for MRS, plus 455. 0 GWh/d for Rough). Note that 1334. 7 GWh = total supply from LNG in current peak day merit order

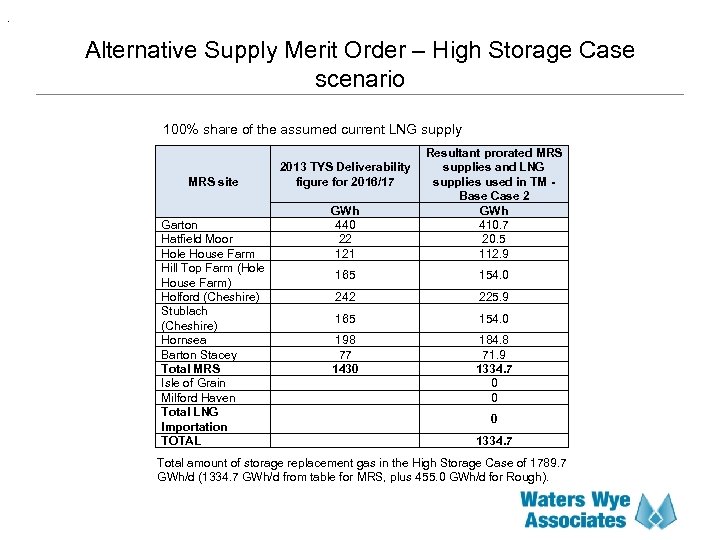

. Alternative Supply Merit Order – High Storage Case scenario 100% share of the assumed current LNG supply MRS site Garton Hatfield Moor Hole House Farm Hill Top Farm (Hole House Farm) Holford (Cheshire) Stublach (Cheshire) Hornsea Barton Stacey Total MRS Isle of Grain Milford Haven Total LNG Importation TOTAL GWh 440 22 121 Resultant prorated MRS supplies and LNG supplies used in TM Base Case 2 GWh 410. 7 20. 5 112. 9 165 154. 0 242 225. 9 165 154. 0 198 77 1430 184. 8 71. 9 1334. 7 0 0 2013 TYS Deliverability figure for 2016/17 0 1334. 7 Total amount of storage replacement gas in the High Storage Case of 1789. 7 GWh/d (1334. 7 GWh/d from table for MRS, plus 455. 0 GWh/d for Rough).

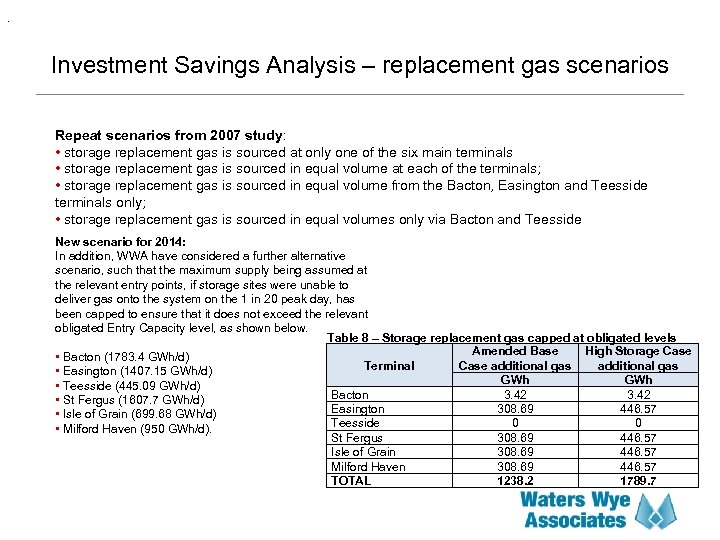

. Investment Savings Analysis – replacement gas scenarios Repeat scenarios from 2007 study: • storage replacement gas is sourced at only one of the six main terminals • storage replacement gas is sourced in equal volume at each of the terminals; • storage replacement gas is sourced in equal volume from the Bacton, Easington and Teesside terminals only; • storage replacement gas is sourced in equal volumes only via Bacton and Teesside New scenario for 2014: In addition, WWA have considered a further alternative scenario, such that the maximum supply being assumed at the relevant entry points, if storage sites were unable to deliver gas onto the system on the 1 in 20 peak day, has been capped to ensure that it does not exceed the relevant obligated Entry Capacity level, as shown below. Table 8 – Storage replacement gas capped at obligated levels Amended Base High Storage Case • Bacton (1783. 4 GWh/d) Terminal Case additional gas • Easington (1407. 15 GWh/d) GWh • Teesside (445. 09 GWh/d) Bacton 3. 42 • St Fergus (1607. 7 GWh/d) Easington 308. 69 446. 57 • Isle of Grain (699. 68 GWh/d) Teesside 0 0 • Milford Haven (950 GWh/d). St Fergus 308. 69 446. 57 Isle of Grain 308. 69 446. 57 Milford Haven 308. 69 446. 57 TOTAL 1238. 2 1789. 7

Investment Savings Analysis – Amended Base Case results Amended Base Case: Total CAPEX savings All values shown in £million capital Bacton Easington Isle of Grain Milford Haven St Fergus Teesside Total 100% 16. 7% 100% 16. 7% £ 304 m £ 435 m £ 27 m £ 630 m £ 1, 921 m £ 688 m £ 404 m 33. 3% 50% 33. 3% 0. 0% 0. 0% 33. 3% 50% £ 376 m £ 390 m 0. 3% 24. 9% 0. 0% £ 458 m Easington Isle of Grain St Fergus Teesside Total 100% £ 31 m £ 45 m £ 3 m £ 65 m £ 197 m £ 71 m 100% Single Source Replacement of Storage Gas 100% Replacement Gas Sourced in proportions: Replacement Gas capped at obligated levels proportions: Amended Base Case – Annual CAPEX savings All values shown in £million annual cost Bacton Milford Haven 100% Single Source Replacement of Storage Gas 100% Replacement Gas Sourced in proportions: 16. 7% £ 41 m Replacement Gas capped at obligated levels proportions: 33. 3% 50% 0. 3% 33. 3% 0. 0% 24. 9% 0. 0% 24. 9% 33. 3% 50% 0. 0% £ 39 m £ 40 m £ 47 m Note: As in 2007 we removed the 0. 0001 p/kwh floor and used an updated Expansion Constant

Investment Savings Analysis – High Storage Case results High Storage Case: Total CAPEX savings All values shown in £million capital Bacton 100% Easington Isle of Grain Milford Haven St Fergus Teesside 100% Total £ 470 m £ 665 m £ 54 m £ 581 m £ 3, 042 m £ 1, 138 m 100% Single Source Replacement of Storage Gas 100% Replacement Gas Sourced in proportions: 16. 7% £ 359 m 33. 3% Replacement Gas capped at obligated levels proportions: 16. 7% 33. 3% 0. 0% 33. 3% £ 612 m 50% 0. 2% 0. 0% 25. 0% 50% 0. 0% £ 680 m £ 359 m High Storage Case – Annual CAPEX savings All values shown in £million annual cost Bacton Easington Isle of Grain Milford Haven St Fergus Teesside Total 100% £ 48 m £ 6 m £ 60 m £ 312 m £ 117 m 100% Single Source Replacement of Storage Gas 100% Replacement Gas Sourced in proportions: Replacement Gas capped at obligated levels proportions: 16. 7% 33. 3% 16. 7% 0. 0% 16. 7% 33. 3% £ 37 m £ 63 m 50% 0. 2% 0. 0% 25. 0% 50% 0. 0% £ 70 m £ 37 m

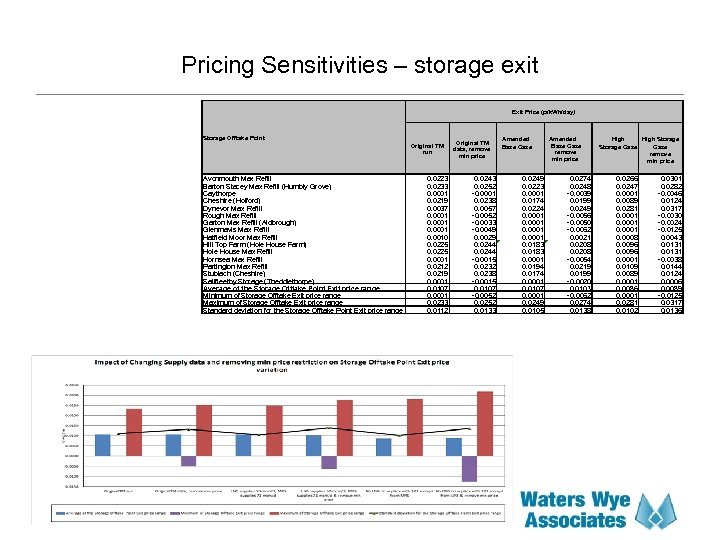

Pricing Sensitivities – storage exit Exit Price (p/k. Wh/day) Storage Offtake Point Original TM run Avonmouth Max Refill Barton Stacey Max Refill (Humbly Grove) Caythorpe Cheshire (Holford) Dynevor Max Refill Rough Max Refill Garton Max Refill (Aldbrough) Glenmavis Max Refill Hatfield Moor Max Refill Hill Top Farm (Hole House Farm) Hole House Max Refill Hornsea Max Refill Partington Max Refill Stublach (Cheshire) Saltfleetby Storage (Theddlethorpe) Average of the Storage Offtake Point Exit price range Minimum of Storage Offtake Exit price range Maximum of Storage Offtake Exit price range Standard deviation for the Storage Offtake Point Exit price range 0. 0223 0. 0233 0. 0001 0. 0219 0. 0037 0. 0001 0. 0010 0. 0225 0. 0001 0. 0212 0. 0219 0. 0001 0. 0107 0. 0001 0. 0233 0. 0112 Original TM data, remove min price 0. 0243 0. 0252 -0. 0001 0. 0238 0. 0057 -0. 0052 -0. 0033 -0. 0049 0. 0029 0. 0244 -0. 0015 0. 0232 0. 0238 -0. 0015 0. 0107 -0. 0052 0. 0252 0. 0133 Amended Base Case 0. 0249 0. 0223 0. 0001 0. 0174 0. 0224 0. 0001 0. 0183 0. 0001 0. 0194 0. 0174 0. 0001 0. 0107 0. 0001 0. 0249 0. 0105 Amended Base Case remove min price 0. 0274 0. 0248 -0. 0039 0. 0199 0. 0249 -0. 0056 -0. 0050 -0. 0062 0. 0021 0. 0208 -0. 0054 0. 0219 0. 0199 -0. 0020 0. 0103 -0. 0062 0. 0274 0. 0138 High Storage Case remove min price 0. 0266 0. 0247 0. 0001 0. 0089 0. 0281 0. 0001 0. 0008 0. 0096 0. 0001 0. 0109 0. 0089 0. 0001 0. 0086 0. 0001 0. 0281 0. 0102 0. 0301 0. 0282 -0. 0046 0. 0124 0. 0317 -0. 0030 -0. 0024 -0. 0125 0. 0043 0. 0131 -0. 0038 0. 0144 0. 0124 0. 0006 0. 0089 -0. 0125 0. 0317 0. 0136

Analysis - observations “The results for the Amended Base Case show a range of annual savings of £ 3 m to over £ 197 m with most concentration around the £ 40 m to £ 50 m range. The results for the High Storage Case show a range of annual savings of £ 6 m to over £ 312 m with most concentration around the £ 50 m to £ 70 m range. “The first main observation to make is that the TM is structured in such a way that it is exceedingly sensitive to changes in assumptions. This is a well understood feature of the TM, but the results produced from this analysis highlight that any modifications to the supply and demand flow assumptions produce extraordinary swings in prices. Secondly, and perhaps less surprising, is that removing the price floor leads to greater swings at each individual system point and higher standards of deviation. Thirdly, when considering those scenarios which include a floor price, the impacts are generally more favourable in relation to exit charges than entry charges for MRS sites. Finally, the analysis does not consider the impacts on overall levels of revenue and by extension does not consider the potential impacts on the TO commodity charge. “ “Gas storage sites do provide a benefit to the transmission system because on peak days they deliver to the system close to consumer demand, thereby reducing the need for pipe and compression capacity between alternative sources of gas and the demand. ”

Alternative Charging Methodologies GB Power Transmission “In the case of the GB electricity there are reasonable analogies to be made if one views gas deliveries into the system as ‘negative demand’ - this is conceptually similar to triad avoidance in electricity (consider the analogous behaviour of embedded generators in electricity). For example an annual capacity charge payment could be made to users based on the average delivery made at a relevant entry point during the year 1 April to 31 March on days: • where overall system demand is greater than 85% of the 1 in 20 peak demand; or • where a) does not apply in a given year, the highest three demand days between (say) November and February “ Gas Distribution Networks “The gas DN entry capacity arrangements are less clear-cut, however, they do permit the application of negative charges based on the premise that the connected entry points provide benefits to the local network. The charge/credit is applied in the form of a commodity charge even though the formula employed to calculate the rate includes elements which are essentially capacity related i. e. the ECN credit and the LDZ credit. This approach to charging for capacity-related elements could be considered in relation to charges applied at storage”

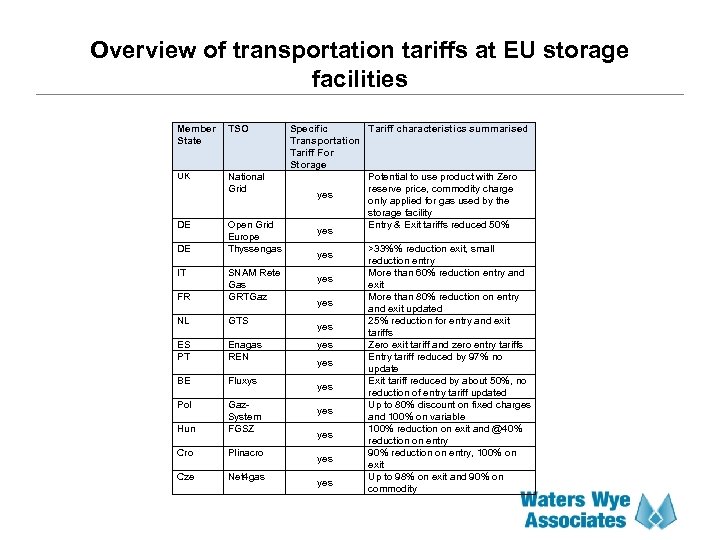

Overview of transportation tariffs at EU storage facilities Member State TSO UK National Grid DE Open Grid Europe Thyssengas DE IT FR SNAM Rete Gas GRTGaz NL GTS ES PT Enagas REN BE Fluxys Pol Hun Gaz. System FGSZ Cro Plinacro Cze Net 4 gas Specific Tariff characteristics summarised Transportation Tariff For Storage Potential to use product with Zero reserve price, commodity charge yes only applied for gas used by the storage facility Entry & Exit tariffs reduced 50% yes yes yes >33%% reduction exit, small reduction entry More than 60% reduction entry and exit More than 80% reduction on entry and exit updated 25% reduction for entry and exit tariffs Zero exit tariff and zero entry tariffs Entry tariff reduced by 97% no update Exit tariff reduced by about 50%, no reduction of entry tariff updated Up to 80% discount on fixed charges and 100% on variable 100% reduction on exit and @40% reduction on entry 90% reduction on entry, 100% on exit Up to 98% on exit and 90% on commodity

45ebab01fe1bda00067b6bec217af90c.ppt