e69a96dac3f2dec2bb1e6a13bf863d8e.ppt

- Количество слайдов: 25

A Strong Performance in a Tough Economy. Annual Meeting May 12, 2010

A Strong Performance in a Tough Economy. Annual Meeting May 12, 2010

‘ 09 2009 HIGHLIGHTS • EPS Q 1&2 ($0. 02); EPS Q 3&4 $0. 28 • EBITDA $16. 3 Million • Record Sales of Defense Products • Substantially strengthened balance sheet Ø Elimination of operating debt – strong working capital • Increase in second half dividends of 60% • Share buy-back

‘ 09 2009 HIGHLIGHTS • EPS Q 1&2 ($0. 02); EPS Q 3&4 $0. 28 • EBITDA $16. 3 Million • Record Sales of Defense Products • Substantially strengthened balance sheet Ø Elimination of operating debt – strong working capital • Increase in second half dividends of 60% • Share buy-back

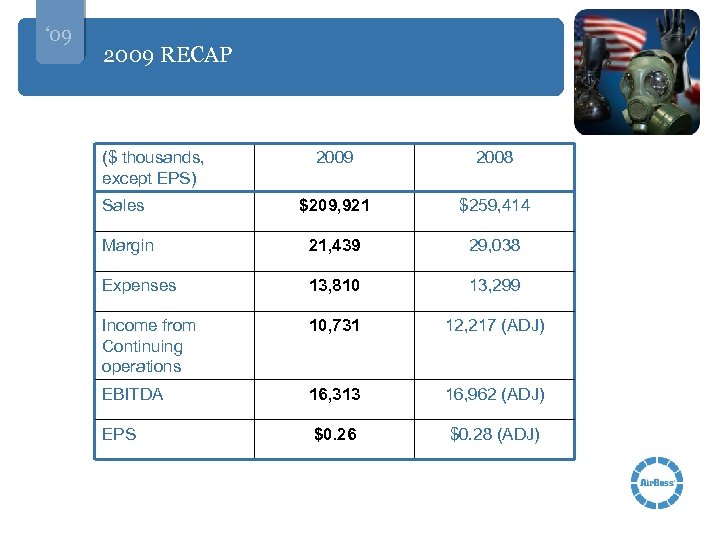

‘ 09 2009 RECAP ($ thousands, except EPS) 2009 2008 Sales $209, 921 $259, 414 Margin 21, 439 29, 038 Expenses 13, 810 13, 299 Income from Continuing operations 10, 731 12, 217 (ADJ) EBITDA 16, 313 16, 962 (ADJ) EPS $0. 26 $0. 28 (ADJ)

‘ 09 2009 RECAP ($ thousands, except EPS) 2009 2008 Sales $209, 921 $259, 414 Margin 21, 439 29, 038 Expenses 13, 810 13, 299 Income from Continuing operations 10, 731 12, 217 (ADJ) EBITDA 16, 313 16, 962 (ADJ) EPS $0. 26 $0. 28 (ADJ)

First Quarter 2010 Results

First Quarter 2010 Results

‘ 10 Q 1 2010 RESULTS ($ thousands, except EPS) 2010 2009 Sales $53, 885 $53, 085 Margin 7, 918 4, 981 Expenses 3, 036 3, 326 Income from operations 4, 777 660 EBITDA 6, 344 2, 291 EPS $0. 13 $0. 02

‘ 10 Q 1 2010 RESULTS ($ thousands, except EPS) 2010 2009 Sales $53, 885 $53, 085 Margin 7, 918 4, 981 Expenses 3, 036 3, 326 Income from operations 4, 777 660 EBITDA 6, 344 2, 291 EPS $0. 13 $0. 02

‘ 10 FIRST QUARTER 2010 • Sales increase of 1. 2 % Ø • 59% increase in total Gross Margin Ø • Volume Increases of 20% and more but offset by declining US dollar Due to product mix and no raw material write-downs EBITDA increase 171%

‘ 10 FIRST QUARTER 2010 • Sales increase of 1. 2 % Ø • 59% increase in total Gross Margin Ø • Volume Increases of 20% and more but offset by declining US dollar Due to product mix and no raw material write-downs EBITDA increase 171%

‘ 10 FIRST QUARTER OTHER HIGHLIGHTS Air. Boss-Defense § § Start-up of injection moulding factory in Vermont on-time, on-budget Continued strong glove and over-boot sales Rubber Compounding § § Innovative joint raw material purchasing/hedging Volume increases across all sectors

‘ 10 FIRST QUARTER OTHER HIGHLIGHTS Air. Boss-Defense § § Start-up of injection moulding factory in Vermont on-time, on-budget Continued strong glove and over-boot sales Rubber Compounding § § Innovative joint raw material purchasing/hedging Volume increases across all sectors

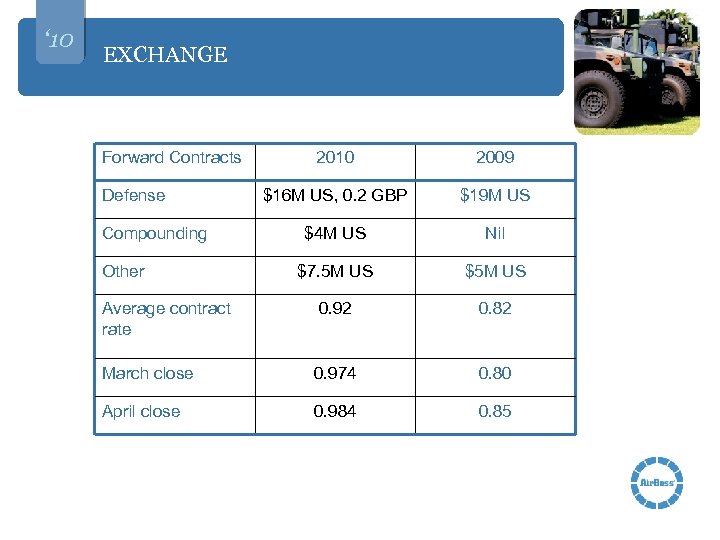

‘ 10 EXCHANGE Forward Contracts 2010 2009 $16 M US, 0. 2 GBP $19 M US $4 M US Nil $7. 5 M US $5 M US Average contract rate 0. 92 0. 82 March close 0. 974 0. 80 April close 0. 984 0. 85 Defense Compounding Other

‘ 10 EXCHANGE Forward Contracts 2010 2009 $16 M US, 0. 2 GBP $19 M US $4 M US Nil $7. 5 M US $5 M US Average contract rate 0. 92 0. 82 March close 0. 974 0. 80 April close 0. 984 0. 85 Defense Compounding Other

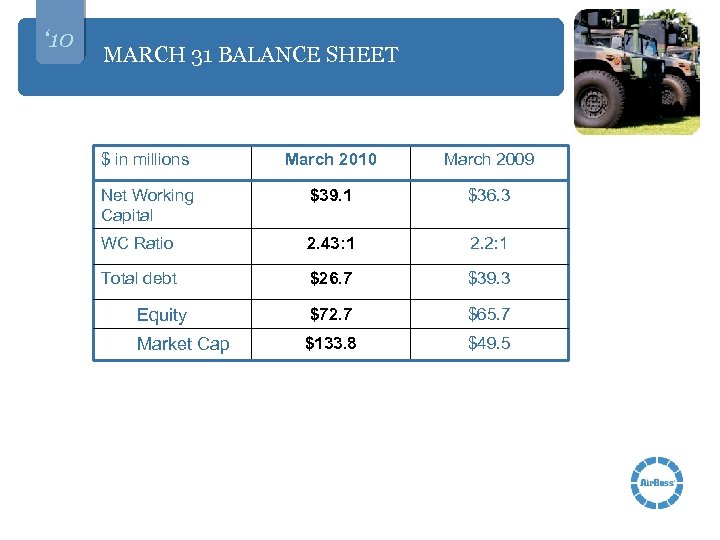

‘ 10 MARCH 31 BALANCE SHEET $ in millions March 2010 March 2009 Net Working Capital $39. 1 $36. 3 WC Ratio 2. 43: 1 2. 2: 1 Total debt $26. 7 $39. 3 Equity $72. 7 $65. 7 Market Cap $133. 8 $49. 5

‘ 10 MARCH 31 BALANCE SHEET $ in millions March 2010 March 2009 Net Working Capital $39. 1 $36. 3 WC Ratio 2. 43: 1 2. 2: 1 Total debt $26. 7 $39. 3 Equity $72. 7 $65. 7 Market Cap $133. 8 $49. 5

Rubber Compounding

Rubber Compounding

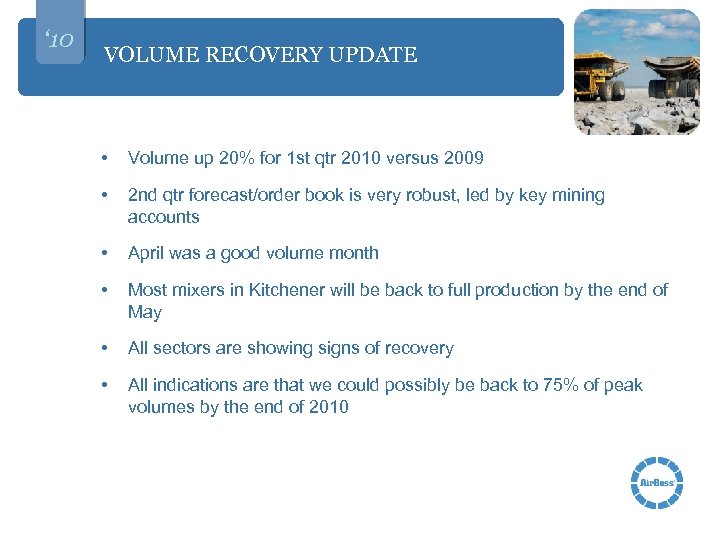

‘ 10 VOLUME RECOVERY UPDATE • Volume up 20% for 1 st qtr 2010 versus 2009 • 2 nd qtr forecast/order book is very robust, led by key mining accounts • April was a good volume month • Most mixers in Kitchener will be back to full production by the end of May • All sectors are showing signs of recovery • All indications are that we could possibly be back to 75% of peak volumes by the end of 2010

‘ 10 VOLUME RECOVERY UPDATE • Volume up 20% for 1 st qtr 2010 versus 2009 • 2 nd qtr forecast/order book is very robust, led by key mining accounts • April was a good volume month • Most mixers in Kitchener will be back to full production by the end of May • All sectors are showing signs of recovery • All indications are that we could possibly be back to 75% of peak volumes by the end of 2010

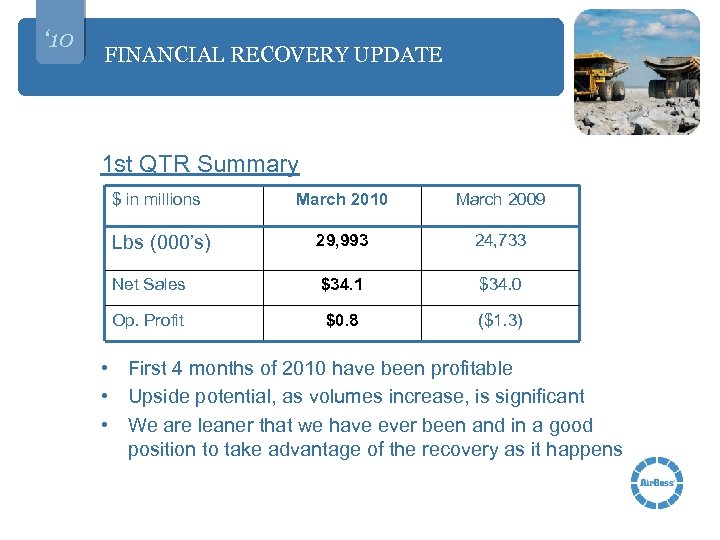

‘ 10 FINANCIAL RECOVERY UPDATE 1 st QTR Summary $ in millions March 2010 March 2009 Lbs (000’s) 29, 993 24, 733 Net Sales $34. 1 $34. 0 Op. Profit $0. 8 ($1. 3) • First 4 months of 2010 have been profitable • Upside potential, as volumes increase, is significant • We are leaner that we have ever been and in a good position to take advantage of the recovery as it happens

‘ 10 FINANCIAL RECOVERY UPDATE 1 st QTR Summary $ in millions March 2010 March 2009 Lbs (000’s) 29, 993 24, 733 Net Sales $34. 1 $34. 0 Op. Profit $0. 8 ($1. 3) • First 4 months of 2010 have been profitable • Upside potential, as volumes increase, is significant • We are leaner that we have ever been and in a good position to take advantage of the recovery as it happens

‘ 10 NEW BUSINESS SEGMENT DEVELOPMENTS • New targeted sectors are wire & cable, oil patch and specialty auto & industrial applications • New polymer types EPDM, CPE, CR, NBR (i. e. different from our normal SBR & NR) • 14 Customers and 54 compounds targeted • Total volume consumed by these customers of these compounds = 98 MM lbs • Our targeted market share 20% • Customers are all now aware of ARC, trials largely completed • Supply and competitive pricing of base polymers have been secured (mainly in China)

‘ 10 NEW BUSINESS SEGMENT DEVELOPMENTS • New targeted sectors are wire & cable, oil patch and specialty auto & industrial applications • New polymer types EPDM, CPE, CR, NBR (i. e. different from our normal SBR & NR) • 14 Customers and 54 compounds targeted • Total volume consumed by these customers of these compounds = 98 MM lbs • Our targeted market share 20% • Customers are all now aware of ARC, trials largely completed • Supply and competitive pricing of base polymers have been secured (mainly in China)

‘ 10 OUTLOOK The outlook for ARC is solid • We have reduced our cost structure • We are well positioned for the upswing • Volumes are beginning to return • The NPDG initiatives undertaken during this period will start to bring rewards • Our balance sheet has never been in better shape

‘ 10 OUTLOOK The outlook for ARC is solid • We have reduced our cost structure • We are well positioned for the upswing • Volumes are beginning to return • The NPDG initiatives undertaken during this period will start to bring rewards • Our balance sheet has never been in better shape

Air. Boss-Defense

Air. Boss-Defense

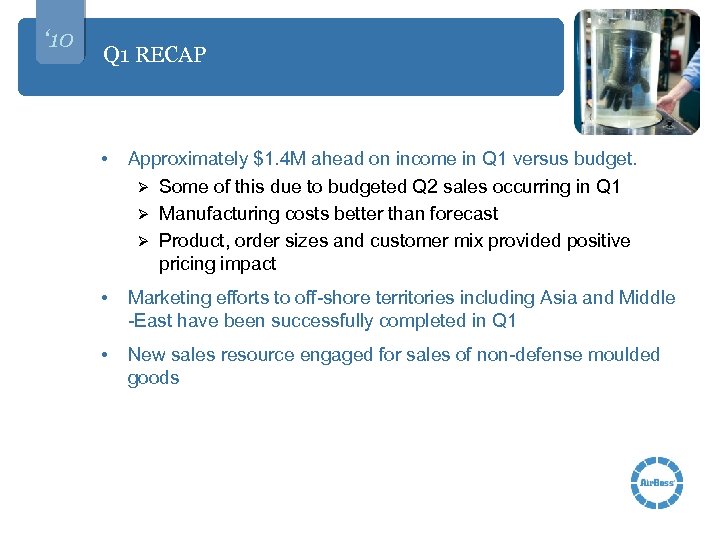

‘ 10 Q 1 RECAP • Approximately $1. 4 M ahead on income in Q 1 versus budget. Ø Some of this due to budgeted Q 2 sales occurring in Q 1 Ø Manufacturing costs better than forecast Ø Product, order sizes and customer mix provided positive pricing impact • Marketing efforts to off-shore territories including Asia and Middle -East have been successfully completed in Q 1 • New sales resource engaged for sales of non-defense moulded goods

‘ 10 Q 1 RECAP • Approximately $1. 4 M ahead on income in Q 1 versus budget. Ø Some of this due to budgeted Q 2 sales occurring in Q 1 Ø Manufacturing costs better than forecast Ø Product, order sizes and customer mix provided positive pricing impact • Marketing efforts to off-shore territories including Asia and Middle -East have been successfully completed in Q 1 • New sales resource engaged for sales of non-defense moulded goods

‘ 10 US EXPANSION / OPERATIONS • New US manufacturing site in production January 2010 Ø Burlington, VT location operating at three shifts in March Ø Fully staffed to plan and operating at or above standard Ø Vermont State incentive programs (VEGI and Training) have saved close to $75 K in Q 1 • The two Air. Boss moulding sites have capacity for surge in orders of gloves and boots • Next Generation CBRN over-boot (MALO) Ø More efficient injection moulding manufacturing will increase margins compared to actual hand assembled product.

‘ 10 US EXPANSION / OPERATIONS • New US manufacturing site in production January 2010 Ø Burlington, VT location operating at three shifts in March Ø Fully staffed to plan and operating at or above standard Ø Vermont State incentive programs (VEGI and Training) have saved close to $75 K in Q 1 • The two Air. Boss moulding sites have capacity for surge in orders of gloves and boots • Next Generation CBRN over-boot (MALO) Ø More efficient injection moulding manufacturing will increase margins compared to actual hand assembled product.

‘ 10 SALES BY PRODUCT

‘ 10 SALES BY PRODUCT

‘ 10 OUTLOOK • Air. Boss-Defense is expected to continue to experience good demand through 2010 and $17 M to $20 M EBITDA range probable depending on exchange • Next Generation MALO over-boot now fully industrialized and sales beginning • Some budgeted off-shore sales of over-boots and gloves are now expected to be delayed into 2011, but new opportunities for offshore mask sales and solid North American defense sales as well as operating efficiencies should compensate and balance income

‘ 10 OUTLOOK • Air. Boss-Defense is expected to continue to experience good demand through 2010 and $17 M to $20 M EBITDA range probable depending on exchange • Next Generation MALO over-boot now fully industrialized and sales beginning • Some budgeted off-shore sales of over-boots and gloves are now expected to be delayed into 2011, but new opportunities for offshore mask sales and solid North American defense sales as well as operating efficiencies should compensate and balance income

‘ 10 OUTLOOK • New sales resource put into place in Q 1 already introducing Air. Boss’ moulded products services to many non-competing targets • Major marketing efforts including key trade shows and customer visits planned for defense and first response sector in Q 2 and Q 3 • Actively seeking complementary acquisitions

‘ 10 OUTLOOK • New sales resource put into place in Q 1 already introducing Air. Boss’ moulded products services to many non-competing targets • Major marketing efforts including key trade shows and customer visits planned for defense and first response sector in Q 2 and Q 3 • Actively seeking complementary acquisitions

Outlook

Outlook

‘ 10 HIGHLIGHTS 2009 Highlights • Record sales and earnings by Air. Boss-Defense drives expansion into the US • EBITDA at $16. 3 million despite difficult economic conditions • $29. 5 million in net cash flow after capital additions eliminates operating loans • Dividend increased by 60% • Strong working capital position Q 1 2010 Highlights • EBITDA and EPS up 171% and 610% compared to Q 1 2009 • EPS $0. 13 vs. $0. 02 from Q 1 2009 • Increase in volumes at both Defense and Rubber Compounding Divisions • New Defense products plant in Vermont operating efficiently on 3 shifts • Quarterly dividend increased by 50% to $0. 03 commencing in Q 2 2010

‘ 10 HIGHLIGHTS 2009 Highlights • Record sales and earnings by Air. Boss-Defense drives expansion into the US • EBITDA at $16. 3 million despite difficult economic conditions • $29. 5 million in net cash flow after capital additions eliminates operating loans • Dividend increased by 60% • Strong working capital position Q 1 2010 Highlights • EBITDA and EPS up 171% and 610% compared to Q 1 2009 • EPS $0. 13 vs. $0. 02 from Q 1 2009 • Increase in volumes at both Defense and Rubber Compounding Divisions • New Defense products plant in Vermont operating efficiently on 3 shifts • Quarterly dividend increased by 50% to $0. 03 commencing in Q 2 2010

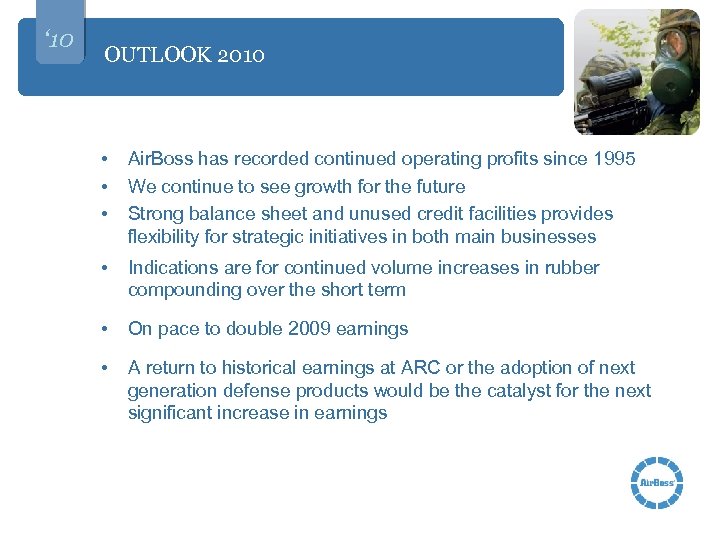

‘ 10 OUTLOOK 2010 • • • Air. Boss has recorded continued operating profits since 1995 We continue to see growth for the future Strong balance sheet and unused credit facilities provides flexibility for strategic initiatives in both main businesses • Indications are for continued volume increases in rubber compounding over the short term • On pace to double 2009 earnings • A return to historical earnings at ARC or the adoption of next generation defense products would be the catalyst for the next significant increase in earnings

‘ 10 OUTLOOK 2010 • • • Air. Boss has recorded continued operating profits since 1995 We continue to see growth for the future Strong balance sheet and unused credit facilities provides flexibility for strategic initiatives in both main businesses • Indications are for continued volume increases in rubber compounding over the short term • On pace to double 2009 earnings • A return to historical earnings at ARC or the adoption of next generation defense products would be the catalyst for the next significant increase in earnings

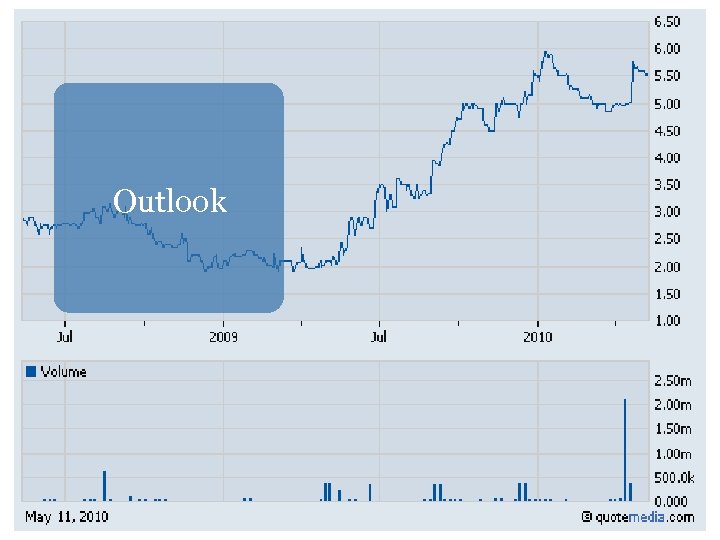

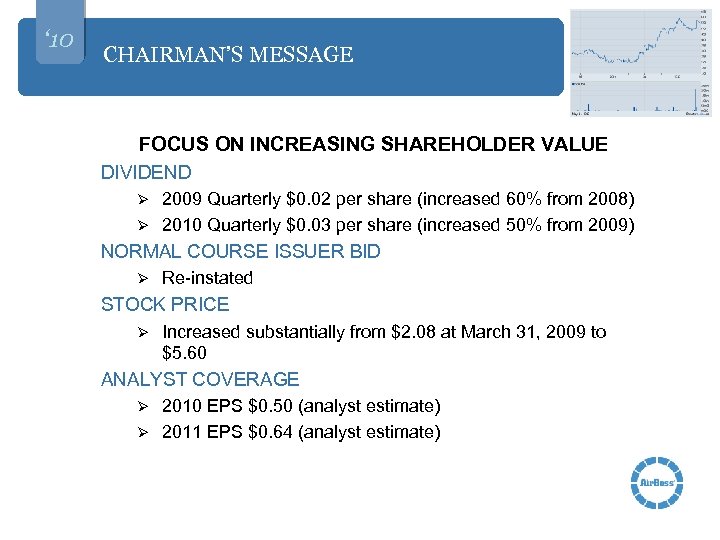

‘ 10 CHAIRMAN’S MESSAGE FOCUS ON INCREASING SHAREHOLDER VALUE DIVIDEND 2009 Quarterly $0. 02 per share (increased 60% from 2008) Ø 2010 Quarterly $0. 03 per share (increased 50% from 2009) Ø NORMAL COURSE ISSUER BID Ø Re-instated STOCK PRICE Ø Increased substantially from $2. 08 at March 31, 2009 to $5. 60 ANALYST COVERAGE 2010 EPS $0. 50 (analyst estimate) Ø 2011 EPS $0. 64 (analyst estimate) Ø

‘ 10 CHAIRMAN’S MESSAGE FOCUS ON INCREASING SHAREHOLDER VALUE DIVIDEND 2009 Quarterly $0. 02 per share (increased 60% from 2008) Ø 2010 Quarterly $0. 03 per share (increased 50% from 2009) Ø NORMAL COURSE ISSUER BID Ø Re-instated STOCK PRICE Ø Increased substantially from $2. 08 at March 31, 2009 to $5. 60 ANALYST COVERAGE 2010 EPS $0. 50 (analyst estimate) Ø 2011 EPS $0. 64 (analyst estimate) Ø

Thank-you! Customers Shareholders Directors Employees • Annual Meeting May 12, 2010

Thank-you! Customers Shareholders Directors Employees • Annual Meeting May 12, 2010