92aed8388b6ba1de610a4f0acb7caf5e.ppt

- Количество слайдов: 48

A Strategic Management Case Study Monday, April 17, 2006 ® 2006, Tony Gauvin, UMFK 1

A Strategic Management Case Study Monday, April 17, 2006 ® 2006, Tony Gauvin, UMFK 1

Overview Who we are, What we sell, Where we are A Brief history of Kroger Value Statement Mission and Vision Internal Assessment - Financial Condition - IFE Matrix External Assessment - EFE Matrix - CPM Matrix 17 -Apr-06 Strategy Formulation - SWOT Matrix - Space Matrix - IE Matrix - Grand Strategy Matrix - Matrix Analysis - QSPM Matrix Strategic Planning for the Future EPS/EBIT Decisions/Implementation/Eval uation Kroger 2006 Update ® 2006, Tony Gauvin, UMFK 2

Overview Who we are, What we sell, Where we are A Brief history of Kroger Value Statement Mission and Vision Internal Assessment - Financial Condition - IFE Matrix External Assessment - EFE Matrix - CPM Matrix 17 -Apr-06 Strategy Formulation - SWOT Matrix - Space Matrix - IE Matrix - Grand Strategy Matrix - Matrix Analysis - QSPM Matrix Strategic Planning for the Future EPS/EBIT Decisions/Implementation/Eval uation Kroger 2006 Update ® 2006, Tony Gauvin, UMFK 2

Sources of Information • The 2004 Kroger Fact Book – http: //www. thekrogerco. com/finance/financiali nfo_reportsandstatements. htm • Kroger Case study notes – Alen Badal: The Union Institute • History from Notable Corporate Chronologies, Online Edition, Thomson Gale, 2006 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 3

Sources of Information • The 2004 Kroger Fact Book – http: //www. thekrogerco. com/finance/financiali nfo_reportsandstatements. htm • Kroger Case study notes – Alen Badal: The Union Institute • History from Notable Corporate Chronologies, Online Edition, Thomson Gale, 2006 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 3

Who we are • • • Headquartered in Cincinnati, Ohio, The Kroger Co. is one of the largest retailers in the United States based on annual sales, holding the #21 ranking on the Fortune 100 list. Kroger was founded in 1883 and incorporated in 1902. At the end of fiscal 2004, Kroger operated (either directly or through its subsidiaries) 2, 532 supermarkets, 536 of which had fuel centers. Approximately 35% of these supermarkets were operated in company-owned facilities, including some companyowned buildings on leased land. In addition to supermarkets, Kroger operates (either directly or through its subsidiaries) 795 convenience stores and 436 fine jewelry stores. Subsidiaries operated 699 of the convenience stores, while 96 were operated through franchise agreements. Approximately 44% of the convenience stores operated by subsidiaries were operated in company-owned facilities. The Company also manufactures and processes some of the food for sale in its supermarkets. As of January 29, 2005, the Company operated 42 manufacturing plants. All of the Company’s operations are domestic. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 4

Who we are • • • Headquartered in Cincinnati, Ohio, The Kroger Co. is one of the largest retailers in the United States based on annual sales, holding the #21 ranking on the Fortune 100 list. Kroger was founded in 1883 and incorporated in 1902. At the end of fiscal 2004, Kroger operated (either directly or through its subsidiaries) 2, 532 supermarkets, 536 of which had fuel centers. Approximately 35% of these supermarkets were operated in company-owned facilities, including some companyowned buildings on leased land. In addition to supermarkets, Kroger operates (either directly or through its subsidiaries) 795 convenience stores and 436 fine jewelry stores. Subsidiaries operated 699 of the convenience stores, while 96 were operated through franchise agreements. Approximately 44% of the convenience stores operated by subsidiaries were operated in company-owned facilities. The Company also manufactures and processes some of the food for sale in its supermarkets. As of January 29, 2005, the Company operated 42 manufacturing plants. All of the Company’s operations are domestic. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 4

What We Sell 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 5

What We Sell 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 5

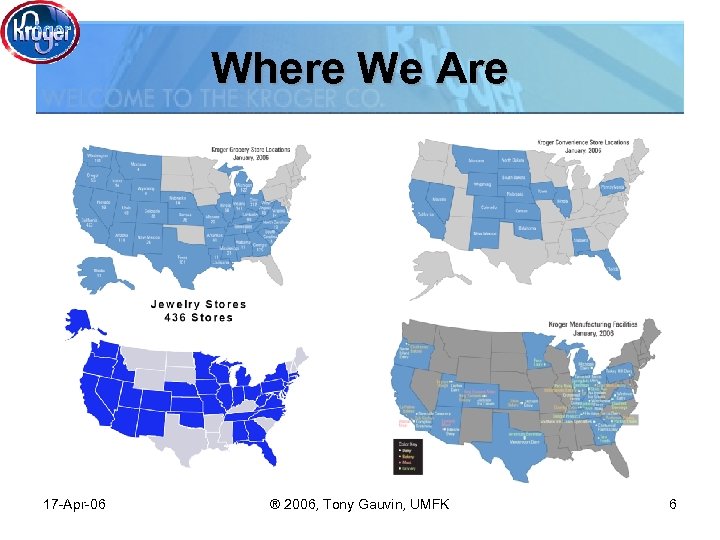

Where We Are 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 6

Where We Are 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 6

History 1883: Bernard H. Kroger and B. A. Branagan open the Great Western Tea Co. , the beginning of the Kroger Co. empire. Kroger is the first grocer to advertise in newspapers. 1884: Branagan sells Kroger his share of the business for $1, 500. 1885: The company expands to four stores in Cincinnati, making the company one of the first chain store operations in America. 1901: It becomes the first store to bake its own bread. 1902: With 40 stores and a factory in Cincinnati, Kroger incorporates and changes the company's name to Kroger Grocery and Baking Co. Kroger buys Nagel Meat Markets and Packing House, and makes the grocery stores the first to include meat departments. 1912: Kroger makes his first long-distance expansion, buying 25 stores in St. Louis, Missouri. The company buys a fleet of trucks, enabling Kroger to move into Detroit, Michigan, Indianapolis, Indiana, and Springfield and Toledo, Ohio. 1920: The company purchases Piggly-Wiggly stores in Ohio, Tennessee, Michigan, Kentucky, Missouri, and Oklahoma and buys most of Piggly-Wiggly's corporate stock. The public begins to accuse food chains of driving small merchants out of business by using unfair business practices. 1928: Kroger sells his shares in Kroger for more than $28 million. William Albers becomes president. 1929: Kroger stores number 5, 575. 1930: Morrill introduces the Kroger Food Foundation, making it the first grocery store company to test food scientifically in order to monitor the quality of products. Kroger manager, Michael Cullen, suggests opening bigger self-service supermarkets, but Kroger executives disagree. 1930: Cullen leaves Kroger and forms the first supermarket, King Kullen, in Jamaica, New Jersey. It introduces frozen foods and shopping carts. The Kroger Food Foundation invents a way of processing beef without chemicals so that it remains tender, calling the product "Tenderay" beef. 1940: Kroger sells its stock in Piggly-Wiggly stores. 1946: The company changes it’s name to the Kroger Co. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 7

History 1883: Bernard H. Kroger and B. A. Branagan open the Great Western Tea Co. , the beginning of the Kroger Co. empire. Kroger is the first grocer to advertise in newspapers. 1884: Branagan sells Kroger his share of the business for $1, 500. 1885: The company expands to four stores in Cincinnati, making the company one of the first chain store operations in America. 1901: It becomes the first store to bake its own bread. 1902: With 40 stores and a factory in Cincinnati, Kroger incorporates and changes the company's name to Kroger Grocery and Baking Co. Kroger buys Nagel Meat Markets and Packing House, and makes the grocery stores the first to include meat departments. 1912: Kroger makes his first long-distance expansion, buying 25 stores in St. Louis, Missouri. The company buys a fleet of trucks, enabling Kroger to move into Detroit, Michigan, Indianapolis, Indiana, and Springfield and Toledo, Ohio. 1920: The company purchases Piggly-Wiggly stores in Ohio, Tennessee, Michigan, Kentucky, Missouri, and Oklahoma and buys most of Piggly-Wiggly's corporate stock. The public begins to accuse food chains of driving small merchants out of business by using unfair business practices. 1928: Kroger sells his shares in Kroger for more than $28 million. William Albers becomes president. 1929: Kroger stores number 5, 575. 1930: Morrill introduces the Kroger Food Foundation, making it the first grocery store company to test food scientifically in order to monitor the quality of products. Kroger manager, Michael Cullen, suggests opening bigger self-service supermarkets, but Kroger executives disagree. 1930: Cullen leaves Kroger and forms the first supermarket, King Kullen, in Jamaica, New Jersey. It introduces frozen foods and shopping carts. The Kroger Food Foundation invents a way of processing beef without chemicals so that it remains tender, calling the product "Tenderay" beef. 1940: Kroger sells its stock in Piggly-Wiggly stores. 1946: The company changes it’s name to the Kroger Co. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 7

History 1947: Kroger opens its first egg processing plant in Wabash, Indiana, to further ensure egg quality. Hall merges the 45 private-label brands into one Kroger brand, and introduces the blue and white logo. 1948: Kroger joins six other firms to establish the Top Value Stamp Co. , trying to bring customers into the stores with stamp collecting promotions. 1952: Kroger sales top $1 billion. 1960: The company begins its expansion into the drugstore business. It buys Sav-on drugstore chain and makes its owner, James Herring, the head of the drugstore division. 1961: The first Supe. Rx drugstore opens next to a Kroger food store in Milford, Ohio. 1963: Sales reach $2 billion. 1971: Enforcing antitrust laws, the Federal Trade Commission proposes a consent order that requires the company to divest itself of three discount food departments. Kroger settles without admitting any violation of antitrust laws, but sells three food departments. FTC prohibits company from purchasing any food store or department in nonfood stores in which the purchase would lessen the competition in that city or county. The government begins to control prices of products. 1972: To increase the accuracy and speed of checkout systems, Kroger, in partnership with RCA, becomes the first grocery company to test electronic scanners to read prices on products under actual working conditions. Kroger introduces an advertising promotion that compares their prices with its competitors' on 150 products a week; the figures are based upon surveys of housewives. 1974: Net profits of the top food chains are up 57%, despite government controlled prices. The FTC reveals illegal business practices of several chains, including Kroger. The company settles out of court on an antitrust claim for fixing beef prices. The FTC sues Kroger for violations of its 1973 trade rule, which forces stores to stock a sufficient supply of specials to meet anticipated demand to give rainchecks when supplies run out. 1977: Kroger consents to the FTC order. 1978: The FTC rules that Kroger slogans like "Documented Proof: Kroger leads in lower prices" are unfair and deceptive because the items surveyed excluded meats, produce, and house brands. A controversy ensues when the Council of Wage and Price Stability expresses concern that tougher standards for Kroger might prevent the dissemination of food price information in the future. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 8

History 1947: Kroger opens its first egg processing plant in Wabash, Indiana, to further ensure egg quality. Hall merges the 45 private-label brands into one Kroger brand, and introduces the blue and white logo. 1948: Kroger joins six other firms to establish the Top Value Stamp Co. , trying to bring customers into the stores with stamp collecting promotions. 1952: Kroger sales top $1 billion. 1960: The company begins its expansion into the drugstore business. It buys Sav-on drugstore chain and makes its owner, James Herring, the head of the drugstore division. 1961: The first Supe. Rx drugstore opens next to a Kroger food store in Milford, Ohio. 1963: Sales reach $2 billion. 1971: Enforcing antitrust laws, the Federal Trade Commission proposes a consent order that requires the company to divest itself of three discount food departments. Kroger settles without admitting any violation of antitrust laws, but sells three food departments. FTC prohibits company from purchasing any food store or department in nonfood stores in which the purchase would lessen the competition in that city or county. The government begins to control prices of products. 1972: To increase the accuracy and speed of checkout systems, Kroger, in partnership with RCA, becomes the first grocery company to test electronic scanners to read prices on products under actual working conditions. Kroger introduces an advertising promotion that compares their prices with its competitors' on 150 products a week; the figures are based upon surveys of housewives. 1974: Net profits of the top food chains are up 57%, despite government controlled prices. The FTC reveals illegal business practices of several chains, including Kroger. The company settles out of court on an antitrust claim for fixing beef prices. The FTC sues Kroger for violations of its 1973 trade rule, which forces stores to stock a sufficient supply of specials to meet anticipated demand to give rainchecks when supplies run out. 1977: Kroger consents to the FTC order. 1978: The FTC rules that Kroger slogans like "Documented Proof: Kroger leads in lower prices" are unfair and deceptive because the items surveyed excluded meats, produce, and house brands. A controversy ensues when the Council of Wage and Price Stability expresses concern that tougher standards for Kroger might prevent the dissemination of food price information in the future. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 8

History 1981: The company acquires Treasury Drug Stores from J. C. Penney Co. Kroger begins marketing its Cost Cutter brand products. 1983: Absorbs Dillion Companies, Inc. and begins to operate stores coast-to-coast. Kroger settles out of court with the FTC. 1984: Kroger and Wetterau form a grocery wholesaler for Michigan called Food. Land Distributors. 1985: Hook Drugs, Inc. merges with Kroger. Acquires Price Savers Wholesalers, Inc. and M&M Supermarkets, Inc. . Dillion Cos. , Inc. purchases Turkey Hill Dairy, Inc. 1986: The company sells most of its interest in Hook and Supe. Rx drug chains to Hook-Supe. Rx, Inc. (HSI), a privately held company, for approximately $415 million. 1987: Kroger sells more of its drug stores to Hook-Supe. Rx, Inc for $88 million. In total, the company has sold approximately 658 stores. 1988: Kroger faces takeover bids from the Dart Group Corp. and from Kohlberg Kravis Roberts, whose highest bid tops $5 billion. Kroger rejects the bids. To ward off the buyout, CEO Everingham and president Joseph Pichler borrow $4. 1 million to pay a special dividend to stockholders and to buy additional shares for an employee stock plan, which is increased by 30%. 1990: The company sells to K-Mart its equity interest in Price Savers Wholesale, Inc. Kroger makes its first major acquisition since 1988 by purchasing Great Scott! supermarkets in Michigan. 1991: Kroger now operates 1, 263 food stores and 940 convenience stores, and owns 37 processing plants, including 11 bakeries, 15 dairies, and facilities for processing cheese and various other dairy products. Sales reach $21. 3 billion, and net income is $101 million. 1993: Kroger, seeking to capitalize on positive views of low-interest credit cards, begins issuing its own co-branded credit cards. Acquires 11 Houston-area supermarkets from Apple. Tree Markets Inc. Kroger loses $12. 2 million for the year. 1994: Kroger secures a credit agreement for a seven-year $1. 75 billion revolving loan, increasing available monies for capital expenditures from $500 million to $650 million annually. Sell seven of its stores to Delchamps Inc. , and buys two from Delchamps. Earns $242 million on sales of $22. 9 billion. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 9

History 1981: The company acquires Treasury Drug Stores from J. C. Penney Co. Kroger begins marketing its Cost Cutter brand products. 1983: Absorbs Dillion Companies, Inc. and begins to operate stores coast-to-coast. Kroger settles out of court with the FTC. 1984: Kroger and Wetterau form a grocery wholesaler for Michigan called Food. Land Distributors. 1985: Hook Drugs, Inc. merges with Kroger. Acquires Price Savers Wholesalers, Inc. and M&M Supermarkets, Inc. . Dillion Cos. , Inc. purchases Turkey Hill Dairy, Inc. 1986: The company sells most of its interest in Hook and Supe. Rx drug chains to Hook-Supe. Rx, Inc. (HSI), a privately held company, for approximately $415 million. 1987: Kroger sells more of its drug stores to Hook-Supe. Rx, Inc for $88 million. In total, the company has sold approximately 658 stores. 1988: Kroger faces takeover bids from the Dart Group Corp. and from Kohlberg Kravis Roberts, whose highest bid tops $5 billion. Kroger rejects the bids. To ward off the buyout, CEO Everingham and president Joseph Pichler borrow $4. 1 million to pay a special dividend to stockholders and to buy additional shares for an employee stock plan, which is increased by 30%. 1990: The company sells to K-Mart its equity interest in Price Savers Wholesale, Inc. Kroger makes its first major acquisition since 1988 by purchasing Great Scott! supermarkets in Michigan. 1991: Kroger now operates 1, 263 food stores and 940 convenience stores, and owns 37 processing plants, including 11 bakeries, 15 dairies, and facilities for processing cheese and various other dairy products. Sales reach $21. 3 billion, and net income is $101 million. 1993: Kroger, seeking to capitalize on positive views of low-interest credit cards, begins issuing its own co-branded credit cards. Acquires 11 Houston-area supermarkets from Apple. Tree Markets Inc. Kroger loses $12. 2 million for the year. 1994: Kroger secures a credit agreement for a seven-year $1. 75 billion revolving loan, increasing available monies for capital expenditures from $500 million to $650 million annually. Sell seven of its stores to Delchamps Inc. , and buys two from Delchamps. Earns $242 million on sales of $22. 9 billion. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 9

History 1995: David B. Dillion is named president, CEO, and a director of Kroger. Annual earnings rise to $302 million on sales of $23. 9 billion. 1996: Kroger is the largest supermarket chain in the U. S. 1998: Kroger and Fred Meyer Inc. announce plans to merge into Kroger-Fred Meyer, the first coast-to-coast food retail operation in the U. S. The $12 billion deal will result in the creation of a $43 billion industry giant with 3, 400 stores, including supermarkets, convenience stores, jewelry stores, and supercenters, spanning 31 states. 1999 July: Kroger announces its plans to partner with US Bancorp to introduce a new co-branded credit card for Kroger customers. 1999: Kroger completes its merger with Fred Meyer, a former grocery powerhouse with a combined $43 billion in annual sales. 2000 May: Kroger announces its plans to partner with Planet. U, the online promotions network for the consumers good industry, to offer U-pons, Internet coupons for dozens of popular national brands, on Kroger's Web site. 2000: Kroger teams up with Priceline Webhouse Club to let customers use the Internet to name their own price for groceries at more than 2, 300 Kroger-owned stores around the country. 2001: Sales exceed $50 billion for the first time ever. Kroger launches a restructuring that includes 1, 500 layoffs and the consolidation of division operations in Nashville, Tennessee, into offices in Louisville, Kentucky, and Atlanta, Georgia. 2002: Kroger acquires 18 Raley's units, which it plans to convert to Food 4 Less or Smith's units; 17 Albertson's stores in the Houston, Texas, and surrounding areas; and seven Winn-Dixie supermarkets in Dallas, Texas. The firm is largest retail grocery store operator in the U. S. 2004: Kroger begins construction on new Kroger Marketplace stores in Ohio and Smith Marketplace stores in Utah. The Marketplace format, which includes general merchandise, is intended to allow the firm to better compete with retail giants like Wal-Mart. 2005 Jan. : The firm posts a fiscal year loss of $100 million, despite a 5% increase in revenues to $56. 4 billion. 2005 Oct. : Kroger enters a bidding war for Albertsons, a struggling chain that put itself up for sale two months ago. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 10

History 1995: David B. Dillion is named president, CEO, and a director of Kroger. Annual earnings rise to $302 million on sales of $23. 9 billion. 1996: Kroger is the largest supermarket chain in the U. S. 1998: Kroger and Fred Meyer Inc. announce plans to merge into Kroger-Fred Meyer, the first coast-to-coast food retail operation in the U. S. The $12 billion deal will result in the creation of a $43 billion industry giant with 3, 400 stores, including supermarkets, convenience stores, jewelry stores, and supercenters, spanning 31 states. 1999 July: Kroger announces its plans to partner with US Bancorp to introduce a new co-branded credit card for Kroger customers. 1999: Kroger completes its merger with Fred Meyer, a former grocery powerhouse with a combined $43 billion in annual sales. 2000 May: Kroger announces its plans to partner with Planet. U, the online promotions network for the consumers good industry, to offer U-pons, Internet coupons for dozens of popular national brands, on Kroger's Web site. 2000: Kroger teams up with Priceline Webhouse Club to let customers use the Internet to name their own price for groceries at more than 2, 300 Kroger-owned stores around the country. 2001: Sales exceed $50 billion for the first time ever. Kroger launches a restructuring that includes 1, 500 layoffs and the consolidation of division operations in Nashville, Tennessee, into offices in Louisville, Kentucky, and Atlanta, Georgia. 2002: Kroger acquires 18 Raley's units, which it plans to convert to Food 4 Less or Smith's units; 17 Albertson's stores in the Houston, Texas, and surrounding areas; and seven Winn-Dixie supermarkets in Dallas, Texas. The firm is largest retail grocery store operator in the U. S. 2004: Kroger begins construction on new Kroger Marketplace stores in Ohio and Smith Marketplace stores in Utah. The Marketplace format, which includes general merchandise, is intended to allow the firm to better compete with retail giants like Wal-Mart. 2005 Jan. : The firm posts a fiscal year loss of $100 million, despite a 5% increase in revenues to $56. 4 billion. 2005 Oct. : Kroger enters a bidding war for Albertsons, a struggling chain that put itself up for sale two months ago. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 10

Values • Honesty : – Doing the right things, telling the truth. • Integrity : – • Living our values in all we do, unified approach to how we do business and treat each other. Respect for Others : – Valuing opinions, property and perspectives of others. • Diversity : – Reflecting a workplace that includes a variety of people from different backgrounds and cultures, diversity of opinions and thoughts. • Safety : – Watching out for others, being secure and safe in your workplace. • Inclusion : – Your voice matters, working together works, encouraging everyone’s involvement, being the best person you can be. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 11

Values • Honesty : – Doing the right things, telling the truth. • Integrity : – • Living our values in all we do, unified approach to how we do business and treat each other. Respect for Others : – Valuing opinions, property and perspectives of others. • Diversity : – Reflecting a workplace that includes a variety of people from different backgrounds and cultures, diversity of opinions and thoughts. • Safety : – Watching out for others, being secure and safe in your workplace. • Inclusion : – Your voice matters, working together works, encouraging everyone’s involvement, being the best person you can be. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 11

Mission Statement Actual “OUR MISSION is to be a leader in the distribution and merchandising of food, health, personal care, and related consumable products and services. By achieving this objective, we will satisfy our responsibilities to shareowners, associates, customers, suppliers, and the communities we serve. We will conduct our business to produce financial returns that reward investment by shareowners and allow the Company to grow. Investments in retailing, distribution and food processing will be continually evaluated for their contribution to our corporate return objectives. We will constantly strive to satisfy the needs of customers as well as, or better than, the best of our competitors. Operating procedures will increasingly reflect our belief that the organization levels closest to the customer are best positioned to serve changing consumer needs. We will provide all associates and customers with a safe, friendly work and shopping environment and will treat each of them with respect, openness, honesty and fairness. We will solicit and respond to the ideas of our associates and reward their meaningful contributions to our success. We value America’s diversity and will strive to reflect that diversity in our work force, the companies with which we do business, and the customers we serve. As a Company, we will convey respect and dignity to all individuals. We will encourage our associates to be active and responsible citizens and will allocate resources for activities that enhance the quality of life for our customers, our associates and the communities we serve. ” 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 12

Mission Statement Actual “OUR MISSION is to be a leader in the distribution and merchandising of food, health, personal care, and related consumable products and services. By achieving this objective, we will satisfy our responsibilities to shareowners, associates, customers, suppliers, and the communities we serve. We will conduct our business to produce financial returns that reward investment by shareowners and allow the Company to grow. Investments in retailing, distribution and food processing will be continually evaluated for their contribution to our corporate return objectives. We will constantly strive to satisfy the needs of customers as well as, or better than, the best of our competitors. Operating procedures will increasingly reflect our belief that the organization levels closest to the customer are best positioned to serve changing consumer needs. We will provide all associates and customers with a safe, friendly work and shopping environment and will treat each of them with respect, openness, honesty and fairness. We will solicit and respond to the ideas of our associates and reward their meaningful contributions to our success. We value America’s diversity and will strive to reflect that diversity in our work force, the companies with which we do business, and the customers we serve. As a Company, we will convey respect and dignity to all individuals. We will encourage our associates to be active and responsible citizens and will allocate resources for activities that enhance the quality of life for our customers, our associates and the communities we serve. ” 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 12

Vision Proposed To remain the largest and best grocery chain in the United States. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 13

Vision Proposed To remain the largest and best grocery chain in the United States. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 13

Internal Assessment 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 14

Internal Assessment 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 14

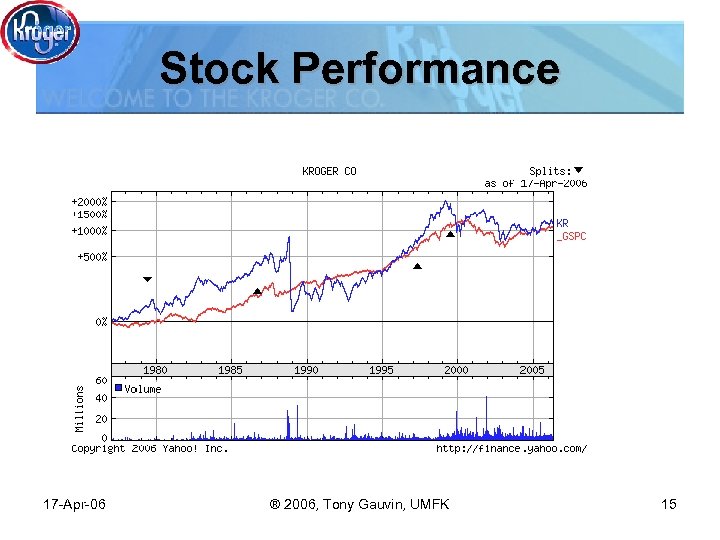

Stock Performance 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 15

Stock Performance 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 15

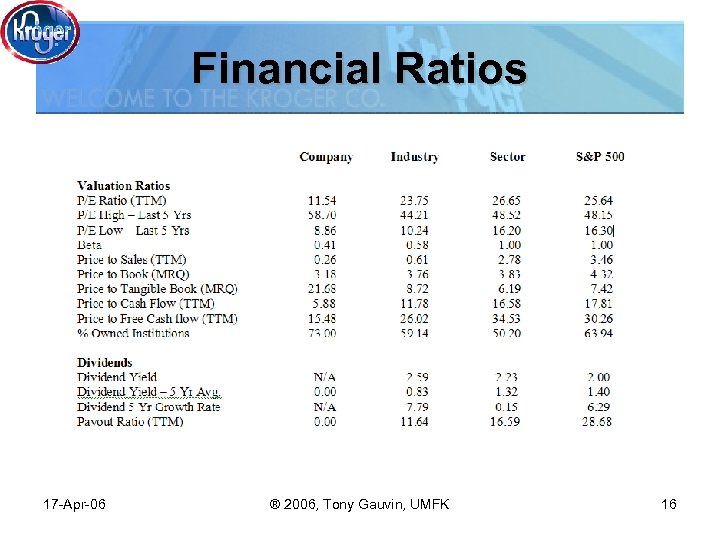

Financial Ratios 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 16

Financial Ratios 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 16

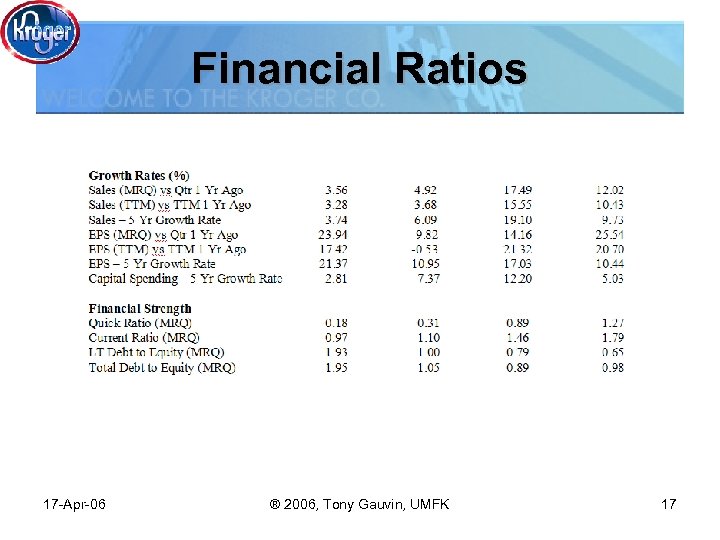

Financial Ratios 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 17

Financial Ratios 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 17

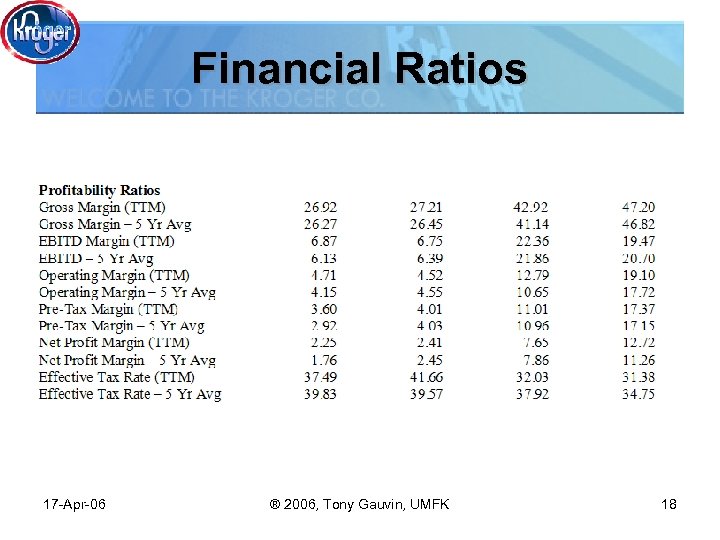

Financial Ratios 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 18

Financial Ratios 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 18

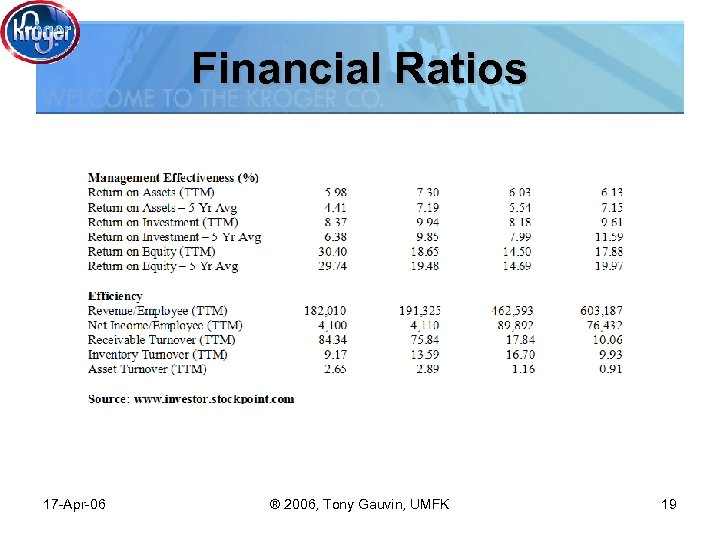

Financial Ratios 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 19

Financial Ratios 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 19

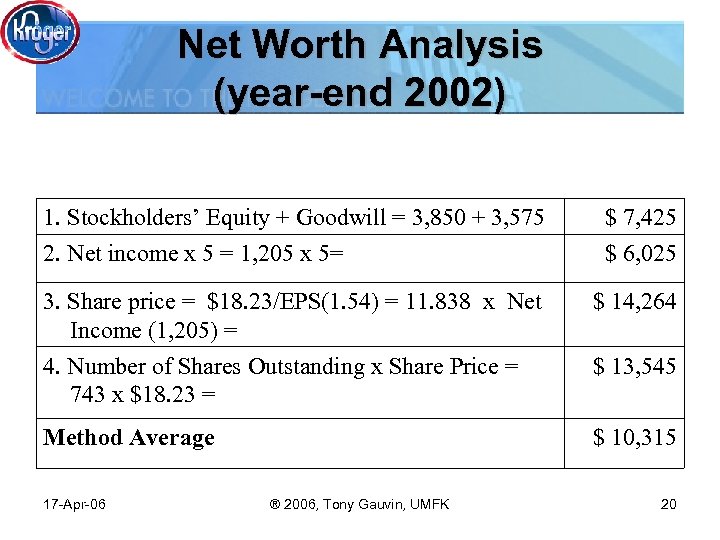

Net Worth Analysis (year-end 2002) 1. Stockholders’ Equity + Goodwill = 3, 850 + 3, 575 2. Net income x 5 = 1, 205 x 5= $ 7, 425 $ 6, 025 3. Share price = $18. 23/EPS(1. 54) = 11. 838 x Net Income (1, 205) = $ 14, 264 4. Number of Shares Outstanding x Share Price = 743 x $18. 23 = $ 13, 545 Method Average $ 10, 315 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 20

Net Worth Analysis (year-end 2002) 1. Stockholders’ Equity + Goodwill = 3, 850 + 3, 575 2. Net income x 5 = 1, 205 x 5= $ 7, 425 $ 6, 025 3. Share price = $18. 23/EPS(1. 54) = 11. 838 x Net Income (1, 205) = $ 14, 264 4. Number of Shares Outstanding x Share Price = 743 x $18. 23 = $ 13, 545 Method Average $ 10, 315 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 20

Strengths 1. 2. 3. 4. 5. 6. 7. 8. Store layouts Diversified portfolio/synergy Product lines Steady sales increases (2002: $51. 8) Net earnings/assets increases Informative and user-friendly homepage One-stop shopping opportunity Ranked # 4 for jewelry & largest florist with 2, 163 locations (www. kroger. com) 9. Technology: self check-out, etc. 10. #1 grocery chain in USA with over 2, 400 locations in 32 states (2) 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 21

Strengths 1. 2. 3. 4. 5. 6. 7. 8. Store layouts Diversified portfolio/synergy Product lines Steady sales increases (2002: $51. 8) Net earnings/assets increases Informative and user-friendly homepage One-stop shopping opportunity Ranked # 4 for jewelry & largest florist with 2, 163 locations (www. kroger. com) 9. Technology: self check-out, etc. 10. #1 grocery chain in USA with over 2, 400 locations in 32 states (2) 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 21

Weaknesses 1. 2. 3. International presence Decrease in convenience store locations Expansion of RX business, perhaps merge with convenience locations 4. Labor dispute 5. Limited Fred Meyer supercenter locations (represented in 5 states) (www. kroger. com) 6. Superstores limited specialty departments/pharmacy 7. Limited store locations in secondary markets (less than 9 locations) 8. Cyclical convenience store operations (opened 19 new locations, closed 24) 9. Convenience store location limitations based on < 75, 000 population 10. Limited northern and southern states jewelry and convenience store locations 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 22

Weaknesses 1. 2. 3. International presence Decrease in convenience store locations Expansion of RX business, perhaps merge with convenience locations 4. Labor dispute 5. Limited Fred Meyer supercenter locations (represented in 5 states) (www. kroger. com) 6. Superstores limited specialty departments/pharmacy 7. Limited store locations in secondary markets (less than 9 locations) 8. Cyclical convenience store operations (opened 19 new locations, closed 24) 9. Convenience store location limitations based on < 75, 000 population 10. Limited northern and southern states jewelry and convenience store locations 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 22

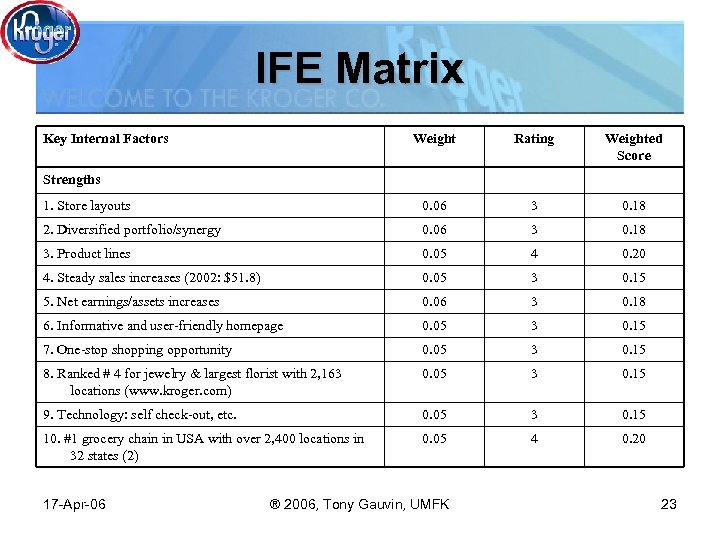

IFE Matrix Key Internal Factors Weight Rating Weighted Score 1. Store layouts 0. 06 3 0. 18 2. Diversified portfolio/synergy 0. 06 3 0. 18 3. Product lines 0. 05 4 0. 20 4. Steady sales increases (2002: $51. 8) 0. 05 3 0. 15 5. Net earnings/assets increases 0. 06 3 0. 18 6. Informative and user-friendly homepage 0. 05 3 0. 15 7. One-stop shopping opportunity 0. 05 3 0. 15 8. Ranked # 4 for jewelry & largest florist with 2, 163 locations (www. kroger. com) 0. 05 3 0. 15 9. Technology: self check-out, etc. 0. 05 3 0. 15 10. #1 grocery chain in USA with over 2, 400 locations in 32 states (2) 0. 05 4 0. 20 Strengths 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 23

IFE Matrix Key Internal Factors Weight Rating Weighted Score 1. Store layouts 0. 06 3 0. 18 2. Diversified portfolio/synergy 0. 06 3 0. 18 3. Product lines 0. 05 4 0. 20 4. Steady sales increases (2002: $51. 8) 0. 05 3 0. 15 5. Net earnings/assets increases 0. 06 3 0. 18 6. Informative and user-friendly homepage 0. 05 3 0. 15 7. One-stop shopping opportunity 0. 05 3 0. 15 8. Ranked # 4 for jewelry & largest florist with 2, 163 locations (www. kroger. com) 0. 05 3 0. 15 9. Technology: self check-out, etc. 0. 05 3 0. 15 10. #1 grocery chain in USA with over 2, 400 locations in 32 states (2) 0. 05 4 0. 20 Strengths 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 23

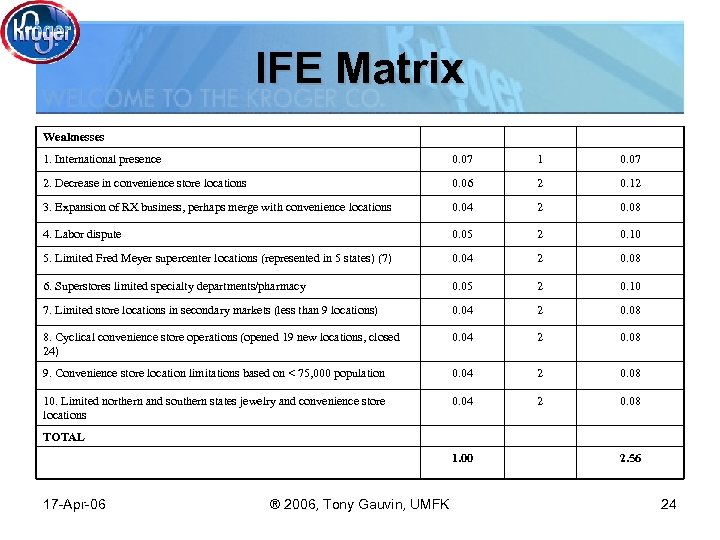

IFE Matrix Weaknesses 1. International presence 0. 07 1 0. 07 2. Decrease in convenience store locations 0. 06 2 0. 12 3. Expansion of RX business, perhaps merge with convenience locations 0. 04 2 0. 08 4. Labor dispute 0. 05 2 0. 10 5. Limited Fred Meyer supercenter locations (represented in 5 states) (7) 0. 04 2 0. 08 6. Superstores limited specialty departments/pharmacy 0. 05 2 0. 10 7. Limited store locations in secondary markets (less than 9 locations) 0. 04 2 0. 08 8. Cyclical convenience store operations (opened 19 new locations, closed 24) 0. 04 2 0. 08 9. Convenience store location limitations based on < 75, 000 population 0. 04 2 0. 08 10. Limited northern and southern states jewelry and convenience store locations 0. 04 2 0. 08 TOTAL 1. 00 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 2. 56 24

IFE Matrix Weaknesses 1. International presence 0. 07 1 0. 07 2. Decrease in convenience store locations 0. 06 2 0. 12 3. Expansion of RX business, perhaps merge with convenience locations 0. 04 2 0. 08 4. Labor dispute 0. 05 2 0. 10 5. Limited Fred Meyer supercenter locations (represented in 5 states) (7) 0. 04 2 0. 08 6. Superstores limited specialty departments/pharmacy 0. 05 2 0. 10 7. Limited store locations in secondary markets (less than 9 locations) 0. 04 2 0. 08 8. Cyclical convenience store operations (opened 19 new locations, closed 24) 0. 04 2 0. 08 9. Convenience store location limitations based on < 75, 000 population 0. 04 2 0. 08 10. Limited northern and southern states jewelry and convenience store locations 0. 04 2 0. 08 TOTAL 1. 00 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 2. 56 24

External Assessment 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 25

External Assessment 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 25

Opportunities 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Consumers are primarily interested in prices Online sales One-stop shopping (petroleum, flowers, pharmacy) Organic foods Consumers purchase store brand name products Family-owned businesses decline More competition between Internet service providers Complex lifestyles (work, school, family) Limited number of direct competitors Utilization of credit cards 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 26

Opportunities 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Consumers are primarily interested in prices Online sales One-stop shopping (petroleum, flowers, pharmacy) Organic foods Consumers purchase store brand name products Family-owned businesses decline More competition between Internet service providers Complex lifestyles (work, school, family) Limited number of direct competitors Utilization of credit cards 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 26

Threats 1. Consumers spend many hours working, with irregular schedules 2. Limited direct competitors results in head-on strategies to compete 3. Cost of living increases sometimes not comparable to wage increases 4. Unemployment rate 5. Cyclical cost of petroleum 6. Tight consumer spending patterns 7. Limited consumer free time 8. Increase in fast-food outlets, value prices/offers 9. Obesity/health issues 10. Limitations of online grocery sales/delivery costs 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 27

Threats 1. Consumers spend many hours working, with irregular schedules 2. Limited direct competitors results in head-on strategies to compete 3. Cost of living increases sometimes not comparable to wage increases 4. Unemployment rate 5. Cyclical cost of petroleum 6. Tight consumer spending patterns 7. Limited consumer free time 8. Increase in fast-food outlets, value prices/offers 9. Obesity/health issues 10. Limitations of online grocery sales/delivery costs 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 27

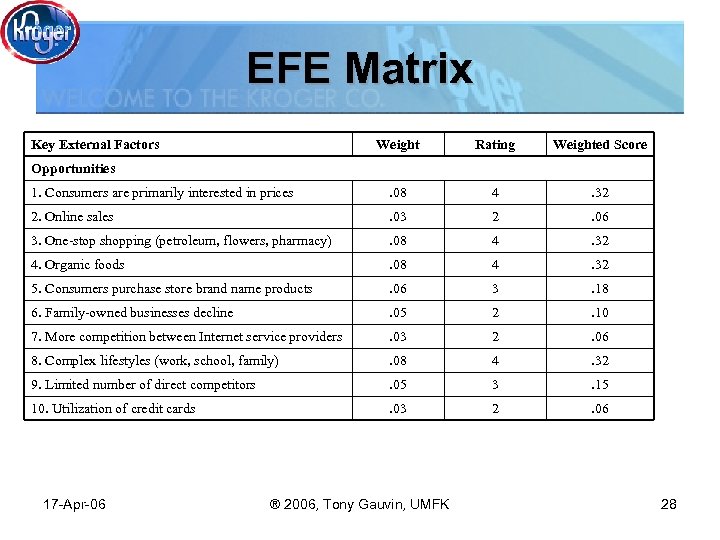

EFE Matrix Key External Factors Weight Rating Weighted Score 1. Consumers are primarily interested in prices . 08 4 . 32 2. Online sales . 03 2 . 06 3. One-stop shopping (petroleum, flowers, pharmacy) . 08 4 . 32 4. Organic foods . 08 4 . 32 5. Consumers purchase store brand name products . 06 3 . 18 6. Family-owned businesses decline . 05 2 . 10 7. More competition between Internet service providers . 03 2 . 06 8. Complex lifestyles (work, school, family) . 08 4 . 32 9. Limited number of direct competitors . 05 3 . 15 10. Utilization of credit cards . 03 2 . 06 Opportunities 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 28

EFE Matrix Key External Factors Weight Rating Weighted Score 1. Consumers are primarily interested in prices . 08 4 . 32 2. Online sales . 03 2 . 06 3. One-stop shopping (petroleum, flowers, pharmacy) . 08 4 . 32 4. Organic foods . 08 4 . 32 5. Consumers purchase store brand name products . 06 3 . 18 6. Family-owned businesses decline . 05 2 . 10 7. More competition between Internet service providers . 03 2 . 06 8. Complex lifestyles (work, school, family) . 08 4 . 32 9. Limited number of direct competitors . 05 3 . 15 10. Utilization of credit cards . 03 2 . 06 Opportunities 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 28

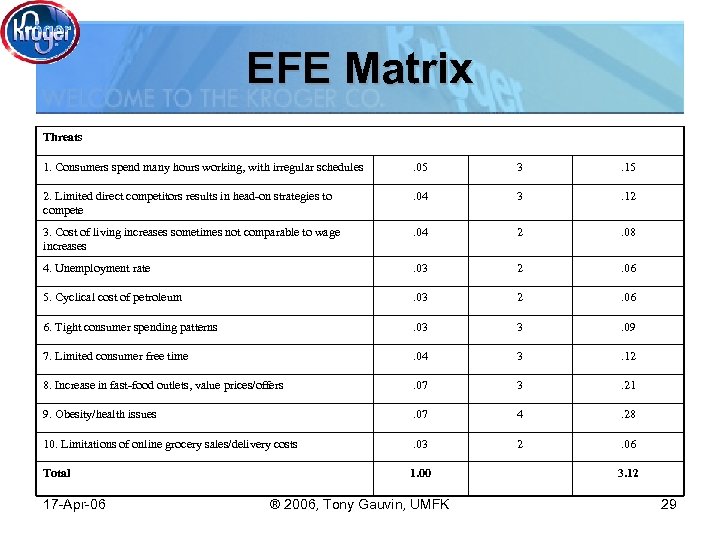

EFE Matrix Threats 1. Consumers spend many hours working, with irregular schedules . 05 3 . 15 2. Limited direct competitors results in head-on strategies to compete . 04 3 . 12 3. Cost of living increases sometimes not comparable to wage increases . 04 2 . 08 4. Unemployment rate . 03 2 . 06 5. Cyclical cost of petroleum . 03 2 . 06 6. Tight consumer spending patterns . 03 3 . 09 7. Limited consumer free time . 04 3 . 12 8. Increase in fast-food outlets, value prices/offers . 07 3 . 21 9. Obesity/health issues . 07 4 . 28 10. Limitations of online grocery sales/delivery costs . 03 2 . 06 Total 1. 00 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 3. 12 29

EFE Matrix Threats 1. Consumers spend many hours working, with irregular schedules . 05 3 . 15 2. Limited direct competitors results in head-on strategies to compete . 04 3 . 12 3. Cost of living increases sometimes not comparable to wage increases . 04 2 . 08 4. Unemployment rate . 03 2 . 06 5. Cyclical cost of petroleum . 03 2 . 06 6. Tight consumer spending patterns . 03 3 . 09 7. Limited consumer free time . 04 3 . 12 8. Increase in fast-food outlets, value prices/offers . 07 3 . 21 9. Obesity/health issues . 07 4 . 28 10. Limitations of online grocery sales/delivery costs . 03 2 . 06 Total 1. 00 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 3. 12 29

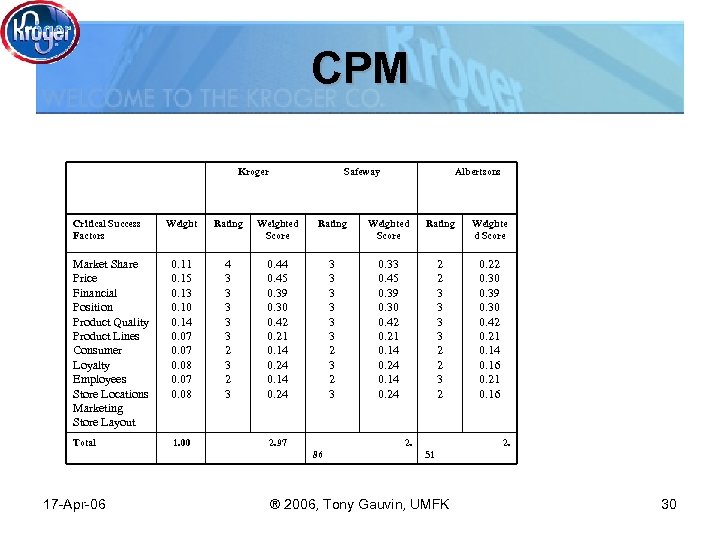

CPM Kroger Critical Success Factors Safeway Albertsons Weight Rating Weighted Score Rating Weighte d Score Market Share Price Financial Position Product Quality Product Lines Consumer Loyalty Employees Store Locations Marketing Store Layout 0. 11 0. 15 0. 13 0. 10 0. 14 0. 07 0. 08 4 3 3 3 2 3 0. 44 0. 45 0. 39 0. 30 0. 42 0. 21 0. 14 0. 24 3 3 3 2 3 0. 33 0. 45 0. 39 0. 30 0. 42 0. 21 0. 14 0. 24 2 2 3 3 2 2 3 2 0. 22 0. 30 0. 39 0. 30 0. 42 0. 21 0. 14 0. 16 0. 21 0. 16 Total 1. 00 2. 97 2. 86 17 -Apr-06 2. 51 ® 2006, Tony Gauvin, UMFK 30

CPM Kroger Critical Success Factors Safeway Albertsons Weight Rating Weighted Score Rating Weighte d Score Market Share Price Financial Position Product Quality Product Lines Consumer Loyalty Employees Store Locations Marketing Store Layout 0. 11 0. 15 0. 13 0. 10 0. 14 0. 07 0. 08 4 3 3 3 2 3 0. 44 0. 45 0. 39 0. 30 0. 42 0. 21 0. 14 0. 24 3 3 3 2 3 0. 33 0. 45 0. 39 0. 30 0. 42 0. 21 0. 14 0. 24 2 2 3 3 2 2 3 2 0. 22 0. 30 0. 39 0. 30 0. 42 0. 21 0. 14 0. 16 0. 21 0. 16 Total 1. 00 2. 97 2. 86 17 -Apr-06 2. 51 ® 2006, Tony Gauvin, UMFK 30

Matrix Analysis 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 31

Matrix Analysis 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 31

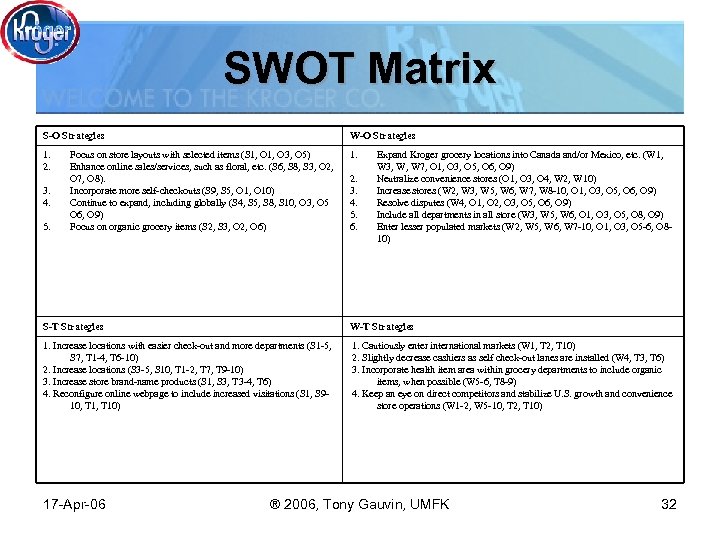

SWOT Matrix S-O Strategies W-O Strategies 1. 2. 1. 3. 4. 5. Focus on store layouts with selected items (S 1, O 3, O 5) Enhance online sales/services, such as floral, etc. (S 6, S 8, S 3, O 2, O 7, O 8). Incorporate more self-checkouts (S 9, S 5, O 10) Continue to expand, including globally (S 4, S 5, S 8, S 10, O 3, O 5 O 6, O 9) Focus on organic grocery items (S 2, S 3, O 2, O 6) 2. 3. 4. 5. 6. Expand Kroger grocery locations into Canada and/or Mexico, etc. (W 1, W 3, W, W 7, O 1, O 3, O 5, O 6, O 9) Neutralize convenience stores (O 1, O 3, O 4, W 2, W 10) Increase stores (W 2, W 3, W 5, W 6, W 7, W 8 -10, O 1, O 3, O 5, O 6, O 9) Resolve disputes (W 4, O 1, O 2, O 3, O 5, O 6, O 9) Include all departments in all store (W 3, W 5, W 6, O 1, O 3, O 5, O 8, O 9) Enter lesser populated markets (W 2, W 5, W 6, W 7 -10, O 1, O 3, O 5 -6, O 810) S-T Strategies W-T Strategies 1. Increase locations with easier check-out and more departments (S 1 -5, S 7, T 1 -4, T 6 -10) 2. Increase locations (S 3 -5, S 10, T 1 -2, T 7, T 9 -10) 3. Increase store brand-name products (S 1, S 3, T 3 -4, T 6) 4. Reconfigure online webpage to include increased visitations (S 1, S 910, T 10) 1. Cautiously enter international markets (W 1, T 2, T 10) 2. Slightly decrease cashiers as self check-out lanes are installed (W 4, T 3, T 6) 3. Incorporate health item area within grocery departments to include organic items, when possible (W 5 -6, T 8 -9) 4. Keep an eye on direct competitors and stabilize U. S. growth and convenience store operations (W 1 -2, W 5 -10, T 2, T 10) 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 32

SWOT Matrix S-O Strategies W-O Strategies 1. 2. 1. 3. 4. 5. Focus on store layouts with selected items (S 1, O 3, O 5) Enhance online sales/services, such as floral, etc. (S 6, S 8, S 3, O 2, O 7, O 8). Incorporate more self-checkouts (S 9, S 5, O 10) Continue to expand, including globally (S 4, S 5, S 8, S 10, O 3, O 5 O 6, O 9) Focus on organic grocery items (S 2, S 3, O 2, O 6) 2. 3. 4. 5. 6. Expand Kroger grocery locations into Canada and/or Mexico, etc. (W 1, W 3, W, W 7, O 1, O 3, O 5, O 6, O 9) Neutralize convenience stores (O 1, O 3, O 4, W 2, W 10) Increase stores (W 2, W 3, W 5, W 6, W 7, W 8 -10, O 1, O 3, O 5, O 6, O 9) Resolve disputes (W 4, O 1, O 2, O 3, O 5, O 6, O 9) Include all departments in all store (W 3, W 5, W 6, O 1, O 3, O 5, O 8, O 9) Enter lesser populated markets (W 2, W 5, W 6, W 7 -10, O 1, O 3, O 5 -6, O 810) S-T Strategies W-T Strategies 1. Increase locations with easier check-out and more departments (S 1 -5, S 7, T 1 -4, T 6 -10) 2. Increase locations (S 3 -5, S 10, T 1 -2, T 7, T 9 -10) 3. Increase store brand-name products (S 1, S 3, T 3 -4, T 6) 4. Reconfigure online webpage to include increased visitations (S 1, S 910, T 10) 1. Cautiously enter international markets (W 1, T 2, T 10) 2. Slightly decrease cashiers as self check-out lanes are installed (W 4, T 3, T 6) 3. Incorporate health item area within grocery departments to include organic items, when possible (W 5 -6, T 8 -9) 4. Keep an eye on direct competitors and stabilize U. S. growth and convenience store operations (W 1 -2, W 5 -10, T 2, T 10) 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 32

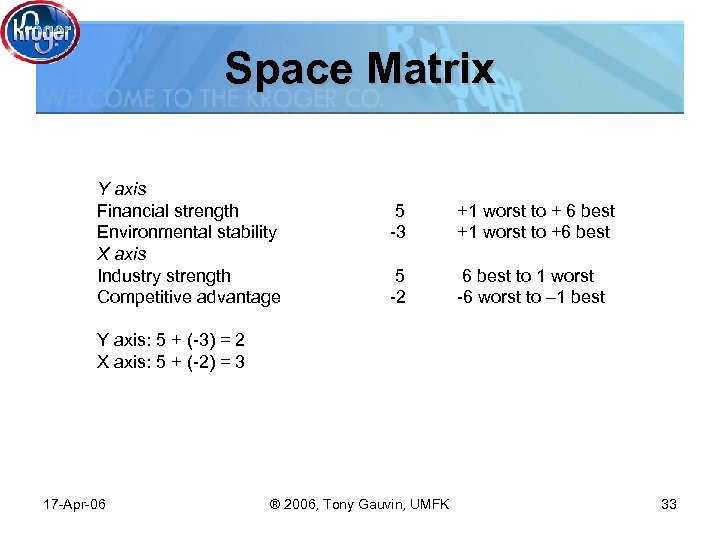

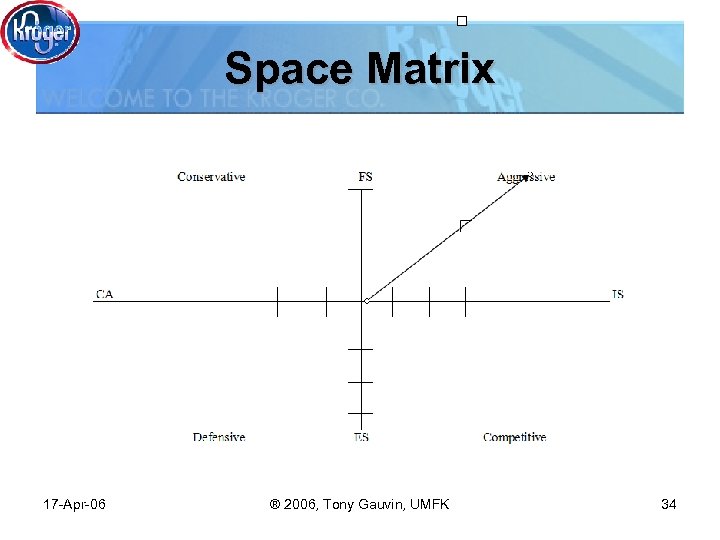

Space Matrix Y axis Financial strength Environmental stability X axis Industry strength Competitive advantage 5 -3 +1 worst to + 6 best +1 worst to +6 best 5 -2 6 best to 1 worst -6 worst to – 1 best Y axis: 5 + (-3) = 2 X axis: 5 + (-2) = 3 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 33

Space Matrix Y axis Financial strength Environmental stability X axis Industry strength Competitive advantage 5 -3 +1 worst to + 6 best +1 worst to +6 best 5 -2 6 best to 1 worst -6 worst to – 1 best Y axis: 5 + (-3) = 2 X axis: 5 + (-2) = 3 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 33

Space Matrix 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 34

Space Matrix 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 34

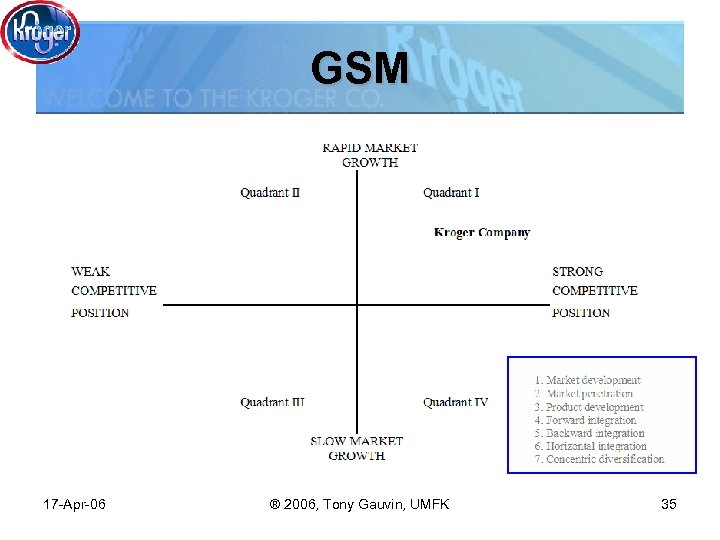

GSM 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 35

GSM 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 35

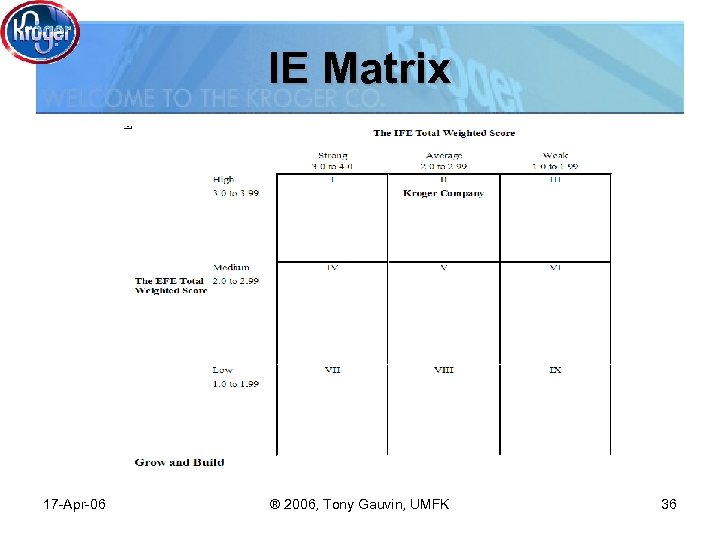

IE Matrix 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 36

IE Matrix 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 36

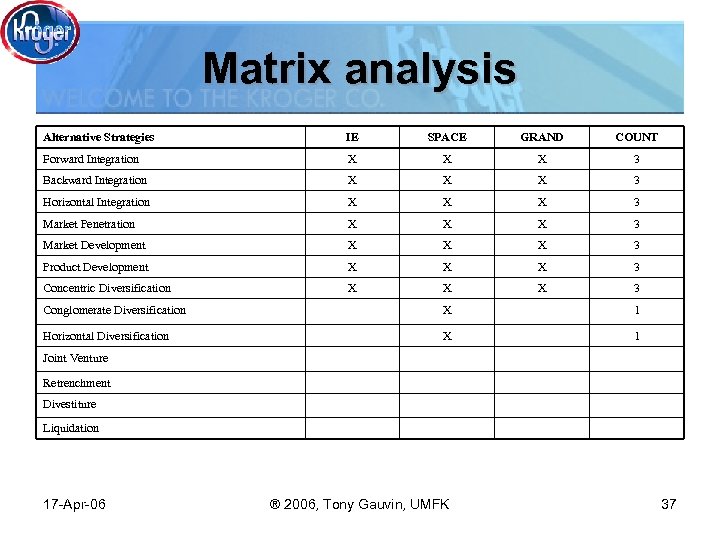

Matrix analysis Alternative Strategies IE SPACE GRAND COUNT Forward Integration X X X 3 Backward Integration X X X 3 Horizontal Integration X X X 3 Market Penetration X X X 3 Market Development X X X 3 Product Development X X X 3 Concentric Diversification X X X 3 Conglomerate Diversification X 1 Horizontal Diversification X 1 Joint Venture Retrenchment Divestiture Liquidation 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 37

Matrix analysis Alternative Strategies IE SPACE GRAND COUNT Forward Integration X X X 3 Backward Integration X X X 3 Horizontal Integration X X X 3 Market Penetration X X X 3 Market Development X X X 3 Product Development X X X 3 Concentric Diversification X X X 3 Conglomerate Diversification X 1 Horizontal Diversification X 1 Joint Venture Retrenchment Divestiture Liquidation 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 37

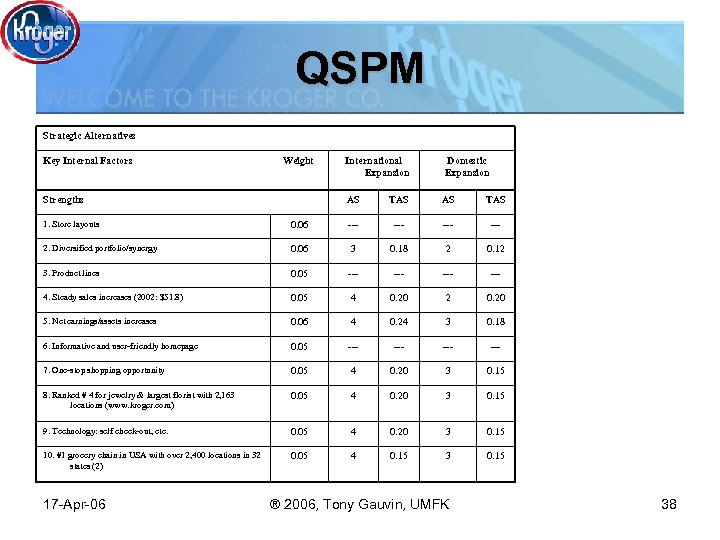

QSPM Strategic Alternatives Key Internal Factors Weight Strengths International Expansion Domestic Expansion AS TAS 1. Store layouts 0. 06 --- --- 2. Diversified portfolio/synergy 0. 06 3 0. 18 2 0. 12 3. Product lines 0. 05 --- --- 4. Steady sales increases (2002: $51. 8) 0. 05 4 0. 20 2 0. 20 5. Net earnings/assets increases 0. 06 4 0. 24 3 0. 18 6. Informative and user-friendly homepage 0. 05 --- --- 7. One-stop shopping opportunity 0. 05 4 0. 20 3 0. 15 8. Ranked # 4 for jewelry & largest florist with 2, 163 locations (www. kroger. com) 0. 05 4 0. 20 3 0. 15 9. Technology: self check-out, etc. 0. 05 4 0. 20 3 0. 15 10. #1 grocery chain in USA with over 2, 400 locations in 32 states (2) 0. 05 4 0. 15 3 0. 15 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 38

QSPM Strategic Alternatives Key Internal Factors Weight Strengths International Expansion Domestic Expansion AS TAS 1. Store layouts 0. 06 --- --- 2. Diversified portfolio/synergy 0. 06 3 0. 18 2 0. 12 3. Product lines 0. 05 --- --- 4. Steady sales increases (2002: $51. 8) 0. 05 4 0. 20 2 0. 20 5. Net earnings/assets increases 0. 06 4 0. 24 3 0. 18 6. Informative and user-friendly homepage 0. 05 --- --- 7. One-stop shopping opportunity 0. 05 4 0. 20 3 0. 15 8. Ranked # 4 for jewelry & largest florist with 2, 163 locations (www. kroger. com) 0. 05 4 0. 20 3 0. 15 9. Technology: self check-out, etc. 0. 05 4 0. 20 3 0. 15 10. #1 grocery chain in USA with over 2, 400 locations in 32 states (2) 0. 05 4 0. 15 3 0. 15 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 38

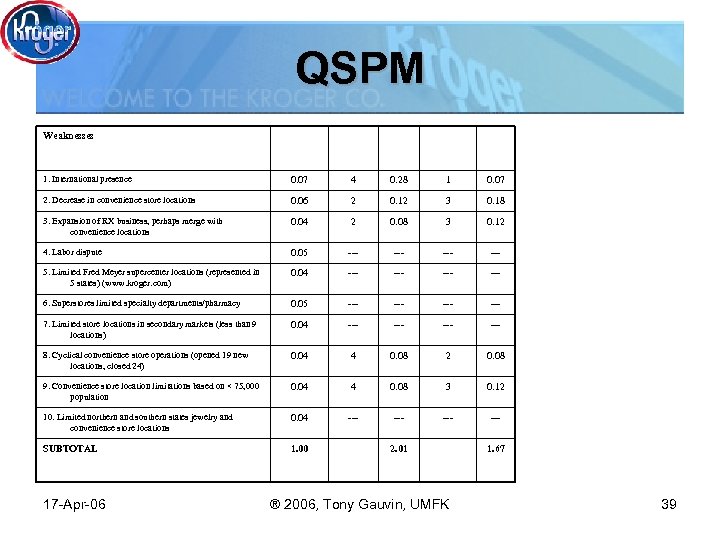

QSPM Weaknesses 1. International presence 0. 07 4 0. 28 1 0. 07 2. Decrease in convenience store locations 0. 06 2 0. 12 3 0. 18 3. Expansion of RX business, perhaps merge with convenience locations 0. 04 2 0. 08 3 0. 12 4. Labor dispute 0. 05 --- --- 5. Limited Fred Meyer supercenter locations (represented in 5 states) (www. kroger. com) 0. 04 --- --- 6. Superstores limited specialty departments/pharmacy 0. 05 --- --- 7. Limited store locations in secondary markets (less than 9 locations) 0. 04 --- --- 8. Cyclical convenience store operations (opened 19 new locations, closed 24) 0. 04 4 0. 08 2 0. 08 9. Convenience store location limitations based on < 75, 000 population 0. 04 4 0. 08 3 0. 12 10. Limited northern and southern states jewelry and convenience store locations 0. 04 --- --- SUBTOTAL 1. 00 17 -Apr-06 2. 01 ® 2006, Tony Gauvin, UMFK 1. 67 39

QSPM Weaknesses 1. International presence 0. 07 4 0. 28 1 0. 07 2. Decrease in convenience store locations 0. 06 2 0. 12 3 0. 18 3. Expansion of RX business, perhaps merge with convenience locations 0. 04 2 0. 08 3 0. 12 4. Labor dispute 0. 05 --- --- 5. Limited Fred Meyer supercenter locations (represented in 5 states) (www. kroger. com) 0. 04 --- --- 6. Superstores limited specialty departments/pharmacy 0. 05 --- --- 7. Limited store locations in secondary markets (less than 9 locations) 0. 04 --- --- 8. Cyclical convenience store operations (opened 19 new locations, closed 24) 0. 04 4 0. 08 2 0. 08 9. Convenience store location limitations based on < 75, 000 population 0. 04 4 0. 08 3 0. 12 10. Limited northern and southern states jewelry and convenience store locations 0. 04 --- --- SUBTOTAL 1. 00 17 -Apr-06 2. 01 ® 2006, Tony Gauvin, UMFK 1. 67 39

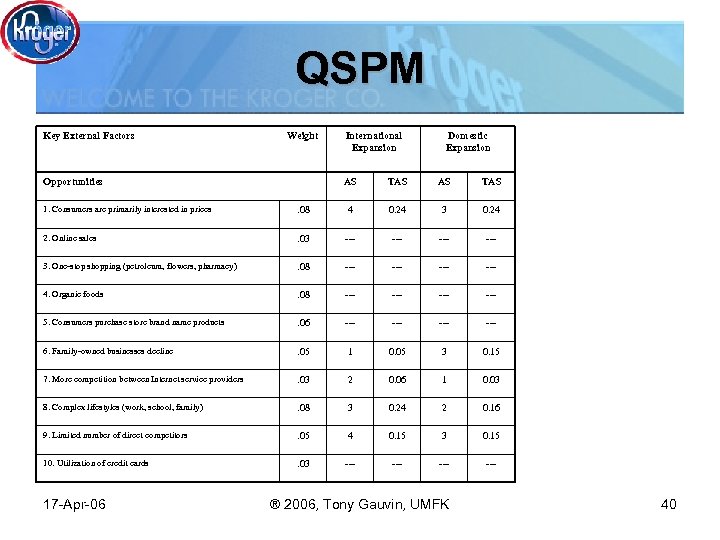

QSPM Key External Factors Weight Opportunities International Expansion Domestic Expansion AS TAS 1. Consumers are primarily interested in prices . 08 4 0. 24 3 0. 24 2. Online sales . 03 --- --- 3. One-stop shopping (petroleum, flowers, pharmacy) . 08 --- --- 4. Organic foods . 08 --- --- 5. Consumers purchase store brand name products . 06 --- --- 6. Family-owned businesses decline . 05 1 0. 05 3 0. 15 7. More competition between Internet service providers . 03 2 0. 06 1 0. 03 8. Complex lifestyles (work, school, family) . 08 3 0. 24 2 0. 16 9. Limited number of direct competitors . 05 4 0. 15 3 0. 15 10. Utilization of credit cards . 03 --- --- 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 40

QSPM Key External Factors Weight Opportunities International Expansion Domestic Expansion AS TAS 1. Consumers are primarily interested in prices . 08 4 0. 24 3 0. 24 2. Online sales . 03 --- --- 3. One-stop shopping (petroleum, flowers, pharmacy) . 08 --- --- 4. Organic foods . 08 --- --- 5. Consumers purchase store brand name products . 06 --- --- 6. Family-owned businesses decline . 05 1 0. 05 3 0. 15 7. More competition between Internet service providers . 03 2 0. 06 1 0. 03 8. Complex lifestyles (work, school, family) . 08 3 0. 24 2 0. 16 9. Limited number of direct competitors . 05 4 0. 15 3 0. 15 10. Utilization of credit cards . 03 --- --- 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 40

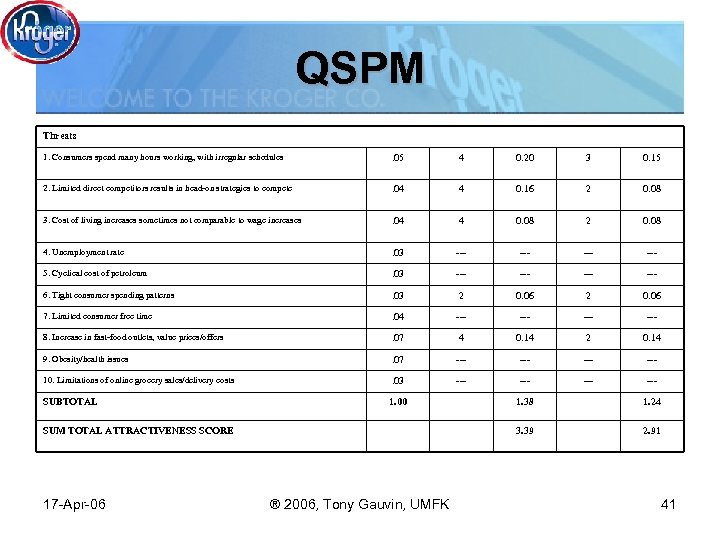

QSPM Threats 1. Consumers spend many hours working, with irregular schedules . 05 4 0. 20 3 0. 15 2. Limited direct competitors results in head-on strategies to compete . 04 4 0. 16 2 0. 08 3. Cost of living increases sometimes not comparable to wage increases . 04 4 0. 08 2 0. 08 4. Unemployment rate . 03 --- --- 5. Cyclical cost of petroleum . 03 --- --- 6. Tight consumer spending patterns . 03 2 0. 06 7. Limited consumer free time . 04 --- --- 8. Increase in fast-food outlets, value prices/offers . 07 4 0. 14 2 0. 14 9. Obesity/health issues . 07 --- --- 10. Limitations of online grocery sales/delivery costs . 03 --- --- SUBTOTAL 1. 00 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 1. 24 3. 39 SUM TOTAL ATTRACTIVENESS SCORE 1. 38 2. 91 41

QSPM Threats 1. Consumers spend many hours working, with irregular schedules . 05 4 0. 20 3 0. 15 2. Limited direct competitors results in head-on strategies to compete . 04 4 0. 16 2 0. 08 3. Cost of living increases sometimes not comparable to wage increases . 04 4 0. 08 2 0. 08 4. Unemployment rate . 03 --- --- 5. Cyclical cost of petroleum . 03 --- --- 6. Tight consumer spending patterns . 03 2 0. 06 7. Limited consumer free time . 04 --- --- 8. Increase in fast-food outlets, value prices/offers . 07 4 0. 14 2 0. 14 9. Obesity/health issues . 07 --- --- 10. Limitations of online grocery sales/delivery costs . 03 --- --- SUBTOTAL 1. 00 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 1. 24 3. 39 SUM TOTAL ATTRACTIVENESS SCORE 1. 38 2. 91 41

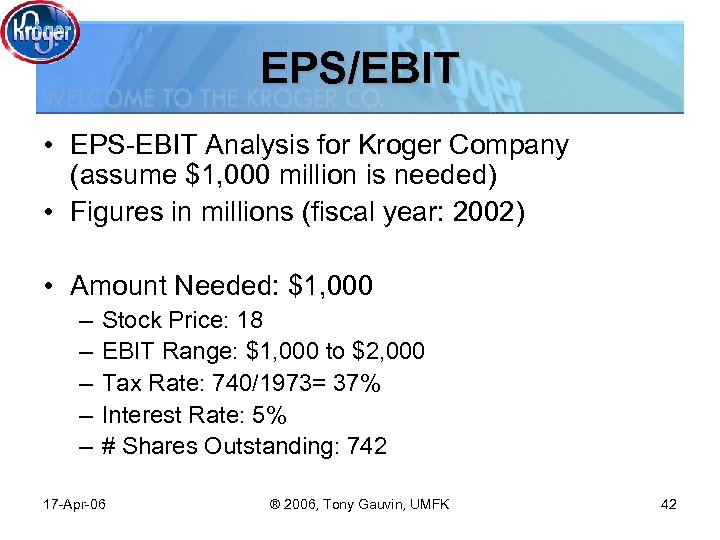

EPS/EBIT • EPS-EBIT Analysis for Kroger Company (assume $1, 000 million is needed) • Figures in millions (fiscal year: 2002) • Amount Needed: $1, 000 – – – Stock Price: 18 EBIT Range: $1, 000 to $2, 000 Tax Rate: 740/1973= 37% Interest Rate: 5% # Shares Outstanding: 742 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 42

EPS/EBIT • EPS-EBIT Analysis for Kroger Company (assume $1, 000 million is needed) • Figures in millions (fiscal year: 2002) • Amount Needed: $1, 000 – – – Stock Price: 18 EBIT Range: $1, 000 to $2, 000 Tax Rate: 740/1973= 37% Interest Rate: 5% # Shares Outstanding: 742 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 42

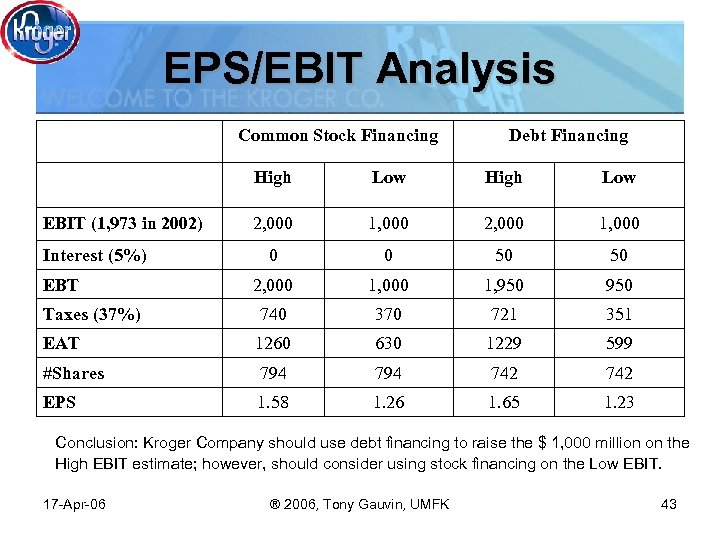

EPS/EBIT Analysis Common Stock Financing Debt Financing High Low 2, 000 1, 000 0 0 50 50 2, 000 1, 950 Taxes (37%) 740 370 721 351 EAT 1260 630 1229 599 #Shares 794 742 EPS 1. 58 1. 26 1. 65 1. 23 EBIT (1, 973 in 2002) Interest (5%) EBT Conclusion: Kroger Company should use debt financing to raise the $ 1, 000 million on the High EBIT estimate; however, should consider using stock financing on the Low EBIT. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 43

EPS/EBIT Analysis Common Stock Financing Debt Financing High Low 2, 000 1, 000 0 0 50 50 2, 000 1, 950 Taxes (37%) 740 370 721 351 EAT 1260 630 1229 599 #Shares 794 742 EPS 1. 58 1. 26 1. 65 1. 23 EBIT (1, 973 in 2002) Interest (5%) EBT Conclusion: Kroger Company should use debt financing to raise the $ 1, 000 million on the High EBIT estimate; however, should consider using stock financing on the Low EBIT. 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 43

Recommendations • Expand into Canada and Mexico – Less Competition from Wal-Mart – Dangers • Carrefour and Wal-Mart are also expanding • Continue to expand Domestically – Super centers – Jewelry Stores • Europe? ? ? • If Growth is not possible than seek to minimize cost to increase profit – Cash Cow 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 44

Recommendations • Expand into Canada and Mexico – Less Competition from Wal-Mart – Dangers • Carrefour and Wal-Mart are also expanding • Continue to expand Domestically – Super centers – Jewelry Stores • Europe? ? ? • If Growth is not possible than seek to minimize cost to increase profit – Cash Cow 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 44

Implementation • Merge with Carrefour of Canada and go head-on against Wal-Mart • Continue to acquire smaller chains in the US • Bomb Wal-Mart (Just Joking!) 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 45

Implementation • Merge with Carrefour of Canada and go head-on against Wal-Mart • Continue to acquire smaller chains in the US • Bomb Wal-Mart (Just Joking!) 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 45

Evaluation Quarterly & Yearly Financial Statements Annual strategic meetings of division management and corporate management 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 46

Evaluation Quarterly & Yearly Financial Statements Annual strategic meetings of division management and corporate management 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 46

Kroger 2006 • Number 21 on Fortune 500 (US Companies) – Dropped from 18 – Wal-Mart is Number 2 • 183 th largest Company in the World – Wal-Mart is 10 th – Carrefour is 88 th • Sales projected at $65 Billion – Steady increases • Net Profit Margin 1. 7% – Better than last year but still down from 2. 5% in 2002 • 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 47

Kroger 2006 • Number 21 on Fortune 500 (US Companies) – Dropped from 18 – Wal-Mart is Number 2 • 183 th largest Company in the World – Wal-Mart is 10 th – Carrefour is 88 th • Sales projected at $65 Billion – Steady increases • Net Profit Margin 1. 7% – Better than last year but still down from 2. 5% in 2002 • 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 47

Questions? 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 48

Questions? 17 -Apr-06 ® 2006, Tony Gauvin, UMFK 48