00319e952c719f3f2a9e6432bea9cd39.ppt

- Количество слайдов: 28

A Staff Presentation Developing a Common Platform for Electricity Trading RAVINDER Chief (Engineering) Central Electricity Regulatory Commission 7 th Floor, Core – 3, SCOPE COMPLEX, Lodhi Road, New Delhi- 110003, INDIA Ph. 91 11 24364960 E mail: ravinderveeksha@hotmail. com 1

A Staff Presentation Developing a Common Platform for Electricity Trading RAVINDER Chief (Engineering) Central Electricity Regulatory Commission 7 th Floor, Core – 3, SCOPE COMPLEX, Lodhi Road, New Delhi- 110003, INDIA Ph. 91 11 24364960 E mail: ravinderveeksha@hotmail. com 1

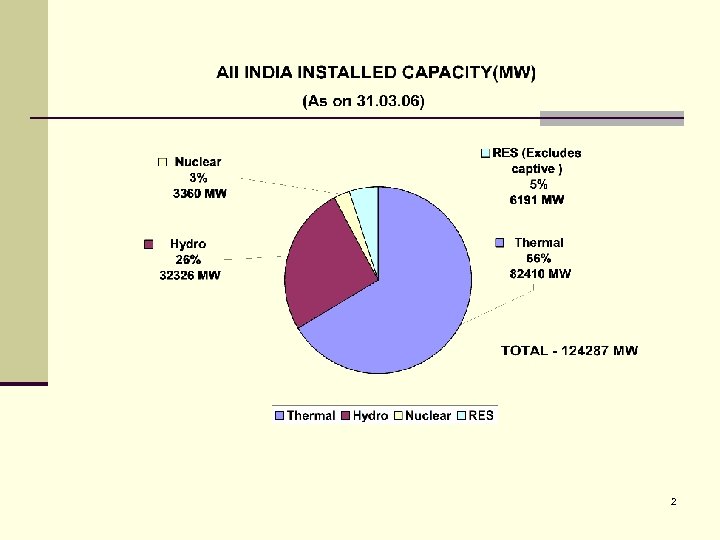

2

2

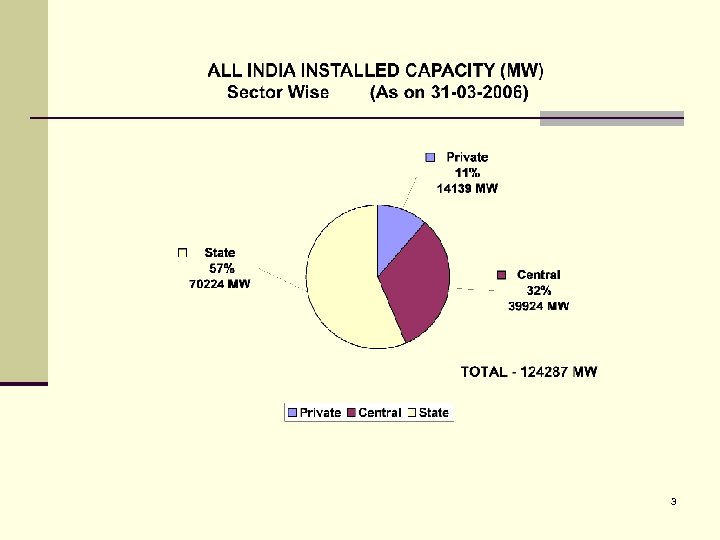

3

3

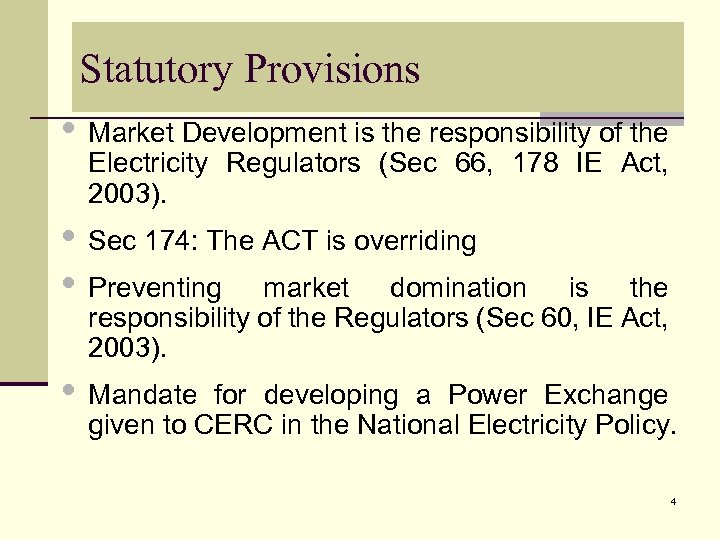

Statutory Provisions • Market Development is the responsibility of the Electricity Regulators (Sec 66, 178 IE Act, 2003). • Sec 174: The ACT is overriding • Preventing market domination is the responsibility of the Regulators (Sec 60, IE Act, 2003). • Mandate for developing a Power Exchange given to CERC in the National Electricity Policy. 4

Statutory Provisions • Market Development is the responsibility of the Electricity Regulators (Sec 66, 178 IE Act, 2003). • Sec 174: The ACT is overriding • Preventing market domination is the responsibility of the Regulators (Sec 60, IE Act, 2003). • Mandate for developing a Power Exchange given to CERC in the National Electricity Policy. 4

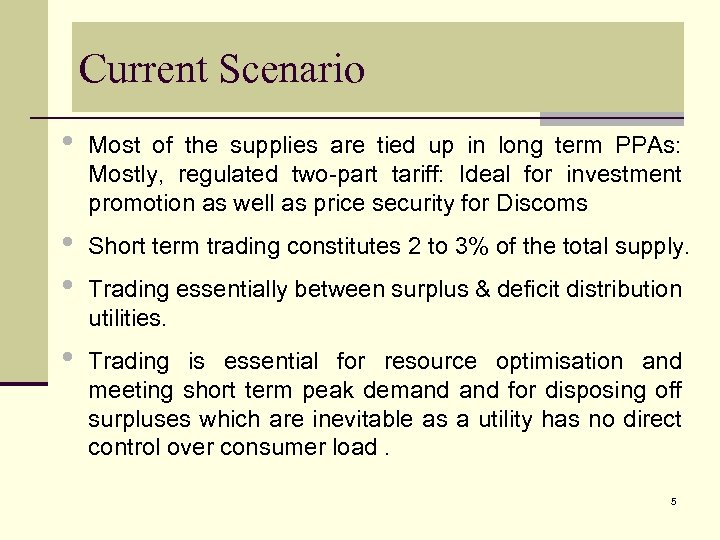

Current Scenario • Most of the supplies are tied up in long term PPAs: Mostly, regulated two-part tariff: Ideal for investment promotion as well as price security for Discoms • • Short term trading constitutes 2 to 3% of the total supply. • Trading is essential for resource optimisation and meeting short term peak demand for disposing off surpluses which are inevitable as a utility has no direct control over consumer load. Trading essentially between surplus & deficit distribution utilities. 5

Current Scenario • Most of the supplies are tied up in long term PPAs: Mostly, regulated two-part tariff: Ideal for investment promotion as well as price security for Discoms • • Short term trading constitutes 2 to 3% of the total supply. • Trading is essential for resource optimisation and meeting short term peak demand for disposing off surpluses which are inevitable as a utility has no direct control over consumer load. Trading essentially between surplus & deficit distribution utilities. 5

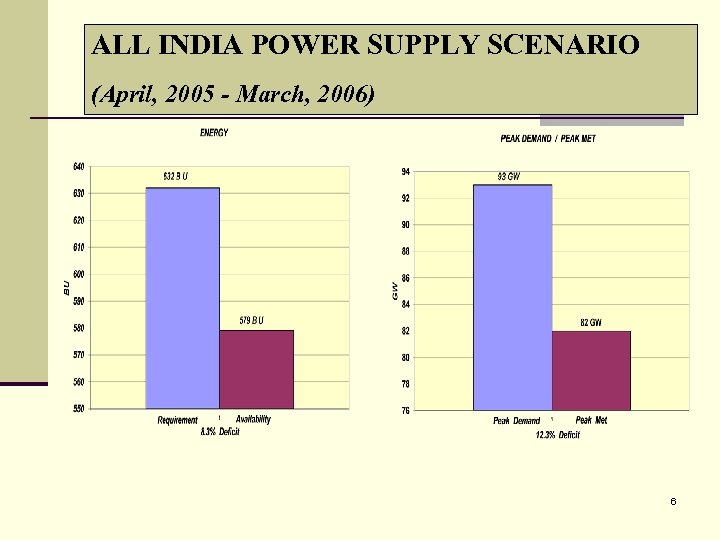

ALL INDIA POWER SUPPLY SCENARIO (April, 2005 - March, 2006) 6

ALL INDIA POWER SUPPLY SCENARIO (April, 2005 - March, 2006) 6

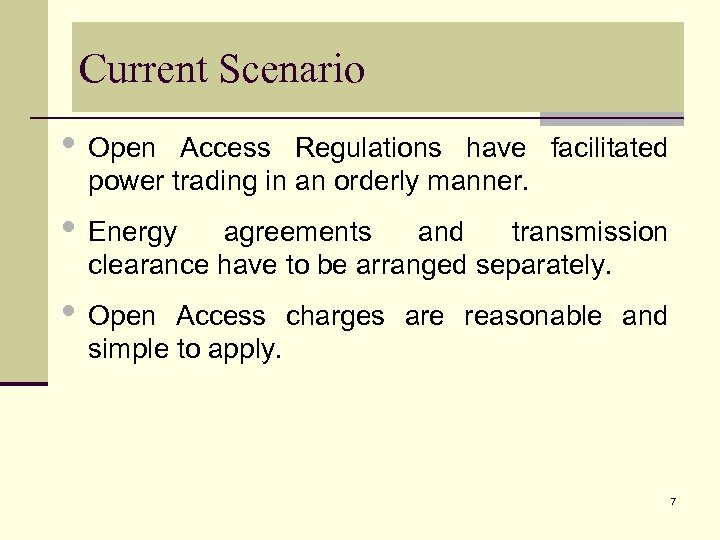

Current Scenario • Open Access Regulations have facilitated power trading in an orderly manner. • Energy agreements and transmission clearance have to be arranged separately. • Open Access charges are reasonable and simple to apply. 7

Current Scenario • Open Access Regulations have facilitated power trading in an orderly manner. • Energy agreements and transmission clearance have to be arranged separately. • Open Access charges are reasonable and simple to apply. 7

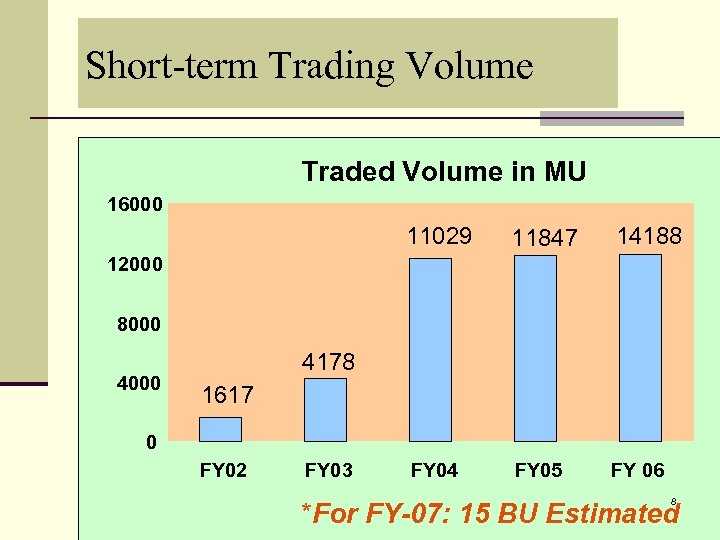

Short-term Trading Volume Traded Volume in MU 16000 11029 11847 14188 FY 04 FY 05 FY 06 12000 8000 4178 1617 0 FY 02 FY 03 8 *For FY-07: 15 BU Estimated

Short-term Trading Volume Traded Volume in MU 16000 11029 11847 14188 FY 04 FY 05 FY 06 12000 8000 4178 1617 0 FY 02 FY 03 8 *For FY-07: 15 BU Estimated

Current Scenario • Suppliers call for bids from buyers/traders. • Traders compete to win the supply bids. • Buyers have no option but to buy from the trader having the supply contract. • Due to deficit scenario, suppliers dominate. • Prices of trades electricity have been going up. • Most of the bilateral trading is inter-regional; - ER, NER are suppliers - NR, WR are buyers 9

Current Scenario • Suppliers call for bids from buyers/traders. • Traders compete to win the supply bids. • Buyers have no option but to buy from the trader having the supply contract. • Due to deficit scenario, suppliers dominate. • Prices of trades electricity have been going up. • Most of the bilateral trading is inter-regional; - ER, NER are suppliers - NR, WR are buyers 9

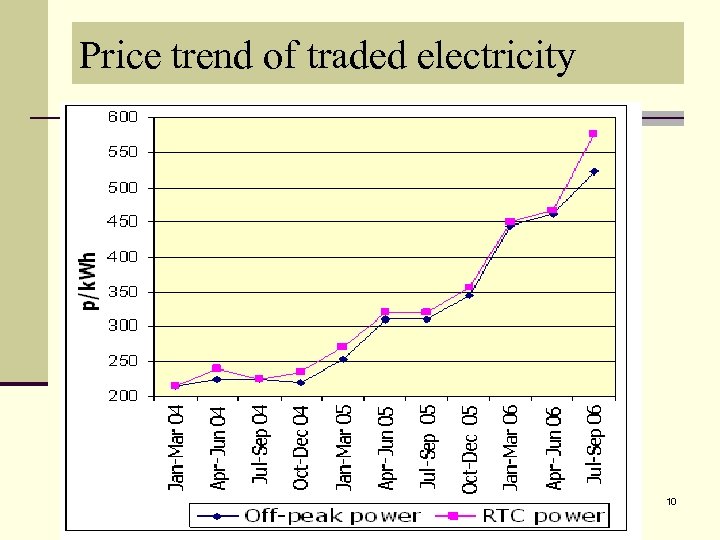

Price trend of traded electricity 10

Price trend of traded electricity 10

Current Scenario • • • Need to curb sellers’ domination • • • Need to increase the supplies • For optimum resource management, need to simultaneously clear energy contracts & transmission paths. Need to put on end to profiteering Need to organize short term trading on a transparent, equitable and efficient platform Need to bring surplus captive generation into the grid. Need to encourage peaking power plants and merchant generation. 11

Current Scenario • • • Need to curb sellers’ domination • • • Need to increase the supplies • For optimum resource management, need to simultaneously clear energy contracts & transmission paths. Need to put on end to profiteering Need to organize short term trading on a transparent, equitable and efficient platform Need to bring surplus captive generation into the grid. Need to encourage peaking power plants and merchant generation. 11

Current Scenario §Adequate Inter-state transmission system, but needs strengthening §Established scheduling, dispatch energy accounting procedures § and UI accounting system for real time deviations from schedules §Established RLDCs, SLDCs 12

Current Scenario §Adequate Inter-state transmission system, but needs strengthening §Established scheduling, dispatch energy accounting procedures § and UI accounting system for real time deviations from schedules §Established RLDCs, SLDCs 12

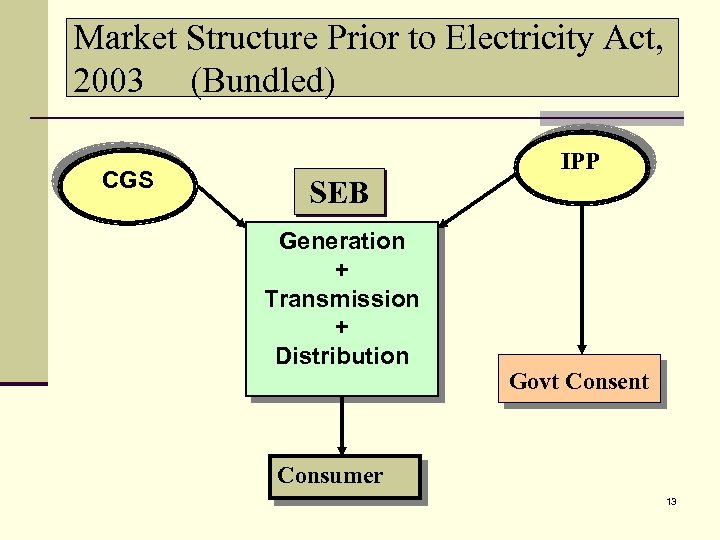

Market Structure Prior to Electricity Act, 2003 (Bundled) CGS SEB Generation + Transmission + Distribution IPP Govt Consent Consumer 13

Market Structure Prior to Electricity Act, 2003 (Bundled) CGS SEB Generation + Transmission + Distribution IPP Govt Consent Consumer 13

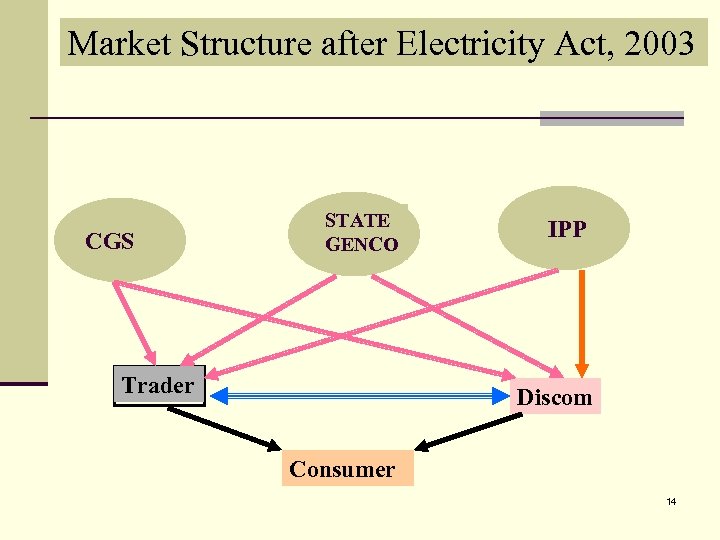

Market Structure after Electricity Act, 2003 CGS STATE GENCO Trader IPP Discom Consumer 14

Market Structure after Electricity Act, 2003 CGS STATE GENCO Trader IPP Discom Consumer 14

Road map for market development n Forward Physical Contracts (Long-term)- Established; n Moving from Regulated Cost-Plus PPAs to Tariff-bid based PPAs for new generating capacity n Forward Physical Contracts (Short-term)Established; but non-standard contracts n Day ahead Spot Market thru’ PX? n Real Time Market (Substituted by UI mechanism) 15

Road map for market development n Forward Physical Contracts (Long-term)- Established; n Moving from Regulated Cost-Plus PPAs to Tariff-bid based PPAs for new generating capacity n Forward Physical Contracts (Short-term)Established; but non-standard contracts n Day ahead Spot Market thru’ PX? n Real Time Market (Substituted by UI mechanism) 15

International Experience n Nord Pool n PJM n UK experience n California PX n South Africa/ ESKOM 16

International Experience n Nord Pool n PJM n UK experience n California PX n South Africa/ ESKOM 16

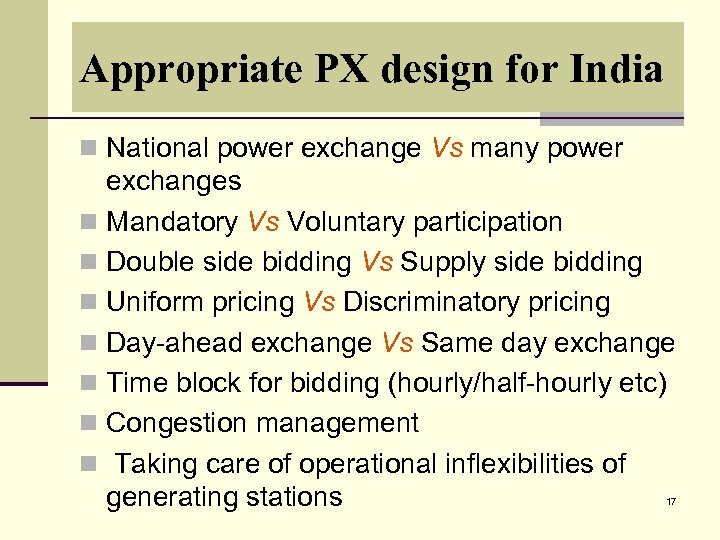

Appropriate PX design for India n National power exchange Vs many power exchanges n Mandatory Vs Voluntary participation n Double side bidding Vs Supply side bidding n Uniform pricing Vs Discriminatory pricing n Day-ahead exchange Vs Same day exchange n Time block for bidding (hourly/half-hourly etc) n Congestion management n Taking care of operational inflexibilities of generating stations 17

Appropriate PX design for India n National power exchange Vs many power exchanges n Mandatory Vs Voluntary participation n Double side bidding Vs Supply side bidding n Uniform pricing Vs Discriminatory pricing n Day-ahead exchange Vs Same day exchange n Time block for bidding (hourly/half-hourly etc) n Congestion management n Taking care of operational inflexibilities of generating stations 17

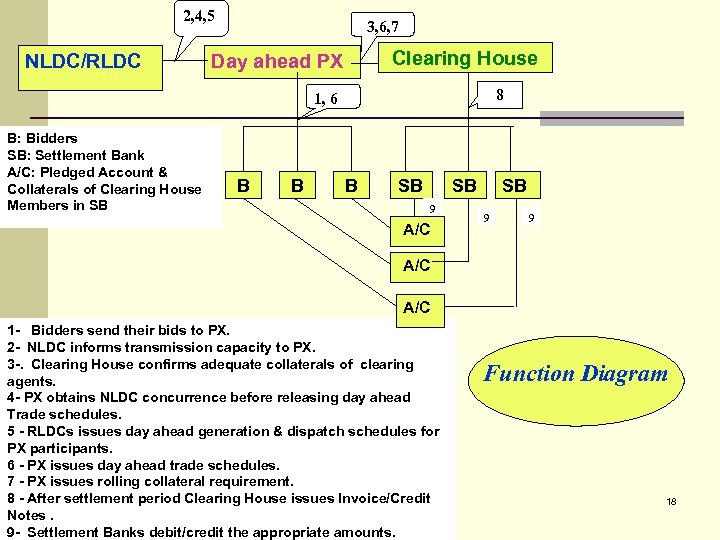

2, 4, 5 NLDC/RLDC 3, 6, 7 Clearing House Day ahead PX 8 1, 6 B: Bidders SB: Settlement Bank A/C: Pledged Account & Collaterals of Clearing House Members in SB B SB SB 9 A/C SB 9 9 A/C 1 - Bidders send their bids to PX. 2 - NLDC informs transmission capacity to PX. 3 -. Clearing House confirms adequate collaterals of clearing agents. 4 - PX obtains NLDC concurrence before releasing day ahead Trade schedules. 5 - RLDCs issues day ahead generation & dispatch schedules for PX participants. 6 - PX issues day ahead trade schedules. 7 - PX issues rolling collateral requirement. 8 - After settlement period Clearing House issues Invoice/Credit Notes. 9 - Settlement Banks debit/credit the appropriate amounts. Function Diagram 18

2, 4, 5 NLDC/RLDC 3, 6, 7 Clearing House Day ahead PX 8 1, 6 B: Bidders SB: Settlement Bank A/C: Pledged Account & Collaterals of Clearing House Members in SB B SB SB 9 A/C SB 9 9 A/C 1 - Bidders send their bids to PX. 2 - NLDC informs transmission capacity to PX. 3 -. Clearing House confirms adequate collaterals of clearing agents. 4 - PX obtains NLDC concurrence before releasing day ahead Trade schedules. 5 - RLDCs issues day ahead generation & dispatch schedules for PX participants. 6 - PX issues day ahead trade schedules. 7 - PX issues rolling collateral requirement. 8 - After settlement period Clearing House issues Invoice/Credit Notes. 9 - Settlement Banks debit/credit the appropriate amounts. Function Diagram 18

Expectations of a Portfolio Manager n Freedom to sell and buy at short notice through a single window n No cap at seller’s bids n Reasonable cost of purchase n Assured availability n Assured delivery/take off n Assured payments 19

Expectations of a Portfolio Manager n Freedom to sell and buy at short notice through a single window n No cap at seller’s bids n Reasonable cost of purchase n Assured availability n Assured delivery/take off n Assured payments 19

Transmission and System Operation • Open Access charges for PX schedules would be socialized. • Transmission losses to be applied on PX participants as applicable. • Part inter- regional capacities would be assigned for PX. • RLDC time line and IEGC would be complied. • PX schedules would be firm. 20

Transmission and System Operation • Open Access charges for PX schedules would be socialized. • Transmission losses to be applied on PX participants as applicable. • Part inter- regional capacities would be assigned for PX. • RLDC time line and IEGC would be complied. • PX schedules would be firm. 20

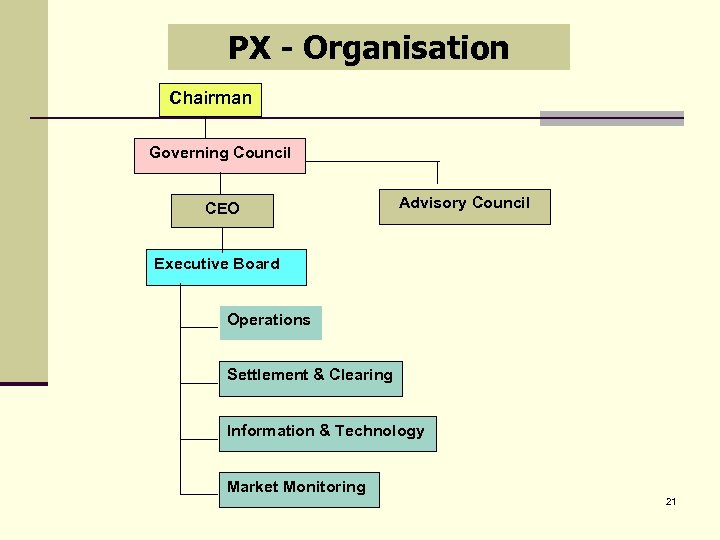

PX - Organisation Chairman Governing Council CEO Advisory Council Executive Board Operations Settlement & Clearing Information & Technology Market Monitoring 21

PX - Organisation Chairman Governing Council CEO Advisory Council Executive Board Operations Settlement & Clearing Information & Technology Market Monitoring 21

Issues- General n Does Px need Licence n Membership to Grid connected entities only n Whether to allow membership to traders n Px- to be a profit or non profit organisation n Role of CERC 22

Issues- General n Does Px need Licence n Membership to Grid connected entities only n Whether to allow membership to traders n Px- to be a profit or non profit organisation n Role of CERC 22

Issues- General n Do we really need a Day-ahead PX, now or in the near future? n What would be the right time? n How to mandate a national PX by law? n How to organize a national PX? 23

Issues- General n Do we really need a Day-ahead PX, now or in the near future? n What would be the right time? n How to mandate a national PX by law? n How to organize a national PX? 23

Issues- Price Discovery and Bidding n Pricing principles n Bid caps, to have them or not n Can bid caps be effective n Sale price in constrained Market n Can we curb market power/abuse n How can Run of River, Thermal, Nuclear and Windmill Generators submit hourly day-ahead bids? 24

Issues- Price Discovery and Bidding n Pricing principles n Bid caps, to have them or not n Can bid caps be effective n Sale price in constrained Market n Can we curb market power/abuse n How can Run of River, Thermal, Nuclear and Windmill Generators submit hourly day-ahead bids? 24

Issues- Preventing Market Abuse n Common market abuses 1. Bidding above the marginal cost 2. Withholding Capacity 3. Avoiding a platform with lower price caps n What would it feel like if most often the marginal bids for Market Clearing Price were of liquid fuel generators? 25

Issues- Preventing Market Abuse n Common market abuses 1. Bidding above the marginal cost 2. Withholding Capacity 3. Avoiding a platform with lower price caps n What would it feel like if most often the marginal bids for Market Clearing Price were of liquid fuel generators? 25

Issues- Market Regulation n Defining the Rules of the Game n Enforcing the Rules and Regulations n Market Monitoring n Ensuring Anonymity of Bids 26

Issues- Market Regulation n Defining the Rules of the Game n Enforcing the Rules and Regulations n Market Monitoring n Ensuring Anonymity of Bids 26

Issues- Congestion Management n To collect congestion revenue Or n Not by charging the Buyers of congested zone at the cost of PX purchase instead of the price offered by the Buyers? 27

Issues- Congestion Management n To collect congestion revenue Or n Not by charging the Buyers of congested zone at the cost of PX purchase instead of the price offered by the Buyers? 27

THANK YOU 28

THANK YOU 28