fd3c746a84245ba014c12ce9d62e9d28.ppt

- Количество слайдов: 15

A REVIEW OF THE RUSSIAN TOURISTS VISITING TURKEY Sevda BIRDIR, Mersin Üniversity Esra BALLI, Çukurova University Elif BAL, AFAT Kemal BIRDIR, Mersin Üniversity

A REVIEW OF THE RUSSIAN TOURISTS VISITING TURKEY Sevda BIRDIR, Mersin Üniversity Esra BALLI, Çukurova University Elif BAL, AFAT Kemal BIRDIR, Mersin Üniversity

Purpose To examine whethere is a difference between the Russian tourist groups visiting Turkey, Antalya, using two sets of data collected in August 2007 and July 2011. Methodology Questionnaires developed by researchers and employing drop-and-collect method. There are two studies utilized for the purpose of this study. These studies are Birdir (2007), “Segmenting tourist market based on benefits sought from a summer holiday: A study in Antalya” and Bal (2012), “The relationship between tourists’ satisfaction, complaints and their tendency to come back: A Study on Tourists Visiting Antalya. ” Results There seems to be some major differences between the Russian tourist groups visiting Antalya, Turkey between 2007 and 2011.

Purpose To examine whethere is a difference between the Russian tourist groups visiting Turkey, Antalya, using two sets of data collected in August 2007 and July 2011. Methodology Questionnaires developed by researchers and employing drop-and-collect method. There are two studies utilized for the purpose of this study. These studies are Birdir (2007), “Segmenting tourist market based on benefits sought from a summer holiday: A study in Antalya” and Bal (2012), “The relationship between tourists’ satisfaction, complaints and their tendency to come back: A Study on Tourists Visiting Antalya. ” Results There seems to be some major differences between the Russian tourist groups visiting Antalya, Turkey between 2007 and 2011.

Tourism Industry in Turkey Since mids of 80’s, Turkey has been experiencing a tremendous growth in Tourism Industry Whereas the number of tourist visiting Turkey was a mere 2. 6 million in 1985, this number has been reached to 31. 7 million in 2012. Turkey, nowadays, is the 6 th largest tourist receiving destination/county in the world. Tourism income, on the other hand, has been rised respectively, and reached to $29. 4 billion compared to $1. 5 billion in 1985.

Tourism Industry in Turkey Since mids of 80’s, Turkey has been experiencing a tremendous growth in Tourism Industry Whereas the number of tourist visiting Turkey was a mere 2. 6 million in 1985, this number has been reached to 31. 7 million in 2012. Turkey, nowadays, is the 6 th largest tourist receiving destination/county in the world. Tourism income, on the other hand, has been rised respectively, and reached to $29. 4 billion compared to $1. 5 billion in 1985.

RUSSIAN TOURIST IN TURKEY Russian tourists are now the second largest group visiting Turkey (Germans are number one) and in 2012, number of Russian tourist visiting Turkey has been reached to 3. 6 million (German tourists- 5 million) Comparing this number to the mere 105, 000 Russian tourist in 2001, it is easy to see the impressive growth in only almost one decade. Today Russian tourists are a very crucial part of the Turkish tourism industry; therefore, understanding the demographic and other changes in this group is important for the future of the Tourism industry in Turkey.

RUSSIAN TOURIST IN TURKEY Russian tourists are now the second largest group visiting Turkey (Germans are number one) and in 2012, number of Russian tourist visiting Turkey has been reached to 3. 6 million (German tourists- 5 million) Comparing this number to the mere 105, 000 Russian tourist in 2001, it is easy to see the impressive growth in only almost one decade. Today Russian tourists are a very crucial part of the Turkish tourism industry; therefore, understanding the demographic and other changes in this group is important for the future of the Tourism industry in Turkey.

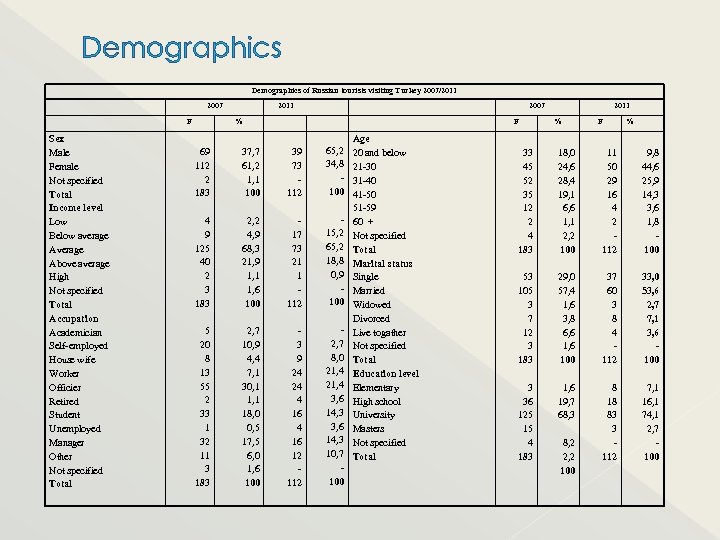

Demographics of Russian tourists visiting Turkey 2007/2011 2007 F Sex Male Female Not specified Total Income level Low Below average Above average High Not specified Total Accupation Academician Self-employed House wife Worker Officier Retired Student Unemployed Manager Other Not specified Total 2011 2007 % F 69 112 2 183 37, 7 61, 2 1, 1 100 39 73 112 65, 2 34, 8 100 4 9 125 40 2 3 183 2, 2 4, 9 68, 3 21, 9 1, 1 1, 6 100 17 73 21 1 112 15, 2 65, 2 18, 8 0, 9 100 5 20 8 13 55 2 33 1 32 11 3 183 2, 7 10, 9 4, 4 7, 1 30, 1 18, 0 0, 5 17, 5 6, 0 1, 6 100 3 9 24 24 4 16 12 112 2, 7 8, 0 21, 4 3, 6 14, 3 10, 7 100 Age 20 and below 21 -30 31 -40 41 -50 51 -59 60 + Not specified Total Marital status Single Married Widowed Divorced Live togather Not specified Total Education level Elementary High school University Masters Not specified Total 2011 % F % 33 45 52 35 12 2 4 183 18, 0 24, 6 28, 4 19, 1 6, 6 1, 1 2, 2 100 11 50 29 16 4 2 112 9, 8 44, 6 25, 9 14, 3 3, 6 1, 8 100 53 105 3 7 12 3 183 29, 0 57, 4 1, 6 3, 8 6, 6 100 37 60 3 8 4 112 33, 0 53, 6 2, 7 7, 1 3, 6 100 3 36 125 15 4 183 1, 6 19, 7 68, 3 8 18 83 3 112 7, 1 16, 1 74, 1 2, 7 100 8, 2 2, 2 100

Demographics of Russian tourists visiting Turkey 2007/2011 2007 F Sex Male Female Not specified Total Income level Low Below average Above average High Not specified Total Accupation Academician Self-employed House wife Worker Officier Retired Student Unemployed Manager Other Not specified Total 2011 2007 % F 69 112 2 183 37, 7 61, 2 1, 1 100 39 73 112 65, 2 34, 8 100 4 9 125 40 2 3 183 2, 2 4, 9 68, 3 21, 9 1, 1 1, 6 100 17 73 21 1 112 15, 2 65, 2 18, 8 0, 9 100 5 20 8 13 55 2 33 1 32 11 3 183 2, 7 10, 9 4, 4 7, 1 30, 1 18, 0 0, 5 17, 5 6, 0 1, 6 100 3 9 24 24 4 16 12 112 2, 7 8, 0 21, 4 3, 6 14, 3 10, 7 100 Age 20 and below 21 -30 31 -40 41 -50 51 -59 60 + Not specified Total Marital status Single Married Widowed Divorced Live togather Not specified Total Education level Elementary High school University Masters Not specified Total 2011 % F % 33 45 52 35 12 2 4 183 18, 0 24, 6 28, 4 19, 1 6, 6 1, 1 2, 2 100 11 50 29 16 4 2 112 9, 8 44, 6 25, 9 14, 3 3, 6 1, 8 100 53 105 3 7 12 3 183 29, 0 57, 4 1, 6 3, 8 6, 6 100 37 60 3 8 4 112 33, 0 53, 6 2, 7 7, 1 3, 6 100 3 36 125 15 4 183 1, 6 19, 7 68, 3 8 18 83 3 112 7, 1 16, 1 74, 1 2, 7 100 8, 2 2, 2 100

Demographics More than %68 of the tourist joined the study in 2007 were “university” graduates. “High” school graduates, on the other hand, were %19, 7. In 2011, university graduates were %74, 1 and high school were %16, 1. It was found that, in 2007, %61, 2 of the tourist joined the study were “women” and %37, 7 were “men. ” In 2011, these numbers were %34, 8 “women” and %65, 2 “men” respectively. Occupations of the tourist in 2007 were found to be; %30, 1 “officer”, %18 “student”, %17, 5 “manager” and %10, 9 “selfemployed. ” On the other hand, in 2011, the occupations were %21, 4 for both “workers” and “officers”’, and %14, 3 for both “manager” and “student. ” Income levels of the tourist in 2007 were found to be %68, 3 for “middle incomers” and %21, 9 for “above middle” income groups. In 2011, the “middle incomers” were found to be %65, 2 and “abve middle” income group to be %18, 8.

Demographics More than %68 of the tourist joined the study in 2007 were “university” graduates. “High” school graduates, on the other hand, were %19, 7. In 2011, university graduates were %74, 1 and high school were %16, 1. It was found that, in 2007, %61, 2 of the tourist joined the study were “women” and %37, 7 were “men. ” In 2011, these numbers were %34, 8 “women” and %65, 2 “men” respectively. Occupations of the tourist in 2007 were found to be; %30, 1 “officer”, %18 “student”, %17, 5 “manager” and %10, 9 “selfemployed. ” On the other hand, in 2011, the occupations were %21, 4 for both “workers” and “officers”’, and %14, 3 for both “manager” and “student. ” Income levels of the tourist in 2007 were found to be %68, 3 for “middle incomers” and %21, 9 for “above middle” income groups. In 2011, the “middle incomers” were found to be %65, 2 and “abve middle” income group to be %18, 8.

ACCOMMODATION PREFERENCES Russian tourists seem to prefer quality accommodation establishments when they have holiday in Turkey. In 2007, %59 and in 2011, %58, 9 of the tourists stayed at “ 5 -star” hotels. Five star hotels were followed by 4 -star hotels (%27, 3 in 2007 and %27, 7 in 2011 respectively).

ACCOMMODATION PREFERENCES Russian tourists seem to prefer quality accommodation establishments when they have holiday in Turkey. In 2007, %59 and in 2011, %58, 9 of the tourists stayed at “ 5 -star” hotels. Five star hotels were followed by 4 -star hotels (%27, 3 in 2007 and %27, 7 in 2011 respectively).

SOURCES OF INFORMATION In 2007, sources of information for Russian tourist were “travel agencies- %52, 5”, “friends-%45, 4”, “internet-%33, 9”, “family%18, 6” and “colleauges-%15, 3” respectively. In 2011, information sources seem to change dramatically. “Internet”, not suprisingly, was number one information source with %44, 6. This was followed by “travel agencies- %33, ” and “family/friends 14, 3. ”

SOURCES OF INFORMATION In 2007, sources of information for Russian tourist were “travel agencies- %52, 5”, “friends-%45, 4”, “internet-%33, 9”, “family%18, 6” and “colleauges-%15, 3” respectively. In 2011, information sources seem to change dramatically. “Internet”, not suprisingly, was number one information source with %44, 6. This was followed by “travel agencies- %33, ” and “family/friends 14, 3. ”

HOLIDAY PACKAGE Package tours are the major holiday product the Russian tourists prefer to buy for holidays in Turkey. In 2007, %87, 4 of the Russian tourist used package tours to have holiday in Antalya, Turkey. In 2011, %92 of the Russian tourists preferred package tours.

HOLIDAY PACKAGE Package tours are the major holiday product the Russian tourists prefer to buy for holidays in Turkey. In 2007, %87, 4 of the Russian tourist used package tours to have holiday in Antalya, Turkey. In 2011, %92 of the Russian tourists preferred package tours.

Holiday Reservation Periods Holiday planning periods seem to change for Russian tourists in 4 years dramatically. While the major holiday planning period in 2007 was “ 1 -4 months (%37, 2) before the holiday “, the major holiday planning period was “ 1 -2 weeks (%43, 8) before the holiday” in 2011. Tourists seems to prefer last minute systems more, probably for better deals. Vast use of internet for holiday purchases may be the reason for this drastic change.

Holiday Reservation Periods Holiday planning periods seem to change for Russian tourists in 4 years dramatically. While the major holiday planning period in 2007 was “ 1 -4 months (%37, 2) before the holiday “, the major holiday planning period was “ 1 -2 weeks (%43, 8) before the holiday” in 2011. Tourists seems to prefer last minute systems more, probably for better deals. Vast use of internet for holiday purchases may be the reason for this drastic change.

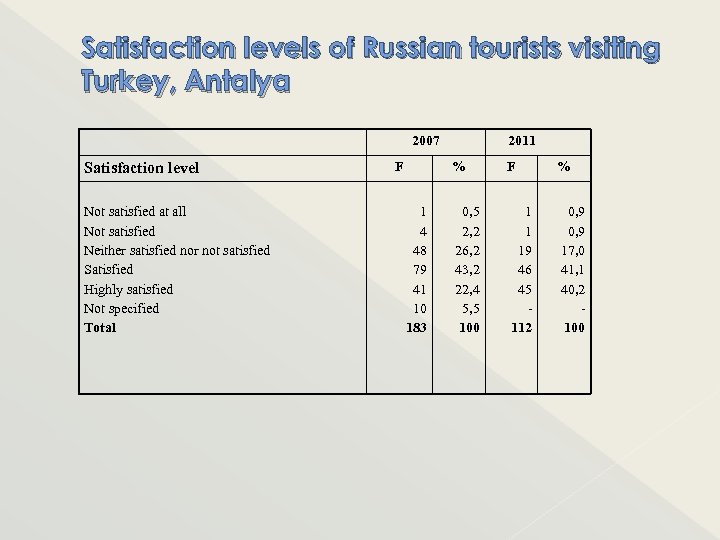

Satisfaction levels of Russian tourists visiting Turkey, Antalya 2007 Satisfaction level Not satisfied at all Not satisfied Neither satisfied nor not satisfied Satisfied Highly satisfied Not specified Total F 2011 % 1 4 48 79 41 10 183 0, 5 2, 2 26, 2 43, 2 22, 4 5, 5 100 F 1 1 19 46 45 112 % 0, 9 17, 0 41, 1 40, 2 100

Satisfaction levels of Russian tourists visiting Turkey, Antalya 2007 Satisfaction level Not satisfied at all Not satisfied Neither satisfied nor not satisfied Satisfied Highly satisfied Not specified Total F 2011 % 1 4 48 79 41 10 183 0, 5 2, 2 26, 2 43, 2 22, 4 5, 5 100 F 1 1 19 46 45 112 % 0, 9 17, 0 41, 1 40, 2 100

Satisfaction levels of Russian tourists visiting Turkey, Antalya Study shows that %43 of the tourist visiting Antalya, Turkey in 2007 were “satisfied” and %22. 4 of them were “highly satisfied” with their holiday. In total, %65. 6 percent of the tourist indicated satisfaction with their holiday. This satisfaction level seems to be highly increased in 2011, totaling %81, 3 percent (%41, 1 “satisfied” and %40, 2 “highly satisfied” ).

Satisfaction levels of Russian tourists visiting Turkey, Antalya Study shows that %43 of the tourist visiting Antalya, Turkey in 2007 were “satisfied” and %22. 4 of them were “highly satisfied” with their holiday. In total, %65. 6 percent of the tourist indicated satisfaction with their holiday. This satisfaction level seems to be highly increased in 2011, totaling %81, 3 percent (%41, 1 “satisfied” and %40, 2 “highly satisfied” ).

Future Holiday Preferences In 2007, %76 of the Russian tourists indicated that they wanted to have another holiday in Antalya in the future. In 2011, %91, 1 of the Russian tourists wanted another holiday in Antalya. This eye-cathing increase is probably due to the quality hotels and service the tourists experience in Antalya.

Future Holiday Preferences In 2007, %76 of the Russian tourists indicated that they wanted to have another holiday in Antalya in the future. In 2011, %91, 1 of the Russian tourists wanted another holiday in Antalya. This eye-cathing increase is probably due to the quality hotels and service the tourists experience in Antalya.

CONCLUSION Two different studies done to analyze the Russian tourists visiting Antalya, Turkey showed some major and important differences. In 2011, Russian tourists seem to be more satisfied with their holidays and heavily plan to have another holiday in Antalya, and prefer internet to plan and buy their holidays over the traditional systems. Tourist industry in Antalya should closely follow the changes in Russian tourist market as it became the second largest tourist sending destination to Turkey.

CONCLUSION Two different studies done to analyze the Russian tourists visiting Antalya, Turkey showed some major and important differences. In 2011, Russian tourists seem to be more satisfied with their holidays and heavily plan to have another holiday in Antalya, and prefer internet to plan and buy their holidays over the traditional systems. Tourist industry in Antalya should closely follow the changes in Russian tourist market as it became the second largest tourist sending destination to Turkey.

THANK YOU FOR YOUR ATTENTION

THANK YOU FOR YOUR ATTENTION