4682808f6e2e0249be7d65774e5b5670.ppt

- Количество слайдов: 46

A Review of the Capital Requirements for Life Insurers in India By Jim Thompson , Raju S, Richard Holloway Presented at the 5 th Global Conference of Actuaries - Delhi, February 2003 1

A Review of the Capital Requirements for Life Insurers in India By Jim Thompson , Raju S, Richard Holloway Presented at the 5 th Global Conference of Actuaries - Delhi, February 2003 1

Content Background n The current situation in India n Developments in other markets n Conclusions and recommendations for India n 2

Content Background n The current situation in India n Developments in other markets n Conclusions and recommendations for India n 2

Why Capital/Solvency Margin? n To give the regulator and the policyholder the peace of mind that he will be paid what he has been promised 3

Why Capital/Solvency Margin? n To give the regulator and the policyholder the peace of mind that he will be paid what he has been promised 3

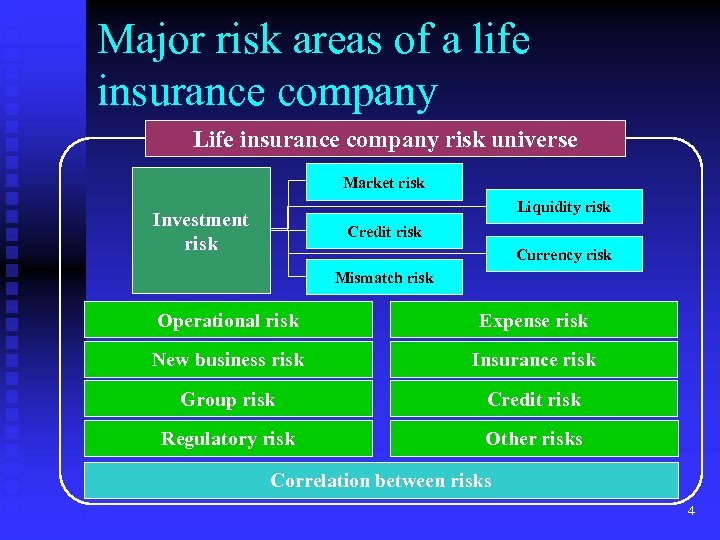

Major risk areas of a life insurance company Life insurance company risk universe Market risk Liquidity risk Investment risk Credit risk Currency risk Mismatch risk Operational risk Expense risk New business risk Insurance risk Group risk Credit risk Regulatory risk Other risks Correlation between risks 4

Major risk areas of a life insurance company Life insurance company risk universe Market risk Liquidity risk Investment risk Credit risk Currency risk Mismatch risk Operational risk Expense risk New business risk Insurance risk Group risk Credit risk Regulatory risk Other risks Correlation between risks 4

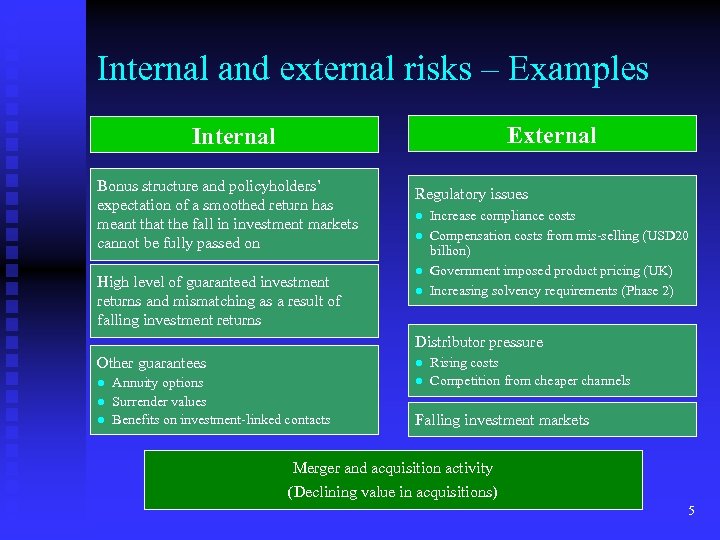

Internal and external risks – Examples External Internal Bonus structure and policyholders’ expectation of a smoothed return has meant that the fall in investment markets cannot be fully passed on High level of guaranteed investment returns and mismatching as a result of falling investment returns Regulatory issues l l Increase compliance costs Compensation costs from mis-selling (USD 20 billion) Government imposed product pricing (UK) Increasing solvency requirements (Phase 2) Distributor pressure Other guarantees l l Annuity options Surrender values Benefits on investment-linked contacts l Rising costs Competition from cheaper channels Falling investment markets Merger and acquisition activity (Declining value in acquisitions) 5

Internal and external risks – Examples External Internal Bonus structure and policyholders’ expectation of a smoothed return has meant that the fall in investment markets cannot be fully passed on High level of guaranteed investment returns and mismatching as a result of falling investment returns Regulatory issues l l Increase compliance costs Compensation costs from mis-selling (USD 20 billion) Government imposed product pricing (UK) Increasing solvency requirements (Phase 2) Distributor pressure Other guarantees l l Annuity options Surrender values Benefits on investment-linked contacts l Rising costs Competition from cheaper channels Falling investment markets Merger and acquisition activity (Declining value in acquisitions) 5

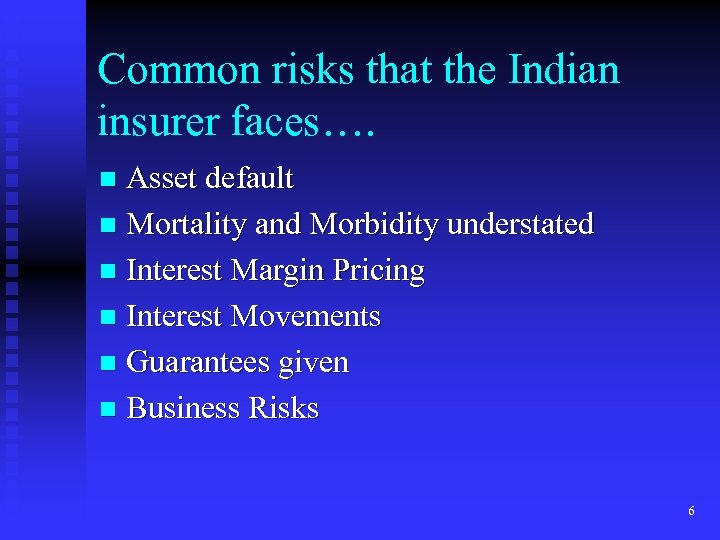

Common risks that the Indian insurer faces…. Asset default n Mortality and Morbidity understated n Interest Margin Pricing n Interest Movements n Guarantees given n Business Risks n 6

Common risks that the Indian insurer faces…. Asset default n Mortality and Morbidity understated n Interest Margin Pricing n Interest Movements n Guarantees given n Business Risks n 6

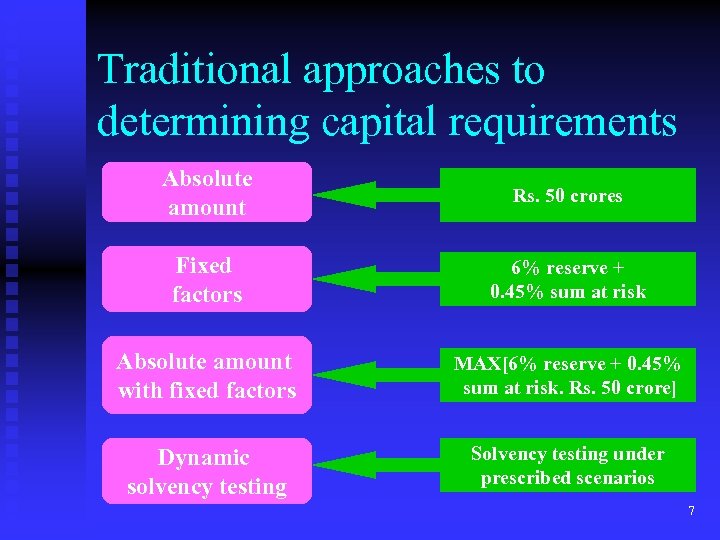

Traditional approaches to determining capital requirements Absolute amount Rs. 50 crores Fixed factors 6% reserve + 0. 45% sum at risk Absolute amount with fixed factors MAX[6% reserve + 0. 45% sum at risk. Rs. 50 crore] Dynamic solvency testing Solvency testing under prescribed scenarios 7

Traditional approaches to determining capital requirements Absolute amount Rs. 50 crores Fixed factors 6% reserve + 0. 45% sum at risk Absolute amount with fixed factors MAX[6% reserve + 0. 45% sum at risk. Rs. 50 crore] Dynamic solvency testing Solvency testing under prescribed scenarios 7

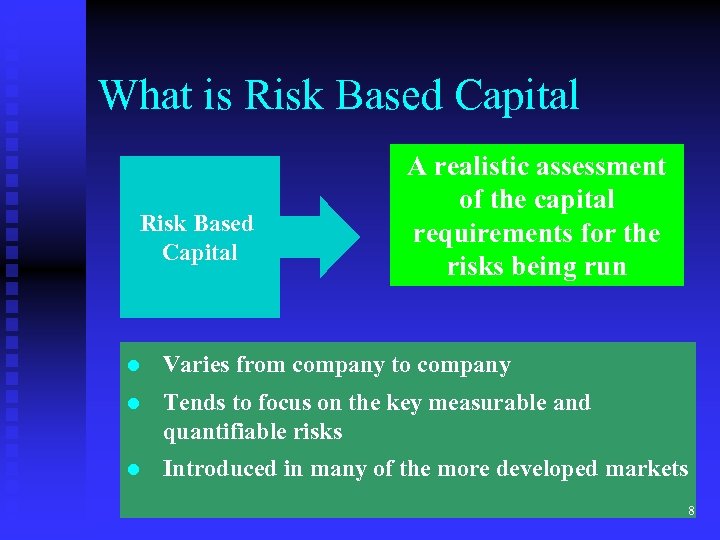

What is Risk Based Capital A realistic assessment of the capital requirements for the risks being run l Varies from company to company l Tends to focus on the key measurable and quantifiable risks l Introduced in many of the more developed markets 8

What is Risk Based Capital A realistic assessment of the capital requirements for the risks being run l Varies from company to company l Tends to focus on the key measurable and quantifiable risks l Introduced in many of the more developed markets 8

Content Background n The current situation in India n Developments in other markets n Conclusions and recommendations for India n 9

Content Background n The current situation in India n Developments in other markets n Conclusions and recommendations for India n 9

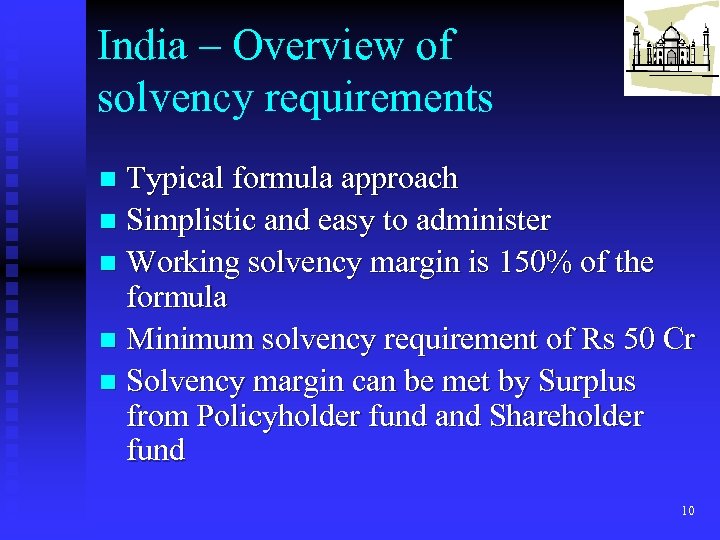

India – Overview of solvency requirements Typical formula approach n Simplistic and easy to administer n Working solvency margin is 150% of the formula n Minimum solvency requirement of Rs 50 Cr n Solvency margin can be met by Surplus from Policyholder fund and Shareholder fund n 10

India – Overview of solvency requirements Typical formula approach n Simplistic and easy to administer n Working solvency margin is 150% of the formula n Minimum solvency requirement of Rs 50 Cr n Solvency margin can be met by Surplus from Policyholder fund and Shareholder fund n 10

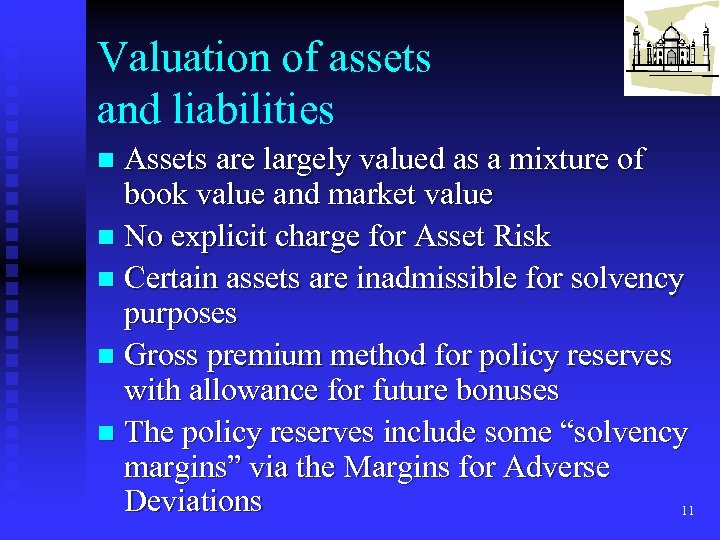

Valuation of assets and liabilities Assets are largely valued as a mixture of book value and market value n No explicit charge for Asset Risk n Certain assets are inadmissible for solvency purposes n Gross premium method for policy reserves with allowance for future bonuses n The policy reserves include some “solvency margins” via the Margins for Adverse Deviations 11 n

Valuation of assets and liabilities Assets are largely valued as a mixture of book value and market value n No explicit charge for Asset Risk n Certain assets are inadmissible for solvency purposes n Gross premium method for policy reserves with allowance for future bonuses n The policy reserves include some “solvency margins” via the Margins for Adverse Deviations 11 n

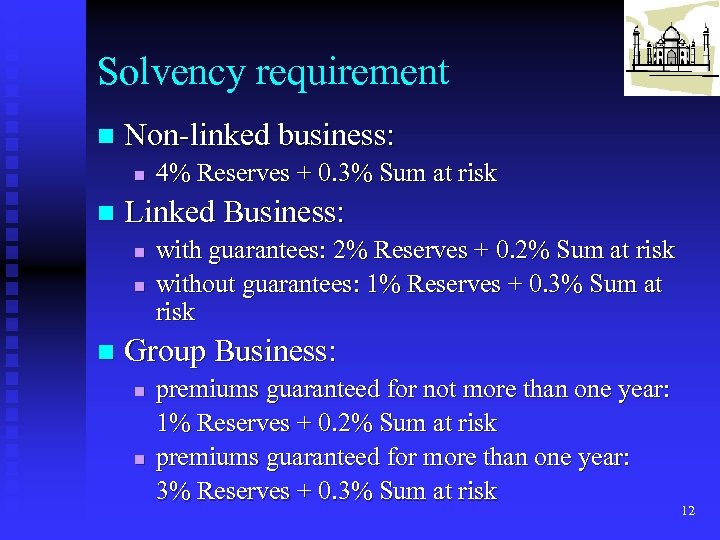

Solvency requirement n Non-linked business: n n Linked Business: n n n 4% Reserves + 0. 3% Sum at risk with guarantees: 2% Reserves + 0. 2% Sum at risk without guarantees: 1% Reserves + 0. 3% Sum at risk Group Business: n n premiums guaranteed for not more than one year: 1% Reserves + 0. 2% Sum at risk premiums guaranteed for more than one year: 3% Reserves + 0. 3% Sum at risk 12

Solvency requirement n Non-linked business: n n Linked Business: n n n 4% Reserves + 0. 3% Sum at risk with guarantees: 2% Reserves + 0. 2% Sum at risk without guarantees: 1% Reserves + 0. 3% Sum at risk Group Business: n n premiums guaranteed for not more than one year: 1% Reserves + 0. 2% Sum at risk premiums guaranteed for more than one year: 3% Reserves + 0. 3% Sum at risk 12

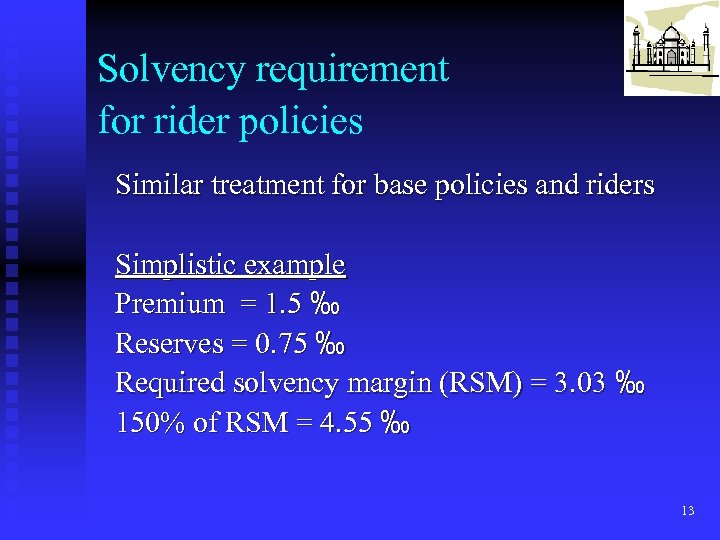

Solvency requirement for rider policies Similar treatment for base policies and riders Simplistic example Premium = 1. 5 ‰ Reserves = 0. 75 ‰ Required solvency margin (RSM) = 3. 03 ‰ 150% of RSM = 4. 55 ‰ 13

Solvency requirement for rider policies Similar treatment for base policies and riders Simplistic example Premium = 1. 5 ‰ Reserves = 0. 75 ‰ Required solvency margin (RSM) = 3. 03 ‰ 150% of RSM = 4. 55 ‰ 13

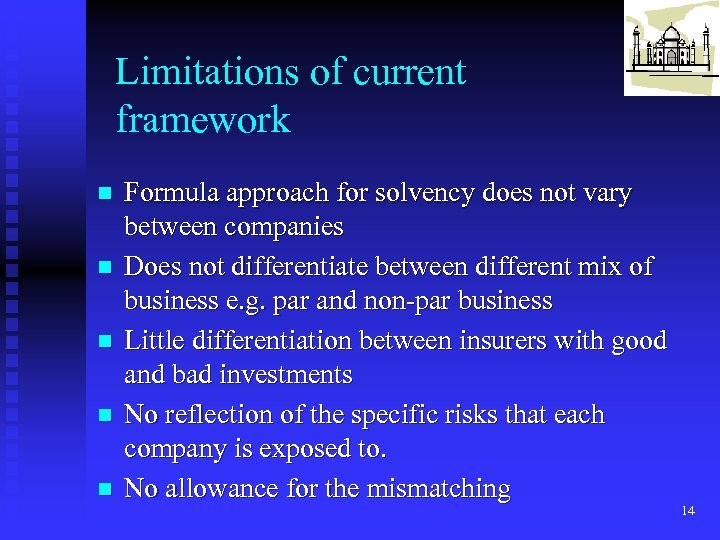

Limitations of current framework n n n Formula approach for solvency does not vary between companies Does not differentiate between different mix of business e. g. par and non-par business Little differentiation between insurers with good and bad investments No reflection of the specific risks that each company is exposed to. No allowance for the mismatching 14

Limitations of current framework n n n Formula approach for solvency does not vary between companies Does not differentiate between different mix of business e. g. par and non-par business Little differentiation between insurers with good and bad investments No reflection of the specific risks that each company is exposed to. No allowance for the mismatching 14

Anomalies n n n Penalizes companies holding stronger reserves by imposing higher solvency requirements Onerous requirement for pure risk policies e. g. Riders and Group Term policies Lighter requirement for health insurance (e. g. 4% reserves), which is known to be a riskier business 15

Anomalies n n n Penalizes companies holding stronger reserves by imposing higher solvency requirements Onerous requirement for pure risk policies e. g. Riders and Group Term policies Lighter requirement for health insurance (e. g. 4% reserves), which is known to be a riskier business 15

Content Background n The current situation in India n Developments in other markets n Conclusions and recommendations for India n 16

Content Background n The current situation in India n Developments in other markets n Conclusions and recommendations for India n 16

UK – Valuation of liabilities n Net Premium method with appropriate margins n PRE to provide for appropriate level of RB to emerge, but provision of TB not required n Mortality/Morbidity rates determined by Appointed Actuary n Valuation interest rate reflects yield on existing assets less 2. 5% n Resilience Reserves determined on various scenarios n Sufficient to cover prescribed scenarios n Different scenarios for par (3 scenarios) and non-par business (1 scenario) 17

UK – Valuation of liabilities n Net Premium method with appropriate margins n PRE to provide for appropriate level of RB to emerge, but provision of TB not required n Mortality/Morbidity rates determined by Appointed Actuary n Valuation interest rate reflects yield on existing assets less 2. 5% n Resilience Reserves determined on various scenarios n Sufficient to cover prescribed scenarios n Different scenarios for par (3 scenarios) and non-par business (1 scenario) 17

Capital requirement Single tier capital requirement – Solvency margin n Solvency margin defined as % of SAR and policy reserves n Minimum solvency margin is 800, 000 ECU n Assets held at market value/net realisable value n Certain assets are inadmissible for solvency purposes 18 n

Capital requirement Single tier capital requirement – Solvency margin n Solvency margin defined as % of SAR and policy reserves n Minimum solvency margin is 800, 000 ECU n Assets held at market value/net realisable value n Certain assets are inadmissible for solvency purposes 18 n

USA – Valuation of liabilities Net Premium method with a prescribed minimum basis n Mortality – 1980 CSO n Prescribed dynamic maximum valuation interest rate n Additional cash-flow testing requirement n n n Asset adequacy using cash-flow testing Project asset and liability cash flows (excluding new business) under various scenarios 19

USA – Valuation of liabilities Net Premium method with a prescribed minimum basis n Mortality – 1980 CSO n Prescribed dynamic maximum valuation interest rate n Additional cash-flow testing requirement n n n Asset adequacy using cash-flow testing Project asset and liability cash flows (excluding new business) under various scenarios 19

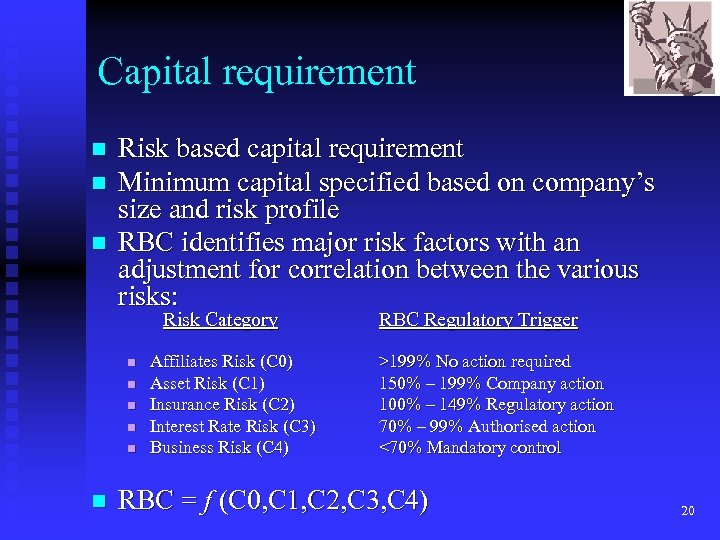

Capital requirement n n n Risk based capital requirement Minimum capital specified based on company’s size and risk profile RBC identifies major risk factors with an adjustment for correlation between the various risks: Risk Category n n n Affiliates Risk (C 0) Asset Risk (C 1) Insurance Risk (C 2) Interest Rate Risk (C 3) Business Risk (C 4) RBC Regulatory Trigger >199% No action required 150% – 199% Company action 100% – 149% Regulatory action 70% – 99% Authorised action <70% Mandatory control RBC = f (C 0, C 1, C 2, C 3, C 4) 20

Capital requirement n n n Risk based capital requirement Minimum capital specified based on company’s size and risk profile RBC identifies major risk factors with an adjustment for correlation between the various risks: Risk Category n n n Affiliates Risk (C 0) Asset Risk (C 1) Insurance Risk (C 2) Interest Rate Risk (C 3) Business Risk (C 4) RBC Regulatory Trigger >199% No action required 150% – 199% Company action 100% – 149% Regulatory action 70% – 99% Authorised action <70% Mandatory control RBC = f (C 0, C 1, C 2, C 3, C 4) 20

Canada – Valuation of liabilities n Gross premium valuation with margins for adverse deviation n Margins represent limited and reasonable level of misestimation and deterioration from expected experience scenario assumptions n Due regard to PRE (provision for all future bonuses) n Discount rate dependent on existing asset yields n No resilience reserve requirement n All assets are admissible 21

Canada – Valuation of liabilities n Gross premium valuation with margins for adverse deviation n Margins represent limited and reasonable level of misestimation and deterioration from expected experience scenario assumptions n Due regard to PRE (provision for all future bonuses) n Discount rate dependent on existing asset yields n No resilience reserve requirement n All assets are admissible 21

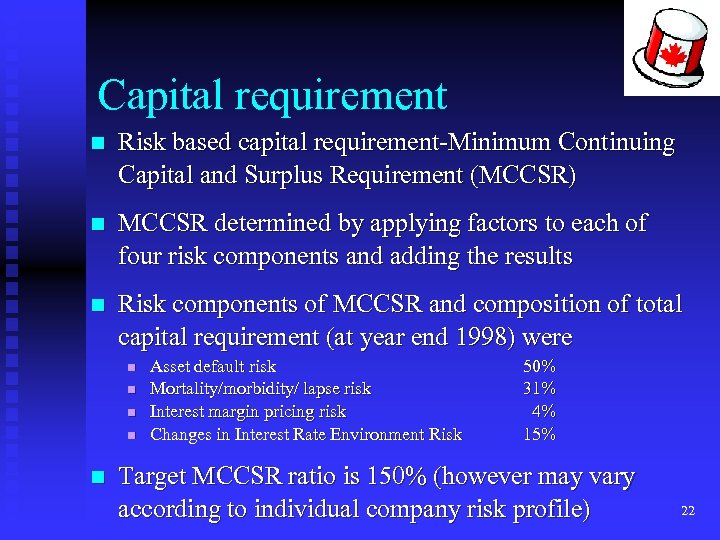

Capital requirement n Risk based capital requirement-Minimum Continuing Capital and Surplus Requirement (MCCSR) n MCCSR determined by applying factors to each of four risk components and adding the results n Risk components of MCCSR and composition of total capital requirement (at year end 1998) were n n n Asset default risk Mortality/morbidity/ lapse risk Interest margin pricing risk Changes in Interest Rate Environment Risk 50% 31% 4% 15% Target MCCSR ratio is 150% (however may vary according to individual company risk profile) 22

Capital requirement n Risk based capital requirement-Minimum Continuing Capital and Surplus Requirement (MCCSR) n MCCSR determined by applying factors to each of four risk components and adding the results n Risk components of MCCSR and composition of total capital requirement (at year end 1998) were n n n Asset default risk Mortality/morbidity/ lapse risk Interest margin pricing risk Changes in Interest Rate Environment Risk 50% 31% 4% 15% Target MCCSR ratio is 150% (however may vary according to individual company risk profile) 22

Australian – Capital Adequacy Standards 1. 2. 3. Margin on Services Valuation – Gross Premium Basis Statutory Valuation = BEL + Profit Margin All assumptions are based on the latest best estimates at the time of valuation – pro active basis 23

Australian – Capital Adequacy Standards 1. 2. 3. Margin on Services Valuation – Gross Premium Basis Statutory Valuation = BEL + Profit Margin All assumptions are based on the latest best estimates at the time of valuation – pro active basis 23

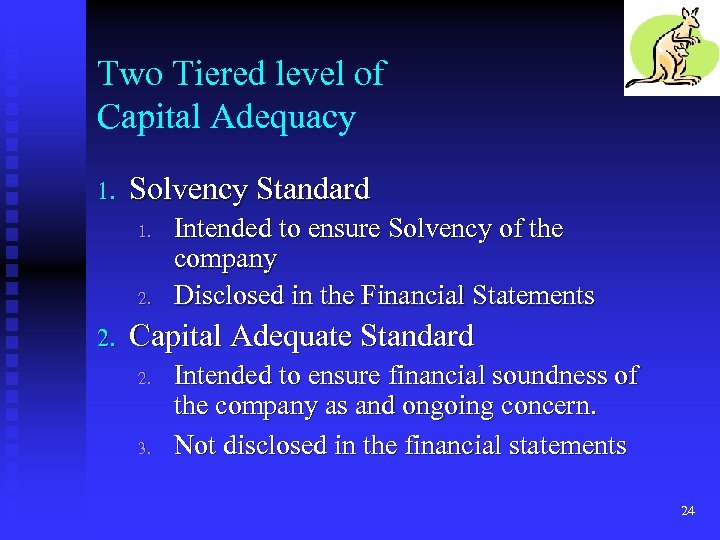

Two Tiered level of Capital Adequacy 1. Solvency Standard 1. 2. Intended to ensure Solvency of the company Disclosed in the Financial Statements Capital Adequate Standard 2. 3. Intended to ensure financial soundness of the company as and ongoing concern. Not disclosed in the financial statements 24

Two Tiered level of Capital Adequacy 1. Solvency Standard 1. 2. Intended to ensure Solvency of the company Disclosed in the Financial Statements Capital Adequate Standard 2. 3. Intended to ensure financial soundness of the company as and ongoing concern. Not disclosed in the financial statements 24

Requirements Solvency n Solvency Requirement n Other Liabilities n Resilience Reserve n Inadmissable Assets Reserve n Expense Reserves Capital Adequacy n Capital Adequacy Requirement n Other Liabilities n Resilience Reserves n Inadmissable Asset Reserve n New Business Reserve 25

Requirements Solvency n Solvency Requirement n Other Liabilities n Resilience Reserve n Inadmissable Assets Reserve n Expense Reserves Capital Adequacy n Capital Adequacy Requirement n Other Liabilities n Resilience Reserves n Inadmissable Asset Reserve n New Business Reserve 25

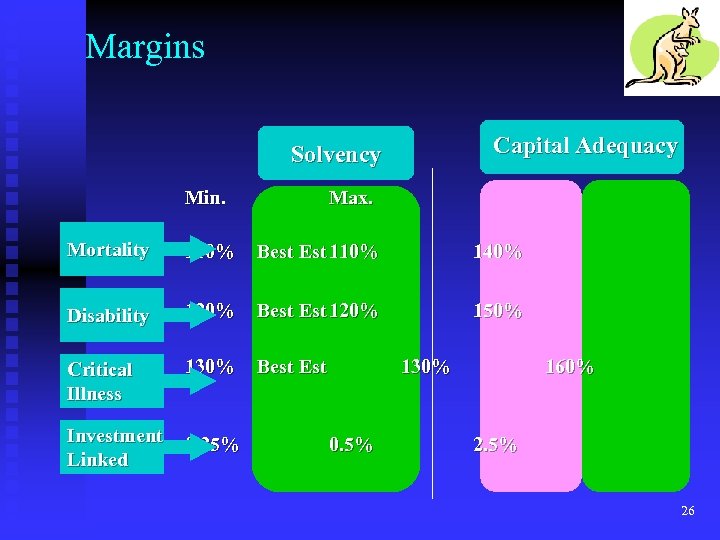

Margins Capital Adequacy Solvency Min. Max. Mortality 110% Best Est 110% 140% Disability 120% Best Est 120% 150% Critical Illness 130% Best Est Investment Linked 0. 25% 130% 0. 5% 160% 2. 5% 26

Margins Capital Adequacy Solvency Min. Max. Mortality 110% Best Est 110% 140% Disability 120% Best Est 120% 150% Critical Illness 130% Best Est Investment Linked 0. 25% 130% 0. 5% 160% 2. 5% 26

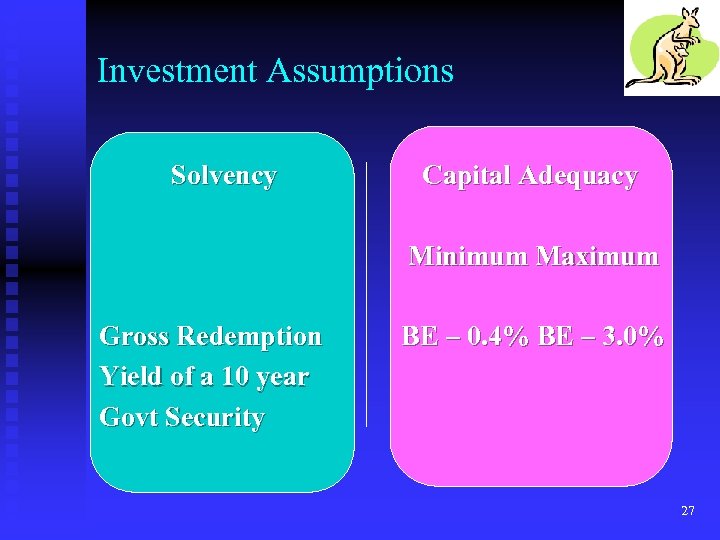

Investment Assumptions Solvency Capital Adequacy Minimum Maximum Gross Redemption Yield of a 10 year Govt Security BE – 0. 4% BE – 3. 0% 27

Investment Assumptions Solvency Capital Adequacy Minimum Maximum Gross Redemption Yield of a 10 year Govt Security BE – 0. 4% BE – 3. 0% 27

Resilience Reserves The amount that needs to be held before the happening of a prescribed set of changes in the economic environment such that after the changes the company is able to meet the liabilities of the fund 28

Resilience Reserves The amount that needs to be held before the happening of a prescribed set of changes in the economic environment such that after the changes the company is able to meet the liabilities of the fund 28

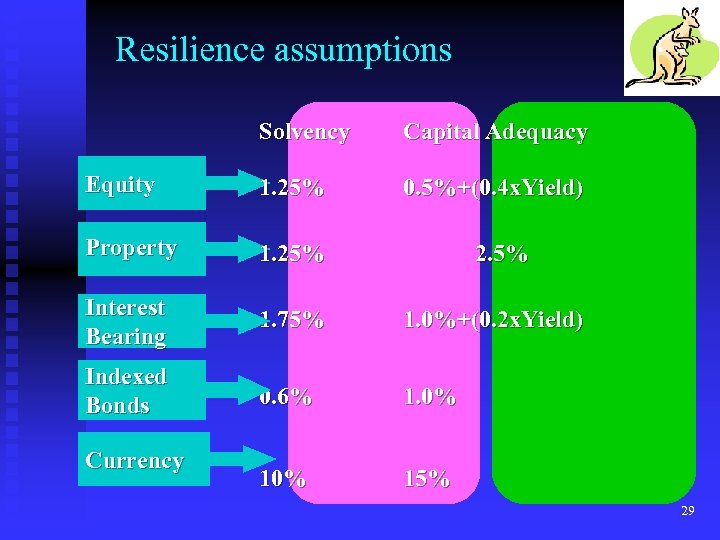

Resilience assumptions Solvency Capital Adequacy Equity 1. 25% 0. 5%+(0. 4 x. Yield) Property 1. 25% Interest Bearing 1. 75% 1. 0%+(0. 2 x. Yield) Indexed Bonds 0. 6% 1. 0% 15% Currency 2. 5% 29

Resilience assumptions Solvency Capital Adequacy Equity 1. 25% 0. 5%+(0. 4 x. Yield) Property 1. 25% Interest Bearing 1. 75% 1. 0%+(0. 2 x. Yield) Indexed Bonds 0. 6% 1. 0% 15% Currency 2. 5% 29

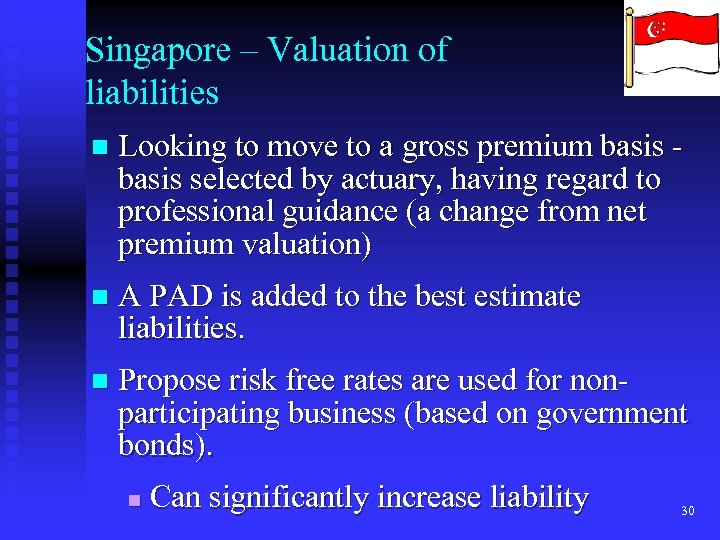

Singapore – Valuation of liabilities n Looking to move to a gross premium basis - basis selected by actuary, having regard to professional guidance (a change from net premium valuation) n A PAD is added to the best estimate liabilities. n Propose risk free rates are used for nonparticipating business (based on government bonds). n Can significantly increase liability 30

Singapore – Valuation of liabilities n Looking to move to a gross premium basis - basis selected by actuary, having regard to professional guidance (a change from net premium valuation) n A PAD is added to the best estimate liabilities. n Propose risk free rates are used for nonparticipating business (based on government bonds). n Can significantly increase liability 30

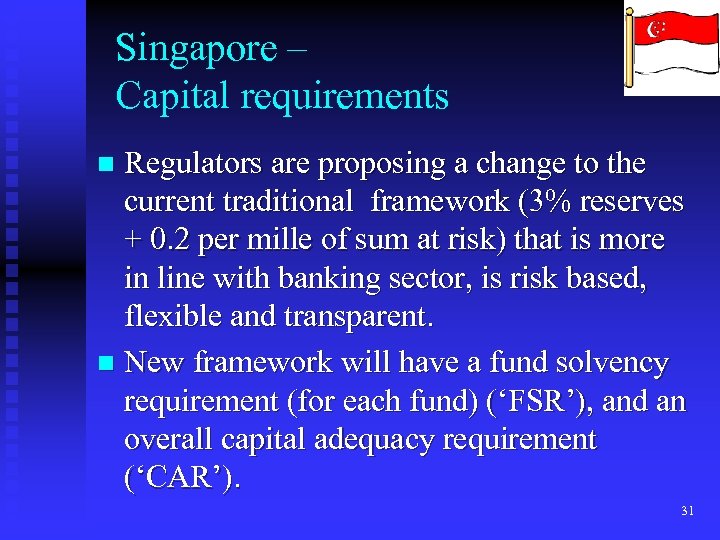

Singapore – Capital requirements Regulators are proposing a change to the current traditional framework (3% reserves + 0. 2 per mille of sum at risk) that is more in line with banking sector, is risk based, flexible and transparent. n New framework will have a fund solvency requirement (for each fund) (‘FSR’), and an overall capital adequacy requirement (‘CAR’). n 31

Singapore – Capital requirements Regulators are proposing a change to the current traditional framework (3% reserves + 0. 2 per mille of sum at risk) that is more in line with banking sector, is risk based, flexible and transparent. n New framework will have a fund solvency requirement (for each fund) (‘FSR’), and an overall capital adequacy requirement (‘CAR’). n 31

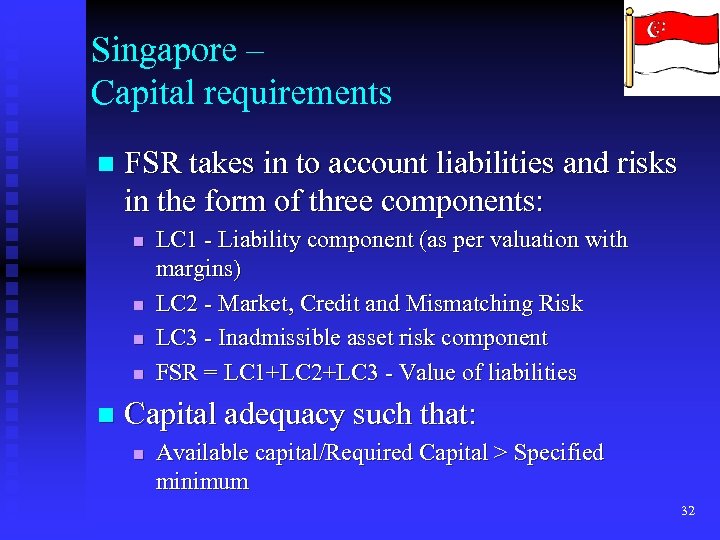

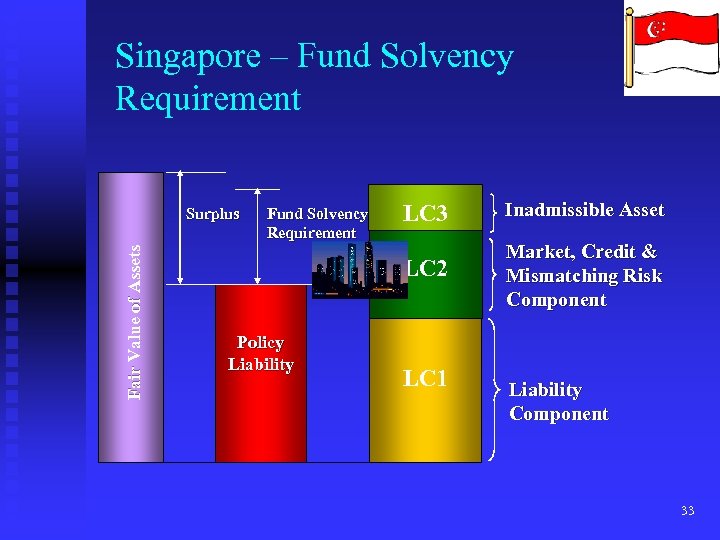

Singapore – Capital requirements n FSR takes in to account liabilities and risks in the form of three components: n n n LC 1 - Liability component (as per valuation with margins) LC 2 - Market, Credit and Mismatching Risk LC 3 - Inadmissible asset risk component FSR = LC 1+LC 2+LC 3 - Value of liabilities Capital adequacy such that: n Available capital/Required Capital > Specified minimum 32

Singapore – Capital requirements n FSR takes in to account liabilities and risks in the form of three components: n n n LC 1 - Liability component (as per valuation with margins) LC 2 - Market, Credit and Mismatching Risk LC 3 - Inadmissible asset risk component FSR = LC 1+LC 2+LC 3 - Value of liabilities Capital adequacy such that: n Available capital/Required Capital > Specified minimum 32

Singapore – Fund Solvency Requirement Fair Value of Assets Fund Solvency Requirement Policy Liability LC 3 Inadmissible Asset LC 2 Surplus Market, Credit & Mismatching Risk Component LC 1 Liability Component 33

Singapore – Fund Solvency Requirement Fair Value of Assets Fund Solvency Requirement Policy Liability LC 3 Inadmissible Asset LC 2 Surplus Market, Credit & Mismatching Risk Component LC 1 Liability Component 33

South Africa Capital Adequacy Requirements Gross Premium Valuation Basis n One level of Capital Adequacy n RBC Approach n 34

South Africa Capital Adequacy Requirements Gross Premium Valuation Basis n One level of Capital Adequacy n RBC Approach n 34

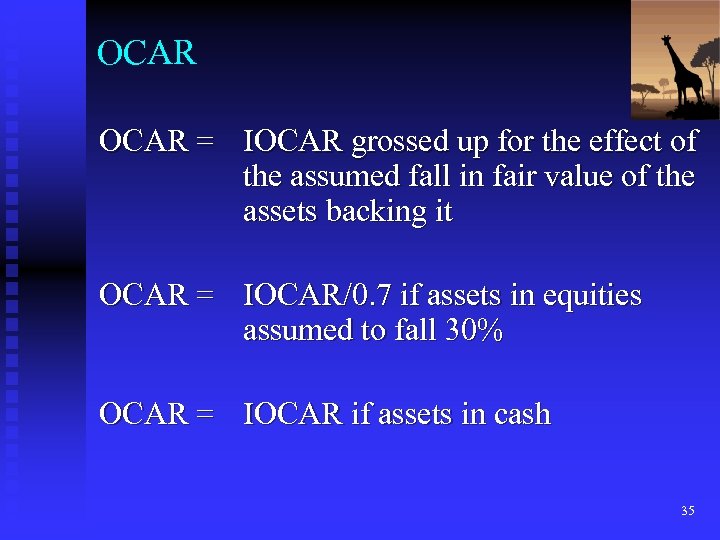

OCAR = IOCAR grossed up for the effect of the assumed fall in fair value of the assets backing it OCAR = IOCAR/0. 7 if assets in equities assumed to fall 30% OCAR = IOCAR if assets in cash 35

OCAR = IOCAR grossed up for the effect of the assumed fall in fair value of the assets backing it OCAR = IOCAR/0. 7 if assets in equities assumed to fall 30% OCAR = IOCAR if assets in cash 35

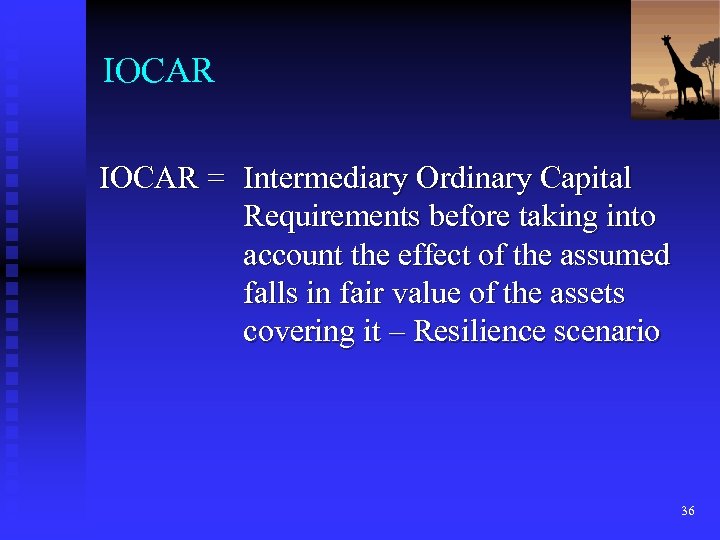

IOCAR = Intermediary Ordinary Capital Requirements before taking into account the effect of the assumed falls in fair value of the assets covering it – Resilience scenario 36

IOCAR = Intermediary Ordinary Capital Requirements before taking into account the effect of the assumed falls in fair value of the assets covering it – Resilience scenario 36

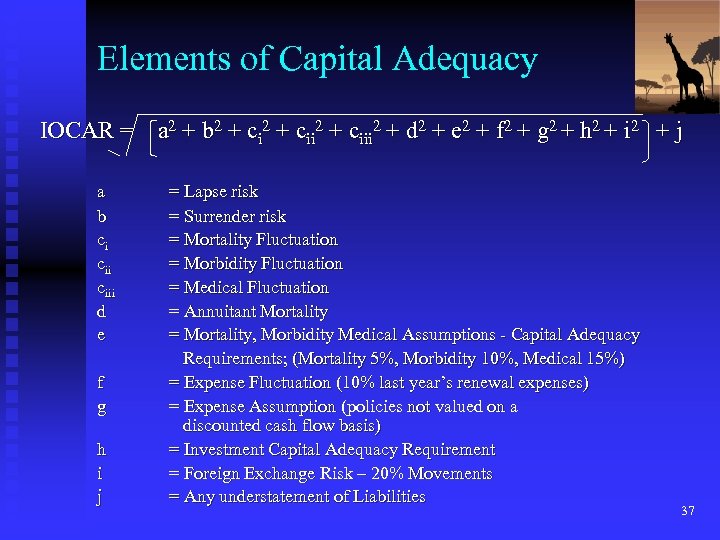

Elements of Capital Adequacy IOCAR = a 2 + b 2 + ciii 2 + d 2 + e 2 + f 2 + g 2 + h 2 + i 2 + j a b ci ciii d e f g h i j = Lapse risk = Surrender risk = Mortality Fluctuation = Morbidity Fluctuation = Medical Fluctuation = Annuitant Mortality = Mortality, Morbidity Medical Assumptions - Capital Adequacy Requirements; (Mortality 5%, Morbidity 10%, Medical 15%) = Expense Fluctuation (10% last year’s renewal expenses) = Expense Assumption (policies not valued on a discounted cash flow basis) = Investment Capital Adequacy Requirement = Foreign Exchange Risk – 20% Movements = Any understatement of Liabilities 37

Elements of Capital Adequacy IOCAR = a 2 + b 2 + ciii 2 + d 2 + e 2 + f 2 + g 2 + h 2 + i 2 + j a b ci ciii d e f g h i j = Lapse risk = Surrender risk = Mortality Fluctuation = Morbidity Fluctuation = Medical Fluctuation = Annuitant Mortality = Mortality, Morbidity Medical Assumptions - Capital Adequacy Requirements; (Mortality 5%, Morbidity 10%, Medical 15%) = Expense Fluctuation (10% last year’s renewal expenses) = Expense Assumption (policies not valued on a discounted cash flow basis) = Investment Capital Adequacy Requirement = Foreign Exchange Risk – 20% Movements = Any understatement of Liabilities 37

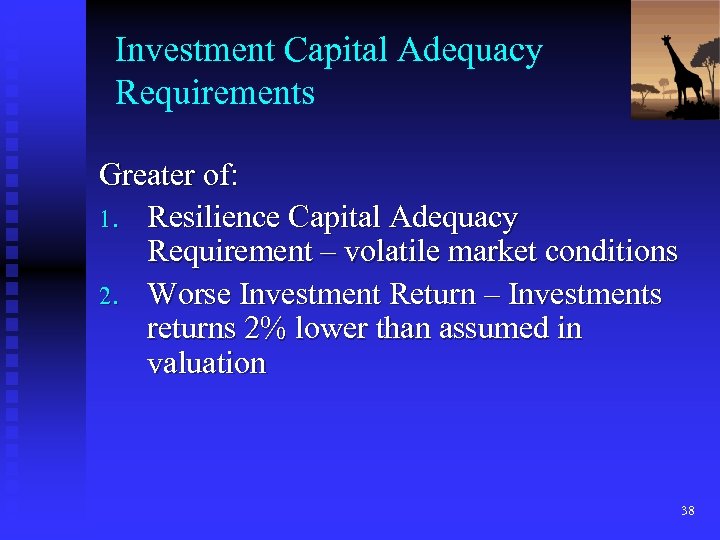

Investment Capital Adequacy Requirements Greater of: 1. Resilience Capital Adequacy Requirement – volatile market conditions 2. Worse Investment Return – Investments returns 2% lower than assumed in valuation 38

Investment Capital Adequacy Requirements Greater of: 1. Resilience Capital Adequacy Requirement – volatile market conditions 2. Worse Investment Return – Investments returns 2% lower than assumed in valuation 38

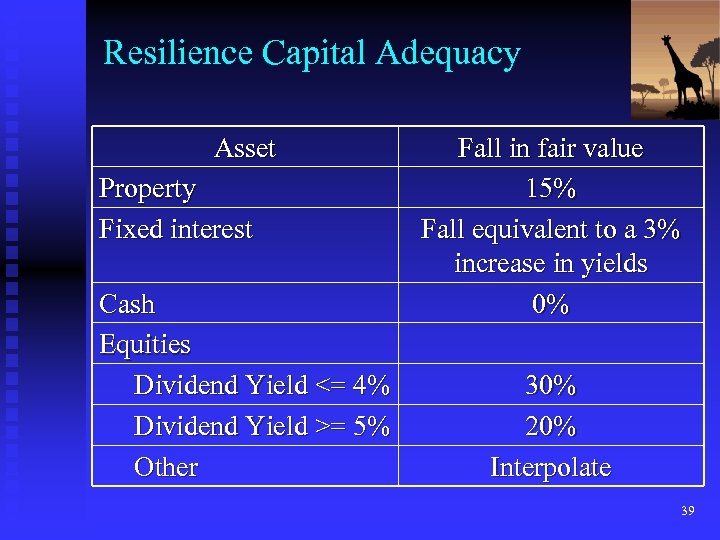

Resilience Capital Adequacy Asset Property Fixed interest Cash Equities Dividend Yield <= 4% Dividend Yield >= 5% Other Fall in fair value 15% Fall equivalent to a 3% increase in yields 0% 30% 20% Interpolate 39

Resilience Capital Adequacy Asset Property Fixed interest Cash Equities Dividend Yield <= 4% Dividend Yield >= 5% Other Fall in fair value 15% Fall equivalent to a 3% increase in yields 0% 30% 20% Interpolate 39

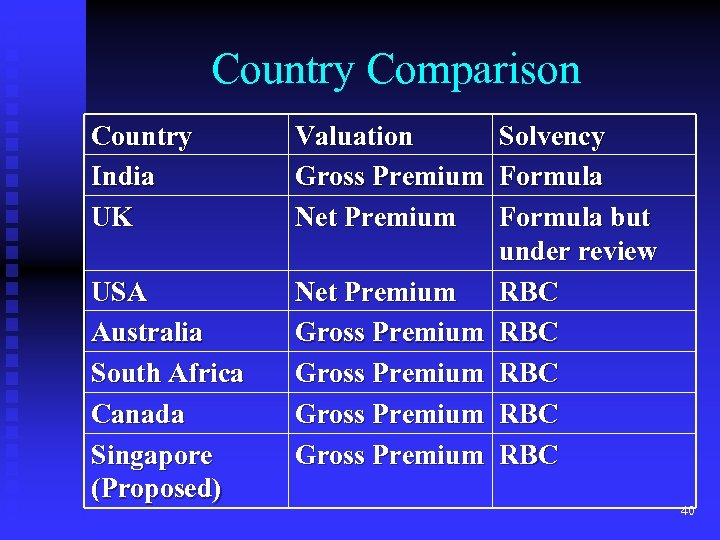

Country Comparison Country India UK USA Australia South Africa Canada Singapore (Proposed) Valuation Solvency Gross Premium Formula Net Premium Formula but under review Net Premium RBC Gross Premium RBC 40

Country Comparison Country India UK USA Australia South Africa Canada Singapore (Proposed) Valuation Solvency Gross Premium Formula Net Premium Formula but under review Net Premium RBC Gross Premium RBC 40

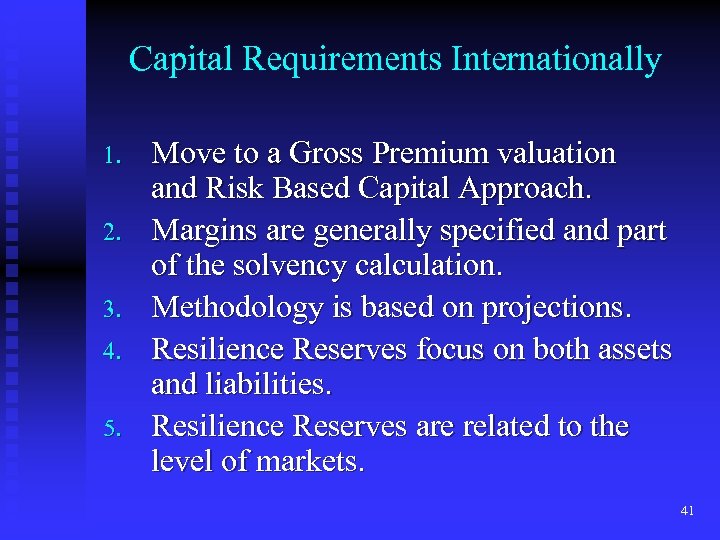

Capital Requirements Internationally 1. 2. 3. 4. 5. Move to a Gross Premium valuation and Risk Based Capital Approach. Margins are generally specified and part of the solvency calculation. Methodology is based on projections. Resilience Reserves focus on both assets and liabilities. Resilience Reserves are related to the level of markets. 41

Capital Requirements Internationally 1. 2. 3. 4. 5. Move to a Gross Premium valuation and Risk Based Capital Approach. Margins are generally specified and part of the solvency calculation. Methodology is based on projections. Resilience Reserves focus on both assets and liabilities. Resilience Reserves are related to the level of markets. 41

Content Background n The current situation in India n Developments in other markets n Conclusions and recommendations for India n 42

Content Background n The current situation in India n Developments in other markets n Conclusions and recommendations for India n 42

Conclusions n Solvency is not a big issue for new companies at the moment, but this will change as companies get bigger. n Globally move to Gross Premium Valuation and RBC Solvency n n Valuation of assets and liabilities consistent n Focuses attention on risk management n n Ensures greater consistency to other financial sectors Can vary by company. India has Gross Premium Valuation move to RBC logical 43

Conclusions n Solvency is not a big issue for new companies at the moment, but this will change as companies get bigger. n Globally move to Gross Premium Valuation and RBC Solvency n n Valuation of assets and liabilities consistent n Focuses attention on risk management n n Ensures greater consistency to other financial sectors Can vary by company. India has Gross Premium Valuation move to RBC logical 43

Implementation Issues to consider Technology n How do we get the know how n Phasing in to existing levels of capital n Setting of the risk charges/parameters n Impact on Business n Big workload on the Regulator and Industry n 44

Implementation Issues to consider Technology n How do we get the know how n Phasing in to existing levels of capital n Setting of the risk charges/parameters n Impact on Business n Big workload on the Regulator and Industry n 44

Recommendation IRDA start giving consideration to adopting a RBC approach to solvency in 3 – 5 years n The Regulator should involve the Industry and work together to discuss the implications of moving to an appropriate RBC regime for India n 45

Recommendation IRDA start giving consideration to adopting a RBC approach to solvency in 3 – 5 years n The Regulator should involve the Industry and work together to discuss the implications of moving to an appropriate RBC regime for India n 45

Acknowledgements We take this opportunity to thank all those actuaries and Appointed Actuaries in India who provided us with valuable inputs for this paper. n All the views expressed in this paper are the views of the authors and are not necessarily the views of our employers n 46

Acknowledgements We take this opportunity to thank all those actuaries and Appointed Actuaries in India who provided us with valuable inputs for this paper. n All the views expressed in this paper are the views of the authors and are not necessarily the views of our employers n 46