1bc3ba2dd199dd8edb7e8eb69428a47f.ppt

- Количество слайдов: 48

A Prescription for Healthcare Reform David B. Snow, Jr. Chairman and Chief Executive Officer Presentation to Citi Private Client Group April 17, 2008

Forward-Looking Statements This presentation contains “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties that may cause results to differ materially from those set forth in the statements. No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. The forward-looking statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and future financial results of the pharmacy benefit management (“PBM”) and specialty pharmacy industries, and other legal, regulatory and economic developments. We use words such as “anticipates, ” “believes, ” “plans, ” “expects, ” “projects, ” “future, ” “intends, ” “may, ” “will, ” “should, ” “could, ” “estimates, ” “predicts, ” “potential, ” “continue, ” “guidance” and similar expressions to identify these forward-looking statements. Medco’s actual results could differ materially from the results contemplated by these forwardlooking statements due to a number of factors. Forward-looking statements in this presentation should be evaluated together with the risks and uncertainties that affect our business, particularly those mentioned in the Risk Factors section of the Company's Annual Report on Form 10 -K, Quarterly Reports on Form 10 -Q and other documents filed from time to time with the Securities and Exchange Commission. © 2008 Medco Health Solutions, Inc. All rights reserved. 2

A Prescription for Healthcare Reform l The Urgent Imperative l A Roadmap to Reform l Medco’s Contribution to Healthcare Reform © 2008 Medco Health Solutions, Inc. All rights reserved. 3

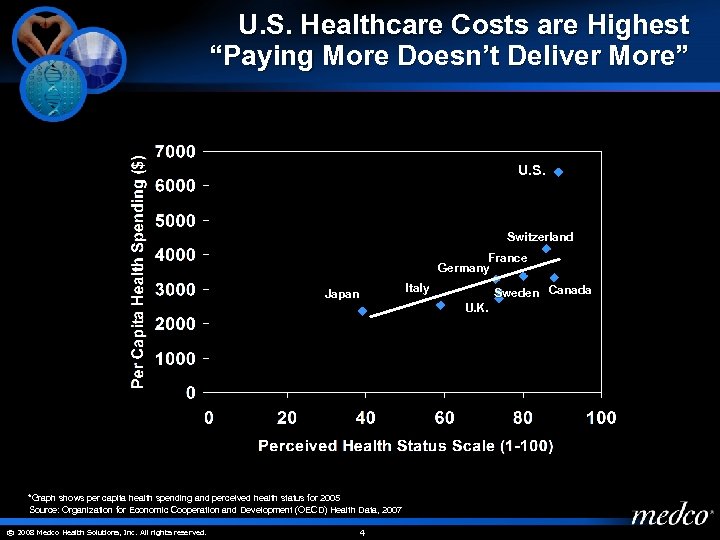

U. S. Healthcare Costs are Highest “Paying More Doesn’t Deliver More” U. S. Switzerland France Germany Japan Italy Sweden Canada U. K. *Graph shows per capita health spending and perceived health status for 2005 Source: Organization for Economic Cooperation and Development (OECD) Health Data, 2007 © 2008 Medco Health Solutions, Inc. All rights reserved. 4

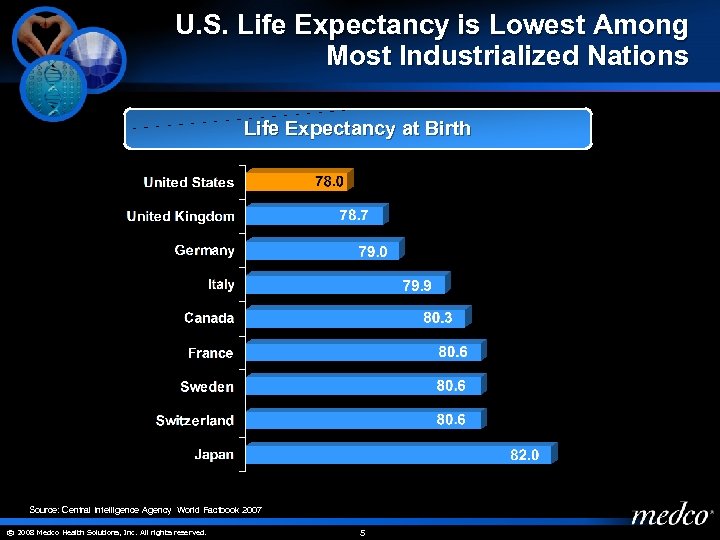

U. S. Life Expectancy is Lowest Among Most Industrialized Nations Life Expectancy at Birth Source: Central Intelligence Agency World Factbook 2007 © 2008 Medco Health Solutions, Inc. All rights reserved. 5

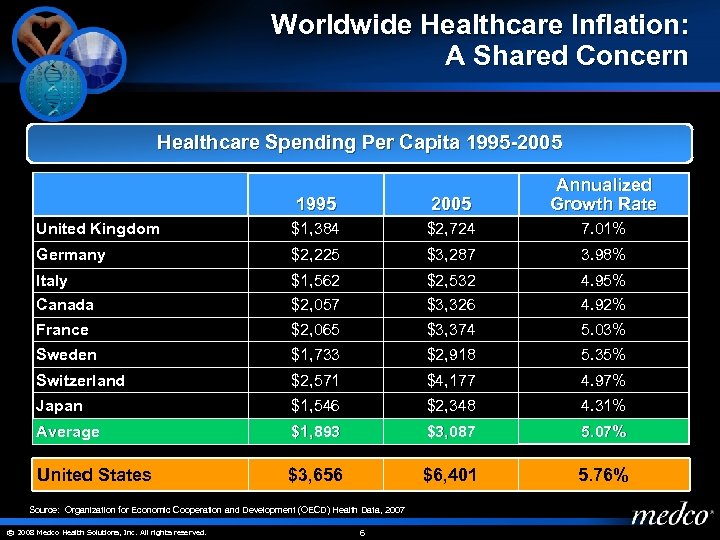

Worldwide Healthcare Inflation: A Shared Concern Healthcare Spending Per Capita 1995 -2005 1995 2005 Annualized Growth Rate United Kingdom $1, 384 $2, 724 7. 01% Germany $2, 225 $3, 287 3. 98% Italy Canada $1, 562 $2, 057 $2, 532 $3, 326 4. 95% 4. 92% France $2, 065 $3, 374 5. 03% Sweden $1, 733 $2, 918 5. 35% Switzerland $2, 571 $4, 177 4. 97% Japan $1, 546 $2, 348 4. 31% Average $1, 893 $3, 087 5. 07% United States $3, 656 $6, 401 5. 76% Source: Organization for Economic Cooperation and Development (OECD) Health Data, 2007 © 2008 Medco Health Solutions, Inc. All rights reserved. 6

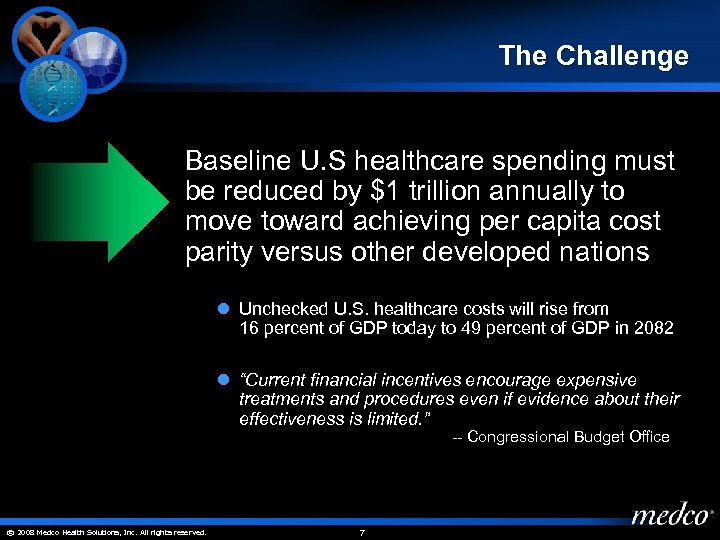

The Challenge Baseline U. S healthcare spending must be reduced by $1 trillion annually to move toward achieving per capita cost parity versus other developed nations l Unchecked U. S. healthcare costs will rise from 16 percent of GDP today to 49 percent of GDP in 2082 l “Current financial incentives encourage expensive treatments and procedures even if evidence about their effectiveness is limited. ” -- Congressional Budget Office © 2008 Medco Health Solutions, Inc. All rights reserved. 7

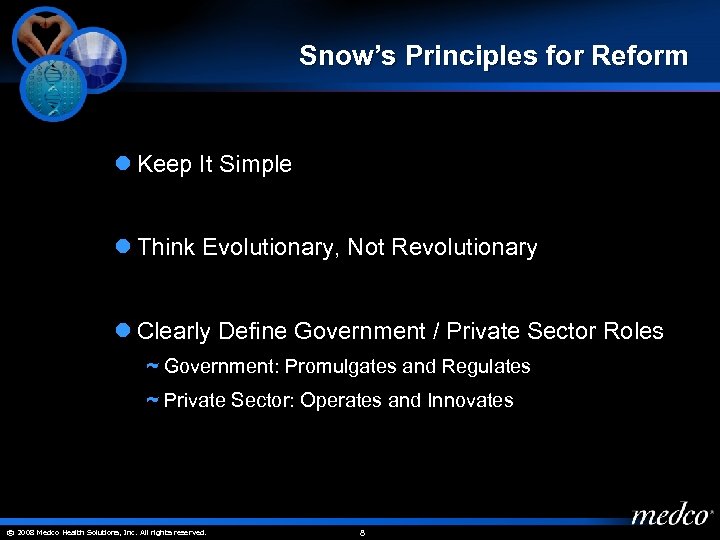

Snow’s Principles for Reform l Keep It Simple l Think Evolutionary, Not Revolutionary l Clearly Define Government / Private Sector Roles ~ Government: Promulgates and Regulates ~ Private Sector: Operates and Innovates © 2008 Medco Health Solutions, Inc. All rights reserved. 8

Radical Healthcare Reform is Not a Government Strength “Hillary. Care 1994” © 2008 Medco Health Solutions, Inc. All rights reserved. 9

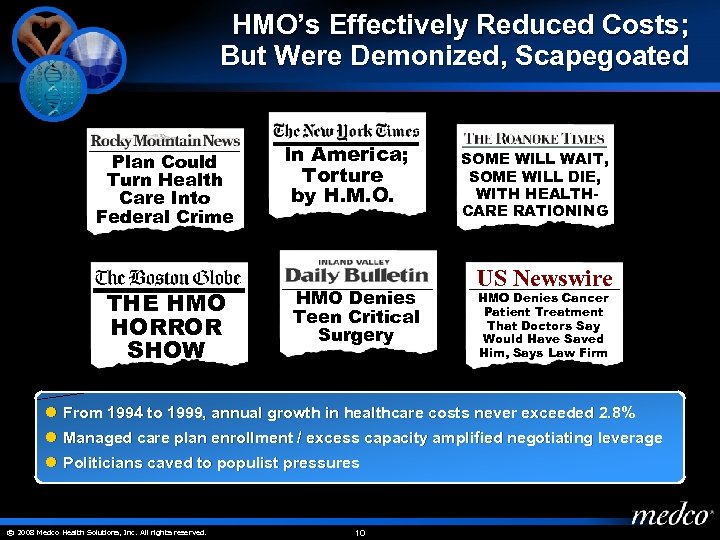

HMO’s Effectively Reduced Costs; But Were Demonized, Scapegoated Plan Could Turn Health Care Into Federal Crime THE HMO HORROR SHOW In America; Torture by H. M. O. HMO Denies Teen Critical Surgery SOME WILL WAIT, SOME WILL DIE, WITH HEALTHCARE RATIONING US Newswire HMO Denies Cancer Patient Treatment That Doctors Say Would Have Saved Him, Says Law Firm l From 1994 to 1999, annual growth in healthcare costs never exceeded 2. 8% l Managed care plan enrollment / excess capacity amplified negotiating leverage l Politicians caved to populist pressures © 2008 Medco Health Solutions, Inc. All rights reserved. 10

The Government Can Make a Difference “Smokey Bear” Wildfire Campaign “Brain on Drugs” Campaign © 2008 Medco Health Solutions, Inc. All rights reserved. “Crying Native American” Littering Campaign 11

A Prescription for Healthcare Reform l The Urgent Imperative l A Roadmap to Reform l Medco’s Contribution to Healthcare Reform © 2008 Medco Health Solutions, Inc. All rights reserved. 12

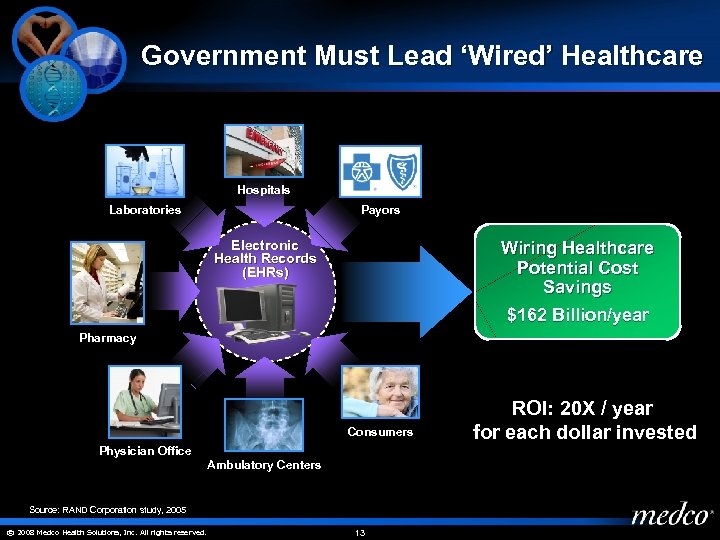

Government Must Lead ‘Wired’ Healthcare Hospitals Laboratories Payors Electronic Health Records (EHRs) Wiring Healthcare Potential Cost Savings $162 Billion/year Pharmacy Consumers Physician Office Ambulatory Centers Source: RAND Corporation study, 2005 © 2008 Medco Health Solutions, Inc. All rights reserved. 13 ROI: 20 X / year for each dollar invested

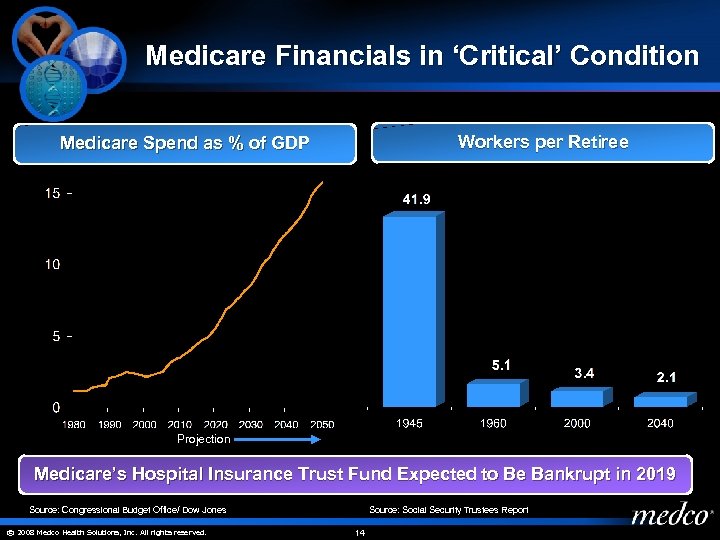

Medicare Financials in ‘Critical’ Condition Workers per Retiree Medicare Spend as % of GDP Projection Medicare’s Hospital Insurance Trust Fund Expected to Be Bankrupt in 2019 Source: Congressional Budget Office/ Dow Jones © 2008 Medco Health Solutions, Inc. All rights reserved. Source: Social Security Trustees Report 14

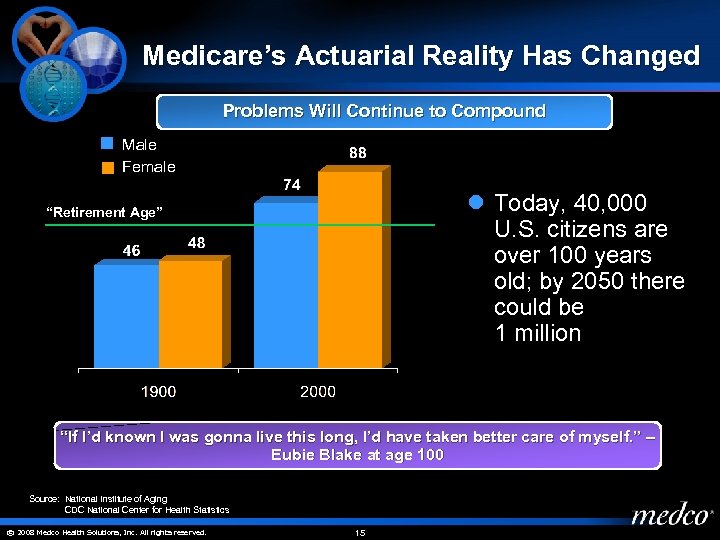

Medicare’s Actuarial Reality Has Changed Problems Will Continue to Compound Male Female l Today, 40, 000 U. S. citizens are over 100 years old; by 2050 there could be 1 million “Retirement Age” “If I’d known I was gonna live this long, I’d have taken better care of myself. ” – Eubie Blake at age 100 Source: National Institute of Aging CDC National Center for Health Statistics © 2008 Medco Health Solutions, Inc. All rights reserved. 15

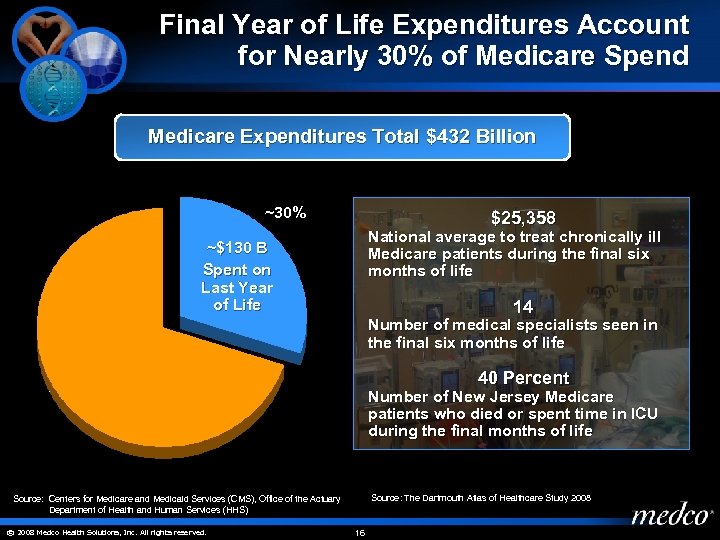

Final Year of Life Expenditures Account for Nearly 30% of Medicare Spend Medicare Expenditures Total $432 Billion ~30% $25, 358 National average to treat chronically ill Medicare patients during the final six months of life ~$130 B Spent on Last Year of Life 14 Number of medical specialists seen in the final six months of life 40 Percent Number of New Jersey Medicare patients who died or spent time in ICU during the final months of life Source: The Dartmouth Atlas of Healthcare Study 2008 Source: Centers for Medicare and Medicaid Services (CMS), Office of the Actuary Department of Health and Human Services (HHS) © 2008 Medco Health Solutions, Inc. All rights reserved. 16

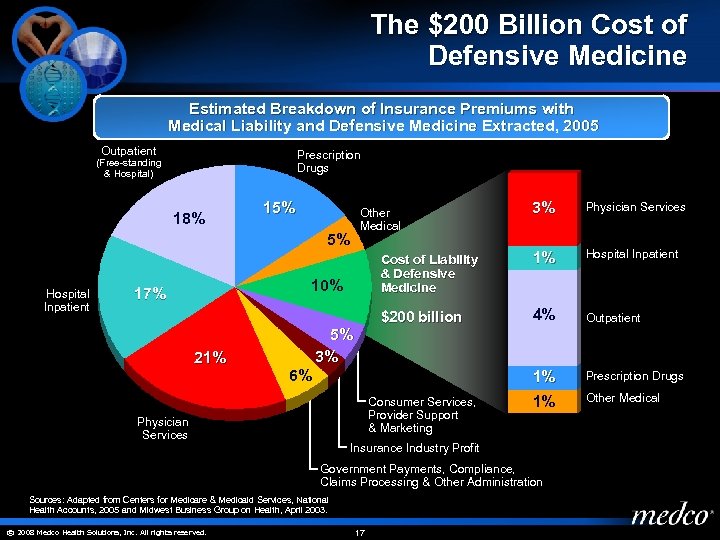

The $200 Billion Cost of Defensive Medicine Estimated Breakdown of Insurance Premiums with Medical Liability and Defensive Medicine Extracted, 2005 Outpatient Prescription Drugs (Free-standing & Hospital) 18% 15% Hospital Inpatient 21% 1% Hospital Inpatient $200 billion 4% Outpatient 1% 10% 17% Physician Services Cost of Liability & Defensive Medicine 5% 3% Prescription Drugs 1% Other Medical 5% 3% 6% Consumer Services, Provider Support & Marketing Physician Services Insurance Industry Profit Government Payments, Compliance, Claims Processing & Other Administration Sources: Adapted from Centers for Medicare & Medicaid Services, National Health Accounts, 2005 and Midwest Business Group on Health, April 2003. © 2008 Medco Health Solutions, Inc. All rights reserved. 17

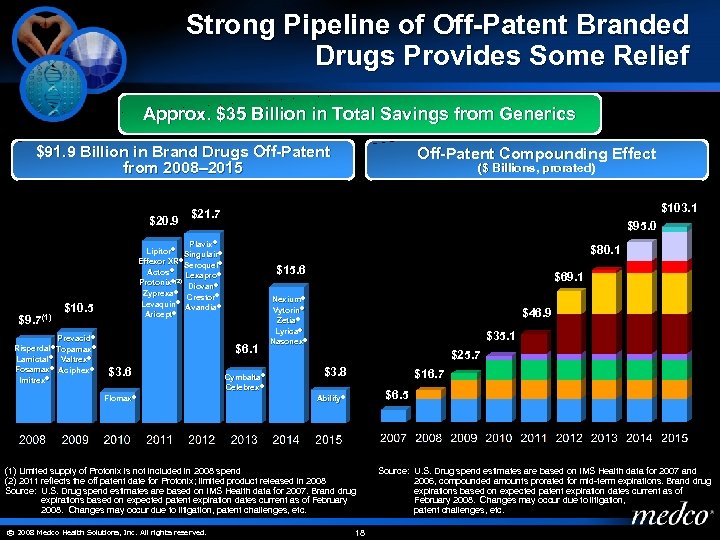

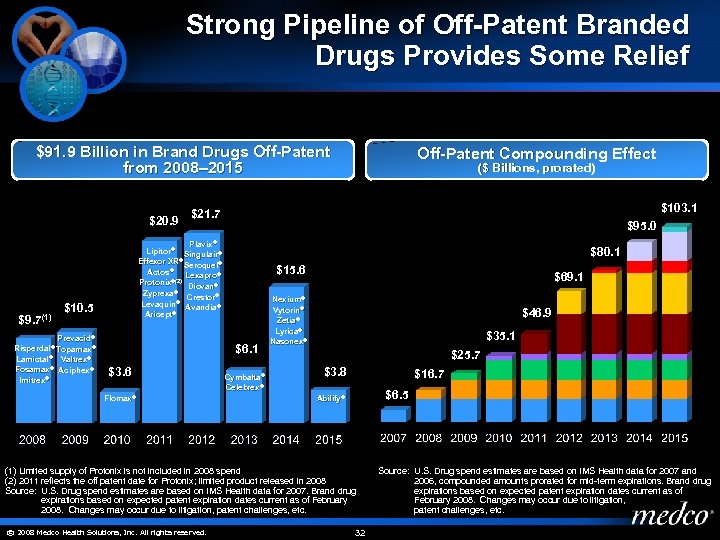

Strong Pipeline of Off-Patent Branded Drugs Provides Some Relief Approx. $35 Billion in Total Savings from Generics $91. 9 Billion in Brand Drugs Off-Patent from 2008– 2015 $20. 9 $9. 7(1) Prevacid ® Risperdal® Topamax® Lamictal® Valtrex® Fosamax® Aciphex® Imitrex® ($ Billions, prorated) $103. 1 $21. 7 $95. 0 Plavix ® Lipitor® Singulair® Effexor XR® Seroquel® Actos® Lexapro® Protonix®(2) Diovan® Zyprexa® Crestor® Levaquin® Avandia® Aricept® $10. 5 Off-Patent Compounding Effect $80. 1 $15. 6 $6. 1 $3. 6 Flomax® Cymbalta® Celebrex® $69. 1 Nexium® Vytorin® Zetia® Lyrica® Nasonex® $46. 9 $35. 1 $25. 7 $3. 8 $16. 7 $6. 5 Abilify® (1) Limited supply of Protonix is not included in 2008 spend (2) 2011 reflects the off patent date for Protonix; limited product released in 2008 Source: U. S. Drug spend estimates are based on IMS Health data for 2007. Brand drug expirations based on expected patent expiration dates current as of February 2008. Changes may occur due to litigation, patent challenges, etc. © 2008 Medco Health Solutions, Inc. All rights reserved. 18 Source: U. S. Drug spend estimates are based on IMS Health data for 2007 and 2006, compounded amounts prorated for mid-term expirations. Brand drug expirations based on expected patent expiration dates current as of February 2008. Changes may occur due to litigation, patent challenges, etc.

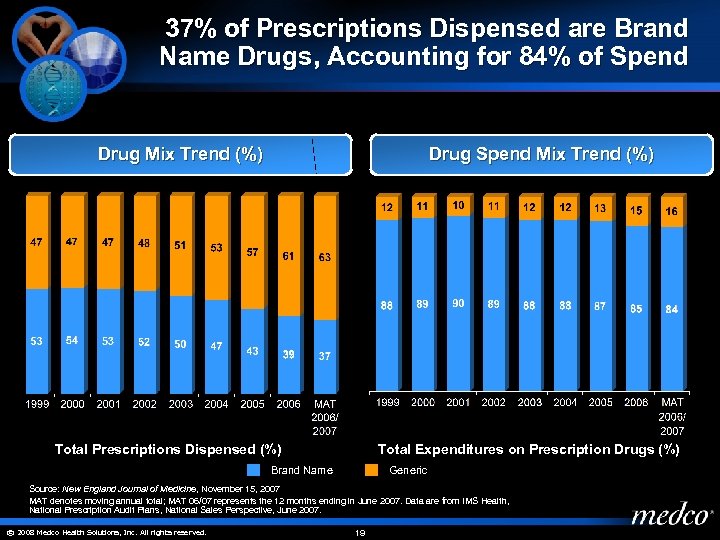

37% of Prescriptions Dispensed are Brand Name Drugs, Accounting for 84% of Spend Drug Mix Trend (%) Drug Spend Mix Trend (%) Total Prescriptions Dispensed (%) Total Expenditures on Prescription Drugs (%) Brand Name Generic Source: New England Journal of Medicine, November 15, 2007 MAT denotes moving annual total; MAT 06/07 represents the 12 months ending in June 2007. Data are from IMS Health, National Prescription Audit Plans, National Sales Perspective, June 2007. © 2008 Medco Health Solutions, Inc. All rights reserved. 19

Government Must Increase Access To Generics 1, 200 More than generic drug applications are backlogged Increase Funding Improve Resources Cost Savings Clear Backlog Source: Office of Generic Drugs © 2008 Medco Health Solutions, Inc. All rights reserved. 20 Increase Competition

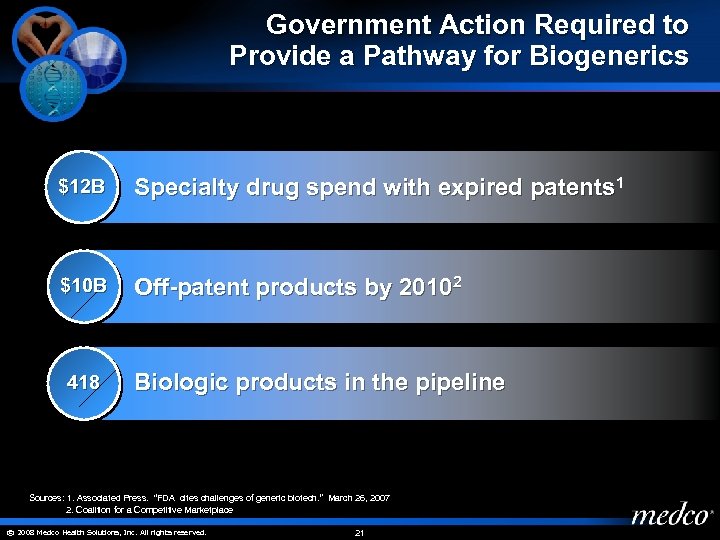

Government Action Required to Provide a Pathway for Biogenerics $12 B Specialty drug spend with expired patents 1 $10 B Off-patent products by 20102 418 Biologic products in the pipeline Sources: 1. Associated Press. “FDA cites challenges of generic biotech. ” March 26, 2007 2. Coalition for a Competitive Marketplace © 2008 Medco Health Solutions, Inc. All rights reserved. 21

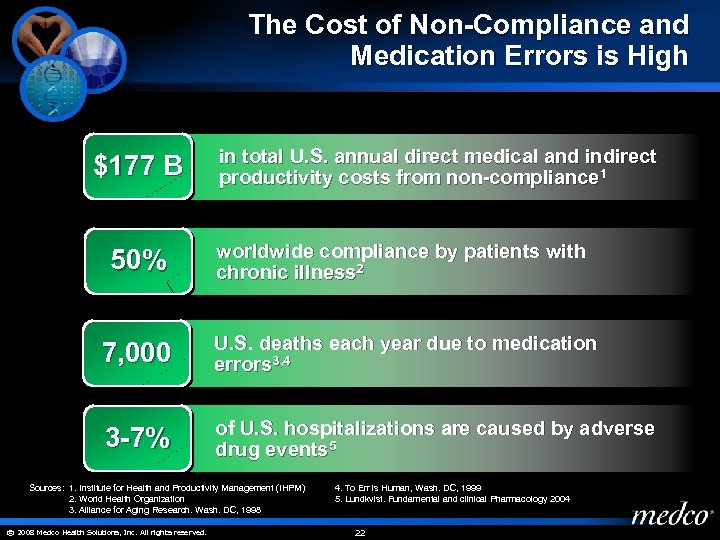

The Cost of Non-Compliance and Medication Errors is High $177 B in total U. S. annual direct medical and indirect productivity costs from non-compliance 1 50% worldwide compliance by patients with chronic illness 2 7, 000 U. S. deaths each year due to medication errors 3, 4 3 -7% of U. S. hospitalizations are caused by adverse drug events 5 Sources: 1. Institute for Health and Productivity Management (IHPM) 2. World Health Organization 3. Alliance for Aging Research. Wash. DC, 1998 © 2008 Medco Health Solutions, Inc. All rights reserved. 4. To Err is Human, Wash. DC, 1999 5. Lundkvist. Fundamental and clinical Pharmacology 2004 22

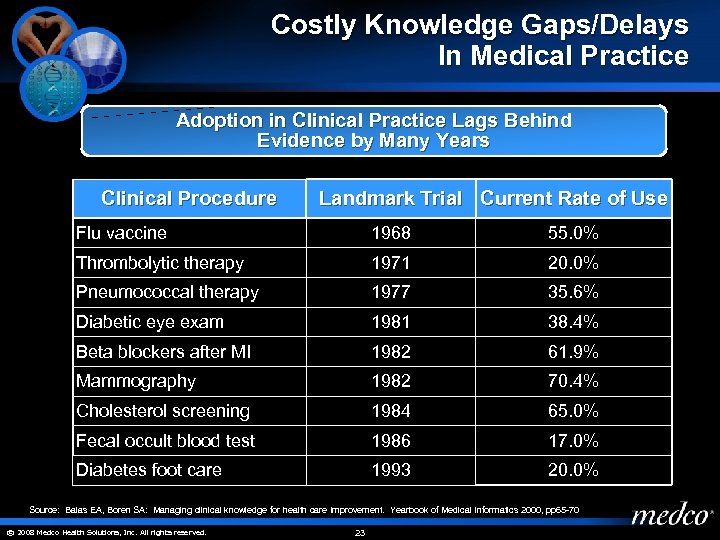

Costly Knowledge Gaps/Delays In Medical Practice Adoption in Clinical Practice Lags Behind Evidence by Many Years Clinical Procedure Landmark Trial Current Rate of Use Flu vaccine 1968 55. 0% Thrombolytic therapy 1971 20. 0% Pneumococcal therapy 1977 35. 6% Diabetic eye exam 1981 38. 4% Beta blockers after MI 1982 61. 9% Mammography 1982 70. 4% Cholesterol screening 1984 65. 0% Fecal occult blood test 1986 17. 0% Diabetes foot care 1993 20. 0% Source: Balas EA, Boren SA: Managing clinical knowledge for health care Improvement. Yearbook of Medical Informatics 2000, pp 65 -70 © 2008 Medco Health Solutions, Inc. All rights reserved. 23

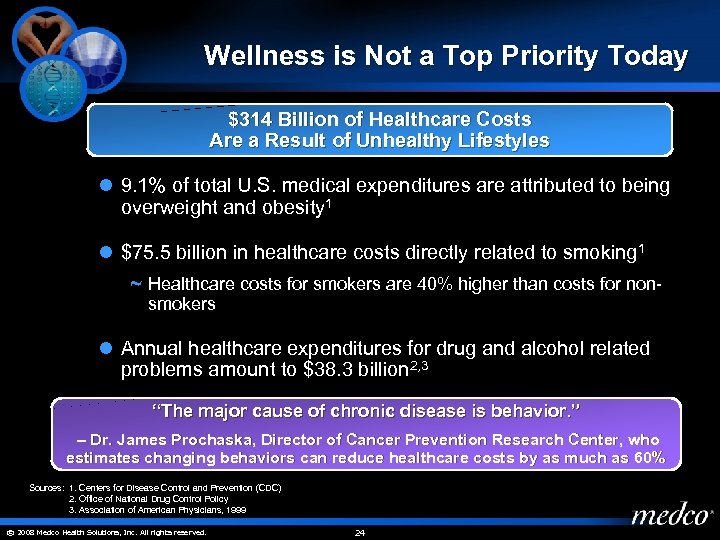

Wellness is Not a Top Priority Today $314 Billion of Healthcare Costs Are a Result of Unhealthy Lifestyles l 9. 1% of total U. S. medical expenditures are attributed to being overweight and obesity 1 l $75. 5 billion in healthcare costs directly related to smoking 1 ~ Healthcare costs for smokers are 40% higher than costs for nonsmokers l Annual healthcare expenditures for drug and alcohol related problems amount to $38. 3 billion 2, 3 “The major cause of chronic disease is behavior. ” – Dr. James Prochaska, Director of Cancer Prevention Research Center, who estimates changing behaviors can reduce healthcare costs by as much as 60% Sources: 1. Centers for Disease Control and Prevention (CDC) 2. Office of National Drug Control Policy 3. Association of American Physicians, 1999 © 2008 Medco Health Solutions, Inc. All rights reserved. 24

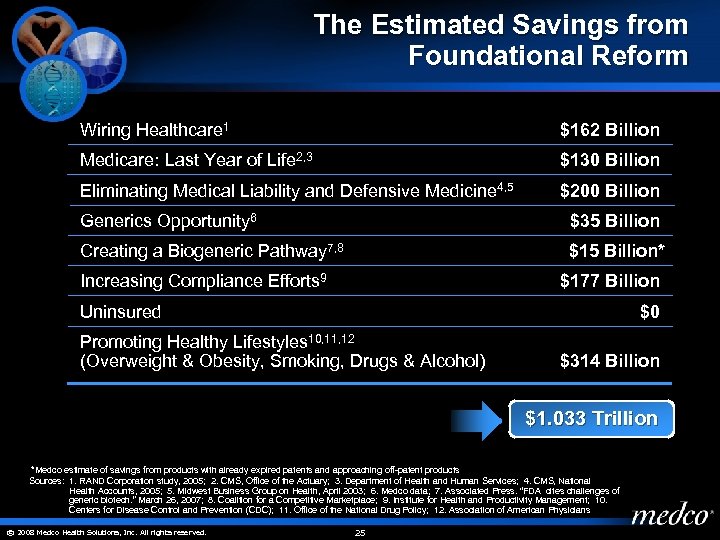

The Estimated Savings from Foundational Reform Wiring Healthcare 1 $162 Billion Medicare: Last Year of Life 2, 3 $130 Billion Eliminating Medical Liability and Defensive Medicine 4, 5 $200 Billion Generics Opportunity 6 $35 Billion Creating a Biogeneric Pathway 7, 8 $15 Billion* Increasing Compliance Efforts 9 $177 Billion Uninsured $0 Promoting Healthy Lifestyles 10, 11, 12 (Overweight & Obesity, Smoking, Drugs & Alcohol) $314 Billion $1. 033 Trillion *Medco estimate of savings from products with already expired patents and approaching off-patent products Sources: 1. RAND Corporation study, 2005; 2. CMS, Office of the Actuary; 3. Department of Health and Human Services; 4. CMS, National Health Accounts, 2005; 5. Midwest Business Group on Health, April 2003; 6. Medco data; 7. Associated Press. “FDA cites challenges of generic biotech. ” March 26, 2007; 8. Coalition for a Competitive Marketplace; 9. Institute for Health and Productivity Management; 10. Centers for Disease Control and Prevention (CDC); 11. Office of the National Drug Policy; 12. Association of American Physicians © 2008 Medco Health Solutions, Inc. All rights reserved. 25

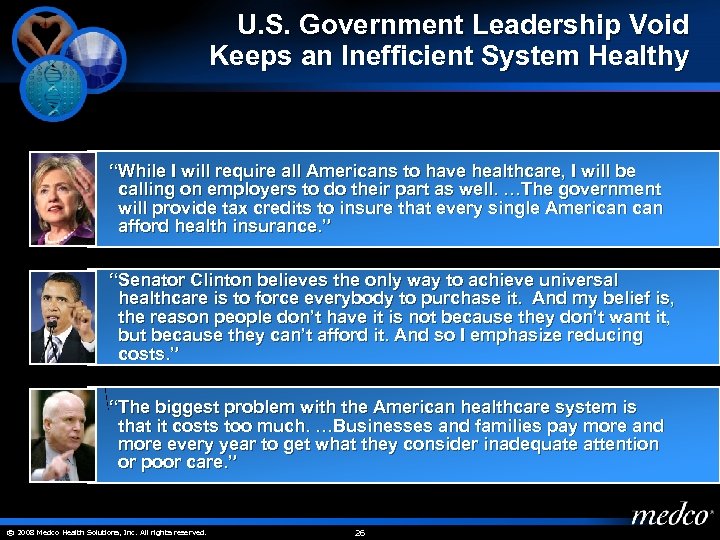

U. S. Government Leadership Void Keeps an Inefficient System Healthy “While I will require all Americans to have healthcare, I will be calling on employers to do their part as well. …The government will provide tax credits to insure that every single American afford health insurance. ” “Senator Clinton believes the only way to achieve universal healthcare is to force everybody to purchase it. And my belief is, the reason people don’t have it is not because they don’t want it, but because they can’t afford it. And so I emphasize reducing costs. ” “The biggest problem with the American healthcare system is that it costs too much. …Businesses and families pay more and more every year to get what they consider inadequate attention or poor care. ” © 2008 Medco Health Solutions, Inc. All rights reserved. 26

A Prescription for Healthcare Reform l The Urgent Imperative l A Roadmap to Reform l Medco’s Contribution to Healthcare Reform ~ Efforts toward wiring healthcare ~ An efficient provider of generics ~ Advancing new science ~ Focus on compliance © 2008 Medco Health Solutions, Inc. All rights reserved. 27

Medco Health Solutions: Leading Pharmacy Benefit Manager Fortune 100 Company with 2007 Revenues of $44. 5 Billion Largest Independent PBM Drug Spend Under Management Largest Mail-Order Pharmacy Most Sophisticated Specialty Pharmacy Leader in Clinical Innovation Industry Leading Drug Trend Management © 2008 Medco Health Solutions, Inc. All rights reserved. 28

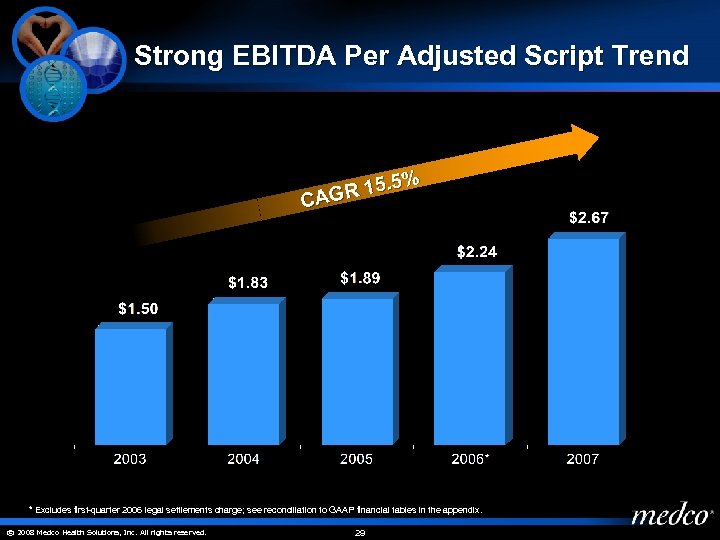

Strong EBITDA Per Adjusted Script Trend % R 15. 5 CAG * Excludes first-quarter 2006 legal settlements charge; see reconciliation to GAAP financial tables in the appendix. © 2008 Medco Health Solutions, Inc. All rights reserved. 29

Strong Earnings Per Share Growth % R 19. 9 CAG 35% $1. 21 $1. 03 $0. 79 $0. 88 * Excludes first-quarter 2006 legal settlements charge; see reconciliation to GAAP financial tables in the appendix. © 2008 Medco Health Solutions, Inc. All rights reserved. 30 $1. 63

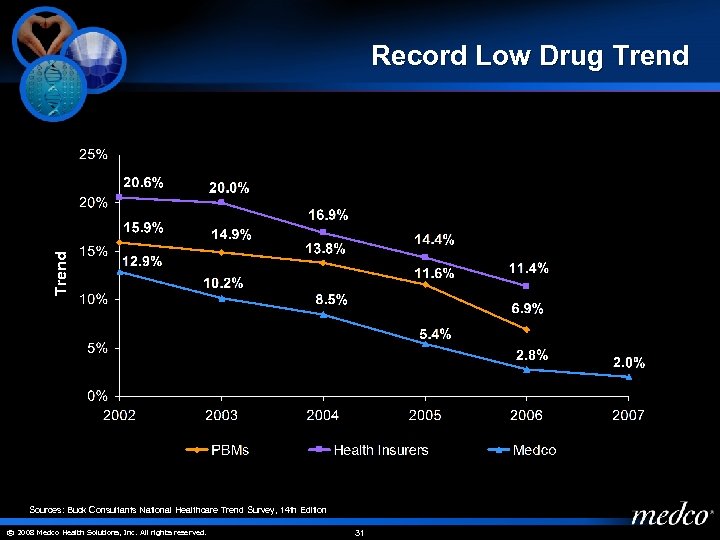

Trend Record Low Drug Trend Sources: Buck Consultants National Healthcare Trend Survey, 14 th Edition © 2008 Medco Health Solutions, Inc. All rights reserved. 31

Strong Pipeline of Off-Patent Branded Drugs Provides Some Relief $91. 9 Billion in Brand Drugs Off-Patent from 2008– 2015 $20. 9 $9. 7(1) Prevacid ® Risperdal® Topamax® Lamictal® Valtrex® Fosamax® Aciphex® Imitrex® ($ Billions, prorated) $103. 1 $21. 7 $95. 0 Plavix ® Lipitor® Singulair® Effexor XR® Seroquel® Actos® Lexapro® Protonix®(2) Diovan® Zyprexa® Crestor® Levaquin® Avandia® Aricept® $10. 5 Off-Patent Compounding Effect $80. 1 $15. 6 $6. 1 $3. 6 Flomax® Cymbalta® Celebrex® $69. 1 Nexium® Vytorin® Zetia® Lyrica® Nasonex® $46. 9 $35. 1 $25. 7 $3. 8 $16. 7 $6. 5 Abilify® (1) Limited supply of Protonix is not included in 2008 spend (2) 2011 reflects the off patent date for Protonix; limited product released in 2008 Source: U. S. Drug spend estimates are based on IMS Health data for 2007. Brand drug expirations based on expected patent expiration dates current as of February 2008. Changes may occur due to litigation, patent challenges, etc. © 2008 Medco Health Solutions, Inc. All rights reserved. 32 Source: U. S. Drug spend estimates are based on IMS Health data for 2007 and 2006, compounded amounts prorated for mid-term expirations. Brand drug expirations based on expected patent expiration dates current as of February 2008. Changes may occur due to litigation, patent challenges, etc.

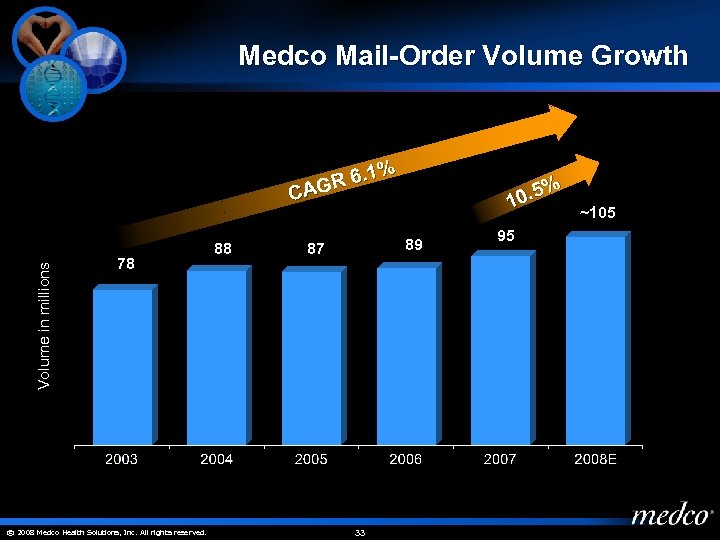

Medco Mail-Order Volume Growth Volume in millions % R 6. 1 CAG 78 © 2008 Medco Health Solutions, Inc. All rights reserved. 88 % 0. 5 1 89 87 33 95 ~105

Video Clip of Technology Innovations with Our Back-End Pharmacy © 2008 Medco Health Solutions, Inc. All rights reserved. 34

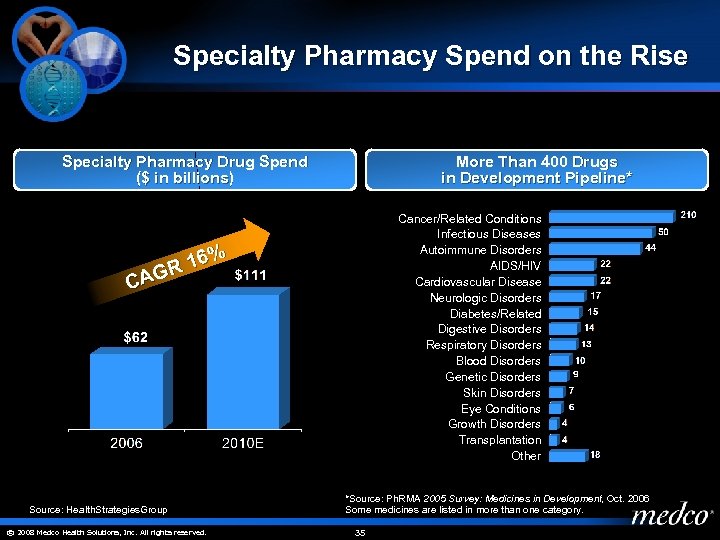

Specialty Pharmacy Spend on the Rise Specialty Pharmacy Drug Spend ($ in billions) More Than 400 Drugs in Development Pipeline* Cancer/Related Conditions Infectious Diseases Autoimmune Disorders AIDS/HIV Cardiovascular Disease Neurologic Disorders Diabetes/Related Digestive Disorders Respiratory Disorders Blood Disorders Genetic Disorders Skin Disorders Eye Conditions Growth Disorders Transplantation Other 6% R 1 CAG Source: Health. Strategies. Group © 2008 Medco Health Solutions, Inc. All rights reserved. *Source: Ph. RMA 2005 Survey: Medicines in Development, Oct. 2006 *Source: Ph. RMA 2005 Development, Oct. 2006 Some medicines are listed in more than one category. 35

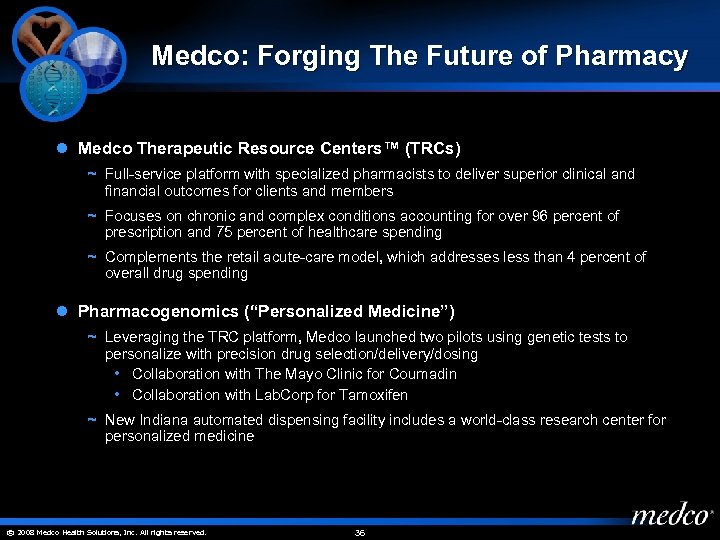

Medco: Forging The Future of Pharmacy l Medco Therapeutic Resource Centers™ (TRCs) ~ Full-service platform with specialized pharmacists to deliver superior clinical and financial outcomes for clients and members ~ Focuses on chronic and complex conditions accounting for over 96 percent of prescription and 75 percent of healthcare spending ~ Complements the retail acute-care model, which addresses less than 4 percent of overall drug spending l Pharmacogenomics (“Personalized Medicine”) ~ Leveraging the TRC platform, Medco launched two pilots using genetic tests to personalize with precision drug selection/delivery/dosing • Collaboration with The Mayo Clinic for Coumadin • Collaboration with Lab. Corp for Tamoxifen ~ New Indiana automated dispensing facility includes a world-class research center for personalized medicine © 2008 Medco Health Solutions, Inc. All rights reserved. 36

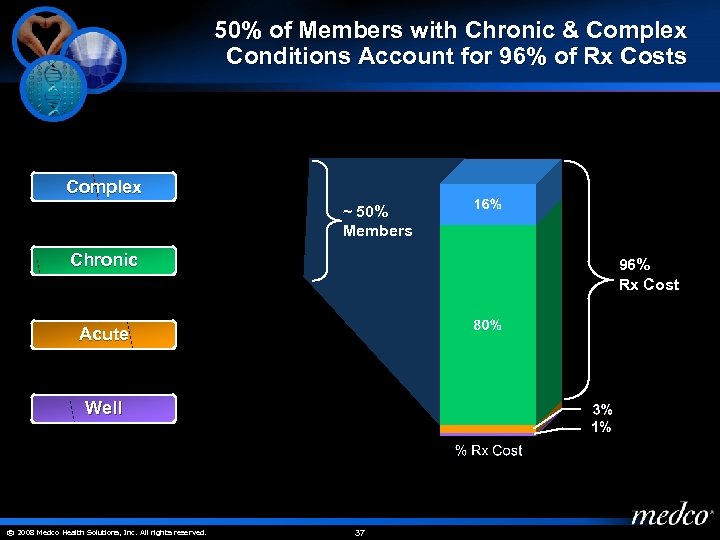

50% of Members with Chronic & Complex Conditions Account for 96% of Rx Costs Complex ~ 50% Members Chronic 96% Rx Cost Acute Well © 2008 Medco Health Solutions, Inc. All rights reserved. 37

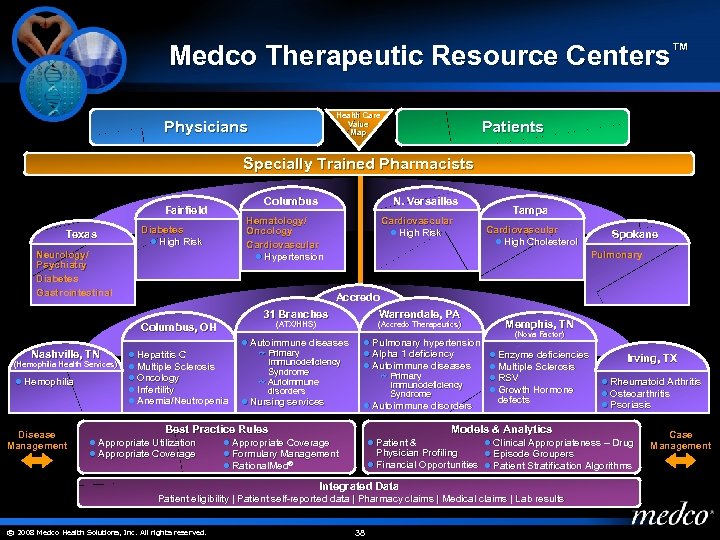

Medco Therapeutic Resource Centers™ Health Care Value Map Physicians Patients Specially Trained Pharmacists Columbus Fairfield Texas N. Versailles Hematology/ Oncology Cardiovascular l Hypertension Diabetes l High Risk Neurology/ Psychiatry Diabetes Gastrointestinal Cardiovascular l High Risk l Hemophilia Disease Management Spokane Pulmonary 31 Branches Nashville, TN Cardiovascular l High Cholesterol Accredo Warrendale, PA (ATX/HHS) Columbus, OH (Hemophilia Health Services) Tampa l Hepatitis C l Multiple Sclerosis l Oncology l Infertility l Anemia/Neutropenia l Autoimmune diseases ~ Primary Immunodeficiency Syndrome ~ Autoimmune disorders l Nursing services (Accredo Therapeutics) (Nova Factor) l Pulmonary hypertension l Alpha 1 deficiency l Enzyme deficiencies l Autoimmune diseases l Multiple Sclerosis ~ Primary l RSV Immunodeficiency l Growth Hormone Syndrome l Autoimmune disorders Best Practice Rules l Appropriate Utilization l Appropriate Coverage Memphis, TN defects l Rheumatoid Arthritis l Osteoarthritis l Psoriasis Models & Analytics l Appropriate Coverage l Formulary Management l Rational. Med® l Clinical Appropriateness – Drug Physician Profiling l Episode Groupers l Financial Opportunities l Patient Stratification Algorithms l Patient & Integrated Data Patient eligibility | Patient self-reported data | Pharmacy claims | Medical claims | Lab results © 2008 Medco Health Solutions, Inc. All rights reserved. Irving, TX 38 Case Management

Quality Care is Delivered Through a Unique Specialist Pharmacy Model Rare & Specialty Oncology & Immunology Pulmonary HIV Diabetes Cardiovascular High Risk Cardiovascular Hypertension Neurology & Psychiatry Cardiovascular High Cholesterol Medco Therapeutic Resource Centers™ © 2008 Medco Health Solutions, Inc. All rights reserved. 39 Gastrointestinal

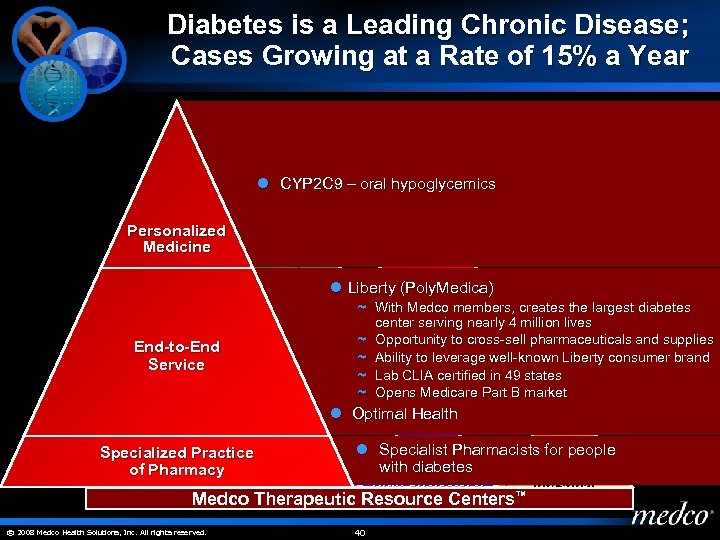

Diabetes is a Leading Chronic Disease; Cases Growing at a Rate of 15% a Year Rare & l CYP 2 C 9 – oral hypoglycemics Specialty Personalized Medicine Oncology Diabetes l Liberty (Poly. Medica) & Immunology ~ With Medco members, creates the largest diabetes center serving nearly 4 million lives ~ Opportunity to cross-sell pharmaceuticals and supplies End-to-End Cardio~ Ability to leverage well-known Liberty consumer brand Service vascular Pulmonary Neurology ~ Lab CLIA certified in 49 states High~ Opens Medicare Part B market Risk & Psychiatry l Optimal Health Specialized Practice Cardiovascular of. HIV Pharmacy Hypertension Cardiol Specialist Pharmacists for people vascular with diabetes Gastro. High Cholesterol Medco Therapeutic Resource © 2008 Medco Health Solutions, Inc. All rights reserved. 40 Centers™ intestinal

Janet Woodcock Interview © 2008 Medco Health Solutions, Inc. All rights reserved. 41

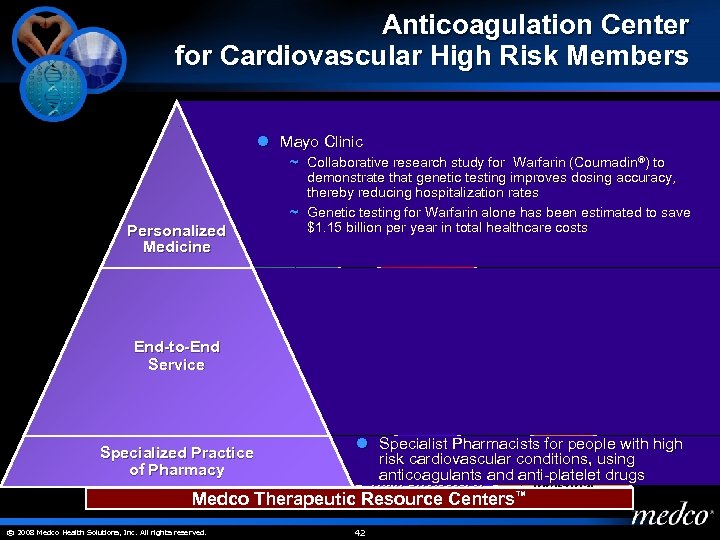

Anticoagulation Center for Cardiovascular High Risk Members l Mayo Clinic ~ Collaborative research study for Warfarin (Coumadin®) to demonstrate that genetic testing improves dosing accuracy, Rare & thereby reducing hospitalization rates Specialty ~ Genetic testing for Warfarin alone has been estimated to save $1. 15 billion per year in total healthcare costs Personalized Medicine Oncology & Immunology End-to-End Service Pulmonary Specialized Practice Cardiovascular of. HIV Pharmacy Diabetes Cardiovascular High Risk Hypertension l Specialist Pharmacists for people with high Cardiorisk cardiovascular conditions, using vascular Gastroanticoagulants and anti-platelet drugs High Cholesterol Medco Therapeutic Resource © 2008 Medco Health Solutions, Inc. All rights reserved. Neurology & Psychiatry 42 Centers™ intestinal

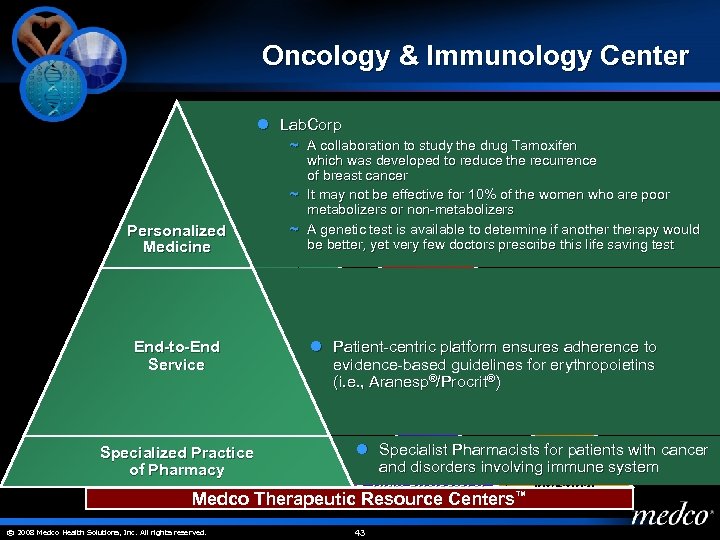

Oncology & Immunology Center l Lab. Corp ~ A collaboration to study the drug Tamoxifen which was developed to reduce the recurrence of breast cancer Rare & ~ It may not be effective for 10% of the women who are poor Specialty metabolizers or non-metabolizers ~ A genetic test is available to determine if anotherapy would be better, yet very few doctors prescribe this life saving test Personalized Medicine Diabetes Oncology & Immunology End-to-End Service Pulmonary l Patient-centric platform ensures adherence to Cardioevidence-based guidelines for erythropoietins vascular Neurology (i. e. , Aranesp®/Procrit®) High Risk & Psychiatry Specialized Practice Cardiovascular of. HIV Pharmacy Hypertension Cardiol Specialist Pharmacists for patients with cancer vascular and disorders involving immune system Gastro. High Cholesterol Medco Therapeutic Resource © 2008 Medco Health Solutions, Inc. All rights reserved. 43 Centers™ intestinal

Medco’s New Business & Retention $4. 9 B 2008 annualized new named drug spend $4. 0 B 2008 net new business 98% 2008 client retention rate *As of fourth-quarter 2007 earnings call © 2008 Medco Health Solutions, Inc. All rights reserved. 44

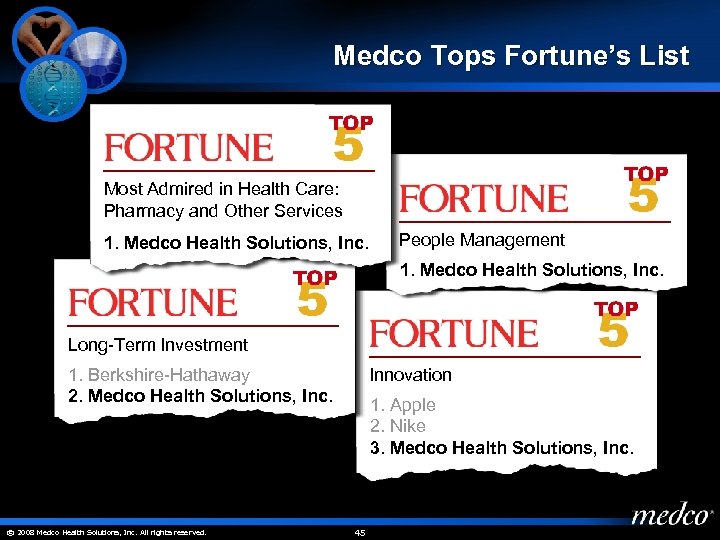

Medco Tops Fortune’s List Most Admired in Health Care: Pharmacy and Other Services 1. Medco Health Solutions, Inc. People Management 1. Medco Health Solutions, Inc. Long-Term Investment 1. Berkshire-Hathaway 2. Medco Health Solutions, Inc. © 2008 Medco Health Solutions, Inc. All rights reserved. Innovation 1. Apple 2. Nike 3. Medco Health Solutions, Inc. 45

® © 2008 Medco Health Solutions, Inc. All rights reserved. 46

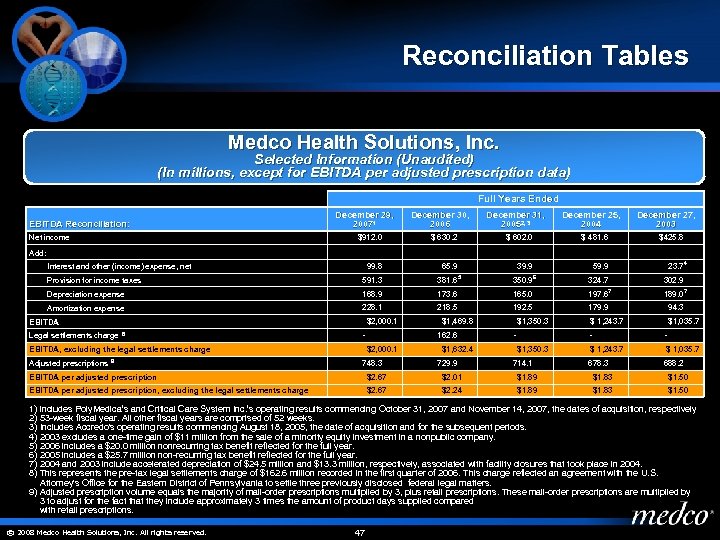

Reconciliation Tables Medco Health Solutions, Inc. Selected Information (Unaudited) (In millions, except for EBITDA per adjusted prescription data) Full Years Ended December 29, 20071 EBITDA Reconciliation: Net income $912. 0 December 30, 2006 $ 630. 2 December 31, 20052, 3 $ 602. 0 December 25, 2004 $ 481. 6 December 27, 2003 $425. 8 Add: 99. 8 Interest and other (income) expense, net 591. 3 Provision for income taxes 65. 9 5 381. 6 39. 9 6 350. 9 59. 9 324. 7 302. 9 Depreciation expense 168. 9 173. 6 165. 0 197. 6 189. 0 7 Amortization expense 228. 1 218. 5 192. 5 179. 9 94. 3 EBITDA Legal settlements charge 8 EBITDA, excluding the legal settlements charge Adjusted prescriptions 9 $2, 000. 1 - $2, 000. 1 748. 3 $1, 469. 8 162. 6 $1, 632. 4 729. 9 $1, 350. 3 - $1, 350. 3 714. 1 7 23. 74 $ 1, 243. 7 - $1, 035. 7 - $ 1, 243. 7 $ 1, 035. 7 678. 3 688. 2 EBITDA per adjusted prescription $2. 67 $2. 01 $1. 89 $1. 83 $1. 50 EBITDA per adjusted prescription, excluding the legal settlements charge $2. 67 $2. 24 $1. 89 $1. 83 $1. 50 1) Includes Poly. Medica’s and Critical Care System Inc. ’s operating results commencing October 31, 2007 and November 14, 2007, the dates of acquisition, respectively 2) 53 -week fiscal year. All other fiscal years are comprised of 52 weeks. 3) Includes Accredo's operating results commencing August 18, 2005, the date of acquisition and for the subsequent periods. 4) 2003 excludes a one-time gain of $11 million from the sale of a minority equity investment in a nonpublic company. 5) 2006 includes a $20. 0 million nonrecurring tax benefit reflected for the full year. 6) 2005 includes a $25. 7 million non-recurring tax benefit reflected for the full year. 7) 2004 and 2003 include accelerated depreciation of $24. 5 million and $13. 3 million, respectively, associated with facility closures that took place in 2004. 8) This represents the pre-tax legal settlements charge of $162. 6 million recorded in the first quarter of 2006. This charge reflected an agreement with the U. S. Attorney's Office for the Eastern District of Pennsylvania to settle three previously disclosed federal legal matters. 9) Adjusted prescription volume equals the majority of mail-order prescriptions multiplied by 3, plus retail prescriptions. These mail-order prescriptions are multiplied by 3 to adjust for the fact that they include approximately 3 times the amount of product days supplied compared with retail prescriptions. © 2008 Medco Health Solutions, Inc. All rights reserved. 47

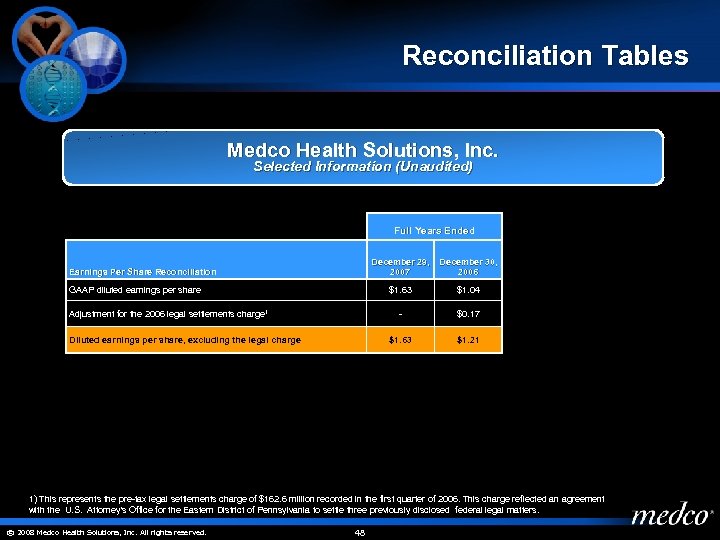

Reconciliation Tables Medco Health Solutions, Inc. Selected Information (Unaudited) Full Years Ended December 29, 2007 Diluted earnings per share, excluding the legal charge $0. 17 $1. 63 Adjustment for the 2006 legal settlements charge 1 $1. 04 - GAAP diluted earnings per share December 30, 2006 $1. 63 Earnings Per Share Reconciliation $1. 21 1) This represents the pre-tax legal settlements charge of $162. 6 million recorded in the first quarter of 2006. This charge reflected an agreement with the U. S. Attorney's Office for the Eastern District of Pennsylvania to settle three previously disclosed federal legal matters. © 2008 Medco Health Solutions, Inc. All rights reserved. 48

1bc3ba2dd199dd8edb7e8eb69428a47f.ppt