adfcb78aa67d85de259cada29e2c01b6.ppt

- Количество слайдов: 54

® A Power. Point Tutorial to Accompany macroeconomics, 5 th ed. N. Gregory Mankiw BAB 11 Aggregate Demand II Chapter Eleven 1

® A Power. Point Tutorial to Accompany macroeconomics, 5 th ed. N. Gregory Mankiw BAB 11 Aggregate Demand II Chapter Eleven 1

• Perpotongan IS dan LM menentukan tingkat pendapatan nasional. Jika salah satu kurva bergeser keseimbangan jk. pendek berubah dan pendapatan nasional berfluktuasi • Dikaji : (1) Fluktuasi pendapatan nasional. Perubahan dalam var. Eksogen (G, T, M) mempengaruhi var. Endagen (r, Y). • Bagaimana guncangan pada pasar brg (IS) dan LM, mempengaruhi r dan Y. (2) Model IS LM memberikan teori tentang kv AD. Asumsi harga tetap dihilangkan → hub. Negatif harga dengan pdpt nasional. (3) Depresi besar th 30 • (lahirnya ekonomi makro). Chapter Eleven 2

• Perpotongan IS dan LM menentukan tingkat pendapatan nasional. Jika salah satu kurva bergeser keseimbangan jk. pendek berubah dan pendapatan nasional berfluktuasi • Dikaji : (1) Fluktuasi pendapatan nasional. Perubahan dalam var. Eksogen (G, T, M) mempengaruhi var. Endagen (r, Y). • Bagaimana guncangan pada pasar brg (IS) dan LM, mempengaruhi r dan Y. (2) Model IS LM memberikan teori tentang kv AD. Asumsi harga tetap dihilangkan → hub. Negatif harga dengan pdpt nasional. (3) Depresi besar th 30 • (lahirnya ekonomi makro). Chapter Eleven 2

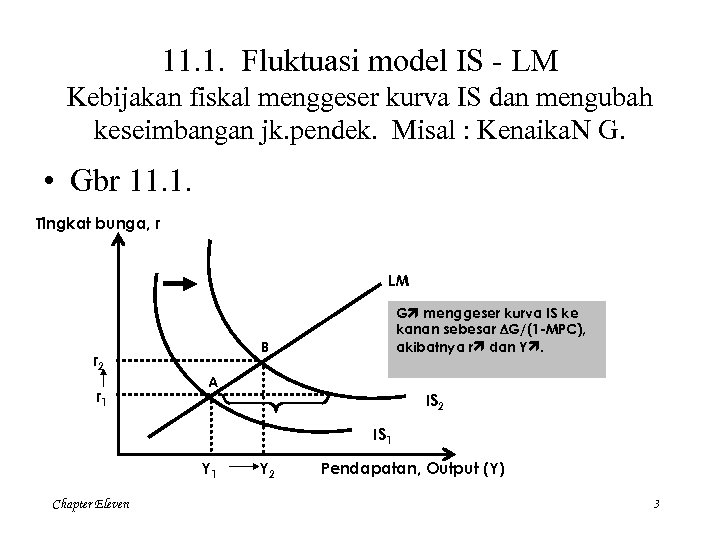

11. 1. Fluktuasi model IS - LM Kebijakan fiskal menggeser kurva IS dan mengubah keseimbangan jk. pendek. Misal : Kenaika. N G. • Gbr 11. 1. Tingkat bunga, r LM r 2 r 1 G menggeser kurva IS ke kanan sebesar ΔG/(1 -MPC), akibatnya r dan Y. B A IS 2 IS 1 Y 1 Chapter Eleven Y 2 Pendapatan, Output (Y) 3

11. 1. Fluktuasi model IS - LM Kebijakan fiskal menggeser kurva IS dan mengubah keseimbangan jk. pendek. Misal : Kenaika. N G. • Gbr 11. 1. Tingkat bunga, r LM r 2 r 1 G menggeser kurva IS ke kanan sebesar ΔG/(1 -MPC), akibatnya r dan Y. B A IS 2 IS 1 Y 1 Chapter Eleven Y 2 Pendapatan, Output (Y) 3

Ket Gambar 11. 1 • Perpotongan keynesian : G E Y • Pasar uang : Y L(r, Y) r dimana (M/P)s tetap • Akibat r I menghapus dampak ekspansif dari kenaikan G. • Y akibat G model IS-LM < Y akibat G keynesian. “Crowding Out of Investment” Chapter Eleven 4

Ket Gambar 11. 1 • Perpotongan keynesian : G E Y • Pasar uang : Y L(r, Y) r dimana (M/P)s tetap • Akibat r I menghapus dampak ekspansif dari kenaikan G. • Y akibat G model IS-LM < Y akibat G keynesian. “Crowding Out of Investment” Chapter Eleven 4

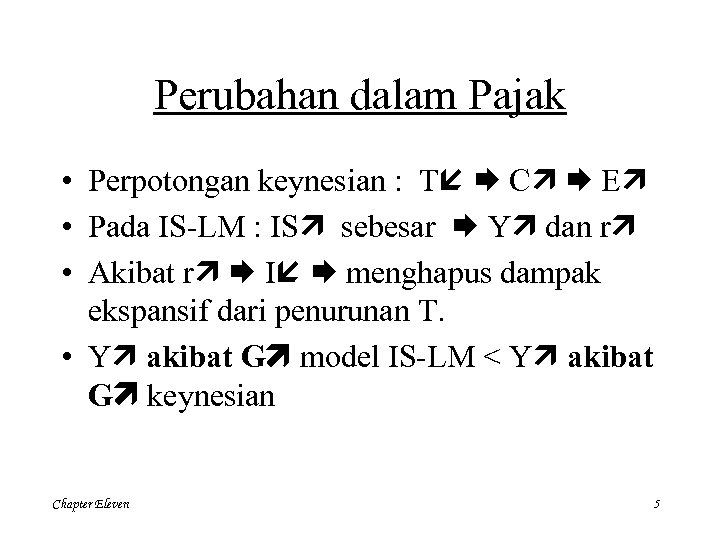

Perubahan dalam Pajak • Perpotongan keynesian : T C E • Pada IS-LM : IS sebesar Y dan r • Akibat r I menghapus dampak ekspansif dari penurunan T. • Y akibat G model IS-LM < Y akibat G keynesian Chapter Eleven 5

Perubahan dalam Pajak • Perpotongan keynesian : T C E • Pada IS-LM : IS sebesar Y dan r • Akibat r I menghapus dampak ekspansif dari penurunan T. • Y akibat G model IS-LM < Y akibat G keynesian Chapter Eleven 5

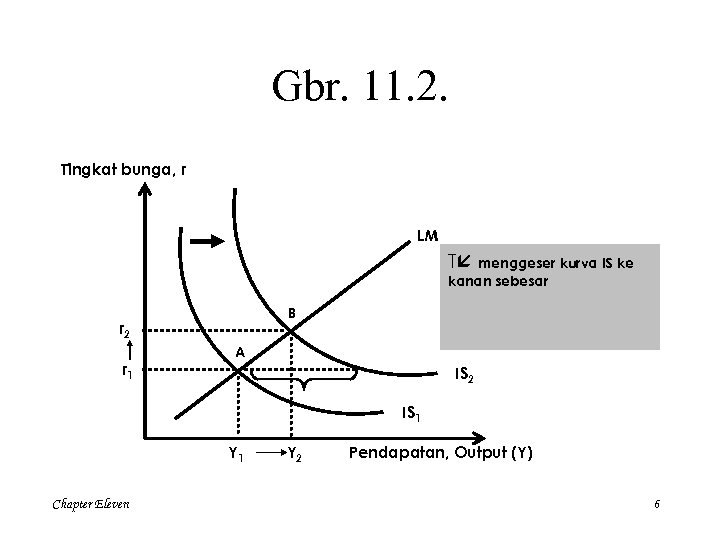

Gbr. 11. 2. Tingkat bunga, r LM T menggeser kurva IS ke kanan sebesar B r 2 r 1 A IS 2 IS 1 Y 1 Chapter Eleven Y 2 Pendapatan, Output (Y) 6

Gbr. 11. 2. Tingkat bunga, r LM T menggeser kurva IS ke kanan sebesar B r 2 r 1 A IS 2 IS 1 Y 1 Chapter Eleven Y 2 Pendapatan, Output (Y) 6

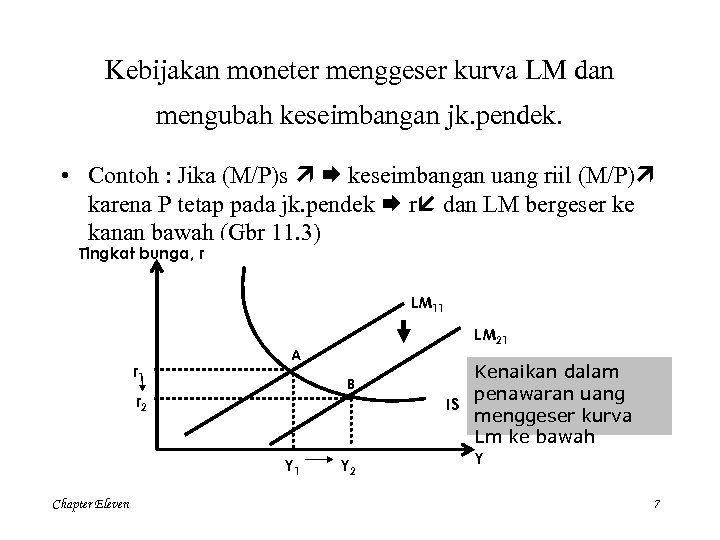

Kebijakan moneter menggeser kurva LM dan mengubah keseimbangan jk. pendek. • Contoh : Jika (M/P)s keseimbangan uang riil (M/P) karena P tetap pada jk. pendek r dan LM bergeser ke kanan bawah (Gbr 11. 3) Tingkat bunga, r LM 11 r 1 A B r 2 Y 1 Chapter Eleven LM 21 Y 2 Kenaikan dalam penawaran uang IS menggeser kurva Lm ke bawah Y 7

Kebijakan moneter menggeser kurva LM dan mengubah keseimbangan jk. pendek. • Contoh : Jika (M/P)s keseimbangan uang riil (M/P) karena P tetap pada jk. pendek r dan LM bergeser ke kanan bawah (Gbr 11. 3) Tingkat bunga, r LM 11 r 1 A B r 2 Y 1 Chapter Eleven LM 21 Y 2 Kenaikan dalam penawaran uang IS menggeser kurva Lm ke bawah Y 7

• Model IS – LM : Kebijakan moneter mempengaruhi Y dgn mengubah tingkat r. Bab 9 : jk pendek, harga kaku, ekspansi jumlah uang beredar meningkatkan Y. Tapi tidak dibahas kalau mendorong pengeluaran yang lebih besar – disebut mekanisme transmisi moneter. • Model IS LM : Kenaikan jumlah uang beredar → Menurunkan suku bunga → mendorong investasi → memperbesar permintaan brg/jasa Chapter Eleven 8

• Model IS – LM : Kebijakan moneter mempengaruhi Y dgn mengubah tingkat r. Bab 9 : jk pendek, harga kaku, ekspansi jumlah uang beredar meningkatkan Y. Tapi tidak dibahas kalau mendorong pengeluaran yang lebih besar – disebut mekanisme transmisi moneter. • Model IS LM : Kenaikan jumlah uang beredar → Menurunkan suku bunga → mendorong investasi → memperbesar permintaan brg/jasa Chapter Eleven 8

Interaksi antara Kebijakan Fiskal dan Moneter • Misal : Tanggapan perekonomian terhadap kenaikan pajak. Hal ini tergantung pada bagaimana otoritas moneter menanggapinya. Ada 3 skenario, yaitu : • 1) Fed mempertahankan penawaran uang konstan • 2) Fed mempertahankan tingkat bunga konstan • 3) Fed mempertahankan pendapatan Chapter Eleven 9

Interaksi antara Kebijakan Fiskal dan Moneter • Misal : Tanggapan perekonomian terhadap kenaikan pajak. Hal ini tergantung pada bagaimana otoritas moneter menanggapinya. Ada 3 skenario, yaitu : • 1) Fed mempertahankan penawaran uang konstan • 2) Fed mempertahankan tingkat bunga konstan • 3) Fed mempertahankan pendapatan Chapter Eleven 9

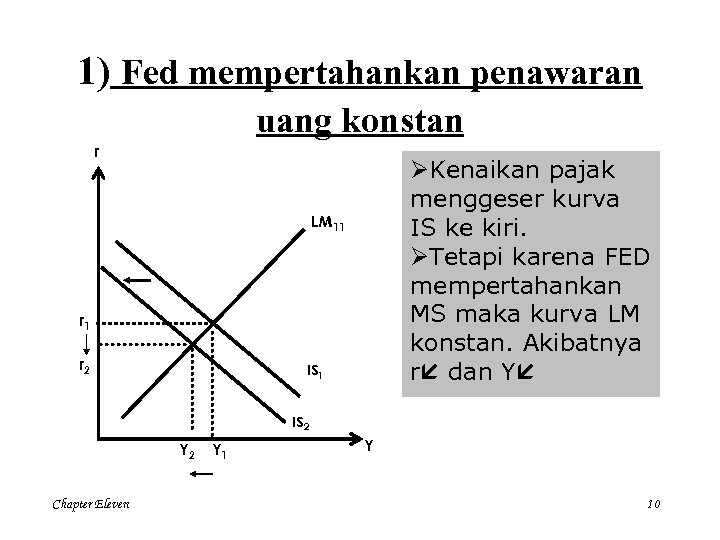

1) Fed mempertahankan penawaran uang konstan r ØKenaikan pajak menggeser kurva IS ke kiri. ØTetapi karena FED mempertahankan MS maka kurva LM konstan. Akibatnya r dan Y LM 11 r 2 IS 1 IS 2 Y 2 Chapter Eleven Y 10

1) Fed mempertahankan penawaran uang konstan r ØKenaikan pajak menggeser kurva IS ke kiri. ØTetapi karena FED mempertahankan MS maka kurva LM konstan. Akibatnya r dan Y LM 11 r 2 IS 1 IS 2 Y 2 Chapter Eleven Y 10

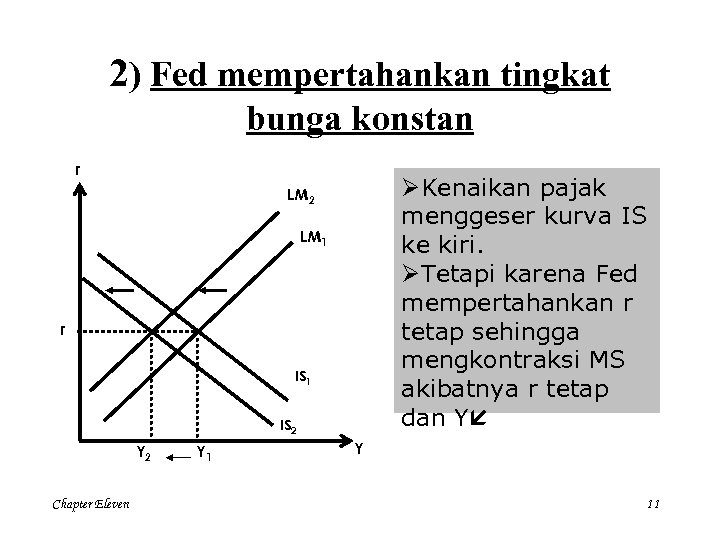

2) Fed mempertahankan tingkat bunga konstan r ØKenaikan pajak menggeser kurva IS ke kiri. ØTetapi karena Fed mempertahankan r tetap sehingga mengkontraksi MS akibatnya r tetap dan Y LM 2 LM 1 r IS 1 IS 2 Y 2 Chapter Eleven Y 11

2) Fed mempertahankan tingkat bunga konstan r ØKenaikan pajak menggeser kurva IS ke kiri. ØTetapi karena Fed mempertahankan r tetap sehingga mengkontraksi MS akibatnya r tetap dan Y LM 2 LM 1 r IS 1 IS 2 Y 2 Chapter Eleven Y 11

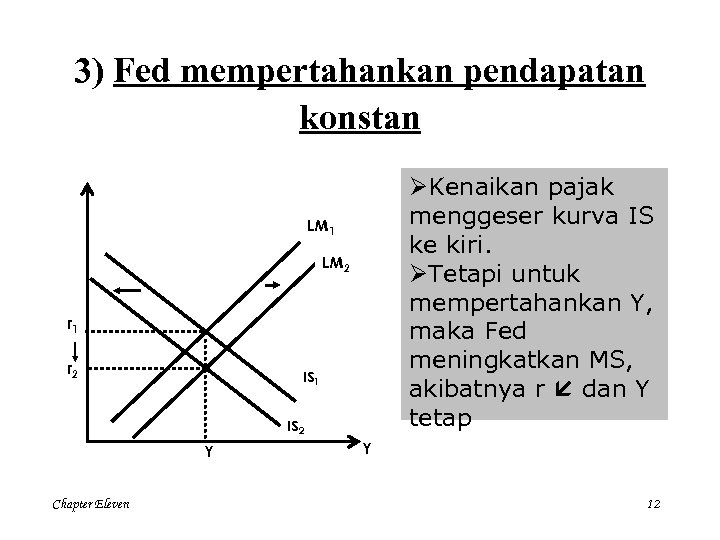

3) Fed mempertahankan pendapatan konstan ØKenaikan pajak menggeser kurva IS ke kiri. ØTetapi untuk mempertahankan Y, maka Fed meningkatkan MS, akibatnya r dan Y tetap LM 1 LM 2 r 1 r 2 IS 1 IS 2 Y Chapter Eleven Y 12

3) Fed mempertahankan pendapatan konstan ØKenaikan pajak menggeser kurva IS ke kiri. ØTetapi untuk mempertahankan Y, maka Fed meningkatkan MS, akibatnya r dan Y tetap LM 1 LM 2 r 1 r 2 IS 1 IS 2 Y Chapter Eleven Y 12

Guncangan dalam Model IS-LM • Guncangan kurva IS dapat terjadi akibat: • perubahan eksogen dalam permintaan terhadap barang dan jasa • perubahan permintaan terhadap barang konsumen • Guncangan kurva LM terjadi akibat : • perubahan eksogen dalam permintaan terhadap uang Chapter Eleven 13

Guncangan dalam Model IS-LM • Guncangan kurva IS dapat terjadi akibat: • perubahan eksogen dalam permintaan terhadap barang dan jasa • perubahan permintaan terhadap barang konsumen • Guncangan kurva LM terjadi akibat : • perubahan eksogen dalam permintaan terhadap uang Chapter Eleven 13

Dari Model IS-LM ke Kurva AD • Mengapa kuva AD miring ke bawah ? • Untuk penawaran uang M tertentu, tingkat harga P yang lebih tinggi mengurangi penawaran keseimbangan uang riil (M/P) mengeser kurva LM ke atas r dan Y Chapter Eleven 14

Dari Model IS-LM ke Kurva AD • Mengapa kuva AD miring ke bawah ? • Untuk penawaran uang M tertentu, tingkat harga P yang lebih tinggi mengurangi penawaran keseimbangan uang riil (M/P) mengeser kurva LM ke atas r dan Y Chapter Eleven 14

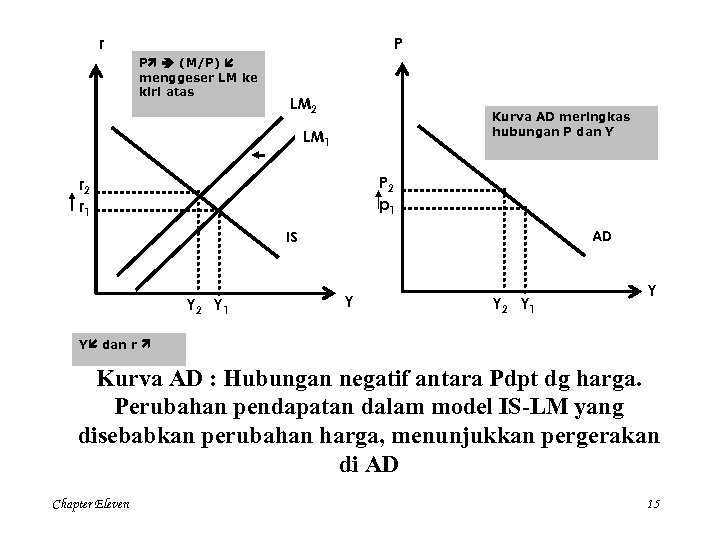

r P P (M/P) menggeser LM ke kiri atas LM 2 Kurva AD meringkas hubungan P dan Y LM 1 P 2 p 1 r 2 r 1 AD IS Y 2 Y 1 Y Y dan r Kurva AD : Hubungan negatif antara Pdpt dg harga. Perubahan pendapatan dalam model IS-LM yang disebabkan perubahan harga, menunjukkan pergerakan di AD Chapter Eleven 15

r P P (M/P) menggeser LM ke kiri atas LM 2 Kurva AD meringkas hubungan P dan Y LM 1 P 2 p 1 r 2 r 1 AD IS Y 2 Y 1 Y Y dan r Kurva AD : Hubungan negatif antara Pdpt dg harga. Perubahan pendapatan dalam model IS-LM yang disebabkan perubahan harga, menunjukkan pergerakan di AD Chapter Eleven 15

Apakah yang menyebabkan kurva AD bergeser ? • Karena kurva AD hanya meringkas hasil dari model IS-LM maka peristiwa yang menggeser kurva IS atau kurva LM pada tingkat harga tertentu menyebabkan kurva AD bergeser Chapter Eleven 16

Apakah yang menyebabkan kurva AD bergeser ? • Karena kurva AD hanya meringkas hasil dari model IS-LM maka peristiwa yang menggeser kurva IS atau kurva LM pada tingkat harga tertentu menyebabkan kurva AD bergeser Chapter Eleven 16

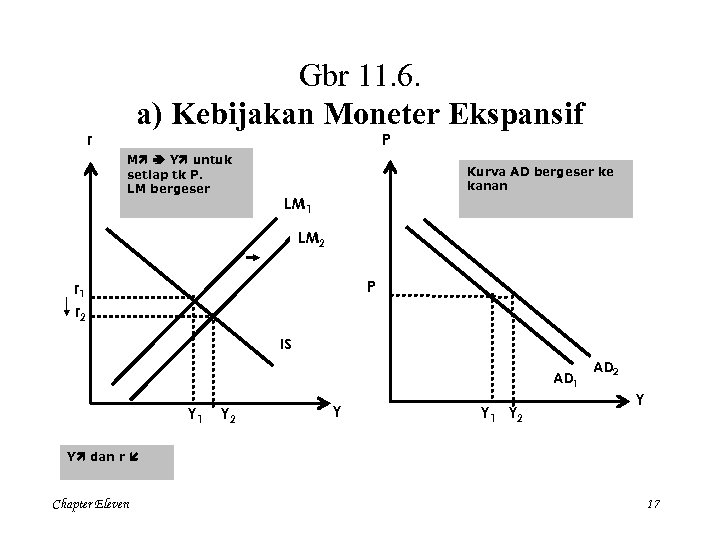

Gbr 11. 6. a) Kebijakan Moneter Ekspansif r P M Y untuk setiap tk P. LM bergeser Kurva AD bergeser ke kanan LM 1 LM 2 P r 1 r 2 IS AD 1 Y 2 Y Y 1 Y 2 AD 2 Y Y dan r Chapter Eleven 17

Gbr 11. 6. a) Kebijakan Moneter Ekspansif r P M Y untuk setiap tk P. LM bergeser Kurva AD bergeser ke kanan LM 1 LM 2 P r 1 r 2 IS AD 1 Y 2 Y Y 1 Y 2 AD 2 Y Y dan r Chapter Eleven 17

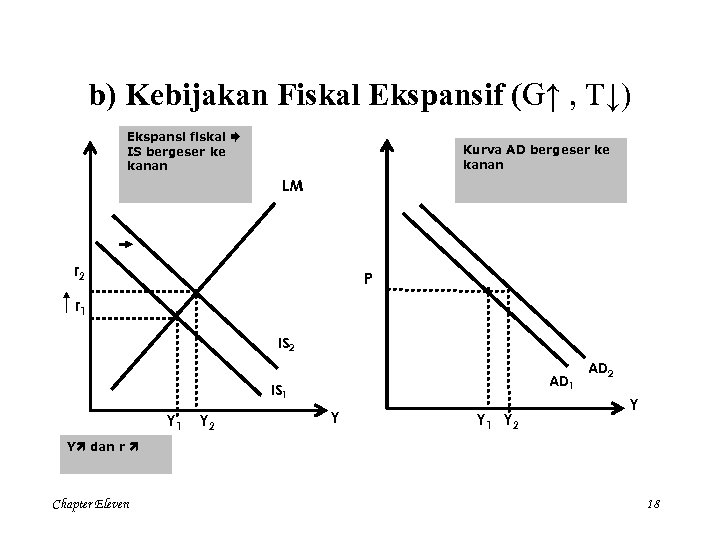

b) Kebijakan Fiskal Ekspansif (G↑ , T↓) Ekspansi fiskal IS bergeser ke kanan Kurva AD bergeser ke kanan LM r 2 P r 1 IS 2 AD 1 IS 1 Y 2 Y Y 1 Y 2 AD 2 Y Y dan r Chapter Eleven 18

b) Kebijakan Fiskal Ekspansif (G↑ , T↓) Ekspansi fiskal IS bergeser ke kanan Kurva AD bergeser ke kanan LM r 2 P r 1 IS 2 AD 1 IS 1 Y 2 Y Y 1 Y 2 AD 2 Y Y dan r Chapter Eleven 18

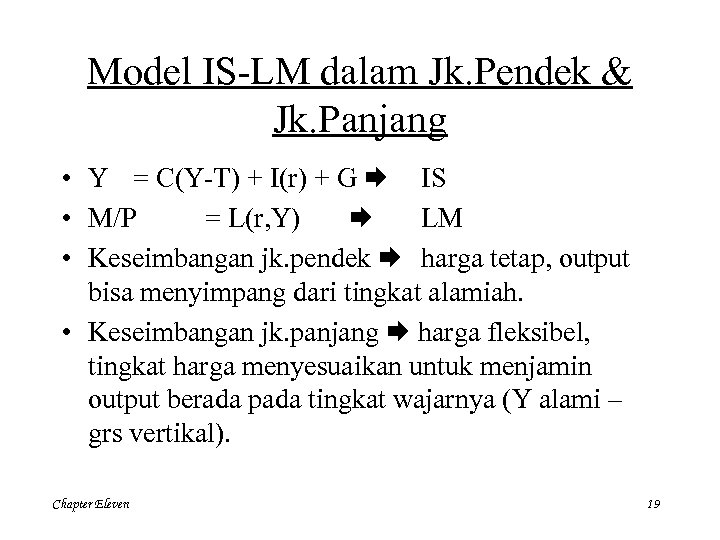

Model IS-LM dalam Jk. Pendek & Jk. Panjang • Y = C(Y-T) + I(r) + G IS • M/P = L(r, Y) LM • Keseimbangan jk. pendek harga tetap, output bisa menyimpang dari tingkat alamiah. • Keseimbangan jk. panjang harga fleksibel, tingkat harga menyesuaikan untuk menjamin output berada pada tingkat wajarnya (Y alami – grs vertikal). Chapter Eleven 19

Model IS-LM dalam Jk. Pendek & Jk. Panjang • Y = C(Y-T) + I(r) + G IS • M/P = L(r, Y) LM • Keseimbangan jk. pendek harga tetap, output bisa menyimpang dari tingkat alamiah. • Keseimbangan jk. panjang harga fleksibel, tingkat harga menyesuaikan untuk menjamin output berada pada tingkat wajarnya (Y alami – grs vertikal). Chapter Eleven 19

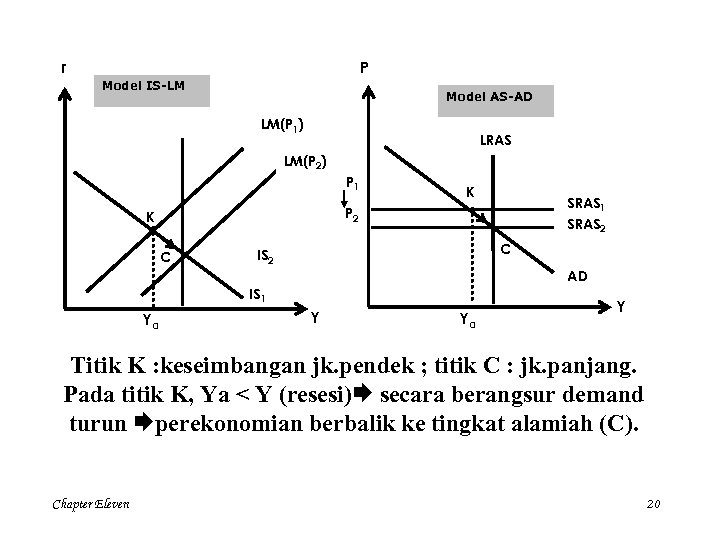

r P Model IS-LM Model AS-AD LM(P 1) LRAS LM(P 2) P 1 K SRAS 1 SRAS 2 P 2 K C C IS 2 AD IS 1 Ya Y Titik K : keseimbangan jk. pendek ; titik C : jk. panjang. Pada titik K, Ya < Y (resesi) secara berangsur demand turun perekonomian berbalik ke tingkat alamiah (C). Chapter Eleven 20

r P Model IS-LM Model AS-AD LM(P 1) LRAS LM(P 2) P 1 K SRAS 1 SRAS 2 P 2 K C C IS 2 AD IS 1 Ya Y Titik K : keseimbangan jk. pendek ; titik C : jk. panjang. Pada titik K, Ya < Y (resesi) secara berangsur demand turun perekonomian berbalik ke tingkat alamiah (C). Chapter Eleven 20

• Persamaan IS-LM memuat 3 var endogen : Y, P, r. • Keynesian : P = P 1. Maka r dan Y harus disesuaikan untuk memenuhi persamaan IS-LM. Baik menjelaskan jk pendek • Pendekatan klasik, melengkapi dengan asumsi output mencapai tingkat alamiahnya. Y = Y • Maka r dan P harus disesuaikan untuk memenuhi • persamaan IS-LM. Baik menjelaskan jk panjang. Chapter Eleven 21

• Persamaan IS-LM memuat 3 var endogen : Y, P, r. • Keynesian : P = P 1. Maka r dan Y harus disesuaikan untuk memenuhi persamaan IS-LM. Baik menjelaskan jk pendek • Pendekatan klasik, melengkapi dengan asumsi output mencapai tingkat alamiahnya. Y = Y • Maka r dan P harus disesuaikan untuk memenuhi • persamaan IS-LM. Baik menjelaskan jk panjang. Chapter Eleven 21

Great Depression (data yang terjadi : tabel 11. 2) • Hipotesis Pengeluaran : Guncangan pada kurva IS • awal tahun 1930 -an, ditunjukkan oleh Y dan r • Akibat pergeseran kontraktif kurva IS “ spending hypotesis” • Beberapa hal yang dipandangan ekonom, menyebabkan pergeseran kontraktif kurva IS : – akibat turunnya konsumsi dan jatuhnya pasar saham – Y akibat penurunan investasi perumahan – penurunan investasi perumahan akibat penurunan populasi – Begitu depresi besar terjadi, banyak bankrut – Kebijakan fiskal pada tahun 1930 -an yang meningkatkan berbagai pajak Chapter Eleven 22

Great Depression (data yang terjadi : tabel 11. 2) • Hipotesis Pengeluaran : Guncangan pada kurva IS • awal tahun 1930 -an, ditunjukkan oleh Y dan r • Akibat pergeseran kontraktif kurva IS “ spending hypotesis” • Beberapa hal yang dipandangan ekonom, menyebabkan pergeseran kontraktif kurva IS : – akibat turunnya konsumsi dan jatuhnya pasar saham – Y akibat penurunan investasi perumahan – penurunan investasi perumahan akibat penurunan populasi – Begitu depresi besar terjadi, banyak bankrut – Kebijakan fiskal pada tahun 1930 -an yang meningkatkan berbagai pajak Chapter Eleven 22

Great Depression • Hipotesis Uang : Guncangan pada kurva LM • Fed membiarkan MS turun (pengangguran) dalam jumlah yang sangat besar LM kontraktif, tetapi ketika keseimbangan uang riil benar-benar turun, kontraksi moneter tidak dengan mudah menjelaskan kemerosotan ekonomi • Dan seharusnya, akibat LM kontraktif maka r , tetapi kenyataannya r • Kedua alasan di atas menolak pandangan bahwa Depresi Besar disebabkan oleh pergeseran kontraktif kurva LM Chapter Eleven 23

Great Depression • Hipotesis Uang : Guncangan pada kurva LM • Fed membiarkan MS turun (pengangguran) dalam jumlah yang sangat besar LM kontraktif, tetapi ketika keseimbangan uang riil benar-benar turun, kontraksi moneter tidak dengan mudah menjelaskan kemerosotan ekonomi • Dan seharusnya, akibat LM kontraktif maka r , tetapi kenyataannya r • Kedua alasan di atas menolak pandangan bahwa Depresi Besar disebabkan oleh pergeseran kontraktif kurva LM Chapter Eleven 23

Perubahan P mempengaruhi Y dalam IS-LM ? • Dampak Deflasi yang Menstabilisasi : (P Y ) • Jika P pada M tetap keseimbangan uang riil (M/P) kurva LM ekspansif Y • Pigou Effect “keseimbangan uang riil adalah bagian kekayaan RT • Jika P pada M tetap keseimbangan uang riil (M/P) konsumen lebih kaya C kurva IS ekspansif Y • Kedua alasan di atas membuat sebagian ekonom percaya bhw penurunan harga membantu stabilkan perekonomian Chapter Eleven 24

Perubahan P mempengaruhi Y dalam IS-LM ? • Dampak Deflasi yang Menstabilisasi : (P Y ) • Jika P pada M tetap keseimbangan uang riil (M/P) kurva LM ekspansif Y • Pigou Effect “keseimbangan uang riil adalah bagian kekayaan RT • Jika P pada M tetap keseimbangan uang riil (M/P) konsumen lebih kaya C kurva IS ekspansif Y • Kedua alasan di atas membuat sebagian ekonom percaya bhw penurunan harga membantu stabilkan perekonomian Chapter Eleven 24

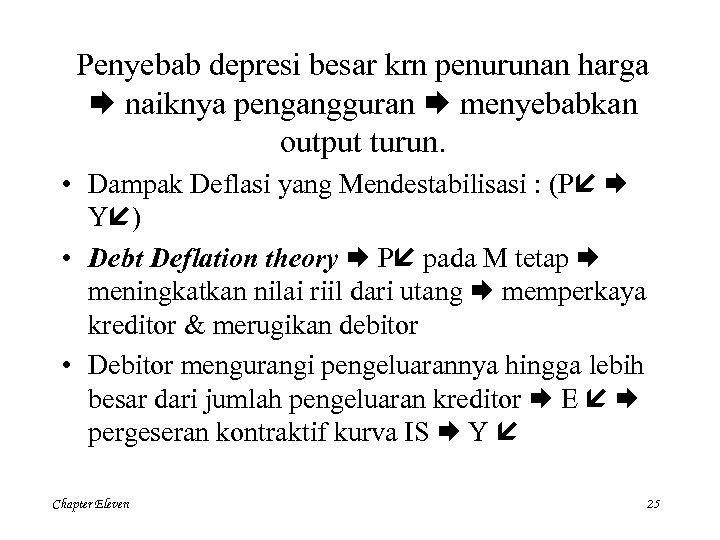

Penyebab depresi besar krn penurunan harga naiknya pengangguran menyebabkan output turun. • Dampak Deflasi yang Mendestabilisasi : (P Y ) • Debt Deflation theory P pada M tetap meningkatkan nilai riil dari utang memperkaya kreditor & merugikan debitor • Debitor mengurangi pengeluarannya hingga lebih besar dari jumlah pengeluaran kreditor E pergeseran kontraktif kurva IS Y Chapter Eleven 25

Penyebab depresi besar krn penurunan harga naiknya pengangguran menyebabkan output turun. • Dampak Deflasi yang Mendestabilisasi : (P Y ) • Debt Deflation theory P pada M tetap meningkatkan nilai riil dari utang memperkaya kreditor & merugikan debitor • Debitor mengurangi pengeluarannya hingga lebih besar dari jumlah pengeluaran kreditor E pergeseran kontraktif kurva IS Y Chapter Eleven 25

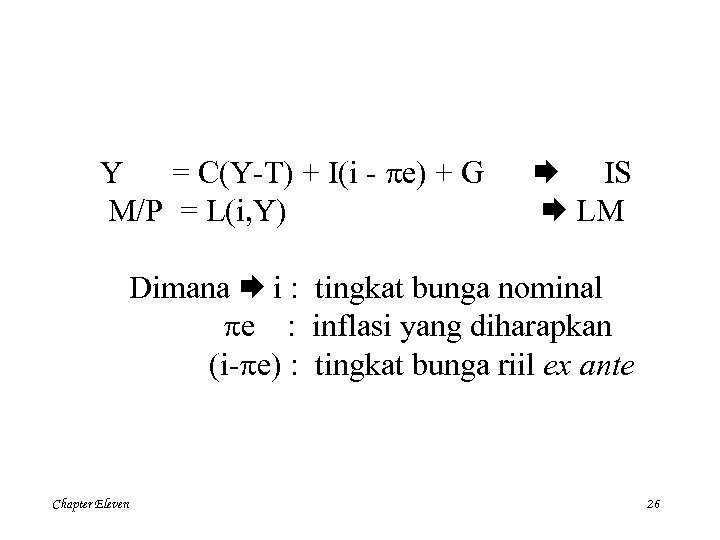

Y = C(Y-T) + I(i - e) + G M/P = L(i, Y) IS LM Dimana i : tingkat bunga nominal e : inflasi yang diharapkan (i- e) : tingkat bunga riil ex ante Chapter Eleven 26

Y = C(Y-T) + I(i - e) + G M/P = L(i, Y) IS LM Dimana i : tingkat bunga nominal e : inflasi yang diharapkan (i- e) : tingkat bunga riil ex ante Chapter Eleven 26

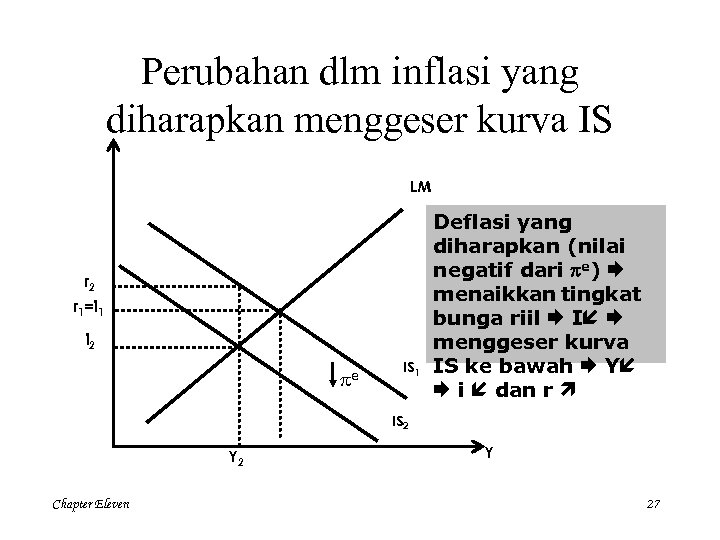

Perubahan dlm inflasi yang diharapkan menggeser kurva IS LM r 2 r 1=i 1 i 2 e IS 1 Deflasi yang diharapkan (nilai negatif dari e) menaikkan tingkat bunga riil I menggeser kurva IS ke bawah Y i dan r IS 2 Y 2 Chapter Eleven Y 27

Perubahan dlm inflasi yang diharapkan menggeser kurva IS LM r 2 r 1=i 1 i 2 e IS 1 Deflasi yang diharapkan (nilai negatif dari e) menaikkan tingkat bunga riil I menggeser kurva IS ke bawah Y i dan r IS 2 Y 2 Chapter Eleven Y 27

• Sampai sekarang para ekonom terus memperdebatkan penyebab kemerosotan ekonomi dahsyat ini. • Kita menunjukkan bagaimana ekonom menggunakan kurva IS-LM untuk menganalisis fluktuasi ekonomi. • Membantu merumuskan kebijakan melawan pengangguran Chapter Eleven 28

• Sampai sekarang para ekonom terus memperdebatkan penyebab kemerosotan ekonomi dahsyat ini. • Kita menunjukkan bagaimana ekonom menggunakan kurva IS-LM untuk menganalisis fluktuasi ekonomi. • Membantu merumuskan kebijakan melawan pengangguran Chapter Eleven 28

• Thank You Ir 1 @ Chapter Eleven 29

• Thank You Ir 1 @ Chapter Eleven 29

Chapter Eleven 30

Chapter Eleven 30

Chapter Eleven 31

Chapter Eleven 31

Now that we’ve assembled the IS-LM model of aggregate demand, let’s apply it to three issues: 1) Causes of fluctuations in national income 2) How IS-LM fits into the model of aggregate supply and aggregate demand 3) The Great Depression Chapter Eleven 32

Now that we’ve assembled the IS-LM model of aggregate demand, let’s apply it to three issues: 1) Causes of fluctuations in national income 2) How IS-LM fits into the model of aggregate supply and aggregate demand 3) The Great Depression Chapter Eleven 32

Chapter Eleven 33

Chapter Eleven 33

Chapter Eleven 34

Chapter Eleven 34

-L M IS Chapter Eleven The intersection of the IS curve and the LM curve determines the level of national income. When one of these curves shifts, the short-run equilibrium of the economy changes, and national income fluctuates. Let’s examine how changes in policy and shocks to the economy can cause these curves to shift. 35

-L M IS Chapter Eleven The intersection of the IS curve and the LM curve determines the level of national income. When one of these curves shifts, the short-run equilibrium of the economy changes, and national income fluctuates. Let’s examine how changes in policy and shocks to the economy can cause these curves to shift. 35

Chapter Eleven 36

Chapter Eleven 36

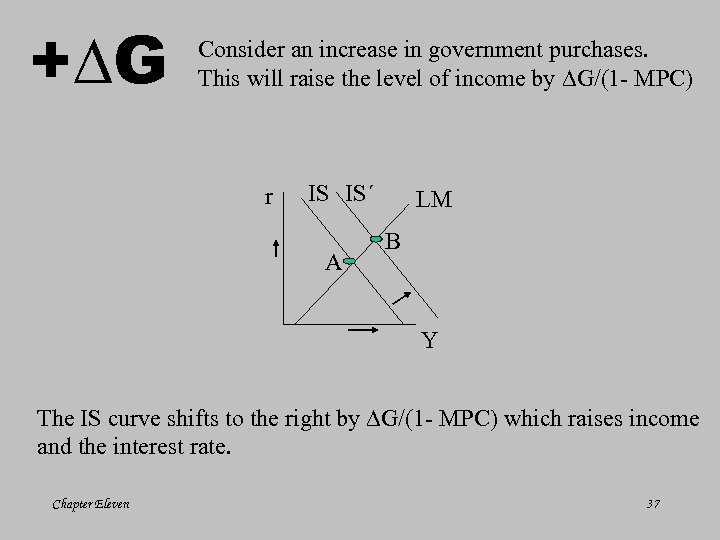

+ G Consider an increase in government purchases. This will raise the level of income by G/(1 - MPC) r IS IS´ A LM B Y The IS curve shifts to the right by G/(1 - MPC) which raises income and the interest rate. Chapter Eleven 37

+ G Consider an increase in government purchases. This will raise the level of income by G/(1 - MPC) r IS IS´ A LM B Y The IS curve shifts to the right by G/(1 - MPC) which raises income and the interest rate. Chapter Eleven 37

Chapter Eleven 38

Chapter Eleven 38

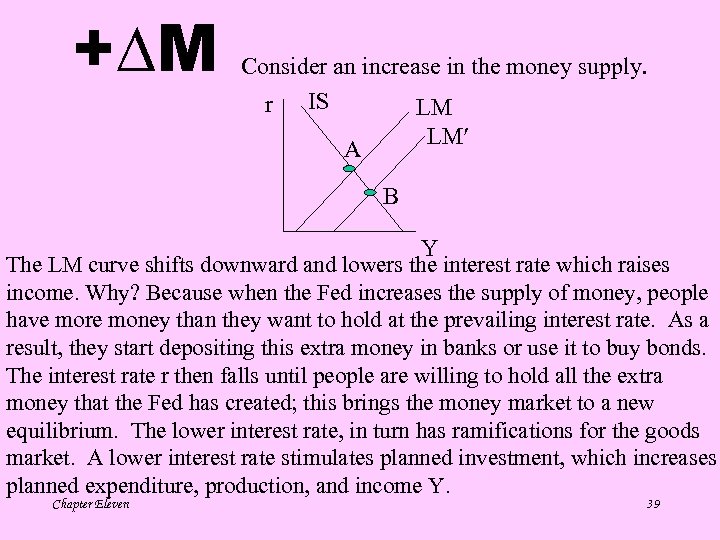

+ M Consider an increase in the money supply. r IS LM LM A B Y The LM curve shifts downward and lowers the interest rate which raises income. Why? Because when the Fed increases the supply of money, people have more money than they want to hold at the prevailing interest rate. As a result, they start depositing this extra money in banks or use it to buy bonds. The interest rate r then falls until people are willing to hold all the extra money that the Fed has created; this brings the money market to a new equilibrium. The lower interest rate, in turn has ramifications for the goods market. A lower interest rate stimulates planned investment, which increases planned expenditure, production, and income Y. Chapter Eleven 39

+ M Consider an increase in the money supply. r IS LM LM A B Y The LM curve shifts downward and lowers the interest rate which raises income. Why? Because when the Fed increases the supply of money, people have more money than they want to hold at the prevailing interest rate. As a result, they start depositing this extra money in banks or use it to buy bonds. The interest rate r then falls until people are willing to hold all the extra money that the Fed has created; this brings the money market to a new equilibrium. The lower interest rate, in turn has ramifications for the goods market. A lower interest rate stimulates planned investment, which increases planned expenditure, production, and income Y. Chapter Eleven 39

The IS-LM model shows that monetary policy influences income by changing the interest rate. This conclusion sheds light on our analysis of monetary policy in Chapter 9. In that chapter we showed that in the short run, when prices are sticky, an expansion in the money supply raises income. But, we didn’t discuss how a monetary expansion induces greater spending on goods and services--a process called the monetary transmission mechanism. The IS-LM model shows that an increase in the money supply lowers the interest rate, which stimulates investment and thereby expands the demand for goods and services. Chapter Eleven 40

The IS-LM model shows that monetary policy influences income by changing the interest rate. This conclusion sheds light on our analysis of monetary policy in Chapter 9. In that chapter we showed that in the short run, when prices are sticky, an expansion in the money supply raises income. But, we didn’t discuss how a monetary expansion induces greater spending on goods and services--a process called the monetary transmission mechanism. The IS-LM model shows that an increase in the money supply lowers the interest rate, which stimulates investment and thereby expands the demand for goods and services. Chapter Eleven 40

Chapter Eleven 41

Chapter Eleven 41

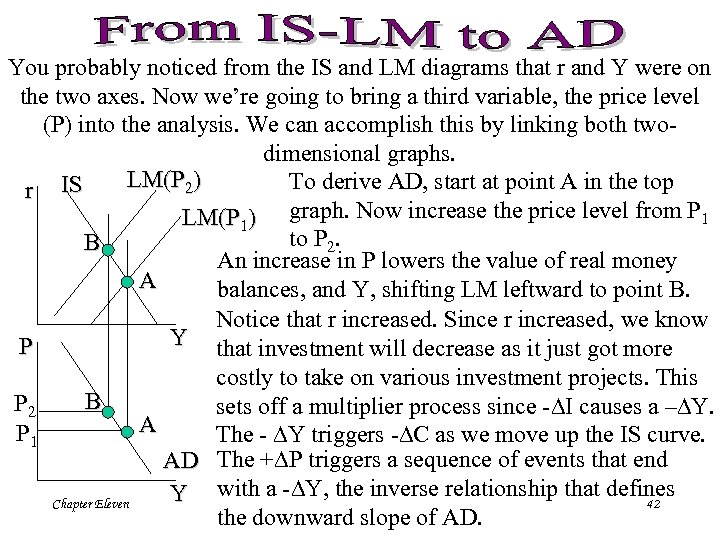

You probably noticed from the IS and LM diagrams that r and Y were on the two axes. Now we’re going to bring a third variable, the price level (P) into the analysis. We can accomplish this by linking both twodimensional graphs. LM(P 2) To derive AD, start at point A in the top r IS LM(P 1) graph. Now increase the price level from P 1 to P 2. B An increase in P lowers the value of real money A balances, and Y, shifting LM leftward to point B. Notice that r increased. Since r increased, we know Y that investment will decrease as it just got more P costly to take on various investment projects. This B P 2 sets off a multiplier process since - I causes a – Y. A P 1 The - Y triggers - C as we move up the IS curve. AD The + P triggers a sequence of events that end Y with a - Y, the inverse relationship that defines Chapter Eleven 42 the downward slope of AD.

You probably noticed from the IS and LM diagrams that r and Y were on the two axes. Now we’re going to bring a third variable, the price level (P) into the analysis. We can accomplish this by linking both twodimensional graphs. LM(P 2) To derive AD, start at point A in the top r IS LM(P 1) graph. Now increase the price level from P 1 to P 2. B An increase in P lowers the value of real money A balances, and Y, shifting LM leftward to point B. Notice that r increased. Since r increased, we know Y that investment will decrease as it just got more P costly to take on various investment projects. This B P 2 sets off a multiplier process since - I causes a – Y. A P 1 The - Y triggers - C as we move up the IS curve. AD The + P triggers a sequence of events that end Y with a - Y, the inverse relationship that defines Chapter Eleven 42 the downward slope of AD.

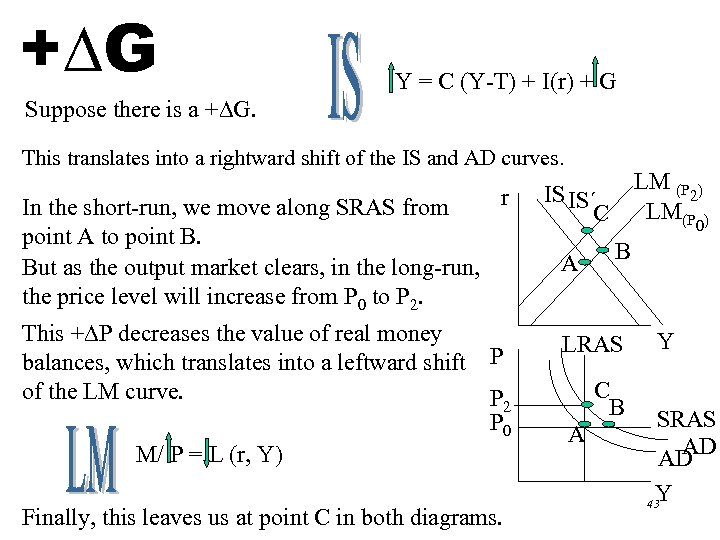

+ G Y = C (Y-T) + I(r) + G Suppose there is a + G. This translates into a rightward shift of the IS and AD curves. r In the short-run, we move along SRAS from point A to point B. But as the output market clears, in the long-run, the price level will increase from P 0 to P 2. This + P decreases the value of real money balances, which translates into a leftward shift P of the LM curve. P 2 P 0 M/ P = L (r, Y) Chapter Eleven Finally, this leaves us at point C in both diagrams. LM (P ) 2 LM(P ) IS IS´ C A 0 B LRAS C B A Y SRAS AD´ AD Y 43

+ G Y = C (Y-T) + I(r) + G Suppose there is a + G. This translates into a rightward shift of the IS and AD curves. r In the short-run, we move along SRAS from point A to point B. But as the output market clears, in the long-run, the price level will increase from P 0 to P 2. This + P decreases the value of real money balances, which translates into a leftward shift P of the LM curve. P 2 P 0 M/ P = L (r, Y) Chapter Eleven Finally, this leaves us at point C in both diagrams. LM (P ) 2 LM(P ) IS IS´ C A 0 B LRAS C B A Y SRAS AD´ AD Y 43

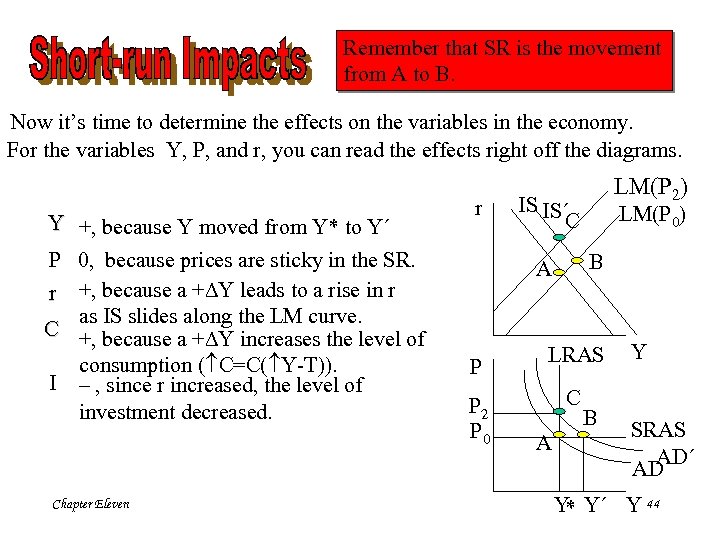

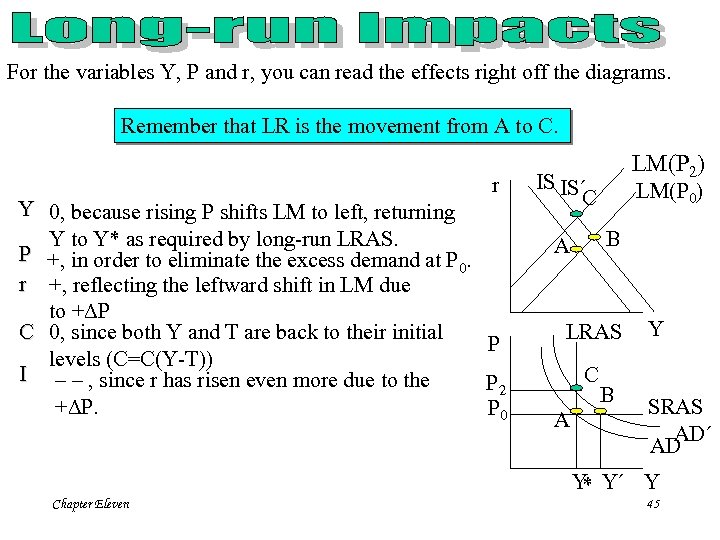

Remember that SR is the movement from A to B. Now it’s time to determine the effects on the variables in the economy. For the variables Y, P, and r, you can read the effects right off the diagrams. Y +, because Y moved from Y* to Y´ P 0, because prices are sticky in the SR. r +, because a + Y leads to a rise in r as IS slides along the LM curve. C +, because a + Y increases the level of consumption ( C=C( Y-T)). I – , since r increased, the level of investment decreased. Chapter Eleven r IS IS´ C P 2 P 0 LM(P 0) B A P LM(P 2) LRAS C A B Y SRAS AD´ AD Y Y´ Y 44 *

Remember that SR is the movement from A to B. Now it’s time to determine the effects on the variables in the economy. For the variables Y, P, and r, you can read the effects right off the diagrams. Y +, because Y moved from Y* to Y´ P 0, because prices are sticky in the SR. r +, because a + Y leads to a rise in r as IS slides along the LM curve. C +, because a + Y increases the level of consumption ( C=C( Y-T)). I – , since r increased, the level of investment decreased. Chapter Eleven r IS IS´ C P 2 P 0 LM(P 0) B A P LM(P 2) LRAS C A B Y SRAS AD´ AD Y Y´ Y 44 *

For the variables Y, P and r, you can read the effects right off the diagrams. Remember that LR is the movement from A to C. r Y 0, because rising P shifts LM to left, returning Y to Y* as required by long-run LRAS. P +, in order to eliminate the excess demand at P. 0 r +, reflecting the leftward shift in LM due to + P C 0, since both Y and T are back to their initial P levels (C=C(Y-T)) I – – , since r has risen even more due to the P 2 + P. P 0 Chapter Eleven LM(P 2) IS IS´ C LM(P 0) B A LRAS C A B Y SRAS AD´ AD Y Y´ Y * 45

For the variables Y, P and r, you can read the effects right off the diagrams. Remember that LR is the movement from A to C. r Y 0, because rising P shifts LM to left, returning Y to Y* as required by long-run LRAS. P +, in order to eliminate the excess demand at P. 0 r +, reflecting the leftward shift in LM due to + P C 0, since both Y and T are back to their initial P levels (C=C(Y-T)) I – – , since r has risen even more due to the P 2 + P. P 0 Chapter Eleven LM(P 2) IS IS´ C LM(P 0) B A LRAS C A B Y SRAS AD´ AD Y Y´ Y * 45

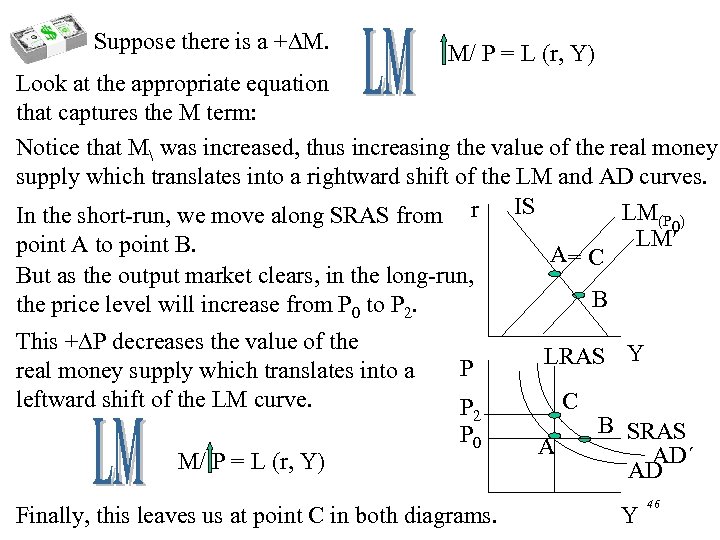

Suppose there is a + M. M/ P = L (r, Y) Look at the appropriate equation that captures the M term: Notice that M was increased, thus increasing the value of the real money supply which translates into a rightward shift of the LM and AD curves. LM(P ) In the short-run, we move along SRAS from r IS 0 LM point A to point B. A= C But as the output market clears, in the long-run, B the price level will increase from P 0 to P 2. This + P decreases the value of the real money supply which translates into a leftward shift of the LM curve. M/ P = L (r, Y) Chapter Eleven P P 2 P 0 Finally, this leaves us at point C in both diagrams. LRAS Y C A B SRAS AD´ AD Y 46

Suppose there is a + M. M/ P = L (r, Y) Look at the appropriate equation that captures the M term: Notice that M was increased, thus increasing the value of the real money supply which translates into a rightward shift of the LM and AD curves. LM(P ) In the short-run, we move along SRAS from r IS 0 LM point A to point B. A= C But as the output market clears, in the long-run, B the price level will increase from P 0 to P 2. This + P decreases the value of the real money supply which translates into a leftward shift of the LM curve. M/ P = L (r, Y) Chapter Eleven P P 2 P 0 Finally, this leaves us at point C in both diagrams. LRAS Y C A B SRAS AD´ AD Y 46

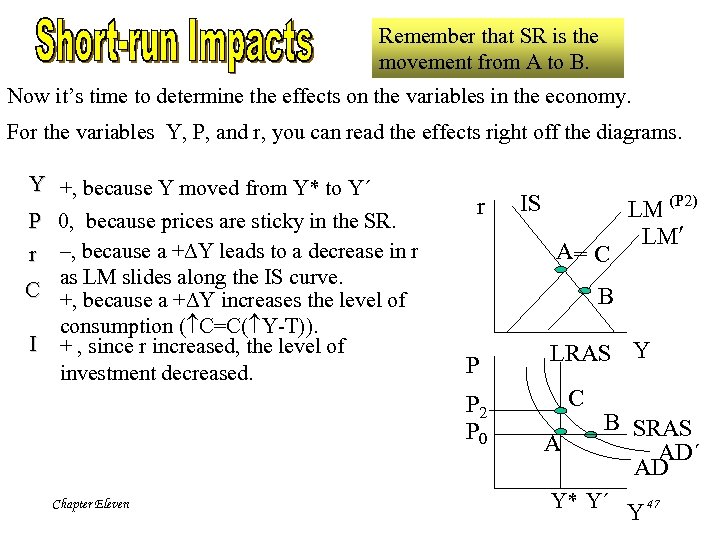

Remember that SR is the movement from A to B. Now it’s time to determine the effects on the variables in the economy. For the variables Y, P, and r, you can read the effects right off the diagrams. Y +, because Y moved from Y* to Y´ P 0, because prices are sticky in the SR. r –, because a + Y leads to a decrease in r as LM slides along the IS curve. C +, because a + Y increases the level of consumption ( C=C( Y-T)). I + , since r increased, the level of investment decreased. r A= C (P 2) LM(P 0) LM B P P 2 P 0 Chapter Eleven IS LRAS Y C A B SRAS AD´ AD Y* Y´ Y 47

Remember that SR is the movement from A to B. Now it’s time to determine the effects on the variables in the economy. For the variables Y, P, and r, you can read the effects right off the diagrams. Y +, because Y moved from Y* to Y´ P 0, because prices are sticky in the SR. r –, because a + Y leads to a decrease in r as LM slides along the IS curve. C +, because a + Y increases the level of consumption ( C=C( Y-T)). I + , since r increased, the level of investment decreased. r A= C (P 2) LM(P 0) LM B P P 2 P 0 Chapter Eleven IS LRAS Y C A B SRAS AD´ AD Y* Y´ Y 47

Remember that LR is the movement from A to C. For the variables Y, P and r, you can read the effects right off the diagrams. Y 0, because rising P shifts LM to left, returning r Y to Y* as required by LRAS. P +, in order to eliminate the excess demand at P. 0 r 0, reflecting the leftward shift in LM due to + P, restoring r to its original level. C 0, since both Y and T are back to their initial levels (C=C(Y-T)). I 0, since Y or r has not changed. P Notice that the only LR impact of an increase in the money supply was an increase in the price level. Chapter Eleven P 2 P 0 IS A= C LM(P 0) LM B LRAS Y C A B SRAS AD´ AD Y* Y´ Y 48

Remember that LR is the movement from A to C. For the variables Y, P and r, you can read the effects right off the diagrams. Y 0, because rising P shifts LM to left, returning r Y to Y* as required by LRAS. P +, in order to eliminate the excess demand at P. 0 r 0, reflecting the leftward shift in LM due to + P, restoring r to its original level. C 0, since both Y and T are back to their initial levels (C=C(Y-T)). I 0, since Y or r has not changed. P Notice that the only LR impact of an increase in the money supply was an increase in the price level. Chapter Eleven P 2 P 0 IS A= C LM(P 0) LM B LRAS Y C A B SRAS AD´ AD Y* Y´ Y 48

Chapter Eleven 49

Chapter Eleven 49

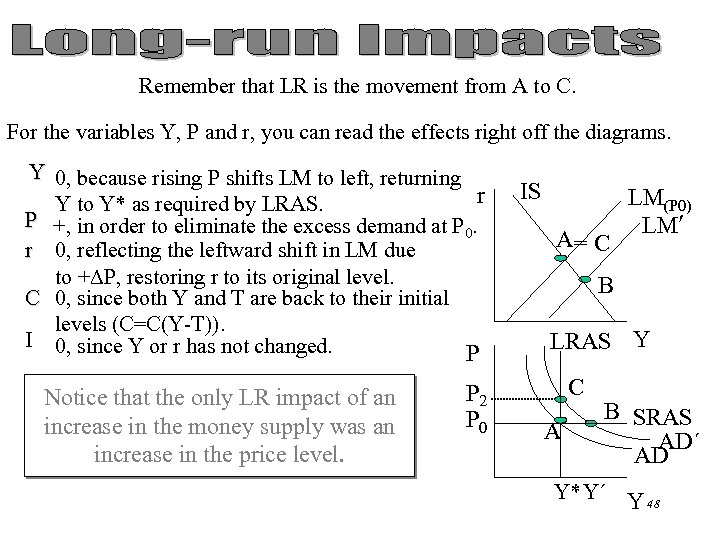

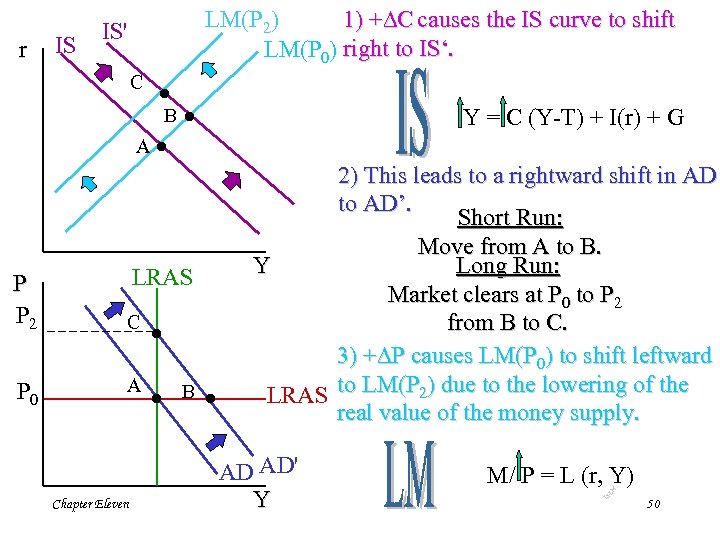

C · B A P P 2 P 0 · · LRAS C · A · B · Chapter Eleven Y = C (Y-T) + I(r) + G 2) This leads to a rightward shift in AD to AD’. Short Run: Move from A to B. Long Run: Y Market clears at P 0 to P 2 from B to C. 3) + P causes LM(P 0) to shift leftward LRAS to LM(P 2) due to the lowering of the real value of the money supply. AD AD' Y M/ P = L (r, Y) -L M IS IS r LM(P 2) 1) + C causes the IS curve to shift LM(P 0) right to IS‘. IS' 50

C · B A P P 2 P 0 · · LRAS C · A · B · Chapter Eleven Y = C (Y-T) + I(r) + G 2) This leads to a rightward shift in AD to AD’. Short Run: Move from A to B. Long Run: Y Market clears at P 0 to P 2 from B to C. 3) + P causes LM(P 0) to shift leftward LRAS to LM(P 2) due to the lowering of the real value of the money supply. AD AD' Y M/ P = L (r, Y) -L M IS IS r LM(P 2) 1) + C causes the IS curve to shift LM(P 0) right to IS‘. IS' 50

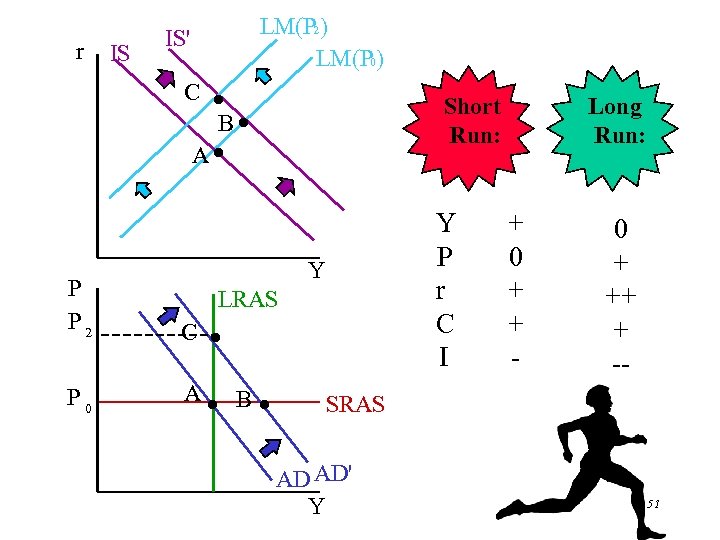

r IS LM(P 2) LM(P 0) IS' C · B· A· Short Run: Y P r C I Y P P 2 C · P 0 A· B· Chapter Eleven LRAS Long Run: + 0 + + - 0 + ++ + -- SRAS AD AD' Y 51

r IS LM(P 2) LM(P 0) IS' C · B· A· Short Run: Y P r C I Y P P 2 C · P 0 A· B· Chapter Eleven LRAS Long Run: + 0 + + - 0 + ++ + -- SRAS AD AD' Y 51

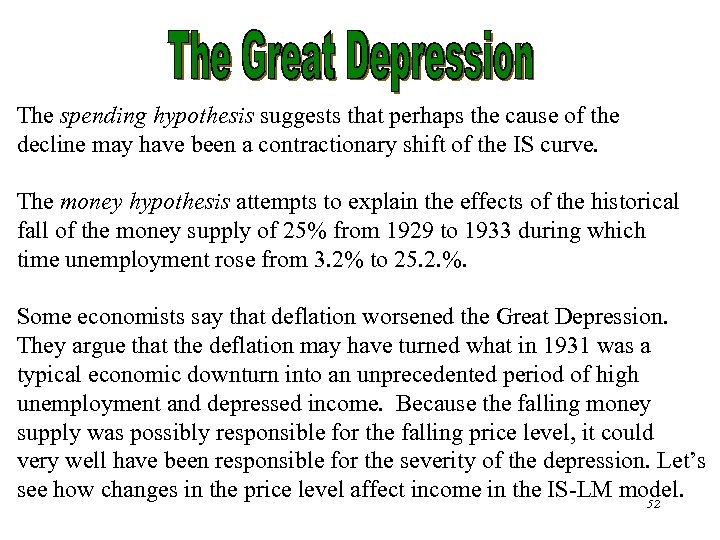

The spending hypothesis suggests that perhaps the cause of the decline may have been a contractionary shift of the IS curve. The money hypothesis attempts to explain the effects of the historical fall of the money supply of 25% from 1929 to 1933 during which time unemployment rose from 3. 2% to 25. 2. %. Some economists say that deflation worsened the Great Depression. They argue that the deflation may have turned what in 1931 was a typical economic downturn into an unprecedented period of high unemployment and depressed income. Because the falling money supply was possibly responsible for the falling price level, it could very well have been responsible for the severity of the depression. Let’s see Chapter Eleven how changes in the price level affect income in the IS-LM model. 52

The spending hypothesis suggests that perhaps the cause of the decline may have been a contractionary shift of the IS curve. The money hypothesis attempts to explain the effects of the historical fall of the money supply of 25% from 1929 to 1933 during which time unemployment rose from 3. 2% to 25. 2. %. Some economists say that deflation worsened the Great Depression. They argue that the deflation may have turned what in 1931 was a typical economic downturn into an unprecedented period of high unemployment and depressed income. Because the falling money supply was possibly responsible for the falling price level, it could very well have been responsible for the severity of the depression. Let’s see Chapter Eleven how changes in the price level affect income in the IS-LM model. 52

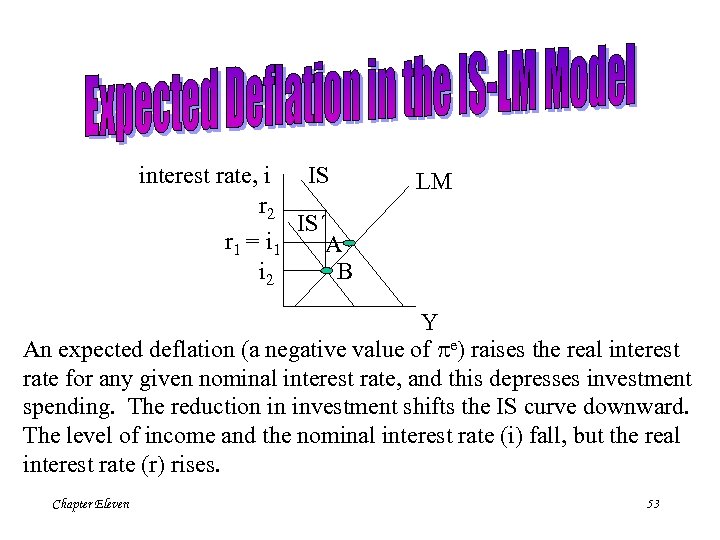

IS interest rate, i r 2 IS´ r 1 = i 1 A i 2 B LM Y An expected deflation (a negative value of e) raises the real interest rate for any given nominal interest rate, and this depresses investment spending. The reduction in investment shifts the IS curve downward. The level of income and the nominal interest rate (i) fall, but the real interest rate (r) rises. Chapter Eleven 53

IS interest rate, i r 2 IS´ r 1 = i 1 A i 2 B LM Y An expected deflation (a negative value of e) raises the real interest rate for any given nominal interest rate, and this depresses investment spending. The reduction in investment shifts the IS curve downward. The level of income and the nominal interest rate (i) fall, but the real interest rate (r) rises. Chapter Eleven 53

Monetary transmission mechanism Pigou Effect Debt-deflation theory Chapter Eleven 54

Monetary transmission mechanism Pigou Effect Debt-deflation theory Chapter Eleven 54