bdc639b4b6700d5aa379088940403b61.ppt

- Количество слайдов: 18

A new deal for people in a global crisis - Social security for all: International Labour Office Making the economic, financial and fiscal case Michael Cichon Social Security Department International Labour Office New York, February 2009 1 1

Structure of the presentation l One: l l Two: Three: l Four: International Labour Office Social security is an economic necessity Social security is fiscally affordable Expected and observed social impact Financing strategies 2 2

One: …in addition to a social necessity social security is an economic necessity… l l l International Labour Office Economies cannot develop and grow without a productive workforce. In order to unlock a country’s full growth potential one has to fight social exclusion, ignorance, unemployability…through social transfers Access to social health protection and education improves productivity levels (we have ample research evidence…) The famous trade-off between growth and equity is a myth… Investments on social security and economic development coincided in OECD countries Cash transfers in developing countries have multiplier effects on local markets (stimulate local production inter alia of food) and Social transfers stabilise domestic demand in times of crises 3 3

Two: Basic social security/essential cash transfers are affordable: A simulation exercise – Assumptions l Basic old age and invalidity pensions: – l based on an health system staffing ratio of 300 medical professionals per 100, 000 population, overhead 67% of staff cost … Basic social assistance for the unemployed: – l 15% of per capita GDP capped at US$ 0. 50 PPP, for a max. of two children in age bracket 0 -14 Essential health care: – l 30% of per capita GDP capped at US$ 1 PPP per day Child benefits: – l International Labour Office 100 day guaranteed employment paid by 30% of per capita daily GDP to 10% of the population Administration cost: 15% of cash benefit expenditure 4 4

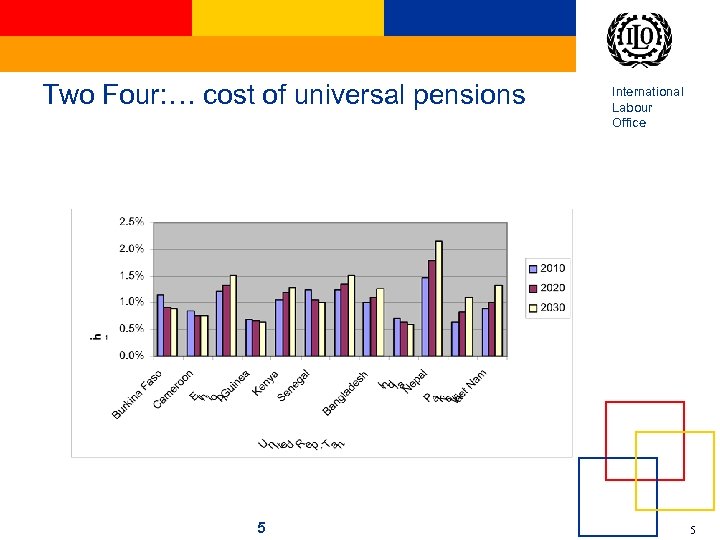

Two Four: … cost of universal pensions 5 International Labour Office 5

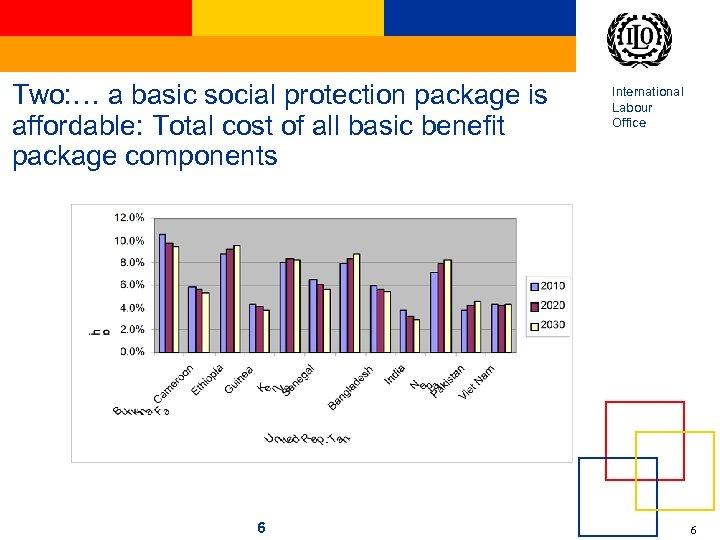

Two: … a basic social protection package is affordable: Total cost of all basic benefit package components 6 International Labour Office 6

Point Two: … a basic social protection package is affordable: share of total cost that can be covered by domestic resources 7 International Labour Office 7

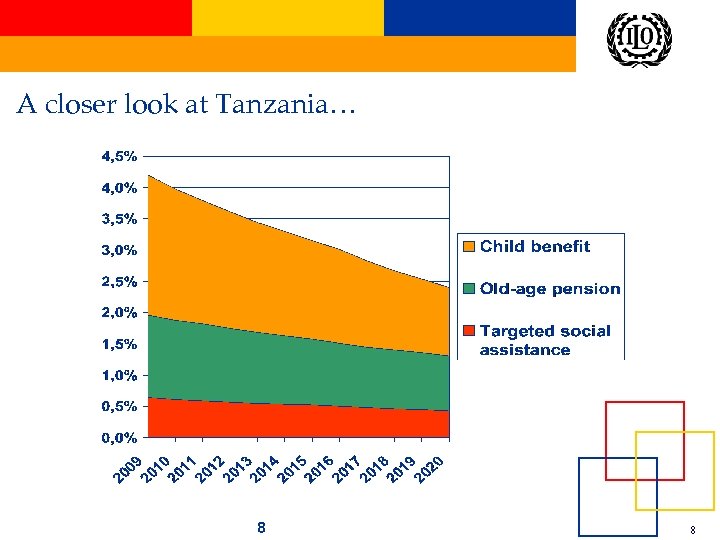

A closer look at Tanzania… 8 International Labour Office 8

Point two: Other studies and experience International Labour Office l l l In Latin America the cost of a modest package of conditional child cash transfers, universal pensions and basic health care can be kept under 5% of GDP; the poverty headcount effects can reach a reduction of more than 50% Universal pension schemes in Botswana, Brazil, Lesotho, Mauritius, Namibia, Nepal, and South Africa, cost between 0. 2 and 2% of GDP. Global view: Less than 2% of Global GDP are needed to provide all the world's poor with a basic benefit package 9 9

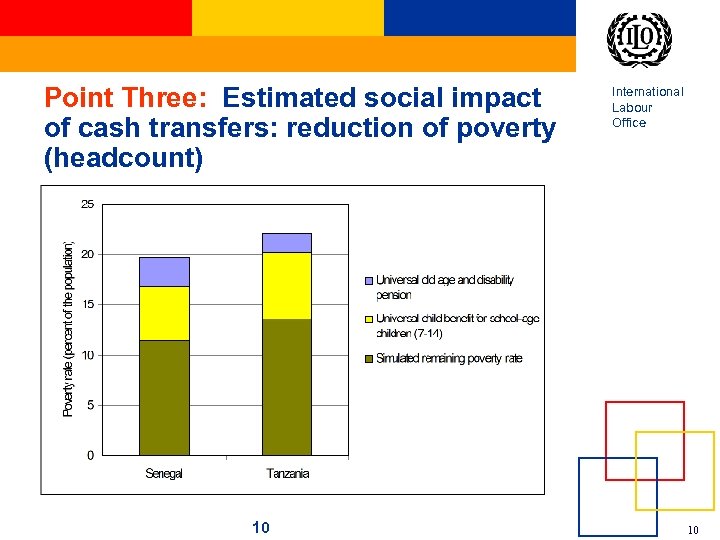

Point Three: Estimated social impact of cash transfers: reduction of poverty (headcount) 10 International Labour Office 10

Point three: Estimated effect of a basic benefit package on poverty headcount: Tanzania 11 International Labour Office 11

Point three: Social impact – lessons learned in developing countries l l International Labour Office Coverage: Basic social transfers presently already cover 150 -200 million people in about 25 to 30 countries Poverty impact: the old age grant in South Africa decreased destitution gap by 45 %, oportunidades in Mexico reduced poverty rate of beneficiary households by about 12 -points, similar order of magnitude in Brazil Education: positive enrolment effects and school attendance duration in Mexico, Brazil, Colombia, Bangladesh, Nicaragua and Zambia Health: positive effects on height, weight of children and nutritional status in Colombia, Mexico, Chile, Malawi, South Africa 12 12

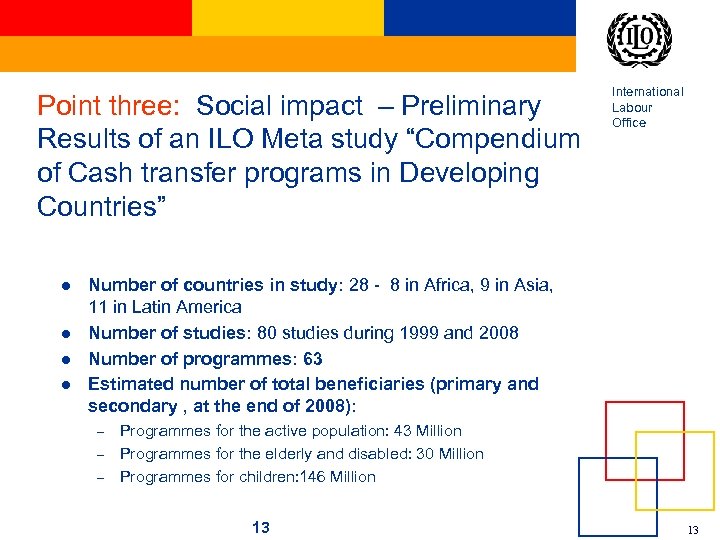

Point three: Social impact – Preliminary Results of an ILO Meta study “Compendium of Cash transfer programs in Developing Countries” l l International Labour Office Number of countries in study: 28 - 8 in Africa, 9 in Asia, 11 in Latin America Number of studies: 80 studies during 1999 and 2008 Number of programmes: 63 Estimated number of total beneficiaries (primary and secondary , at the end of 2008): – – – Programmes for the active population: 43 Million Programmes for the elderly and disabled: 30 Million Programmes for children: 146 Million 13 13

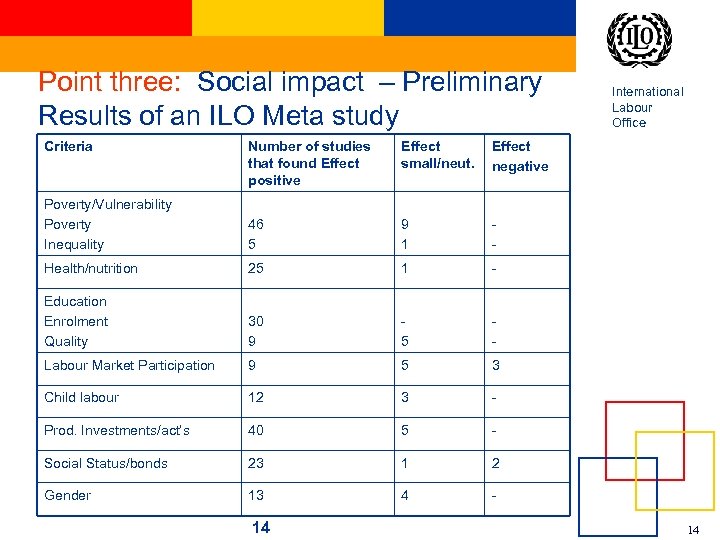

Point three: Social impact – Preliminary Results of an ILO Meta study Criteria Number of studies that found Effect positive Effect small/neut. Effect negative Poverty/Vulnerability Poverty Inequality 46 5 9 1 - Health/nutrition 25 1 - Education Enrolment Quality 30 9 5 - Labour Market Participation 9 5 3 Child labour 12 3 - Prod. Investments/act’s 40 5 - Social Status/bonds 23 1 2 Gender 13 4 International Labour Office - 14 14

Point Four: Financing strategies: Lack of fiscal space? The good news – part I 15 International Labour Office 15

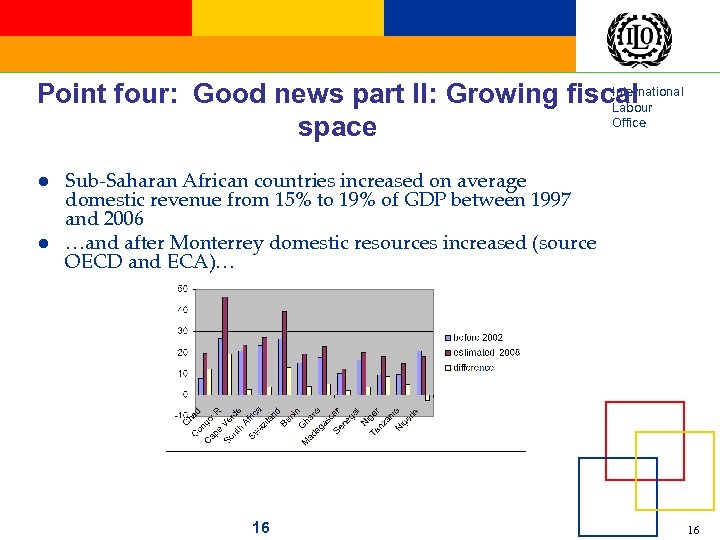

International Point four: Good news part II: Growing fiscal Labour Office space l l Sub-Saharan African countries increased on average domestic revenue from 15% to 19% of GDP between 1997 and 2006 …and after Monterrey domestic resources increased (source OECD and ECA)… 16 16

Four: Financing strategies- revisited l l Domestic resource mobilisation – Increase the efficiency of tax collection – Reduce waste – Broaden tax base – Reduce tax evasion and avoidance – Introduce self financing insurance systems (largely health care) – Increase overall tax rates International resources (transitional financing) – Modified social security targeted budget support ? – Project financing to build national delivery capacity – International financing of health care goods and services – People-to-People Partnerships: Global Social Trust – A new Fund finance the start-up of basic social security schemes ? …or can we use the World Solidarity Fund that is already existing but empty…l 17 International Labour Office 17

Four: What can be done now…? l National social security development plans cum social budgets required, that International Labour Office l Determine social security gaps, priority needs and fiscal requirements for the crisis and the next 10 years l Develop national fiscal space through tax reform l Specify transitional external funding for basic benefits l Determine the capacity requirements 18 18

bdc639b4b6700d5aa379088940403b61.ppt