9315af7c38e84cfb36e3ecaa3b0f13c7.ppt

- Количество слайдов: 28

A new and popular financial website: www. giovanniciraolo. altervista. org This site is a business project of disclosure in financial matters through an assessment of the companies listed on the Milan stock exchange and a promotion of specialized research on stock-markets around the world. The site is aimed primarily at satisfying knowledge and advising necessities of small and medium investors, young people and professionals serving in the economy: these people probably seek summary assessments on enterprises but expressed in an unsophisticated language. This project must contribute to the financial literacy of the country (Italy) and to the dissemination of views, problems and formulas of economics. 1

How can the financial culture be transmitted? The case of Italy • • For some time in Italy there have been studies (generally promoted by the OECD) on the degree of "financial literacy" of young students that progress toward working life Financial literacy is supposed to be the ability to understand financial language and to reach knowledge of financial products and consumer choices in a way that makes individuals sufficiently competent also in their perception of economy and in view of their family Research in Europe on young people highlights a certain distance of our country on financial education, with strong variations between the Italian regions and more than one in five students that does not reach the basic level of financial literacy Contrary to the rest of Europe, in Italy the knowledge in mathematics and reading is related to the degree of financial literacy and therefore this literacy is weaker if acquired independently from other teachings: in fact, a certain level of financial literacy is acquired only in the power of knowledge of other subjects How to raise awareness of financial matters? Pilot programs were advanced with the scope of testing financial education in school curricula: this method is constructive because in Italy, very surprisingly, no significant correlation is detected between financial literacy and socioeconomic status; so mainstream practice at a very national level may give good fruit In particular, projects of financial literacy can acquire more effect if they operate on the experience gained by young people about their economic activity: 44% possess a bank account or a prepaid card and about half of them performs work especially outside school hours Perhaps the most important of these data is the will declared from a majority of students to want to save in anticipation of a major purchase out of their budget 2

A basic sample of information to be introduced in a literacy project: the data source of the “Financial Times” (www. financialtimes. com) • • In order to read and disseminate information and financial data for investors, it is convenient to choose a source that contains authoritative publications and updates the "building blocks" that make up the economic and financial world In the specific case of this site, we consider for this purpose the Financial Times final pages that contain all data and parameters of global finance, classified under the heading of "Market data“ The sub-heading of "World Markets at a glance“ includes a series of graphical representations of various stock markets in the world, with discounted values of most traded stocks ("stock market biggest movers“, see also the value of a share: http: //giovanniciraolo. altervista. org/wp-content/uploads/2015/02/Shares-valuation. pdf) and the "highest performance" or the negative one (in relation to the United Kingdom); following the bottom of the page the main stock market indices appear together with their reclassification according to the various categories of activity of enterprises In another page of "Market data“, the prices of the largest companies listed on world stock exchanges are divided by the market to which they belong, followed by bond indexes ("Bond indices") and indicators related to government bonds (Bonds: government benchmark) and parameters of the money market also used for indexing bank loans and mortgages ect (Libor, Euribor) which are listed in the subtitle "interest rates "and" market interest rates (to explore the world of bonds and rates, see also http: //giovanniciraolo. altervista. org/wpcontent/uploads/2015/02/Bond-price-analysis-and-zero-coupon. pdf) 3

Site structure: www. giovanniciraolo. altervista. org • The site is a not-only-financial product and its main purpose is to provide analyses and comments on wide finance and listed companies in Milan stockmarket and beyond for the benefit of average investors and young people who are struggling to understand the language of high finance The main items that make up the menu of the site include: Home page: general description of site’s matters Who I am: a short personal biography Companies evaluation: files on quoted companies Formulas for finance: the whole mathematics of investment analysis Socially responsible finance: ethical finance, sustainable investments Financial sites and forecasts on markets: main sites and data links News: current news of general interest Calendar: schedule of news and announcements planned by authorities Contacts: telephone numbers / email companies / groups Opinions: published articles on economics and markets Finance and Sport: organization of the sporting events (http: //giovanniciraolo. altervista. org/finanza-e-sport-5/) Industrial sectors analysis: major stockmarket sectors The site at a glance: includes this presentation 4

The world and Italian economy (see also page "Opinions" in the menu of the website and http: //giovanniciraolo. altervista. org/wpcontent/uploads/2015/02/Equilibrium-open-economy-Mundell-Fleming. pdf) • • • The world economy in 2014 has improved its performance but unevenly and with many unknowns In 2014, the US economic growth has largely outperformed Europe (3. 0% versus 0. 9%) and the difficulties of the euro-zone, despite an attenuation in the first quarter of 2015, affect every country and also the upper performers already in recovery (including Spain, with unemployment still very high) The euro area recorded a reduction of public deficits (except in the case of France and Spain) and an unprecedented evolution on public debt interest rates which in some countries (first of all Germany) reached the zero In the euro-zone the stagnation of domestic demand, partly due to the efforts deployed on controlling state budgets (required by Euro treaties and subsequent corrections), has forced the ECB to adopt a double action including refinancing rates at record lows and a push to devalue the euro against the dollar in order to increase business competitiveness and domestic demand (see also http: //giovanniciraolo. altervista. org/wpcontent/uploads/2015/02/state-budget-investment-and-multiplier. pdf) The ECB has added another instrument of monetary expansion, the "quantitative easing”. This measure creates new monetary base through the purchase of government bonds of the euro-zone Member States (see the basic economics of monetary variables: http: //giovanniciraolo. altervista. org/wp-content/uploads/2015/02/aggregate-supply-relations. LM-curve. pdf) Will the ECB win the bet? Will domestic demand in the euro zone grow enough to generate growth? The coming months will tell the truth more clearly. 5

Italian economy faced with international defies • • International challenges are represented by strong imbalances in the world between countries with sustained growth and large trade deficits (US and UK) and surplus nations (China and Japan, hugely manufacturing Europe); among the latter Italy runs the third surplus in the current Euro-zone behind Germany Italy is particularly competitive in certain areas such as industrial machinery and plant that exports annually about up to € 100 bn How will Italian economy react to QE (monetary easing of the ECB) and the depreciation of the euro? An increase in exports will have a direct influence on aggregate demand for goods and services; investment activity should benefit from the outlook but returns on direct investment are often modest and must be raised with a lower tax burden and more incentives on human capital (bigger universities, more qualified technical-scientific graduates, more new businesses and innovative start-ups, greater advanced advice on management and business financing) Italy's problems are also linked to the great disparity of geographical situations: the Italian unemployment rate is aligned on the European standard but this hides the fact that the North of the country evolves at a fast pace while one in two young people is unemployed in the South and in great cities even qualified graduates do not find reasonable jobs. 6

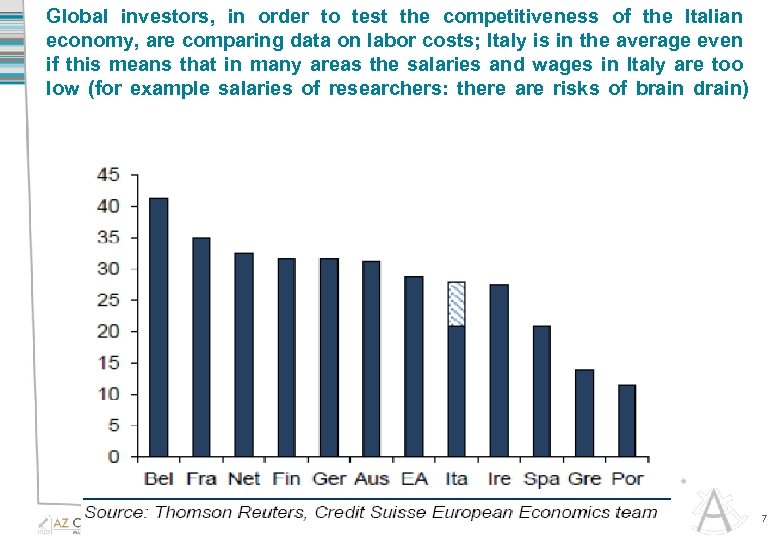

Global investors, in order to test the competitiveness of the Italian economy, are comparing data on labor costs; Italy is in the average even if this means that in many areas the salaries and wages in Italy are too low (for example salaries of researchers: there are risks of brain drain) 7

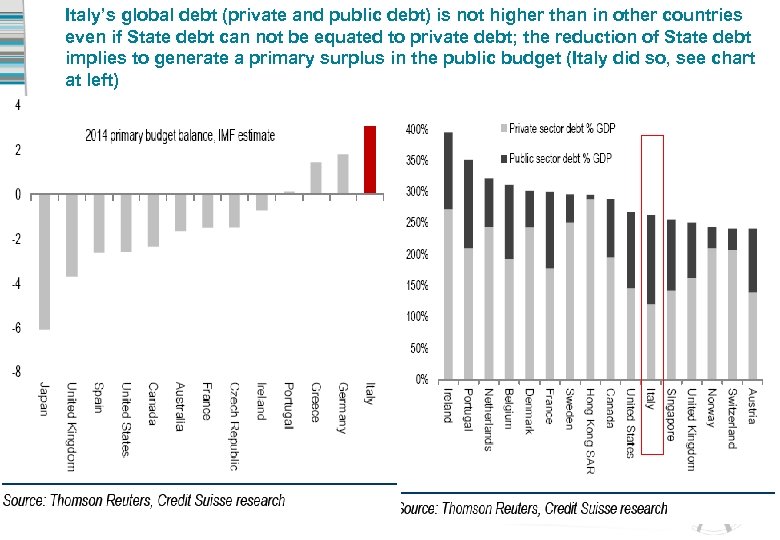

Italy’s global debt (private and public debt) is not higher than in other countries even if State debt can not be equated to private debt; the reduction of State debt implies to generate a primary surplus in the public budget (Italy did so, see chart at left) 8

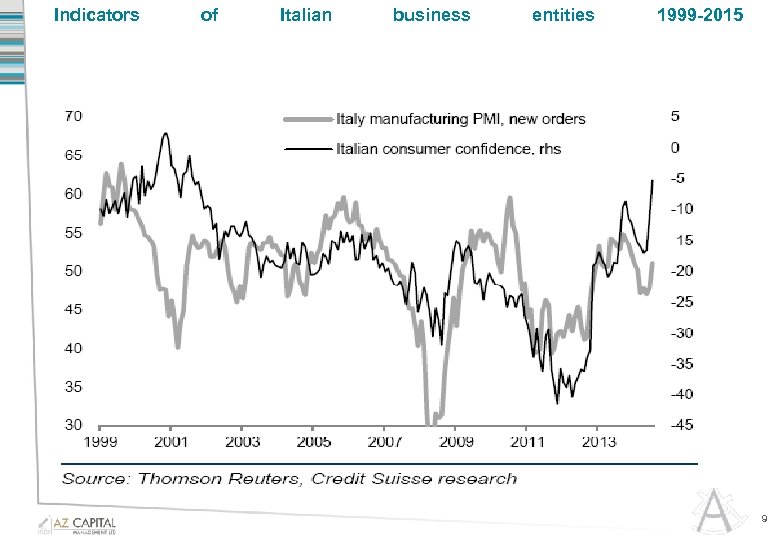

Indicators of Italian business entities 1999 -2015 9

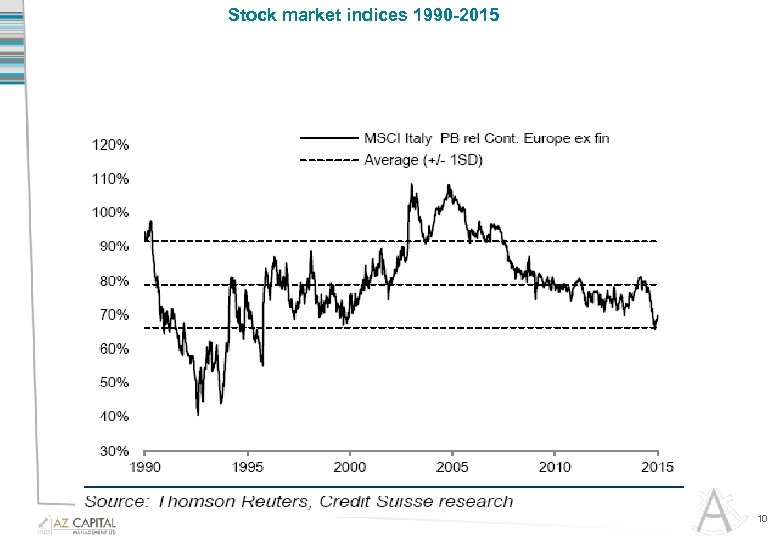

Stock market indices 1990 -2015 10

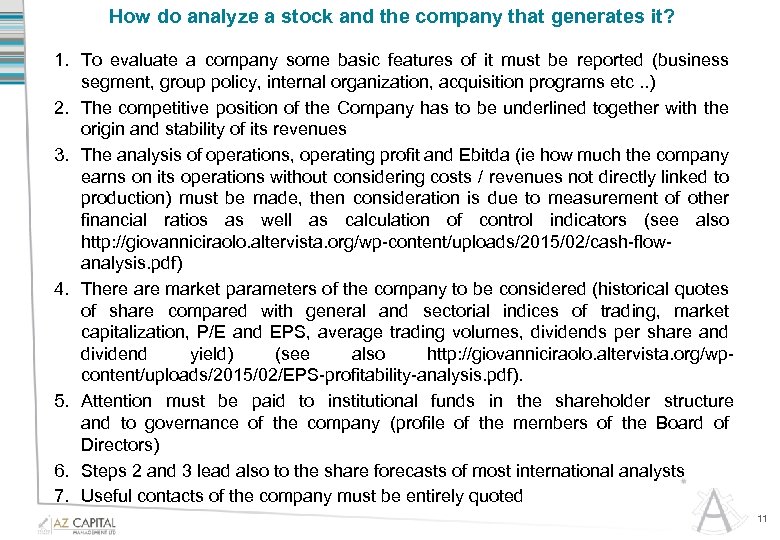

How do analyze a stock and the company that generates it? 1. To evaluate a company some basic features of it must be reported (business segment, group policy, internal organization, acquisition programs etc. . ) 2. The competitive position of the Company has to be underlined together with the origin and stability of its revenues 3. The analysis of operations, operating profit and Ebitda (ie how much the company earns on its operations without considering costs / revenues not directly linked to production) must be made, then consideration is due to measurement of other financial ratios as well as calculation of control indicators (see also http: //giovanniciraolo. altervista. org/wp-content/uploads/2015/02/cash-flowanalysis. pdf) 4. There are market parameters of the company to be considered (historical quotes of share compared with general and sectorial indices of trading, market capitalization, P/E and EPS, average trading volumes, dividends per share and dividend yield) (see also http: //giovanniciraolo. altervista. org/wpcontent/uploads/2015/02/EPS-profitability-analysis. pdf). 5. Attention must be paid to institutional funds in the shareholder structure and to governance of the company (profile of the members of the Board of Directors) 6. Steps 2 and 3 lead also to the share forecasts of most international analysts 7. Useful contacts of the company must be entirely quoted 11

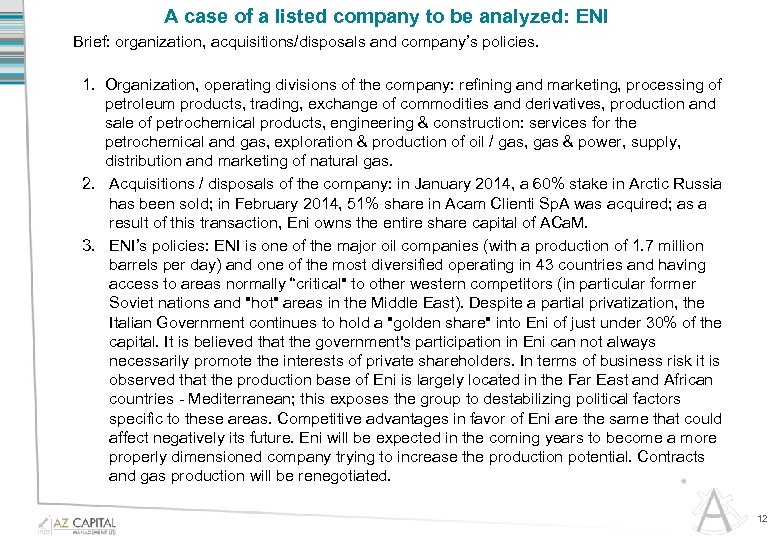

A case of a listed company to be analyzed: ENI Brief: organization, acquisitions/disposals and company’s policies. 1. Organization, operating divisions of the company: refining and marketing, processing of petroleum products, trading, exchange of commodities and derivatives, production and sale of petrochemical products, engineering & construction: services for the petrochemical and gas, exploration & production of oil / gas, gas & power, supply, distribution and marketing of natural gas. 2. Acquisitions / disposals of the company: in January 2014, a 60% stake in Arctic Russia has been sold; in February 2014, 51% share in Acam Clienti Sp. A was acquired; as a result of this transaction, Eni owns the entire share capital of ACa. M. 3. ENI’s policies: ENI is one of the major oil companies (with a production of 1. 7 million barrels per day) and one of the most diversified operating in 43 countries and having access to areas normally “critical" to other western competitors (in particular former Soviet nations and "hot" areas in the Middle East). Despite a partial privatization, the Italian Government continues to hold a "golden share" into Eni of just under 30% of the capital. It is believed that the government's participation in Eni can not always necessarily promote the interests of private shareholders. In terms of business risk it is observed that the production base of Eni is largely located in the Far East and African countries - Mediterranean; this exposes the group to destabilizing political factors specific to these areas. Competitive advantages in favor of Eni are the same that could affect negatively its future. Eni will be expected in the coming years to become a more properly dimensioned company trying to increase the production potential. Contracts and gas production will be renegotiated. 12

Comparison with competitors (point 2 of the analysis of a company) – (a further view on financial management: http: //giovanniciraolo. altervista. org/wpcontent/uploads/2015/02/profitability-development. pdf • Comparison of Eni with companies of similar importance In comparison with major competitors Eni has an exploratory and research capacity of high standard and shows a replacement ratio of production among the highest. These positive aspects (strengthened by the ability to manage excellent global contacts in the world) collide against inefficiency of some units of the group (which is reflected in the operating income per capita). With respect to Total and BP (British Petroleum) Eni highlights in 2014 lower revenues (€ 110 billion against € 198. 9 billion of Total and € 331. 5 billion BP) and net profit roughly reflects the differences in operating income. Even in market capitalization Eni is proportionally similar to Total. Eni has 85, 000 employees and Total has about 100, 000. Apart from this there are differences of P/E because Eni (Eni’s P/E is high) reflects expectations of an increase of profits compared to the current situation of limited rewards for shareholders. • • For a wider comparison between Eni and competitors let go to the table: http: //giovanniciraolo. altervista. org/wp-content/uploads/2015/04/Main-factors-of-competitiveadvantage 3. pdf 13

Main ratios for corporate analysis The most important indicators for analyzing the "health” of a business are: 1. the profitability ratios, which measure gross profit compared to the assets and business aggregates: (Net income + taxes) / assets (ROA) (Net income + taxes) / Shareholders' equity (ROE) (for formulas see also: http: //giovanniciraolo. altervista. org/wp-content/uploads/2015/02/profitabilitydevelopment. pdf ) Operating income / financial sources (ROI) 2. the ratios expressing financial security and growth, highlighting the growth of company revenue with respect to company’s funding (long-term debt or not) and to the extent the financial costs are covered by the operating result; the indicator may be the one that compares company's outstanding debt (long- term debt - Long-term receivables) to EBITDA: Net debt / EBITDA (EBITDA is the operating margin business (operating revenues - operating costs before the entries of interest, taxes, depreciation and amortization); N. B. the value of this index should not exceed 5 (see also http: //giovanniciraolo. altervista. org/wp-content/uploads/2015/02/models-on-equityfinance. pdf); 3. Other considerations include ratios like: Financial charges / turnover and Revenues/turnover to find the number of times the revenues totally transform their receivables into cash: Consider also: Net debt / shareholders' equity (not to exceed 3); Net revenues / Total assets 14

Operating profitability and balance-sheet management (to fix knowledge on profitability: http: //giovanniciraolo. altervista. org/wpcontent/uploads/2015/02/cash-flow-analysis. pdf) • Operating profitability and balance management Gross margin in 2014 ($ 7, 945 billion) was in line with net income (€ 1. 33 billion) for the decline in revenues (€ 110 bn compared with € 114. 3 billion in 2013) was offset by an almost equally strong decrease in operating costs (€ 102. 43 against € 105. 49). The ratio of current assets to current liabilities (1. 47) decreased compared to the previous year (due to the contraction of growth) but remains high, with domestic policies that improve the operating profitability of the group. The financial strength is sufficient by considering that the company's equity is worth over a 40. 9% on assets. The ratio of net debt to EBITDA (2. 4) seems to indicate a reasonable (although not optimal) correlation between debt, financial security and profitability. 15

Stock Market performance: P / E and EPS, capitalization, average volumes, dividends and returns (to widen knowledge on statistical aspects of stocks: http: //giovanniciraolo. altervista. org/wpcontent/uploads/2015/02/models-on-equity-finance. pdf) The share performance includes: current price, changes in the period, average volumes traded (number of shares that changed hands), Beta (correlation between share course and market indices), company's market capitalization (number of shares outstanding x share value), EPS (net profit / number of shares), annual and interim dividend, dividend yield, payment dates. The Eni share trend a comparison between it and some significant market indices can be obtained via the link constantly updated with the Financial Times: http: //markets. ft. com/research/Markets/Tearsheets/Summary? s=ENI: MIL The following information can be read under the share indication: current value ("close in Eur"), daily change ("today's change"), volume traded ("shares traded "), annual change (" 1 year change "), beta coefficient (" beta ") expressing the reactivity of share value towards the market as a whole. By clicking on "1 M" in the chart above the performance of the Eni share is given over last month. The "Summary" below the graph includes calculation of the consistency of the shares ("shares outstanding"), the float ("free float"), the price/earnings ratio ("P / E"), the market capitalization ("market cap"), the earnings per share ("EPS"), the dividend ("Annual div") and its annual return ("Annual div yield"), the date of the dividend payment ("pay Div -at your place"). At the bottom of the page there is a comparison between Eni and stock market indices over 90 days. 16

Shareholders - international financial funds (asset management) Eni’s shareholding structure “Public shareholders”: Treasury and Cassa Depositi e Prestiti, with about 30% of the share capital; They can stop any extraordinary decision; they represent the State because ENI is a strategic enterprise linked to energy supply in the country Institutional funds, among them the largest (representing 8. 7% of the share capital), are Norges Bank Investment, Management, Capital Research & Management Co. , The Vanguard Group, Inc. , Black. Rock Fund Advisors, Black. Rock Investment Management (UK ) Ltd. , Fidelity Management & Research Co. , Templeton Global Advisors Ltd. , Theam Sas, Grantham, Mayo, Van Otterloo & Co. LLC 17

GOVERNANCE: ORGANIZATION AND CONTROL OF THE BUSINESS STRUCTURE • How to evaluate the executives of a company? The main question is whether they originate from inside or outside the enterprise. Executives have grown their carrier from within the company (founders and long time administrators) or they come from the international market of managers? In case of internal growth the company is less expansionary but more stable: the company does not adopt excessive "leverage" (to widen views on leverage: http: //giovanniciraolo. altervista. org/wp-content/uploads/2015/02/leverageoperations-cash-flow. pdf) with revenue-related guarantees in order to defend the control of the company placed in "good hands“. On the contrary, if executives originate outside the company the expansion of sales is often a primary objective and the related shareholders’ remuneration represents almost always a strategic goal. If the company operates in the fields of high technology (Eni is in this group), the prevailing internal careers confer to the management an extremely technical and vocational content and also a specialized organization based on functions and divisions: this can be denominated as “federal decentralization” where only narrow and technical problems are treated by more complicated simulation and matrix structures. 18

Example of Governance: Eni Management The Board of Directors of Eni is composed as follows: • Emma Marcegaglia – Eni Chaiman from May 8 2014 - degree in economics at Bocconi, after leaving her family business (Marcegaglia) she was President of Confindustria from 2008 to 2012; from 1996 to 2000 she was President of the Young Entrepreneurs of Confindustria; from 1997 to 2000 she was President of the European Confederation of Young Entrepreneurs - she is President of Businesseurope and Luiss Guido Carli University, Deputy Chairman and CEO of Marcegaglia Sp. A, Member of the Board of Directors of Bracco Sp. A, Italcementi Sp. A and Gabetti Property Solutions Sp. A. • Claudio Descalzi - CEO (AD) since 2008, and Chief Operating Officer for Exploration and Production - Bachelor's degree in physics in 1979 from University of Milan – Specialized in Petroleum Engineering in France and the United States - Joined Eni in 1981 as a leader in ' engineering and design of the oil fields; in 1990 he became the head of operations in Italy. From 2002 to 2005 he was Regional Manager for Italy, Africa, the Middle East at the Division Exploration & Production; in 2006 he became Deputy Director General of the same Division. • Massimo Mondazzi - CFO (Chief Financial Officer) since September 2012 - graduated from Bocconi in 1987, he was Director of Planning and Control, and still currently Vice President for Central Asia, the Far East and the Pacific region at the Division Exploration & production. • Angelo Fanelli - Chief Operating Officer (AD) of the Refining and Marketing Division - Mechanical Engineering degree from La Sapienza University of Rome - Joined Eni in 1981, started in the Extra-Network Engineer and as a promoter - in 2006 he became Commercial Director (Executive Vice President) of the Refining and Marketing. • Roberto Ulissi - Secretary of the Board of Directors - After an experience in the Bank of Italy in 1998 he was appointed Director General of the Ministry of Economy and Finance and Head of Banking and Financial System and Legal Affairs. He was government representative in the Governing Council of the Bank of Italy. Professor of banking law. 19

Forecasts on the Eni share and advice to the investor (choice between option "hold" - keep the share in the portfolio, "sell" - Sell share or "overperforming" hold and then sell the share in strong growth and better than market average; (to widen knowledge on dividends and earnings: http: //giovanniciraolo. altervista. org/wp-content/uploads/2015/02/models-onequity-finance. pdf) • Eni share forecasts A group of analysts reported by the Financial Times actually (24/7/2015) sees Eni share with an orientation towards "hold” by providing a median value around € 16. 60 and an indicative max price of € 20. 00 with a min of € 12. 50. The expected dividend for 2015 is around € 0. 83 per share (decline of 25. 5% on previous year) following EPS of € 1. 03 per share. Stabilization of revenues produces cash flow and dividend yields stable in an industry that is not rewarding risk capital significantly well. Eni paid in 2014 a dividend of € 1. 12 per share and distributes € 0. 8 per share for 2015 and € 0. 4 per share for Q 2 2015 (however, Eni reported a loss in 3 rd quarter of 2015); the numbers for the direct competitors are: Total SA, € 2. 71 per share for 2015 and € 0. 61 per share for 2 Q 2015; Exxon, $ 2. 87 per share for 2015 and $ 0. 73 per share for 2 Q 2015; British Petroleum, $ 0. 4 per share for 2015 and $ 0. 1 per share for 2 Q 2015; Royal Dutch Shell, $ 0. 47 per share for 2 Q 2015. 20

Company headquarters and main contacts Contacts Eni Sp. A Piazzale Mattei, 1 ROMA 00144 Italy ITA Phone+39 659821 Fax+39 659822141 Website: http: //www. eni. com Investors Relations: http: //www. eni. com/en_IT/investor-relation/investor_relations. shtml Press releases: http: //www. eni. com/en_IT/media/press-releases/press-release. page 21

Once a company has been studied… … after having indicated its business… …and once assessed its competitive position and the profitability of its operations… …and after having also tested the policy of dividends. . . …then some reasonable predictions can be made basing assessment on the prospective value of the listed security! To determine an intermediate theoretical value of the share, the potential of the entire market must be considered because if the listing is depressed on the whole this trend can also diffuse to valuable stocks as some traders (especially foreign and large institutional funds) tend to go towards other more predictable markets (this is called arbitrage, playing to exploit any price difference between the various phases of the markets and make a profit); (to widen knowledge on the argument: http: //giovanniciraolo. altervista. org/wpcontent/uploads/2015/02/Arbitrage-and-Market-Models. pdf ) 22

Moreover, in addition to the performance of the economy, attention must be paid to stock market participants' expectations about future profits of companies listed on the Stock Exchange (comparing single stocks to stockmarket performance: http: //giovanniciraolo. altervista. org/wpcontent/uploads/2015/02/Risk-adjusted-Relative-Investment-performance. pdf) In addition to the forecast on dividends, "earnings per share" (EPS) are considered as the net profit available for distribution to shareholders per any share in circulation To give a feedback on current evolution of stock prices, the most important indicator is the price/earnings ratio (P/E) which reflects the relationship between the market value of the shares and the profits of enterprises (this means in practice how many times the price of a share reflects the profits made by the company. A n average P/E in stable stockmarkets could be around 15. 23

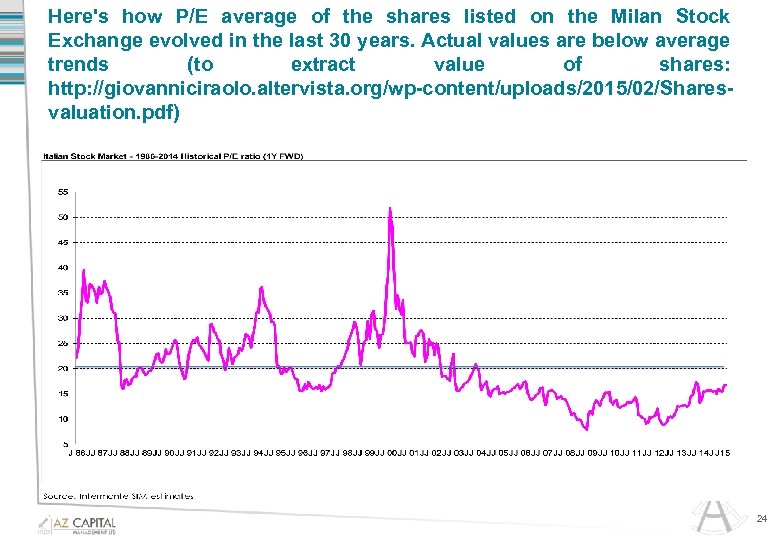

Here's how P/E average of the shares listed on the Milan Stock Exchange evolved in the last 30 years. Actual values are below average trends (to extract value of shares: http: //giovanniciraolo. altervista. org/wp-content/uploads/2015/02/Sharesvaluation. pdf) 24

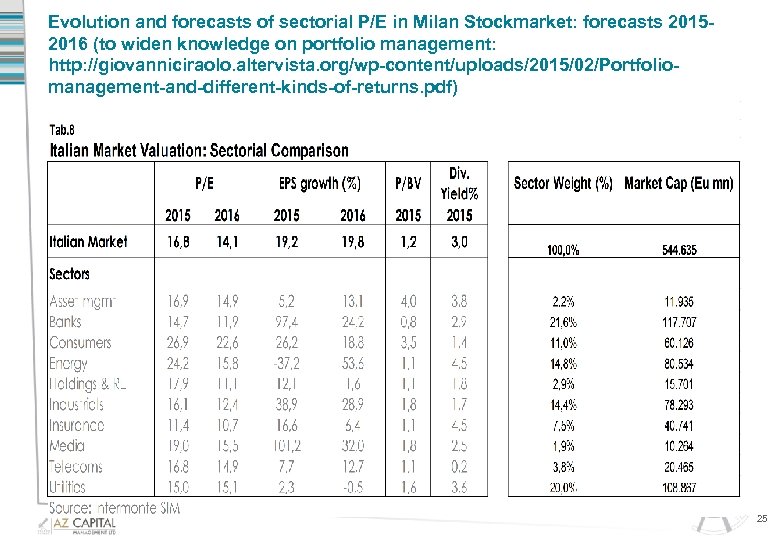

Evolution and forecasts of sectorial P/E in Milan Stockmarket: forecasts 20152016 (to widen knowledge on portfolio management: http: //giovanniciraolo. altervista. org/wp-content/uploads/2015/02/Portfoliomanagement-and-different-kinds-of-returns. pdf) 25

Methods of technical analysis – graphic representation (Stockmarkets/Currency markets) – operations on markets, decomposition of risk (to improve knowledge: http: //giovanniciraolo. altervista. org/wpcontent/uploads/2015/02/decomposition-of-risk-and-market-models. pdf) In the financial world the values that change in price over time (bonds, currencies, commodities etc. . . ) can be represented graphically by a curve (see next page) whose key aspects are: - the bullish trend or bearish chart: the points of maximum and minimum in the trace; the existence of several successive minimum or maximum number in the curve of the graph may herald reverse trend (a rise may be down after 2 or 3 maximum consecutive decline) - the "oscillators" that "extract" from the data graph some successions of values that show lines of resistance and support where evolutions are uncertain like in numbers of "Fibonacci“ - the moving averages, which are averages that continually “lose" the most extreme former value and take the immediate new element: the moving averages are worth indicating of a trend - Bollinger bands, indicating how much variability is in the values represented in the chart; if the bands tend to widen, this indicates a greater variability and the opposite is true if the bands narrow (indicating a lower statistical fluctuation); If the track "break" these lines of fluctuation, the trend is bullish or bearish trends reverse 26

Financial graphical analysis – markets trends 27

What are derivatives (see "Lexicon" in site)? (Black and Scholes formulas on options: http: //giovanniciraolo. altervista. org/wp-content/uploads/2015/02/Blackand-Scholes-formulae-on-Stocks-European-Options. pdf) • • Derivatives are financial contracts (traded on specific markets) dependent on underlying and autonomous values of stocks, bonds, interest rate, currency, credit, goods etc. . . Assuming for example that a portfolio of bonds makes a 4% return and whose price is expected to decrease by 2% due to a probable but not certain rise in interest rates, this latter case of loss can be neutralized through purchasing derivatives in the form of options that make it possible to buy the securities portfolio at a fixed price lower than the initial value of the portfolio. The value of the derivative will be positive if the current price of the portfolio is higher than the right to purchase coming from the derivative; on the contrary, if the market price of the portfolio goes down the fixed value purchase option the value of the derivative drops to zero. Derivatives can benefit many subjects. In particular, there are “swap” transactions in financial and currency markets where companies are exposed to large risks. It is interesting to evaluate cases of swaps between debtors of different rating. For example, we can assume a company with high rating and borrowing satisfactorily at both fixed and variable rates; then consider another company that has a hard turn to the market of the fixed rate because of lower ratings. The first company (financially stronger) may issue at a fixed rate of 4% and at 3% on the variable; the second company can issue at floating rate of 5% and borrowing at a fixed rate of 6%. So the first company issues at a fixed rate of 4% by receiving a fixed rate of 5% from the second company; at the same time, the second company pays to the other a 4% and receives from it a 2% (with a difference of spread equal to 1%). Both companies have improved their bargaining power on the cost of debt compared to the alternative access for themselves on the market. 28

9315af7c38e84cfb36e3ecaa3b0f13c7.ppt