11764beabb1ef913456c694b1e301601.ppt

- Количество слайдов: 16

A Multi-Asset Class Trading Platform for the Buy-Side Gary E. Maier Chief Information and Technology Officer © Gary Maier and Five Mile Capital Partners LLC, 2007

About Five Mile • 4 years old; launched in February, 2003 • Started by highly regarded, C-level, fixed-income veterans from leading firms, like UBS/Paine Webber, Greenwich Capital, FSA and Salomon • Approx. $1. 5 Billion AUM • Current strategies include liquid G 7 fixed-income and derivatives; whole loans, CMBS and non-syndicate; CDO/CLO structures; and private equity • Current headcount of 45, including management, trading, operations, accounting, systems and support staff © Gary Maier and Five Mile Capital Partners LLC, 2007 2

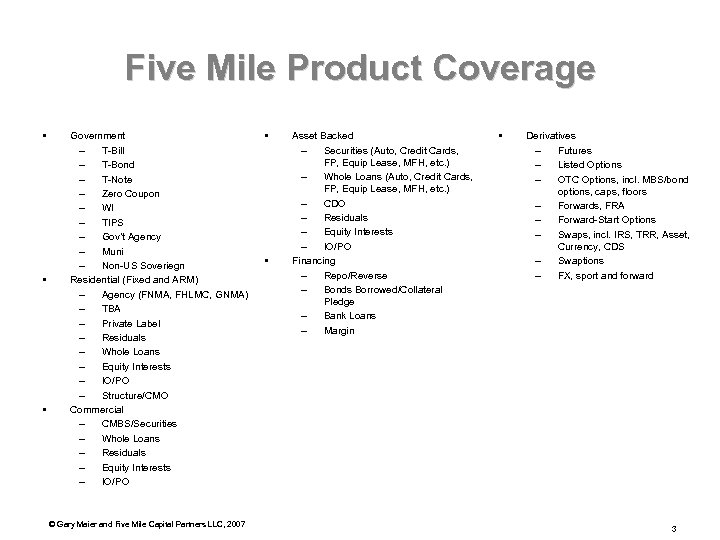

Five Mile Product Coverage • • • Government – T-Bill – T-Bond – T-Note – Zero Coupon – WI – TIPS – Gov’t Agency – Muni – Non-US Soveriegn Residential (Fixed and ARM) – Agency (FNMA, FHLMC, GNMA) – TBA – Private Label – Residuals – Whole Loans – Equity Interests – IO/PO – Structure/CMO Commercial – CMBS/Securities – Whole Loans – Residuals – Equity Interests – IO/PO © Gary Maier and Five Mile Capital Partners LLC, 2007 • • Asset Backed – Securities (Auto, Credit Cards, FP, Equip Lease, MFH, etc. ) – Whole Loans (Auto, Credit Cards, FP, Equip Lease, MFH, etc. ) – CDO – Residuals – Equity Interests – IO/PO Financing – Repo/Reverse – Bonds Borrowed/Collateral Pledge – Bank Loans – Margin • Derivatives – Futures – Listed Options – OTC Options, incl. MBS/bond options, caps, floors – Forwards, FRA – Forward-Start Options – Swaps, incl. IRS, TRR, Asset, Currency, CDS – Swaptions – FX, sport and forward 3

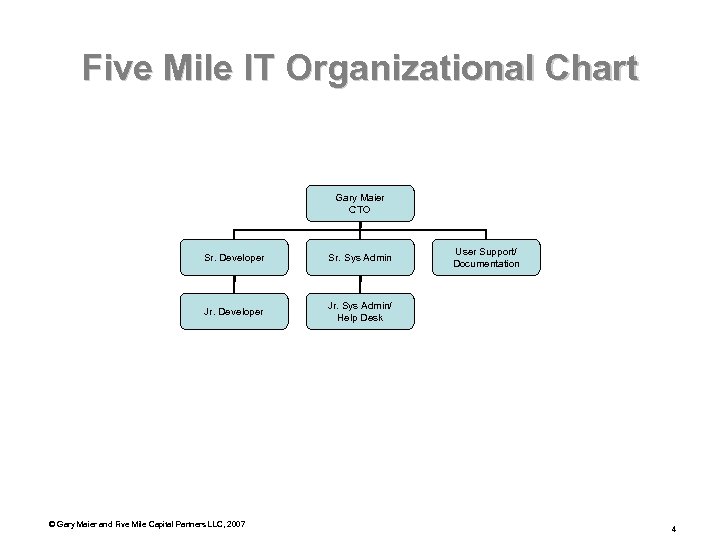

Five Mile IT Organizational Chart Gary Maier CTO Sr. Developer Sr. Sys Admin Jr. Developer User Support/ Documentation Jr. Sys Admin/ Help Desk © Gary Maier and Five Mile Capital Partners LLC, 2007 4

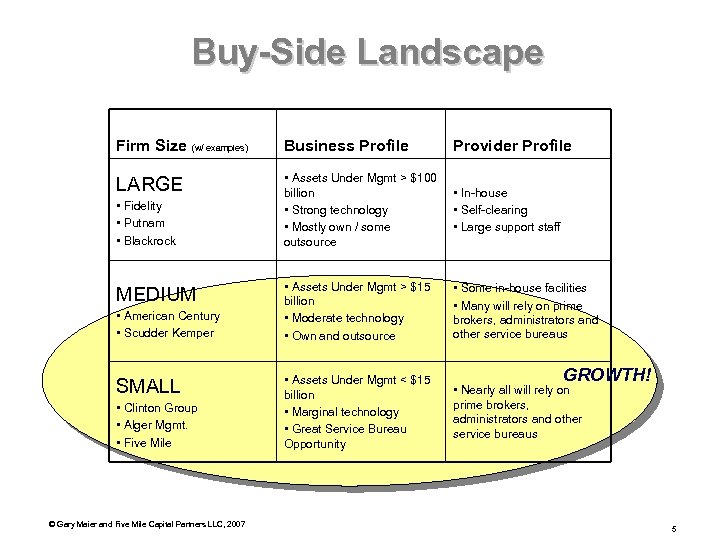

Buy-Side Landscape Firm Size (w/ examples) Business Profile Provider Profile LARGE • Assets Under Mgmt > $100 billion • Strong technology • Mostly own / some outsource • In-house • Self-clearing • Large support staff • Assets Under Mgmt > $15 billion • Moderate technology • Own and outsource • Some in-house facilities • Many will rely on prime brokers, administrators and other service bureaus • Assets Under Mgmt < $15 billion • Marginal technology • Great Service Bureau Opportunity • Nearly all will rely on prime brokers, administrators and other service bureaus • Fidelity • Putnam • Blackrock MEDIUM • American Century • Scudder Kemper SMALL • Clinton Group • Alger Mgmt. • Five Mile © Gary Maier and Five Mile Capital Partners LLC, 2007 GROWTH! 5

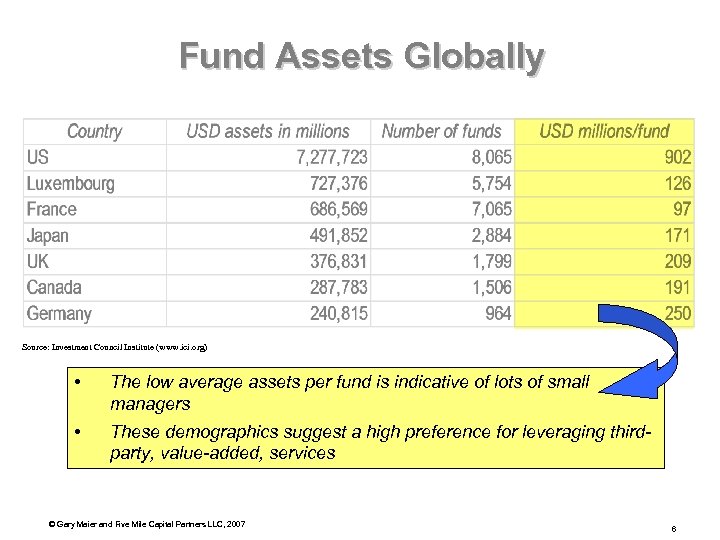

Fund Assets Globally Source: Investment Council Institute (www. ici. org) • The low average assets per fund is indicative of lots of small managers • These demographics suggest a high preference for leveraging thirdparty, value-added, services © Gary Maier and Five Mile Capital Partners LLC, 2007 6

A Typical Service Bureau • Tactical body shops, often with high turnover and nominal product knowledge. • A commodity offering, generally unresponsive to client specific needs and differentiators • Core services delivered as silos • No integration with other client processes and services, resulting in an inefficient workflow • Inflexible and immutable • Who’s data is it, anyway? • Low customer satisfaction © Gary Maier and Five Mile Capital Partners LLC, 2007 7

Ideal Multi Asset Class Model • Leverage vertical product knowledge and specialization: can’t be all things to all people • Foster and embrace client and product differentiation • Commingle functionality and presentation • Multiple, flexible, views of portfolio holdings and risk • Transparent integration across internal and external client processes and services • Seamless user experience • Centralized, logical, data repositories • Streamlined, event-driven, workflow • Efficacy, malleability and affordability © Gary Maier and Five Mile Capital Partners LLC, 2007 8

Design for Optimal User Experience • • • Familiarity and Depth of Coverage Rich and Interactive Don’t Sacrifice Desktop-Class User Interface Quick Turnaround Application Inter-Operability Real-time Data Discovery, Delivery and Display Third-Party Market Data and Execution Connectivity Flexibility and Customization Straight-Through Processing Cost Effective Upstream/Downstream Market Access © Gary Maier and Five Mile Capital Partners LLC, 2007 9

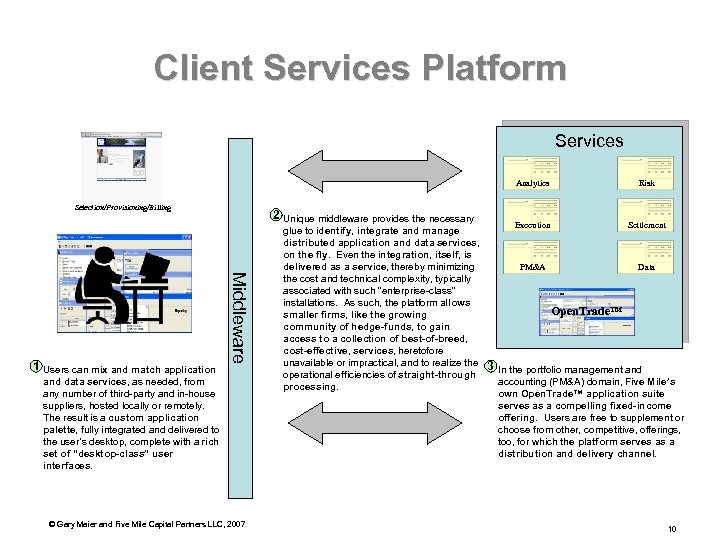

Client Services Platform Services Analytics Selection/Provisioning/Billing Middleware 1 Users can mix and match application 2 Unique middleware provides the necessary and data services, as needed, from any number of third-party and in-house suppliers, hosted locally or remotely. The result is a custom application palette, fully integrated and delivered to the user’s desktop, complete with a rich set of “desktop-class” user interfaces. © Gary Maier and Five Mile Capital Partners LLC, 2007 glue to identify, integrate and manage distributed application and data services, on the fly. Even the integration, itself, is delivered as a service, thereby minimizing the cost and technical complexity, typically associated with such “enterprise-class” installations. As such, the platform allows smaller firms, like the growing community of hedge-funds, to gain access to a collection of best-of-breed, cost-effective, services, heretofore unavailable or impractical, and to realize the operational efficiencies of straight-through processing. Risk Execution Settlement PM&A Data Open. Trade™ 3 In the portfolio management and accounting (PM&A) domain, Five Mile’s own Open. Trade™ application suite serves as a compelling fixed-income offering. Users are free to supplement or choose from other, competitive, offerings, too, for which the platform serves as a distribution and delivery channel. 10

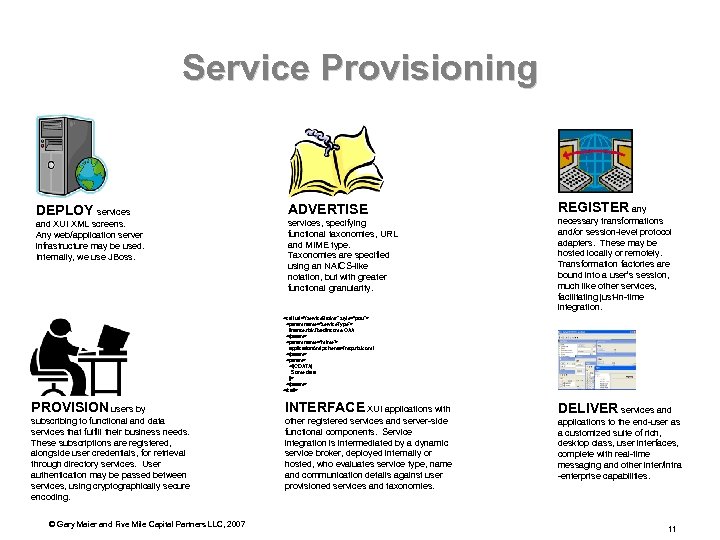

Service Provisioning DEPLOY services and XUI XML screens. Any web/application server infrastructure may be used. Internally, we use JBoss. ADVERTISE services, specifying functional taxonomies, URL and MIME type. Taxonomies are specified using an NAICS-like notation, but with greater functional granularity. REGISTER any necessary transformations and/or session-level protocol adapters. These may be hosted locally or remotely. Transformation factories are bound into a user’s session, much like other services, facilitating just-in-time integration. <call url=“/service. Broker” style=“post”> <param name=“service. Type”> finance. risk. fixed. Income. OAA </param> <param name=“mime”> application/xml; schema=fmcp. risk. txml </param> <![CDATA[ Some data ]]> </param> </call> PROVISION users by INTERFACE XUI applications with subscribing to functional and data services that fulfill their business needs. These subscriptions are registered, alongside user credentials, for retrieval through directory services. User authentication may be passed between services, using cryptographically secure encoding. other registered services and server-side functional components. Service integration is intermediated by a dynamic service broker, deployed internally or hosted, who evaluates service type, name and communication details against user provisioned services and taxonomies. © Gary Maier and Five Mile Capital Partners LLC, 2007 DELIVER services and applications to the end-user as a customized suite of rich, desktop class, user interfaces, complete with real-time messaging and other inter/intra -enterprise capabilities. 11

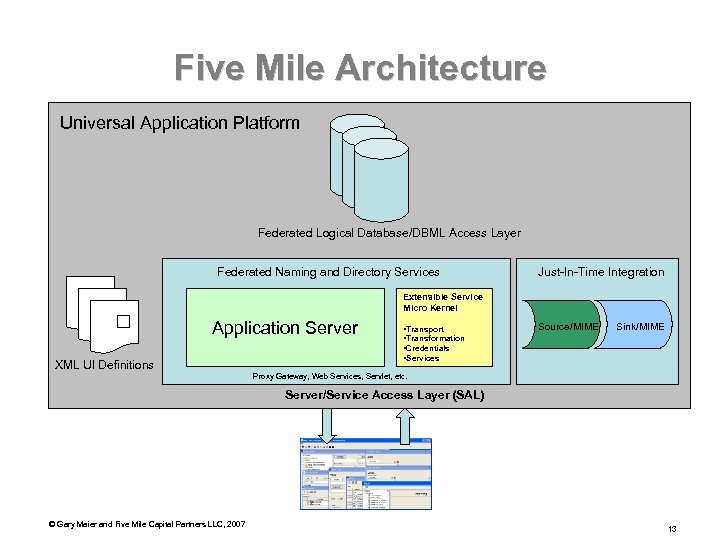

Technology Employed • Universal application platform • SOA on steroids! Integration is a service! Screens are a service! Everything is a service! • Rich application screens are fully defined in XML • Just-in-time integration • Functionality and data delivered, at runtime, as discrete, decoupled, additions to the platform: – New features introduced in shorter, more iterative, cycles – Easy mix-and-match of services and providers – Plug-and-play within the architecture – Centralized maintenance and deployment – Lower marginal cost for each service added – Solves the “impedance mismatch” problem © Gary Maier and Five Mile Capital Partners LLC, 2007 12

Five Mile Architecture Universal Application Platform Federated Logical Database/DBML Access Layer Federated Naming and Directory Services Just-In-Time Integration Extensible Service Micro Kernel Application Server XML UI Definitions • Transport • Transformation • Credentials • Services Source/MIME Sink/MIME Proxy Gateway, Web Services, Servlet, etc. Server/Service Access Layer (SAL) © Gary Maier and Five Mile Capital Partners LLC, 2007 13

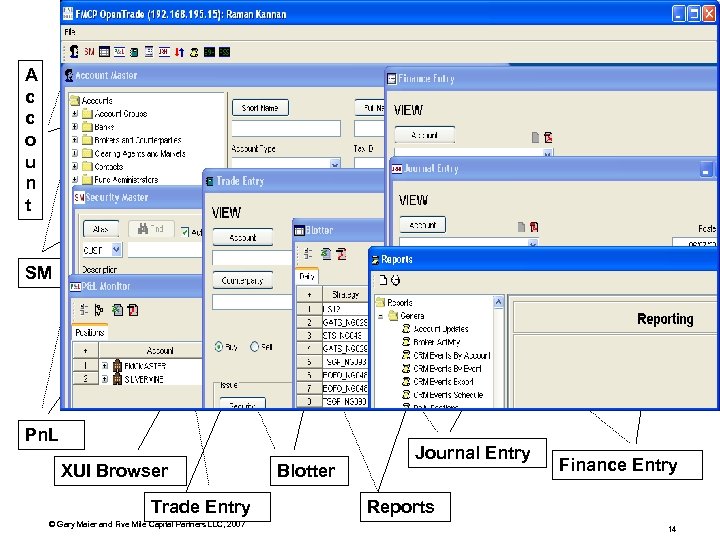

A c c o u n t SM Pn. L XUI Browser Trade Entry © Gary Maier and Five Mile Capital Partners LLC, 2007 Blotter Journal Entry Finance Entry Reports 14

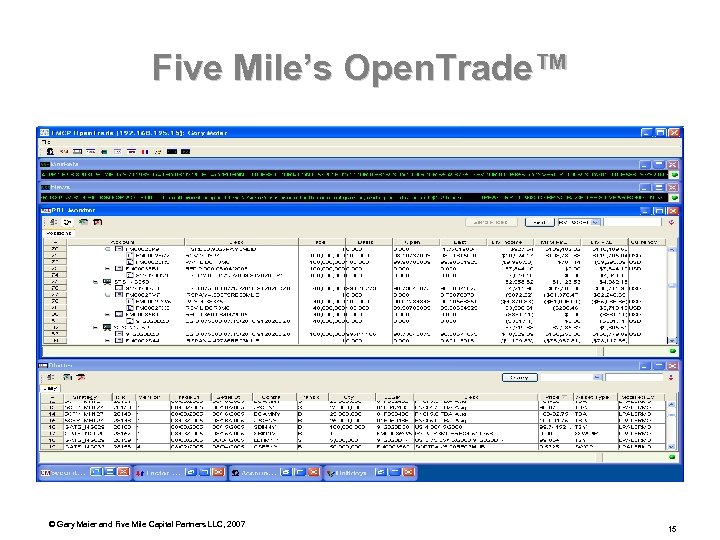

Five Mile’s Open. Trade™ © Gary Maier and Five Mile Capital Partners LLC, 2007 15

Speaker Background • Gary Maier – Managing Director/CTO, Five Mile Capital Partners – Over 19 years on Wall Street, serving in senior business and technology roles at firms, like Drexel Burnham, Blackrock and Nomura – Extensive buy-side and sell-side experience in fixed-income trading, analysis, risk management, accounting and operations – Founded and led the highly regarded Blackrock Trading System Department; designed and developed one of the industry’s first realtime, multi-product, STP trading and portfolio management systems, later commercialized through Blackrock Solutions – A noted expert in the application of Web Services and other integration technologies to financial services, Gary has been a frequent lecturer at major industry conferences, in the US and abroad. He is regularly interviewed by the financial technology press and has authored numerous articles and white papers, published worldwide. © Gary Maier and Five Mile Capital Partners LLC, 2007 16

11764beabb1ef913456c694b1e301601.ppt