469b4ca6fea17969553335e763edc10a.ppt

- Количество слайдов: 121

A Market. Search Study South Carolina Education Lottery Player Profile Study 2005 September 2005 Market. Search Corporation 2721 Devine Street Columbia, SC 29205 803/254 -6958

A Market. Search Study South Carolina Education Lottery Player Profile Study 2005 September 2005 Market. Search Corporation 2721 Devine Street Columbia, SC 29205 803/254 -6958

Table of Contents (1 of 2) Introduction 1 Background and Purpose 1 Study Specifications 2 Qualification of “Players” 3 Qualification of Frequency of Play 4 Current Lottery Games 5 Report Format 7 Key Findings Comprehensive Study Findings Incidence of Lottery Play 9 14 14 General Incidence of Lottery Play 14 Incidence of Play by Game 16 Dynamics of Lottery Play 19

Table of Contents (1 of 2) Introduction 1 Background and Purpose 1 Study Specifications 2 Qualification of “Players” 3 Qualification of Frequency of Play 4 Current Lottery Games 5 Report Format 7 Key Findings Comprehensive Study Findings Incidence of Lottery Play 9 14 14 General Incidence of Lottery Play 14 Incidence of Play by Game 16 Dynamics of Lottery Play 19

Table of Contents (2 of 2) Demographic Profiles 24 Demographic Profile of Players and Non-Players 24 Incidence Profiles (Disproportionate Representation) 33 Demographic Variations Based on Game 43 Demographic Variations Based on Frequency of Play 53 Purchase Characteristics 63 Review of Individual Games 74 Powerball 74 Scratch Off 81 Pick 3 86 Palmetto Cash 5 93 Pick 4 100 Game to Game Comparisons 107 APPENDIX (Questionnaire with frequency distributions)

Table of Contents (2 of 2) Demographic Profiles 24 Demographic Profile of Players and Non-Players 24 Incidence Profiles (Disproportionate Representation) 33 Demographic Variations Based on Game 43 Demographic Variations Based on Frequency of Play 53 Purchase Characteristics 63 Review of Individual Games 74 Powerball 74 Scratch Off 81 Pick 3 86 Palmetto Cash 5 93 Pick 4 100 Game to Game Comparisons 107 APPENDIX (Questionnaire with frequency distributions)

A Market. Search Study Introduction

A Market. Search Study Introduction

Background and Purpose • The South Carolina Education Lottery was launched in January 2002. • The “Player Profile Study” has been conducted annually since 2002. This is the fourth annual study. • The purpose of the Study is to: ü ü monitor penetration of the South Carolina Education Lottery, in general and by specific game; provide a demographic profile of “Players”, including income, age, gender, and education; ü track frequency and dollar value of participation; and ü assess general purchase dynamics. 1

Background and Purpose • The South Carolina Education Lottery was launched in January 2002. • The “Player Profile Study” has been conducted annually since 2002. This is the fourth annual study. • The purpose of the Study is to: ü ü monitor penetration of the South Carolina Education Lottery, in general and by specific game; provide a demographic profile of “Players”, including income, age, gender, and education; ü track frequency and dollar value of participation; and ü assess general purchase dynamics. 1

Study Specifications Methodology: Telephone Survey Interview Dates: September 9 - 16, 2005 Respondent Specs: Statewide stratified sample Adults 18+ No Lottery employees No elected/appointed officials Age and gender quotas Data weighted during data processing to reflect appropriate distribution of ethnicity Weighted Sample Size: 1, 252 Total, 633 “Players” Sampling Error: + 3. 9% at 95% confidence level among “Players”; + 2. 8% at the 95% confidence level among the Total Sample. 2

Study Specifications Methodology: Telephone Survey Interview Dates: September 9 - 16, 2005 Respondent Specs: Statewide stratified sample Adults 18+ No Lottery employees No elected/appointed officials Age and gender quotas Data weighted during data processing to reflect appropriate distribution of ethnicity Weighted Sample Size: 1, 252 Total, 633 “Players” Sampling Error: + 3. 9% at 95% confidence level among “Players”; + 2. 8% at the 95% confidence level among the Total Sample. 2

Qualification of “Players” • For the purposes of this study, “Players” are defined as those who have ever purchased a South Carolina Education Lottery ticket (of any game). • Overall, 1, 252 interviews were completed with South Carolina residents meeting the qualification specifications. Of these, 633 identified themselves as “Players” of the South Carolina Education Lottery. • “Players” were then interviewed regarding games played, frequency of play, dollars spent, and purchase dynamics, as well as demographic information. • Demographic information only was collected among “Non. Players. ” 3

Qualification of “Players” • For the purposes of this study, “Players” are defined as those who have ever purchased a South Carolina Education Lottery ticket (of any game). • Overall, 1, 252 interviews were completed with South Carolina residents meeting the qualification specifications. Of these, 633 identified themselves as “Players” of the South Carolina Education Lottery. • “Players” were then interviewed regarding games played, frequency of play, dollars spent, and purchase dynamics, as well as demographic information. • Demographic information only was collected among “Non. Players. ” 3

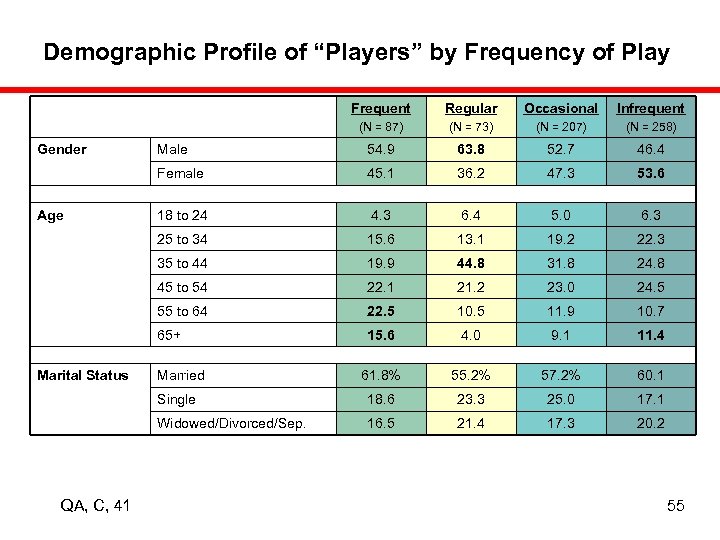

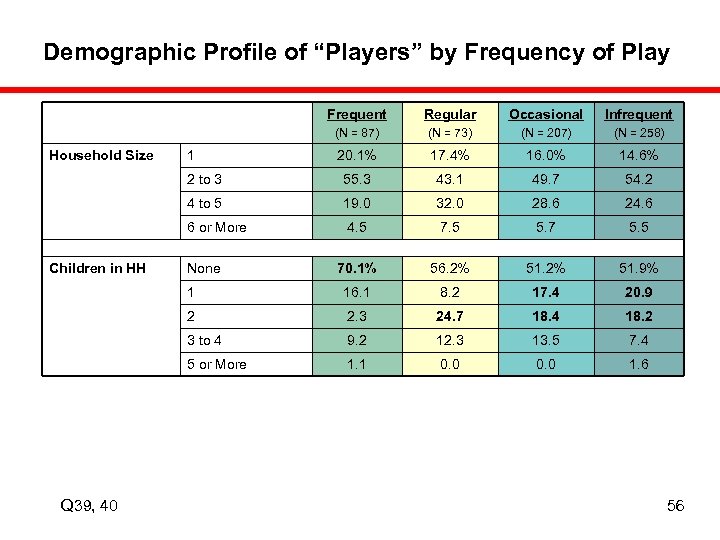

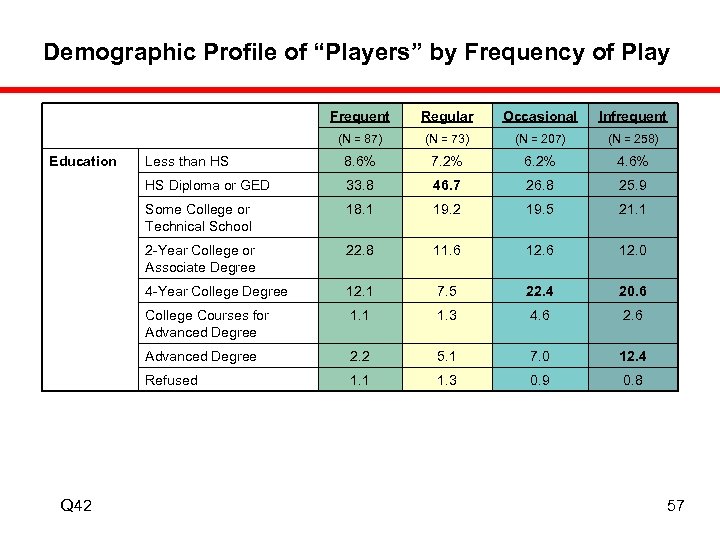

Qualification of Frequency of Play • “Players” have also been categorized relative to their frequency of play of any South Carolina Education Lottery game: ü ü “Regular” - purchase tickets for any game about once a week (N = 73); ü “Occasional” - purchase tickets for any game one to three times a month (N = 207); and ü • “Frequent” - purchase tickets for any game more than once a week (N = 87); “Infrequent” - purchase tickets for any game less than once a month ( N = 258). “Active” Players are those who play a game at least once a month. 4

Qualification of Frequency of Play • “Players” have also been categorized relative to their frequency of play of any South Carolina Education Lottery game: ü ü “Regular” - purchase tickets for any game about once a week (N = 73); ü “Occasional” - purchase tickets for any game one to three times a month (N = 207); and ü • “Frequent” - purchase tickets for any game more than once a week (N = 87); “Infrequent” - purchase tickets for any game less than once a month ( N = 258). “Active” Players are those who play a game at least once a month. 4

Current Lottery Games • Scratch Off ü Introduced 1/7/02 ü $10 game introduced at the end of 2003 • Pick 3 ü Introduced 3/7/02 • Palmetto Cash 5 ü Introduced 6/17/02 ü Introduced as “Carolina 5”; name changed to “Palmetto Cash 5” in 2005. ü Draws increased to 2 draws per week in May 2003, then 4 draws per week in March 2004. 5

Current Lottery Games • Scratch Off ü Introduced 1/7/02 ü $10 game introduced at the end of 2003 • Pick 3 ü Introduced 3/7/02 • Palmetto Cash 5 ü Introduced 6/17/02 ü Introduced as “Carolina 5”; name changed to “Palmetto Cash 5” in 2005. ü Draws increased to 2 draws per week in May 2003, then 4 draws per week in March 2004. 5

Current Lottery Games • Powerball ü Introduced 10/5/02 • Pick 4 ü Introduced 1/27/03 6

Current Lottery Games • Powerball ü Introduced 10/5/02 • Pick 4 ü Introduced 1/27/03 6

Report Format 1. Unless otherwise indicated, findings in this report reflect 2005 results only. 2. Data are presented in percent and based on the weighted sample size of 633 for “Players, ” 620 for Non-Players, or 1, 252 for the Total Sample. 3. Graphs indicate in the title whether they are based on the Total Sample, “Players, ” or some other subsegment. As a general rule, green bars reflect percentages among “Players” and blue bars reflect percentages among all the Total Sample. 7

Report Format 1. Unless otherwise indicated, findings in this report reflect 2005 results only. 2. Data are presented in percent and based on the weighted sample size of 633 for “Players, ” 620 for Non-Players, or 1, 252 for the Total Sample. 3. Graphs indicate in the title whether they are based on the Total Sample, “Players, ” or some other subsegment. As a general rule, green bars reflect percentages among “Players” and blue bars reflect percentages among all the Total Sample. 7

Report Format • Percentages have been rounded to the nearest whole number. In some instances rounding may cause the “total” to add to more than 100%. • In tables, bolded numbers represent those that have a statistically significant difference at the 95% confidence level. 8

Report Format • Percentages have been rounded to the nearest whole number. In some instances rounding may cause the “total” to add to more than 100%. • In tables, bolded numbers represent those that have a statistically significant difference at the 95% confidence level. 8

A Market. Search Study Summary of Key Findings

A Market. Search Study Summary of Key Findings

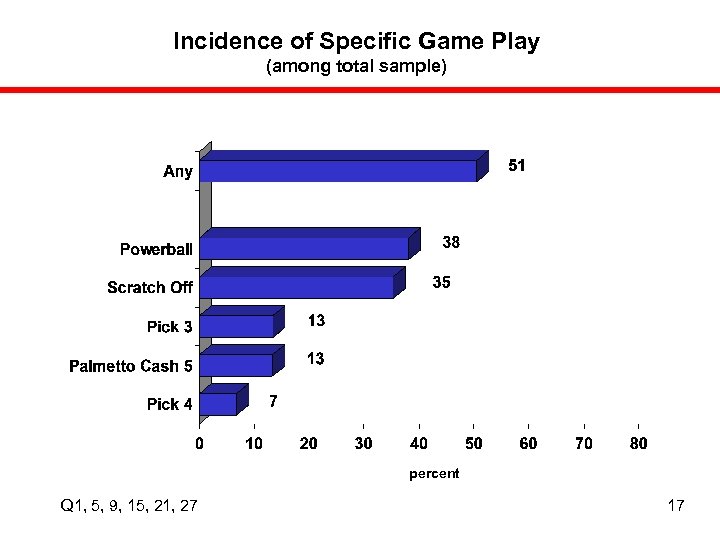

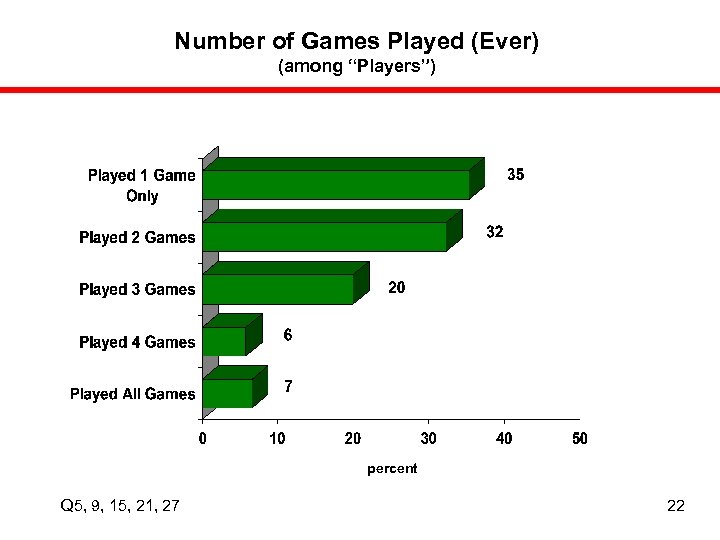

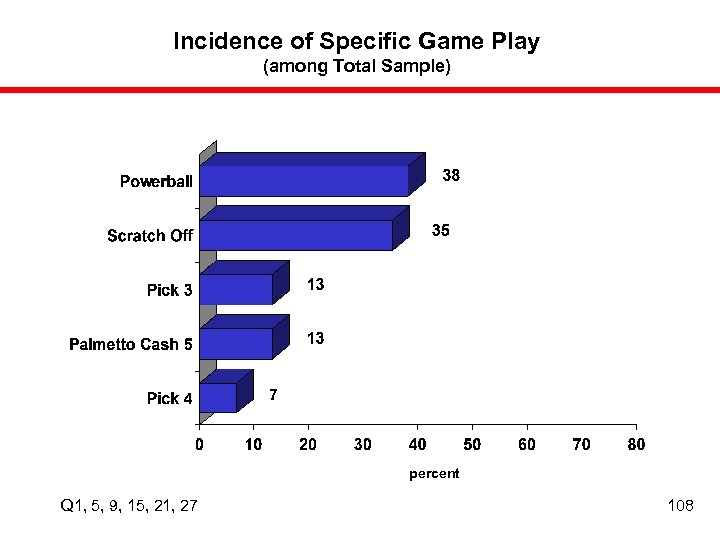

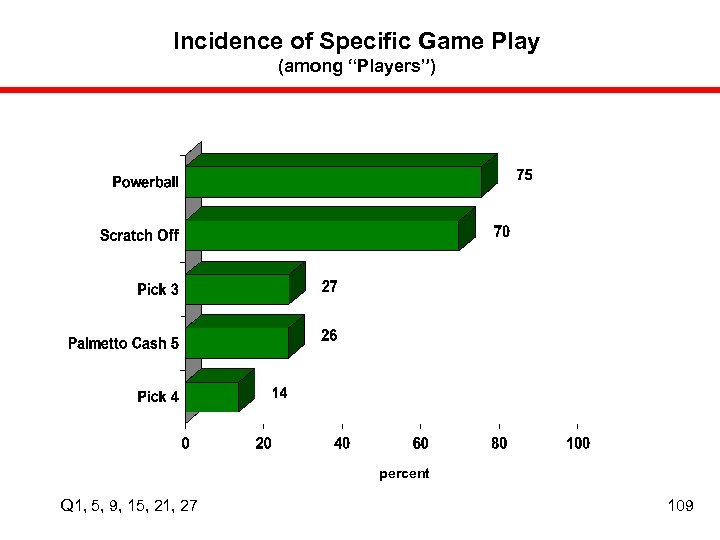

Summary of Key Findings • Study findings indicate that about half of South Carolina residents (51%) have ever played a SC Education Lottery game. Powerball (38%) and Scratch Off (35%) tickets have the highest penetration, followed by Pick 3 (13%), Palmetto Cash 5 (13%), and Pick 4 (7%). • Overall, 58% of SC Education Lottery “Players” are classified as “Active, ” playing one or more games once a month or more. • Most “Players” (65%) play more than one SC Education Lottery game, but only 7% have played them all. 9

Summary of Key Findings • Study findings indicate that about half of South Carolina residents (51%) have ever played a SC Education Lottery game. Powerball (38%) and Scratch Off (35%) tickets have the highest penetration, followed by Pick 3 (13%), Palmetto Cash 5 (13%), and Pick 4 (7%). • Overall, 58% of SC Education Lottery “Players” are classified as “Active, ” playing one or more games once a month or more. • Most “Players” (65%) play more than one SC Education Lottery game, but only 7% have played them all. 9

Summary of Key Findings • In large part, the demographic profile of SC Education Lottery “Players” tends to be similar to the demographic profile of adult residents in general. The majority of “Players” are employed outside the home (65%), have at least some college education (64%), are Caucasian (61%), are married (59%), have no children under 18 in the household (55%), have 2 to 3 people residing in their household (52%), are male (52%), and are between the ages of 35 and 54 (52%). • Demographic segments with disproportionate representation among Lottery “Players, ” however, include: ü ü African-Americans (61%); Those with household incomes between $40, 000 and $50, 000 per year (64%), between $60, 000 and $70, 000 per year (61%), and between $10, 000 and $20, 000 per year (59%); 10

Summary of Key Findings • In large part, the demographic profile of SC Education Lottery “Players” tends to be similar to the demographic profile of adult residents in general. The majority of “Players” are employed outside the home (65%), have at least some college education (64%), are Caucasian (61%), are married (59%), have no children under 18 in the household (55%), have 2 to 3 people residing in their household (52%), are male (52%), and are between the ages of 35 and 54 (52%). • Demographic segments with disproportionate representation among Lottery “Players, ” however, include: ü ü African-Americans (61%); Those with household incomes between $40, 000 and $50, 000 per year (64%), between $60, 000 and $70, 000 per year (61%), and between $10, 000 and $20, 000 per year (59%); 10

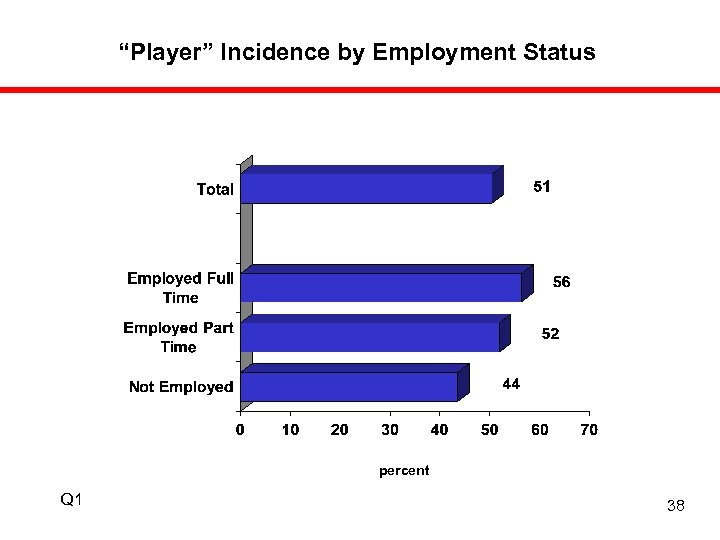

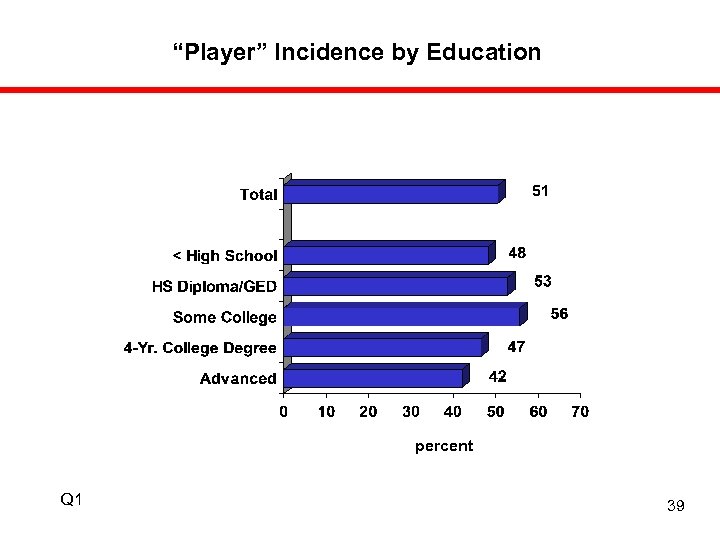

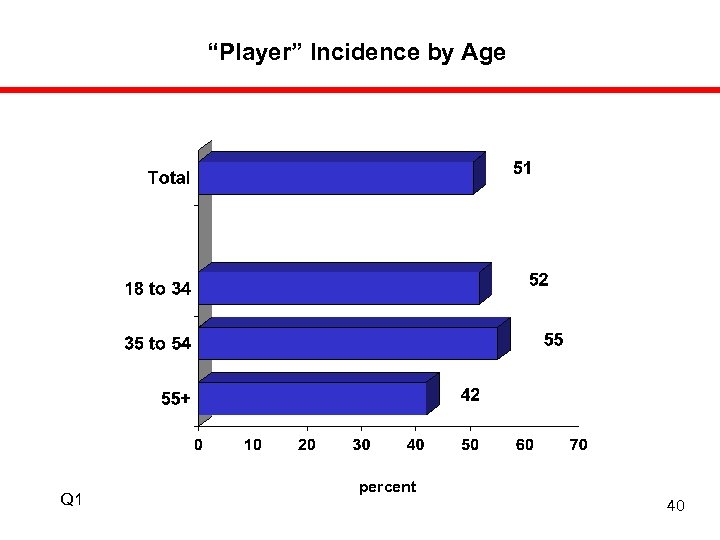

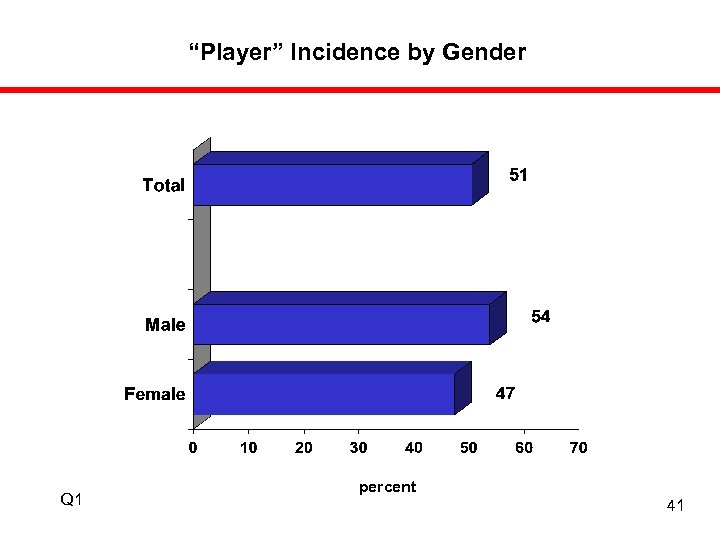

Summary of Key Findings ü ü Those employed full time outside the home (56%); ü Those with high school (53%) or some college/tech education but no college degree (56%); ü Those between the ages of 35 and 54 (55%) and those under the age of 35 (52%); and ü • Those with six or more people in the household (59%); Men (54%). There are some demographic differences among “Players” based on the games they play and the frequency of play. For example, “Active” Powerball players are significantly more likely than “Players” in general to be Caucasian, married, and to have higher income households, while “Active” Pick 3 and Pick 4 players are significantly more likely to be African-American, lower household incomes, and have blue collar jobs. 11

Summary of Key Findings ü ü Those employed full time outside the home (56%); ü Those with high school (53%) or some college/tech education but no college degree (56%); ü Those between the ages of 35 and 54 (55%) and those under the age of 35 (52%); and ü • Those with six or more people in the household (59%); Men (54%). There are some demographic differences among “Players” based on the games they play and the frequency of play. For example, “Active” Powerball players are significantly more likely than “Players” in general to be Caucasian, married, and to have higher income households, while “Active” Pick 3 and Pick 4 players are significantly more likely to be African-American, lower household incomes, and have blue collar jobs. 11

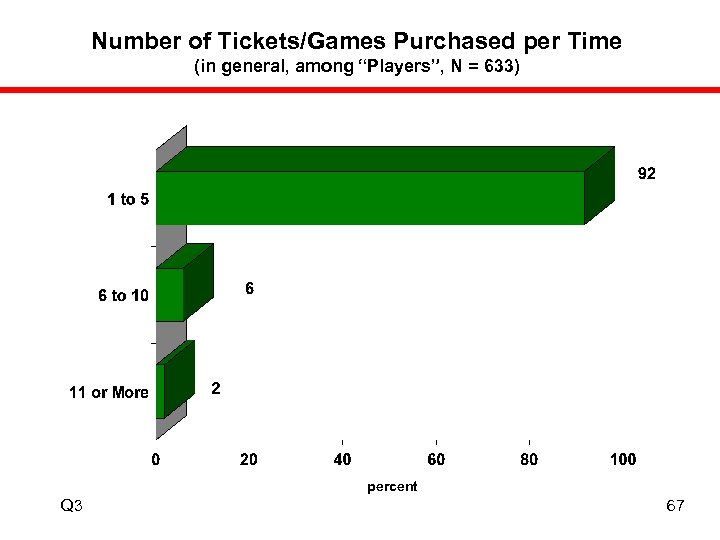

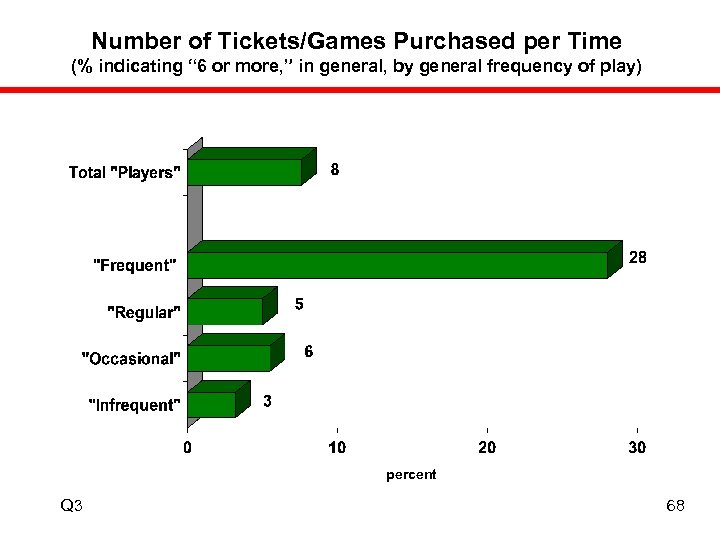

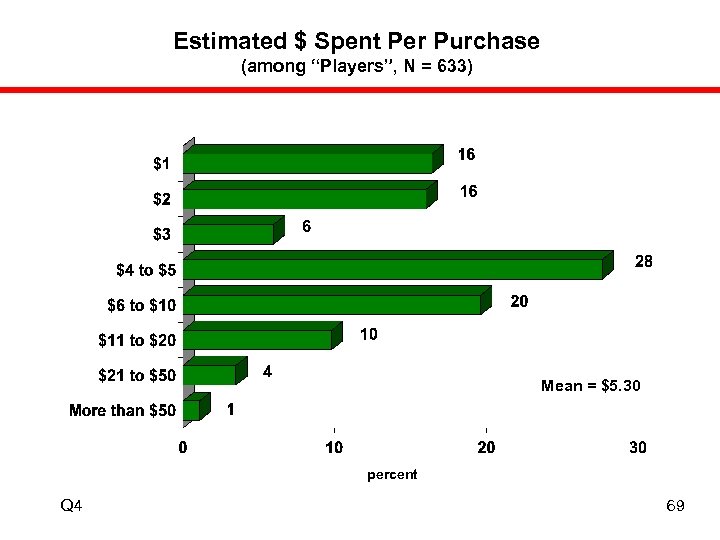

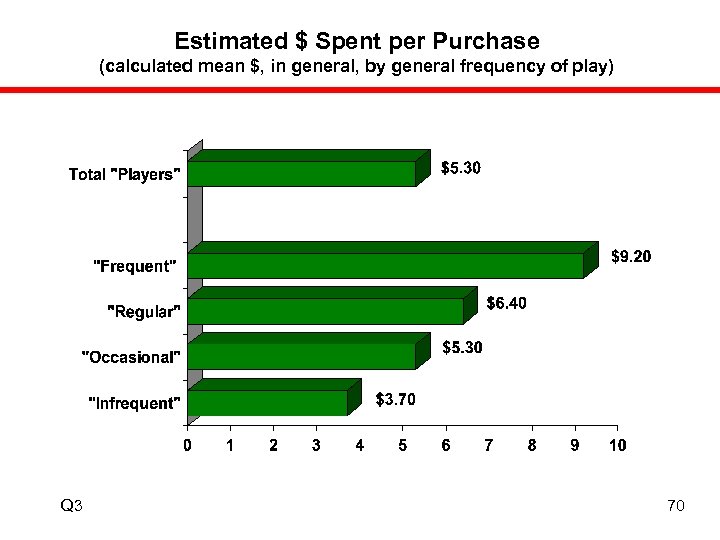

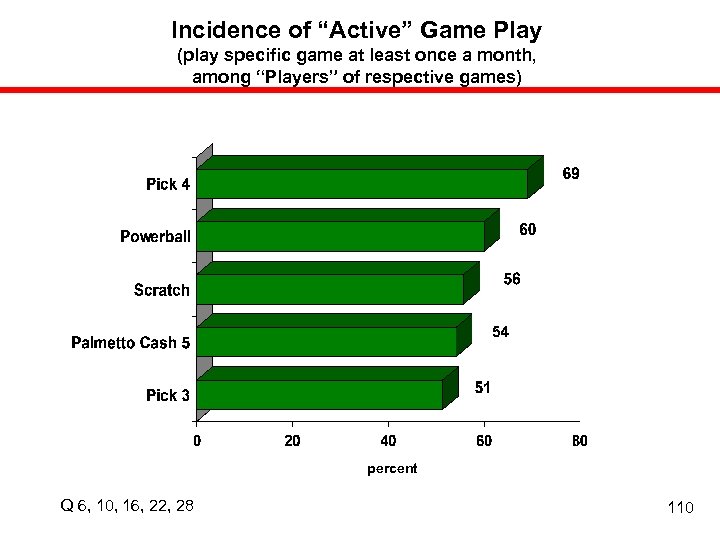

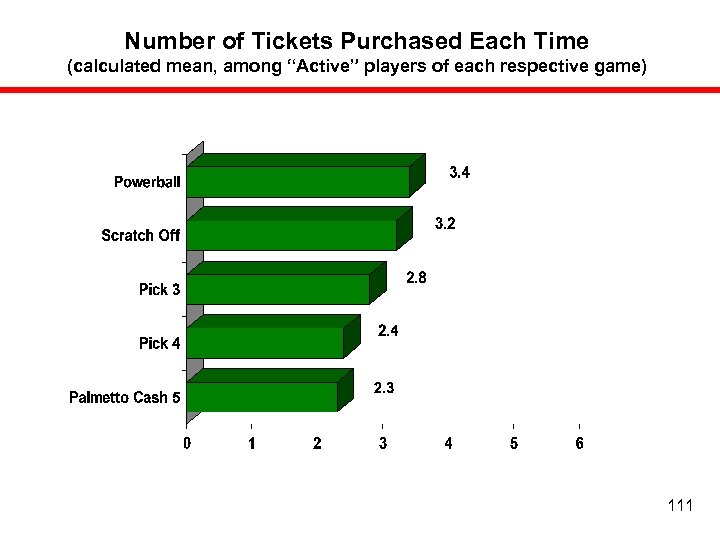

Summary of Key Findings “Frequent” players are significantly more likely than “Players” in general to be African-American, over 55 years of age, to not have children present in the household, to have moderate household incomes, and to be employed in manufacturing or other blue collar positions. • The overwhelming majority (92%) indicates they buy five or fewer tickets per purchase, spending an average of $5. 30. “Frequent” players, however, tend to buy more tickets (28% buy more than five per purchase) and spend more (average of $9. 20) each time they play. Although Pick 4 has the lowest penetration, its players are among the most active and, Pick 3 and Pick 4 players spend the most per month. 12

Summary of Key Findings “Frequent” players are significantly more likely than “Players” in general to be African-American, over 55 years of age, to not have children present in the household, to have moderate household incomes, and to be employed in manufacturing or other blue collar positions. • The overwhelming majority (92%) indicates they buy five or fewer tickets per purchase, spending an average of $5. 30. “Frequent” players, however, tend to buy more tickets (28% buy more than five per purchase) and spend more (average of $9. 20) each time they play. Although Pick 4 has the lowest penetration, its players are among the most active and, Pick 3 and Pick 4 players spend the most per month. 12

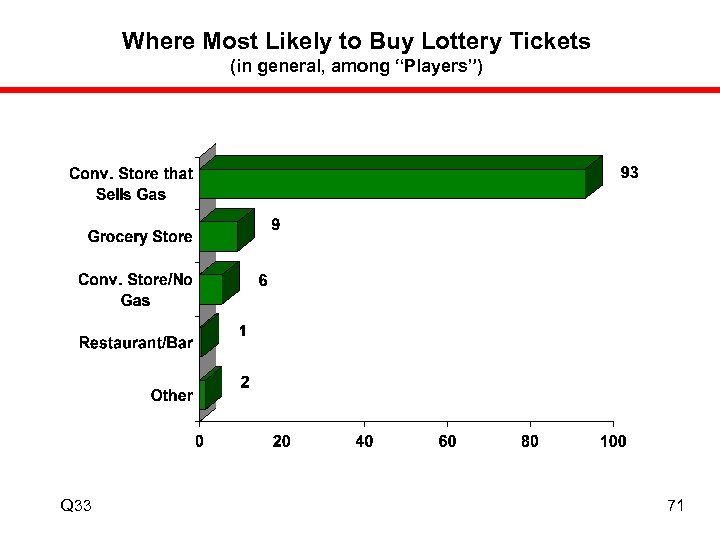

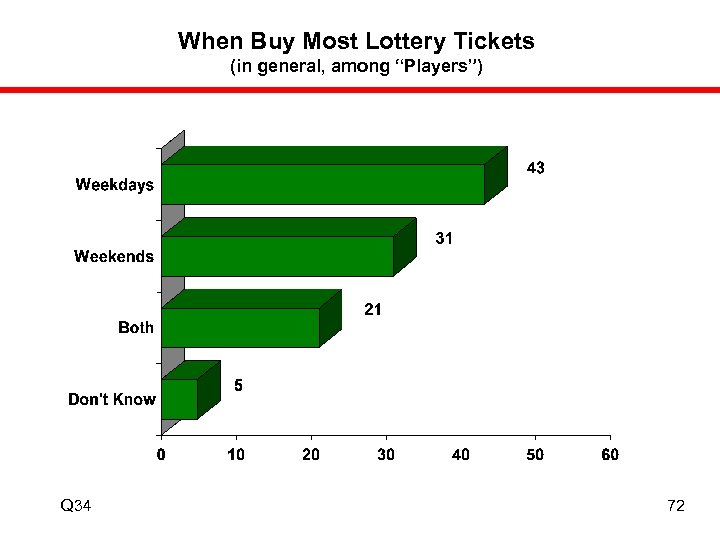

Summary of Key Findings • Most players: ü Buy their tickets at a convenience store that also sells gasoline; ü Buy their tickets between 4: 00 p. m. and 8: 00 a. m. ; and ü Buy tickets throughout the week. 13

Summary of Key Findings • Most players: ü Buy their tickets at a convenience store that also sells gasoline; ü Buy their tickets between 4: 00 p. m. and 8: 00 a. m. ; and ü Buy tickets throughout the week. 13

A Market. Search Study Incidence of Lottery Play

A Market. Search Study Incidence of Lottery Play

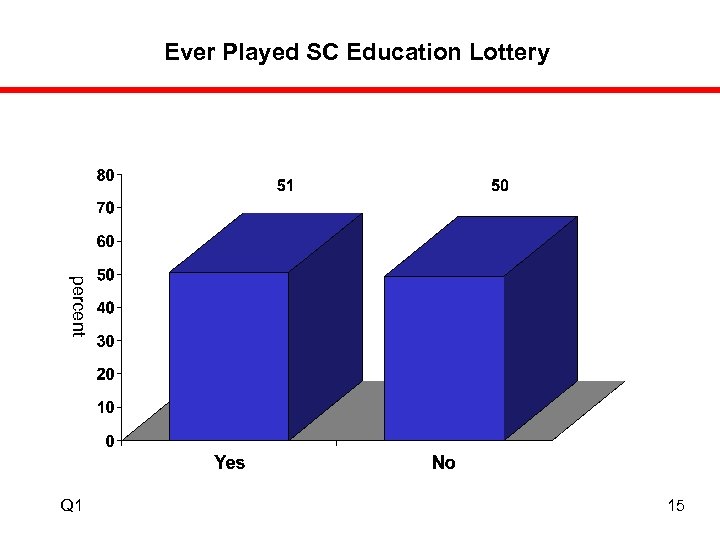

General Incidence of Lottery Play • Findings indicate that just over half (51%) of South Carolina residents say they have ever purchased a South Carolina Education Lottery ticket. 14

General Incidence of Lottery Play • Findings indicate that just over half (51%) of South Carolina residents say they have ever purchased a South Carolina Education Lottery ticket. 14

Ever Played SC Education Lottery percent Q 1 15

Ever Played SC Education Lottery percent Q 1 15

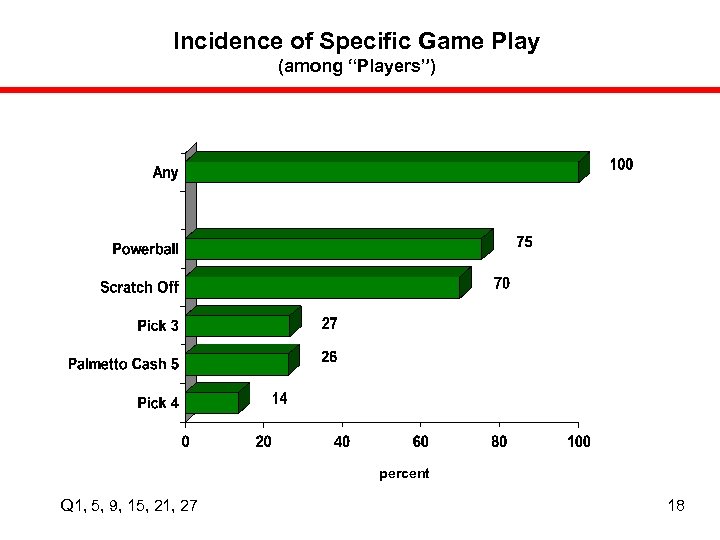

Incidence of Lottery Play by Game • Powerball (38% of state residents have ever purchased) and Scratch Off tickets (35% have ever purchased) have the highest penetration among residents. • Among “Players” (N = 633), 75% have played Powerball and 70% have purchased a Scratch Off ticket, while only 27% have played Pick 3, 26% have played Palmetto Cash 5, and 14% have played Pick 4. 16

Incidence of Lottery Play by Game • Powerball (38% of state residents have ever purchased) and Scratch Off tickets (35% have ever purchased) have the highest penetration among residents. • Among “Players” (N = 633), 75% have played Powerball and 70% have purchased a Scratch Off ticket, while only 27% have played Pick 3, 26% have played Palmetto Cash 5, and 14% have played Pick 4. 16

Incidence of Specific Game Play (among total sample) percent Q 1, 5, 9, 15, 21, 27 17

Incidence of Specific Game Play (among total sample) percent Q 1, 5, 9, 15, 21, 27 17

Incidence of Specific Game Play (among “Players”) percent Q 1, 5, 9, 15, 21, 27 18

Incidence of Specific Game Play (among “Players”) percent Q 1, 5, 9, 15, 21, 27 18

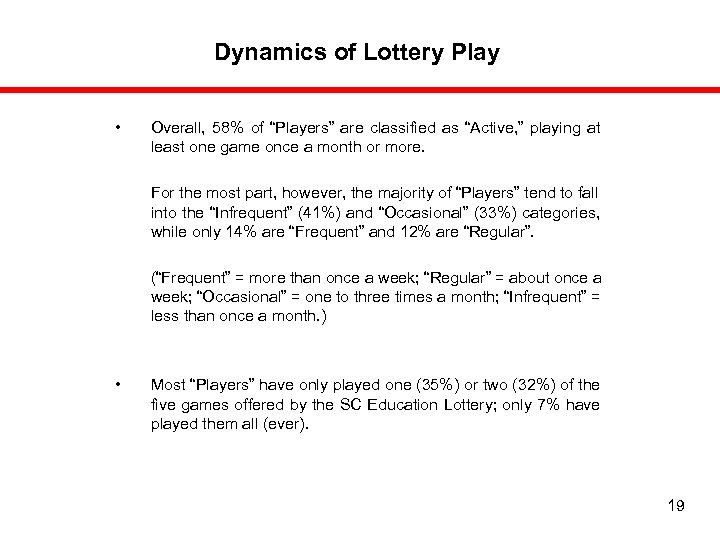

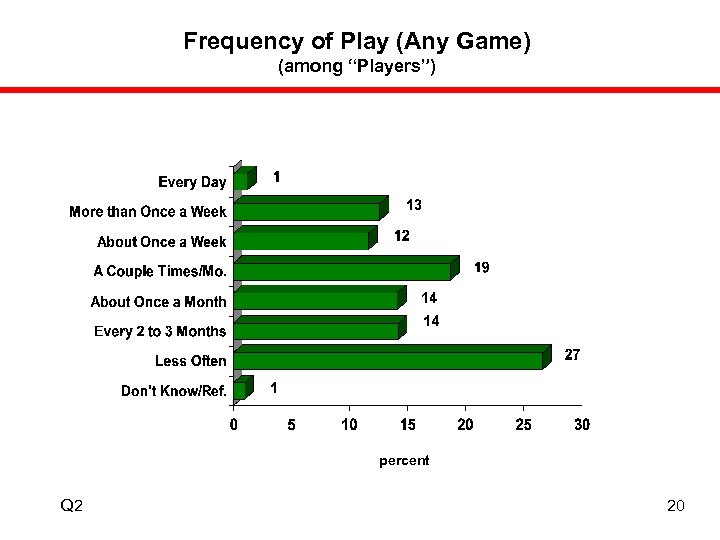

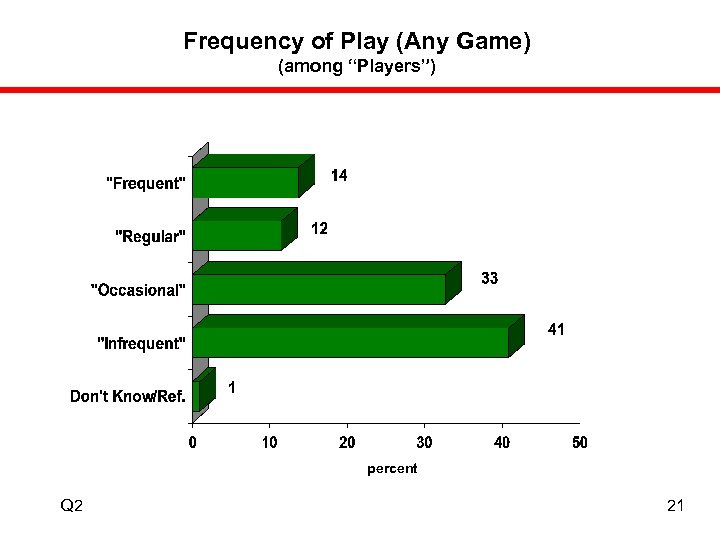

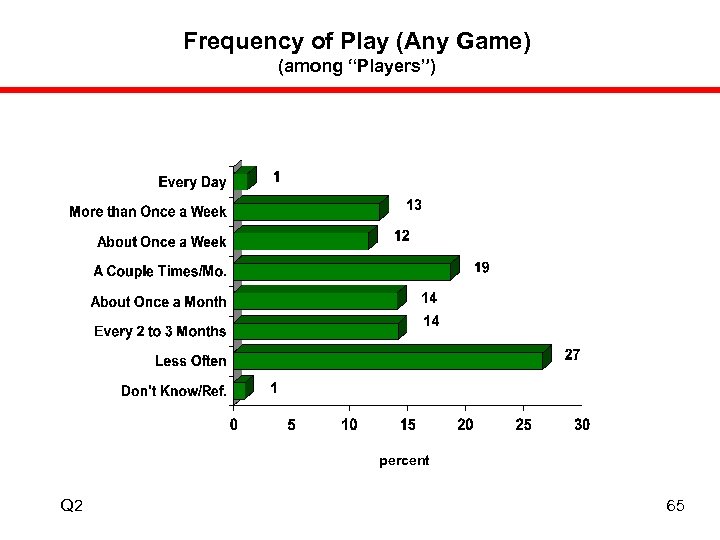

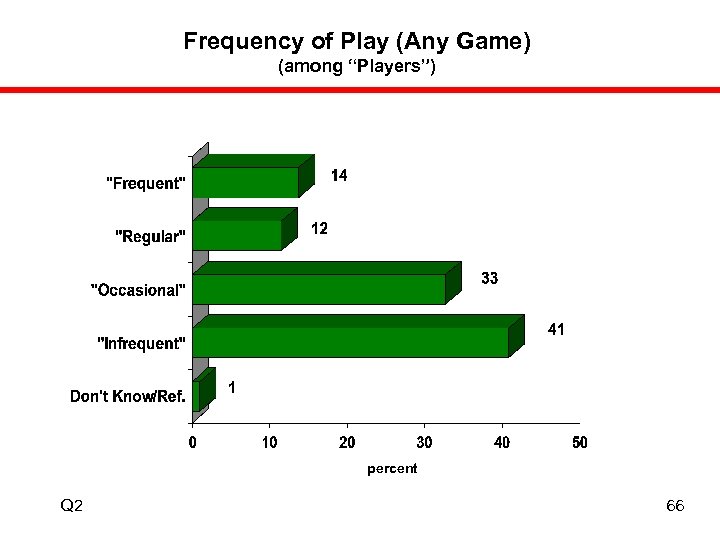

Dynamics of Lottery Play • Overall, 58% of “Players” are classified as “Active, ” playing at least one game once a month or more. For the most part, however, the majority of “Players” tend to fall into the “Infrequent” (41%) and “Occasional” (33%) categories, while only 14% are “Frequent” and 12% are “Regular”. (“Frequent” = more than once a week; “Regular” = about once a week; “Occasional” = one to three times a month; “Infrequent” = less than once a month. ) • Most “Players” have only played one (35%) or two (32%) of the five games offered by the SC Education Lottery; only 7% have played them all (ever). 19

Dynamics of Lottery Play • Overall, 58% of “Players” are classified as “Active, ” playing at least one game once a month or more. For the most part, however, the majority of “Players” tend to fall into the “Infrequent” (41%) and “Occasional” (33%) categories, while only 14% are “Frequent” and 12% are “Regular”. (“Frequent” = more than once a week; “Regular” = about once a week; “Occasional” = one to three times a month; “Infrequent” = less than once a month. ) • Most “Players” have only played one (35%) or two (32%) of the five games offered by the SC Education Lottery; only 7% have played them all (ever). 19

Frequency of Play (Any Game) (among “Players”) percent Q 2 20

Frequency of Play (Any Game) (among “Players”) percent Q 2 20

Frequency of Play (Any Game) (among “Players”) percent Q 2 21

Frequency of Play (Any Game) (among “Players”) percent Q 2 21

Number of Games Played (Ever) (among “Players”) percent Q 5, 9, 15, 21, 27 22

Number of Games Played (Ever) (among “Players”) percent Q 5, 9, 15, 21, 27 22

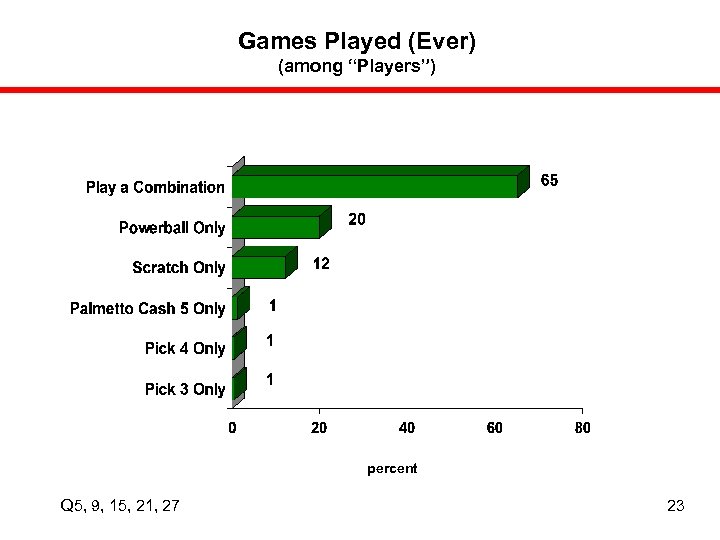

Games Played (Ever) (among “Players”) percent Q 5, 9, 15, 21, 27 23

Games Played (Ever) (among “Players”) percent Q 5, 9, 15, 21, 27 23

A Market. Search Study Demographic Profile of Players and Non-Players

A Market. Search Study Demographic Profile of Players and Non-Players

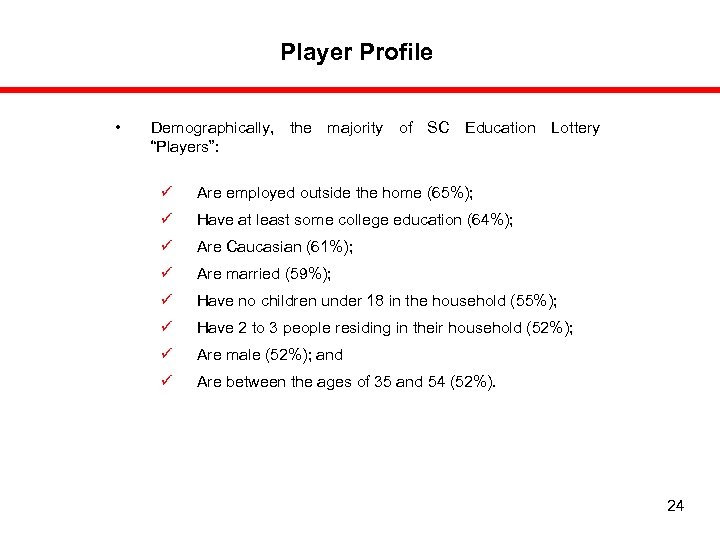

Player Profile • Demographically, the majority of SC Education Lottery “Players”: ü Are employed outside the home (65%); ü Have at least some college education (64%); ü Are Caucasian (61%); ü Are married (59%); ü Have no children under 18 in the household (55%); ü Have 2 to 3 people residing in their household (52%); ü Are male (52%); and ü Are between the ages of 35 and 54 (52%). 24

Player Profile • Demographically, the majority of SC Education Lottery “Players”: ü Are employed outside the home (65%); ü Have at least some college education (64%); ü Are Caucasian (61%); ü Are married (59%); ü Have no children under 18 in the household (55%); ü Have 2 to 3 people residing in their household (52%); ü Are male (52%); and ü Are between the ages of 35 and 54 (52%). 24

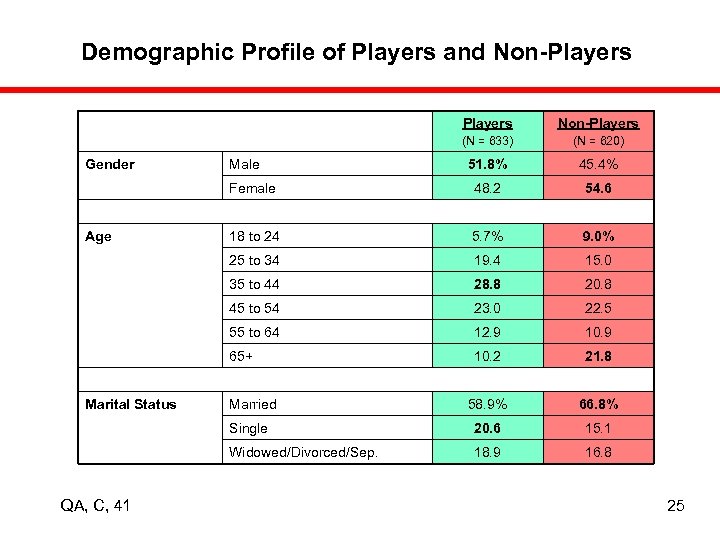

Demographic Profile of Players and Non-Players (N = 633) 48. 2 54. 6 18 to 24 5. 7% 9. 0% 19. 4 15. 0 28. 8 20. 8 45 to 54 23. 0 22. 5 55 to 64 12. 9 10. 9 65+ 10. 2 21. 8 58. 9% 66. 8% Single 20. 6 15. 1 Widowed/Divorced/Sep. QA, C, 41 45. 4% 35 to 44 Marital Status 51. 8% 25 to 34 Age (N = 620) Female Gender Non-Players 18. 9 16. 8 Male Married 25

Demographic Profile of Players and Non-Players (N = 633) 48. 2 54. 6 18 to 24 5. 7% 9. 0% 19. 4 15. 0 28. 8 20. 8 45 to 54 23. 0 22. 5 55 to 64 12. 9 10. 9 65+ 10. 2 21. 8 58. 9% 66. 8% Single 20. 6 15. 1 Widowed/Divorced/Sep. QA, C, 41 45. 4% 35 to 44 Marital Status 51. 8% 25 to 34 Age (N = 620) Female Gender Non-Players 18. 9 16. 8 Male Married 25

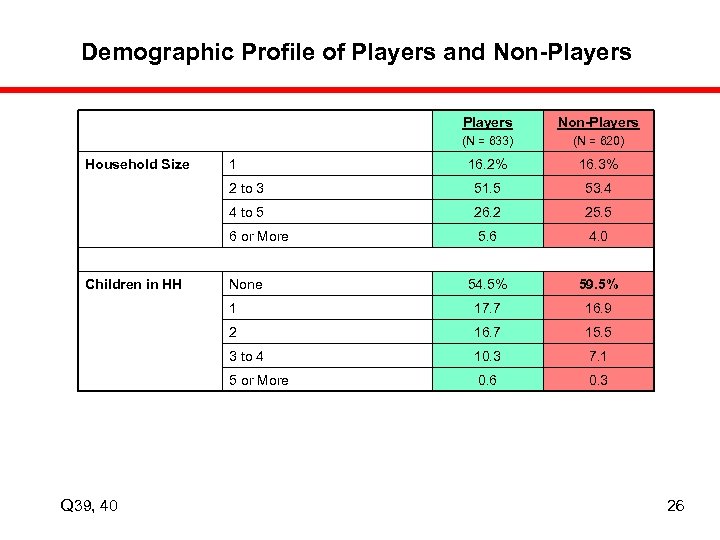

Demographic Profile of Players and Non-Players (N = 633) 16. 3% 51. 5 53. 4 26. 2 25. 5 6 or More 5. 6 4. 0 54. 5% 59. 5% 1 17. 7 16. 9 2 16. 7 15. 5 3 to 4 10. 3 7. 1 5 or More Q 39, 40 16. 2% 4 to 5 Children in HH (N = 620) 2 to 3 Household Size Non-Players 0. 6 0. 3 1 None 26

Demographic Profile of Players and Non-Players (N = 633) 16. 3% 51. 5 53. 4 26. 2 25. 5 6 or More 5. 6 4. 0 54. 5% 59. 5% 1 17. 7 16. 9 2 16. 7 15. 5 3 to 4 10. 3 7. 1 5 or More Q 39, 40 16. 2% 4 to 5 Children in HH (N = 620) 2 to 3 Household Size Non-Players 0. 6 0. 3 1 None 26

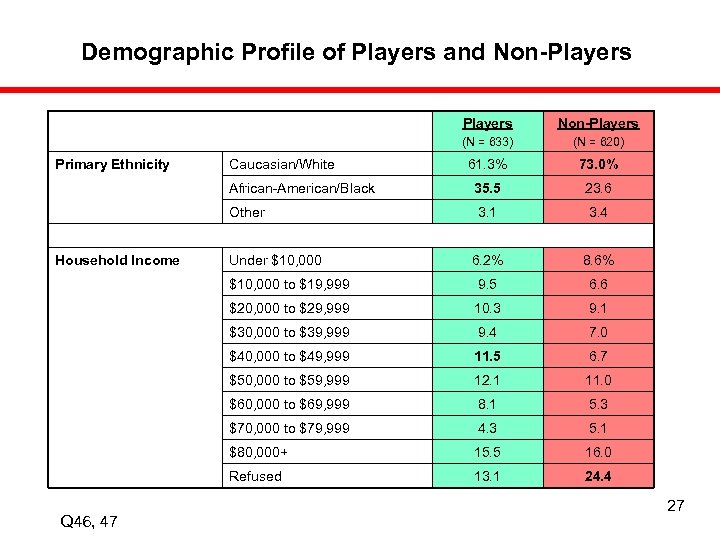

Demographic Profile of Players and Non-Players (N = 633) 73. 0% 35. 5 23. 6 3. 1 3. 4 6. 2% 8. 6% $10, 000 to $19, 999 9. 5 6. 6 $20, 000 to $29, 999 10. 3 9. 1 $30, 000 to $39, 999 9. 4 7. 0 $40, 000 to $49, 999 11. 5 6. 7 $50, 000 to $59, 999 12. 1 11. 0 $60, 000 to $69, 999 8. 1 5. 3 $70, 000 to $79, 999 4. 3 5. 1 $80, 000+ 15. 5 16. 0 Refused Q 46, 47 61. 3% Other Household Income (N = 620) African-American/Black Primary Ethnicity Non-Players 13. 1 24. 4 Caucasian/White Under $10, 000 27

Demographic Profile of Players and Non-Players (N = 633) 73. 0% 35. 5 23. 6 3. 1 3. 4 6. 2% 8. 6% $10, 000 to $19, 999 9. 5 6. 6 $20, 000 to $29, 999 10. 3 9. 1 $30, 000 to $39, 999 9. 4 7. 0 $40, 000 to $49, 999 11. 5 6. 7 $50, 000 to $59, 999 12. 1 11. 0 $60, 000 to $69, 999 8. 1 5. 3 $70, 000 to $79, 999 4. 3 5. 1 $80, 000+ 15. 5 16. 0 Refused Q 46, 47 61. 3% Other Household Income (N = 620) African-American/Black Primary Ethnicity Non-Players 13. 1 24. 4 Caucasian/White Under $10, 000 27

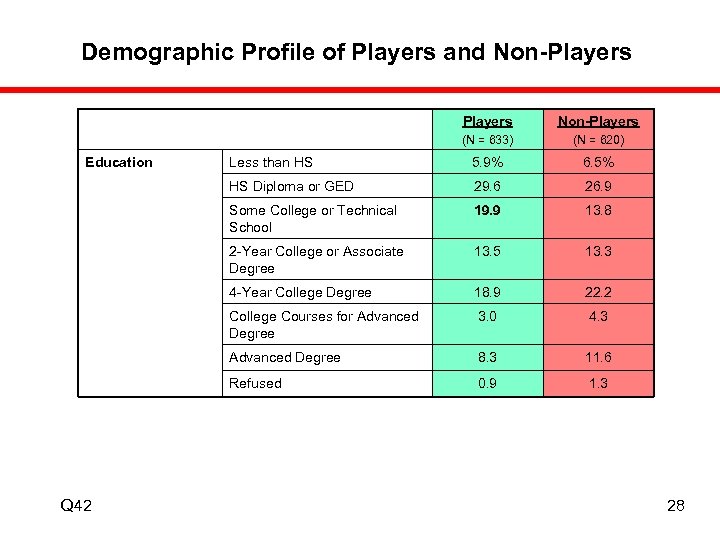

Demographic Profile of Players and Non-Players (N = 633) Less than HS 5. 9% 6. 5% 29. 6 26. 9 Some College or Technical School 19. 9 13. 8 2 -Year College or Associate Degree 13. 5 13. 3 4 -Year College Degree 18. 9 22. 2 College Courses for Advanced Degree 3. 0 4. 3 Advanced Degree 8. 3 11. 6 Refused Q 42 (N = 620) HS Diploma or GED Education Non-Players 0. 9 1. 3 28

Demographic Profile of Players and Non-Players (N = 633) Less than HS 5. 9% 6. 5% 29. 6 26. 9 Some College or Technical School 19. 9 13. 8 2 -Year College or Associate Degree 13. 5 13. 3 4 -Year College Degree 18. 9 22. 2 College Courses for Advanced Degree 3. 0 4. 3 Advanced Degree 8. 3 11. 6 Refused Q 42 (N = 620) HS Diploma or GED Education Non-Players 0. 9 1. 3 28

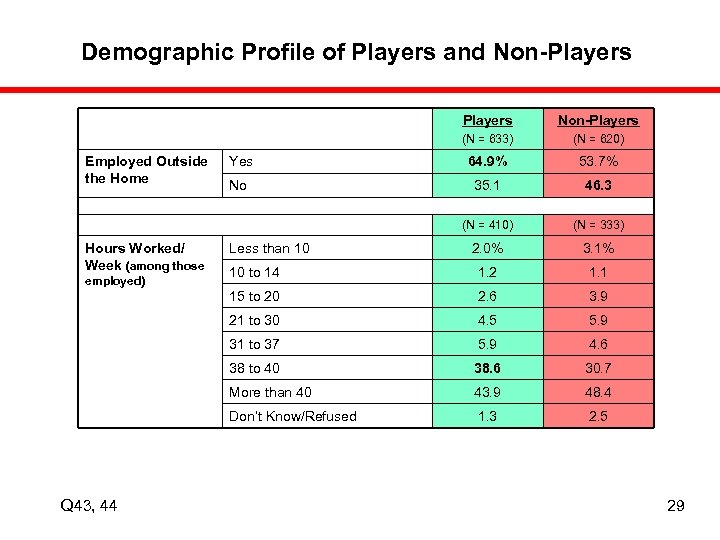

Demographic Profile of Players and Non-Players (N = 633) 53. 7% No 35. 1 46. 3 (N = 333) 2. 0% 3. 1% 10 to 14 1. 2 1. 1 2. 6 3. 9 4. 5 5. 9 31 to 37 5. 9 4. 6 38 to 40 38. 6 30. 7 More than 40 43. 9 48. 4 Don’t Know/Refused Q 43, 44 64. 9% 21 to 30 employed) Yes 15 to 20 Hours Worked/ Week (among those (N = 620) (N = 410) Employed Outside the Home Non-Players 1. 3 2. 5 Less than 10 29

Demographic Profile of Players and Non-Players (N = 633) 53. 7% No 35. 1 46. 3 (N = 333) 2. 0% 3. 1% 10 to 14 1. 2 1. 1 2. 6 3. 9 4. 5 5. 9 31 to 37 5. 9 4. 6 38 to 40 38. 6 30. 7 More than 40 43. 9 48. 4 Don’t Know/Refused Q 43, 44 64. 9% 21 to 30 employed) Yes 15 to 20 Hours Worked/ Week (among those (N = 620) (N = 410) Employed Outside the Home Non-Players 1. 3 2. 5 Less than 10 29

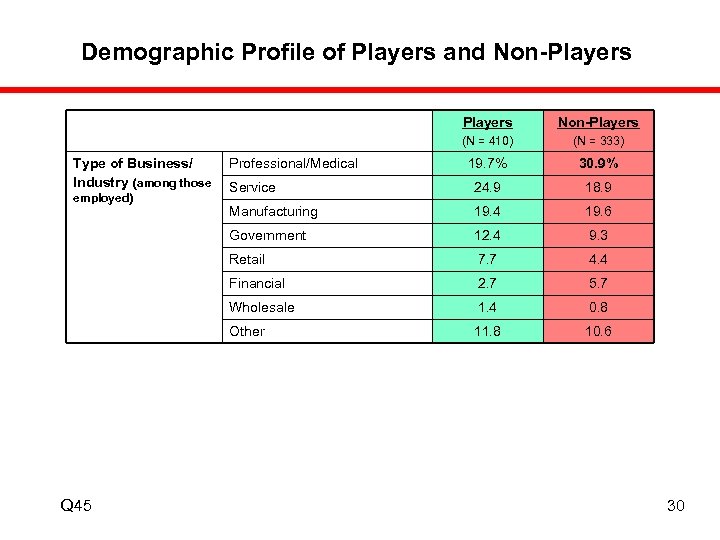

Demographic Profile of Players and Non-Players (N = 410) 30. 9% Service 24. 9 18. 9 Manufacturing 19. 4 19. 6 12. 4 9. 3 7. 7 4. 4 Financial 2. 7 5. 7 Wholesale 1. 4 0. 8 Other Q 45 19. 7% Retail employed) (N = 333) Government Type of Business/ Industry (among those Non-Players 11. 8 10. 6 Professional/Medical 30

Demographic Profile of Players and Non-Players (N = 410) 30. 9% Service 24. 9 18. 9 Manufacturing 19. 4 19. 6 12. 4 9. 3 7. 7 4. 4 Financial 2. 7 5. 7 Wholesale 1. 4 0. 8 Other Q 45 19. 7% Retail employed) (N = 333) Government Type of Business/ Industry (among those Non-Players 11. 8 10. 6 Professional/Medical 30

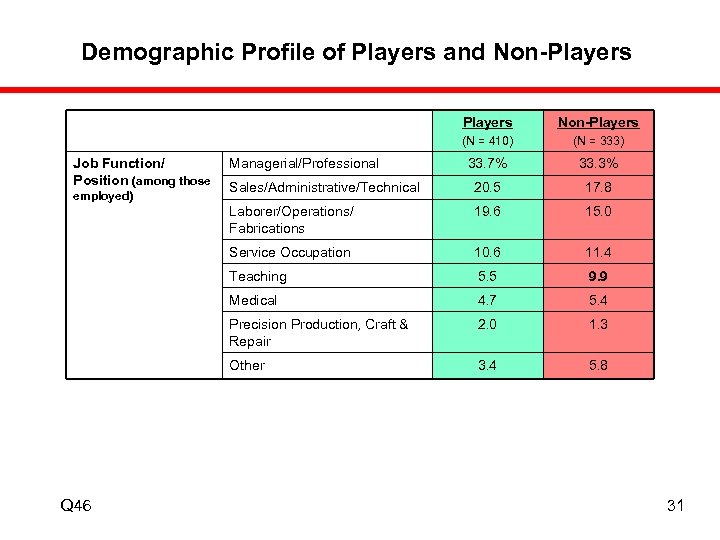

Demographic Profile of Players and Non-Players (N = 410) 33. 3% Sales/Administrative/Technical 20. 5 17. 8 19. 6 15. 0 10. 6 11. 4 Teaching 5. 5 9. 9 Medical 4. 7 5. 4 Precision Production, Craft & Repair 2. 0 1. 3 Other Q 46 33. 7% Service Occupation employed) (N = 333) Laborer/Operations/ Fabrications Job Function/ Position (among those Non-Players 3. 4 5. 8 Managerial/Professional 31

Demographic Profile of Players and Non-Players (N = 410) 33. 3% Sales/Administrative/Technical 20. 5 17. 8 19. 6 15. 0 10. 6 11. 4 Teaching 5. 5 9. 9 Medical 4. 7 5. 4 Precision Production, Craft & Repair 2. 0 1. 3 Other Q 46 33. 7% Service Occupation employed) (N = 333) Laborer/Operations/ Fabrications Job Function/ Position (among those Non-Players 3. 4 5. 8 Managerial/Professional 31

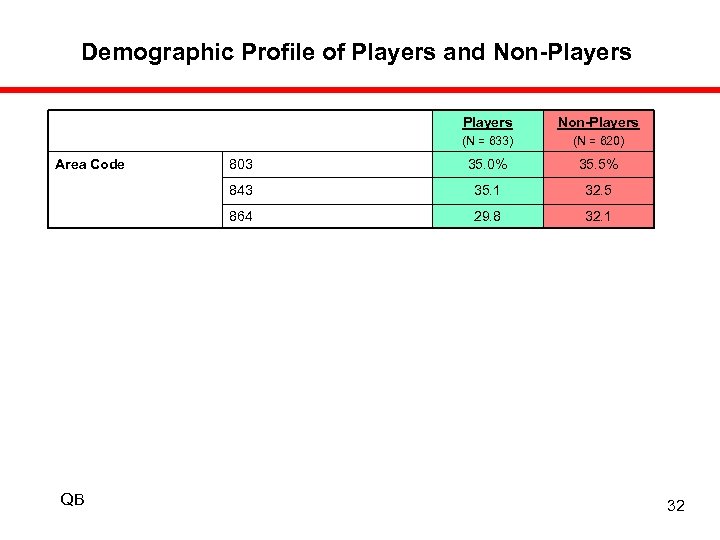

Demographic Profile of Players and Non-Players (N = 633) 803 35. 0% 35. 5% 35. 1 32. 5 864 QB (N = 620) 843 Area Code Non-Players 29. 8 32. 1 32

Demographic Profile of Players and Non-Players (N = 633) 803 35. 0% 35. 5% 35. 1 32. 5 864 QB (N = 620) 843 Area Code Non-Players 29. 8 32. 1 32

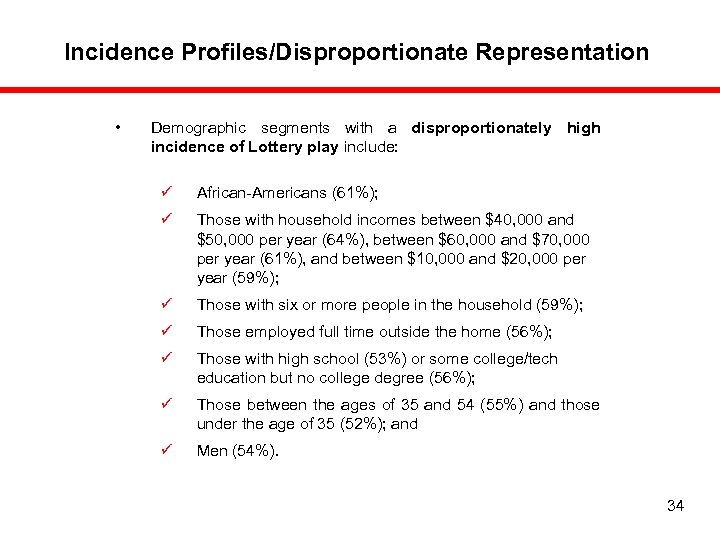

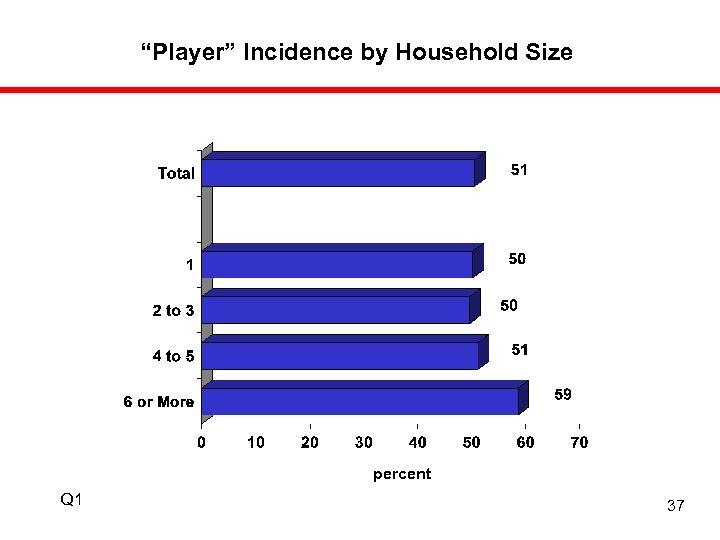

Incidence Profiles/Disproportionate Representation • In large part, however, the reason that Lottery players have these demographic profiles is because these segments represent the majority of South Carolina residents in general. By looking at “Incidence of Lottery Play” among each of the demographic groups, we can get a better perspective of which segments are more inclined to play than others. For example, 51% of all residents have played the South Carolina Education Lottery. Among African-Americans, however, 61% have ever played. This compares to 46% of Caucasians. Therefore, although the majority of players are Caucasian, incidence is disproportionately higher among African-Americans. 33

Incidence Profiles/Disproportionate Representation • In large part, however, the reason that Lottery players have these demographic profiles is because these segments represent the majority of South Carolina residents in general. By looking at “Incidence of Lottery Play” among each of the demographic groups, we can get a better perspective of which segments are more inclined to play than others. For example, 51% of all residents have played the South Carolina Education Lottery. Among African-Americans, however, 61% have ever played. This compares to 46% of Caucasians. Therefore, although the majority of players are Caucasian, incidence is disproportionately higher among African-Americans. 33

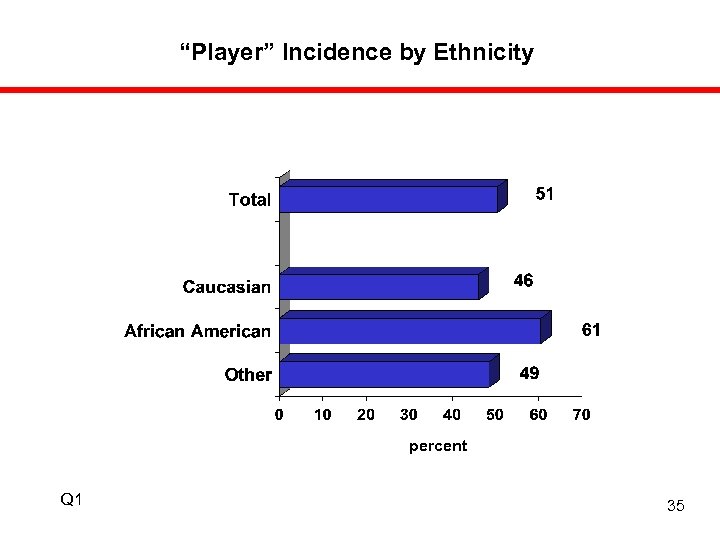

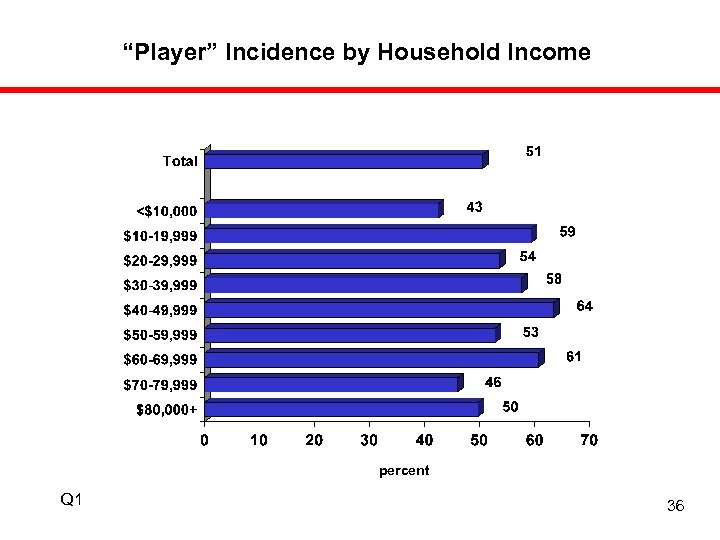

Incidence Profiles/Disproportionate Representation • Demographic segments with a disproportionately high incidence of Lottery play include: ü African-Americans (61%); ü Those with household incomes between $40, 000 and $50, 000 per year (64%), between $60, 000 and $70, 000 per year (61%), and between $10, 000 and $20, 000 per year (59%); ü Those with six or more people in the household (59%); ü Those employed full time outside the home (56%); ü Those with high school (53%) or some college/tech education but no college degree (56%); ü Those between the ages of 35 and 54 (55%) and those under the age of 35 (52%); and ü Men (54%). 34

Incidence Profiles/Disproportionate Representation • Demographic segments with a disproportionately high incidence of Lottery play include: ü African-Americans (61%); ü Those with household incomes between $40, 000 and $50, 000 per year (64%), between $60, 000 and $70, 000 per year (61%), and between $10, 000 and $20, 000 per year (59%); ü Those with six or more people in the household (59%); ü Those employed full time outside the home (56%); ü Those with high school (53%) or some college/tech education but no college degree (56%); ü Those between the ages of 35 and 54 (55%) and those under the age of 35 (52%); and ü Men (54%). 34

“Player” Incidence by Ethnicity percent Q 1 35

“Player” Incidence by Ethnicity percent Q 1 35

“Player” Incidence by Household Income percent Q 1 36

“Player” Incidence by Household Income percent Q 1 36

“Player” Incidence by Household Size percent Q 1 37

“Player” Incidence by Household Size percent Q 1 37

“Player” Incidence by Employment Status percent Q 1 38

“Player” Incidence by Employment Status percent Q 1 38

“Player” Incidence by Education percent Q 1 39

“Player” Incidence by Education percent Q 1 39

“Player” Incidence by Age Q 1 percent 40

“Player” Incidence by Age Q 1 percent 40

“Player” Incidence by Gender Q 1 percent 41

“Player” Incidence by Gender Q 1 percent 41

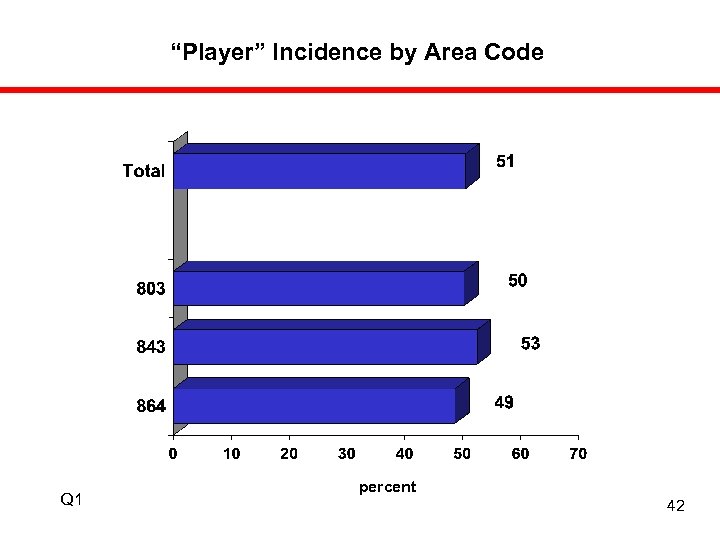

“Player” Incidence by Area Code Q 1 percent 42

“Player” Incidence by Area Code Q 1 percent 42

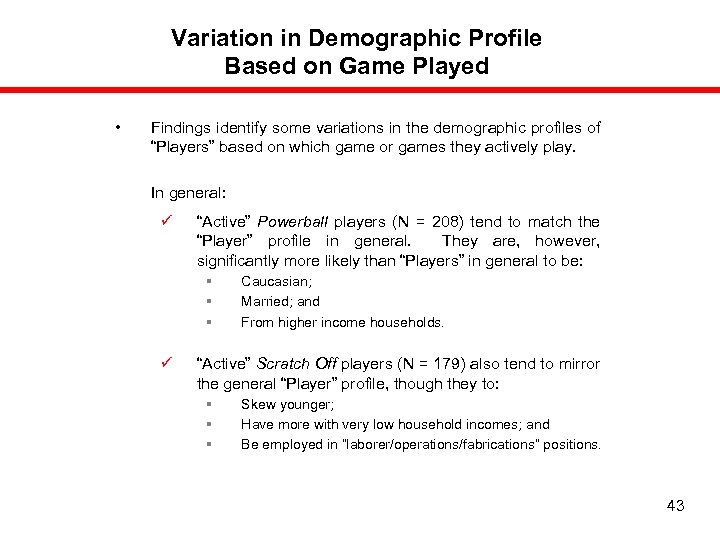

Variation in Demographic Profile Based on Game Played • Findings identify some variations in the demographic profiles of “Players” based on which game or games they actively play. In general: ü “Active” Powerball players (N = 208) tend to match the “Player” profile in general. They are, however, significantly more likely than “Players” in general to be: § § § ü Caucasian; Married; and From higher income households. “Active” Scratch Off players (N = 179) also tend to mirror the general “Player” profile, though they to: § § § Skew younger; Have more with very low household incomes; and Be employed in “laborer/operations/fabrications” positions. 43

Variation in Demographic Profile Based on Game Played • Findings identify some variations in the demographic profiles of “Players” based on which game or games they actively play. In general: ü “Active” Powerball players (N = 208) tend to match the “Player” profile in general. They are, however, significantly more likely than “Players” in general to be: § § § ü Caucasian; Married; and From higher income households. “Active” Scratch Off players (N = 179) also tend to mirror the general “Player” profile, though they to: § § § Skew younger; Have more with very low household incomes; and Be employed in “laborer/operations/fabrications” positions. 43

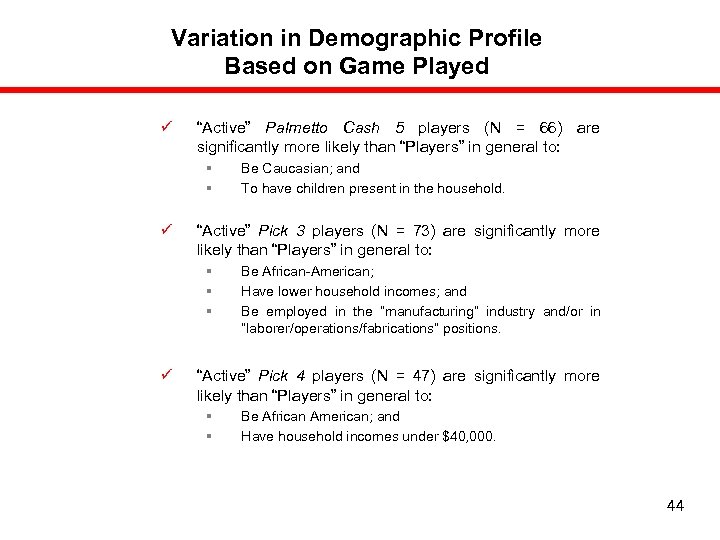

Variation in Demographic Profile Based on Game Played ü “Active” Palmetto Cash 5 players (N = 66) are significantly more likely than “Players” in general to: § § ü “Active” Pick 3 players (N = 73) are significantly more likely than “Players” in general to: § § § ü Be Caucasian; and To have children present in the household. Be African-American; Have lower household incomes; and Be employed in the “manufacturing” industry and/or in “laborer/operations/fabrications” positions. “Active” Pick 4 players (N = 47) are significantly more likely than “Players” in general to: § § Be African American; and Have household incomes under $40, 000. 44

Variation in Demographic Profile Based on Game Played ü “Active” Palmetto Cash 5 players (N = 66) are significantly more likely than “Players” in general to: § § ü “Active” Pick 3 players (N = 73) are significantly more likely than “Players” in general to: § § § ü Be Caucasian; and To have children present in the household. Be African-American; Have lower household incomes; and Be employed in the “manufacturing” industry and/or in “laborer/operations/fabrications” positions. “Active” Pick 4 players (N = 47) are significantly more likely than “Players” in general to: § § Be African American; and Have household incomes under $40, 000. 44

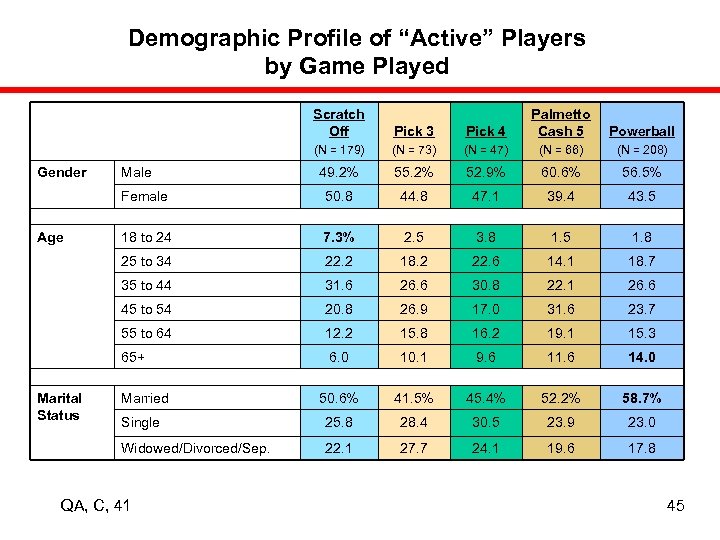

Demographic Profile of “Active” Players by Game Played Scratch Off (N = 47) (N = 66) (N = 208) 49. 2% 55. 2% 52. 9% 60. 6% 56. 5% 50. 8 44. 8 47. 1 39. 4 43. 5 18 to 24 7. 3% 2. 5 3. 8 1. 5 1. 8 25 to 34 22. 2 18. 2 22. 6 14. 1 18. 7 35 to 44 31. 6 26. 6 30. 8 22. 1 26. 6 45 to 54 20. 8 26. 9 17. 0 31. 6 23. 7 55 to 64 12. 2 15. 8 16. 2 19. 1 15. 3 65+ 6. 0 10. 1 9. 6 11. 6 14. 0 50. 6% 41. 5% 45. 4% 52. 2% 58. 7% Single 25. 8 28. 4 30. 5 23. 9 23. 0 Widowed/Divorced/Sep. Marital Status (N = 73) Female Age Powerball 22. 1 27. 7 24. 1 19. 6 17. 8 Male Married QA, C, 41 Pick 3 (N = 179) Gender Pick 4 Palmetto Cash 5 45

Demographic Profile of “Active” Players by Game Played Scratch Off (N = 47) (N = 66) (N = 208) 49. 2% 55. 2% 52. 9% 60. 6% 56. 5% 50. 8 44. 8 47. 1 39. 4 43. 5 18 to 24 7. 3% 2. 5 3. 8 1. 5 1. 8 25 to 34 22. 2 18. 2 22. 6 14. 1 18. 7 35 to 44 31. 6 26. 6 30. 8 22. 1 26. 6 45 to 54 20. 8 26. 9 17. 0 31. 6 23. 7 55 to 64 12. 2 15. 8 16. 2 19. 1 15. 3 65+ 6. 0 10. 1 9. 6 11. 6 14. 0 50. 6% 41. 5% 45. 4% 52. 2% 58. 7% Single 25. 8 28. 4 30. 5 23. 9 23. 0 Widowed/Divorced/Sep. Marital Status (N = 73) Female Age Powerball 22. 1 27. 7 24. 1 19. 6 17. 8 Male Married QA, C, 41 Pick 3 (N = 179) Gender Pick 4 Palmetto Cash 5 45

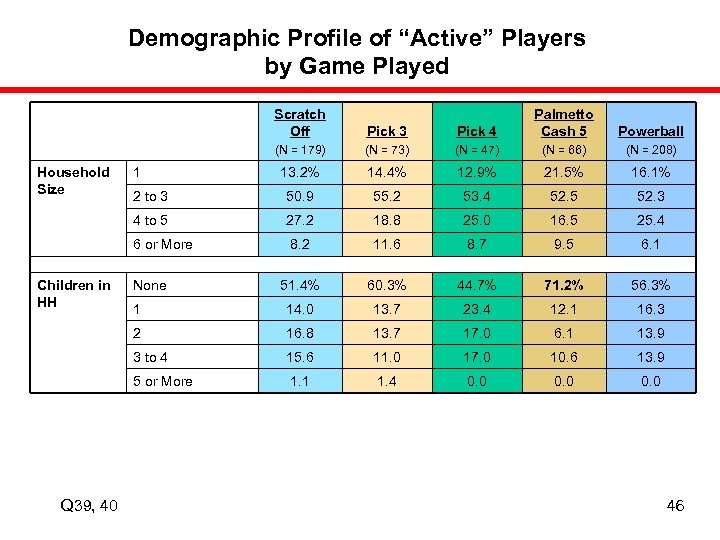

Demographic Profile of “Active” Players by Game Played Scratch Off (N = 47) (N = 66) (N = 208) 13. 2% 14. 4% 12. 9% 21. 5% 16. 1% 2 to 3 50. 9 55. 2 53. 4 52. 5 52. 3 27. 2 18. 8 25. 0 16. 5 25. 4 6 or More 8. 2 11. 6 8. 7 9. 5 6. 1 51. 4% 60. 3% 44. 7% 71. 2% 56. 3% 1 14. 0 13. 7 23. 4 12. 1 16. 3 2 16. 8 13. 7 17. 0 6. 1 13. 9 3 to 4 15. 6 11. 0 17. 0 10. 6 13. 9 5 or More Q 39, 40 (N = 73) 4 to 5 Children in HH Powerball 1. 1 1. 4 0. 0 1 None Pick 3 (N = 179) Household Size Pick 4 Palmetto Cash 5 46

Demographic Profile of “Active” Players by Game Played Scratch Off (N = 47) (N = 66) (N = 208) 13. 2% 14. 4% 12. 9% 21. 5% 16. 1% 2 to 3 50. 9 55. 2 53. 4 52. 5 52. 3 27. 2 18. 8 25. 0 16. 5 25. 4 6 or More 8. 2 11. 6 8. 7 9. 5 6. 1 51. 4% 60. 3% 44. 7% 71. 2% 56. 3% 1 14. 0 13. 7 23. 4 12. 1 16. 3 2 16. 8 13. 7 17. 0 6. 1 13. 9 3 to 4 15. 6 11. 0 17. 0 10. 6 13. 9 5 or More Q 39, 40 (N = 73) 4 to 5 Children in HH Powerball 1. 1 1. 4 0. 0 1 None Pick 3 (N = 179) Household Size Pick 4 Palmetto Cash 5 46

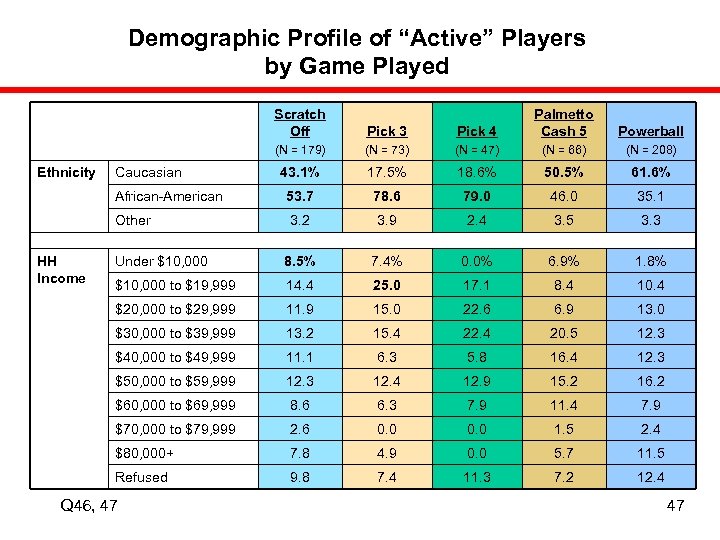

Demographic Profile of “Active” Players by Game Played Scratch Off (N = 73) (N = 47) (N = 66) (N = 208) 43. 1% 17. 5% 18. 6% 50. 5% 61. 6% African-American 53. 7 78. 6 79. 0 46. 0 35. 1 Other 3. 2 3. 9 2. 4 3. 5 3. 3 Under $10, 000 8. 5% 7. 4% 0. 0% 6. 9% 1. 8% $10, 000 to $19, 999 14. 4 25. 0 17. 1 8. 4 10. 4 $20, 000 to $29, 999 11. 9 15. 0 22. 6 6. 9 13. 0 $30, 000 to $39, 999 13. 2 15. 4 22. 4 20. 5 12. 3 $40, 000 to $49, 999 11. 1 6. 3 5. 8 16. 4 12. 3 $50, 000 to $59, 999 12. 3 12. 4 12. 9 15. 2 16. 2 $60, 000 to $69, 999 8. 6 6. 3 7. 9 11. 4 7. 9 $70, 000 to $79, 999 2. 6 0. 0 1. 5 2. 4 $80, 000+ 7. 8 4. 9 0. 0 5. 7 11. 5 Refused HH Income Powerball 9. 8 7. 4 11. 3 7. 2 12. 4 Caucasian Q 46, 47 Pick 3 (N = 179) Ethnicity Pick 4 Palmetto Cash 5 47

Demographic Profile of “Active” Players by Game Played Scratch Off (N = 73) (N = 47) (N = 66) (N = 208) 43. 1% 17. 5% 18. 6% 50. 5% 61. 6% African-American 53. 7 78. 6 79. 0 46. 0 35. 1 Other 3. 2 3. 9 2. 4 3. 5 3. 3 Under $10, 000 8. 5% 7. 4% 0. 0% 6. 9% 1. 8% $10, 000 to $19, 999 14. 4 25. 0 17. 1 8. 4 10. 4 $20, 000 to $29, 999 11. 9 15. 0 22. 6 6. 9 13. 0 $30, 000 to $39, 999 13. 2 15. 4 22. 4 20. 5 12. 3 $40, 000 to $49, 999 11. 1 6. 3 5. 8 16. 4 12. 3 $50, 000 to $59, 999 12. 3 12. 4 12. 9 15. 2 16. 2 $60, 000 to $69, 999 8. 6 6. 3 7. 9 11. 4 7. 9 $70, 000 to $79, 999 2. 6 0. 0 1. 5 2. 4 $80, 000+ 7. 8 4. 9 0. 0 5. 7 11. 5 Refused HH Income Powerball 9. 8 7. 4 11. 3 7. 2 12. 4 Caucasian Q 46, 47 Pick 3 (N = 179) Ethnicity Pick 4 Palmetto Cash 5 47

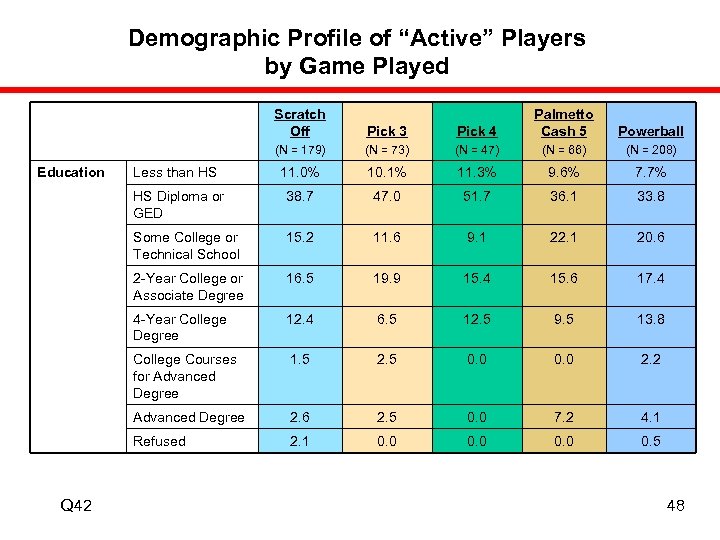

Demographic Profile of “Active” Players by Game Played Scratch Off Powerball (N = 73) (N = 47) (N = 66) (N = 208) 11. 0% 10. 1% 11. 3% 9. 6% 7. 7% HS Diploma or GED 38. 7 47. 0 51. 7 36. 1 33. 8 Some College or Technical School 15. 2 11. 6 9. 1 22. 1 20. 6 2 -Year College or Associate Degree 16. 5 19. 9 15. 4 15. 6 17. 4 4 -Year College Degree 12. 4 6. 5 12. 5 9. 5 13. 8 College Courses for Advanced Degree 1. 5 2. 5 0. 0 2. 2 Advanced Degree 2. 6 2. 5 0. 0 7. 2 4. 1 Refused Q 42 Pick 3 (N = 179) Education Pick 4 Palmetto Cash 5 Less than HS 2. 1 0. 0 0. 5 48

Demographic Profile of “Active” Players by Game Played Scratch Off Powerball (N = 73) (N = 47) (N = 66) (N = 208) 11. 0% 10. 1% 11. 3% 9. 6% 7. 7% HS Diploma or GED 38. 7 47. 0 51. 7 36. 1 33. 8 Some College or Technical School 15. 2 11. 6 9. 1 22. 1 20. 6 2 -Year College or Associate Degree 16. 5 19. 9 15. 4 15. 6 17. 4 4 -Year College Degree 12. 4 6. 5 12. 5 9. 5 13. 8 College Courses for Advanced Degree 1. 5 2. 5 0. 0 2. 2 Advanced Degree 2. 6 2. 5 0. 0 7. 2 4. 1 Refused Q 42 Pick 3 (N = 179) Education Pick 4 Palmetto Cash 5 Less than HS 2. 1 0. 0 0. 5 48

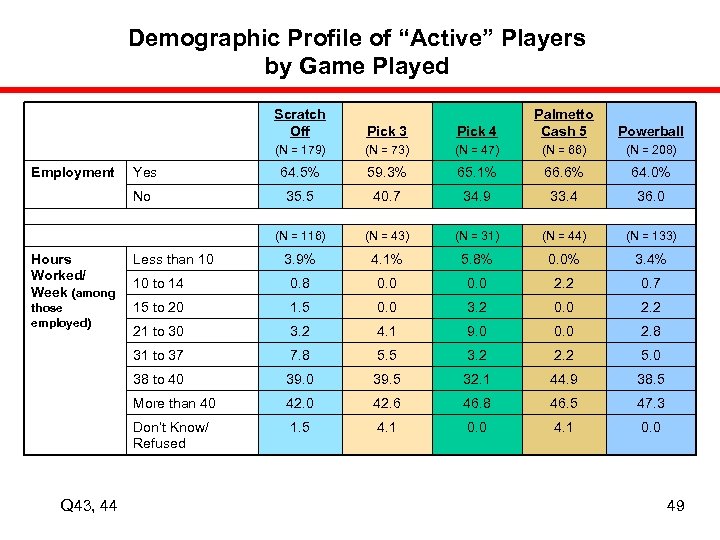

Demographic Profile of “Active” Players by Game Played Scratch Off (N = 73) (N = 47) (N = 66) (N = 208) 64. 5% 59. 3% 65. 1% 66. 6% 64. 0% 35. 5 40. 7 34. 9 33. 4 36. 0 (N = 43) (N = 31) (N = 44) (N = 133) 3. 9% 4. 1% 5. 8% 0. 0% 3. 4% 10 to 14 0. 8 0. 0 2. 2 0. 7 15 to 20 1. 5 0. 0 3. 2 0. 0 2. 2 21 to 30 3. 2 4. 1 9. 0 0. 0 2. 8 31 to 37 7. 8 5. 5 3. 2 2. 2 5. 0 38 to 40 39. 5 32. 1 44. 9 38. 5 More than 40 42. 6 46. 8 46. 5 47. 3 Don’t Know/ Refused Q 43, 44 Powerball (N = 116) those employed) Yes No Hours Worked/ Week (among Pick 3 (N = 179) Employment Pick 4 Palmetto Cash 5 1. 5 4. 1 0. 0 Less than 10 49

Demographic Profile of “Active” Players by Game Played Scratch Off (N = 73) (N = 47) (N = 66) (N = 208) 64. 5% 59. 3% 65. 1% 66. 6% 64. 0% 35. 5 40. 7 34. 9 33. 4 36. 0 (N = 43) (N = 31) (N = 44) (N = 133) 3. 9% 4. 1% 5. 8% 0. 0% 3. 4% 10 to 14 0. 8 0. 0 2. 2 0. 7 15 to 20 1. 5 0. 0 3. 2 0. 0 2. 2 21 to 30 3. 2 4. 1 9. 0 0. 0 2. 8 31 to 37 7. 8 5. 5 3. 2 2. 2 5. 0 38 to 40 39. 5 32. 1 44. 9 38. 5 More than 40 42. 6 46. 8 46. 5 47. 3 Don’t Know/ Refused Q 43, 44 Powerball (N = 116) those employed) Yes No Hours Worked/ Week (among Pick 3 (N = 179) Employment Pick 4 Palmetto Cash 5 1. 5 4. 1 0. 0 Less than 10 49

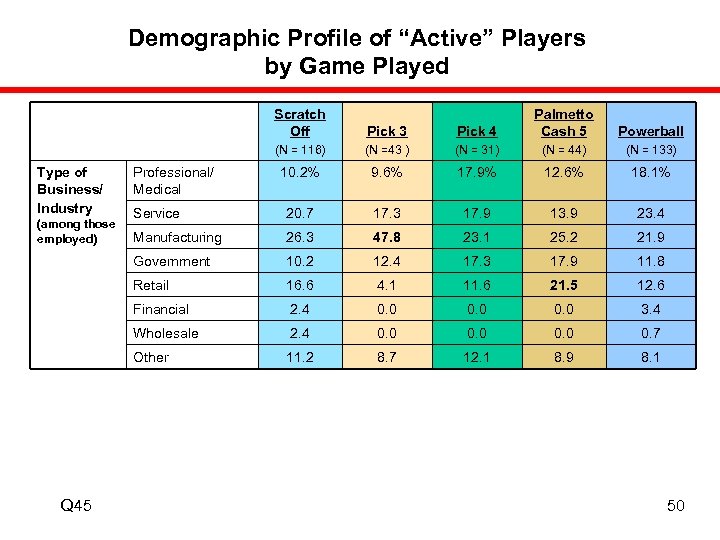

Demographic Profile of “Active” Players by Game Played Scratch Off (N = 31) (N = 44) (N = 133) 10. 2% 9. 6% 17. 9% 12. 6% 18. 1% Service 20. 7 17. 3 17. 9 13. 9 23. 4 Manufacturing 26. 3 47. 8 23. 1 25. 2 21. 9 10. 2 12. 4 17. 3 17. 9 11. 8 Retail 16. 6 4. 1 11. 6 21. 5 12. 6 Financial 2. 4 0. 0 3. 4 Wholesale 2. 4 0. 0 0. 7 Other Q 45 (N =43 ) Government (among those employed) Powerball 11. 2 8. 7 12. 1 8. 9 8. 1 Professional/ Medical Pick 3 (N = 116) Type of Business/ Industry Pick 4 Palmetto Cash 5 50

Demographic Profile of “Active” Players by Game Played Scratch Off (N = 31) (N = 44) (N = 133) 10. 2% 9. 6% 17. 9% 12. 6% 18. 1% Service 20. 7 17. 3 17. 9 13. 9 23. 4 Manufacturing 26. 3 47. 8 23. 1 25. 2 21. 9 10. 2 12. 4 17. 3 17. 9 11. 8 Retail 16. 6 4. 1 11. 6 21. 5 12. 6 Financial 2. 4 0. 0 3. 4 Wholesale 2. 4 0. 0 0. 7 Other Q 45 (N =43 ) Government (among those employed) Powerball 11. 2 8. 7 12. 1 8. 9 8. 1 Professional/ Medical Pick 3 (N = 116) Type of Business/ Industry Pick 4 Palmetto Cash 5 50

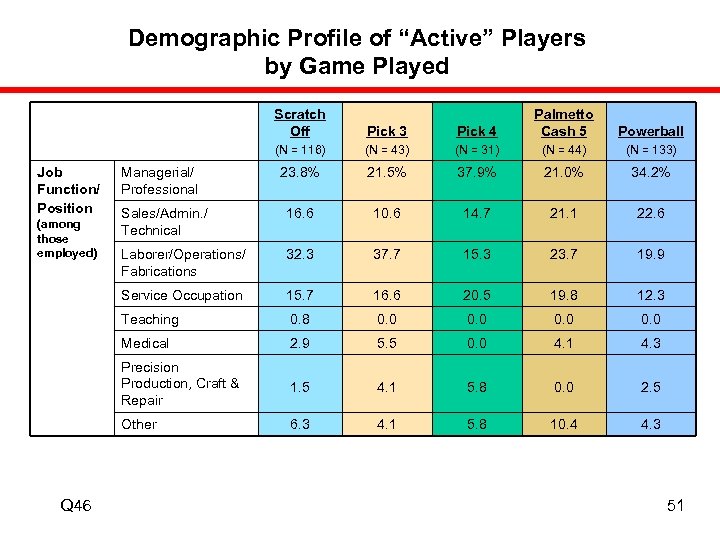

Demographic Profile of “Active” Players by Game Played Scratch Off (N = 31) (N = 44) (N = 133) 23. 8% 21. 5% 37. 9% 21. 0% 34. 2% Sales/Admin. / Technical 16. 6 10. 6 14. 7 21. 1 22. 6 Laborer/Operations/ Fabrications 32. 3 37. 7 15. 3 23. 7 19. 9 15. 7 16. 6 20. 5 19. 8 12. 3 Teaching 0. 8 0. 0 Medical 2. 9 5. 5 0. 0 4. 1 4. 3 Precision Production, Craft & Repair 1. 5 4. 1 5. 8 0. 0 2. 5 Other Q 46 (N = 43) Service Occupation (among those employed) Powerball 6. 3 4. 1 5. 8 10. 4 4. 3 Managerial/ Professional Pick 3 (N = 116) Job Function/ Position Pick 4 Palmetto Cash 5 51

Demographic Profile of “Active” Players by Game Played Scratch Off (N = 31) (N = 44) (N = 133) 23. 8% 21. 5% 37. 9% 21. 0% 34. 2% Sales/Admin. / Technical 16. 6 10. 6 14. 7 21. 1 22. 6 Laborer/Operations/ Fabrications 32. 3 37. 7 15. 3 23. 7 19. 9 15. 7 16. 6 20. 5 19. 8 12. 3 Teaching 0. 8 0. 0 Medical 2. 9 5. 5 0. 0 4. 1 4. 3 Precision Production, Craft & Repair 1. 5 4. 1 5. 8 0. 0 2. 5 Other Q 46 (N = 43) Service Occupation (among those employed) Powerball 6. 3 4. 1 5. 8 10. 4 4. 3 Managerial/ Professional Pick 3 (N = 116) Job Function/ Position Pick 4 Palmetto Cash 5 51

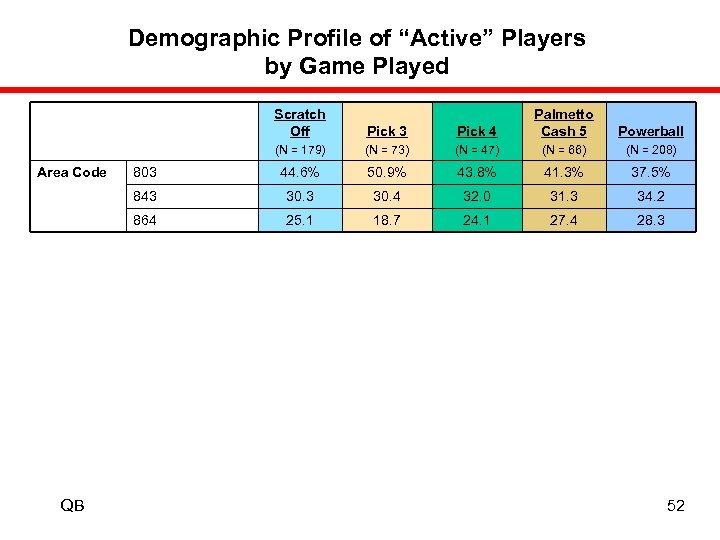

Demographic Profile of “Active” Players by Game Played Scratch Off Powerball (N = 73) (N = 47) (N = 66) (N = 208) 44. 6% 50. 9% 43. 8% 41. 3% 37. 5% 843 30. 4 32. 0 31. 3 34. 2 864 QB Pick 3 (N = 179) Area Code Pick 4 Palmetto Cash 5 803 25. 1 18. 7 24. 1 27. 4 28. 3 52

Demographic Profile of “Active” Players by Game Played Scratch Off Powerball (N = 73) (N = 47) (N = 66) (N = 208) 44. 6% 50. 9% 43. 8% 41. 3% 37. 5% 843 30. 4 32. 0 31. 3 34. 2 864 QB Pick 3 (N = 179) Area Code Pick 4 Palmetto Cash 5 803 25. 1 18. 7 24. 1 27. 4 28. 3 52

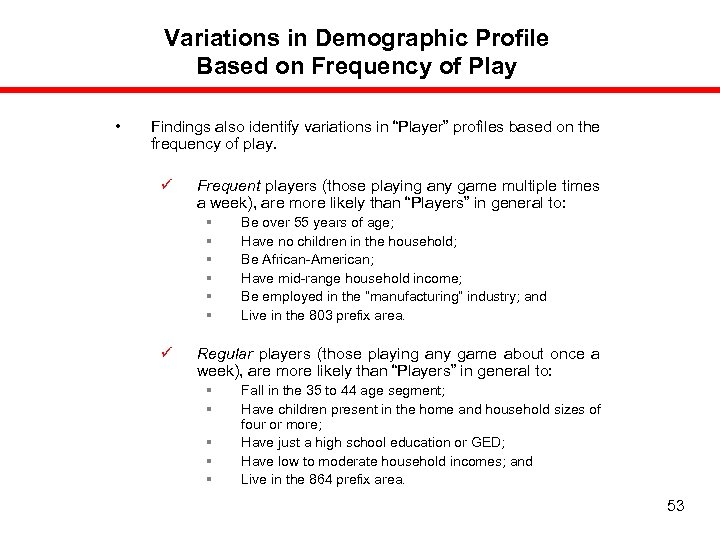

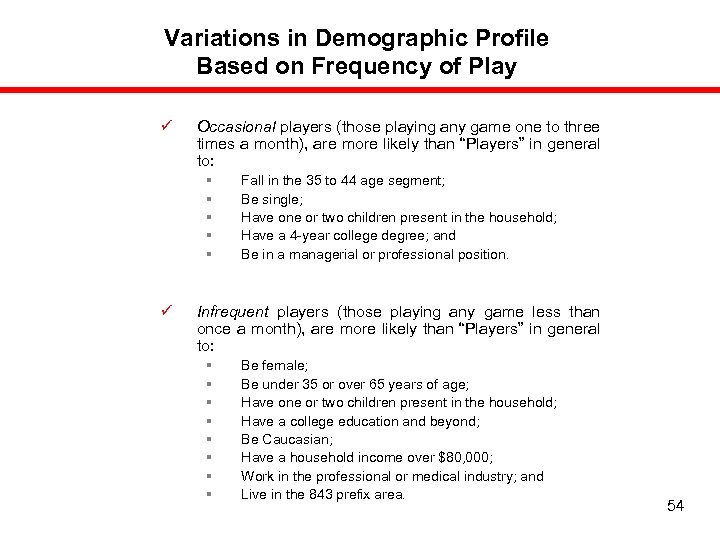

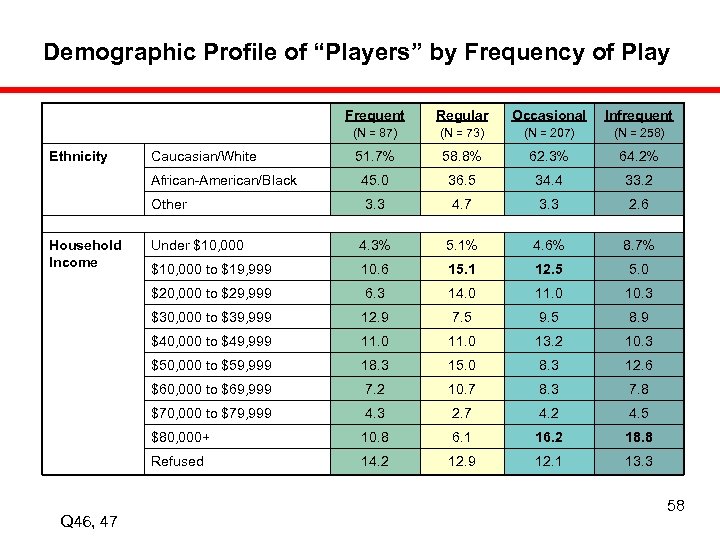

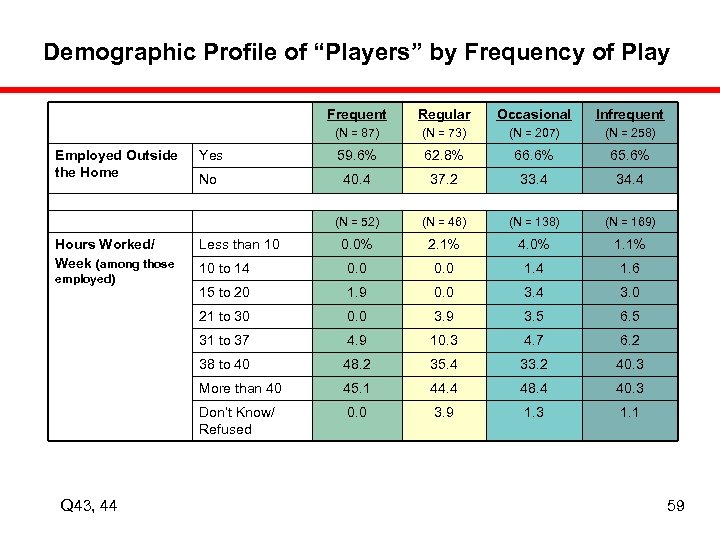

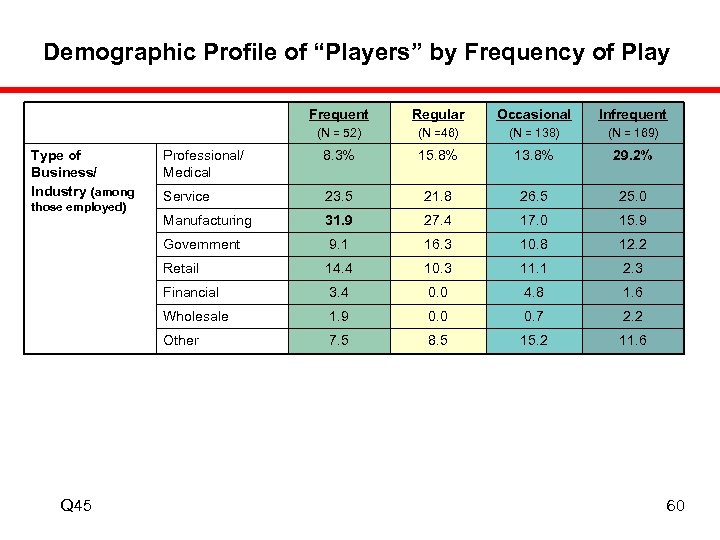

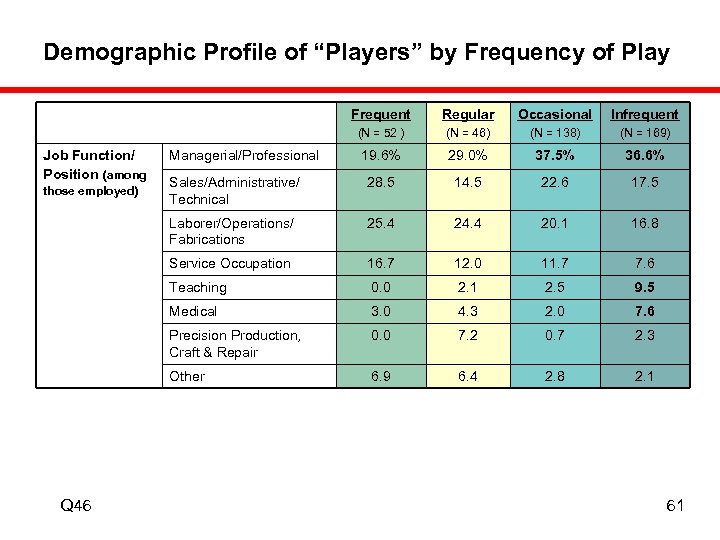

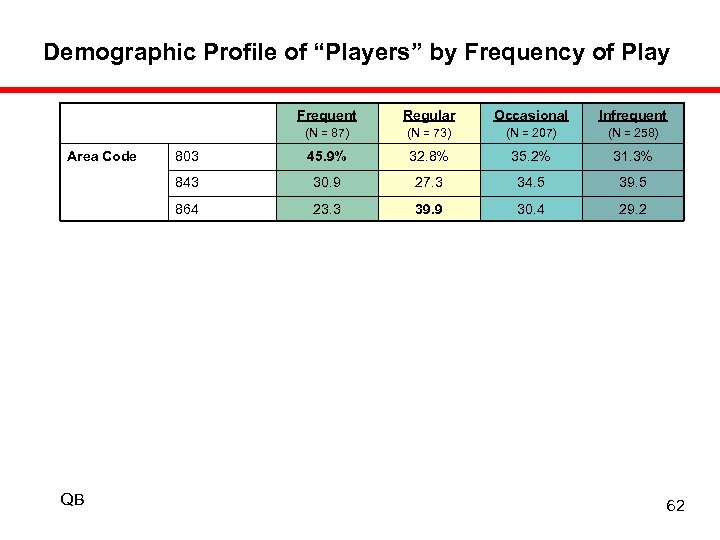

Variations in Demographic Profile Based on Frequency of Play • Findings also identify variations in “Player” profiles based on the frequency of play. ü Frequent players (those playing any game multiple times a week), are more likely than “Players” in general to: § § § ü Be over 55 years of age; Have no children in the household; Be African-American; Have mid-range household income; Be employed in the “manufacturing” industry; and Live in the 803 prefix area. Regular players (those playing any game about once a week), are more likely than “Players” in general to: § § § Fall in the 35 to 44 age segment; Have children present in the home and household sizes of four or more; Have just a high school education or GED; Have low to moderate household incomes; and Live in the 864 prefix area. 53

Variations in Demographic Profile Based on Frequency of Play • Findings also identify variations in “Player” profiles based on the frequency of play. ü Frequent players (those playing any game multiple times a week), are more likely than “Players” in general to: § § § ü Be over 55 years of age; Have no children in the household; Be African-American; Have mid-range household income; Be employed in the “manufacturing” industry; and Live in the 803 prefix area. Regular players (those playing any game about once a week), are more likely than “Players” in general to: § § § Fall in the 35 to 44 age segment; Have children present in the home and household sizes of four or more; Have just a high school education or GED; Have low to moderate household incomes; and Live in the 864 prefix area. 53

Variations in Demographic Profile Based on Frequency of Play ü Occasional players (those playing any game one to three times a month), are more likely than “Players” in general to: § § § ü Fall in the 35 to 44 age segment; Be single; Have one or two children present in the household; Have a 4 -year college degree; and Be in a managerial or professional position. Infrequent players (those playing any game less than once a month), are more likely than “Players” in general to: § § § § Be female; Be under 35 or over 65 years of age; Have one or two children present in the household; Have a college education and beyond; Be Caucasian; Have a household income over $80, 000; Work in the professional or medical industry; and Live in the 843 prefix area. 54

Variations in Demographic Profile Based on Frequency of Play ü Occasional players (those playing any game one to three times a month), are more likely than “Players” in general to: § § § ü Fall in the 35 to 44 age segment; Be single; Have one or two children present in the household; Have a 4 -year college degree; and Be in a managerial or professional position. Infrequent players (those playing any game less than once a month), are more likely than “Players” in general to: § § § § Be female; Be under 35 or over 65 years of age; Have one or two children present in the household; Have a college education and beyond; Be Caucasian; Have a household income over $80, 000; Work in the professional or medical industry; and Live in the 843 prefix area. 54

Demographic Profile of “Players” by Frequency of Play Frequent (N = 207) (N = 258) Male 54. 9 63. 8 52. 7 46. 4 45. 1 36. 2 47. 3 53. 6 18 to 24 4. 3 6. 4 5. 0 6. 3 15. 6 13. 1 19. 2 22. 3 35 to 44 19. 9 44. 8 31. 8 24. 8 45 to 54 22. 1 21. 2 23. 0 24. 5 55 to 64 22. 5 10. 5 11. 9 10. 7 65+ 15. 6 4. 0 9. 1 11. 4 61. 8% 55. 2% 57. 2% 60. 1 Single 18. 6 23. 3 25. 0 17. 1 Widowed/Divorced/Sep. QA, C, 41 (N = 73) 25 to 34 Marital Status Infrequent Female Age Occasional (N = 87) Gender Regular 16. 5 21. 4 17. 3 20. 2 Married 55

Demographic Profile of “Players” by Frequency of Play Frequent (N = 207) (N = 258) Male 54. 9 63. 8 52. 7 46. 4 45. 1 36. 2 47. 3 53. 6 18 to 24 4. 3 6. 4 5. 0 6. 3 15. 6 13. 1 19. 2 22. 3 35 to 44 19. 9 44. 8 31. 8 24. 8 45 to 54 22. 1 21. 2 23. 0 24. 5 55 to 64 22. 5 10. 5 11. 9 10. 7 65+ 15. 6 4. 0 9. 1 11. 4 61. 8% 55. 2% 57. 2% 60. 1 Single 18. 6 23. 3 25. 0 17. 1 Widowed/Divorced/Sep. QA, C, 41 (N = 73) 25 to 34 Marital Status Infrequent Female Age Occasional (N = 87) Gender Regular 16. 5 21. 4 17. 3 20. 2 Married 55

Demographic Profile of “Players” by Frequency of Play Frequent (N = 73) (N = 207) (N = 258) 20. 1% 17. 4% 16. 0% 14. 6% 55. 3 43. 1 49. 7 54. 2 4 to 5 19. 0 32. 0 28. 6 24. 6 6 or More 4. 5 7. 5 5. 7 5. 5 70. 1% 56. 2% 51. 9% 1 16. 1 8. 2 17. 4 20. 9 2 2. 3 24. 7 18. 4 18. 2 3 to 4 9. 2 12. 3 13. 5 7. 4 5 or More Q 39, 40 Infrequent 2 to 3 Children in HH Occasional (N = 87) Household Size Regular 1. 1 0. 0 1. 6 1 None 56

Demographic Profile of “Players” by Frequency of Play Frequent (N = 73) (N = 207) (N = 258) 20. 1% 17. 4% 16. 0% 14. 6% 55. 3 43. 1 49. 7 54. 2 4 to 5 19. 0 32. 0 28. 6 24. 6 6 or More 4. 5 7. 5 5. 7 5. 5 70. 1% 56. 2% 51. 9% 1 16. 1 8. 2 17. 4 20. 9 2 2. 3 24. 7 18. 4 18. 2 3 to 4 9. 2 12. 3 13. 5 7. 4 5 or More Q 39, 40 Infrequent 2 to 3 Children in HH Occasional (N = 87) Household Size Regular 1. 1 0. 0 1. 6 1 None 56

Demographic Profile of “Players” by Frequency of Play Frequent Infrequent (N = 73) (N = 207) (N = 258) Less than HS 8. 6% 7. 2% 6. 2% 4. 6% HS Diploma or GED 33. 8 46. 7 26. 8 25. 9 Some College or Technical School 18. 1 19. 2 19. 5 21. 1 2 -Year College or Associate Degree 22. 8 11. 6 12. 0 4 -Year College Degree 12. 1 7. 5 22. 4 20. 6 College Courses for Advanced Degree 1. 1 1. 3 4. 6 2. 6 Advanced Degree 2. 2 5. 1 7. 0 12. 4 Refused Q 42 Occasional (N = 87) Education Regular 1. 1 1. 3 0. 9 0. 8 57

Demographic Profile of “Players” by Frequency of Play Frequent Infrequent (N = 73) (N = 207) (N = 258) Less than HS 8. 6% 7. 2% 6. 2% 4. 6% HS Diploma or GED 33. 8 46. 7 26. 8 25. 9 Some College or Technical School 18. 1 19. 2 19. 5 21. 1 2 -Year College or Associate Degree 22. 8 11. 6 12. 0 4 -Year College Degree 12. 1 7. 5 22. 4 20. 6 College Courses for Advanced Degree 1. 1 1. 3 4. 6 2. 6 Advanced Degree 2. 2 5. 1 7. 0 12. 4 Refused Q 42 Occasional (N = 87) Education Regular 1. 1 1. 3 0. 9 0. 8 57

Demographic Profile of “Players” by Frequency of Play Frequent (N = 73) (N = 207) (N = 258) 51. 7% 58. 8% 62. 3% 64. 2% 45. 0 36. 5 34. 4 33. 2 Other 3. 3 4. 7 3. 3 2. 6 Under $10, 000 4. 3% 5. 1% 4. 6% 8. 7% $10, 000 to $19, 999 10. 6 15. 1 12. 5 5. 0 $20, 000 to $29, 999 6. 3 14. 0 11. 0 10. 3 $30, 000 to $39, 999 12. 9 7. 5 9. 5 8. 9 $40, 000 to $49, 999 11. 0 13. 2 10. 3 $50, 000 to $59, 999 18. 3 15. 0 8. 3 12. 6 $60, 000 to $69, 999 7. 2 10. 7 8. 3 7. 8 $70, 000 to $79, 999 4. 3 2. 7 4. 2 4. 5 $80, 000+ 10. 8 6. 1 16. 2 18. 8 Refused Q 46, 47 Infrequent African-American/Black Household Income Occasional (N = 87) Ethnicity Regular 14. 2 12. 9 12. 1 13. 3 Caucasian/White 58

Demographic Profile of “Players” by Frequency of Play Frequent (N = 73) (N = 207) (N = 258) 51. 7% 58. 8% 62. 3% 64. 2% 45. 0 36. 5 34. 4 33. 2 Other 3. 3 4. 7 3. 3 2. 6 Under $10, 000 4. 3% 5. 1% 4. 6% 8. 7% $10, 000 to $19, 999 10. 6 15. 1 12. 5 5. 0 $20, 000 to $29, 999 6. 3 14. 0 11. 0 10. 3 $30, 000 to $39, 999 12. 9 7. 5 9. 5 8. 9 $40, 000 to $49, 999 11. 0 13. 2 10. 3 $50, 000 to $59, 999 18. 3 15. 0 8. 3 12. 6 $60, 000 to $69, 999 7. 2 10. 7 8. 3 7. 8 $70, 000 to $79, 999 4. 3 2. 7 4. 2 4. 5 $80, 000+ 10. 8 6. 1 16. 2 18. 8 Refused Q 46, 47 Infrequent African-American/Black Household Income Occasional (N = 87) Ethnicity Regular 14. 2 12. 9 12. 1 13. 3 Caucasian/White 58

Demographic Profile of “Players” by Frequency of Play Frequent (N = 207) (N = 258) Yes 59. 6% 62. 8% 66. 6% 65. 6% No 40. 4 37. 2 33. 4 34. 4 (N = 46) (N = 138) (N = 169) 0. 0% 2. 1% 4. 0% 1. 1% 10 to 14 0. 0 1. 4 1. 6 15 to 20 1. 9 0. 0 3. 4 3. 0 0. 0 3. 9 3. 5 6. 5 31 to 37 4. 9 10. 3 4. 7 6. 2 38 to 40 48. 2 35. 4 33. 2 40. 3 More than 40 45. 1 44. 4 48. 4 40. 3 Don’t Know/ Refused Q 43, 44 (N = 73) 21 to 30 employed) Infrequent (N = 52) Hours Worked/ Week (among those Occasional (N = 87) Employed Outside the Home Regular 0. 0 3. 9 1. 3 1. 1 Less than 10 59

Demographic Profile of “Players” by Frequency of Play Frequent (N = 207) (N = 258) Yes 59. 6% 62. 8% 66. 6% 65. 6% No 40. 4 37. 2 33. 4 34. 4 (N = 46) (N = 138) (N = 169) 0. 0% 2. 1% 4. 0% 1. 1% 10 to 14 0. 0 1. 4 1. 6 15 to 20 1. 9 0. 0 3. 4 3. 0 0. 0 3. 9 3. 5 6. 5 31 to 37 4. 9 10. 3 4. 7 6. 2 38 to 40 48. 2 35. 4 33. 2 40. 3 More than 40 45. 1 44. 4 48. 4 40. 3 Don’t Know/ Refused Q 43, 44 (N = 73) 21 to 30 employed) Infrequent (N = 52) Hours Worked/ Week (among those Occasional (N = 87) Employed Outside the Home Regular 0. 0 3. 9 1. 3 1. 1 Less than 10 59

Demographic Profile of “Players” by Frequency of Play Frequent (N =46) (N = 138) (N = 169) Professional/ Medical 8. 3% 15. 8% 13. 8% 29. 2% Service 23. 5 21. 8 26. 5 25. 0 Manufacturing 31. 9 27. 4 17. 0 15. 9 9. 1 16. 3 10. 8 12. 2 Retail 14. 4 10. 3 11. 1 2. 3 Financial 3. 4 0. 0 4. 8 1. 6 Wholesale 1. 9 0. 0 0. 7 2. 2 Other Q 45 Infrequent Government those employed) Occasional (N = 52) Type of Business/ Industry (among Regular 7. 5 8. 5 15. 2 11. 6 60

Demographic Profile of “Players” by Frequency of Play Frequent (N =46) (N = 138) (N = 169) Professional/ Medical 8. 3% 15. 8% 13. 8% 29. 2% Service 23. 5 21. 8 26. 5 25. 0 Manufacturing 31. 9 27. 4 17. 0 15. 9 9. 1 16. 3 10. 8 12. 2 Retail 14. 4 10. 3 11. 1 2. 3 Financial 3. 4 0. 0 4. 8 1. 6 Wholesale 1. 9 0. 0 0. 7 2. 2 Other Q 45 Infrequent Government those employed) Occasional (N = 52) Type of Business/ Industry (among Regular 7. 5 8. 5 15. 2 11. 6 60

Demographic Profile of “Players” by Frequency of Play Frequent (N = 46) (N = 138) (N = 169) 19. 6% 29. 0% 37. 5% 36. 6% Sales/Administrative/ Technical 28. 5 14. 5 22. 6 17. 5 25. 4 24. 4 20. 1 16. 8 Service Occupation 16. 7 12. 0 11. 7 7. 6 Teaching 0. 0 2. 1 2. 5 9. 5 Medical 3. 0 4. 3 2. 0 7. 6 Precision Production, Craft & Repair 0. 0 7. 2 0. 7 2. 3 Other Q 46 Infrequent Laborer/Operations/ Fabrications those employed) Occasional (N = 52 ) Job Function/ Position (among Regular 6. 9 6. 4 2. 8 2. 1 Managerial/Professional 61

Demographic Profile of “Players” by Frequency of Play Frequent (N = 46) (N = 138) (N = 169) 19. 6% 29. 0% 37. 5% 36. 6% Sales/Administrative/ Technical 28. 5 14. 5 22. 6 17. 5 25. 4 24. 4 20. 1 16. 8 Service Occupation 16. 7 12. 0 11. 7 7. 6 Teaching 0. 0 2. 1 2. 5 9. 5 Medical 3. 0 4. 3 2. 0 7. 6 Precision Production, Craft & Repair 0. 0 7. 2 0. 7 2. 3 Other Q 46 Infrequent Laborer/Operations/ Fabrications those employed) Occasional (N = 52 ) Job Function/ Position (among Regular 6. 9 6. 4 2. 8 2. 1 Managerial/Professional 61

Demographic Profile of “Players” by Frequency of Play Frequent Infrequent (N = 73) (N = 207) (N = 258) 803 45. 9% 32. 8% 35. 2% 31. 3% 843 30. 9 27. 3 34. 5 39. 5 864 QB Occasional (N = 87) Area Code Regular 23. 3 39. 9 30. 4 29. 2 62

Demographic Profile of “Players” by Frequency of Play Frequent Infrequent (N = 73) (N = 207) (N = 258) 803 45. 9% 32. 8% 35. 2% 31. 3% 843 30. 9 27. 3 34. 5 39. 5 864 QB Occasional (N = 87) Area Code Regular 23. 3 39. 9 30. 4 29. 2 62

A Market. Search Study General Purchase Characteristics

A Market. Search Study General Purchase Characteristics

General Purchase Characteristics • As already indicated, most “Players” purchase SC Education Lottery tickets on an “Occasional” (33%) or “Infrequent” (41%) basis, with only about a quarter buying them on a “Frequent” (14%) or “Regular” (12%) basis. • The overwhelming majority (92%) indicates they buy five or fewer tickets per purchase, spending an average of $5. 30. “Frequent” players, however, tend to buy more tickets (28% buy more than five per purchase) and spend more (average of $9. 20) each time they play. “Regular” ($6. 40) and “Occasional” ($5. 30) players also spend more per purchase (on average) than “Infrequent” players ($3. 70). 63

General Purchase Characteristics • As already indicated, most “Players” purchase SC Education Lottery tickets on an “Occasional” (33%) or “Infrequent” (41%) basis, with only about a quarter buying them on a “Frequent” (14%) or “Regular” (12%) basis. • The overwhelming majority (92%) indicates they buy five or fewer tickets per purchase, spending an average of $5. 30. “Frequent” players, however, tend to buy more tickets (28% buy more than five per purchase) and spend more (average of $9. 20) each time they play. “Regular” ($6. 40) and “Occasional” ($5. 30) players also spend more per purchase (on average) than “Infrequent” players ($3. 70). 63

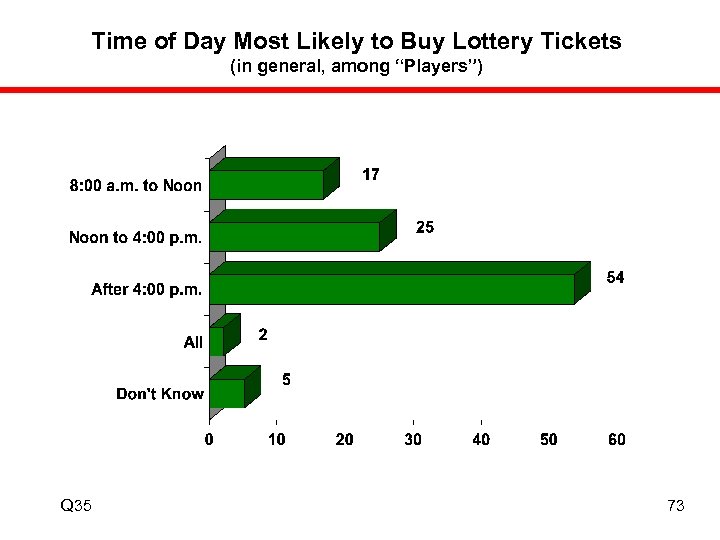

General Purchase Characteristics • More than nine out of ten (93%) “Players” indicate they purchase their tickets at a convenience store that also sells gasoline. This tends to be consistent regardless of frequency of play or type of game played. • Findings suggest there is not a dramatic difference between weekdays and weekends as far as Lottery ticket purchase is concerned -- 43% say they buy tickets primarily during the week, 31% primarily on the weekends, and 21% both. • The most common time of day, however, is after 4: 00 p. m. (before 8: 00 a. m. ). More than half (54%) indicate they buy their tickets between these times. 64

General Purchase Characteristics • More than nine out of ten (93%) “Players” indicate they purchase their tickets at a convenience store that also sells gasoline. This tends to be consistent regardless of frequency of play or type of game played. • Findings suggest there is not a dramatic difference between weekdays and weekends as far as Lottery ticket purchase is concerned -- 43% say they buy tickets primarily during the week, 31% primarily on the weekends, and 21% both. • The most common time of day, however, is after 4: 00 p. m. (before 8: 00 a. m. ). More than half (54%) indicate they buy their tickets between these times. 64

Frequency of Play (Any Game) (among “Players”) percent Q 2 65

Frequency of Play (Any Game) (among “Players”) percent Q 2 65

Frequency of Play (Any Game) (among “Players”) percent Q 2 66

Frequency of Play (Any Game) (among “Players”) percent Q 2 66

Number of Tickets/Games Purchased per Time (in general, among “Players”, N = 633) percent Q 3 67

Number of Tickets/Games Purchased per Time (in general, among “Players”, N = 633) percent Q 3 67

Number of Tickets/Games Purchased per Time (% indicating “ 6 or more, ” in general, by general frequency of play) percent Q 3 68

Number of Tickets/Games Purchased per Time (% indicating “ 6 or more, ” in general, by general frequency of play) percent Q 3 68

Estimated $ Spent Per Purchase (among “Players”, N = 633) Mean = $5. 30 percent Q 4 69

Estimated $ Spent Per Purchase (among “Players”, N = 633) Mean = $5. 30 percent Q 4 69

Estimated $ Spent per Purchase (calculated mean $, in general, by general frequency of play) Q 3 70

Estimated $ Spent per Purchase (calculated mean $, in general, by general frequency of play) Q 3 70

Where Most Likely to Buy Lottery Tickets (in general, among “Players”) Q 33 71

Where Most Likely to Buy Lottery Tickets (in general, among “Players”) Q 33 71

When Buy Most Lottery Tickets (in general, among “Players”) Q 34 72

When Buy Most Lottery Tickets (in general, among “Players”) Q 34 72

Time of Day Most Likely to Buy Lottery Tickets (in general, among “Players”) Q 35 73

Time of Day Most Likely to Buy Lottery Tickets (in general, among “Players”) Q 35 73

A Market. Search Study Review of Individual Games

A Market. Search Study Review of Individual Games

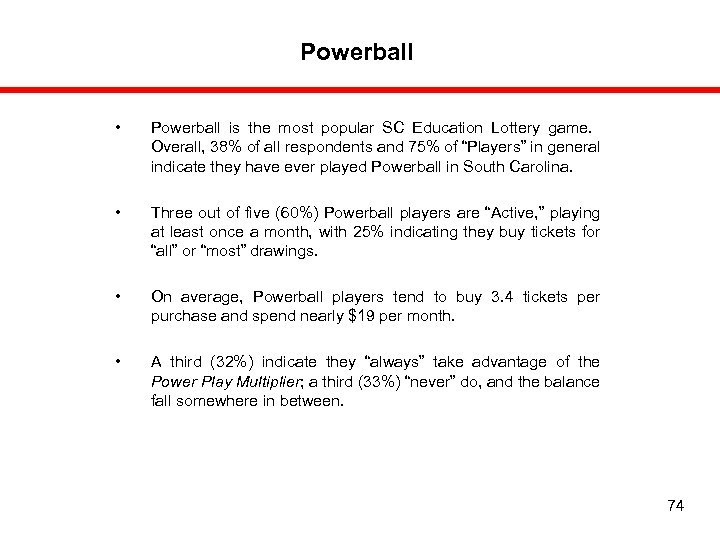

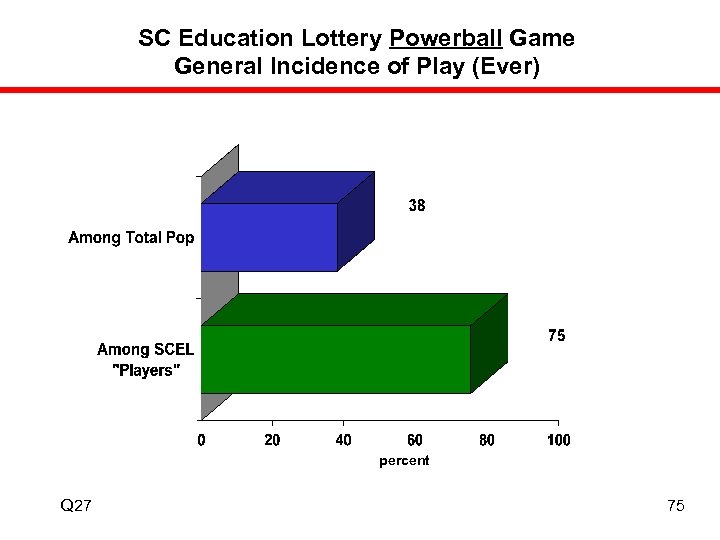

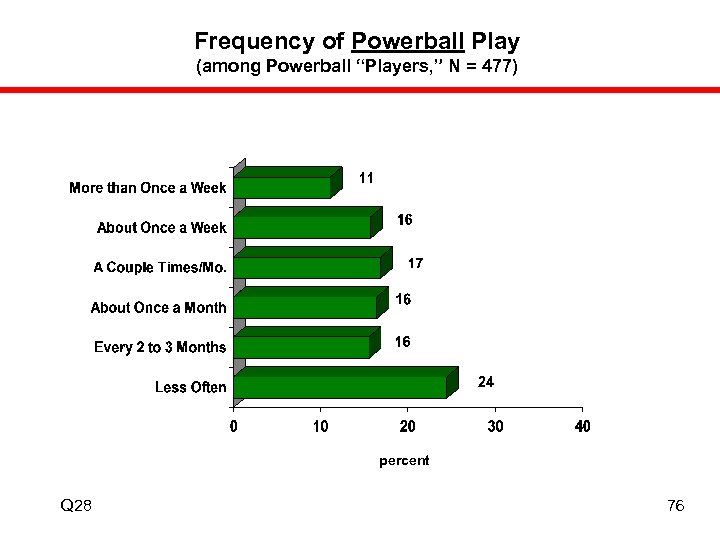

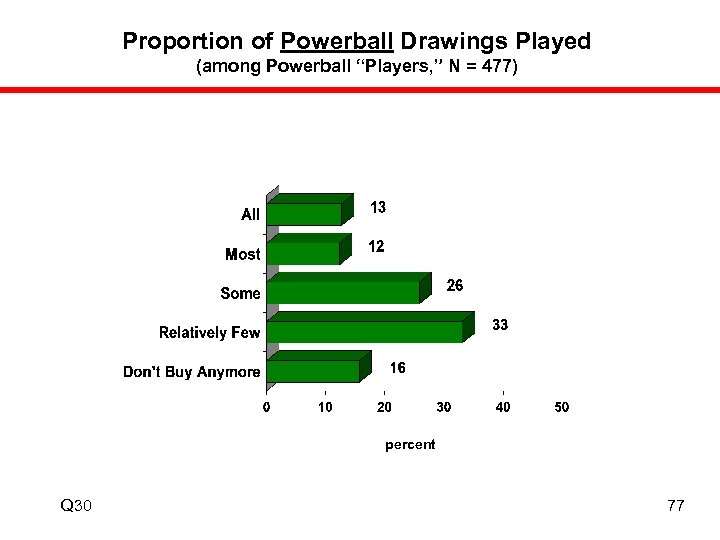

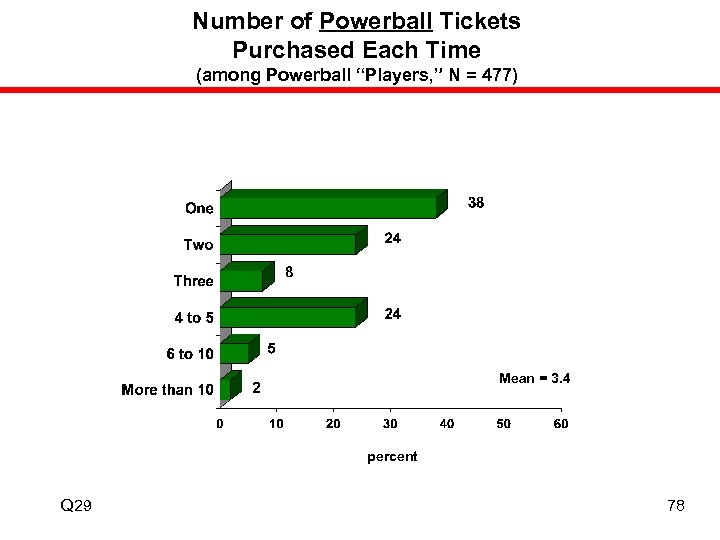

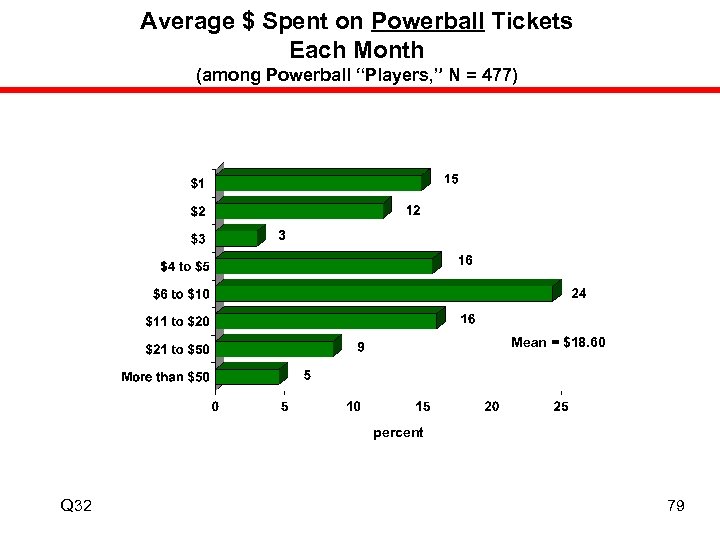

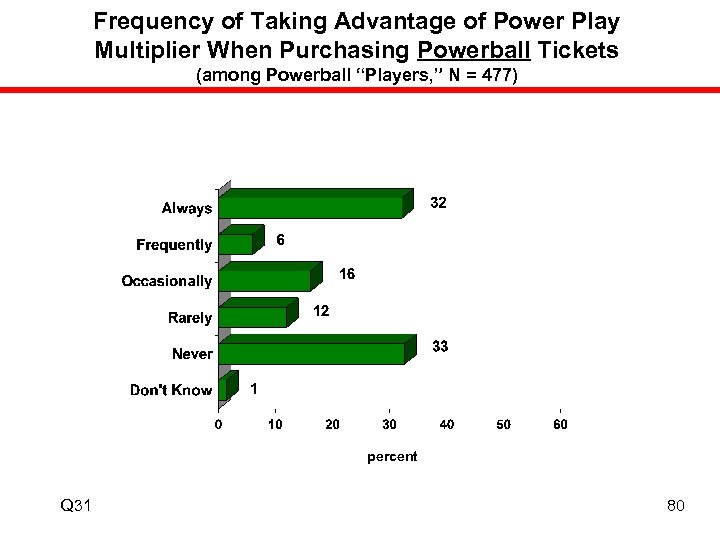

Powerball • Powerball is the most popular SC Education Lottery game. Overall, 38% of all respondents and 75% of “Players” in general indicate they have ever played Powerball in South Carolina. • Three out of five (60%) Powerball players are “Active, ” playing at least once a month, with 25% indicating they buy tickets for “all” or “most” drawings. • On average, Powerball players tend to buy 3. 4 tickets per purchase and spend nearly $19 per month. • A third (32%) indicate they “always” take advantage of the Power Play Multiplier; a third (33%) “never” do, and the balance fall somewhere in between. 74

Powerball • Powerball is the most popular SC Education Lottery game. Overall, 38% of all respondents and 75% of “Players” in general indicate they have ever played Powerball in South Carolina. • Three out of five (60%) Powerball players are “Active, ” playing at least once a month, with 25% indicating they buy tickets for “all” or “most” drawings. • On average, Powerball players tend to buy 3. 4 tickets per purchase and spend nearly $19 per month. • A third (32%) indicate they “always” take advantage of the Power Play Multiplier; a third (33%) “never” do, and the balance fall somewhere in between. 74

SC Education Lottery Powerball Game General Incidence of Play (Ever) percent Q 27 75

SC Education Lottery Powerball Game General Incidence of Play (Ever) percent Q 27 75

Frequency of Powerball Play (among Powerball “Players, ” N = 477) percent Q 28 76

Frequency of Powerball Play (among Powerball “Players, ” N = 477) percent Q 28 76

Proportion of Powerball Drawings Played (among Powerball “Players, ” N = 477) percent Q 30 77

Proportion of Powerball Drawings Played (among Powerball “Players, ” N = 477) percent Q 30 77

Number of Powerball Tickets Purchased Each Time (among Powerball “Players, ” N = 477) Mean = 3. 4 percent Q 29 78

Number of Powerball Tickets Purchased Each Time (among Powerball “Players, ” N = 477) Mean = 3. 4 percent Q 29 78

Average $ Spent on Powerball Tickets Each Month (among Powerball “Players, ” N = 477) Mean = $18. 60 percent Q 32 79

Average $ Spent on Powerball Tickets Each Month (among Powerball “Players, ” N = 477) Mean = $18. 60 percent Q 32 79

Frequency of Taking Advantage of Power Play Multiplier When Purchasing Powerball Tickets (among Powerball “Players, ” N = 477) percent Q 31 80

Frequency of Taking Advantage of Power Play Multiplier When Purchasing Powerball Tickets (among Powerball “Players, ” N = 477) percent Q 31 80

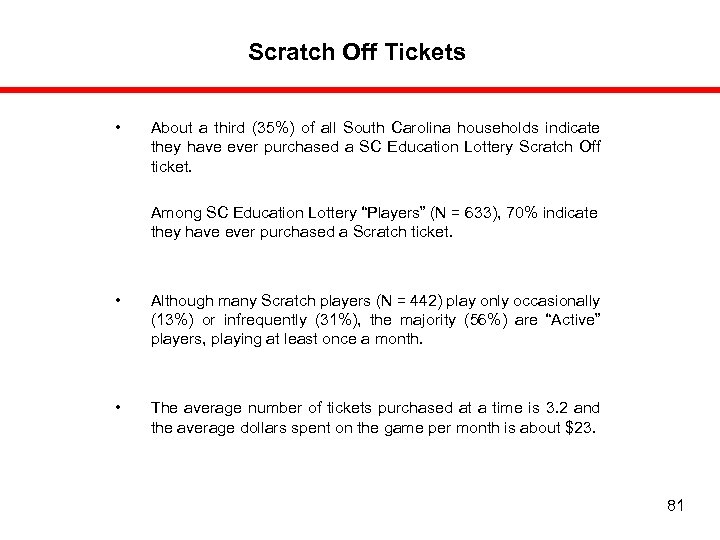

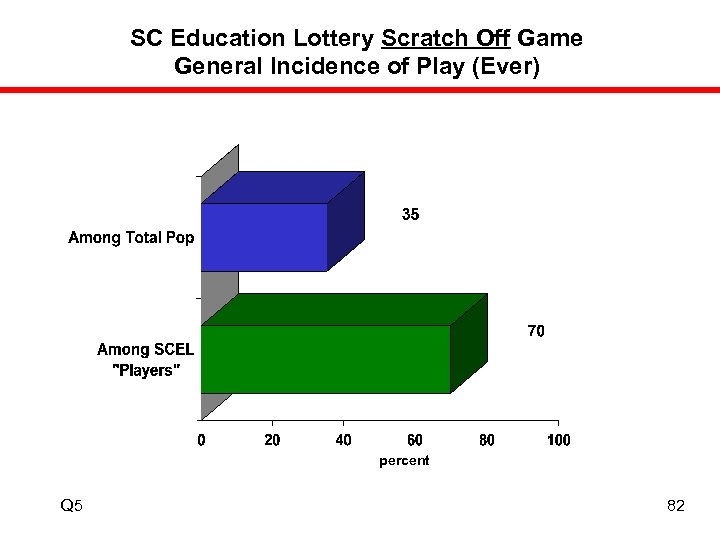

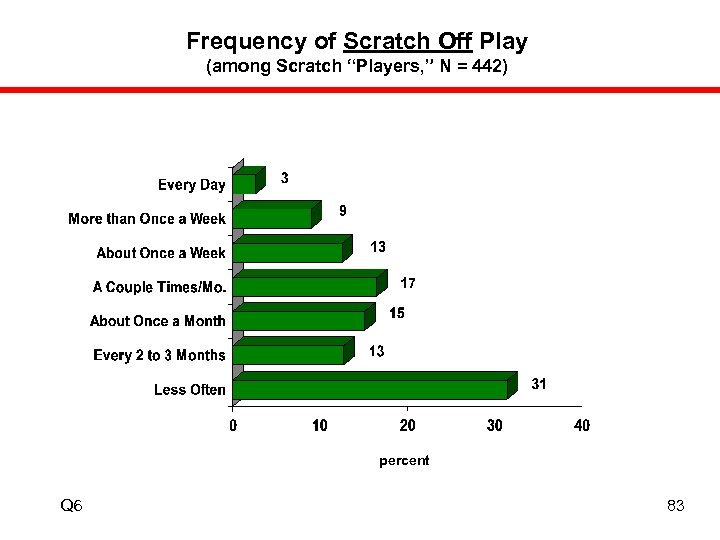

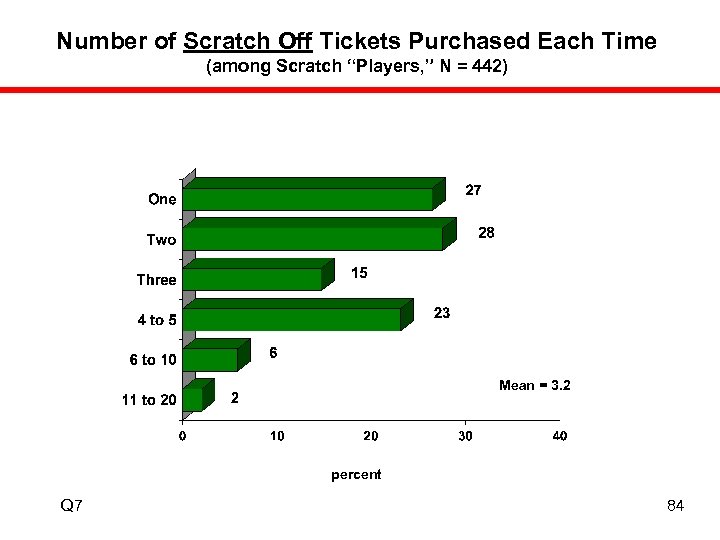

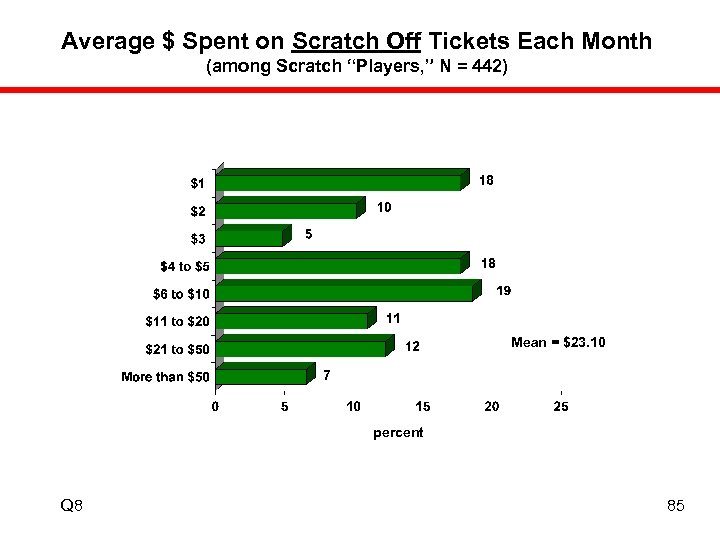

Scratch Off Tickets • About a third (35%) of all South Carolina households indicate they have ever purchased a SC Education Lottery Scratch Off ticket. Among SC Education Lottery “Players” (N = 633), 70% indicate they have ever purchased a Scratch ticket. • Although many Scratch players (N = 442) play only occasionally (13%) or infrequently (31%), the majority (56%) are “Active” players, playing at least once a month. • The average number of tickets purchased at a time is 3. 2 and the average dollars spent on the game per month is about $23. 81

Scratch Off Tickets • About a third (35%) of all South Carolina households indicate they have ever purchased a SC Education Lottery Scratch Off ticket. Among SC Education Lottery “Players” (N = 633), 70% indicate they have ever purchased a Scratch ticket. • Although many Scratch players (N = 442) play only occasionally (13%) or infrequently (31%), the majority (56%) are “Active” players, playing at least once a month. • The average number of tickets purchased at a time is 3. 2 and the average dollars spent on the game per month is about $23. 81

SC Education Lottery Scratch Off Game General Incidence of Play (Ever) percent Q 5 82

SC Education Lottery Scratch Off Game General Incidence of Play (Ever) percent Q 5 82

Frequency of Scratch Off Play (among Scratch “Players, ” N = 442) percent Q 6 83

Frequency of Scratch Off Play (among Scratch “Players, ” N = 442) percent Q 6 83

Number of Scratch Off Tickets Purchased Each Time (among Scratch “Players, ” N = 442) Mean = 3. 2 percent Q 7 84

Number of Scratch Off Tickets Purchased Each Time (among Scratch “Players, ” N = 442) Mean = 3. 2 percent Q 7 84

Average $ Spent on Scratch Off Tickets Each Month (among Scratch “Players, ” N = 442) Mean = $23. 10 percent Q 8 85

Average $ Spent on Scratch Off Tickets Each Month (among Scratch “Players, ” N = 442) Mean = $23. 10 percent Q 8 85

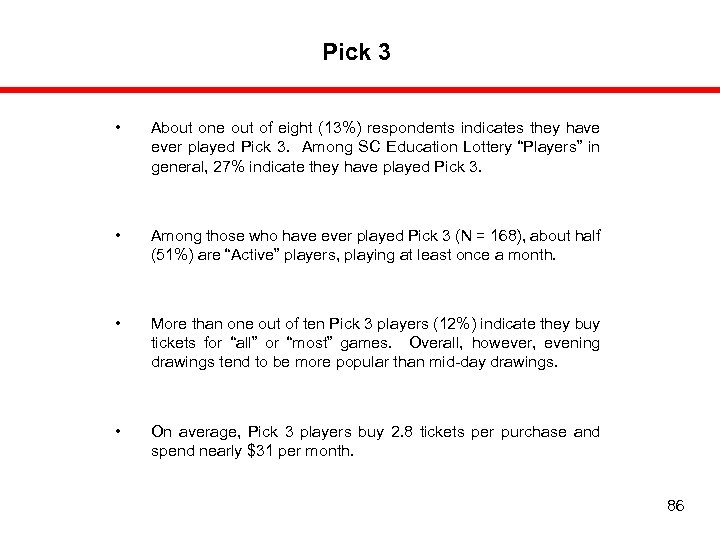

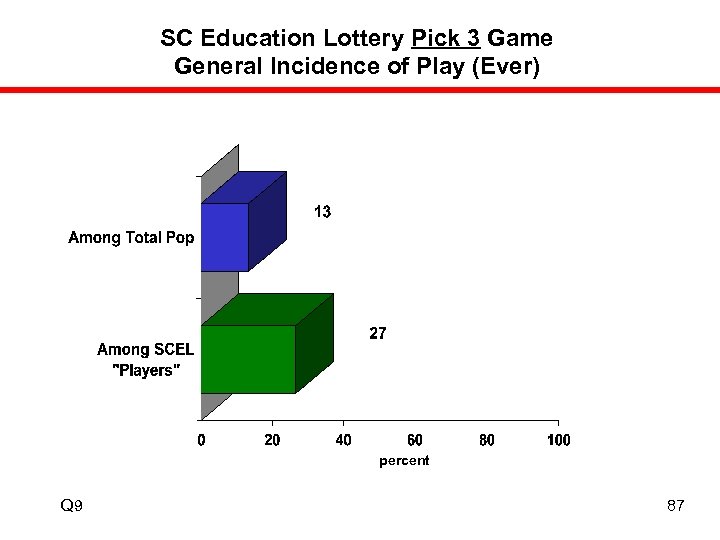

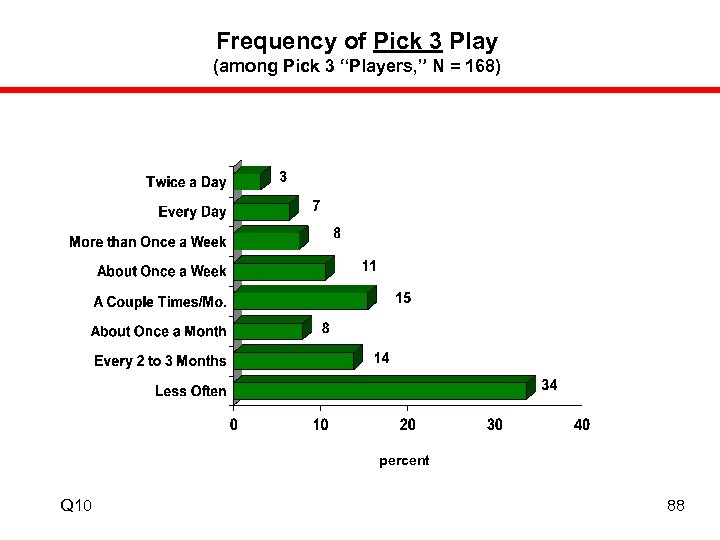

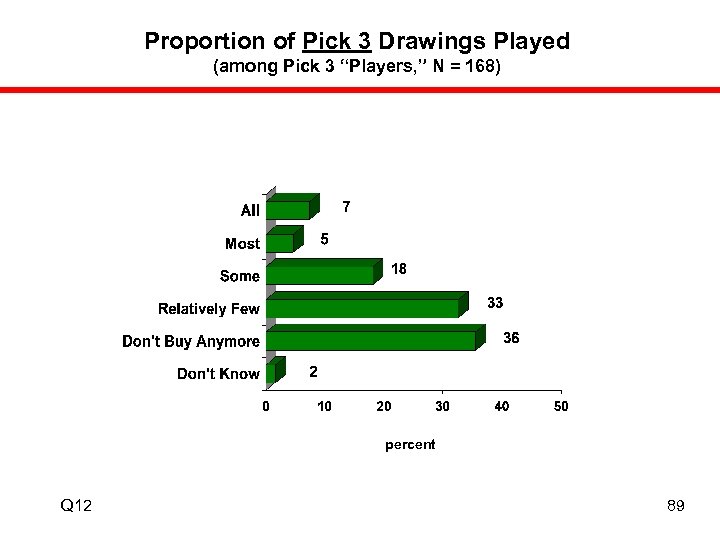

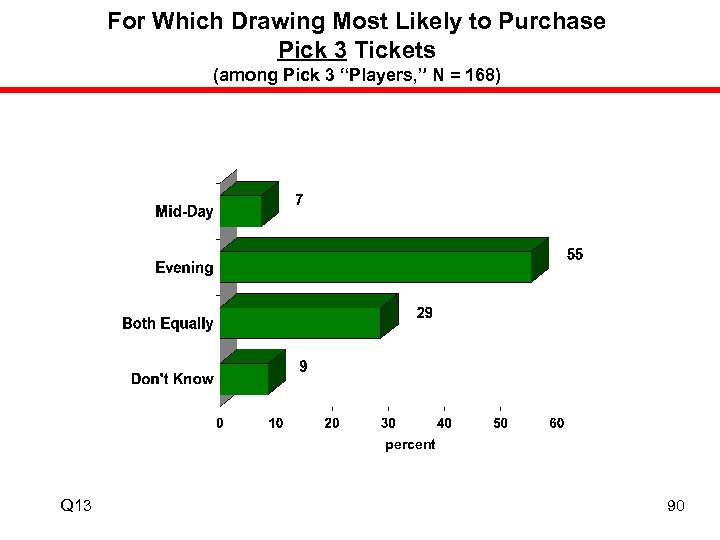

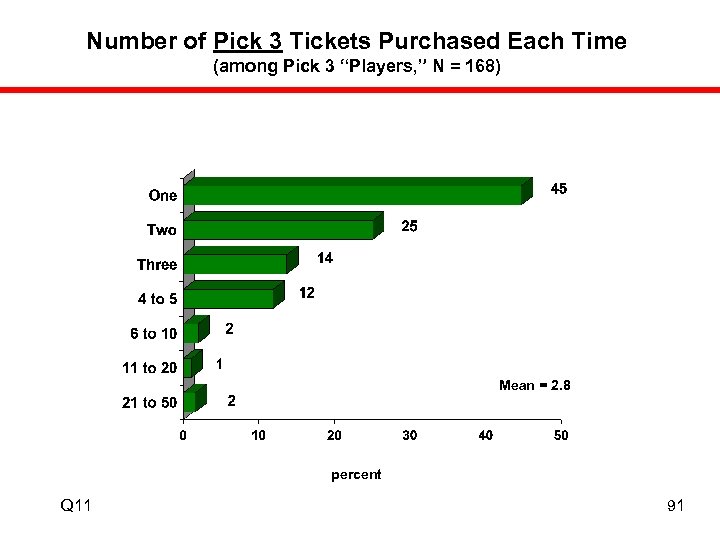

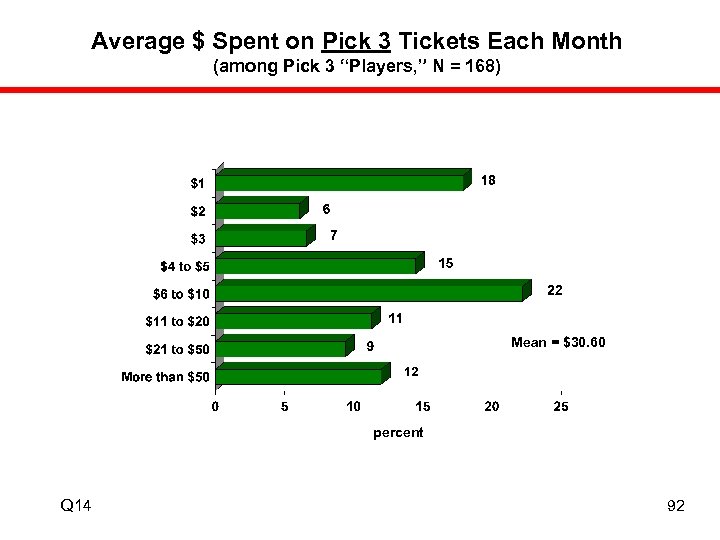

Pick 3 • About one out of eight (13%) respondents indicates they have ever played Pick 3. Among SC Education Lottery “Players” in general, 27% indicate they have played Pick 3. • Among those who have ever played Pick 3 (N = 168), about half (51%) are “Active” players, playing at least once a month. • More than one out of ten Pick 3 players (12%) indicate they buy tickets for “all” or “most” games. Overall, however, evening drawings tend to be more popular than mid-day drawings. • On average, Pick 3 players buy 2. 8 tickets per purchase and spend nearly $31 per month. 86

Pick 3 • About one out of eight (13%) respondents indicates they have ever played Pick 3. Among SC Education Lottery “Players” in general, 27% indicate they have played Pick 3. • Among those who have ever played Pick 3 (N = 168), about half (51%) are “Active” players, playing at least once a month. • More than one out of ten Pick 3 players (12%) indicate they buy tickets for “all” or “most” games. Overall, however, evening drawings tend to be more popular than mid-day drawings. • On average, Pick 3 players buy 2. 8 tickets per purchase and spend nearly $31 per month. 86

SC Education Lottery Pick 3 Game General Incidence of Play (Ever) percent Q 9 87

SC Education Lottery Pick 3 Game General Incidence of Play (Ever) percent Q 9 87

Frequency of Pick 3 Play (among Pick 3 “Players, ” N = 168) percent Q 10 88

Frequency of Pick 3 Play (among Pick 3 “Players, ” N = 168) percent Q 10 88

Proportion of Pick 3 Drawings Played (among Pick 3 “Players, ” N = 168) percent Q 12 89

Proportion of Pick 3 Drawings Played (among Pick 3 “Players, ” N = 168) percent Q 12 89

For Which Drawing Most Likely to Purchase Pick 3 Tickets (among Pick 3 “Players, ” N = 168) percent Q 13 90

For Which Drawing Most Likely to Purchase Pick 3 Tickets (among Pick 3 “Players, ” N = 168) percent Q 13 90

Number of Pick 3 Tickets Purchased Each Time (among Pick 3 “Players, ” N = 168) Mean = 2. 8 percent Q 11 91

Number of Pick 3 Tickets Purchased Each Time (among Pick 3 “Players, ” N = 168) Mean = 2. 8 percent Q 11 91

Average $ Spent on Pick 3 Tickets Each Month (among Pick 3 “Players, ” N = 168) Mean = $30. 60 percent Q 14 92

Average $ Spent on Pick 3 Tickets Each Month (among Pick 3 “Players, ” N = 168) Mean = $30. 60 percent Q 14 92

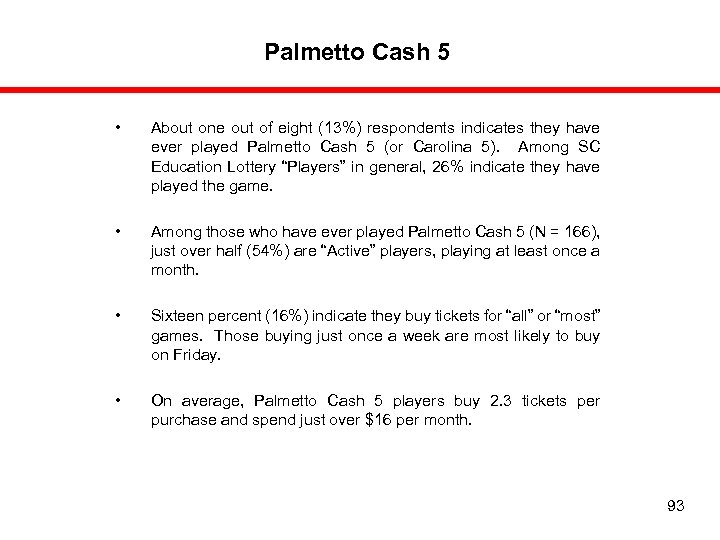

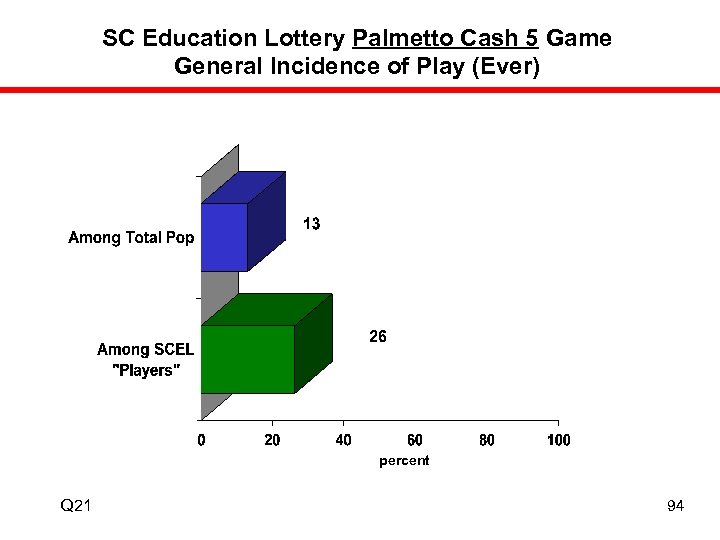

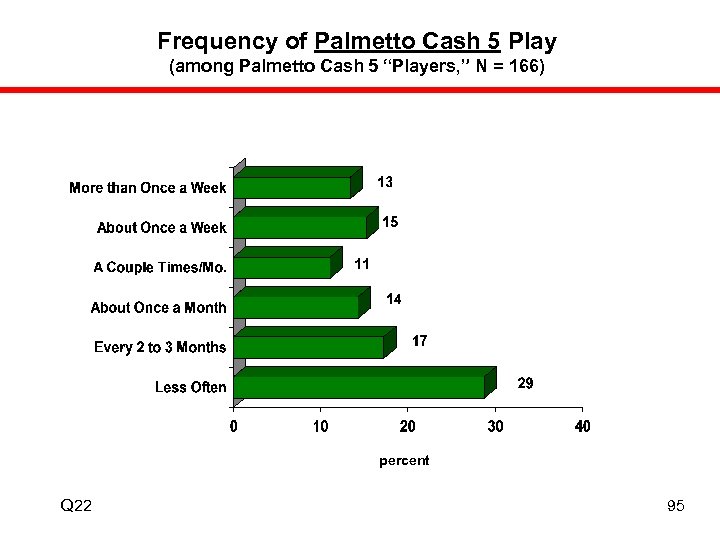

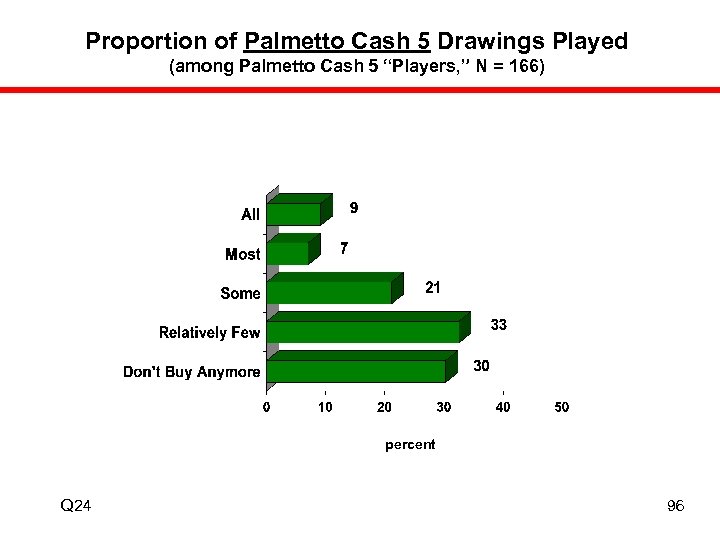

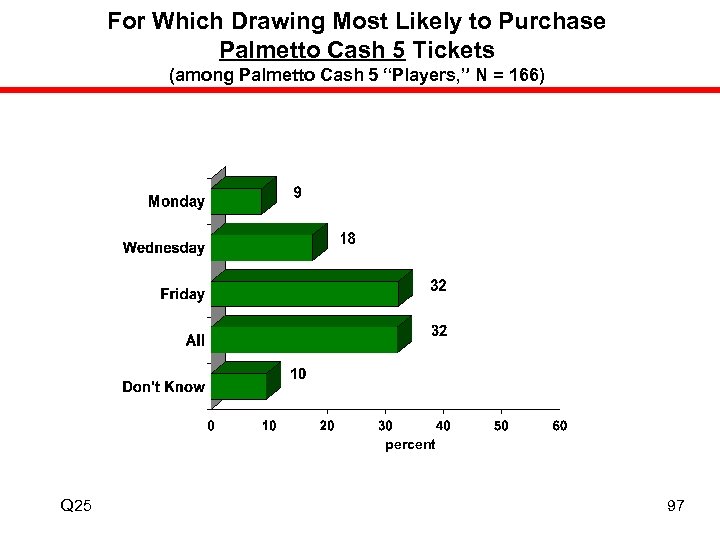

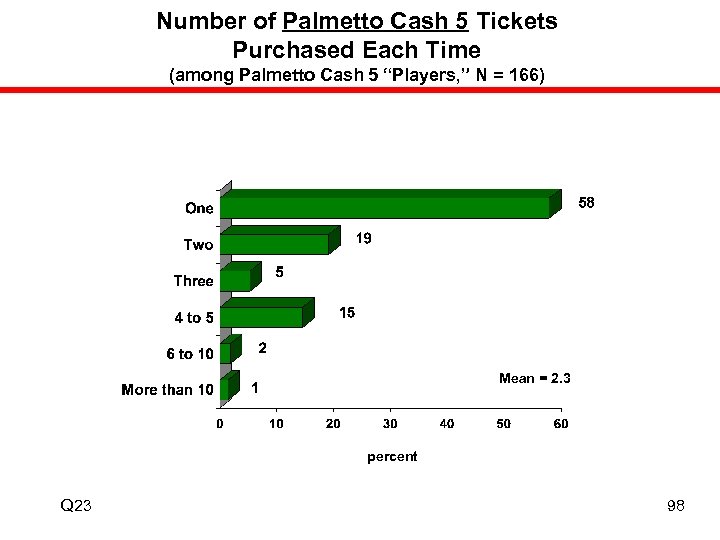

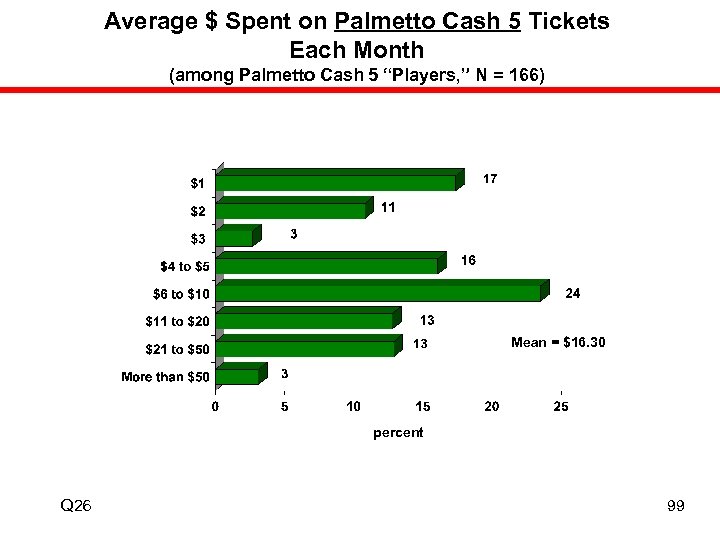

Palmetto Cash 5 • About one out of eight (13%) respondents indicates they have ever played Palmetto Cash 5 (or Carolina 5). Among SC Education Lottery “Players” in general, 26% indicate they have played the game. • Among those who have ever played Palmetto Cash 5 (N = 166), just over half (54%) are “Active” players, playing at least once a month. • Sixteen percent (16%) indicate they buy tickets for “all” or “most” games. Those buying just once a week are most likely to buy on Friday. • On average, Palmetto Cash 5 players buy 2. 3 tickets per purchase and spend just over $16 per month. 93

Palmetto Cash 5 • About one out of eight (13%) respondents indicates they have ever played Palmetto Cash 5 (or Carolina 5). Among SC Education Lottery “Players” in general, 26% indicate they have played the game. • Among those who have ever played Palmetto Cash 5 (N = 166), just over half (54%) are “Active” players, playing at least once a month. • Sixteen percent (16%) indicate they buy tickets for “all” or “most” games. Those buying just once a week are most likely to buy on Friday. • On average, Palmetto Cash 5 players buy 2. 3 tickets per purchase and spend just over $16 per month. 93

SC Education Lottery Palmetto Cash 5 Game General Incidence of Play (Ever) percent Q 21 94

SC Education Lottery Palmetto Cash 5 Game General Incidence of Play (Ever) percent Q 21 94

Frequency of Palmetto Cash 5 Play (among Palmetto Cash 5 “Players, ” N = 166) percent Q 22 95

Frequency of Palmetto Cash 5 Play (among Palmetto Cash 5 “Players, ” N = 166) percent Q 22 95

Proportion of Palmetto Cash 5 Drawings Played (among Palmetto Cash 5 “Players, ” N = 166) percent Q 24 96

Proportion of Palmetto Cash 5 Drawings Played (among Palmetto Cash 5 “Players, ” N = 166) percent Q 24 96

For Which Drawing Most Likely to Purchase Palmetto Cash 5 Tickets (among Palmetto Cash 5 “Players, ” N = 166) percent Q 25 97

For Which Drawing Most Likely to Purchase Palmetto Cash 5 Tickets (among Palmetto Cash 5 “Players, ” N = 166) percent Q 25 97

Number of Palmetto Cash 5 Tickets Purchased Each Time (among Palmetto Cash 5 “Players, ” N = 166) Mean = 2. 3 percent Q 23 98

Number of Palmetto Cash 5 Tickets Purchased Each Time (among Palmetto Cash 5 “Players, ” N = 166) Mean = 2. 3 percent Q 23 98

Average $ Spent on Palmetto Cash 5 Tickets Each Month (among Palmetto Cash 5 “Players, ” N = 166) Mean = $16. 30 percent Q 26 99

Average $ Spent on Palmetto Cash 5 Tickets Each Month (among Palmetto Cash 5 “Players, ” N = 166) Mean = $16. 30 percent Q 26 99

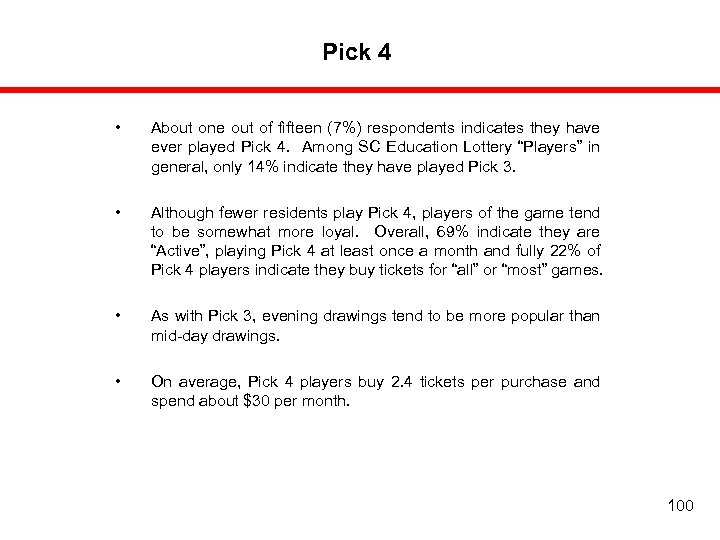

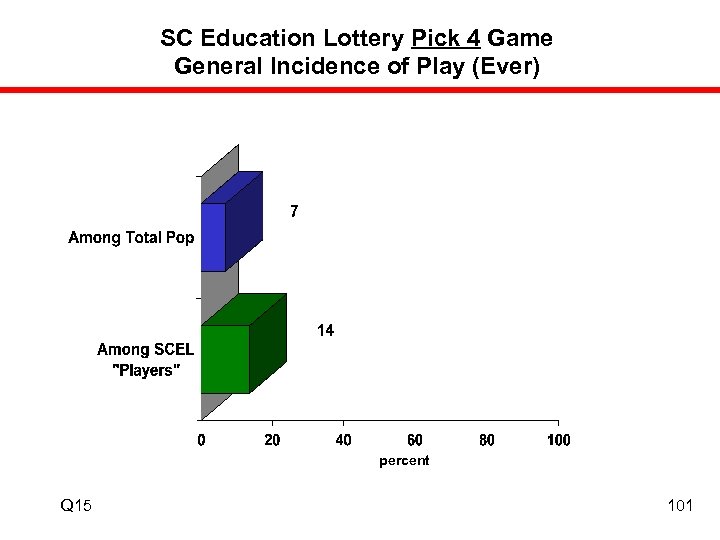

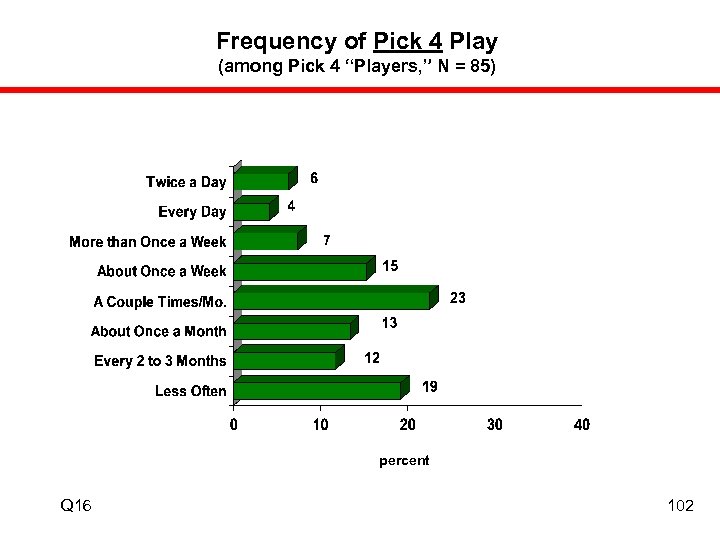

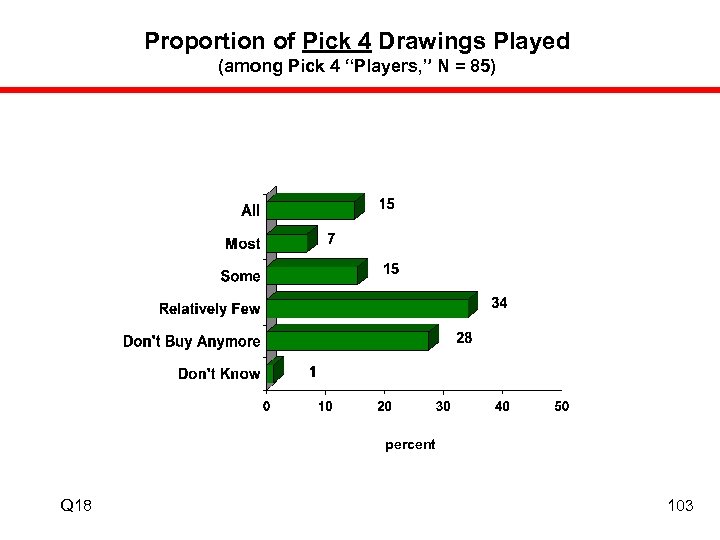

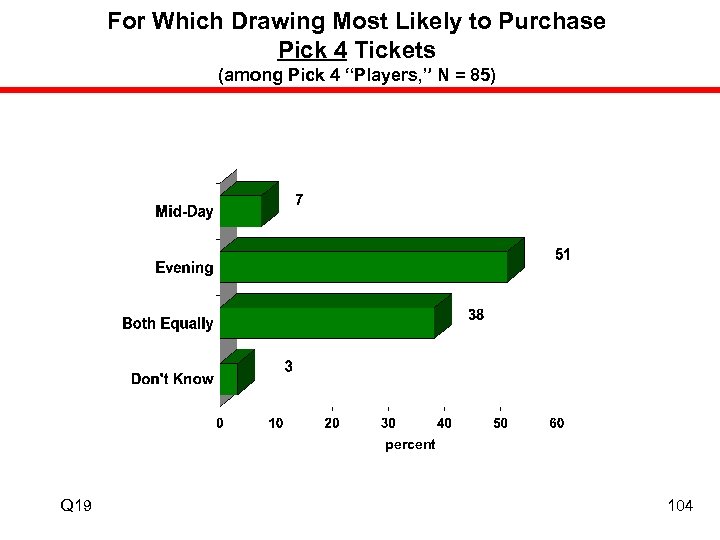

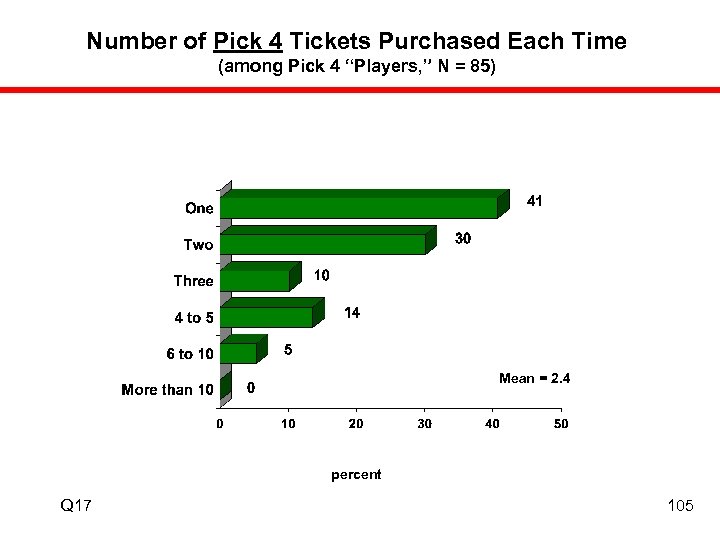

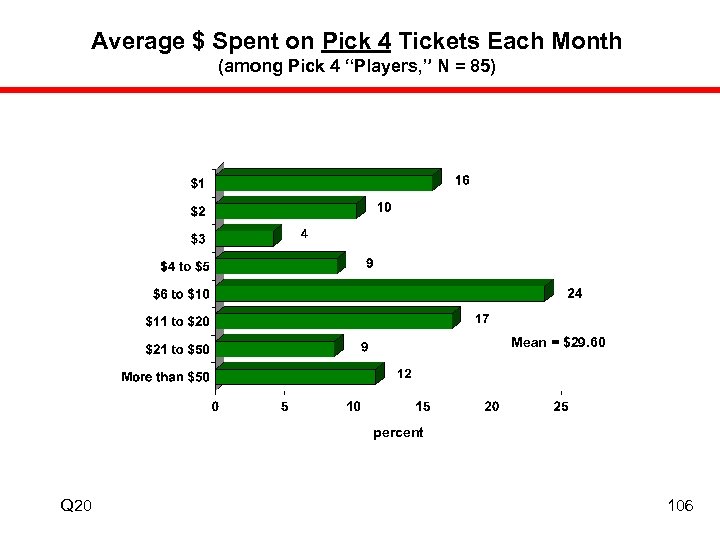

Pick 4 • About one out of fifteen (7%) respondents indicates they have ever played Pick 4. Among SC Education Lottery “Players” in general, only 14% indicate they have played Pick 3. • Although fewer residents play Pick 4, players of the game tend to be somewhat more loyal. Overall, 69% indicate they are “Active”, playing Pick 4 at least once a month and fully 22% of Pick 4 players indicate they buy tickets for “all” or “most” games. • As with Pick 3, evening drawings tend to be more popular than mid-day drawings. • On average, Pick 4 players buy 2. 4 tickets per purchase and spend about $30 per month. 100

Pick 4 • About one out of fifteen (7%) respondents indicates they have ever played Pick 4. Among SC Education Lottery “Players” in general, only 14% indicate they have played Pick 3. • Although fewer residents play Pick 4, players of the game tend to be somewhat more loyal. Overall, 69% indicate they are “Active”, playing Pick 4 at least once a month and fully 22% of Pick 4 players indicate they buy tickets for “all” or “most” games. • As with Pick 3, evening drawings tend to be more popular than mid-day drawings. • On average, Pick 4 players buy 2. 4 tickets per purchase and spend about $30 per month. 100

SC Education Lottery Pick 4 Game General Incidence of Play (Ever) percent Q 15 101

SC Education Lottery Pick 4 Game General Incidence of Play (Ever) percent Q 15 101

Frequency of Pick 4 Play (among Pick 4 “Players, ” N = 85) percent Q 16 102

Frequency of Pick 4 Play (among Pick 4 “Players, ” N = 85) percent Q 16 102

Proportion of Pick 4 Drawings Played (among Pick 4 “Players, ” N = 85) percent Q 18 103

Proportion of Pick 4 Drawings Played (among Pick 4 “Players, ” N = 85) percent Q 18 103

For Which Drawing Most Likely to Purchase Pick 4 Tickets (among Pick 4 “Players, ” N = 85) percent Q 19 104

For Which Drawing Most Likely to Purchase Pick 4 Tickets (among Pick 4 “Players, ” N = 85) percent Q 19 104

Number of Pick 4 Tickets Purchased Each Time (among Pick 4 “Players, ” N = 85) Mean = 2. 4 percent Q 17 105

Number of Pick 4 Tickets Purchased Each Time (among Pick 4 “Players, ” N = 85) Mean = 2. 4 percent Q 17 105

Average $ Spent on Pick 4 Tickets Each Month (among Pick 4 “Players, ” N = 85) Mean = $29. 60 percent Q 20 106

Average $ Spent on Pick 4 Tickets Each Month (among Pick 4 “Players, ” N = 85) Mean = $29. 60 percent Q 20 106

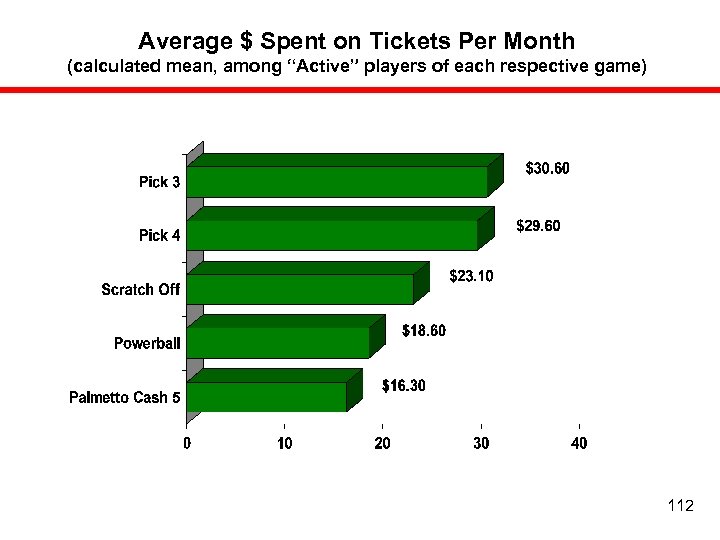

Game to Game Comparisons • Powerball and Scratch Off games have the highest penetration of SC Education Lottery’s five game options. • Although Pick 4 has the lowest penetration, its players are among the most active and, Pick 3 and Pick 4 players spend the most per month. 107

Game to Game Comparisons • Powerball and Scratch Off games have the highest penetration of SC Education Lottery’s five game options. • Although Pick 4 has the lowest penetration, its players are among the most active and, Pick 3 and Pick 4 players spend the most per month. 107

Incidence of Specific Game Play (among Total Sample) percent Q 1, 5, 9, 15, 21, 27 108

Incidence of Specific Game Play (among Total Sample) percent Q 1, 5, 9, 15, 21, 27 108

Incidence of Specific Game Play (among “Players”) percent Q 1, 5, 9, 15, 21, 27 109

Incidence of Specific Game Play (among “Players”) percent Q 1, 5, 9, 15, 21, 27 109

Incidence of “Active” Game Play (play specific game at least once a month, among “Players” of respective games) percent Q 6, 10, 16, 22, 28 110

Incidence of “Active” Game Play (play specific game at least once a month, among “Players” of respective games) percent Q 6, 10, 16, 22, 28 110

Number of Tickets Purchased Each Time (calculated mean, among “Active” players of each respective game) 111

Number of Tickets Purchased Each Time (calculated mean, among “Active” players of each respective game) 111

Average $ Spent on Tickets Per Month (calculated mean, among “Active” players of each respective game) 112

Average $ Spent on Tickets Per Month (calculated mean, among “Active” players of each respective game) 112