8105339ebdadce655151105e4d46c6e7.ppt

- Количество слайдов: 23

A Macro Theory of the Open Economy Copyright © 2004 South-Western 32

A Macro Theory of the Open Economy Copyright © 2004 South-Western 32

Open Economies • An open economy is one that interacts with other economies around the world. • The key macro variables: • • net exports:NX net foreign investment (net capital outflow:NCO) nominal exchange rates:e real exchange rates: (P/e. PF). Copyright © 2004 South-Western

Open Economies • An open economy is one that interacts with other economies around the world. • The key macro variables: • • net exports:NX net foreign investment (net capital outflow:NCO) nominal exchange rates:e real exchange rates: (P/e. PF). Copyright © 2004 South-Western

A Macro Model of an Open Economy: Basic Assumptions • A simplified but workable model • Takes GDP (Y and YF) as given: (補充:exogenous 外生變數:模型外決定的變數) 排除Y對IM的影響,排除YF對EX的影響 • Takes price level (P and PF) as given: Nominal and Real exchange rate: 1 -1對應 eg, 台幣升值 e↓ <=> (P/e. PF) ↑ (△foreign goods/△domestic goods)↑ Copyright © 2004 South-Western

A Macro Model of an Open Economy: Basic Assumptions • A simplified but workable model • Takes GDP (Y and YF) as given: (補充:exogenous 外生變數:模型外決定的變數) 排除Y對IM的影響,排除YF對EX的影響 • Takes price level (P and PF) as given: Nominal and Real exchange rate: 1 -1對應 eg, 台幣升值 e↓ <=> (P/e. PF) ↑ (△foreign goods/△domestic goods)↑ Copyright © 2004 South-Western

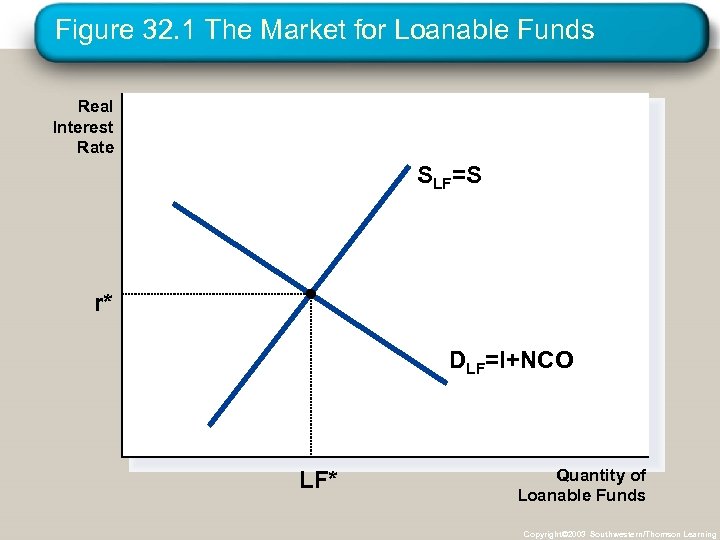

Two markets: Markets for Loanable Funds and for Foreign-Currency Exchange 1. The Market for Loanable Funds (LF) S = I + NCO • Supply of LF:SLF=S Demand for LF:DLF=I+NCO domestic investment and net capital outflows (net foreign investment). • The price in LF market is the real interest rate, r=R-π. Copyright © 2004 South-Western

Two markets: Markets for Loanable Funds and for Foreign-Currency Exchange 1. The Market for Loanable Funds (LF) S = I + NCO • Supply of LF:SLF=S Demand for LF:DLF=I+NCO domestic investment and net capital outflows (net foreign investment). • The price in LF market is the real interest rate, r=R-π. Copyright © 2004 South-Western

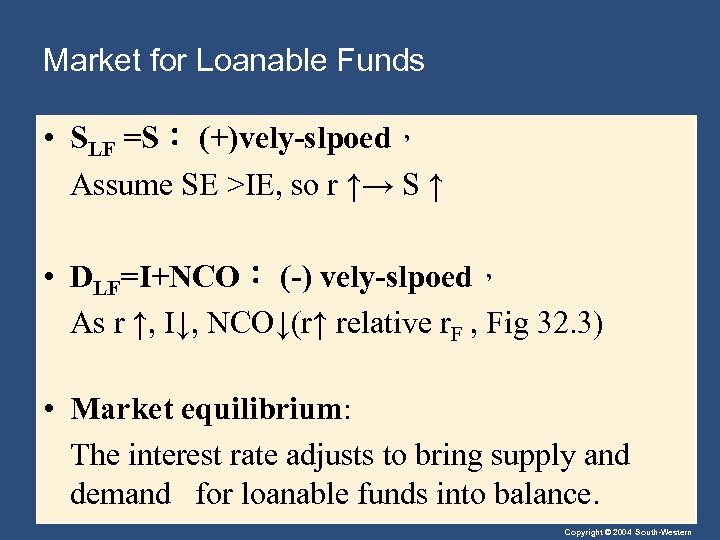

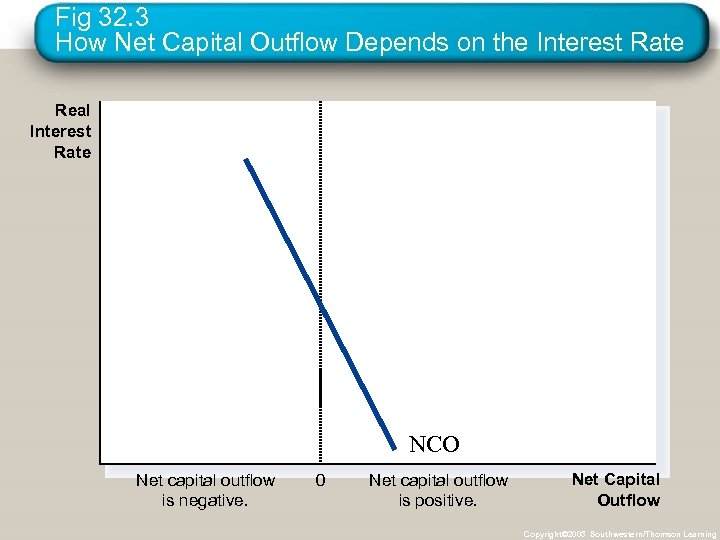

Market for Loanable Funds • SLF =S: (+)vely-slpoed, Assume SE >IE, so r ↑→ S ↑ • DLF=I+NCO: (-) vely-slpoed, As r ↑, I↓, NCO↓(r↑ relative r. F , Fig 32. 3) • Market equilibrium: The interest rate adjusts to bring supply and demand for loanable funds into balance. Copyright © 2004 South-Western

Market for Loanable Funds • SLF =S: (+)vely-slpoed, Assume SE >IE, so r ↑→ S ↑ • DLF=I+NCO: (-) vely-slpoed, As r ↑, I↓, NCO↓(r↑ relative r. F , Fig 32. 3) • Market equilibrium: The interest rate adjusts to bring supply and demand for loanable funds into balance. Copyright © 2004 South-Western

Fig 32. 3 How Net Capital Outflow Depends on the Interest Rate Real Interest Rate NCO Net capital outflow is negative. 0 Net capital outflow is positive. Net Capital Outflow Copyright © 2004 South-Western Copyright© 2003 Southwestern/Thomson Learning

Fig 32. 3 How Net Capital Outflow Depends on the Interest Rate Real Interest Rate NCO Net capital outflow is negative. 0 Net capital outflow is positive. Net Capital Outflow Copyright © 2004 South-Western Copyright© 2003 Southwestern/Thomson Learning

Figure 32. 1 The Market for Loanable Funds Real Interest Rate SLF=S r* DLF=I+NCO LF* Quantity of Loanable Funds Copyright© 2003 Southwestern/Thomson Learning

Figure 32. 1 The Market for Loanable Funds Real Interest Rate SLF=S r* DLF=I+NCO LF* Quantity of Loanable Funds Copyright© 2003 Southwestern/Thomson Learning

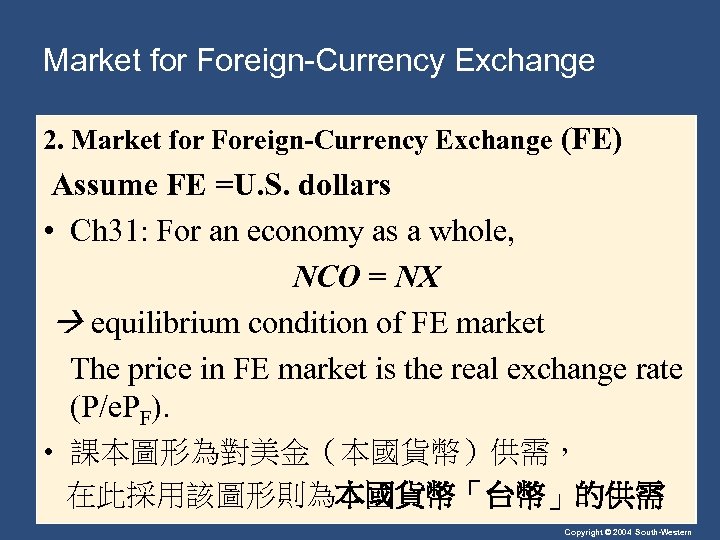

Market for Foreign-Currency Exchange 2. Market for Foreign-Currency Exchange (FE) Assume FE =U. S. dollars • Ch 31: For an economy as a whole, NCO = NX equilibrium condition of FE market The price in FE market is the real exchange rate (P/e. PF). • 課本圖形為對美金(本國貨幣)供需, 在此採用該圖形則為本國貨幣「台幣」的供需 Copyright © 2004 South-Western

Market for Foreign-Currency Exchange 2. Market for Foreign-Currency Exchange (FE) Assume FE =U. S. dollars • Ch 31: For an economy as a whole, NCO = NX equilibrium condition of FE market The price in FE market is the real exchange rate (P/e. PF). • 課本圖形為對美金(本國貨幣)供需, 在此採用該圖形則為本國貨幣「台幣」的供需 Copyright © 2004 South-Western

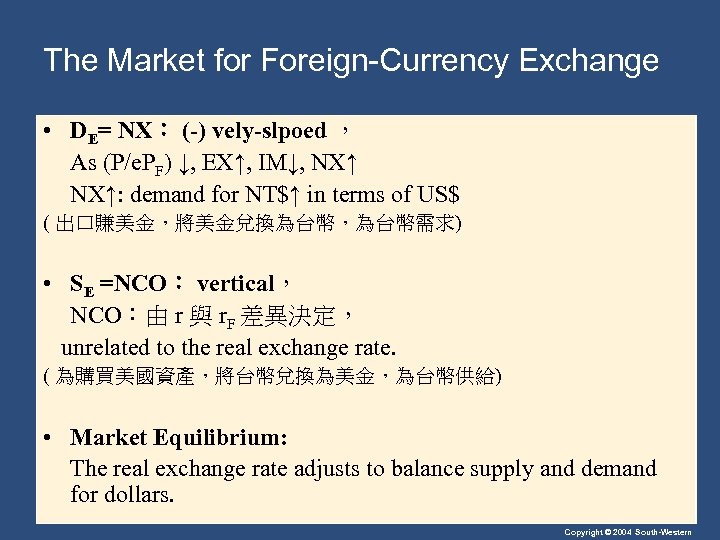

The Market for Foreign-Currency Exchange • DE= NX: (-) vely-slpoed , As (P/e. PF) ↓, EX↑, IM↓, NX↑: demand for NT$↑ in terms of US$ ( 出口賺美金,將美金兌換為台幣,為台幣需求) • SE =NCO: vertical, NCO:由 r 與 r. F 差異決定, unrelated to the real exchange rate. ( 為購買美國資產,將台幣兌換為美金,為台幣供給) • Market Equilibrium: The real exchange rate adjusts to balance supply and demand for dollars. Copyright © 2004 South-Western

The Market for Foreign-Currency Exchange • DE= NX: (-) vely-slpoed , As (P/e. PF) ↓, EX↑, IM↓, NX↑: demand for NT$↑ in terms of US$ ( 出口賺美金,將美金兌換為台幣,為台幣需求) • SE =NCO: vertical, NCO:由 r 與 r. F 差異決定, unrelated to the real exchange rate. ( 為購買美國資產,將台幣兌換為美金,為台幣供給) • Market Equilibrium: The real exchange rate adjusts to balance supply and demand for dollars. Copyright © 2004 South-Western

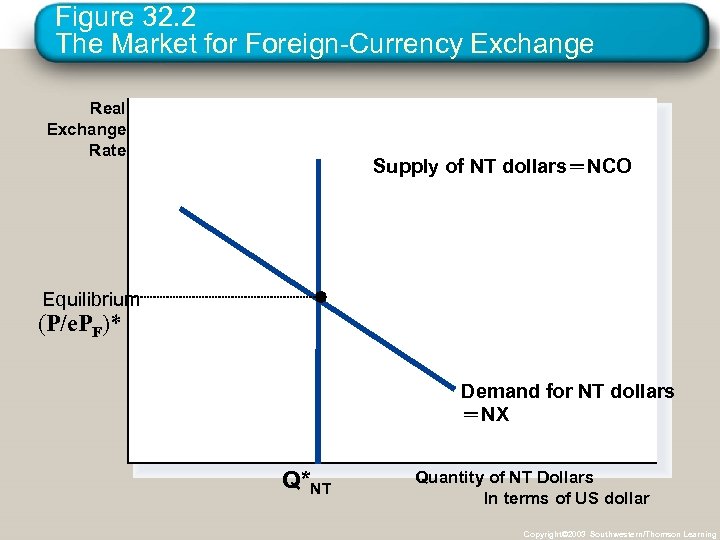

Figure 32. 2 The Market for Foreign-Currency Exchange Real Exchange Rate Supply of NT dollars=NCO Equilibrium (P/e. PF)* Demand for NT dollars =NX Q*NT Quantity of NT Dollars In terms of US dollar Copyright© 2003 Southwestern/Thomson Learning

Figure 32. 2 The Market for Foreign-Currency Exchange Real Exchange Rate Supply of NT dollars=NCO Equilibrium (P/e. PF)* Demand for NT dollars =NX Q*NT Quantity of NT Dollars In terms of US dollar Copyright© 2003 Southwestern/Thomson Learning

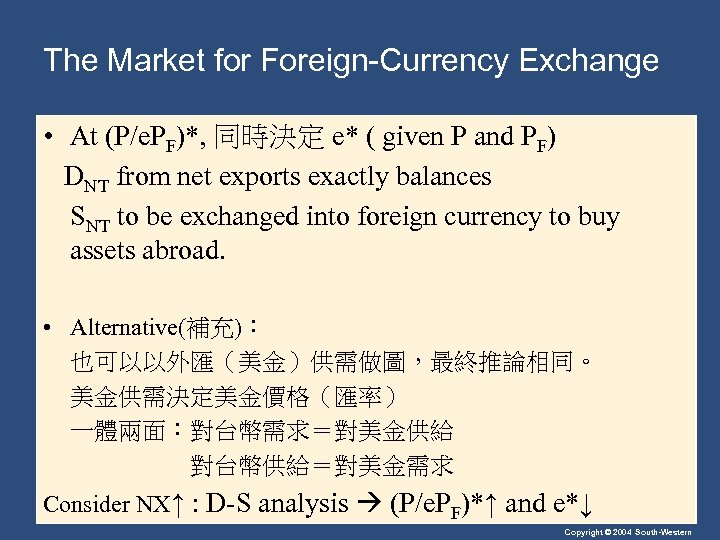

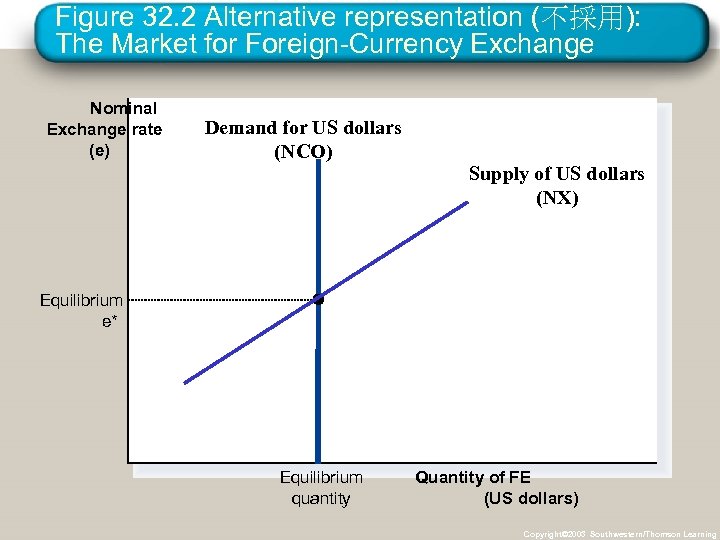

The Market for Foreign-Currency Exchange • At (P/e. PF)*, 同時決定 e* ( given P and PF) DNT from net exports exactly balances SNT to be exchanged into foreign currency to buy assets abroad. • Alternative(補充): 也可以以外匯(美金)供需做圖,最終推論相同。 美金供需決定美金價格(匯率) 一體兩面:對台幣需求=對美金供給 對台幣供給=對美金需求 Consider NX↑ : D-S analysis (P/e. PF)*↑ and e*↓ Copyright © 2004 South-Western

The Market for Foreign-Currency Exchange • At (P/e. PF)*, 同時決定 e* ( given P and PF) DNT from net exports exactly balances SNT to be exchanged into foreign currency to buy assets abroad. • Alternative(補充): 也可以以外匯(美金)供需做圖,最終推論相同。 美金供需決定美金價格(匯率) 一體兩面:對台幣需求=對美金供給 對台幣供給=對美金需求 Consider NX↑ : D-S analysis (P/e. PF)*↑ and e*↓ Copyright © 2004 South-Western

Figure 32. 2 Alternative representation (不採用): The Market for Foreign-Currency Exchange Nominal Exchange rate (e) Demand for US dollars (NCO) Supply of US dollars (NX) Equilibrium e* Equilibrium quantity Quantity of FE (US dollars) Copyright © 2004 South-Western Copyright© 2003 Southwestern/Thomson Learning

Figure 32. 2 Alternative representation (不採用): The Market for Foreign-Currency Exchange Nominal Exchange rate (e) Demand for US dollars (NCO) Supply of US dollars (NX) Equilibrium e* Equilibrium quantity Quantity of FE (US dollars) Copyright © 2004 South-Western Copyright© 2003 Southwestern/Thomson Learning

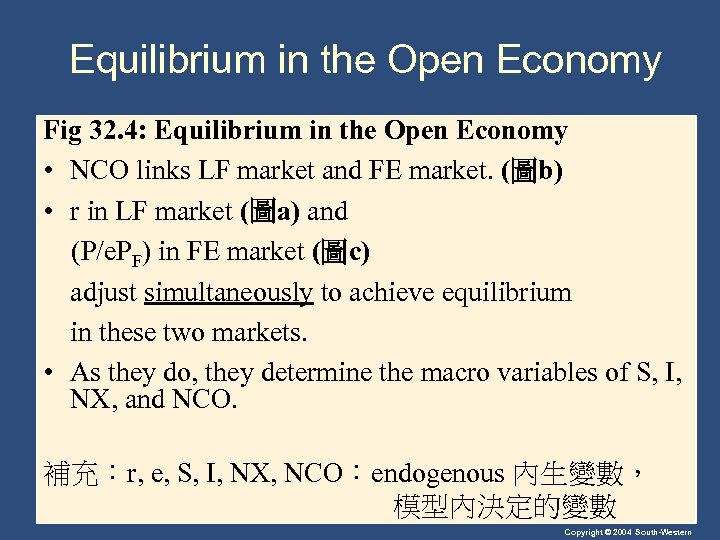

Equilibrium in the Open Economy Fig 32. 4: Equilibrium in the Open Economy • NCO links LF market and FE market. (圖b) • r in LF market (圖a) and (P/e. PF) in FE market (圖c) adjust simultaneously to achieve equilibrium in these two markets. • As they do, they determine the macro variables of S, I, NX, and NCO. 補充:r, e, S, I, NX, NCO:endogenous 內生變數, 模型內決定的變數 Copyright © 2004 South-Western

Equilibrium in the Open Economy Fig 32. 4: Equilibrium in the Open Economy • NCO links LF market and FE market. (圖b) • r in LF market (圖a) and (P/e. PF) in FE market (圖c) adjust simultaneously to achieve equilibrium in these two markets. • As they do, they determine the macro variables of S, I, NX, and NCO. 補充:r, e, S, I, NX, NCO:endogenous 內生變數, 模型內決定的變數 Copyright © 2004 South-Western

Figure 32. 4 The Real Equilibrium in an Open Economy (a) The Market for Loanable Funds Real Interest Rate (b) Net Capital Outflow Real Interest Rate Supply r r Demand Net capital outflow, NCO Quantity of Loanable Funds Net Capital Outflow Real Exchange Rate Supply E Demand Quantity of Dollars (c) The Market for Foreign-Currency Exchange Copyright© 2003 Southwestern/Thomson Learning

Figure 32. 4 The Real Equilibrium in an Open Economy (a) The Market for Loanable Funds Real Interest Rate (b) Net Capital Outflow Real Interest Rate Supply r r Demand Net capital outflow, NCO Quantity of Loanable Funds Net Capital Outflow Real Exchange Rate Supply E Demand Quantity of Dollars (c) The Market for Foreign-Currency Exchange Copyright© 2003 Southwestern/Thomson Learning

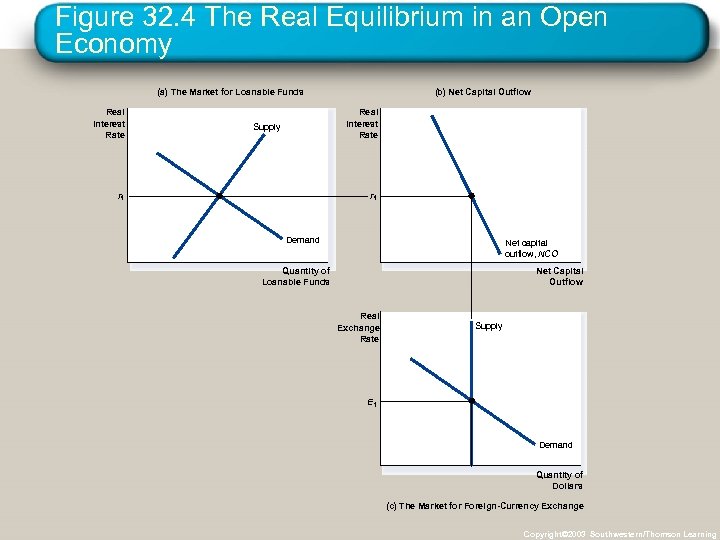

Comparative Statics • The magnitude and variation in open macro variables depend on: 1. Government budget deficits 2. Trade policies 3. Political and economic stability Copyright © 2004 South-Western

Comparative Statics • The magnitude and variation in open macro variables depend on: 1. Government budget deficits 2. Trade policies 3. Political and economic stability Copyright © 2004 South-Western

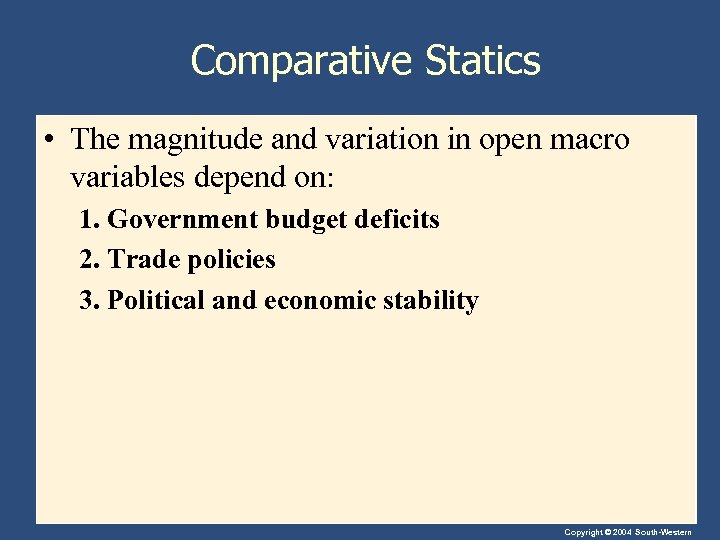

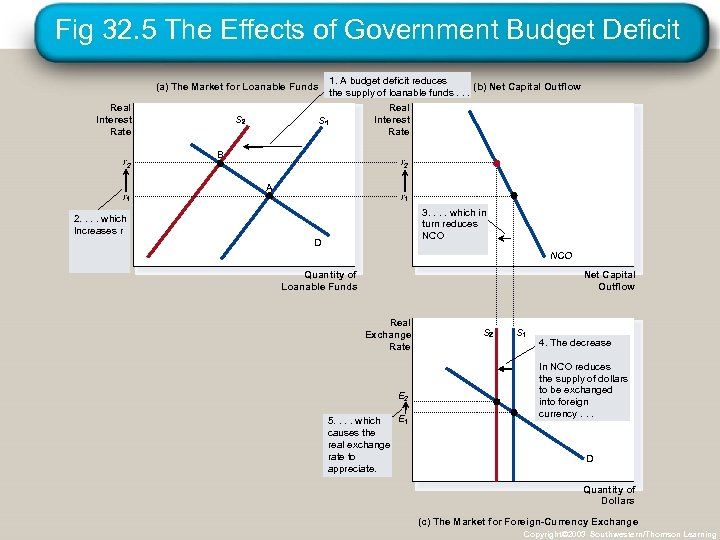

1. Government Budget Deficits: Sg < 0 (Fig 32. 5) (圖a) In an open economy, government budget deficits (Sg < 0) reduce the supply of LF market: S↓ SLF ↓ r*↑ I↓ and NCO↓ (圖b) Movement along with NCO curve (圖c) Effect on FE Market NCO↓ SE ↓: shifts to the left real exchange rate↑(課本符號 E↑):升值 and also e*↓ (升值,P, PF as given ) E↑ NX↓ eg, Twin deficits (1980 s US: Sg<0 and NX<0) Copyright © 2004 South-Western

1. Government Budget Deficits: Sg < 0 (Fig 32. 5) (圖a) In an open economy, government budget deficits (Sg < 0) reduce the supply of LF market: S↓ SLF ↓ r*↑ I↓ and NCO↓ (圖b) Movement along with NCO curve (圖c) Effect on FE Market NCO↓ SE ↓: shifts to the left real exchange rate↑(課本符號 E↑):升值 and also e*↓ (升值,P, PF as given ) E↑ NX↓ eg, Twin deficits (1980 s US: Sg<0 and NX<0) Copyright © 2004 South-Western

Fig 32. 5 The Effects of Government Budget Deficit (a) The Market for Loanable Funds Real Interest Rate r 2 r S 1. A budget deficit reduces (b) Net Capital Outflow the supply of loanable funds. . . Real Interest Rate S B r 2 A r 3. . which in turn reduces NCO 2. . which Increases r D NCO Quantity of Loanable Funds Net Capital Outflow Real Exchange Rate E 2 E 1 5. . which causes the real exchange rate to appreciate. S S 4. The decrease In NCO reduces the supply of dollars to be exchanged into foreign currency. . . D Quantity of Dollars (c) The Market for Foreign-Currency Exchange Copyright© 2003 Southwestern/Thomson Learning

Fig 32. 5 The Effects of Government Budget Deficit (a) The Market for Loanable Funds Real Interest Rate r 2 r S 1. A budget deficit reduces (b) Net Capital Outflow the supply of loanable funds. . . Real Interest Rate S B r 2 A r 3. . which in turn reduces NCO 2. . which Increases r D NCO Quantity of Loanable Funds Net Capital Outflow Real Exchange Rate E 2 E 1 5. . which causes the real exchange rate to appreciate. S S 4. The decrease In NCO reduces the supply of dollars to be exchanged into foreign currency. . . D Quantity of Dollars (c) The Market for Foreign-Currency Exchange Copyright© 2003 Southwestern/Thomson Learning

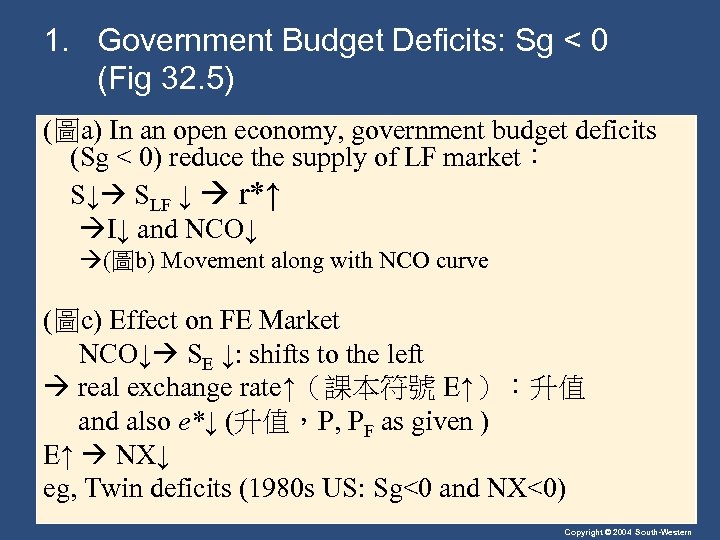

2. Trade Policy 貿易政策 • A trade policy is a government policy that directly influences the quantity of goods and services that a country imports or exports. • Tariff 關稅: A tax on an imported good. • Import quota 進口配額: A limit on the quantity of a good produced abroad and sold domestically. Copyright © 2004 South-Western

2. Trade Policy 貿易政策 • A trade policy is a government policy that directly influences the quantity of goods and services that a country imports or exports. • Tariff 關稅: A tax on an imported good. • Import quota 進口配額: A limit on the quantity of a good produced abroad and sold domestically. Copyright © 2004 South-Western

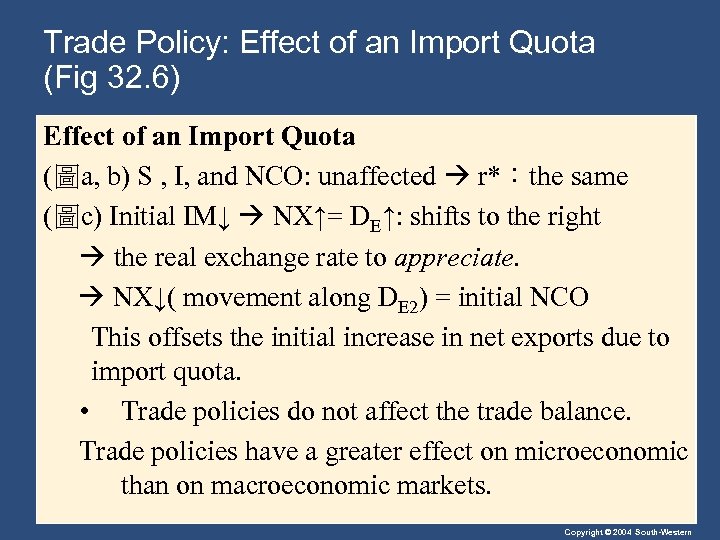

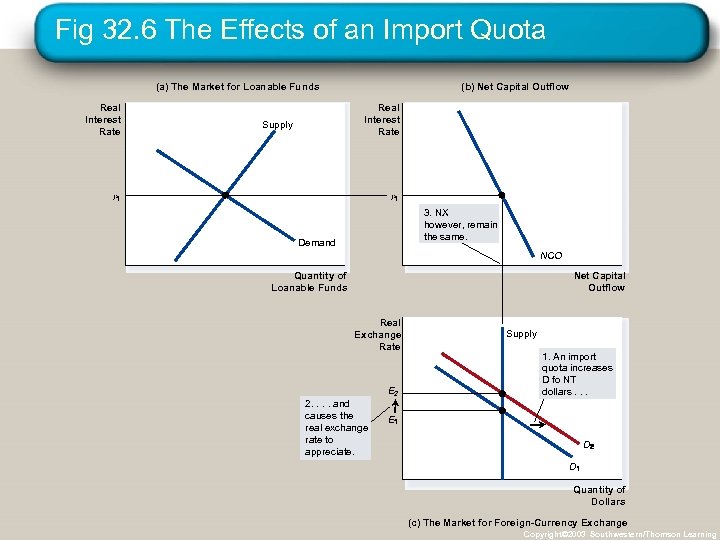

Trade Policy: Effect of an Import Quota (Fig 32. 6) Effect of an Import Quota (圖a, b) S , I, and NCO: unaffected r*:the same (圖c) Initial IM↓ NX↑= DE↑: shifts to the right the real exchange rate to appreciate. NX↓( movement along DE 2) = initial NCO This offsets the initial increase in net exports due to import quota. • Trade policies do not affect the trade balance. Trade policies have a greater effect on microeconomic than on macroeconomic markets. Copyright © 2004 South-Western

Trade Policy: Effect of an Import Quota (Fig 32. 6) Effect of an Import Quota (圖a, b) S , I, and NCO: unaffected r*:the same (圖c) Initial IM↓ NX↑= DE↑: shifts to the right the real exchange rate to appreciate. NX↓( movement along DE 2) = initial NCO This offsets the initial increase in net exports due to import quota. • Trade policies do not affect the trade balance. Trade policies have a greater effect on microeconomic than on macroeconomic markets. Copyright © 2004 South-Western

Fig 32. 6 The Effects of an Import Quota (a) The Market for Loanable Funds Real Interest Rate (b) Net Capital Outflow Real Interest Rate Supply r r 3. NX however, remain the same. Demand NCO Quantity of Loanable Funds Net Capital Outflow Real Exchange Rate E 2 2. . and causes the real exchange rate to appreciate. Supply 1. An import quota increases D fo NT dollars. . . E D D Quantity of Dollars (c) The Market for Foreign-Currency Exchange Copyright© 2003 Southwestern/Thomson Learning

Fig 32. 6 The Effects of an Import Quota (a) The Market for Loanable Funds Real Interest Rate (b) Net Capital Outflow Real Interest Rate Supply r r 3. NX however, remain the same. Demand NCO Quantity of Loanable Funds Net Capital Outflow Real Exchange Rate E 2 2. . and causes the real exchange rate to appreciate. Supply 1. An import quota increases D fo NT dollars. . . E D D Quantity of Dollars (c) The Market for Foreign-Currency Exchange Copyright© 2003 Southwestern/Thomson Learning

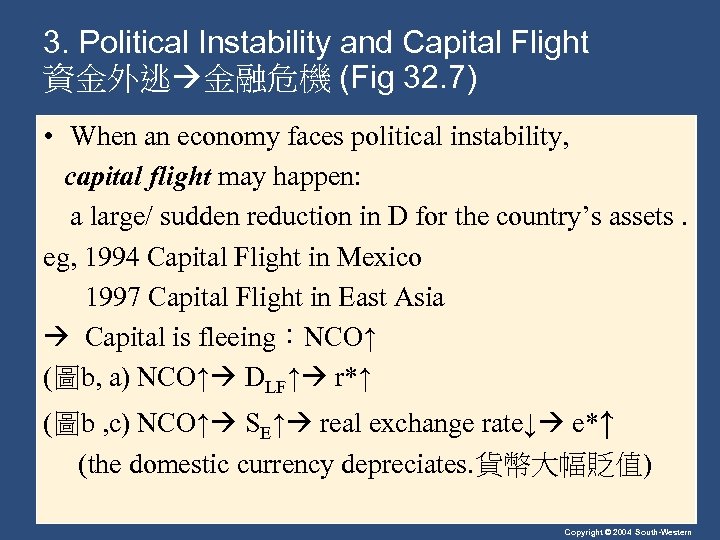

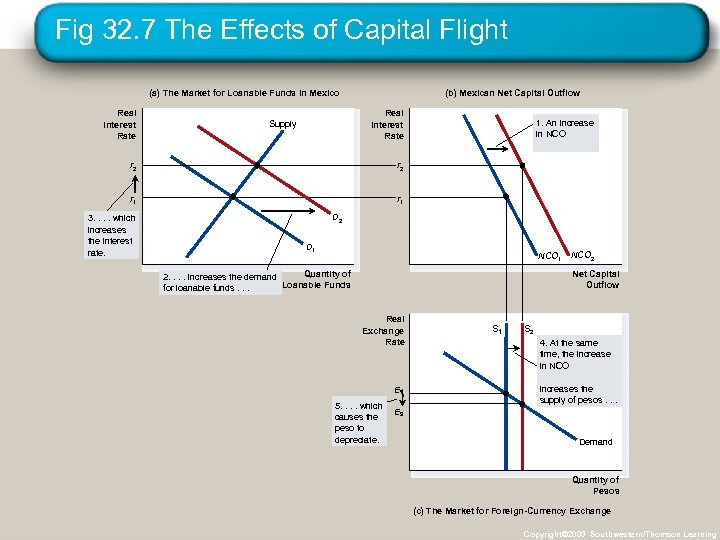

3. Political Instability and Capital Flight 資金外逃 金融危機 (Fig 32. 7) • When an economy faces political instability, capital flight may happen: a large/ sudden reduction in D for the country’s assets. eg, 1994 Capital Flight in Mexico 1997 Capital Flight in East Asia Capital is fleeing:NCO↑ (圖b, a) NCO↑ DLF↑ r*↑ (圖b , c) NCO↑ SE↑ real exchange rate↓ e*↑ (the domestic currency depreciates. 貨幣大幅貶值) Copyright © 2004 South-Western

3. Political Instability and Capital Flight 資金外逃 金融危機 (Fig 32. 7) • When an economy faces political instability, capital flight may happen: a large/ sudden reduction in D for the country’s assets. eg, 1994 Capital Flight in Mexico 1997 Capital Flight in East Asia Capital is fleeing:NCO↑ (圖b, a) NCO↑ DLF↑ r*↑ (圖b , c) NCO↑ SE↑ real exchange rate↓ e*↑ (the domestic currency depreciates. 貨幣大幅貶值) Copyright © 2004 South-Western

Fig 32. 7 The Effects of Capital Flight (a) The Market for Loanable Funds in Mexico Real Interest Rate (b) Mexican Net Capital Outflow Real Interest Rate Supply r 2 r 1 1. An increase in NCO r 1 3. . which increases the interest rate. D 2 D 1 NCO 1 Quantity of 2. . increases the demand Loanable Funds for loanable funds. . . NCO 2 Net Capital Outflow Real Exchange Rate E 5. . which causes the peso to depreciate. S S 2 4. At the same time, the increase in NCO increases the supply of pesos. . . E Demand Quantity of Pesos (c) The Market for Foreign-Currency Exchange Copyright© 2003 Southwestern/Thomson Learning

Fig 32. 7 The Effects of Capital Flight (a) The Market for Loanable Funds in Mexico Real Interest Rate (b) Mexican Net Capital Outflow Real Interest Rate Supply r 2 r 1 1. An increase in NCO r 1 3. . which increases the interest rate. D 2 D 1 NCO 1 Quantity of 2. . increases the demand Loanable Funds for loanable funds. . . NCO 2 Net Capital Outflow Real Exchange Rate E 5. . which causes the peso to depreciate. S S 2 4. At the same time, the increase in NCO increases the supply of pesos. . . E Demand Quantity of Pesos (c) The Market for Foreign-Currency Exchange Copyright© 2003 Southwestern/Thomson Learning

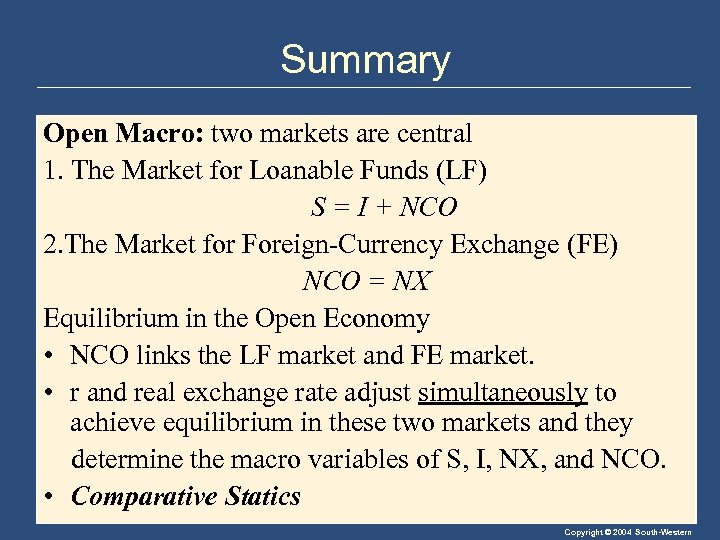

Summary Open Macro: two markets are central 1. The Market for Loanable Funds (LF) S = I + NCO 2. The Market for Foreign-Currency Exchange (FE) NCO = NX Equilibrium in the Open Economy • NCO links the LF market and FE market. • r and real exchange rate adjust simultaneously to achieve equilibrium in these two markets and they determine the macro variables of S, I, NX, and NCO. • Comparative Statics Copyright © 2004 South-Western

Summary Open Macro: two markets are central 1. The Market for Loanable Funds (LF) S = I + NCO 2. The Market for Foreign-Currency Exchange (FE) NCO = NX Equilibrium in the Open Economy • NCO links the LF market and FE market. • r and real exchange rate adjust simultaneously to achieve equilibrium in these two markets and they determine the macro variables of S, I, NX, and NCO. • Comparative Statics Copyright © 2004 South-Western