cae5ba238a4b1ec47c053510bec08483.ppt

- Количество слайдов: 58

A Guide to Financing Luxury Properties Continuing Education With Patricia Lavigne Team Leader – Loan Originator Cell (845)234 -5472 1

A Guide to Financing Luxury Properties Continuing Education With Patricia Lavigne Team Leader – Loan Originator Cell (845)234 -5472 1

q q q q q Safety– Intro 8: 45 am – 9: 00 am Overview / Outline 9: 01 am – 9: 10 am Pre. Qualification / Pre. Approval 9: 11 am – 9: 30 am Applying / Docs / Costs 9: 31 am – 10: 30 am Break 10: 31 am -10 -40 am Types of Mortgages 10: 41 am – 11: 30 am Property Types / Case Studies 11: 31 am – 11: 45 am FAQ’s TRID 11: 46 am – 12: 05 pm Avoiding Issues / Q&A 12: 06 pm – 12: 30 pm

q q q q q Safety– Intro 8: 45 am – 9: 00 am Overview / Outline 9: 01 am – 9: 10 am Pre. Qualification / Pre. Approval 9: 11 am – 9: 30 am Applying / Docs / Costs 9: 31 am – 10: 30 am Break 10: 31 am -10 -40 am Types of Mortgages 10: 41 am – 11: 30 am Property Types / Case Studies 11: 31 am – 11: 45 am FAQ’s TRID 11: 46 am – 12: 05 pm Avoiding Issues / Q&A 12: 06 pm – 12: 30 pm

• Pre-Qualification; Pre-Approval • Things to consider when applying for a loan. • Loan options & Underwriting styles. • Does the property itself matter? • TRID FAQ’s • Pittfalls

• Pre-Qualification; Pre-Approval • Things to consider when applying for a loan. • Loan options & Underwriting styles. • Does the property itself matter? • TRID FAQ’s • Pittfalls

Shopping for a Home Everyone, even luxury home shoppers need to be Pre. Qualified or Pre-pproved.

Shopping for a Home Everyone, even luxury home shoppers need to be Pre. Qualified or Pre-pproved.

Shopping For a Home Mortgage affordability estimate* As soon as you think about buying a home, you should first get an estimate of the mortgage amount you can afford based on your income and debt. Rule of thumb You can usually borrow 4 to 5 times your annual income, depending on your monthly debt, including Real Estate Taxes / Insurance / Common Charges or Maintenance on the subject unit. * Results of the mortgage affordability estimate/prequalification are guidelines; the estimate is not an application for credit and results do not guarantee loan approval or denial. 5

Shopping For a Home Mortgage affordability estimate* As soon as you think about buying a home, you should first get an estimate of the mortgage amount you can afford based on your income and debt. Rule of thumb You can usually borrow 4 to 5 times your annual income, depending on your monthly debt, including Real Estate Taxes / Insurance / Common Charges or Maintenance on the subject unit. * Results of the mortgage affordability estimate/prequalification are guidelines; the estimate is not an application for credit and results do not guarantee loan approval or denial. 5

Pre-Approval • Allows you to choose a mortgage program and determine whether you will qualify for a mortgage, without any obligation while you shop for a home. • You can receive a conditional approval letter within 24 to 48 hours ~ A Conditional Approval makes your offer more attractive to the seller. • You’re serious about an offer since you have initiated your financing. • Your offer is credible since a bank has approved you. 22

Pre-Approval • Allows you to choose a mortgage program and determine whether you will qualify for a mortgage, without any obligation while you shop for a home. • You can receive a conditional approval letter within 24 to 48 hours ~ A Conditional Approval makes your offer more attractive to the seller. • You’re serious about an offer since you have initiated your financing. • Your offer is credible since a bank has approved you. 22

Applying for the Loan • Documents typically needed: § Pay stubs for the last month § W-2 forms for the past two years to match the filed returns submitted § Full Federal tax returns for the last 2 years -in most cases. § Bank statements for the most recent 2 months (ALL pages) with any large deposits sourced with a paper trail § Signed Contract of Sale for the property you are purchasing § Evidence of down payment being made (cancelled check & bank stmnt. ) § Letters of Explanation (credit derogatory / employment gaps , etc. ) ü Once a Contract of Sale / Purchase Contract is available, Buildingspecific documents will also be required when the subject is a co-op or condominium

Applying for the Loan • Documents typically needed: § Pay stubs for the last month § W-2 forms for the past two years to match the filed returns submitted § Full Federal tax returns for the last 2 years -in most cases. § Bank statements for the most recent 2 months (ALL pages) with any large deposits sourced with a paper trail § Signed Contract of Sale for the property you are purchasing § Evidence of down payment being made (cancelled check & bank stmnt. ) § Letters of Explanation (credit derogatory / employment gaps , etc. ) ü Once a Contract of Sale / Purchase Contract is available, Buildingspecific documents will also be required when the subject is a co-op or condominium

Qualifying for a Loan • Employment • Verification of employment – MAY BE DONE SEVERAL TIMES THROUGHOUT THE PROCESS • Income • Full-time, part-time, overtime • Commissions, interest • Self-employment • Salaried employment • Seasonal employment • Other (Social Security, Social Security benefits, disability income, annuities, pensions, retirement benefits, interest, dividends, public assistance, alimony*, child support*, separate maintenance*) *You do not have to disclose alimony, child support, separate maintenance or its sources unless you want the lender to consider it as a basis for repaying the loan.

Qualifying for a Loan • Employment • Verification of employment – MAY BE DONE SEVERAL TIMES THROUGHOUT THE PROCESS • Income • Full-time, part-time, overtime • Commissions, interest • Self-employment • Salaried employment • Seasonal employment • Other (Social Security, Social Security benefits, disability income, annuities, pensions, retirement benefits, interest, dividends, public assistance, alimony*, child support*, separate maintenance*) *You do not have to disclose alimony, child support, separate maintenance or its sources unless you want the lender to consider it as a basis for repaying the loan.

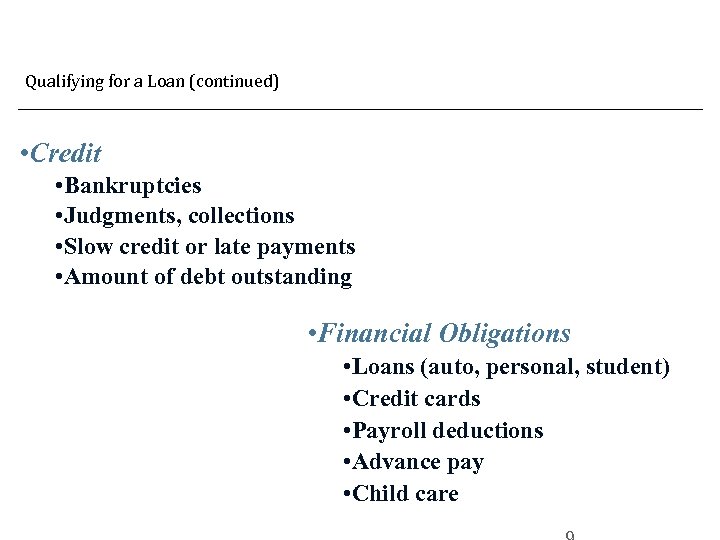

Qualifying for a Loan (continued) • Credit • Bankruptcies • Judgments, collections • Slow credit or late payments • Amount of debt outstanding • Financial Obligations • Loans (auto, personal, student) • Credit cards • Payroll deductions • Advance pay • Child care

Qualifying for a Loan (continued) • Credit • Bankruptcies • Judgments, collections • Slow credit or late payments • Amount of debt outstanding • Financial Obligations • Loans (auto, personal, student) • Credit cards • Payroll deductions • Advance pay • Child care

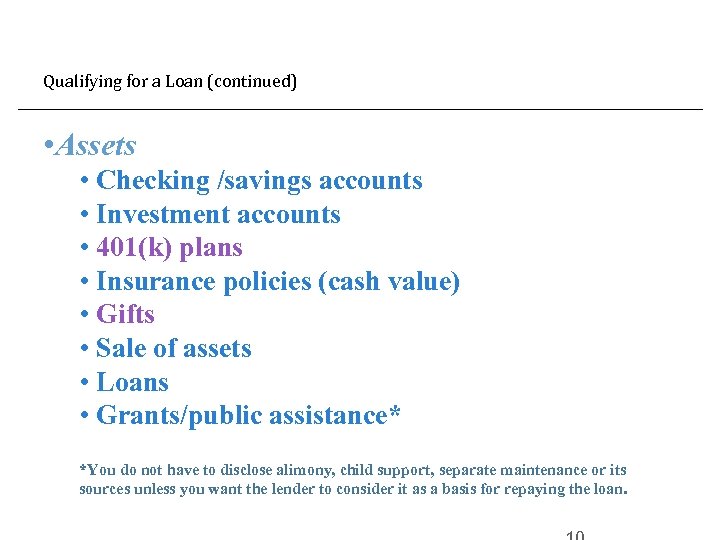

Qualifying for a Loan (continued) • Assets • Checking /savings accounts • Investment accounts • 401(k) plans • Insurance policies (cash value) • Gifts • Sale of assets • Loans • Grants/public assistance* *You do not have to disclose alimony, child support, separate maintenance or its sources unless you want the lender to consider it as a basis for repaying the loan.

Qualifying for a Loan (continued) • Assets • Checking /savings accounts • Investment accounts • 401(k) plans • Insurance policies (cash value) • Gifts • Sale of assets • Loans • Grants/public assistance* *You do not have to disclose alimony, child support, separate maintenance or its sources unless you want the lender to consider it as a basis for repaying the loan.

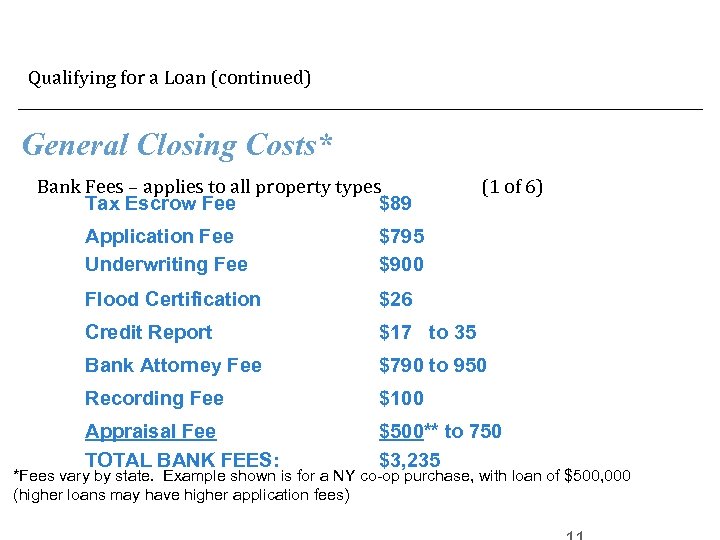

Qualifying for a Loan (continued) General Closing Costs* Bank Fees – applies to all property types Tax Escrow Fee $89 (1 of 6) Application Fee Underwriting Fee $795 $900 Flood Certification $26 Credit Report $17 to 35 Bank Attorney Fee $790 to 950 Recording Fee $100 Appraisal Fee TOTAL BANK FEES: $500** to 750 $3, 235 *Fees vary by state. Example shown is for a NY co-op purchase, with loan of $500, 000 (higher loans may have higher application fees)

Qualifying for a Loan (continued) General Closing Costs* Bank Fees – applies to all property types Tax Escrow Fee $89 (1 of 6) Application Fee Underwriting Fee $795 $900 Flood Certification $26 Credit Report $17 to 35 Bank Attorney Fee $790 to 950 Recording Fee $100 Appraisal Fee TOTAL BANK FEES: $500** to 750 $3, 235 *Fees vary by state. Example shown is for a NY co-op purchase, with loan of $500, 000 (higher loans may have higher application fees)

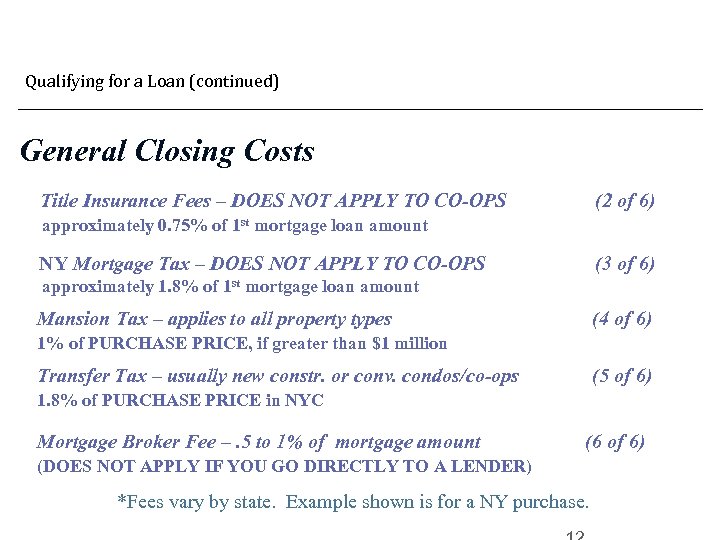

Qualifying for a Loan (continued) General Closing Costs Title Insurance Fees – DOES NOT APPLY TO CO-OPS (2 of 6) approximately 0. 75% of 1 st mortgage loan amount NY Mortgage Tax – DOES NOT APPLY TO CO-OPS (3 of 6) approximately 1. 8% of 1 st mortgage loan amount Mansion Tax – applies to all property types (4 of 6) 1% of PURCHASE PRICE, if greater than $1 million Transfer Tax – usually new constr. or conv. condos/co-ops (5 of 6) 1. 8% of PURCHASE PRICE in NYC Mortgage Broker Fee –. 5 to 1% of mortgage amount (6 of 6) (DOES NOT APPLY IF YOU GO DIRECTLY TO A LENDER) *Fees vary by state. Example shown is for a NY purchase.

Qualifying for a Loan (continued) General Closing Costs Title Insurance Fees – DOES NOT APPLY TO CO-OPS (2 of 6) approximately 0. 75% of 1 st mortgage loan amount NY Mortgage Tax – DOES NOT APPLY TO CO-OPS (3 of 6) approximately 1. 8% of 1 st mortgage loan amount Mansion Tax – applies to all property types (4 of 6) 1% of PURCHASE PRICE, if greater than $1 million Transfer Tax – usually new constr. or conv. condos/co-ops (5 of 6) 1. 8% of PURCHASE PRICE in NYC Mortgage Broker Fee –. 5 to 1% of mortgage amount (6 of 6) (DOES NOT APPLY IF YOU GO DIRECTLY TO A LENDER) *Fees vary by state. Example shown is for a NY purchase.

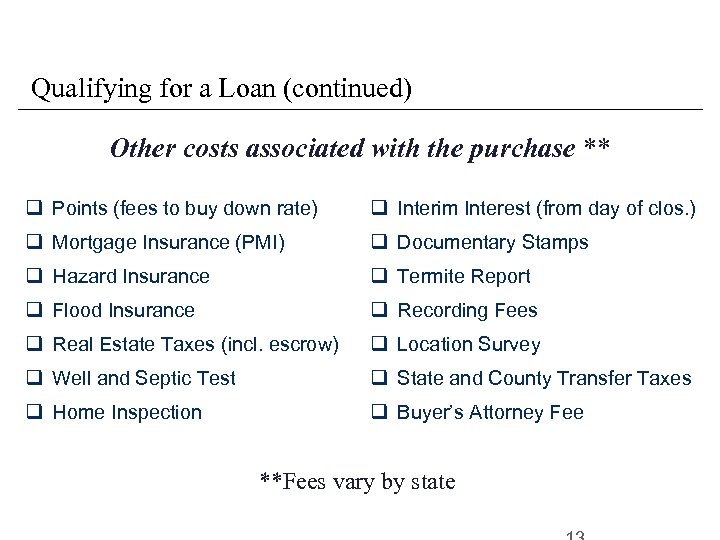

Qualifying for a Loan (continued) Other costs associated with the purchase ** q Points (fees to buy down rate) q Interim Interest (from day of clos. ) q Mortgage Insurance (PMI) q Documentary Stamps q Hazard Insurance q Termite Report q Flood Insurance q Recording Fees q Real Estate Taxes (incl. escrow) q Location Survey q Well and Septic Test q State and County Transfer Taxes q Home Inspection q Buyer’s Attorney Fee **Fees vary by state

Qualifying for a Loan (continued) Other costs associated with the purchase ** q Points (fees to buy down rate) q Interim Interest (from day of clos. ) q Mortgage Insurance (PMI) q Documentary Stamps q Hazard Insurance q Termite Report q Flood Insurance q Recording Fees q Real Estate Taxes (incl. escrow) q Location Survey q Well and Septic Test q State and County Transfer Taxes q Home Inspection q Buyer’s Attorney Fee **Fees vary by state

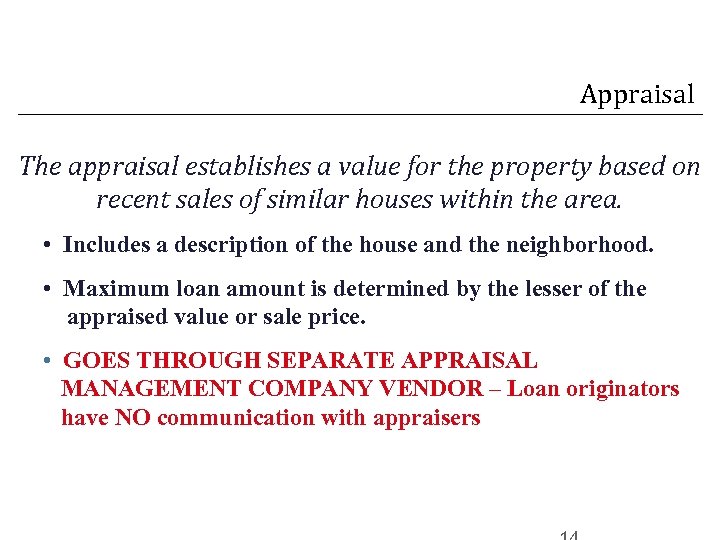

Appraisal The appraisal establishes a value for the property based on recent sales of similar houses within the area. • Includes a description of the house and the neighborhood. • Maximum loan amount is determined by the lesser of the appraised value or sale price. • GOES THROUGH SEPARATE APPRAISAL MANAGEMENT COMPANY VENDOR – Loan originators have NO communication with appraisers

Appraisal The appraisal establishes a value for the property based on recent sales of similar houses within the area. • Includes a description of the house and the neighborhood. • Maximum loan amount is determined by the lesser of the appraised value or sale price. • GOES THROUGH SEPARATE APPRAISAL MANAGEMENT COMPANY VENDOR – Loan originators have NO communication with appraisers

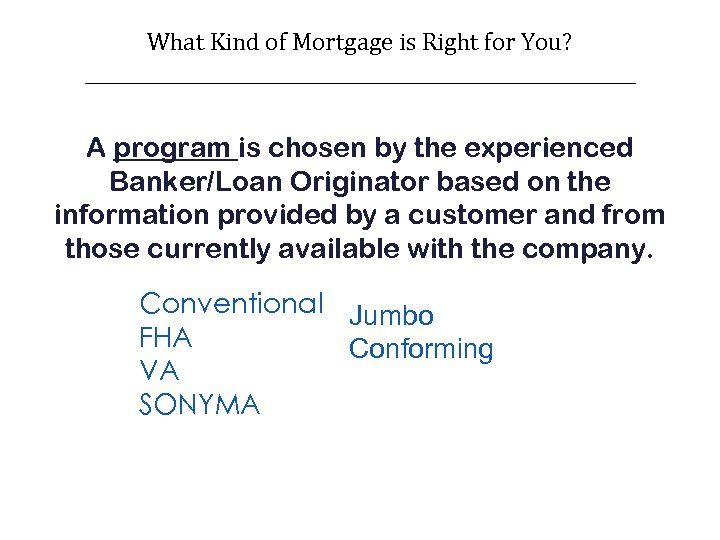

What Kind of Mortgage is Right for You? ______________________ A program is chosen by the experienced Banker/Loan Originator based on the information provided by a customer and from those currently available with the company. Conventional Jumbo FHA Conforming VA SONYMA

What Kind of Mortgage is Right for You? ______________________ A program is chosen by the experienced Banker/Loan Originator based on the information provided by a customer and from those currently available with the company. Conventional Jumbo FHA Conforming VA SONYMA

Deciding on the product is up to the borrower – a decision that is made based on the personal goals and both short and long term plans as related to personal Income/Credit/Assets/Anticipated Cash Flow. + Considering what options are available.

Deciding on the product is up to the borrower – a decision that is made based on the personal goals and both short and long term plans as related to personal Income/Credit/Assets/Anticipated Cash Flow. + Considering what options are available.

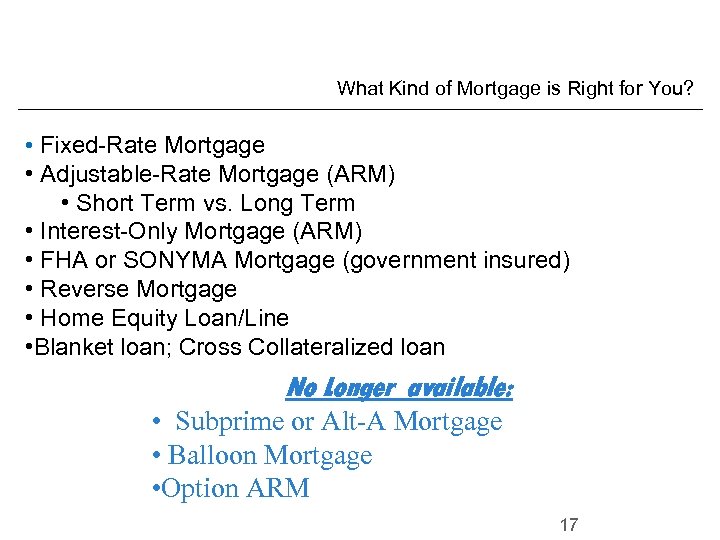

What Kind of Mortgage is Right for You? • Fixed-Rate Mortgage • Adjustable-Rate Mortgage (ARM) • Short Term vs. Long Term • Interest-Only Mortgage (ARM) • FHA or SONYMA Mortgage (government insured) • Reverse Mortgage • Home Equity Loan/Line • Blanket loan; Cross Collateralized loan No Longer available: • Subprime or Alt-A Mortgage • Balloon Mortgage • Option ARM 17

What Kind of Mortgage is Right for You? • Fixed-Rate Mortgage • Adjustable-Rate Mortgage (ARM) • Short Term vs. Long Term • Interest-Only Mortgage (ARM) • FHA or SONYMA Mortgage (government insured) • Reverse Mortgage • Home Equity Loan/Line • Blanket loan; Cross Collateralized loan No Longer available: • Subprime or Alt-A Mortgage • Balloon Mortgage • Option ARM 17

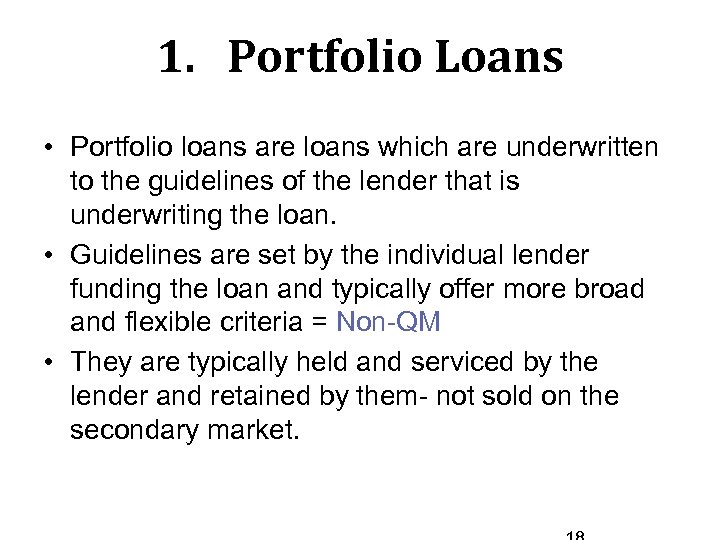

1. Portfolio Loans • Portfolio loans are loans which are underwritten to the guidelines of the lender that is underwriting the loan. • Guidelines are set by the individual lender funding the loan and typically offer more broad and flexible criteria = Non-QM • They are typically held and serviced by the lender and retained by them- not sold on the secondary market.

1. Portfolio Loans • Portfolio loans are loans which are underwritten to the guidelines of the lender that is underwriting the loan. • Guidelines are set by the individual lender funding the loan and typically offer more broad and flexible criteria = Non-QM • They are typically held and serviced by the lender and retained by them- not sold on the secondary market.

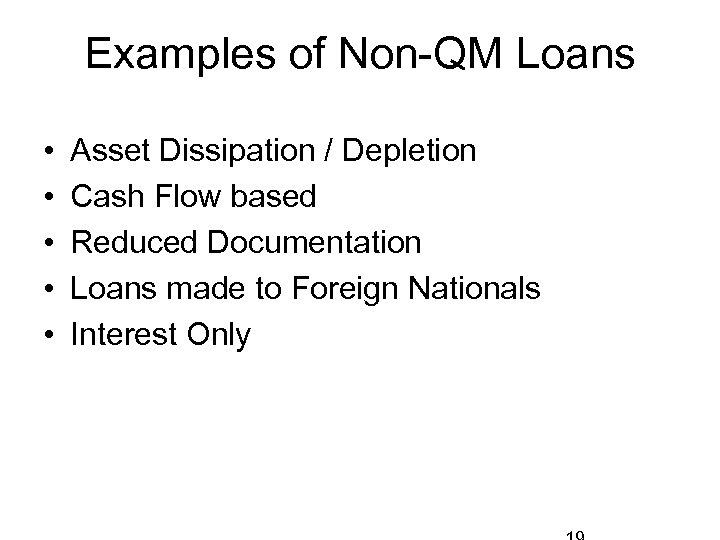

Examples of Non-QM Loans • • • Asset Dissipation / Depletion Cash Flow based Reduced Documentation Loans made to Foreign Nationals Interest Only

Examples of Non-QM Loans • • • Asset Dissipation / Depletion Cash Flow based Reduced Documentation Loans made to Foreign Nationals Interest Only

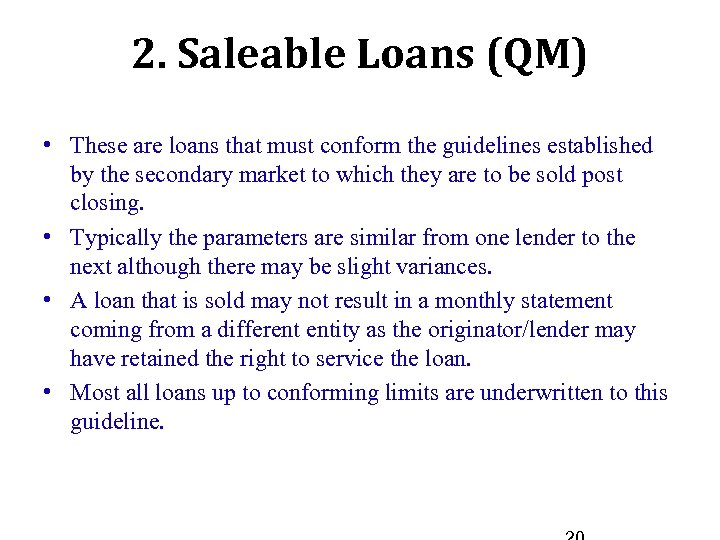

2. Saleable Loans (QM) • These are loans that must conform the guidelines established by the secondary market to which they are to be sold post closing. • Typically the parameters are similar from one lender to the next although there may be slight variances. • A loan that is sold may not result in a monthly statement coming from a different entity as the originator/lender may have retained the right to service the loan. • Most all loans up to conforming limits are underwritten to this guideline.

2. Saleable Loans (QM) • These are loans that must conform the guidelines established by the secondary market to which they are to be sold post closing. • Typically the parameters are similar from one lender to the next although there may be slight variances. • A loan that is sold may not result in a monthly statement coming from a different entity as the originator/lender may have retained the right to service the loan. • Most all loans up to conforming limits are underwritten to this guideline.

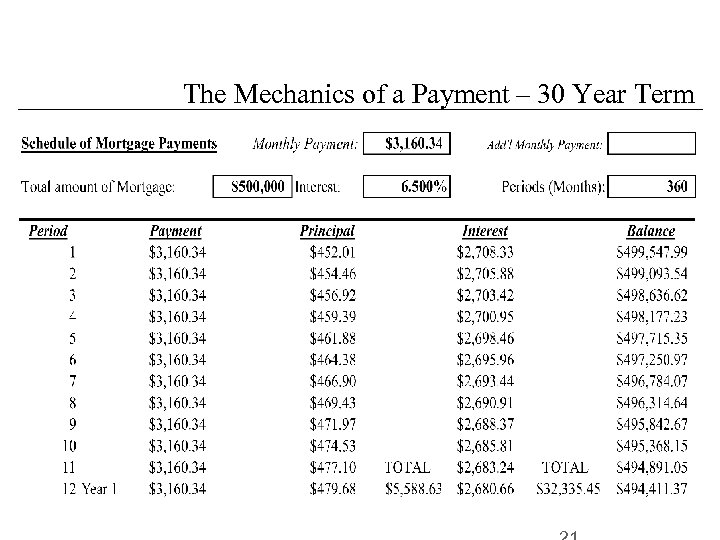

The Mechanics of a Payment – 30 Year Term

The Mechanics of a Payment – 30 Year Term

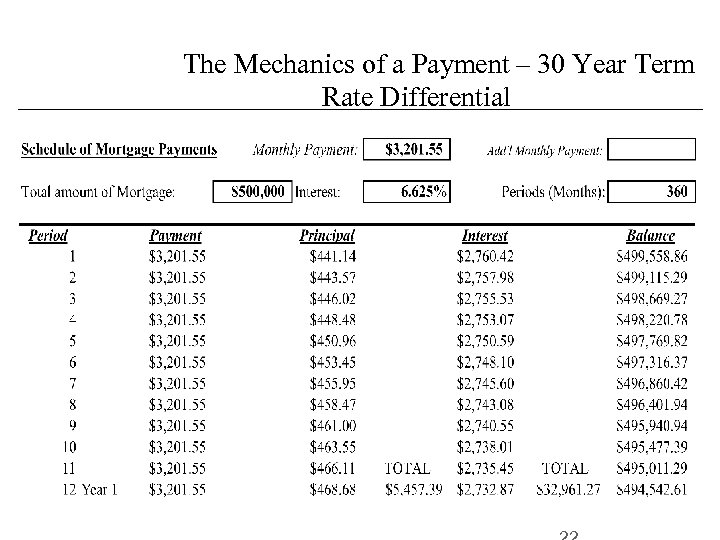

The Mechanics of a Payment – 30 Year Term Rate Differential

The Mechanics of a Payment – 30 Year Term Rate Differential

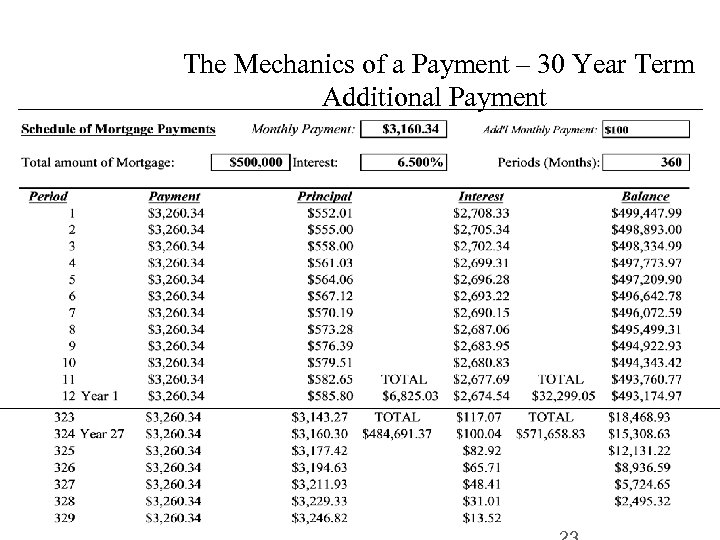

The Mechanics of a Payment – 30 Year Term Additional Payment

The Mechanics of a Payment – 30 Year Term Additional Payment

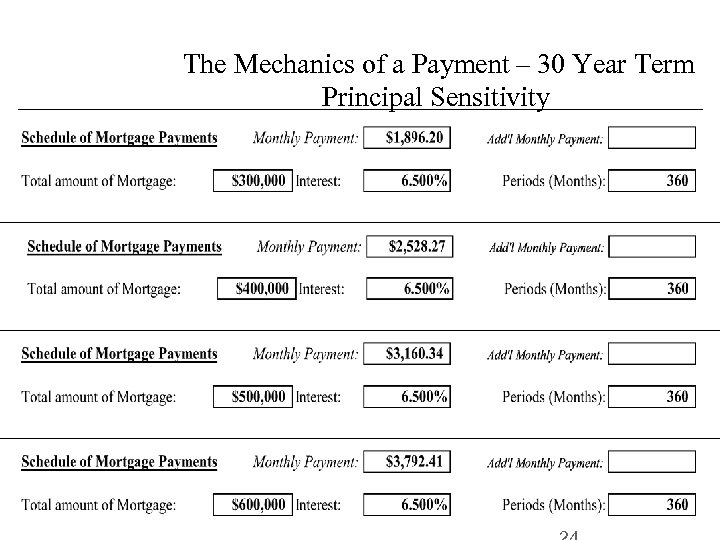

The Mechanics of a Payment – 30 Year Term Principal Sensitivity

The Mechanics of a Payment – 30 Year Term Principal Sensitivity

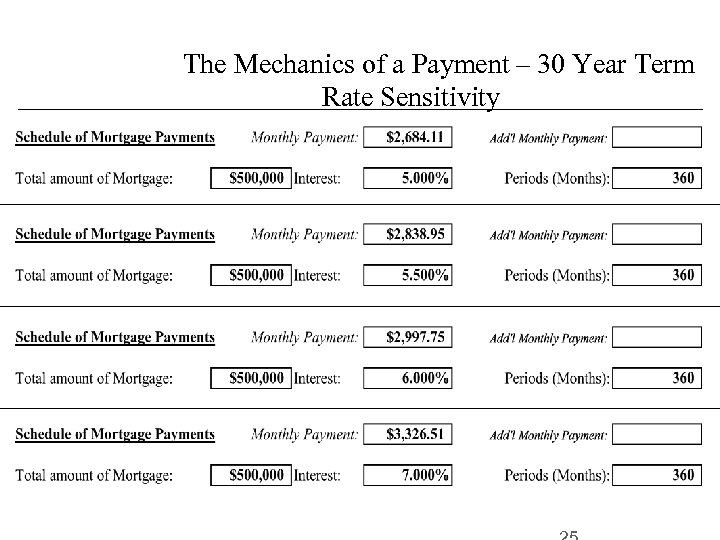

The Mechanics of a Payment – 30 Year Term Rate Sensitivity

The Mechanics of a Payment – 30 Year Term Rate Sensitivity

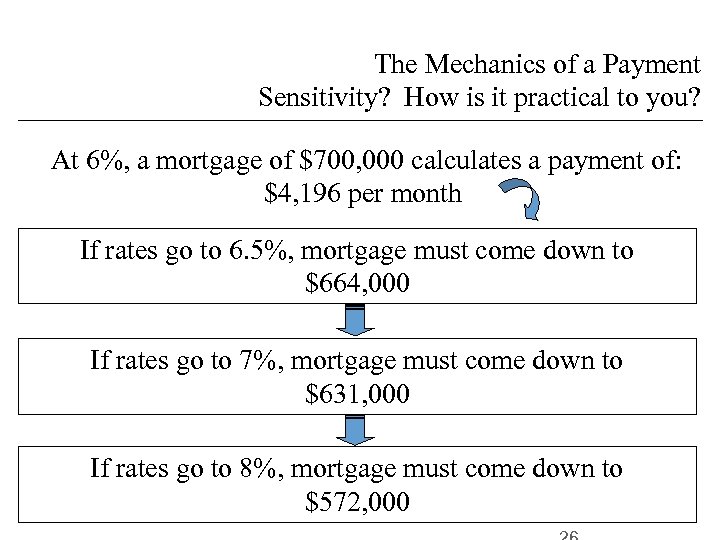

The Mechanics of a Payment Sensitivity? How is it practical to you? At 6%, a mortgage of $700, 000 calculates a payment of: $4, 196 per month If rates go to 6. 5%, mortgage must come down to $664, 000 If rates go to 7%, mortgage must come down to $631, 000 If rates go to 8%, mortgage must come down to $572, 000

The Mechanics of a Payment Sensitivity? How is it practical to you? At 6%, a mortgage of $700, 000 calculates a payment of: $4, 196 per month If rates go to 6. 5%, mortgage must come down to $664, 000 If rates go to 7%, mortgage must come down to $631, 000 If rates go to 8%, mortgage must come down to $572, 000

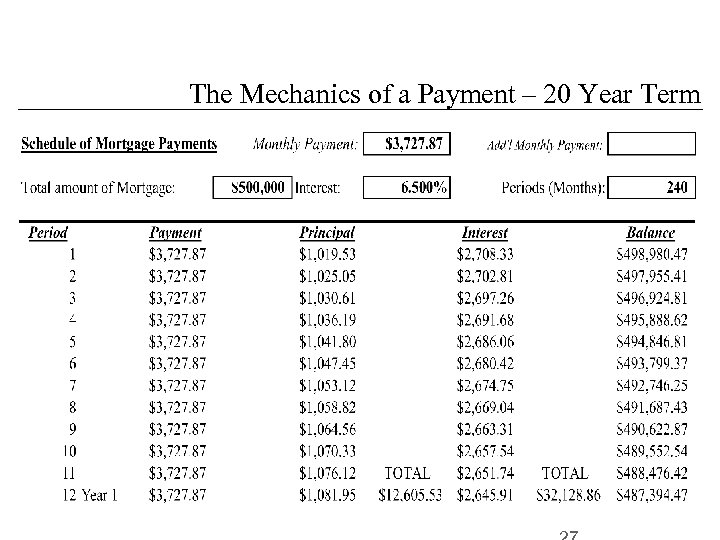

The Mechanics of a Payment – 20 Year Term

The Mechanics of a Payment – 20 Year Term

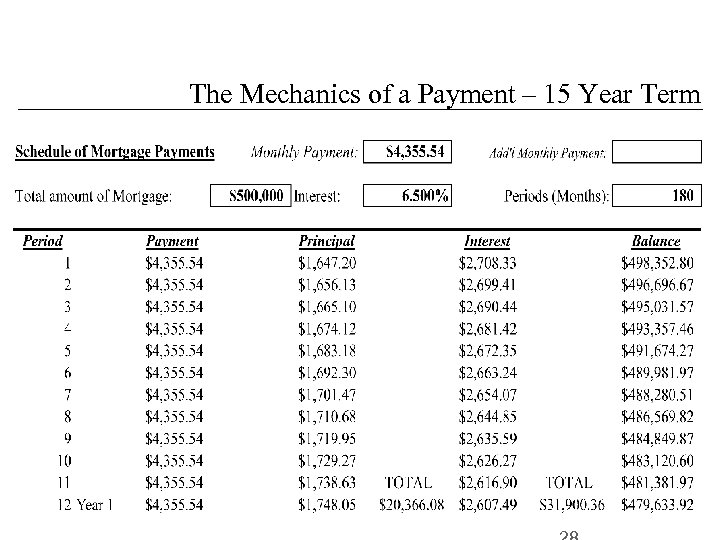

The Mechanics of a Payment – 15 Year Term

The Mechanics of a Payment – 15 Year Term

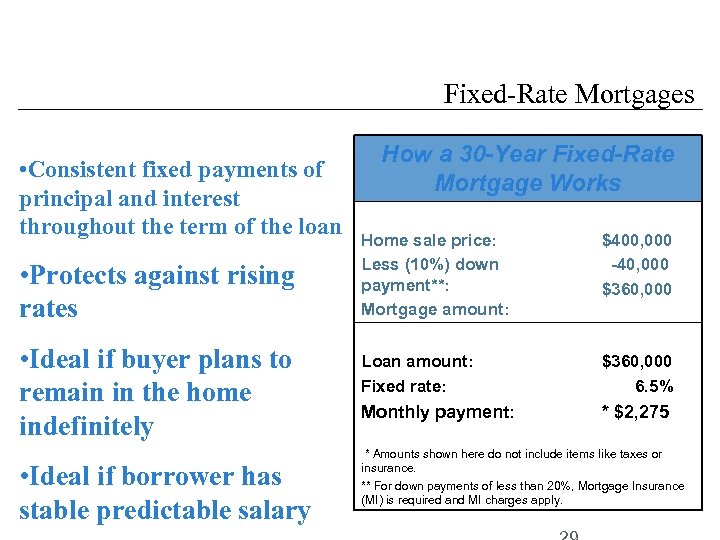

Fixed-Rate Mortgages • Consistent fixed payments of principal and interest throughout the term of the loan • Protects against rising rates • Ideal if buyer plans to remain in the home indefinitely • Ideal if borrower has stable predictable salary How a 30 -Year Fixed-Rate Mortgage Works Home sale price: Less (10%) down payment**: Mortgage amount: $400, 000 -40, 000 $360, 000 Loan amount: Fixed rate: $360, 000 6. 5% Monthly payment: * $2, 275 * Amounts shown here do not include items like taxes or insurance. ** For down payments of less than 20%, Mortgage Insurance (MI) is required and MI charges apply.

Fixed-Rate Mortgages • Consistent fixed payments of principal and interest throughout the term of the loan • Protects against rising rates • Ideal if buyer plans to remain in the home indefinitely • Ideal if borrower has stable predictable salary How a 30 -Year Fixed-Rate Mortgage Works Home sale price: Less (10%) down payment**: Mortgage amount: $400, 000 -40, 000 $360, 000 Loan amount: Fixed rate: $360, 000 6. 5% Monthly payment: * $2, 275 * Amounts shown here do not include items like taxes or insurance. ** For down payments of less than 20%, Mortgage Insurance (MI) is required and MI charges apply.

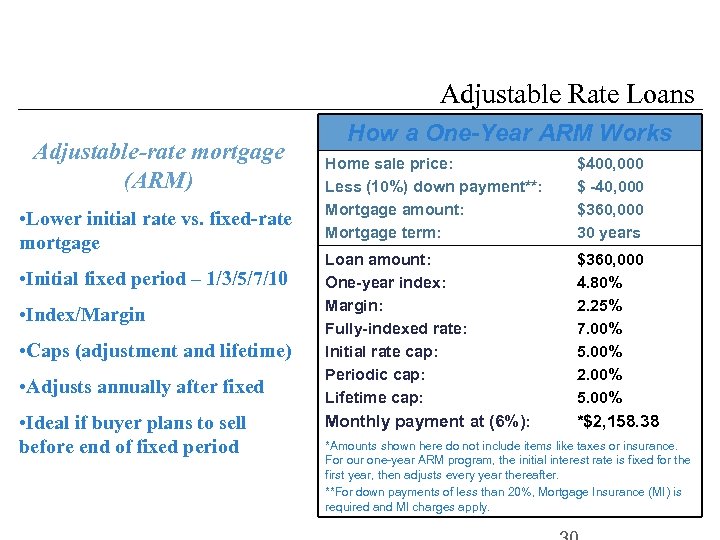

Adjustable Rate Loans Adjustable-rate mortgage (ARM) • Lower initial rate vs. fixed-rate mortgage • Initial fixed period – 1/3/5/7/10 • Index/Margin • Caps (adjustment and lifetime) • Adjusts annually after fixed • Ideal if buyer plans to sell before end of fixed period How a One-Year ARM Works Home sale price: Less (10%) down payment**: Mortgage amount: Mortgage term: $400, 000 $ -40, 000 $360, 000 30 years Loan amount: One-year index: Margin: Fully-indexed rate: Initial rate cap: Periodic cap: Lifetime cap: $360, 000 4. 80% 2. 25% 7. 00% 5. 00% 2. 00% 5. 00% Monthly payment at (6%): *$2, 158. 38 *Amounts shown here do not include items like taxes or insurance. For our one-year ARM program, the initial interest rate is fixed for the first year, then adjusts every year thereafter. **For down payments of less than 20%, Mortgage Insurance (MI) is required and MI charges apply.

Adjustable Rate Loans Adjustable-rate mortgage (ARM) • Lower initial rate vs. fixed-rate mortgage • Initial fixed period – 1/3/5/7/10 • Index/Margin • Caps (adjustment and lifetime) • Adjusts annually after fixed • Ideal if buyer plans to sell before end of fixed period How a One-Year ARM Works Home sale price: Less (10%) down payment**: Mortgage amount: Mortgage term: $400, 000 $ -40, 000 $360, 000 30 years Loan amount: One-year index: Margin: Fully-indexed rate: Initial rate cap: Periodic cap: Lifetime cap: $360, 000 4. 80% 2. 25% 7. 00% 5. 00% 2. 00% 5. 00% Monthly payment at (6%): *$2, 158. 38 *Amounts shown here do not include items like taxes or insurance. For our one-year ARM program, the initial interest rate is fixed for the first year, then adjusts every year thereafter. **For down payments of less than 20%, Mortgage Insurance (MI) is required and MI charges apply.

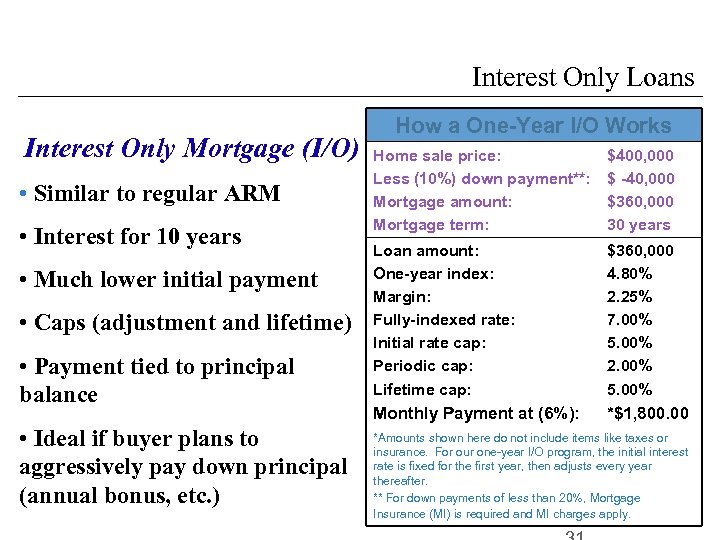

Interest Only Loans Interest Only Mortgage (I/O) • Similar to regular ARM • Interest for 10 years • Much lower initial payment • Caps (adjustment and lifetime) • Payment tied to principal balance • Ideal if buyer plans to aggressively pay down principal (annual bonus, etc. ) How a One-Year I/O Works Home sale price: Less (10%) down payment**: Mortgage amount: Mortgage term: $400, 000 $ -40, 000 $360, 000 30 years Loan amount: One-year index: Margin: Fully-indexed rate: Initial rate cap: Periodic cap: Lifetime cap: $360, 000 4. 80% 2. 25% 7. 00% 5. 00% 2. 00% 5. 00% Monthly Payment at (6%): *$1, 800. 00 *Amounts shown here do not include items like taxes or insurance. For our one-year I/O program, the initial interest rate is fixed for the first year, then adjusts every year thereafter. ** For down payments of less than 20%, Mortgage Insurance (MI) is required and MI charges apply.

Interest Only Loans Interest Only Mortgage (I/O) • Similar to regular ARM • Interest for 10 years • Much lower initial payment • Caps (adjustment and lifetime) • Payment tied to principal balance • Ideal if buyer plans to aggressively pay down principal (annual bonus, etc. ) How a One-Year I/O Works Home sale price: Less (10%) down payment**: Mortgage amount: Mortgage term: $400, 000 $ -40, 000 $360, 000 30 years Loan amount: One-year index: Margin: Fully-indexed rate: Initial rate cap: Periodic cap: Lifetime cap: $360, 000 4. 80% 2. 25% 7. 00% 5. 00% 2. 00% 5. 00% Monthly Payment at (6%): *$1, 800. 00 *Amounts shown here do not include items like taxes or insurance. For our one-year I/O program, the initial interest rate is fixed for the first year, then adjusts every year thereafter. ** For down payments of less than 20%, Mortgage Insurance (MI) is required and MI charges apply.

Adjustable Rate Loans (continued) ARM vs. fixed-rate mortgage • How long are you going to keep this home? • Do you need more house than a fixed-rate affords? • Will your cash-flow accommodate potential rate increases? • Would you use money saved in interest to prepay or otherwise invest for a higher return?

Adjustable Rate Loans (continued) ARM vs. fixed-rate mortgage • How long are you going to keep this home? • Do you need more house than a fixed-rate affords? • Will your cash-flow accommodate potential rate increases? • Would you use money saved in interest to prepay or otherwise invest for a higher return?

Interest Only Loans Interest Only vs. ARM mortgage Do you plan to pay down mortgage aggressively? If not… • In the adjustment period…payment shock • Higher interest rate possible • Full or near full balance still outstanding • Less time to amortize (27, 25, 23, 20 years) depending on product selected

Interest Only Loans Interest Only vs. ARM mortgage Do you plan to pay down mortgage aggressively? If not… • In the adjustment period…payment shock • Higher interest rate possible • Full or near full balance still outstanding • Less time to amortize (27, 25, 23, 20 years) depending on product selected

Creative Financing Alternatives to traditional mortgages… • Home equity programs that permit a simultaneous first mortgage and second mortgage closing • Temporary buy-downs (up-front fee or premium used to buy down the interest rate for a temporary time period)

Creative Financing Alternatives to traditional mortgages… • Home equity programs that permit a simultaneous first mortgage and second mortgage closing • Temporary buy-downs (up-front fee or premium used to buy down the interest rate for a temporary time period)

Creative Financing Continued Using a creative underwriting style • Asset Dissipation – This is when an asset such as a mutual fund / stock/ savings / checking / vested amount in retirement account is averaged and considered income. The method can be used for employed or retired borrowers.

Creative Financing Continued Using a creative underwriting style • Asset Dissipation – This is when an asset such as a mutual fund / stock/ savings / checking / vested amount in retirement account is averaged and considered income. The method can be used for employed or retired borrowers.

Property Types • Single Family • 1 to 4 Family • Mixed Use property • Condominium • Cooperative

Property Types • Single Family • 1 to 4 Family • Mixed Use property • Condominium • Cooperative

Condominiums - Where’s the Risk Condominium living means participation in an association where the residents must rely on each other and their Board members to keep the property and its financials in good standing. HOAs which are run poorly: § Run the budget in the red § Levy large assessments for unnecessary work § Apply for improper insurance coverage (in an effort to cut costs) leading to additional cost for the association members § Allow too many investors to purchase units in one building § Have Board members who are unwilling to address building needs in an effort to reduce costs § Have relaxed policies for delinquent dues

Condominiums - Where’s the Risk Condominium living means participation in an association where the residents must rely on each other and their Board members to keep the property and its financials in good standing. HOAs which are run poorly: § Run the budget in the red § Levy large assessments for unnecessary work § Apply for improper insurance coverage (in an effort to cut costs) leading to additional cost for the association members § Allow too many investors to purchase units in one building § Have Board members who are unwilling to address building needs in an effort to reduce costs § Have relaxed policies for delinquent dues

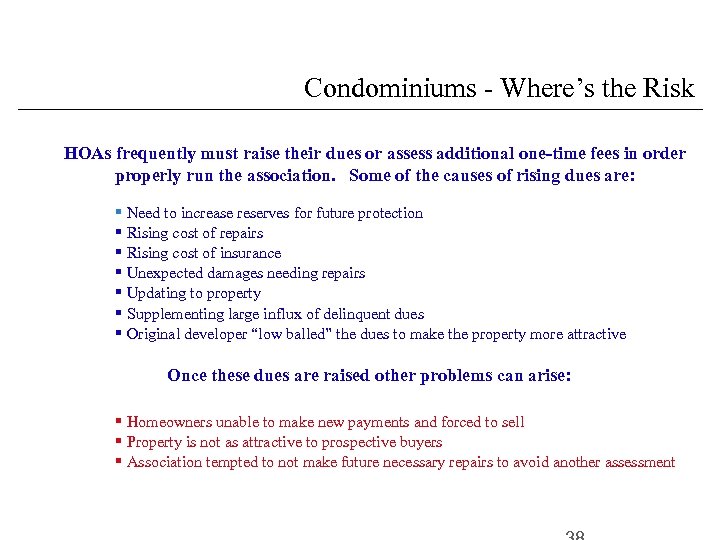

Condominiums - Where’s the Risk HOAs frequently must raise their dues or assess additional one-time fees in order properly run the association. Some of the causes of rising dues are: § Need to increase reserves for future protection § Rising cost of repairs § Rising cost of insurance § Unexpected damages needing repairs § Updating to property § Supplementing large influx of delinquent dues § Original developer “low balled” the dues to make the property more attractive Once these dues are raised other problems can arise: § Homeowners unable to make new payments and forced to sell § Property is not as attractive to prospective buyers § Association tempted to not make future necessary repairs to avoid another assessment

Condominiums - Where’s the Risk HOAs frequently must raise their dues or assess additional one-time fees in order properly run the association. Some of the causes of rising dues are: § Need to increase reserves for future protection § Rising cost of repairs § Rising cost of insurance § Unexpected damages needing repairs § Updating to property § Supplementing large influx of delinquent dues § Original developer “low balled” the dues to make the property more attractive Once these dues are raised other problems can arise: § Homeowners unable to make new payments and forced to sell § Property is not as attractive to prospective buyers § Association tempted to not make future necessary repairs to avoid another assessment

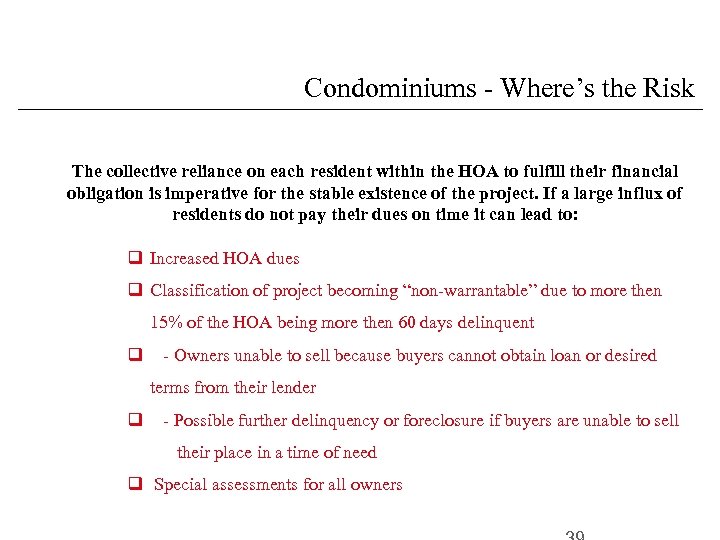

Condominiums - Where’s the Risk The collective reliance on each resident within the HOA to fulfill their financial obligation is imperative for the stable existence of the project. If a large influx of residents do not pay their dues on time it can lead to: q Increased HOA dues q Classification of project becoming “non-warrantable” due to more then 15% of the HOA being more then 60 days delinquent q - Owners unable to sell because buyers cannot obtain loan or desired terms from their lender q - Possible further delinquency or foreclosure if buyers are unable to sell their place in a time of need q Special assessments for all owners

Condominiums - Where’s the Risk The collective reliance on each resident within the HOA to fulfill their financial obligation is imperative for the stable existence of the project. If a large influx of residents do not pay their dues on time it can lead to: q Increased HOA dues q Classification of project becoming “non-warrantable” due to more then 15% of the HOA being more then 60 days delinquent q - Owners unable to sell because buyers cannot obtain loan or desired terms from their lender q - Possible further delinquency or foreclosure if buyers are unable to sell their place in a time of need q Special assessments for all owners

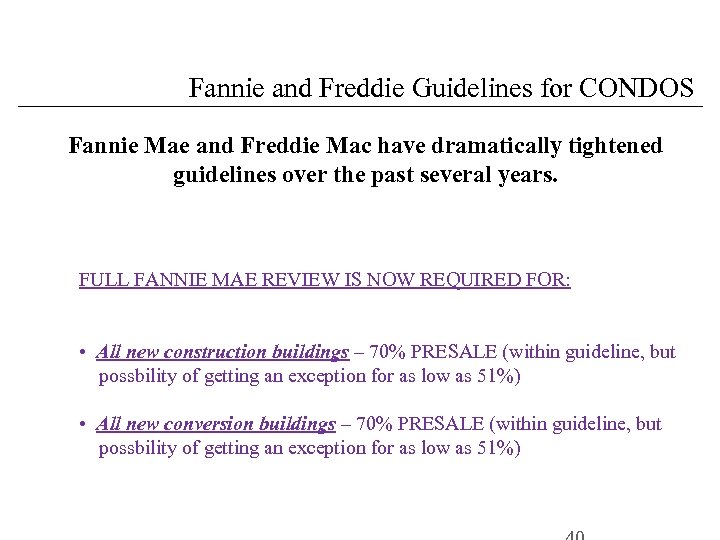

Fannie and Freddie Guidelines for CONDOS Fannie Mae and Freddie Mac have dramatically tightened guidelines over the past several years. FULL FANNIE MAE REVIEW IS NOW REQUIRED FOR: • All new construction buildings – 70% PRESALE (within guideline, but possbility of getting an exception for as low as 51%) • All new conversion buildings – 70% PRESALE (within guideline, but possbility of getting an exception for as low as 51%)

Fannie and Freddie Guidelines for CONDOS Fannie Mae and Freddie Mac have dramatically tightened guidelines over the past several years. FULL FANNIE MAE REVIEW IS NOW REQUIRED FOR: • All new construction buildings – 70% PRESALE (within guideline, but possbility of getting an exception for as low as 51%) • All new conversion buildings – 70% PRESALE (within guideline, but possbility of getting an exception for as low as 51%)

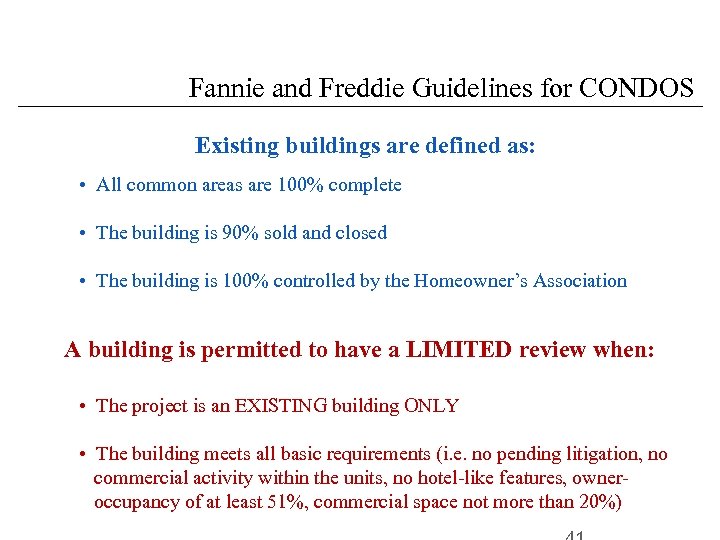

Fannie and Freddie Guidelines for CONDOS Existing buildings are defined as: • All common areas are 100% complete • The building is 90% sold and closed • The building is 100% controlled by the Homeowner’s Association A building is permitted to have a LIMITED review when: • The project is an EXISTING building ONLY • The building meets all basic requirements (i. e. no pending litigation, no commercial activity within the units, no hotel-like features, owneroccupancy of at least 51%, commercial space not more than 20%)

Fannie and Freddie Guidelines for CONDOS Existing buildings are defined as: • All common areas are 100% complete • The building is 90% sold and closed • The building is 100% controlled by the Homeowner’s Association A building is permitted to have a LIMITED review when: • The project is an EXISTING building ONLY • The building meets all basic requirements (i. e. no pending litigation, no commercial activity within the units, no hotel-like features, owneroccupancy of at least 51%, commercial space not more than 20%)

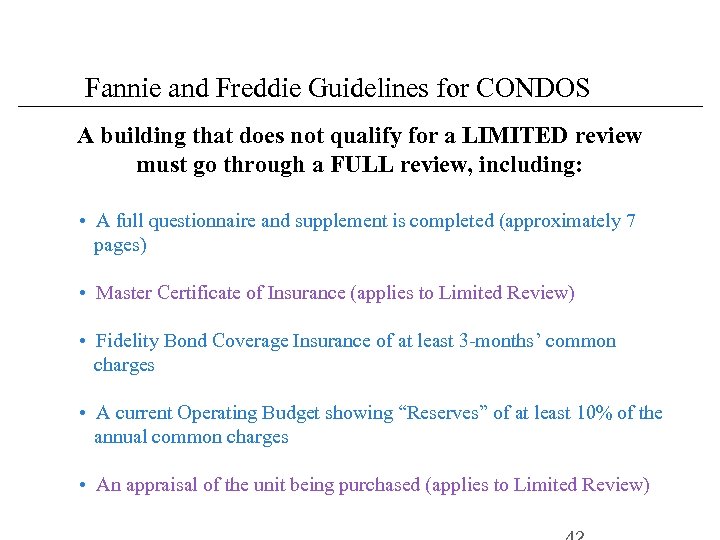

Fannie and Freddie Guidelines for CONDOS A building that does not qualify for a LIMITED review must go through a FULL review, including: • A full questionnaire and supplement is completed (approximately 7 pages) • Master Certificate of Insurance (applies to Limited Review) • Fidelity Bond Coverage Insurance of at least 3 -months’ common charges • A current Operating Budget showing “Reserves” of at least 10% of the annual common charges • An appraisal of the unit being purchased (applies to Limited Review)

Fannie and Freddie Guidelines for CONDOS A building that does not qualify for a LIMITED review must go through a FULL review, including: • A full questionnaire and supplement is completed (approximately 7 pages) • Master Certificate of Insurance (applies to Limited Review) • Fidelity Bond Coverage Insurance of at least 3 -months’ common charges • A current Operating Budget showing “Reserves” of at least 10% of the annual common charges • An appraisal of the unit being purchased (applies to Limited Review)

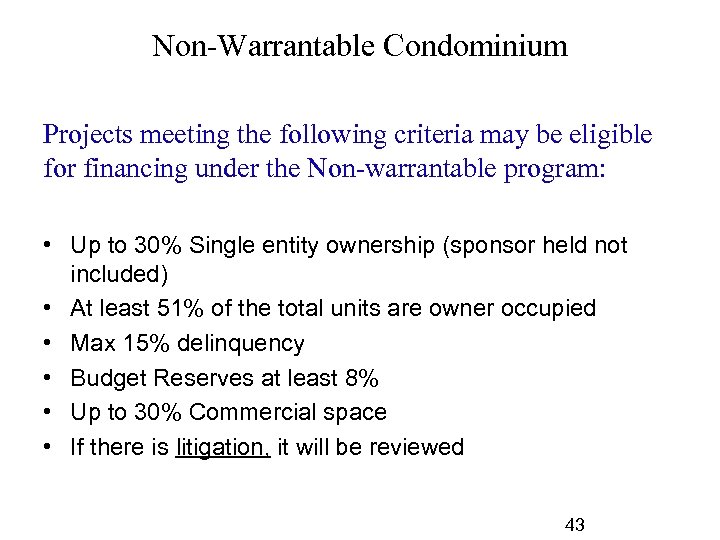

Non-Warrantable Condominium Projects meeting the following criteria may be eligible for financing under the Non-warrantable program: • Up to 30% Single entity ownership (sponsor held not included) • At least 51% of the total units are owner occupied • Max 15% delinquency • Budget Reserves at least 8% • Up to 30% Commercial space • If there is litigation, it will be reviewed 43

Non-Warrantable Condominium Projects meeting the following criteria may be eligible for financing under the Non-warrantable program: • Up to 30% Single entity ownership (sponsor held not included) • At least 51% of the total units are owner occupied • Max 15% delinquency • Budget Reserves at least 8% • Up to 30% Commercial space • If there is litigation, it will be reviewed 43

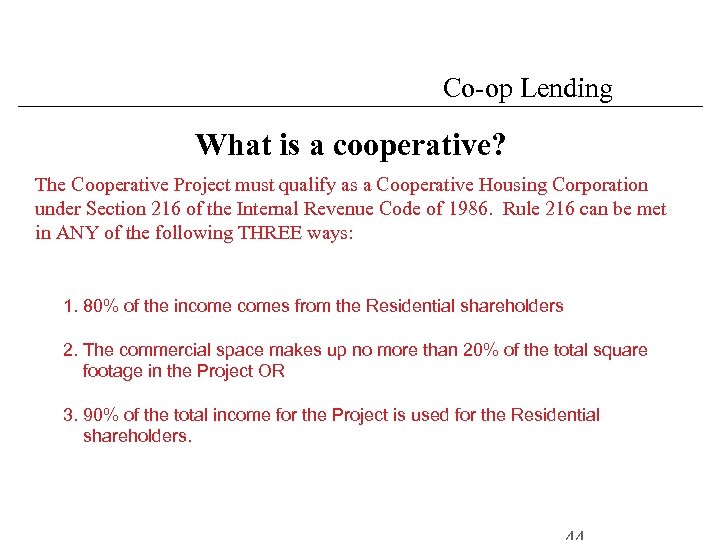

Co-op Lending What is a cooperative? The Cooperative Project must qualify as a Cooperative Housing Corporation under Section 216 of the Internal Revenue Code of 1986. Rule 216 can be met in ANY of the following THREE ways: 1. 80% of the incomes from the Residential shareholders 2. The commercial space makes up no more than 20% of the total square footage in the Project OR 3. 90% of the total income for the Project is used for the Residential shareholders.

Co-op Lending What is a cooperative? The Cooperative Project must qualify as a Cooperative Housing Corporation under Section 216 of the Internal Revenue Code of 1986. Rule 216 can be met in ANY of the following THREE ways: 1. 80% of the incomes from the Residential shareholders 2. The commercial space makes up no more than 20% of the total square footage in the Project OR 3. 90% of the total income for the Project is used for the Residential shareholders.

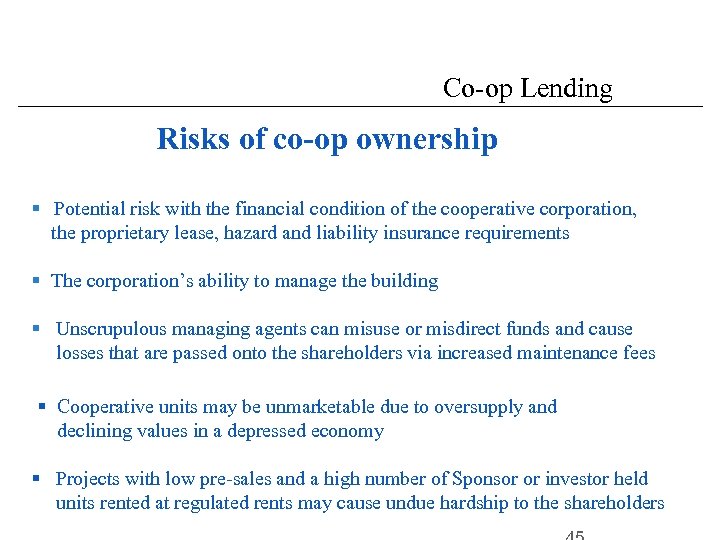

Co-op Lending Risks of co-op ownership § Potential risk with the financial condition of the cooperative corporation, the proprietary lease, hazard and liability insurance requirements § The corporation’s ability to manage the building § Unscrupulous managing agents can misuse or misdirect funds and cause losses that are passed onto the shareholders via increased maintenance fees § Cooperative units may be unmarketable due to oversupply and declining values in a depressed economy § Projects with low pre-sales and a high number of Sponsor or investor held units rented at regulated rents may cause undue hardship to the shareholders

Co-op Lending Risks of co-op ownership § Potential risk with the financial condition of the cooperative corporation, the proprietary lease, hazard and liability insurance requirements § The corporation’s ability to manage the building § Unscrupulous managing agents can misuse or misdirect funds and cause losses that are passed onto the shareholders via increased maintenance fees § Cooperative units may be unmarketable due to oversupply and declining values in a depressed economy § Projects with low pre-sales and a high number of Sponsor or investor held units rented at regulated rents may cause undue hardship to the shareholders

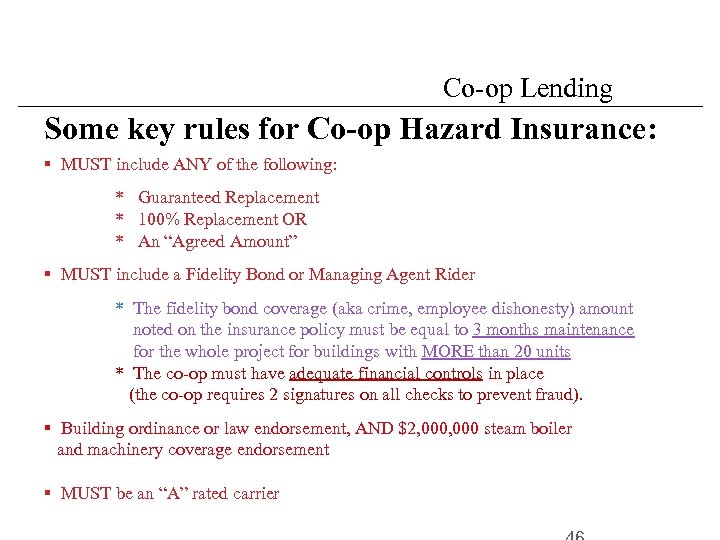

Co-op Lending Some key rules for Co-op Hazard Insurance: § MUST include ANY of the following: * Guaranteed Replacement * 100% Replacement OR * An “Agreed Amount” § MUST include a Fidelity Bond or Managing Agent Rider * The fidelity bond coverage (aka crime, employee dishonesty) amount noted on the insurance policy must be equal to 3 months maintenance for the whole project for buildings with MORE than 20 units * The co-op must have adequate financial controls in place (the co-op requires 2 signatures on all checks to prevent fraud). § Building ordinance or law endorsement, AND $2, 000 steam boiler and machinery coverage endorsement § MUST be an “A” rated carrier

Co-op Lending Some key rules for Co-op Hazard Insurance: § MUST include ANY of the following: * Guaranteed Replacement * 100% Replacement OR * An “Agreed Amount” § MUST include a Fidelity Bond or Managing Agent Rider * The fidelity bond coverage (aka crime, employee dishonesty) amount noted on the insurance policy must be equal to 3 months maintenance for the whole project for buildings with MORE than 20 units * The co-op must have adequate financial controls in place (the co-op requires 2 signatures on all checks to prevent fraud). § Building ordinance or law endorsement, AND $2, 000 steam boiler and machinery coverage endorsement § MUST be an “A” rated carrier

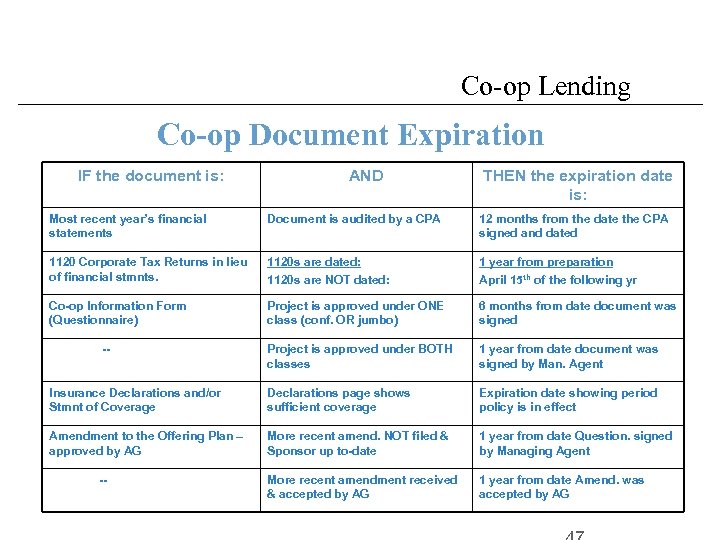

Co-op Lending Co-op Document Expiration IF the document is: AND THEN the expiration date is: Most recent year’s financial statements Document is audited by a CPA 12 months from the date the CPA signed and dated 1120 Corporate Tax Returns in lieu of financial stmnts. 1120 s are dated: 1120 s are NOT dated: 1 year from preparation April 15 th of the following yr Co-op Information Form (Questionnaire) Project is approved under ONE class (conf. OR jumbo) 6 months from date document was signed -- Project is approved under BOTH classes 1 year from date document was signed by Man. Agent Insurance Declarations and/or Stmnt of Coverage Declarations page shows sufficient coverage Expiration date showing period policy is in effect Amendment to the Offering Plan – approved by AG More recent amend. NOT filed & Sponsor up to-date 1 year from date Question. signed by Managing Agent -- More recent amendment received & accepted by AG 1 year from date Amend. was accepted by AG

Co-op Lending Co-op Document Expiration IF the document is: AND THEN the expiration date is: Most recent year’s financial statements Document is audited by a CPA 12 months from the date the CPA signed and dated 1120 Corporate Tax Returns in lieu of financial stmnts. 1120 s are dated: 1120 s are NOT dated: 1 year from preparation April 15 th of the following yr Co-op Information Form (Questionnaire) Project is approved under ONE class (conf. OR jumbo) 6 months from date document was signed -- Project is approved under BOTH classes 1 year from date document was signed by Man. Agent Insurance Declarations and/or Stmnt of Coverage Declarations page shows sufficient coverage Expiration date showing period policy is in effect Amendment to the Offering Plan – approved by AG More recent amend. NOT filed & Sponsor up to-date 1 year from date Question. signed by Managing Agent -- More recent amendment received & accepted by AG 1 year from date Amend. was accepted by AG

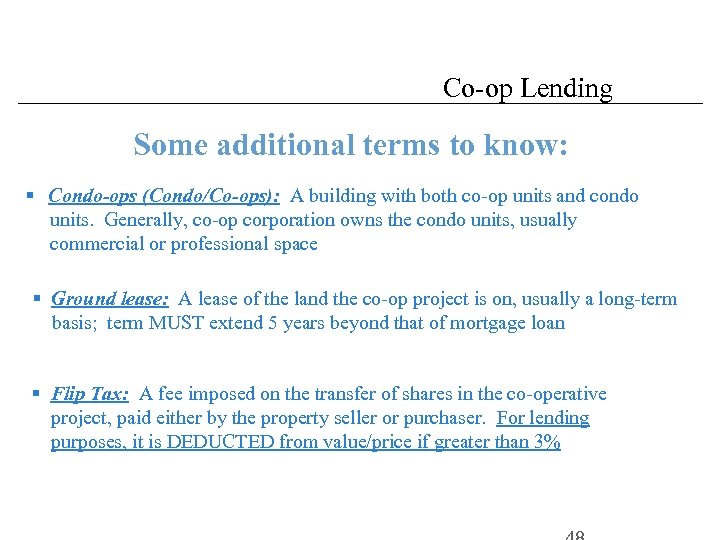

Co-op Lending Some additional terms to know: § Condo-ops (Condo/Co-ops): A building with both co-op units and condo units. Generally, co-op corporation owns the condo units, usually commercial or professional space § Ground lease: A lease of the land the co-op project is on, usually a long-term basis; term MUST extend 5 years beyond that of mortgage loan § Flip Tax: A fee imposed on the transfer of shares in the co-operative project, paid either by the property seller or purchaser. For lending purposes, it is DEDUCTED from value/price if greater than 3%

Co-op Lending Some additional terms to know: § Condo-ops (Condo/Co-ops): A building with both co-op units and condo units. Generally, co-op corporation owns the condo units, usually commercial or professional space § Ground lease: A lease of the land the co-op project is on, usually a long-term basis; term MUST extend 5 years beyond that of mortgage loan § Flip Tax: A fee imposed on the transfer of shares in the co-operative project, paid either by the property seller or purchaser. For lending purposes, it is DEDUCTED from value/price if greater than 3%

Preparing for the Closing • Meet conditions of the commitment • Resolve title questions • Obtain homeowner’s insurance • Final walk-through inspection • Final estimate of closing costs • Certified checks

Preparing for the Closing • Meet conditions of the commitment • Resolve title questions • Obtain homeowner’s insurance • Final walk-through inspection • Final estimate of closing costs • Certified checks

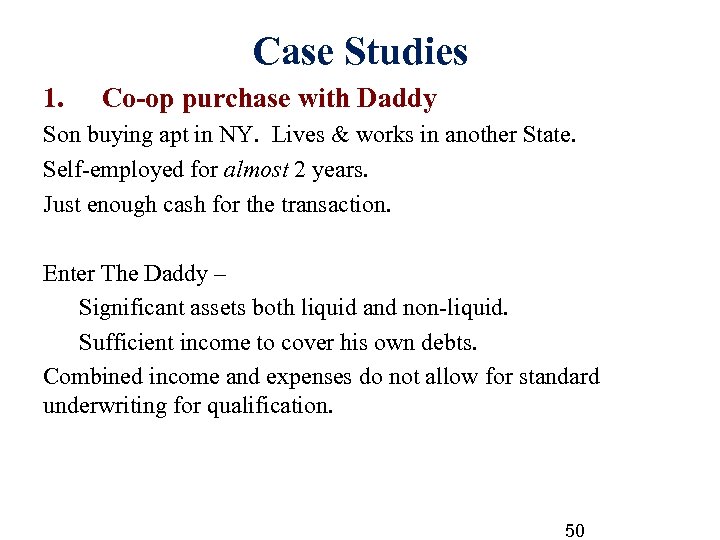

Case Studies 1. Co-op purchase with Daddy Son buying apt in NY. Lives & works in another State. Self-employed for almost 2 years. Just enough cash for the transaction. Enter The Daddy – Significant assets both liquid and non-liquid. Sufficient income to cover his own debts. Combined income and expenses do not allow for standard underwriting for qualification. 50

Case Studies 1. Co-op purchase with Daddy Son buying apt in NY. Lives & works in another State. Self-employed for almost 2 years. Just enough cash for the transaction. Enter The Daddy – Significant assets both liquid and non-liquid. Sufficient income to cover his own debts. Combined income and expenses do not allow for standard underwriting for qualification. 50

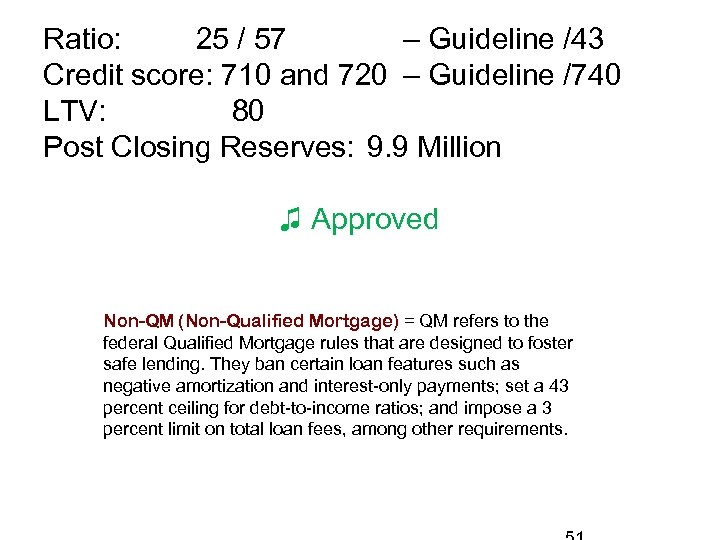

Ratio: 25 / 57 – Guideline /43 Credit score: 710 and 720 – Guideline /740 LTV: 80 Post Closing Reserves: 9. 9 Million ♫ Approved Non-QM (Non-Qualified Mortgage) = QM refers to the federal Qualified Mortgage rules that are designed to foster safe lending. They ban certain loan features such as negative amortization and interest-only payments; set a 43 percent ceiling for debt-to-income ratios; and impose a 3 percent limit on total loan fees, among other requirements.

Ratio: 25 / 57 – Guideline /43 Credit score: 710 and 720 – Guideline /740 LTV: 80 Post Closing Reserves: 9. 9 Million ♫ Approved Non-QM (Non-Qualified Mortgage) = QM refers to the federal Qualified Mortgage rules that are designed to foster safe lending. They ban certain loan features such as negative amortization and interest-only payments; set a 43 percent ceiling for debt-to-income ratios; and impose a 3 percent limit on total loan fees, among other requirements.

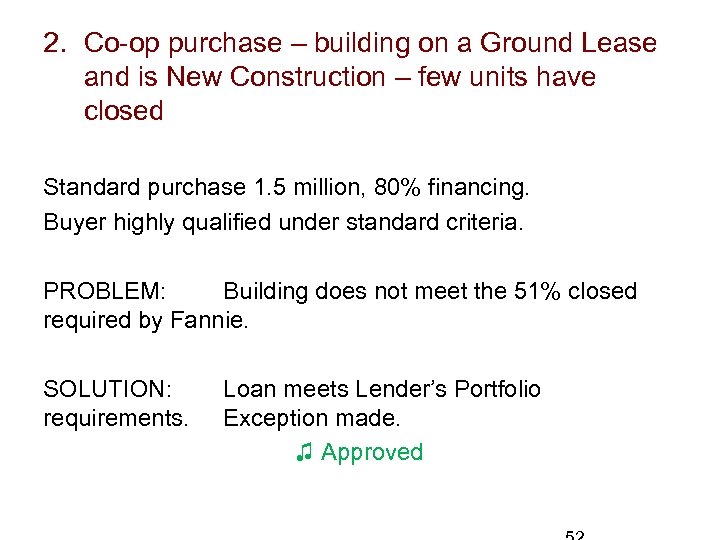

2. Co-op purchase – building on a Ground Lease and is New Construction – few units have closed Standard purchase 1. 5 million, 80% financing. Buyer highly qualified under standard criteria. PROBLEM: Building does not meet the 51% closed required by Fannie. SOLUTION: Loan meets Lender’s Portfolio requirements. Exception made. ♫ Approved

2. Co-op purchase – building on a Ground Lease and is New Construction – few units have closed Standard purchase 1. 5 million, 80% financing. Buyer highly qualified under standard criteria. PROBLEM: Building does not meet the 51% closed required by Fannie. SOLUTION: Loan meets Lender’s Portfolio requirements. Exception made. ♫ Approved

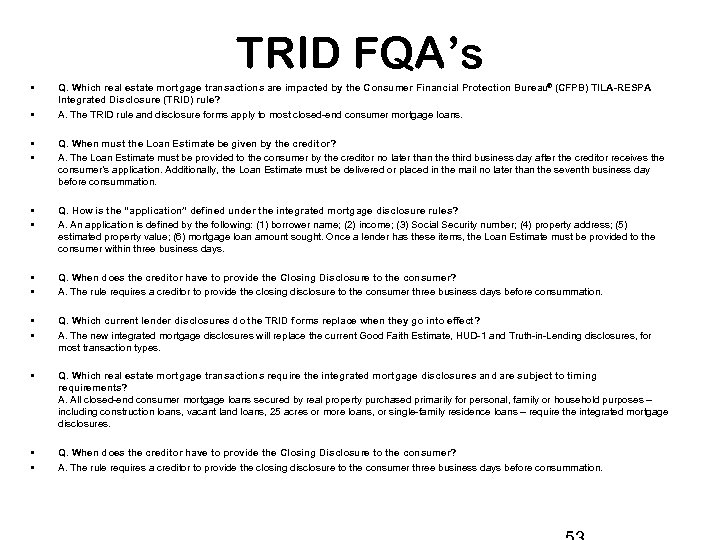

TRID FQA’s • • Q. Which real estate mortgage transactions are impacted by the Consumer Financial Protection Bureau® (CFPB) TILA-RESPA Integrated Disclosure (TRID) rule? A. The TRID rule and disclosure forms apply to most closed-end consumer mortgage loans. • • Q. When must the Loan Estimate be given by the creditor? A. The Loan Estimate must be provided to the consumer by the creditor no later than the third business day after the creditor receives the consumer’s application. Additionally, the Loan Estimate must be delivered or placed in the mail no later than the seventh business day before consummation. • • Q. How is the “application” defined under the integrated mortgage disclosure rules? A. An application is defined by the following: (1) borrower name; (2) income; (3) Social Security number; (4) property address; (5) estimated property value; (6) mortgage loan amount sought. Once a lender has these items, the Loan Estimate must be provided to the consumer within three business days. • • Q. When does the creditor have to provide the Closing Disclosure to the consumer? A. The rule requires a creditor to provide the closing disclosure to the consumer three business days before consummation. • • Q. Which current lender disclosures do the TRID forms replace when they go into effect? A. The new integrated mortgage disclosures will replace the current Good Faith Estimate, HUD-1 and Truth-in-Lending disclosures, for most transaction types. • Q. Which real estate mortgage transactions require the integrated mortgage disclosures and are subject to timing requirements? A. All closed-end consumer mortgage loans secured by real property purchased primarily for personal, family or household purposes – including construction loans, vacant land loans, 25 acres or more loans, or single-family residence loans – require the integrated mortgage disclosures. • • Q. When does the creditor have to provide the Closing Disclosure to the consumer? A. The rule requires a creditor to provide the closing disclosure to the consumer three business days before consummation.

TRID FQA’s • • Q. Which real estate mortgage transactions are impacted by the Consumer Financial Protection Bureau® (CFPB) TILA-RESPA Integrated Disclosure (TRID) rule? A. The TRID rule and disclosure forms apply to most closed-end consumer mortgage loans. • • Q. When must the Loan Estimate be given by the creditor? A. The Loan Estimate must be provided to the consumer by the creditor no later than the third business day after the creditor receives the consumer’s application. Additionally, the Loan Estimate must be delivered or placed in the mail no later than the seventh business day before consummation. • • Q. How is the “application” defined under the integrated mortgage disclosure rules? A. An application is defined by the following: (1) borrower name; (2) income; (3) Social Security number; (4) property address; (5) estimated property value; (6) mortgage loan amount sought. Once a lender has these items, the Loan Estimate must be provided to the consumer within three business days. • • Q. When does the creditor have to provide the Closing Disclosure to the consumer? A. The rule requires a creditor to provide the closing disclosure to the consumer three business days before consummation. • • Q. Which current lender disclosures do the TRID forms replace when they go into effect? A. The new integrated mortgage disclosures will replace the current Good Faith Estimate, HUD-1 and Truth-in-Lending disclosures, for most transaction types. • Q. Which real estate mortgage transactions require the integrated mortgage disclosures and are subject to timing requirements? A. All closed-end consumer mortgage loans secured by real property purchased primarily for personal, family or household purposes – including construction loans, vacant land loans, 25 acres or more loans, or single-family residence loans – require the integrated mortgage disclosures. • • Q. When does the creditor have to provide the Closing Disclosure to the consumer? A. The rule requires a creditor to provide the closing disclosure to the consumer three business days before consummation.

Q. Can settlement agents prepare the Closing Disclosure and send it to the lender for approval, just as they can today for the HUD-1? A. Lenders are accountable for compliance, including the timing and accuracy of the Closing Disclosure, and most will therefore prepare and deliver the Closing Disclosure to the consumer. Q. Which real estate mortgage transactions are exempt from the integrated mortgage disclosures? A. The integrated mortgage disclosures do not apply to: Home-equity lines of credit (HELOCs; not subject to RESPA); Reverse mortgages (continue to be subject to RESPA); Mortgages secured by a mobile home or dwelling not attached to land (if the mobile home is real property, the rule does apply); No-interest second mortgage made for down payment assistance, energy efficiency or foreclosure avoidance (§ 12 CFR 1026. 3(h)); Loans made by a creditor who makes five or fewer mortgages in a single year. Q. Do the integrated mortgage disclosures apply to cash transactions? A. Currently, they do not. Q. Is the lender required to issue a revised Closing Disclosure at the closing table if the initial Closing Disclosure contains inaccurate fees and costs? A. Yes. Under TRID, the settlement agent must close only on an accurate Closing Disclosure. The lender must issue a revised Closing Disclosure at the closing table if any fees and costs have changed since the initial Closing Disclosure. Permitting a closing to move forward without a revised Closing Disclosure could jeopardize the settlement agent and lender's compliance with the rule, which is not acceptable at any time. Q. Which changes (inaccuracies) before consummation require a new three business day waiting period and a corrected Closing Disclosure? (§ 12 CFR 1026. 19(f)(2)(ii); Comment 19 (f)(2)(ii)-1) A. If one of the following occurs before delivery of the Closing Disclosure and before consummation, the consumers must receive a revised Closing Disclosure and an additional three business day waiting period: The APR increases by more than 1/8% on fixed loans and 1/4% on adjustable loans; (§ 12 CFR 1026. 22) (§ 1026. 19(f)(2)(ii)(A)). APR is above APR tolerance. The loan product previously disclosed changes or becomes inaccurate (§ 1026. 19(f)(2)(ii)(B)) unless a bona fide personal financial emergency (§ 1026. 19(f)(1)(iv)). A prepayment penalty is added to the transaction (§ 1026. 19(f)(2)(ii)(C)).

Q. Can settlement agents prepare the Closing Disclosure and send it to the lender for approval, just as they can today for the HUD-1? A. Lenders are accountable for compliance, including the timing and accuracy of the Closing Disclosure, and most will therefore prepare and deliver the Closing Disclosure to the consumer. Q. Which real estate mortgage transactions are exempt from the integrated mortgage disclosures? A. The integrated mortgage disclosures do not apply to: Home-equity lines of credit (HELOCs; not subject to RESPA); Reverse mortgages (continue to be subject to RESPA); Mortgages secured by a mobile home or dwelling not attached to land (if the mobile home is real property, the rule does apply); No-interest second mortgage made for down payment assistance, energy efficiency or foreclosure avoidance (§ 12 CFR 1026. 3(h)); Loans made by a creditor who makes five or fewer mortgages in a single year. Q. Do the integrated mortgage disclosures apply to cash transactions? A. Currently, they do not. Q. Is the lender required to issue a revised Closing Disclosure at the closing table if the initial Closing Disclosure contains inaccurate fees and costs? A. Yes. Under TRID, the settlement agent must close only on an accurate Closing Disclosure. The lender must issue a revised Closing Disclosure at the closing table if any fees and costs have changed since the initial Closing Disclosure. Permitting a closing to move forward without a revised Closing Disclosure could jeopardize the settlement agent and lender's compliance with the rule, which is not acceptable at any time. Q. Which changes (inaccuracies) before consummation require a new three business day waiting period and a corrected Closing Disclosure? (§ 12 CFR 1026. 19(f)(2)(ii); Comment 19 (f)(2)(ii)-1) A. If one of the following occurs before delivery of the Closing Disclosure and before consummation, the consumers must receive a revised Closing Disclosure and an additional three business day waiting period: The APR increases by more than 1/8% on fixed loans and 1/4% on adjustable loans; (§ 12 CFR 1026. 22) (§ 1026. 19(f)(2)(ii)(A)). APR is above APR tolerance. The loan product previously disclosed changes or becomes inaccurate (§ 1026. 19(f)(2)(ii)(B)) unless a bona fide personal financial emergency (§ 1026. 19(f)(1)(iv)). A prepayment penalty is added to the transaction (§ 1026. 19(f)(2)(ii)(C)).

• Q. How are weekends and holidays factored into the three business day rule? A. For purposes of counting the three business day rule as it relates to delivery of the Closing Disclosure, Saturdays count but Sundays do not. All U. S. Postal holidays do not count. • Q. Who is responsible for preparing and providing Seller’s Closing Disclosure to the Seller? A. The settlement agent is responsible for preparing and providing the Seller’s Closing Disclosure to the seller, reflecting the actual fees and terms related to the seller’s transaction. (See § 1026. 19(f)(4)(i)). • • Q. Is the settlement agent required to provide an updated Seller’s Closing Disclosure if amounts change? A. Yes. If any amounts change, the settlement agent must provide a revised Seller’s Closing Disclosure no later than 30 days after receiving information that necessitates the change that occurred. (See § 1026. 19(f)(4)(ii). ) The revised Seller’s Closing Disclosure should be consistent with the finalized Seller’s ALTA Settlement Statement. • Q. Will all lenders collaborate on a standard and consistent process for meeting all of the TILA-RESPA Integrated Disclosure provisions? A. No. Each will determine its own procedures for TRID compliance and is accountable for compliance. • Q. Which changes (inaccuracies) before consummation require a new three business day waiting period and a corrected Closing Disclosure? (§ 12 CFR 1026. 19(f)(2)(ii); Comment 19 (f)(2)(ii)-1) • A. If one of the following occurs before deliver of the Closing Disclosure and before consummation, the consumers must receive a revised Closing Disclosure and an additional three business day waiting period: The APR increases by more than 1/8% on fixed loans and 1/4% on adjustable loans; (§ 12 CFR 1026. 22) (§ 1026. 19(f)(2)(ii)(A)). APR is above APR tolerance. The loan product previously disclosed changes or becomes inaccurate (§ 1026. 19(f)(2)(ii)(B)) unless a bona fide personal financial emergency (§ 1026. 19(f)(1)(iv)). A prepayment penalty is added to the transaction (§ 1026. 19(f)(2)(ii)(C)). • • •

• Q. How are weekends and holidays factored into the three business day rule? A. For purposes of counting the three business day rule as it relates to delivery of the Closing Disclosure, Saturdays count but Sundays do not. All U. S. Postal holidays do not count. • Q. Who is responsible for preparing and providing Seller’s Closing Disclosure to the Seller? A. The settlement agent is responsible for preparing and providing the Seller’s Closing Disclosure to the seller, reflecting the actual fees and terms related to the seller’s transaction. (See § 1026. 19(f)(4)(i)). • • Q. Is the settlement agent required to provide an updated Seller’s Closing Disclosure if amounts change? A. Yes. If any amounts change, the settlement agent must provide a revised Seller’s Closing Disclosure no later than 30 days after receiving information that necessitates the change that occurred. (See § 1026. 19(f)(4)(ii). ) The revised Seller’s Closing Disclosure should be consistent with the finalized Seller’s ALTA Settlement Statement. • Q. Will all lenders collaborate on a standard and consistent process for meeting all of the TILA-RESPA Integrated Disclosure provisions? A. No. Each will determine its own procedures for TRID compliance and is accountable for compliance. • Q. Which changes (inaccuracies) before consummation require a new three business day waiting period and a corrected Closing Disclosure? (§ 12 CFR 1026. 19(f)(2)(ii); Comment 19 (f)(2)(ii)-1) • A. If one of the following occurs before deliver of the Closing Disclosure and before consummation, the consumers must receive a revised Closing Disclosure and an additional three business day waiting period: The APR increases by more than 1/8% on fixed loans and 1/4% on adjustable loans; (§ 12 CFR 1026. 22) (§ 1026. 19(f)(2)(ii)(A)). APR is above APR tolerance. The loan product previously disclosed changes or becomes inaccurate (§ 1026. 19(f)(2)(ii)(B)) unless a bona fide personal financial emergency (§ 1026. 19(f)(1)(iv)). A prepayment penalty is added to the transaction (§ 1026. 19(f)(2)(ii)(C)). • • •

Common Things That Can Derail a File 1. 2. 3. 4. 5. 6. Information missing from the Application Pay stubs that are not consecutive or do not show required info Bonus received for 1 year only Credit Issues Bank statement shows other persons as account holder/Trust Deposit paper trails missing or incomplete/ unknown source of deposit / cash 7. Income verified does not match income provided: Tax returns, P&L’s or Balance sheets, or K-1’s missing 8. Borrower’s Visa is Expired 9. Customer refuses to transfer reserve funds to US account 10. Low Appraised value 11. Borrower received a new auto or other loan prior to anticipated closing 12. Building is not approvable

Common Things That Can Derail a File 1. 2. 3. 4. 5. 6. Information missing from the Application Pay stubs that are not consecutive or do not show required info Bonus received for 1 year only Credit Issues Bank statement shows other persons as account holder/Trust Deposit paper trails missing or incomplete/ unknown source of deposit / cash 7. Income verified does not match income provided: Tax returns, P&L’s or Balance sheets, or K-1’s missing 8. Borrower’s Visa is Expired 9. Customer refuses to transfer reserve funds to US account 10. Low Appraised value 11. Borrower received a new auto or other loan prior to anticipated closing 12. Building is not approvable

Questions

Questions

Thank you ~ Patricia Lavigne 646 -519 -7690 Cell 845 -234 -5472 Direct

Thank you ~ Patricia Lavigne 646 -519 -7690 Cell 845 -234 -5472 Direct