892223dc41dc5aa0d49ec4be3213c552.ppt

- Количество слайдов: 15

A Guide to Co-Director’s Insurance Prepared by SSD Insurances Ltd.

Planning is an essential part of any business strategy. The purpose of this guide is to suggest a potential solution to one of the most serious problems that can arise on the death of a co-director.

Importance of People in Business In modern Ireland, many small firms are established as private companies. The directors, who are often the company’s key people and most valuable assets, may also be the main shareholders. While managing the business together, the shareholders or directors will generally rely heavily on each other for support and advice, trusting each other’s judgement. If one of the business directors were to die, the company may encounter serious problems and issues may arise with regard to their share of the business. All businesses, whether large or small, are heavily dependent on one important asset – their people. It is people who are responsible for managing and developing the business as well as providing the drive, initiative and inventiveness to make the business a success.

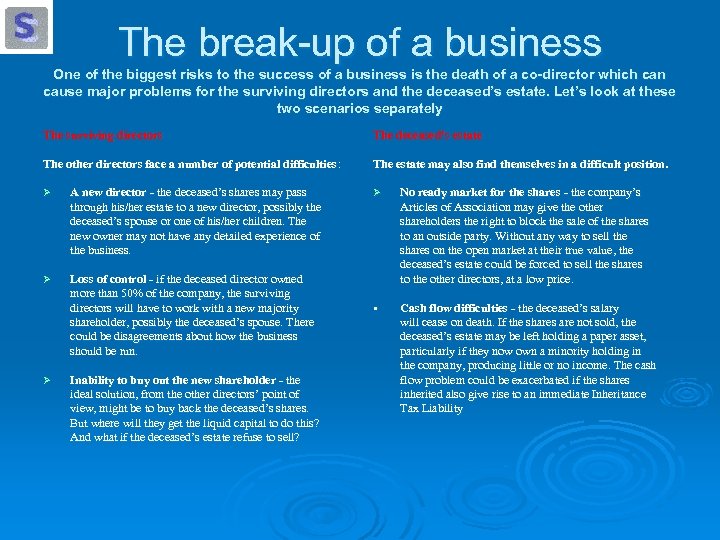

The break-up of a business One of the biggest risks to the success of a business is the death of a co-director which can cause major problems for the surviving directors and the deceased’s estate. Let’s look at these two scenarios separately The surviving directors The deceased’s estate The other directors face a number of potential difficulties: The estate may also find themselves in a difficult position. Ø A new director - the deceased’s shares may pass through his/her estate to a new director, possibly the deceased’s spouse or one of his/her children. The new owner may not have any detailed experience of the business. Ø Loss of control - if the deceased director owned more than 50% of the company, the surviving directors will have to work with a new majority shareholder, possibly the deceased’s spouse. There could be disagreements about how the business should be run. Ø Inability to buy out the new shareholder - the ideal solution, from the other directors’ point of view, might be to buy back the deceased’s shares. But where will they get the liquid capital to do this? And what if the deceased’s estate refuse to sell? Ø No ready market for the shares - the company’s Articles of Association may give the other shareholders the right to block the sale of the shares to an outside party. Without any way to sell the shares on the open market at their true value, the deceased’s estate could be forced to sell the shares to the other directors, at a low price. • Cash flow difficulties - the deceased’s salary will cease on death. If the shares are not sold, the deceased’s estate may be left holding a paper asset, particularly if they now own a minority holding in the company, producing little or no income. The cash flow problem could be exacerbated if the shares inherited also give rise to an immediate Inheritance Tax Liability

To ensure the proper transfer of the deceased director’s interest in the business, it makes sense to have an agreement in place

Providing a solution Where does life assurance fit in? Ø Arranging the Co-Director’s Insurance Life assurance is a very effective way of providing the necessary funds the surviving directors need to maintain control of the business on the death of a fellow director. A Co-Director’s Insurance plan is usually arranged by the directors of a company, who agree that in the event that any of them should die, the surviving directors will buy his/her shares in the business. Life assurance is arranged on each person’s life, ensuring that the surviving directors of the business receive funds that they can use to buy their deceased colleague’s share of the business. In this way, they do not have to strain their own financial resources or rely on large borrowings. Co-Director’s Insurance Ø The main objective of Co-Director’s Insurance is to ensure that the surviving directors receive the necessary funds to purchase the deceased director’s shareholding in the business. Under this arrangement, the surviving directors purchase their deceased colleague’s shareholding from his/her estate at market value. The benefits of this are: • • The surviving directors are left in control of the business. The deceased’s estate will also be adequately recompensed for selling their inherited stake in the business.

Creating a Buy/Sell Agreement The directors of the business enter into an agreement which states that if any of them should die, the surviving directors can purchase the other’s holding from his/her estate at a fair open market price. This agreement is known as a Buy/Sell Agreement. A Buy/Sell Agreement places an obligation on: 1. The personal representatives of the deceased’s estate to sell, and 2. The surviving directors of the business to buy the shareholding at a price, which is calculated in accordance with the terms of the agreement. A Double Option Agreement is an alternative arrangement to a Buy/Sell Agreement, the difference being that if both parties (i. e. the deceased’s estate and the surviving directors) are in agreement, they do not have to exercise their respective options at that time. As a result, the shares can pass to the deceased’s estate if so desired. This could be useful in a situation where all parties agree to a member of the deceased’s family retaining the shares and joining the business. Another example is where a member of the deceased’s family is already working in the business and this person simply takes over the share(s) and becomes more share(s) involved in the business. It should be noted that the purchase price should reflect the market value of the business. This ensures that the deceased’s estate receives a fair price. In addition, there could be tax implications if the agreement is not based on a fair price. However, independent legal and professional tax advice should be sought to ensure that the agreement most appropriate to the particular circumstances of each case is put in place

Setting up the Policies The most common arrangements used are based on the co-directors taking out life insurance policies on an “Own Life in Trust” or “Life of Another” basis. Before proceeding with the policy, however, all parties satisfy themselves with regard to the legal and tax implications of taking out Partnership Assurance. If in any doubt about the legal or tax position, independent advice should be sought. Let’s look at both types of agreement. Option 1 – “Own Life in Trust” Basis Example 1 On this plan basis, each of the directors takes out a life policy on his/her own life under trust for a sum assured equal to the value of his/her share of the business. In the event of one of the directors’ deaths, the trust ensures that the proceeds are payable to the surviving directors, who then use the proceeds to buy the deceased’s share of the business. The trust also allows for members to leave the business, with the policy reverting to personal cover under the terms of the trust. Any new director who joins the business can be included as a beneficiary under the terms of the existing trusts as long as they take out the appropriate life cover in trust for the other directors and become a party to the Buy/Sell or Double Option A, B and C are in business together. The value of the business is € 9 m and they each have a share of 1/3. If they were to take out Co. Director’s Insurance on a Life of Another basis the procedure would be: Ø A would take out a life policy on his/her own life in trust for B & C for a sum assured of € 3 m. Ø B would take out a life policy on his/her own life in trust for A & C for a sum assured of € 3 m. Ø C would take out a life policy on his/her own life in trust for A & B for a sum assured of € 3 m. In the event of A’s death, the proceeds of the life policies on A’s life would be paid to B & C would then use this money to pay A’s estate for A’s holding in the business. B & C would then each have a 50% holding in the business. At this stage, B & C should now review their existing business protection arrangement to take account of their revised holding in the business

The choice is normally between taking out life assurance policies on an “Own Life in Trust” or “Life of Another” basis. Option 1 - Tax implications Premiums can be paid: 1. By the individual director out of after-tax income or 2. By the company on behalf of the individual and declared as a benefit in kind by the individual. Capital Acquisitions Tax The proceeds of the policies are exempt from Capital Acquisitions Tax (CAT) provided the Co. Director’s arrangement falls within Revenue guidelines. Capital Gains Tax Under current legislation, any proceeds becoming payable under the terms of the policy are not liable to Capital Gains Tax. For Capital Gains Tax purposes, shares on death are deemed to be acquired by the deceased’s estate, at their market value at the date of death. There is no Capital Gains Tax liability on death. If the deceased’s estate sells their shares to the surviving partners, a liability to Capital Gains Tax would only arise in respect of any increase in the value of the shares from the date of death to the date of disposal. Revenue Guidelines Ø The Revenue approach to such policies, written in the form of”Own Life in Trust”, is to treat the proceeds as exempt from Capital Acquisitions Tax in certain circumstances. The following is an extract from the Revenue Commissioner’s Capital Aquisitions Tax Manual: “These are policies which are effected purely for commercial purposes and agreed between the individual partners/shareholders on an arms length basis without any intention to make a gift. The approach to such policies, written in the form of own life in trust for others, is to treat the proceeds as exempt from Inheritance Tax in the following circumstances:

Ø Proceeds on death will be used • to purchase the deceased’s shareholding. Any surplus arising will be liable to Inheritance Tax. Ø The capital sum under each policy will reflect the policyholder’s shareholding. Ø Payment of premiums will be made by the individual members, or on their behalf by the company or partnership out of the individual’s own company or partnership account. Ø New partner(s)/shareholder(s) can join the arrangement at any time, subject to the conditions applicable to the existing members of the plan. Ø On withdrawal from the company or on retirement, the policy of the partner who leaves reverts to himself and he will no longer benefit in the continuing arrangement, provided he sells his shareholding on withdrawal, otherwise he can remain a party to the arrangement. Such a policy will be an asset in his estate on his death and will not be exempt from C. A. T. Ø Where a partner refuses to join the arrangement or is unable to effect life insurance on medical grounds, he will be precluded from benefiting from the policies of his co-shareholders. Ø On the death of a sole surviving partner or shareholder, the policy on his life will be an asset in his estate and will not be exempt from C. A. T. Similarly, if a partnership breaks up or a company is wound up, policies which do not lapse will be liable on a death to C. A. T. Ø The insurance policies can either be term assurance, endowment or whole of life policies, with the death benefit only passing to the surviving shareholders. Ø • Co-Director’s/Partnership insurance using “Own Life in Trust” must be supported by relevant documentation: a) Buy/sell (or Double Option) Agreement b) Reciprocal agreement c) Trust document. ”

Setting up the Policies (continued) Option 2 – “Life of Another” basis Example 2 On this plan basis, each director takes out a life insurance policy on the life of each of the other directors for a specified sum assured. It is intended that this will enable the purchase of the appropriate portion of the deceased’s shareholding in the event of any of their deaths. A, B and C are in business together. The value of the business is € 9 m and they each have a share of 1/3. If they were to take out Co-Director’s Insurance on a Life of Another basis the procedure would be: The “Life of Another” method is very attractive where there are only two or three directors, but has a number of disadvantages when there a large number of directors involved in the business. Additionally, it is not a flexible arrangement for situations where new directors join the business or existing directors leave. When these kinds of change occur, it is necessary to alter the existing policies. As mentioned previously, it is important that the agreed price should reflect the fair value of the business. There could be tax implications if the agreement is not based on a fair price, not to mention the importance of ensuring that the estate receives an adequate price for the shares sold. A & B would each take out a life policy on C’s life for a sum assured of € 1. 5 m. B & C would each take out a life policy on A’s life for a sum assured of € 1. 5 m. A & C would each take out a life policy on B’s life for a sum assured of € 1. 5 m. In the event of A’s death, the proceeds of the life policies on A’s life (E 3 m in total) would be paid to B & C would then use this money to pay A’s estate for A’s holding in the business. B & C would then each have a 50% holding in the business. At this stage, B & C should now review their existing business protection arrangement to take account of their revised holding in the business.

Option 2 - Tax implications Capital Acquisitions Tax Premiums There is no Capital Acquisitions Tax liability on payment of proceeds of the life policies to the policyholders, since each person has paid for any specific benefit that they will receive. Premiums can be paid: 1. By the individual director out of after-tax income or 2. By the company on behalf of the individual and declared as a benefit in kind by the individual. Capital Gains Tax Under current legislation, any proceeds becoming payable under the terms of the policy are not liable to Capital Gains Tax. For Capital Gains Tax purposes, shares on death are deemed to be acquired by the deceased’s estate, at their market value at the date of death. There is no Capital Gains Tax liability on death. If the deceased’s estate sells their shares to the surviving directors, a liability to Capital Gains Tax would only arise in respect of any increase in the value of the shares from the date of death to the date of disposal. However, the deceased’s estate may have inheritance Tax liability on the value of the share(s) of the business inherited if that value exceeds their appropriate tax-free threshold(s). For more information on Inheritance Tax, please refer to our Inheritance Tax Guide.

Which Instance ? ? In the majority of situations an “Own Life in Trust” basis will provide a more satisfactory arrangement as it has a number of advantages: Ø Where there are more than two directors, only one policy per director needs to be put in place. When a director leaves the business, the trust provisions no longer apply to their policy. Ø New directors who join the business can be included as beneficiaries under the terms of the trust. The new person should take out a policy under trust for the benefit of the other directors to maintain equity. Important Before proceeding with the policy, we strongly recommend that all parties satisfy themselves with regard to the legal and tax implications of taking out Co-Director’s Insurance. If in any doubt about the legal or tax position, independent advice should be sought.

Specified Illness Cover Tax treatment of Specified Illness Benefit It is also possible to take out Specified Illness Cover under a Co-Director’s Insurance arrangement. The diagnosis of a specified illness can give rise to a situation similar to that arising on death: The payment of the proceeds of a specified illness policy will not be regarded as giving rise to CAT liability as long as they are used to purchase the ill director’s shares. Creating a Single Option agreement Ø Ø The ill director may want to sell his/her shares and realise a lump sum to retire from the company. The other directors may not have the necessary capital available at that time to buy the ill director’s shares. The benefit of adding specified illness cover to the arrangement is that should a director suffer a specified illness, the policy will pay out a pre-determined lump sum. This means the other directors will have access to the appropriate funds to buy their ill colleague’s share in the company. A single option agreement is normally used to cover the situation where one of the directors suffers a specified illness. The director that suffers the illness has the option, within an agreed period, to sell his/her shares to the other directors. If he/she chooses to exercise this option, it will become binding on the other directors. The advantage of the single option agreement is that the director who suffers the specified illness cannot be forced out of the business.

NOTES This guide has been drafted by SSD Insurances Limited. While great care has been taken to ensure the accuracy of this information, SSD Insurances Limited cannot accept any responsibility for error or omission. We recommend that legal or taxation advice should be sought to confirm suitability. It is not intended to be comprehensive and should not be used as a substitute for legal/taxation advice.

892223dc41dc5aa0d49ec4be3213c552.ppt