0aea0b31c2cc0b3d6a849c195e249d35.ppt

- Количество слайдов: 14

A Decision Support Based on Data Mining in e-Banking Irina Ionita Liviu Ionita Department of Informatics University Petroleum-Gas of Ploiesti

Topics • • • Data mining Stages in the lending process Credit scoring Lending process automation SADM – the automated system based on data mining SADM and e-banking

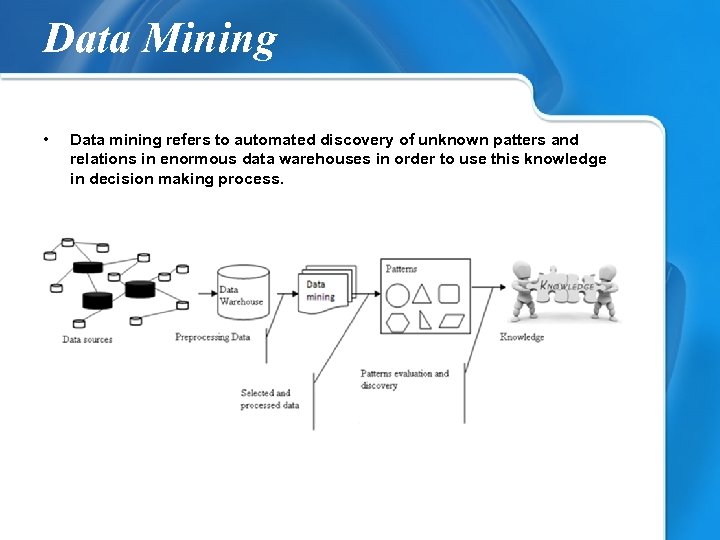

Data Mining • Data mining refers to automated discovery of unknown patters and relations in enormous data warehouses in order to use this knowledge in decision making process.

Data Mining algorithms Supervised algorithms: • Simple and multiple regression; • k-NN algorithm; • Artificial neural networks; • Decision trees; • Naive Bayes classification algorithm. Unsupervised algorithms: • Rule association; • Clustering.

Stages in the lending process • • A customer applies for a loan; Loan officer collects the preliminary data from customer and computes a score; Customer is informed about the obtained score and the options he can make; In favorable case, the customer meets the preconditions and completes a credit application form; The data are stored in the credit bureau database and analyzed; A credit agreement and/or an insurance certificate is signed, if it is required; After data analysis and credit scoring, a decision is made and the customer receive the answer for it’s request; If the bank’s decision is favorable, an account is created and fed with the established amount.

Credit scoring • A bank is able to choose eligible customers by calculating the score based on various parameters such as: monthly income, credit rate, number of dependents, years of employment, years on actual addresses etc. • By implementing a scoring model, each customer receives a “note”, based on a set of variables that takes into account all available information in the database, not only the negative one.

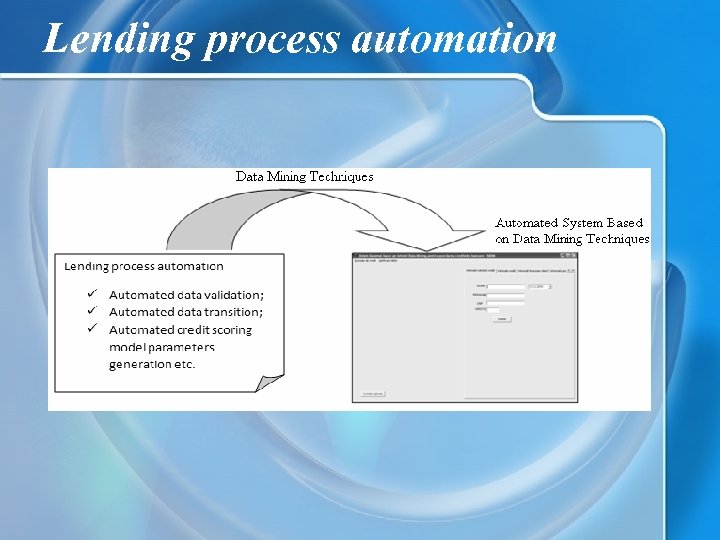

Lending process automation

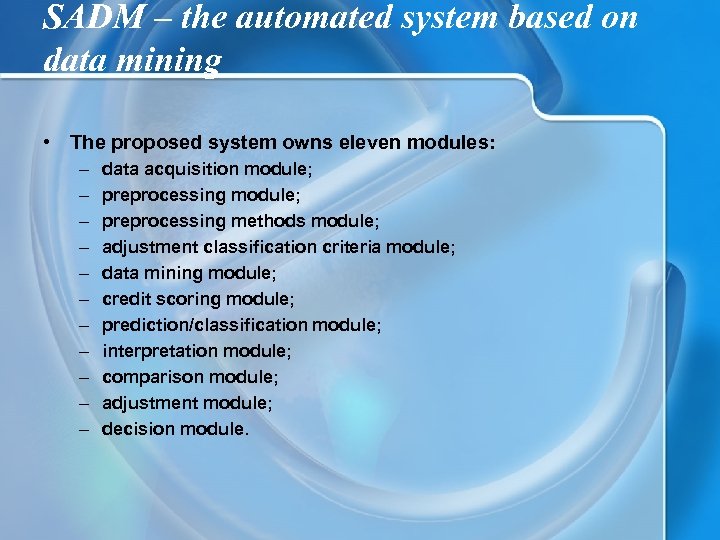

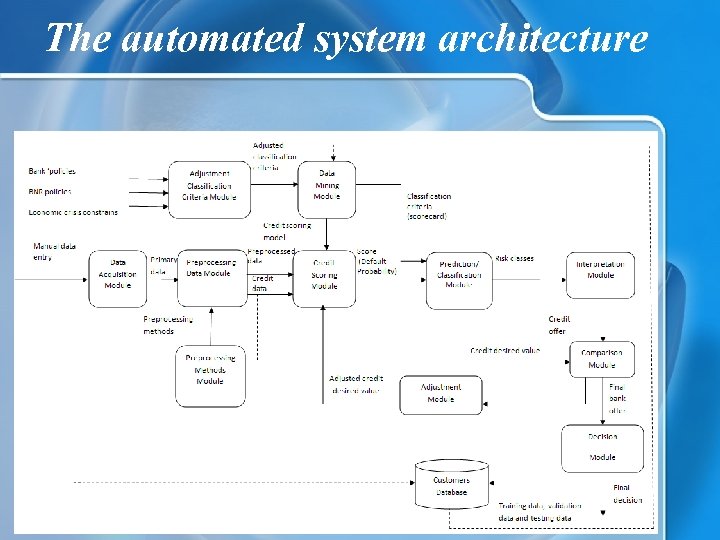

SADM – the automated system based on data mining • The proposed system owns eleven modules: – – – data acquisition module; preprocessing methods module; adjustment classification criteria module; data mining module; credit scoring module; prediction/classification module; interpretation module; comparison module; adjustment module; decision module.

The automated system architecture

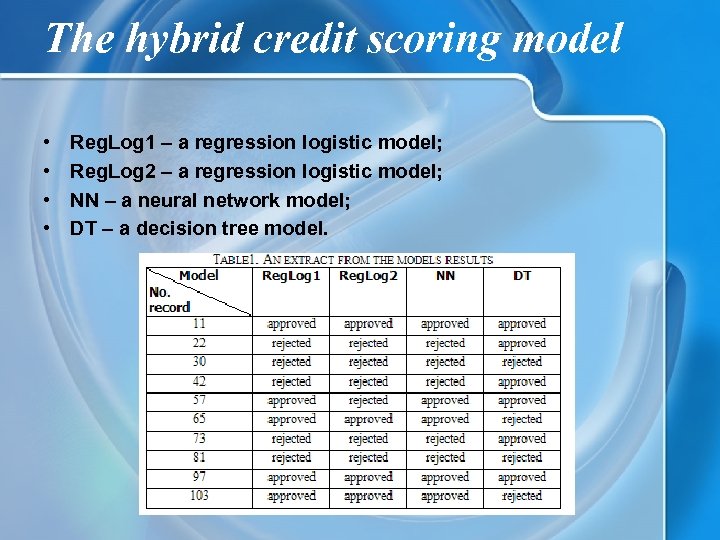

The hybrid credit scoring model • • Reg. Log 1 – a regression logistic model; Reg. Log 2 – a regression logistic model; NN – a neural network model; DT – a decision tree model.

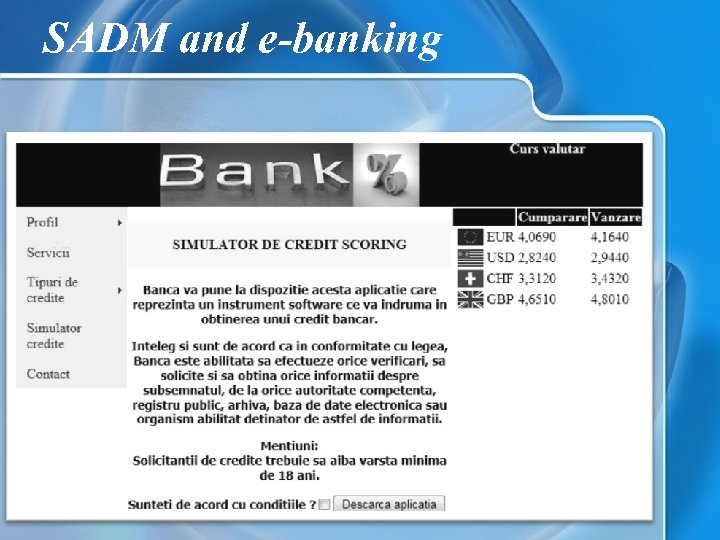

SADM and e-banking

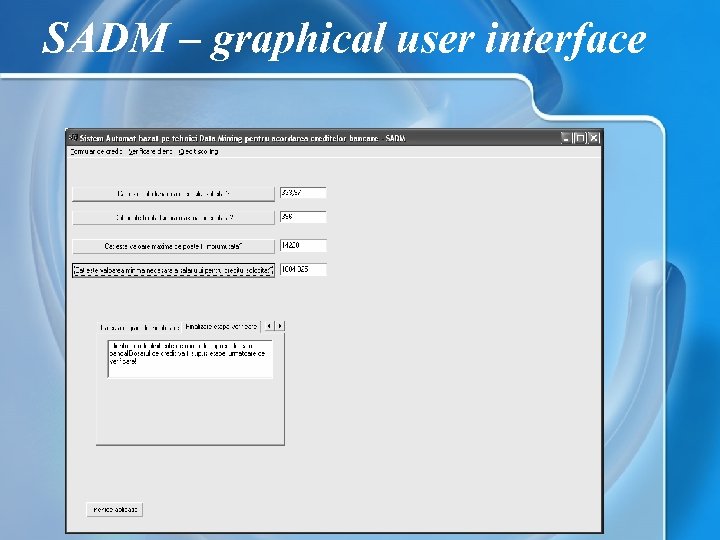

SADM – graphical user interface

Conclusion • The proposed system (SADM) can be considered a useful tool both for banks and clients. • The banks can minimize the credit risk and the clients receive objective answers. • A new approach of decision support is presented by designing an automated system based on data mining techniques used in banking area. • A hybrid credit scoring model is proposed for computing the probability of default associated to bank’s customers. • SADM can be integrated on a bank’s website and customers can access it after they accept the bank’s conditions.

Thank you for your attention!

0aea0b31c2cc0b3d6a849c195e249d35.ppt