59c0d5a095b47a47226f0795e3339a53.ppt

- Количество слайдов: 14

A Comparison of Municipal Responsibilities and Resources Enid Slack Institute on Municipal Finance and Governance Munk Centre for International Studies University of Toronto Presentation to the Union des Municipalités du Québec May 10, 2007 1

Introduction q q q Do municipalities have sufficient revenue-raising capacity to meet their expenditure needs? Is there a fiscal imbalance? This presentation will provide an inter-provincial comparison of recent trends in municipal expenditures and revenues The information is based on Statistics Canada data 2

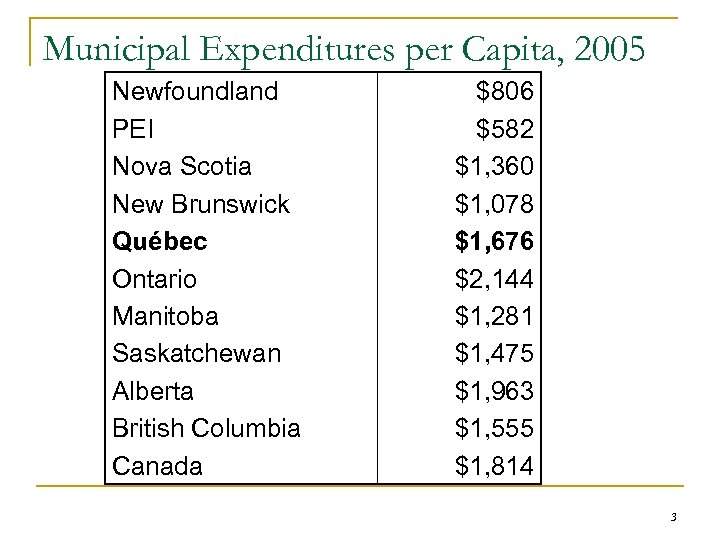

Municipal Expenditures per Capita, 2005 Newfoundland PEI Nova Scotia New Brunswick Québec Ontario Manitoba Saskatchewan Alberta British Columbia Canada $806 $582 $1, 360 $1, 078 $1, 676 $2, 144 $1, 281 $1, 475 $1, 963 $1, 555 $1, 814 3

Municipal Responsibilities n Municipalities in all provinces provide: q q q q Water and sewers Roads and streets Solid waste collection/disposal Parks and recreation Planning Policing (not all municipalities) Fire protection (not all municipalities) 4

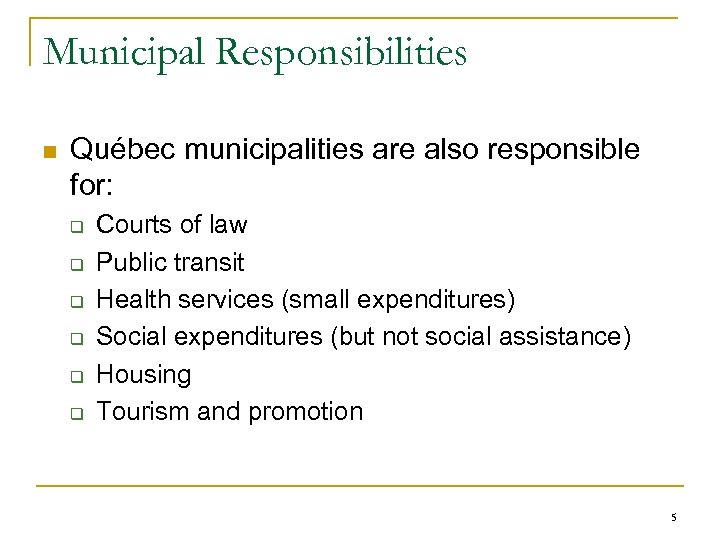

Municipal Responsibilities n Québec municipalities are also responsible for: q q q Courts of law Public transit Health services (small expenditures) Social expenditures (but not social assistance) Housing Tourism and promotion 5

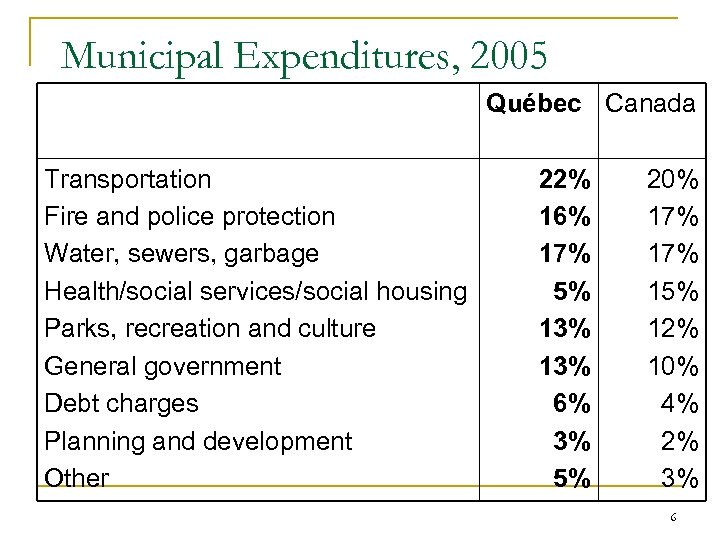

Municipal Expenditures, 2005 Québec Canada Transportation Fire and police protection Water, sewers, garbage Health/social services/social housing Parks, recreation and culture General government Debt charges Planning and development Other 22% 16% 17% 5% 13% 6% 3% 5% 20% 17% 15% 12% 10% 4% 2% 3% 6

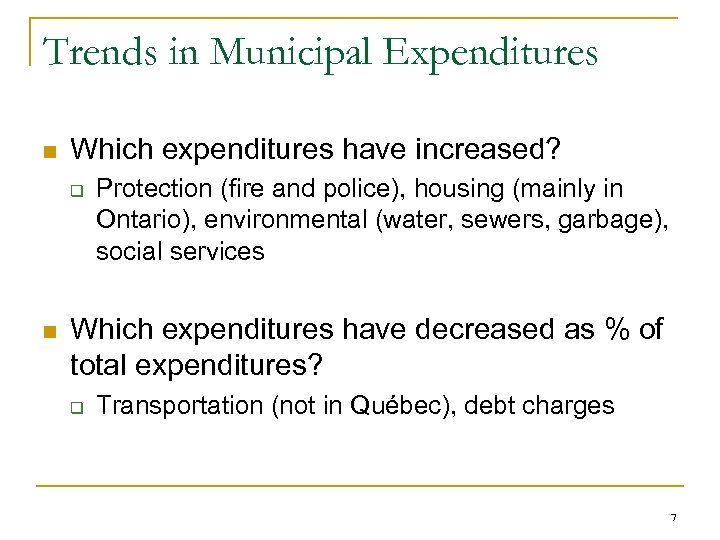

Trends in Municipal Expenditures n Which expenditures have increased? q n Protection (fire and police), housing (mainly in Ontario), environmental (water, sewers, garbage), social services Which expenditures have decreased as % of total expenditures? q Transportation (not in Québec), debt charges 7

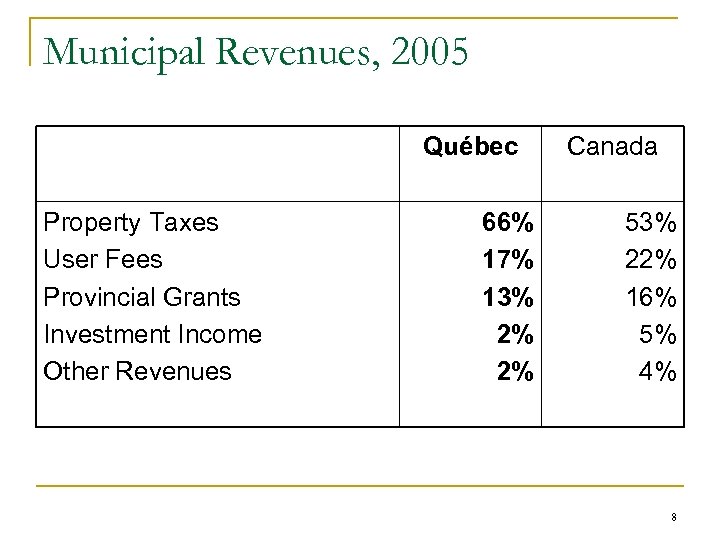

Municipal Revenues, 2005 Québec Property Taxes User Fees Provincial Grants Investment Income Other Revenues 66% 17% 13% 2% 2% Canada 53% 22% 16% 5% 4% 8

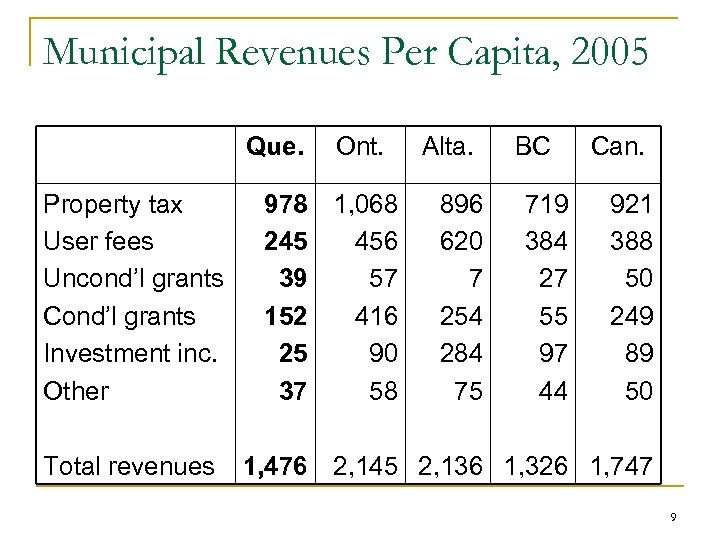

Municipal Revenues Per Capita, 2005 Que. Property tax User fees Uncond’l grants Cond’l grants Investment inc. Other Total revenues Ont. 978 1, 068 245 456 39 57 152 416 25 90 37 58 Alta. 896 620 7 254 284 75 BC 719 384 27 55 97 44 Can. 921 388 50 249 89 50 1, 476 2, 145 2, 136 1, 326 1, 747 9

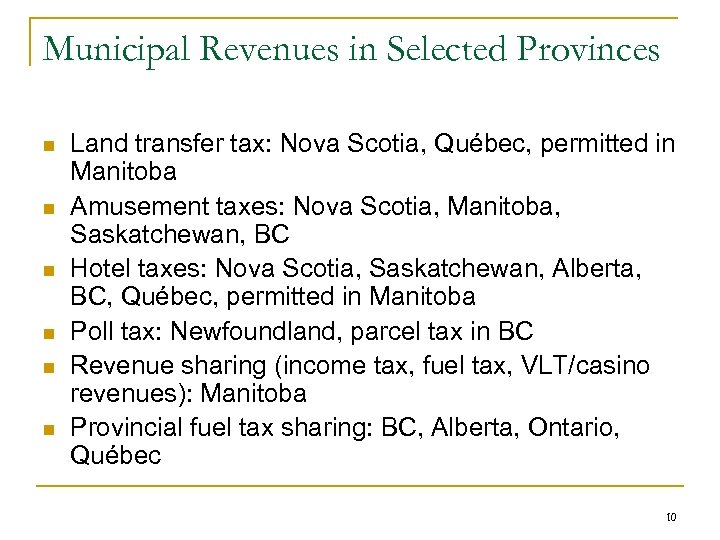

Municipal Revenues in Selected Provinces n n n Land transfer tax: Nova Scotia, Québec, permitted in Manitoba Amusement taxes: Nova Scotia, Manitoba, Saskatchewan, BC Hotel taxes: Nova Scotia, Saskatchewan, Alberta, BC, Québec, permitted in Manitoba Poll tax: Newfoundland, parcel tax in BC Revenue sharing (income tax, fuel tax, VLT/casino revenues): Manitoba Provincial fuel tax sharing: BC, Alberta, Ontario, Québec 10

Trends in Municipal Revenues n Which revenues have increased as % of total revenues? q n Property taxes and user fees Which revenues have decreased as % of total revenues? q Intergovernmental transfers fell across Canada but not in Québec (still a smaller % of total revenues) 11

Summary of Expenditures and Revenues n Municipalities in all provinces provide similar services; some additional services are provided by municipalities in only some provinces n All municipalities levy property taxes and user fees and receive provincial transfers; municipalities in some provinces levy land transfer taxes, hotel taxes, etc. 12

Is There a Fiscal Imbalance? n Municipalities have done well on fiscal measures: q q q Size of the operating deficit (no deficit by statute) Amount of borrowing for capital Size of reserves Rate of property tax increases Reliance on provincial grants Extent of tax arrears 13

Is There a Fiscal Imbalance? n Fiscal health may been achieved at the expense of the overall health of Canadian municipalities: q q The state of municipal infrastructure (water, sewers, roads, recreational facilities, etc. ) The quality of service delivery 14

59c0d5a095b47a47226f0795e3339a53.ppt