9b4a77af9fe38966cdcb152e03598c94.ppt

- Количество слайдов: 45

A Collaborative Review and Discussion of North. STAR System Performance and Trends May 19 th, 2010 Meeting DSHS, NTBHA, Value. Options, and Select North. STAR Providers

Goals of Meeting ► To evaluate the status of the system using a variety of data points and measurements. ► Review these data to stimulate conversation and attempt to develop consensus about the system’s performance, and where it is performing well and where it needs to be adjusted or improved. ► Take action on any consensus-driven recommendations. 05/19/2010 2 Page 2

Core Challenge for North. STAR Since Inception ► Single system, open access, expansive provider network, consumer choice, braided funding streams, data driven, risk based insurance model…. . these are terrific and cutting edge features, but…. . ► Many of the funding streams do not keep pace with utilization demands. Medicaid premiums are re-based each year and grow with utilization, but non-Medicaid funding does not follow the same methodology. Actuarially unsound. ► Medicaid eligibility in Texas is relatively restrictive, thus leading to a financing model that is incongruent with the realities that the system faces, and the design that was intended. 05/19/2010 3 Page 3

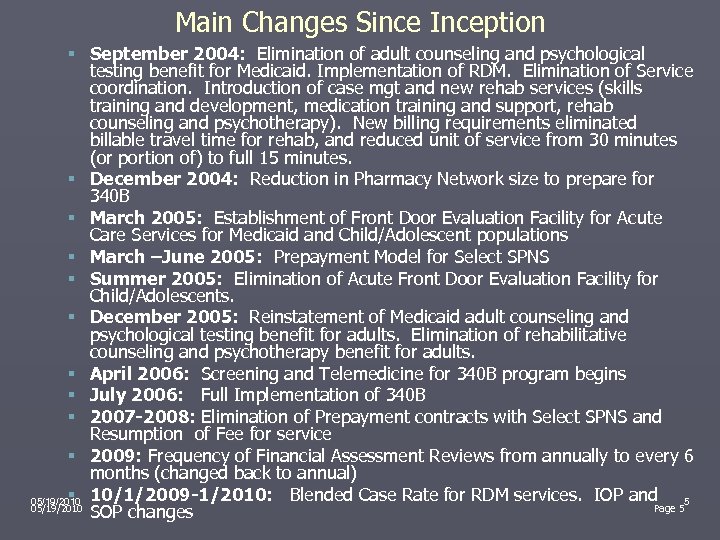

Main Changes Since Inception ► Over the years, a variety of adaptations have been instituted to keep the system more or less as it was designed. Some are as follows: § May 2000: Financial Eligibility changes and pharmacy benefit changes (200% FPL limit for enrollment; preferred medication program) § July 2000: Magellan announces they will not renew contract. BHOs and State develop transition plans § October 2000: Magellan ceases participation in North. STAR. All Magellan enrollees transitioned to Value. Options § October 2000: Implementation of single mobile crisis system in North. STAR § March 2001: Establishment of Front Door Evaluation Facility for Acute Care Services (applicable to non-Medicaid adults only); Establishment of designated enrollment sites for enrollment. Service Coordination rate reduced from $100/month to $60/month. § May 2001. Diagnostic and UM changes for service coordination and psychosocial rehab services. § October 2001: 10% rate cut for substance use disorder svs § January 2004: 10% rate cut for psychosocial rehab and service coordination. 05/19/2010 4 Page 4

Main Changes Since Inception § September 2004: Elimination of adult counseling and psychological testing benefit for Medicaid. Implementation of RDM. Elimination of Service coordination. Introduction of case mgt and new rehab services (skills training and development, medication training and support, rehab counseling and psychotherapy). New billing requirements eliminated billable travel time for rehab, and reduced unit of service from 30 minutes (or portion of) to full 15 minutes. § December 2004: Reduction in Pharmacy Network size to prepare for 340 B § March 2005: Establishment of Front Door Evaluation Facility for Acute Care Services for Medicaid and Child/Adolescent populations § March –June 2005: Prepayment Model for Select SPNS § Summer 2005: Elimination of Acute Front Door Evaluation Facility for Child/Adolescents. § December 2005: Reinstatement of Medicaid adult counseling and psychological testing benefit for adults. Elimination of rehabilitative counseling and psychotherapy benefit for adults. § April 2006: Screening and Telemedicine for 340 B program begins § July 2006: Full Implementation of 340 B § 2007 -2008: Elimination of Prepayment contracts with Select SPNS and Resumption of Fee for service § 2009: Frequency of Financial Assessment Reviews from annually to every 6 months (changed back to annual) § 05/19/2010 10/1/2009 -1/2010: Blended Case Rate for RDM services. IOP and 5 05/19/2010 Page 5 SOP changes

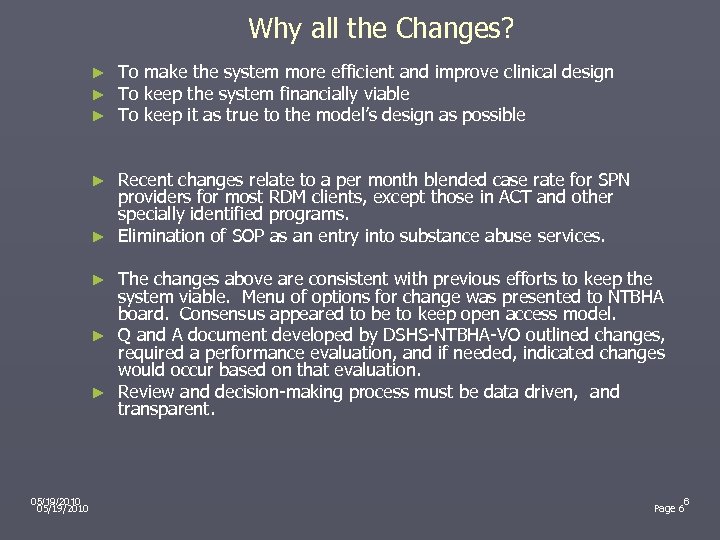

Why all the Changes? ► ► ► To make the system more efficient and improve clinical design To keep the system financially viable To keep it as true to the model’s design as possible Recent changes relate to a per month blended case rate for SPN providers for most RDM clients, except those in ACT and other specially identified programs. ► Elimination of SOP as an entry into substance abuse services. ► The changes above are consistent with previous efforts to keep the system viable. Menu of options for change was presented to NTBHA board. Consensus appeared to be to keep open access model. ► Q and A document developed by DSHS-NTBHA-VO outlined changes, required a performance evaluation, and if needed, indicated changes would occur based on that evaluation. ► Review and decision-making process must be data driven, and transparent. ► 05/19/2010 6 Page 6

What Did We Anticipate With the Most Recent Changes? ► Keep the Open Access System ► Shift in some enrollees’ LOCA ► Reduction in Provider (SPN) Revenue ► Some Reduction in Provider Administrative Costs ► More Targeted Service Provision ► No Increase in Acuity ► No Increase in Other Adverse Outcomes ► Modifications if Indicated by Data Review 05/19/2010 7 Page 7

Trending Data Related to Recent Changes ► Multiple data points covering a range of performance metrics, from cost, routine versus acute trends, clinical assessment (TRAG), utilization management, customer service, etc. ► North. STAR is a large, interconnected behavioral healthcare system. Data analysis has to be comprehensive. Data provided in this document are generally based on FY 06 thru present (Q 2 or Q 3 FY 10). Pre-FY 06 data is archived. ► Data will be reviewed at all levels: system level, service level, provider level, enrollee level. ► Data consists of service and medication encounter data, MH and SA/CD assessment data, surveys of providers, other information gleaned from meetings and conversations. 05/19/2010 8 Page 8

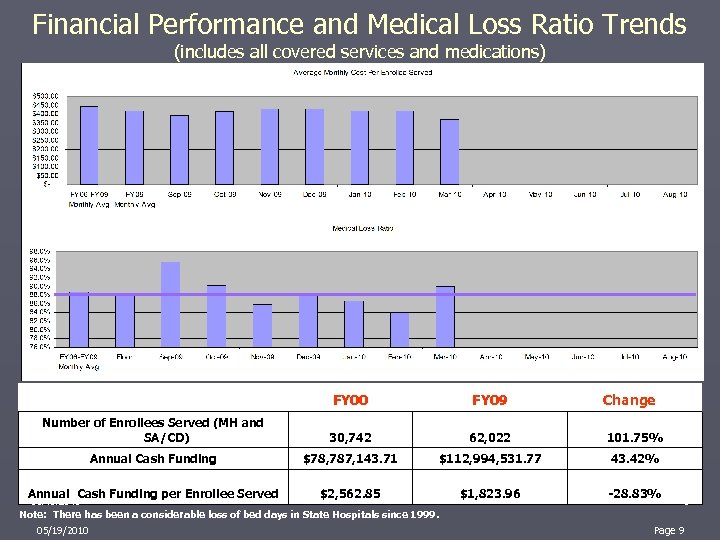

Financial Performance and Medical Loss Ratio Trends (includes all covered services and medications) FY 00 FY 09 Number of Enrollees Served (MH and SA/CD) 30, 742 62, 022 101. 75% Annual Cash Funding $78, 787, 143. 71 $112, 994, 531. 77 43. 42% Annual Cash Funding per Enrollee Served $2, 562. 85 $1, 823. 96 -28. 83% 05/19/2010 Note: There has been a considerable loss of bed days in State Hospitals since 1999. 05/19/2010 Change 9 Page 9

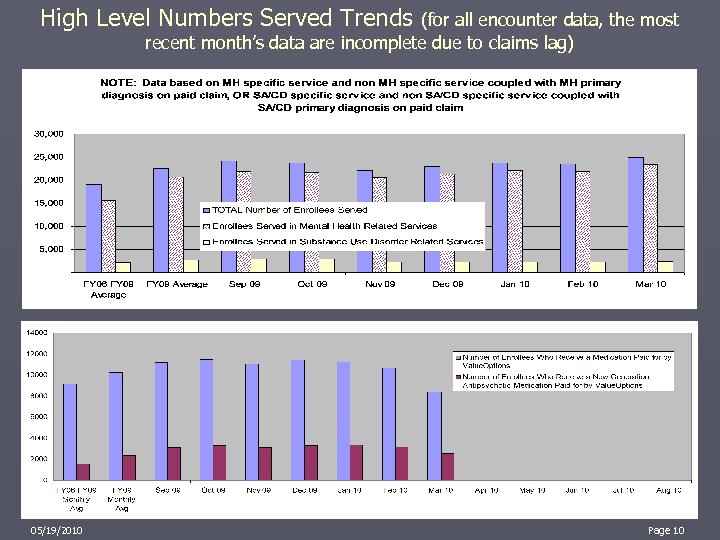

High Level Numbers Served Trends (for all encounter data, the most recent month’s data are incomplete due to claims lag) 05/19/2010 10 Page 10

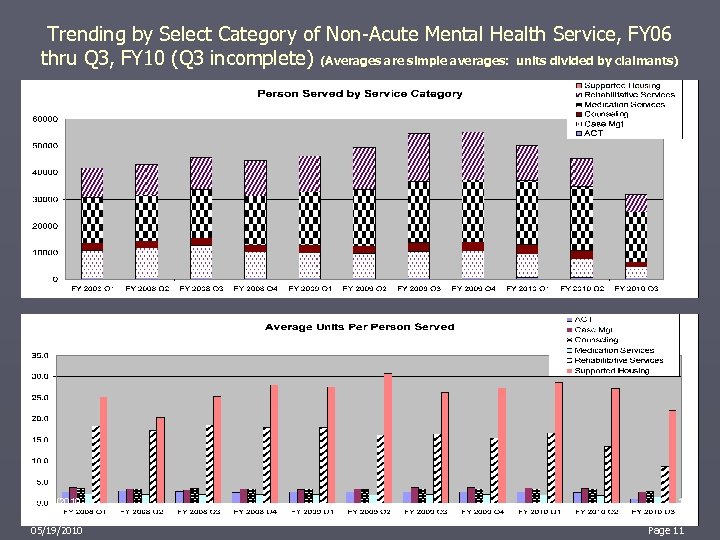

Trending by Select Category of Non-Acute Mental Health Service, FY 06 thru Q 3, FY 10 (Q 3 incomplete) (Averages are simple averages: units divided by claimants) 05/19/2010 11 Page 11

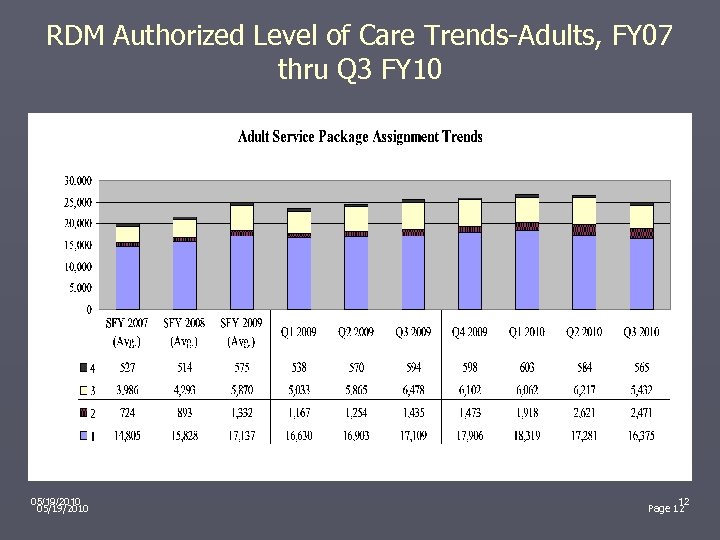

RDM Authorized Level of Care Trends-Adults, FY 07 thru Q 3 FY 10 05/19/2010 12 Page 12

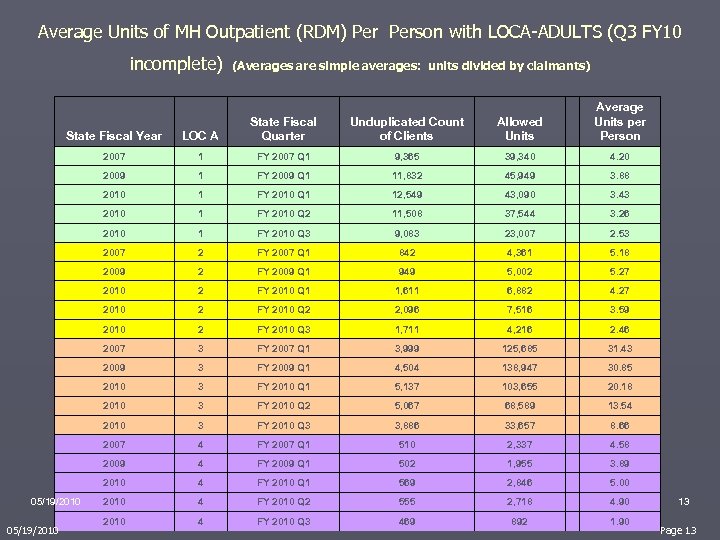

Average Units of MH Outpatient (RDM) Person with LOCA-ADULTS (Q 3 FY 10 incomplete) (Averages are simple averages: units divided by claimants) Unduplicated Count of Clients Allowed Units Average Units per Person State Fiscal Year LOC A State Fiscal Quarter 2007 1 FY 2007 Q 1 9, 365 39, 340 4. 20 2009 1 FY 2009 Q 1 11, 832 45, 949 3. 88 2010 1 FY 2010 Q 1 12, 549 43, 090 3. 43 2010 1 FY 2010 Q 2 11, 508 37, 544 3. 26 2010 1 FY 2010 Q 3 9, 083 23, 007 2. 53 2007 2 FY 2007 Q 1 842 4, 361 5. 18 2009 2 FY 2009 Q 1 949 5, 002 5. 27 2010 2 FY 2010 Q 1 1, 611 6, 882 4. 27 2010 2 FY 2010 Q 2 2, 096 7, 516 3. 59 2010 2 FY 2010 Q 3 1, 711 4, 216 2. 46 2007 3 FY 2007 Q 1 3, 999 125, 685 31. 43 2009 3 FY 2009 Q 1 4, 504 138, 947 30. 85 2010 3 FY 2010 Q 1 5, 137 103, 655 20. 18 2010 3 FY 2010 Q 2 5, 067 68, 589 13. 54 2010 3 FY 2010 Q 3 3, 886 33, 657 8. 66 2007 4 FY 2007 Q 1 510 2, 337 4. 58 2009 4 FY 2009 Q 1 502 1, 955 3. 89 2010 4 FY 2010 Q 1 569 2, 846 5. 00 2010 4 FY 2010 Q 2 555 2, 718 4. 90 2010 4 FY 2010 Q 3 469 892 1. 90 05/19/2010 13 Page 13

RDM Authorized Level of Care Trends-Youth, FY 07 thru Q 3 FY 10 05/19/2010 14 Page 14

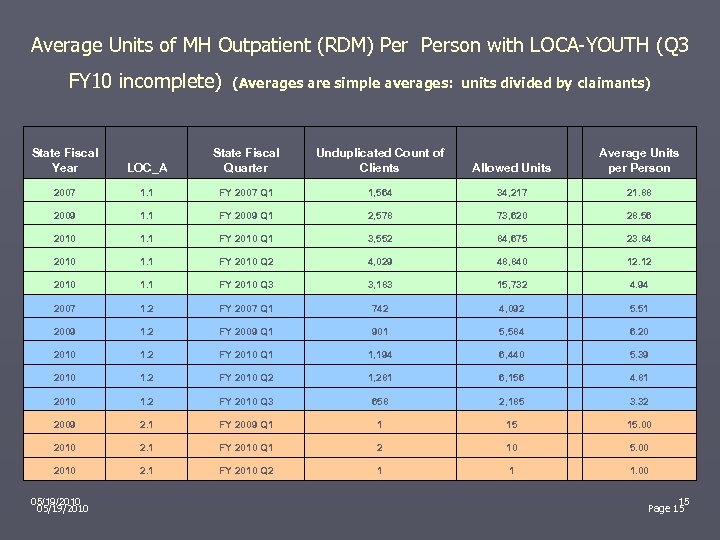

Average Units of MH Outpatient (RDM) Person with LOCA-YOUTH (Q 3 (Averages are simple averages: units divided by claimants) FY 10 incomplete) State Fiscal Year LOC_A State Fiscal Quarter Unduplicated Count of Clients Allowed Units Average Units per Person 2007 1. 1 FY 2007 Q 1 1, 564 34, 217 21. 88 2009 1. 1 FY 2009 Q 1 2, 578 73, 620 28. 56 2010 1. 1 FY 2010 Q 1 3, 552 84, 675 23. 84 2010 1. 1 FY 2010 Q 2 4, 029 48, 840 12. 12 2010 1. 1 FY 2010 Q 3 3, 183 15, 732 4. 94 2007 1. 2 FY 2007 Q 1 742 4, 092 5. 51 2009 1. 2 FY 2009 Q 1 901 5, 584 6. 20 2010 1. 2 FY 2010 Q 1 1, 194 6, 440 5. 39 2010 1. 2 FY 2010 Q 2 1, 281 6, 156 4. 81 2010 1. 2 FY 2010 Q 3 658 2, 185 3. 32 2009 2. 1 FY 2009 Q 1 1 15 15. 00 2010 2. 1 FY 2010 Q 1 2 10 5. 00 2010 2. 1 FY 2010 Q 2 1 1 1. 00 05/19/2010 15 Page 15

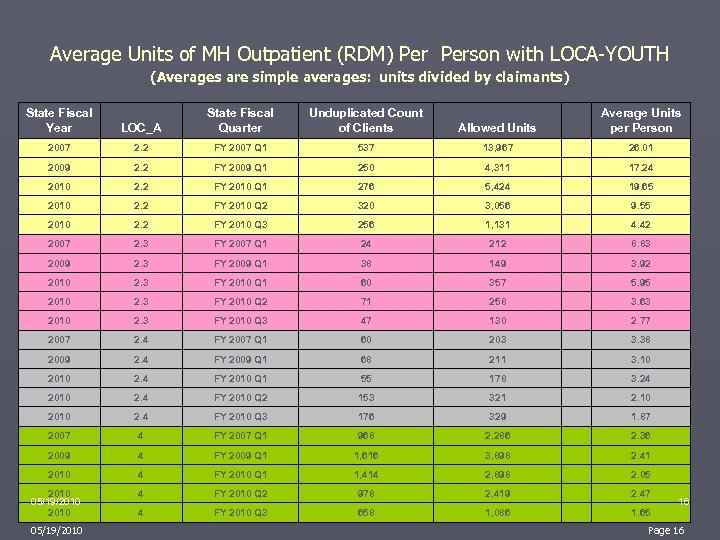

Average Units of MH Outpatient (RDM) Person with LOCA-YOUTH (Averages are simple averages: units divided by claimants) State Fiscal Year LOC_A State Fiscal Quarter Unduplicated Count of Clients Allowed Units Average Units per Person 2007 2. 2 FY 2007 Q 1 537 13, 967 26. 01 2009 2. 2 FY 2009 Q 1 250 4, 311 17. 24 2010 2. 2 FY 2010 Q 1 276 5, 424 19. 65 2010 2. 2 FY 2010 Q 2 320 3, 056 9. 55 2010 2. 2 FY 2010 Q 3 256 1, 131 4. 42 2007 2. 3 FY 2007 Q 1 24 212 8. 83 2009 2. 3 FY 2009 Q 1 38 149 3. 92 2010 2. 3 FY 2010 Q 1 60 357 5. 95 2010 2. 3 FY 2010 Q 2 71 258 3. 63 2010 2. 3 FY 2010 Q 3 47 130 2. 77 2007 2. 4 FY 2007 Q 1 60 203 3. 38 2009 2. 4 FY 2009 Q 1 68 211 3. 10 2010 2. 4 FY 2010 Q 1 55 178 3. 24 2010 2. 4 FY 2010 Q 2 153 321 2. 10 2010 2. 4 FY 2010 Q 3 176 329 1. 87 2007 4 FY 2007 Q 1 968 2, 286 2. 36 2009 4 FY 2009 Q 1 1, 616 3, 898 2. 41 2010 4 FY 2010 Q 1 1, 414 2, 898 2. 05 4 FY 2010 Q 2 978 2, 419 2. 47 4 FY 2010 Q 3 658 1, 086 1. 65 2010 05/19/2010 16 Page 16

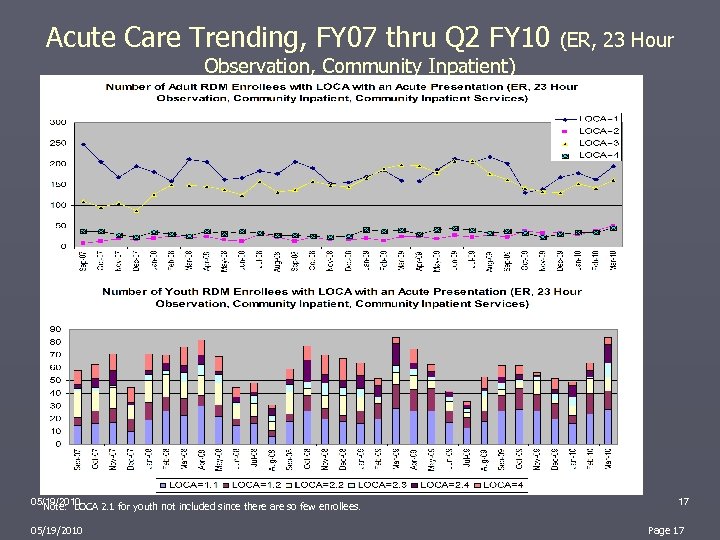

Acute Care Trending, FY 07 thru Q 2 FY 10 (ER, 23 Hour Observation, Community Inpatient) 05/19/2010 Note: LOCA 2. 1 for youth not included since there are so few enrollees. 05/19/2010 17 Page 17

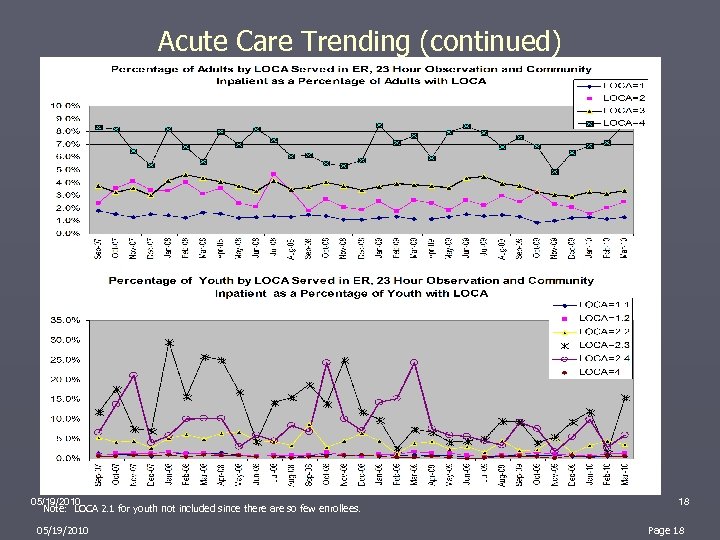

Acute Care Trending (continued) 05/19/2010 Note: LOCA 2. 1 for youth not included since there are so few enrollees. 05/19/2010 18 Page 18

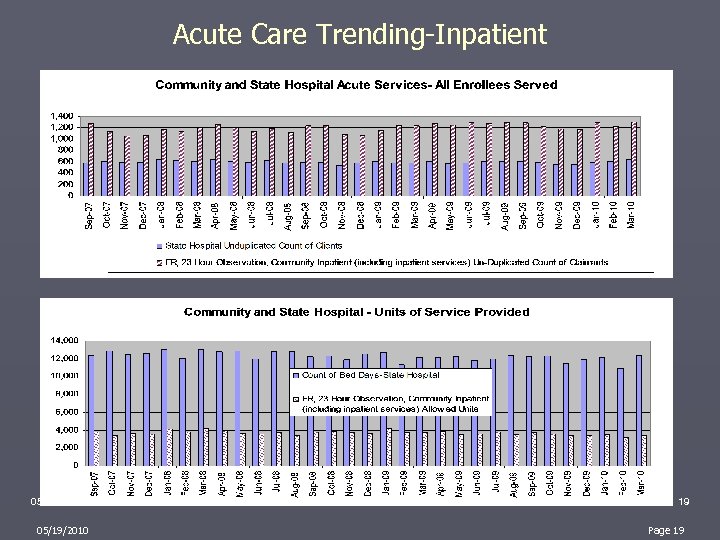

Acute Care Trending-Inpatient 05/19/2010 19 Page 19

Acute Care Trending-Various Slides 05/19/2010 20 Page 20

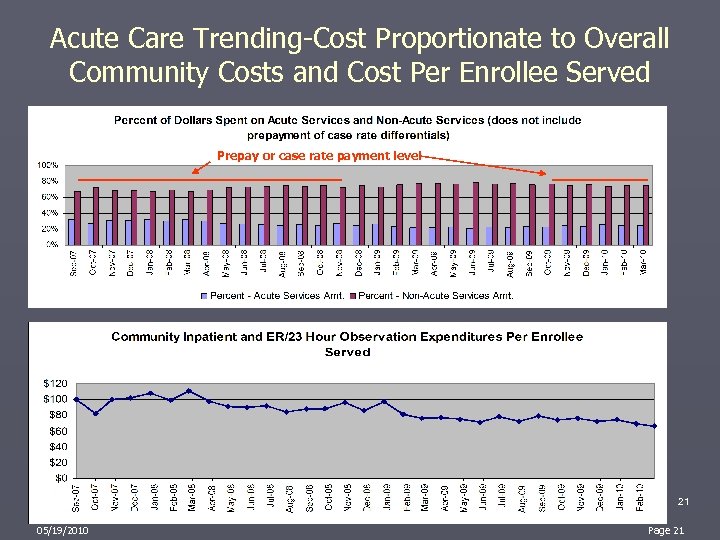

Acute Care Trending-Cost Proportionate to Overall Community Costs and Cost Per Enrollee Served Prepay or case rate payment level 05/19/2010 21 Page 21

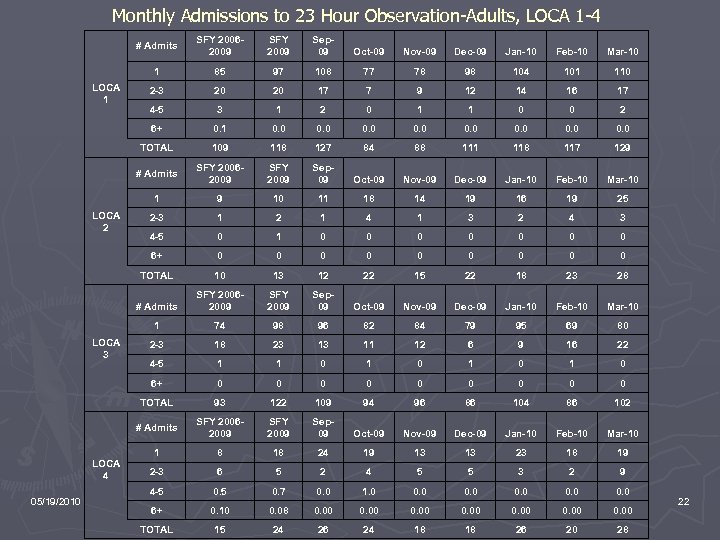

Monthly Admissions to 23 Hour Observation-Adults, LOCA 1 -4 # Admits Dec-09 Jan-10 Feb-10 Mar-10 85 97 108 77 78 98 104 101 110 2 -3 20 20 17 7 9 12 14 16 17 4 -5 3 1 2 0 1 1 0 0 2 0. 1 0. 0 0. 0 109 118 127 84 88 111 118 117 129 SFY 20062009 SFY 2009 Sep 09 Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 1 9 10 11 18 14 19 16 19 25 2 -3 1 2 1 4 1 3 2 4 3 4 -5 0 1 0 0 0 0 6+ 0 0 0 0 0 TOTAL 10 13 12 22 15 22 18 23 28 # Admits SFY 20062009 SFY 2009 Sep 09 Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 1 74 98 96 82 84 79 95 69 80 2 -3 18 23 13 11 12 6 9 16 22 4 -5 1 1 0 1 0 6+ 0 0 0 0 0 TOTAL 93 122 109 94 96 86 104 86 102 # Admits 05/19/2010 Nov-09 # Admits LOCA 4 Oct-09 TOTAL LOCA 3 Sep 09 6+ LOCA 2 SFY 2009 1 LOCA 1 SFY 20062009 SFY 2009 Sep 09 Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 1 8 18 24 19 13 13 23 18 19 2 -3 6 5 2 4 5 5 3 2 9 4 -5 0. 7 0. 0 1. 0 0. 0 6+ 0. 10 0. 08 0. 00 0. 00 TOTAL 15 24 26 24 18 18 26 20 28 22

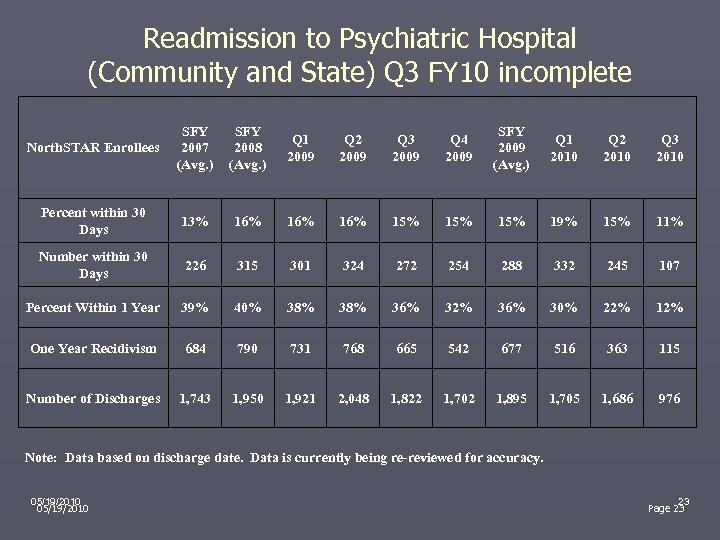

Readmission to Psychiatric Hospital (Community and State) Q 3 FY 10 incomplete North. STAR Enrollees SFY 2007 (Avg. ) SFY 2008 (Avg. ) Q 1 2009 Q 2 2009 Q 3 2009 Q 4 2009 SFY 2009 (Avg. ) Q 1 2010 Q 2 2010 Q 3 2010 Percent within 30 Days 13% 16% 16% 15% 15% 19% 15% 11% Number within 30 Days 226 315 301 324 272 254 288 332 245 107 Percent Within 1 Year 39% 40% 38% 36% 32% 36% 30% 22% 12% One Year Recidivism 684 790 731 768 665 542 677 516 363 115 Number of Discharges 1, 743 1, 950 1, 921 2, 048 1, 822 1, 702 1, 895 1, 705 1, 686 976 Note: Data based on discharge date. Data is currently being re-reviewed for accuracy. 05/19/2010 23 Page 23

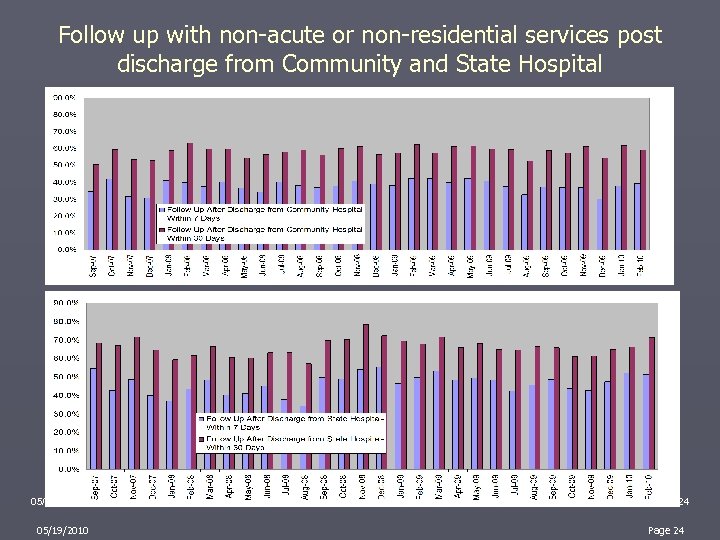

Follow up with non-acute or non-residential services post discharge from Community and State Hospital 05/19/2010 24 Page 24

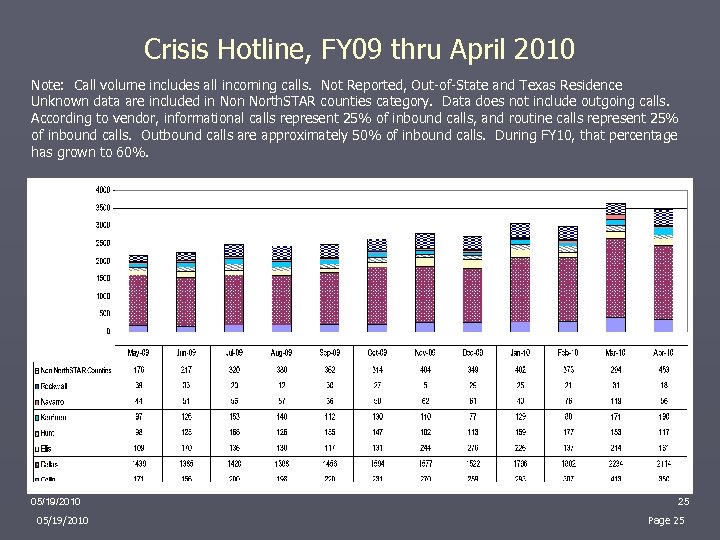

Crisis Hotline, FY 09 thru April 2010 Note: Call volume includes all incoming calls. Not Reported, Out-of-State and Texas Residence Unknown data are included in North. STAR counties category. Data does not include outgoing calls. According to vendor, informational calls represent 25% of inbound calls, and routine calls represent 25% of inbound calls. Outbound calls are approximately 50% of inbound calls. During FY 10, that percentage has grown to 60%. 05/19/2010 25 Page 25

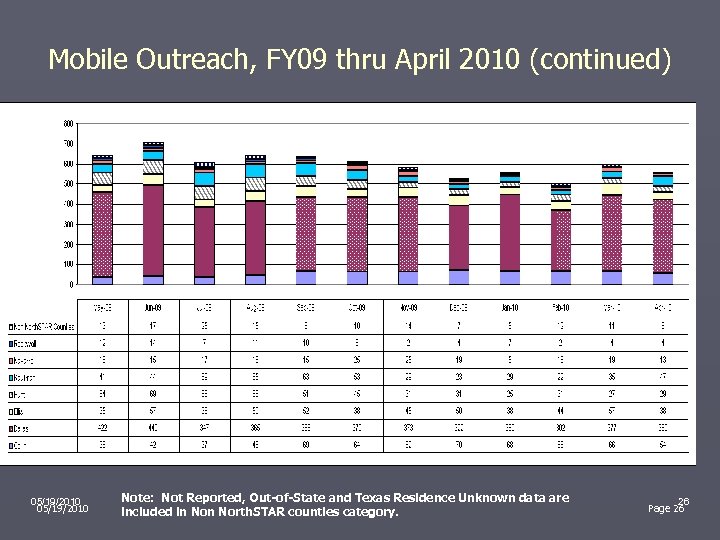

Mobile Outreach, FY 09 thru April 2010 (continued) 05/19/2010 Note: Not Reported, Out-of-State and Texas Residence Unknown data are included in North. STAR counties category. 26 Page 26

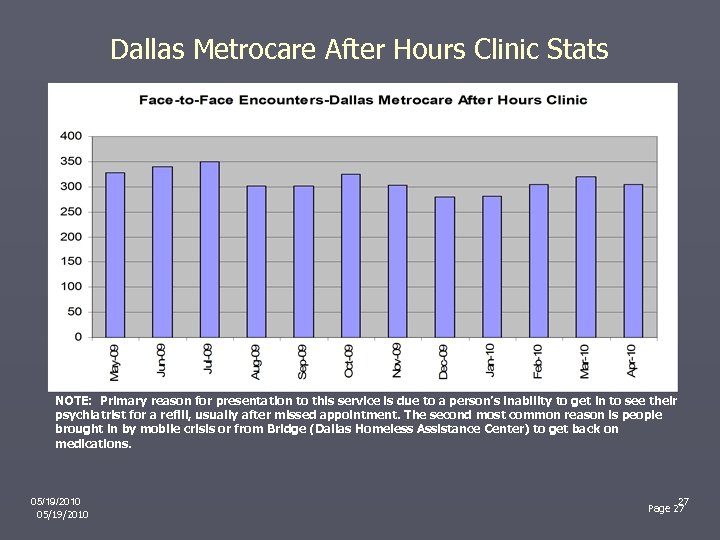

Dallas Metrocare After Hours Clinic Stats NOTE: Primary reason for presentation to this service is due to a person’s inability to get in to see their psychiatrist for a refill, usually after missed appointment. The second most common reason is people brought in by mobile crisis or from Bridge (Dallas Homeless Assistance Center) to get back on medications. 05/19/2010 27 Page 27

Select TRAG Dimension Trends, FY 07 thru Q 3 FY 10 Adults (look back previous 12 months) Functioning: Acceptable – 1 on latest and first; Improving – latest < first Criminal Justice: Improving – latest < first and first 2+ Housing: Acceptable – 1 on latest and first; Improving – latest < first 05/19/2010 Substance Use: Acceptable – 2 on latest and first; Improving – latest < first and first 2+ 05/19/2010 28 Page 28

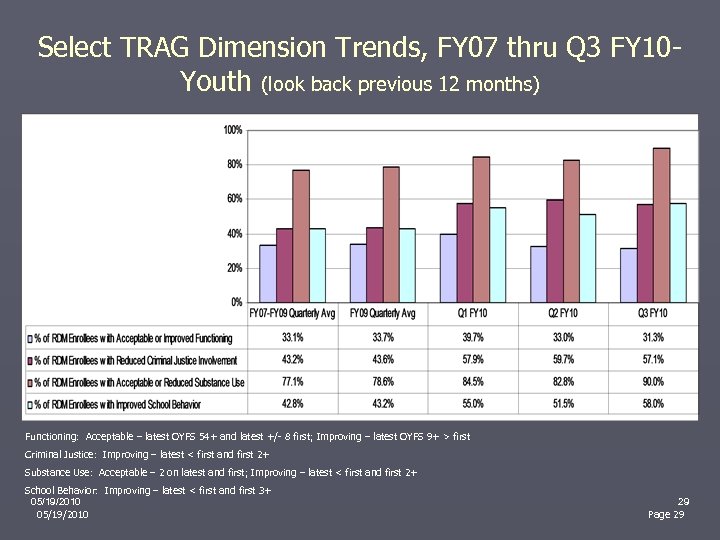

Select TRAG Dimension Trends, FY 07 thru Q 3 FY 10 Youth (look back previous 12 months) Functioning: Acceptable – latest OYFS 54+ and latest +/- 8 first; Improving – latest OYFS 9+ > first Criminal Justice: Improving – latest < first and first 2+ Substance Use: Acceptable – 2 on latest and first; Improving – latest < first and first 2+ School Behavior: Improving – latest < first and first 3+ 05/19/2010 29 Page 29

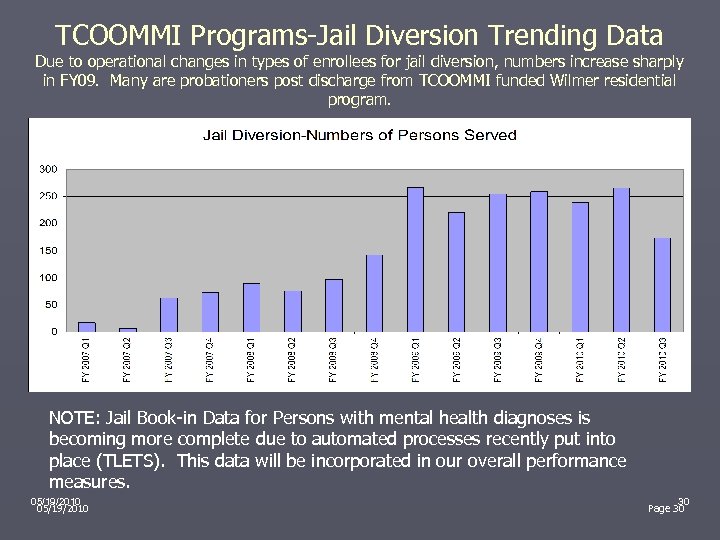

TCOOMMI Programs-Jail Diversion Trending Data Due to operational changes in types of enrollees for jail diversion, numbers increase sharply in FY 09. Many are probationers post discharge from TCOOMMI funded Wilmer residential program. NOTE: Jail Book-in Data for Persons with mental health diagnoses is becoming more complete due to automated processes recently put into place (TLETS). This data will be incorporated in our overall performance measures. 05/19/2010 30 Page 30

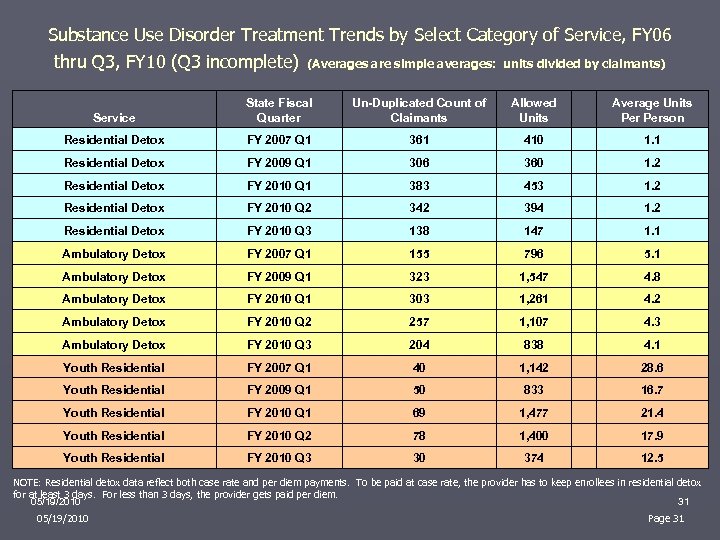

Substance Use Disorder Treatment Trends by Select Category of Service, FY 06 thru Q 3, FY 10 (Q 3 incomplete) (Averages are simple averages: units divided by claimants) Service State Fiscal Quarter Un-Duplicated Count of Claimants Allowed Units Average Units Person Residential Detox FY 2007 Q 1 361 410 1. 1 Residential Detox FY 2009 Q 1 306 360 1. 2 Residential Detox FY 2010 Q 1 383 453 1. 2 Residential Detox FY 2010 Q 2 342 394 1. 2 Residential Detox FY 2010 Q 3 138 147 1. 1 Ambulatory Detox FY 2007 Q 1 155 796 5. 1 Ambulatory Detox FY 2009 Q 1 323 1, 547 4. 8 Ambulatory Detox FY 2010 Q 1 303 1, 261 4. 2 Ambulatory Detox FY 2010 Q 2 257 1, 107 4. 3 Ambulatory Detox FY 2010 Q 3 204 838 4. 1 Youth Residential FY 2007 Q 1 40 1, 142 28. 6 Youth Residential FY 2009 Q 1 50 833 16. 7 Youth Residential FY 2010 Q 1 69 1, 477 21. 4 Youth Residential FY 2010 Q 2 78 1, 400 17. 9 Youth Residential FY 2010 Q 3 30 374 12. 5 NOTE: Residential detox data reflect both case rate and per diem payments. To be paid at case rate, the provider has to keep enrollees in residential detox for at least 3 days. For less than 3 days, the provider gets paid per diem. 05/19/2010 31 05/19/2010 Page 31

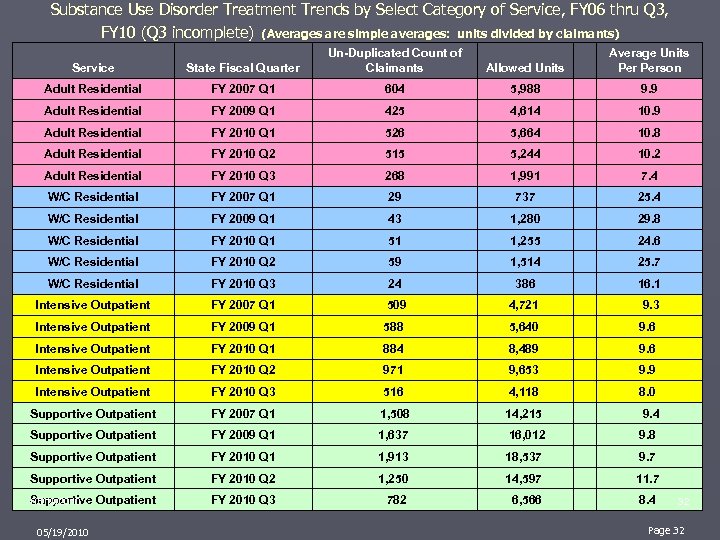

Substance Use Disorder Treatment Trends by Select Category of Service, FY 06 thru Q 3, FY 10 (Q 3 incomplete) (Averages are simple averages: units divided by claimants) Service State Fiscal Quarter Un-Duplicated Count of Claimants Allowed Units Average Units Person Adult Residential FY 2007 Q 1 604 5, 988 9. 9 Adult Residential FY 2009 Q 1 425 4, 614 10. 9 Adult Residential FY 2010 Q 1 526 5, 664 10. 8 Adult Residential FY 2010 Q 2 515 5, 244 10. 2 Adult Residential FY 2010 Q 3 268 1, 991 7. 4 W/C Residential FY 2007 Q 1 29 737 25. 4 W/C Residential FY 2009 Q 1 43 1, 280 29. 8 W/C Residential FY 2010 Q 1 51 1, 255 24. 6 W/C Residential FY 2010 Q 2 59 1, 514 25. 7 W/C Residential FY 2010 Q 3 24 386 16. 1 Intensive Outpatient FY 2007 Q 1 509 4, 721 9. 3 Intensive Outpatient FY 2009 Q 1 588 5, 640 9. 6 Intensive Outpatient FY 2010 Q 1 884 8, 489 9. 6 Intensive Outpatient FY 2010 Q 2 971 9, 653 9. 9 Intensive Outpatient FY 2010 Q 3 516 4, 118 8. 0 Supportive Outpatient FY 2007 Q 1 1, 508 14, 215 9. 4 Supportive Outpatient FY 2009 Q 1 1, 637 16, 012 9. 8 Supportive Outpatient FY 2010 Q 1 1, 913 18, 537 9. 7 Supportive Outpatient FY 2010 Q 2 1, 250 14, 597 11. 7 Supportive Outpatient 05/19/2010 FY 2010 Q 3 782 6, 566 8. 4 05/19/2010 32 Page 32

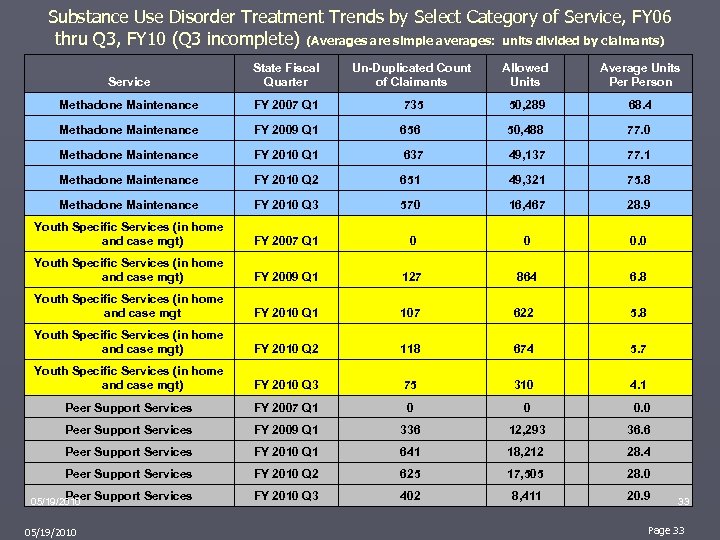

Substance Use Disorder Treatment Trends by Select Category of Service, FY 06 thru Q 3, FY 10 (Q 3 incomplete) (Averages are simple averages: units divided by claimants) Service State Fiscal Quarter Un-Duplicated Count of Claimants Allowed Units Average Units Person Methadone Maintenance FY 2007 Q 1 735 50, 289 68. 4 Methadone Maintenance FY 2009 Q 1 656 50, 488 77. 0 Methadone Maintenance FY 2010 Q 1 637 49, 137 77. 1 Methadone Maintenance FY 2010 Q 2 651 49, 321 75. 8 Methadone Maintenance FY 2010 Q 3 570 16, 467 28. 9 Youth Specific Services (in home and case mgt) FY 2007 Q 1 0 0 0. 0 Youth Specific Services (in home and case mgt) FY 2009 Q 1 127 864 6. 8 Youth Specific Services (in home and case mgt FY 2010 Q 1 107 622 5. 8 Youth Specific Services (in home and case mgt) FY 2010 Q 2 118 674 5. 7 Youth Specific Services (in home and case mgt) FY 2010 Q 3 75 310 4. 1 Peer Support Services FY 2007 Q 1 0 0 0. 0 Peer Support Services FY 2009 Q 1 336 12, 293 36. 6 Peer Support Services FY 2010 Q 1 641 18, 212 28. 4 Peer Support Services FY 2010 Q 2 625 17, 505 28. 0 Peer Support Services FY 2010 Q 3 402 8, 411 20. 9 05/19/2010 33 Page 33

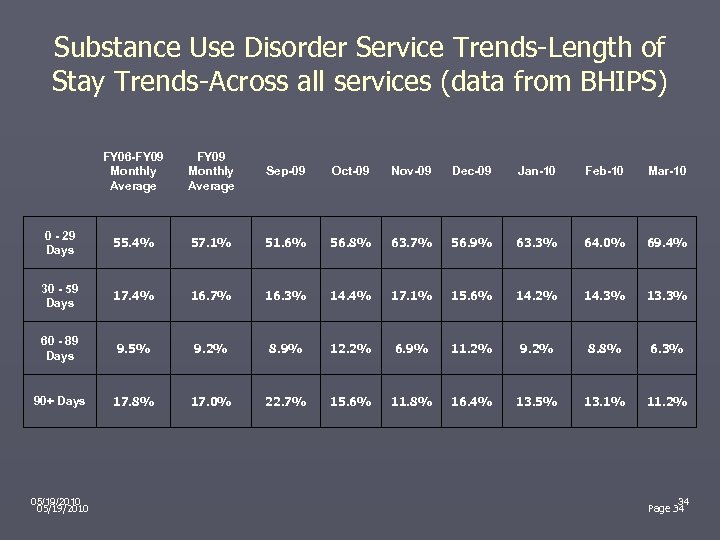

Substance Use Disorder Service Trends-Length of Stay Trends-Across all services (data from BHIPS) FY 06 -FY 09 Monthly Average Sep-09 Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 0 - 29 Days 55. 4% 57. 1% 51. 6% 56. 8% 63. 7% 56. 9% 63. 3% 64. 0% 69. 4% 30 - 59 Days 17. 4% 16. 7% 16. 3% 14. 4% 17. 1% 15. 6% 14. 2% 14. 3% 13. 3% 60 - 89 Days 9. 5% 9. 2% 8. 9% 12. 2% 6. 9% 11. 2% 9. 2% 8. 8% 6. 3% 90+ Days 17. 8% 17. 0% 22. 7% 15. 6% 11. 8% 16. 4% 13. 5% 13. 1% 11. 2% 05/19/2010 34 Page 34

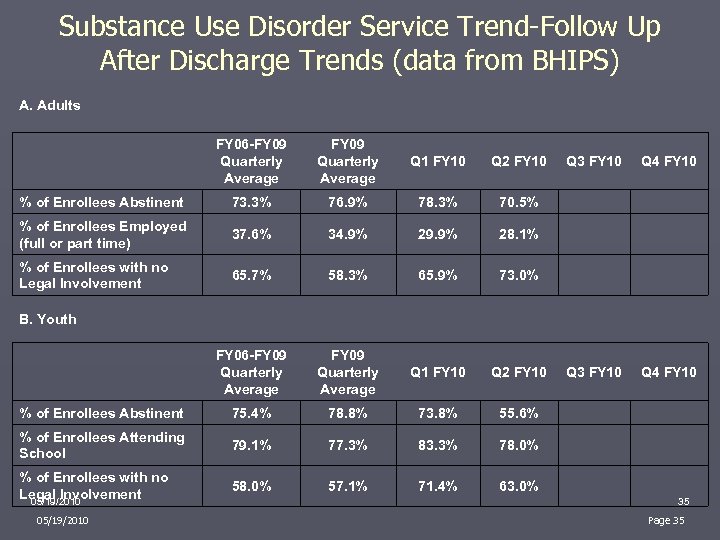

Substance Use Disorder Service Trend-Follow Up After Discharge Trends (data from BHIPS) A. Adults FY 06 -FY 09 Quarterly Average Q 1 FY 10 Q 2 FY 10 % of Enrollees Abstinent 73. 3% 76. 9% 78. 3% 70. 5% % of Enrollees Employed (full or part time) 37. 6% 34. 9% 29. 9% 28. 1% % of Enrollees with no Legal Involvement 65. 7% 58. 3% 65. 9% 73. 0% FY 06 -FY 09 Quarterly Average Q 1 FY 10 % of Enrollees Abstinent 75. 4% 78. 8% % of Enrollees Attending School 79. 1% % of Enrollees with no Legal Involvement 05/19/2010 58. 0% Q 3 FY 10 Q 4 FY 10 Q 2 FY 10 Q 3 FY 10 Q 4 FY 10 73. 8% 55. 6% 77. 3% 83. 3% 78. 0% 57. 1% 71. 4% 63. 0% B. Youth 05/19/2010 35 Page 35

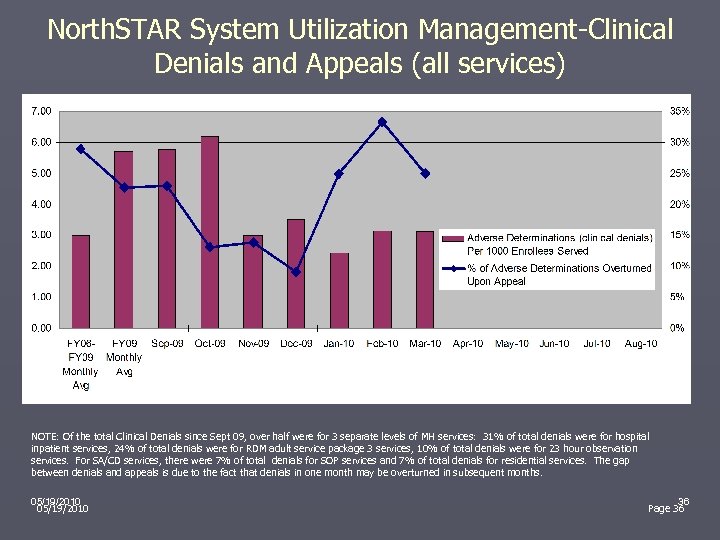

North. STAR System Utilization Management-Clinical Denials and Appeals (all services) NOTE: Of the total Clinical Denials since Sept 09, over half were for 3 separate levels of MH services: 31% of total denials were for hospital inpatient services, 24% of total denials were for RDM adult service package 3 services, 10% of total denials were for 23 hour observation services. For SA/CD services, there were 7% of total denials for SOP services and 7% of total denials for residential services. The gap between denials and appeals is due to the fact that denials in one month may be overturned in subsequent months. 05/19/2010 36 Page 36

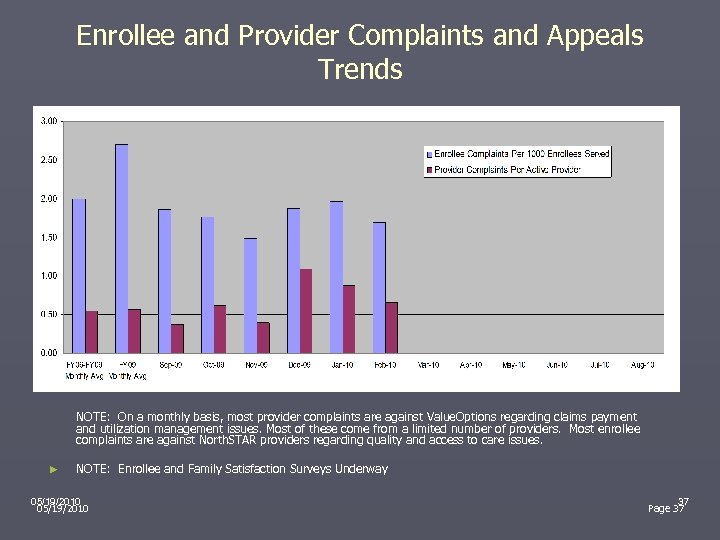

Enrollee and Provider Complaints and Appeals Trends NOTE: On a monthly basis, most provider complaints are against Value. Options regarding claims payment and utilization management issues. Most of these come from a limited number of providers. Most enrollee complaints are against North. STAR providers regarding quality and access to care issues. ► NOTE: Enrollee and Family Satisfaction Surveys Underway 05/19/2010 37 Page 37

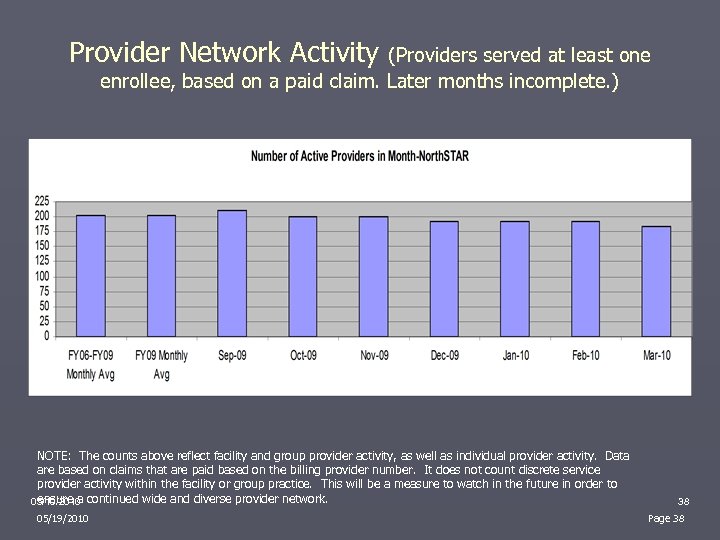

Provider Network Activity (Providers served at least one enrollee, based on a paid claim. Later months incomplete. ) NOTE: The counts above reflect facility and group provider activity, as well as individual provider activity. Data are based on claims that are paid based on the billing provider number. It does not count discrete service provider activity within the facility or group practice. This will be a measure to watch in the future in order to ensure a continued wide and diverse provider network. 05/19/2010 38 Page 38

Value. Options Call Center Activity Trends 05/19/2010 39 Page 39

SPN Survey on Blended Case Rate Impact-Summary of Comments NTBHA and DSHS developed a five question SPN survey in April 2010 to gain reactions to the newly implemented blended case rate. Generally, providers expressed that due to the case rate: ► ► ► Revenues decreased FTE’s were cut and caseloads increased Services provided in the community have decreased More easily attained authorization for services More tailored treatment plans to meet individual needs 05/19/2010 40 Page 40

SPN Survey of Intake Systems In April 2010, NTBHA conducted a non-crisis intake survey to determine response times and wait times to receive services. Overall providers surveyed: ► ► Answered phone and questions appropriately Able to accommodate an intake and doctor appointment in appropriate time frames Few providers had difficulty: ► ► Getting a live person or appropriate person on the phone Scheduling or allowing new patient intakes 05/19/2010 41 Page 41

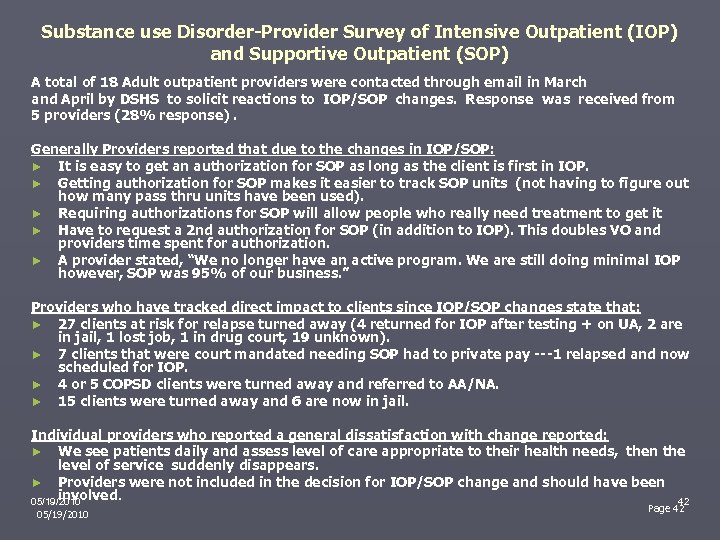

Substance use Disorder-Provider Survey of Intensive Outpatient (IOP) and Supportive Outpatient (SOP) A total of 18 Adult outpatient providers were contacted through email in March and April by DSHS to solicit reactions to IOP/SOP changes. Response was received from 5 providers (28% response). Generally Providers reported that due to the changes in IOP/SOP: ► It is easy to get an authorization for SOP as long as the client is first in IOP. ► Getting authorization for SOP makes it easier to track SOP units (not having to figure out how many pass thru units have been used). ► Requiring authorizations for SOP will allow people who really need treatment to get it ► Have to request a 2 nd authorization for SOP (in addition to IOP). This doubles VO and providers time spent for authorization. ► A provider stated, “We no longer have an active program. We are still doing minimal IOP however, SOP was 95% of our business. ” Providers who have tracked direct impact to clients since IOP/SOP changes state that: ► 27 clients at risk for relapse turned away (4 returned for IOP after testing + on UA, 2 are in jail, 1 lost job, 1 in drug court, 19 unknown). ► 7 clients that were court mandated needing SOP had to private pay ---1 relapsed and now scheduled for IOP. ► 4 or 5 COPSD clients were turned away and referred to AA/NA. ► 15 clients were turned away and 6 are now in jail. Individual providers who reported a general dissatisfaction with change reported: ► We see patients daily and assess level of care appropriate to their health needs, then the level of service suddenly disappears. ► Providers were not included in the decision for IOP/SOP change and should have been involved. 05/19/2010 42 Page 42 05/19/2010

Initial Synthesis of Data and Discussion ► ► ► ► Overall, the data suggest that while average number of outpatient MH services per client has decreased, it may be that this decrease may not be applicable for all SPN enrollees. Some adverse outcomes (acuity, readmissions, follow-up after discharge from inpatient, TRAG dimensions) seem to be comparable to performance in fee-forservice environment. Some uptick in acute utilization, but unclear whether it constitutes a trend yet. Are trends simply proportional to program growth or the result of other factors? With some exceptions, medications and medication services have remained relatively constant and accessible. Significant adjustments with providers under the blended case rate, both financially and clinically. Continued growth in persons served. RDM fidelity versus dilution of RDM tenets? § § § ► ► Flexibility versus prescriptiveness? Adherence to service definitions? Operationalizing case rate appropriately? Some downward trend in SA/CD length of stay compared to benchmarks. Although Q 2 FY 10 is not yet complete, there are some 60 days follow up after discharge from SA/CD treatment results that are lower than benchmarks. 05/19/2010 43 Page 43

Summary and Next Steps ► Trending analysis contained in this document needs to be continued to review for trends. ► Next level analysis needs to be conducted. This consists of: § Analysis of Acuity and LOCA by County and by SPN. This would allow determination of service levels by SPN and how that might be affecting acuity ( which may not be discernible by looking at the system as a whole). § Analysis of acute utilization of enrollees without an LOCA. Since this is a very high percentage of acute presentations, this group needs to be analyzed. § Further analysis of SA/CD enrollee cohorts by length of stay. § Further discussion on mobile crisis call center and mobile outreach trends, and ways to optimize this service. § A question was asked about 60 day follow ups post discharge (page 35). The percentages shown reflect those who were actually contacted 60 days after discharge. § DSHS will do further analysis on re-admission data (page 23), to ensure that enrollees who are transported directly from community hospitals to the State Hospital system are not counted as readmissions. DSHS will review the data analysis methodology to ensure that it does not count these individuals. 05/19/2010 44 Page 44

Questions? ► More information may be found on the North. STAR web page: http: //www. dshs. state. tx. us/mhsa/northstar. shtm ► Specific questions may be addressed to the appropriate staff contact: http: //www. dshs. state. tx. us/mhsa/northstar/staff. shtm#ns 05/19/2010 45 Page 45

9b4a77af9fe38966cdcb152e03598c94.ppt