2ee72fa0bcb04d34a543485d77fa3d50.ppt

- Количество слайдов: 19

A Career in Investment Banking Lafayette College Easton, PA November 8, 2013

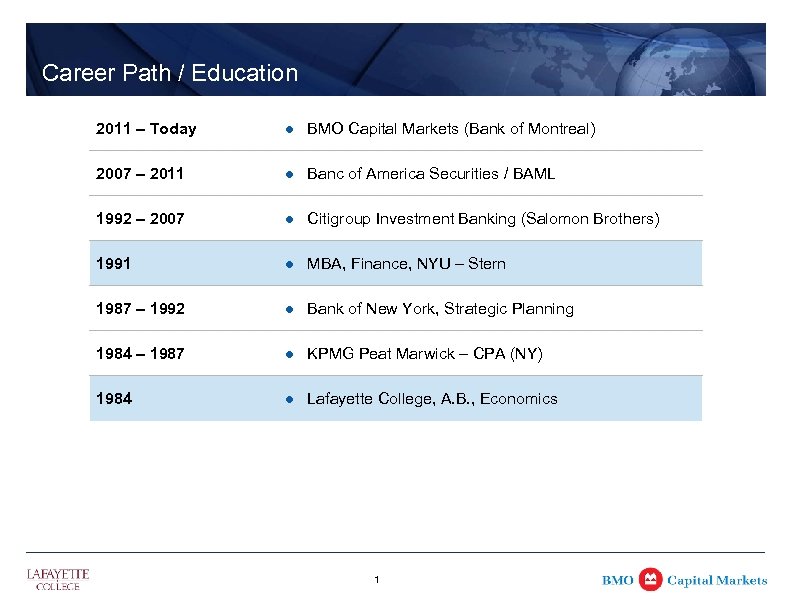

Career Path / Education 2011 – Today l BMO Capital Markets (Bank of Montreal) 2007 – 2011 l Banc of America Securities / BAML 1992 – 2007 l Citigroup Investment Banking (Salomon Brothers) 1991 l MBA, Finance, NYU – Stern 1987 – 1992 l Bank of New York, Strategic Planning 1984 – 1987 l KPMG Peat Marwick – CPA (NY) 1984 l Lafayette College, A. B. , Economics 1

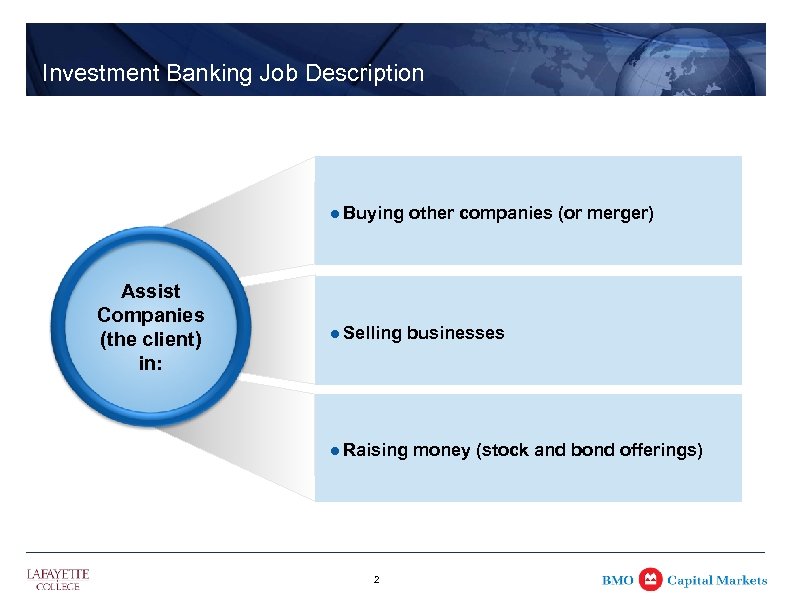

Investment Banking Job Description l Buying other companies (or merger) Assist Companies (the client) in: l Selling businesses l Raising money (stock and bond offerings) 2

Investment Banking Clients Pay Fees for Products and Services l Financial advisory (Buy / selling companies; M&A) n Source idea (pitch) n Negotiate transaction (execute) n Valuation analysis (fairness opinion) l Underwriting / Capital Markets (Raising money) n Assume the risk of distributing securities to investors n Structure the security n Market and sell to investors – Valuation 3

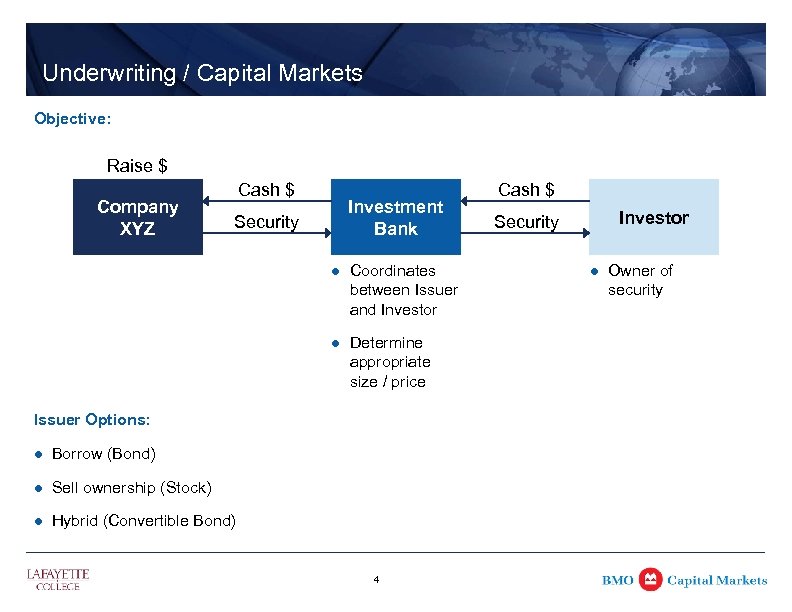

Underwriting / Capital Markets Objective: Raise $ Company XYZ Cash $ Investment Bank Security l Coordinates between Issuer and Investor l Determine appropriate size / price Issuer Options: l Borrow (Bond) l Sell ownership (Stock) l Hybrid (Convertible Bond) 4 Cash $ Investor Security l Owner of security

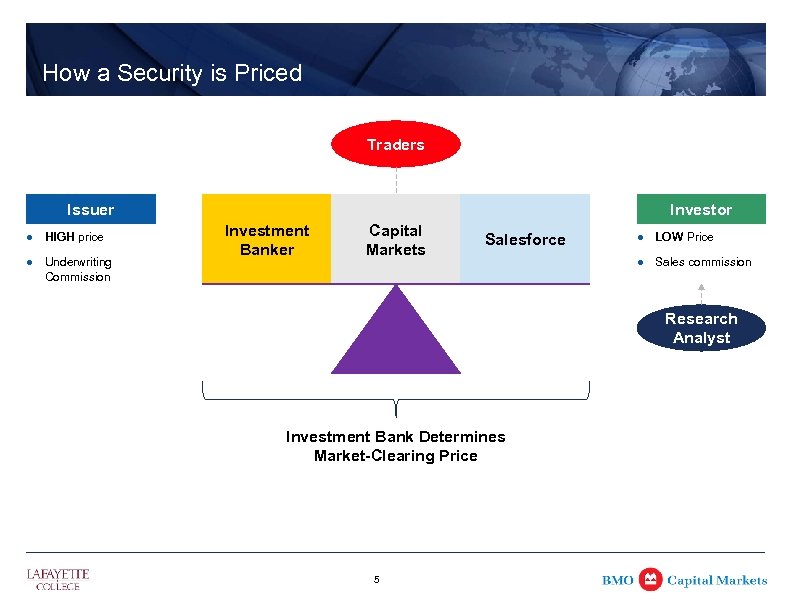

How a Security is Priced Traders Issuer l HIGH price l Underwriting Commission Investor Investment Banker Capital Markets l LOW Price l Salesforce Sales commission Research Analyst Investment Bank Determines Market-Clearing Price 5

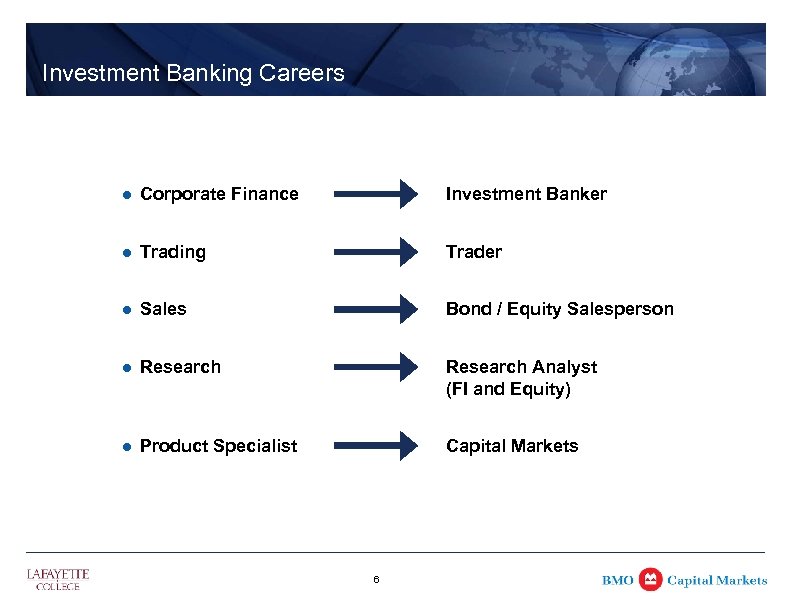

Investment Banking Careers l Corporate Finance Investment Banker l Trading Trader l Sales Bond / Equity Salesperson l Research Analyst (FI and Equity) l Product Specialist Capital Markets 6

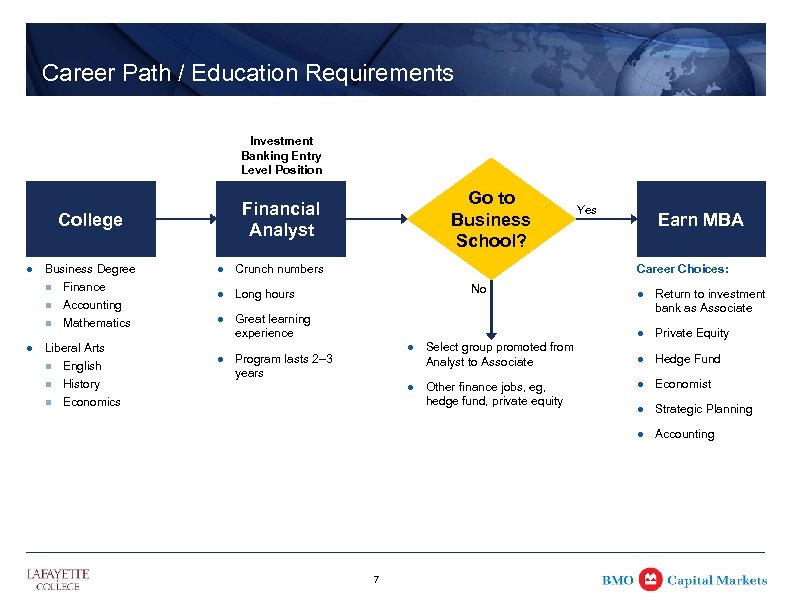

Career Path / Education Requirements Investment Banking Entry Level Position College l Business Degree n Finance n n l Accounting Mathematics Liberal Arts n English n History n Go to Business School? Financial Analyst l Crunch numbers l Long hours l Yes Great learning experience l Earn MBA Career Choices: No l Economics 7 Other finance jobs, eg, hedge fund, private equity Private Equity l Hedge Fund l Economist l Strategic Planning l Program lasts 2– 3 years Select group promoted from Analyst to Associate Return to investment bank as Associate l l l Accounting

The Path to Success l Highly analytical n Comfortable with math n Make the complex simple l Marketing / sales n Idea generation / “break new ground” n Make the simple interesting l Attention to detail n Pitch books n Prospectuses l Persistence / teamwork n Maintain client relationships n One out of ten pitches may land an assignment n Competitive "fire" 8

Rewards of the Job l Creativity is encouraged l Every day and every deal is different l Meet interesting people l You see the results of your work in the newspaper l Travel 9

Challenges of the Job l The client is always right l The client has many “friends” l Long hours l “Roadmaps” don't apply n Answers / agenda often not obvious l Travel 10

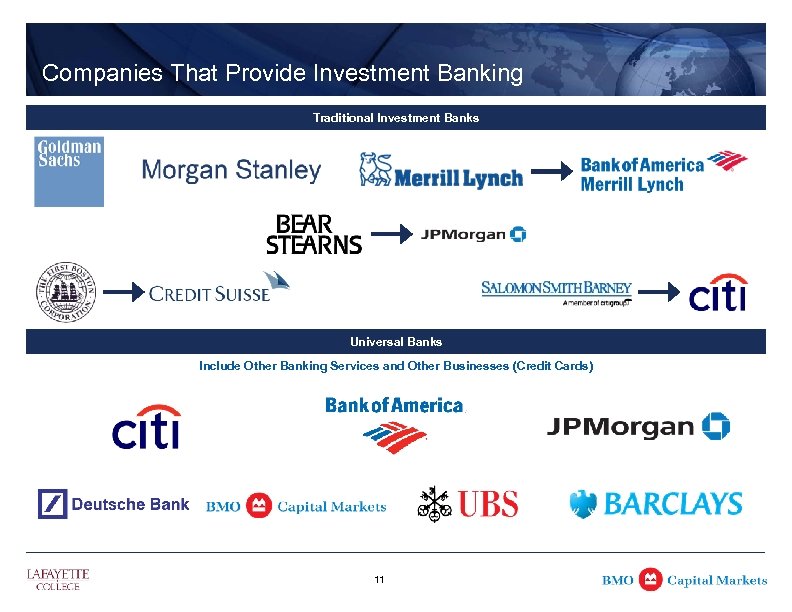

Companies That Provide Investment Banking Traditional Investment Banks Universal Banks Include Other Banking Services and Other Businesses (Credit Cards) 11

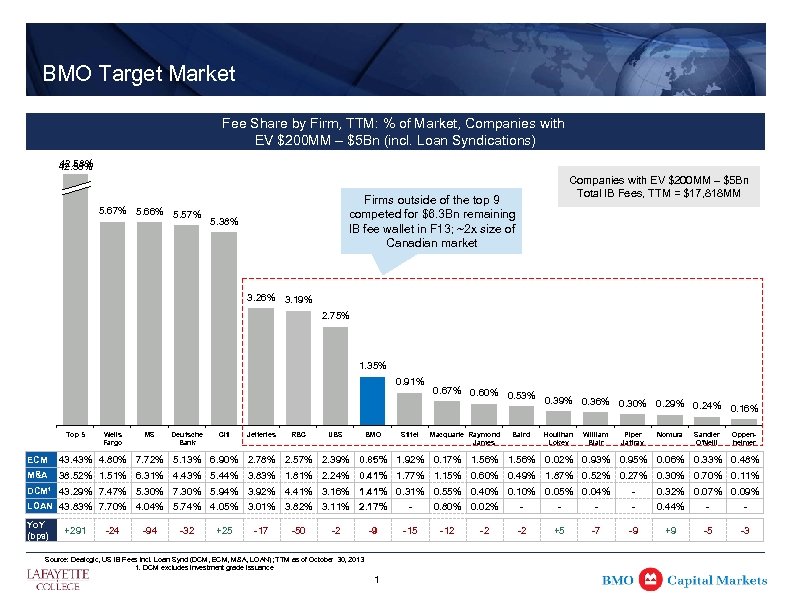

BMO Target Market Fee Share by Firm, TTM: % of Market, Companies with EV $200 MM – $5 Bn (incl. Loan Syndications) 42. 58% 5. 67% 5. 66% 5. 57% Companies with EV $200 MM – $5 Bn Total IB Fees, TTM = $17, 818 MM Firms outside of the top 9 competed for $6. 3 Bn remaining IB fee wallet in F 13; ~2 x size of Canadian market 5. 38% 3. 26% 3. 19% 2. 75% 1. 35% 0. 91% Top 5 Wells Fargo MS Deutsche Bank Citi Jefferies RBC UBS BMO Stifel 0. 67% 0. 60% 0. 53% Macquarie Raymond James Baird 0. 39% 0. 36% 0. 30% 0. 29% 0. 24% 0. 16% Houlihan Lokey William Blair Piper Jaffray Nomura Sandler O'Neill Oppen- heimer ECM 43. 43% 4. 80% 7. 72% 5. 13% 6. 90% 2. 78% 2. 57% 2. 39% 0. 85% 1. 92% 0. 17% 1. 56% 0. 02% 0. 93% 0. 95% 0. 06% 0. 33% 0. 48% M&A 38. 52% 1. 51% 6. 31% 4. 43% 5. 44% 3. 83% 1. 81% 2. 24% 0. 41% 1. 77% 1. 15% 0. 60% 0. 49% 1. 87% 0. 52% 0. 27% 0. 30% 0. 70% 0. 11% DCM 1 43. 29% 7. 47% 5. 30% 7. 30% 5. 94% 3. 92% 4. 41% 3. 16% 1. 41% 0. 31% 0. 55% 0. 40% 0. 10% 0. 05% 0. 04% LOAN 43. 83% 7. 70% 4. 04% 5. 74% 4. 05% 3. 01% 3. 82% 3. 11% 2. 17% - - 0. 44% - - +291 -24 -94 -32 +25 -17 -50 -2 -9 -15 -12 -2 -2 +5 -7 -9 +9 -5 -3 Source: Dealogic, US IB Fees incl. Loan Synd (DCM, ECM, M&A, LOAN); TTM as of October 30, 2013 1. DCM excludes investment grade issuance 12 0. 80% 0. 02% 0. 32% 0. 07% 0. 09% Yo. Y (bps) - -

My Lessons Learned 1. Understand before being understood 2. Make the complex simple; and make the simple interesting 3. Consider the source 4. Ask the second question 5. Sleep on it 6. Lead by example, not by cloning 7. Don’t oversell familiarity 8. Engage in face to face 9. Everyone’s allowed to have a bad day 10. Think different 13

Appendix 14

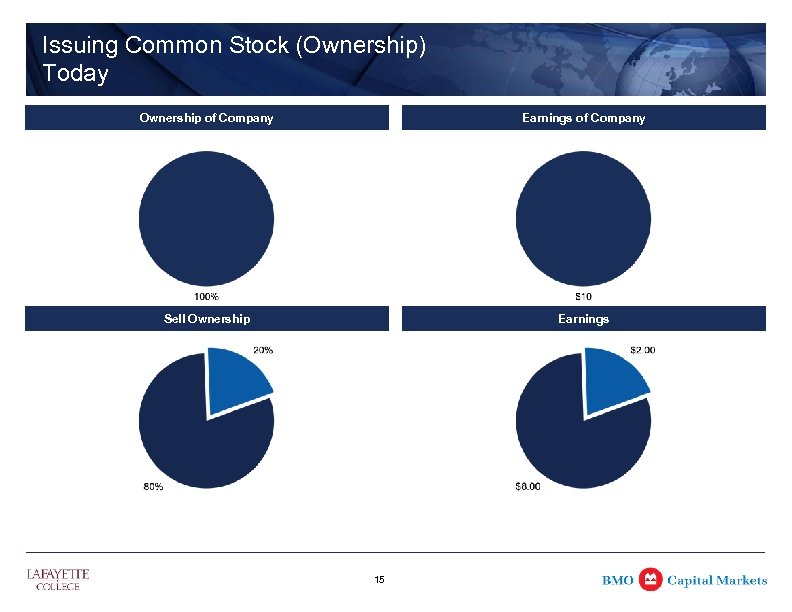

Issuing Common Stock (Ownership) Today Ownership of Company Earnings of Company Sell Ownership Earnings 15

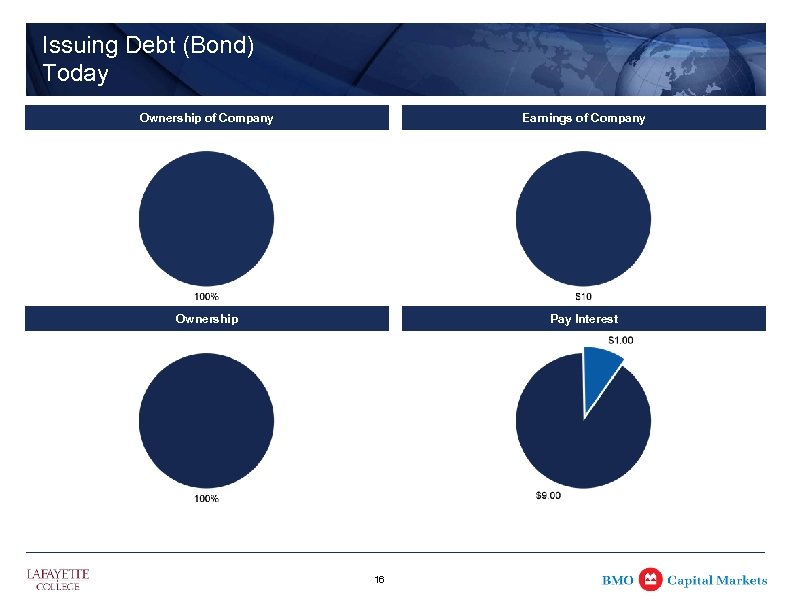

Issuing Debt (Bond) Today Ownership of Company Earnings of Company Ownership Pay Interest 16

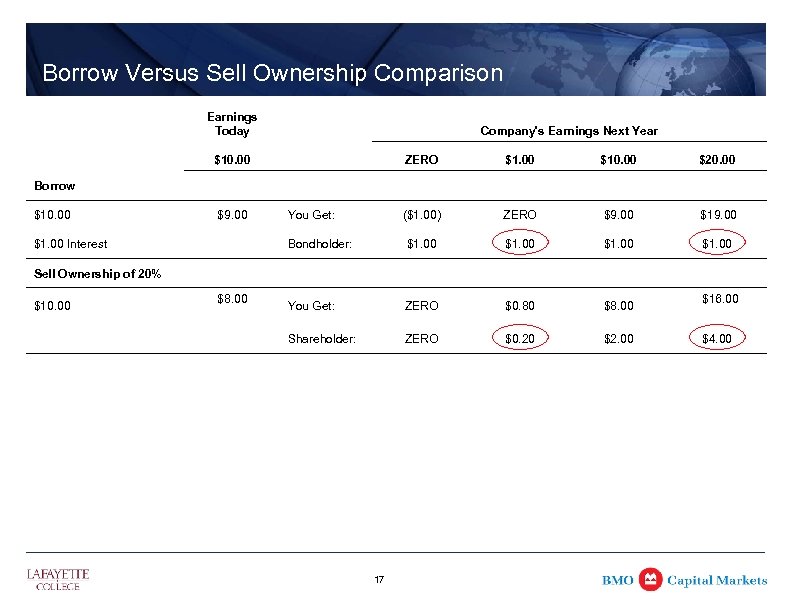

Borrow Versus Sell Ownership Comparison Earnings Today Company's Earnings Next Year $10. 00 ZERO $1. 00 $10. 00 $20. 00 ($1. 00) ZERO $9. 00 $19. 00 Bondholder: $1. 00 You Get: ZERO $0. 80 $8. 00 Shareholder: ZERO $0. 20 $2. 00 Borrow $10. 00 $9. 00 $1. 00 Interest You Get: Sell Ownership of 20% $10. 00 $8. 00 17 $16. 00 $4. 00

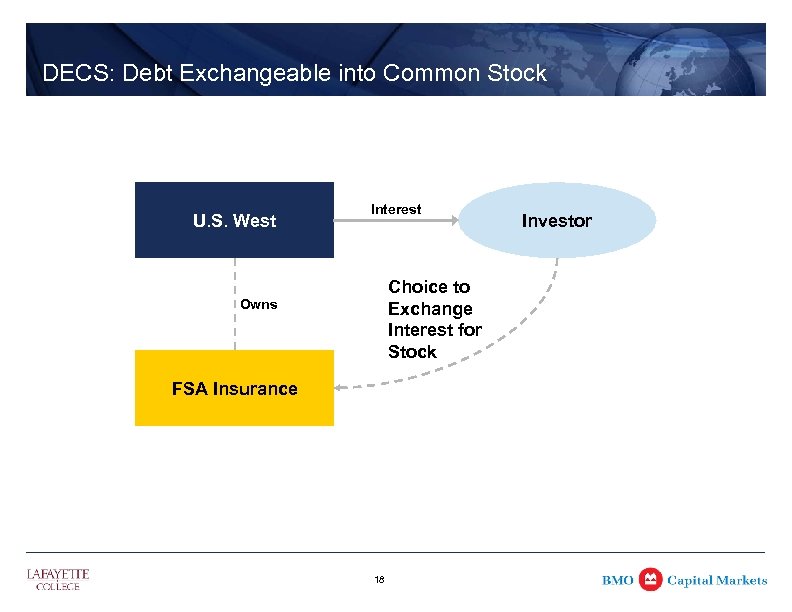

DECS: Debt Exchangeable into Common Stock U. S. West Interest Choice to Exchange Interest for Stock Owns FSA Insurance 18 Investor

2ee72fa0bcb04d34a543485d77fa3d50.ppt