0d48b097bebc4cbf5b2deaff79167ab0.ppt

- Количество слайдов: 23

A Bright Future for Buy to Let NLA Mortgages Andrew Rudkin www. landlords. org. uk To promote and protect private residential landlords

Agenda • • Introduction Is this a good time to be a Landlord? The BTL marketplace Looking forward Paragon Mortgages / Mortgage Trust NLA Mortgages Summary and Questions www. landlords. org. uk To promote and protect private residential landlords

Introduction • • Provided by TBMC Group Award winning specialist broker and distributor Systems and expertise Paragon Group www. landlords. org. uk To promote and protect private residential landlords

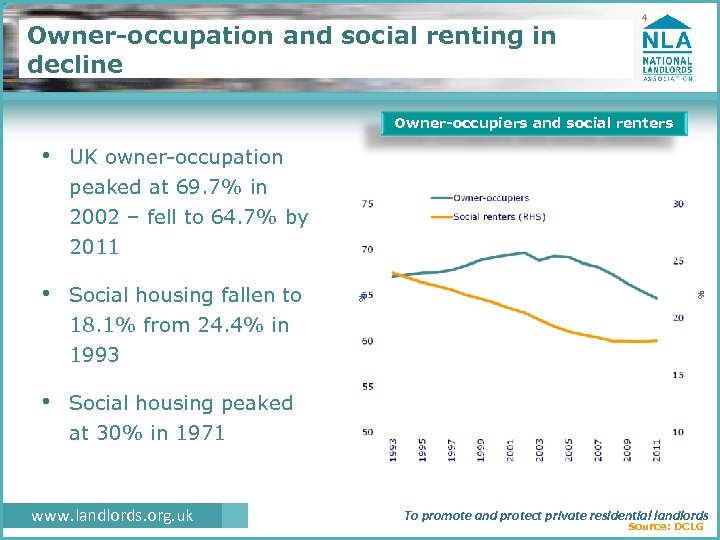

Owner-occupation and social renting in decline 4 Owner-occupiers and social renters • UK owner-occupation peaked at 69. 7% in % • Social housing fallen to % 2002 – fell to 64. 7% by 2011 18. 1% from 24. 4% in 1993 • Social housing peaked at 30% in 1971 www. landlords. org. uk To promote and protect private residential landlords Source: DCLG

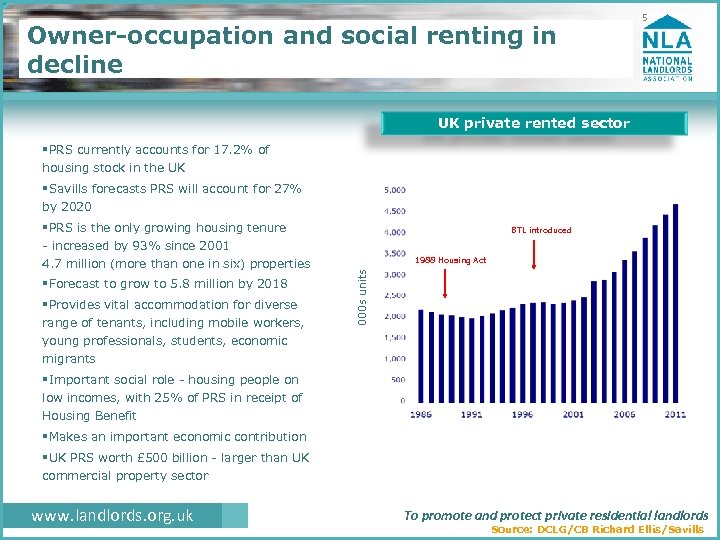

Owner-occupation and social renting in decline 5 UK private rented sector §PRS currently accounts for 17. 2% of housing stock in the UK §Savills forecasts PRS will account for 27% by 2020 §PRS is the only growing housing tenure §Forecast to grow to 5. 8 million by 2018 §Provides vital accommodation for diverse range of tenants, including mobile workers, young professionals, students, economic migrants 1988 Housing Act 000 s units - increased by 93% since 2001 4. 7 million (more than one in six) properties BTL introduced §Important social role - housing people on low incomes, with 25% of PRS in receipt of Housing Benefit §Makes an important economic contribution §UK PRS worth £ 500 billion - larger than UK commercial property sector www. landlords. org. uk To promote and protect private residential landlords Source: DCLG/CB Richard Ellis/Savills

Why is now a good time to be a landlord? • Property Prices. • Average current property prices up 7. 1% on 2012 • Future property prices? . . . forecasts reflect continued steady growth. • Supply & demand – current shortage of around 1 million homes in UK. • New housing remain at low levels • Normally around 175, 000 units per annum • 142, 000 completed in 2011 • Need to build 240, 000 new homes each year www. landlords. org. uk To promote and protect private residential landlords

Why is now a good time to be a Landlord? • 1. 8 m people currently on council house waiting lists in England • Up 10% over last 5 years • Increasing Rents. • Average rental return of 5% for houses and 5. 2% for flats • 39% of landlords increased rents in Q 4 2013 • Outlook for Private Rented Sector. • PRS is growing – • up from 10. 1% of housing stock in UK to 17. 2% in 2011 and predicted to increase to 27% by 2020 (Savills) www. landlords. org. uk To promote and protect private residential landlords

Why is now a good time to be a Landlord? • Tenant Demand Remains Strong • Mortgages for first time buyers still difficult with stringent underwriting criteria • Growing student population. • Growing immigrant population. • Mobile workforce. • Split families. • Personal choice. . . movement towards European market? • Average void period – 3 weeks • 46% of ARLA agents reported more tenants than properties www. landlords. org. uk To promote and protect private residential landlords

The Buy to Let Marketplace The BTL marketplace www. landlords. org. uk To promote and protect private residential landlords

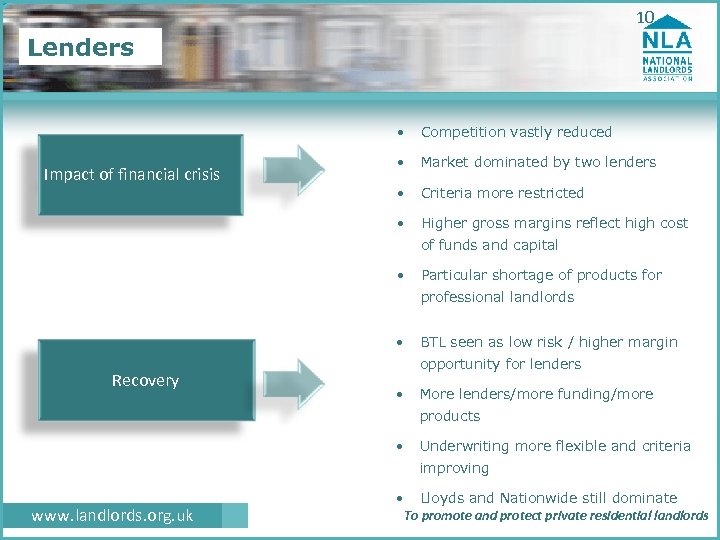

10 Lenders • • Market dominated by two lenders • Criteria more restricted • Impact of financial crisis Competition vastly reduced Higher gross margins reflect high cost of funds and capital • Particular shortage of products for professional landlords • Recovery BTL seen as low risk / higher margin opportunity for lenders • More lenders/more funding/more products • Underwriting more flexible and criteria improving www. landlords. org. uk • Lloyds and Nationwide still dominate To promote and protect private residential landlords

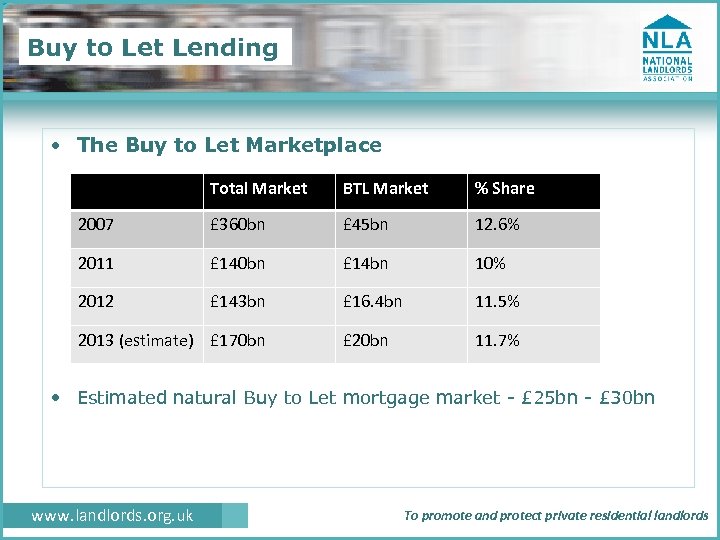

Buy to Let Lending • The Buy to Let Marketplace Total Market BTL Market % Share 2007 £ 360 bn £ 45 bn 12. 6% 2011 £ 140 bn £ 14 bn 10% 2012 £ 143 bn £ 16. 4 bn 11. 5% £ 20 bn 11. 7% 2013 (estimate) £ 170 bn • Estimated natural Buy to Let mortgage market - £ 25 bn - £ 30 bn www. landlords. org. uk To promote and protect private residential landlords

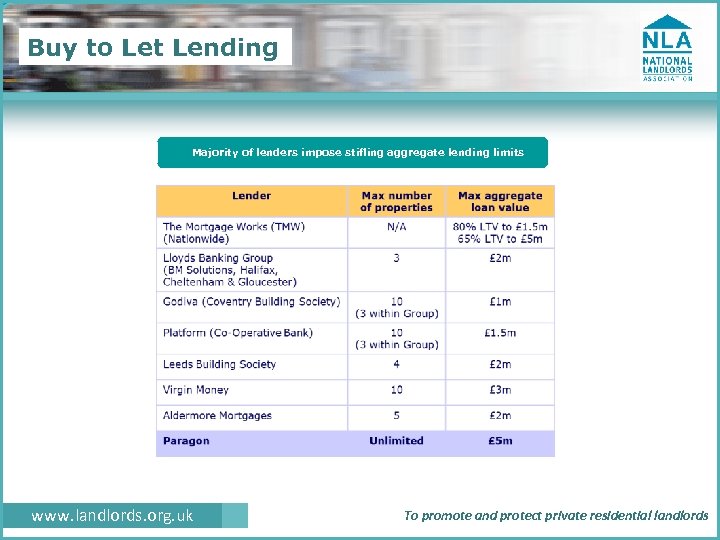

Buy to Let Lending Majority of lenders impose stifling aggregate lending limits www. landlords. org. uk To promote and protect private residential landlords

Lenders and their approach to market • Only a few specialist BTL lenders cater for the professional landlord sector - Paragon, Aldermore, Kent Reliance and TMW. • What differentiates the professional sector? • HMOs and multi unit properties • Variety of tenant types (including DSS and students) • Larger portfolios • Limited company lending • More complicated underwriting propositions • Larger lending limits www. landlords. org. uk To promote and protect private residential landlords

Buy to Let Looking forward www. landlords. org. uk To promote and protect private residential landlords

The Buy to Let Marketplace • Continued recovery in 2014 with more lenders • Concentration on mainstream buy to let • There are now 30 plus lenders offering a wide range of products • Overall Buy to Let lending has proven to be very resilient during the crises with many lenders reporting lower arrears than residential mortgages www. landlords. org. uk To promote and protect private residential landlords

The Buy to Let Marketplace – looking forward • Mortgage products: • More choice – fixed rates/discounts/trackers • Easing of rental requirements • Increase in available products • Over 2000 products available in 2007 • Down to less than 80 in 2008 • Over 400 products now available and expected to increase www. landlords. org. uk To promote and protect private residential landlords

The Buy to Let Marketplace – looking forward • Paragon Mortgages • Professional landlords • HMOs – 3 years experience as a landlord • Multi Unit properties – max 20 units, 3 years experience • Limited company Lending • Under 6 month ownership remortgages • Portfolio lending up to £ 5 m • Lending up to 75% LTV • Maximum loan £ 2 m per property • No restriction to number of properties in a portfolio All the above difficult to place elsewhere! www. landlords. org. uk To promote and protect private residential landlords

The Buy to Let Marketplace – looking forward • Wide range of acceptable tenancies • ASTs (6 -12 months) • Student and Housing Benefit tenants • Company lets (up to 3 years) • Local Authorities and Housing Associations (up to 5 years) • New Build • Experienced “In house” surveyors • Rental calculation assessed on individual or joint tenancy www. landlords. org. uk To promote and protect private residential landlords

The Buy to Let Marketplace – looking forward • Mortgage Trust • Simple BTL product range • Simple application process, immediate decision • Competitive rates • Standard properties, single ASTs • Available through NLA mortgages www. landlords. org. uk To promote and protect private residential landlords

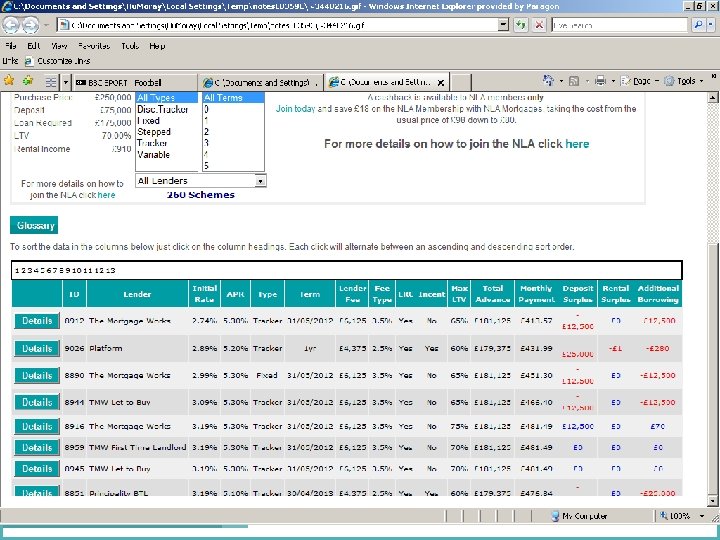

NLA Mortgages • Bespoke mortgage service for NLA members • Whole of market offering • Currently 30 Lenders with close to 400 products • Self select from a web based sourcing system • Cash back incentive on all products available for NLA members only • Website – www. nlamortgages. co. uk • Helpline – 02920 695 555 www. landlords. org. uk To promote and protect private residential landlords

www. landlords. org. uk To promote and protect private residential landlords

Summary • Private rented sector will continue to grow and is a vital part of housing infrastructure in the U K • BTL is good business for Lenders but a specialist area • Traditional & new Lenders will emerge into the market • More products and special deals will become available • Still a good time to be a Landlord www. landlords. org. uk To promote and protect private residential landlords

Questions www. landlords. org. uk To promote and protect private residential landlords

0d48b097bebc4cbf5b2deaff79167ab0.ppt