433fe634673d133df21963896d8a396f.ppt

- Количество слайдов: 90

A Brave New World for U. S. Taxpayers with Foreign Assets: The New and Enhanced FBAR and FATCA Reporting Requirements

Matthew D. Lee

Learning Objectives

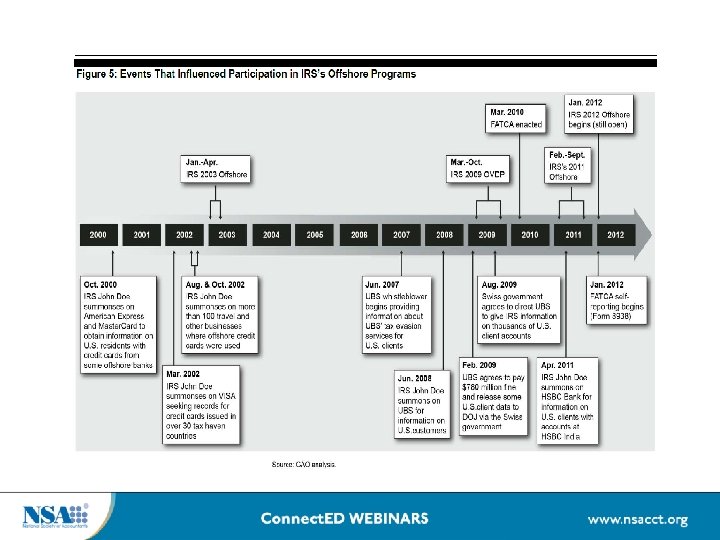

The IRS Crackdown on Offshore Tax Evasion

May 28, 2014 DOJ Press Release

Enforcement Efforts to Date

Enforcement Efforts To Date (continued)

Credit Suisse Guilty Plea May 19, 2014

What’s Next After Credit Suisse?

Foreign Bank Accounting Reporting

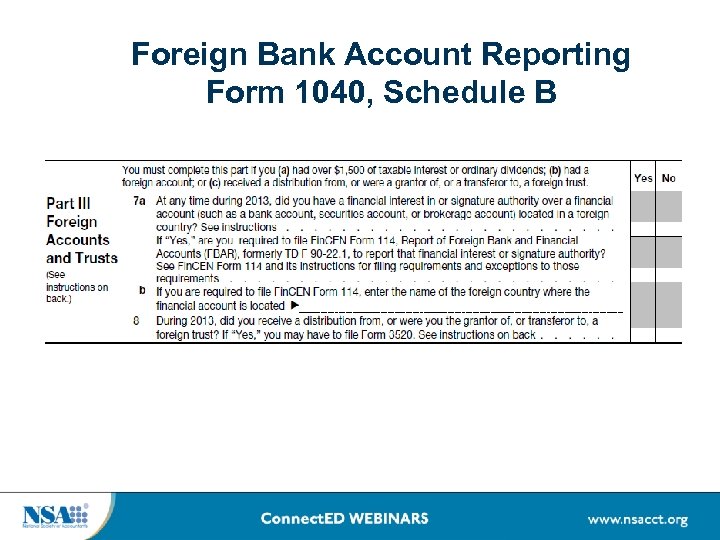

Foreign Bank Account Reporting Form 1040, Schedule B

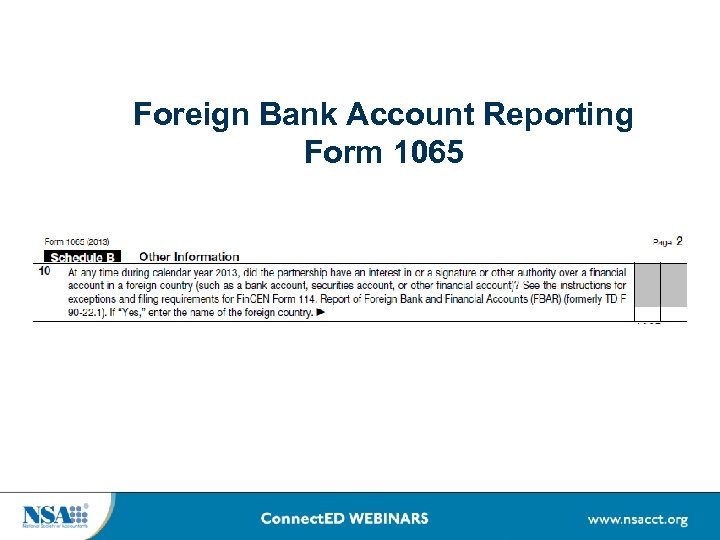

Foreign Bank Account Reporting Form 1065

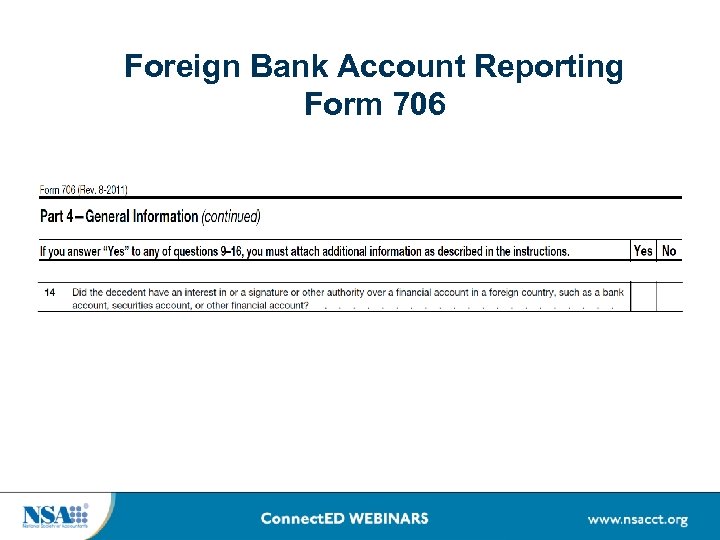

Foreign Bank Account Reporting Form 706

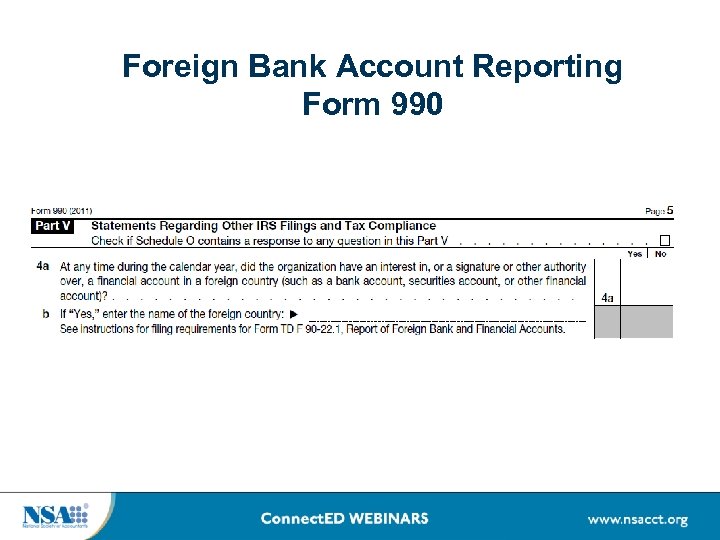

Foreign Bank Account Reporting Form 990

Fin. CEN 114 (FBAR)

Fin. CEN 114 (FBAR) (continued)

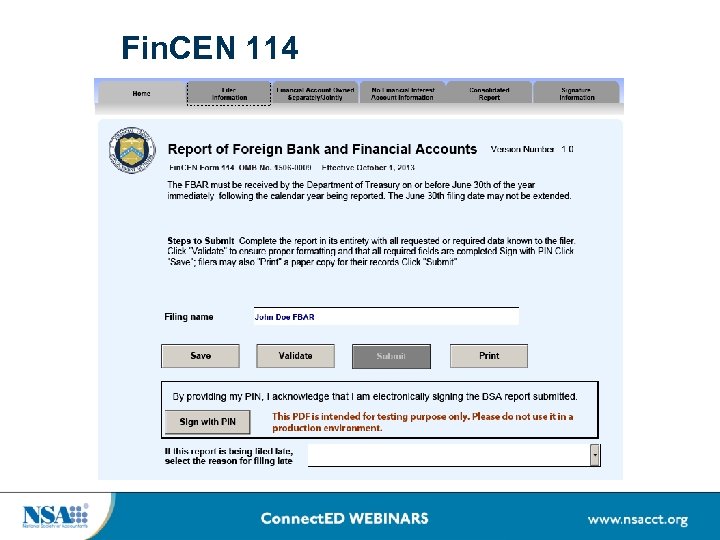

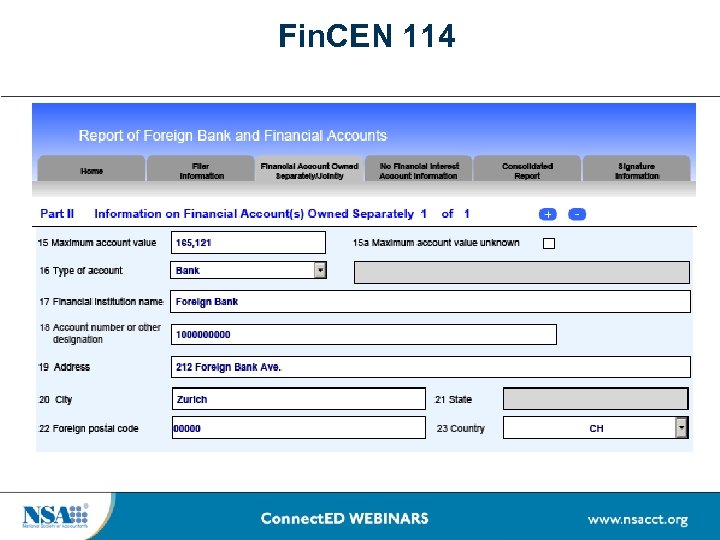

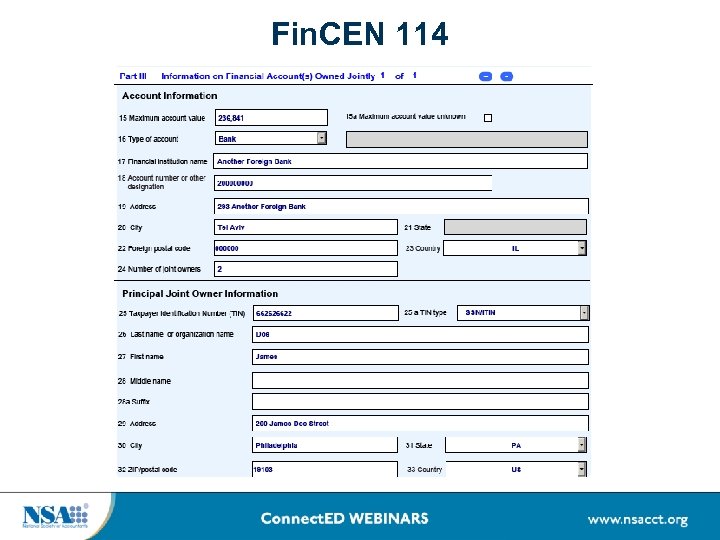

Fin. CEN 114

Fin. CEN 114

Fin. CEN 114

Fin. CEN 114

Who is Required to File an FBAR?

Who is a “U. S. Person”?

What is a Reportable Financial Account?

What is a “Financial Interest”?

What is a “Financial Interest”? (continued)

What is “Signature Authority”?

FBAR Filing Exemptions

FBAR Filing Exemptions (continued)

FBAR Penalties for Non-Compliance

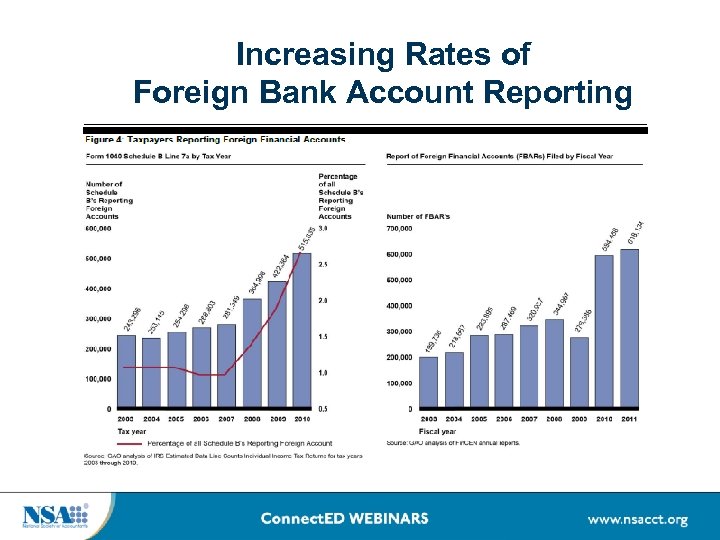

Increasing Rates of Foreign Bank Account Reporting

Circular 230 Obligations and FBAR

Circular 230 Obligations and FBAR

Review Questions for Self Study CPE:

Two Primary FATCA Requirements

FATCA History

FATCA Policy in Context of U. S. Tax Laws

What Does FATCA Require of FFIs?

International Coordination and Model Intergovernmental Agreements

FATCA Also Requires Reporting of Foreign Assets by U. S. Taxpayers

Overview of Section 6038 D

Section 6038 D Is Effective Now

Who Is Required to File Form 8938?

Who is a “Specified Individual”?

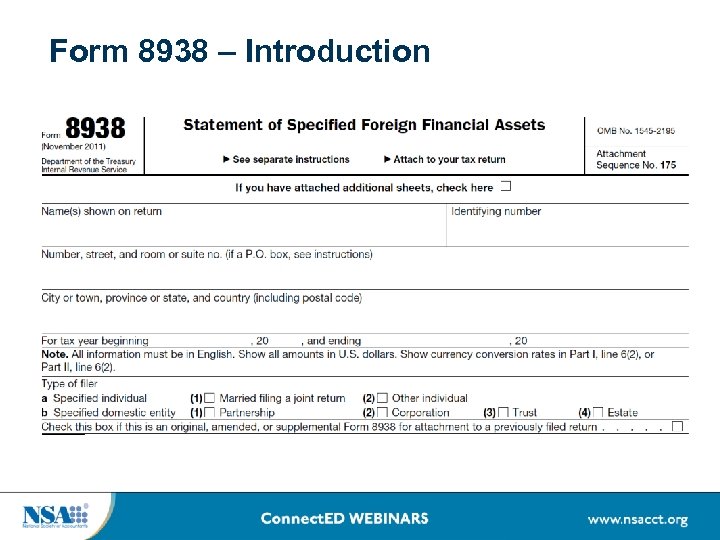

Form 8938 – Introduction

What is a “Specified Foreign Financial Asset”?

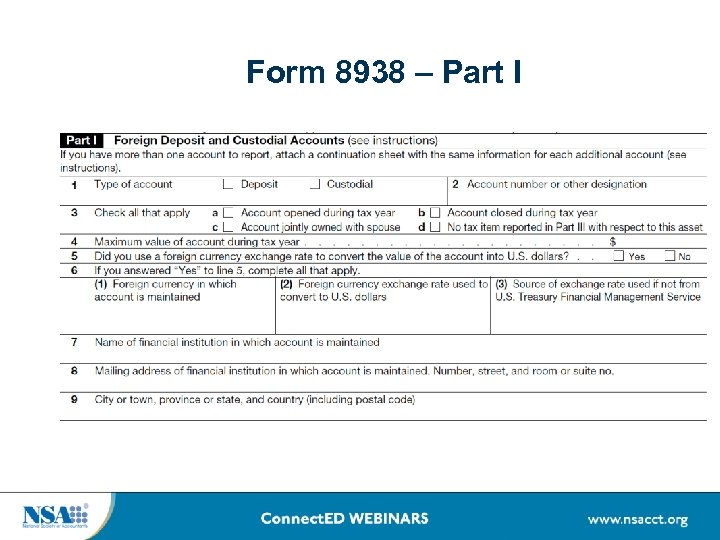

Form 8938 – Part I

What is a SFFA? (continued)

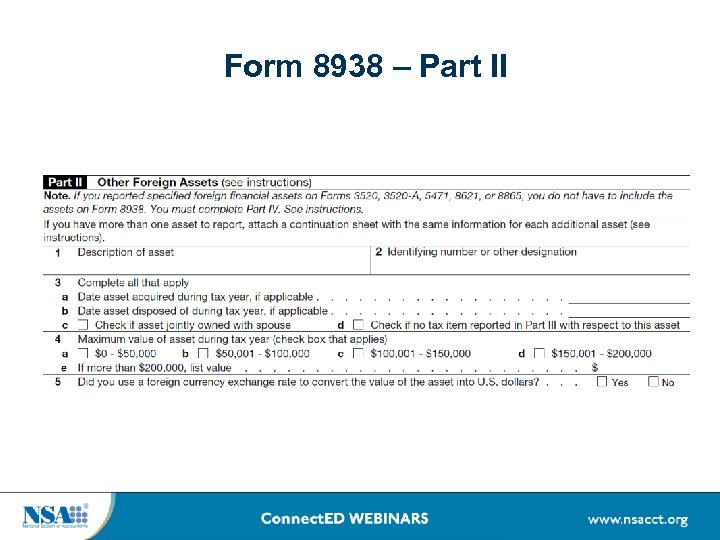

Form 8938 – Part II

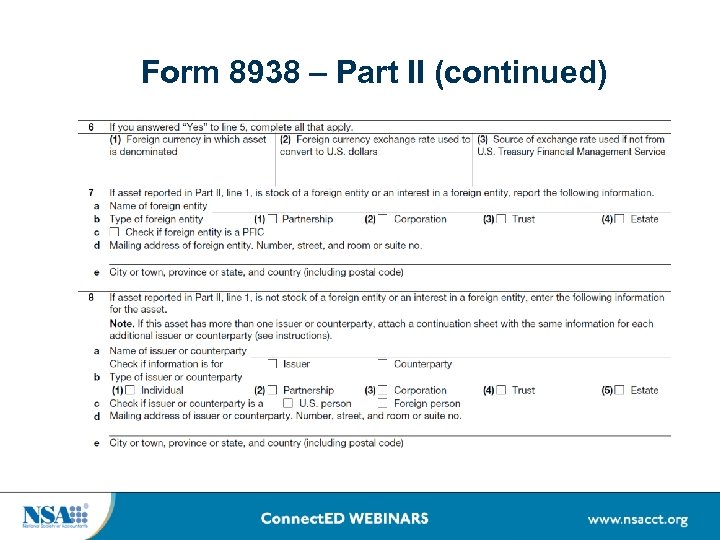

Form 8938 – Part II (continued)

Determining Whether a “Specified Individual” Has An “Interest” in a SFFA

What are the Reporting Thresholds for Domestic Taxpayers?

What are the reporting thresholds for taxpayers living abroad?

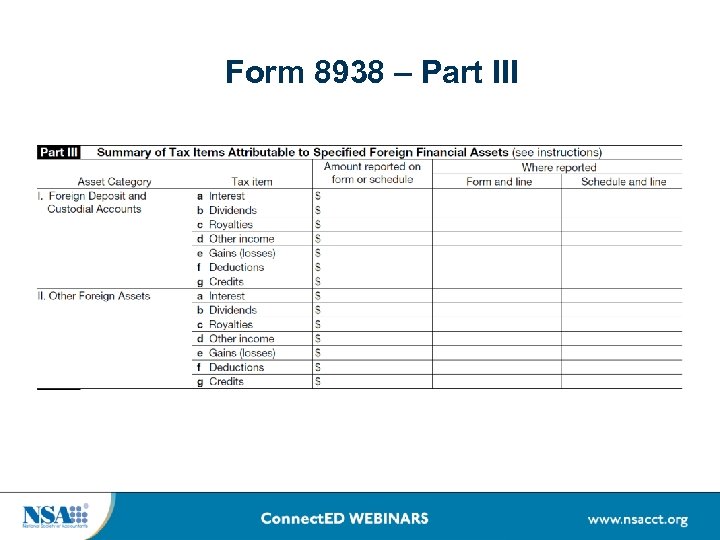

Form 8938 Requires Disclosure of Tax Items Attributable to SFFAs

Form 8938 – Part III

Other Rules for Form 8938

No Duplicative Reporting Required

No Duplicative Reporting Required (continued)

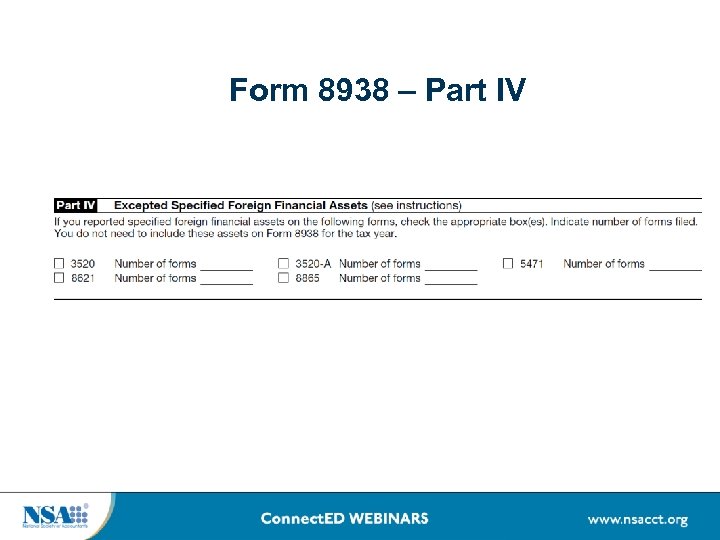

Form 8938 – Part IV

Guidance for Valuing SFFAs

Penalties for Non-Filing of Form 8938

IRS Offshore Voluntary Disclosure Program

OVDP (continued)

OVDP Offshore Penalty: 27. 5 percent

OVDP Offshore Penalty: 5 percent FAQ 52

OVDP Offshore Penalty: 12. 5 percent

OVDP: “Opt Out” Option

OVDP: “Opt Out” Option (continued)

Risks of “Quiet Disclosure”

Streamlined Compliance Procedures for U. S. Taxpayers and Dual Citizens Residing Abroad

Streamlined Compliance Procedures: Details Announced August 31, 2012

Streamlined Compliance Procedures: Details Announced August 31, 2012

IRS Guidance for U. S. Citizens Residing Abroad

Review Questions for Self Study CPE:

Questions?

Thank you for participating in this webinar. Below is the link to the online survey and CPE quiz:

433fe634673d133df21963896d8a396f.ppt