800b9f7117439c2ef3684a6eb05d00d7.ppt

- Количество слайдов: 167

A basket contains 5 apples. Do you know how to divide them among 5 people so that each person gets 1 apple and 1 apple stays in the basket? 1

4 people get an apple (one for each of them) and the fifth person gets the basket with an apple in it. 2

Welcome To The Minnesota Statewide Prevailing Wage (PW) Compliance Workshop Presented by: Clancy Finnegan and Charles Groshens Other State and Federal Agencies

Registration Things To Note ◦ name tag ◦ blue folder ◦ calculator Restrooms Snacks and beverages Cell phones off or vibrate Lunch Evaluations Professional Development Hour certificates www. dot. state. mn. us/const/labor/index. html Questions 4

Course Documents Course agenda Workshop folder ◦ PW Law Handbook Forms Section ◦ Other Contents Resource table DVD RTN Other handouts PDH Certificate Course Evaluation 5

Workshop Purpose 6

To educate contractors about the federal and state PW regulations, and to provide direction on how to properly demonstrate compliance. Classification Wages Reporting However, the LCU recognizes that each contractor and project/contract is unique and that other methods may be utilized to demonstrate compliance. Funding and federal/state law clarification. 7

What Is Prevailing Wage (PW) and Why Is It Important? 8

Federal and State minimum wage laws. What Applicable to contracts funded in whole or part with federal and/or state funds. ◦ Local Ordinances Wages and fringe benefits established are based on data provided by contractors through a voluntary, periodic survey process. The intent is to establish wages and fringe benefits that are reflective of the area where the project is located, which 9

prevents local wage standards from being undercut. Why Promotes competitive bidding by establishing a wage standard that all contractors must follow. ◦ Non-compliance – bidding advantage Tends to attract a workforce that is well trained; resulting in quality workmanship and projects that are completed on time and on budget. 10

True or False? Prevailing wage regulations only apply to construction contracts that are funded in whole or part with state and/or federal funds. True or False? Prevailing wage rates are solely based on union pay scales. 11

Role Of The LCU? 12

To ensure that the labor specifications incorporated into a contract funded in whole or part with federal and/or state funds are followed. The specifications include but are not limited to: ◦ ◦ federal Davis-Bacon and Related Acts Special Provisions Division A Minnesota prevailing wage law wage determinations (federal and/or state) state truck rental rates (Mn. DOT Only) Provide contract administration assistance and education to contractors and the Contracting Agency (CA), and 13

Investigate allegations regarding violations of the contract provisions which may entail ◦ analyzing various records, ◦ issuing determinations, ◦ processing restitution ◦ compliance orders, and ◦ referring matters to other authorities administrative, civil or action. for governmental criminal 14

Role Of The Contracting Agency (CA) 15

The CA includes ◦ state personnel (DOT, DNR, PCA, PFA, MNSCU, etc. ), ◦ county / city personnel (State-Aid, Schools, etc. ), and ◦ consulting firms. a representative of Mn. DOT, the CA is also required to ensure that all contractors comply with the federal and state prevailing wage laws. Failure to enforce could subject the CA to possible legal actions and loss of funding. Again, the main goal is to ensure that a contractor complies with the proper Classifications Wages Reporting 16

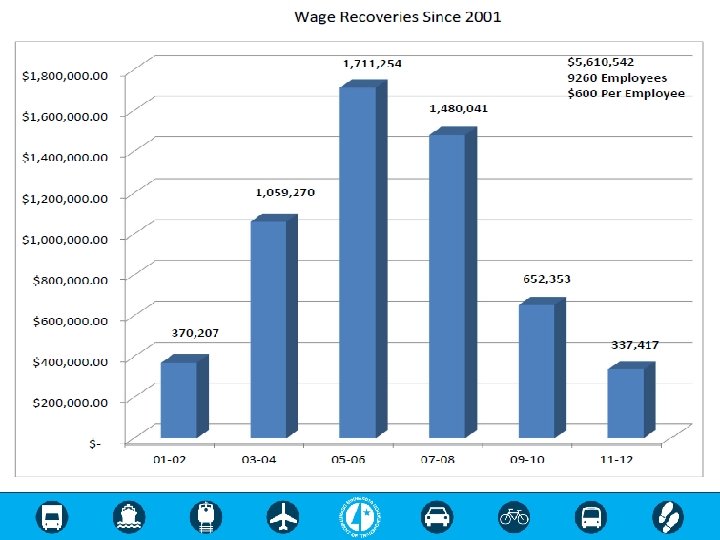

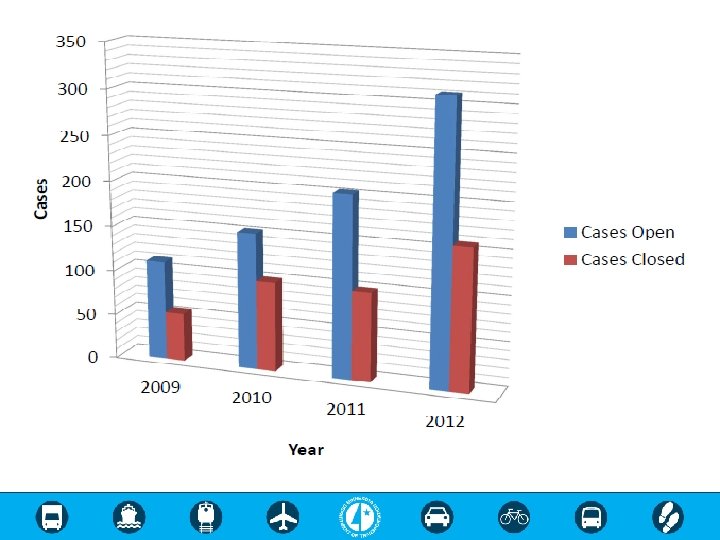

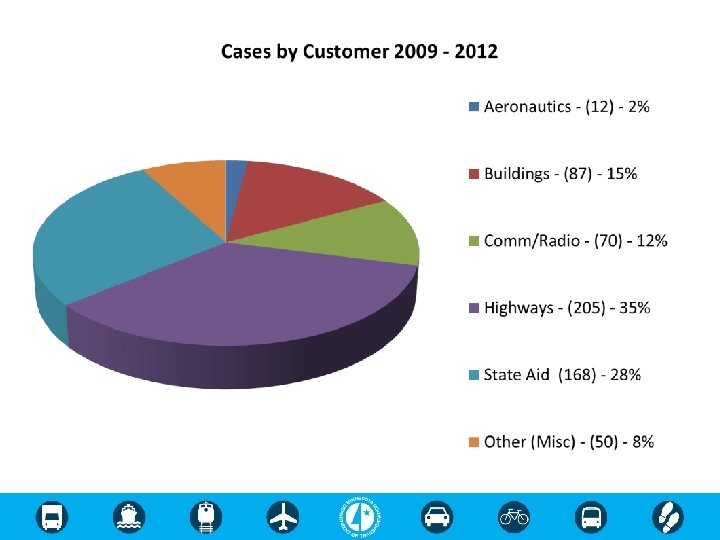

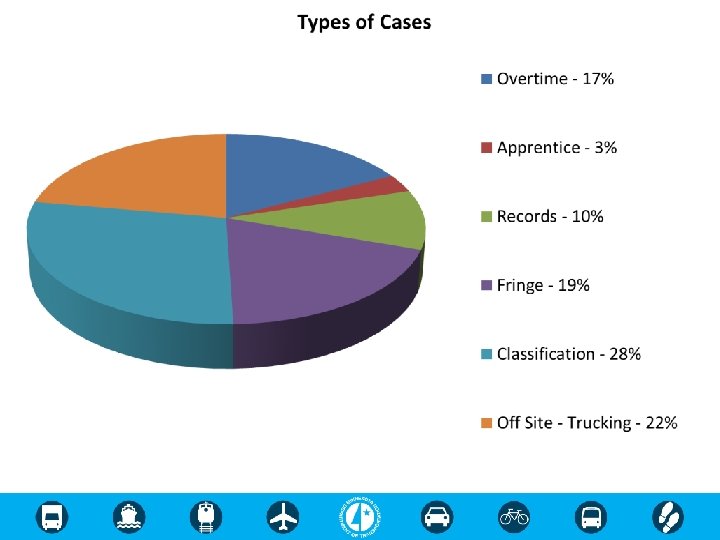

Case History 17

18

19

20

21

Mn. DOT/County/USDOT Investigation Closed St. Cloud contractor plead guilty to “Theft By Swindle” in January 2013 and agreed to: o o o a felony, $52, 000 restitution, and local, state and federal debarment. Mn. DOT will be working with the prime contractors on approximately 85 other contracts to recover $200, 000 in restitution. Mn. DOT/FBI Investigation Closed o So. St. Paul contractor plead guilty in July 2011, to $185, 000 in wage fraud for 27 employees, and sentenced to 15 months in prison. 22

Classification Definitions o o Laborers Specialty Crafts Classification Clarification o o o 110 112 203 205 303 - Survey Field Technician - Quality Control Tester - Landscape Equipment – Pavement Marking/Removal Equipment – Concrete Pump w. T – CRLMS (Civil Rights & Labor Management System) SWIFT Number & Vendor Forms (Refer to Handbook) ◦ Link provided on the LCU website homepage or by contacting ◦ Minnesota Management and Budget (MMB) helpline at (651) 201 -8106 or efthelpline. mmb@state. mn. us 23

Labor Classifications 24

Who is subject to PW ◦ A laborer or mechanic (worker) that performs “work” under a contract. ◦ Work is considered duties that are manual or physical in nature as distinguished from mental or managerial duties. Workers include ◦ ◦ ◦ (Refer to CPR Lesson WD) Laborers Specialty Equipment Operators Truck Drivers Skilled Journeyman Carpenters Electricians Ironworkers Plumbers, etc. 25

A worker must be classified based on the actual work performed regardless of the worker’s skill level. 26

To determine an applicable state classification of labor, the contractor must classify a worker based on a “same or similar trade or occupation”. In order to do this, the contractor shall refer to the ◦ wage decision(s) incorporated into the contract, ◦ the MN definition rules (refer to handbook), or ◦ the Dictionary of Occupational Titles (O*NET On. Line) Contact the LCU for assistance. Disputes require a CCRF, which will be forwarded to Mn. DLI for a determination. 27

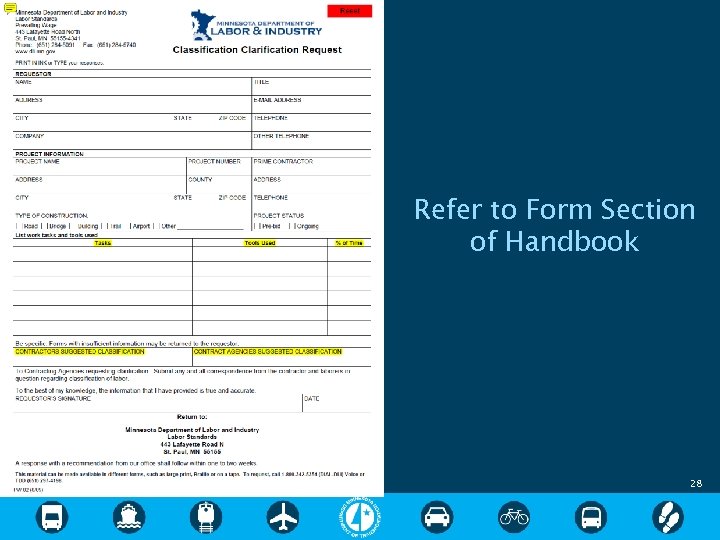

Refer to Form Section of Handbook 28

Federal Missing Classification Process 29

Prior to Bid Opening (Federal Funds) Because of the recent adoption of the state highway rates, most classifications should be included in the federal wage decision and have a wage rate. However, if not ◦ The contractor shall compare the labor classifications contained within the federal general wage decision with those anticipated to be utilized on the project to identify missing labor classifications, and estimate labor costs for bidding. (refer to page 18) 30

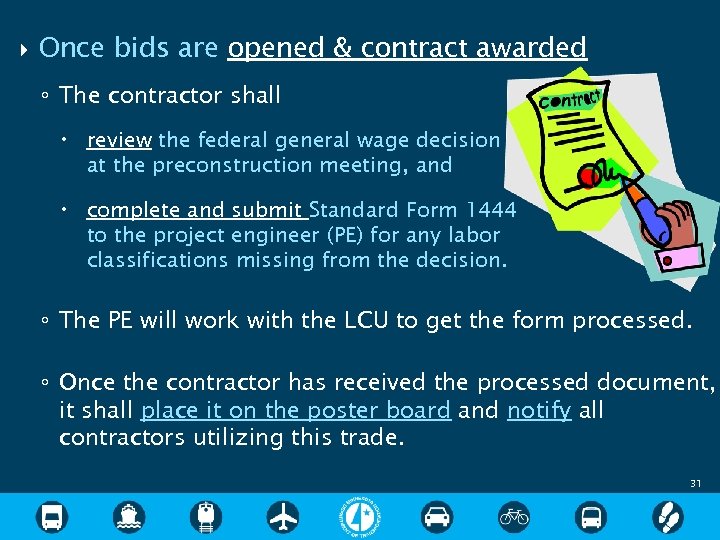

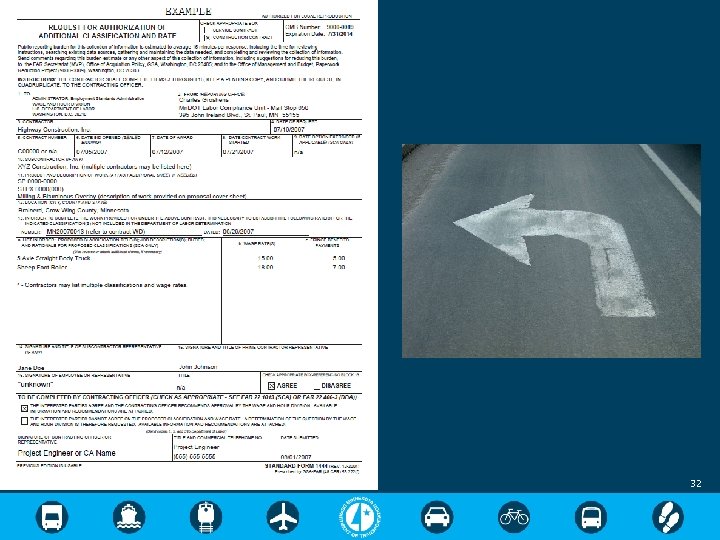

Once bids are opened & contract awarded ◦ The contractor shall review the federal general wage decision at the preconstruction meeting, and complete and submit Standard Form 1444 to the project engineer (PE) for any labor classifications missing from the decision. ◦ The PE will work with the LCU to get the form processed. ◦ Once the contractor has received the processed document, it shall place it on the poster board and notify all contractors utilizing this trade. 31

32

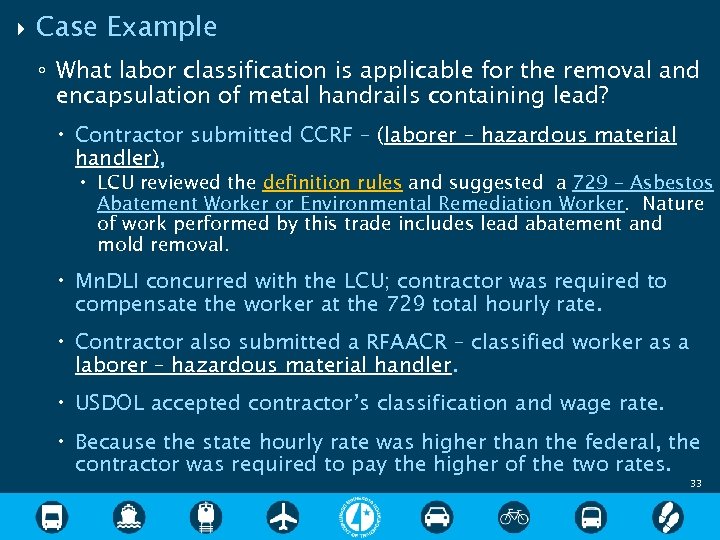

Case Example ◦ What labor classification is applicable for the removal and encapsulation of metal handrails containing lead? Contractor submitted CCRF – (laborer – hazardous material handler), LCU reviewed the definition rules and suggested a 729 – Asbestos Abatement Worker or Environmental Remediation Worker. Nature of work performed by this trade includes lead abatement and mold removal. Mn. DLI concurred with the LCU; contractor was required to compensate the worker at the 729 total hourly rate. Contractor also submitted a RFAACR – classified worker as a laborer – hazardous material handler. USDOL accepted contractor’s classification and wage rate. Because the state hourly rate was higher than the federal, the contractor was required to pay the higher of the two rates. 33

Commonly misused classification include ◦ ◦ ◦ Common Laborer (101) Skilled Laborer (102) (definition - limited trades) Landscape Laborer (103) Landscape Equipment (203) vs. Heavy Equipment Mechanic-Welder (601) (318) (Special Craft - Ironworker) Greaser (610) vs. (392) These classifications are often utilized because they are generally the lowest paid. ◦ THIS IS NOT ALLOWED. ◦ Workers must be classified and compensated for the actual work performed regardless of the worker’s skill level. 34

What is an apprentice ◦ A person enrolled in a formal system of employee training that combines on-the-job training with related technical instruction. The program is designed to produce specialty craft workers that are fully competent in all aspects of an occupation. 35

If the program and the apprentice are bona fide, an apprentice is not subject to the federal and/or state prevailing wage laws, provided the contractor can demonstrate the following ◦ the apprentice is performing the work the trade, of ◦ the apprentice is registered with the USDOL or the Mn. DLI, ◦ the apprentice is compensated according to the rate specified in the program based on level of progress, ◦ the ratio of apprentices to journeymen on the project is not greater than the ratio permitted for the contractor’s entire work force under the registered program. (page 9) 36

If a contractor fails to comply with the terms of the apprenticeship requirements, the contractor shall compensate its worker not less than the applicable total prevailing wage rate for the actual work performed. 37

When are owners, supervisors and foreman subject to PW ◦ Pursuant with federal regulations, owners, supervisors or foremen who devote more than 20 percent of their time during a work week to laborer or mechanic duties are considered laborers or mechanics for the time so spent and are subject to prevailing wage. (Aeronautic projects, Army Corps of Engineers projects, etc. ) ◦ Pursuant with state regulations, owners, supervisors or foremen performing work as a laborer or mechanic are subject to prevailing wage for the time so spent. 38

When are owners, supervisors and foreman not subject to PW ◦ Not engaged in or performing work the project, or on ◦ duties are primarily administrative, executive or clerical. If this is the case, these individuals do not need to be reported. 39

Are family members, relatives or self-employed contractors subject to PW ◦ Both the federal and state prevailing wage regulations do not provide an exemption family members, relatives or employed contractors that performing work under a contract. selfare for ◦ These individuals are considered laborers or mechanics and must be classified and compensated appropriately for the actual work performed. 40

Can young persons perform work on a construction project ◦ Both the federal and state labor laws attempt to protect young people from working in professions that are considered dangerous or hazardous. Therefore, no worker under the age of 18 will be allowed to perform work on a construction project. (FLSA Requirement) ◦ In order to ensure compliance the project engineer (PE) or a representative of the PE may request proof of age for any worker that appears to be under the age of 18. If proof cannot be provided, the worker will not be allowed to continue work until the worker can demonstrate proof of age and compliance with all applicable federal and/or state regulations. 41

True or False? Only union contractors can create an apprenticeship program. True or False? If a person works in more than one classification during a day, the contractor should assign that person the classification with the highest pay rate. True or False? An bona-fide electrical apprentice is exempt from PW when performing carpenter work? 42

Wages and Overtime 43

PW = Basic Wage Rate + Fringe Benefit Rate To demonstrate compliance ◦ a contractor must compensate a worker at a minimum, a combination of cash and fringe benefits that meets or exceeds the total PW rate required a specific labor classification. for Wages are reflected in a state and/or federal WD incorporated into a contract. (Provide to Subs) 44

A contractor assigns a worker a “Common Laborer” classification; the wage decision incorporated into a contract requires the following ◦ Basic Hourly Rate ◦ Fringe Benefits ◦ TOTAL Prevailing Wage $12. 00 $14. 00 A contractor may comply by paying the following hourly rates: ◦ ◦ $12. 00 $14. 00 $13. 00 $11. 00 as as a a wage plus with plus $2. 00 in fringe benefits, NO fringe benefits, $1. 00 in fringe benefits, $3. 00 in fringe benefits. 45

What is a federal general decision ◦ A wage decision or WD established by the USDOL, ◦ must be physically incorporated into a federally funded contract, ◦ it’s usually specific to a county and state; (regional for highway) ◦ does not cross county, state or regional boundaries (various locations require multiple WD’s), and ◦ USDOL adopted state highway rates 2010. Categories include ◦ Laborers, Heavy Equipment Operators, Truck Drivers and Special Crafts. 46

Types of federal wage decisions ◦ Building Construction, rehabilitation and repair of enclosures with walk-in access persons, machinery, equipment sheltered to house or supplies. ◦ Highway (adoption of state rates) Construction, alteration or repair of roads, streets, highways, runways, parking areas and paving work. other ◦ Heavy “Catch All” category. ◦ Residential Construction, rehabilitation and repair of single family houses, townhouses and apartment buildings not more than 4 stories. 47

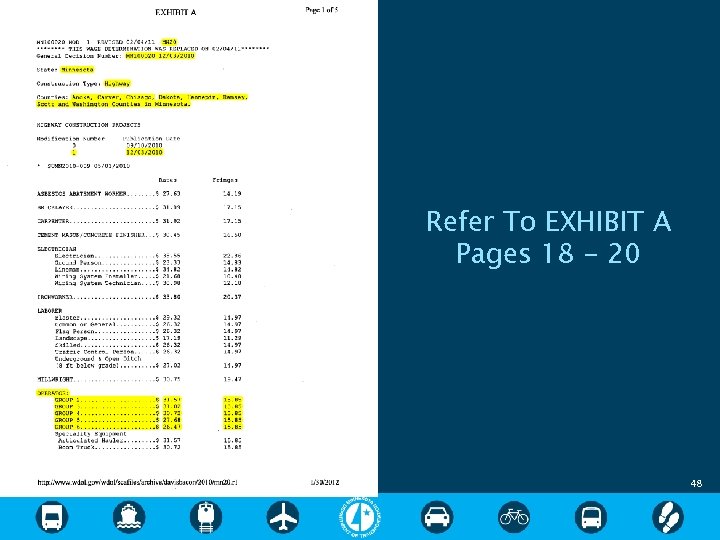

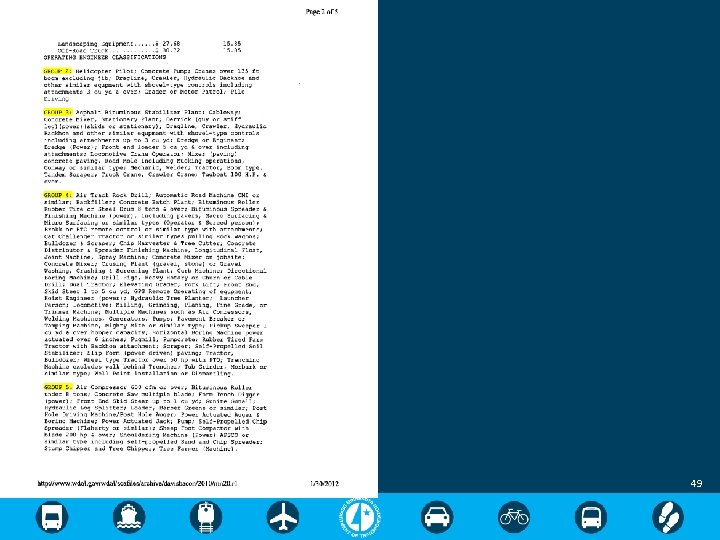

Refer To EXHIBIT A Pages 18 - 20 48

49

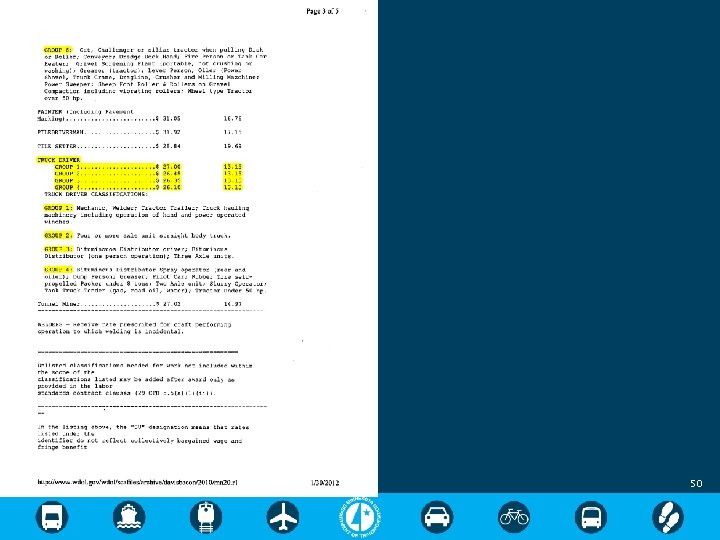

50

What is a state wage determination ◦ A wage decision established by the Mn. DLI, ◦ must be physically incorporated into a state funded contract, ◦ it’s specific to a county and region, (Mn. DOT Regional Map) ◦ it does not cross regional lines (various regions require multiple WD’s). ◦ However, only one standard of hours of labor and wage rates apply for entire project. Categories include ◦ Laborers, Specialty Equipment, Heavy Equipment Operators, Truck Drivers and Special Crafts. 51

Types of state wage determinations ◦ Commercial All building construction exclusive of residential construction. ◦ Highway Construction or maintenance of highways other public works and includes roads, streets, airport runways, plants, dams and utilities. highways, bridges, power or ◦ Residential Construction, remodeling, or repairing of single or two family homes and structures to… added 52

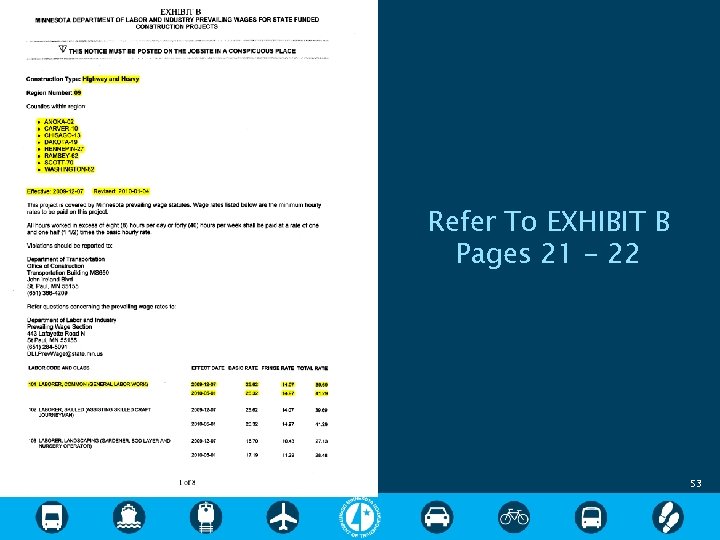

Refer To EXHIBIT B Pages 21 - 22 53

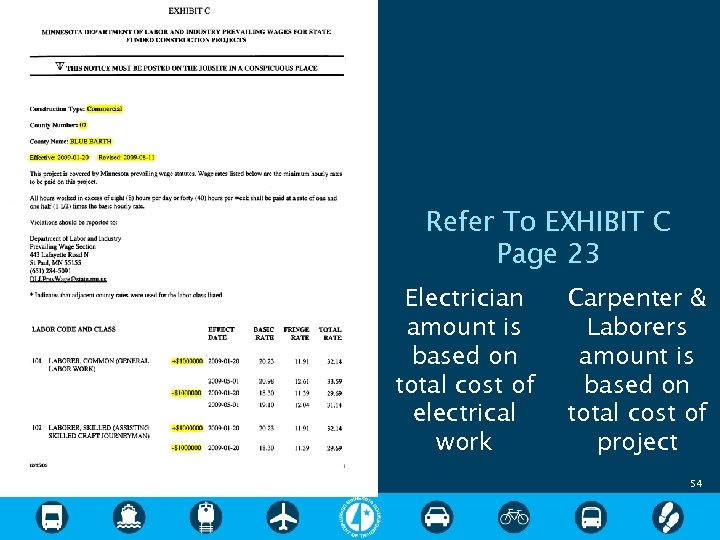

Refer To EXHIBIT C Page 23 Electrician amount is based on total cost of electrical work Carpenter & Laborers amount is based on total cost of project 54

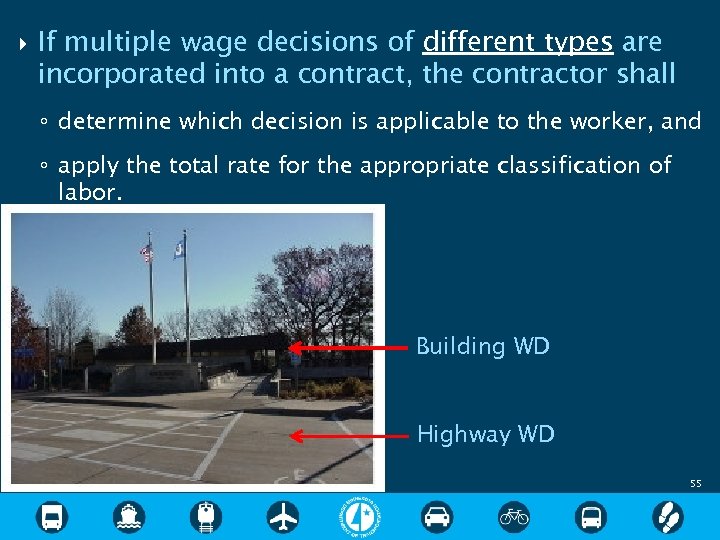

If multiple wage decisions of different types are incorporated into a contract, the contractor shall ◦ determine which decision is applicable to the worker, and ◦ apply the total rate for the appropriate classification of labor. Building WD Highway WD 55

If multiple wage decisions of the same type of work are incorporated into a contract, the contractor shall ◦ examine all wage decisions applicable to the worker, and apply the total rate that is greater. 56

True or False? The CA may incorporate the state and/or federal wage determinations by reference. True or False? Each classification of labor utilized on the project must have a wage rate. True or False? If a contract contains a federal and state highway WD, the contractor is required to review the wage rates in each decision and apply the greater of the two? 57

Reduction of wages and rebates are prohibited ◦ A contractor may not reduce a worker’s private regular rate of pay when the wage rate certified by the USDOL or Mn. DLI is less than the worker’s normal hourly wage. ◦ A contractor making payment to an employee, laborer, mechanic, worker, or ITO may not accept a rebate for the purpose of reducing or otherwise decreasing the value of the compensation paid. Contractor normally pays a worker $15. 00 per hour for nongovernment work, on a government project contractor pays a worker $20. 00 per hour (PW), contractor returns to non-government work and pays a worker a rate of $10. 00 per hour instead of $15. 00. 58

What if there’s a work delay ◦ From the time a worker is required to report for duty at the project site until the worker is allowed to leave the site, no deductions shall be made from the worker’s hours for any delays of less than twenty consecutive minutes. ◦ If the delay will exceed twenty consecutive minutes and the contractor requires a worker to remain on the premises or so close to the premises that the worker cannot use the time effectively for the worker’s own purposes (ON CALL) shall be compensated at the appropriate prevailing wage rate for that time. However, if the worker is allowed or required to leave the project site for a defined period of time, prevailing wage would not apply. 59

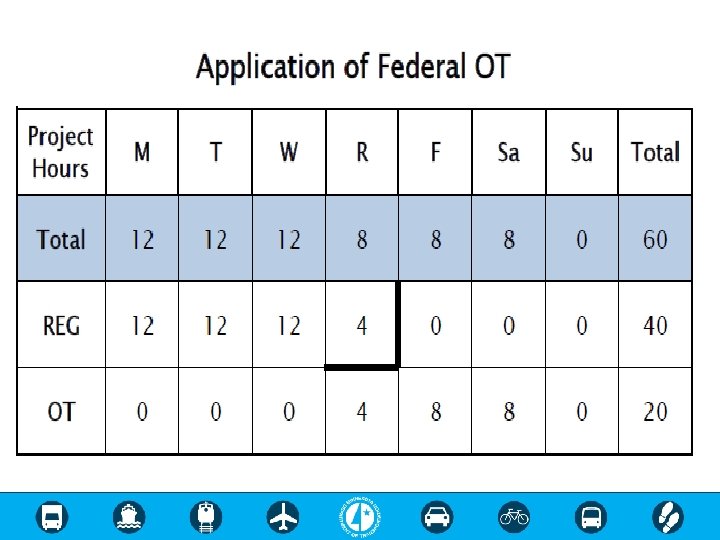

Pursuant with federal overtime (OT) regulations, a contractor shall not ◦ Permit or require a worker to work in excess of 40 hours per week on the project, unless the worker is paid at a rate not less than 1 -1/2 times the basic hourly rate plus fringe benefits. Violations could result in ◦ Liquidated damages at a rate of $10 per day for each laborer or mechanic not paid proper overtime. At a minimum, the contractor must use the Secretary of Labor’s base rate of pay to determine overtime, unless the employee’s normal rate of pay is higher. 60

61

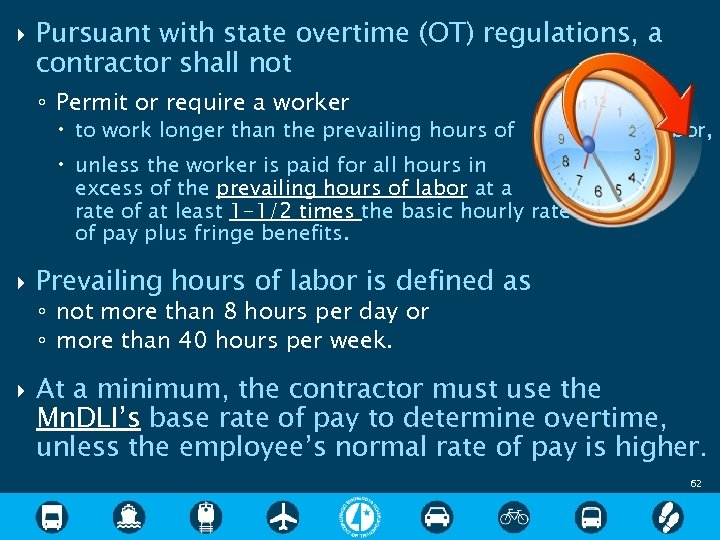

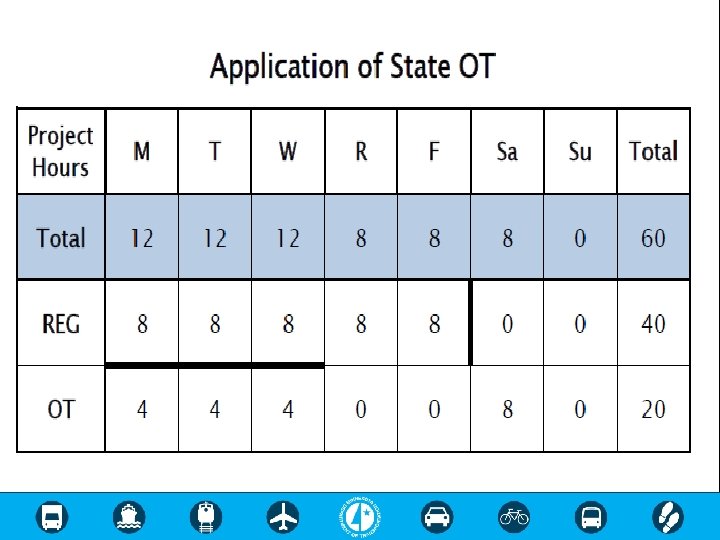

Pursuant with state overtime (OT) regulations, a contractor shall not ◦ Permit or require a worker to work longer than the prevailing hours of labor, unless the worker is paid for all hours in excess of the prevailing hours of labor at a rate of at least 1 -1/2 times the basic hourly rate of pay plus fringe benefits. Prevailing hours of labor is defined as ◦ not more than 8 hours per day or ◦ more than 40 hours per week. At a minimum, the contractor must use the Mn. DLI’s base rate of pay to determine overtime, unless the employee’s normal rate of pay is higher. 62

63

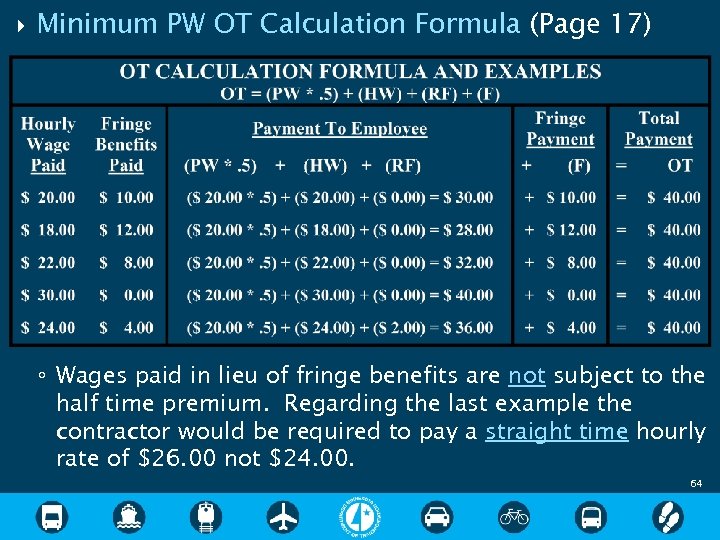

Minimum PW OT Calculation Formula (Page 17) ◦ Wages paid in lieu of fringe benefits are not subject to the half time premium. Regarding the last example the contractor would be required to pay a straight time hourly rate of $26. 00 not $24. 00. 64

What if an employee performs work in multiple classifications during a work week ◦ An employee performing work in multiple labor classifications during a work week shall be compensated at the applicable labor classification overtime rate in effect at the time the employee works in excess of 8 hours per day or 40 hours per week. 65

What about the overtime requirements contained in a collectively bargaining agreement (CBA) ◦ A CBA does not supersede federal and state OT regulations, ◦ therefore, contractors with such agreements shall demonstrate compliance with all applicable federal and state OT regulations. 66

Case File ◦ Contractor felt that the overtime (OT) language contained in its collective bargaining agreement (CBA) superseded the state prevailing wage overtime requirement. The facts were as follows: collective bargaining agreement defined OT as over 40 hours per week, state prevailing wage law defines OT as over 8 hours per day or 40 hours per week. ◦ It was determined that a CBA does not supersede state law and the contractor was ordered to pay restitution to 9 employees in the gross amount of $619. 34. 67

Case File ◦ Employees wanted to work four 10 hour days instead of five 8 hour days so that they could have three day weekends; the employees were willing to forgo the OT payments. The facts of the case were as follows: employees and contractor agreed to the terms, employees were willing to keep quiet, on-site interviews revealed that the employees were working four 10 hour days, contractor submitted CPRs stating that the employees worked five 8 hour days. ◦ It was determined that the contractor’s CPRs were false, contractor was ordered to pay restitution to 10 employees in the gross amount of $854. 84. 68

True or False? A contractor that contributes more than the certified fringe rate for an employee can pay less than the certified basic hourly rate to the employee. True or False? An individual that works 5 hours on one state funded project and 5 hours on a different state funded project must be paid for 2 hours of overtime under state law. True or False? A contractor that has a worker performing work in multiple trades during a week can take advantage of the lowest rate during OT? 69

Brain Teaser #2 Why can’t a person living in the USA be buried in Canada? 70

Because the person is still alive. 71

Fringe Benefits 72

Funded fringe benefit plans ◦ allows a contractor to make an irrevocable contribution on behalf of an employee, without prior approval from the USDOL, to a financially responsible trustee, third person, fund, plan or program. ◦ Types of funded plans may include Pension plans Health insurance Life insurance Contributions must be made regularly, not less often than quarterly. 73

For a funded plan to be considered, it must be ◦ an irrevocable contribution made on of an employee to a financially trustee, third person, program, behalf responsible fund, plan or ◦ a commitment that be legally enforced, ◦ has been communicated in writing to the employee, and ◦ is made available to the employee. Annual contributions for other plans such as a profit sharing plan ◦ require contractors to escrow money at least quarterly based on what the profit is expected to be. 74

Unfunded fringe benefit plans ◦ allow a contractor to furnish an in-house benefit on behalf of an employee; the cost to provide the benefit is funded from the contractor’s general assets rather than contributions made to a financially responsible trustee, third person, fund, plan or program. ◦ Typical unfunded plans that don’t require approval from the USDOL include Vacation pay Holiday pay Sick or PTO pay 75

For an unfunded plan to be considered, it must be ◦ reasonably anticipated to provide a benefit, ◦ a commitment that can be legally enforced, ◦ carried out under a financially responsible plan or program, and ◦ communicated in writing to the employee. Plans other than those previously would need approval USDOL before accepted. mentioned from the 76

To determine an hourly fringe benefit credit the contractor shall ◦ determine an hourly credit for each individual employee, ◦ ◦ based on total annual amount of the fringe benefit divided by all hours worked (government & non-government). If the value of the fringe benefit provided is less than the fringe rate specified in the federal and/or state WD, the contractor must compensate the employee the difference as a wage. 77

Fringe benefit calculation example ◦ An electrician hourly basic rate is $12. 00 and the fringe rate is $2. 50; total rate is $14. 50. ◦ The employer provides medical insurance in the amount of $200. 00/month; ◦ If the employee worked 2080 hours (government and non-government), the would divide $2, 400. 00 by 2080 hours. $2, 400/year. employer ◦ The hourly credit would be $1. 15. ◦ The contractor would have to pay an additional $1. 35 per hour as part of the taxable wage to the employee. 78

Other costs not considered fringe benefits include ◦ Workers Compensation ◦ Unemployment Compensation ◦ Social Security Contributions ◦ Per Diem (Meal &Travel Expenses) ◦ Lodging Expenses ◦ In-house Training Plans ◦ Cell Phones &Vehicles Federal, State and Local Requirements Non-approved Plans “Cost of Doing Business” 79

True or False? An employee that is required to travel out of town, overnight for work is responsible to pay for his/her lodging expenses? True or False? A contractor can take the full amount of PW fringe that is required to be paid to an employee and use it to fund an entire year’s worth of medical insurance? 80

United States Department of Labor Employee Benefits Security Administration 81

United States Federal Bureau of Investigation 82

Brain Teaser #3 83

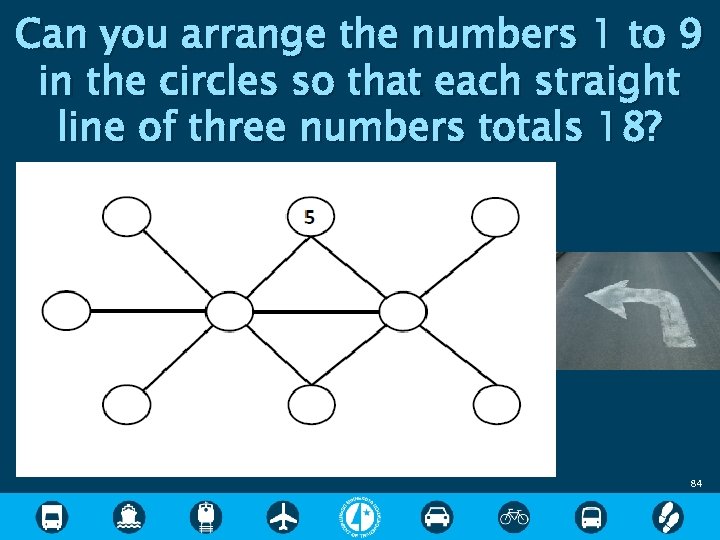

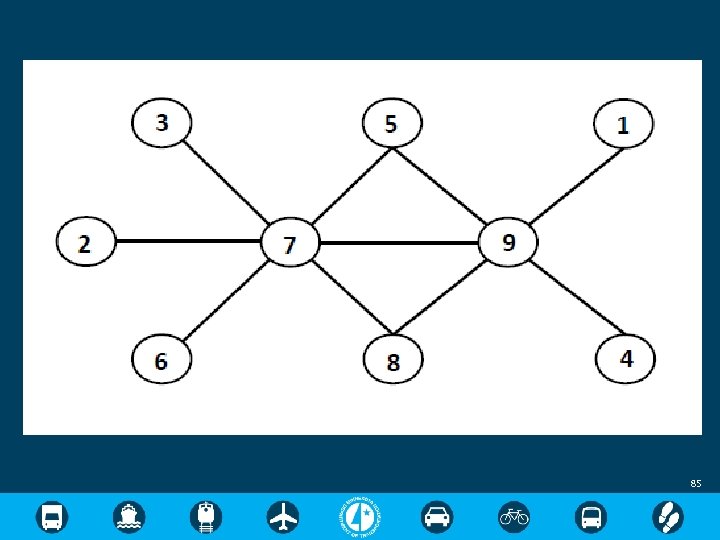

Can you arrange the numbers 1 to 9 in the circles so that each straight line of three numbers totals 18? 84

85

United States Department of Labor Wage & Hour 86

Certified Payroll Reports 87

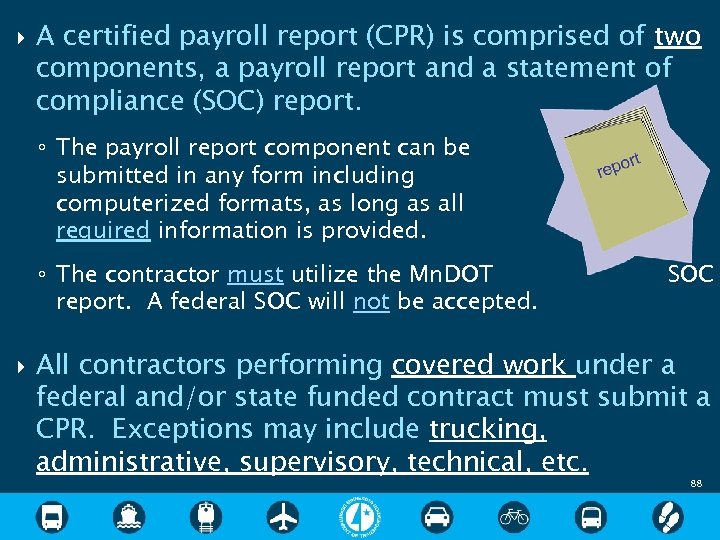

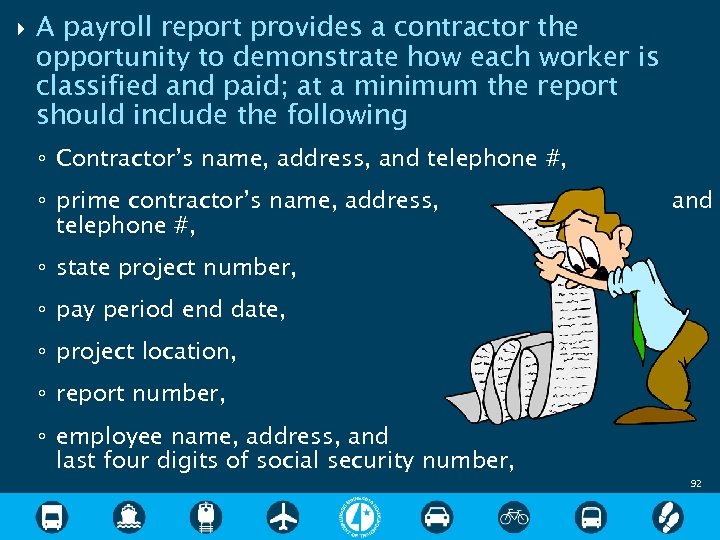

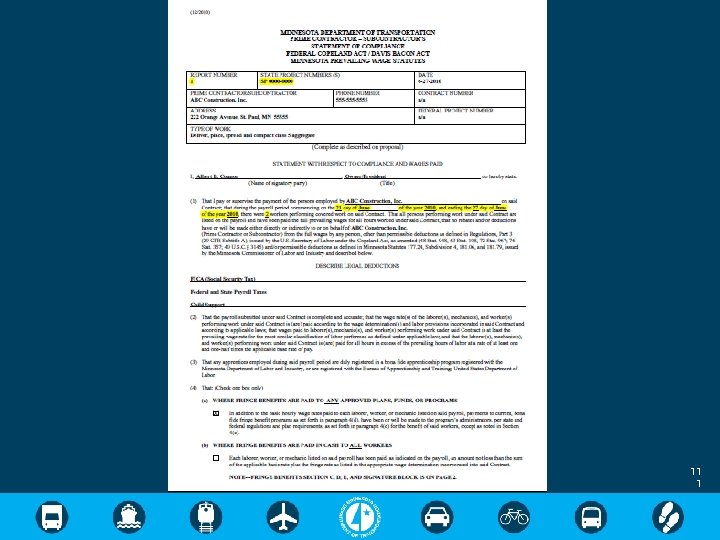

A certified payroll report (CPR) is comprised of two components, a payroll report and a statement of compliance (SOC) report. ◦ The payroll report component can be submitted in any form including computerized formats, as long as all required information is provided. ◦ The contractor must utilize the Mn. DOT report. A federal SOC will not be accepted. SOC All contractors performing covered work under a federal and/or state funded contract must submit a CPR. Exceptions may include trucking, administrative, supervisory, technical, etc. 88

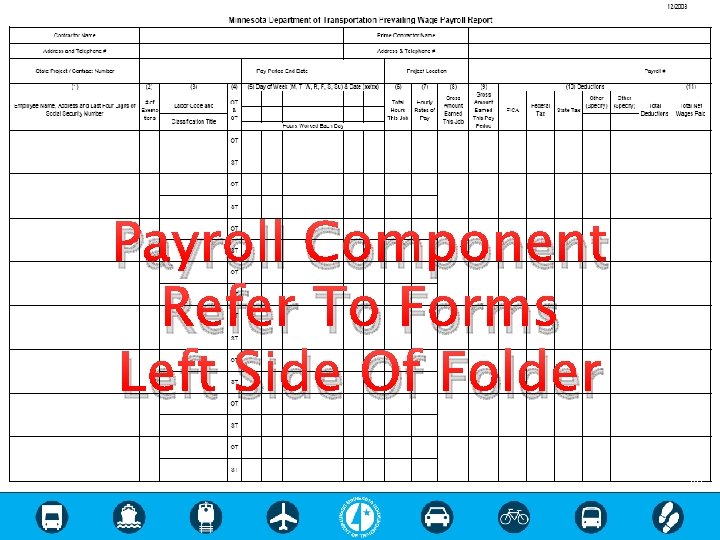

Payroll Component Refer To Forms Left Side Of Folder 89

Fringe Component Refer To Forms Left Side Of Folder 90

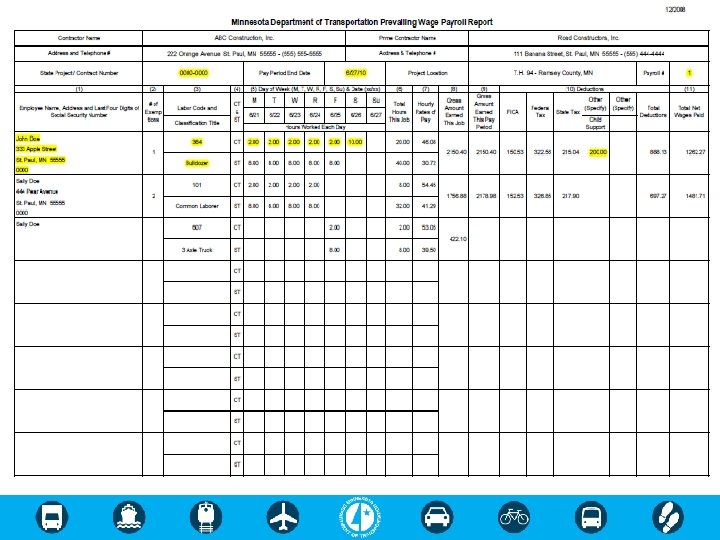

91

A payroll report provides a contractor the opportunity to demonstrate how each worker is classified and paid; at a minimum the report should include the following ◦ Contractor’s name, address, and telephone #, ◦ prime contractor’s name, address, telephone #, and ◦ state project number, ◦ pay period end date, ◦ project location, ◦ report number, ◦ employee name, address, and last four digits of social security number, 92

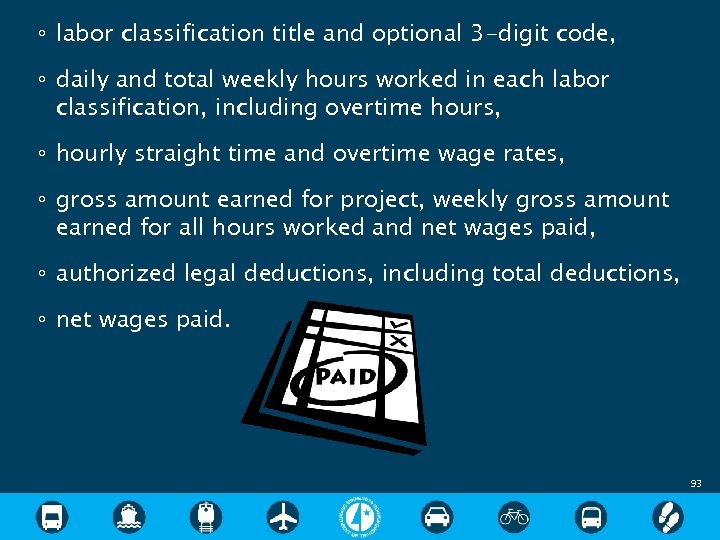

◦ labor classification title and optional 3 -digit code, ◦ daily and total weekly hours worked in each labor classification, including overtime hours, ◦ hourly straight time and overtime wage rates, ◦ gross amount earned for project, weekly gross amount earned for all hours worked and net wages paid, ◦ authorized legal deductions, including total deductions, ◦ net wages paid. 93

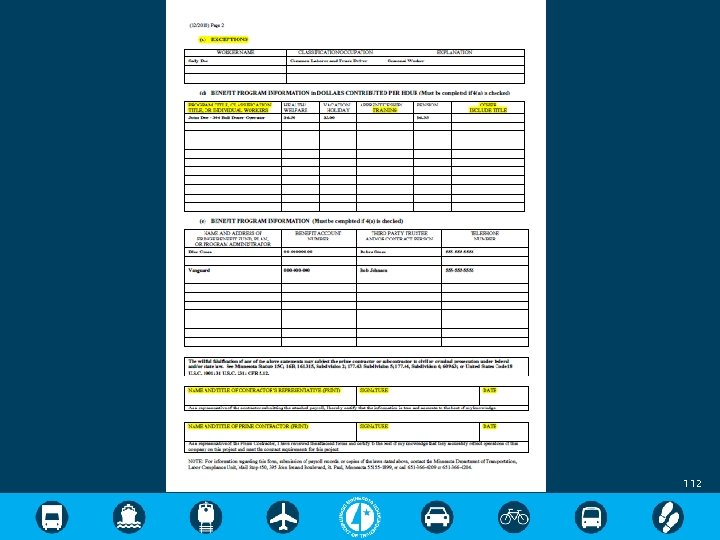

A statement of compliance (SOC) report provides the opportunity to describe fringe benefit contributions and to attest to the accuracy of all data provided. At a minimum, the SOC report should include the following ◦ report number, ◦ state project number, ◦ date the form was completed, ◦ contractor’s name, address, and telephone #, ◦ contract and federal project number (if known), ◦ name of person certifying the CPR, along with title, ◦ contractor name, pay period start and end date, along with number of employees performing work, ◦ describe legal deductions, ◦ check box – fringe paid to plan or fringe paid in cash, 94

◦ exceptions (employees not receiving fringe), ◦ hourly fringe contribution per employee per plan, ◦ plan name, account number, contact person and telephone number, ◦ signature of contractor and prime contractor. 95

The contractor must attach a SOC report to its payroll report and submit based on the following ◦ subcontractor to prime contractor, prime contractor must review and sign, ◦ prime contractor to PE or CA. Submission requirements are ◦ Federal – 7 days after pay period ends ◦ State – 14 days after pay period ends 96

The following deductions are generally allowable without prior approval from the USDOL ◦ federal and state income and social security tax, ◦ amounts required by a court order, such as child support payments, ◦ repayment of employee advances or loans without discounts or interest, ◦ employee contributions to medical, life insurance, retirement or pension plans, ◦ purchase of US savings bonds, ◦ employee authorized deductions for charitable organizations, ◦ automatic payroll deposits, ◦ union dues or membership fees. 97

The following deductions are not allowable ◦ uniforms or other items which are considered to be primarily for the benefit or convenience of a contractor, ◦ tools and contractor provided vehicles utilized by the employee to perform work, ◦ financial loss due to a customer not paying its bills, ◦ theft or damage of property owned by the contractor by an employee or other individual. 98

If deductions other than “legal deductions” are to be subtracted from an employee’s wages, the contractor must obtain prior written approval from the employee and ◦ there must be no direct or indirect financial interest accruing to the employer, ◦ the deduction must not be condition of employment and must be in the best interest of the employee, ◦ a copy of this written approval must be provided to the CA upon request. 99

As per audit requirements ◦ CPRs should be tracked and secured. Retention requirements mandate that ◦ The prime contractor maintain all CPR’s, including those of all subcontractors throughout the course of a construction project for at least three years after final contract voucher has been issued, other laws may require a longer retention period for other employment related records. 100

The contractor shall promptly furnish copies of CPRs along with other records deemed necessary when requested from any of the following agencies ◦ ◦ ◦ Mn. DOT CA Mn. DLI USDOL FHWA 101

In addition to CPRs, the following documentation may be requested ◦ ◦ ◦ daily time-keeping records (include tasks for hours), detailed earning statements (pay-stubs), cancelled payroll checks, haul slips, invoices, payroll journals, accounting records, trust fund or fringe benefit statements, bank statements, daily work journals, other records deemed necessary to ensure compliance. 102

The prime contractor is responsible to ensure that its CPRs ◦ and those of all sub contractors are a true representation of the work performed, and ◦ accurately reflect the following correct project information and dates, payroll report and SOC numbers match, classifications of labor are appropriate, hours reported match inspection reports or invoices, the hourly rates of pay match the wage decisions, overtime is reported correctly, deductions are defined, and fringe benefit contributions are not excessive, SOC is signed – if not, return to contractor. 103

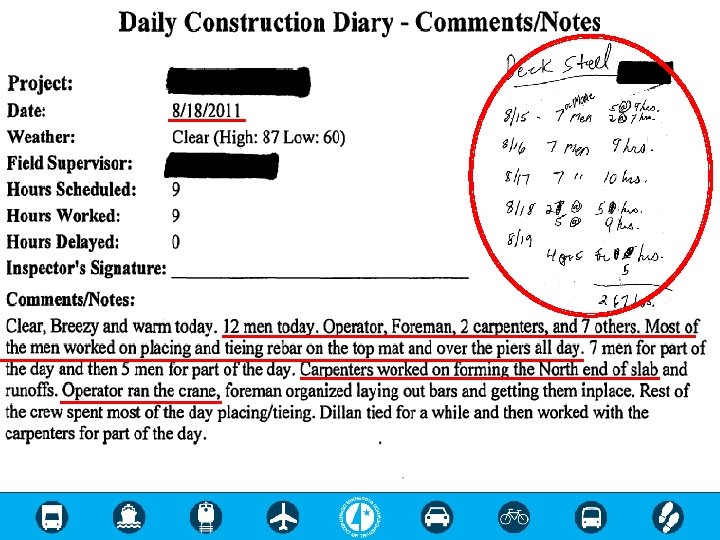

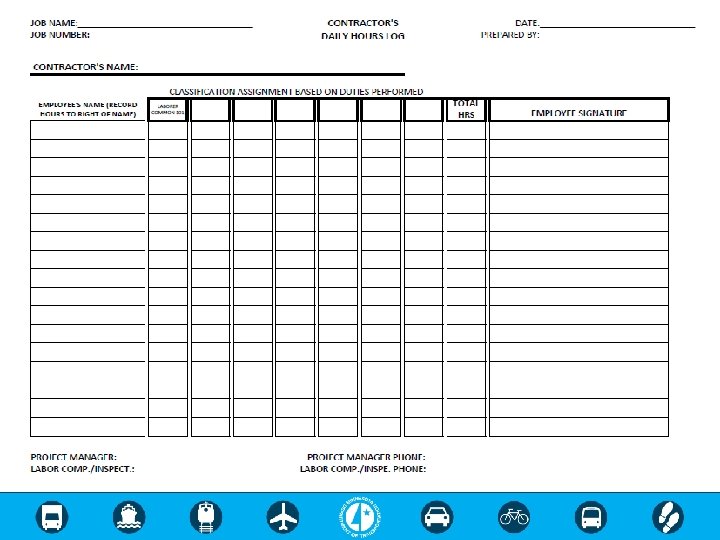

This can be done by ◦ interviewing workers to collect the following information name, employer, type of work performed, hourly wage rate, fringe benefits, OT after 8 or 40, and ◦ documenting daily construction activities, which may include the name of each contractor performing work on the project, including trucking contractors, type of work performed, number of workers on site, hours worked (start and stop times) and, types of equipment used. 104

The LCU recognizes that a thorough examination of all CPRs is time consuming. Therefore, the LCU recommends that the prime contractor ◦ examining the first two CPRs submitted by each subcontractor and a random review thereafter. 105

Discrepancies may include overuse of 102 skilled laborers and apprentices (ratios), specialty craft work performed by laborers, hours reported for non-working days (five 8 hour days vs. four 10 hour days), overtime based on the classification of labor with the lowest wage rate, crew worked 8 hour days but reported as 4 hour days, 4 hours * PW ($20) = $80 vs. 8 hours * ($10) = $80 10 6

Hours not reported in quarters or halves (i. e. , . 37), hours worked are determined by dividing gross earnings by the PW rate SOC – the person who attest to the data should be the person signing the document, Fringe benefits improperly calculated, inflated or the same for every employee, Improper or undefined Lodging expenses Tools or equipment Cell Phone Vehicle deductions. 10 7

A contractor that intentionally misrepresents the work performed may be subject to administrative, civil or criminal action. 108

Certified Payroll Lesson 109

11 0

11 1

112

True or False? On a state funded only project, the contractor should be submitting CPR’s weekly. True or False? The Contractor should only review the first two payroll reports submitted by each contractor and a random one thereafter. 11 3

Brain Teaser #4 How far can a dog run into the woods? 114

Halfway because after that the dog would be running out of the woods. 115

Minnesota Department of Labor & Industry 11 6

Trucking & Material Production 117

Assume that all the work surrounding the processing, manufacturing and hauling of materials or products to a state or federally funded project IS subject to PW. EXCEPTIONS 118

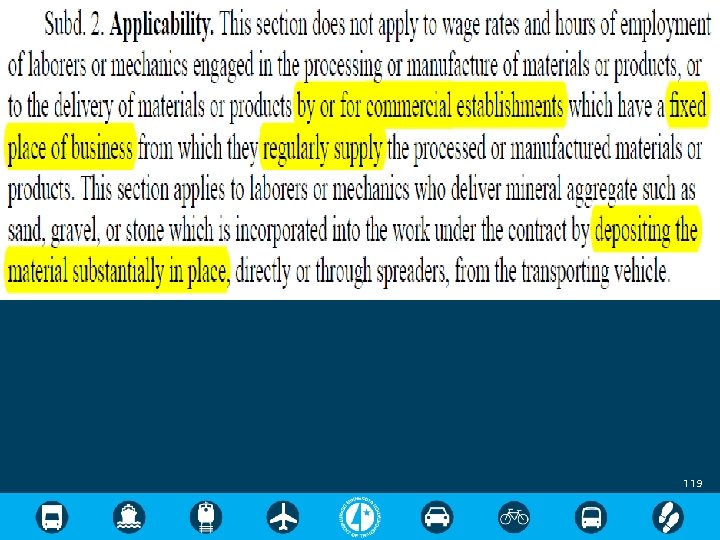

119

“by or for” Self explanatory. An individual that is directly employed by the material operation or an individual that is independently employed or employed by a different entity that is hired by the material operation. “commercial establishment” (prior to advertisement) own or lease, business records – sales to general public, advertising, facilities to effect sales, s ard n permits. Me 120

“fixed place of business” a commercial establishment must serve the government project form a location from which it served the public prior to and at the time of advertisement of the public works contract and that has sufficient utilities and equipment to serve the public upon demand. “regularly supply” includes supply by a commercial establishment that is closed on a seasonal basis. “depositing the material substantially in place” Mineral aggregate is deposited on the project site directly or through spreaders where it can be spread from or compacted at the location where it was deposited. 121

Work not subject to State PW the processing or manufacturing of materials or products by or for a commercial establishment. The delivery of materials or products by the employees of a commercial establishment, including the ITOs and MTOs hired and paid by the commercial establishment, unless the material or product is deposited substantially in place. 122

Work not subject to federal PW processing or manufacturing of material including hauling of material to and from an operation that is NOT immediately adjacent, or dedicated to the project. loading or unloading materials and supplies on the site of work, if such time is de minimis. 123

Federal and state laws differ when it comes to the application of PW for workers involved in the processing, manufacturing and delivery of materials. ◦ If a project is federally and state workers covered by both subject to both the state PW determinations. ◦ funded, laws are federal and However, in most circumstances state law will apply and federal will not. 124

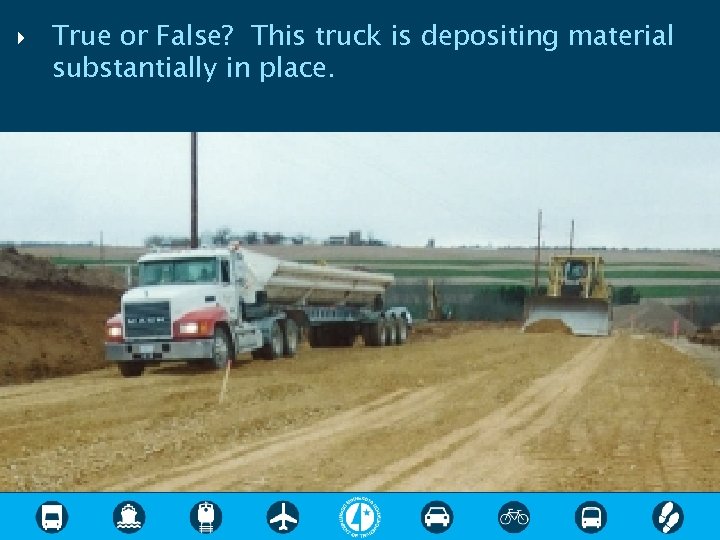

True or False? This truck is depositing material substantially in place. 125

True or False? An individual that is hauling aggregate material from one state funded construction project to another is not subject to PW. True or False? An employee of a prime contractor or subcontractor that picks up material from a commercial establishment and delivers it to the project is not subject to PW. State Flow Chart Federal Flow Chart 126

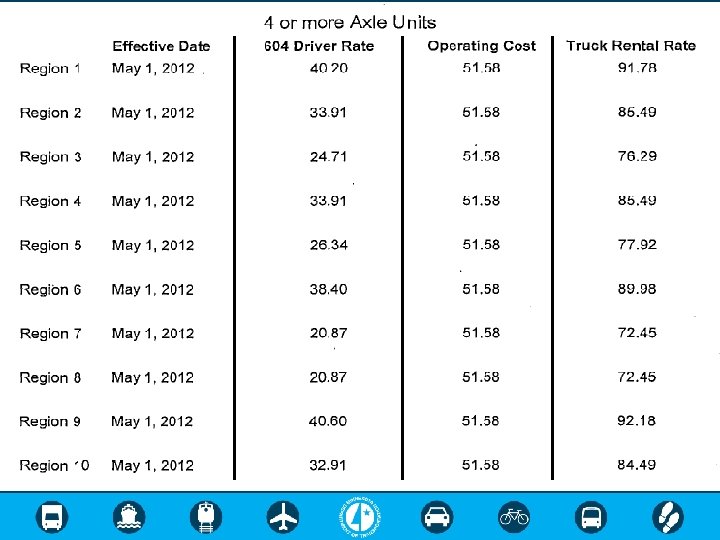

Once it’s determined that the delivery of material is subject to the state prevailing wage law, truck rental rates apply (Mn. DOT Only). Truck rental rates are as follows: 127

The truck rental rate is comprised of ◦ Labor Cost + Operating Cost Labor Cost ◦ Prevailing wage established by Mn. DLI using existing survey processes. Operating Cost ◦ Average statewide costs of operating a truck purchase price divided by 7, fuel, maintenance, insurance, taxes, licenses and permits, broker fees, administrative expenses. 128

12 9

The contractor needs to be aware that the truck rental rates incorporated into a contract may or may not reflect the hourly prevailing wage that is required to be paid to a worker. ◦ BID ACCORDINGLY! Contractors are required to notify and to compensate all trucking entities the minimum truck rental rate. Truck rental rates to be posted. 130

The purpose of a month-end trucking report (METR) is to document the following: ◦ ◦ ◦ ◦ name of entity that hired the hauling provider, name of entity that was hired to perform hauling activities, type of truck(s) used to haul material, number of trucks each day, total hours hauled by each truck, hourly rate paid for the truck, gross amount paid for the truck, and broker fees. The METR (MTO, ITO, SOC) can be obtained by visiting the LCU website. 131

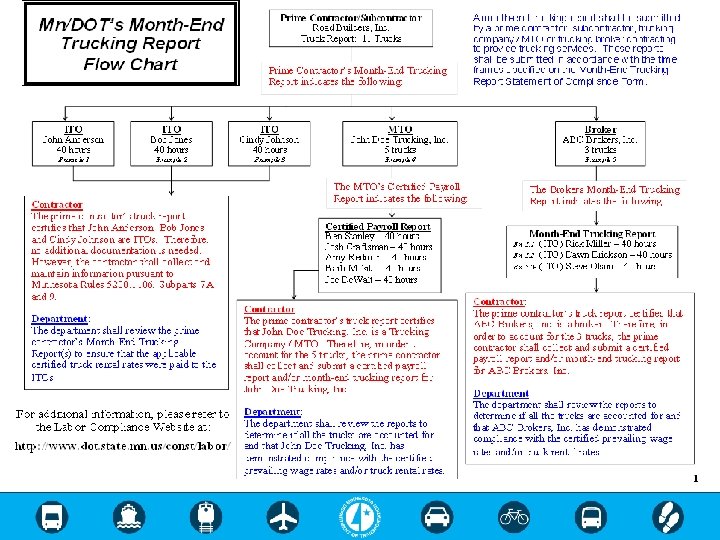

METR replaces CPR requirements for ITOs; however, trucking companies with employees must submit certified payrolls. Reports must be certified and submitted monthly to Project Engineer. METR takes place of the Request To Sublet Form for ITOs and MTOs. (10 day requirement) Review first two METRs submitted by each entity and randomly thereafter. The process for completing a METR is as follows 132

13 3

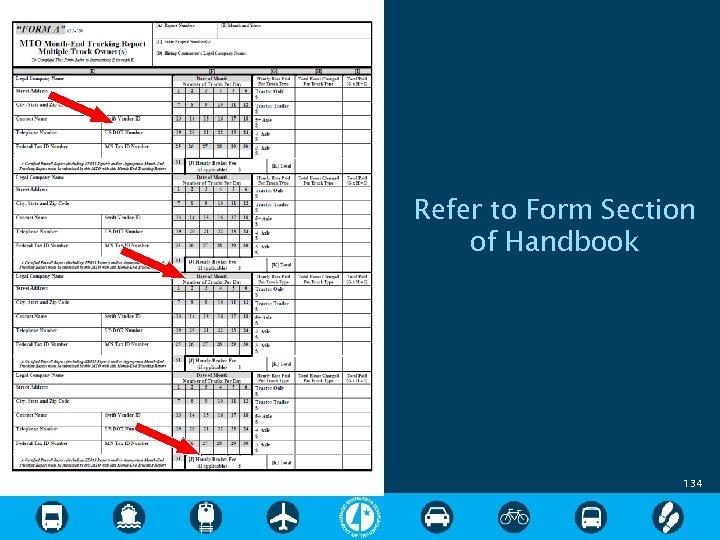

Refer to Form Section of Handbook 134

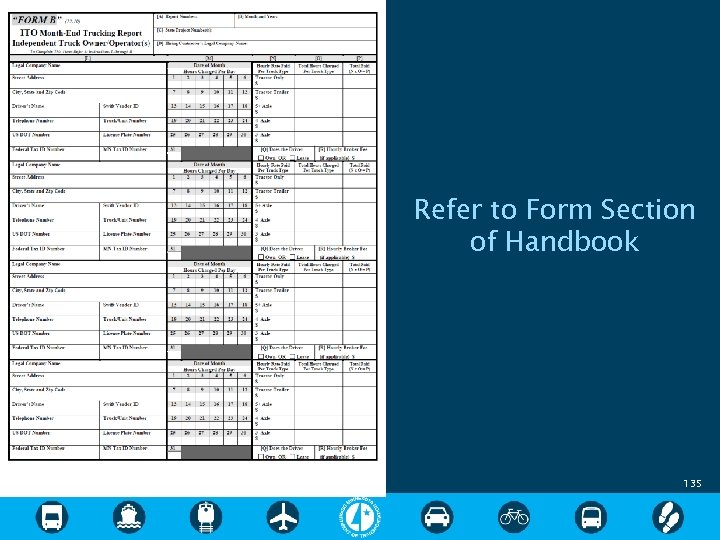

Refer to Form Section of Handbook 135

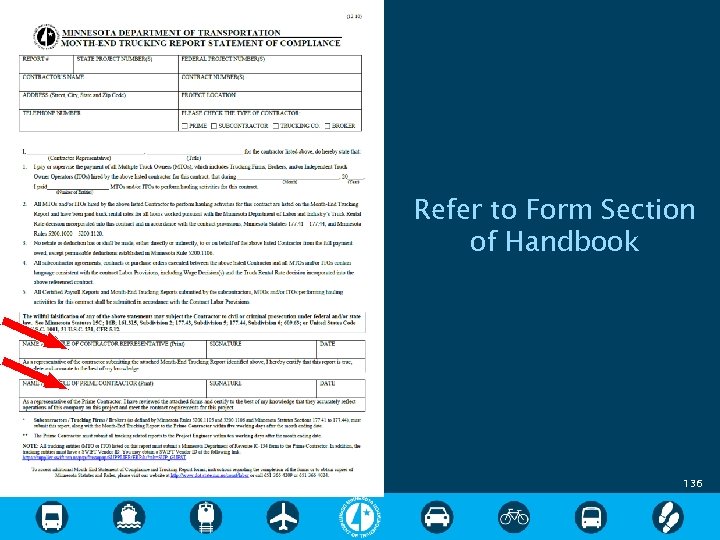

Refer to Form Section of Handbook 136

Broker fees are a component of the operational costs of a truck; who can and cannot assess the fee ◦ Brokers contracting to provide trucking services may assess the contractor a broker fee. ◦ Current practice also allows the broker to assess a reasonable fee to the truck provider. Currently Mn. DOT and Mn. DLI are broker fees and how they applied. discussing are to be ◦ A prime contractor or subcontractor contracting to receive trucking services may not assess a broker fee. 137

True or False? All entities hiring MTO’s or ITO’s need to fill out a METR. True or False? MTO’s that have employee drivers need to submit a certified payroll report. True or False? A broker that is hired to provide trucks needs to report the fee charged to the truck owner. 138

Contract Administration In order to demonstrate compliance, the prime contractor, along with subcontractors shall consider the following administration strategies 139

The prime contractor shall schedule a preconstruction meeting with its subcontractors, trucking entities and possibly material suppliers to discuss the contract specifications. ◦ Mn. DOT 10 minute DVD. Other items to be discussed ◦ contract labor provisions, which include Wage Decision(s) (WD) Truck Rental Rates (TRR) Special Provisions Division A ◦ subcontracting requirements, ◦ poster board contents and location, 140

◦ Reporting requirements CPR and METR requirements and submission frequency ◦ Overtime after 8 hours per day or 40 hours per week ◦ Employee interviews CA or other governmental agencies Prime contractor ◦ Noncompliance actions Withholding of payments to subcontractors 141

Was a Request to Sublet form executed and submitted for each contractor that performed work under the contract; the requirements are as follows ◦ A contractor that intends to sublet a portion of its work shall not sublet any portion of its contract without prior consent from the Project Engineer (PE). ◦ A prime contractor shall perform work amounting to not less than 40% of the total original contract cost, or on contracts with DBE or TBG goals, perform work amounting to not less than 30% of the original contract cost. total 142

A first tier subcontractor may ◦ sublet a portion of its work, not to exceed 50% of the work originally sublet. A second tier subcontractor shall not ◦ be permitted to sublet any portion of its work. Approval to subcontract does not ◦ relieve the prime contractor of liabilities and obligations under the contract. 143

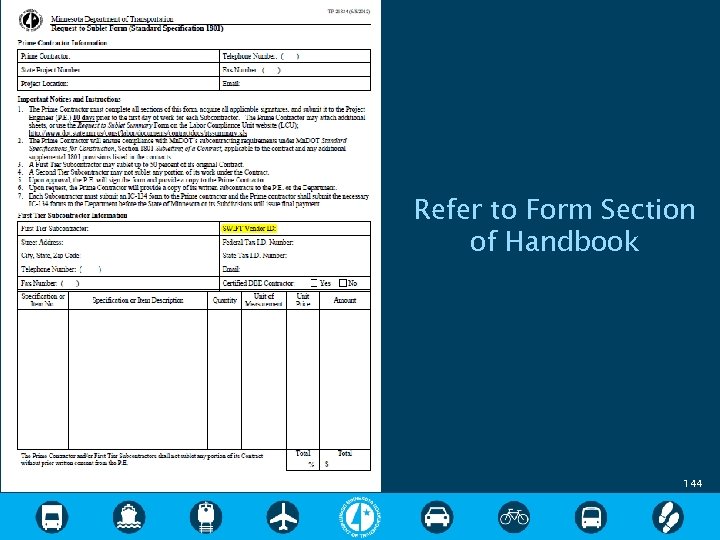

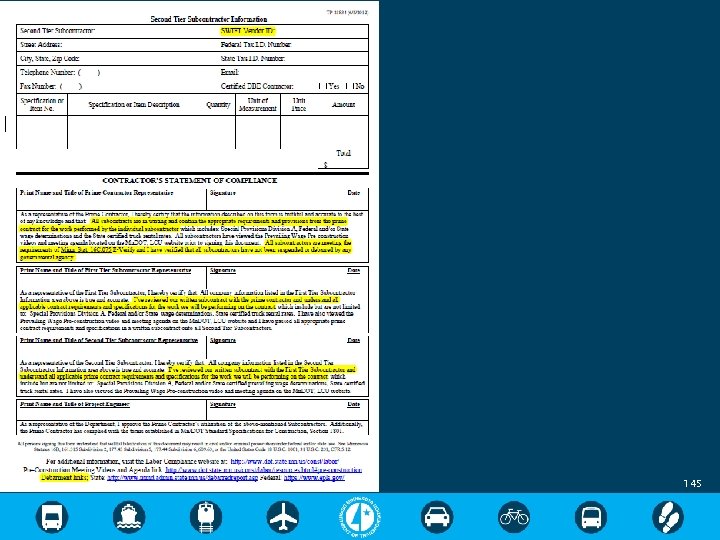

Refer to Form Section of Handbook 144

145

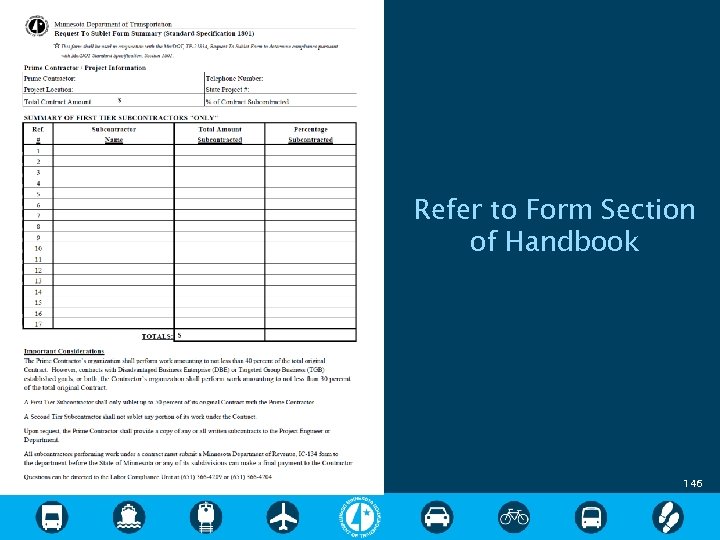

Refer to Form Section of Handbook 146

True or False? A prime contractor is liable for any prevailing wage issues associated with a subcontractor. True or False? Work may not be subcontracted any further than a second tier. 14 7

Was a poster board constructed and placed on the site of work? The prime contractor shall ◦ maintain and display current posters on the site of work, ◦ from first day of work until project is 100% completed by all contractors, and ◦ place it in a location that is accessible for all workers working on the project at all times. email Poster Board Request Form to: Michelle. Travers@state. mn. us Posters and examples also available on LCU website. 148

Was a payroll tracking system utilized to track the submission of CPRs and METRs from all contractors that documents the ◦ subcontractor name, ◦ dates work was scheduled and performed, ◦ CPRs submitted, and ◦ METRs submitted. 149

Did the prime contractor notify its subcontractors that various governmental agencies may interview its workers ◦ at any time during working hours on the project, and ◦ such time is considered time worked, ◦ interviews will not be conducted during break time. 150

Did the prime contractor interview the workers of its subcontractors to determine if they are compensated correctly, receiving overtime after 8 or 40 hours, receiving fringe benefits, assigned an appropriate classification of labor and, ◦ CPRs and METRs are being submitted for all contractors. ◦ ◦ 151

True or False? A poster board can be placed inside a contractor’s construction trailer. True or False? Interviews should be conducted only when a problem exists. 15 2

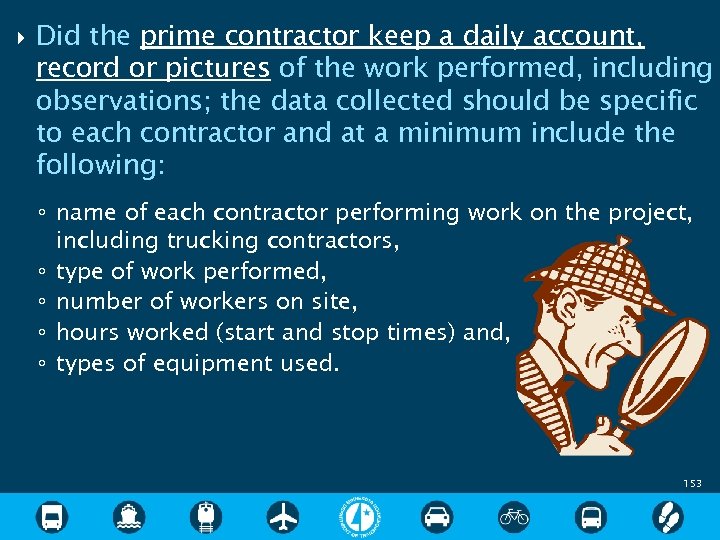

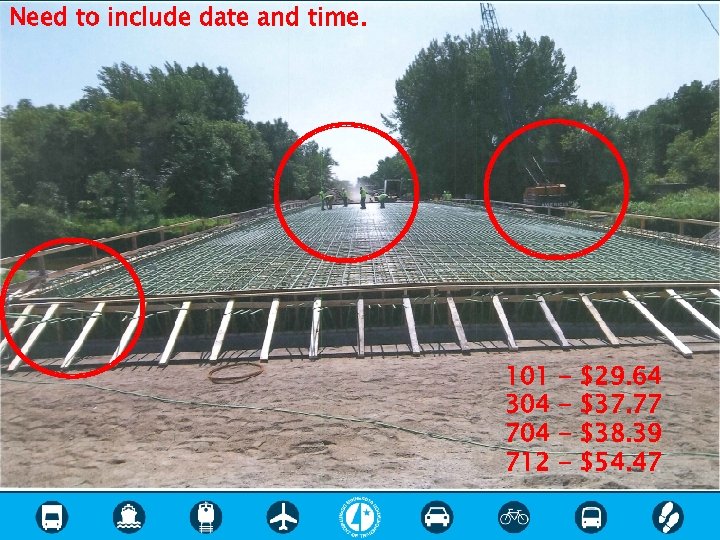

Did the prime contractor keep a daily account, record or pictures of the work performed, including observations; the data collected should be specific to each contractor and at a minimum include the following: ◦ name of each contractor performing work on the project, including trucking contractors, ◦ type of work performed, ◦ number of workers on site, ◦ hours worked (start and stop times) and, ◦ types of equipment used. 153

Need to include date and time. 101 304 712 - $29. 64 $37. 77 $38. 39 $54. 47 15 4

155

15 6

Based on the data obtained from employee interviews and daily construction reports, the prime contractor shall consider using this information during its review of ◦ CPRs, ◦ METRs, and ◦ invoices submitted by subcontractors. Before signing the SOC form and to ensure completeness and accuracy, the prime contractor shall consider reviewing the first two CPRs and METRs submitted by each contractor and a random one thereafter. 157

True or False? The prime contractor’s daily inspection reports don’t need to include data about subcontractor’s workers duties and hours worked because the subcontractor’s time keeping records should have that information. 15 8

Non-Compliance and Enforcement 159

A contractor that fails to comply with the PW specifications will result in the following ◦ employees underpaid, ◦ employee loss of benefits, Employees will file a complaint, which will affect payments to the prime contractor and the finalization of a the contract. ◦ inequitable bidding, which may result in potential litigation from other contractors, labor unions and workers, 160

Furthermore, a contractor that intentionally misrepresents the work performed may be subject to administrative, civil or criminal “case by case” proceedings, which may result in the ◦ notification of surety (bonding company), ◦ rejection of future bids, ◦ default and termination of a contract, ◦ suspension or debarment, ◦ referral to county attorney, ◦ referral to other government agencies. 161

True or False? Contractors believe that administering the contract prevailing wage specifications is difficult. True or False? The contractor is not alone in its efforts to ensure that the contract prevailing wage specifications are followed? 162

Brain Teaser FINAL If there are 3 chocolate bars and you take away 2, how many do you have? 163

If you take 2 chocolate bars, then obviously you have 2. 164

Questions and Evaluations 165

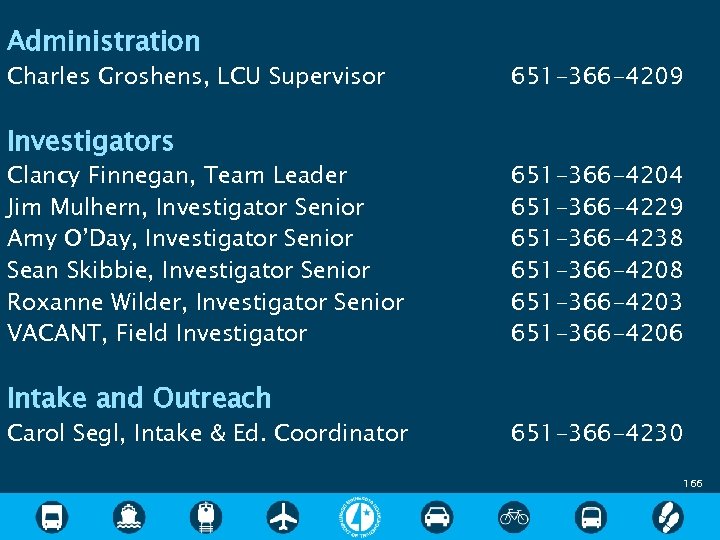

Administration Charles Groshens, LCU Supervisor Investigators Clancy Finnegan, Team Leader Jim Mulhern, Investigator Senior Amy O’Day, Investigator Senior Sean Skibbie, Investigator Senior Roxanne Wilder, Investigator Senior VACANT, Field Investigator Intake and Outreach Carol Segl, Intake & Ed. Coordinator 651 -366 -4209 651 -366 -4204 651 -366 -4229 651 -366 -4238 651 -366 -4203 651 -366 -4206 651 -366 -4230 166

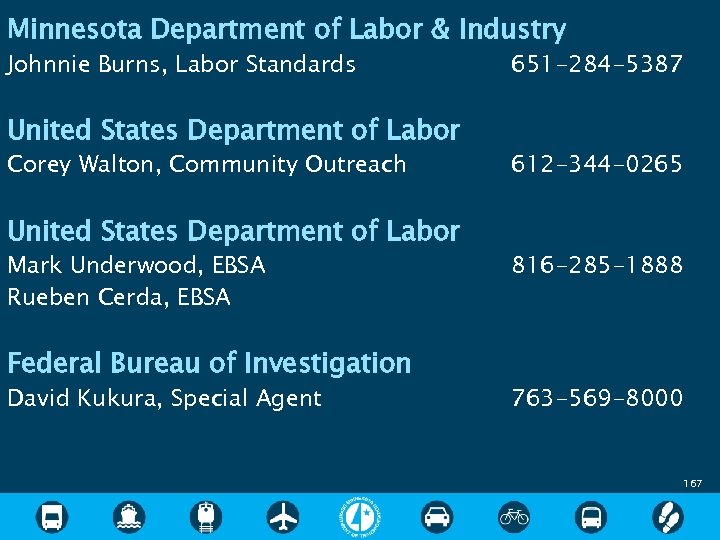

Minnesota Department of Labor & Industry Johnnie Burns, Labor Standards United States Department of Labor Corey Walton, Community Outreach United States Department of Labor Mark Underwood, EBSA Rueben Cerda, EBSA Federal Bureau of Investigation David Kukura, Special Agent 651 -284 -5387 612 -344 -0265 816 -285 -1888 763 -569 -8000 167

800b9f7117439c2ef3684a6eb05d00d7.ppt