0a72e117a09ca3c23ec751f504ef0489.ppt

- Количество слайдов: 78

a 5490 - 1 - FINAL CONFIDENTIAL The UK Book Industry Unlocking the Supply Chain’s Hidden Prize 16 th February 1998 Working together for a more profitable industry Management report

a 5490 - 1 - FINAL CONFIDENTIAL The UK Book Industry Unlocking the Supply Chain’s Hidden Prize 16 th February 1998 Working together for a more profitable industry Management report

Contents a 5490 - 2 - FINAL CONFIDENTIAL n Summary of main conclusions and recommendations n Introduction n Objectives and scope n Approach n Participants n Analysis of current situation n 5 areas of change – transaction processes – partnership in demand list management – management of stock and capacity – distribution efficiencies – returns n Our recommendations – quick wins – strategic change programme: – benefits n Obstacles to change n The case for change n Next steps priority projects longer term projects

Contents a 5490 - 2 - FINAL CONFIDENTIAL n Summary of main conclusions and recommendations n Introduction n Objectives and scope n Approach n Participants n Analysis of current situation n 5 areas of change – transaction processes – partnership in demand list management – management of stock and capacity – distribution efficiencies – returns n Our recommendations – quick wins – strategic change programme: – benefits n Obstacles to change n The case for change n Next steps priority projects longer term projects

Book Industry Supply Chain Project Phase 1 - Conclusions The current book industry supply chain structure is complex and costly, characterised by high fragmentation, few economies of scale, and many-to-many trading relationships The structure is the legacy of an age of large batch sizes and infrequent orders and is not relevant to today’s little-andoften ordering patterns n a 5490 - 3 - FINAL CONFIDENTIAL At root are fundamental issues about the nature of the publishing and bookselling process n There is an inevitable tension between the creative processes in publishing and bookselling and the technical disciplines of supply chain management n There is little exploitation of opportunities for economies of scale in physical distribution and transaction processing n The long tail of slow moving titles is responsible for a disproportionate share of costs and wastage n Trading relationships are complex, largely adversarial, with little partnership activity n The very high number of new titles is dealt with inefficiently and cause lost sales, high costs and wastage n There is little joint planning across the supply chain n Little-and-often ordering has reduced returns somewhat, but sales are being lost in the process n n Category management and demand planning are not properly understood or applied in the book industry The competition for retail exposure causes Publishers to push stock into the supply chain, accepting the risk of returns this creates. Partly this is due to: – dependency on new titles – shortcomings in the responsiveness and efficiency of the supply n Opportunities for electronic commerce are not being seized – – chain perceived limitation of retailers’ re-ordering policies retailers not incentivised to resist because they carry little stock risk There a number of obstacles to change to be overcome for the industry to reap all the benefits available n These include mistrust of trading partners’ motives, complacency, the difficulty of balancing requirements for individual versus industry-wide benefits, and short-termism There is a pressing need for action, as financial returns are low, and there is major competition for consumer attention and spending

Book Industry Supply Chain Project Phase 1 - Conclusions The current book industry supply chain structure is complex and costly, characterised by high fragmentation, few economies of scale, and many-to-many trading relationships The structure is the legacy of an age of large batch sizes and infrequent orders and is not relevant to today’s little-andoften ordering patterns n a 5490 - 3 - FINAL CONFIDENTIAL At root are fundamental issues about the nature of the publishing and bookselling process n There is an inevitable tension between the creative processes in publishing and bookselling and the technical disciplines of supply chain management n There is little exploitation of opportunities for economies of scale in physical distribution and transaction processing n The long tail of slow moving titles is responsible for a disproportionate share of costs and wastage n Trading relationships are complex, largely adversarial, with little partnership activity n The very high number of new titles is dealt with inefficiently and cause lost sales, high costs and wastage n There is little joint planning across the supply chain n Little-and-often ordering has reduced returns somewhat, but sales are being lost in the process n n Category management and demand planning are not properly understood or applied in the book industry The competition for retail exposure causes Publishers to push stock into the supply chain, accepting the risk of returns this creates. Partly this is due to: – dependency on new titles – shortcomings in the responsiveness and efficiency of the supply n Opportunities for electronic commerce are not being seized – – chain perceived limitation of retailers’ re-ordering policies retailers not incentivised to resist because they carry little stock risk There a number of obstacles to change to be overcome for the industry to reap all the benefits available n These include mistrust of trading partners’ motives, complacency, the difficulty of balancing requirements for individual versus industry-wide benefits, and short-termism There is a pressing need for action, as financial returns are low, and there is major competition for consumer attention and spending

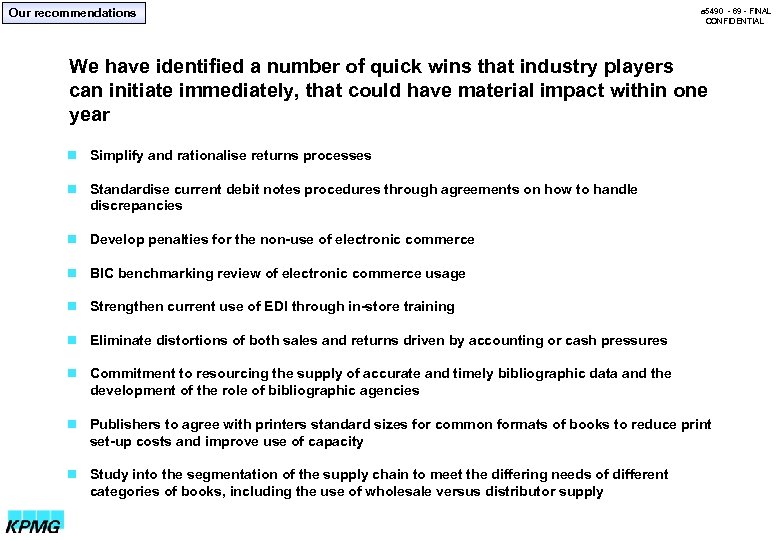

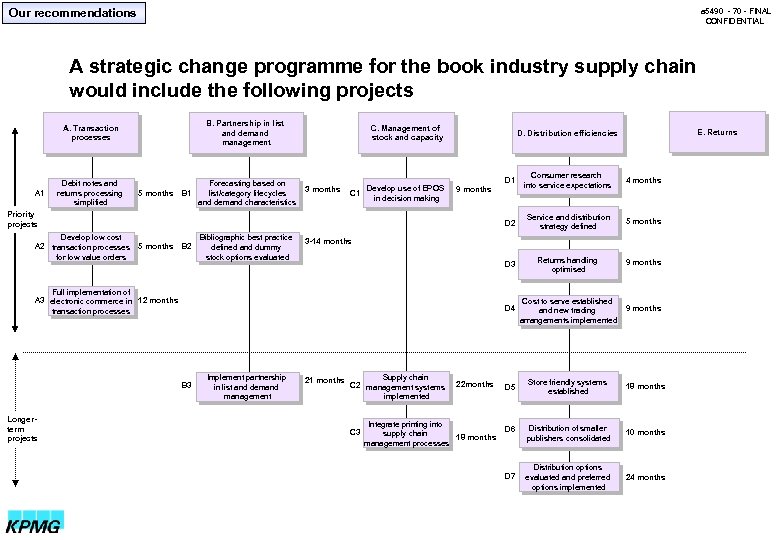

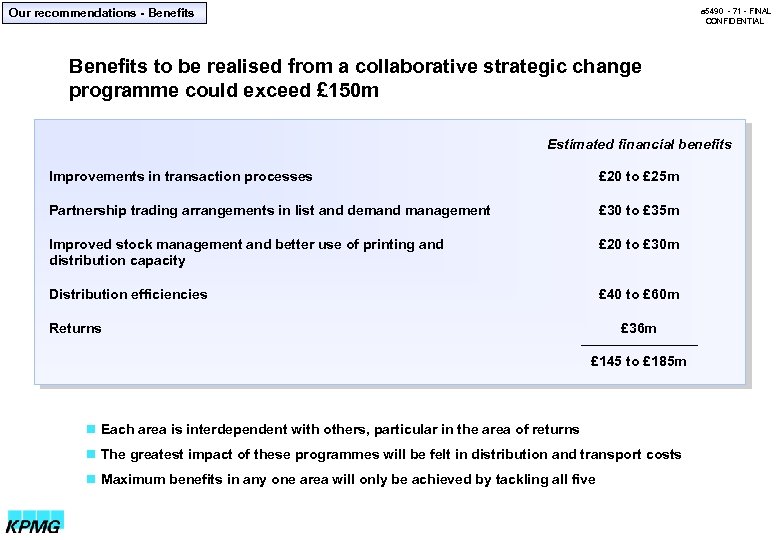

Book Industry Supply Chain Project Phase 1 - Recommendations a 5490 - 4 - FINAL CONFIDENTIAL Phase I has identified a number of quick wins that industry players can initiate by themselves n These will have a material impact on the supply chain within one year The industry needs to take co-ordinated action in five interrelated areas to move from high cost trading conditions to more effective and efficient trading relationships n Improvements in transaction processes n Partnership trading arrangements in list and demand management n Improved stock management and better use of printing and distribution capacity n Distribution efficiencies n Reduction in the level and cost of returns We recommend a number of priority and longer term projects that form a strategic change programme to unlock the benefits available An industry pressure group of senior executives should be appointed to overcome existing obstacles, drive through the change programme, and co-ordinate industry action KPMG also recommends that the industry establish formal liaison mechanisms between the Booksellers and the Publishers Associations to reflect their common supply chain

Book Industry Supply Chain Project Phase 1 - Recommendations a 5490 - 4 - FINAL CONFIDENTIAL Phase I has identified a number of quick wins that industry players can initiate by themselves n These will have a material impact on the supply chain within one year The industry needs to take co-ordinated action in five interrelated areas to move from high cost trading conditions to more effective and efficient trading relationships n Improvements in transaction processes n Partnership trading arrangements in list and demand management n Improved stock management and better use of printing and distribution capacity n Distribution efficiencies n Reduction in the level and cost of returns We recommend a number of priority and longer term projects that form a strategic change programme to unlock the benefits available An industry pressure group of senior executives should be appointed to overcome existing obstacles, drive through the change programme, and co-ordinate industry action KPMG also recommends that the industry establish formal liaison mechanisms between the Booksellers and the Publishers Associations to reflect their common supply chain

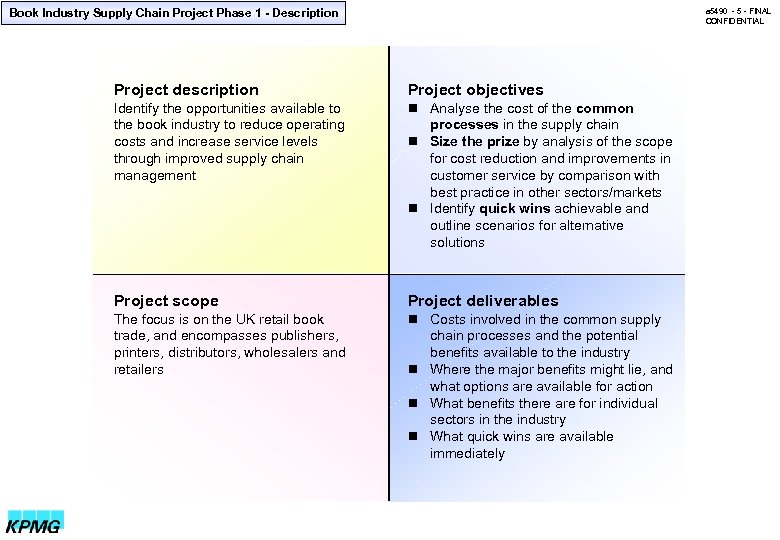

Book Industry Supply Chain Project Phase 1 - Description a 5490 - 5 - FINAL CONFIDENTIAL Project description Project objectives Identify the opportunities available to the book industry to reduce operating costs and increase service levels through improved supply chain management n Analyse the cost of the common Project scope Project deliverables The focus is on the UK retail book trade, and encompasses publishers, printers, distributors, wholesalers and retailers n Costs involved in the common supply processes in the supply chain n Size the prize by analysis of the scope for cost reduction and improvements in customer service by comparison with best practice in other sectors/markets n Identify quick wins achievable and outline scenarios for alternative solutions chain processes and the potential benefits available to the industry n Where the major benefits might lie, and what options are available for action n What benefits there are for individual sectors in the industry n What quick wins are available immediately

Book Industry Supply Chain Project Phase 1 - Description a 5490 - 5 - FINAL CONFIDENTIAL Project description Project objectives Identify the opportunities available to the book industry to reduce operating costs and increase service levels through improved supply chain management n Analyse the cost of the common Project scope Project deliverables The focus is on the UK retail book trade, and encompasses publishers, printers, distributors, wholesalers and retailers n Costs involved in the common supply processes in the supply chain n Size the prize by analysis of the scope for cost reduction and improvements in customer service by comparison with best practice in other sectors/markets n Identify quick wins achievable and outline scenarios for alternative solutions chain processes and the potential benefits available to the industry n Where the major benefits might lie, and what options are available for action n What benefits there are for individual sectors in the industry n What quick wins are available immediately

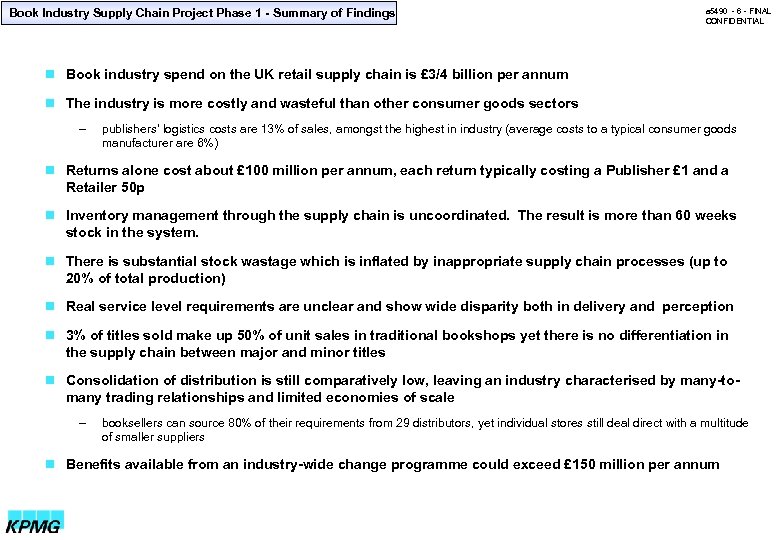

Book Industry Supply Chain Project Phase 1 - Summary of Findings a 5490 - 6 - FINAL CONFIDENTIAL n Book industry spend on the UK retail supply chain is £ 3/4 billion per annum n The industry is more costly and wasteful than other consumer goods sectors – publishers’ logistics costs are 13% of sales, amongst the highest in industry (average costs to a typical consumer goods manufacturer are 6%) n Returns alone cost about £ 100 million per annum, each return typically costing a Publisher £ 1 and a Retailer 50 p n Inventory management through the supply chain is uncoordinated. The result is more than 60 weeks stock in the system. n There is substantial stock wastage which is inflated by inappropriate supply chain processes (up to 20% of total production) n Real service level requirements are unclear and show wide disparity both in delivery and perception n 3% of titles sold make up 50% of unit sales in traditional bookshops yet there is no differentiation in the supply chain between major and minor titles n Consolidation of distribution is still comparatively low, leaving an industry characterised by many-to- many trading relationships and limited economies of scale – booksellers can source 80% of their requirements from 29 distributors, yet individual stores still deal direct with a multitude of smaller suppliers n Benefits available from an industry-wide change programme could exceed £ 150 million per annum

Book Industry Supply Chain Project Phase 1 - Summary of Findings a 5490 - 6 - FINAL CONFIDENTIAL n Book industry spend on the UK retail supply chain is £ 3/4 billion per annum n The industry is more costly and wasteful than other consumer goods sectors – publishers’ logistics costs are 13% of sales, amongst the highest in industry (average costs to a typical consumer goods manufacturer are 6%) n Returns alone cost about £ 100 million per annum, each return typically costing a Publisher £ 1 and a Retailer 50 p n Inventory management through the supply chain is uncoordinated. The result is more than 60 weeks stock in the system. n There is substantial stock wastage which is inflated by inappropriate supply chain processes (up to 20% of total production) n Real service level requirements are unclear and show wide disparity both in delivery and perception n 3% of titles sold make up 50% of unit sales in traditional bookshops yet there is no differentiation in the supply chain between major and minor titles n Consolidation of distribution is still comparatively low, leaving an industry characterised by many-to- many trading relationships and limited economies of scale – booksellers can source 80% of their requirements from 29 distributors, yet individual stores still deal direct with a multitude of smaller suppliers n Benefits available from an industry-wide change programme could exceed £ 150 million per annum

Contents a 5490 - 7 - FINAL CONFIDENTIAL n Summary of main conclusions and recommendations n Introduction n Objectives and scope n Approach n Participants n Analysis of current situation n 5 areas of change – transaction processes – partnership in demand list management – management of stock and capacity – distribution efficiencies – returns n Our recommendations – quick wins – strategic change programme: – benefits n Obstacles to change n The case for change n Next steps priority projects longer term projects

Contents a 5490 - 7 - FINAL CONFIDENTIAL n Summary of main conclusions and recommendations n Introduction n Objectives and scope n Approach n Participants n Analysis of current situation n 5 areas of change – transaction processes – partnership in demand list management – management of stock and capacity – distribution efficiencies – returns n Our recommendations – quick wins – strategic change programme: – benefits n Obstacles to change n The case for change n Next steps priority projects longer term projects

Introduction a 5490 - 8 - FINAL CONFIDENTIAL The supply chain has become a much quoted phrase and its importance was highlighted at the 1997 Booksellers Association conference in Dublin. There is a substantial prize for all players if the industry can move towards a more efficient supply chain model n The book industry's supply chain is particularly complex and has to handle a large number and wide variety of products. It involves many different players (publishers, printers, distributors, wholesalers, retailers) and many common processes and related information flows (e. g. buying, distribution, sales, customer service, returns) n The key to achieving the benefits available from improved supply chain management is to simplify and standardise these common processes by co-operation between trading partners. All players can benefit from lower operating costs, improvements in customer service and a reduction in lost sales n To achieve change requires industry focus. In order to address the challenge, the PA and the BA together set up a steering committee to identify the size of the benefits locked within the supply chain and how to release them in ways which bring mutual benefit to all players n This management report summarises phase 1 of the study

Introduction a 5490 - 8 - FINAL CONFIDENTIAL The supply chain has become a much quoted phrase and its importance was highlighted at the 1997 Booksellers Association conference in Dublin. There is a substantial prize for all players if the industry can move towards a more efficient supply chain model n The book industry's supply chain is particularly complex and has to handle a large number and wide variety of products. It involves many different players (publishers, printers, distributors, wholesalers, retailers) and many common processes and related information flows (e. g. buying, distribution, sales, customer service, returns) n The key to achieving the benefits available from improved supply chain management is to simplify and standardise these common processes by co-operation between trading partners. All players can benefit from lower operating costs, improvements in customer service and a reduction in lost sales n To achieve change requires industry focus. In order to address the challenge, the PA and the BA together set up a steering committee to identify the size of the benefits locked within the supply chain and how to release them in ways which bring mutual benefit to all players n This management report summarises phase 1 of the study

Contents a 5490 - 9 - FINAL CONFIDENTIAL n Summary of main conclusions and recommendations n Introduction n Objectives and scope n Approach n Participants n Analysis of current situation n 5 areas of change – transaction processes – partnership in demand list management – management of stock and capacity – distribution efficiencies – returns n Our recommendations – quick wins – strategic change programme: – benefits n Obstacles to change n The case for change n Next steps priority projects longer term projects

Contents a 5490 - 9 - FINAL CONFIDENTIAL n Summary of main conclusions and recommendations n Introduction n Objectives and scope n Approach n Participants n Analysis of current situation n 5 areas of change – transaction processes – partnership in demand list management – management of stock and capacity – distribution efficiencies – returns n Our recommendations – quick wins – strategic change programme: – benefits n Obstacles to change n The case for change n Next steps priority projects longer term projects

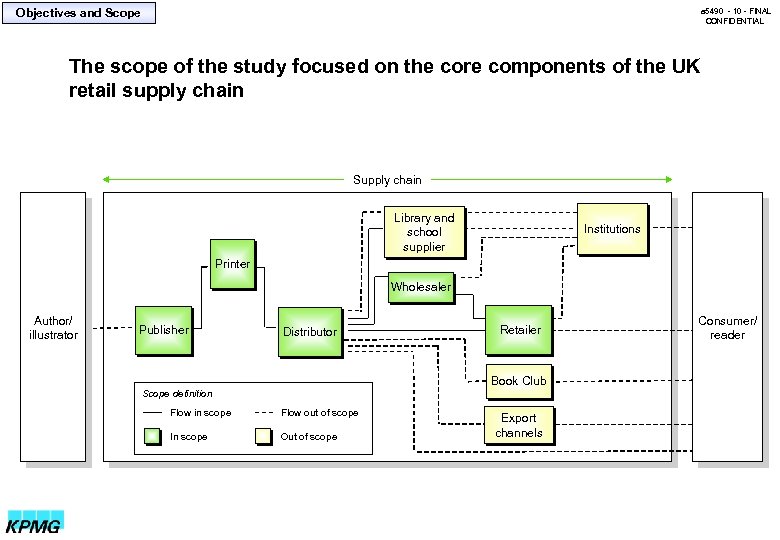

Objectives and Scope a 5490 - 10 - FINAL CONFIDENTIAL The scope of the study focused on the core components of the UK retail supply chain Supply chain Library and school supplier Institutions Printer Wholesaler Author/ illustrator Publisher Distributor Retailer Book Club Scope definition Flow in scope Flow out of scope In scope Out of scope Export channels Consumer/ reader

Objectives and Scope a 5490 - 10 - FINAL CONFIDENTIAL The scope of the study focused on the core components of the UK retail supply chain Supply chain Library and school supplier Institutions Printer Wholesaler Author/ illustrator Publisher Distributor Retailer Book Club Scope definition Flow in scope Flow out of scope In scope Out of scope Export channels Consumer/ reader

Contents a 5490 - 11 - FINAL CONFIDENTIAL n Summary of main conclusions and recommendations n Introduction n Objectives and scope n Approach n Participants n Analysis of current situation n 5 areas of change – transaction processes – partnership in demand list management – management of stock and capacity – distribution efficiencies – returns n Our recommendations – quick wins – strategic change programme: – benefits n Obstacles to change n The case for change n Next steps priority projects longer term projects

Contents a 5490 - 11 - FINAL CONFIDENTIAL n Summary of main conclusions and recommendations n Introduction n Objectives and scope n Approach n Participants n Analysis of current situation n 5 areas of change – transaction processes – partnership in demand list management – management of stock and capacity – distribution efficiencies – returns n Our recommendations – quick wins – strategic change programme: – benefits n Obstacles to change n The case for change n Next steps priority projects longer term projects

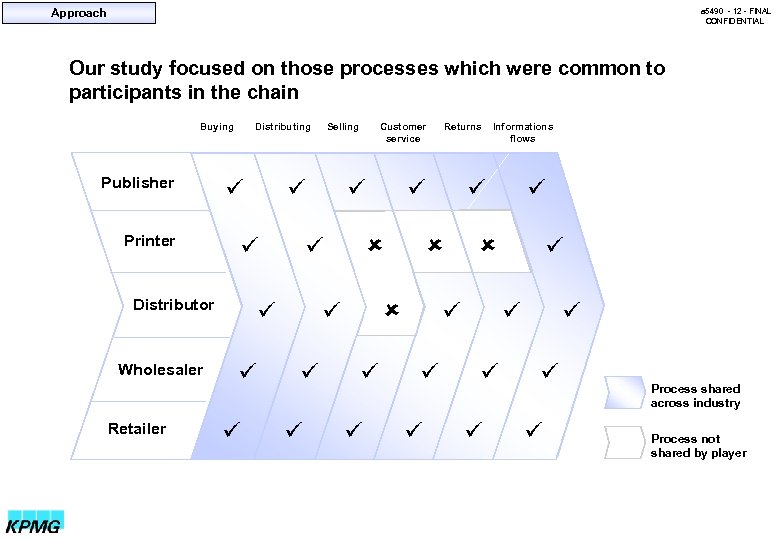

Approach a 5490 - 12 - FINAL CONFIDENTIAL Our study focused on those processes which were common to participants in the chain Buying Publisher Printer Distributor Wholesaler Retailer Distributing Selling Customer service Returns Informations flows Process shared across industry Process not shared by player

Approach a 5490 - 12 - FINAL CONFIDENTIAL Our study focused on those processes which were common to participants in the chain Buying Publisher Printer Distributor Wholesaler Retailer Distributing Selling Customer service Returns Informations flows Process shared across industry Process not shared by player

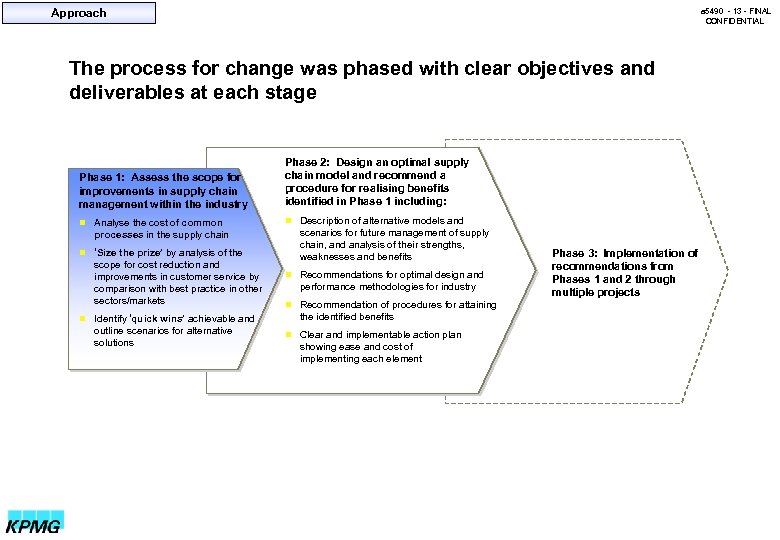

Approach a 5490 - 13 - FINAL CONFIDENTIAL The process for change was phased with clear objectives and deliverables at each stage Phase 1: Assess the scope for improvements in supply chain management within the industry Phase 2: Design an optimal supply chain model and recommend a procedure for realising benefits identified in Phase 1 including: n Analyse the cost of common n Description of alternative models and processes in the supply chain n ‘Size the prize’ by analysis of the scope for cost reduction and improvements in customer service by comparison with best practice in other sectors/markets n Identify ‘quick wins’ achievable and outline scenarios for alternative solutions scenarios for future management of supply chain, and analysis of their strengths, weaknesses and benefits n Recommendations for optimal design and performance methodologies for industry n Recommendation of procedures for attaining the identified benefits n Clear and implementable action plan showing ease and cost of implementing each element Phase 3: Implementation of recommendations from Phases 1 and 2 through multiple projects

Approach a 5490 - 13 - FINAL CONFIDENTIAL The process for change was phased with clear objectives and deliverables at each stage Phase 1: Assess the scope for improvements in supply chain management within the industry Phase 2: Design an optimal supply chain model and recommend a procedure for realising benefits identified in Phase 1 including: n Analyse the cost of common n Description of alternative models and processes in the supply chain n ‘Size the prize’ by analysis of the scope for cost reduction and improvements in customer service by comparison with best practice in other sectors/markets n Identify ‘quick wins’ achievable and outline scenarios for alternative solutions scenarios for future management of supply chain, and analysis of their strengths, weaknesses and benefits n Recommendations for optimal design and performance methodologies for industry n Recommendation of procedures for attaining the identified benefits n Clear and implementable action plan showing ease and cost of implementing each element Phase 3: Implementation of recommendations from Phases 1 and 2 through multiple projects

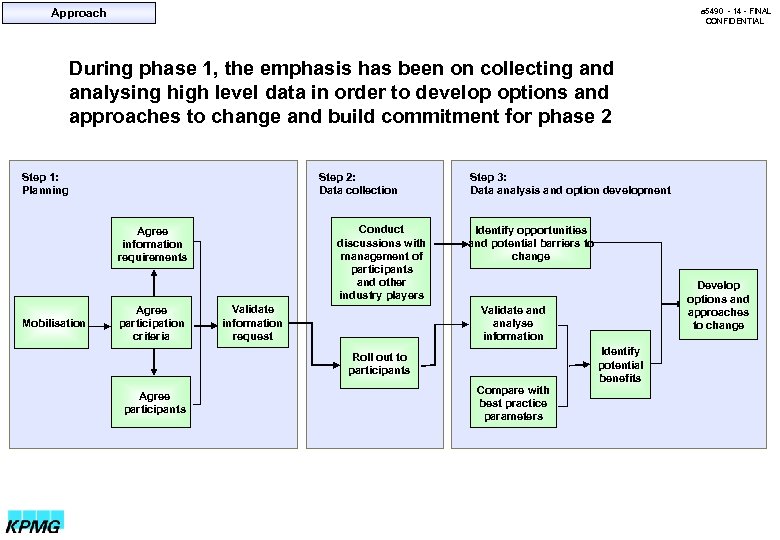

Approach a 5490 - 14 - FINAL CONFIDENTIAL During phase 1, the emphasis has been on collecting and analysing high level data in order to develop options and approaches to change and build commitment for phase 2 Step 1: Planning Step 2: Data collection Conduct discussions with management of participants and other industry players Agree information requirements Mobilisation Agree participation criteria Validate information request Step 3: Data analysis and option development Identify opportunities and potential barriers to change Validate and analyse information Roll out to participants Agree participants Develop options and approaches to change Compare with best practice parameters Identify potential benefits

Approach a 5490 - 14 - FINAL CONFIDENTIAL During phase 1, the emphasis has been on collecting and analysing high level data in order to develop options and approaches to change and build commitment for phase 2 Step 1: Planning Step 2: Data collection Conduct discussions with management of participants and other industry players Agree information requirements Mobilisation Agree participation criteria Validate information request Step 3: Data analysis and option development Identify opportunities and potential barriers to change Validate and analyse information Roll out to participants Agree participants Develop options and approaches to change Compare with best practice parameters Identify potential benefits

Contents a 5490 - 15 - FINAL CONFIDENTIAL n Summary of main conclusions and recommendations n Introduction n Objectives and scope n Approach n Participants n Analysis of current situation n 5 areas of change – transaction processes – partnership in demand list management – management of stock and capacity – distribution efficiencies – returns n Our recommendations – quick wins – strategic change programme: – benefits n Obstacles to change n The case for change n Next steps priority projects longer term projects

Contents a 5490 - 15 - FINAL CONFIDENTIAL n Summary of main conclusions and recommendations n Introduction n Objectives and scope n Approach n Participants n Analysis of current situation n 5 areas of change – transaction processes – partnership in demand list management – management of stock and capacity – distribution efficiencies – returns n Our recommendations – quick wins – strategic change programme: – benefits n Obstacles to change n The case for change n Next steps priority projects longer term projects

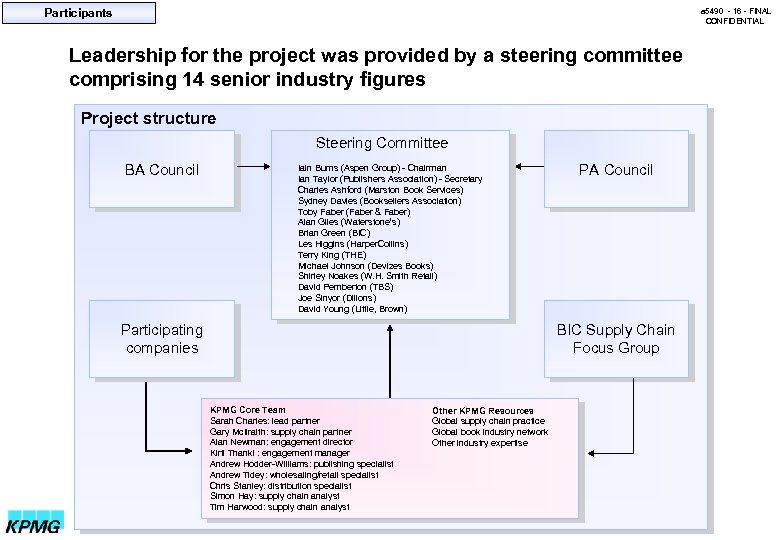

Participants a 5490 - 16 - FINAL CONFIDENTIAL Leadership for the project was provided by a steering committee comprising 14 senior industry figures Project structure Steering Committee BA Council Iain Burns (Aspen Group) - Chairman Ian Taylor (Publishers Association) - Secretary Charles Ashford (Marston Book Services) Sydney Davies (Booksellers Association) Toby Faber (Faber & Faber) Alan Giles (Waterstone’s) Brian Green (BIC) Les Higgins (Harper. Collins) Terry King (THE) Michael Johnson (Devizes Books) Shirley Noakes (W. H. Smith Retail) David Pemberton (TBS) Joe Sinyor (Dillons) David Young (Little, Brown) Participating companies PA Council BIC Supply Chain Focus Group KPMG Core Team Sarah Charles: lead partner Gary Mc. Ilraith: supply chain partner Alan Newman: engagement director Kirti Thanki : engagement manager Andrew Hodder-Williams: publishing specialist Andrew Tidey: wholesaling/retail specialist Chris Stanley: distribution specialist Simon Hay: supply chain analyst Tim Harwood: supply chain analyst Other KPMG Resources Global supply chain practice Global book industry network Other industry expertise

Participants a 5490 - 16 - FINAL CONFIDENTIAL Leadership for the project was provided by a steering committee comprising 14 senior industry figures Project structure Steering Committee BA Council Iain Burns (Aspen Group) - Chairman Ian Taylor (Publishers Association) - Secretary Charles Ashford (Marston Book Services) Sydney Davies (Booksellers Association) Toby Faber (Faber & Faber) Alan Giles (Waterstone’s) Brian Green (BIC) Les Higgins (Harper. Collins) Terry King (THE) Michael Johnson (Devizes Books) Shirley Noakes (W. H. Smith Retail) David Pemberton (TBS) Joe Sinyor (Dillons) David Young (Little, Brown) Participating companies PA Council BIC Supply Chain Focus Group KPMG Core Team Sarah Charles: lead partner Gary Mc. Ilraith: supply chain partner Alan Newman: engagement director Kirti Thanki : engagement manager Andrew Hodder-Williams: publishing specialist Andrew Tidey: wholesaling/retail specialist Chris Stanley: distribution specialist Simon Hay: supply chain analyst Tim Harwood: supply chain analyst Other KPMG Resources Global supply chain practice Global book industry network Other industry expertise

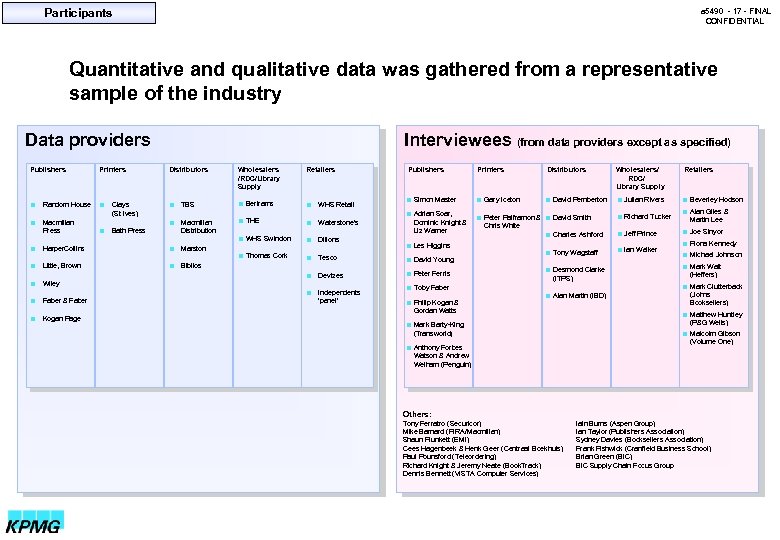

Participants a 5490 - 17 - FINAL CONFIDENTIAL Quantitative and qualitative data was gathered from a representative sample of the industry Data providers Publishers Printers Interviewees (from data providers except as specified) Distributors Wholesalers /RDC/Library Supply Retailers Printers Distributors Wholesalers/ RDC/ Library Supply Retailers n Simon Master n Gary Iceton n David Pemberton n Julian Rivers n Beverley Hodson n Adrian Soar, Dominic Knight & Liz Warner n Peter Palframon & n David Smith Chris White n Charles Ashford n Richard Tucker n Alan Giles & Martin Lee n Jeff Prince n Joe Sinyor Publishers n Macmillan Press n n Harper. Collins Little, Brown n Faber & Faber n Kogan Page n WHS Retail Macmillan Distribution n THE n Waterstone’s n WHS Swindon n Dillons n Thomas Cork n Tesco n David Young Devizes n Peter Ferris Independents ‘panel’ Bath Press n n Marston Biblios Wiley n n Clays (St Ives) n Bertrams n n TBS n Random House n n Les Higgins n Tony Wagstaff n Fiona Kennedy n Michael Johnson n Desmond Clarke (ITPS) n Mark Wait (Heffers) n Alan Martin (IBD) n Mark Clutterback (Johns Booksellers) n Toby Faber n Philip Kogan & Gordan Watts n Ian Walker n Mark Barty-King (Transworld) n Anthony Forbes Watson & Andrew Welham (Penguin) n Matthew Huntley (P&G Wells) n Malcolm Gibson (Volume One) Others: Tony Ferratro (Securicor) Mike Barnard (PIRA/Macmillan) Shaun Plunkett (EMI) Cees Hagenbeek & Henk Geer (Centraal Boekhuis) Paul Pounsford (Teleordering) Richard Knight & Jeremy Neate (Book. Track) Dennis Bennett (VISTA Computer Services) Iain Burns (Aspen Group) Ian Taylor (Publishers Association) Sydney Davies (Booksellers Association) Frank Fishwick (Cranfield Business School) Brian Green (BIC) BIC Supply Chain Focus Group

Participants a 5490 - 17 - FINAL CONFIDENTIAL Quantitative and qualitative data was gathered from a representative sample of the industry Data providers Publishers Printers Interviewees (from data providers except as specified) Distributors Wholesalers /RDC/Library Supply Retailers Printers Distributors Wholesalers/ RDC/ Library Supply Retailers n Simon Master n Gary Iceton n David Pemberton n Julian Rivers n Beverley Hodson n Adrian Soar, Dominic Knight & Liz Warner n Peter Palframon & n David Smith Chris White n Charles Ashford n Richard Tucker n Alan Giles & Martin Lee n Jeff Prince n Joe Sinyor Publishers n Macmillan Press n n Harper. Collins Little, Brown n Faber & Faber n Kogan Page n WHS Retail Macmillan Distribution n THE n Waterstone’s n WHS Swindon n Dillons n Thomas Cork n Tesco n David Young Devizes n Peter Ferris Independents ‘panel’ Bath Press n n Marston Biblios Wiley n n Clays (St Ives) n Bertrams n n TBS n Random House n n Les Higgins n Tony Wagstaff n Fiona Kennedy n Michael Johnson n Desmond Clarke (ITPS) n Mark Wait (Heffers) n Alan Martin (IBD) n Mark Clutterback (Johns Booksellers) n Toby Faber n Philip Kogan & Gordan Watts n Ian Walker n Mark Barty-King (Transworld) n Anthony Forbes Watson & Andrew Welham (Penguin) n Matthew Huntley (P&G Wells) n Malcolm Gibson (Volume One) Others: Tony Ferratro (Securicor) Mike Barnard (PIRA/Macmillan) Shaun Plunkett (EMI) Cees Hagenbeek & Henk Geer (Centraal Boekhuis) Paul Pounsford (Teleordering) Richard Knight & Jeremy Neate (Book. Track) Dennis Bennett (VISTA Computer Services) Iain Burns (Aspen Group) Ian Taylor (Publishers Association) Sydney Davies (Booksellers Association) Frank Fishwick (Cranfield Business School) Brian Green (BIC) BIC Supply Chain Focus Group

Contents a 5490 - 18 - FINAL CONFIDENTIAL n Summary of main conclusions and recommendations n Introduction n Objectives and scope n Approach n Participants n Analysis of current situation n 5 areas of change – transaction processes – partnership in demand list management – management of stock and capacity – distribution efficiencies – returns n Our recommendations – quick wins – strategic change programme: – benefits n Obstacles to change n The case for change n Next steps priority projects longer term projects

Contents a 5490 - 18 - FINAL CONFIDENTIAL n Summary of main conclusions and recommendations n Introduction n Objectives and scope n Approach n Participants n Analysis of current situation n 5 areas of change – transaction processes – partnership in demand list management – management of stock and capacity – distribution efficiencies – returns n Our recommendations – quick wins – strategic change programme: – benefits n Obstacles to change n The case for change n Next steps priority projects longer term projects

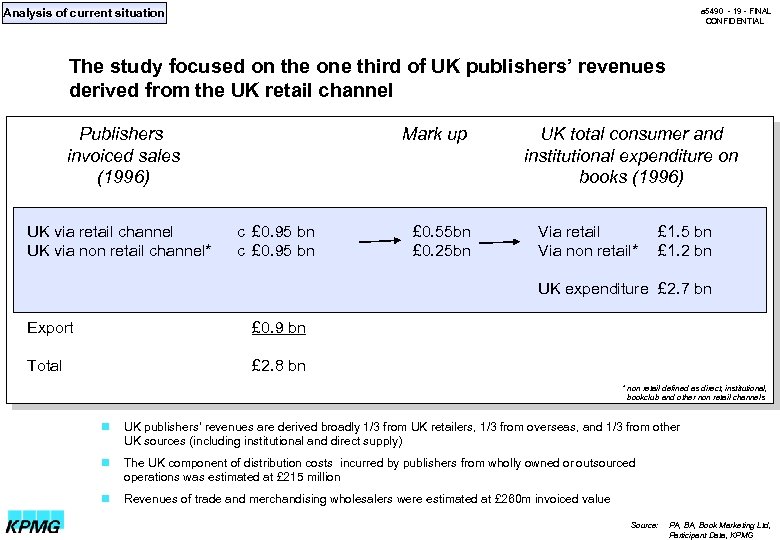

Analysis of current situation a 5490 - 19 - FINAL CONFIDENTIAL The study focused on the one third of UK publishers’ revenues derived from the UK retail channel Publishers invoiced sales (1996) UK via retail channel UK via non retail channel* Mark up c £ 0. 95 bn £ 0. 55 bn £ 0. 25 bn UK total consumer and institutional expenditure on books (1996) Via retail Via non retail* £ 1. 5 bn £ 1. 2 bn UK expenditure £ 2. 7 bn Export £ 0. 9 bn Total £ 2. 8 bn * non retail defined as direct, institutional, bookclub and other non retail channels n UK publishers’ revenues are derived broadly 1/3 from UK retailers, 1/3 from overseas, and 1/3 from other UK sources (including institutional and direct supply) n The UK component of distribution costs incurred by publishers from wholly owned or outsourced operations was estimated at £ 215 million n Revenues of trade and merchandising wholesalers were estimated at £ 260 m invoiced value Source: PA, Book Marketing Ltd, Participant Data, KPMG

Analysis of current situation a 5490 - 19 - FINAL CONFIDENTIAL The study focused on the one third of UK publishers’ revenues derived from the UK retail channel Publishers invoiced sales (1996) UK via retail channel UK via non retail channel* Mark up c £ 0. 95 bn £ 0. 55 bn £ 0. 25 bn UK total consumer and institutional expenditure on books (1996) Via retail Via non retail* £ 1. 5 bn £ 1. 2 bn UK expenditure £ 2. 7 bn Export £ 0. 9 bn Total £ 2. 8 bn * non retail defined as direct, institutional, bookclub and other non retail channels n UK publishers’ revenues are derived broadly 1/3 from UK retailers, 1/3 from overseas, and 1/3 from other UK sources (including institutional and direct supply) n The UK component of distribution costs incurred by publishers from wholly owned or outsourced operations was estimated at £ 215 million n Revenues of trade and merchandising wholesalers were estimated at £ 260 m invoiced value Source: PA, Book Marketing Ltd, Participant Data, KPMG

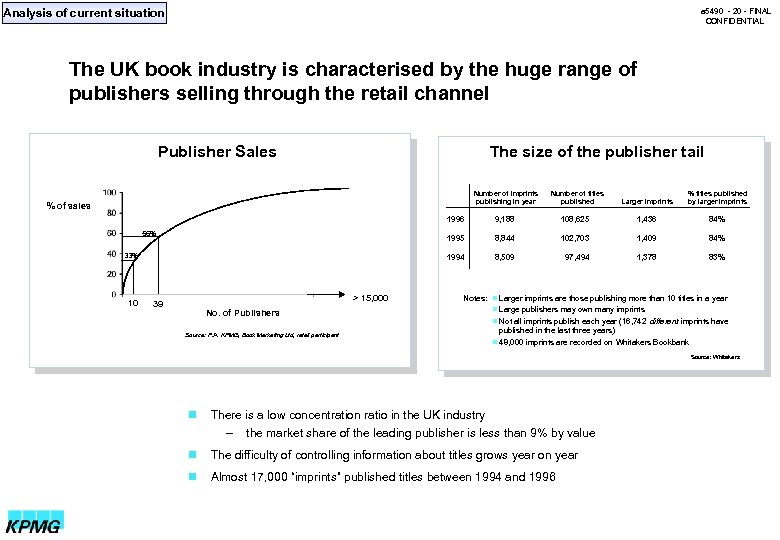

Analysis of current situation a 5490 - 20 - FINAL CONFIDENTIAL The UK book industry is characterised by the huge range of publishers selling through the retail channel Publisher Sales The size of the publisher tail Number of imprints publishing in year % of sales Number of titles published Larger imprints % titles published by larger imprints 1996 10 > 15, 000 39 No. of Publishers Source: P. A. KPMG, Book Marketing Ltd, retail participant 108, 625 1, 436 84% 8, 844 102, 703 1, 409 84% 1994 33% 9, 188 1995 56% 8, 509 97, 494 1, 378 83% Notes: n Larger imprints are those publishing more than 10 titles in a year n Large publishers may own many imprints n Not all imprints publish each year (16, 742 different imprints have published in the last three years) n 48, 000 imprints are recorded on Whitakers Bookbank Source: Whitakers n There is a low concentration ratio in the UK industry – the market share of the leading publisher is less than 9% by value n The difficulty of controlling information about titles grows year on year n Almost 17, 000 “imprints” published titles between 1994 and 1996

Analysis of current situation a 5490 - 20 - FINAL CONFIDENTIAL The UK book industry is characterised by the huge range of publishers selling through the retail channel Publisher Sales The size of the publisher tail Number of imprints publishing in year % of sales Number of titles published Larger imprints % titles published by larger imprints 1996 10 > 15, 000 39 No. of Publishers Source: P. A. KPMG, Book Marketing Ltd, retail participant 108, 625 1, 436 84% 8, 844 102, 703 1, 409 84% 1994 33% 9, 188 1995 56% 8, 509 97, 494 1, 378 83% Notes: n Larger imprints are those publishing more than 10 titles in a year n Large publishers may own many imprints n Not all imprints publish each year (16, 742 different imprints have published in the last three years) n 48, 000 imprints are recorded on Whitakers Bookbank Source: Whitakers n There is a low concentration ratio in the UK industry – the market share of the leading publisher is less than 9% by value n The difficulty of controlling information about titles grows year on year n Almost 17, 000 “imprints” published titles between 1994 and 1996

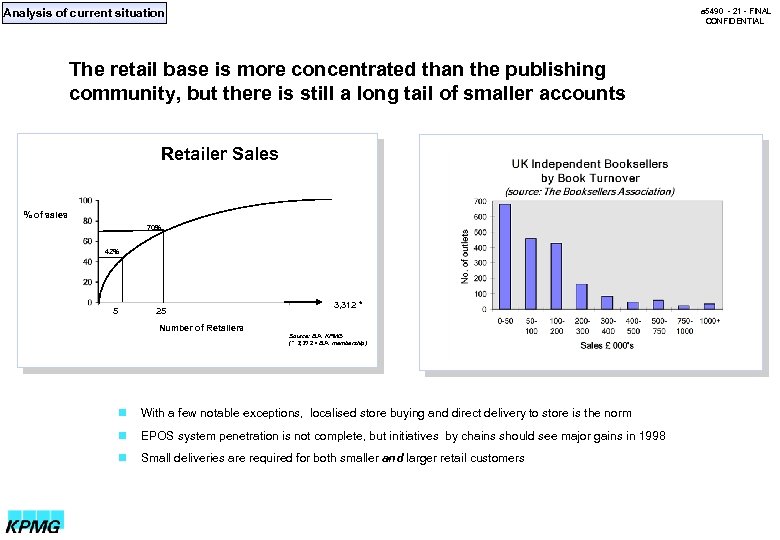

Analysis of current situation a 5490 - 21 - FINAL CONFIDENTIAL The retail base is more concentrated than the publishing community, but there is still a long tail of smaller accounts Retailer Sales % of sales 70% 42% 25 5 Number of Retailers 3, 312 * Source: B. A. KPMG (* 3, 312 = B. A. membership) n With a few notable exceptions, localised store buying and direct delivery to store is the norm n EPOS system penetration is not complete, but initiatives by chains should see major gains in 1998 n Small deliveries are required for both smaller and larger retail customers

Analysis of current situation a 5490 - 21 - FINAL CONFIDENTIAL The retail base is more concentrated than the publishing community, but there is still a long tail of smaller accounts Retailer Sales % of sales 70% 42% 25 5 Number of Retailers 3, 312 * Source: B. A. KPMG (* 3, 312 = B. A. membership) n With a few notable exceptions, localised store buying and direct delivery to store is the norm n EPOS system penetration is not complete, but initiatives by chains should see major gains in 1998 n Small deliveries are required for both smaller and larger retail customers

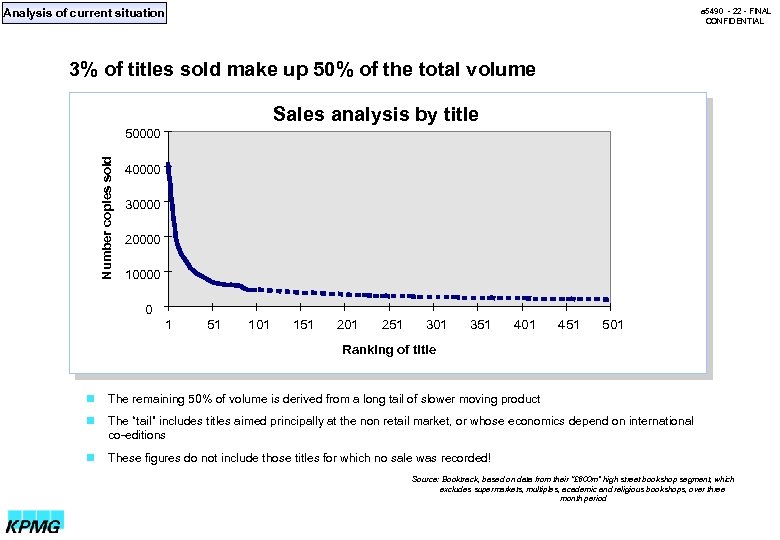

Analysis of current situation a 5490 - 22 - FINAL CONFIDENTIAL 3% of titles sold make up 50% of the total volume Sales analysis by title Number copies sold 50000 40000 30000 20000 10000 0 1 51 101 151 201 251 301 351 401 451 501 Ranking of title n The remaining 50% of volume is derived from a long tail of slower moving product n The “tail” includes titles aimed principally at the non retail market, or whose economics depend on international co-editions n These figures do not include those titles for which no sale was recorded! Source: Booktrack, based on data from their “£ 600 m” high street bookshop segment, which excludes supermarkets, multiples, academic and religious bookshops, over three month period

Analysis of current situation a 5490 - 22 - FINAL CONFIDENTIAL 3% of titles sold make up 50% of the total volume Sales analysis by title Number copies sold 50000 40000 30000 20000 10000 0 1 51 101 151 201 251 301 351 401 451 501 Ranking of title n The remaining 50% of volume is derived from a long tail of slower moving product n The “tail” includes titles aimed principally at the non retail market, or whose economics depend on international co-editions n These figures do not include those titles for which no sale was recorded! Source: Booktrack, based on data from their “£ 600 m” high street bookshop segment, which excludes supermarkets, multiples, academic and religious bookshops, over three month period

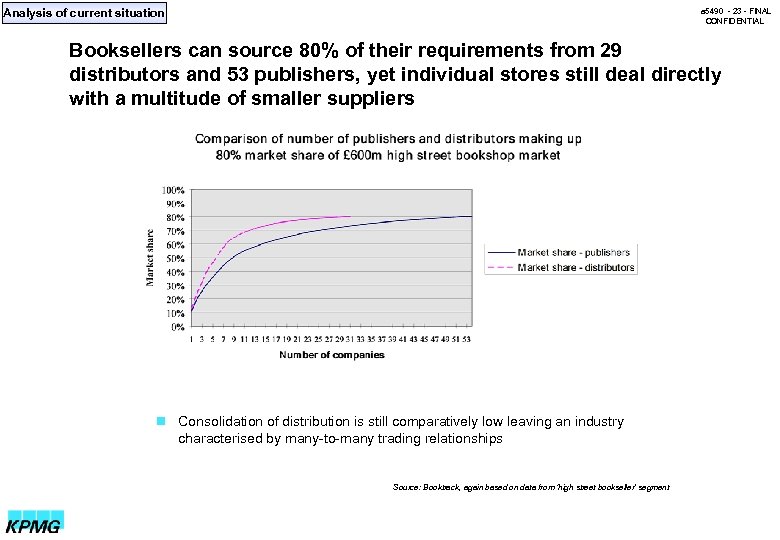

Analysis of current situation a 5490 - 23 - FINAL CONFIDENTIAL Booksellers can source 80% of their requirements from 29 distributors and 53 publishers, yet individual stores still deal directly with a multitude of smaller suppliers n Consolidation of distribution is still comparatively low leaving an industry characterised by many-to-many trading relationships Source: Booktrack, again based on data from ‘high street bookseller’ segment

Analysis of current situation a 5490 - 23 - FINAL CONFIDENTIAL Booksellers can source 80% of their requirements from 29 distributors and 53 publishers, yet individual stores still deal directly with a multitude of smaller suppliers n Consolidation of distribution is still comparatively low leaving an industry characterised by many-to-many trading relationships Source: Booktrack, again based on data from ‘high street bookseller’ segment

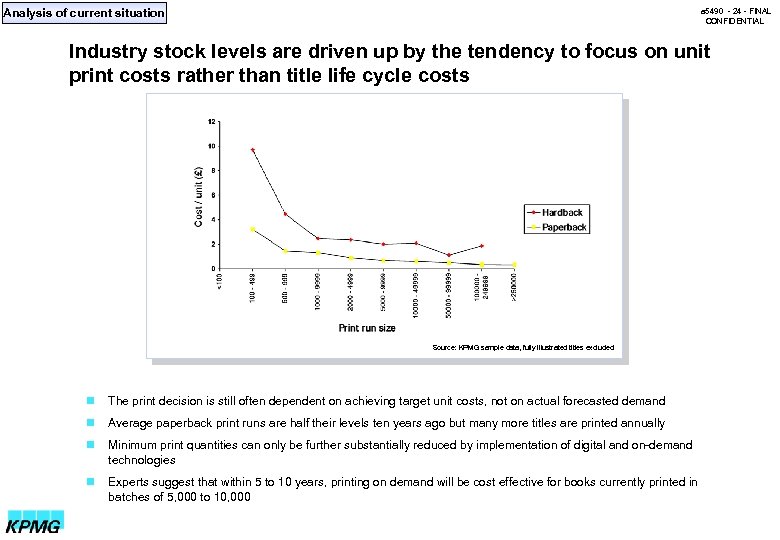

Analysis of current situation a 5490 - 24 - FINAL CONFIDENTIAL Industry stock levels are driven up by the tendency to focus on unit print costs rather than title life cycle costs Source: KPMG sample data, fully illustrated titles excluded n The print decision is still often dependent on achieving target unit costs, not on actual forecasted demand n Average paperback print runs are half their levels ten years ago but many more titles are printed annually n Minimum print quantities can only be further substantially reduced by implementation of digital and on-demand technologies n Experts suggest that within 5 to 10 years, printing on demand will be cost effective for books currently printed in batches of 5, 000 to 10, 000

Analysis of current situation a 5490 - 24 - FINAL CONFIDENTIAL Industry stock levels are driven up by the tendency to focus on unit print costs rather than title life cycle costs Source: KPMG sample data, fully illustrated titles excluded n The print decision is still often dependent on achieving target unit costs, not on actual forecasted demand n Average paperback print runs are half their levels ten years ago but many more titles are printed annually n Minimum print quantities can only be further substantially reduced by implementation of digital and on-demand technologies n Experts suggest that within 5 to 10 years, printing on demand will be cost effective for books currently printed in batches of 5, 000 to 10, 000

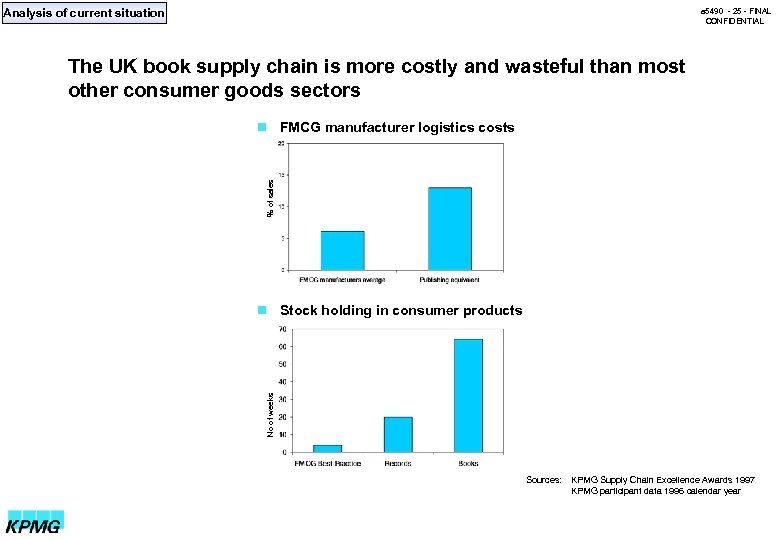

Analysis of current situation a 5490 - 25 - FINAL CONFIDENTIAL The UK book supply chain is more costly and wasteful than most other consumer goods sectors % of sales n FMCG manufacturer logistics costs No of weeks n Stock holding in consumer products Sources: KPMG Supply Chain Excellence Awards 1997 KPMG participant data 1996 calendar year

Analysis of current situation a 5490 - 25 - FINAL CONFIDENTIAL The UK book supply chain is more costly and wasteful than most other consumer goods sectors % of sales n FMCG manufacturer logistics costs No of weeks n Stock holding in consumer products Sources: KPMG Supply Chain Excellence Awards 1997 KPMG participant data 1996 calendar year

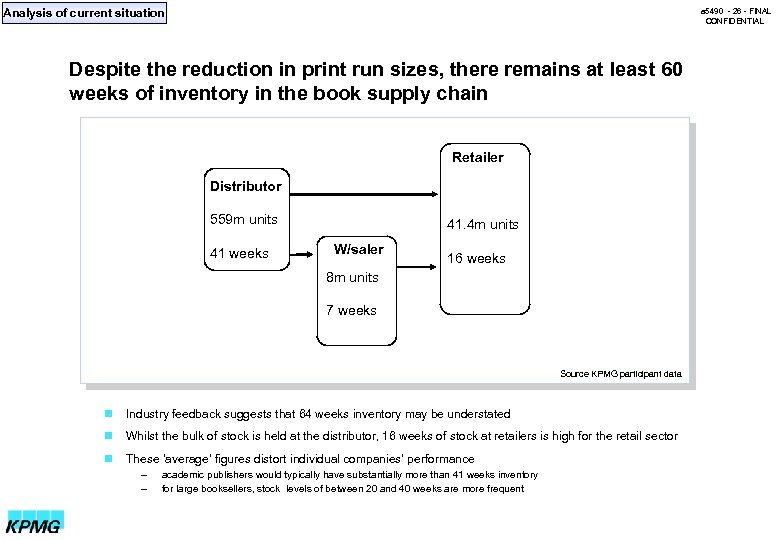

Analysis of current situation a 5490 - 26 - FINAL CONFIDENTIAL Despite the reduction in print run sizes, there remains at least 60 weeks of inventory in the book supply chain Retailer Distributor 559 m units 41 weeks 41. 4 m units W/saler 16 weeks 8 m units 7 weeks Source KPMG participant data n Industry feedback suggests that 64 weeks inventory may be understated n Whilst the bulk of stock is held at the distributor, 16 weeks of stock at retailers is high for the retail sector n These ‘average’ figures distort individual companies’ performance – – academic publishers would typically have substantially more than 41 weeks inventory for large booksellers, stock levels of between 20 and 40 weeks are more frequent

Analysis of current situation a 5490 - 26 - FINAL CONFIDENTIAL Despite the reduction in print run sizes, there remains at least 60 weeks of inventory in the book supply chain Retailer Distributor 559 m units 41 weeks 41. 4 m units W/saler 16 weeks 8 m units 7 weeks Source KPMG participant data n Industry feedback suggests that 64 weeks inventory may be understated n Whilst the bulk of stock is held at the distributor, 16 weeks of stock at retailers is high for the retail sector n These ‘average’ figures distort individual companies’ performance – – academic publishers would typically have substantially more than 41 weeks inventory for large booksellers, stock levels of between 20 and 40 weeks are more frequent

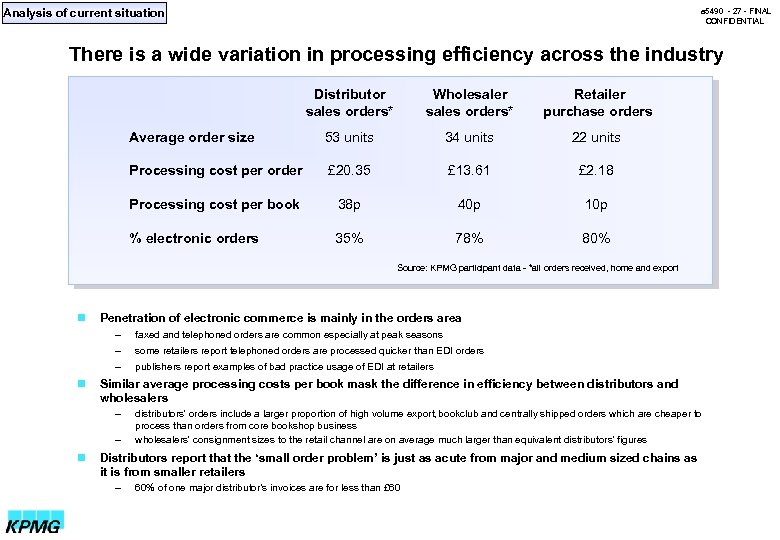

Analysis of current situation a 5490 - 27 - FINAL CONFIDENTIAL There is a wide variation in processing efficiency across the industry Distributor sales orders* Wholesaler sales orders* Retailer purchase orders Average order size 53 units 34 units 22 units Processing cost per order £ 20. 35 £ 13. 61 £ 2. 18 Processing cost per book 38 p 40 p 10 p % electronic orders 35% 78% 80% Source: KPMG participant data - *all orders received, home and export n Penetration of electronic commerce is mainly in the orders area – – – n some retailers report telephoned orders are processed quicker than EDI orders publishers report examples of bad practice usage of EDI at retailers Similar average processing costs per book mask the difference in efficiency between distributors and wholesalers – – n faxed and telephoned orders are common especially at peak seasons distributors' orders include a larger proportion of high volume export, bookclub and centrally shipped orders which are cheaper to process than orders from core bookshop business wholesalers' consignment sizes to the retail channel are on average much larger than equivalent distributors' figures Distributors report that the ‘small order problem’ is just as acute from major and medium sized chains as it is from smaller retailers – 60% of one major distributor’s invoices are for less than £ 60

Analysis of current situation a 5490 - 27 - FINAL CONFIDENTIAL There is a wide variation in processing efficiency across the industry Distributor sales orders* Wholesaler sales orders* Retailer purchase orders Average order size 53 units 34 units 22 units Processing cost per order £ 20. 35 £ 13. 61 £ 2. 18 Processing cost per book 38 p 40 p 10 p % electronic orders 35% 78% 80% Source: KPMG participant data - *all orders received, home and export n Penetration of electronic commerce is mainly in the orders area – – – n some retailers report telephoned orders are processed quicker than EDI orders publishers report examples of bad practice usage of EDI at retailers Similar average processing costs per book mask the difference in efficiency between distributors and wholesalers – – n faxed and telephoned orders are common especially at peak seasons distributors' orders include a larger proportion of high volume export, bookclub and centrally shipped orders which are cheaper to process than orders from core bookshop business wholesalers' consignment sizes to the retail channel are on average much larger than equivalent distributors' figures Distributors report that the ‘small order problem’ is just as acute from major and medium sized chains as it is from smaller retailers – 60% of one major distributor’s invoices are for less than £ 60

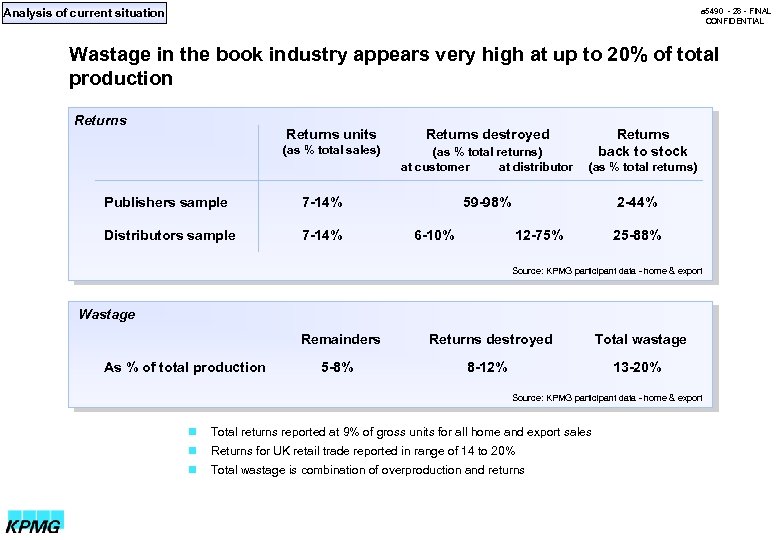

Analysis of current situation a 5490 - 28 - FINAL CONFIDENTIAL Wastage in the book industry appears very high at up to 20% of total production Returns units Returns destroyed (as % total sales) (as % total returns) at customer at distributor Publishers sample 7 -14% Distributors sample 7 -14% Returns back to stock (as % total returns) 59 -98% 6 -10% 2 -44% 12 -75% 25 -88% Source: KPMG participant data - home & export Wastage Remainders As % of total production Returns destroyed Total wastage 5 -8% 8 -12% 13 -20% Source: KPMG participant data - home & export n Total returns reported at 9% of gross units for all home and export sales n Returns for UK retail trade reported in range of 14 to 20% n Total wastage is combination of overproduction and returns

Analysis of current situation a 5490 - 28 - FINAL CONFIDENTIAL Wastage in the book industry appears very high at up to 20% of total production Returns units Returns destroyed (as % total sales) (as % total returns) at customer at distributor Publishers sample 7 -14% Distributors sample 7 -14% Returns back to stock (as % total returns) 59 -98% 6 -10% 2 -44% 12 -75% 25 -88% Source: KPMG participant data - home & export Wastage Remainders As % of total production Returns destroyed Total wastage 5 -8% 8 -12% 13 -20% Source: KPMG participant data - home & export n Total returns reported at 9% of gross units for all home and export sales n Returns for UK retail trade reported in range of 14 to 20% n Total wastage is combination of overproduction and returns

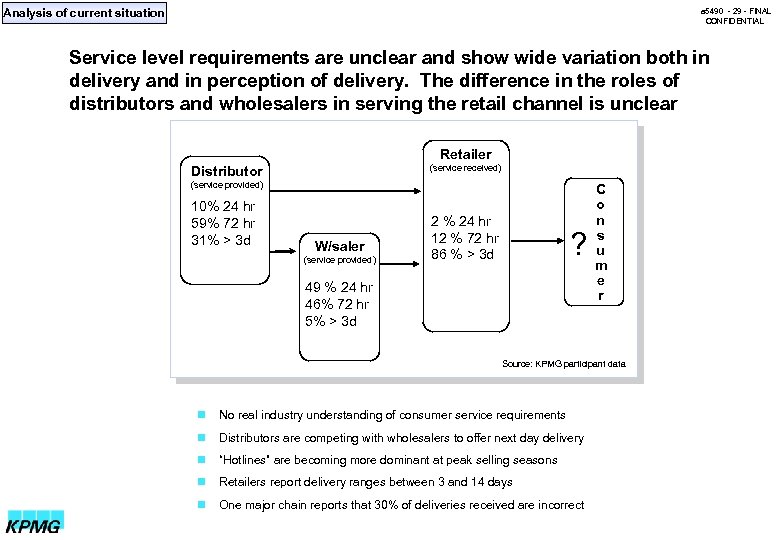

Analysis of current situation a 5490 - 29 - FINAL CONFIDENTIAL Service level requirements are unclear and show wide variation both in delivery and in perception of delivery. The difference in the roles of distributors and wholesalers in serving the retail channel is unclear Retailer (service received) Distributor (service provided) 10% 24 hr 59% 72 hr 31% > 3 d W/saler (service provided) 2 % 24 hr 12 % 72 hr 86 % > 3 d ? 49 % 24 hr 46% 72 hr 5% > 3 d C o n s u m e r Source: KPMG participant data n No real industry understanding of consumer service requirements n Distributors are competing with wholesalers to offer next day delivery n “Hotlines” are becoming more dominant at peak selling seasons n Retailers report delivery ranges between 3 and 14 days n One major chain reports that 30% of deliveries received are incorrect

Analysis of current situation a 5490 - 29 - FINAL CONFIDENTIAL Service level requirements are unclear and show wide variation both in delivery and in perception of delivery. The difference in the roles of distributors and wholesalers in serving the retail channel is unclear Retailer (service received) Distributor (service provided) 10% 24 hr 59% 72 hr 31% > 3 d W/saler (service provided) 2 % 24 hr 12 % 72 hr 86 % > 3 d ? 49 % 24 hr 46% 72 hr 5% > 3 d C o n s u m e r Source: KPMG participant data n No real industry understanding of consumer service requirements n Distributors are competing with wholesalers to offer next day delivery n “Hotlines” are becoming more dominant at peak selling seasons n Retailers report delivery ranges between 3 and 14 days n One major chain reports that 30% of deliveries received are incorrect

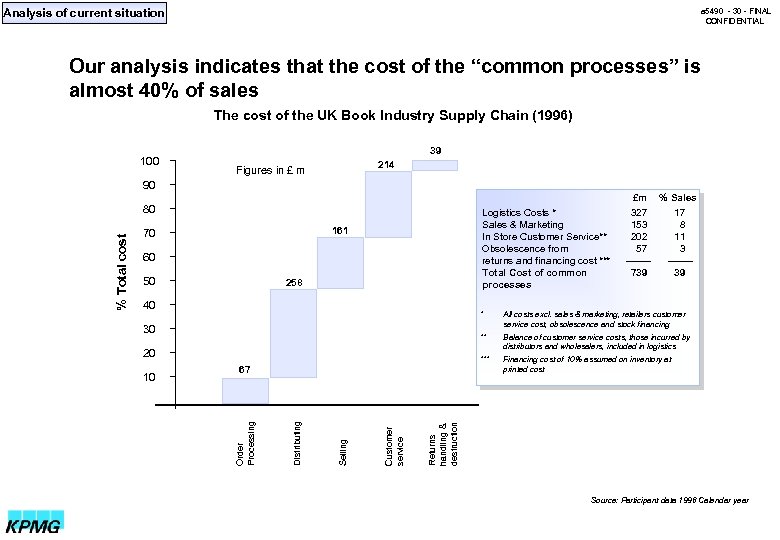

Analysis of current situation a 5490 - 30 - FINAL CONFIDENTIAL Our analysis indicates that the cost of the “common processes” is almost 40% of sales The cost of the UK Book Industry Supply Chain (1996) 100 39 214 Figures in £ m 90 £m Logistics Costs * Sales & Marketing In Store Customer Service** Obsolescence from returns and financing cost *** Total Cost of common processes 161 70 60 50 258 40 17 8 11 3 739 39 Financing cost of 10% assumed on inventory at printed cost Returns handling & destruction Customer service Selling Distributing 67 Balance of customer service costs, those incurred by distributors and wholesalers, included in logistics *** 20 All costs excl. sales & marketing, retailers customer service cost, obsolescence and stock financing ** 30 10 % Sales 327 153 202 57 * Order Processing % Total cost 80 Source: Participant data 1996 Calendar year

Analysis of current situation a 5490 - 30 - FINAL CONFIDENTIAL Our analysis indicates that the cost of the “common processes” is almost 40% of sales The cost of the UK Book Industry Supply Chain (1996) 100 39 214 Figures in £ m 90 £m Logistics Costs * Sales & Marketing In Store Customer Service** Obsolescence from returns and financing cost *** Total Cost of common processes 161 70 60 50 258 40 17 8 11 3 739 39 Financing cost of 10% assumed on inventory at printed cost Returns handling & destruction Customer service Selling Distributing 67 Balance of customer service costs, those incurred by distributors and wholesalers, included in logistics *** 20 All costs excl. sales & marketing, retailers customer service cost, obsolescence and stock financing ** 30 10 % Sales 327 153 202 57 * Order Processing % Total cost 80 Source: Participant data 1996 Calendar year

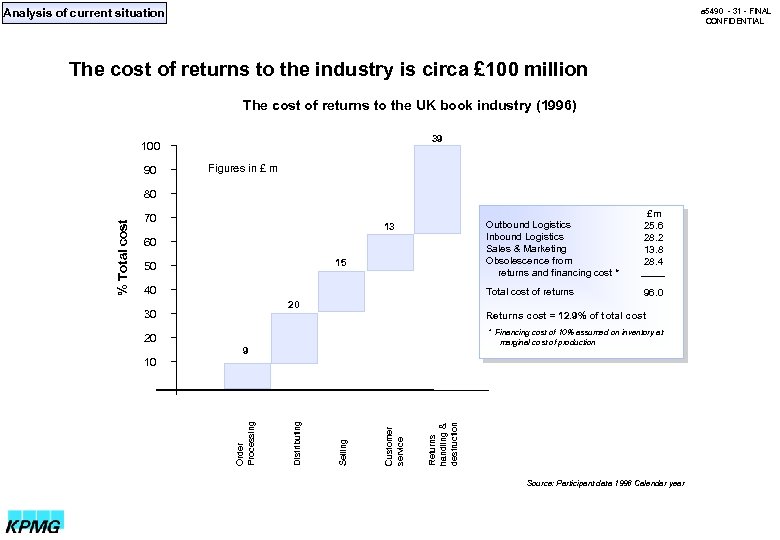

Analysis of current situation a 5490 - 31 - FINAL CONFIDENTIAL The cost of returns to the industry is circa £ 100 million The cost of returns to the UK book industry (1996) 39 100 90 Figures in £ m 70 Outbound Logistics Inbound Logistics Sales & Marketing Obsolescence from returns and financing cost * 13 60 15 50 40 Total cost of returns £m 25. 6 28. 2 13. 8 28. 4 96. 0 20 30 Returns cost = 12. 9% of total cost * Financing cost of 10% assumed on inventory at marginal cost of production 20 9 Returns handling & destruction Customer service Selling Distributing 10 Order Processing % Total cost 80 Source: Participant data 1996 Calendar year

Analysis of current situation a 5490 - 31 - FINAL CONFIDENTIAL The cost of returns to the industry is circa £ 100 million The cost of returns to the UK book industry (1996) 39 100 90 Figures in £ m 70 Outbound Logistics Inbound Logistics Sales & Marketing Obsolescence from returns and financing cost * 13 60 15 50 40 Total cost of returns £m 25. 6 28. 2 13. 8 28. 4 96. 0 20 30 Returns cost = 12. 9% of total cost * Financing cost of 10% assumed on inventory at marginal cost of production 20 9 Returns handling & destruction Customer service Selling Distributing 10 Order Processing % Total cost 80 Source: Participant data 1996 Calendar year

Analysis of current situation a 5490 - 32 - FINAL CONFIDENTIAL At root are fundamental issues about the nature of the publishing and bookselling process n There is an inevitable tension between the creative processes in publishing and bookselling and the technical disciplines of supply chain management n There is little exploitation of opportunities for economies of scale in physical distribution and transaction processing n Trading relationships are complex, largely adversarial, with little partnership activity n There is little joint planning across the supply chain n The competition for retail exposure causes Publishers to push stock into the supply chain, accepting the risk of returns this creates. Partly this is due to the following: – – dependency on new titles shortcomings in the responsivness and efficiency of the supply chain perceived limitation of retailers’ re-ordering policies retailers not incentivised to resist because they carry little stock risk

Analysis of current situation a 5490 - 32 - FINAL CONFIDENTIAL At root are fundamental issues about the nature of the publishing and bookselling process n There is an inevitable tension between the creative processes in publishing and bookselling and the technical disciplines of supply chain management n There is little exploitation of opportunities for economies of scale in physical distribution and transaction processing n Trading relationships are complex, largely adversarial, with little partnership activity n There is little joint planning across the supply chain n The competition for retail exposure causes Publishers to push stock into the supply chain, accepting the risk of returns this creates. Partly this is due to the following: – – dependency on new titles shortcomings in the responsivness and efficiency of the supply chain perceived limitation of retailers’ re-ordering policies retailers not incentivised to resist because they carry little stock risk

Analysis of current situation a 5490 - 33 - FINAL CONFIDENTIAL The current book industry supply chain structure is complex and costly, characterised by high fragmentation, few economies of scale, and manyto-many trading relationships n The structure is the legacy of an age of large batch sizes and infrequent orders and is not relevant to today’s little-and-often ordering patterns n The industry is dominated by the long tail of slow moving titles which is responsible for a disproportionate share of costs and wastage n The very high number of new titles is dealt with inefficiently, creating high sales and buying costs, and causing lost sales, high costs and wastage n Little-and-often ordering has reduced returns somewhat, but sales are being lost in the process n Category management and demand planning, techniques which have been developed and widely adopted in other areas of consumer retail, are not properly understood or applied in the book industry n Opportunities for electronic commerce are not being seized

Analysis of current situation a 5490 - 33 - FINAL CONFIDENTIAL The current book industry supply chain structure is complex and costly, characterised by high fragmentation, few economies of scale, and manyto-many trading relationships n The structure is the legacy of an age of large batch sizes and infrequent orders and is not relevant to today’s little-and-often ordering patterns n The industry is dominated by the long tail of slow moving titles which is responsible for a disproportionate share of costs and wastage n The very high number of new titles is dealt with inefficiently, creating high sales and buying costs, and causing lost sales, high costs and wastage n Little-and-often ordering has reduced returns somewhat, but sales are being lost in the process n Category management and demand planning, techniques which have been developed and widely adopted in other areas of consumer retail, are not properly understood or applied in the book industry n Opportunities for electronic commerce are not being seized

Contents a 5490 - 34 - FINAL CONFIDENTIAL n Summary of main conclusions and recommendations n Introduction n Objectives and scope n Approach n Participants n Analysis of current situation n 5 areas of change – transaction processes – partnership in demand list management – management of stock and capacity – distribution efficiencies – returns n Our recommendations – quick wins – strategic change programme: – benefits n Obstacles to change n The case for change n Next steps priority projects longer term projects

Contents a 5490 - 34 - FINAL CONFIDENTIAL n Summary of main conclusions and recommendations n Introduction n Objectives and scope n Approach n Participants n Analysis of current situation n 5 areas of change – transaction processes – partnership in demand list management – management of stock and capacity – distribution efficiencies – returns n Our recommendations – quick wins – strategic change programme: – benefits n Obstacles to change n The case for change n Next steps priority projects longer term projects

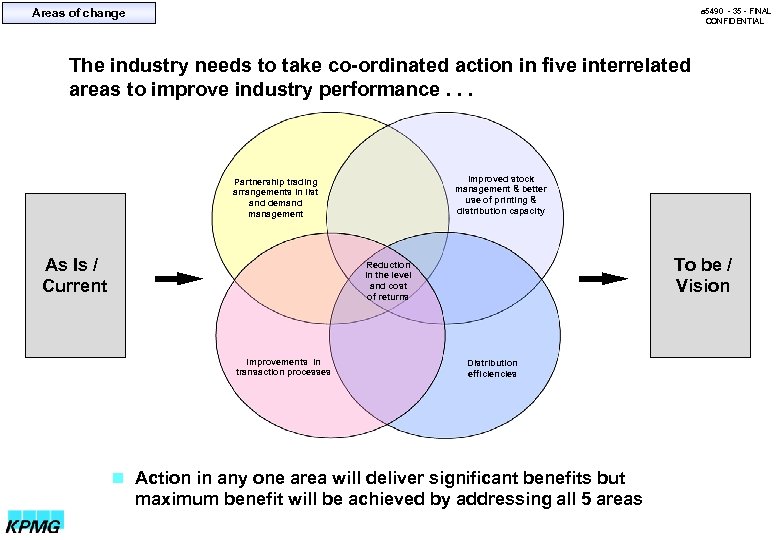

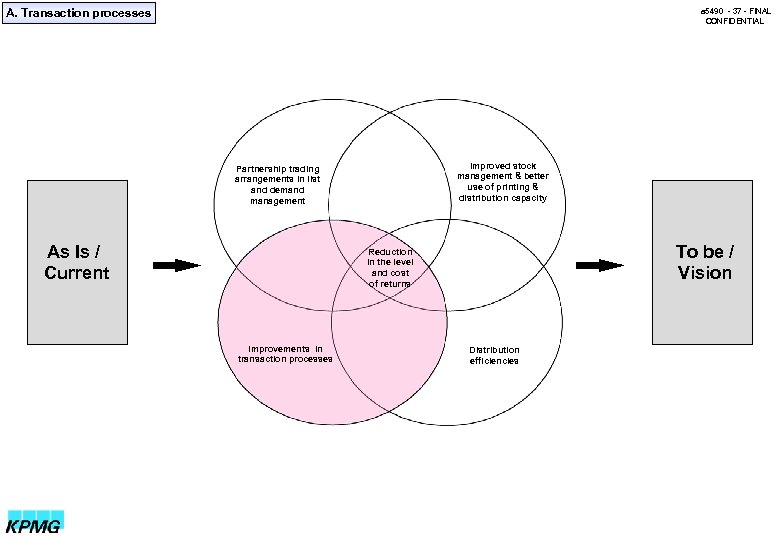

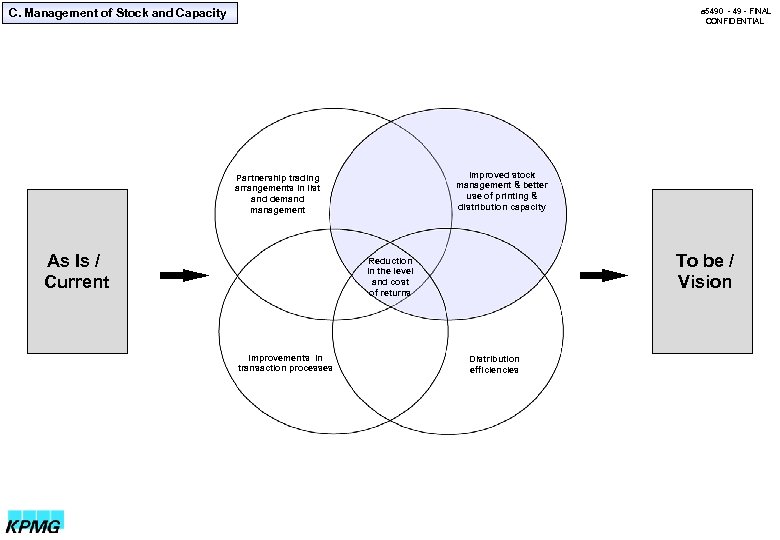

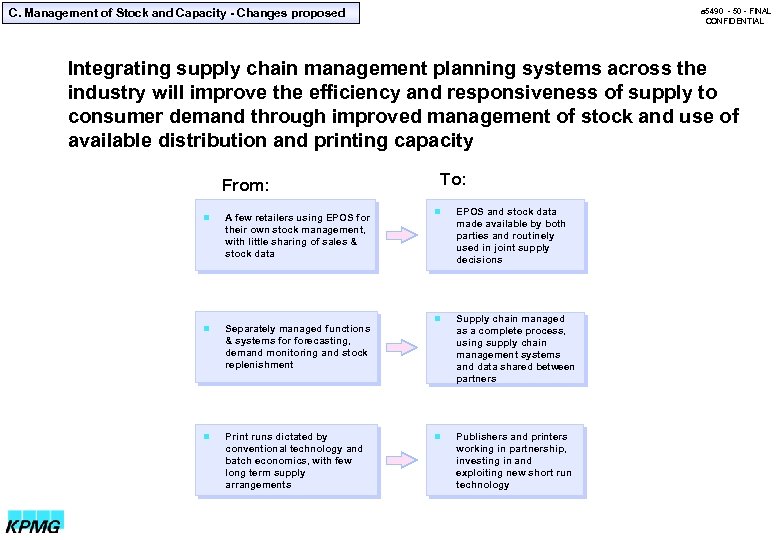

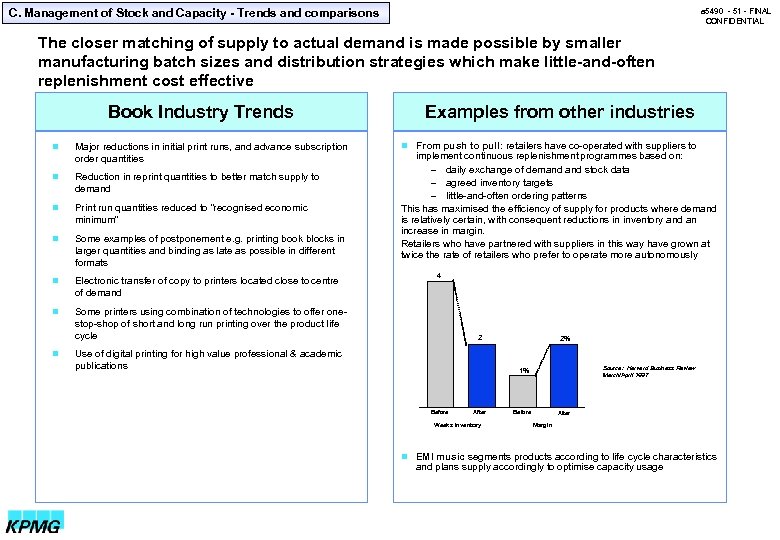

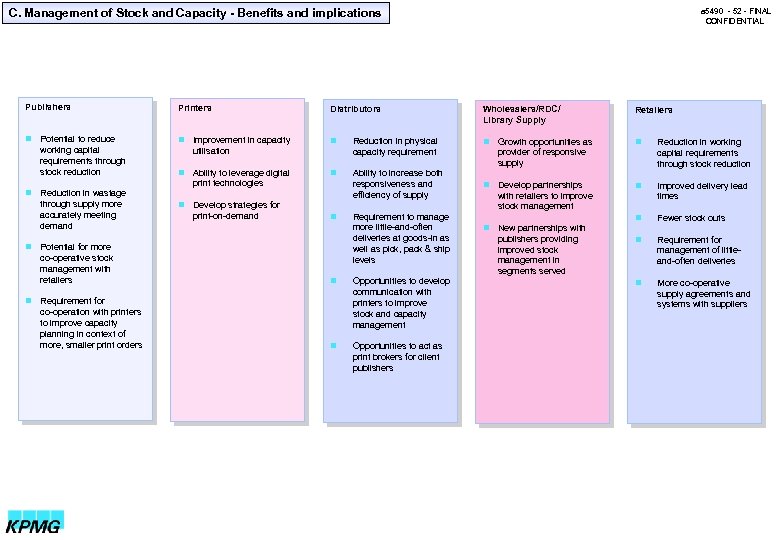

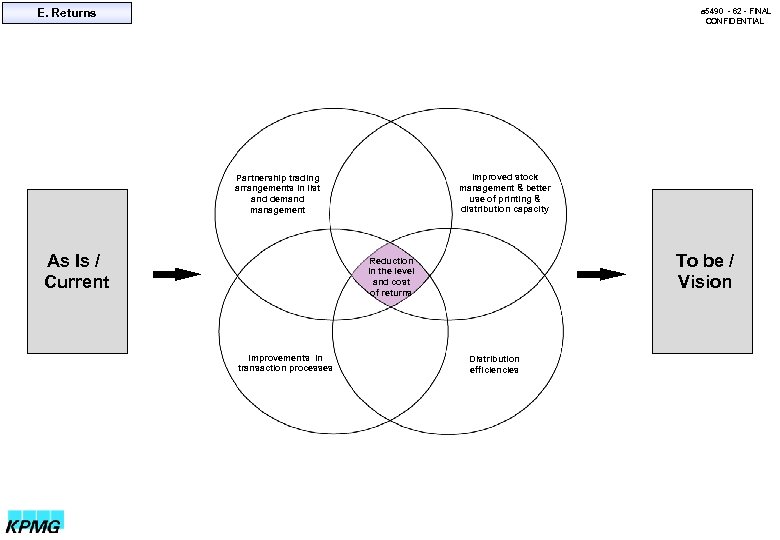

Areas of change a 5490 - 35 - FINAL CONFIDENTIAL The industry needs to take co-ordinated action in five interrelated areas to improve industry performance. . . Improved stock management & better use of printing & distribution capacity Partnership trading arrangements in list and demand management As Is / Current To be / Vision Reduction in the level and cost of returns Improvements in transaction processes Distribution efficiencies n Action in any one area will deliver significant benefits but maximum benefit will be achieved by addressing all 5 areas

Areas of change a 5490 - 35 - FINAL CONFIDENTIAL The industry needs to take co-ordinated action in five interrelated areas to improve industry performance. . . Improved stock management & better use of printing & distribution capacity Partnership trading arrangements in list and demand management As Is / Current To be / Vision Reduction in the level and cost of returns Improvements in transaction processes Distribution efficiencies n Action in any one area will deliver significant benefits but maximum benefit will be achieved by addressing all 5 areas

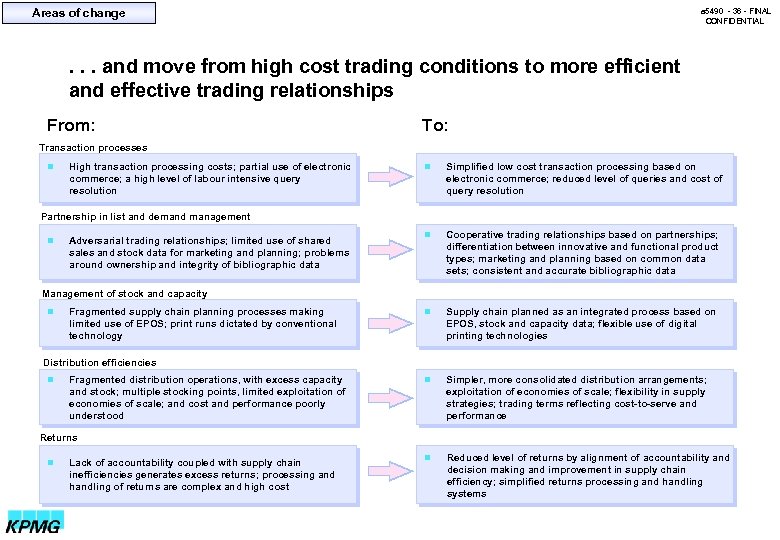

Areas of change a 5490 - 36 - FINAL CONFIDENTIAL . . . and move from high cost trading conditions to more efficient and effective trading relationships From: To: Transaction processes n High transaction processing costs; partial use of electronic commerce; a high level of labour intensive query resolution n Simplified low cost transaction processing based on electronic commerce; reduced level of queries and cost of query resolution n Cooperative trading relationships based on partnerships; differentiation between innovative and functional product types; marketing and planning based on common data sets; consistent and accurate bibliographic data n Supply chain planned as an integrated process based on EPOS, stock and capacity data; flexible use of digital printing technologies n Simpler, more consolidated distribution arrangements; exploitation of economies of scale; flexibility in supply strategies; trading terms reflecting cost-to-serve and performance n Reduced level of returns by alignment of accountability and decision making and improvement in supply chain efficiency; simplified returns processing and handling systems Partnership in list and demand management n Adversarial trading relationships; limited use of shared sales and stock data for marketing and planning; problems around ownership and integrity of bibliographic data Management of stock and capacity n Fragmented supply chain planning processes making limited use of EPOS; print runs dictated by conventional technology Distribution efficiencies n Fragmented distribution operations, with excess capacity and stock; multiple stocking points, limited exploitation of economies of scale; and cost and performance poorly understood Returns n Lack of accountability coupled with supply chain inefficiencies generates excess returns; processing and handling of returns are complex and high cost

Areas of change a 5490 - 36 - FINAL CONFIDENTIAL . . . and move from high cost trading conditions to more efficient and effective trading relationships From: To: Transaction processes n High transaction processing costs; partial use of electronic commerce; a high level of labour intensive query resolution n Simplified low cost transaction processing based on electronic commerce; reduced level of queries and cost of query resolution n Cooperative trading relationships based on partnerships; differentiation between innovative and functional product types; marketing and planning based on common data sets; consistent and accurate bibliographic data n Supply chain planned as an integrated process based on EPOS, stock and capacity data; flexible use of digital printing technologies n Simpler, more consolidated distribution arrangements; exploitation of economies of scale; flexibility in supply strategies; trading terms reflecting cost-to-serve and performance n Reduced level of returns by alignment of accountability and decision making and improvement in supply chain efficiency; simplified returns processing and handling systems Partnership in list and demand management n Adversarial trading relationships; limited use of shared sales and stock data for marketing and planning; problems around ownership and integrity of bibliographic data Management of stock and capacity n Fragmented supply chain planning processes making limited use of EPOS; print runs dictated by conventional technology Distribution efficiencies n Fragmented distribution operations, with excess capacity and stock; multiple stocking points, limited exploitation of economies of scale; and cost and performance poorly understood Returns n Lack of accountability coupled with supply chain inefficiencies generates excess returns; processing and handling of returns are complex and high cost

A. Transaction processes a 5490 - 37 - FINAL CONFIDENTIAL Improved stock management & better use of printing & distribution capacity Partnership trading arrangements in list and demand management As Is / Current To be / Vision Reduction in the level and cost of returns Improvements in transaction processes Distribution efficiencies

A. Transaction processes a 5490 - 37 - FINAL CONFIDENTIAL Improved stock management & better use of printing & distribution capacity Partnership trading arrangements in list and demand management As Is / Current To be / Vision Reduction in the level and cost of returns Improvements in transaction processes Distribution efficiencies

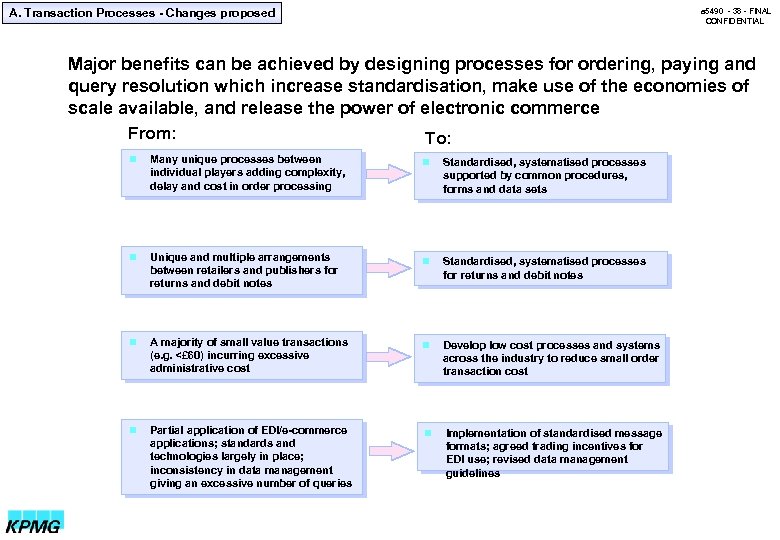

A. Transaction Processes - Changes proposed a 5490 - 38 - FINAL CONFIDENTIAL Major benefits can be achieved by designing processes for ordering, paying and query resolution which increase standardisation, make use of the economies of scale available, and release the power of electronic commerce From: To: n Many unique processes between individual players adding complexity, delay and cost in order processing n Standardised, systematised processes supported by common procedures, forms and data sets n Unique and multiple arrangements between retailers and publishers for returns and debit notes n Standardised, systematised processes for returns and debit notes n A majority of small value transactions (e. g. <£ 60) incurring excessive administrative cost n Develop low cost processes and systems across the industry to reduce small order transaction cost n Partial application of EDI/e-commerce applications; standards and technologies largely in place; inconsistency in data management giving an excessive number of queries n Implementation of standardised message formats; agreed trading incentives for EDI use; revised data management guidelines

A. Transaction Processes - Changes proposed a 5490 - 38 - FINAL CONFIDENTIAL Major benefits can be achieved by designing processes for ordering, paying and query resolution which increase standardisation, make use of the economies of scale available, and release the power of electronic commerce From: To: n Many unique processes between individual players adding complexity, delay and cost in order processing n Standardised, systematised processes supported by common procedures, forms and data sets n Unique and multiple arrangements between retailers and publishers for returns and debit notes n Standardised, systematised processes for returns and debit notes n A majority of small value transactions (e. g. <£ 60) incurring excessive administrative cost n Develop low cost processes and systems across the industry to reduce small order transaction cost n Partial application of EDI/e-commerce applications; standards and technologies largely in place; inconsistency in data management giving an excessive number of queries n Implementation of standardised message formats; agreed trading incentives for EDI use; revised data management guidelines

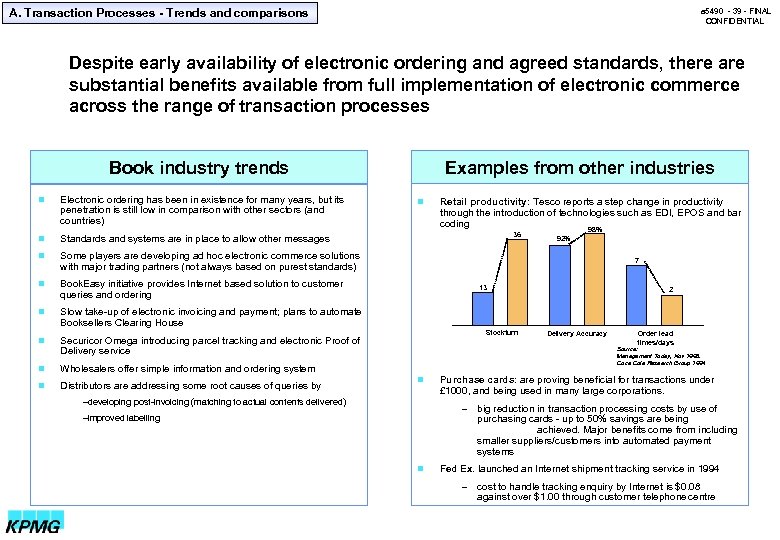

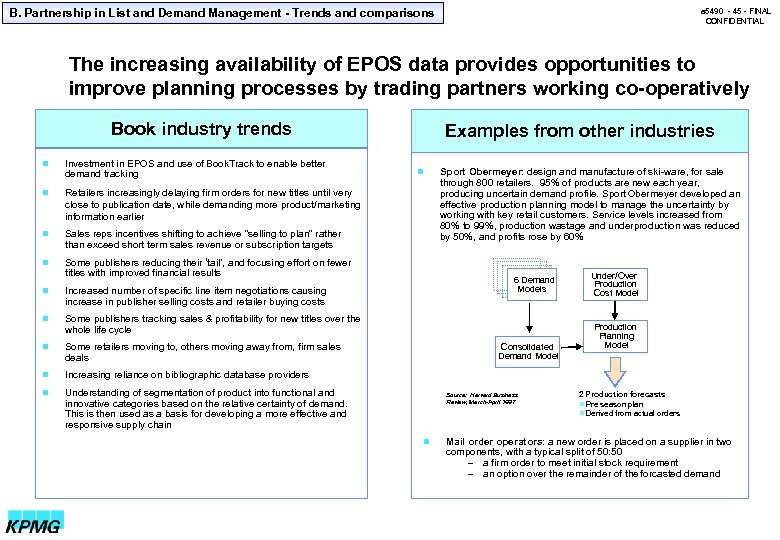

A. Transaction Processes - Trends and comparisons a 5490 - 39 - FINAL CONFIDENTIAL Despite early availability of electronic ordering and agreed standards, there are substantial benefits available from full implementation of electronic commerce across the range of transaction processes Examples from other industries Book industry trends n Electronic ordering has been in existence for many years, but its penetration is still low in comparison with other sectors (and countries) n Standards and systems are in place to allow other messages n Some players are developing ad hoc electronic commerce solutions with major trading partners (not always based on purest standards) n Book. Easy initiative provides Internet based solution to customer queries and ordering n Slow take-up of electronic invoicing and payment; plans to automate Booksellers Clearing House n Securicor Omega introducing parcel tracking and electronic Proof of Delivery service n Wholesalers offer simple information and ordering system n Distributors are addressing some root causes of queries by n Retail productivity: Tesco reports a step change in productivity through the introduction of technologies such as EDI, EPOS and bar coding 36 98% 92% 7 13 Stockturn 2 Delivery Accuracy Order lead times/days Source: Management Today, Nov 1996. Coca Cola Research Group 1994 n –developing post-invoicing (matching to actual contents delivered) Purchase cards: are proving beneficial for transactions under £ 1000, and being used in many large corporations. – –improved labelling n big reduction in transaction processing costs by use of purchasing cards - up to 50% savings are being achieved. Major benefits come from including smaller suppliers/customers into automated payment systems Fed Ex. launched an Internet shipment tracking service in 1994 – cost to handle tracking enquiry by Internet is $0. 08 against over $1. 00 through customer telephone centre

A. Transaction Processes - Trends and comparisons a 5490 - 39 - FINAL CONFIDENTIAL Despite early availability of electronic ordering and agreed standards, there are substantial benefits available from full implementation of electronic commerce across the range of transaction processes Examples from other industries Book industry trends n Electronic ordering has been in existence for many years, but its penetration is still low in comparison with other sectors (and countries) n Standards and systems are in place to allow other messages n Some players are developing ad hoc electronic commerce solutions with major trading partners (not always based on purest standards) n Book. Easy initiative provides Internet based solution to customer queries and ordering n Slow take-up of electronic invoicing and payment; plans to automate Booksellers Clearing House n Securicor Omega introducing parcel tracking and electronic Proof of Delivery service n Wholesalers offer simple information and ordering system n Distributors are addressing some root causes of queries by n Retail productivity: Tesco reports a step change in productivity through the introduction of technologies such as EDI, EPOS and bar coding 36 98% 92% 7 13 Stockturn 2 Delivery Accuracy Order lead times/days Source: Management Today, Nov 1996. Coca Cola Research Group 1994 n –developing post-invoicing (matching to actual contents delivered) Purchase cards: are proving beneficial for transactions under £ 1000, and being used in many large corporations. – –improved labelling n big reduction in transaction processing costs by use of purchasing cards - up to 50% savings are being achieved. Major benefits come from including smaller suppliers/customers into automated payment systems Fed Ex. launched an Internet shipment tracking service in 1994 – cost to handle tracking enquiry by Internet is $0. 08 against over $1. 00 through customer telephone centre

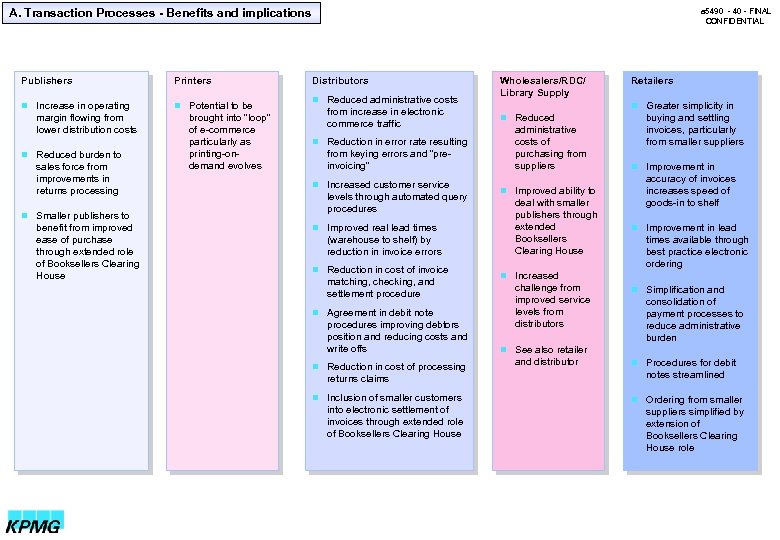

A. Transaction Processes - Benefits and implications Publishers Printers n Increase in operating n Potential to be margin flowing from lower distribution costs n Reduced burden to sales force from improvements in returns processing n Smaller publishers to benefit from improved ease of purchase through extended role of Booksellers Clearing House brought into “loop” of e-commerce particularly as printing-ondemand evolves a 5490 - 40 - FINAL CONFIDENTIAL Distributors n Reduced administrative costs from increase in electronic commerce traffic n Reduction in error rate resulting from keying errors and “preinvoicing” n Increased customer service levels through automated query procedures n Improved real lead times (warehouse to shelf) by reduction in invoice errors n Reduction in cost of invoice matching, checking, and settlement procedure n Agreement in debit note procedures improving debtors position and reducing costs and write offs n Reduction in cost of processing returns claims n Inclusion of smaller customers into electronic settlement of invoices through extended role of Booksellers Clearing House Wholesalers/RDC/ Library Supply Retailers n Greater simplicity in n Reduced administrative costs of purchasing from suppliers n Improved ability to deal with smaller publishers through extended Booksellers Clearing House buying and settling invoices, particularly from smaller suppliers n Improvement in accuracy of invoices increases speed of goods-in to shelf n Improvement in lead times available through best practice electronic ordering n Increased challenge from improved service levels from distributors n Simplification and consolidation of payment processes to reduce administrative burden n See also retailer and distributor n Procedures for debit notes streamlined n Ordering from smaller suppliers simplified by extension of Booksellers Clearing House role

A. Transaction Processes - Benefits and implications Publishers Printers n Increase in operating n Potential to be margin flowing from lower distribution costs n Reduced burden to sales force from improvements in returns processing n Smaller publishers to benefit from improved ease of purchase through extended role of Booksellers Clearing House brought into “loop” of e-commerce particularly as printing-ondemand evolves a 5490 - 40 - FINAL CONFIDENTIAL Distributors n Reduced administrative costs from increase in electronic commerce traffic n Reduction in error rate resulting from keying errors and “preinvoicing” n Increased customer service levels through automated query procedures n Improved real lead times (warehouse to shelf) by reduction in invoice errors n Reduction in cost of invoice matching, checking, and settlement procedure n Agreement in debit note procedures improving debtors position and reducing costs and write offs n Reduction in cost of processing returns claims n Inclusion of smaller customers into electronic settlement of invoices through extended role of Booksellers Clearing House Wholesalers/RDC/ Library Supply Retailers n Greater simplicity in n Reduced administrative costs of purchasing from suppliers n Improved ability to deal with smaller publishers through extended Booksellers Clearing House buying and settling invoices, particularly from smaller suppliers n Improvement in accuracy of invoices increases speed of goods-in to shelf n Improvement in lead times available through best practice electronic ordering n Increased challenge from improved service levels from distributors n Simplification and consolidation of payment processes to reduce administrative burden n See also retailer and distributor n Procedures for debit notes streamlined n Ordering from smaller suppliers simplified by extension of Booksellers Clearing House role

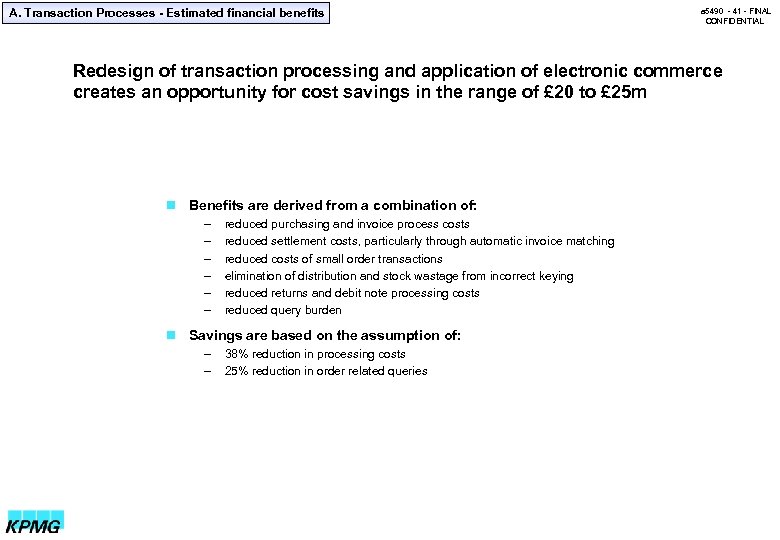

A. Transaction Processes - Estimated financial benefits a 5490 - 41 - FINAL CONFIDENTIAL Redesign of transaction processing and application of electronic commerce creates an opportunity for cost savings in the range of £ 20 to £ 25 m n Benefits are derived from a combination of: – reduced purchasing and invoice process costs – reduced settlement costs, particularly through automatic invoice matching – reduced costs of small order transactions – elimination of distribution and stock wastage from incorrect keying – reduced returns and debit note processing costs – reduced query burden n Savings are based on the assumption of: – 38% reduction in processing costs – 25% reduction in order related queries

A. Transaction Processes - Estimated financial benefits a 5490 - 41 - FINAL CONFIDENTIAL Redesign of transaction processing and application of electronic commerce creates an opportunity for cost savings in the range of £ 20 to £ 25 m n Benefits are derived from a combination of: – reduced purchasing and invoice process costs – reduced settlement costs, particularly through automatic invoice matching – reduced costs of small order transactions – elimination of distribution and stock wastage from incorrect keying – reduced returns and debit note processing costs – reduced query burden n Savings are based on the assumption of: – 38% reduction in processing costs – 25% reduction in order related queries

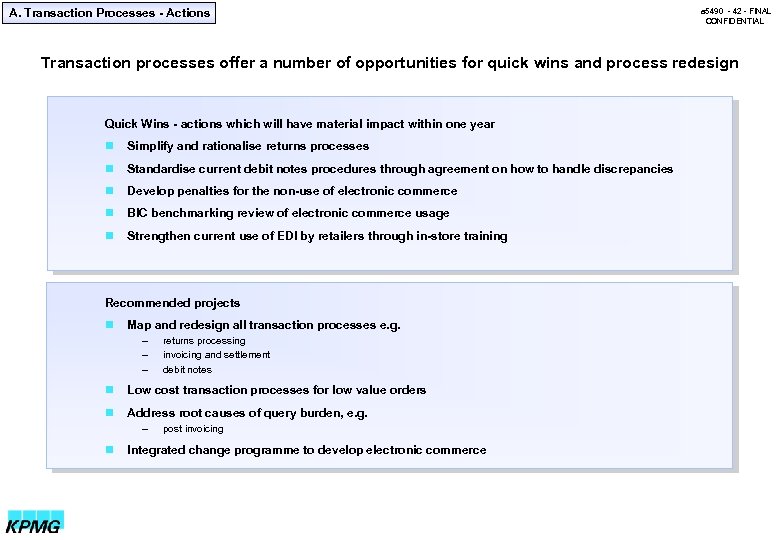

A. Transaction Processes - Actions a 5490 - 42 - FINAL CONFIDENTIAL Transaction processes offer a number of opportunities for quick wins and process redesign Quick Wins - actions which will have material impact within one year n Simplify and rationalise returns processes n Standardise current debit notes procedures through agreement on how to handle discrepancies n Develop penalties for the non-use of electronic commerce n BIC benchmarking review of electronic commerce usage n Strengthen current use of EDI by retailers through in-store training Recommended projects n Map and redesign all transaction processes e. g. – – – returns processing invoicing and settlement debit notes n Low cost transaction processes for low value orders n Address root causes of query burden, e. g. – n post invoicing Integrated change programme to develop electronic commerce

A. Transaction Processes - Actions a 5490 - 42 - FINAL CONFIDENTIAL Transaction processes offer a number of opportunities for quick wins and process redesign Quick Wins - actions which will have material impact within one year n Simplify and rationalise returns processes n Standardise current debit notes procedures through agreement on how to handle discrepancies n Develop penalties for the non-use of electronic commerce n BIC benchmarking review of electronic commerce usage n Strengthen current use of EDI by retailers through in-store training Recommended projects n Map and redesign all transaction processes e. g. – – – returns processing invoicing and settlement debit notes n Low cost transaction processes for low value orders n Address root causes of query burden, e. g. – n post invoicing Integrated change programme to develop electronic commerce

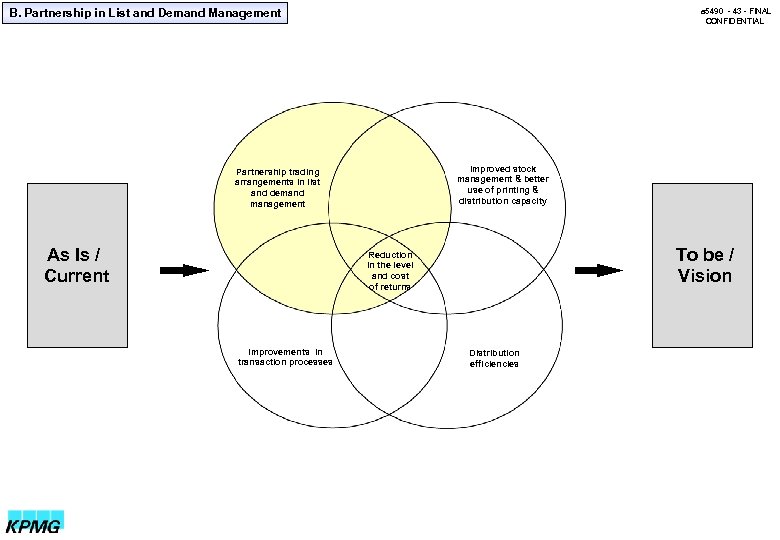

B. Partnership in List and Demand Management a 5490 - 43 - FINAL CONFIDENTIAL Improved stock management & better use of printing & distribution capacity Partnership trading arrangements in list and demand management As Is / Current To be / Vision Reduction in the level and cost of returns Improvements in transaction processes Distribution efficiencies

B. Partnership in List and Demand Management a 5490 - 43 - FINAL CONFIDENTIAL Improved stock management & better use of printing & distribution capacity Partnership trading arrangements in list and demand management As Is / Current To be / Vision Reduction in the level and cost of returns Improvements in transaction processes Distribution efficiencies

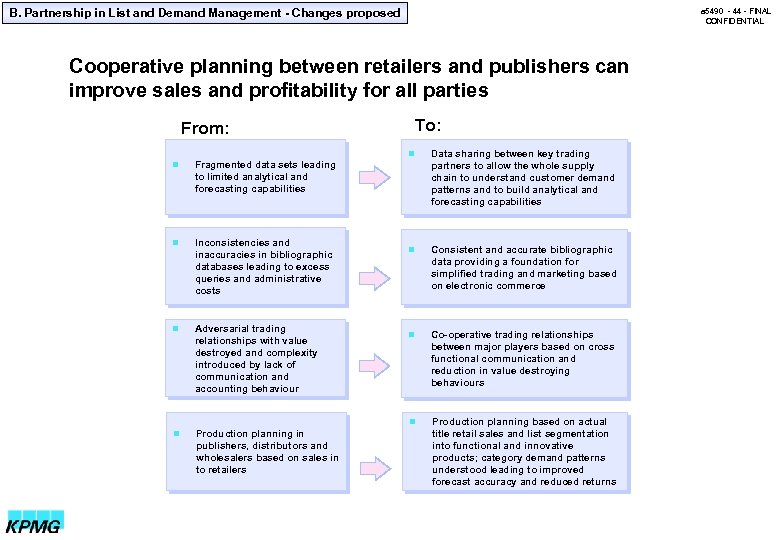

B. Partnership in List and Demand Management - Changes proposed a 5490 - 44 - FINAL CONFIDENTIAL Cooperative planning between retailers and publishers can improve sales and profitability for all parties From: To: n Inconsistencies and inaccuracies in bibliographic databases leading to excess queries and administrative costs n Adversarial trading relationships with value destroyed and complexity introduced by lack of communication and accounting behaviour n Production planning in publishers, distributors and wholesalers based on sales in to retailers n Consistent and accurate bibliographic data providing a foundation for simplified trading and marketing based on electronic commerce n Co-operative trading relationships between major players based on cross functional communication and reduction in value destroying behaviours Production planning based on actual title retail sales and list segmentation into functional and innovative products; category demand patterns understood leading to improved forecast accuracy and reduced returns Fragmented data sets leading to limited analytical and forecasting capabilities n Data sharing between key trading partners to allow the whole supply chain to understand customer demand patterns and to build analytical and forecasting capabilities n n

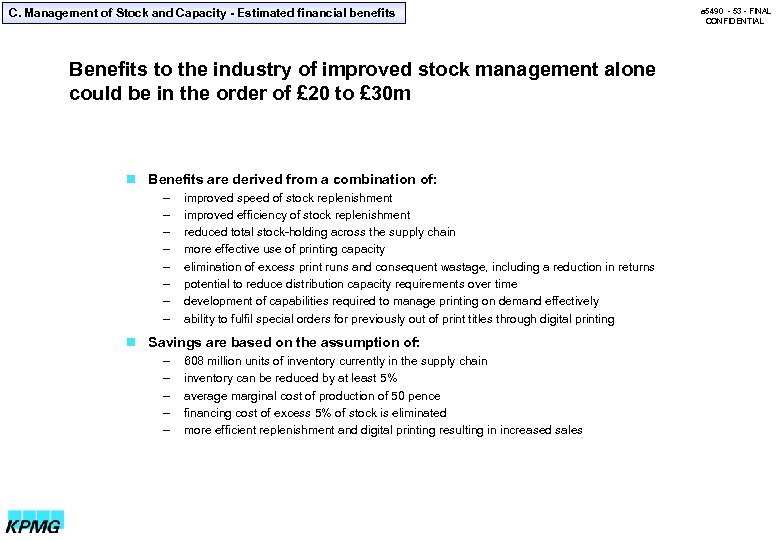

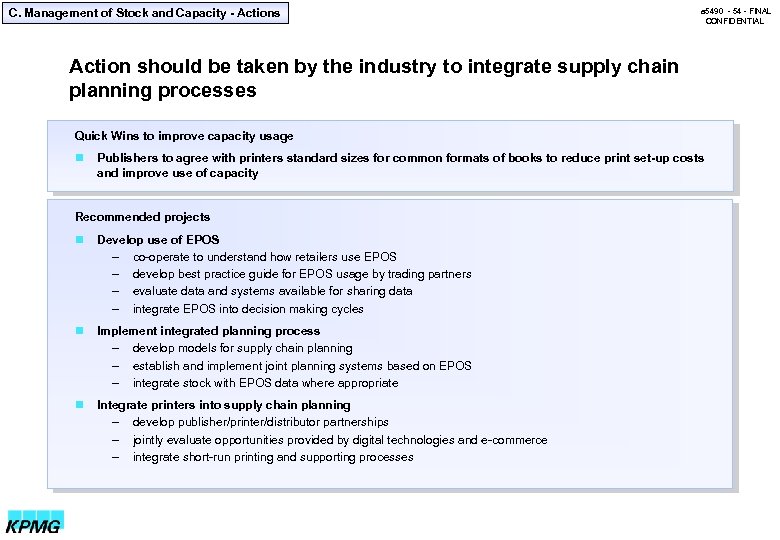

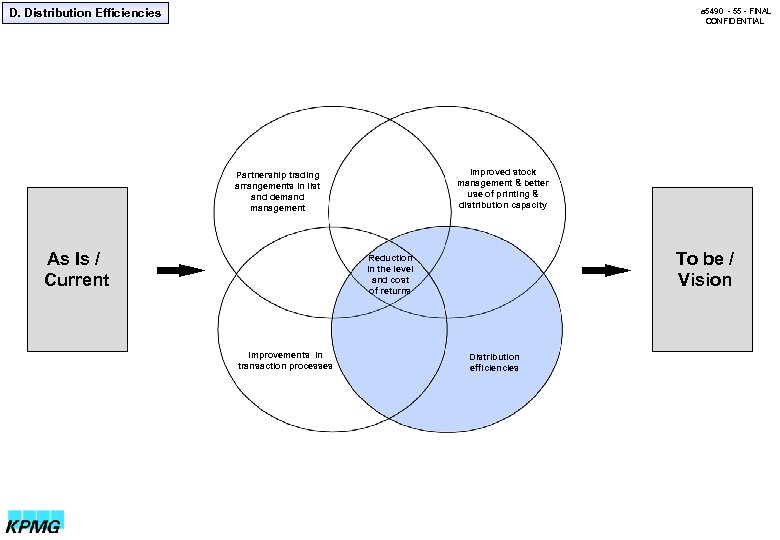

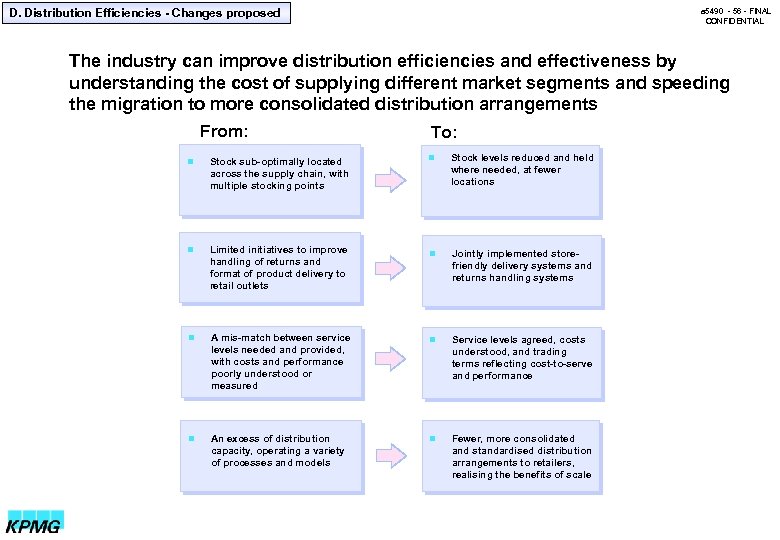

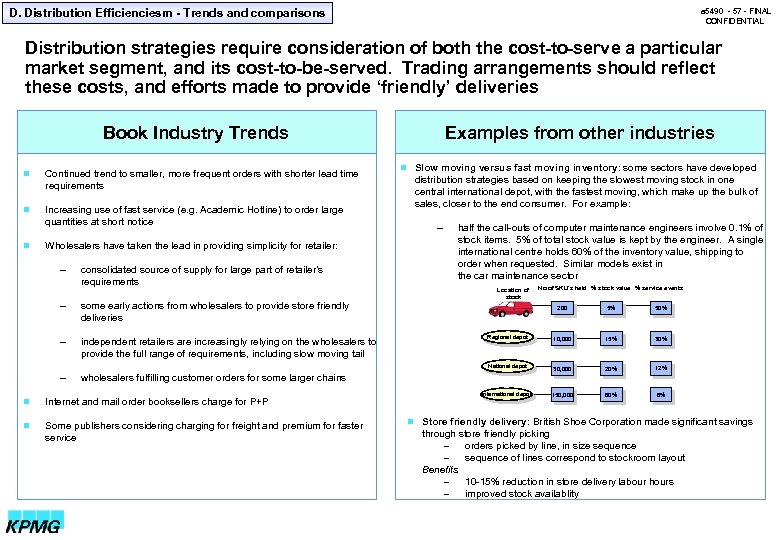

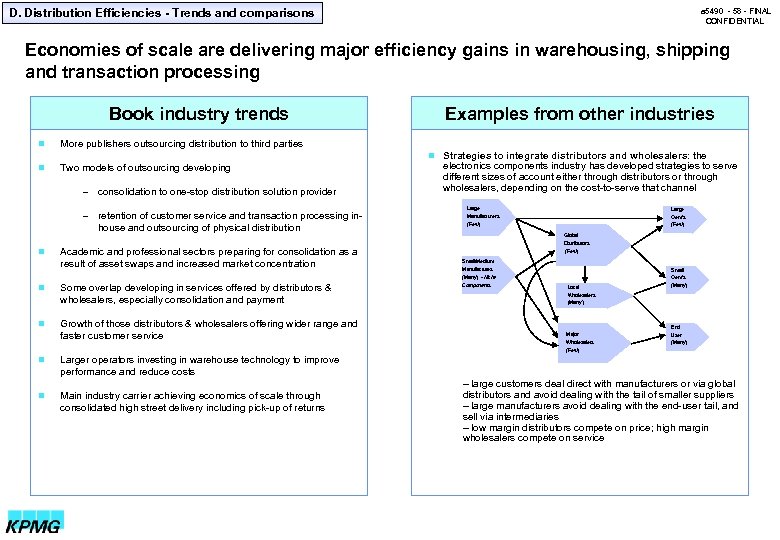

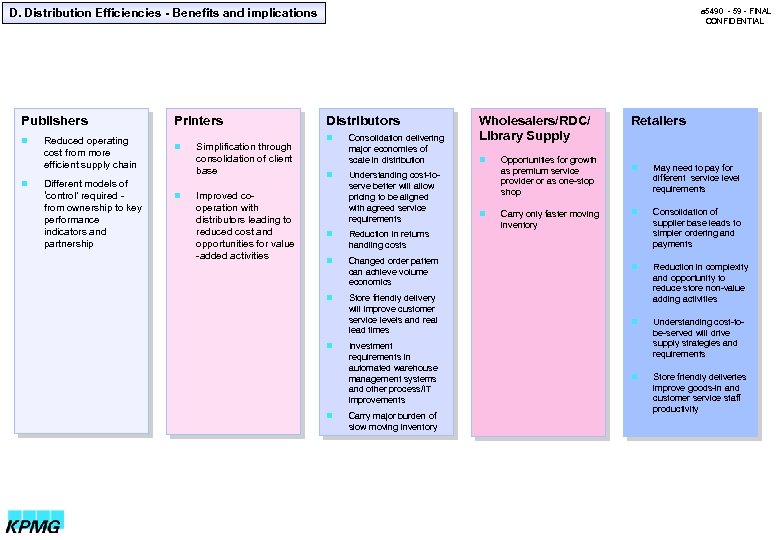

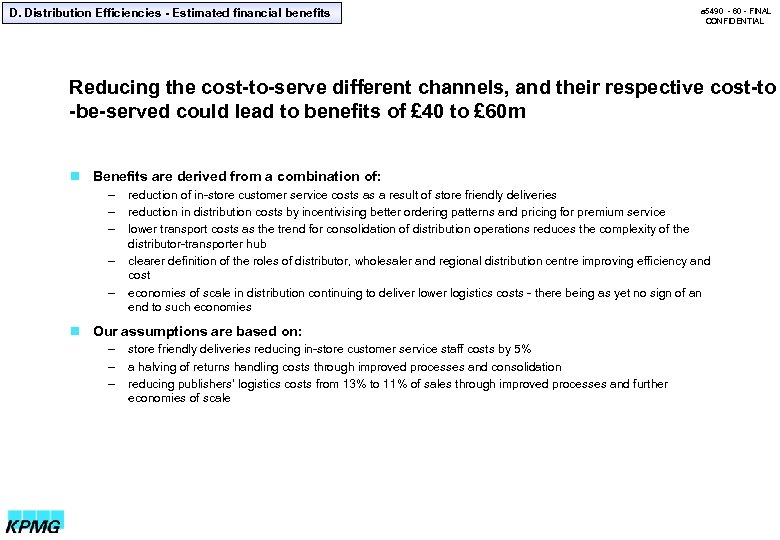

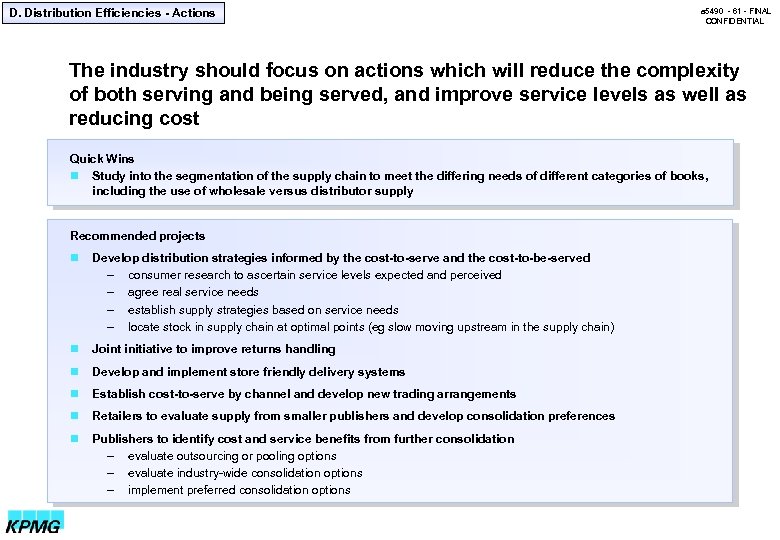

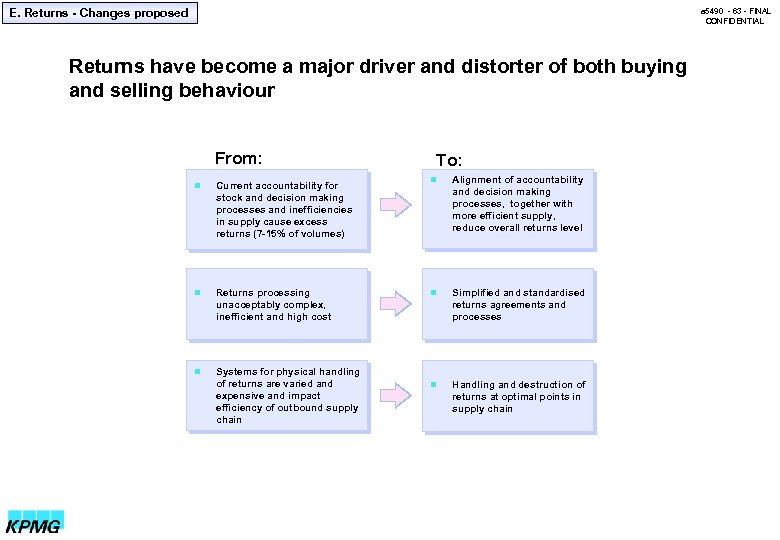

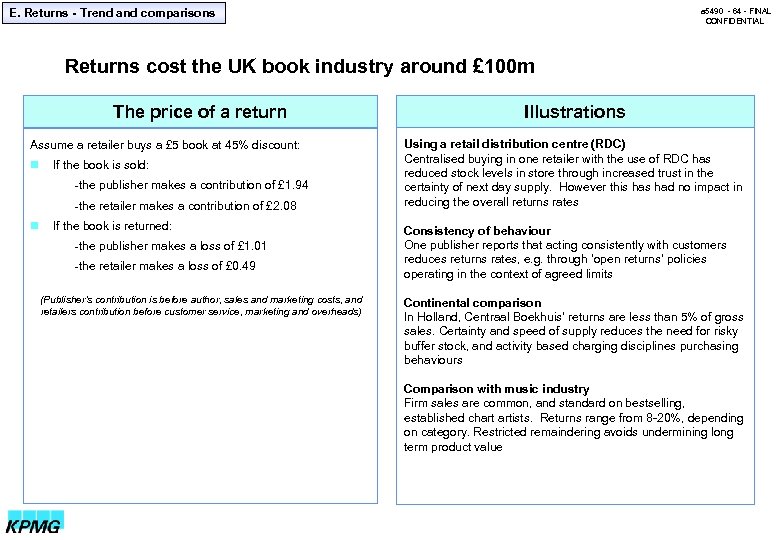

B. Partnership in List and Demand Management - Changes proposed a 5490 - 44 - FINAL CONFIDENTIAL Cooperative planning between retailers and publishers can improve sales and profitability for all parties From: To: n Inconsistencies and inaccuracies in bibliographic databases leading to excess queries and administrative costs n Adversarial trading relationships with value destroyed and complexity introduced by lack of communication and accounting behaviour n Production planning in publishers, distributors and wholesalers based on sales in to retailers n Consistent and accurate bibliographic data providing a foundation for simplified trading and marketing based on electronic commerce n Co-operative trading relationships between major players based on cross functional communication and reduction in value destroying behaviours Production planning based on actual title retail sales and list segmentation into functional and innovative products; category demand patterns understood leading to improved forecast accuracy and reduced returns Fragmented data sets leading to limited analytical and forecasting capabilities n Data sharing between key trading partners to allow the whole supply chain to understand customer demand patterns and to build analytical and forecasting capabilities n n