5f3cb73ff14c390afc3ca34a730e9518.ppt

- Количество слайдов: 19

A 2 Business Studies – External Influences Exchange Rates

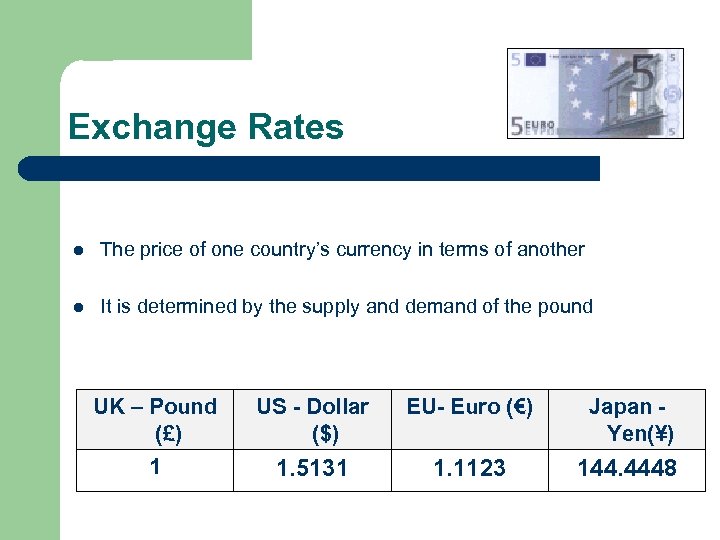

Exchange Rates l The price of one country’s currency in terms of another l It is determined by the supply and demand of the pound UK – Pound (£) US - Dollar ($) EU- Euro (€) Japan Yen(¥) 1 1. 5131 1. 1123 144. 4448

l Exports - goods sold in foreign markets l Imports - foreign goods brought into the market

Demand for pounds l Caused by: l Desire for UK goods/services Desire to save in the UK (higher interest rates) More tourism in the UK Speculators - believe pound will rise in future so buy now l l l Higher demand will push pound value up

Supply of pounds l May increase if: l Greater demand foreign goods Greater desire to save abroad More tourism abroad Speculators believe pound will fall in the future l l l Higher supply will push value of pound down

AS External Influences Exchange rate changes

Interest rates and exchange rates l High interest rates attract foreign investment and therefore demand for pounds which pushes the value of the pound up (exchange rate) l Low interest rates do not attract foreign investment and encourage investors to save abroad

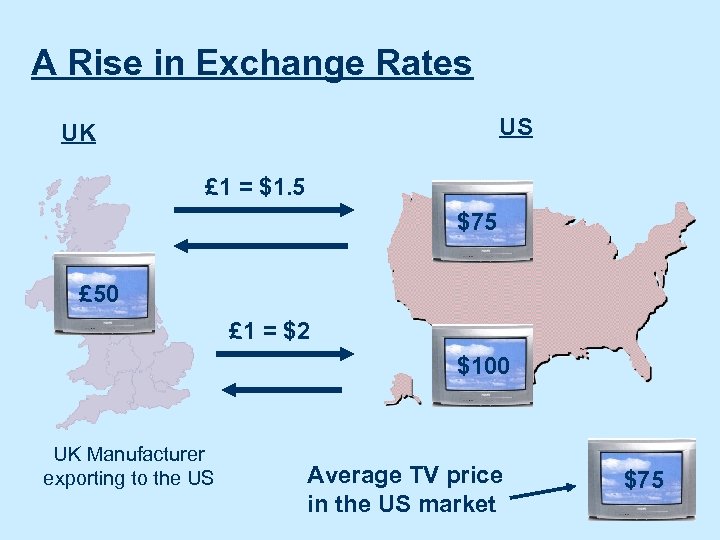

A Rise in Exchange Rates US UK £ 1 = $1. 5 $75 £ 50 £ 1 = $2 $100 UK Manufacturer exporting to the US Average TV price in the US market $75

A Rise in Exchange Rates l Exporters become less competitive abroad = sales fall l Imports are cheaper compared with home market produced goods l Firms buying imported raw materials reduce costs

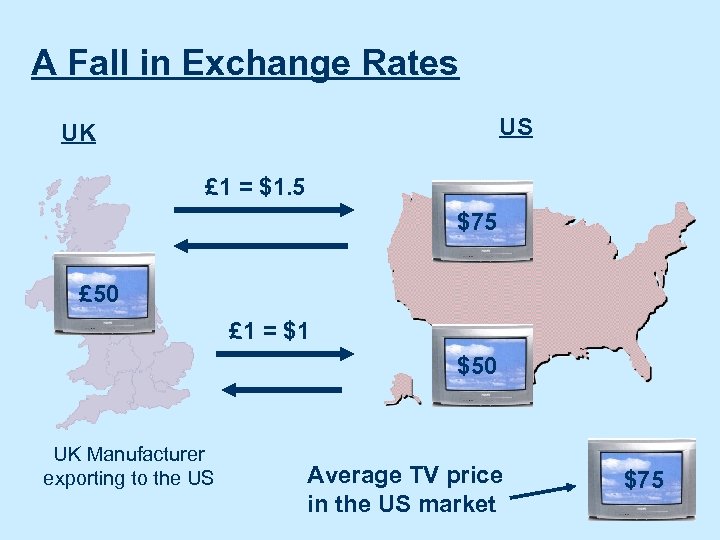

A Fall in Exchange Rates US UK £ 1 = $1. 5 $75 £ 50 £ 1 = $1 $50 UK Manufacturer exporting to the US Average TV price in the US market $75

A Fall in Exchange Rates l Exports are cheaper abroad and therefore more competitive = sales rise l Imports are more expensive l Firms importing raw materials will see costs rise

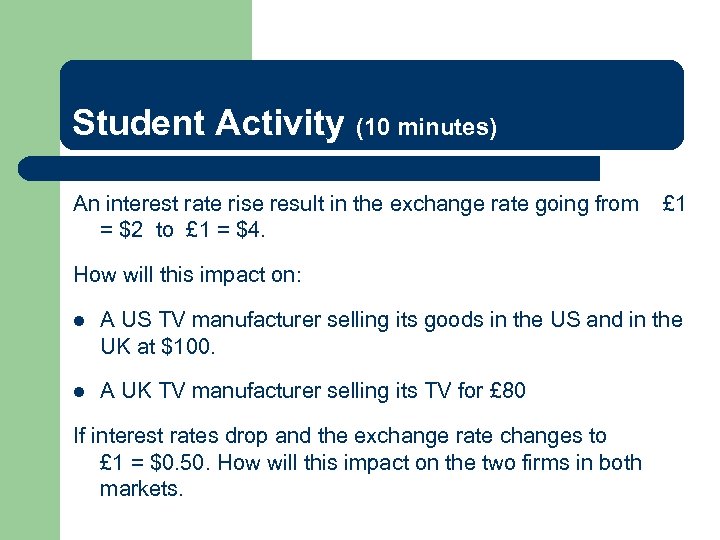

Student Activity (10 minutes) An interest rate rise result in the exchange rate going from = $2 to £ 1 = $4. £ 1 How will this impact on: l A US TV manufacturer selling its goods in the US and in the UK at $100. l A UK TV manufacturer selling its TV for £ 80 If interest rates drop and the exchange rate changes to £ 1 = $0. 50. How will this impact on the two firms in both markets.

Businesses affected by exchange rates l Businesses that export l Businesses selling goods in the UK competing against foreign imports l Businesses that purchase imported fuel, raw materials and components to produce their goods etc

Effects of an increase in exchange rates l l l e. g. before £ 1=$1. 50, now £ 1=$2 Price of exports sold abroad increases and import prices from abroad fall Price elasticity of goods determines how much their demand revenue falls Inelastic goods = less impact on sales, so higher revenue from more favourable exchange rate Likewise an importing company may get cheaper raw materials. However, domestic businesses may face cheaper competition from abroad.

Businesses benefiting from a strong pound. Will firms increase profit margins or pass the saving onto the consumer with lower prices?

Problems of fluctuating exchange rates l Rate can change from day to day as determined by supply and demand of currency l Importers & exporters will face difficulties in predicting sales and long term planning may not be accurate l Firms have ability to buy futures contracts - insurance that enables them to buy currency in advance at a guaranteed fixed rate. This reduces uncertainty l Fluctuations also make marketing and administration difficult e. g. changing pricing and advertising literature abroad

The effect of exchange rates on different types of business l Exporters - will exchange rate changes impact on good and make them more or less competitive. (availability of substitutes) l UK firms - are foreign firms becoming more competitive in home market? l Firms importing raw materials - will impact on costs l Exchange rates always must be considered when moving into another country. They are a great source of uncertainty.

Student Activity l Complete the questions related to the Jaguar case study.

Exam Style Question l A UK manufacturer selling its goods in the UK and US is facing a lower exchange rate (e. g. £ 1 = $1. 70 rather than $2. 00). How will this impact the manufacturer and what might they do about it?

5f3cb73ff14c390afc3ca34a730e9518.ppt