4dc591056b0ea881fbee54770008645a.ppt

- Количество слайдов: 32

9 International Financial Markets

Chapter Objectives Discuss the purposes, development, and financial centers of the international capital market Describe the international bond, international equity, and Eurocurrency markets Discuss the four primary functions of the foreign exchange market Explain how currencies are quoted and the different rates that are given Identify the main instruments and institutions of the foreign exchange market Explain why and how governments restrict currency convertibility 9 -2

Nintendo • Exchange rates affect financial performance • Convert foreign earnings into home currency • Rising home currency means lower earnings 9 -3

Capital Market System that allocates financial resources according to their most efficient uses Debt: Repay principal plus interest Ø Bond has timed principal & interest payments Equity: Part ownership of a company Ø Stock shares in financial gains or losses 9 -4

International Capital Market Network of people, firms, financial institutions, and governments borrowing and investing internationally Borrowers Ø Expands money supply Ø Reduces cost of money Lenders Ø Ø Spread / reduce risk Offset gains / losses 9 -5

International Capital Market Drivers Information technology Deregulation Financial instruments 9 -6

Offshore Financial Centers Operational center Extensive financial activity and currency trading Country or territory whose financial sector features few regulations and few, if any, taxes Booking center Mostly for bookkeeping and tax purposes 9 -7

Discussion Question What key factors are driving growth of the international capital market? 9 -8

Answer to Discussion Question Information technology is reducing the costs of global communication. Deregulation increases competition, lowers the cost of financial transactions, and opens national markets to global investing and borrowing. Innovative financial instruments expand the options available to lenders and borrowers. 9 -9

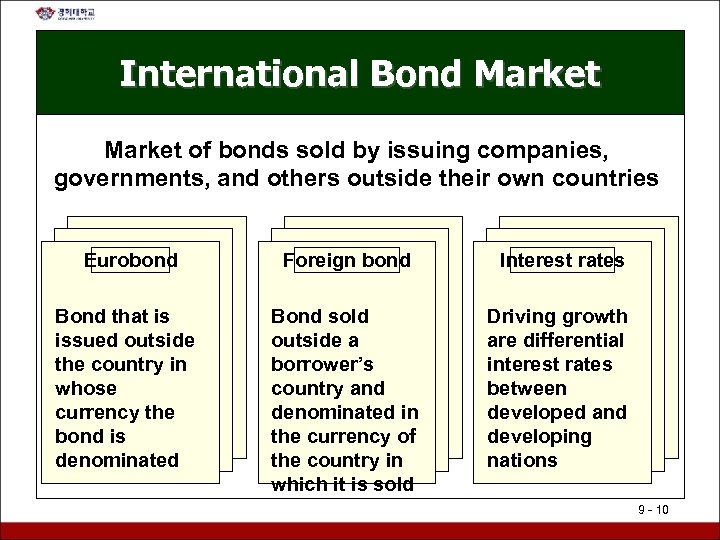

International Bond Market of bonds sold by issuing companies, governments, and others outside their own countries Eurobond Foreign bond Interest rates Bond that is issued outside the country in whose currency the bond is denominated Bond sold outside a borrower’s country and denominated in the currency of the country in which it is sold Driving growth are differential interest rates between developed and developing nations 9 - 10

International Equity Market of stocks bought and sold outside the issuer’s home country Privatization Emerging markets Investment banks Electronic markets 9 - 11

Eurocurrency Market Unregulated market of currencies banked outside their countries of origin Ø Ø Governments Commercial banks International companies Wealthy individuals 9 - 12

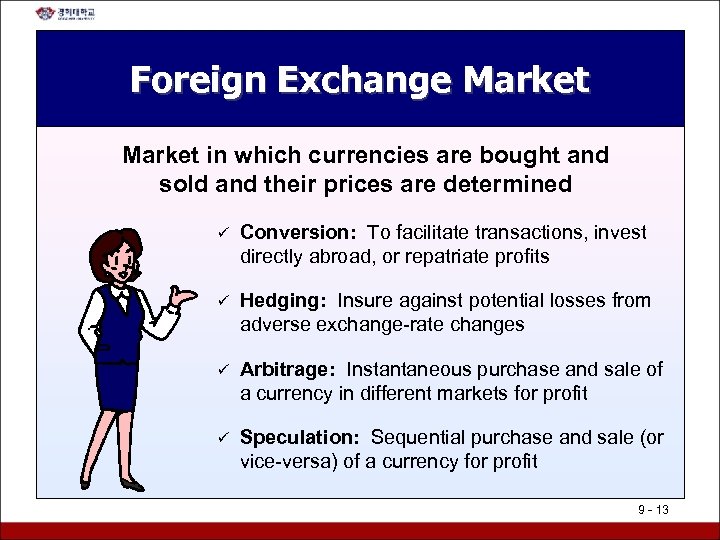

Foreign Exchange Market in which currencies are bought and sold and their prices are determined ü Conversion: To facilitate transactions, invest directly abroad, or repatriate profits ü Hedging: Insure against potential losses from adverse exchange-rate changes ü Arbitrage: Instantaneous purchase and sale of a currency in different markets for profit ü Speculation: Sequential purchase and sale (or vice-versa) of a currency for profit 9 - 13

Largest Currency Markets UK: $1. 33 trillion US: $0. 62 trillion Japan: $0. 24 trillion Source: */Kyodo/Newscom 9 - 14

Discussion Question Using the foreign exchange market to insure against potential losses from adverse changes in exchange rates is called currency _____. a. Arbitrage b. Hedging c. Speculation 9 - 15

Answer to Discussion Question Using the foreign exchange market to insure against potential losses from adverse changes in exchange rates is called currency _____. a. Arbitrage b. Hedging c. Speculation 9 - 16

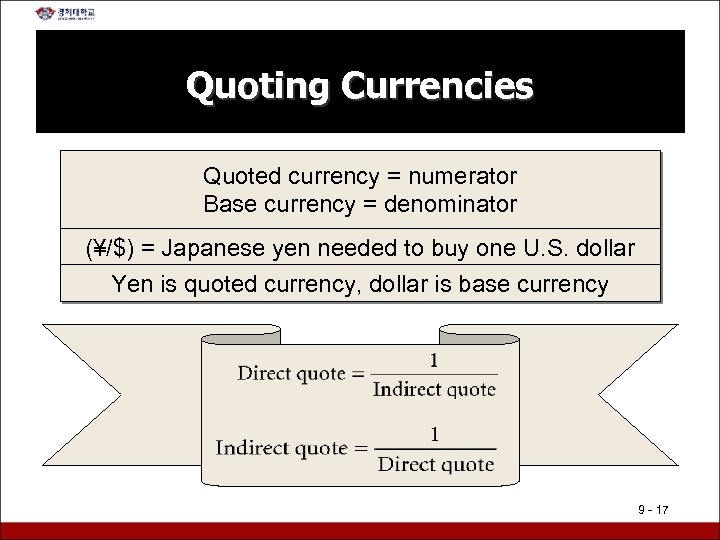

Quoting Currencies Quoted currency = numerator Base currency = denominator (¥/$) = Japanese yen needed to buy one U. S. dollar Yen is quoted currency, dollar is base currency 9 - 17

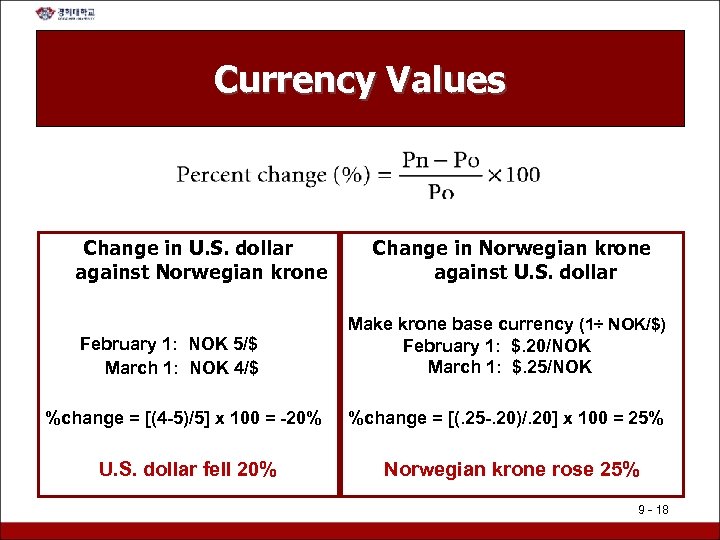

Currency Values Change in U. S. dollar against Norwegian krone February 1: NOK 5/$ March 1: NOK 4/$ %change = [(4 -5)/5] x 100 = -20% U. S. dollar fell 20% Change in Norwegian krone against U. S. dollar Make krone base currency (1÷ NOK/$) February 1: $. 20/NOK March 1: $. 25/NOK %change = [(. 25 -. 20)/. 20] x 100 = 25% Norwegian krone rose 25% 9 - 18

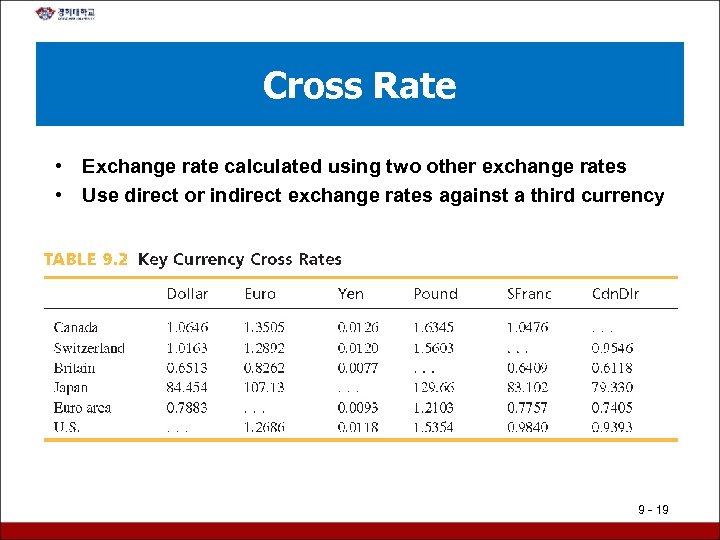

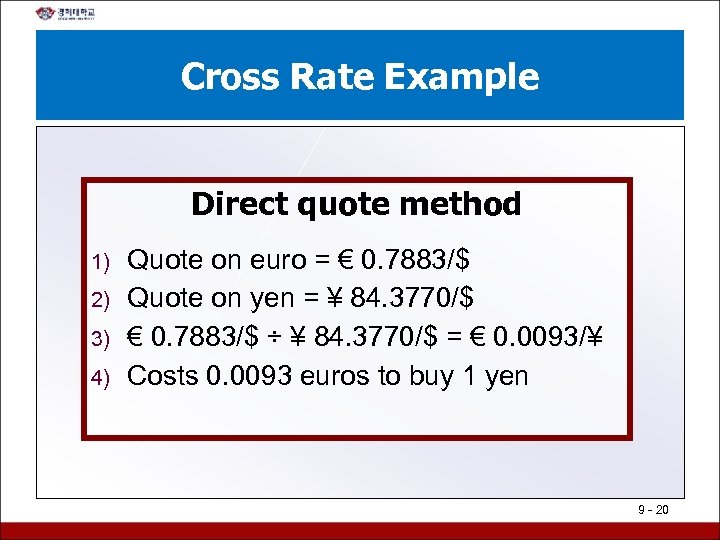

Cross Rate • Exchange rate calculated using two other exchange rates • Use direct or indirect exchange rates against a third currency 9 - 19

Cross Rate Example Direct quote method 1) 2) 3) 4) Quote on euro = € 0. 7883/$ Quote on yen = ¥ 84. 3770/$ € 0. 7883/$ ÷ ¥ 84. 3770/$ = € 0. 0093/¥ Costs 0. 0093 euros to buy 1 yen 9 - 20

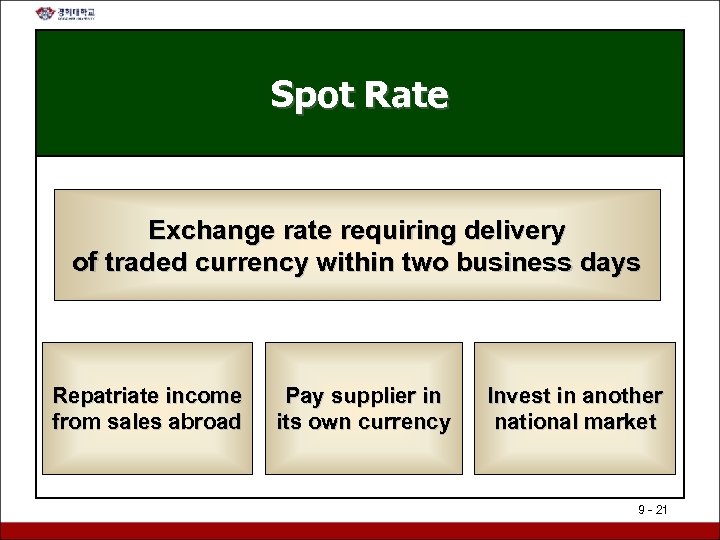

Spot Rate Exchange rate requiring delivery of traded currency within two business days Repatriate income from sales abroad Pay supplier in its own currency Invest in another national market 9 - 21

Forward Rate at which two parties will exchange currencies on a specified future date Ø Forward Contracts Ø Reduce exchange-rate risk Ø 30, 90, 180 days or custom lengths 9 - 22

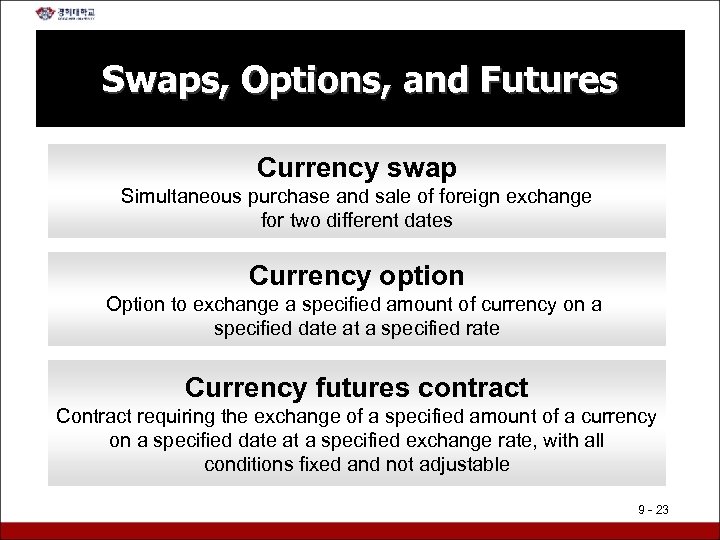

Swaps, Options, and Futures Currency swap Simultaneous purchase and sale of foreign exchange for two different dates Currency option Option to exchange a specified amount of currency on a specified date at a specified rate Currency futures contract Contract requiring the exchange of a specified amount of a currency on a specified date at a specified exchange rate, with all conditions fixed and not adjustable 9 - 23

Discussion Question Why is exchange rate risk important to companies involved in international business? 9 - 24

Answer to Discussion Question Exchange-rate risk is important because it can jeopardize profits from current and future international transactions. 9 - 25

24 -Hour Trading 9 - 26

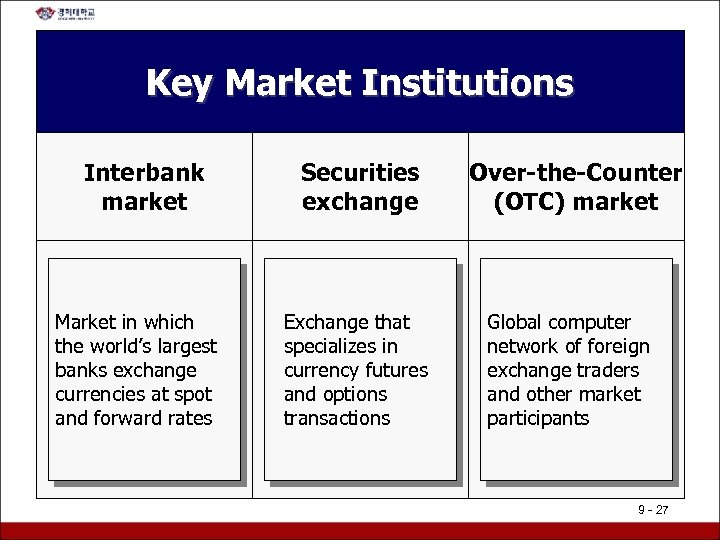

Key Market Institutions Interbank market Market in which the world’s largest banks exchange currencies at spot and forward rates Securities exchange Exchange that specializes in currency futures and options transactions Over-the-Counter (OTC) market Global computer network of foreign exchange traders and other market participants 9 - 27

Manager’s Briefcase: Managing Foreign Exchange 1. Match Needs to Providers 2. Work with the Major Banks 3. Consolidate Multiple Transactions 4. Get the Best Rate Possible 5. Embrace Information Technology 9 - 28

Goals of Currency Restriction Preserve hard currency to repay debts owed to other nations Preserve hard currency to pay for imports and finance trade deficits Protect a currency from speculators Constrain individuals and companies from investing abroad 9 - 29

Currency Restriction Policies Central bank approval Import licenses Multiple exchange rate system Import deposit requirements Quantity restrictions What’s a firm to do? Countertrade 9 - 30

Discussion Question A currency that trades freely in the foreign exchange market is called a _____ currency. a. Cross b. Vehicle c. Convertible 9 - 31

Answer to Discussion Question A currency that trades freely in the foreign exchange market is called a _____ currency. a. Cross b. Vehicle c. Convertible 9 - 32

4dc591056b0ea881fbee54770008645a.ppt