f20b5c502d7b7650ba9430dd2cb6012b.ppt

- Количество слайдов: 38

9 -1 CHAPTER 9 The Cost of Capital Components Debt Preferred Common Equity WACC MCC IOS © 1998 The Dryden Press

9 -1 CHAPTER 9 The Cost of Capital Components Debt Preferred Common Equity WACC MCC IOS © 1998 The Dryden Press

9 -2 What types of long-term capital do firms use? Long-term debt Preferred stock Common equity: Retained earnings New common stock © 1998 The Dryden Press

9 -2 What types of long-term capital do firms use? Long-term debt Preferred stock Common equity: Retained earnings New common stock © 1998 The Dryden Press

9 -3 Should we focus on before-tax or after-tax capital costs? Stockholders focus on A-T CFs. Thus, focus on A-T capital costs, i. e. , use A-T costs in WACC. Only kd needs adjustment. © 1998 The Dryden Press

9 -3 Should we focus on before-tax or after-tax capital costs? Stockholders focus on A-T CFs. Thus, focus on A-T capital costs, i. e. , use A-T costs in WACC. Only kd needs adjustment. © 1998 The Dryden Press

9 -4 Should we focus on historical (embedded) costs or new (marginal) costs? The cost of capital is used primarily to make decisions which involve raising new capital. So, focus on today’s marginal costs (for WACC). © 1998 The Dryden Press

9 -4 Should we focus on historical (embedded) costs or new (marginal) costs? The cost of capital is used primarily to make decisions which involve raising new capital. So, focus on today’s marginal costs (for WACC). © 1998 The Dryden Press

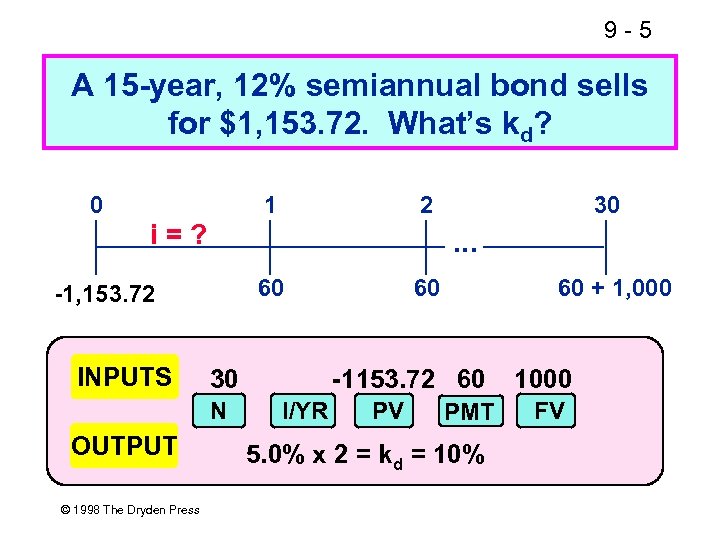

9 -5 A 15 -year, 12% semiannual bond sells for $1, 153. 72. What’s kd? 0 1 i=? 60 30 N OUTPUT © 1998 The Dryden Press 30 . . . -1, 153. 72 INPUTS 2 60 60 + 1, 000 -1153. 72 60 I/YR PV PMT 5. 0% x 2 = kd = 10% 1000 FV

9 -5 A 15 -year, 12% semiannual bond sells for $1, 153. 72. What’s kd? 0 1 i=? 60 30 N OUTPUT © 1998 The Dryden Press 30 . . . -1, 153. 72 INPUTS 2 60 60 + 1, 000 -1153. 72 60 I/YR PV PMT 5. 0% x 2 = kd = 10% 1000 FV

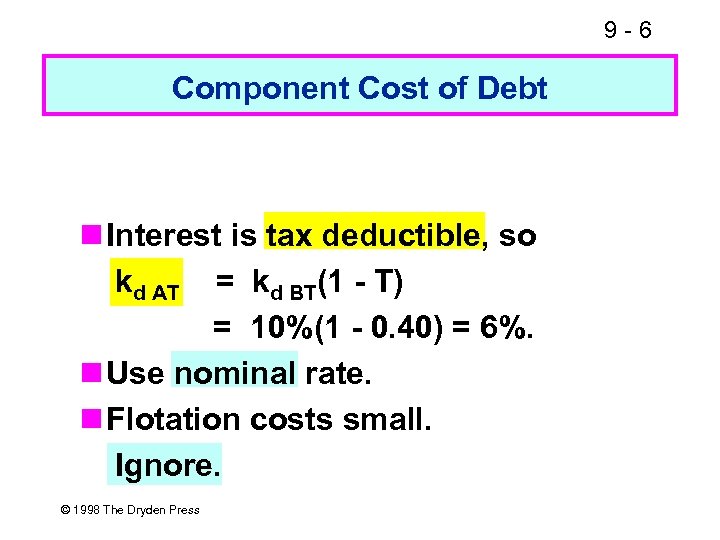

9 -6 Component Cost of Debt Interest is tax deductible, so kd AT = kd BT(1 - T) = 10%(1 - 0. 40) = 6%. Use nominal rate. Flotation costs small. Ignore. © 1998 The Dryden Press

9 -6 Component Cost of Debt Interest is tax deductible, so kd AT = kd BT(1 - T) = 10%(1 - 0. 40) = 6%. Use nominal rate. Flotation costs small. Ignore. © 1998 The Dryden Press

9 -7 What’s the cost of preferred stock? PP = $113. 10; 10%Q; Par = $100; F = $2. Use this formula: © 1998 The Dryden Press

9 -7 What’s the cost of preferred stock? PP = $113. 10; 10%Q; Par = $100; F = $2. Use this formula: © 1998 The Dryden Press

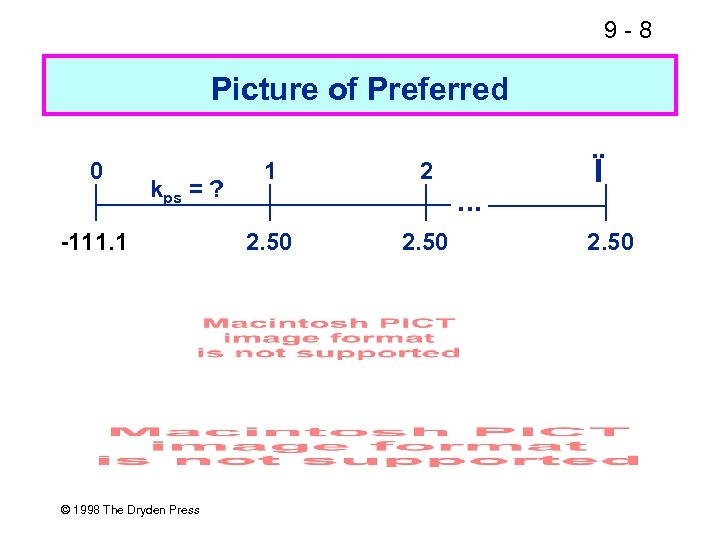

9 -8 Picture of Preferred 0 kps = ? -111. 1 © 1998 The Dryden Press 1 2 2. 50 . . . Ï 2. 50

9 -8 Picture of Preferred 0 kps = ? -111. 1 © 1998 The Dryden Press 1 2 2. 50 . . . Ï 2. 50

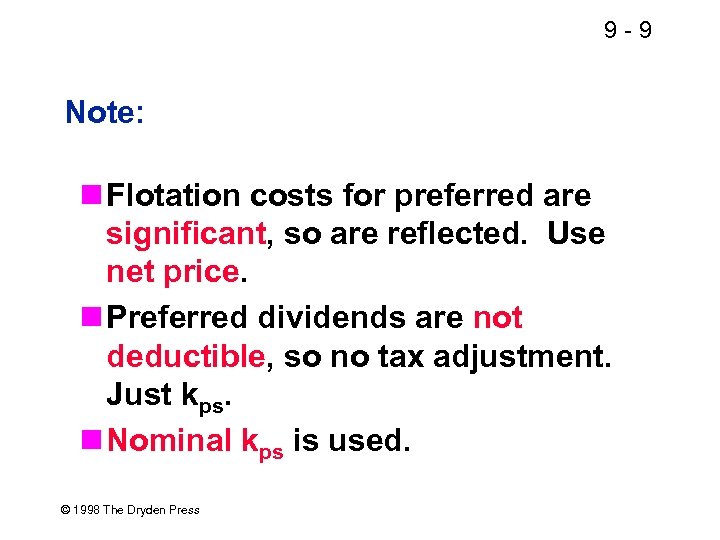

9 -9 Note: Flotation costs for preferred are significant, so are reflected. Use net price. Preferred dividends are not deductible, so no tax adjustment. Just kps. Nominal kps is used. © 1998 The Dryden Press

9 -9 Note: Flotation costs for preferred are significant, so are reflected. Use net price. Preferred dividends are not deductible, so no tax adjustment. Just kps. Nominal kps is used. © 1998 The Dryden Press

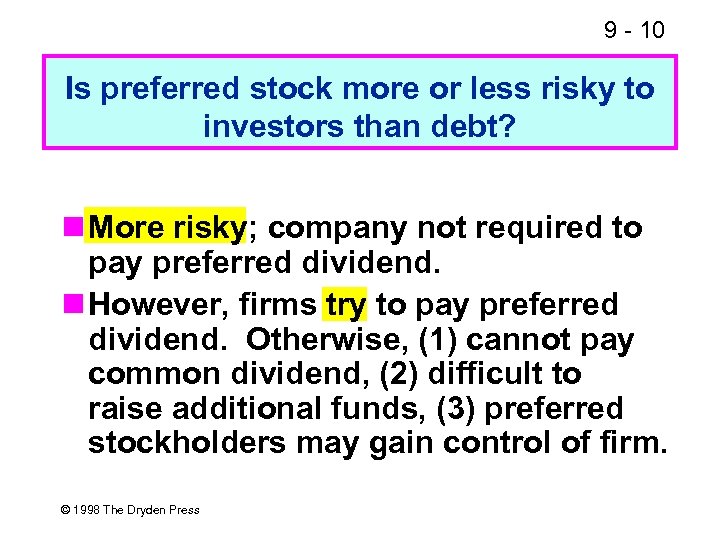

9 - 10 Is preferred stock more or less risky to investors than debt? More risky; company not required to pay preferred dividend. However, firms try to pay preferred dividend. Otherwise, (1) cannot pay common dividend, (2) difficult to raise additional funds, (3) preferred stockholders may gain control of firm. © 1998 The Dryden Press

9 - 10 Is preferred stock more or less risky to investors than debt? More risky; company not required to pay preferred dividend. However, firms try to pay preferred dividend. Otherwise, (1) cannot pay common dividend, (2) difficult to raise additional funds, (3) preferred stockholders may gain control of firm. © 1998 The Dryden Press

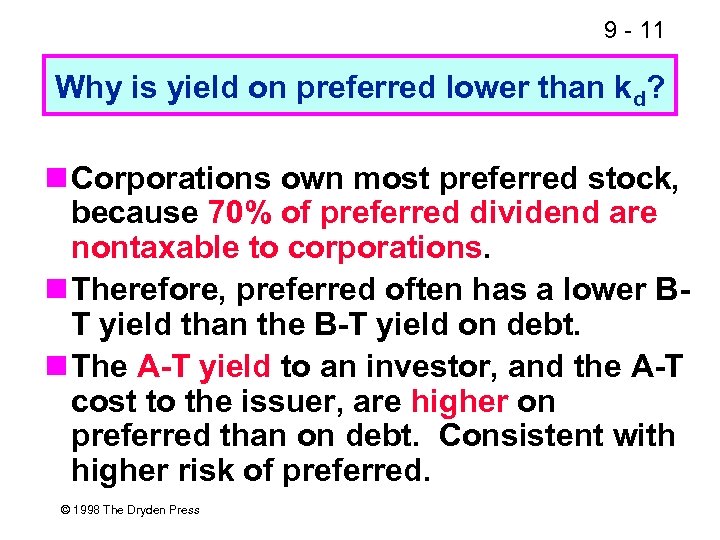

9 - 11 Why is yield on preferred lower than kd? Corporations own most preferred stock, because 70% of preferred dividend are nontaxable to corporations. Therefore, preferred often has a lower BT yield than the B-T yield on debt. The A-T yield to an investor, and the A-T cost to the issuer, are higher on preferred than on debt. Consistent with higher risk of preferred. © 1998 The Dryden Press

9 - 11 Why is yield on preferred lower than kd? Corporations own most preferred stock, because 70% of preferred dividend are nontaxable to corporations. Therefore, preferred often has a lower BT yield than the B-T yield on debt. The A-T yield to an investor, and the A-T cost to the issuer, are higher on preferred than on debt. Consistent with higher risk of preferred. © 1998 The Dryden Press

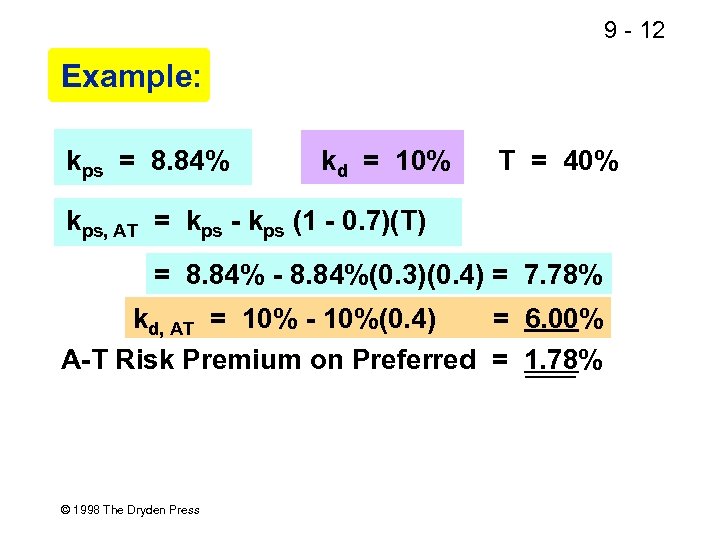

9 - 12 Example: kps = 8. 84% kd = 10% T = 40% kps, AT = kps - kps (1 - 0. 7)(T) = 8. 84% - 8. 84%(0. 3)(0. 4) = 7. 78% kd, AT = 10% - 10%(0. 4) = 6. 00% A-T Risk Premium on Preferred = 1. 78% © 1998 The Dryden Press

9 - 12 Example: kps = 8. 84% kd = 10% T = 40% kps, AT = kps - kps (1 - 0. 7)(T) = 8. 84% - 8. 84%(0. 3)(0. 4) = 7. 78% kd, AT = 10% - 10%(0. 4) = 6. 00% A-T Risk Premium on Preferred = 1. 78% © 1998 The Dryden Press

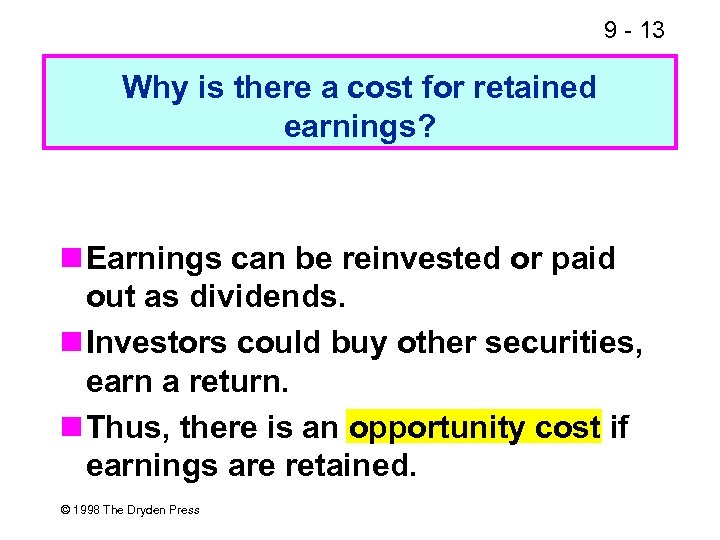

9 - 13 Why is there a cost for retained earnings? Earnings can be reinvested or paid out as dividends. Investors could buy other securities, earn a return. Thus, there is an opportunity cost if earnings are retained. © 1998 The Dryden Press

9 - 13 Why is there a cost for retained earnings? Earnings can be reinvested or paid out as dividends. Investors could buy other securities, earn a return. Thus, there is an opportunity cost if earnings are retained. © 1998 The Dryden Press

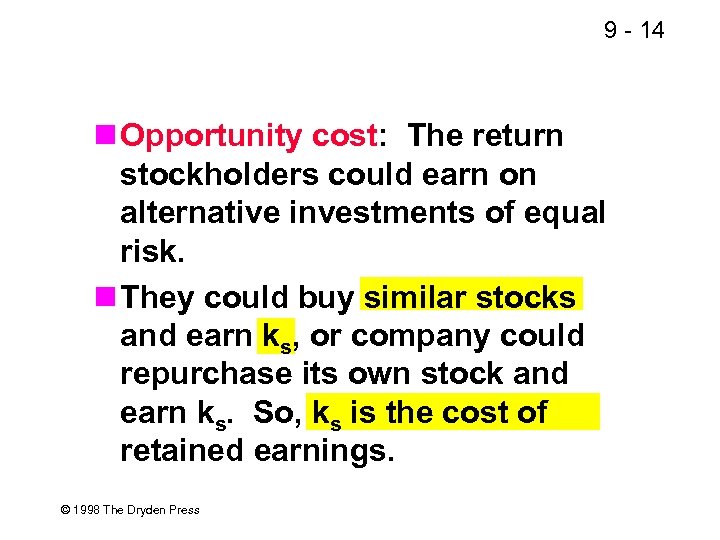

9 - 14 Opportunity cost: The return stockholders could earn on alternative investments of equal risk. They could buy similar stocks and earn ks, or company could repurchase its own stock and earn ks. So, ks is the cost of retained earnings. © 1998 The Dryden Press

9 - 14 Opportunity cost: The return stockholders could earn on alternative investments of equal risk. They could buy similar stocks and earn ks, or company could repurchase its own stock and earn ks. So, ks is the cost of retained earnings. © 1998 The Dryden Press

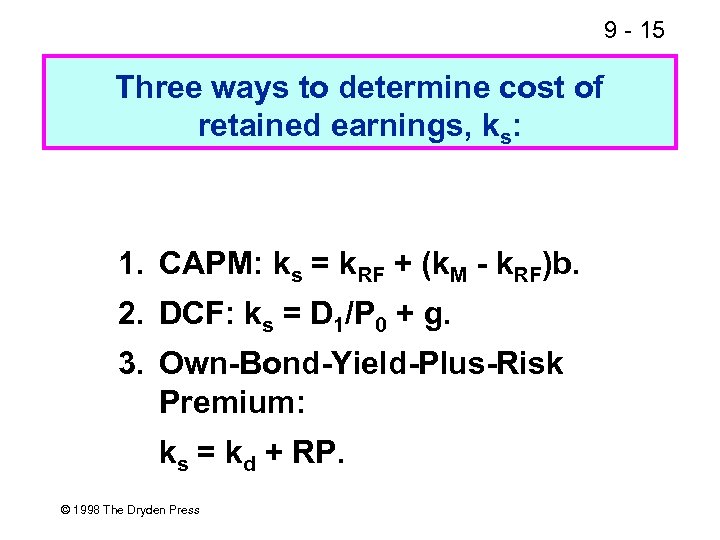

9 - 15 Three ways to determine cost of retained earnings, ks: 1. CAPM: ks = k. RF + (k. M - k. RF)b. 2. DCF: ks = D 1/P 0 + g. 3. Own-Bond-Yield-Plus-Risk Premium: ks = kd + RP. © 1998 The Dryden Press

9 - 15 Three ways to determine cost of retained earnings, ks: 1. CAPM: ks = k. RF + (k. M - k. RF)b. 2. DCF: ks = D 1/P 0 + g. 3. Own-Bond-Yield-Plus-Risk Premium: ks = kd + RP. © 1998 The Dryden Press

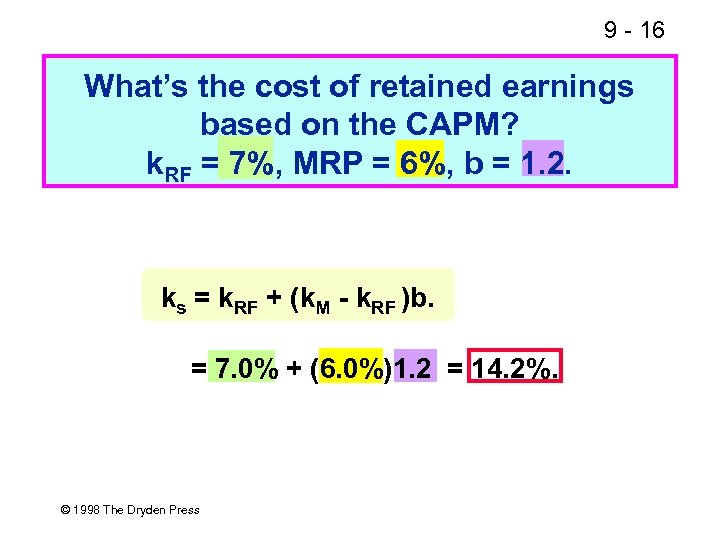

9 - 16 What’s the cost of retained earnings based on the CAPM? k. RF = 7%, MRP = 6%, b = 1. 2. ks = k. RF + (k. M - k. RF )b. = 7. 0% + (6. 0%)1. 2 = 14. 2%. © 1998 The Dryden Press

9 - 16 What’s the cost of retained earnings based on the CAPM? k. RF = 7%, MRP = 6%, b = 1. 2. ks = k. RF + (k. M - k. RF )b. = 7. 0% + (6. 0%)1. 2 = 14. 2%. © 1998 The Dryden Press

9 - 17 What’s the DCF cost of retained earnings, ks? Given: D 0 = $4. 19; P 0 = $50; g = 5%. © 1998 The Dryden Press

9 - 17 What’s the DCF cost of retained earnings, ks? Given: D 0 = $4. 19; P 0 = $50; g = 5%. © 1998 The Dryden Press

9 - 18 Suppose the company has been earning 15% on equity (ROE = 15%) and retaining 35% (dividend payout = 65%), and this situation is expected to continue. What’s the expected future g? © 1998 The Dryden Press

9 - 18 Suppose the company has been earning 15% on equity (ROE = 15%) and retaining 35% (dividend payout = 65%), and this situation is expected to continue. What’s the expected future g? © 1998 The Dryden Press

9 - 19 Retention growth rate: g = b(ROE) = 0. 35(15%) = 5. 25%. Here b = Fraction retained. Close to g = 5% given earlier. Think of bank account paying 10% with b = 0, b = 1. 0, and b = 0. 5. What’s g? © 1998 The Dryden Press

9 - 19 Retention growth rate: g = b(ROE) = 0. 35(15%) = 5. 25%. Here b = Fraction retained. Close to g = 5% given earlier. Think of bank account paying 10% with b = 0, b = 1. 0, and b = 0. 5. What’s g? © 1998 The Dryden Press

9 - 20 Could DCF methodology be applied if g is not constant? YES, nonconstant g stocks are expected to have constant g at some point, generally in 5 to 10 years. But calculations get complicated. © 1998 The Dryden Press

9 - 20 Could DCF methodology be applied if g is not constant? YES, nonconstant g stocks are expected to have constant g at some point, generally in 5 to 10 years. But calculations get complicated. © 1998 The Dryden Press

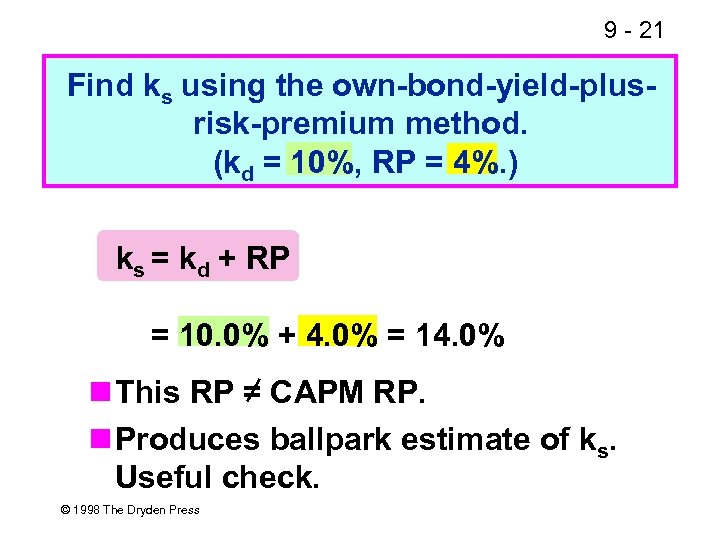

9 - 21 Find ks using the own-bond-yield-plusrisk-premium method. (kd = 10%, RP = 4%. ) ks = kd + RP = 10. 0% + 4. 0% = 14. 0% This RP = CAPM RP. Produces ballpark estimate of ks. Useful check. © 1998 The Dryden Press

9 - 21 Find ks using the own-bond-yield-plusrisk-premium method. (kd = 10%, RP = 4%. ) ks = kd + RP = 10. 0% + 4. 0% = 14. 0% This RP = CAPM RP. Produces ballpark estimate of ks. Useful check. © 1998 The Dryden Press

9 - 22 What’s a reasonable final estimate of ks? © 1998 The Dryden Press

9 - 22 What’s a reasonable final estimate of ks? © 1998 The Dryden Press

9 - 23 How do we find the cost of new common stock, ke? Use DCF formula, but adjust P 0 for flotation cost. End up with ke > ks. © 1998 The Dryden Press

9 - 23 How do we find the cost of new common stock, ke? Use DCF formula, but adjust P 0 for flotation cost. End up with ke > ks. © 1998 The Dryden Press

9 - 24 New common, F = 15%: © 1998 The Dryden Press

9 - 24 New common, F = 15%: © 1998 The Dryden Press

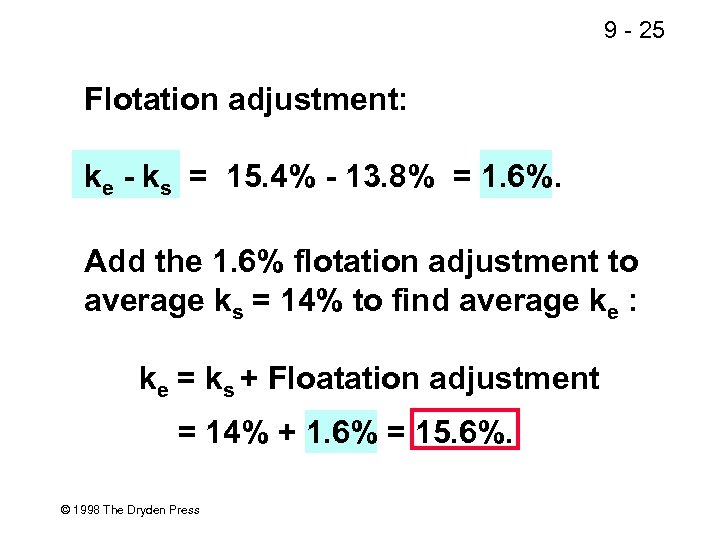

9 - 25 Flotation adjustment: ke - ks = 15. 4% - 13. 8% = 1. 6%. Add the 1. 6% flotation adjustment to average ks = 14% to find average ke : ke = ks + Floatation adjustment = 14% + 1. 6% = 15. 6%. © 1998 The Dryden Press

9 - 25 Flotation adjustment: ke - ks = 15. 4% - 13. 8% = 1. 6%. Add the 1. 6% flotation adjustment to average ks = 14% to find average ke : ke = ks + Floatation adjustment = 14% + 1. 6% = 15. 6%. © 1998 The Dryden Press

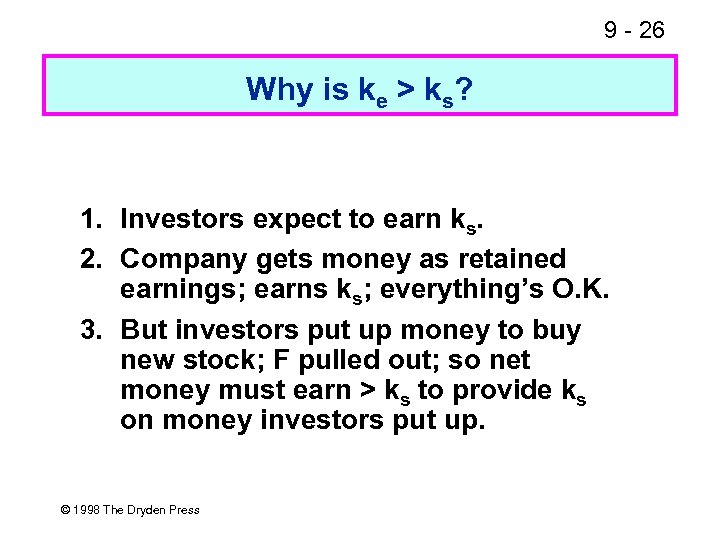

9 - 26 Why is ke > ks? 1. Investors expect to earn ks. 2. Company gets money as retained earnings; earns ks; everything’s O. K. 3. But investors put up money to buy new stock; F pulled out; so net money must earn > ks to provide ks on money investors put up. © 1998 The Dryden Press

9 - 26 Why is ke > ks? 1. Investors expect to earn ks. 2. Company gets money as retained earnings; earns ks; everything’s O. K. 3. But investors put up money to buy new stock; F pulled out; so net money must earn > ks to provide ks on money investors put up. © 1998 The Dryden Press

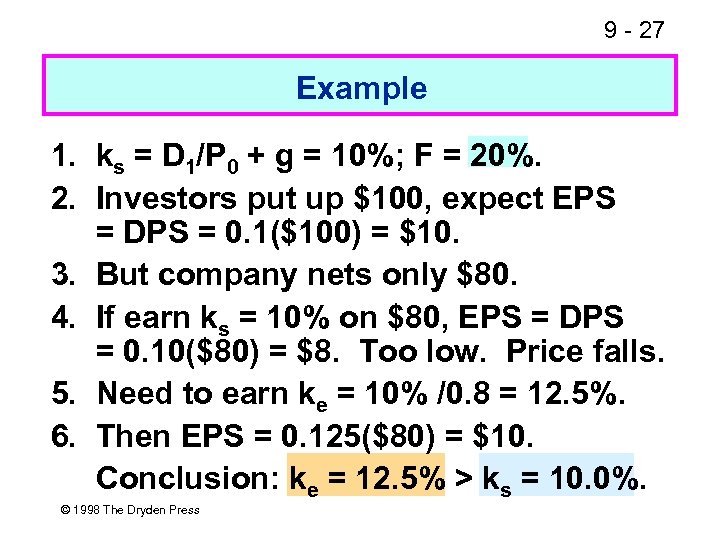

9 - 27 Example 1. ks = D 1/P 0 + g = 10%; F = 20%. 2. Investors put up $100, expect EPS = DPS = 0. 1($100) = $10. 3. But company nets only $80. 4. If earn ks = 10% on $80, EPS = DPS = 0. 10($80) = $8. Too low. Price falls. 5. Need to earn ke = 10% /0. 8 = 12. 5%. 6. Then EPS = 0. 125($80) = $10. Conclusion: ke = 12. 5% > ks = 10. 0%. © 1998 The Dryden Press

9 - 27 Example 1. ks = D 1/P 0 + g = 10%; F = 20%. 2. Investors put up $100, expect EPS = DPS = 0. 1($100) = $10. 3. But company nets only $80. 4. If earn ks = 10% on $80, EPS = DPS = 0. 10($80) = $8. Too low. Price falls. 5. Need to earn ke = 10% /0. 8 = 12. 5%. 6. Then EPS = 0. 125($80) = $10. Conclusion: ke = 12. 5% > ks = 10. 0%. © 1998 The Dryden Press

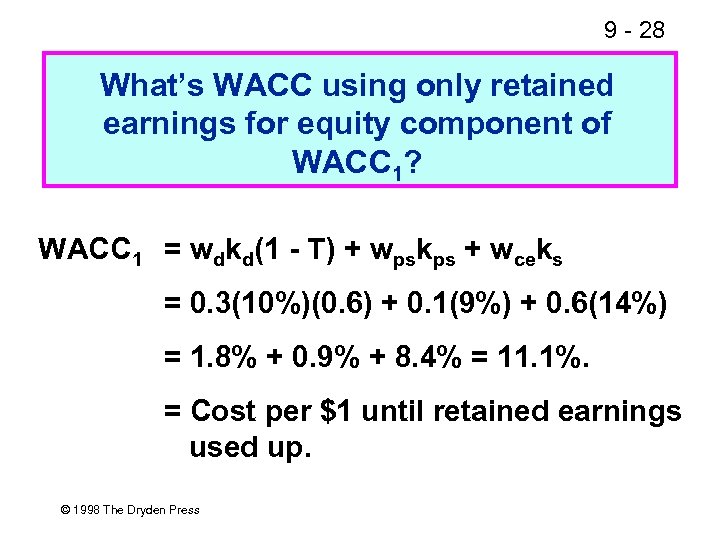

9 - 28 What’s WACC using only retained earnings for equity component of WACC 1? WACC 1 = wdkd(1 - T) + wpskps + wceks = 0. 3(10%)(0. 6) + 0. 1(9%) + 0. 6(14%) = 1. 8% + 0. 9% + 8. 4% = 11. 1%. = Cost per $1 until retained earnings used up. © 1998 The Dryden Press

9 - 28 What’s WACC using only retained earnings for equity component of WACC 1? WACC 1 = wdkd(1 - T) + wpskps + wceks = 0. 3(10%)(0. 6) + 0. 1(9%) + 0. 6(14%) = 1. 8% + 0. 9% + 8. 4% = 11. 1%. = Cost per $1 until retained earnings used up. © 1998 The Dryden Press

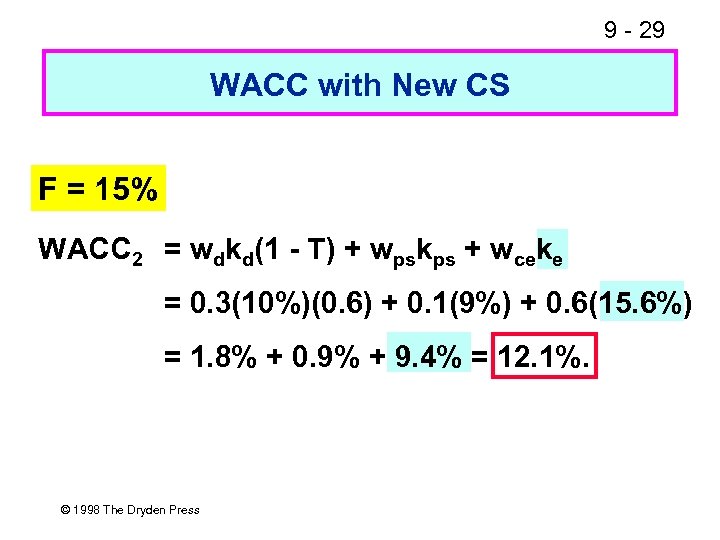

9 - 29 WACC with New CS F = 15% WACC 2 = wdkd(1 - T) + wpskps + wceke = 0. 3(10%)(0. 6) + 0. 1(9%) + 0. 6(15. 6%) = 1. 8% + 0. 9% + 9. 4% = 12. 1%. © 1998 The Dryden Press

9 - 29 WACC with New CS F = 15% WACC 2 = wdkd(1 - T) + wpskps + wceke = 0. 3(10%)(0. 6) + 0. 1(9%) + 0. 6(15. 6%) = 1. 8% + 0. 9% + 9. 4% = 12. 1%. © 1998 The Dryden Press

9 - 30 Summary to this Point WACC rises because equity cost is rising. © 1998 The Dryden Press

9 - 30 Summary to this Point WACC rises because equity cost is rising. © 1998 The Dryden Press

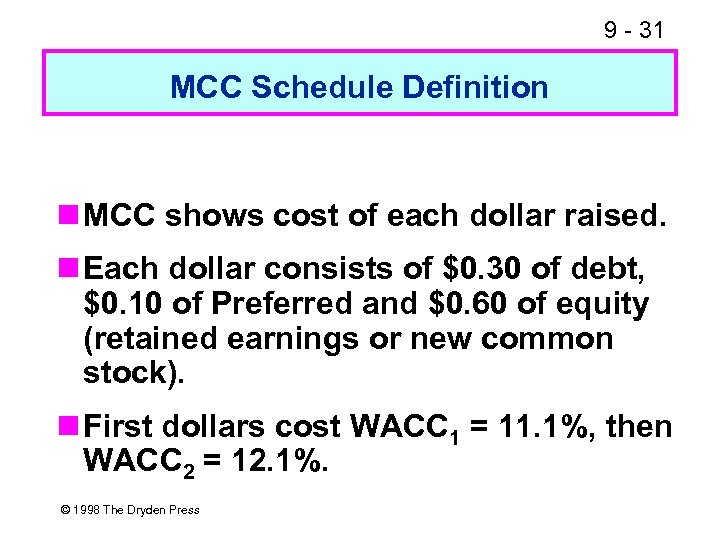

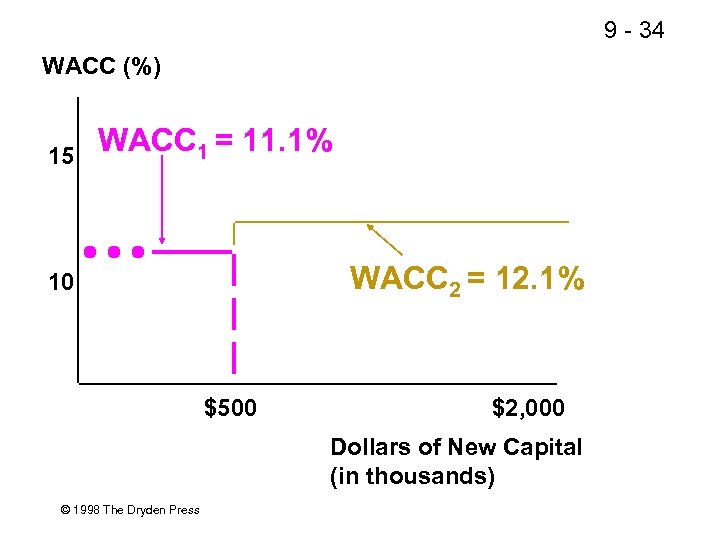

9 - 31 MCC Schedule Definition MCC shows cost of each dollar raised. Each dollar consists of $0. 30 of debt, $0. 10 of Preferred and $0. 60 of equity (retained earnings or new common stock). First dollars cost WACC 1 = 11. 1%, then WACC 2 = 12. 1%. © 1998 The Dryden Press

9 - 31 MCC Schedule Definition MCC shows cost of each dollar raised. Each dollar consists of $0. 30 of debt, $0. 10 of Preferred and $0. 60 of equity (retained earnings or new common stock). First dollars cost WACC 1 = 11. 1%, then WACC 2 = 12. 1%. © 1998 The Dryden Press

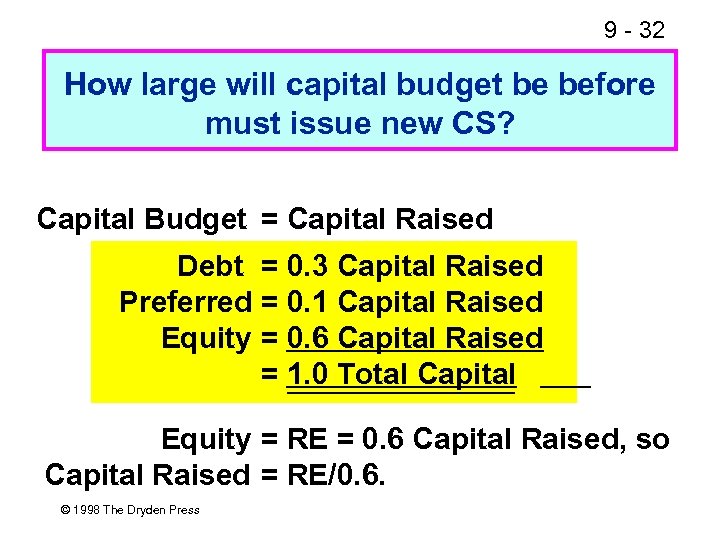

9 - 32 How large will capital budget be before must issue new CS? Capital Budget = Capital Raised Debt = 0. 3 Capital Raised Preferred = 0. 1 Capital Raised Equity = 0. 6 Capital Raised = 1. 0 Total Capital Equity = RE = 0. 6 Capital Raised, so Capital Raised = RE/0. 6. © 1998 The Dryden Press

9 - 32 How large will capital budget be before must issue new CS? Capital Budget = Capital Raised Debt = 0. 3 Capital Raised Preferred = 0. 1 Capital Raised Equity = 0. 6 Capital Raised = 1. 0 Total Capital Equity = RE = 0. 6 Capital Raised, so Capital Raised = RE/0. 6. © 1998 The Dryden Press

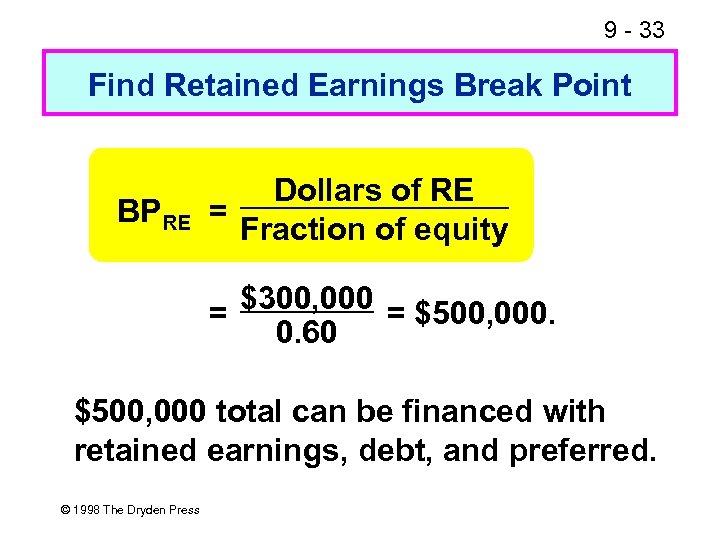

9 - 33 Find Retained Earnings Break Point BPRE Dollars of RE = Fraction of equity $300, 000 = $500, 000. = 0. 60 $500, 000 total can be financed with retained earnings, debt, and preferred. © 1998 The Dryden Press

9 - 33 Find Retained Earnings Break Point BPRE Dollars of RE = Fraction of equity $300, 000 = $500, 000. = 0. 60 $500, 000 total can be financed with retained earnings, debt, and preferred. © 1998 The Dryden Press

9 - 34 WACC (%) 15 WACC 1 = 11. 1% WACC 2 = 12. 1% 10 $500 $2, 000 Dollars of New Capital (in thousands) © 1998 The Dryden Press

9 - 34 WACC (%) 15 WACC 1 = 11. 1% WACC 2 = 12. 1% 10 $500 $2, 000 Dollars of New Capital (in thousands) © 1998 The Dryden Press

9 - 35 Investment Opportunities (Capital Budgeting Projects) Which to accept? © 1998 The Dryden Press

9 - 35 Investment Opportunities (Capital Budgeting Projects) Which to accept? © 1998 The Dryden Press

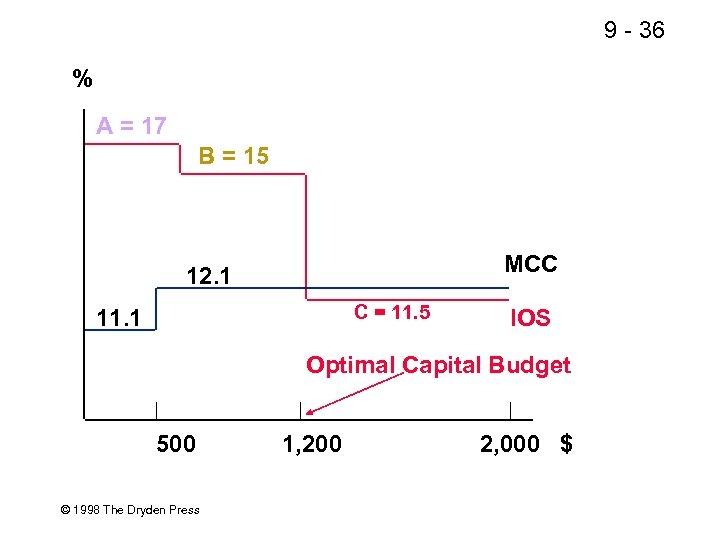

9 - 36 % A = 17 B = 15 MCC 12. 1 C = 11. 5 11. 1 IOS Optimal Capital Budget 500 © 1998 The Dryden Press 1, 200 2, 000 $

9 - 36 % A = 17 B = 15 MCC 12. 1 C = 11. 5 11. 1 IOS Optimal Capital Budget 500 © 1998 The Dryden Press 1, 200 2, 000 $

9 - 37 Projects A and B would be accepted (IRR exceeds the MCC). Project C would be rejected (IRR is less than the MCC). Capital Budget = $1. 2 million. © 1998 The Dryden Press

9 - 37 Projects A and B would be accepted (IRR exceeds the MCC). Project C would be rejected (IRR is less than the MCC). Capital Budget = $1. 2 million. © 1998 The Dryden Press

9 - 38 Would the MCC remain constant beyond $2 million? No. WACC would eventually rise above 12. 1%. Costs of debt, preferred stock would rise. Large increases in capital budget may also increase the perceived risk of the firm, increasing WACC. © 1998 The Dryden Press

9 - 38 Would the MCC remain constant beyond $2 million? No. WACC would eventually rise above 12. 1%. Costs of debt, preferred stock would rise. Large increases in capital budget may also increase the perceived risk of the firm, increasing WACC. © 1998 The Dryden Press