6dc99e35d8bca857c5178fccec07e19a.ppt

- Количество слайдов: 42

9 -1

9 -1

9 -2 Income Statement

9 -2 Income Statement

9 -3 What happened to sales and net income?

9 -3 What happened to sales and net income?

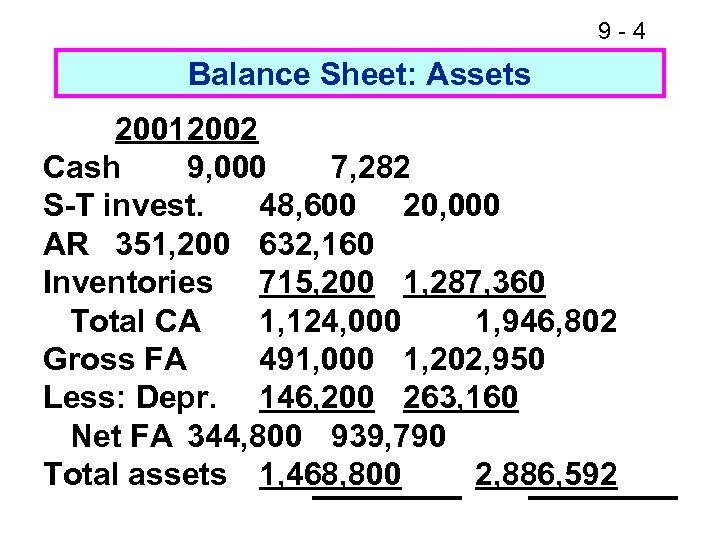

9 -4 Balance Sheet: Assets 20012002 Cash 9, 000 7, 282 S-T invest. 48, 600 20, 000 AR 351, 200 632, 160 Inventories 715, 200 1, 287, 360 Total CA 1, 124, 000 1, 946, 802 Gross FA 491, 000 1, 202, 950 Less: Depr. 146, 200 263, 160 Net FA 344, 800 939, 790 Total assets 1, 468, 800 2, 886, 592

9 -4 Balance Sheet: Assets 20012002 Cash 9, 000 7, 282 S-T invest. 48, 600 20, 000 AR 351, 200 632, 160 Inventories 715, 200 1, 287, 360 Total CA 1, 124, 000 1, 946, 802 Gross FA 491, 000 1, 202, 950 Less: Depr. 146, 200 263, 160 Net FA 344, 800 939, 790 Total assets 1, 468, 800 2, 886, 592

9 -5 What effect did the expansion have on the asset section of the balance sheet?

9 -5 What effect did the expansion have on the asset section of the balance sheet?

9 -6 Statement of Retained Earnings: 2002

9 -6 Statement of Retained Earnings: 2002

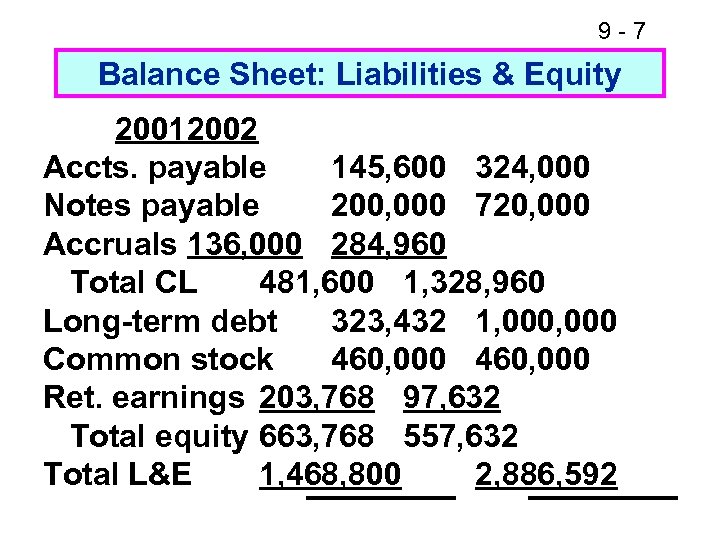

9 -7 Balance Sheet: Liabilities & Equity 20012002 Accts. payable 145, 600 324, 000 Notes payable 200, 000 720, 000 Accruals 136, 000 284, 960 Total CL 481, 600 1, 328, 960 Long-term debt 323, 432 1, 000 Common stock 460, 000 Ret. earnings 203, 768 97, 632 Total equity 663, 768 557, 632 Total L&E 1, 468, 800 2, 886, 592

9 -7 Balance Sheet: Liabilities & Equity 20012002 Accts. payable 145, 600 324, 000 Notes payable 200, 000 720, 000 Accruals 136, 000 284, 960 Total CL 481, 600 1, 328, 960 Long-term debt 323, 432 1, 000 Common stock 460, 000 Ret. earnings 203, 768 97, 632 Total equity 663, 768 557, 632 Total L&E 1, 468, 800 2, 886, 592

9 -8 What effect did the expansion have on liabilities & equity?

9 -8 What effect did the expansion have on liabilities & equity?

9 -9 Statement of Cash Flows: 2002

9 -9 Statement of Cash Flows: 2002

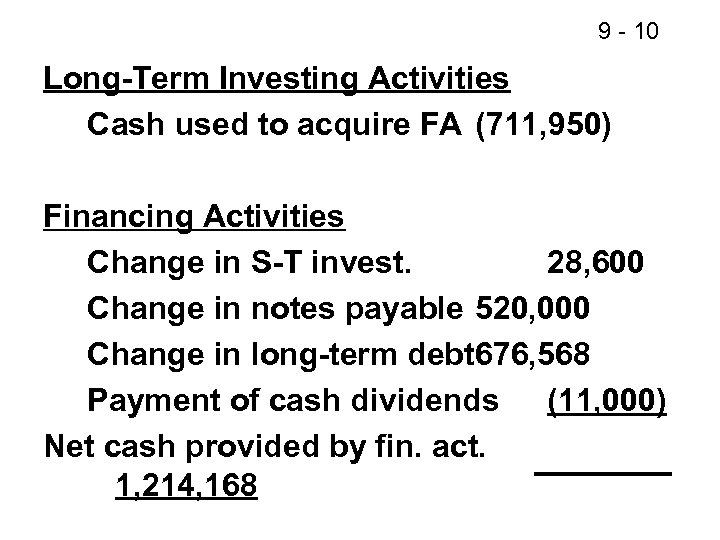

9 - 10 Long-Term Investing Activities Cash used to acquire FA (711, 950) Financing Activities Change in S-T invest. 28, 600 Change in notes payable 520, 000 Change in long-term debt 676, 568 Payment of cash dividends (11, 000) Net cash provided by fin. act. 1, 214, 168

9 - 10 Long-Term Investing Activities Cash used to acquire FA (711, 950) Financing Activities Change in S-T invest. 28, 600 Change in notes payable 520, 000 Change in long-term debt 676, 568 Payment of cash dividends (11, 000) Net cash provided by fin. act. 1, 214, 168

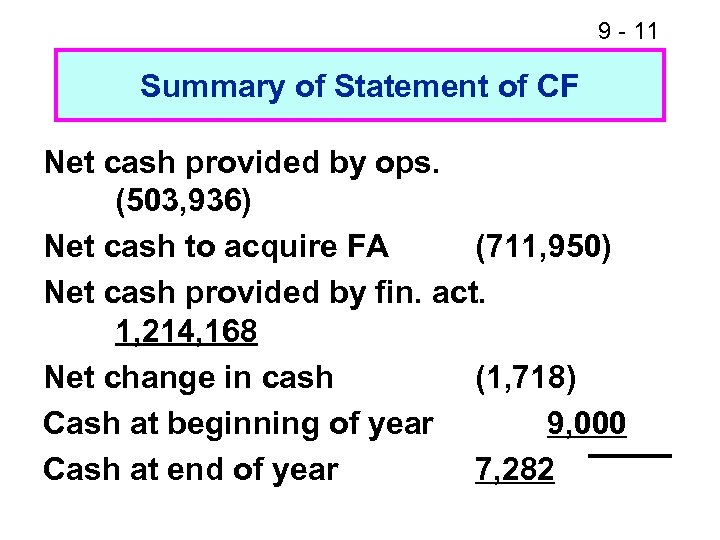

9 - 11 Summary of Statement of CF Net cash provided by ops. (503, 936) Net cash to acquire FA (711, 950) Net cash provided by fin. act. 1, 214, 168 Net change in cash (1, 718) Cash at beginning of year 9, 000 Cash at end of year 7, 282

9 - 11 Summary of Statement of CF Net cash provided by ops. (503, 936) Net cash to acquire FA (711, 950) Net cash provided by fin. act. 1, 214, 168 Net change in cash (1, 718) Cash at beginning of year 9, 000 Cash at end of year 7, 282

9 - 12 What can you conclude from the statement of cash flows?

9 - 12 What can you conclude from the statement of cash flows?

9 - 13 What is free cash flow (FCF)? Why is it important?

9 - 13 What is free cash flow (FCF)? Why is it important?

9 - 14 What are the five uses of FCF? 1. Pay interest on debt. 2. Pay back principal on debt. 3. Pay dividends. 4. Buy back stock. 5. Buy nonoperating assets (e. g. , marketable securities, investments in other companies, etc. )

9 - 14 What are the five uses of FCF? 1. Pay interest on debt. 2. Pay back principal on debt. 3. Pay dividends. 4. Buy back stock. 5. Buy nonoperating assets (e. g. , marketable securities, investments in other companies, etc. )

9 - 15 What are operating current assets?

9 - 15 What are operating current assets?

9 - 16 What are operating current liabilities?

9 - 16 What are operating current liabilities?

9 - 17 What effect did the expansion have on net operating working capital (NOWC)? Operating NOWC = CA CL

9 - 17 What effect did the expansion have on net operating working capital (NOWC)? Operating NOWC = CA CL

9 - 18 What effect did the expansion have on total operating capital? Operating capital

9 - 18 What effect did the expansion have on total operating capital? Operating capital

9 - 19 Did the expansion create additional net operating profit after taxes (NOPAT)?

9 - 19 Did the expansion create additional net operating profit after taxes (NOPAT)?

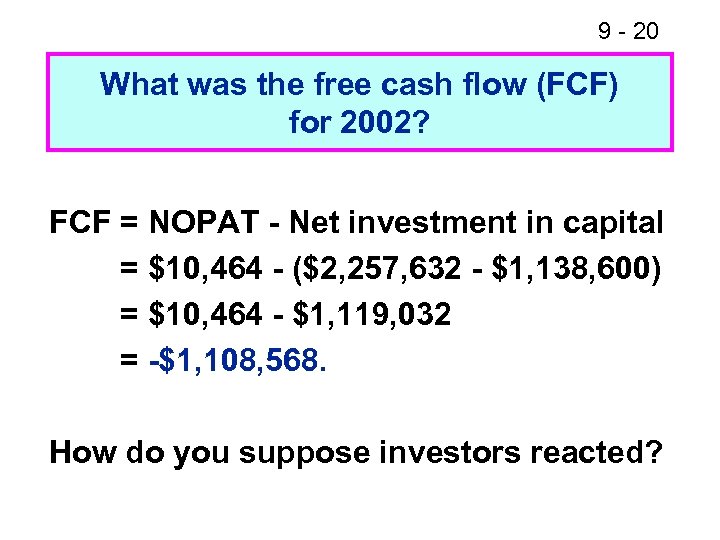

9 - 20 What was the free cash flow (FCF) for 2002? FCF = NOPAT - Net investment in capital = $10, 464 - ($2, 257, 632 - $1, 138, 600) = $10, 464 - $1, 119, 032 = -$1, 108, 568. How do you suppose investors reacted?

9 - 20 What was the free cash flow (FCF) for 2002? FCF = NOPAT - Net investment in capital = $10, 464 - ($2, 257, 632 - $1, 138, 600) = $10, 464 - $1, 119, 032 = -$1, 108, 568. How do you suppose investors reacted?

9 - 21 Return on Invested Capital (ROIC)

9 - 21 Return on Invested Capital (ROIC)

9 - 22 The firm’s cost of capital is 10%. Did the growth add value?

9 - 22 The firm’s cost of capital is 10%. Did the growth add value?

9 - 23 Calculate EVA. Assume the cost of capital (WACC) was 10% for both years.

9 - 23 Calculate EVA. Assume the cost of capital (WACC) was 10% for both years.

9 - 24 Stock Price and Other Data

9 - 24 Stock Price and Other Data

9 - 25 What is MVA (Market Value Added)?

9 - 25 What is MVA (Market Value Added)?

9 - 26 MVA (Continued)

9 - 26 MVA (Continued)

9 - 27 Find 2002 MVA. (Assume market value of debt = book value of debt. )

9 - 27 Find 2002 MVA. (Assume market value of debt = book value of debt. )

9 - 28 Key Features of the Tax Code

9 - 28 Key Features of the Tax Code

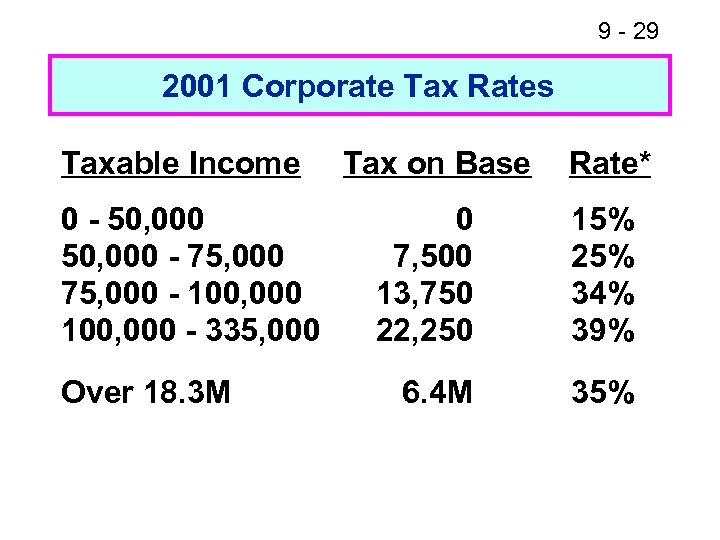

9 - 29 2001 Corporate Tax Rates Taxable Income 0 - 50, 000 - 75, 000 - 100, 000 - 335, 000 Over 18. 3 M Tax on Base Rate* 0 7, 500 13, 750 22, 250 15% 25% 34% 39% 6. 4 M 35%

9 - 29 2001 Corporate Tax Rates Taxable Income 0 - 50, 000 - 75, 000 - 100, 000 - 335, 000 Over 18. 3 M Tax on Base Rate* 0 7, 500 13, 750 22, 250 15% 25% 34% 39% 6. 4 M 35%

9 - 30 Features of Corporate Taxation

9 - 30 Features of Corporate Taxation

9 - 31 Features of Corporate Taxes (Cont. )

9 - 31 Features of Corporate Taxes (Cont. )

9 - 32 Assume a corporation has $100, 000 of taxable income from operations, $5, 000 of interest income, and $10, 000 of dividend income. What is its tax liability?

9 - 32 Assume a corporation has $100, 000 of taxable income from operations, $5, 000 of interest income, and $10, 000 of dividend income. What is its tax liability?

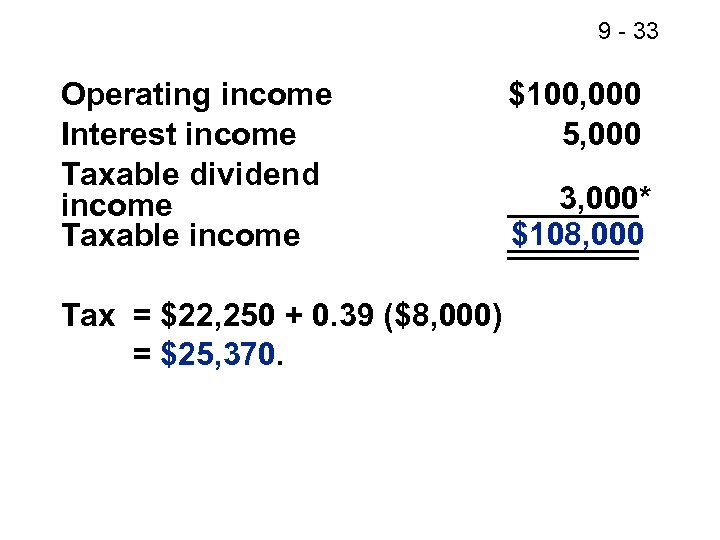

9 - 33 Operating income Interest income Taxable dividend income Taxable income Tax = $22, 250 + 0. 39 ($8, 000) = $25, 370. $100, 000 5, 000 3, 000* $108, 000

9 - 33 Operating income Interest income Taxable dividend income Taxable income Tax = $22, 250 + 0. 39 ($8, 000) = $25, 370. $100, 000 5, 000 3, 000* $108, 000

9 - 34 Key Features of Individual Taxation

9 - 34 Key Features of Individual Taxation

9 - 35 Individual Rates for 2001

9 - 35 Individual Rates for 2001

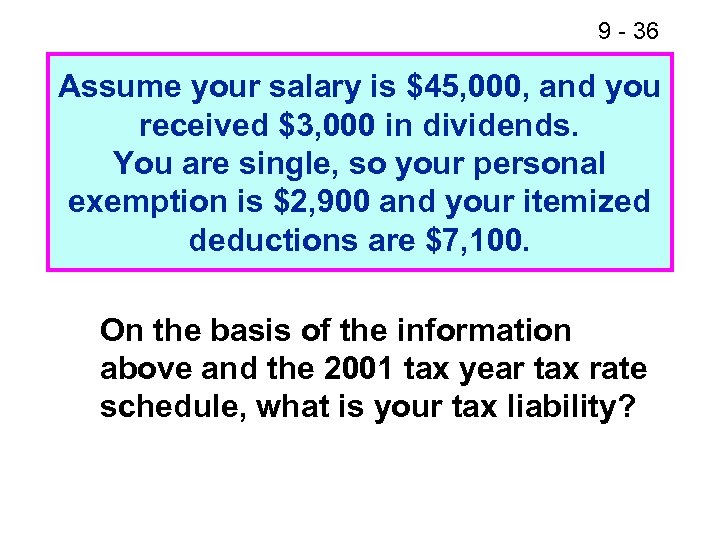

9 - 36 Assume your salary is $45, 000, and you received $3, 000 in dividends. You are single, so your personal exemption is $2, 900 and your itemized deductions are $7, 100. On the basis of the information above and the 2001 tax year tax rate schedule, what is your tax liability?

9 - 36 Assume your salary is $45, 000, and you received $3, 000 in dividends. You are single, so your personal exemption is $2, 900 and your itemized deductions are $7, 100. On the basis of the information above and the 2001 tax year tax rate schedule, what is your tax liability?

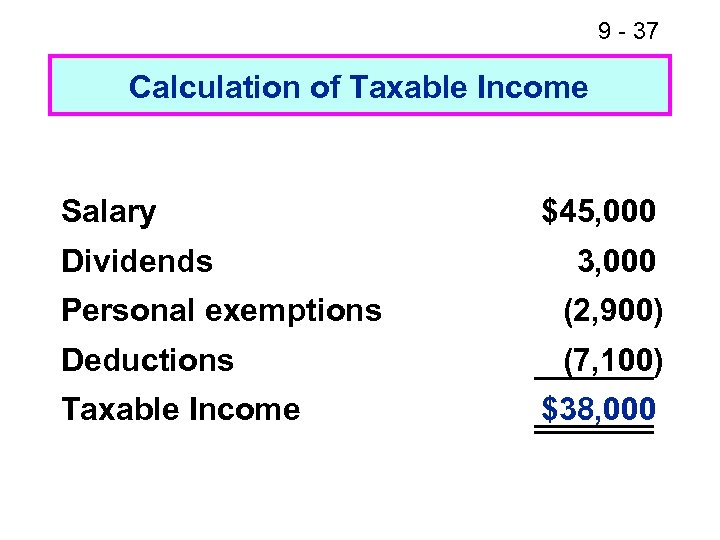

9 - 37 Calculation of Taxable Income Salary Dividends $45, 000 3, 000 Personal exemptions (2, 900) Deductions (7, 100) Taxable Income $38, 000

9 - 37 Calculation of Taxable Income Salary Dividends $45, 000 3, 000 Personal exemptions (2, 900) Deductions (7, 100) Taxable Income $38, 000

9 - 38

9 - 38

9 - 39 Taxable versus Tax Exempt Bonds State and local government bonds (municipals, or “munis”) are generally exempt from federal taxes.

9 - 39 Taxable versus Tax Exempt Bonds State and local government bonds (municipals, or “munis”) are generally exempt from federal taxes.

9 - 40

9 - 40

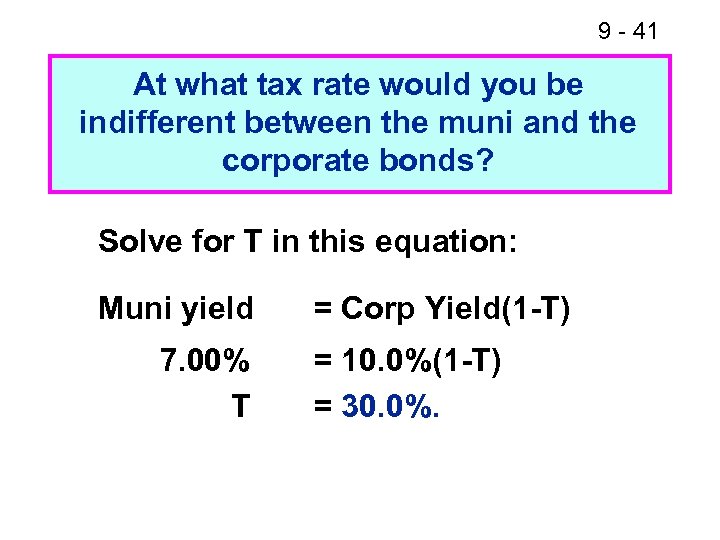

9 - 41 At what tax rate would you be indifferent between the muni and the corporate bonds? Solve for T in this equation: Muni yield 7. 00% T = Corp Yield(1 -T) = 10. 0%(1 -T) = 30. 0%.

9 - 41 At what tax rate would you be indifferent between the muni and the corporate bonds? Solve for T in this equation: Muni yield 7. 00% T = Corp Yield(1 -T) = 10. 0%(1 -T) = 30. 0%.

9 - 42 Implications

9 - 42 Implications