bf90927ea7f8fc1cfa87f994bb02790a.ppt

- Количество слайдов: 44

9 -1

9 -2 Facts about Common Stock

9 -3 Social/Ethical Question Should management be equally concerned about employees, customers, suppliers, “the public, ” or just the stockholders? In enterprise economy, work for stockholders subject to constraints (environmental, fair hiring, etc. ) and competition.

9 -4 What’s classified stock? How might classified stock be used?

9 -5 When is a stock sale an initial public offering (IPO)? A firm “goes public” through an IPO when the stock is first offered to the public.

9 -6 Average Initial Returns on IPOs in Various Countries

9 -7 Different Approaches for Valuing Common Stock

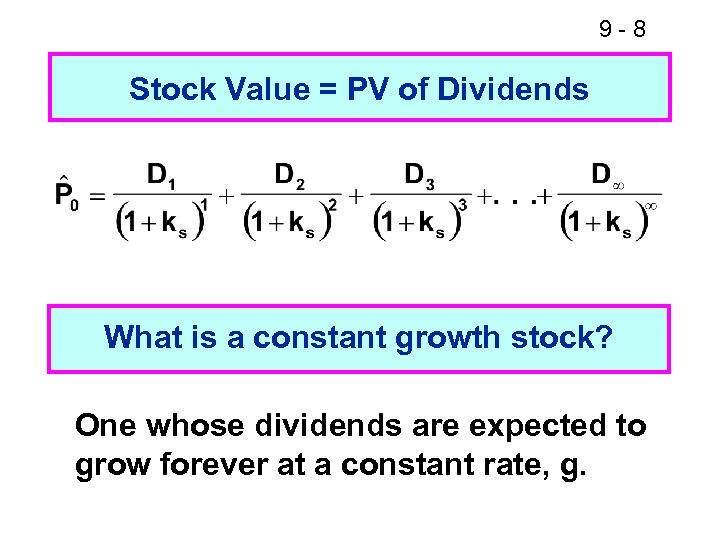

9 -8 Stock Value = PV of Dividends What is a constant growth stock? One whose dividends are expected to grow forever at a constant rate, g.

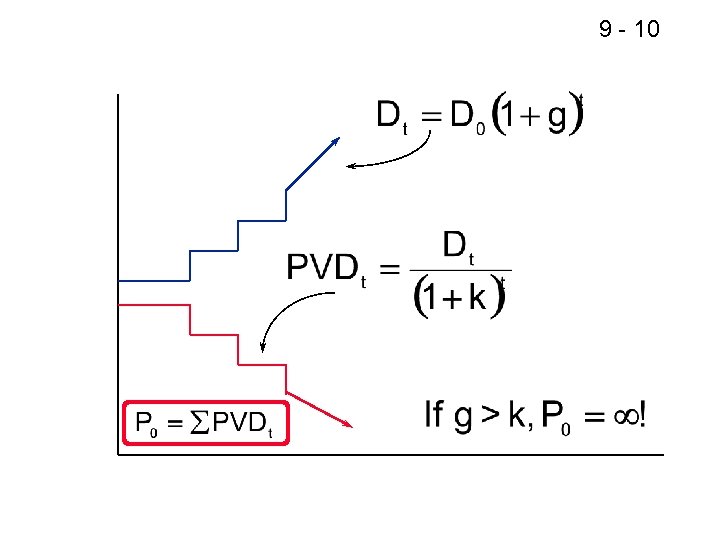

9 -9 For a Constant Growth Stock If g is constant, then:

9 - 10

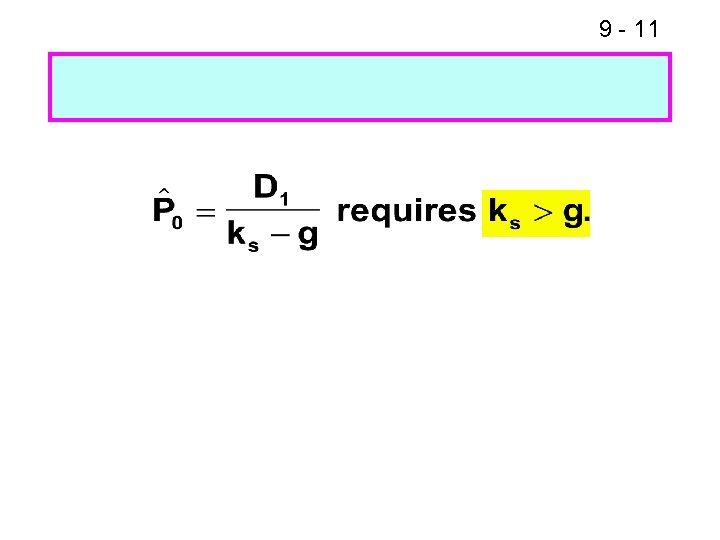

9 - 11

9 - 12

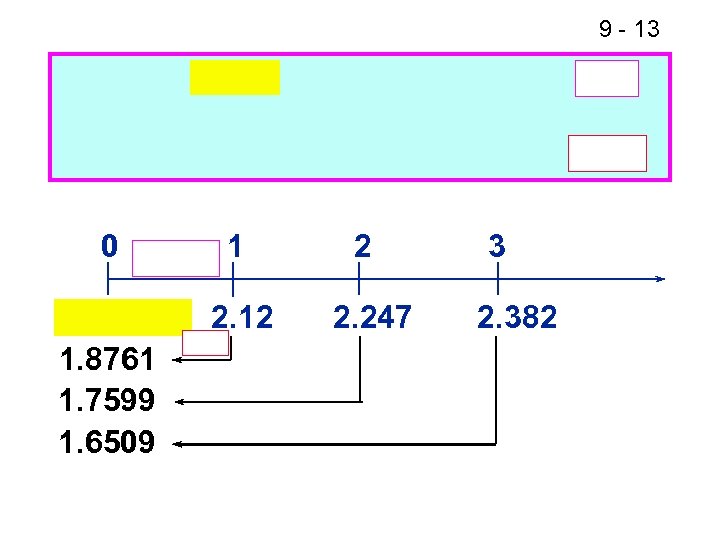

9 - 13 0 1 2. 12 1. 8761 1. 7599 1. 6509 2 2. 247 3 2. 382

9 - 14 Constant growth model: = =

9 - 15

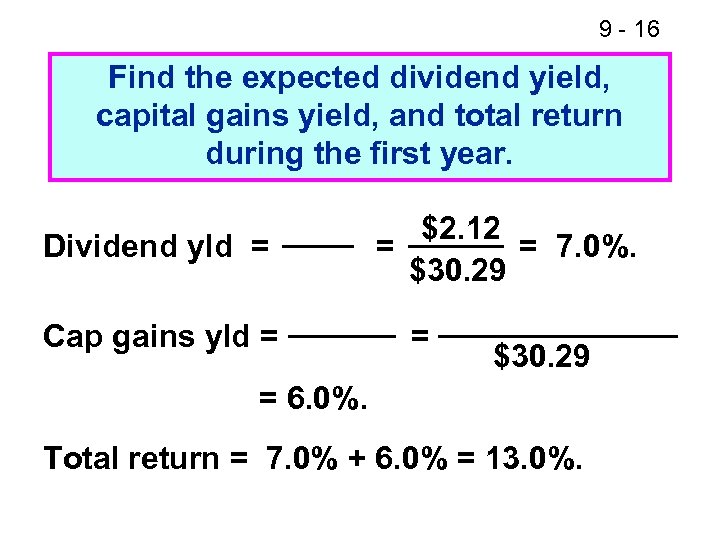

9 - 16 Find the expected dividend yield, capital gains yield, and total return during the first year. Dividend yld = Cap gains yld = $2. 12 = = 7. 0%. $30. 29 = 6. 0%. Total return = 7. 0% + 6. 0% = 13. 0%.

9 - 17 Rearrange model to rate of return form:

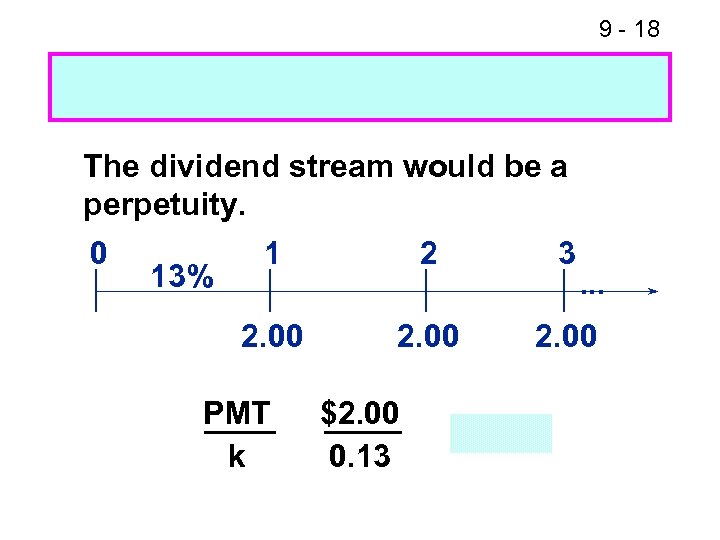

9 - 18 The dividend stream would be a perpetuity. 0 2 3 2. 00 13% 1 2. 00 PMT k $2. 00 0. 13 . . .

9 - 19

9 - 20 Nonconstant growth followed by constant growth: . . .

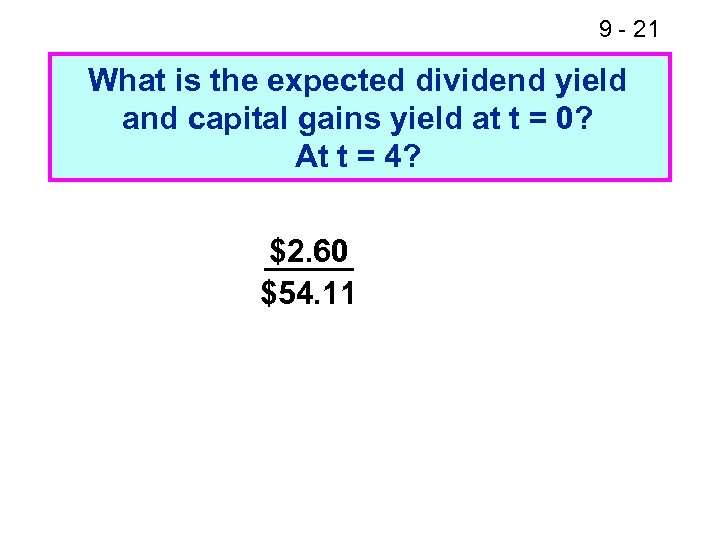

9 - 21 What is the expected dividend yield and capital gains yield at t = 0? At t = 4? $2. 60 $54. 11

9 - 22

9 - 23 . . .

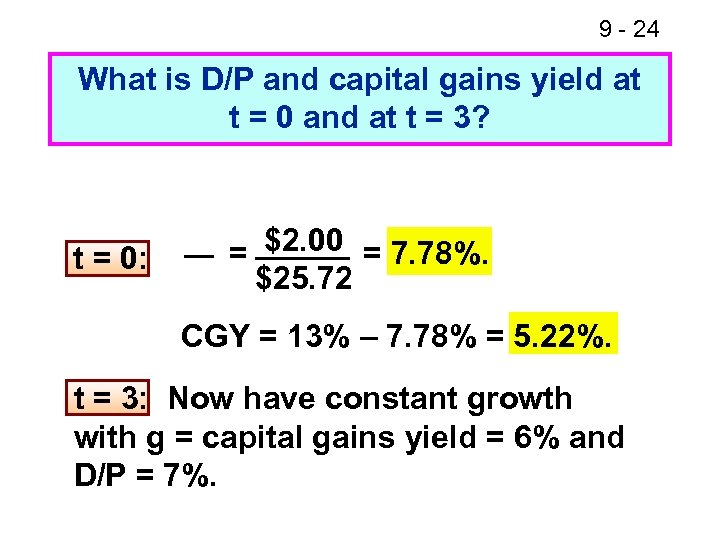

9 - 24 What is D/P and capital gains yield at t = 0 and at t = 3? t = 0: = $2. 00 = 7. 78%. $25. 72 CGY = 13% – 7. 78% = 5. 22%. t = 3: Now have constant growth with g = capital gains yield = 6% and D/P = 7%.

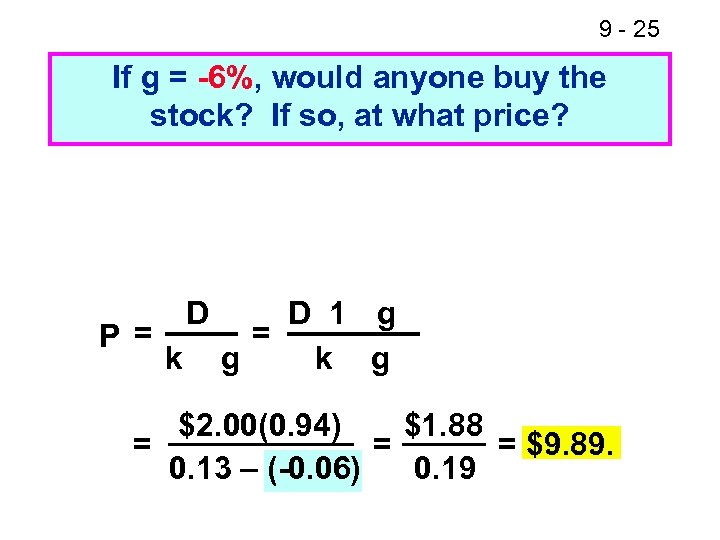

9 - 25 If g = -6%, would anyone buy the stock? If so, at what price? P = D k D 1 g = g k g $2. 00(0. 94) $1. 88 = = = $9. 89. 0. 13 – (-0. 06) 0. 19

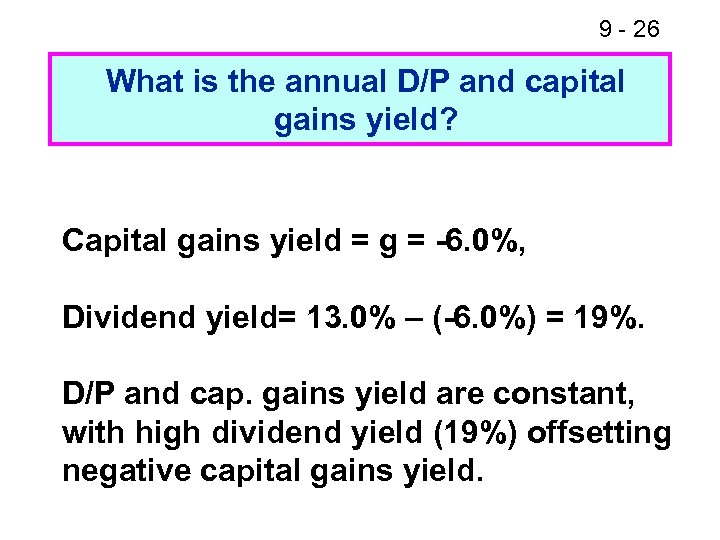

9 - 26 What is the annual D/P and capital gains yield? Capital gains yield = g = -6. 0%, Dividend yield= 13. 0% – (-6. 0%) = 19%. D/P and cap. gains yield are constant, with high dividend yield (19%) offsetting negative capital gains yield.

9 - 27 Free Cash Flow Method

9 - 28 Using the Free Cash Flow Method

9 - 29 Issues Regarding the Free Cash Flow Method

9 - 30 FCF Method Issues Continued

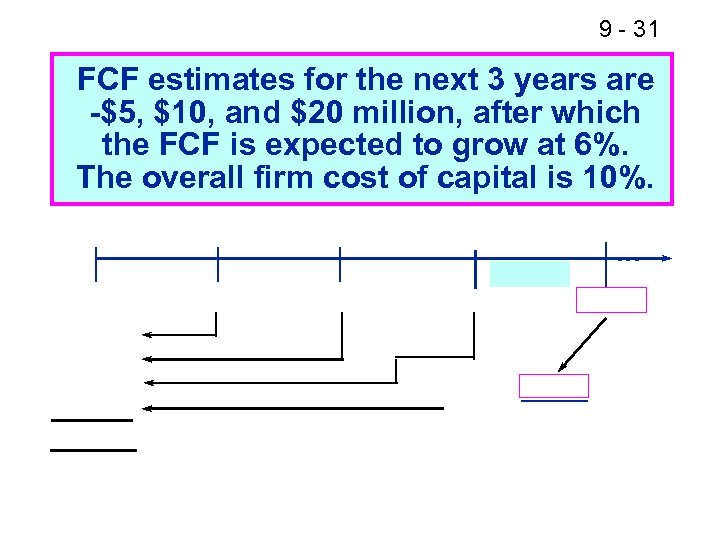

9 - 31 FCF estimates for the next 3 years are -$5, $10, and $20 million, after which the FCF is expected to grow at 6%. The overall firm cost of capital is 10%. .

9 - 32 If the firm has $40 million in debt and has 10 million shares of stock, what is the price per share?

9 - 33 Using the Multiples of Comparable Firms to Estimate Stock Price

9 - 34 What is market equilibrium? In equilibrium, stock prices are stable. There is no general tendency for people to buy versus to sell. In equilibrium, expected returns must equal required returns:

9 - 35 Expected returns are obtained by estimating dividends and expected capital gains (which can be found using any of the three common stock valuation approaches). Required returns are obtained from the CAPM.

9 - 36 How is equilibrium established?

9 - 37 Why do stock prices change?

9 - 38 What’s the Efficient Market Hypothesis? EMH: Securities are normally in equilibrium and are “fairly priced. ” One cannot “beat the market” except through good luck or better information.

9 - 39 1. Weak-form EMH: Can’t profit by looking at past trends. A recent decline is no reason to think stocks will go up (or down) in the future. Evidence supports weak-form EMH, but “technical analysis” is still used.

9 - 40 2. Semistrong-form EMH: All publicly available information is reflected in stock prices, so doesn’t pay to pore over annual reports looking for undervalued stocks. Largely true, but superior analysts can still profit by finding and using new information.

9 - 41 3. Strong-form EMH: All information, even inside information, is embedded in stock prices. Not true--insiders can gain by trading on the basis of insider information, but that’s illegal.

9 - 42 Markets are generally efficient because:

9 - 43 Preferred Stock

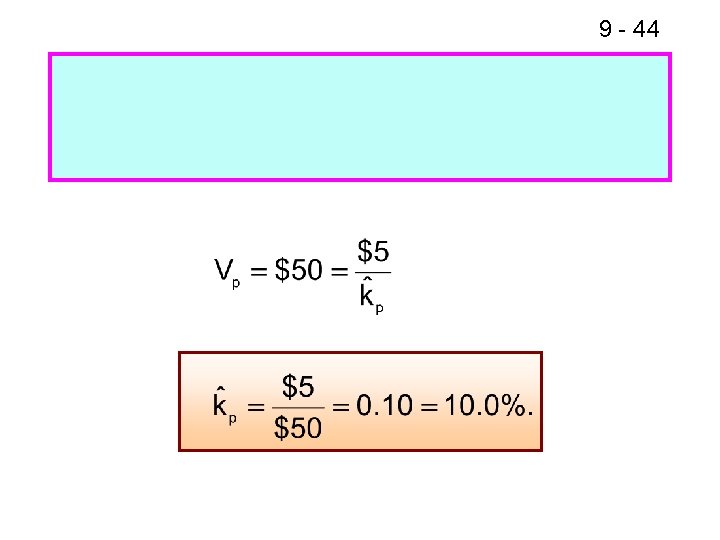

9 - 44

bf90927ea7f8fc1cfa87f994bb02790a.ppt