7716f9b0485f05938762d852a4028282.ppt

- Количество слайдов: 24

8 th Anual Association of Power Exchanges Conference (APEx) Cartagena de Indias – Colombia. Octubre 14 & 15 - 2003 Overview and Perspectives on the Mexican Electricity Industry Regulatory Framework Marcelino Madrigal, Ph. D. Comisión Reguladora de Energía * This document and comments during its presentation do not represent the commission's collegiate official positions. Cartagena de Indias – Colombia. 1 Octubre 14 & 15 - 2003

8 th Anual Association of Power Exchanges Conference (APEx) Cartagena de Indias – Colombia. Octubre 14 & 15 - 2003 Overview and Perspectives on the Mexican Electricity Industry Regulatory Framework Marcelino Madrigal, Ph. D. Comisión Reguladora de Energía * This document and comments during its presentation do not represent the commission's collegiate official positions. Cartagena de Indias – Colombia. 1 Octubre 14 & 15 - 2003

Agenda • The Mexican Electricity Industry: Overview • Current Regulatory Framework • Electricity Supply Adequacy Challenges • Reform Proposals • Closing Remarks 2

Agenda • The Mexican Electricity Industry: Overview • Current Regulatory Framework • Electricity Supply Adequacy Challenges • Reform Proposals • Closing Remarks 2

Agenda • The Mexican Electricity Industry: Overview • Current Regulatory Framework • Electricity Supply Adequacy Challenges • Reform Proposals • Closing Remarks 3

Agenda • The Mexican Electricity Industry: Overview • Current Regulatory Framework • Electricity Supply Adequacy Challenges • Reform Proposals • Closing Remarks 3

Mexican Electricity Industry: Overview Short historical overview and the actual picture • Before 1960’s several private utilities operated • Nationalization and creation two mayor public utilities • LFC “Luz y Fuerza del Centro” Supplies Mexico city an metro area • CFE “Comisión Federal de Electricidad” Supplies the rest of the country • Until 1992 only central public investment by CFE • In 1992 allowed private investment trough PPA programs • The Energy Regulatory Commission is created • In 1999 the first market reform proposal 4

Mexican Electricity Industry: Overview Short historical overview and the actual picture • Before 1960’s several private utilities operated • Nationalization and creation two mayor public utilities • LFC “Luz y Fuerza del Centro” Supplies Mexico city an metro area • CFE “Comisión Federal de Electricidad” Supplies the rest of the country • Until 1992 only central public investment by CFE • In 1992 allowed private investment trough PPA programs • The Energy Regulatory Commission is created • In 1999 the first market reform proposal 4

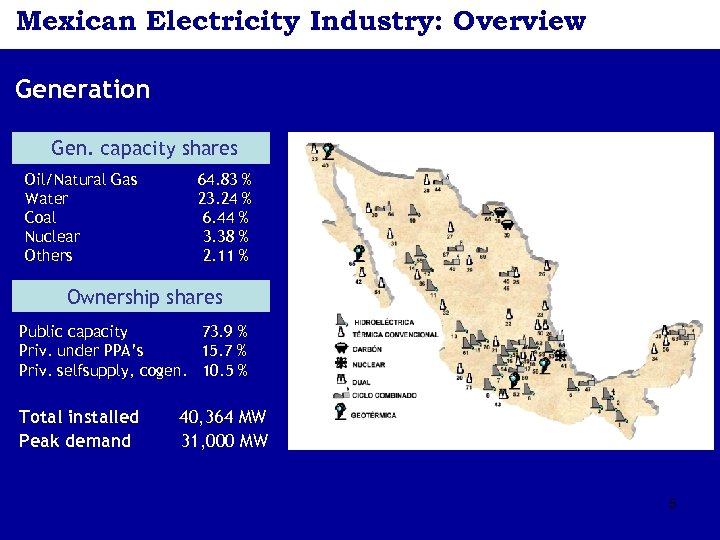

Mexican Electricity Industry: Overview Generation Gen. capacity shares Oil/Natural Gas Water Coal Nuclear Others 64. 83 % 23. 24 % 6. 44 % 3. 38 % 2. 11 % Ownership shares Public capacity 73. 9 % Priv. under PPA’s 15. 7 % Priv. selfsupply, cogen. 10. 5 % Total installed Peak demand 40, 364 MW 31, 000 MW 5

Mexican Electricity Industry: Overview Generation Gen. capacity shares Oil/Natural Gas Water Coal Nuclear Others 64. 83 % 23. 24 % 6. 44 % 3. 38 % 2. 11 % Ownership shares Public capacity 73. 9 % Priv. under PPA’s 15. 7 % Priv. selfsupply, cogen. 10. 5 % Total installed Peak demand 40, 364 MW 31, 000 MW 5

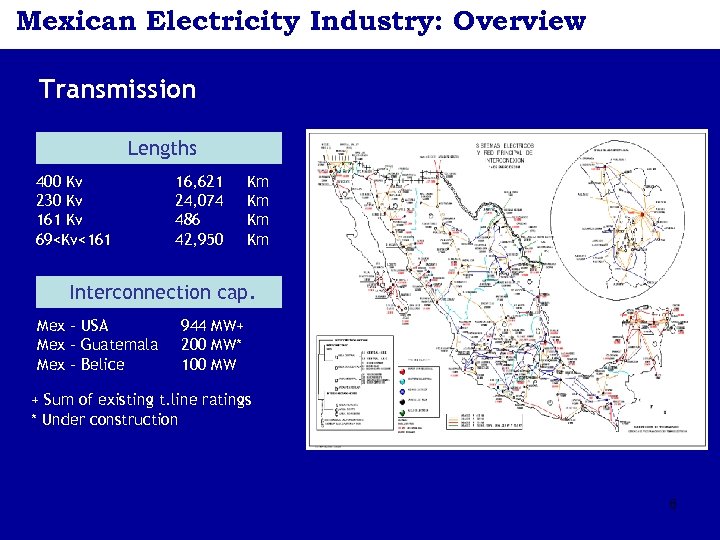

Mexican Electricity Industry: Overview Transmission Lengths 400 Kv 230 Kv 161 Kv 69

Mexican Electricity Industry: Overview Transmission Lengths 400 Kv 230 Kv 161 Kv 69

Agenda • The Mexican Electricity Industry: Overview • Current Regulatory Framework • Electricity Supply Adequacy Challenges • Reform Proposals • Closing Remarks 7

Agenda • The Mexican Electricity Industry: Overview • Current Regulatory Framework • Electricity Supply Adequacy Challenges • Reform Proposals • Closing Remarks 7

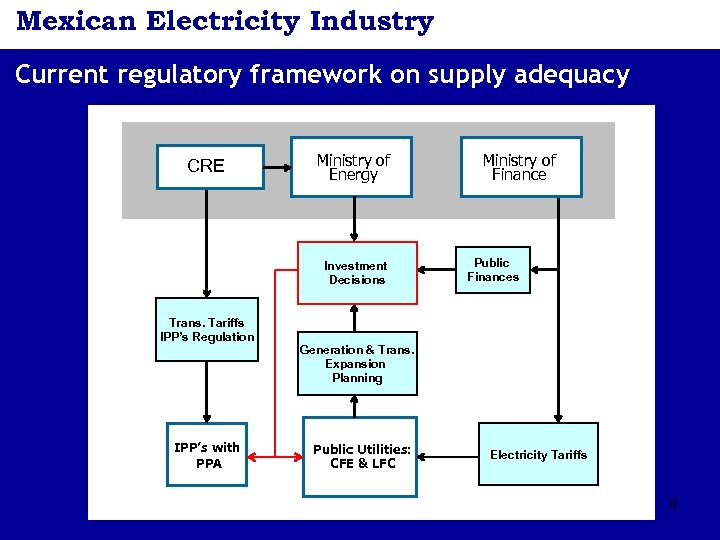

Mexican Electricity Industry Current regulatory framework on supply adequacy CRE Ministry of Energy Investment Decisions Trans. Tariffs IPP’s Regulation IPP’s with PPA Ministry of Finance Public Finances Generation & Trans. Expansion Planning Public Utilities: CFE & LFC Electricity Tariffs 8

Mexican Electricity Industry Current regulatory framework on supply adequacy CRE Ministry of Energy Investment Decisions Trans. Tariffs IPP’s Regulation IPP’s with PPA Ministry of Finance Public Finances Generation & Trans. Expansion Planning Public Utilities: CFE & LFC Electricity Tariffs 8

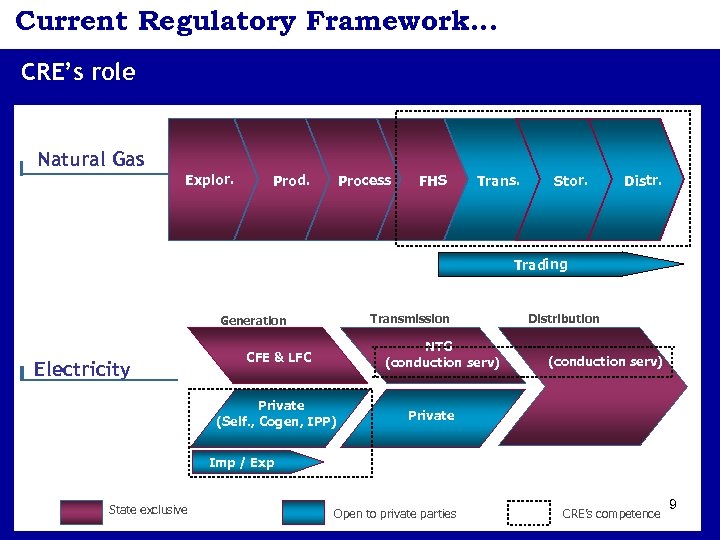

Current Regulatory Framework… CRE’s role Natural Gas Explor. Prod. Process FHS Trans. Stor. Distr. Trading Transmission Generation Electricity National NTG Transmission (conduction serv) Grid CFE & LFC Private (Self. , Cogen, IPP) Third Parties Distribution (conduction serv) Others Private Imp / Exp Imports State exclusive Open to private parties CRE’s competence 9

Current Regulatory Framework… CRE’s role Natural Gas Explor. Prod. Process FHS Trans. Stor. Distr. Trading Transmission Generation Electricity National NTG Transmission (conduction serv) Grid CFE & LFC Private (Self. , Cogen, IPP) Third Parties Distribution (conduction serv) Others Private Imp / Exp Imports State exclusive Open to private parties CRE’s competence 9

Agenda • The Mexican Electricity Industry: Overview • Current Regulatory Framework • Electricity Supply Adequacy Challenges • Reform Proposals • Closing Remarks 10

Agenda • The Mexican Electricity Industry: Overview • Current Regulatory Framework • Electricity Supply Adequacy Challenges • Reform Proposals • Closing Remarks 10

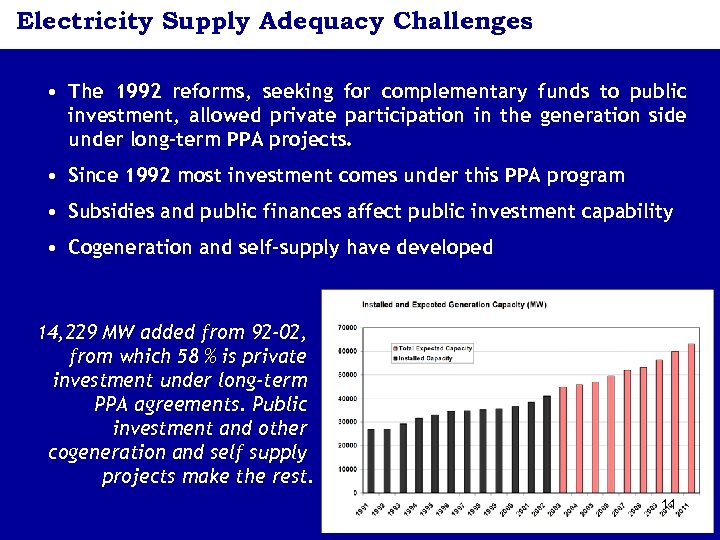

Electricity Supply Adequacy Challenges • The 1992 reforms, seeking for complementary funds to public investment, allowed private participation in the generation side under long-term PPA projects. • Since 1992 most investment comes under this PPA program • Subsidies and public finances affect public investment capability • Cogeneration and self-supply have developed 14, 229 MW added from 92 -02, from which 58 % is private investment under long-term PPA agreements. Public investment and other cogeneration and self supply projects make the rest. 11

Electricity Supply Adequacy Challenges • The 1992 reforms, seeking for complementary funds to public investment, allowed private participation in the generation side under long-term PPA projects. • Since 1992 most investment comes under this PPA program • Subsidies and public finances affect public investment capability • Cogeneration and self-supply have developed 14, 229 MW added from 92 -02, from which 58 % is private investment under long-term PPA agreements. Public investment and other cogeneration and self supply projects make the rest. 11

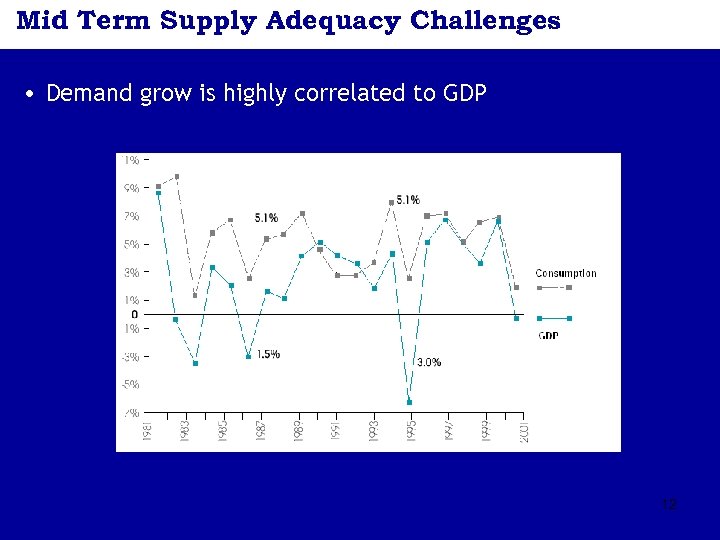

Mid Term Supply Adequacy Challenges • Demand grow is highly correlated to GDP 12

Mid Term Supply Adequacy Challenges • Demand grow is highly correlated to GDP 12

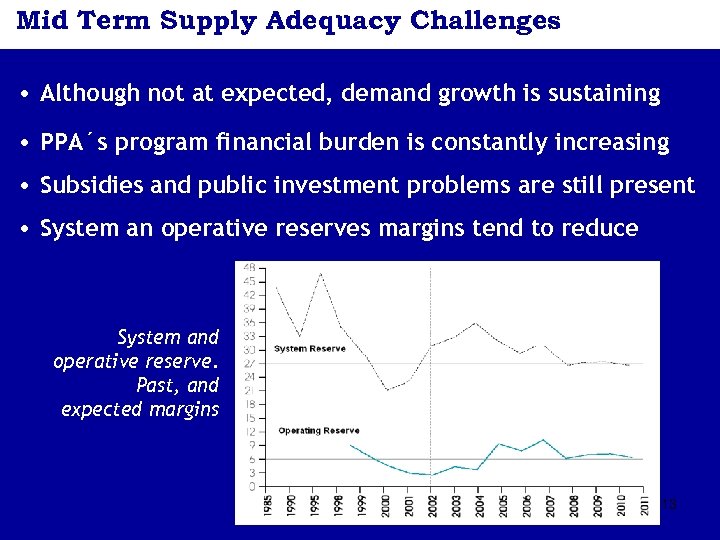

Mid Term Supply Adequacy Challenges • Although not at expected, demand growth is sustaining • PPA´s program financial burden is constantly increasing • Subsidies and public investment problems are still present • System an operative reserves margins tend to reduce System and operative reserve. Past, and expected margins 13

Mid Term Supply Adequacy Challenges • Although not at expected, demand growth is sustaining • PPA´s program financial burden is constantly increasing • Subsidies and public investment problems are still present • System an operative reserves margins tend to reduce System and operative reserve. Past, and expected margins 13

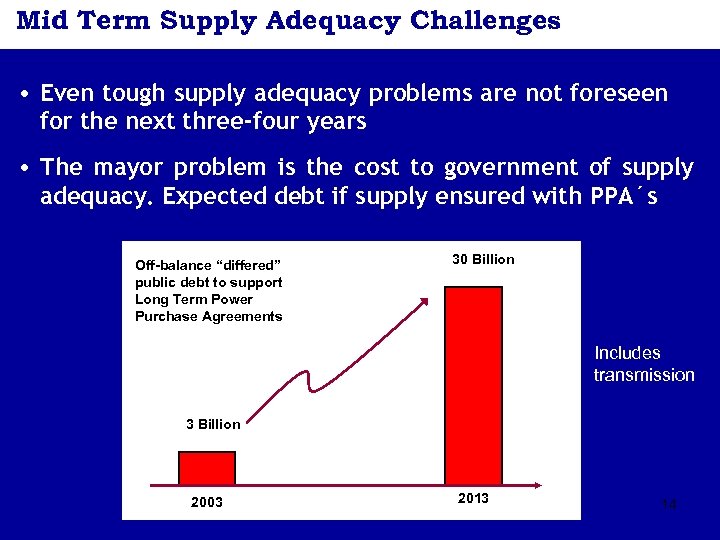

Mid Term Supply Adequacy Challenges • Even tough supply adequacy problems are not foreseen for the next three-four years • The mayor problem is the cost to government of supply adequacy. Expected debt if supply ensured with PPA´s Off-balance “differed” public debt to support Long Term Power Purchase Agreements 30 Billion Includes transmission 3 Billion 2003 2013 14

Mid Term Supply Adequacy Challenges • Even tough supply adequacy problems are not foreseen for the next three-four years • The mayor problem is the cost to government of supply adequacy. Expected debt if supply ensured with PPA´s Off-balance “differed” public debt to support Long Term Power Purchase Agreements 30 Billion Includes transmission 3 Billion 2003 2013 14

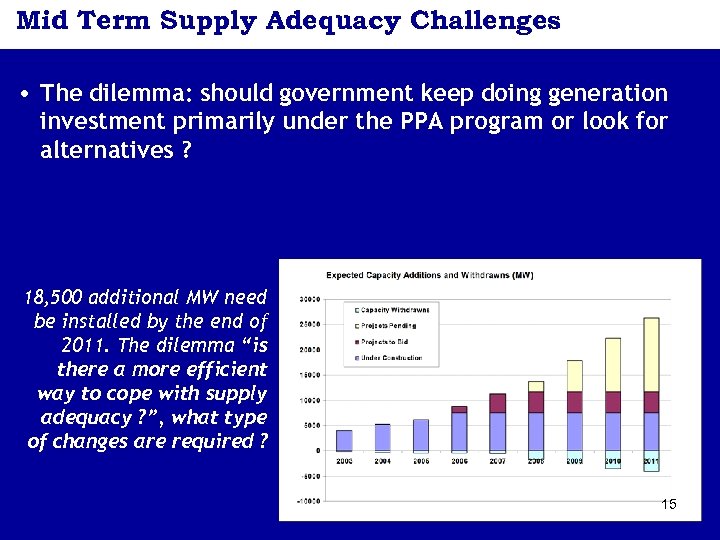

Mid Term Supply Adequacy Challenges • The dilemma: should government keep doing generation investment primarily under the PPA program or look for alternatives ? 18, 500 additional MW need be installed by the end of 2011. The dilemma “is there a more efficient way to cope with supply adequacy ? ”, what type of changes are required ? 15

Mid Term Supply Adequacy Challenges • The dilemma: should government keep doing generation investment primarily under the PPA program or look for alternatives ? 18, 500 additional MW need be installed by the end of 2011. The dilemma “is there a more efficient way to cope with supply adequacy ? ”, what type of changes are required ? 15

Agenda • The Mexican Electricity Industry: Overview • Current Regulatory Framework • The Last Ten Years of Generation Expansion • Supply Adequacy Challenges • Reform Proposals • Closing Remarks 16

Agenda • The Mexican Electricity Industry: Overview • Current Regulatory Framework • The Last Ten Years of Generation Expansion • Supply Adequacy Challenges • Reform Proposals • Closing Remarks 16

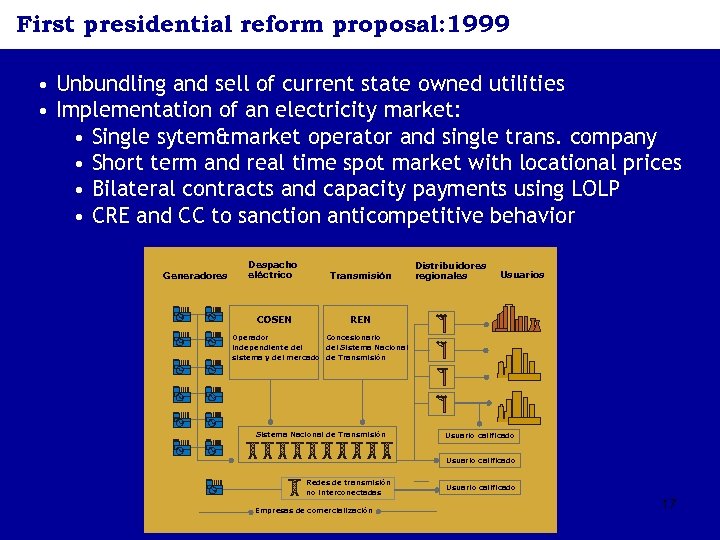

First presidential reform proposal: 1999 • Unbundling and sell of current state owned utilities • Implementation of an electricity market: • Single sytem&market operator and single trans. company • Short term and real time spot market with locational prices • Bilateral contracts and capacity payments using LOLP • CRE and CC to sanction anticompetitive behavior Generadores Despacho eléctrico Transmisión COSEN REN Distribuidores regionales Usuarios Operador Concesionario independiente del Sistema Nacional sistema y del mercado de Transmisión Sistema Nacional de Transmisión Usuario calificado Redes de transmisión no interconectadas Empresas de comercialización Usuario calificado 17

First presidential reform proposal: 1999 • Unbundling and sell of current state owned utilities • Implementation of an electricity market: • Single sytem&market operator and single trans. company • Short term and real time spot market with locational prices • Bilateral contracts and capacity payments using LOLP • CRE and CC to sanction anticompetitive behavior Generadores Despacho eléctrico Transmisión COSEN REN Distribuidores regionales Usuarios Operador Concesionario independiente del Sistema Nacional sistema y del mercado de Transmisión Sistema Nacional de Transmisión Usuario calificado Redes de transmisión no interconectadas Empresas de comercialización Usuario calificado 17

Developments from 1999 to 2002 • Presidential elections led to new government in 2000 • New political configuration • More experiences, good and BAD, with markets worldwide • Reform process slowed down due to an amalgam of factors: • historical factors, new political configuration • continued debate worldwide on electricity markets • bad experiences easier noticed • debate has strongly polarized • This led to other ten “minor” (not structural) proposals that range from the two opposite visions: “market” and “full regulation” • If consensus arrives, this year, future configuration will likely look as second presidential reform proposal, 2002. 18

Developments from 1999 to 2002 • Presidential elections led to new government in 2000 • New political configuration • More experiences, good and BAD, with markets worldwide • Reform process slowed down due to an amalgam of factors: • historical factors, new political configuration • continued debate worldwide on electricity markets • bad experiences easier noticed • debate has strongly polarized • This led to other ten “minor” (not structural) proposals that range from the two opposite visions: “market” and “full regulation” • If consensus arrives, this year, future configuration will likely look as second presidential reform proposal, 2002. 18

Readiness activities • From 1999 to 2002 • CFE implemented a virtual market according to guidelines in 1999 proposal • A new set of computer systems and models has been generating 1400 nodal prices out of the virtual market since 2000 • Hydro generation is dispatched by a mid-term hydro-thermal coordination procedure • Then, the model contains a day-ahead and real-time bid-based spot markets with financial bilateral contracts • A settlement system in also in place assuming a particular CFE´s configuration of generation and distribution virtual utilities 19

Readiness activities • From 1999 to 2002 • CFE implemented a virtual market according to guidelines in 1999 proposal • A new set of computer systems and models has been generating 1400 nodal prices out of the virtual market since 2000 • Hydro generation is dispatched by a mid-term hydro-thermal coordination procedure • Then, the model contains a day-ahead and real-time bid-based spot markets with financial bilateral contracts • A settlement system in also in place assuming a particular CFE´s configuration of generation and distribution virtual utilities 19

Readiness activities • From 1999 to 2002 • CRE performed analytical and simulation studies predict market power possibilities: • Initially only HHI indexes of first proposed division of assets according to CFE administrative structure • Later implemented simulation studies to predict market power • Study showed the need for bilateral contracting and other hedging mechanisms including load involvement, and the need for market monitoring and oversight • Other activities: transmission pricing review, cross-border tariffs and congestion management, quality of service regulation, market design and oversight issues. 20

Readiness activities • From 1999 to 2002 • CRE performed analytical and simulation studies predict market power possibilities: • Initially only HHI indexes of first proposed division of assets according to CFE administrative structure • Later implemented simulation studies to predict market power • Study showed the need for bilateral contracting and other hedging mechanisms including load involvement, and the need for market monitoring and oversight • Other activities: transmission pricing review, cross-border tariffs and congestion management, quality of service regulation, market design and oversight issues. 20

Current government proposal • A proposal in between the two poles: perhaps low risk but also low return (investment wise) • Main public company with separated accounts in G/T/D • Large costumers can switch supplier contracting in a long-term bilateral format to share the risk in supply investment in the long run using bilateral contracts, with financial transmission rights mechanisms. • Short term nodal price signals only to settle imbalances in system operation and buy or sell opportunity energy. Possible additional mechanisms to help complement market signals for long term supply adequacy (adequacy-like mechanisms) • Real-time pricing, where technically and economically feasible, under investigation for its implementation even before reform: demand as a potential capacity addition mechanism • Market monitoring, perhaps “communicating” with the additional (adequacy-like) mechanisms 21

Current government proposal • A proposal in between the two poles: perhaps low risk but also low return (investment wise) • Main public company with separated accounts in G/T/D • Large costumers can switch supplier contracting in a long-term bilateral format to share the risk in supply investment in the long run using bilateral contracts, with financial transmission rights mechanisms. • Short term nodal price signals only to settle imbalances in system operation and buy or sell opportunity energy. Possible additional mechanisms to help complement market signals for long term supply adequacy (adequacy-like mechanisms) • Real-time pricing, where technically and economically feasible, under investigation for its implementation even before reform: demand as a potential capacity addition mechanism • Market monitoring, perhaps “communicating” with the additional (adequacy-like) mechanisms 21

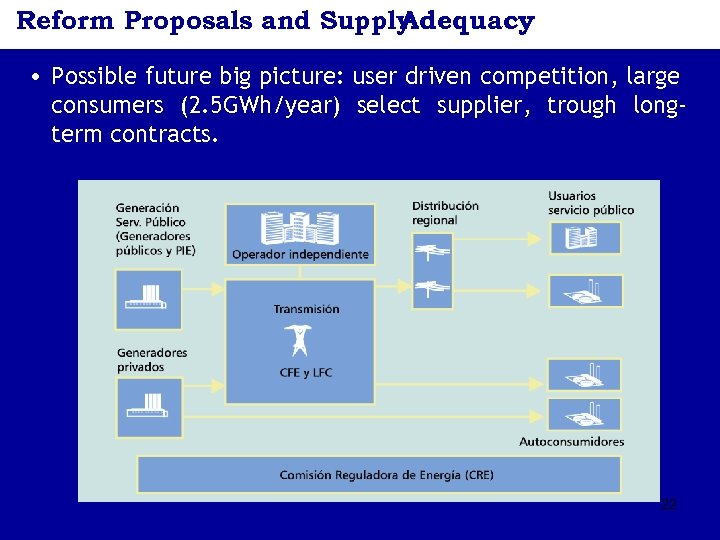

Reform Proposals and Supply Adequacy • Possible future big picture: user driven competition, large consumers (2. 5 GWh/year) select supplier, trough longterm contracts. 22

Reform Proposals and Supply Adequacy • Possible future big picture: user driven competition, large consumers (2. 5 GWh/year) select supplier, trough longterm contracts. 22

Agenda • The Mexican Electricity Industry: Overview • Current Regulatory Framework • The Last Ten Years of Generation Expansion • Supply Adequacy Challenges • Reform Proposals • Closing Remarks 23

Agenda • The Mexican Electricity Industry: Overview • Current Regulatory Framework • The Last Ten Years of Generation Expansion • Supply Adequacy Challenges • Reform Proposals • Closing Remarks 23

Closing Remarks • Supply adequacy (physical) problems are not seen for the next four years; however, the increasing cost of supply adequacy is the main challenge (financial). • Further relying in present PPA contracts may not be the best approach: increasing government debt, affecting general public balance sheet and other important social investment decisions • Other important problems related to electricity subsidies and revising the role and attributions of public companies need be fixed beforehand. • Reform proposals, mainly focused to solve investment for supply adequacy. If agreements come this year it will Likely to be a share of long-term direct private & public investment. Short term and real-time “market” limited to natural adjustments. • CRE to regulate all other activities: transmission, distribution, public service tariffs and market oversight. • We expect to keep learning from all your experiences, thanks for the invitation ! 24

Closing Remarks • Supply adequacy (physical) problems are not seen for the next four years; however, the increasing cost of supply adequacy is the main challenge (financial). • Further relying in present PPA contracts may not be the best approach: increasing government debt, affecting general public balance sheet and other important social investment decisions • Other important problems related to electricity subsidies and revising the role and attributions of public companies need be fixed beforehand. • Reform proposals, mainly focused to solve investment for supply adequacy. If agreements come this year it will Likely to be a share of long-term direct private & public investment. Short term and real-time “market” limited to natural adjustments. • CRE to regulate all other activities: transmission, distribution, public service tariffs and market oversight. • We expect to keep learning from all your experiences, thanks for the invitation ! 24