f4ae438f5dd642b8012bbd92b9cbe702.ppt

- Количество слайдов: 41

8 - 1 Fundamentals of Corporate Finance Sixth Edition Chapter 8 Net Present Value and Other Investment Criteria Richard A. Brealey Stewart C. Myers Alan J. Marcus Slides by Matthew Will Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Inc. All rights reserved 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 1 Fundamentals of Corporate Finance Sixth Edition Chapter 8 Net Present Value and Other Investment Criteria Richard A. Brealey Stewart C. Myers Alan J. Marcus Slides by Matthew Will Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Inc. All rights reserved 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 2 Topics Covered w Net Present Value w Other Investment Criteria w Mutually Exclusive Projects w Capital Rationing Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 2 Topics Covered w Net Present Value w Other Investment Criteria w Mutually Exclusive Projects w Capital Rationing Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 3 Net Present Value - Present value of cash flows minus initial investments. Opportunity Cost of Capital - Expected rate of return given up by investing in a project Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 3 Net Present Value - Present value of cash flows minus initial investments. Opportunity Cost of Capital - Expected rate of return given up by investing in a project Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 4 Net Present Value Example Q: Suppose we can invest $50 today & receive $60 later today. What is our increase in value? A: Profit = - $50 + $60 = $10 $50 Mc. Graw Hill/Irwin Added Value Initial Investment Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 4 Net Present Value Example Q: Suppose we can invest $50 today & receive $60 later today. What is our increase in value? A: Profit = - $50 + $60 = $10 $50 Mc. Graw Hill/Irwin Added Value Initial Investment Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

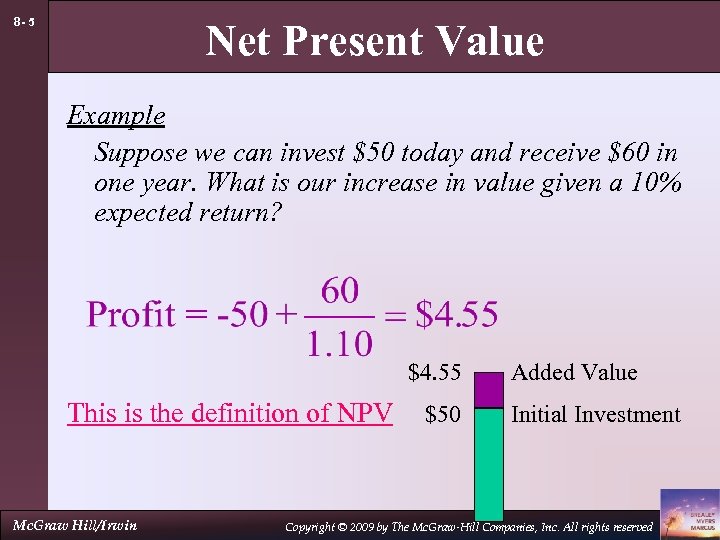

8 - 5 Net Present Value Example Suppose we can invest $50 today and receive $60 in one year. What is our increase in value given a 10% expected return? $4. 55 This is the definition of NPV Mc. Graw Hill/Irwin $50 Added Value Initial Investment Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 5 Net Present Value Example Suppose we can invest $50 today and receive $60 in one year. What is our increase in value given a 10% expected return? $4. 55 This is the definition of NPV Mc. Graw Hill/Irwin $50 Added Value Initial Investment Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

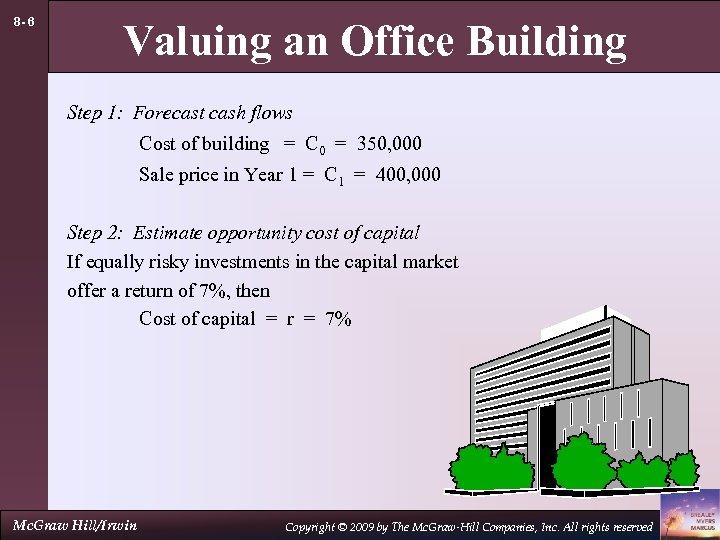

8 - 6 Valuing an Office Building Step 1: Forecast cash flows Cost of building = C 0 = 350, 000 Sale price in Year 1 = C 1 = 400, 000 Step 2: Estimate opportunity cost of capital If equally risky investments in the capital market offer a return of 7%, then Cost of capital = r = 7% Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 6 Valuing an Office Building Step 1: Forecast cash flows Cost of building = C 0 = 350, 000 Sale price in Year 1 = C 1 = 400, 000 Step 2: Estimate opportunity cost of capital If equally risky investments in the capital market offer a return of 7%, then Cost of capital = r = 7% Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

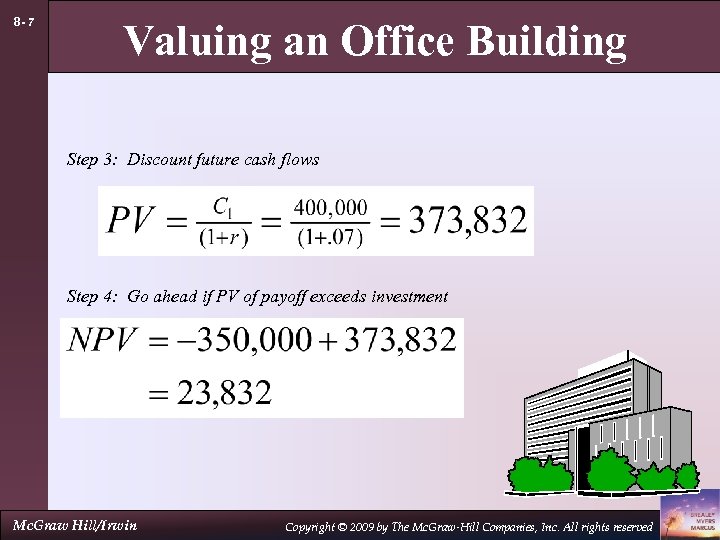

8 - 7 Valuing an Office Building Step 3: Discount future cash flows Step 4: Go ahead if PV of payoff exceeds investment Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 7 Valuing an Office Building Step 3: Discount future cash flows Step 4: Go ahead if PV of payoff exceeds investment Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

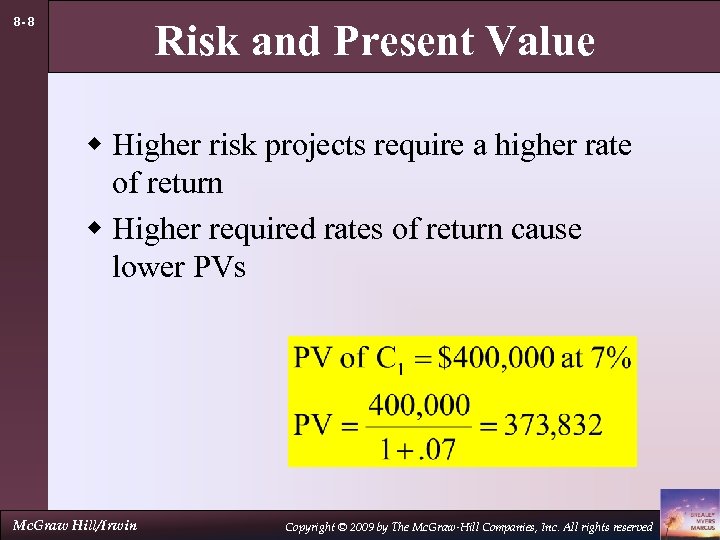

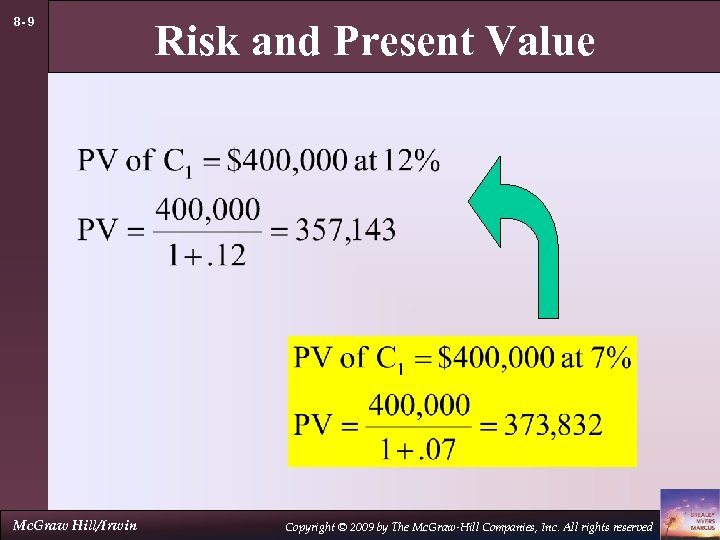

8 - 8 Risk and Present Value w Higher risk projects require a higher rate of return w Higher required rates of return cause lower PVs Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 8 Risk and Present Value w Higher risk projects require a higher rate of return w Higher required rates of return cause lower PVs Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 9 Mc. Graw Hill/Irwin Risk and Present Value Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 9 Mc. Graw Hill/Irwin Risk and Present Value Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

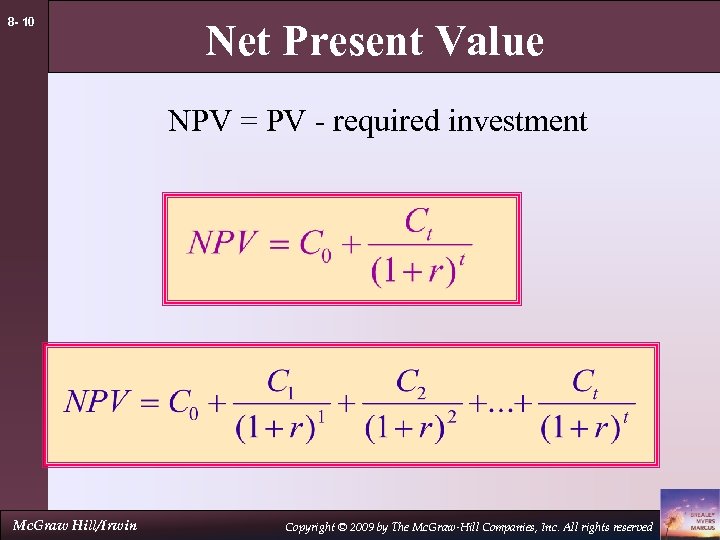

8 - 10 Net Present Value NPV = PV - required investment Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 10 Net Present Value NPV = PV - required investment Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 11 Net Present Value Terminology C = Cash Flow t = time period of the investment r = “opportunity cost of capital” w The Cash Flow could be positive or negative at any time period. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 11 Net Present Value Terminology C = Cash Flow t = time period of the investment r = “opportunity cost of capital” w The Cash Flow could be positive or negative at any time period. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 12 Net Present Value Rule Managers increase shareholders’ wealth by accepting all projects that are worth more than they cost. Therefore, they should accept all projects with a positive net present value. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 12 Net Present Value Rule Managers increase shareholders’ wealth by accepting all projects that are worth more than they cost. Therefore, they should accept all projects with a positive net present value. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 13 Net Present Value Example You have the opportunity to purchase an office building. You have a tenant lined up that will generate $16, 000 per year in cash flows for three years. At the end of three years you anticipate selling the building for $450, 000. How much would you be willing to pay for the building? Assume a 7% opportunity cost of capital Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 13 Net Present Value Example You have the opportunity to purchase an office building. You have a tenant lined up that will generate $16, 000 per year in cash flows for three years. At the end of three years you anticipate selling the building for $450, 000. How much would you be willing to pay for the building? Assume a 7% opportunity cost of capital Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

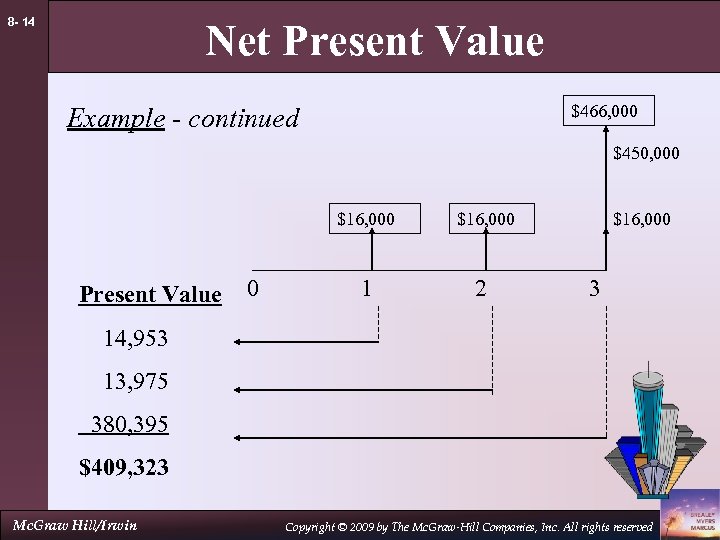

8 - 14 Net Present Value $466, 000 Example - continued $450, 000 $16, 000 Present Value 0 $16, 000 1 2 $16, 000 3 14, 953 13, 975 380, 395 $409, 323 Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 14 Net Present Value $466, 000 Example - continued $450, 000 $16, 000 Present Value 0 $16, 000 1 2 $16, 000 3 14, 953 13, 975 380, 395 $409, 323 Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 15 Net Present Value Example - continued If the building is being offered for sale at a price of $350, 000, would you buy the building and what is the added value generated by your purchase and management of the building? Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 15 Net Present Value Example - continued If the building is being offered for sale at a price of $350, 000, would you buy the building and what is the added value generated by your purchase and management of the building? Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

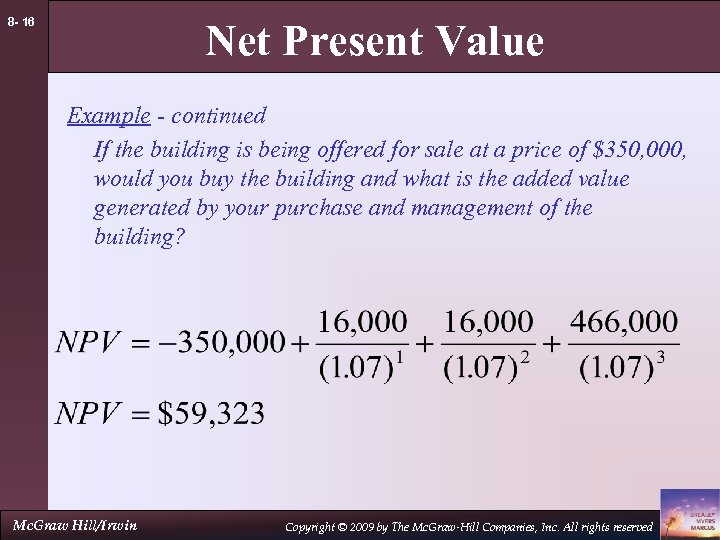

8 - 16 Net Present Value Example - continued If the building is being offered for sale at a price of $350, 000, would you buy the building and what is the added value generated by your purchase and management of the building? Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 16 Net Present Value Example - continued If the building is being offered for sale at a price of $350, 000, would you buy the building and what is the added value generated by your purchase and management of the building? Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 17 Payback Method Payback Period - Time until cash flows recover the initial investment of the project. w The payback rule specifies that a project be accepted if its payback period is less than the specified cutoff period. The following example will demonstrate the absurdity of this statement. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 17 Payback Method Payback Period - Time until cash flows recover the initial investment of the project. w The payback rule specifies that a project be accepted if its payback period is less than the specified cutoff period. The following example will demonstrate the absurdity of this statement. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

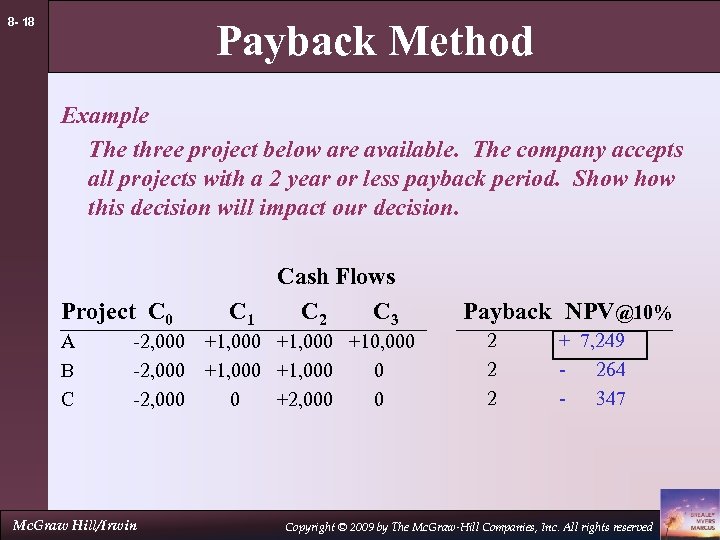

8 - 18 Payback Method Example The three project below are available. The company accepts all projects with a 2 year or less payback period. Show this decision will impact our decision. Project C 0 A B C -2, 000 Mc. Graw Hill/Irwin C 1 Cash Flows C 2 C 3 +1, 000 +10, 000 +1, 000 0 0 +2, 000 0 Payback NPV@10% 2 2 2 + 7, 249 - 264 - 347 Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 18 Payback Method Example The three project below are available. The company accepts all projects with a 2 year or less payback period. Show this decision will impact our decision. Project C 0 A B C -2, 000 Mc. Graw Hill/Irwin C 1 Cash Flows C 2 C 3 +1, 000 +10, 000 +1, 000 0 0 +2, 000 0 Payback NPV@10% 2 2 2 + 7, 249 - 264 - 347 Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

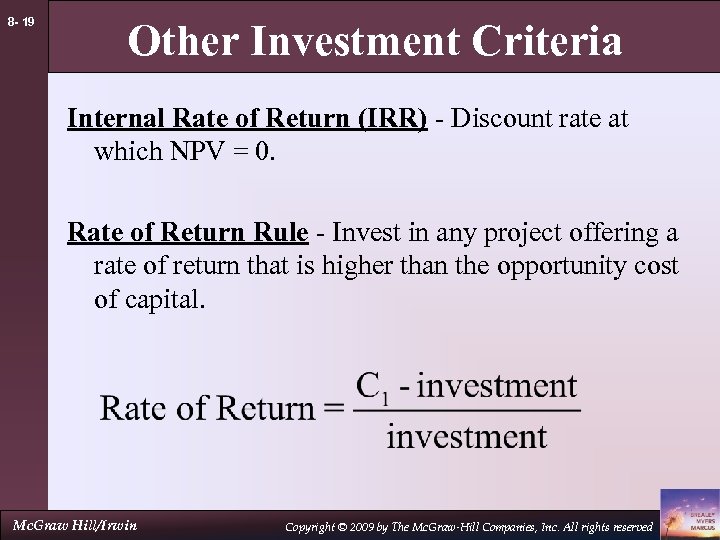

8 - 19 Other Investment Criteria Internal Rate of Return (IRR) - Discount rate at which NPV = 0. Rate of Return Rule - Invest in any project offering a rate of return that is higher than the opportunity cost of capital. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 19 Other Investment Criteria Internal Rate of Return (IRR) - Discount rate at which NPV = 0. Rate of Return Rule - Invest in any project offering a rate of return that is higher than the opportunity cost of capital. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

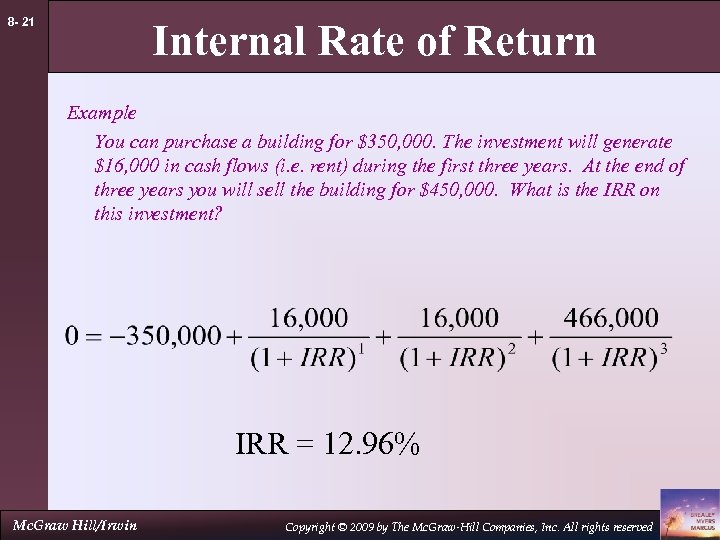

8 - 20 Internal Rate of Return Example You can purchase a building for $350, 000. The investment will generate $16, 000 in cash flows (i. e. rent) during the first three years. At the end of three years you will sell the building for $450, 000. What is the IRR on this investment? Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 20 Internal Rate of Return Example You can purchase a building for $350, 000. The investment will generate $16, 000 in cash flows (i. e. rent) during the first three years. At the end of three years you will sell the building for $450, 000. What is the IRR on this investment? Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 21 Internal Rate of Return Example You can purchase a building for $350, 000. The investment will generate $16, 000 in cash flows (i. e. rent) during the first three years. At the end of three years you will sell the building for $450, 000. What is the IRR on this investment? IRR = 12. 96% Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 21 Internal Rate of Return Example You can purchase a building for $350, 000. The investment will generate $16, 000 in cash flows (i. e. rent) during the first three years. At the end of three years you will sell the building for $450, 000. What is the IRR on this investment? IRR = 12. 96% Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

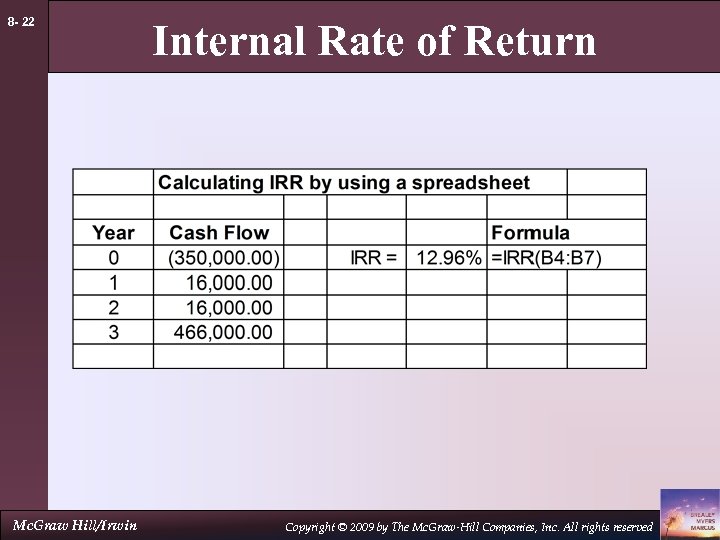

8 - 22 Mc. Graw Hill/Irwin Internal Rate of Return Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 22 Mc. Graw Hill/Irwin Internal Rate of Return Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

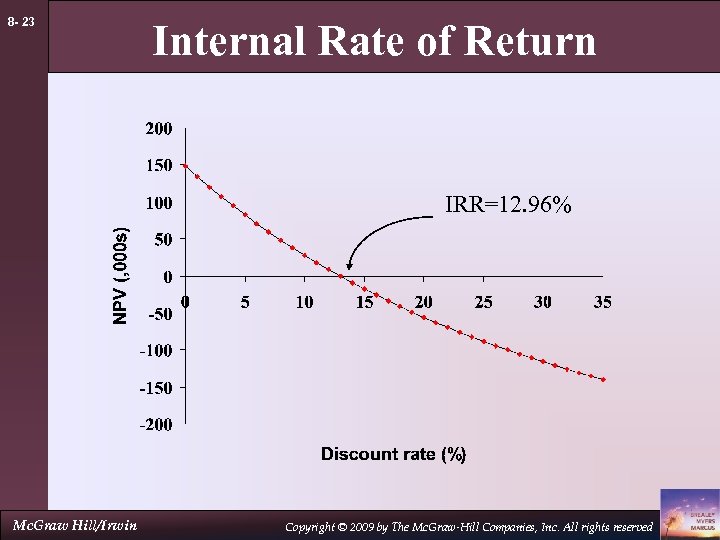

8 - 23 Internal Rate of Return IRR=12. 96% Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 23 Internal Rate of Return IRR=12. 96% Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

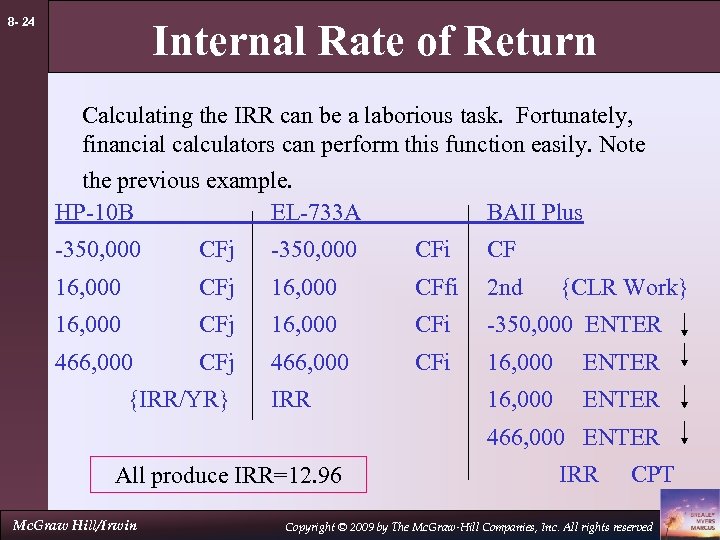

8 - 24 Internal Rate of Return Calculating the IRR can be a laborious task. Fortunately, financial calculators can perform this function easily. Note the previous example. HP-10 B EL-733 A BAII Plus -350, 000 CFj -350, 000 CFi CF 16, 000 CFj 16, 000 CFfi 2 nd 16, 000 CFj 16, 000 CFi -350, 000 ENTER 466, 000 CFj 466, 000 CFi 16, 000 ENTER {IRR/YR} IRR {CLR Work} 466, 000 ENTER All produce IRR=12. 96 Mc. Graw Hill/Irwin IRR CPT Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 24 Internal Rate of Return Calculating the IRR can be a laborious task. Fortunately, financial calculators can perform this function easily. Note the previous example. HP-10 B EL-733 A BAII Plus -350, 000 CFj -350, 000 CFi CF 16, 000 CFj 16, 000 CFfi 2 nd 16, 000 CFj 16, 000 CFi -350, 000 ENTER 466, 000 CFj 466, 000 CFi 16, 000 ENTER {IRR/YR} IRR {CLR Work} 466, 000 ENTER All produce IRR=12. 96 Mc. Graw Hill/Irwin IRR CPT Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

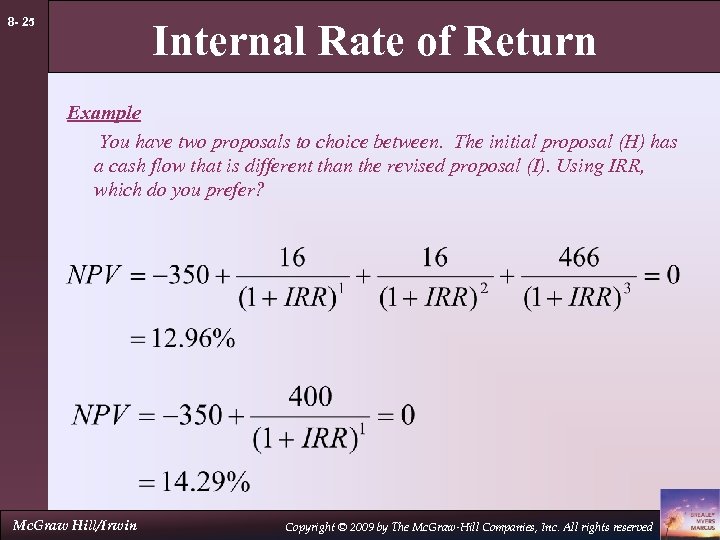

8 - 25 Internal Rate of Return Example You have two proposals to choice between. The initial proposal (H) has a cash flow that is different than the revised proposal (I). Using IRR, which do you prefer? Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 25 Internal Rate of Return Example You have two proposals to choice between. The initial proposal (H) has a cash flow that is different than the revised proposal (I). Using IRR, which do you prefer? Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

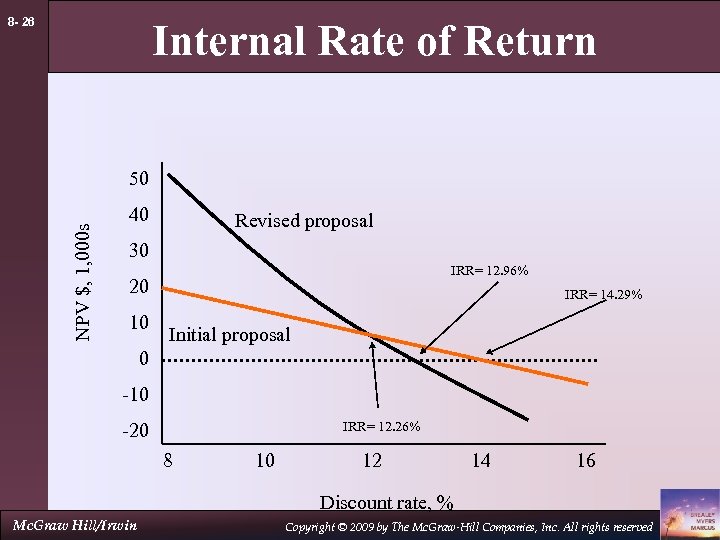

8 - 26 Internal Rate of Return NPV $, 1, 000 s 50 40 Revised proposal 30 IRR= 12. 96% 20 10 IRR= 14. 29% Initial proposal 0 -10 IRR= 12. 26% -20 8 10 12 14 16 Discount rate, % Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 26 Internal Rate of Return NPV $, 1, 000 s 50 40 Revised proposal 30 IRR= 12. 96% 20 10 IRR= 14. 29% Initial proposal 0 -10 IRR= 12. 26% -20 8 10 12 14 16 Discount rate, % Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 27 Internal Rate of Return Pitfall 1 - Lending or Borrowing? w With some cash the NPV of the project increases as the discount rate increases w This is contrary to the normal relationship between PV and discount rates. Pitfall 2 - Multiple Rates of Return Ü Certain cash flows can generate NPV=0 at two different discount rates. Pitfall 3 - Mutually Exclusive Projects Ü IRR sometimes ignores the magnitude of the project. Ü The following two projects illustrate that problem. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 27 Internal Rate of Return Pitfall 1 - Lending or Borrowing? w With some cash the NPV of the project increases as the discount rate increases w This is contrary to the normal relationship between PV and discount rates. Pitfall 2 - Multiple Rates of Return Ü Certain cash flows can generate NPV=0 at two different discount rates. Pitfall 3 - Mutually Exclusive Projects Ü IRR sometimes ignores the magnitude of the project. Ü The following two projects illustrate that problem. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

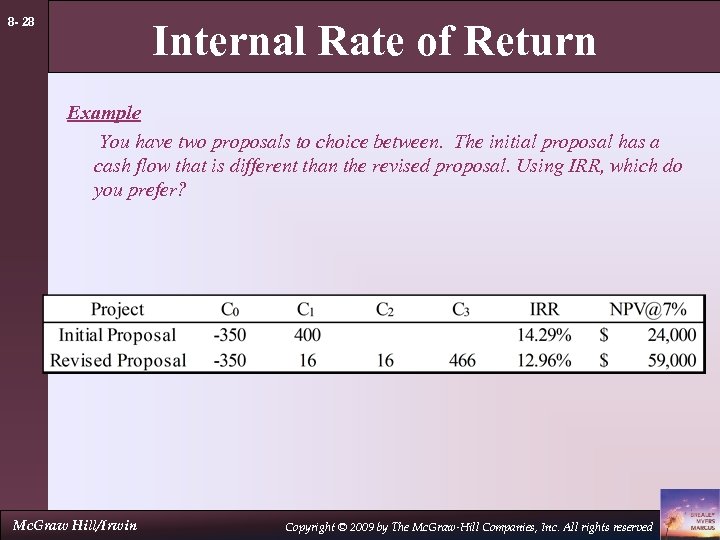

8 - 28 Internal Rate of Return Example You have two proposals to choice between. The initial proposal has a cash flow that is different than the revised proposal. Using IRR, which do you prefer? Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 28 Internal Rate of Return Example You have two proposals to choice between. The initial proposal has a cash flow that is different than the revised proposal. Using IRR, which do you prefer? Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 29 Project Interactions When you need to choose between mutually exclusive projects, the decision rule is simple. Calculate the NPV of each project, and, from those options that have a positive NPV, choose the one whose NPV is highest. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 29 Project Interactions When you need to choose between mutually exclusive projects, the decision rule is simple. Calculate the NPV of each project, and, from those options that have a positive NPV, choose the one whose NPV is highest. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

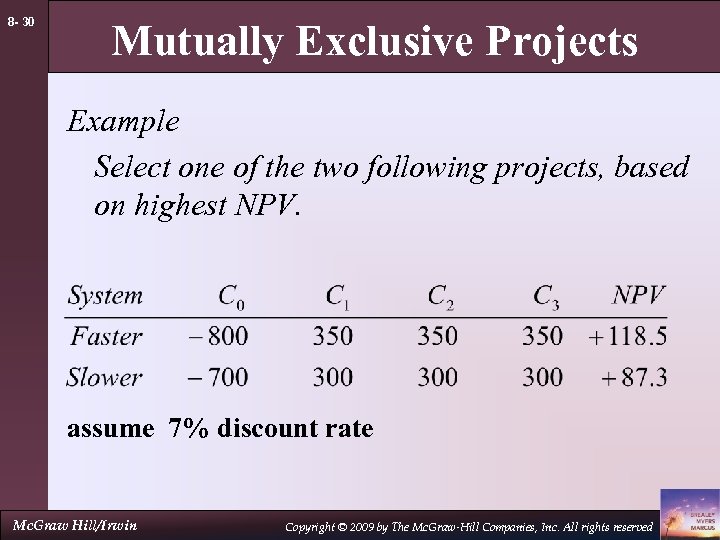

8 - 30 Mutually Exclusive Projects Example Select one of the two following projects, based on highest NPV. assume 7% discount rate Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 30 Mutually Exclusive Projects Example Select one of the two following projects, based on highest NPV. assume 7% discount rate Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 31 Investment Timing Sometimes you have the ability to defer an investment and select a time that is more ideal at which to make the investment decision. A common example involves a tree farm. You may defer the harvesting of trees. By doing so, you defer the receipt of the cash flow, yet increase the cash flow. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 31 Investment Timing Sometimes you have the ability to defer an investment and select a time that is more ideal at which to make the investment decision. A common example involves a tree farm. You may defer the harvesting of trees. By doing so, you defer the receipt of the cash flow, yet increase the cash flow. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

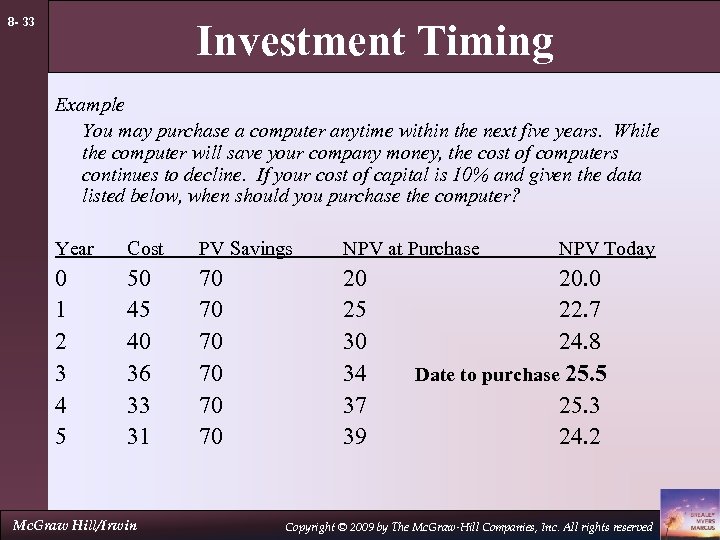

8 - 32 Investment Timing Example You may purchase a computer anytime within the next five years. While the computer will save your company money, the cost of computers continues to decline. If your cost of capital is 10% and given the data listed below, when should you purchase the computer? Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 32 Investment Timing Example You may purchase a computer anytime within the next five years. While the computer will save your company money, the cost of computers continues to decline. If your cost of capital is 10% and given the data listed below, when should you purchase the computer? Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 33 Investment Timing Example You may purchase a computer anytime within the next five years. While the computer will save your company money, the cost of computers continues to decline. If your cost of capital is 10% and given the data listed below, when should you purchase the computer? Year Cost PV Savings NPV at Purchase 0 1 2 3 4 5 50 45 40 36 33 31 70 70 70 20 25 30 34 37 39 Mc. Graw Hill/Irwin NPV Today 20. 0 22. 7 24. 8 Date to purchase 25. 5 25. 3 24. 2 Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 33 Investment Timing Example You may purchase a computer anytime within the next five years. While the computer will save your company money, the cost of computers continues to decline. If your cost of capital is 10% and given the data listed below, when should you purchase the computer? Year Cost PV Savings NPV at Purchase 0 1 2 3 4 5 50 45 40 36 33 31 70 70 70 20 25 30 34 37 39 Mc. Graw Hill/Irwin NPV Today 20. 0 22. 7 24. 8 Date to purchase 25. 5 25. 3 24. 2 Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

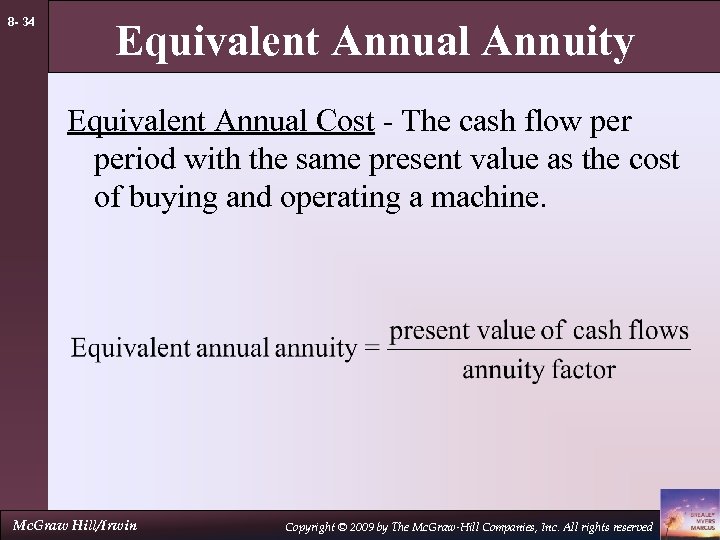

8 - 34 Equivalent Annual Annuity Equivalent Annual Cost - The cash flow period with the same present value as the cost of buying and operating a machine. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 34 Equivalent Annual Annuity Equivalent Annual Cost - The cash flow period with the same present value as the cost of buying and operating a machine. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

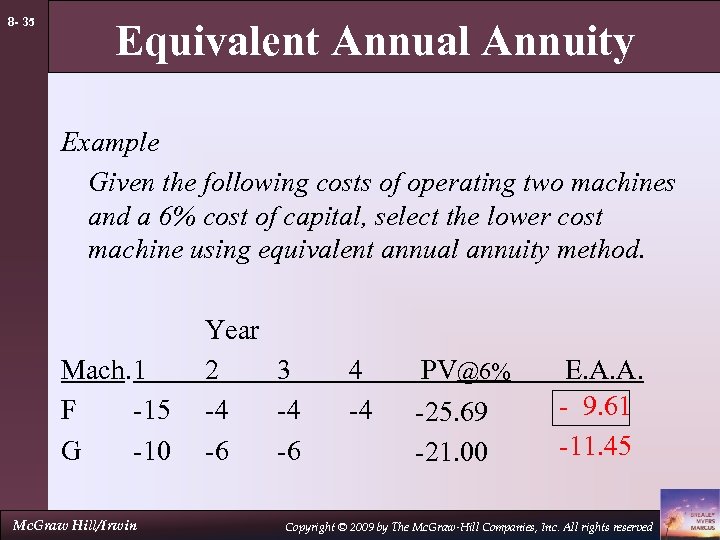

8 - 35 Equivalent Annual Annuity Example Given the following costs of operating two machines and a 6% cost of capital, select the lower cost machine using equivalent annual annuity method. Mach. 1 F -15 G -10 Mc. Graw Hill/Irwin Year 2 3 -4 -4 -6 -6 4 -4 PV@6% -25. 69 -21. 00 E. A. A. - 9. 61 -11. 45 Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 35 Equivalent Annual Annuity Example Given the following costs of operating two machines and a 6% cost of capital, select the lower cost machine using equivalent annual annuity method. Mach. 1 F -15 G -10 Mc. Graw Hill/Irwin Year 2 3 -4 -4 -6 -6 4 -4 PV@6% -25. 69 -21. 00 E. A. A. - 9. 61 -11. 45 Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

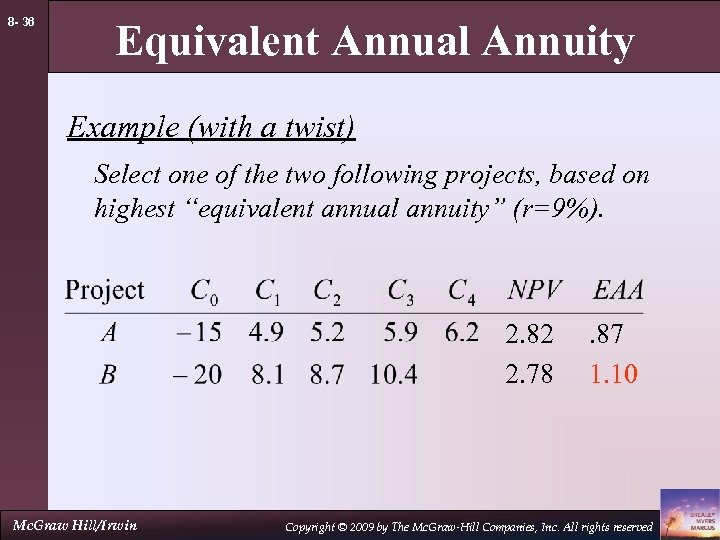

8 - 36 Equivalent Annual Annuity Example (with a twist) Select one of the two following projects, based on highest “equivalent annual annuity” (r=9%). 2. 82 2. 78 Mc. Graw Hill/Irwin . 87 1. 10 Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 36 Equivalent Annual Annuity Example (with a twist) Select one of the two following projects, based on highest “equivalent annual annuity” (r=9%). 2. 82 2. 78 Mc. Graw Hill/Irwin . 87 1. 10 Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 37 Capital Rationing - Limit set on the amount of funds available for investment. Soft Rationing - Limits on available funds imposed by management. Hard Rationing - Limits on available funds imposed by the unavailability of funds in the capital market. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 37 Capital Rationing - Limit set on the amount of funds available for investment. Soft Rationing - Limits on available funds imposed by management. Hard Rationing - Limits on available funds imposed by the unavailability of funds in the capital market. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

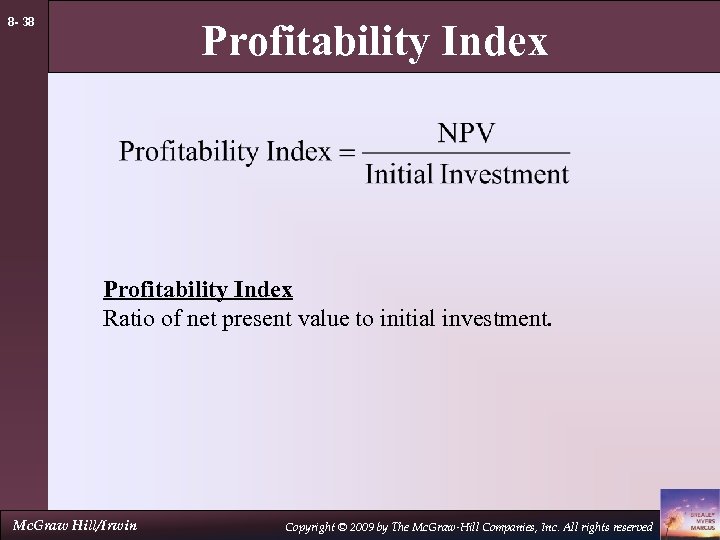

8 - 38 Profitability Index Ratio of net present value to initial investment. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 38 Profitability Index Ratio of net present value to initial investment. Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

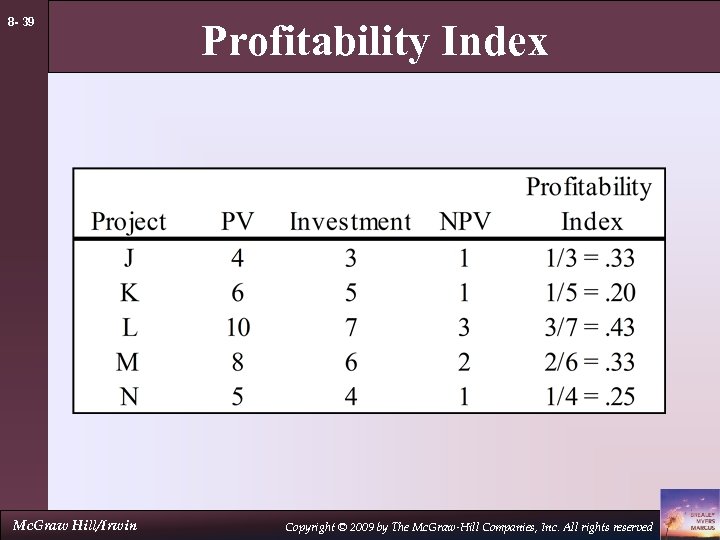

8 - 39 Mc. Graw Hill/Irwin Profitability Index Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 39 Mc. Graw Hill/Irwin Profitability Index Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

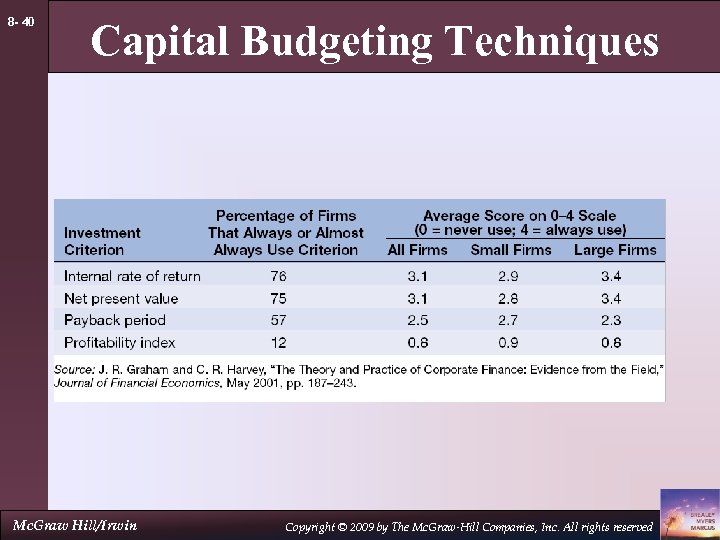

8 - 40 Capital Budgeting Techniques Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 40 Capital Budgeting Techniques Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 41 Web Resources www. fintools. com www. loanpricing. com www. djindexes. com www. spglobal. com www. wilshire. com www. msci. com www. barra. com Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 41 Web Resources www. fintools. com www. loanpricing. com www. djindexes. com www. spglobal. com www. wilshire. com www. msci. com www. barra. com Mc. Graw Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved