da24122e1451b2bb58b92d21b5209e57.ppt

- Количество слайдов: 68

7 -1

7 -1

7 -2 Time lines show timing of cash flows. 0 1 2 3 Tick marks at ends of periods, so Time 0 is today; Time 1 is the end of Period 1; or the beginning of Period 2.

7 -2 Time lines show timing of cash flows. 0 1 2 3 Tick marks at ends of periods, so Time 0 is today; Time 1 is the end of Period 1; or the beginning of Period 2.

7 -3 Time line for a $100 lump sum due at the end of Year 2. 0 1 2 Year 100

7 -3 Time line for a $100 lump sum due at the end of Year 2. 0 1 2 Year 100

7 -4 Time line for an ordinary annuity of $100 for 3 years. 0 1 2 3 100 100

7 -4 Time line for an ordinary annuity of $100 for 3 years. 0 1 2 3 100 100

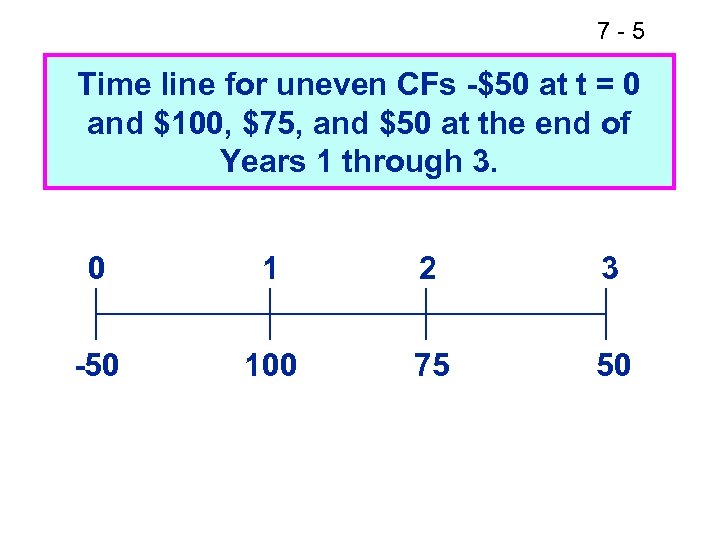

7 -5 Time line for uneven CFs -$50 at t = 0 and $100, $75, and $50 at the end of Years 1 through 3. 0 1 2 3 -50 100 75 50

7 -5 Time line for uneven CFs -$50 at t = 0 and $100, $75, and $50 at the end of Years 1 through 3. 0 1 2 3 -50 100 75 50

7 -6 What’s the FV of an initial $100 after 3 years if i = 10%? 0 100 1 2 3 FV = ? Finding FVs is compounding.

7 -6 What’s the FV of an initial $100 after 3 years if i = 10%? 0 100 1 2 3 FV = ? Finding FVs is compounding.

7 -7 After 1 year: After 2 years:

7 -7 After 1 year: After 2 years:

7 -8 After 3 years: In general,

7 -8 After 3 years: In general,

7 -9 Four Ways to Find FVs

7 -9 Four Ways to Find FVs

7 - 10 Financial Calculator Solution

7 - 10 Financial Calculator Solution

7 - 11 Here’s the setup to find FV: Clearing automatically sets everything to 0, but for safety enter PMT = 0. Set: P/YR = 1, END

7 - 11 Here’s the setup to find FV: Clearing automatically sets everything to 0, but for safety enter PMT = 0. Set: P/YR = 1, END

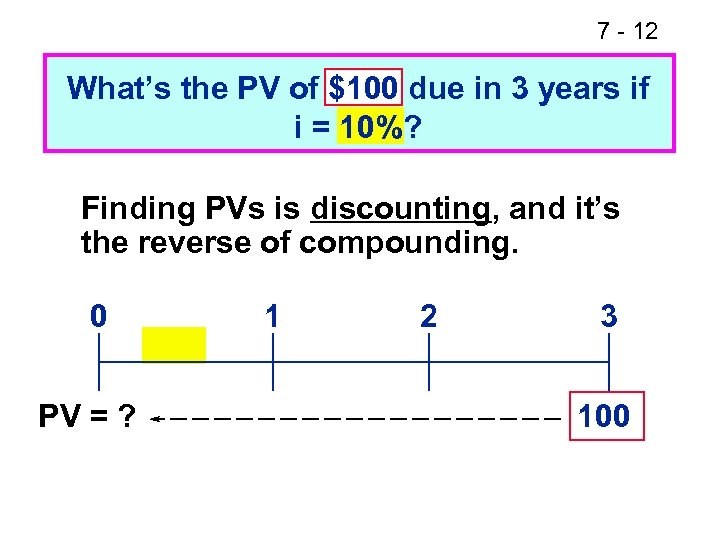

7 - 12 What’s the PV of $100 due in 3 years if i = 10%? Finding PVs is discounting, and it’s the reverse of compounding. 0 PV = ? 1 2 3 100

7 - 12 What’s the PV of $100 due in 3 years if i = 10%? Finding PVs is discounting, and it’s the reverse of compounding. 0 PV = ? 1 2 3 100

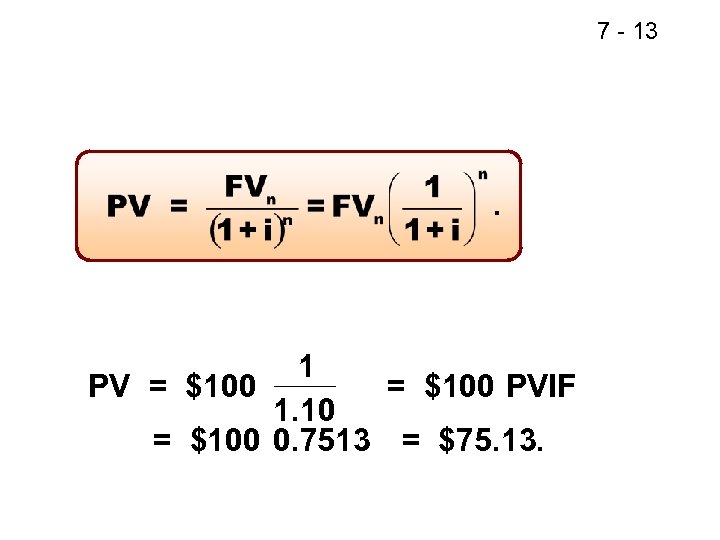

7 - 13 . 1 PV = $100 PVIF 1. 10 = $100 0. 7513 = $75. 13.

7 - 13 . 1 PV = $100 PVIF 1. 10 = $100 0. 7513 = $75. 13.

7 - 14 Financial Calculator Solution Either PV or FV must be negative. Here PV = -75. 13. Put in $75. 13 today, take out $100 after 3 years.

7 - 14 Financial Calculator Solution Either PV or FV must be negative. Here PV = -75. 13. Put in $75. 13 today, take out $100 after 3 years.

7 - 15 If sales grow at 20% per year, how long before sales double? Solve for n: Use calculator to solve, see next slide.

7 - 15 If sales grow at 20% per year, how long before sales double? Solve for n: Use calculator to solve, see next slide.

7 - 16 Graphical Illustration:

7 - 16 Graphical Illustration:

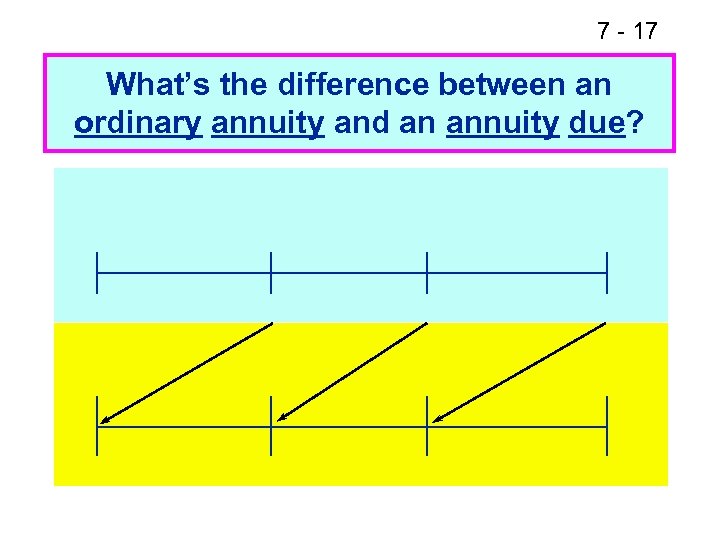

7 - 17 What’s the difference between an ordinary annuity and an annuity due?

7 - 17 What’s the difference between an ordinary annuity and an annuity due?

7 - 18 What’s the FV of a 3 -year ordinary annuity of $100 at 10%? 0 1 2 100 3 100 110 121 FV = 331

7 - 18 What’s the FV of a 3 -year ordinary annuity of $100 at 10%? 0 1 2 100 3 100 110 121 FV = 331

7 - 19 Financial Calculator Solution Have payments but no lump sum PV, so enter 0 for present value.

7 - 19 Financial Calculator Solution Have payments but no lump sum PV, so enter 0 for present value.

7 - 20 What’s the PV of this ordinary annuity? 0 2 3 100 90. 91 82. 64 75. 13 248. 68 = PV 1 100

7 - 20 What’s the PV of this ordinary annuity? 0 2 3 100 90. 91 82. 64 75. 13 248. 68 = PV 1 100

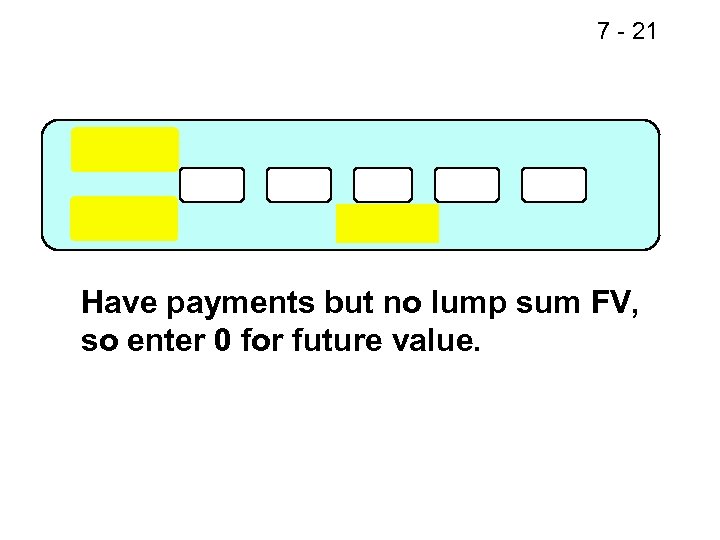

7 - 21 Have payments but no lump sum FV, so enter 0 for future value.

7 - 21 Have payments but no lump sum FV, so enter 0 for future value.

7 - 22 Find the FV and PV if the annuity were an annuity due. 0 1 2 100 100 3

7 - 22 Find the FV and PV if the annuity were an annuity due. 0 1 2 100 100 3

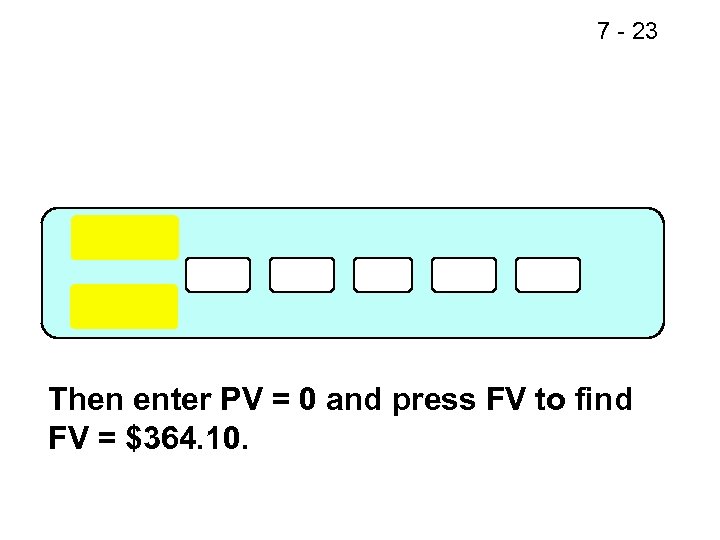

7 - 23 Then enter PV = 0 and press FV to find FV = $364. 10.

7 - 23 Then enter PV = 0 and press FV to find FV = $364. 10.

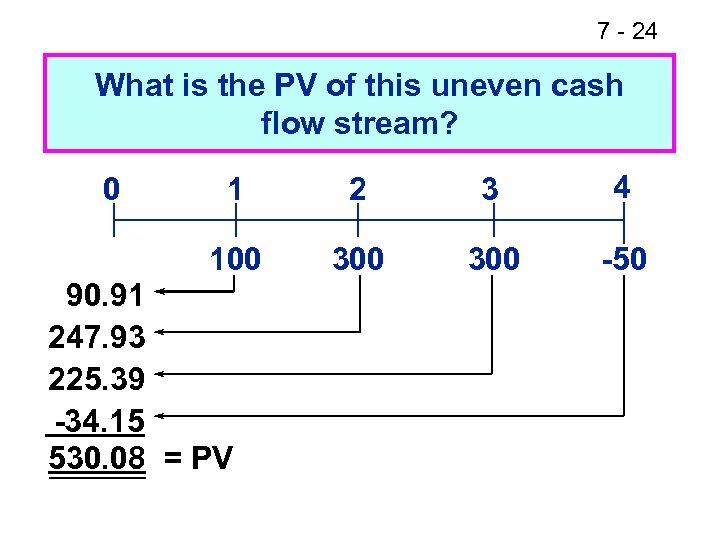

7 - 24 What is the PV of this uneven cash flow stream? 1 2 3 4 100 0 300 -50 90. 91 247. 93 225. 39 -34. 15 530. 08 = PV

7 - 24 What is the PV of this uneven cash flow stream? 1 2 3 4 100 0 300 -50 90. 91 247. 93 225. 39 -34. 15 530. 08 = PV

7 - 25

7 - 25

7 - 26 What interest rate would cause $100 to grow to $125. 97 in 3 years?

7 - 26 What interest rate would cause $100 to grow to $125. 97 in 3 years?

7 - 27 Will the FV of a lump sum be larger or smaller if we compound more often, holding the stated I% constant? Why? LARGER! If compounding is more frequent than once a year--for example, semiannually, quarterly, or daily--interest is earned on interest more often.

7 - 27 Will the FV of a lump sum be larger or smaller if we compound more often, holding the stated I% constant? Why? LARGER! If compounding is more frequent than once a year--for example, semiannually, quarterly, or daily--interest is earned on interest more often.

7 - 28

7 - 28

7 - 29 effective annual rate

7 - 29 effective annual rate

7 - 30

7 - 30

7 - 31

7 - 31

7 - 32

7 - 32

7 - 33

7 - 33

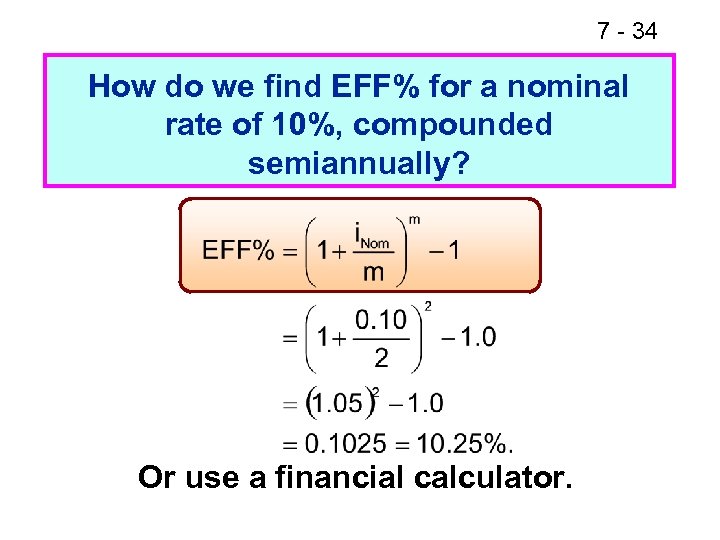

7 - 34 How do we find EFF% for a nominal rate of 10%, compounded semiannually? Or use a financial calculator.

7 - 34 How do we find EFF% for a nominal rate of 10%, compounded semiannually? Or use a financial calculator.

7 - 35 EAR = EFF% of 10%

7 - 35 EAR = EFF% of 10%

7 - 36 Can the effective rate ever be equal to the nominal rate?

7 - 36 Can the effective rate ever be equal to the nominal rate?

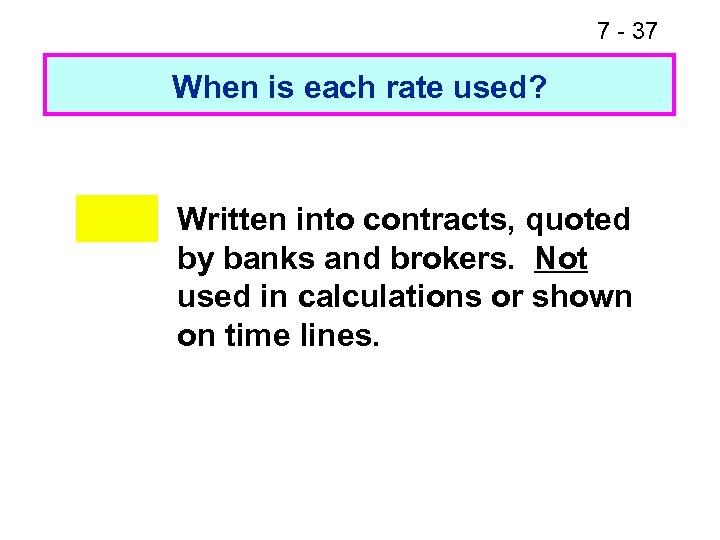

7 - 37 When is each rate used? Written into contracts, quoted by banks and brokers. Not used in calculations or shown on time lines.

7 - 37 When is each rate used? Written into contracts, quoted by banks and brokers. Not used in calculations or shown on time lines.

7 - 38 Used in calculations, shown on time lines.

7 - 38 Used in calculations, shown on time lines.

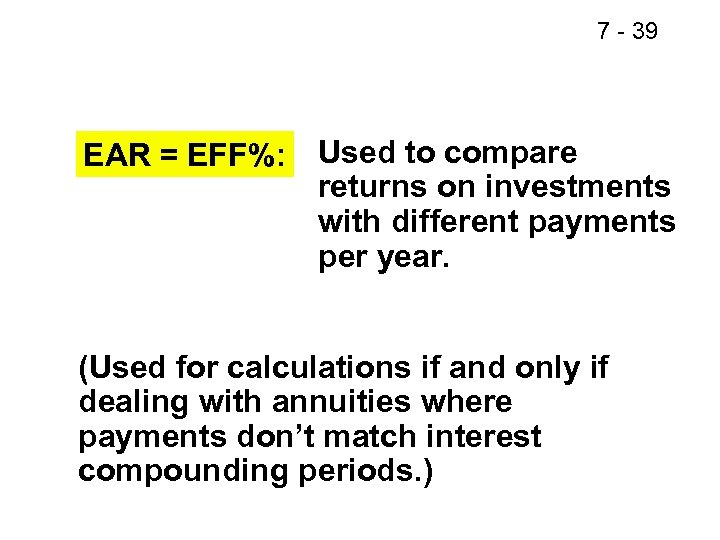

7 - 39 EAR = EFF%: Used to compare returns on investments with different payments per year. (Used for calculations if and only if dealing with annuities where payments don’t match interest compounding periods. )

7 - 39 EAR = EFF%: Used to compare returns on investments with different payments per year. (Used for calculations if and only if dealing with annuities where payments don’t match interest compounding periods. )

7 - 40 FV of $100 after 3 years under 10% semiannual compounding? Quarterly? FV = PV 1 + FV i m 0. 10 = $100 1 + 2 .

7 - 40 FV of $100 after 3 years under 10% semiannual compounding? Quarterly? FV = PV 1 + FV i m 0. 10 = $100 1 + 2 .

7 - 41 What’s the value at the end of Year 3 of the following CF stream if the quoted interest rate is 10%, compounded semiannually? 0 1 2 100 3 4 100 5 100

7 - 41 What’s the value at the end of Year 3 of the following CF stream if the quoted interest rate is 10%, compounded semiannually? 0 1 2 100 3 4 100 5 100

7 - 42

7 - 42

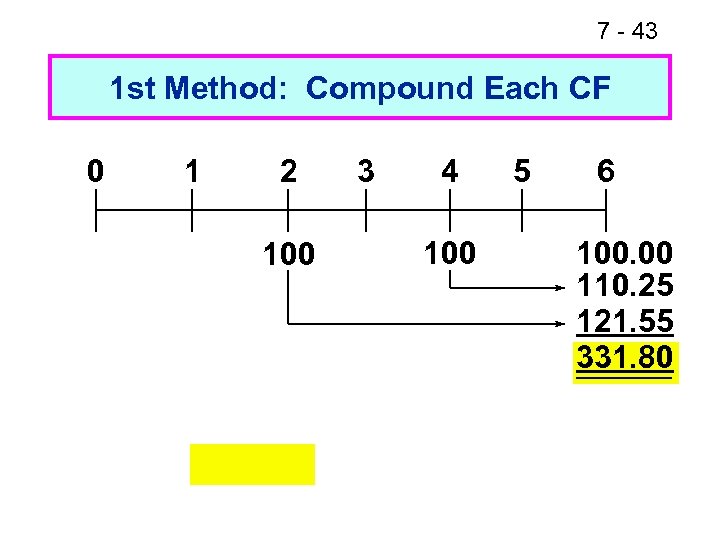

7 - 43 1 st Method: Compound Each CF 0 1 2 100 3 4 100 5 6 100. 00 110. 25 121. 55 331. 80

7 - 43 1 st Method: Compound Each CF 0 1 2 100 3 4 100 5 6 100. 00 110. 25 121. 55 331. 80

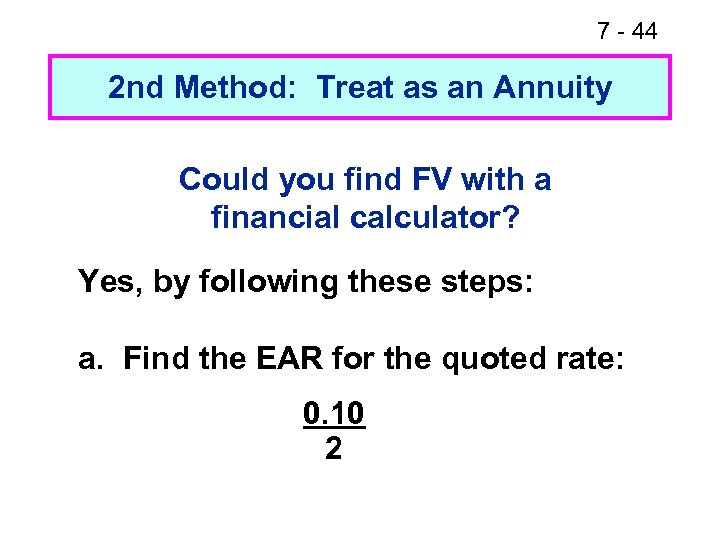

7 - 44 2 nd Method: Treat as an Annuity Could you find FV with a financial calculator? Yes, by following these steps: a. Find the EAR for the quoted rate: 0. 10 2

7 - 44 2 nd Method: Treat as an Annuity Could you find FV with a financial calculator? Yes, by following these steps: a. Find the EAR for the quoted rate: 0. 10 2

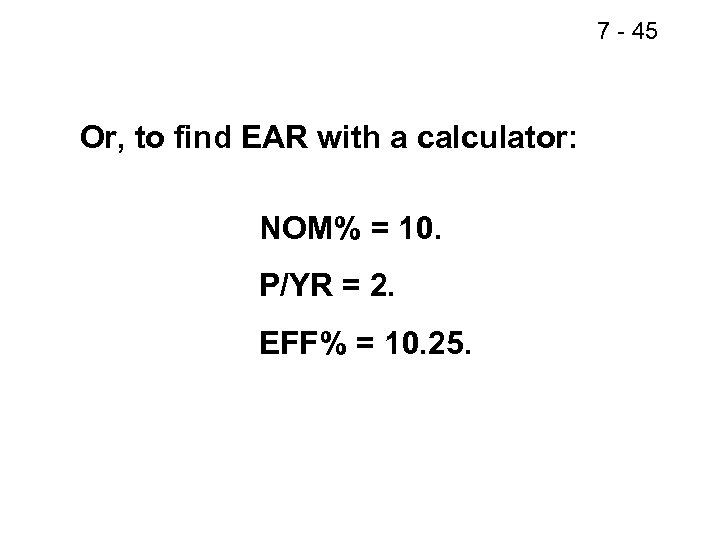

7 - 45 Or, to find EAR with a calculator: NOM% = 10. P/YR = 2. EFF% = 10. 25.

7 - 45 Or, to find EAR with a calculator: NOM% = 10. P/YR = 2. EFF% = 10. 25.

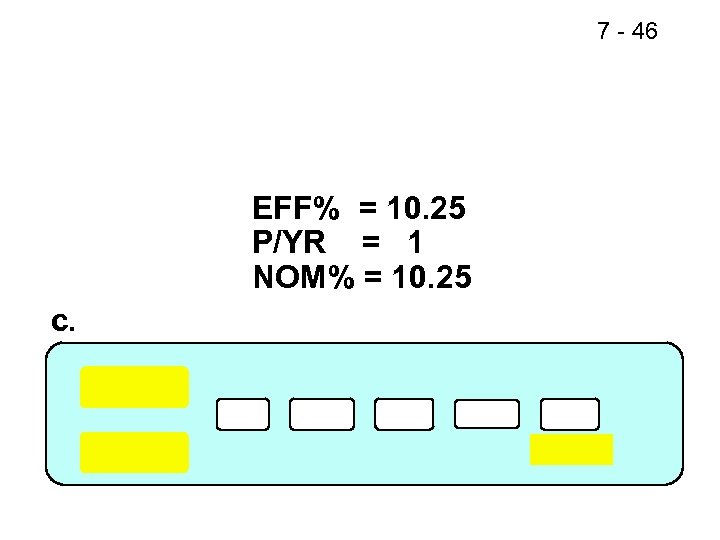

7 - 46 EFF% = 10. 25 P/YR = 1 NOM% = 10. 25 c.

7 - 46 EFF% = 10. 25 P/YR = 1 NOM% = 10. 25 c.

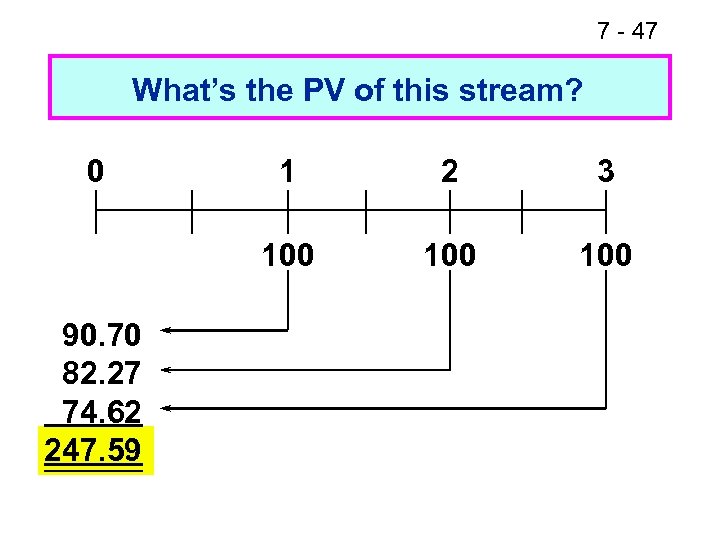

7 - 47 What’s the PV of this stream? 0 2 3 100 90. 70 82. 27 74. 62 247. 59 1 100

7 - 47 What’s the PV of this stream? 0 2 3 100 90. 70 82. 27 74. 62 247. 59 1 100

7 - 48 Amortization Construct an amortization schedule for a $1, 000, 10% annual rate loan with 3 equal payments.

7 - 48 Amortization Construct an amortization schedule for a $1, 000, 10% annual rate loan with 3 equal payments.

7 - 49 Step 1: Find the required payments. 0 1 2 3 -1, 000 PMT PMT

7 - 49 Step 1: Find the required payments. 0 1 2 3 -1, 000 PMT PMT

7 - 50 Step 2: Find interest charge for Year 1. Step 3: Find repayment of principal in Year 1. Repmt = PMT – INT = $402. 11 – $100 = $302. 11.

7 - 50 Step 2: Find interest charge for Year 1. Step 3: Find repayment of principal in Year 1. Repmt = PMT – INT = $402. 11 – $100 = $302. 11.

7 - 51 Step 4: Find ending balance after Year 1. End bal = Beg bal – Repmt = $1, 000 – $302. 11 = $697. 89. Repeat these steps for Years 2 and 3 to complete the amortization table.

7 - 51 Step 4: Find ending balance after Year 1. End bal = Beg bal – Repmt = $1, 000 – $302. 11 = $697. 89. Repeat these steps for Years 2 and 3 to complete the amortization table.

7 - 52 Interest declines. Tax implications.

7 - 52 Interest declines. Tax implications.

7 - 53

7 - 53

7 - 54

7 - 54

7 - 55 On January 1 you deposit $100 in an account that pays a nominal interest rate of 10%, with daily compounding (365 days). How much will you have on October 1, or after 9 months (273 days)? (Days given. )

7 - 55 On January 1 you deposit $100 in an account that pays a nominal interest rate of 10%, with daily compounding (365 days). How much will you have on October 1, or after 9 months (273 days)? (Days given. )

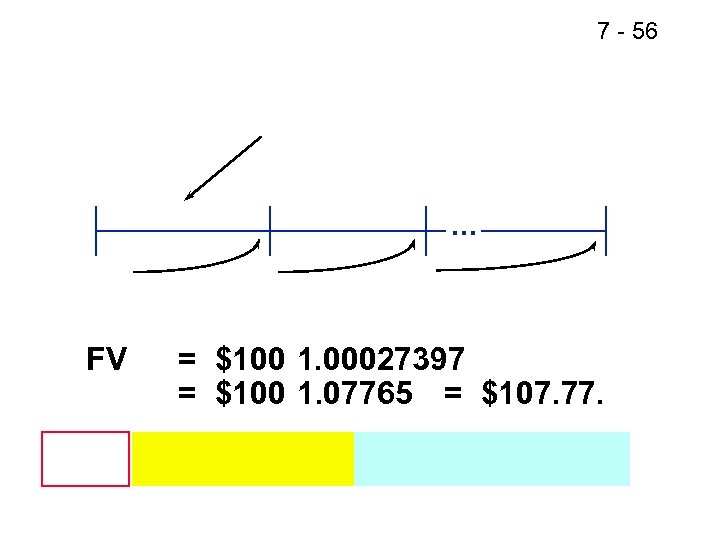

7 - 56 . . . FV = $100 1. 00027397 = $100 1. 07765 = $107. 77.

7 - 56 . . . FV = $100 1. 00027397 = $100 1. 07765 = $107. 77.

7 - 57 Enter i in one step. Leave data in calculator.

7 - 57 Enter i in one step. Leave data in calculator.

7 - 58 Now suppose you leave your money in the bank for 21 months, which is 1. 75 years or 273 + 365 = 638 days. How much will be in your account at maturity? Answer: Override N = 273 with N = 638. FV = $119. 10.

7 - 58 Now suppose you leave your money in the bank for 21 months, which is 1. 75 years or 273 + 365 = 638 days. How much will be in your account at maturity? Answer: Override N = 273 with N = 638. FV = $119. 10.

7 - 59 . . .

7 - 59 . . .

7 - 60 You are offered a note that pays $1, 000 in 15 months (or 456 days) for $850. You have $850 in a bank that pays a 7. 0% nominal rate, with 365 daily compounding, which is a daily rate of 0. 019178% and an EAR of 7. 25%. You plan to leave the money in the bank if you don’t buy the note. The note is riskless. Should you buy it?

7 - 60 You are offered a note that pays $1, 000 in 15 months (or 456 days) for $850. You have $850 in a bank that pays a 7. 0% nominal rate, with 365 daily compounding, which is a daily rate of 0. 019178% and an EAR of 7. 25%. You plan to leave the money in the bank if you don’t buy the note. The note is riskless. Should you buy it?

7 - 61 . . . 3 Ways to Solve: 1. Greatest future wealth: FV 2. Greatest wealth today: PV 3. Highest rate of return: Highest EFF%

7 - 61 . . . 3 Ways to Solve: 1. Greatest future wealth: FV 2. Greatest wealth today: PV 3. Highest rate of return: Highest EFF%

7 - 62 1. Greatest Future Wealth Find FV of $850 left in bank for 15 months and compare with note’s FV = $1, 000. Buy the note: $1, 000 > $927. 67.

7 - 62 1. Greatest Future Wealth Find FV of $850 left in bank for 15 months and compare with note’s FV = $1, 000. Buy the note: $1, 000 > $927. 67.

7 - 63 Calculator Solution to FV:

7 - 63 Calculator Solution to FV:

7 - 64 2. Greatest Present Wealth Find PV of note, and compare with its $850 cost:

7 - 64 2. Greatest Present Wealth Find PV of note, and compare with its $850 cost:

7 - 65 PV of note is greater than its $850 cost, so buy the note. Raises your wealth.

7 - 65 PV of note is greater than its $850 cost, so buy the note. Raises your wealth.

7 - 66 3. Rate of Return Find the EFF% on note and compare with 7. 25% bank pays, which is your opportunity cost of capital: Now we must solve for i.

7 - 66 3. Rate of Return Find the EFF% on note and compare with 7. 25% bank pays, which is your opportunity cost of capital: Now we must solve for i.

7 - 67 Convert % to decimal: Decimal = 0. 035646/100 = 0. 00035646.

7 - 67 Convert % to decimal: Decimal = 0. 035646/100 = 0. 00035646.

7 - 68 Using interest conversion: P/YR = 365. NOM% = 0. 035646(365) = 13. 01. EFF% = 13. 89. Since 13. 89% > 7. 25% opportunity cost, buy the note.

7 - 68 Using interest conversion: P/YR = 365. NOM% = 0. 035646(365) = 13. 01. EFF% = 13. 89. Since 13. 89% > 7. 25% opportunity cost, buy the note.