d81afeeb91265a860fcb4f29d8e1c4de.ppt

- Количество слайдов: 21

6 -6 Applications of Percents Warm Up Problem of the Day Lesson Presentation Course 3 3

6 -6 Applications of Percents Warm Up Estimate. Possible answers: 1. 20% of 602 120 2. 133 out of 264 50% 3. 151% of 78 120 4. 0. 28 out of 0. 95 30% Course 3

6 -6 Applications of Percents Problem of the Day A clothing outlet has a storewide clearance of 10% off all items. In addition, there is a “buy two, get one free” sale on a set of shirts of equal price. What is the total percent price reduction if you buy 3 shirts? 40% Course 3

6 -6 Applications of Percents Learn to find commission, sales tax, and percent of earnings. Course 3

6 -6 Applications of Percents Vocabulary commission rate sales tax Course 3

6 -6 Applications of Percents Car salespeople often work for commission. A commission is a fee paid to a person who makes a sale. It is usually a percent of the selling price. This percent is called the commission rate. Often salespeople are paid a commission plus a regular salary. The total pay is a percent of the sales they make plus a salary. commission rate Course 3 sales = commission

6 -6 Applications of Percents Additional Example 1: Multiplying by Percents to Find Commission Amounts A real-estate agent is paid a monthly salary of $900 plus commission. Last month he sold one condominium for $65, 000, earning a 4% commission on the sale. How much was his commission? What was his total pay last month? First find his commission. 4% $65, 000 = c commission rate commission Course 3 sales =

6 -6 Applications of Percents Additional Example 1 Continued 0. 04 65, 000 = c 2600 = c Change the percent to a decimal. Solve for c. He earned a commission of $2600 on the sale. Now find his total pay for last month. $2600 + $900 = $3500 commission + salary = total pay. His total pay for last month was $3500. Course 3

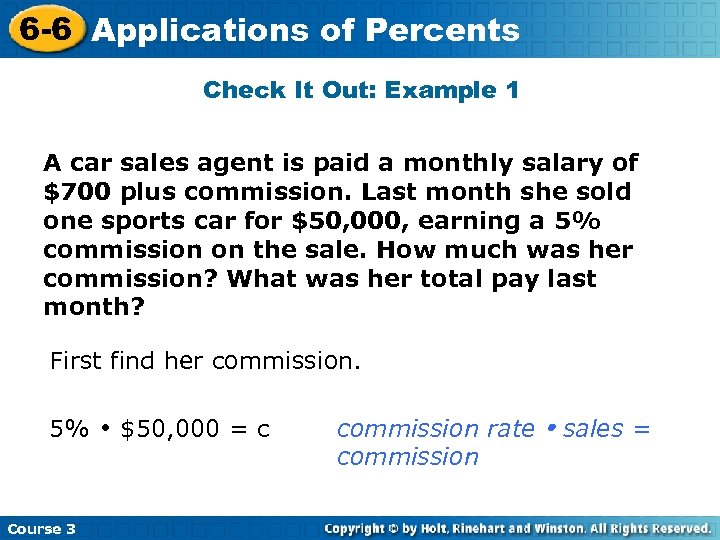

6 -6 Applications of Percents Check It Out: Example 1 A car sales agent is paid a monthly salary of $700 plus commission. Last month she sold one sports car for $50, 000, earning a 5% commission on the sale. How much was her commission? What was her total pay last month? First find her commission. 5% Course 3 $50, 000 = c commission rate commission sales =

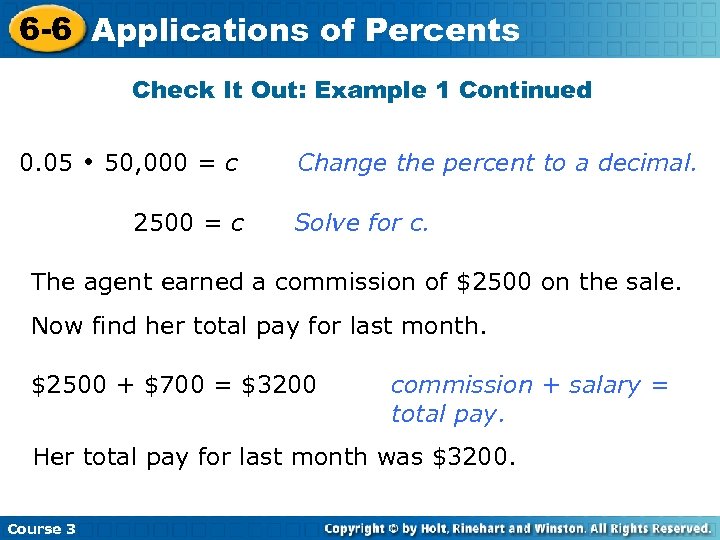

6 -6 Applications of Percents Check It Out: Example 1 Continued 0. 05 50, 000 = c 2500 = c Change the percent to a decimal. Solve for c. The agent earned a commission of $2500 on the sale. Now find her total pay for last month. $2500 + $700 = $3200 commission + salary = total pay. Her total pay for last month was $3200. Course 3

6 -6 Applications of Percents Sales tax is the tax on the sale of an item or service. It is a percent of the purchase price and is collected by the seller. Course 3

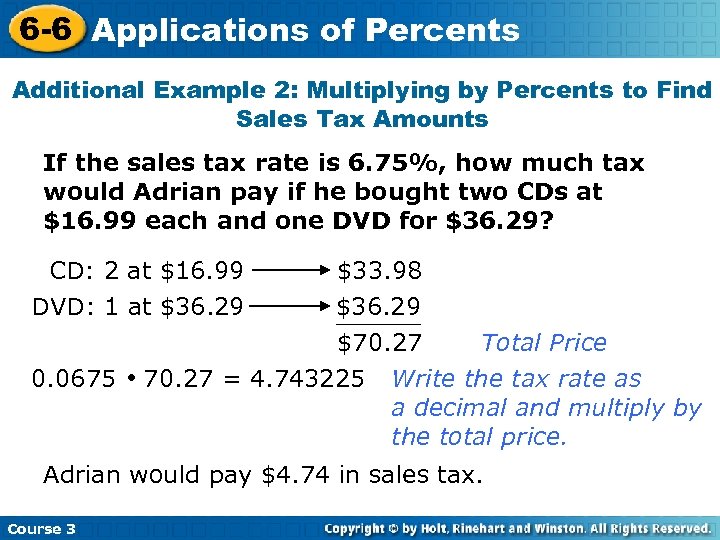

6 -6 Applications of Percents Additional Example 2: Multiplying by Percents to Find Sales Tax Amounts If the sales tax rate is 6. 75%, how much tax would Adrian pay if he bought two CDs at $16. 99 each and one DVD for $36. 29? CD: 2 at $16. 99 DVD: 1 at $36. 29 $33. 98 $36. 29 $70. 27 Total Price 0. 0675 70. 27 = 4. 743225 Write the tax rate as a decimal and multiply by the total price. Adrian would pay $4. 74 in sales tax. Course 3

6 -6 Applications of Percents Check It Out: Example 2 Amy rents a hotel for $45 per night. She rents for two nights and pays a sales tax of 13%. How much tax did she pay? $45 2 = $90 Find the total price for the hotel stay. $90 0. 13 = $11. 70 Write the tax rate as a decimal and multiply by the total price. Amy spent $11. 70 on sales tax. Course 3

6 -6 Applications of Percents Additional Example 3: Using Proportions to Find the Percent of Earnings Anna earns $1500 monthly. Of that, $114. 75 is withheld for Social Security and Medicare. What percent of Anna’s earnings are withheld for Social Security and Medicare? Think: What percent of $1500 is $114. 75? n = 114. 75 100 1500 n Course 3 1500 = 100 Set up a proportion. 114. 75 Find the cross products.

6 -6 Applications of Percents Additional Example 3 Continued 1500 n = 11, 475 Divide both sides by 1500. n = 11, 475 1500 n = 7. 65 Simplify. 7. 65% of Anna’s earnings is withheld for Social Security and Medicare. Course 3

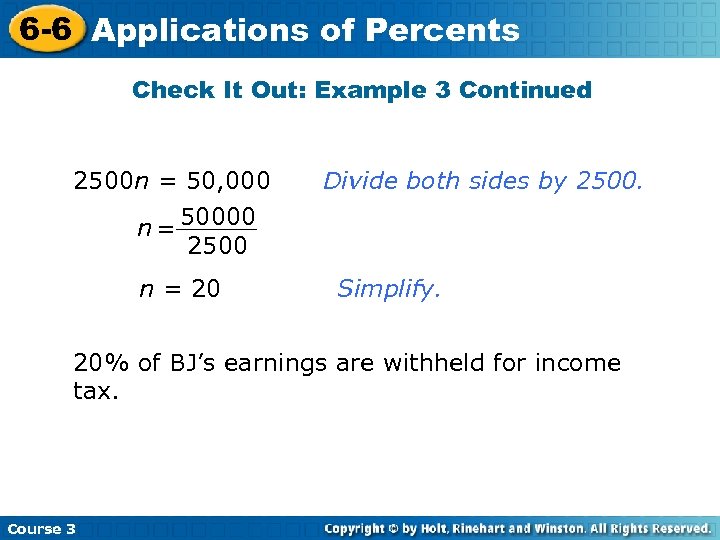

6 -6 Applications of Percents Check It Out: Example 3 BJ earns $2500 monthly. Of that, $500 is withheld for income tax. What percent of BJ’s earnings are withheld for income tax? Think: What percent of $2500 is $500? n = 500 100 2500 n Course 3 2500 = 100 Set up a proportion. 500 Find the cross products.

6 -6 Applications of Percents Check It Out: Example 3 Continued 2500 n = 50, 000 n = 50000 2500 n = 20 Divide both sides by 2500. Simplify. 20% of BJ’s earnings are withheld for income tax. Course 3

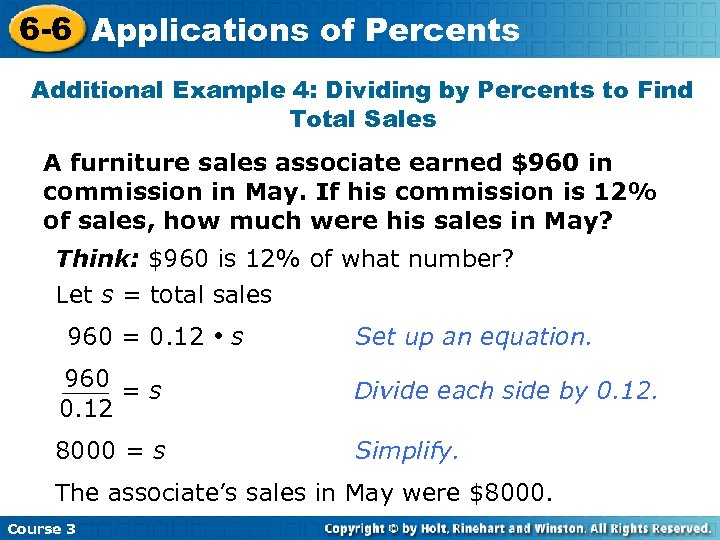

6 -6 Applications of Percents Additional Example 4: Dividing by Percents to Find Total Sales A furniture sales associate earned $960 in commission in May. If his commission is 12% of sales, how much were his sales in May? Think: $960 is 12% of what number? Let s = total sales 960 = 0. 12 s Set up an equation. 960 = s 0. 12 Divide each side by 0. 12. 8000 = s Simplify. The associate’s sales in May were $8000. Course 3

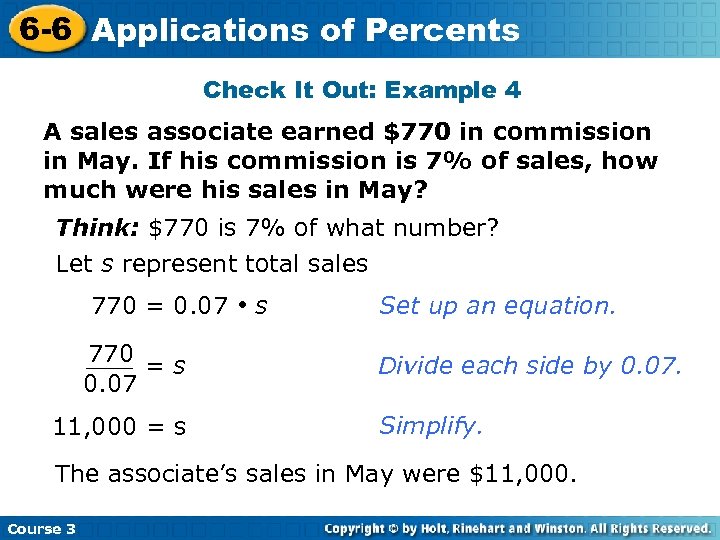

6 -6 Applications of Percents Check It Out: Example 4 A sales associate earned $770 in commission in May. If his commission is 7% of sales, how much were his sales in May? Think: $770 is 7% of what number? Let s represent total sales 770 = 0. 07 770 = s 0. 07 11, 000 = s s Set up an equation. Divide each side by 0. 07. Simplify. The associate’s sales in May were $11, 000. Course 3

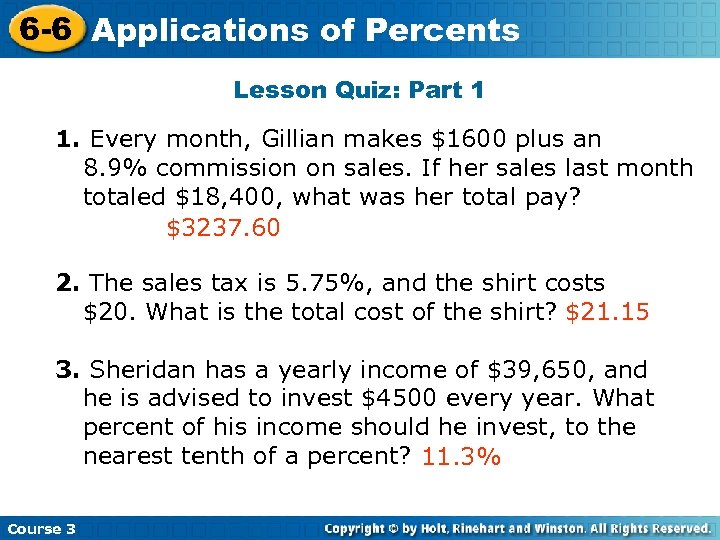

6 -6 Applications of Percents Lesson Quiz: Part 1 1. Every month, Gillian makes $1600 plus an 8. 9% commission on sales. If her sales last month totaled $18, 400, what was her total pay? $3237. 60 2. The sales tax is 5. 75%, and the shirt costs $20. What is the total cost of the shirt? $21. 15 3. Sheridan has a yearly income of $39, 650, and he is advised to invest $4500 every year. What percent of his income should he invest, to the nearest tenth of a percent? 11. 3% Course 3

6 -6 Applications of Percents Lesson Quiz: Part 2 4. If you earn a 4% commission, how much would your total sales have to be to make a commission of $115? $2875 Course 3

d81afeeb91265a860fcb4f29d8e1c4de.ppt