45abc90da642859f409fba8fc5610b74.ppt

- Количество слайдов: 24

4 -1 CHAPTER 4 The Financial Environment: Markets, Institutions, and Interest Rates n Financial markets n Types of financial institutions n Determinants of interest rates n Yield curves Copyright © 1999 by The Dryden Press All rights reserved.

4 -1 CHAPTER 4 The Financial Environment: Markets, Institutions, and Interest Rates n Financial markets n Types of financial institutions n Determinants of interest rates n Yield curves Copyright © 1999 by The Dryden Press All rights reserved.

4 -2 Define these markets n Markets in general n Markets for physical assets n Markets for financial assets n Money versus capital markets n Primary versus secondary markets n Spot versus future markets Copyright © 1999 by The Dryden Press All rights reserved.

4 -2 Define these markets n Markets in general n Markets for physical assets n Markets for financial assets n Money versus capital markets n Primary versus secondary markets n Spot versus future markets Copyright © 1999 by The Dryden Press All rights reserved.

4 -3 Three Primary Ways Capital Is Transferred Between Savers and Borrowers n Direct transfer n Through an investment banking house n Through a financial intermediary Copyright © 1999 by The Dryden Press All rights reserved.

4 -3 Three Primary Ways Capital Is Transferred Between Savers and Borrowers n Direct transfer n Through an investment banking house n Through a financial intermediary Copyright © 1999 by The Dryden Press All rights reserved.

4 -4 Organized Exchanges versus Over-the-Counter Market n Auction markets versus dealer markets (exchanges versus the OTC market) n NYSE versus NASDAQ system n Differences are narrowing Copyright © 1999 by The Dryden Press All rights reserved.

4 -4 Organized Exchanges versus Over-the-Counter Market n Auction markets versus dealer markets (exchanges versus the OTC market) n NYSE versus NASDAQ system n Differences are narrowing Copyright © 1999 by The Dryden Press All rights reserved.

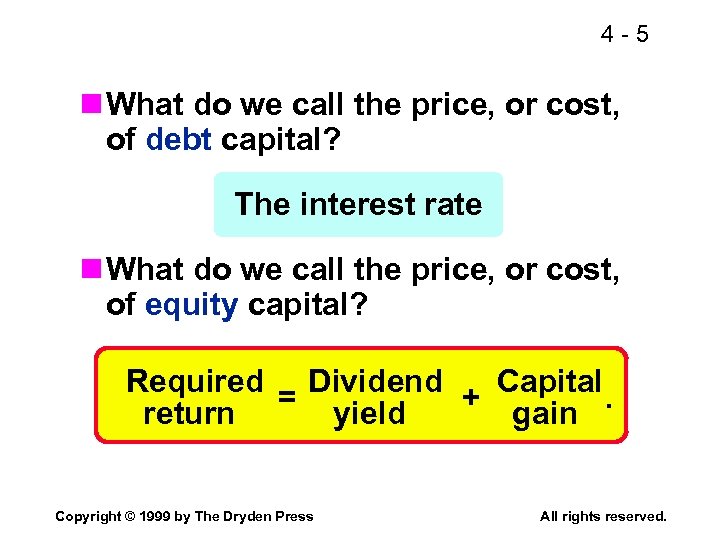

4 -5 n What do we call the price, or cost, of debt capital? The interest rate n What do we call the price, or cost, of equity capital? Required Dividend Capital = +. return yield gain Copyright © 1999 by The Dryden Press All rights reserved.

4 -5 n What do we call the price, or cost, of debt capital? The interest rate n What do we call the price, or cost, of equity capital? Required Dividend Capital = +. return yield gain Copyright © 1999 by The Dryden Press All rights reserved.

4 -6 What four factors affect the cost of money? n Production opportunities n Time preferences for consumption n Risk n Expected inflation Copyright © 1999 by The Dryden Press All rights reserved.

4 -6 What four factors affect the cost of money? n Production opportunities n Time preferences for consumption n Risk n Expected inflation Copyright © 1999 by The Dryden Press All rights reserved.

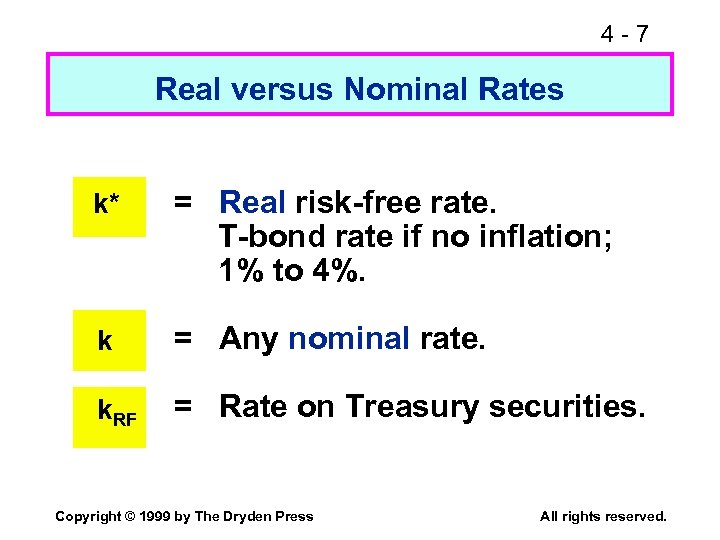

4 -7 Real versus Nominal Rates k* = Real risk-free rate. T-bond rate if no inflation; 1% to 4%. k = Any nominal rate. k. RF = Rate on Treasury securities. Copyright © 1999 by The Dryden Press All rights reserved.

4 -7 Real versus Nominal Rates k* = Real risk-free rate. T-bond rate if no inflation; 1% to 4%. k = Any nominal rate. k. RF = Rate on Treasury securities. Copyright © 1999 by The Dryden Press All rights reserved.

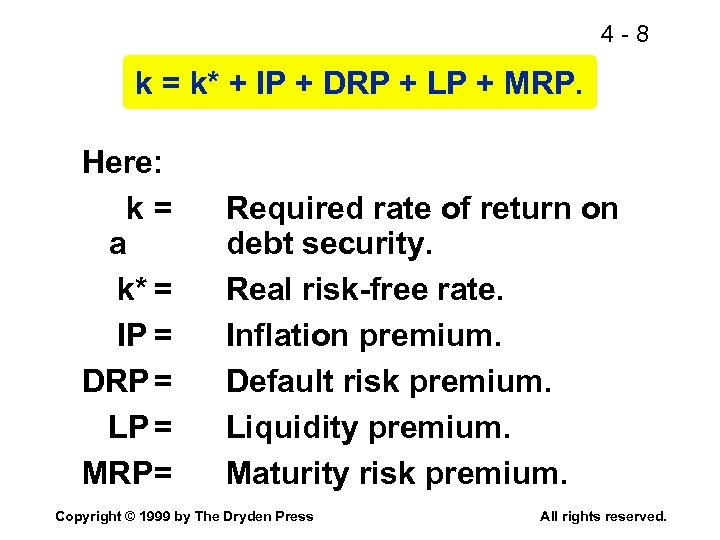

4 -8 k = k* + IP + DRP + LP + MRP. Here: k= a k* = IP = DRP = LP = MRP= Required rate of return on debt security. Real risk-free rate. Inflation premium. Default risk premium. Liquidity premium. Maturity risk premium. Copyright © 1999 by The Dryden Press All rights reserved.

4 -8 k = k* + IP + DRP + LP + MRP. Here: k= a k* = IP = DRP = LP = MRP= Required rate of return on debt security. Real risk-free rate. Inflation premium. Default risk premium. Liquidity premium. Maturity risk premium. Copyright © 1999 by The Dryden Press All rights reserved.

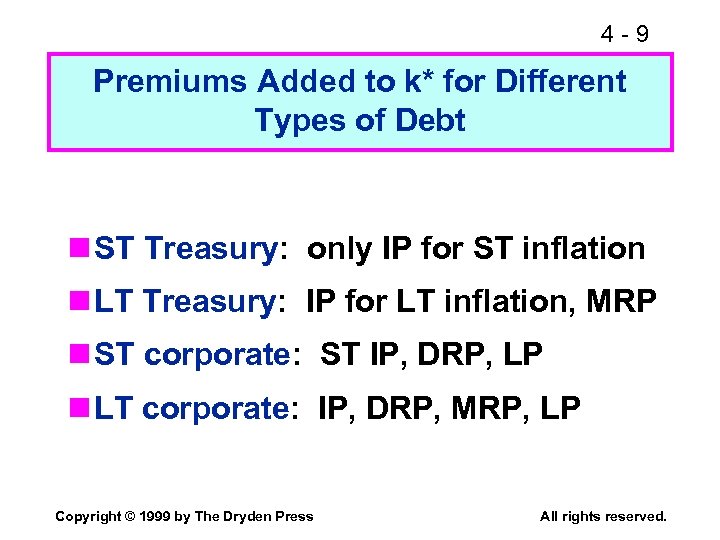

4 -9 Premiums Added to k* for Different Types of Debt n ST Treasury: only IP for ST inflation n LT Treasury: IP for LT inflation, MRP n ST corporate: ST IP, DRP, LP n LT corporate: IP, DRP, MRP, LP Copyright © 1999 by The Dryden Press All rights reserved.

4 -9 Premiums Added to k* for Different Types of Debt n ST Treasury: only IP for ST inflation n LT Treasury: IP for LT inflation, MRP n ST corporate: ST IP, DRP, LP n LT corporate: IP, DRP, MRP, LP Copyright © 1999 by The Dryden Press All rights reserved.

4 - 10 What various types of risks arise when investing overseas? Country risk: Arises from investing or doing business in a particular country. It depends on the country’s economic, political, and social environment. Exchange rate risk: If investment is denominated in a currency other than the dollar, the investment’s value will depend on what happens to exchange rate. Copyright © 1999 by The Dryden Press All rights reserved.

4 - 10 What various types of risks arise when investing overseas? Country risk: Arises from investing or doing business in a particular country. It depends on the country’s economic, political, and social environment. Exchange rate risk: If investment is denominated in a currency other than the dollar, the investment’s value will depend on what happens to exchange rate. Copyright © 1999 by The Dryden Press All rights reserved.

4 - 11 Two Factors Lead to Exchange Rate Fluctuations n Changes in relative inflation will lead to changes in exchange rates. n An increase in country risk will also cause that country’s currency to fall. Copyright © 1999 by The Dryden Press All rights reserved.

4 - 11 Two Factors Lead to Exchange Rate Fluctuations n Changes in relative inflation will lead to changes in exchange rates. n An increase in country risk will also cause that country’s currency to fall. Copyright © 1999 by The Dryden Press All rights reserved.

4 - 12 What is the “term structure of interest rates”? What is a “yield curve”? n Term structure: the relationship between interest rates (or yields) and maturities. n A graph of the term structure is called the yield curve. Copyright © 1999 by The Dryden Press All rights reserved.

4 - 12 What is the “term structure of interest rates”? What is a “yield curve”? n Term structure: the relationship between interest rates (or yields) and maturities. n A graph of the term structure is called the yield curve. Copyright © 1999 by The Dryden Press All rights reserved.

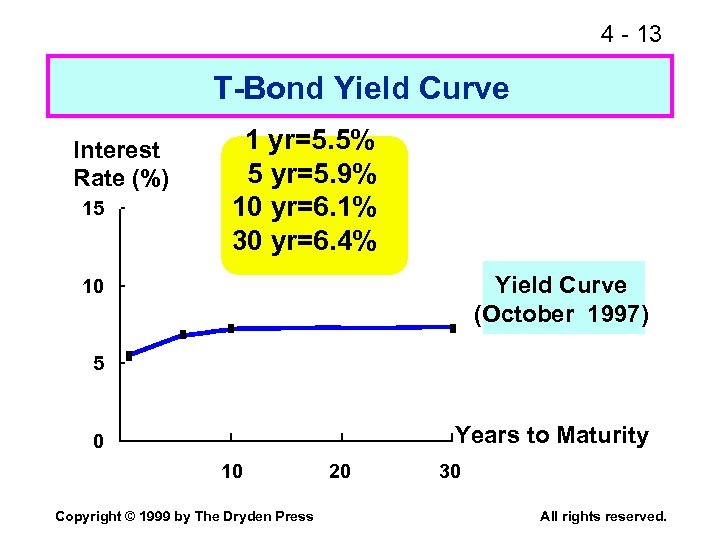

4 - 13 T-Bond Yield Curve Interest Rate (%) 15 1 yr=5. 5% 5 yr=5. 9% 10 yr=6. 1% 30 yr=6. 4% Yield Curve (October 1997) 10 5 Years to Maturity 0 10 Copyright © 1999 by The Dryden Press 20 30 All rights reserved.

4 - 13 T-Bond Yield Curve Interest Rate (%) 15 1 yr=5. 5% 5 yr=5. 9% 10 yr=6. 1% 30 yr=6. 4% Yield Curve (October 1997) 10 5 Years to Maturity 0 10 Copyright © 1999 by The Dryden Press 20 30 All rights reserved.

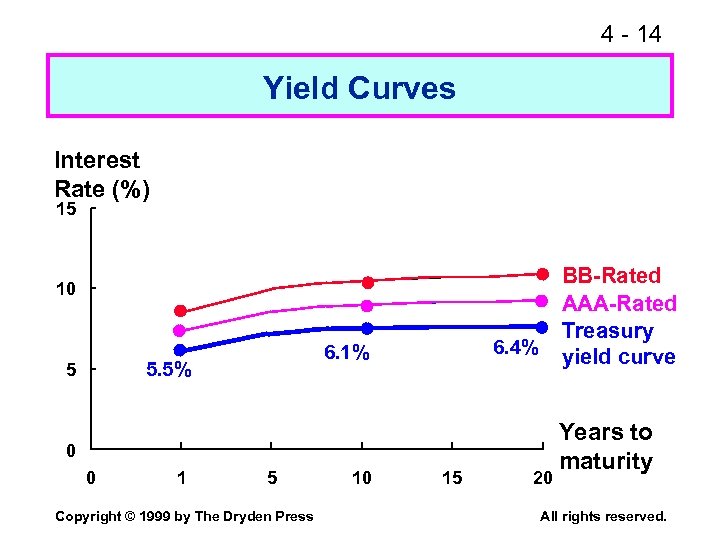

4 - 14 Yield Curves Interest Rate (%) 15 BB-Rated AAA-Rated Treasury yield curve 10 5. 5% 5 6. 4% 6. 1% 0 0 1 5 Copyright © 1999 by The Dryden Press 10 15 20 Years to maturity All rights reserved.

4 - 14 Yield Curves Interest Rate (%) 15 BB-Rated AAA-Rated Treasury yield curve 10 5. 5% 5 6. 4% 6. 1% 0 0 1 5 Copyright © 1999 by The Dryden Press 10 15 20 Years to maturity All rights reserved.

4 - 15 What are the two main factors that explain the shape of the yield curve? n Inflation expectations n Risk Copyright © 1999 by The Dryden Press All rights reserved.

4 - 15 What are the two main factors that explain the shape of the yield curve? n Inflation expectations n Risk Copyright © 1999 by The Dryden Press All rights reserved.

4 - 16 Expectations Theory n Shape of the yield curve depends on the investors’ expectations about future interest rates. n If interest rates are expected to increase, long-term rates will be higher than short-term rates, and vice versa. Thus, the yield curve can slope up or down. Copyright © 1999 by The Dryden Press All rights reserved.

4 - 16 Expectations Theory n Shape of the yield curve depends on the investors’ expectations about future interest rates. n If interest rates are expected to increase, long-term rates will be higher than short-term rates, and vice versa. Thus, the yield curve can slope up or down. Copyright © 1999 by The Dryden Press All rights reserved.

4 - 17 The Pure Expectations Hypothesis (PEH) n MRP = 0. n Long-term rates are an average of current and expected future shortterm rates. n If PEH is correct, you can use the yield curve to back out expected future interest rates. Copyright © 1999 by The Dryden Press All rights reserved.

4 - 17 The Pure Expectations Hypothesis (PEH) n MRP = 0. n Long-term rates are an average of current and expected future shortterm rates. n If PEH is correct, you can use the yield curve to back out expected future interest rates. Copyright © 1999 by The Dryden Press All rights reserved.

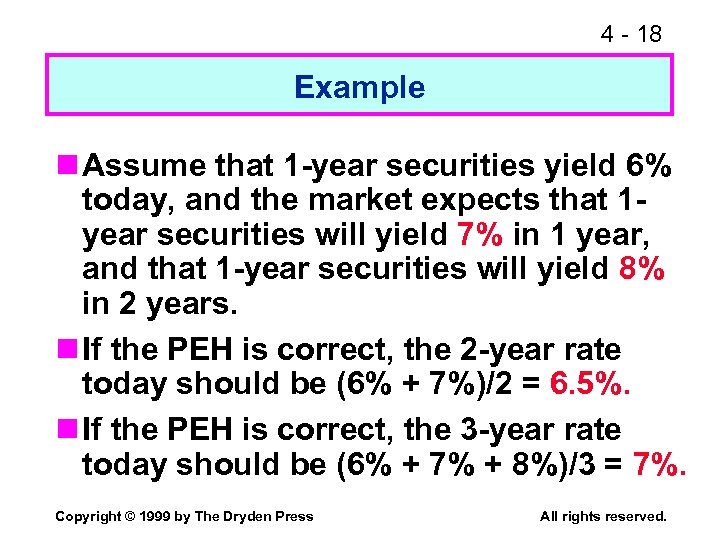

4 - 18 Example n Assume that 1 -year securities yield 6% today, and the market expects that 1 year securities will yield 7% in 1 year, and that 1 -year securities will yield 8% in 2 years. n If the PEH is correct, the 2 -year rate today should be (6% + 7%)/2 = 6. 5%. n If the PEH is correct, the 3 -year rate today should be (6% + 7% + 8%)/3 = 7%. Copyright © 1999 by The Dryden Press All rights reserved.

4 - 18 Example n Assume that 1 -year securities yield 6% today, and the market expects that 1 year securities will yield 7% in 1 year, and that 1 -year securities will yield 8% in 2 years. n If the PEH is correct, the 2 -year rate today should be (6% + 7%)/2 = 6. 5%. n If the PEH is correct, the 3 -year rate today should be (6% + 7% + 8%)/3 = 7%. Copyright © 1999 by The Dryden Press All rights reserved.

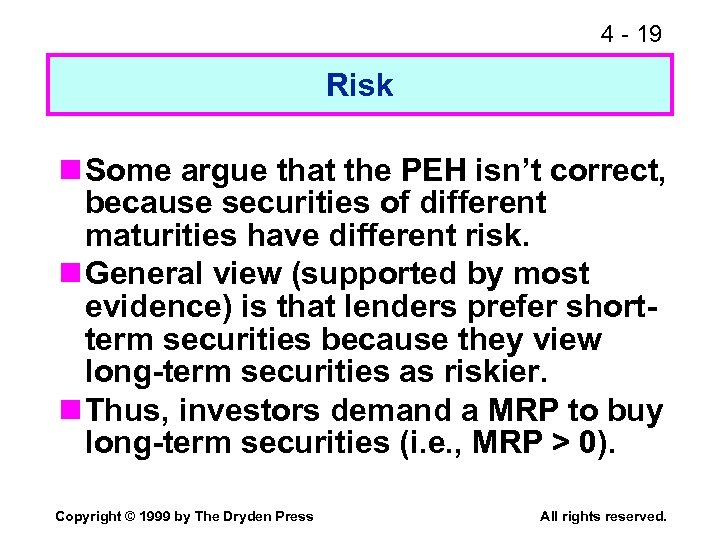

4 - 19 Risk n Some argue that the PEH isn’t correct, because securities of different maturities have different risk. n General view (supported by most evidence) is that lenders prefer shortterm securities because they view long-term securities as riskier. n Thus, investors demand a MRP to buy long-term securities (i. e. , MRP > 0). Copyright © 1999 by The Dryden Press All rights reserved.

4 - 19 Risk n Some argue that the PEH isn’t correct, because securities of different maturities have different risk. n General view (supported by most evidence) is that lenders prefer shortterm securities because they view long-term securities as riskier. n Thus, investors demand a MRP to buy long-term securities (i. e. , MRP > 0). Copyright © 1999 by The Dryden Press All rights reserved.

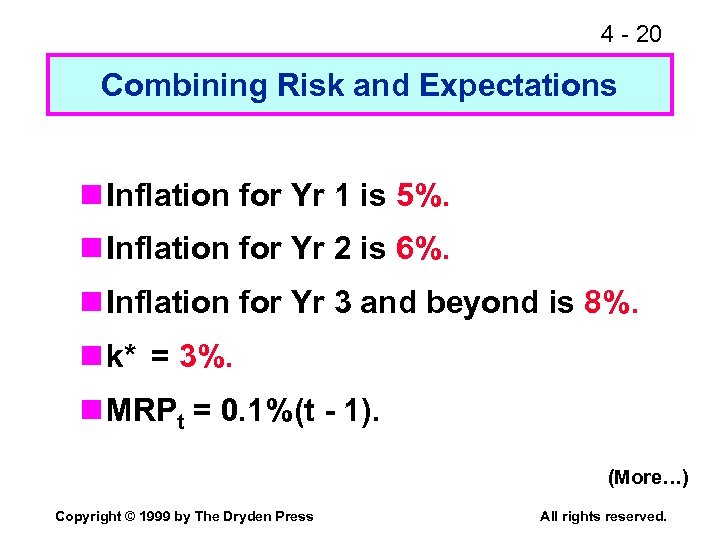

4 - 20 Combining Risk and Expectations n Inflation for Yr 1 is 5%. n Inflation for Yr 2 is 6%. n Inflation for Yr 3 and beyond is 8%. n k* = 3%. n MRPt = 0. 1%(t - 1). (More…) Copyright © 1999 by The Dryden Press All rights reserved.

4 - 20 Combining Risk and Expectations n Inflation for Yr 1 is 5%. n Inflation for Yr 2 is 6%. n Inflation for Yr 3 and beyond is 8%. n k* = 3%. n MRPt = 0. 1%(t - 1). (More…) Copyright © 1999 by The Dryden Press All rights reserved.

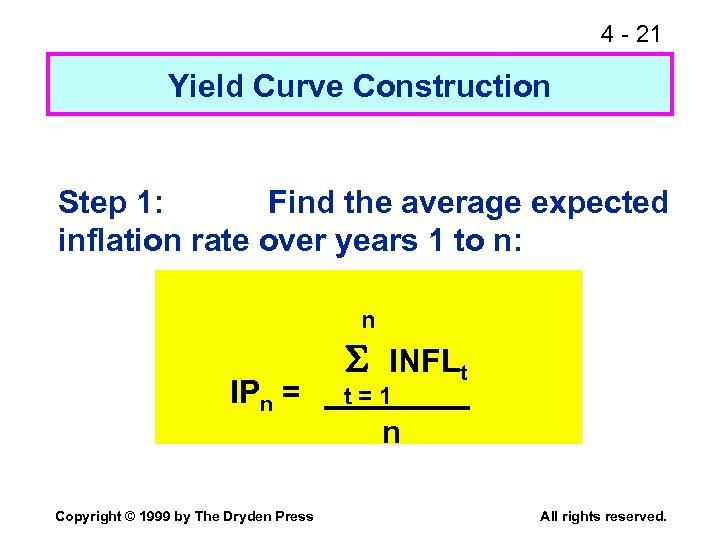

4 - 21 Yield Curve Construction Step 1: Find the average expected inflation rate over years 1 to n: n IPn = Copyright © 1999 by The Dryden Press S INFLt t=1 n All rights reserved.

4 - 21 Yield Curve Construction Step 1: Find the average expected inflation rate over years 1 to n: n IPn = Copyright © 1999 by The Dryden Press S INFLt t=1 n All rights reserved.

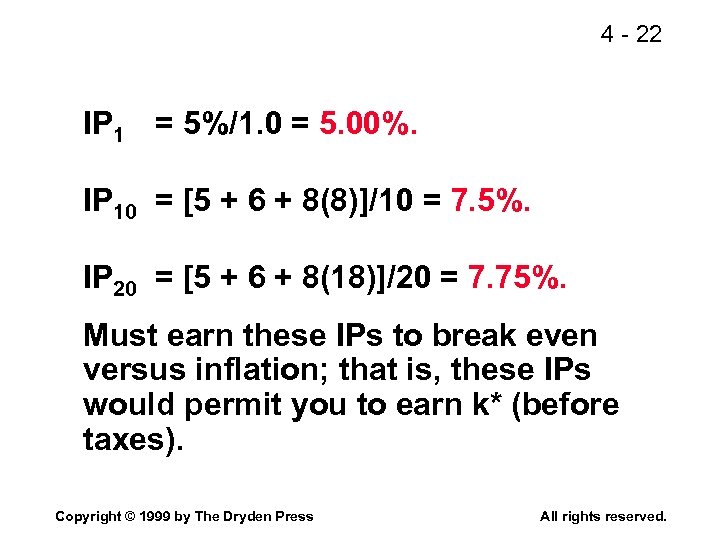

4 - 22 IP 1 = 5%/1. 0 = 5. 00%. IP 10 = [5 + 6 + 8(8)]/10 = 7. 5%. IP 20 = [5 + 6 + 8(18)]/20 = 7. 75%. Must earn these IPs to break even versus inflation; that is, these IPs would permit you to earn k* (before taxes). Copyright © 1999 by The Dryden Press All rights reserved.

4 - 22 IP 1 = 5%/1. 0 = 5. 00%. IP 10 = [5 + 6 + 8(8)]/10 = 7. 5%. IP 20 = [5 + 6 + 8(18)]/20 = 7. 75%. Must earn these IPs to break even versus inflation; that is, these IPs would permit you to earn k* (before taxes). Copyright © 1999 by The Dryden Press All rights reserved.

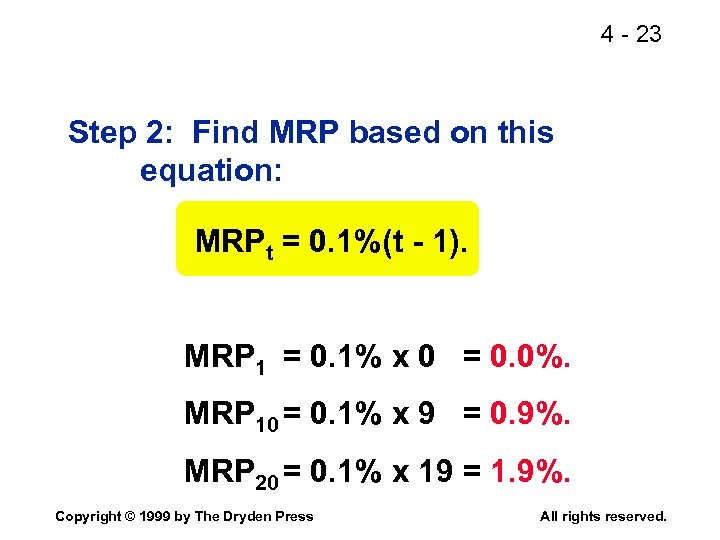

4 - 23 Step 2: Find MRP based on this equation: MRPt = 0. 1%(t - 1). MRP 1 = 0. 1% x 0 = 0. 0%. MRP 10 = 0. 1% x 9 = 0. 9%. MRP 20 = 0. 1% x 19 = 1. 9%. Copyright © 1999 by The Dryden Press All rights reserved.

4 - 23 Step 2: Find MRP based on this equation: MRPt = 0. 1%(t - 1). MRP 1 = 0. 1% x 0 = 0. 0%. MRP 10 = 0. 1% x 9 = 0. 9%. MRP 20 = 0. 1% x 19 = 1. 9%. Copyright © 1999 by The Dryden Press All rights reserved.

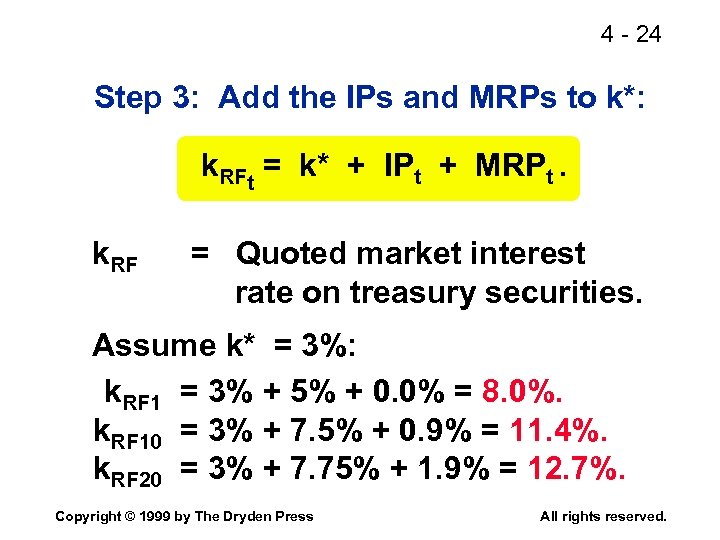

4 - 24 Step 3: Add the IPs and MRPs to k*: k. RFt = k* + IPt + MRPt. k. RF = Quoted market interest rate on treasury securities. Assume k* = 3%: k. RF 1 = 3% + 5% + 0. 0% = 8. 0%. k. RF 10 = 3% + 7. 5% + 0. 9% = 11. 4%. k. RF 20 = 3% + 7. 75% + 1. 9% = 12. 7%. Copyright © 1999 by The Dryden Press All rights reserved.

4 - 24 Step 3: Add the IPs and MRPs to k*: k. RFt = k* + IPt + MRPt. k. RF = Quoted market interest rate on treasury securities. Assume k* = 3%: k. RF 1 = 3% + 5% + 0. 0% = 8. 0%. k. RF 10 = 3% + 7. 5% + 0. 9% = 11. 4%. k. RF 20 = 3% + 7. 75% + 1. 9% = 12. 7%. Copyright © 1999 by The Dryden Press All rights reserved.