498287f169e6938c353df4bf4cf95e07.ppt

- Количество слайдов: 17

4. 03 Solve Related Mathematical Problems

Opening Cash Fund The opening cash drawer contains the ____and _______for the day’s business The till is over if there is more money than planned The till is short if there is _____than planned

Balancing the Cash Drawer At end of shift, the drawer must be______ The money must be counted and a ______ filled out

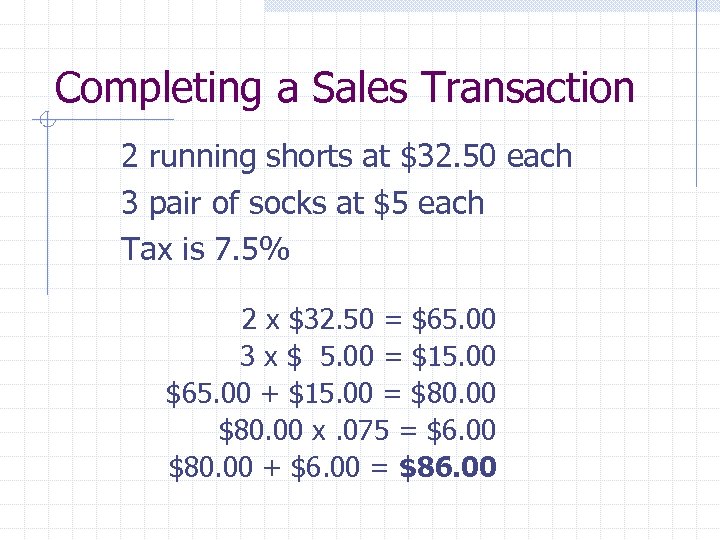

Completing a Sales Transaction The ______is the result of multiplying the number of units by the cost per unit Add item amounts Calculate _______tax and total

Completing a Sales Transaction 2 running shorts at $32. 50 each 3 pair of socks at $5 each Tax is 7. 5% 2 x $32. 50 = $65. 00 3 x $ 5. 00 = $15. 00 $65. 00 + $15. 00 = $80. 00 x. 075 = $6. 00 $80. 00 + $6. 00 = $86. 00

Types of Retail Sales Cash sales include _____or_____ Debit cards are ____ or _____cards – funds are withdrawn from the customers checking account Visa, Master. Card, American Express, and Discover are examples of credit cards

Cost of Merchandise Sold The amount a retailer actually pays for______ Determined by quoted wholesale cost, discounts, and ______ charges

Factors Affecting the Cost of Merchandise Sold Cost may be negotiable due to discounts and terms ____– a reduction in the selling price offered by manufacturers and distributors to their customers to encourage prompt payment and stimulate purchasing ____– free merchandise given by a manufacturer for large orders as a means of goodwill and to encourage future purchases

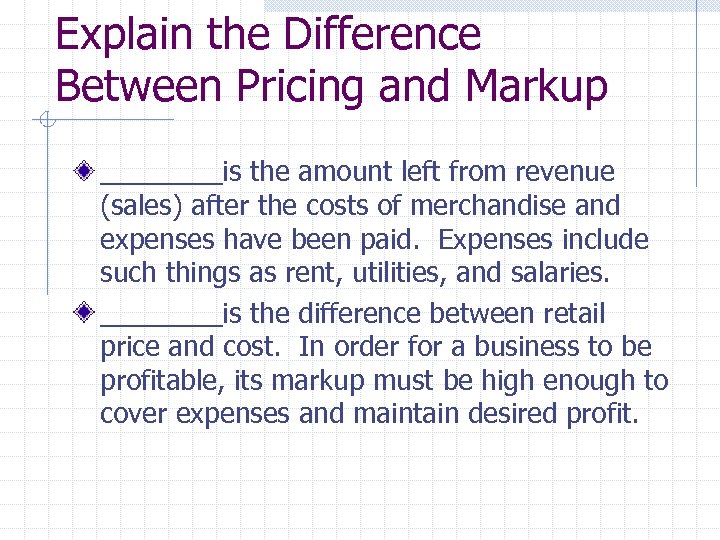

Explain the Difference Between Pricing and Markup ____is the amount left from revenue (sales) after the costs of merchandise and expenses have been paid. Expenses include such things as rent, utilities, and salaries. ____is the difference between retail price and cost. In order for a business to be profitable, its markup must be high enough to cover expenses and maintain desired profit.

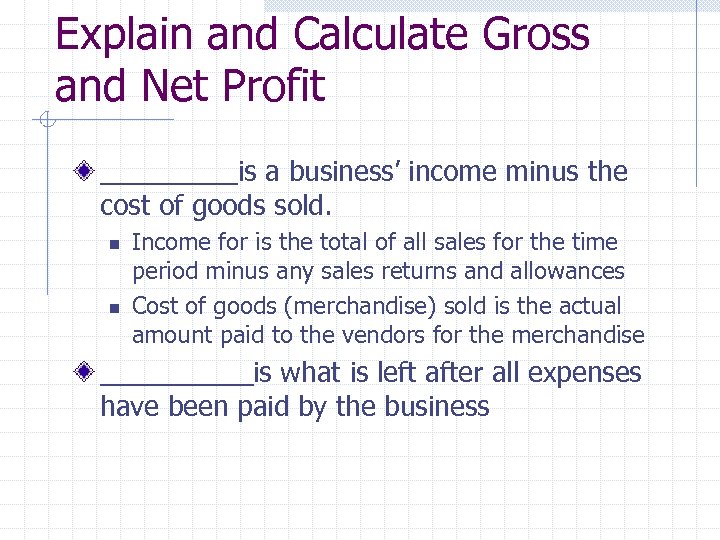

Explain and Calculate Gross and Net Profit _____is a business’ income minus the cost of goods sold. n n Income for is the total of all sales for the time period minus any sales returns and allowances Cost of goods (merchandise) sold is the actual amount paid to the vendors for the merchandise _____is what is left after all expenses have been paid by the business

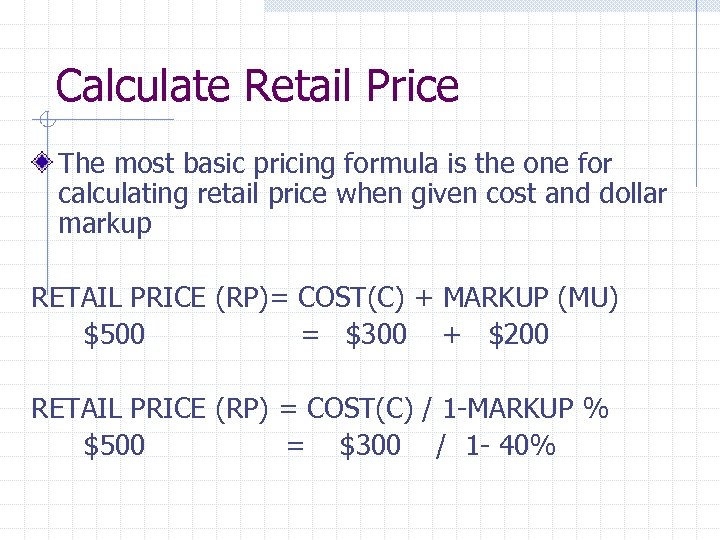

Calculate Retail Price The most basic pricing formula is the one for calculating retail price when given cost and dollar markup RETAIL PRICE (RP)= COST(C) + MARKUP (MU) $500 = $300 + $200 RETAIL PRICE (RP) = COST(C) / 1 -MARKUP % $500 = $300 / 1 - 40%

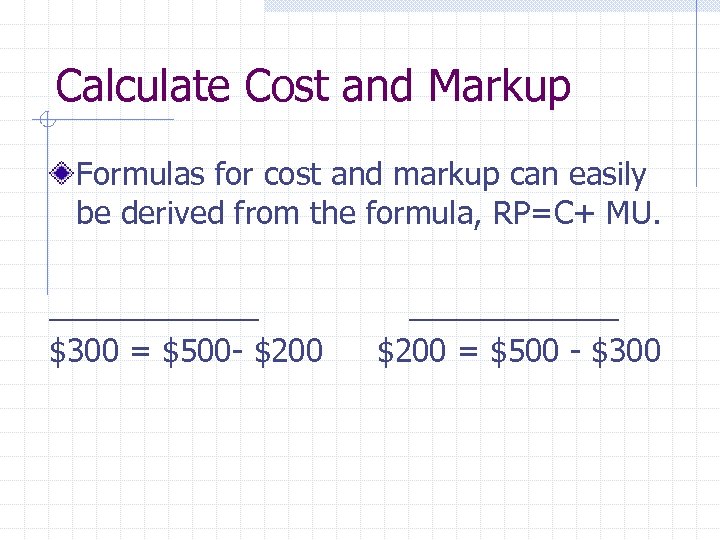

Calculate Cost and Markup Formulas for cost and markup can easily be derived from the formula, RP=C+ MU. ______ $300 = $500 - $200 ______ $200 = $500 - $300

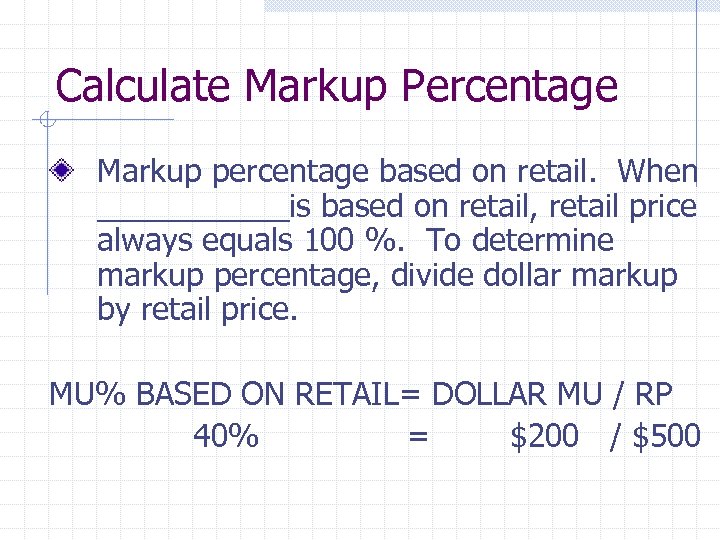

Calculate Markup Percentage Markup percentage based on retail. When ______is based on retail, retail price always equals 100 %. To determine markup percentage, divide dollar markup by retail price. MU% BASED ON RETAIL= DOLLAR MU / RP 40% = $200 / $500

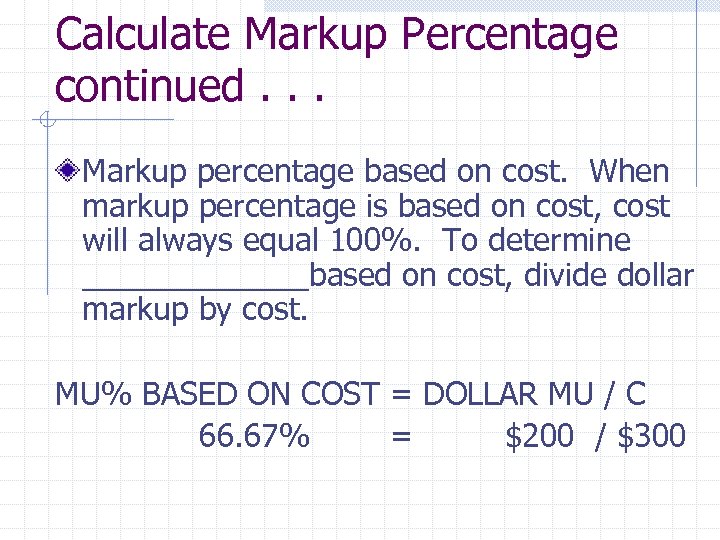

Calculate Markup Percentage continued. . . Markup percentage based on cost. When markup percentage is based on cost, cost will always equal 100%. To determine _______based on cost, divide dollar markup by cost. MU% BASED ON COST = DOLLAR MU / C 66. 67% = $200 / $300

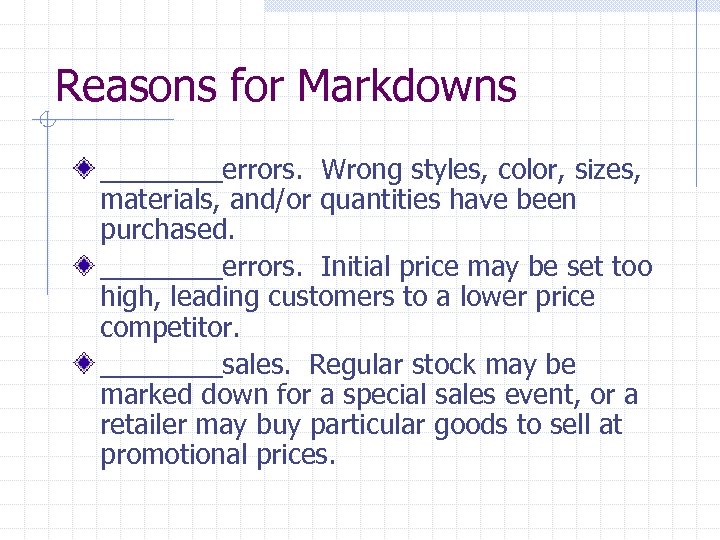

Reasons for Markdowns ____errors. Wrong styles, color, sizes, materials, and/or quantities have been purchased. ____errors. Initial price may be set too high, leading customers to a lower price competitor. ____sales. Regular stock may be marked down for a special sales event, or a retailer may buy particular goods to sell at promotional prices.

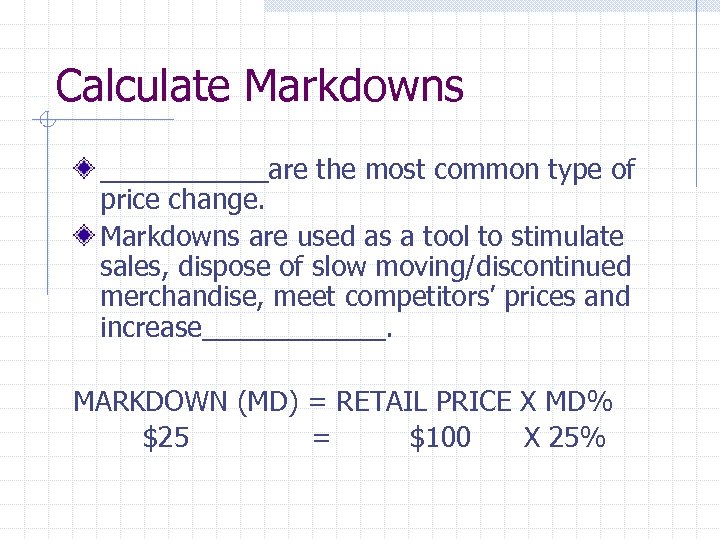

Calculate Markdowns ______are the most common type of price change. Markdowns are used as a tool to stimulate sales, dispose of slow moving/discontinued merchandise, meet competitors’ prices and increase______. MARKDOWN (MD) = RETAIL PRICE X MD% $25 = $100 X 25%

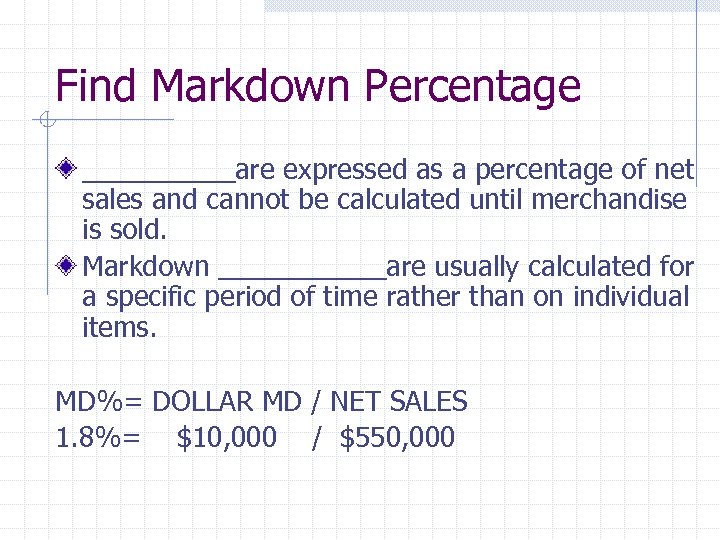

Find Markdown Percentage _____are expressed as a percentage of net sales and cannot be calculated until merchandise is sold. Markdown ______are usually calculated for a specific period of time rather than on individual items. MD%= DOLLAR MD / NET SALES 1. 8%= $10, 000 / $550, 000

498287f169e6938c353df4bf4cf95e07.ppt