9c7d91b37a74a2f0d5578b3b5e760b48.ppt

- Количество слайдов: 19

37 TH CATA ANNUAL TECHNICAL CONFERENCE 2016 LEVERAGING TECHNOLOGY TO SUPPORT AND IMPROVE VOLUNTARY COMPLIANCE IN KENYA The Case of i. Tax Presented By: E. K. OBURA HILTON HOTEL, BRIDGETOWN, BARBADOS 7 th – 11 th November 2016 1 www. KRA. go. ke 19/03/2018

37 TH CATA ANNUAL TECHNICAL CONFERENCE 2016 LEVERAGING TECHNOLOGY TO SUPPORT AND IMPROVE VOLUNTARY COMPLIANCE IN KENYA The Case of i. Tax Presented By: E. K. OBURA HILTON HOTEL, BRIDGETOWN, BARBADOS 7 th – 11 th November 2016 1 www. KRA. go. ke 19/03/2018

SCOPE Locating Kenya q Kenya’s Economic Activities q Background of Automation in KRA q i. Tax q Milestones q 2 www. KRA. go. ke 19/03/2018

SCOPE Locating Kenya q Kenya’s Economic Activities q Background of Automation in KRA q i. Tax q Milestones q 2 www. KRA. go. ke 19/03/2018

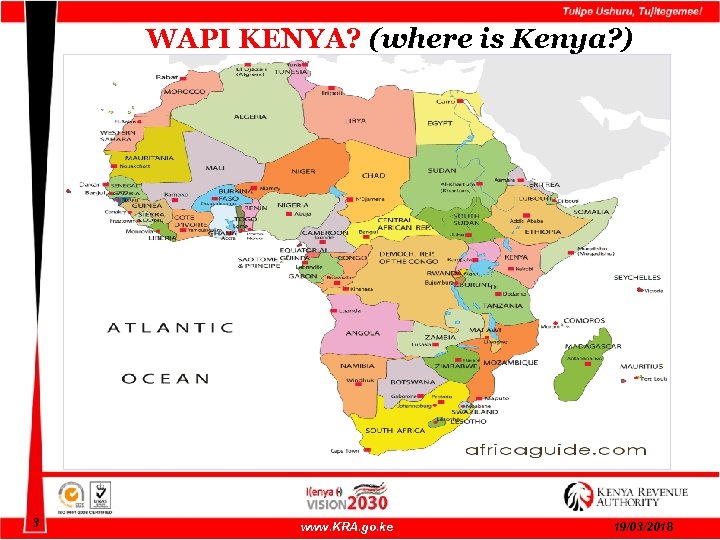

WAPI KENYA? (where is Kenya? ) 3 www. KRA. go. ke 19/03/2018

WAPI KENYA? (where is Kenya? ) 3 www. KRA. go. ke 19/03/2018

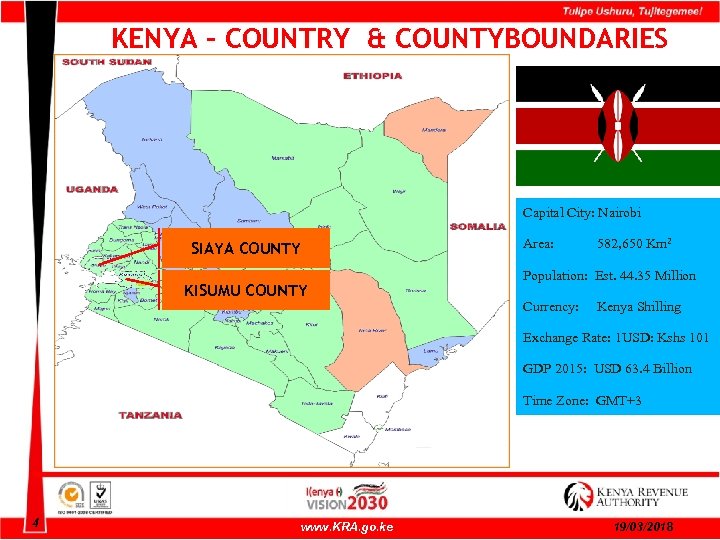

KENYA – COUNTRY & COUNTYBOUNDARIES Capital City: Nairobi Area: SIAYA COUNTY KISUMU COUNTY 582, 650 Km 2 Population: Est. 44. 35 Million Currency: Kenya Shilling Exchange Rate: 1 USD: Kshs 101 GDP 2015: USD 63. 4 Billion Time Zone: GMT+3 4 www. KRA. go. ke 19/03/2018

KENYA – COUNTRY & COUNTYBOUNDARIES Capital City: Nairobi Area: SIAYA COUNTY KISUMU COUNTY 582, 650 Km 2 Population: Est. 44. 35 Million Currency: Kenya Shilling Exchange Rate: 1 USD: Kshs 101 GDP 2015: USD 63. 4 Billion Time Zone: GMT+3 4 www. KRA. go. ke 19/03/2018

KEY ECONOMIC ACTIVITIES SM I UR TO E UR LT CU RI AG 5 www. KRA. go. ke T IC R SG & IL S O A G 19/03/2018

KEY ECONOMIC ACTIVITIES SM I UR TO E UR LT CU RI AG 5 www. KRA. go. ke T IC R SG & IL S O A G 19/03/2018

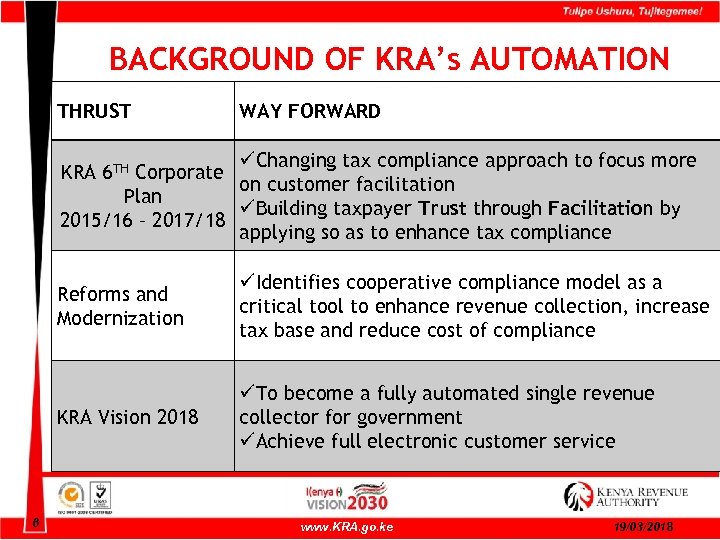

BACKGROUND OF KRA’s AUTOMATION THRUST WAY FORWARD üChanging tax compliance approach to focus more KRA 6 TH Corporate on customer facilitation Plan üBuilding taxpayer Trust through Facilitation by 2015/16 – 2017/18 applying so as to enhance tax compliance Reforms and Modernization KRA Vision 2018 6 üIdentifies cooperative compliance model as a critical tool to enhance revenue collection, increase tax base and reduce cost of compliance üTo become a fully automated single revenue collector for government üAchieve full electronic customer service www. KRA. go. ke 19/03/2018

BACKGROUND OF KRA’s AUTOMATION THRUST WAY FORWARD üChanging tax compliance approach to focus more KRA 6 TH Corporate on customer facilitation Plan üBuilding taxpayer Trust through Facilitation by 2015/16 – 2017/18 applying so as to enhance tax compliance Reforms and Modernization KRA Vision 2018 6 üIdentifies cooperative compliance model as a critical tool to enhance revenue collection, increase tax base and reduce cost of compliance üTo become a fully automated single revenue collector for government üAchieve full electronic customer service www. KRA. go. ke 19/03/2018

7 www. KRA. go. ke 19/03/2018

7 www. KRA. go. ke 19/03/2018

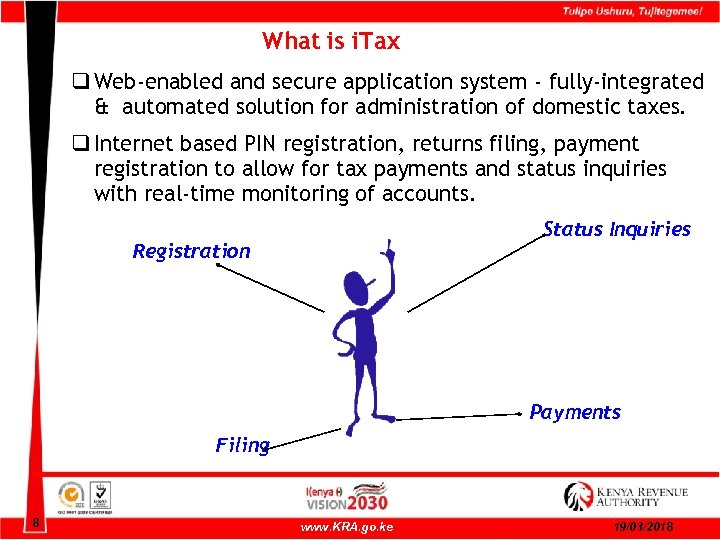

What is i. Tax q Web-enabled and secure application system - fully-integrated & automated solution for administration of domestic taxes. q Internet based PIN registration, returns filing, payment registration to allow for tax payments and status inquiries with real-time monitoring of accounts. Status Inquiries Registration Payments Filing 8 www. KRA. go. ke 19/03/2018

What is i. Tax q Web-enabled and secure application system - fully-integrated & automated solution for administration of domestic taxes. q Internet based PIN registration, returns filing, payment registration to allow for tax payments and status inquiries with real-time monitoring of accounts. Status Inquiries Registration Payments Filing 8 www. KRA. go. ke 19/03/2018

i. Tax Home page 9 www. KRA. go. ke 19/03/2018

i. Tax Home page 9 www. KRA. go. ke 19/03/2018

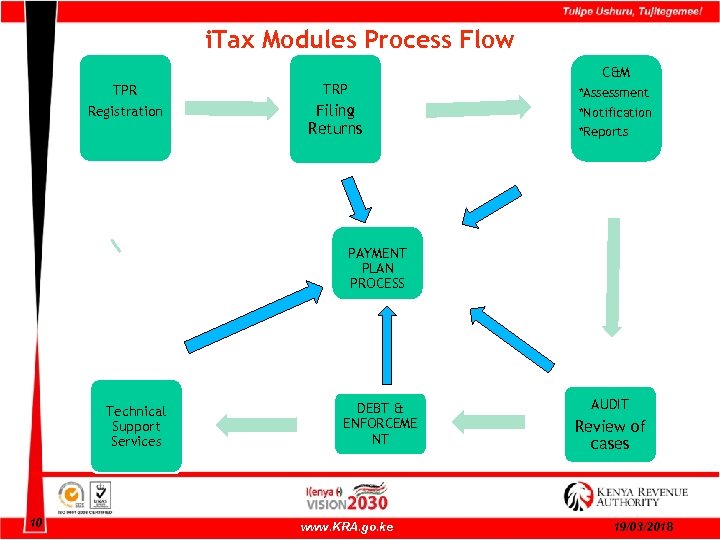

i. Tax Modules Process Flow C&M TPR Registration TRP Filing Returns *Assessment *Notification *Reports PAYMENT PLAN PROCESS Technical Support Services 10 DEBT & ENFORCEME NT www. KRA. go. ke AUDIT Review of cases 19/03/2018

i. Tax Modules Process Flow C&M TPR Registration TRP Filing Returns *Assessment *Notification *Reports PAYMENT PLAN PROCESS Technical Support Services 10 DEBT & ENFORCEME NT www. KRA. go. ke AUDIT Review of cases 19/03/2018

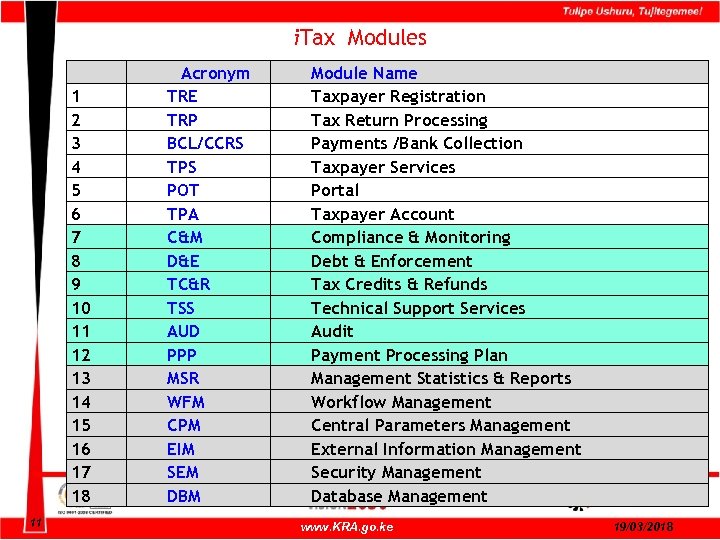

i. Tax Modules 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 11 Acronym TRE TRP BCL/CCRS TPS POT TPA C&M D&E TC&R TSS AUD PPP MSR WFM CPM EIM SEM DBM Module Name Taxpayer Registration Tax Return Processing Payments /Bank Collection Taxpayer Services Portal Taxpayer Account Compliance & Monitoring Debt & Enforcement Tax Credits & Refunds Technical Support Services Audit Payment Processing Plan Management Statistics & Reports Workflow Management Central Parameters Management External Information Management Security Management Database Management www. KRA. go. ke 19/03/2018

i. Tax Modules 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 11 Acronym TRE TRP BCL/CCRS TPS POT TPA C&M D&E TC&R TSS AUD PPP MSR WFM CPM EIM SEM DBM Module Name Taxpayer Registration Tax Return Processing Payments /Bank Collection Taxpayer Services Portal Taxpayer Account Compliance & Monitoring Debt & Enforcement Tax Credits & Refunds Technical Support Services Audit Payment Processing Plan Management Statistics & Reports Workflow Management Central Parameters Management External Information Management Security Management Database Management www. KRA. go. ke 19/03/2018

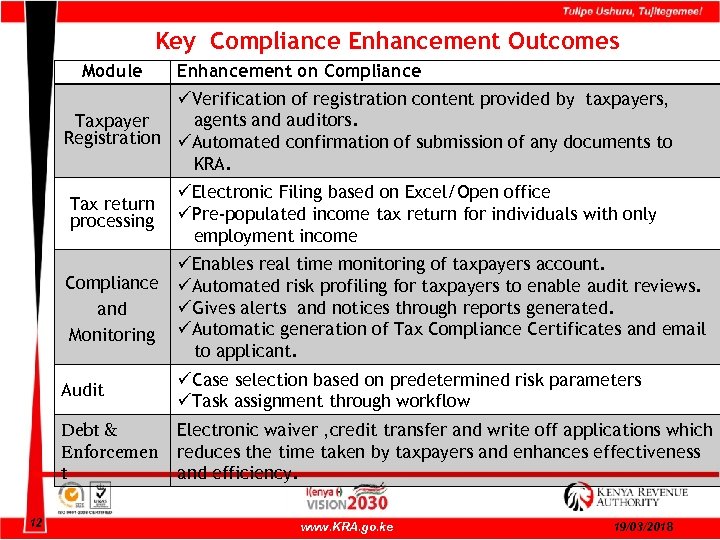

Key Compliance Enhancement Outcomes Module Enhancement on Compliance üVerification of registration content provided by taxpayers, agents and auditors. Taxpayer Registration üAutomated confirmation of submission of any documents to KRA. Tax return processing üElectronic Filing based on Excel/Open office üPre-populated income tax return for individuals with only employment income üEnables real time monitoring of taxpayers account. Compliance üAutomated risk profiling for taxpayers to enable audit reviews. üGives alerts and notices through reports generated. and Monitoring üAutomatic generation of Tax Compliance Certificates and email to applicant. Audit Debt & Enforcemen t 12 üCase selection based on predetermined risk parameters üTask assignment through workflow Electronic waiver , credit transfer and write off applications which reduces the time taken by taxpayers and enhances effectiveness and efficiency. www. KRA. go. ke 19/03/2018

Key Compliance Enhancement Outcomes Module Enhancement on Compliance üVerification of registration content provided by taxpayers, agents and auditors. Taxpayer Registration üAutomated confirmation of submission of any documents to KRA. Tax return processing üElectronic Filing based on Excel/Open office üPre-populated income tax return for individuals with only employment income üEnables real time monitoring of taxpayers account. Compliance üAutomated risk profiling for taxpayers to enable audit reviews. üGives alerts and notices through reports generated. and Monitoring üAutomatic generation of Tax Compliance Certificates and email to applicant. Audit Debt & Enforcemen t 12 üCase selection based on predetermined risk parameters üTask assignment through workflow Electronic waiver , credit transfer and write off applications which reduces the time taken by taxpayers and enhances effectiveness and efficiency. www. KRA. go. ke 19/03/2018

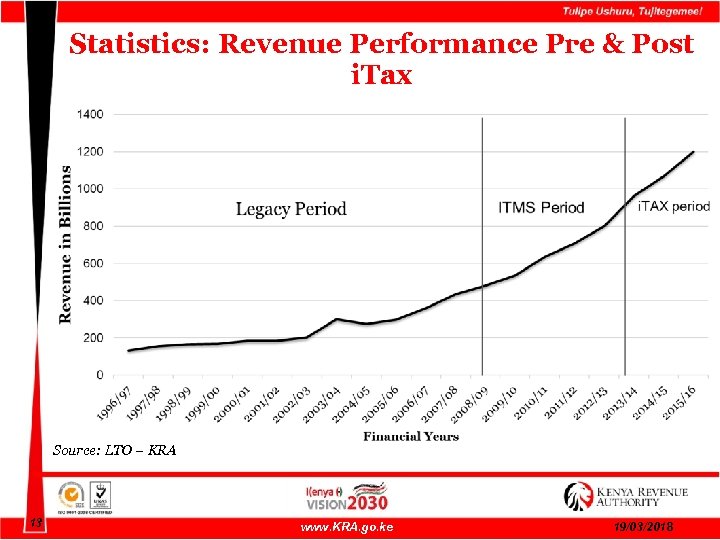

Statistics: Revenue Performance Pre & Post i. Tax Source: LTO – KRA 13 www. KRA. go. ke 19/03/2018

Statistics: Revenue Performance Pre & Post i. Tax Source: LTO – KRA 13 www. KRA. go. ke 19/03/2018

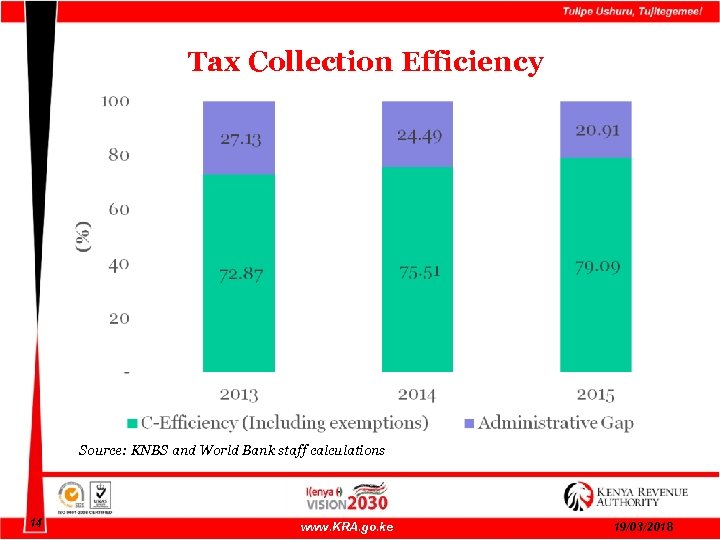

Tax Collection Efficiency Source: KNBS and World Bank staff calculations 14 www. KRA. go. ke 19/03/2018

Tax Collection Efficiency Source: KNBS and World Bank staff calculations 14 www. KRA. go. ke 19/03/2018

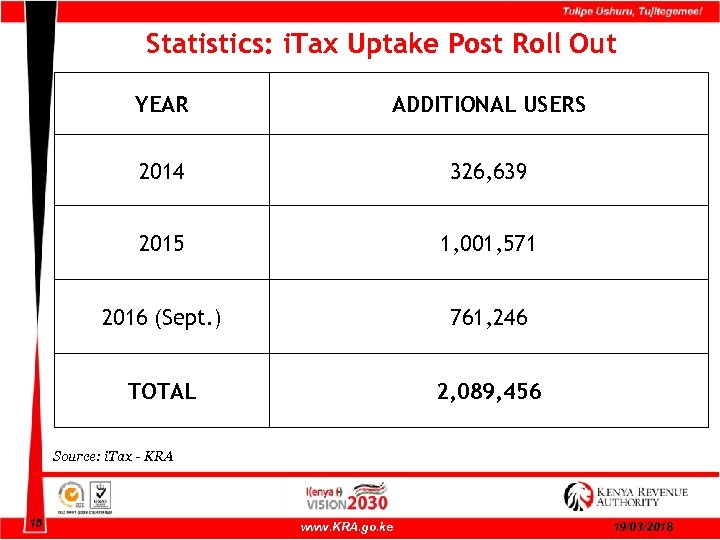

Statistics: i. Tax Uptake Post Roll Out YEAR ADDITIONAL USERS 2014 326, 639 2015 1, 001, 571 2016 (Sept. ) 761, 246 TOTAL 2, 089, 456 Source: i. Tax - KRA 15 www. KRA. go. ke 19/03/2018

Statistics: i. Tax Uptake Post Roll Out YEAR ADDITIONAL USERS 2014 326, 639 2015 1, 001, 571 2016 (Sept. ) 761, 246 TOTAL 2, 089, 456 Source: i. Tax - KRA 15 www. KRA. go. ke 19/03/2018

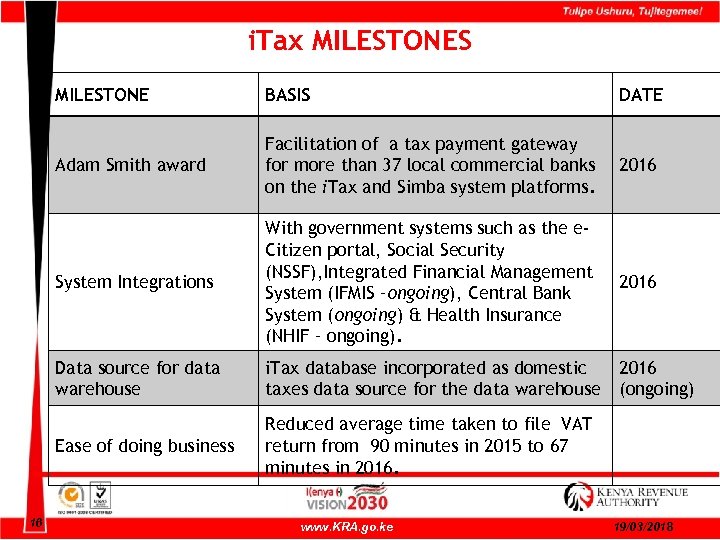

i. Tax MILESTONES MILESTONE DATE Adam Smith award Facilitation of a tax payment gateway for more than 37 local commercial banks on the i. Tax and Simba system platforms. 2016 System Integrations With government systems such as the e. Citizen portal, Social Security (NSSF), Integrated Financial Management System (IFMIS –ongoing), Central Bank System (ongoing) & Health Insurance (NHIF – ongoing). 2016 Data source for data warehouse i. Tax database incorporated as domestic taxes data source for the data warehouse 2016 (ongoing) Ease of doing business 16 BASIS Reduced average time taken to file VAT return from 90 minutes in 2015 to 67 minutes in 2016. www. KRA. go. ke 19/03/2018

i. Tax MILESTONES MILESTONE DATE Adam Smith award Facilitation of a tax payment gateway for more than 37 local commercial banks on the i. Tax and Simba system platforms. 2016 System Integrations With government systems such as the e. Citizen portal, Social Security (NSSF), Integrated Financial Management System (IFMIS –ongoing), Central Bank System (ongoing) & Health Insurance (NHIF – ongoing). 2016 Data source for data warehouse i. Tax database incorporated as domestic taxes data source for the data warehouse 2016 (ongoing) Ease of doing business 16 BASIS Reduced average time taken to file VAT return from 90 minutes in 2015 to 67 minutes in 2016. www. KRA. go. ke 19/03/2018

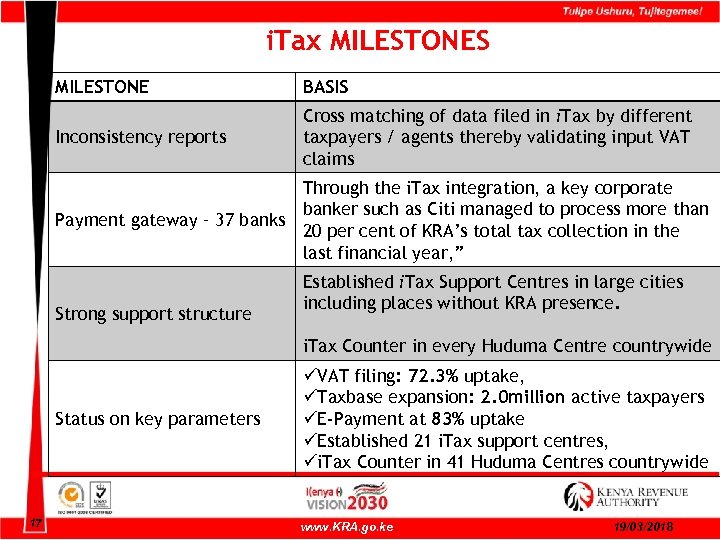

i. Tax MILESTONES MILESTONE BASIS Inconsistency reports Cross matching of data filed in i. Tax by different taxpayers / agents thereby validating input VAT claims Through the i. Tax integration, a key corporate banker such as Citi managed to process more than Payment gateway – 37 banks 20 per cent of KRA’s total tax collection in the last financial year, ” Strong support structure Established i. Tax Support Centres in large cities including places without KRA presence. i. Tax Counter in every Huduma Centre countrywide Status on key parameters 17 üVAT filing: 72. 3% uptake, üTaxbase expansion: 2. 0 million active taxpayers üE-Payment at 83% uptake üEstablished 21 i. Tax support centres, üi. Tax Counter in 41 Huduma Centres countrywide www. KRA. go. ke 19/03/2018

i. Tax MILESTONES MILESTONE BASIS Inconsistency reports Cross matching of data filed in i. Tax by different taxpayers / agents thereby validating input VAT claims Through the i. Tax integration, a key corporate banker such as Citi managed to process more than Payment gateway – 37 banks 20 per cent of KRA’s total tax collection in the last financial year, ” Strong support structure Established i. Tax Support Centres in large cities including places without KRA presence. i. Tax Counter in every Huduma Centre countrywide Status on key parameters 17 üVAT filing: 72. 3% uptake, üTaxbase expansion: 2. 0 million active taxpayers üE-Payment at 83% uptake üEstablished 21 i. Tax support centres, üi. Tax Counter in 41 Huduma Centres countrywide www. KRA. go. ke 19/03/2018

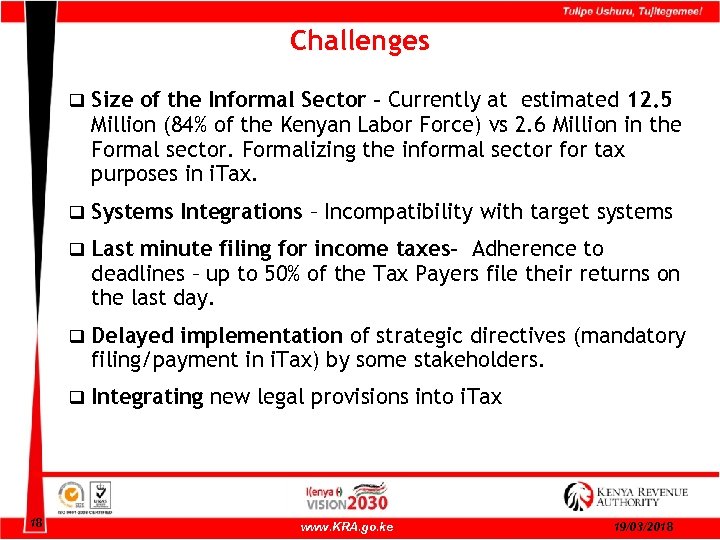

Challenges q q Systems Integrations – Incompatibility with target systems q Last minute filing for income taxes– Adherence to deadlines – up to 50% of the Tax Payers file their returns on the last day. q Delayed implementation of strategic directives (mandatory filing/payment in i. Tax) by some stakeholders. q 18 Size of the Informal Sector – Currently at estimated 12. 5 Million (84% of the Kenyan Labor Force) vs 2. 6 Million in the Formal sector. Formalizing the informal sector for tax purposes in i. Tax. Integrating new legal provisions into i. Tax www. KRA. go. ke 19/03/2018

Challenges q q Systems Integrations – Incompatibility with target systems q Last minute filing for income taxes– Adherence to deadlines – up to 50% of the Tax Payers file their returns on the last day. q Delayed implementation of strategic directives (mandatory filing/payment in i. Tax) by some stakeholders. q 18 Size of the Informal Sector – Currently at estimated 12. 5 Million (84% of the Kenyan Labor Force) vs 2. 6 Million in the Formal sector. Formalizing the informal sector for tax purposes in i. Tax. Integrating new legal provisions into i. Tax www. KRA. go. ke 19/03/2018

END OF PRESENTATION 19 www. KRA. go. ke 19/03/2018

END OF PRESENTATION 19 www. KRA. go. ke 19/03/2018