f30929d142a1632442215e99c562ae1f.ppt

- Количество слайдов: 15

360 T - Workshop in Praha Alpiq Holding Ltd, 6 th October 2009 André Boppart, Corporate Treasury + Insurance

360 T - Workshop in Praha Alpiq Holding Ltd, 6 th October 2009 André Boppart, Corporate Treasury + Insurance

André Boppart Treasury Manager of Alpiq Holding AG since February 1, 2007 Responsibilities: • act as in-house bank for intercompany transactions such as financing, hedging, cash-pooling usw. • optimize short-term liquidity • assure and maintain an efficient payment system • assure a sound liquidity forecast • work on project 360 T workshop in Praha; 6 th October 2009 2

André Boppart Treasury Manager of Alpiq Holding AG since February 1, 2007 Responsibilities: • act as in-house bank for intercompany transactions such as financing, hedging, cash-pooling usw. • optimize short-term liquidity • assure and maintain an efficient payment system • assure a sound liquidity forecast • work on project 360 T workshop in Praha; 6 th October 2009 2

Alpiq Holding AG Facts and figuers • CHF 16‘ 032 Mio. annual turnover in 2007 • CHF 1‘ 800 Mio. EBITA in 2007 • Energy production of approx. 20 TWh in 2007 53% produced in Switzerland Energy production by fossil (41. 5%), hydraulic (28. 5%), nuclear (29. 0%) and renewable energy (1. 0%) • More than 10‘ 000 employees 360 T workshop in Praha; 6 th October 2009 3

Alpiq Holding AG Facts and figuers • CHF 16‘ 032 Mio. annual turnover in 2007 • CHF 1‘ 800 Mio. EBITA in 2007 • Energy production of approx. 20 TWh in 2007 53% produced in Switzerland Energy production by fossil (41. 5%), hydraulic (28. 5%), nuclear (29. 0%) and renewable energy (1. 0%) • More than 10‘ 000 employees 360 T workshop in Praha; 6 th October 2009 3

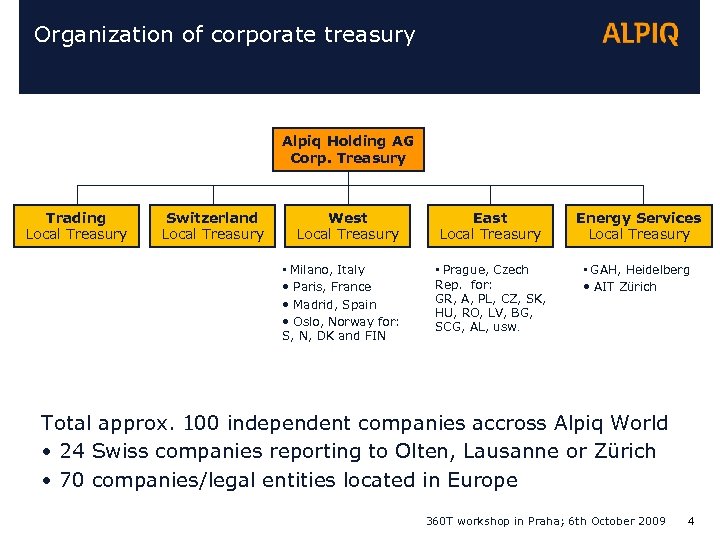

Organization of corporate treasury Alpiq Holding AG Corp. Treasury Trading Local Treasury Switzerland Local Treasury West Local Treasury • Milano, Italy • Paris, France • Madrid, Spain • Oslo, Norway for: S, N, DK and FIN East Local Treasury Energy Services Local Treasury • Prague, Czech Rep. for: GR, A, PL, CZ, SK, HU, RO, LV, BG, SCG, AL, usw. • GAH, Heidelberg • AIT Zürich Total approx. 100 independent companies accross Alpiq World • 24 Swiss companies reporting to Olten, Lausanne or Zürich • 70 companies/legal entities located in Europe 360 T workshop in Praha; 6 th October 2009 4

Organization of corporate treasury Alpiq Holding AG Corp. Treasury Trading Local Treasury Switzerland Local Treasury West Local Treasury • Milano, Italy • Paris, France • Madrid, Spain • Oslo, Norway for: S, N, DK and FIN East Local Treasury Energy Services Local Treasury • Prague, Czech Rep. for: GR, A, PL, CZ, SK, HU, RO, LV, BG, SCG, AL, usw. • GAH, Heidelberg • AIT Zürich Total approx. 100 independent companies accross Alpiq World • 24 Swiss companies reporting to Olten, Lausanne or Zürich • 70 companies/legal entities located in Europe 360 T workshop in Praha; 6 th October 2009 4

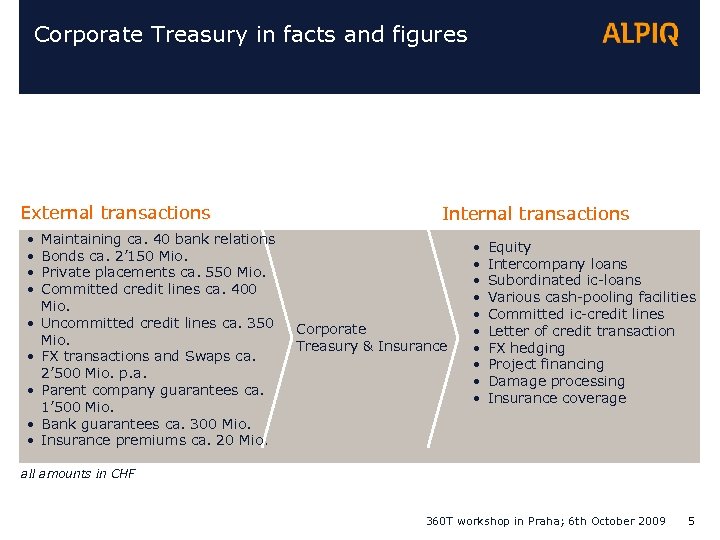

Corporate Treasury in facts and figures External transactions • • • Maintaining ca. 40 bank relations Bonds ca. 2’ 150 Mio. Private placements ca. 550 Mio. Committed credit lines ca. 400 Mio. Uncommitted credit lines ca. 350 Mio. FX transactions and Swaps ca. 2’ 500 Mio. p. a. Parent company guarantees ca. 1’ 500 Mio. Bank guarantees ca. 300 Mio. Insurance premiums ca. 20 Mio. Internal transactions Corporate Treasury & Insurance • • • Equity Intercompany loans Subordinated ic-loans Various cash-pooling facilities Committed ic-credit lines Letter of credit transaction FX hedging Project financing Damage processing Insurance coverage all amounts in CHF 360 T workshop in Praha; 6 th October 2009 5

Corporate Treasury in facts and figures External transactions • • • Maintaining ca. 40 bank relations Bonds ca. 2’ 150 Mio. Private placements ca. 550 Mio. Committed credit lines ca. 400 Mio. Uncommitted credit lines ca. 350 Mio. FX transactions and Swaps ca. 2’ 500 Mio. p. a. Parent company guarantees ca. 1’ 500 Mio. Bank guarantees ca. 300 Mio. Insurance premiums ca. 20 Mio. Internal transactions Corporate Treasury & Insurance • • • Equity Intercompany loans Subordinated ic-loans Various cash-pooling facilities Committed ic-credit lines Letter of credit transaction FX hedging Project financing Damage processing Insurance coverage all amounts in CHF 360 T workshop in Praha; 6 th October 2009 5

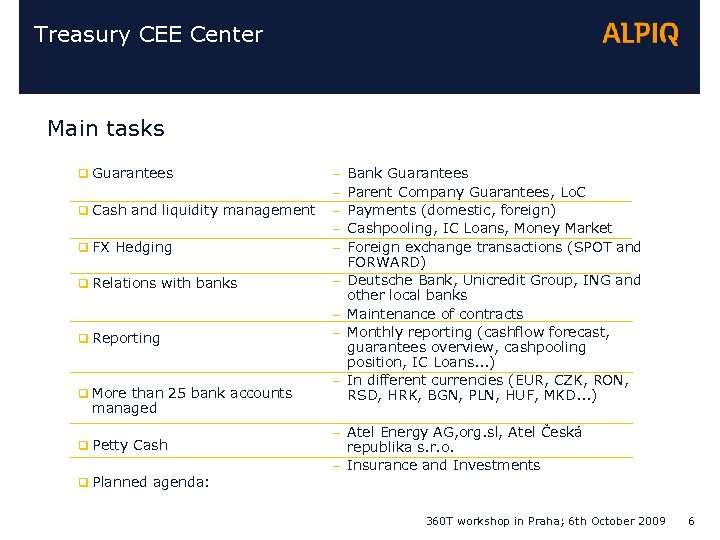

Treasury CEE Center Main tasks q Guarantees q FX Hedging – – – q Relations with banks – q Cash and liquidity management q Reporting q More than 25 bank accounts managed q Petty Cash q Planned agenda: – – – Bank Guarantees Parent Company Guarantees, Lo. C Payments (domestic, foreign) Cashpooling, IC Loans, Money Market Foreign exchange transactions (SPOT and FORWARD) Deutsche Bank, Unicredit Group, ING and other local banks Maintenance of contracts Monthly reporting (cashflow forecast, guarantees overview, cashpooling position, IC Loans. . . ) In different currencies (EUR, CZK, RON, RSD, HRK, BGN, PLN, HUF, MKD. . . ) – Atel Energy AG, org. sl, Atel Česká republika s. r. o. – Insurance and Investments 360 T workshop in Praha; 6 th October 2009 6

Treasury CEE Center Main tasks q Guarantees q FX Hedging – – – q Relations with banks – q Cash and liquidity management q Reporting q More than 25 bank accounts managed q Petty Cash q Planned agenda: – – – Bank Guarantees Parent Company Guarantees, Lo. C Payments (domestic, foreign) Cashpooling, IC Loans, Money Market Foreign exchange transactions (SPOT and FORWARD) Deutsche Bank, Unicredit Group, ING and other local banks Maintenance of contracts Monthly reporting (cashflow forecast, guarantees overview, cashpooling position, IC Loans. . . ) In different currencies (EUR, CZK, RON, RSD, HRK, BGN, PLN, HUF, MKD. . . ) – Atel Energy AG, org. sl, Atel Česká republika s. r. o. – Insurance and Investments 360 T workshop in Praha; 6 th October 2009 6

Treasury policy – hedging strategies The policy says: „whenever local treasury is aware of a funds flow, different from local reporting currency, local treasury has to hedge this foreign currency flow with corporate treasury“ It is up to the discretion of corporate treasury to transfer the currency risk to the market. Actual most hedging activities of our subsidiaries are hedged against the market except of EUR/CHF exposure. 360 T workshop in Praha; 6 th October 2009 7

Treasury policy – hedging strategies The policy says: „whenever local treasury is aware of a funds flow, different from local reporting currency, local treasury has to hedge this foreign currency flow with corporate treasury“ It is up to the discretion of corporate treasury to transfer the currency risk to the market. Actual most hedging activities of our subsidiaries are hedged against the market except of EUR/CHF exposure. 360 T workshop in Praha; 6 th October 2009 7

FX hedging CEE – 1 FX position = difference between assets and liabilities values in each currency => FX revaluation Position can be created by: Natural position = services costs in different currency Conversion = asset and liability from trade have different currencies Hedging of: • CBTC (daily, monthly or yearly auction) • End consumer offers • Office expenses 360 T workshop in Praha; 6 th October 2009 8

FX hedging CEE – 1 FX position = difference between assets and liabilities values in each currency => FX revaluation Position can be created by: Natural position = services costs in different currency Conversion = asset and liability from trade have different currencies Hedging of: • CBTC (daily, monthly or yearly auction) • End consumer offers • Office expenses 360 T workshop in Praha; 6 th October 2009 8

FX hedging CEE – 3 FX forward rates – updated daily Larger energy deals (above EUR 500 000 equiv. ) – prompt information from sales department after deal commit – FX hedge done immediately Small energy deals - daily monitoring of Energy position vs FX position, if amount exceeds certain limit – FX hedge done 360 T workshop in Praha; 6 th October 2009 9

FX hedging CEE – 3 FX forward rates – updated daily Larger energy deals (above EUR 500 000 equiv. ) – prompt information from sales department after deal commit – FX hedge done immediately Small energy deals - daily monitoring of Energy position vs FX position, if amount exceeds certain limit – FX hedge done 360 T workshop in Praha; 6 th October 2009 9

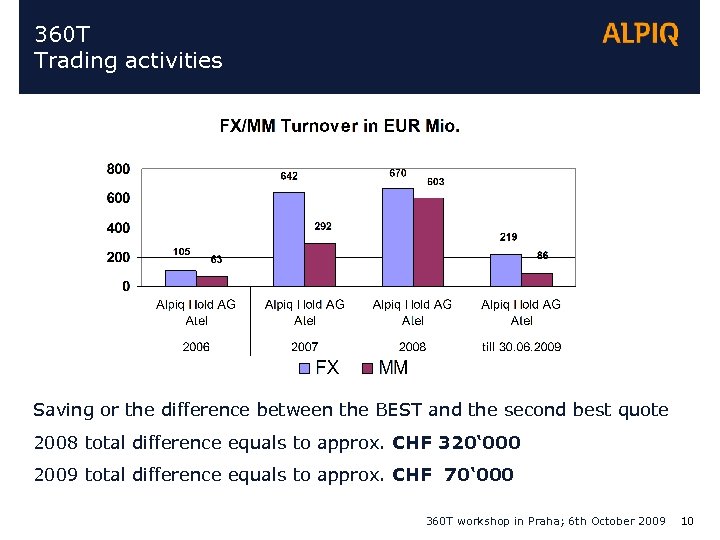

360 T Trading activities Saving or the difference between the BEST and the second best quote 2008 total difference equals to approx. CHF 320‘ 000 2009 total difference equals to approx. CHF 70‘ 000 360 T workshop in Praha; 6 th October 2009 10

360 T Trading activities Saving or the difference between the BEST and the second best quote 2008 total difference equals to approx. CHF 320‘ 000 2009 total difference equals to approx. CHF 70‘ 000 360 T workshop in Praha; 6 th October 2009 10

360 T – The next steps inter-company dealing Phase 1: Set up of a pilot subsidiary – Atel Ceska getting more experience and confidence in 360 T Phase 2: Set up of HU-Atel and PL-Atel (ic-dealing by Prague) Phase 3: Planned to set up other major sub-treasuries such as: • Energie Ouest Suisse, Lausanne FX dealing with banks • Alpiq Norway AS, Oslo FX dealing with banks • Alpiq Energia Italia (ic-dealing) Phase 4: In case of enough trading volume tend to go for STP 360 T workshop in Praha; 6 th October 2009 11

360 T – The next steps inter-company dealing Phase 1: Set up of a pilot subsidiary – Atel Ceska getting more experience and confidence in 360 T Phase 2: Set up of HU-Atel and PL-Atel (ic-dealing by Prague) Phase 3: Planned to set up other major sub-treasuries such as: • Energie Ouest Suisse, Lausanne FX dealing with banks • Alpiq Norway AS, Oslo FX dealing with banks • Alpiq Energia Italia (ic-dealing) Phase 4: In case of enough trading volume tend to go for STP 360 T workshop in Praha; 6 th October 2009 11

360 T – Inter-Company dealing Goal Major goals: • Larger volumes lead to more competitive FX pricing for Alpiq • Improve transparency • Having a contol tool as well as a risk measurement tool vs. those dealing now with banks instead ic • Having a group wide standard process in place that all FX activities are centralized in Coporate Treasury Olten • Basis for group wide FX reporting 360 T workshop in Praha; 6 th October 2009 12

360 T – Inter-Company dealing Goal Major goals: • Larger volumes lead to more competitive FX pricing for Alpiq • Improve transparency • Having a contol tool as well as a risk measurement tool vs. those dealing now with banks instead ic • Having a group wide standard process in place that all FX activities are centralized in Coporate Treasury Olten • Basis for group wide FX reporting 360 T workshop in Praha; 6 th October 2009 12

360 T Advantages and disadvantages Advantages: • good/competitive FX pricing • good comparison tool of our banks • getting very accurate indications market rates • IC-dealing good transparency for transfer pricing problematic (tax issue) Disadvantages: • not yet all our favorite banks participate/quote on 360 T • small/local banks shy away from 360 T • in the middle of the financing turmoil less competive forward pricing in „exotic“-cee currencies due to large safety spreads 360 T workshop in Praha; 6 th October 2009 13

360 T Advantages and disadvantages Advantages: • good/competitive FX pricing • good comparison tool of our banks • getting very accurate indications market rates • IC-dealing good transparency for transfer pricing problematic (tax issue) Disadvantages: • not yet all our favorite banks participate/quote on 360 T • small/local banks shy away from 360 T • in the middle of the financing turmoil less competive forward pricing in „exotic“-cee currencies due to large safety spreads 360 T workshop in Praha; 6 th October 2009 13

Corporate treasury – Administration FX-Settlement • Maintaining good bank relations sound understanding of business model • Exchange of standard settlement instruction for FX/MM Chinese Wall • At execution of FX/MM deals capture deal in accounting system (SAP) and deal gets signed by group treasurer 4 eyes control • Banks are instructed to send MM/FX confirmation to our B/O • B/O checks external confirmation with our system mismatch call to F/O • 2 days before maturity F/O effects payment 4 eyes control 360 T workshop in Praha; 6 th October 2009 14

Corporate treasury – Administration FX-Settlement • Maintaining good bank relations sound understanding of business model • Exchange of standard settlement instruction for FX/MM Chinese Wall • At execution of FX/MM deals capture deal in accounting system (SAP) and deal gets signed by group treasurer 4 eyes control • Banks are instructed to send MM/FX confirmation to our B/O • B/O checks external confirmation with our system mismatch call to F/O • 2 days before maturity F/O effects payment 4 eyes control 360 T workshop in Praha; 6 th October 2009 14

Contact Alpiq Holding AG phone + 41 62 286 71 11 info@alpiq. com André Boppart phone + 41 62 286 70 35 andre. boppart@alpiq. com

Contact Alpiq Holding AG phone + 41 62 286 71 11 info@alpiq. com André Boppart phone + 41 62 286 70 35 andre. boppart@alpiq. com