3f95a9a356bb4321e5b444a292203ef9.ppt

- Количество слайдов: 52

30 CHAPTER 30 NOT-FOR-PROFIT ORGANIZATIONS: INTRODUCTION & PRIVATE NPOs Slide 30 -1

30 CHAPTER 30 NOT-FOR-PROFIT ORGANIZATIONS: INTRODUCTION & PRIVATE NPOs Slide 30 -1

30 FOCUS OF CHAPTER 30 l Types of Not-for-Profits Organizations l Characteristics of Not-for-Profit Organizations l FASB Guidance Versus GASB Guidance l Accounting for Private Not-for-Profit Organizations Slide 30 -2

30 FOCUS OF CHAPTER 30 l Types of Not-for-Profits Organizations l Characteristics of Not-for-Profit Organizations l FASB Guidance Versus GASB Guidance l Accounting for Private Not-for-Profit Organizations Slide 30 -2

30 Types of Not-for-Profit Organizations l Health Care Organizations l Colleges and Universities l Voluntary Health and Welfare Organizations l Certain (or “all other”) Nonprofit Organizations Volunteers Slide 30 -3

30 Types of Not-for-Profit Organizations l Health Care Organizations l Colleges and Universities l Voluntary Health and Welfare Organizations l Certain (or “all other”) Nonprofit Organizations Volunteers Slide 30 -3

30 Excluded Entities l The following entities are not NPOs because they solely serve the economic interests of their owners, members, participants, or trust beneficiaries: n Credit unions and mutual banks. n Employee benefit and pension plans. n Mutual insurance companies. n Farms and rural cooperatives. n Trusts. Slide 30 -4

30 Excluded Entities l The following entities are not NPOs because they solely serve the economic interests of their owners, members, participants, or trust beneficiaries: n Credit unions and mutual banks. n Employee benefit and pension plans. n Mutual insurance companies. n Farms and rural cooperatives. n Trusts. Slide 30 -4

30 Characteristics of NPOs l No outside ownership interest. l A mission to provide services: n To their users, patients, society as a whole, or members--but NOT at a profit. l A dependence on significant levels of contributions. l A significant level of assets that are restricted as to use because of donor stipulations. l Tax-exempt status. IRS Form 990, 990 A, or 990 PF Slide 30 -5

30 Characteristics of NPOs l No outside ownership interest. l A mission to provide services: n To their users, patients, society as a whole, or members--but NOT at a profit. l A dependence on significant levels of contributions. l A significant level of assets that are restricted as to use because of donor stipulations. l Tax-exempt status. IRS Form 990, 990 A, or 990 PF Slide 30 -5

The Dependence on Contributions: 30 And Federal Handouts l Nonprofit religious, charitable, and educational groups receive roughly $40 billion annually in federal government grants. U. S. Treasury $ Slide 30 -6

The Dependence on Contributions: 30 And Federal Handouts l Nonprofit religious, charitable, and educational groups receive roughly $40 billion annually in federal government grants. U. S. Treasury $ Slide 30 -6

30 Tax-Exempt Status l Private NPOs are exempt from U. S. income taxes if the NPO: n Serves some common good. n Does not make an accounting profit. n Does not primarily benefit its own executives. $ n Does not function for political purposes. Slide 30 -7

30 Tax-Exempt Status l Private NPOs are exempt from U. S. income taxes if the NPO: n Serves some common good. n Does not make an accounting profit. n Does not primarily benefit its own executives. $ n Does not function for political purposes. Slide 30 -7

30 Tax-Exempt Status l Additional Advantages to Tax-Exempt Status for U. S. Income Tax Reporting Purposes (in most states): n No state income tax. n No local property taxes. n No sales taxes on purchases. Slide 30 -8

30 Tax-Exempt Status l Additional Advantages to Tax-Exempt Status for U. S. Income Tax Reporting Purposes (in most states): n No state income tax. n No local property taxes. n No sales taxes on purchases. Slide 30 -8

30 Tax-Exempt Status l IRS Audits of Tax-Exempt Groups: n Annually, the IRS audits approximately 11, 000 of the 1. 2 million tax-exempt groups. n The IRS assesses taxes & penalties of over $100 million per year. n Such taxes are on businessrelated income (which is taxable at the highest corporate). Slide 30 -9

30 Tax-Exempt Status l IRS Audits of Tax-Exempt Groups: n Annually, the IRS audits approximately 11, 000 of the 1. 2 million tax-exempt groups. n The IRS assesses taxes & penalties of over $100 million per year. n Such taxes are on businessrelated income (which is taxable at the highest corporate). Slide 30 -9

The Matching Concept: 30 It Applies to NPOs l REVENUES AND SUPPORT may be and are compared with EXPENSES--even though: n Expenses are incurred to provide services (rather than to generate revenues as in commercial accounting) n The purpose of NPOs is not to maximize return on an ownership interest. ROE = Not Applicable Slide 30 -10

The Matching Concept: 30 It Applies to NPOs l REVENUES AND SUPPORT may be and are compared with EXPENSES--even though: n Expenses are incurred to provide services (rather than to generate revenues as in commercial accounting) n The purpose of NPOs is not to maximize return on an ownership interest. ROE = Not Applicable Slide 30 -10

30 The Reporting Model: Private NPOs l The Flow of ECONOMIC RESOURCES --it requires the use of: n The accrual basis of accounting. n The recognition of depreciation expense in the operating statement. l The use of this reporting model (the same one used in the commercial sector) reveals: n The improvement or deterioration in the NPO’s financial condition for the period. Slide 30 -11

30 The Reporting Model: Private NPOs l The Flow of ECONOMIC RESOURCES --it requires the use of: n The accrual basis of accounting. n The recognition of depreciation expense in the operating statement. l The use of this reporting model (the same one used in the commercial sector) reveals: n The improvement or deterioration in the NPO’s financial condition for the period. Slide 30 -11

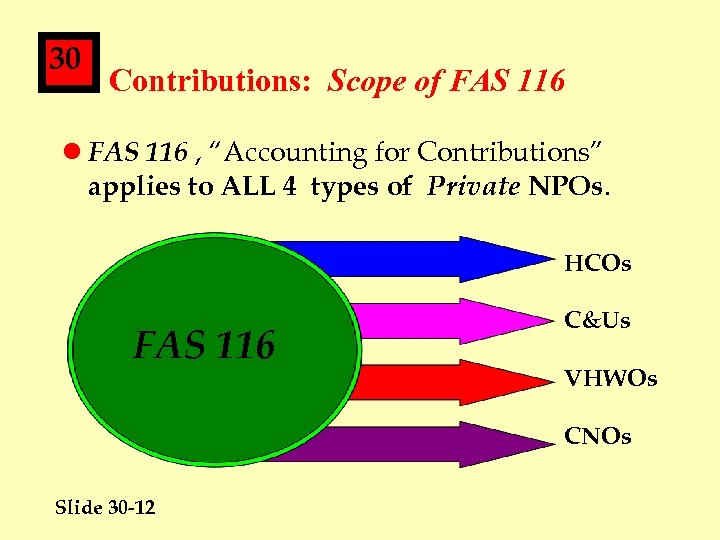

30 Contributions: Scope of FAS 116 l FAS 116 , “Accounting for Contributions” applies to ALL 4 types of Private NPOs. HCOs FAS 116 C&Us VHWOs CNOs Slide 30 -12

30 Contributions: Scope of FAS 116 l FAS 116 , “Accounting for Contributions” applies to ALL 4 types of Private NPOs. HCOs FAS 116 C&Us VHWOs CNOs Slide 30 -12

30 Contributions: The Basic Requirements l WHAT: Report almost ALL unrestricted and unrestricted contributions (including contributions that establish endowments). l WHERE: In the REVENUES AND GAINS category of the statement of activities. l WHEN: When they are received [defined later]. Slide 30 -13

30 Contributions: The Basic Requirements l WHAT: Report almost ALL unrestricted and unrestricted contributions (including contributions that establish endowments). l WHERE: In the REVENUES AND GAINS category of the statement of activities. l WHEN: When they are received [defined later]. Slide 30 -13

30 Contributions: Defined l Contribution: An unconditional (no strings attached) TRANSFER of (1) CASH or (2) OTHER ASSETS: n In a voluntary, nonreciprocal transfer. n By a person or entity acting other than as an owner of the NPO. Examples of OTHER ASSETS: Equipment, vehicles, land, and promises of cash. Slide 30 -14

30 Contributions: Defined l Contribution: An unconditional (no strings attached) TRANSFER of (1) CASH or (2) OTHER ASSETS: n In a voluntary, nonreciprocal transfer. n By a person or entity acting other than as an owner of the NPO. Examples of OTHER ASSETS: Equipment, vehicles, land, and promises of cash. Slide 30 -14

30 Contributions: “Promises, Promises” l “Unconditional transfers” include “unconditional promises” to give cash or other assets in the future. Promises may be: n Oral or n Written or l Unconditional promises result in reporting “Contributions Receivable” in the B/S, (subject to an allowance for uncollectibles). Slide 30 -15

30 Contributions: “Promises, Promises” l “Unconditional transfers” include “unconditional promises” to give cash or other assets in the future. Promises may be: n Oral or n Written or l Unconditional promises result in reporting “Contributions Receivable” in the B/S, (subject to an allowance for uncollectibles). Slide 30 -15

Contributions: 30 Recognizing Unconditional Promises l Recognizing unconditional promises in the financial statements requires having: n Sufficient EVIDENCE in the form of verifiable documentation n That a promise was made. Slide 30 -16

Contributions: 30 Recognizing Unconditional Promises l Recognizing unconditional promises in the financial statements requires having: n Sufficient EVIDENCE in the form of verifiable documentation n That a promise was made. Slide 30 -16

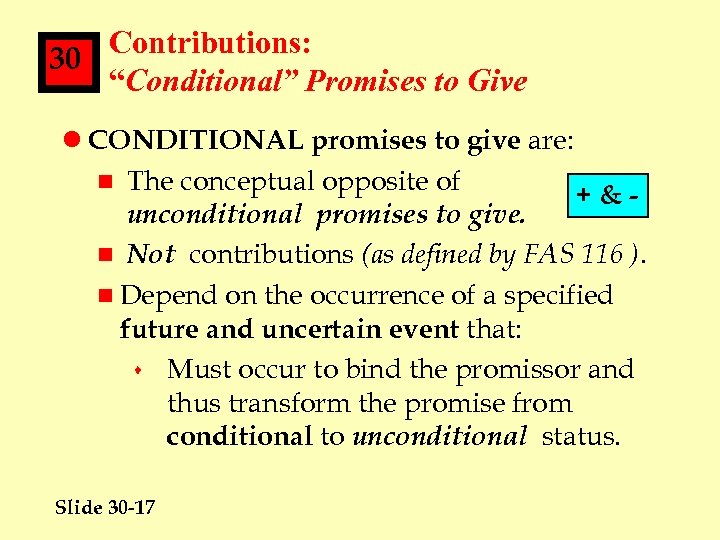

Contributions: 30 “Conditional” Promises to Give l CONDITIONAL promises to give are: n The conceptual opposite of +&unconditional promises to give. n Not contributions (as defined by FAS 116 ). n Depend on the occurrence of a specified future and uncertain event that: s Must occur to bind the promissor and thus transform the promise from conditional to unconditional status. Slide 30 -17

Contributions: 30 “Conditional” Promises to Give l CONDITIONAL promises to give are: n The conceptual opposite of +&unconditional promises to give. n Not contributions (as defined by FAS 116 ). n Depend on the occurrence of a specified future and uncertain event that: s Must occur to bind the promissor and thus transform the promise from conditional to unconditional status. Slide 30 -17

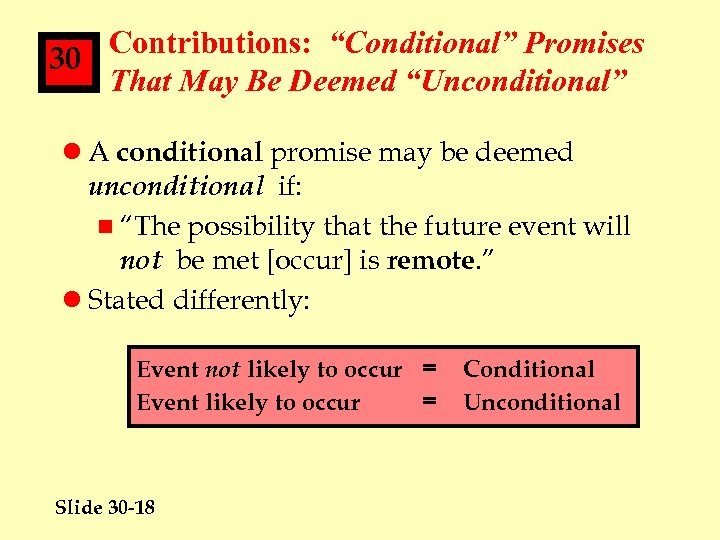

Contributions: “Conditional” Promises 30 That May Be Deemed “Unconditional” l A conditional promise may be deemed unconditional if: n “The possibility that the future event will not be met [occur] is remote. ” l Stated differently: Event not likely to occur = Event likely to occur = Slide 30 -18 Conditional Unconditional

Contributions: “Conditional” Promises 30 That May Be Deemed “Unconditional” l A conditional promise may be deemed unconditional if: n “The possibility that the future event will not be met [occur] is remote. ” l Stated differently: Event not likely to occur = Event likely to occur = Slide 30 -18 Conditional Unconditional

Contributions: 30 “Conditional” Use of Assets Received l If assets have been received and the retention and use of such assets is conditional upon a future event that is not likely to occur: n The offsetting credit is to a REFUNDABLE ADVANCE account (a liability) n Until the conditional event occurs. Slide 30 -19

Contributions: 30 “Conditional” Use of Assets Received l If assets have been received and the retention and use of such assets is conditional upon a future event that is not likely to occur: n The offsetting credit is to a REFUNDABLE ADVANCE account (a liability) n Until the conditional event occurs. Slide 30 -19

Contributions: 30 Manner of Reporting By Category l Contributions are reported in the statement of activities (the operating statement) by category: n Unrestricted. n Temporarily restricted. n Permanently restricted. Slide 30 -20

Contributions: 30 Manner of Reporting By Category l Contributions are reported in the statement of activities (the operating statement) by category: n Unrestricted. n Temporarily restricted. n Permanently restricted. Slide 30 -20

Contributions: 30 Manner of Reporting By Category l Donor-restricted contributions whose conditions are fulfilled in the same period in which the contribution is recognized may be: n Reported in the unrestricted category of the operating statement (O/S) if the entity: s Consistently follows this policy and s Discloses this policy. Note: This option negates the need to show transfers between categories in the O/S. Slide 30 -21

Contributions: 30 Manner of Reporting By Category l Donor-restricted contributions whose conditions are fulfilled in the same period in which the contribution is recognized may be: n Reported in the unrestricted category of the operating statement (O/S) if the entity: s Consistently follows this policy and s Discloses this policy. Note: This option negates the need to show transfers between categories in the O/S. Slide 30 -21

30 Contributions: Endowments l Endowments: contribution that cannot be spent. n The unspendable amount is called the n. A principal--it is invested in perpetuity. l Income on Endowments: n Donor stipulations dictate the reporting classification (unrestricted, temporarily restricted or permanently restricted) Slide 30 -22

30 Contributions: Endowments l Endowments: contribution that cannot be spent. n The unspendable amount is called the n. A principal--it is invested in perpetuity. l Income on Endowments: n Donor stipulations dictate the reporting classification (unrestricted, temporarily restricted or permanently restricted) Slide 30 -22

30 Contributions: Temporary Restrictions l Contributed assets that are restricted as to either: n Purpose or n Time period, n Are classified as temporarily restricted assets. Slide 30 -23

30 Contributions: Temporary Restrictions l Contributed assets that are restricted as to either: n Purpose or n Time period, n Are classified as temporarily restricted assets. Slide 30 -23

30 Contributions: Fixed Assets l Contributed fixed assets are classified (as unrestricted, temporarily restricted, or permanently restricted) based on either: n Donor stipulations or Policy Manual (last resort) n The Donor Agreement NPO’s ACCOUNTING POLICY in the absence of donor stipulations. Slide 30 -24

30 Contributions: Fixed Assets l Contributed fixed assets are classified (as unrestricted, temporarily restricted, or permanently restricted) based on either: n Donor stipulations or Policy Manual (last resort) n The Donor Agreement NPO’s ACCOUNTING POLICY in the absence of donor stipulations. Slide 30 -24

30 Contributions: Fixed Assets l When donor stipulations are absent on a contributed fixed asset: n The NPO must establish an accounting policy as to whether a TIME RESTRICTION EXISTS. s If YES: Classify fixed asset as restricted (temporarily or permanently). s If NO: Classify as unrestricted--when placed in service. Slide 30 -25

30 Contributions: Fixed Assets l When donor stipulations are absent on a contributed fixed asset: n The NPO must establish an accounting policy as to whether a TIME RESTRICTION EXISTS. s If YES: Classify fixed asset as restricted (temporarily or permanently). s If NO: Classify as unrestricted--when placed in service. Slide 30 -25

Contributions: 30 Expirations of Restrictions l Restrictions on long-lived assets classified as temporarily restricted (that have been placed in service): n Expire over the estimated useful lives of the assets n As DEPRECIATION occurs. Slide 30 -26

Contributions: 30 Expirations of Restrictions l Restrictions on long-lived assets classified as temporarily restricted (that have been placed in service): n Expire over the estimated useful lives of the assets n As DEPRECIATION occurs. Slide 30 -26

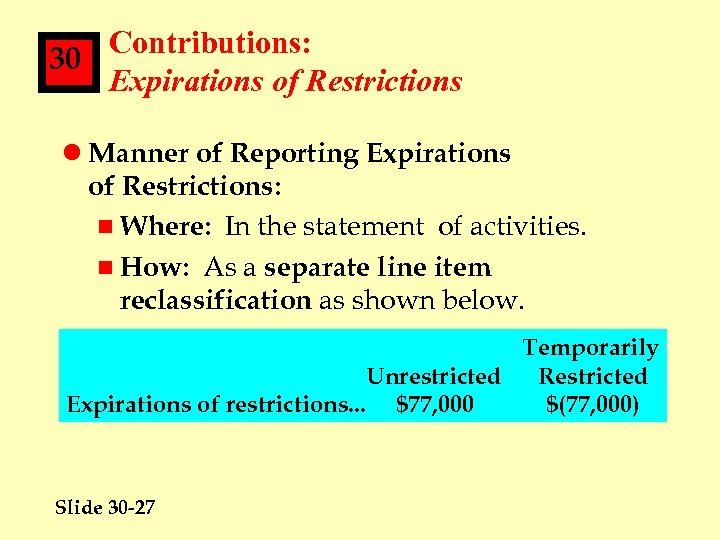

Contributions: 30 Expirations of Restrictions l Manner of Reporting Expirations of Restrictions: n Where: In the statement of activities. n How: As a separate line item reclassification as shown below. Temporarily Unrestricted Restricted Expirations of restrictions. . . $77, 000 $(77, 000) Slide 30 -27

Contributions: 30 Expirations of Restrictions l Manner of Reporting Expirations of Restrictions: n Where: In the statement of activities. n How: As a separate line item reclassification as shown below. Temporarily Unrestricted Restricted Expirations of restrictions. . . $77, 000 $(77, 000) Slide 30 -27

Contributions: Delayed Discussion 30 of Additional Issues l The following issues are covered after we discuss FAS 117 “Financial Statements of Notfor-Profit Organizations” so that you may more readily see the close interrelation-ship that exists between FAS 116 and FAS 117. n Valuation n Contributed services n Collection items. Slide 30 -28

Contributions: Delayed Discussion 30 of Additional Issues l The following issues are covered after we discuss FAS 117 “Financial Statements of Notfor-Profit Organizations” so that you may more readily see the close interrelation-ship that exists between FAS 116 and FAS 117. n Valuation n Contributed services n Collection items. Slide 30 -28

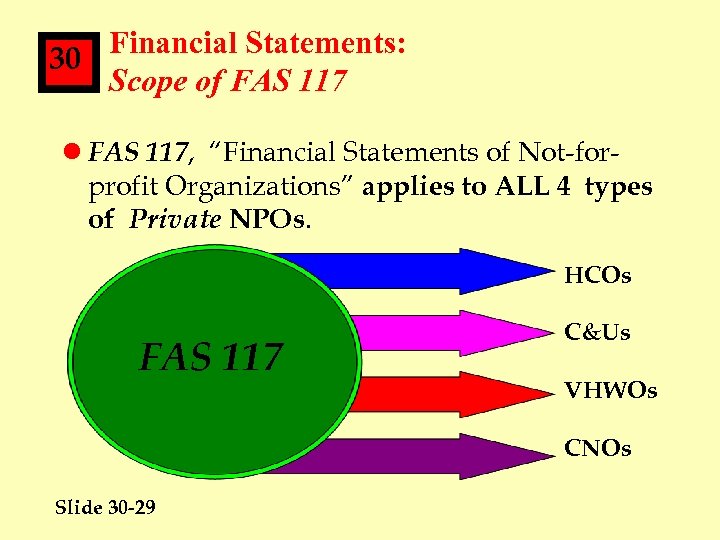

Financial Statements: 30 Scope of FAS 117 l FAS 117, “Financial Statements of Not-forprofit Organizations” applies to ALL 4 types of Private NPOs. HCOs FAS 117 C&Us VHWOs CNOs Slide 30 -29

Financial Statements: 30 Scope of FAS 117 l FAS 117, “Financial Statements of Not-forprofit Organizations” applies to ALL 4 types of Private NPOs. HCOs FAS 117 C&Us VHWOs CNOs Slide 30 -29

Financial Statements: 30 FAS 117 --The Basic Requirements l FAS 117 specifies: n What financial statements are to be presented. n What specific information, as a minimum, is to be shown. Slide 30 -30

Financial Statements: 30 FAS 117 --The Basic Requirements l FAS 117 specifies: n What financial statements are to be presented. n What specific information, as a minimum, is to be shown. Slide 30 -30

Financial Statements: 30 Which Financial Statements l FAS 117 requires for the NPO as a whole: n A statement of financial position. n A statement of activities. n A statement of cash flows. n VHWOs must also report--in a separate statement--EXPENSES BY NATURAL CLASSIFICATION in a matrix format. Slide 30 -31

Financial Statements: 30 Which Financial Statements l FAS 117 requires for the NPO as a whole: n A statement of financial position. n A statement of activities. n A statement of cash flows. n VHWOs must also report--in a separate statement--EXPENSES BY NATURAL CLASSIFICATION in a matrix format. Slide 30 -31

Financial Statements: 30 Stringency l AICPA Audit Guides are fairly prescriptive. l In contrast, FAS 117 imposes no more stringent reporting standards than those that exist for commercial entities. l Thus NPOs have the option to present an intermediate measure of “operating income. ” If presented, it must be done in a statement that also reports the change in unrestricted net assets (equity) for the period. Slide 30 -32

Financial Statements: 30 Stringency l AICPA Audit Guides are fairly prescriptive. l In contrast, FAS 117 imposes no more stringent reporting standards than those that exist for commercial entities. l Thus NPOs have the option to present an intermediate measure of “operating income. ” If presented, it must be done in a statement that also reports the change in unrestricted net assets (equity) for the period. Slide 30 -32

Financial Statements: 30 Financial Flexibility l FAS 117 mandates the use of certain classifications to provide information on financial flexibility. l An NPOs net assets (equity) are classified based on: n Whether donor-imposed restrictions exist and n The type of donor-imposed restrictions. Slide 30 -33

Financial Statements: 30 Financial Flexibility l FAS 117 mandates the use of certain classifications to provide information on financial flexibility. l An NPOs net assets (equity) are classified based on: n Whether donor-imposed restrictions exist and n The type of donor-imposed restrictions. Slide 30 -33

Financial Statements: 30 The 3 Classifications of Net Assets l The 3 mandated classifications of net assets are: n Unrestricted. n Temporarily restricted. n Permanently restricted. l Note that these are the same 3 classifications used for reporting contributions. Slide 30 -34

Financial Statements: 30 The 3 Classifications of Net Assets l The 3 mandated classifications of net assets are: n Unrestricted. n Temporarily restricted. n Permanently restricted. l Note that these are the same 3 classifications used for reporting contributions. Slide 30 -34

Financial Statements: 30 The Statement of Financial Position l Its Purpose: n To focus on the NPO as a whole. n To show amounts for the NPO’s total assets, total liabilities, and total net assets (equity). l The net assets (equity) section must show the total amount for each class of net assets. If a fund structure is used, it is not displayed. Slide 30 -35

Financial Statements: 30 The Statement of Financial Position l Its Purpose: n To focus on the NPO as a whole. n To show amounts for the NPO’s total assets, total liabilities, and total net assets (equity). l The net assets (equity) section must show the total amount for each class of net assets. If a fund structure is used, it is not displayed. Slide 30 -35

30 Financial Statements: The Statement of Financial Position l Additional Points: n Information about liquidity may be shown in any of several ways: n Disclosures about the nature and amount of donor-imposed restrictions must be made. The term “fund balance” is not used in any of the statements prescribed by FAS 117. Slide 30 -36

30 Financial Statements: The Statement of Financial Position l Additional Points: n Information about liquidity may be shown in any of several ways: n Disclosures about the nature and amount of donor-imposed restrictions must be made. The term “fund balance” is not used in any of the statements prescribed by FAS 117. Slide 30 -36

Financial Statements: 30 The Statement of Activities l Its Purpose: n To show revenues, gains, and other support by category (unrestricted, temporarily restricted, and permanently restricted). n. Expirations of restrictions are to be reported separately in this statement. n ALL EXPENSES are to be shown in the unrestricted category. Slide 30 -37

Financial Statements: 30 The Statement of Activities l Its Purpose: n To show revenues, gains, and other support by category (unrestricted, temporarily restricted, and permanently restricted). n. Expirations of restrictions are to be reported separately in this statement. n ALL EXPENSES are to be shown in the unrestricted category. Slide 30 -37

Financial Statements: 30 The Statement of Activities l Additional Points: n The amount of the change in each classification of net assets must be shown for the NPO as a whole. n Gross amounts must be reported for revenues and expenses (including special events) with limited exceptions. If fund accounting is used for internal record keeping purposes, an aggregating worksheet will be needed to arrive at amounts to be presented for external reporting. Slide 30 -38

Financial Statements: 30 The Statement of Activities l Additional Points: n The amount of the change in each classification of net assets must be shown for the NPO as a whole. n Gross amounts must be reported for revenues and expenses (including special events) with limited exceptions. If fund accounting is used for internal record keeping purposes, an aggregating worksheet will be needed to arrive at amounts to be presented for external reporting. Slide 30 -38

30 Contributions: Additional Issues l Contributions of monetary and nonmonetary assets are valued at the FAIR VALUE of the assets received. l. Determining the fair value may require: n Obtaining quoted market prices. n Using independent appraisals. n Using other appropriate methods. Slide 30 -39

30 Contributions: Additional Issues l Contributions of monetary and nonmonetary assets are valued at the FAIR VALUE of the assets received. l. Determining the fair value may require: n Obtaining quoted market prices. n Using independent appraisals. n Using other appropriate methods. Slide 30 -39

30 Contributions: Additional Issues l Use of Present Value Procedures: n Can use for estimated future cash flows on unconditional promises to contribute that are expected to be collected over a period of longer than one year. n If used, subsequent recognition of the interest element is reported as contribution income--not as interest income. Slide 30 -40

30 Contributions: Additional Issues l Use of Present Value Procedures: n Can use for estimated future cash flows on unconditional promises to contribute that are expected to be collected over a period of longer than one year. n If used, subsequent recognition of the interest element is reported as contribution income--not as interest income. Slide 30 -40

30 Contributions: Additional Issues l Contributed Services: n Recognize as revenues only if: s Nonfinancial assets are created or enhanced. s Specialized skills are provided by individuals possessing these skills (e. g. . , carpenters, electricians, plumbers, lawyers, CPAs) Slide 30 -41

30 Contributions: Additional Issues l Contributed Services: n Recognize as revenues only if: s Nonfinancial assets are created or enhanced. s Specialized skills are provided by individuals possessing these skills (e. g. . , carpenters, electricians, plumbers, lawyers, CPAs) Slide 30 -41

30 Contributions: Additional Issues l Contributed Services--Required Disclosures: n A description of the nature and extent. n The amounts recognized as revenues. n The programs or activities in which the services were used. Slide 30 -42

30 Contributions: Additional Issues l Contributed Services--Required Disclosures: n A description of the nature and extent. n The amounts recognized as revenues. n The programs or activities in which the services were used. Slide 30 -42

30 Contributions: Additional Issues l Contributed Services: n Recognizable contributed services are usually recorded as revenues at the fair value of the SERVICES CONTRIBUTED. n Allowed alternative valuation method for the creation or enhancement of nonfinancial assets: s May value at the fair value of the ASSET created or ASSET enhancement. Slide 30 -43

30 Contributions: Additional Issues l Contributed Services: n Recognizable contributed services are usually recorded as revenues at the fair value of the SERVICES CONTRIBUTED. n Allowed alternative valuation method for the creation or enhancement of nonfinancial assets: s May value at the fair value of the ASSET created or ASSET enhancement. Slide 30 -43

30 Contributions: Additional Issues l “COLLECTION ITEMS” (the exception): n Consist of contributed works of art, historical treasures, and similar assets. n NEED NOT be recognized in the financial statements if 3 conditions are satisfied [how used, how cared for, & use of proceeds upon sale]. n CANNOT be capitalized on a selective or arbitrary basis. Slide 30 -44

30 Contributions: Additional Issues l “COLLECTION ITEMS” (the exception): n Consist of contributed works of art, historical treasures, and similar assets. n NEED NOT be recognized in the financial statements if 3 conditions are satisfied [how used, how cared for, & use of proceeds upon sale]. n CANNOT be capitalized on a selective or arbitrary basis. Slide 30 -44

Recognizing Depreciation 30 on Long-Lived Assets l SAS 93 addresses depreciation. NPOs: n Must recognize depreciation on long-lived assets in the statement of activities. n Need not depreciate “collection items. ” n Must disclose: s Depreciation methods and the expense for the period. s The major classes of depreciable assets and accumulated depreciation. Slide 30 -45

Recognizing Depreciation 30 on Long-Lived Assets l SAS 93 addresses depreciation. NPOs: n Must recognize depreciation on long-lived assets in the statement of activities. n Need not depreciate “collection items. ” n Must disclose: s Depreciation methods and the expense for the period. s The major classes of depreciable assets and accumulated depreciation. Slide 30 -45

Investments (in General): 30 Manner of Valuation l FAS 124 addresses investments. NPOs: n Must value the following securities at their fair value in the financial statements: s Investments in equity securities that have a readily determinable fair value (excluding investments accounted for under the equity method). s ALL investments in debt securities. Slide 30 -46

Investments (in General): 30 Manner of Valuation l FAS 124 addresses investments. NPOs: n Must value the following securities at their fair value in the financial statements: s Investments in equity securities that have a readily determinable fair value (excluding investments accounted for under the equity method). s ALL investments in debt securities. Slide 30 -46

Investments (in General): Manner of 30 Reporting Income, Gains, and Losses l Report currently in the Statement of Activities all: n Investment income: s Interest s Dividends s Other investment income n Gains and losses: s Realized s Unrealized Slide 30 -47

Investments (in General): Manner of 30 Reporting Income, Gains, and Losses l Report currently in the Statement of Activities all: n Investment income: s Interest s Dividends s Other investment income n Gains and losses: s Realized s Unrealized Slide 30 -47

30 End of Chapter 30 (Appendix material follows) l. Time to Clear Things Up-Any Questions? Slide 30 -48

30 End of Chapter 30 (Appendix material follows) l. Time to Clear Things Up-Any Questions? Slide 30 -48

30 Appendix: Classifying Endowment Gains and Losses l Determination Hierarchy for Treatment as to Whether UR , TR , or PR Net Assets : n First: See if the donor has stipulated the treatment. n Second: If no donor stipulation exists, refer to state law. n Third (last resort): Follow rules of FAS 124, “Accounting for Investments. ” Slide 30 -49

30 Appendix: Classifying Endowment Gains and Losses l Determination Hierarchy for Treatment as to Whether UR , TR , or PR Net Assets : n First: See if the donor has stipulated the treatment. n Second: If no donor stipulation exists, refer to state law. n Third (last resort): Follow rules of FAS 124, “Accounting for Investments. ” Slide 30 -49

30 Appendix: Accounting for Endowment Investment Income, Gains, and Losses l Specific Donated Assets to be Held in Perpetuity: s Unrealized gains and losses are reported as changes to PR net assets. l Specific Donated Assets to be Held for a Stipulated Time Period: s Unrealized gains and losses are reported as changes to TR net assets. Slide 30 -50

30 Appendix: Accounting for Endowment Investment Income, Gains, and Losses l Specific Donated Assets to be Held in Perpetuity: s Unrealized gains and losses are reported as changes to PR net assets. l Specific Donated Assets to be Held for a Stipulated Time Period: s Unrealized gains and losses are reported as changes to TR net assets. Slide 30 -50

30 Appendix: Accounting for Endowment Investment Income, Gains, and Losses l Principal (or Corpus) [nonspecific donated assets] to be Held in Perpetuity: n Earnings Restricted to a Specific Program: s Income and any net unrealized gains both increase TR net assets. Slide 30 -51

30 Appendix: Accounting for Endowment Investment Income, Gains, and Losses l Principal (or Corpus) [nonspecific donated assets] to be Held in Perpetuity: n Earnings Restricted to a Specific Program: s Income and any net unrealized gains both increase TR net assets. Slide 30 -51

30 Appendix: Accounting for Endowment Investment Income, Gains, and Losses l Principal (or Corpus) [nonspecific donated assets] to be Held in Perpetuity (cont. ): n Earnings Restricted to a Specific Program: s Total of income and any net unrealized losses: l If positive, increase TR net assets. l If negative, decrease UR net assets--but only after eliminating any positive balance in TR net assets from prior years. Slide 30 -52

30 Appendix: Accounting for Endowment Investment Income, Gains, and Losses l Principal (or Corpus) [nonspecific donated assets] to be Held in Perpetuity (cont. ): n Earnings Restricted to a Specific Program: s Total of income and any net unrealized losses: l If positive, increase TR net assets. l If negative, decrease UR net assets--but only after eliminating any positive balance in TR net assets from prior years. Slide 30 -52