66c2625e53b6de9a79f9f3d221f543ce.ppt

- Количество слайдов: 37

3/16/2018 7: 42 AM CHAPTER 2 COST CONCEPTS AND DESIGN ECONOMICS 1 Dr. Mohammad Abuhaiba, PE

3/16/2018 7: 42 AM CHAPTER 2 COST CONCEPTS AND DESIGN ECONOMICS 1 Dr. Mohammad Abuhaiba, PE

2 3/16/2018 7: 42 AM FIXED, VARIABLE, AND INCREMENTAL COSTS Fixed costs: unaffected by changes in activity level over a feasible range of operations for the capacity or capability available. Typical fixed costs include: q q insurance and taxes on facilities general management and administrative salaries license fees interest costs on borrowed capital. Fixed costs will be affected When: q q large changes in usage of resources occur plant expansion or shutdown is involved Dr. Mohammad Abuhaiba, PE

2 3/16/2018 7: 42 AM FIXED, VARIABLE, AND INCREMENTAL COSTS Fixed costs: unaffected by changes in activity level over a feasible range of operations for the capacity or capability available. Typical fixed costs include: q q insurance and taxes on facilities general management and administrative salaries license fees interest costs on borrowed capital. Fixed costs will be affected When: q q large changes in usage of resources occur plant expansion or shutdown is involved Dr. Mohammad Abuhaiba, PE

3 3/16/2018 7: 42 AM FIXED, VARIABLE AND INCREMENTAL COSTS Variable costs: associated with an operation that vary in total with the quantity of output or other measures of activity level. Example of variable costs include : q costs of material and labor used in a product or service, because they vary in total with the number of output units -- even though costs per unit remain the same. Example 2. 1 Dr. Mohammad Abuhaiba, PE

3 3/16/2018 7: 42 AM FIXED, VARIABLE AND INCREMENTAL COSTS Variable costs: associated with an operation that vary in total with the quantity of output or other measures of activity level. Example of variable costs include : q costs of material and labor used in a product or service, because they vary in total with the number of output units -- even though costs per unit remain the same. Example 2. 1 Dr. Mohammad Abuhaiba, PE

4 3/16/2018 7: 42 AM FIXED, VARIABLE AND INCREMENTAL COSTS Incremental cost: additional cost that results from increasing output of a system by one (or more) units. Incremental cost is often associated with “go / no go” decisions that involve a limited change in output or activity level. EXAMPLE: the incremental cost of driving an automobile might be $0. 27 / mile. This cost depends on: 1. 2. 3. mileage driven; mileage expected to drive; age of car; Dr. Mohammad Abuhaiba, PE

4 3/16/2018 7: 42 AM FIXED, VARIABLE AND INCREMENTAL COSTS Incremental cost: additional cost that results from increasing output of a system by one (or more) units. Incremental cost is often associated with “go / no go” decisions that involve a limited change in output or activity level. EXAMPLE: the incremental cost of driving an automobile might be $0. 27 / mile. This cost depends on: 1. 2. 3. mileage driven; mileage expected to drive; age of car; Dr. Mohammad Abuhaiba, PE

5 3/16/2018 7: 42 AM SUNK COST AND OPPORTUNITY COST sunk cost is one that has occurred in the past and has no relevance to estimates of future costs and revenues related to an alternative course of action; An opportunity cost is the cost of the best rejected ( i. e. , foregone ) opportunity and is hidden or implied; A Dr. Mohammad Abuhaiba, PE

5 3/16/2018 7: 42 AM SUNK COST AND OPPORTUNITY COST sunk cost is one that has occurred in the past and has no relevance to estimates of future costs and revenues related to an alternative course of action; An opportunity cost is the cost of the best rejected ( i. e. , foregone ) opportunity and is hidden or implied; A Dr. Mohammad Abuhaiba, PE

6 3/16/2018 7: 42 AM CASH COST VERSUS BOOK COST Cash cost is a cost that involves payment in cash and results in cash flow; Book cost or noncash cost is a payment that does not involve cash transaction q book costs represent the recovery of past expenditures over a fixed period of time; Depreciation is the most common example of book cost; q depreciation is what is charged for the use of assets, such as plant and equipment; depreciation is not a cash flow; Dr. Mohammad Abuhaiba, PE

6 3/16/2018 7: 42 AM CASH COST VERSUS BOOK COST Cash cost is a cost that involves payment in cash and results in cash flow; Book cost or noncash cost is a payment that does not involve cash transaction q book costs represent the recovery of past expenditures over a fixed period of time; Depreciation is the most common example of book cost; q depreciation is what is charged for the use of assets, such as plant and equipment; depreciation is not a cash flow; Dr. Mohammad Abuhaiba, PE

7 3/16/2018 7: 42 AM LIFE-CYCLE COST Life-cycle cost: sum of all costs, both recurring and nonrecurring, related to a product, structure, system, or service during its life span. Life cycle begins with the identification of the economic need or want and ends with the retirement and disposal activities. Dr. Mohammad Abuhaiba, PE

7 3/16/2018 7: 42 AM LIFE-CYCLE COST Life-cycle cost: sum of all costs, both recurring and nonrecurring, related to a product, structure, system, or service during its life span. Life cycle begins with the identification of the economic need or want and ends with the retirement and disposal activities. Dr. Mohammad Abuhaiba, PE

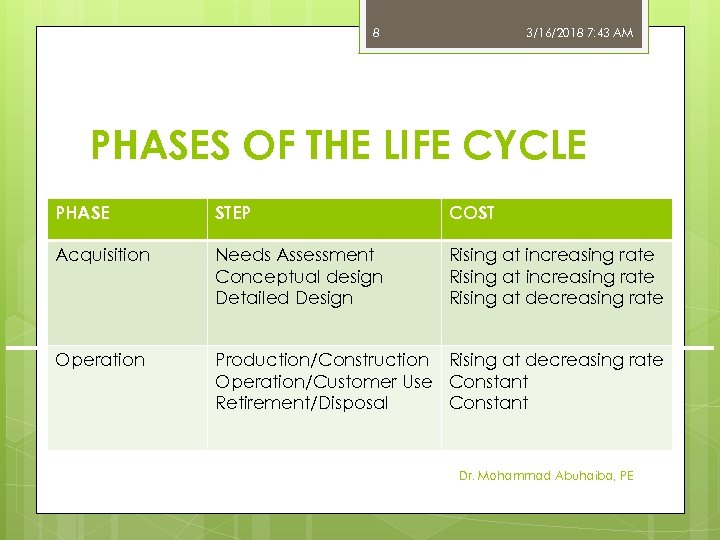

8 3/16/2018 7: 43 AM PHASES OF THE LIFE CYCLE PHASE STEP COST Acquisition Needs Assessment Conceptual design Detailed Design Rising at increasing rate Rising at decreasing rate Operation Production/Construction Rising at decreasing rate Operation/Customer Use Constant Retirement/Disposal Constant Dr. Mohammad Abuhaiba, PE

8 3/16/2018 7: 43 AM PHASES OF THE LIFE CYCLE PHASE STEP COST Acquisition Needs Assessment Conceptual design Detailed Design Rising at increasing rate Rising at decreasing rate Operation Production/Construction Rising at decreasing rate Operation/Customer Use Constant Retirement/Disposal Constant Dr. Mohammad Abuhaiba, PE

9 3/16/2018 7: 43 AM CAPITAL AND INVESTMENT Investment Cost or capital investment: capital (money) required for most activities of the acquisition phase; Working Capital: funds required for current assets needed for start-up and subsequent support of operation activities; Operation and Maintenance Cost includes many of the recurring annual expense items associated with the operation phase of the life cycle; Disposal Cost includes non-recurring costs of shutting down the operation; Dr. Mohammad Abuhaiba, PE

9 3/16/2018 7: 43 AM CAPITAL AND INVESTMENT Investment Cost or capital investment: capital (money) required for most activities of the acquisition phase; Working Capital: funds required for current assets needed for start-up and subsequent support of operation activities; Operation and Maintenance Cost includes many of the recurring annual expense items associated with the operation phase of the life cycle; Disposal Cost includes non-recurring costs of shutting down the operation; Dr. Mohammad Abuhaiba, PE

10 3/16/2018 7: 43 AM RECURRING AND NONRECURRING COSTS Recurring costs: repetitive and occur when a firm produces similar goods and services on a continuing basis. Variable costs are recurring because they repeat with each unit of output. A fixed cost that is paid on a repeatable basis is also a recurring cost: $ q Office space rental Dr. Mohammad Abuhaiba, PE

10 3/16/2018 7: 43 AM RECURRING AND NONRECURRING COSTS Recurring costs: repetitive and occur when a firm produces similar goods and services on a continuing basis. Variable costs are recurring because they repeat with each unit of output. A fixed cost that is paid on a repeatable basis is also a recurring cost: $ q Office space rental Dr. Mohammad Abuhaiba, PE

11 3/16/2018 7: 43 AM RECURRING AND NONRECURRING COSTS Nonrecurring costs: not repetitive, even though the total expenditure may be cumulative over a relatively short period of time; Typically involve developing or establishing a capability or capacity to operate; Examples are purchase cost for real estate upon which a plant will be built, and the construction costs of the plant itself; Dr. Mohammad Abuhaiba, PE

11 3/16/2018 7: 43 AM RECURRING AND NONRECURRING COSTS Nonrecurring costs: not repetitive, even though the total expenditure may be cumulative over a relatively short period of time; Typically involve developing or establishing a capability or capacity to operate; Examples are purchase cost for real estate upon which a plant will be built, and the construction costs of the plant itself; Dr. Mohammad Abuhaiba, PE

12 3/16/2018 7: 43 AM DIRECT, INDIRECT AND OVERHEAD COSTS Direct costs can be reasonably measured and allocated to a specific output or work activity q labor and material directly allocated with a product, service or construction activity; Indirect costs are difficult to allocate to a specific output or activity q costs of common tools, general supplies, and equipment maintenance ; Dr. Mohammad Abuhaiba, PE

12 3/16/2018 7: 43 AM DIRECT, INDIRECT AND OVERHEAD COSTS Direct costs can be reasonably measured and allocated to a specific output or work activity q labor and material directly allocated with a product, service or construction activity; Indirect costs are difficult to allocate to a specific output or activity q costs of common tools, general supplies, and equipment maintenance ; Dr. Mohammad Abuhaiba, PE

13 3/16/2018 7: 43 AM DIRECT, INDIRECT AND OVERHEAD COSTS Overhead consists of plant operating costs that are not direct labor or material costs indirect costs, overhead and burden are the same; Prime Cost is a common method of allocating overhead costs among products, services and activities in proportion the sum of direct labor and materials cost ; Dr. Mohammad Abuhaiba, PE

13 3/16/2018 7: 43 AM DIRECT, INDIRECT AND OVERHEAD COSTS Overhead consists of plant operating costs that are not direct labor or material costs indirect costs, overhead and burden are the same; Prime Cost is a common method of allocating overhead costs among products, services and activities in proportion the sum of direct labor and materials cost ; Dr. Mohammad Abuhaiba, PE

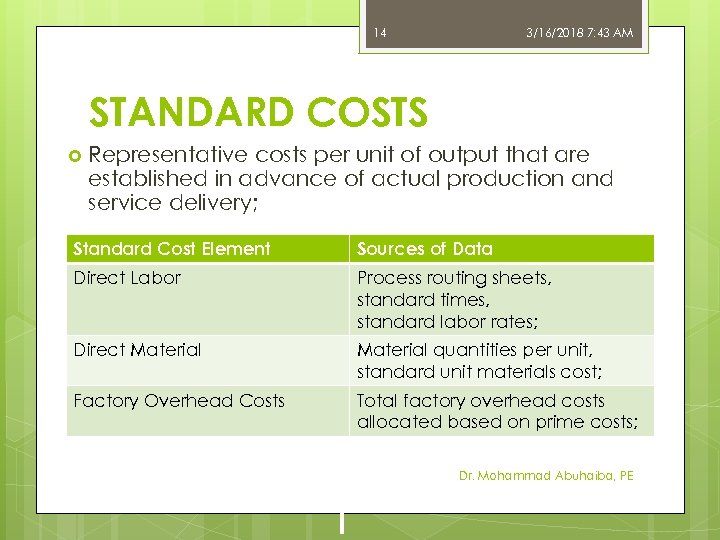

14 3/16/2018 7: 43 AM STANDARD COSTS Representative costs per unit of output that are established in advance of actual production and service delivery; Standard Cost Element Sources of Data Direct Labor Process routing sheets, standard times, standard labor rates; Direct Material quantities per unit, standard unit materials cost; Factory Overhead Costs Total factory overhead costs allocated based on prime costs; Dr. Mohammad Abuhaiba, PE

14 3/16/2018 7: 43 AM STANDARD COSTS Representative costs per unit of output that are established in advance of actual production and service delivery; Standard Cost Element Sources of Data Direct Labor Process routing sheets, standard times, standard labor rates; Direct Material quantities per unit, standard unit materials cost; Factory Overhead Costs Total factory overhead costs allocated based on prime costs; Dr. Mohammad Abuhaiba, PE

15 3/16/2018 7: 43 AM CONSUMER GOODS AND PRODUCER GOODS AND SERVICES Consumer goods and services: directly used by people to satisfy their wants; Producer goods and services: used in the production of consumer goods and services: machine tools, q factory buildings, q buses and farm machinery q Dr. Mohammad Abuhaiba, PE

15 3/16/2018 7: 43 AM CONSUMER GOODS AND PRODUCER GOODS AND SERVICES Consumer goods and services: directly used by people to satisfy their wants; Producer goods and services: used in the production of consumer goods and services: machine tools, q factory buildings, q buses and farm machinery q Dr. Mohammad Abuhaiba, PE

16 3/16/2018 7: 43 AM UTILITY AND DEMAND Utility is a measure of the value which consumers of a product or service place on that product or service; Demand is a reflection of this measure of value, and is represented by price per quantity of output; Dr. Mohammad Abuhaiba, PE

16 3/16/2018 7: 43 AM UTILITY AND DEMAND Utility is a measure of the value which consumers of a product or service place on that product or service; Demand is a reflection of this measure of value, and is represented by price per quantity of output; Dr. Mohammad Abuhaiba, PE

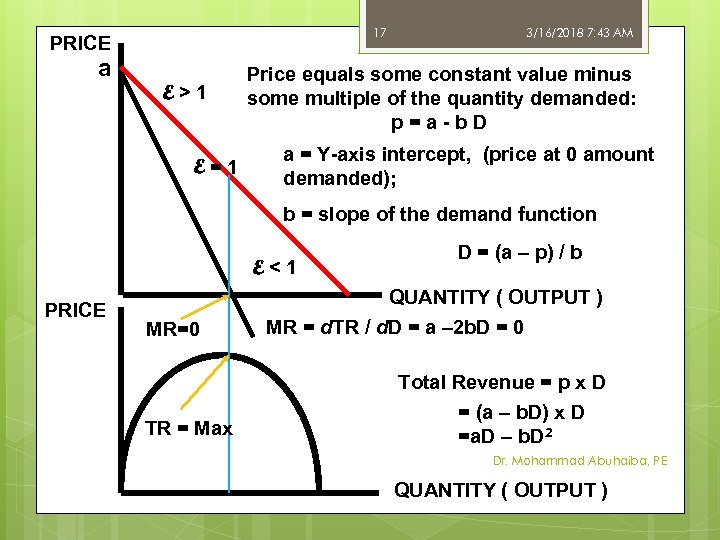

17 PRICE a E>1 E=1 3/16/2018 7: 43 AM Price equals some constant value minus some multiple of the quantity demanded: p=a-b. D a = Y-axis intercept, (price at 0 amount demanded); b = slope of the demand function E<1 PRICE MR=0 TR = Max D = (a – p) / b QUANTITY ( OUTPUT ) MR = d. TR / d. D = a – 2 b. D = 0 Total Revenue = p x D = (a – b. D) x D =a. D – b. D 2 Dr. Mohammad Abuhaiba, PE QUANTITY ( OUTPUT )

17 PRICE a E>1 E=1 3/16/2018 7: 43 AM Price equals some constant value minus some multiple of the quantity demanded: p=a-b. D a = Y-axis intercept, (price at 0 amount demanded); b = slope of the demand function E<1 PRICE MR=0 TR = Max D = (a – p) / b QUANTITY ( OUTPUT ) MR = d. TR / d. D = a – 2 b. D = 0 Total Revenue = p x D = (a – b. D) x D =a. D – b. D 2 Dr. Mohammad Abuhaiba, PE QUANTITY ( OUTPUT )

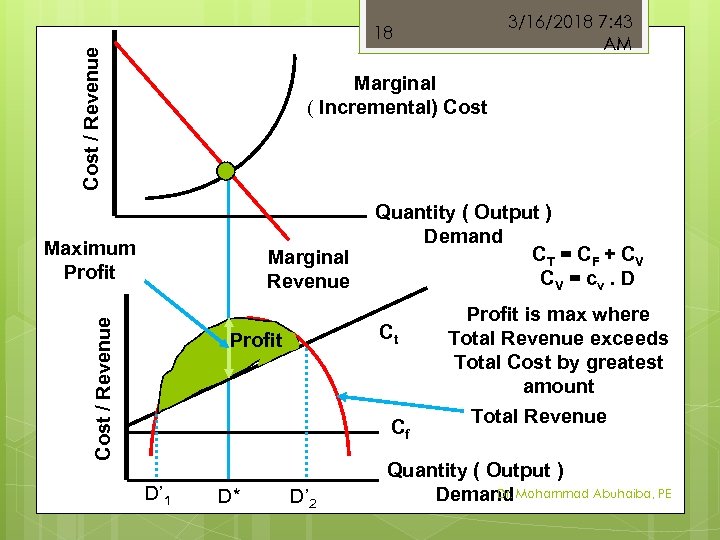

3/16/2018 7: 43 AM Cost / Revenue 18 Marginal ( Incremental) Cost Maximum Profit Cost / Revenue Marginal Revenue Quantity ( Output ) Demand CT = C F + C V CV = c v. D Ct Profit Cf D’ 1 D* D’ 2 Profit is max where Total Revenue exceeds Total Cost by greatest amount Total Revenue Quantity ( Output ) Dr. Demand Mohammad Abuhaiba, PE

3/16/2018 7: 43 AM Cost / Revenue 18 Marginal ( Incremental) Cost Maximum Profit Cost / Revenue Marginal Revenue Quantity ( Output ) Demand CT = C F + C V CV = c v. D Ct Profit Cf D’ 1 D* D’ 2 Profit is max where Total Revenue exceeds Total Cost by greatest amount Total Revenue Quantity ( Output ) Dr. Demand Mohammad Abuhaiba, PE

19 3/16/2018 7: 43 AM PROFIT MAXIMIZATION D* Occurs where total revenue exceeds total cost by the greatest amount; Occurs where marginal cost = marginal revenue; Occurs D* where d. TR/d. D = d Ct /d. D; = [ a - b ( C v) ] / 2 Dr. Mohammad Abuhaiba, PE

19 3/16/2018 7: 43 AM PROFIT MAXIMIZATION D* Occurs where total revenue exceeds total cost by the greatest amount; Occurs where marginal cost = marginal revenue; Occurs D* where d. TR/d. D = d Ct /d. D; = [ a - b ( C v) ] / 2 Dr. Mohammad Abuhaiba, PE

20 3/16/2018 7: 43 AM Example 2. 4 A company produces an electronic timing switch that is used in consumer and commercial products. The fixed cost (CF) is $73, 000 per month, and the variable cost (cv) is $83/unit. The selling price is p = $180 – 0. 02 D, based on equation 2 -1. For this situation, a. Determine the optimal volume for this product and confirm that a profit occur (instead of a loss) at this demand. b. Find the volumes at which breakeven occurs; that is, what is the range of profitable demand? Solve by hand by spreadsheet. Dr. Mohammad Abuhaiba, PE

20 3/16/2018 7: 43 AM Example 2. 4 A company produces an electronic timing switch that is used in consumer and commercial products. The fixed cost (CF) is $73, 000 per month, and the variable cost (cv) is $83/unit. The selling price is p = $180 – 0. 02 D, based on equation 2 -1. For this situation, a. Determine the optimal volume for this product and confirm that a profit occur (instead of a loss) at this demand. b. Find the volumes at which breakeven occurs; that is, what is the range of profitable demand? Solve by hand by spreadsheet. Dr. Mohammad Abuhaiba, PE

21 3/16/2018 7: 43 AM Price per unit is independent of demand Price per unit (p) is greater than the variable cost per unit (cv) Dr. Mohammad Abuhaiba, PE

21 3/16/2018 7: 43 AM Price per unit is independent of demand Price per unit (p) is greater than the variable cost per unit (cv) Dr. Mohammad Abuhaiba, PE

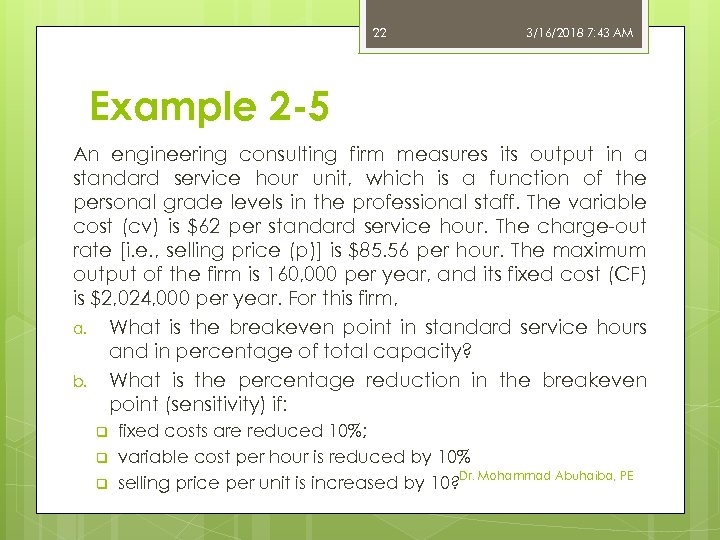

22 3/16/2018 7: 43 AM Example 2 -5 An engineering consulting firm measures its output in a standard service hour unit, which is a function of the personal grade levels in the professional staff. The variable cost (cv) is $62 per standard service hour. The charge-out rate [i. e. , selling price (p)] is $85. 56 per hour. The maximum output of the firm is 160, 000 per year, and its fixed cost (CF) is $2, 024, 000 per year. For this firm, a. What is the breakeven point in standard service hours and in percentage of total capacity? b. What is the percentage reduction in the breakeven point (sensitivity) if: q q q fixed costs are reduced 10%; variable cost per hour is reduced by 10% Dr. Mohammad Abuhaiba, PE selling price per unit is increased by 10?

22 3/16/2018 7: 43 AM Example 2 -5 An engineering consulting firm measures its output in a standard service hour unit, which is a function of the personal grade levels in the professional staff. The variable cost (cv) is $62 per standard service hour. The charge-out rate [i. e. , selling price (p)] is $85. 56 per hour. The maximum output of the firm is 160, 000 per year, and its fixed cost (CF) is $2, 024, 000 per year. For this firm, a. What is the breakeven point in standard service hours and in percentage of total capacity? b. What is the percentage reduction in the breakeven point (sensitivity) if: q q q fixed costs are reduced 10%; variable cost per hour is reduced by 10% Dr. Mohammad Abuhaiba, PE selling price per unit is increased by 10?

23 3/16/2018 7: 43 AM COST-DRIVEN DESIGN OPTIMIZATION Must maintain a life-cycle design perspective Ensures engineers consider: Initial investment costs q Operation and maintenance expenses q Other annual expenses in later years q Environmental and social consequences over design life q Dr. Mohammad Abuhaiba, PE

23 3/16/2018 7: 43 AM COST-DRIVEN DESIGN OPTIMIZATION Must maintain a life-cycle design perspective Ensures engineers consider: Initial investment costs q Operation and maintenance expenses q Other annual expenses in later years q Environmental and social consequences over design life q Dr. Mohammad Abuhaiba, PE

24 3/16/2018 7: 43 AM COST-DRIVEN DESIGN OPTIMIZATION PROBLEM TASKS 1. 2. Determine optimal value for certain alternative’s design variable Select the best alternative, each with its own unique value for the design variable Dr. Mohammad Abuhaiba, PE

24 3/16/2018 7: 43 AM COST-DRIVEN DESIGN OPTIMIZATION PROBLEM TASKS 1. 2. Determine optimal value for certain alternative’s design variable Select the best alternative, each with its own unique value for the design variable Dr. Mohammad Abuhaiba, PE

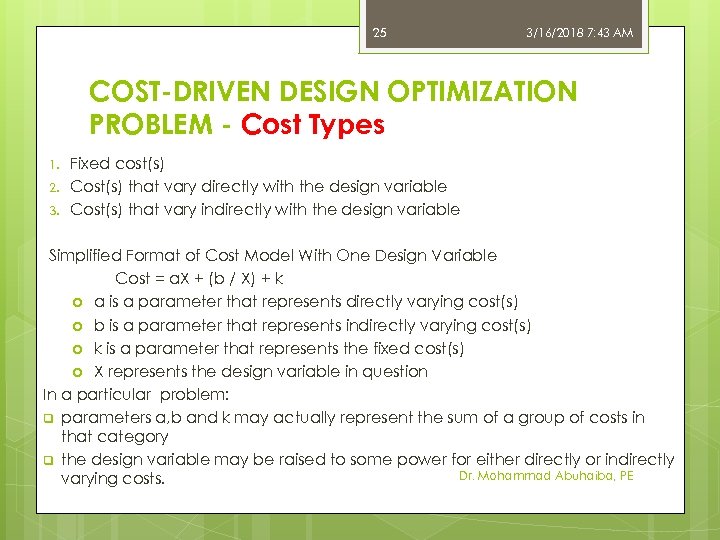

25 3/16/2018 7: 43 AM COST-DRIVEN DESIGN OPTIMIZATION PROBLEM - Cost Types 1. 2. 3. Fixed cost(s) Cost(s) that vary directly with the design variable Cost(s) that vary indirectly with the design variable Simplified Format of Cost Model With One Design Variable Cost = a. X + (b / X) + k a is a parameter that represents directly varying cost(s) b is a parameter that represents indirectly varying cost(s) k is a parameter that represents the fixed cost(s) X represents the design variable in question In a particular problem: q parameters a, b and k may actually represent the sum of a group of costs in that category q the design variable may be raised to some power for either directly or indirectly Dr. Mohammad Abuhaiba, PE varying costs.

25 3/16/2018 7: 43 AM COST-DRIVEN DESIGN OPTIMIZATION PROBLEM - Cost Types 1. 2. 3. Fixed cost(s) Cost(s) that vary directly with the design variable Cost(s) that vary indirectly with the design variable Simplified Format of Cost Model With One Design Variable Cost = a. X + (b / X) + k a is a parameter that represents directly varying cost(s) b is a parameter that represents indirectly varying cost(s) k is a parameter that represents the fixed cost(s) X represents the design variable in question In a particular problem: q parameters a, b and k may actually represent the sum of a group of costs in that category q the design variable may be raised to some power for either directly or indirectly Dr. Mohammad Abuhaiba, PE varying costs.

26 3/16/2018 7: 43 AM GENERAL APPROACH FOR OPTIMIZING A DESIGN WITH RESPECT TO COST 1. 2. 3. 4. 5. Identify primary cost-driving design variable Write an expression for cost model in terms of design variable Set first derivative of cost model with respect to continuous design variable equal to 0. Solve equation in step 3 for optimum value of continuous design variables For continuous design variables, use 2 nd derivative of cost model with respect to design variable to determine whether optimum corresponds to global max or min. Dr. Mohammad Abuhaiba, PE

26 3/16/2018 7: 43 AM GENERAL APPROACH FOR OPTIMIZING A DESIGN WITH RESPECT TO COST 1. 2. 3. 4. 5. Identify primary cost-driving design variable Write an expression for cost model in terms of design variable Set first derivative of cost model with respect to continuous design variable equal to 0. Solve equation in step 3 for optimum value of continuous design variables For continuous design variables, use 2 nd derivative of cost model with respect to design variable to determine whether optimum corresponds to global max or min. Dr. Mohammad Abuhaiba, PE

27 3/16/2018 7: 43 AM Example 2 -6 How Fast Should the Airplane Fly? The cost of operating a jet-powered commercial (passengercarrying) airplane varies as the (3/2) power of its velocity; specifically, Co = kn v 3/2, where n is the trip length in miles, k is a constant of proportionality, and v is velocity in mph. It is known that at 400 mph the average cost of operation is $300/mile. The company that owns the aircraft wants to minimize the cost of operation, but the cost must be balanced against the cost of passenger’s time (CC), which has been set at $300, 000/hour. a. At what velocity should the trip be planned to minimize the total cost, which is the sum of the cost of operating the airplane and the cost of passenger’s time? b. How do you know that your answer for the problem in part (a) minimizes the total cost? Dr. Mohammad Abuhaiba, PE

27 3/16/2018 7: 43 AM Example 2 -6 How Fast Should the Airplane Fly? The cost of operating a jet-powered commercial (passengercarrying) airplane varies as the (3/2) power of its velocity; specifically, Co = kn v 3/2, where n is the trip length in miles, k is a constant of proportionality, and v is velocity in mph. It is known that at 400 mph the average cost of operation is $300/mile. The company that owns the aircraft wants to minimize the cost of operation, but the cost must be balanced against the cost of passenger’s time (CC), which has been set at $300, 000/hour. a. At what velocity should the trip be planned to minimize the total cost, which is the sum of the cost of operating the airplane and the cost of passenger’s time? b. How do you know that your answer for the problem in part (a) minimizes the total cost? Dr. Mohammad Abuhaiba, PE

28 3/16/2018 7: 43 AM PRESENT ECONOMY STUDIES When alternatives for accomplishing a task are compared for one year or less (I. e. , influence of time on money is irrelevant) Rules for Selecting Preferred Alternative 1. Rule 1 – When revenues and other economic benefits are present and vary among alternatives, choose alternative that maximizes overall profitability based on the number of defect-free units of output 2. Rule 2 – When revenues and economic benefits are not present or are constant among alternatives, consider only costs and select alternative that minimizes total cost per defect-free output Dr. Mohammad Abuhaiba, PE

28 3/16/2018 7: 43 AM PRESENT ECONOMY STUDIES When alternatives for accomplishing a task are compared for one year or less (I. e. , influence of time on money is irrelevant) Rules for Selecting Preferred Alternative 1. Rule 1 – When revenues and other economic benefits are present and vary among alternatives, choose alternative that maximizes overall profitability based on the number of defect-free units of output 2. Rule 2 – When revenues and economic benefits are not present or are constant among alternatives, consider only costs and select alternative that minimizes total cost per defect-free output Dr. Mohammad Abuhaiba, PE

29 3/16/2018 7: 43 AM PRESENT ECONOMY STUDIES Total Cost in Material Selection In many cases, selection of among materials cannot be based solely on costs of materials. Frequently, change in materials affect design, processing, and shipping costs. Example 2 -9 Dr. Mohammad Abuhaiba, PE

29 3/16/2018 7: 43 AM PRESENT ECONOMY STUDIES Total Cost in Material Selection In many cases, selection of among materials cannot be based solely on costs of materials. Frequently, change in materials affect design, processing, and shipping costs. Example 2 -9 Dr. Mohammad Abuhaiba, PE

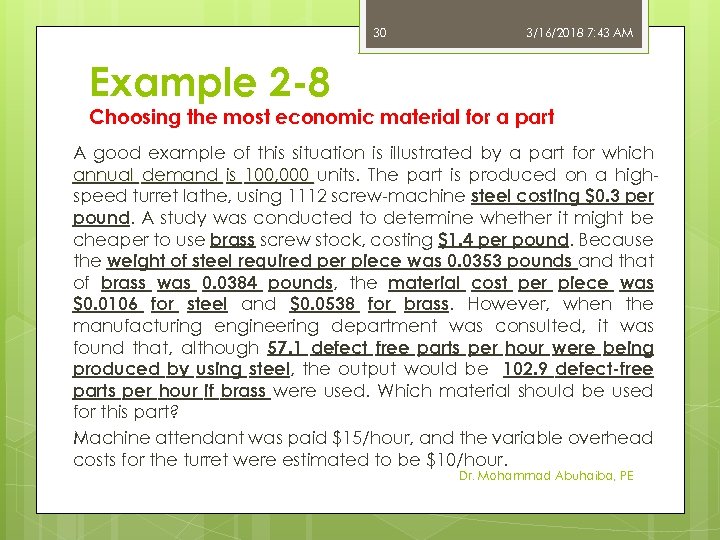

30 3/16/2018 7: 43 AM Example 2 -8 Choosing the most economic material for a part A good example of this situation is illustrated by a part for which annual demand is 100, 000 units. The part is produced on a highspeed turret lathe, using 1112 screw-machine steel costing $0. 3 per pound. A study was conducted to determine whether it might be cheaper to use brass screw stock, costing $1. 4 per pound. Because the weight of steel required per piece was 0. 0353 pounds and that of brass was 0. 0384 pounds, the material cost per piece was $0. 0106 for steel and $0. 0538 for brass. However, when the manufacturing engineering department was consulted, it was found that, although 57. 1 defect free parts per hour were being produced by using steel, the output would be 102. 9 defect-free parts per hour if brass were used. Which material should be used for this part? Machine attendant was paid $15/hour, and the variable overhead costs for the turret were estimated to be $10/hour. Dr. Mohammad Abuhaiba, PE

30 3/16/2018 7: 43 AM Example 2 -8 Choosing the most economic material for a part A good example of this situation is illustrated by a part for which annual demand is 100, 000 units. The part is produced on a highspeed turret lathe, using 1112 screw-machine steel costing $0. 3 per pound. A study was conducted to determine whether it might be cheaper to use brass screw stock, costing $1. 4 per pound. Because the weight of steel required per piece was 0. 0353 pounds and that of brass was 0. 0384 pounds, the material cost per piece was $0. 0106 for steel and $0. 0538 for brass. However, when the manufacturing engineering department was consulted, it was found that, although 57. 1 defect free parts per hour were being produced by using steel, the output would be 102. 9 defect-free parts per hour if brass were used. Which material should be used for this part? Machine attendant was paid $15/hour, and the variable overhead costs for the turret were estimated to be $10/hour. Dr. Mohammad Abuhaiba, PE

31 3/16/2018 7: 43 AM Example 2 -9 Choosing the most economical machine for production Dr. Mohammad Abuhaiba, PE

31 3/16/2018 7: 43 AM Example 2 -9 Choosing the most economical machine for production Dr. Mohammad Abuhaiba, PE

32 3/16/2018 7: 43 AM PRESENT ECONOMY STUDIES Alternative Machine Speeds Machines can frequently be operated at different speeds, resulting in different rates of product output. However, this usually results in different frequencies of machine downtime. Such situations lead to present economy studies to determine preferred operating speed. Example 2 -10 Example 2 -11 Dr. Mohammad Abuhaiba, PE

32 3/16/2018 7: 43 AM PRESENT ECONOMY STUDIES Alternative Machine Speeds Machines can frequently be operated at different speeds, resulting in different rates of product output. However, this usually results in different frequencies of machine downtime. Such situations lead to present economy studies to determine preferred operating speed. Example 2 -10 Example 2 -11 Dr. Mohammad Abuhaiba, PE

33 3/16/2018 7: 43 AM PRESENT ECONOMY STUDIES Make Versus Purchase (Outsourcing) Studies A company may choose to produce an item in house, rather than purchase from a supplier at a price lower than production costs if: 1. 2. direct, indirect or overhead costs are incurred regardless of whether the item is purchased from an outside supplier, and The incremental cost of producing the item in the short run is less than the supplier’s price The relevant short-run costs of the make versus purchase decisions are the incremental costs incurred and the opportunity costs of resources Example 2 -11 Dr. Mohammad Abuhaiba, PE

33 3/16/2018 7: 43 AM PRESENT ECONOMY STUDIES Make Versus Purchase (Outsourcing) Studies A company may choose to produce an item in house, rather than purchase from a supplier at a price lower than production costs if: 1. 2. direct, indirect or overhead costs are incurred regardless of whether the item is purchased from an outside supplier, and The incremental cost of producing the item in the short run is less than the supplier’s price The relevant short-run costs of the make versus purchase decisions are the incremental costs incurred and the opportunity costs of resources Example 2 -11 Dr. Mohammad Abuhaiba, PE

34 3/16/2018 7: 43 AM PRESENT ECONOMY STUDIES Make Versus Purchase (Outsourcing) Studies Opportunity costs may become significant when in-house manufacture of an item causes other production opportunities to be foregone (E. G. , insufficient capacity) In the long run, capital investments in additional manufacturing plant and capacity are often feasible alternatives to outsourcing. Dr. Mohammad Abuhaiba, PE

34 3/16/2018 7: 43 AM PRESENT ECONOMY STUDIES Make Versus Purchase (Outsourcing) Studies Opportunity costs may become significant when in-house manufacture of an item causes other production opportunities to be foregone (E. G. , insufficient capacity) In the long run, capital investments in additional manufacturing plant and capacity are often feasible alternatives to outsourcing. Dr. Mohammad Abuhaiba, PE

35 3/16/2018 7: 43 AM PRESENT ECONOMY STUDIES Trade-Offs in Energy Efficiency Studies Example 2 -13: Investing in Electrical Efficiency Dr. Mohammad Abuhaiba, PE

35 3/16/2018 7: 43 AM PRESENT ECONOMY STUDIES Trade-Offs in Energy Efficiency Studies Example 2 -13: Investing in Electrical Efficiency Dr. Mohammad Abuhaiba, PE

36 3/16/2018 7: 43 AM Home Work Assignment 2. 2, 2. 6, 2. 12, 2. 17, 2. 24, 2. 28, 2. 32, 2. 37, 2. 42, 2. 48 Due Wednesday 28/9/2011 Dr. Mohammad Abuhaiba, PE

36 3/16/2018 7: 43 AM Home Work Assignment 2. 2, 2. 6, 2. 12, 2. 17, 2. 24, 2. 28, 2. 32, 2. 37, 2. 42, 2. 48 Due Wednesday 28/9/2011 Dr. Mohammad Abuhaiba, PE

37 3/16/2018 7: 43 AM 1 st Case Study Re-solve case study in the book (page 51) Solve case study 2. 53 on page 61 Dr. Mohammad Abuhaiba, PE

37 3/16/2018 7: 43 AM 1 st Case Study Re-solve case study in the book (page 51) Solve case study 2. 53 on page 61 Dr. Mohammad Abuhaiba, PE